Collateral-Free Trustworthiness-based Personal Lending on a

Decentralized Application (DApp)

Wisnu Uriawan

1

, Omar Hasan

1

, Youakim Badr

2

and Lionel Brunie

1

1

Institut National des Sciences Appliquées de Lyon, 20 Avenue Albert Einstein, Villeurbanne CEDEX, France

2

The Pennsylvania State University, Malvern, PA, U.S.A.

Keywords: Lending, Collateral, Trustworthiness, Recommendation, Blockchain, DApp, Ethereum.

Abstract: Most loans given by banks are secured loans and require the borrower to provide collateral as a guarantee for

returning the loan principal and interest. With a secured loan, the lender can take over an asset provided as

collateral if the customer cannot make the loan payments. In this paper, we propose a peer-to-peer personal

lending platform that minimizes the requirement of collateral. The trustworthiness of borrowers is considered

as an indicator of whether the borrowers will pay the installments on time. Borrowers’ reliability is viewed

as a function of their reputation and relationships. The lending platform is designed as a Blockchain

Decentralized Application (DApp).

1 INTRODUCTION

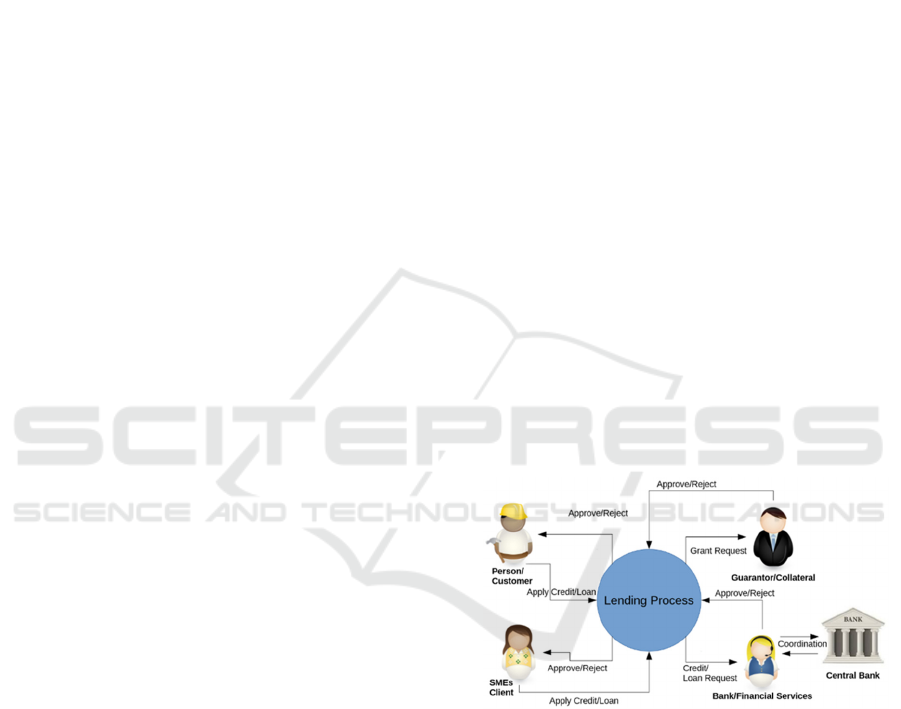

The traditional loan application process is shown in

Figure 1. Many loan applicants are rejected because

they do not meet the terms and conditions (Malik &

Thomas, 2012; Martínez Sánchez & Pérez Lechuga,

2016; Milian, Spinola, & Carvalho, 2019; Pokorná &

Sponer, 2016; Setiawan, Suharjito, & Diana, 2019;

Tang, 2019; Yang & Lee, 2016; Zhao et al., 2017).

Banks and non-bank entities provide loans with terms

and conditions that are sometimes not easy for

borrowers to fulfill. Individual borrowers request

loans for personal projects or urgent requirements.

Small, medium-sized enterprises (SMEs) need loans

to scale up their businesses (Liang, Huang, Liao, &

Gao, 2017). Banks or financial institutions require

collateral or guarantors to guarantee that borrowers

return their loans. Collateral can be in the form of

assets (i.e., houses, vehicles, savings, deposits, and

securities)(Capital, 2018; Mammadli, 2016; Pokorná

& Sponer, 2016). A guarantor is a person who gives

some guarantee for the person or SME applying for

loans (Abdou, Tsafack, Ntim, & Baker, 2016; Bilbao

& Argentaria, 2018).

