DigiMove Analysis for Manufacturing SMEs to Identify Their

Current Status and next Digitalisation Steps

Leila Saari

1a

, Risto Kuivanen

2b

and Jyrki Poikkimäki

2c

1

VTT Technical Research Centre of Finland Ltd, Kaitoväylä 1, Oulu, Finland

2

VTT Technical Research Centre of Finland Ltd, Visiokatu 4, Tampere, Finland

Keywords: Manufacturing SME, Digital Transformation, beyond Industry 4.0, Digitalisation.

Abstract: The digitalisation level of Finnish manufacturing companies must be improved in order to remain in Finland

and keep the manufacturing industry competitive. Digitalisation was found to have a positive correlation with

the business result. This was discovered by analysing the digitalisation level of 43 manufacturing companies

in Finland. The analysis was performed with the DigiMove matrix, which contains the following six

digitalisation subjects: i) Manufacturing, ii) Products and services, iii) Digital skills of production staff, iv)

Foresight, v) Customer interface, and vi) Administrative functions. It also contains five maturity levels: i)

General, ii) Improved, iii) Advanced, iv) Forerunner, and v) Future opportunity. Each cell in the matrix

contains the description of the expected digital solutions to be used and implemented. These descriptions were

discussed in detail with each company in the workshop, and their actual level of digitalisation was jointly

defined. In addition to the instant analysis map created in the workshop, each company also received

recommendations for their next digitalisation steps within a week. Subsequently, 43 DigiMove statistical

analyses were conducted with the companies’ public financial data, and a positive correlation was found

between digitalisation and the financial result.

1 INTRODUCTION

Digital transformation is sweeping across the globe,

much like the current pandemic, and is affecting the

manufacturing industry, too. It is evident that the

manufacturing industry shall and will proceed

towards Industry 4.0 and beyond. Digitalisation of the

manufacturing industry is developing from the

manual data management of single companies to

intelligent data processing and analytics in partner

networks enriched by the capabilities of artificial

intelligence (Heilala et al., 2020). The long-term

digitalisation goal for the manufacturing industry is

for digitalisation to support all manufacturing

processes and enable safe and transparent

collaboration within a partner network. The European

Union (EU) promotes a twin transition of the

industry, combining both green values and

digitalisation goals (Paasi et al., 2020) (European

Comission, 2021).

a

https://orcid.org/0000-0001-6789-3497

b

https://orcid.org/0000-0002-3491-8915

c

https://orcid.org/0000-0001-9128-3576

The digitalisation level of Finnish manufacturing

companies must be improved in order to remain in

Finland and keep the industry competitive.

Manufacturing is considered a technology industry by

the association of Technology Industries of Finland.

According to its statistics the technology industry

provides direct employment to approximately

313,000 people and indirect employment to about

660,000 people, and it represents over 50% of

Finland’s exports. In Finland, all companies’ export

of goods was about €65 billion in 2019. The share of

SMEs amounted to €9.4 billion, or 15%, of this total.

SMEs are responsible approximately 17% of the

technology industry’s export of goods (Technology

Industries of Finland, 2021).

Saari, L., Kuivanen, R. and Poikkimäki, J.

DigiMove Analysis for Manufacturing SMEs to Identify Their Current Status and next Digitalisation Steps.

DOI: 10.5220/0010642200003062

In Proceedings of the 2nd International Conference on Innovative Intelligent Industrial Production and Logistics (IN4PL 2021), pages 59-66

ISBN: 978-989-758-535-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

59

2 RELATION TO THE EXISTING

THEORIES AND WORK

In this section, we will briefly look at the process of

digital transformation, maturity models and the

digitalisation issues within small and medium sized

enterprises (SMEs).

2.1 Digital Transformation

Digital transformation (DT) is a continuous

technology-driven change process of both companies

and the society as a whole (Ebert & Duarte, 2018). It

includes the changes in roles, ways of working and

business offerings caused by adoption of digital

technologies either in the company or in the operation

environment. DT indicates changes occurring within

several areas: i) process, ii) organisation, iii) business

domain, and iv) society (Parviainen et al., 2017).

2.2 Maturity Models

Maturity has become a popular measure to evaluate

the capabilities of an entity since the Capability

Maturity Model (CMM) was proposed, and it has

been proven in practice (Paulk et al., 1993) (Wendler,

2012). In CMMs, there are five maturity levels:

Initial, Managed, Defined, Quantitatively Managed

and Optimising. Maturity models have a long history,

and many models applied to various topics can be

found in the literature. With regard to digital

transformation, there are over 20 maturity models

available (Teichert, 2019).

The VTT Technical Research Centre of Finland

Ltd (VTT) alone has developed three maturity tools

that are available for self-assessment for non-

commercial use. The tools are: DigiMaturity (Leino

et al., 2017), AI maturity (Saari et al., 2019) and

ManuMaturity (Saari et al., 2021). These tools help to

form an understanding of the concept in question and

assess current readiness and performance. Also, an

immediate result graph illustrates the present state

and identifies potential development needs.

