A Preliminary Analysis of the Use of Valuation Methods by

Technology Transfer Offices

António Rocha

1a

, Fernando Romero

2b,*

, Manuela Cunha

1c

, Rui Lima

2d

and Marlene Amorim

3e

1

IPCA Polytechnic Institute of Cávado and Ave, Vila Frescainha S. Martinho, Barcelos, Portugal

2

Centro ALGORITMI, School of Engineering, University of Minho, Guimarães, Portugal

3

GOVCOPP, Governance Competitiveness and Public Policies, University of Aveiro, Aveiro, Portugal

Keywords: Technology Transfer, Technology Evaluation and Licensing, University and Industry Relation, Innovation.

Abstract: Valuing invention disclosures in universities involves an assessment of research outcomes that go well beyond

the opportunity to make financial profits. Valuation is also about determining what technical solutions are

worth, either in terms of technical and scientific achievements but overall, what benefits does it bring to

industry and the larger society. The good use of valuation methods to estimate and predict the outcomes of

continuing to invest in the technical solution, is a major issue addressed by universities’ Technology transfer

Offices (TTOs), which have to decide whether to file or not a patent to enforce industrial property rights and

to gain the exclusivity to use and grant exploration rights over the new technical solution. University

Technology Transfer Offices, in close connection with the research teams, must also make decisions regarding

the technology roadmap and what avenues of investment will be used, and what valorisation routes will bring

greater benefits to move the technology to industry where the results are developed into new products,

compounds or systems or even services that benefit multiple stakeholders. This paper provides evidence on

what are the main technology valuation methods in use by technology transfer offices. Qualitative and

quantitative data has been collected by surveying eight Portuguese University TTOs. The statistical data has

been treated using the one-sample T-test to identify the most common technology valuation methods. From

the data it was possible to conclude that rating/ranking methods and models are the most frequently used

valuation methods, followed by market valuation approaches. Previous agreements and discounted cash-flow

projections are mainly used when a spin-off firm is under consideration or when there is a manifestation of

interest from a potential investor. Royalty standards are used to prepare licensing negotiations, and Real

Options, Monte Carlo simulation and Auctions are hardly ever used.

1 INTRODUCTION

Technology transfer corresponds to the process of

transferring technical solutions and scientific and

technological knowledge from one organization to

another, with the aim of harnessing and exploring

research results in favour of the development of

science, technology, economy, industry and society.

Technology transfer processes in universities are

often carried out by research team members in close

a

https://orcid.org/0000-0003-0863-6567

b

https://orcid.org/0000-0002-7540-8540

c

https://orcid.org/0000-0002-7709-8777

d

https://orcid.org/0000-0002-7991-0132

e

https://orcid.org/0000-0002-0901-0614

* Corresponding author

collaboration with Technology Transfer Offices

(TTOs) and interested companies.

TTOs promote the use of R&D results through the

evaluation and protection of intellectual property

rights and through the dissemination of information,

the negotiation of technology transfer agreements and

the support for the creation of spin-off companies

(start-up companies created to explore research

results). TTOs also proceed to the administration and

monitoring of licensing and material transfer

136

Rocha, A., Romero, F., Cunha, M., Lima, R. and Amorim, M.

A Preliminary Analysis of the Use of Valuation Methods by Technology Transfer Offices.

DOI: 10.5220/0010599901360143

In Proceedings of the 18th International Conference on e-Business (ICE-B 2021), pages 136-143

ISBN: 978-989-758-527-2

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

contracts, to the management of university equity

participations, and they are responsible for collecting

and sharing revenues from technology transfer

agreements.

The stronger the bound between the technology

transfer offices and researchers, the more efficient

they are in establishing a relationship of cooperation,

which paves the way to encourage researchers to

provide regular information about their research

activities and results.

The invention disclosure triggers the valuation

process to define the protection and

commercialization strategy for the new technical and

knowledge solution, which must combine its unique

characteristics with the needs and interests of the

organizations concerning economic, scientific,

industrial and societal development dimensions. The

acquisition of technology and its transformation into

new or improved products and processes reinforces

the organizations’ competitive advantages, either by

(1) gaining solutions not owned by other companies,

(2) updating and improving their range of products

and services, or (3) by answering to specific customer

needs that other companies do not serve. The

acquisition of intellectual property rights may also

enhance the possibly of developing better quality

solutions or more competitive solutions either in

terms of industrial manufacturing savings or in terms

of the costs associated with the commercialization

process.

To further expand our knowledge regarding

valuation processes used in technology transfer this

paper provides evidence on what are the main

technology valuation methods in use by Portuguese

university Technology Transfer Offices.