In addition, many documents may be needed

during the loan application process. Administrative

costs may be required at the time of submission. The

required interest can also be more significant, making

it burdensome for the borrower (Shen, Zhao, & Kou,

2020). There is also little visibility in the centralized

process, so the borrower does not know the clear

reasons for being accepted or rejected. Moreover, the

traditional loan application is time-consuming.

Figure 1: A traditional lending system.

Lending marketplaces offer loans that can speed

up the lending process (Jagtiani & John, 2018; Malik

& Thomas, 2012). However, they still require similar

terms and conditions. The types of debt financing and

estimated times for funding are shown in

Table 1

.

The percentage of approval studied for 100

borrowers showed that 45 are approved, and 55 are

rejected in the traditional bank system. For cash

advance lenders, 90 are approved and 10 are rejected.

For alternative lenders, 70 are approved and 30 are

declined. For large banks, 25 are approved, and 75 are

denied (Capital, 2018). It is clearly difficult to obtain

loans from the traditional lending systems.

Uriawan, W., Hasan, O., Badr, Y. and Brunie, L.

Collateral-Free Trustworthiness-based Personal Lending on a Decentralized Application (DApp).

DOI: 10.5220/0010605108390844

In Proceedings of the 18th International Conference on Security and Cryptography (SECRYPT 2021), pages 839-844

ISBN: 978-989-758-524-1

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

839

Table 1: Rates, Terms, and Speed of Funding (Capital,

2021).

Types Rates (%)

Terms

(y

ears

)

Funding

(

da

y

s

)

Ban

k

6-10 3-7 14-30

SBA (Small

Business

Administration

)

6-10 3-7 10-30

Line of Credit 5-15 1

–

3 7-30

Alternative 6-25 1-5 5-7

Cash Advance 1.16-1.55 3-24 months 1-3

Invoice Finance 1-2

(

weekl

y)

1

–

90 1-3

On the other hand, Blockchain technology is

emerging and successfully applied in many business

applications, such as banking and financial services.

Recently, Blockchain technology (Shao, Jin, Zhang,

Qian, & Zhou, 2018) has been applied to Peer-to-Peer

lending (Setiawan et al., 2019) and fintech

(Anagnostopoulos, 2018). In 2013, peer-to-peer

lending worldwide reached 3.5 billion U.S. dollars.

Peer-to-peer lending is a new trend of the “sharing

economy”. P2P lending platforms allow lenders and

borrowers to meet without going through a bank. A

significant increase is estimated to be close to one

trillion U.S. dollars by 2050. In 2018, mobile P2P

payments’ value reached U.S. $86 billion and

continued to increase (Statista, n.d.).

Today many lending platforms are available

supported by Blockchain technology, but they still

require collateral (Norta & Leiding, 2019). ETHLend

provides secured lending with the use of ERC-20

compatible tokens as collateral. Borrowers’

trustworthiness (Bartoletti, Cimoli, Pompianu, &

Serusi, 2018) is an alternative in a lending application

so that borrowers are no longer burdened with

collateral or guarantor since not every borrower can

provide collateral. The problem is how to calculate

trustworthiness. The evaluation for borrowers is only

based on credit score until the present. Borrowers can

apply for a loan in a lending platform with a credit

score (Tunç, 2019).

In this paper, we summarize our contributions

below. We design a lending platform, a completely

decentralized and Ethereum-based platform on the

blockchain. The trustworthiness score is calculated

from collected information such as borrower profile,

business activities, recommendation, and loan risk to

minimize collateral. In addition, the platform aims for

several other properties: Scalability: our lending

platform should provide accessibility for borrowers,

lenders, and investors in a large community. Cost-

effectiveness: enable low-cost transactions.

Transparency: all transactions of the system should be

traceable and accountable. Automatic enforcement of

terms: autonomous transactions by smart contracts as

a legal agreement. Efficient: reduce the latency time

for the transactions. Security: every user must be

protected from unauthorized access. The remainder of

the paper is structured as follows: Section 2

introduces related work and the state of the art of

lending platforms. Section 3 presents our lending

platform. Section 4 concludes the paper.