In addition to the ManuMaturity tool, there are

several other maturity tools developed for Industry

4.0 and the manufacturing industry (Liebrecht et al.,

2021; Rauch et al., 2020) as well as applications

especially for SMEs and micro-sized enterprises

(Kuusisto et al., 2020).

2.3 Digitalisation and SMEs

Digital transformation provides new business

possibilities, but it also sets challenges for manufac-

turing companies. Aside from manufacturing skills,

these companies must also learn new capabilities.

Current manufacturing SMEs are struggling with

resource constraints and knowledge gaps that slow

down their digitalisation efforts and investments. The

main challenges and barriers to overcome are limited

understanding, insufficient resources and gaps in

bringing digitalisation into practice (Heilala et al.,

2020).

The ApuaDigiin.fi web service was developed to

help SMEs in proceeding with digitalisation. The

service presents a four-phase digital transformation

model, practical tools and methods for its

exploitation, company success stories and related

research results (Kääriäinen & Saari, 2020).

Franka et al. described the Industry 4.0

implementation patterns in manufacturing companies

and proposed four digitalisation domains: smart

manufacturing, smart products, smart working and

smart supply-chain. In addition to these domains,

there were general base technologies like the cloud,

the internet of things, big data and analytics. The

complexity level of implementation naturally grows

from cloud to analytics (Frank et al., 2019)

According to an SME inquiry commissioned by

VTT, less than 10% of respondents considered the

introduction of new digital systems and tools. The

inquiry was answered by 200 Finnish manufacturing

SME decision-makers. The inquiry was conducted

between November 2020 and December 2020. The

inquiry asked about the kinds of digitalisation

solutions companies already used and which of these

solutions were in the pipeline. Based on the

responses, digitalisation has already begun within

companies. However, the process has occurred at a

slower pace than desired. For example, of the control

tools, Enterprise Resource Planning (ERP) was used

by almost 90 percent of the respondents. However,

Manufacturing Executing System (MES)—

combining both factory automation and the

production control system—are used in only one out

of ten companies. Only two percent of respondents

considered introducing a MES system. This result

accurately describes the situation of digitalisation in

the Finnish manufacturing industry. The basic

systems are in use, but the actual digital leap has yet

to occur. A striking feature is that less than 10% of

respondents typically consider introducing new

systems and tools.

It is clear that SMEs need guidance and simple

tools to exploit before they can select their next

digitalisation step (Kääriäinen & Saari, 2020). In

addition to the existing maturity tools, we propose the

DigiMove matrix. DigiMove analysis provides both

IN4PL 2021 - 2nd International Conference on Innovative Intelligent Industrial Production and Logistics