2 METHODOLOGY

The heads of staff of eight Portuguese University

Technology Transfer Offices have been inquired by

employing a semi-structured survey.

The eight TTOs that answered the semi-structured

survey are linked to eight Portuguese Universities:

1. TecMinho, University of Minho;

2. UPIN, University of Porto;

3. UATEC, University of Aveiro;

4. DITS, University of Coimbra;

5. Innovation and Development Office, University

of Beira Interior;

6. RIA – Research and Innovation Accelerator,

University Nova of Lisboa;

7. Technology Transfer Office, University of

Évora;

8. CRIA, University of Algarve;

This sample was purposefully chosen due to the

high regional and national influence of the

universities, and to the experience and ability of the

TTOs to provide data that would expand the

understanding of technology transfer processes. Five

out of the eight universities appear regularly in world

rankings of the top 1000 universities (CWUR, 2019).

The semi-structured survey was focused on

technology valuation methods. A Likert scale has

been used to classify the frequency of each method.

The higher the value the higher was the frequency of

use, in a scale between 1 and 5.

A statistical analysis was done using one-sample

T-tests for the means of relevant variables. IBM SPSS

Statistics 19 was used to perform this analysis.

As a framework for the one-sample T-test

analysis we used throughout the article two

hypotheses, considering a 95% confidence interval:

H0 – the average frequency is equal to 4, meaning

that the method is quite frequently used.

H1 – the average frequency is not equal to 4,

meaning that the method is not quite frequently used.

This approach lend us the opportunity to get to

know the frequency of use of different valuation

methods used by Portuguese University technology

transfer offices.

3 INVENTION DISCLOSURE

AND VALUATION METHODS

IDENTIFICATION

Technology evaluation is a task that sweeps across

different moments of the technology transfer process.

From the invention disclosure until the negotiation

valuation methods are used. At an initial stage,

methods based on rating/ranking scales or on brief

assessment models are frequently used. At a later

stage, more in-depth valuation models are used like

the projection of discounted cash flows.

Among the valuation practices assuming greater

importance to understand the new technical solution

are (Rocha, 2009): (1) Analysis and description of the

technology, including its maturity level, claims and

identification of all possible applications; (2)

Analysis of further development stages, sources of

finance and the definition of a roadmap to bring the

technical solution to market; (3) Assessment of the

A Preliminary Analysis of the Use of Valuation Methods by Technology Transfer Offices

137

technical solution innovativeness and possibility to be

redesigned (at what cost, time and technical and legal

risks) to decide whether to patent; (4) Competitive

advantages of the technical solution relative to

comparable technologies.

To assess the value of a technical solution, we

must get to know every aspect of the invention and all

tasks to prove the technology-concept must be

clarified to define the steps ahead and a value

proposition. The proof of the technology-concept is

essential to identify its applications, potential market

and commercialization value. Having this

assessment, the most promising applications must be

selected, and licensing efforts must start. To this end,

a market study makes possible to establish the bound

between technology, its applications and its market,

identifying the end consumers and their needs, and

identifying competing companies and applications.

The information gathered is used to screen the

technology applications that might have better

acceptance, and it also provides information to define

the technology value proposition to market, attract

and start negotiations to license the technical solution.

To value the invention and its market potential,

there are several methods with different levels of

depth that can be used at different stages of the

technology transfer process.

The most common valuation methods according

to Razgaities (2007) are:

‐ Rating/Ranking methods to determine

valuation;

‐ Market value assessment;

‐ Valuation based on technology costs;

‐ Evaluation based on development costs;

‐ Economic value assessment;

‐ Valuation rules of thumb;

‐ Real options and Monte Carlo valuation;

‐ Valuation through auctions.

4 VALUATION METHODS

4.1 Analysis and Description of the

Technology

The application of valuation methods implies a close

review of the technical solution. With this aim the

Technology Transfer Offices screen several

considerations. In here some of those considerations

are briefly presented.

To thoroughly understand the invention the

TTOs, together with the research team, perform an

analysis and description of the technology, its

attributes and claims, to identify new development

stages and to define an action plan or an industrial

roadmap specifying what to do and what can be done

to bring the technology to market (see Table 1, a, c

and d). They also carry-out a patent search to figure-

out if it is new, unique and has industrial application,

and if there are other technical solutions with the

same scope of applicability or targeting same

purposes. Simultaneously the information from this

search is used to assess patentability, to figure-out

how the patent claims and applications must be

described to enforce protection rights, and to identify

the strongest links between the invention, its

applications and its market (see Table 1, b and e).