2 RELATED WORK

The WeTrust lending platform provides a user

dashboard system with a trust lending circle and

support by ROSCA, Ethereum Blockchain-based,

autonomous, frictionless, decentralized. Sybill Attack

Prevention, product (Mutual Insurance, Trusted

Lending Circles), Country implementation (India,

Latin America, China, USA). However, the

weaknesses are that collateral (deposit on WeTrust

wallet) is still needed and the involvement of a

foreperson (Token, 2018). SALT Lending, support by

Automated Lending Technology. Ethereum

Blockchain-based, distributed ledger (Decentralized),

Multi-Currency Support (USD, EUR, GBP, JPY, and

RMB). In the countries implemented (Europe and

current African Expansion), collateral is still required

with automatic collateral technology and high deposit

multi-variant product (Bilbao & Argentaria, 2018).

Table 2: Ethereum Lending Platform (Tran, 2019).

SALT BlockFi ETHLen

d

Dharma Com

p

oun

d

MakerDAO

Registration

Re

q

uire

d

Yes Yes Yes Yes No No

Interest Rate

for Loans

(

Min.

)

5.99% 4.5% Market Market Market 3.5%

Lend or

Borrow

Borrow Both Both Both Both Borrow

Loan-to-

Value

(

Max.

)

70% 50% 50% Market 66% 66%

Own Token Yes No Yes No No Yes

BlockFi is a lending platform U.S. Dollar,

profiling, register, Ethereum, and Bitcoin support.

Loans security by Gemini, a New York trust company

regulated by the New York Department of Financial

Services, requires cryptocurrencies as collateral.

Darma Lever is a P2P Ethereum-based lending, open

marketplace, lending system, and borrowing terms.

Crypto as collateral, alpha mode, and does not have

its token. ETHLend is an Ethereum token platform

ready for registration or profiling, which supports

over 180 Ethereum tokens, Ethereum, Bitcoin, and

LEND tokens as collateral. MakerDAO is Ethereum

based. DAI stable coin decentralized finance

application U.S. dollar support. The compound,

SECRYPT 2021 - 18th International Conference on Security and Cryptography

840

decentralized lending application behind MakerDAO

relies on a wholly decentralized smart contracts

system that can be accessed without permission or

registration. Users can customize rates they want to

lend out or pick which loans they are willing to

accept, support Ether, and multiple ERC20 tokens.

MakerDAO lending and borrowing support

borrowers need to maintain a collateral value that is

150% of what they borrowers (Tran, 2019). A

comparison of lending platforms is shown in Table 2.