60

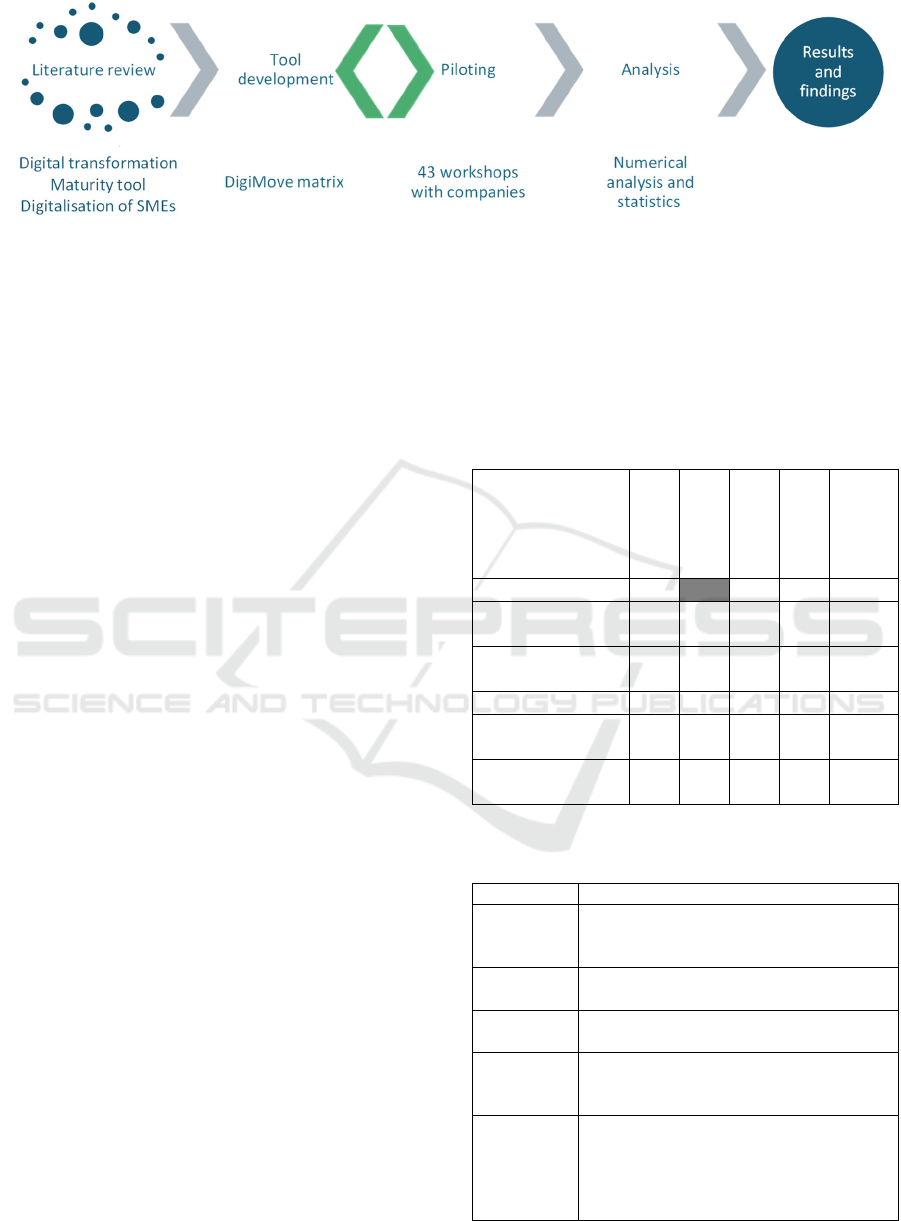

Figure 1: Research method.

the digitalisation analysis map—as maturity tools

usually do—and a customised proposal for the

company’s next steps in digitalisation.

3 RESEARCH METHOD

In this section, we describe our research method, as

shown in Figure 1. The background and a brief

literature review were previously presented in Section

2. The subtitles there were digital transformation,

maturity tools and digitalisation from the viewpoint

of SMEs. Based on the background, we proceeded

into the tool development and the result, known as the

DigiMove matrix.

After 12 company assessment experiments, we

clarified our definitions to make the matrix more self-

sustainable and user-friendly. In the piloting phase, a

total of 43 Finnish SMEs completed a workshop with

us to pilot our tool and receive both their assessment

results and a unique proposal to proceed with

digitalisation. Finally the piloting results of

companies were analysed against their financial data.

The findings are presented in Section 4.

3.1 Tool Development and the

DigiMove Matrix

The DigiMove matrix is used to identify the level of

the company's current digital solutions and possible

developments in a 1.5-hour analysis workshop. The

matrix uses a five-point scale that is completed for six

digitalisation subjects. The subjects of digitalisation

are: i) Manufacturing, ii) Products and services, iii)

Digital skills of production staff, iv) Foresight, v)

Customer interface, and vi) Administrative functions.

Furthermore, the five-point maturity scale has five

levels for digitalisation: i) General, ii) Improved, iii)

Advanced, iv) Forerunner, and v) Future opportunity

(Table 1). The maturity levels and their digitalisation

features are described in more detail in Table 2.

The analysis was based on the description of

expected digital solutions to be used and implemented

for each cell in the matrix. As an example, the

description of digitalisation in the crossing of the

‘Manufacturing’ and ‘Improved’ maturity level is

displayed in Table 3.

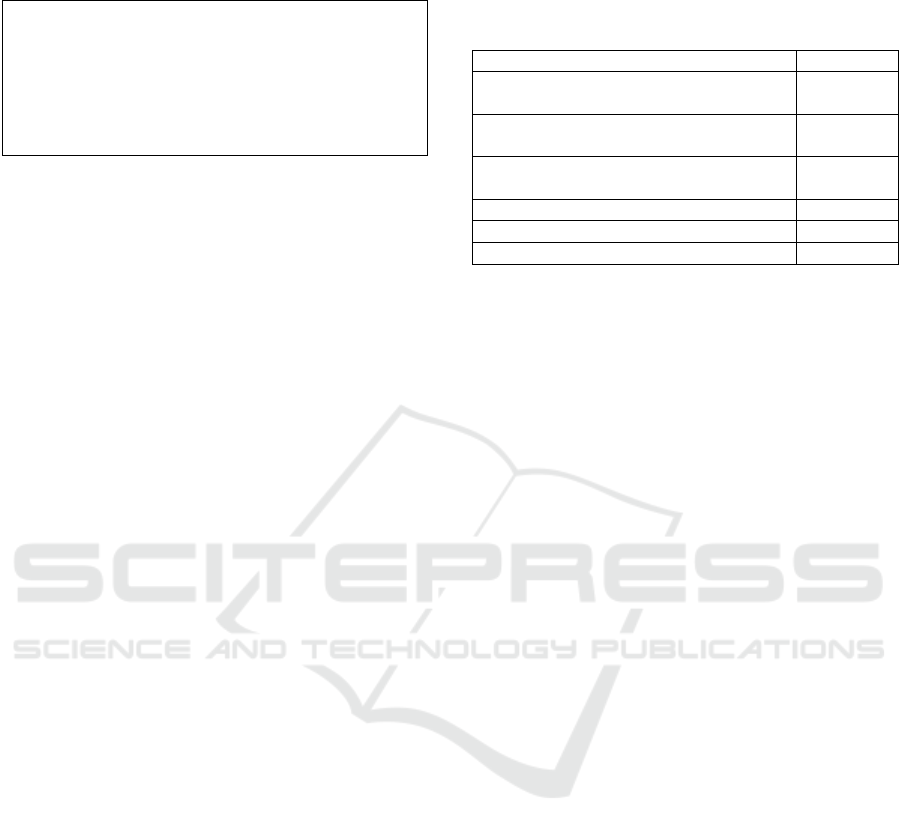

Table 1: The dimensions of the DigiMove matrix.