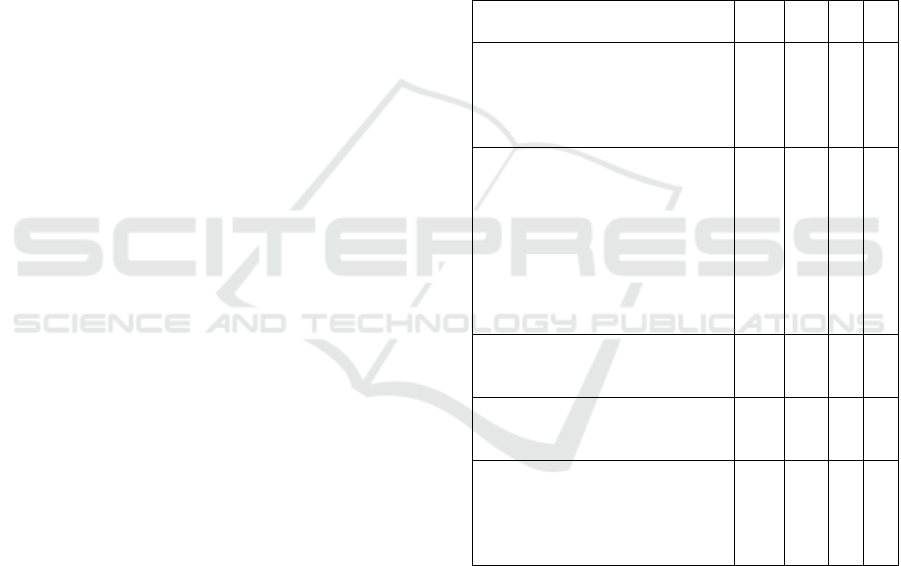

Table 1: Invention analysis and patentability.

Results: One-sample T-test Test-

value = 4

p-

value

t-

value

Ave

ra

g

e

Std.

D

ev.

a) Support in the identification of

new technology development stages

and the definition of an action plan

to gather the necessary resources

for its implementation

0,516 -0,68 3,8 1,0

b) Analyse with the research team

all product alternatives and

technological applications,

seeking to determine what

applications or products have a

stronger relationship between

technology, product and market to

define the protection strategy and to

identify potential licensees

0,351 1,00 4,3 0,7

c) Assess the technology maturity

(Little achieved? Reduced to

p

ractice? Commerciall

y

p

roven?

0,763 0,317 4,1 1,1

d) Identify the availability of public

funding sources to continue the

technolo

gy

develo

p

ment

0,732 0,357 4,1 1,0

e) Assess whether protecting

intellectual property rights creates

an efficient and effective

barrier against current and potential

alternatives

1,00 0,00 4,0 0,8

TTOs want to know every aspect of the invention

to clarify all tasks necessary to obtain the invention

proof of concept (if not already attained) and to obtain

a complete commercial product. With this aim,

several assessment considerations must be

thoroughly analysed. Table 2 presents the most

frequent practices carried out by TTOs to evaluate the

technical solution and its market to gain information

for further stages of the technology transfer process

and also to be used as a baseline for the application of

valuation methods.

ICE-B 2021 - 18th International Conference on e-Business

138

After all aspects of the invention have been

understood, and after having done initial insights

regarding the invention market, a more in-depth

analysis is performed by applying technology

valuation methods.