3 OUR LENDING PLATFORM

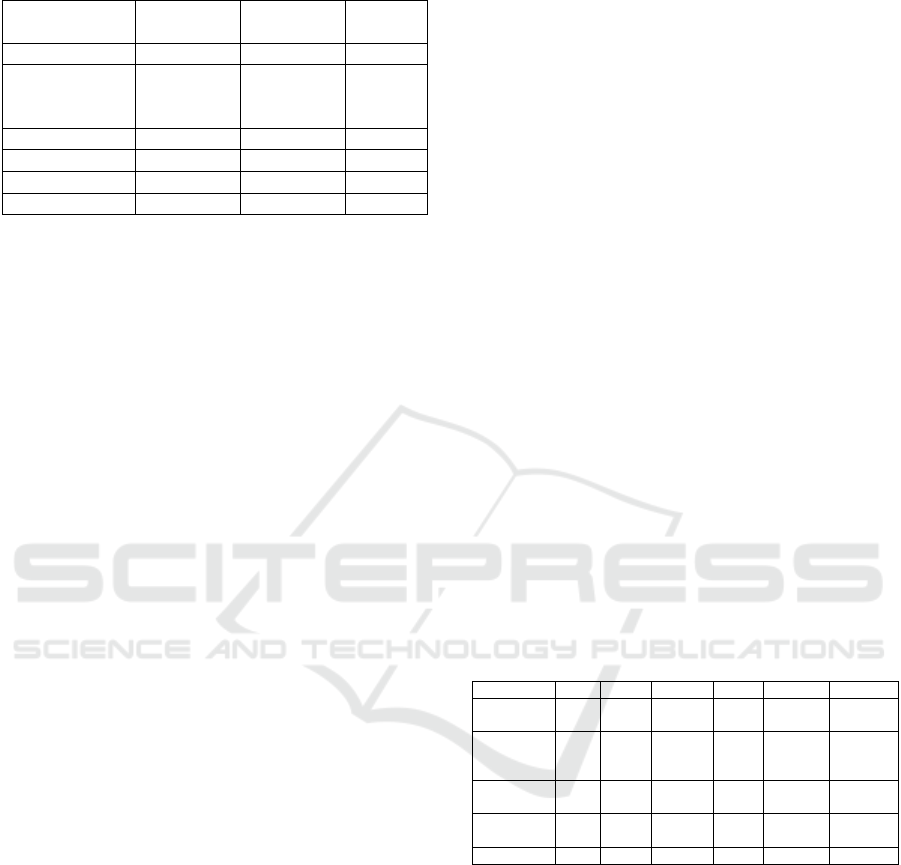

To deal with the aforementioned challenges, we

propose a DApp platform for Ethereum blockchain-

based personal lending to assist borrowers in

proposing and receiving loans. To this end, we reduce

or eliminate the need for collateral by assessing the

borrower’s trustworthiness for the loan’s repayment

as shown in Figure 2.

Figure 2: DApp platform for blockchain-based personal

lending.

3.1 Trustworthiness Score

Underlying beliefs or personality factors contribute to

credit scores. Four factors include impatience,

impulsivity, risk tolerance, and trustworthiness

(Arya, Eckel, & Wichman, 2013). It seems reasonable

to expect a lower credit score associated with the

payments process if there is evidence of impatience

with current and future consumptive activity with

borrowing. A higher loan application risk implies the

possibility of not being able to pay the installments.

Impulsive individuals who have difficulty resisting

the temptation to borrow for consumptive needs will

increase debt.

A lack of trust can also cause a bad credit score

due to a lack of trustworthiness and failure to meet

obligations. And finally, credit scores can be

significantly affected by financial risk-taking because

those who accumulate debt will experience

repayment difficulties. Credit score using a third

party based on information reported by the applicant,

such as the FICO score. This credit score estimation

uses measuring tools: risky attitude, trustworthiness,

and time preference, and impulsive survey measures

so that it can be used to determine the correlation of

behavior of creditors as reflected in the credit score.

The standards of impatience, trustworthiness, and

impulsivity affected credit scores, as reported in

(Tunç, 2019). We define the trustworthiness score in

term of four variables, namely profile_score,

activity_score, social_recommendation_score, and

loan_risk_score, as follows Equation (1):

𝑇𝑟𝑢𝑠𝑡𝑤𝑜𝑟𝑡ℎ𝑖𝑛𝑒𝑠𝑠

𝑃𝑟𝑜𝑓𝑖𝑙𝑒

𝐴𝑐𝑡𝑖𝑣𝑖𝑡𝑦

𝑆𝑜𝑐𝑖𝑎𝑙𝑅𝑒𝑐𝑜𝑚𝑚𝑒𝑛𝑑𝑎𝑡𝑖𝑜𝑛

𝐿𝑜𝑎𝑛𝑅𝑖𝑠𝑘

(1)

Where:

Trustworthiness_score: Borrower credit score

Profile_score: Personal information of Borrower.

Activity_score: Business activity or job information

of Borrower.

SocialRecommendation_score: The recommendation

value of Borrowers from Recommender.

LoanRisk_score: Information of the record from

another loan of Borrower.

3.2 Users Management

Figure 3: User management process.

The public key is used to create account addresses

similar to bank identities or like account numbers in

traditional banking. The private key will be required

when signing transactions originating from the

account (Figure 3). Each node on the network can

verify its signature (Dingman et al., 2019; Zhong,

Wu, Xie, Guan, & Qin, 2019).

Add

Cryptographic

signature(privat

e key)

Broadcast and

authenticate

transaction

Update to

Blockchain

Complete

transaction

Propose Loan

transaction

Collateral-Free Trustworthiness-based Personal Lending on a Decentralized Application (DApp)

841

3.3 Functionality

The system functionality is offered to three actors:

Borrowers, Lenders/Investors, and Recommenders.