Digitalisation

level / subject

General

Improved

Advanced

Forerunner

Future

opportunity

Manufacturing

Products and

services

Digital skills of

production staff

Foresight

Customer

interface

Administrative

functions

Table 2: The maturity levels of the DigiMove matrix with

description.

Level Features of di

g

italisation

General Most of the activities are manual, CNC

controlled machines are in use, standard

office

p

ro

g

rams.

Improved Production data aggregation,

optimisation, separate ERP and MES

Advanced Robotic cells, automatic operation, ERP-

enable

d

Forerunner Real-time data utilised, remote control

over the network, interoperable ERP and

MES

Future

opportunity

Production of digital twin in partner

network. Interoperable quality

management and traceability with block

chains. Reliable data transmission in the

network

(

IDS conce

p

t

)

DigiMove Analysis for Manufacturing SMEs to Identify Their Current Status and next Digitalisation Steps

61

Table 3: An example of the descriptions in the matrix:

‘Improved’ level of ‘Manufacturing’.

Separate digital manufacturing cells with CNC

machines and industrial robots

IoT sensors

Multi cell monitoring

Cell-specific 24/7 automatic operation mode

possible

Production is controlled by ERP

3.2 Piloting with the DigiMove Matrix

Piloting with companies was conducted with a total

of 43 manufacturing companies from Finland

between November 2020 and January 2021. Piloting

in this case is defined as remote workshop sessions

with one or more company representatives at a time.

The DigiMove matrix discussion took a period of

approximately 1.5 hours. Workshops were organised

remotely via Microsoft Teams.

Typically, the company representative was the

chief executive officer (CEO), the production director

or other decision-makers. Each company had a

general number of 1–3 participants. The DigiMove

matrix discussions followed the same four-item

agenda. The session began with a warm-up and an

introduction of each person and their role. Then,

facilitators clarified the purpose and the background

of the session. Next, the facilitators led the discussion

and digitalisation assessment of the company via

DigiMove matrix row-by-row. The facilitator’s role

was to lead the discussion as well as guide and

challenge the company representatives to evaluate the

company’s actual implemented digitalisation level.

The analysis was supplemented by a numeric

evaluation (0-100) describing the actual realisation of

the cells, which is proportional to its business

importance. After the session, the mutual

understanding of the digitalisation status of the

company was displayed as an analysis map. In

addition to the immediate result (numerical

evaluation of the matrix), a verbal analysis and

proposals for the next digital development steps were

provided by facilitators within a week.

The DigiMove matrix pilot project was performed

in close co-operation with VTT’s regional agent

network. VTT has 11 regional agents around Finland;

these individuals are local experts who are very

familiar with their region’s SMEs. The selected

companies are growing and internationalising,

eligible for such funding as Business Finland’s R&D

funding, have no tax debt, and are not in debt

restructuring. The sample is small but comprehensive

and accurately represents Finnish manufacturing

SMEs. Table 4 displays the key business numbers of

the pilot companies.

Table 4: The basic numbers of the analysed companies.

Number of enterprises 43

Average turnover of the previous

financial statements

€636.2 M

Aggregate result of the previous financial

statements

€24.6 M

Percentage of profit on previous financial

statements

4.1%

Growth rate of the previous 3-4 years 4%

Avera

g

e of latest

g

rowth rate 2.7%

Sum of latest total number of staff 3860

3.3 Calculation and Statistics

This section describes how the numeric values were

created and handled during the analysis. To describe

the current situation at the digitalisation level, one of

the six objects and five levels of the analysis tool was

formed so that the objects were of equal value, but the

total score of the next level always increased by one

hundred. Thus, 100 points were given in the first

level, 200 points were given in the second level, 300

points were given in the third level and so on. The

points given to the levels in the analysis were

multiplied by these coefficients and the summed

result was divided by 500. On the aforementioned

scale, the activity at the absolute ‘General’ level gives

a figure of 20 and the activity at the absolute ‘Future

possibility’ level gives a figure of 100.

Consistency in the implementation of the analyses

was ensured and the scoring was harmonised among

20 companies in the first phase of the results. The

companies were organised in a greatest-to-least order

using their respective points. Financial data on

companies over the last 3–4 years were collected

from public sources, depending on the periods

reported by the companies. Cumulative revenue,

cumulative earnings and the cumulative earnings

margin were calculated from the financial data. The

conversion rate was combined with the level of

digitalisation, and the correlation of the numbers was

calculated.