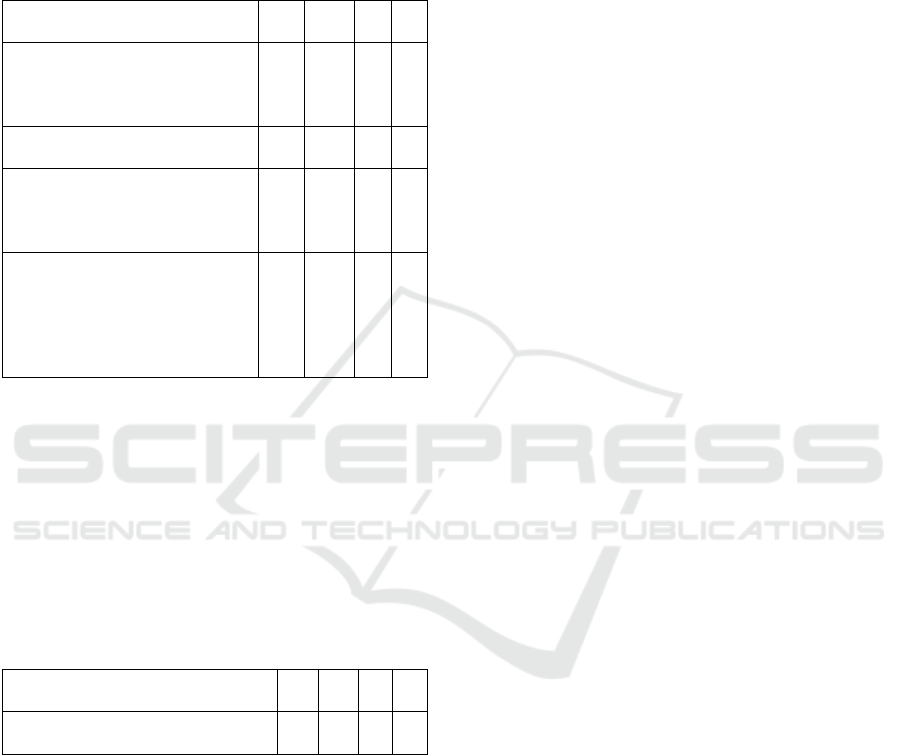

Table 2: Invention analysis and its market.

Results: One-sample T-test Test-

value = 4

p-

value

t-

value

Ave

ra

g

e

Std.

Dev.

a) Assess to what extent there is a

technology demand from

companies or from target

markets

(

market

p

ull

)

1,00 0,00 4,0 1,1

b) Prepare the technology value

p

roposition

1,00 0,00 4,0 1,3

c) Analyse the possibility of

licensing the technology to an

organization willing to assume the

costs of later develo

p

ments

1,00 0,00 4,0 0,8

d) Analyse whether the technology

can improve production factors

(avoid or reduce costs, promote

stability and ease of production,

increase scalability and production

s

p

eed, or im

p

rove

p

roduct

q

ualit

y)

0,516 -0,683 3,8 1,0

4.2 Rating/Ranking Methods to

Determine Valuation

The rating/ranking methods are based on checklists

and on pre-defined models to speed up the evaluation

process considering multiple dimensions, from its

intrinsic quality to its market potential and

profitability. These methods are the most widely used

in the evaluation of invention disclosures.

Table 3: Pre-defined evaluation models.

Results: One-sample T-test Test-

value = 4

p-

value

t-

value

Ave

ra

g

e

Std.

D

ev.

Predefined evaluation models and

matrices

0,329-1,04 3,4 1,7

In Table 3, the test presents a p-value=0,329 with

a t=-1,04 which means that we do not have evidence

to reject the null hypothesis, meaning that the average

frequency does not differ significantly from 4, a quite

frequent practice.

Some of these models and matrices are:

a) TEC algorithm, phase 1 functional assessment,

developed by the North Carolina State

University. This tool aims to find the strongest T-

P-M (Technology-Product-Market) connections.

A market study is carried out to verify whether

the product concepts derived from the

technology are viable and have potential to be

licensed and valued.

b) EPO IPscore, is a tool to evaluate patents,

technologies and research projects, available at

the European Patent Office website. This tool can

be used to (1) evaluate patent portfolios,

individual patent applications and granted

patents; (2) analyse complex patented

technologies; (3) assess research projects before

filing a patent application. IPscore has 32 factors

grouped in four categories (legal status,

technology, Market conditions and finance), and

the results are presented in a ranking radar graph.

c) IPR Valuation checklist, developed by the UK

Intellectual property Office, consists of sixty

questions devised to help realise the value of IPR

to assess and discussions with potential

licensees.

d) COAP – Commercial Opportunities Appraisal

Process, developed by Warwick University, in

which ten evaluation criteria are scored;

e) Quicklook Commercialization Assessment,

developed by the University of Texas, consisting

in a four steps study allowing the collection of

information to prepare a final report about the

technology commercial potential.

f) Checklist of 100 important considerations in

setting value of technology license, by Tom

Arnold and Tim Headley presented by Razgaitis

(2007). This checklist includes an assessment in

nine categories: (1) Intrinsic quality; (2)

Protections and threats of protection; (3) Market;

(4) Competitiveness; (5) Value brought to the

table by the licensee; (6) Finance; (7) Risk; (8)

Legal issues; (9) Government regulatory

considerations.

Some TTOs have also created their own pre-

defined evaluation models that usually group a set of

criteria into six major categories: technology stage of

development, intrinsic quality, market potential,

strategic importance, patentability and profitability.

4.3 Market Value Assessment

The market approach consists of obtaining

information about the invention market to estimate its

value, using, usually, the analysis of predecessor or

competing inventions, technologies and products,

when existing, and the observation of (1) comparable

agreements, (2) market values and (3) standard

payments practiced in the industrial sector. This

approach is very frequent alongside the use of

ranking/rating methods.