The borrower actor can access direct use cases,

including: Create Account, Loan Proposal/Request,

Join Investment Group, Withdrawal, Payment

Installment, and Delete Account. The borrower actors

fill out a form username and password. In the loan use

case, the borrowers’ actor put the loan request into the

system by determining the loan amount and period.

After the loan application has been received, the

borrower actor can make payments according to the

agreement’s dates. In the last use case, the borrower

actor can delete their account if they have finished

paying off installments.

The investor actor can: Create Account, Fund

Accounts, Create Investment Units, Manage

Investment Units, Withdraw Funds, Delete Accounts.

Create User Account use case, and investors actor

only creates an account if it has never been created

before. If successful in creating an account, the

investor actor can access the Fund Account use case

and make a transfer balance that will be used for

investment. The investor actor can access the Create

Investment Units case to make an investment

selection after transferring funds. In this use case, the

investor actor determines the allocation of funds for

the type of investment desired. If the investor actor

has finished investing, they can withdraw all funds in

withdrawal funds use case. If the investor actor does

not continue the investment, the investor actor can

delete their account in the Delete Account use case.

The recommender actor can access the

trustworthiness score use case to give a

recommendation score to borrowers. The

Lenders/Investors can use the trustworthiness score to

make a loan decision.

3.4 Lending Management

Lending management will provide how the borrowers

request some loans, terms, and conditions.

Trustworthiness score gives the borrowers scores

from the system after registering with a default value

for the first time. The recommendation provides the

borrowers with a person who can give good

recommendations to propose some loans. An

essential part of our lending platform is a

recommendation that aims to reduce dependence on

collateral. Some borrowers’ users give good

comments. The number of other users who make

recommendations will cause the loan application to

be granted or not. Investors will get a message that

there are new borrowers who are recommended to be

given loans. So that may help convince investors to

approve their loans.

There will be no credit score when creating an

account, but the borrower can apply for a loan with a

certain amount. The system will detect someone who

requested a loan. The investors will see an

opportunity, so there may be several prospective

investors to provide loans. Investors may decide to

bear the risk depending on the borrower’s profile.

Smart contracts as a legal agreement (investors and

borrowers) are the core of the lending platform that

we are proposing. Trustworthiness score and

recommendations are significant factors in lending in

this platform that can reduce collateral dependence.

3.5 Calculating the Trustworthiness

Score

The trustworthiness score that we propose is a value

of borrowers set by the smart contract so that both

parties understand each other’s obligations and risks

that will be accepted. The variables include profile

score, activity score, social recommendation score,

and loan risk score as shown in Equation (1). The

borrowers can request some loans with their

trustworthiness score, which will determine the

maximum loan. Trustworthiness scores will increase

alongside the track record of payments from

borrowers. The value will get better, and the borrower

has the opportunity to get a larger loan in the next

submission. The system will reduce the

trustworthiness score if the investors and

recommenders give a bad report to borrowers.

On the other hand, if investors get a borrower who

has a good commitment, they may profit. The

borrower will get a high trustworthiness score, so it

will be easier to request loans in the next cycle with

increasing loan plan limits. The smart contracts

management at borrowers, lenders/investors, and

recommenders’ sides will handle each functionality

from the available services on the Ethereum-based

blockchain.

3.6 Sidechains and Ethereum

We propose reducing users’ burden by installing the

sidechains on the mobile application side in this

lending platform. DApp platform lending platform

Ethereum-based can handle complex transactions.

The users feel more confident in making transactions.

Setting up a recommendation to support the lending

process and establishing a high level of trust—

allowing users who have already done a transaction

SECRYPT 2021 - 18th International Conference on Security and Cryptography

842

without additional costs for making the same

transaction will reduce the cost burden on making

transactions. It can also control users’ traffic

(investors and borrowers) of this lending platform. It

allows the user to download only the application

client so that it is unnecessary to download the whole

Ethereum-based lending platform and reduce the

exchanged messages (transactions) through the

internet to access the main blockchain (e.g.,

connectivity problems, internet not available). The

weaknesses are to perform off-chain transactions will

be increasing transaction time because all members

must be approved. Transaction queueing will occur

because each transaction needs action requires from

other users and will impact additional time to process.