Among the 43 companies, the data showed that

there were seven companies who had achieved

exceptional results during the last 2–3 periods. Aside

from digitalisation, there were clearly other factors

behind these numbers. These factors could come in

the form of corporate acquisition, monopoly in the

customer sector, temporary economic difficulties or

recent heavy investments in basic technologies. The

results of these companies were removed from the

IN4PL 2021 - 2nd International Conference on Innovative Intelligent Industrial Production and Logistics

62

data prior to the correlation calculation. The main

conclusions are valid with 83% of the collected data.

4 FINDINGS

Based on the DigiMove analysis of 43 Finnish

manufacturing companies, the findings are split into

two topics: the digitalisation level of the Finnish

manufacturing industry and its correlation with the

business results. Furthermore, there are some

digitalisation proposals generated during the piloting;

these proposals have been generalised for this paper.

4.1 Digitalisation Level of Finnish

Manufacturing Industry

From the 43 analysed manufacturing SMEs, a

‘General’ level of digitalisation was found among

majority of the companies for the evaluation subjects

of ‘Manufacturing’ and ‘Digital skills of production

staff’ (see Table 5, where the highest share of

companies is highlighted on each row). This indicates

that most of these companies utilise manual work in

their production. This was expected with complicated

welding structures, where robotisation and

automatization are difficult to utilise, especially in

regard to small series production. It is possible,

however, to digitalise other parts of the production

process.

Table 5: Analysis summary of 43 company assessments.

Digitalisation

level / subject

General

Improved

Advanced

Forerunner

Future

opportunity

Manufacturin

g

34 31 22 12 1

Products and

services

26 41 25 7 1

Digital skills of

p

roduction staff

39 38 18 5 0

Foresight 28 36 25 9 1

Customer

interface

38 35 20 7 1

Administrative

functions

30

43 21 7 0

The ‘Customer interface’ was also evaluated to be

on the ‘General’ level. Many small companies have

only a few customers, and it is easy to communicate

with them. It is easy to forget, however, that the

changes in the market may have an extremely

dramatic effect on the future order backlog. Small

companies should never fail to look for new

customers as this maintains the resilience of the

business.

Among the analysed companies, the digitalisation

of ‘Products and services’ were developed to an

‘Improved’ level. In many cases, the SMEs did not

have their own products or a product and service

combination. Oftentimes, they were working in the

manufacturing ecosystem with bigger companies and

manufactured products. It is evident that small

companies should develop their own products to

remain as competitive in the market as possible.

Today, this translates to computer controlled features

and functions, even with relatively simple structures

and products.

Digitalisation for ‘Foresight’ translates to better

performance of supply, which is very important for

the continuity of the business. There are effective

digital means available for retrieving supply chain

information from the partners, but this information is

not shared. In the workshops, it was often mentioned

that the foresight data was not accessible to the third

and fourth tier companies of the supply chain. As a

result, other companies were following up to one-

month old predictions despite the fact that the direct,

first level suppliers could read updated foresight data

directly from the customer’s database. This broken

link in data flow weakens the productivity of the

whole network.

In the evaluations, the ‘Administrative functions’

were also in the ‘Improved’ level. In the analysing

phase of these results, it was noted that these

functions were not essential to the result of the

business.

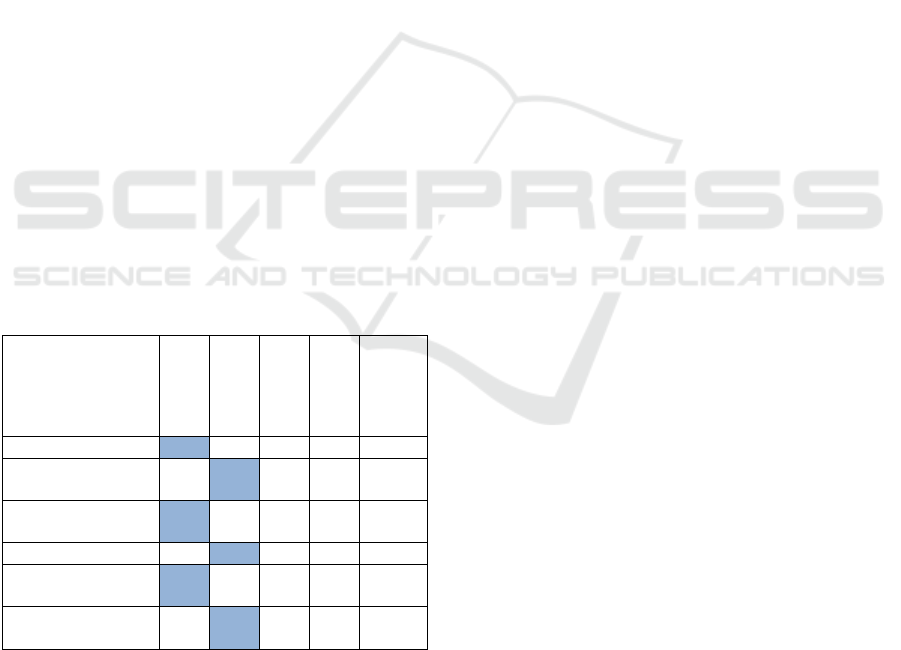

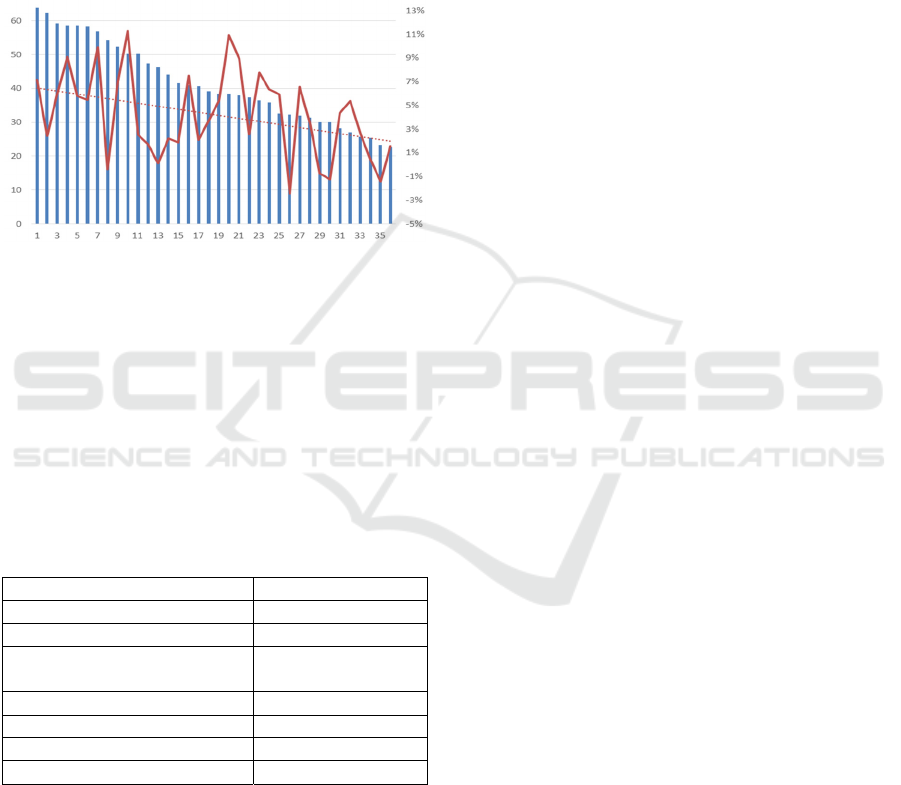

The digitalisation score of 36 assessed companies

are displayed in Figure 2. Among these 36 companies

there was none reaching the ‘Future opportunity’

level on each digitalisation subject. Two companies

reached the ‘Forerunner’ level as their average

digitalisation scored over 60. Fifteen companies

(41%) scored between 40-60, which indicates the

‘Advanced’ level. Majority, nineteen companies

scored between 20-40, indicating ‘Improved’ level of

digitalisation. This shows clearly that the

“digitalisation leap” has begun, but it remains in

infancy under the scope of manufacturing SMEs in

Finland.

4.2 Digitalisation Correlates with the

Business Result

For each of the companies, the economical result for

the previous 3–4 years—depending on the available

data—was gathered from the public sources. The

cumulative result was divided by the cumulative

DigiMove Analysis for Manufacturing SMEs to Identify Their Current Status and next Digitalisation Steps

63

turnover at the same amount of years. This average

result was compared to the scored digitalisation level

evaluated with the DigiMove matrix. This was chosen

for the reason that the latest economical result may

often include special events, investments or company

trades.

The overall digitalisation result correlates

positively with the average financial result of the

previous 3–4 years in 83% of the companies analysed

(Figure 2).

Figure 2: The overall result of the digitalisation (blue bars,

left scale) and the financial result of 36 companies (red

curve, right scale).

The highest correlation was found to be between

the financial result and the digitalisation of ‘Customer

interface’, ‘Product and services’ and ‘Digital skills

of the production staff’. Digitalisation of

‘Administrative functions’ and ‘Foresight’ was

lowest in correlation with the financial result, as

shown in Table 6.

Table 6: Correlation with the digitalisation subjects and

financial result for total 36 companies.

Correlation

Manufacturing 0.4

Products and services 0.5

Digital skills of production

staff

0.5

Foresight 0.2

Customer interface 0.5

Administrative functions 0.2

Overall 0.5

It is obvious, that digitalisation is only one factor

in competitiveness. However, it appears to be quite

significant. There were several companies in the data,

which had a relatively low level of digitalisation in

the DigiMove analysis but a high level of annual

profit in their business. The companies that achieved

the highest results in this group specialised in the

competitiveness of the product in the market or in a

narrow customer segment with almost monopoly-like

characteristics (e.g., defence industry, border guard).

The largest financial result was for a company that

specialised in a single manufacturing phase

(machining).

4.3 Digitalisation Step Proposals

In addition to the immediate analysis map, each

company also received a set of recommendations for

the next digitalisation steps. The anonymised set of

potential development actions were listed for three

digitalisation subjects: i) Manufacturing, ii) Digital

skills of the production staff, and iii) Customer

interface (Table 7).