Blockchain technology is a combination of trust

and consensus in a legal agreement between investors

and borrowers, so there is no need to represent data,

processes, and transactions on the blockchain to

increase trust’s expected value. The permissioned

blockchain makes it possible to give privilege to all

users (investors and borrowers), as described in one

infrastructure that is complete. Users can obtain

permission only through various applications and

integration of multiple components, such as security,

speed, immutability, scalability, resilience, and

trustworthiness, including ledgers that cannot be

changed except through the consensus.

3.7 Smart Contracts

On our lending platform, smart contracts will regulate

conditions from the borrowers’ and investors’ sides,

as well as determine the business logic from the

borrowers’ side to propose a loan. Investors can

capture demand signals to offer an agreement

between borrowers and investors regarding interest

and other fees (also called gas) until both parties set

up a contract. Our lending platform is allowed to

maintain an access control layer (lending

management) compared to existing blockchain-based

lending. Users enable specific actions to be carried

out only by individual investors or borrowers that can

be identified and possibly with predetermined access

rights. This smart contract requires a communication

model to define a legal agreement as a smart contract.

In addition, the direct involvement of investors

and borrowers in managing this lending platform can

reduce the risk of failure associated with the

execution of smart contracts and regulate the

conditions for the existence of privilege given to each

user (investor and borrower side) to keep the service

running in the long run and the investor and borrower

sides does not need to download the whole

blockchain of a lending platform for the client.

4 CONCLUSION

We propose a personal lending platform that

minimizes collateral by introducing a trustworthiness

score and replacing the guarantor with a

recommendation from family members, colleagues,

peers, and small businesses. The transactions are

conducted with smart contracts as an enforceable

agreement between the borrowers and the

lenders/investors. A recommendation will support

trustworthiness scores at the borrowers’ side and give

decision-making at the investors’ side. The platform

is designed as Blockchain Decentralized Application

(DApp), a rapidly growing technology, especially for

fintech. The DApp architecture enables borrowers

and lenders to transact in a P2P manner, thus

eliminating the disadvantages of a centralized loan

process.

ACKNOWLEDGEMENTS

The first author wishes to acknowledge the MORA

Scholarship from the Indonesian Government, which

partially supports and funds this research work.

REFERENCES

Abdou, H. A., Tsafack, M. D. D. D., Ntim, C. G., & Baker,

R. D. (2016). Predicting creditworthiness in retail

banking with limited scoring data. Knowledge-Based

Systems, 103, 89–103. https://doi.org/10.1016/

j.knosys.2016.03.023

Anagnostopoulos, I. (2018). Fintech and regtech: Impact

on regulators and banks. Journal of Economics

and Business, 100 (June 2017), 7–25.

https://doi.org/10.1016/j.jeconbus.2018.07.003

Arya, S., Eckel, C., & Wichman, C. (2013). Anatomy

of the credit score. Journal of Economic

Behavior and Organization, 95(47783), 175–185.

https://doi.org/10.1016/j.jebo.2011.05.005

Bartoletti, M., Cimoli, T., Pompianu, L., & Serusi, S.

(2018). Blockchain for social good: a quantitative

analysis. 37–42. https://doi.org/10.1145/3284869.32

84881

Bilbao, B., & Argentaria, V. (2018). Top blockchain

projects related to loans : SALT Lending - Crypto-

collateral lending.

Collateral-Free Trustworthiness-based Personal Lending on a Decentralized Application (DApp)

843

Capital, G. (2018). Unsecured Business Loans Without

Collateral. Retrieved from https://gudcapital.com/

unsecured-business-loans-without-collateral/

Capital, G. (2021). Rates, Terms & Speed of Funding.

Retrieved from https://gudcapital.com/types-of-

business-loans/

Dingman, W., Cohen, A., Ferrara, N., Lynch, A., Jasinski,

P., Black, P. E., & Deng, L. (2019). Defects and

vulnerabilities in smart contracts, a classification using

the NIST bugs framework. International Journal of

Networked and Distributed Computing, 7(3), 121–132.

https://doi.org/10.2991/ijndc.k.190710.003

Jagtiani, J., & John, K. (2018). Fintech: The Impact on

Consumers and Regulatory Responses. Journal of

Economics and Business, 100, 1–6. https://doi.org/

10.1016/j.jeconbus.2018.11.002

Liang, L.-W. W., Huang, B.-Y. Y., Liao, C.-F. F., & Gao,

Y.-T. T. (2017). The impact of SMEs’ lending and

credit guarantee on bank efficiency in South Korea.