5 CONCLUSIONS AND FURTHER

WORK

The main goal was to discover tools and processes to

help manufacturing SMEs proceed with

digitalisation. The target group is challenging due to

the key. The idea was to increase the usability of the

maturity assessment results—in addition to the status

analysis map common in maturity tools—by

providing a unique list of further digitalisation steps

to each pilot company.

The DigiMove analysis was conducted using a

matrix with six digitalisation subjects (rows) and five

maturity levels (columns). The matrix was

concretised with the description of expected digital

solutions on each cell in the matrix. A clear matrix

with facilitators made the assessment as time

effective as possible. The matrix was easy to

understand, and the work and discussions were

effective in the workshop within minutes.

The developed DigiMove analysis was piloted

with 43 manufacturing companies. The workshop

was successfully performed in a remote manner. The

evaluation session took about 1.5 hours from the

attendees. The company representatives found the use

of time useful.

The DigiMove analysis provides an analysis map

of the digitalisation level of a company, and it is

possible to compare the level with other companies.

The mean value in the scale of 20–100 was 43 with a

deviation from 23 to 64 in the evaluations (Figure 2).

This means that in the Finnish manufacturing SME

industry, the so-called digital leap is still in its

infancy.

There is a positive correlation between the

investment in digitalisation and the business results

for a large number of analysed companies.

Investments to the digitalisation of ‘Customer

IN4PL 2021 - 2nd International Conference on Innovative Intelligent Industrial Production and Logistics

64

Table 7: Potential digitalisation steps for the manufacturing SMEs.

Manufacturin

g

Di

g

ital skills of the

p

roduction staff Customer interface

Production environment

Layout development and production

cell formation

Optimisation of material flows and

manufacturing

Automation

Selection of new manufacturing

technologies utilising automation

Introduction of production automation

in manufacturing processes

Development of online monitoring of

manufacturing cells

Utilisation of IoT sensing to support

unsupervised automation

Enabling unattended automatic

operation

Robotics

Increasing robotics in machine service

and welding

Development of human-robot

interaction

Production control

Enabling co-operation between ERP

and MESs (i.e., connecting

production control directly to

machine control)

Paperless production control

Quality and traceability

Digital identification of products and

parts, quality assurance and

traceability

Marking products with bar, RFID or

QR code in production

Information work

Digitalisation of work instructions

available to everyone

Management and quality of product

information and linking of tracking

information to digitally manufactured

products

Recording changes made and hours

worked directly in the systems used

Competence

Microsoft Office365 system training

and access for everyone

Capacity building of personnel to

introduce automation or cobotics in

production

Strengthening the digitalisation skills

of employees to make better use of

the potential of manufacturing

technologies

Improving the digital capabilities of

production staff in utilising IoT

sensing

Programming of automatic machines

Teaching tracks to robots.

Remote working

Development and training of tools for

on-line monitoring of manufacturing

cells

Real-time control and monitoring of

manufacturing cells via mobile

Support schemes

Utilising the use of 3D models on a

mobile device at the installation site

Utilisation of AR welding visors or

AR glasses to aid manual work

Situation awareness

Manufacturing status table and KPIs

available to everyone

Direct contacts to customers

Online store

Product customisation online

Delivery time promise for a

customised product

Faultlessness

Order formatting with EDI to EDI

interface

Utilisation of software robotics in the

ordering process

Brand

Up-to-date websites

Website optimisation and search

engine optimisation

Visibility

Own channels on social media (e.g.,

LinkedIn, Twitter, Facebook)

News videos

Email bots

Bots

Transparency in the customer

interface

Analytics

Dynamic graphs for mobile devices

Evaluation of potential customers

interface’, ‘Products and services’ and ‘Digital skills

of production staff’ are most likely to emerge in

business results. When deploying this tool for the next

trial in the manufacturing field, modification within

‘Products and services’ must be considered. The

products and services in our target group may be

either the company’s own products, or the company

may be system supplier or subcontractor in an

ecosystem. Considering this role might have an effect

on the overall digitalisation points of the company.

As a self-assessment tool, the DigiMove analysis

is quite sensitive for skewing the company’s

situation. This can be prevented by using experienced

external experts to facilitate the assessment

workshop.

The tool was developed to help Finnish

manufacturing companies to proceed in their

digitalisation process. VTT is looking for

opportunities to continue this work in various projects

both in Finland and in Europe.

In addition to the DigiMove matrix results

described above, a weak signal was intuitively

detected during the study. The information flow is not

transparent in supply-chains. The transparency and

DigiMove Analysis for Manufacturing SMEs to Identify Their Current Status and next Digitalisation Steps

65

flow of information in a supply-chain weakens

sharply at the third and fourth subcontracting levels,

even if modern IT solutions are used at the higher

levels. This degrades the overall productivity of the

network in particular, especially in the productivity of

SMEs on the third and fourth level.

ACKNOWLEDGEMENTS

The authors of this paper wish to express our sincere

thanks to the key persons of the 43 manufacturing

SMEs who piloted our DigiMove matrix analysis.

Comments and the actual execution of the analysis

helped us to fine-tune the method. These companies

also gave valuable data for the evaluation of the

current digitalisation level in manufacturing industry

in Finland.

We wish to express many thanks to the VTT

regional agents who helped us find this group of pilot

companies around Finland and execute a large

number of analyses in a short period of time.

Thanks are also due to the Ministry of Economic

Affairs and Employment of Finland and VTT for

giving us possibility to perform this study.

REFERENCES

Ebert, C., & Duarte, C. H. C. (2018). Digital

Transformation. IEEE Software, 35(4). https://doi.org/

10.1109/MS.2018.2801537

European Comission. (2021). Horizon Europe’s first

strategic plan 2021-2014: Commission sets research

and innovation priorities for a sustainable future.

Retrieved from https://ec.europa.eu/commission/

presscorner/detail/en/IP_21_1122

Frank, A. G., Dalenogare, L. S., & Ayala, N. F. (2019).

Industry 4.0 technologies: Implementation patterns in

manufacturing companies. International Journal of

Production Economics, 210(January), 15–26.

https://doi.org/10.1016/j.ijpe.2019.01.004

Heilala, J., Helaakoski, H., Kuivanen, R., Kääriäinen, J., &

Saari, L. (2020). A review of digitalisation in the

Finnish manufacturing SME companies. (November).

Kääriäinen, J., & Saari, L. (2020). Applying the positioning

phase of the digital transformation model in practice

for SMEs : toward systematic development of

digitalization. 8(4), 24–43. https://doi.org/10.12821/

ijispm080402

Kuusisto, O., Kääriäinen, J., Hänninen, K., & Saarela, M.

(2020). Towards a Micro-Enterprise–Focused Digital

Maturity Framework. International Journal of

Innovation in the Digital Economy, 12(1), 72–85.

https://doi.org/10.4018/ijide.2021010105

Leino, Simo-Pekka; Kuusisto, Olli; Paasi, Jaakko; Tihinen,

M. (2017). Towards a new era in manufacturing: Final

report of VTT’s For Industry spearhead programme.

Liebrecht, C., Kandler, M., Lang, M., Schaumann, S.,

Stricker, N., Wuest, T., & Lanza, G. (2021). Decision

support for the implementation of Industry 4.0

methods: Toolbox, Assessment and Implementation

Sequences for Industry 4.0. Journal of Manufacturing

Systems, 58(PA), 412–430. https://doi.org/10.1016/

j.jmsy.2020.12.008

Paasi, J., Nieminen, H., Kurki, S., Apilo, T., Martins, J.,

Malinen, S., Salminen, K. (2020). Sustainable Industry

X - Kohti suomalaista teollisuusvisiota ja -agendaa

2030. https://doi.org/10.32040/2242-122X.2021.T389

Parviainen, P., Tihinen, M., Kääriäinen, J., & Teppola, S.

n(2017). Tackling the digitalization challenge: How to

benefit from digitalization in practice. International

Journal of Information Systems and Project

Management, 5(1), 63–77. https://doi.org/10.12821/

ijispm050104

Paulk, M. C., Curtis, B., Chrissis, M. B., Weber, C. V.

(1993). Capability maturity model. IEEE Software,

10(4), 18–27.

Rauch, E., Unterhofer, M., Rojas, R. A., Gualtieri, L.,

Woschank, M., & Matt, D. T. (2020). A maturity level-

based assessment tool to enhance the implementation of

industry 4.0 in small and medium-sized enterprises.

Sustainability (Switzerland), 12(9).

https://doi.org/10.3390/SU12093559

Saari, L., Kuusisto, O., & Häikiö, J. (2021). ManuMaturity

- the maturity tool for manufacturing companies to

reach beyond Industry 4 . 0.

Saari, L., Kuusisto, O., & Pirttikangas, S. (2019). AI

Maturity Web Tool Helps Organisations Proceed with

AI.

Statistics_Finland. (2008). Standard Industrial

Classification TOL 2008. Retrieved from Statistics

Finland website: https://www.stat.fi/en/luokitukset/

toimiala/

Technology Industries of Finland. (2021).

Teknologiateollisuus on Suomen suurin vientiala.

Retrieved from website: https://teknologiateollisuus.fi/

fi/teknologiateollisuus-suomen-suurin-vientiala

Teichert, R. (2019). Digital transformation maturity: A

systematic review of literature. Acta Universitatis

Agriculturae et Silviculturae Mendelianae Brunensis,

67(6), 1673–1687. https://doi.org/10.11118/actaun

201967061673

Tihinen, M., Saari, L., & Kääriäinen, J. (2020). Työkaluja

pk-yritysten digitalisaation edistämiseksi (Tools to

boost the digitalisation of SMEs). LUMEN, (3).

Wendler, R. (2012). The maturity of maturity model

research: A systematic mapping study. Information and

Software Technology, 54(12), 1317–1339.

https://doi.org/10.1016/j.infsof.2012.07.007

IN4PL 2021 - 2nd International Conference on Innovative Intelligent Industrial Production and Logistics

66