Review of Development Finance, 7(2), 134–141.

https://doi.org/10.1016/j.rdf.2017.04.003

Malik, M., & Thomas, L. C. (2012). Transition matrix

models of consumer credit ratings. International

Journal of Forecasting, 28(1), 261–272.

https://doi.org/10.1016/j.ijforecast.2011.01.007

Mammadli, S. (2016). Fuzzy Logic Based Loan Evaluation

System. Procedia Computer Science, 102(August),

495–499. https://doi.org/10.1016/j.procs.2016.09.433

Martínez Sánchez, J. F., & Pérez Lechuga, G. (2016).

Assessment of a credit scoring system for popular bank

savings and credit. Contaduria y Administracion, 61(2),

391–417. https://doi.org/10.1016/j.cya.2015.11.004

Milian, E. Z., Spinola, M. de M., & Carvalho, M. M. d.

(2019). Fintechs: A literature review and

research agenda. Electronic Commerce Research

and Applications, 34 (September 2018).

https://doi.org/10.1016/j.elerap.2019.100833

Norta, A., & Leiding, B. (2019). Lowering Financial

Inclusion Barriers With a Blockchain-Based Capital

Transfer System. Infocom, 1–6.

Pokorná, M., & Sponer, M. (2016). Social Lending and Its

Risks. Procedia - Social and Behavioral Sciences,

220(March), 330–337. https://doi.org/10.1016/

j.sbspro.2016.05.506

Setiawan, N., Suharjito, & Diana. (2019). A Comparison of

Prediction Methods for Credit Default on Peer to Peer

Lending using Machine Learning. Procedia Computer

Science, 157, 38–45. https://doi.org/10.1016/

j.procs.2019.08.139

Shao, Q. F., Jin, C. Q., Zhang, Z., Qian, W. N., & Zhou, A.

Y. (2018). Blockchain: Architecture and Research

Progress. Jisuanji Xuebao/Chinese Journal of

Computers.

https://doi.org/10.11897/SP.J.1016.2018.00969

Shen, F., Zhao, X., & Kou, G. (2020). Three-stage reject

inference learning framework for credit scoring using

unsupervised transfer learning and three-way decision

theory.

Decision Support Systems, 137(July), 113366.

https://doi.org/10.1016/j.dss.2020.113366

Statista. (n.d.). Value of global P2P loans 2012-2025.

Retrieved from https://www.statista.com/statistics/

325902/global-p2p-lending/

Tang, H. (2019). Peer-to-Peer Lenders Versus Banks:

Substitutes or Complements? Review of Financial

Studies, 32(5), 1900–1938. https://doi.org/10.1093/

rfs/hhy137

Token, A. (2018). WeTrust Whitepaper Table of Contents.

Bravenewcoin.Com, (January). Retrieved from

https://bravenewcoin.com/assets/Whitepapers/WeTrus

tWhitePaper.pdf

Tran, K. C. (2019). Ultimate Guide to Ethereum Lending:

ETHLend, MakerDAO, BlockFi, SALT, Dharma &

Compound. Retrieved from https://blokt.com/guides/

ethereum-lending

Tunç, A. (2019). Feature Selection in Credibility Study For

Finance Sector. Procedia Computer Science, 158, 254–

259. https://doi.org/10.1016/j.procs.2019.09.049

Yang, Q., & Lee, Y.-C. (2016). Critical Factors of the

Lending Intention of Online P2P: Moderating Role of

Perceived Benefit. Proceedings of the 18th Annual

International Conference on Electronic Commerce: E-

Commerce in Smart Connected World, 15:1--15:8.

https://doi.org/10.1145/2971603.2971618

Zhao, H., Ge, Y., Liu, Q., Wang, G., Chen, E., & Zhang,

H. (2017). P2P lending survey: Platforms, recent

advances and prospects. ACM Transactions on

Intelligent Systems and Technology, 8(6), 1–28.

https://doi.org/10.1145/3078848

Zhong, L., Wu, Q., Xie, J., Guan, Z., & Qin, B. (2019). A

secure large-scale instant payment system based on

blockchain. Computers and Security, 84, 349–364.

https://doi.org/10.1016/j.cose.2019.04.007

SECRYPT 2021 - 18th International Conference on Security and Cryptography

844