A Preliminary Analysis of the Use of Valuation Methods by Technology Transfer Offices

139

The analysis of previous licensing agreements

(Table 4, a) and payment values practiced in industry,

known as royalty standards (Table 4, b), may provide

guidance to define and defend the payments structure

and its value during the negotiation of a technology

transfer agreement (WIPO/ITC, 2005; Nabulsi & Belt

2015; Stevens, 2016; Pressman et al, 2017; Heiden &

Petit, 2017). The search for comparable licensing

agreements and royalty standards is an effort which

usually pays-off (Razgaities, 2003), although the

specificity of each technology does not call for

standard agreements. However, it is important for the

TTOs to build and maintain a portfolio of reference

agreements which can be used if needed (Dodds &

Somersalo, 2007).

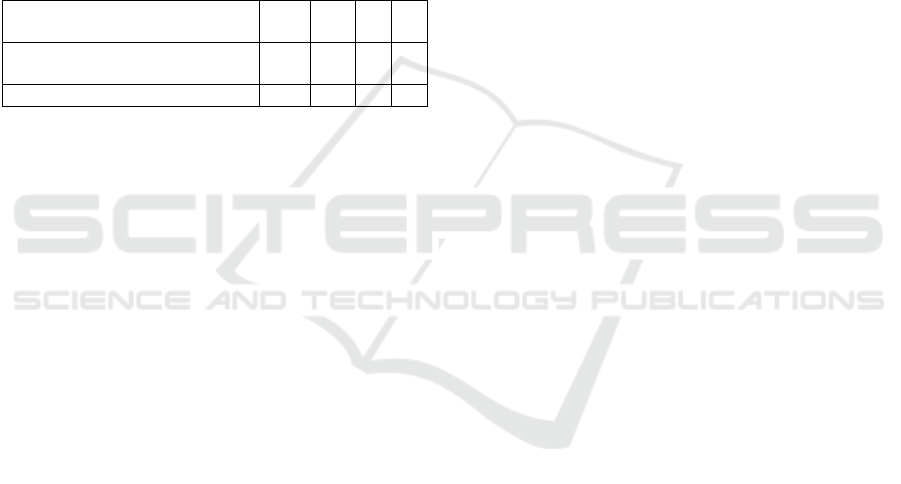

Table 4: Industry standards assessment.

Results: One-sample T-test Test-

value = 4

p-

value

t-

value

Ave

rage

Std.

Dev.

a) Comparable agreements 1,00 0,00

3,8

0,9

b

) Royalty standards 1,00 0,00 4,0 0,9

The results in Table 4, show that for a) and b) we

do have evidence to accept the null hypothesis,

meaning that their average frequency by Portuguese

TTOs does not differ significantly from 4, a quite

frequent method.

4.4 Valuation based on Technology

Costs

The cost approach aims to quantify the costs incurred

to obtain a technology. However, knowing how much

it cost does not mean we know how much it is worth.

This approach can be used before the start of a project

to estimate future costs or to determine if it is worth

to license a technology instead of further developing

it into a product or to create a spin-off firm to value

the investment done or to be done.

Evaluation based on development costs is rarely a

base on which firms negotiate licensing agreements

(Razgaities, 2003; Lagrost, 2010). Firms are

interested in obtaining technology in an easy and

cheaper way than it would cost if they developed the

technology by themselves, and the cost of creating a

technology may have little to do with its value

(Speser, 2006). The evaluation based on development

costs should not be used to put a price on a

technology.

The evaluation of the technology development

costs for a Test-value equal to 4, the null hypothesis

is rejected, the average frequency is not equal to 4,

meaning that the evaluation of the technology

development costs is not very frequently used by

TTOs.

4.5 Economic Value Assessment

The economic approach consists of forecasting the

profits from the technology license from a certain

period to derive financial return metrics, such as the

return on investment, the payback period, the internal

rate of return and the net-present value considering

specific hurdle rates, that some time can be rather

high, for example, they may reach 30% due to the

investment risk involved (Razgaities, 2003).

The economic approach uses the discounted cash-

flow method to deal and license technology (Degan

& Horton, cited by Kemmerer and Jiaquing, 2008).

The discounted cash-flow calculus is important for

business profitability discussions and to provide a

basis for setting up royalties and other payments. It is

also important when the deal involves a single lump

sum payment for the utilization of a technology

during a specified period of time, or when the creation

of a firm is under consideration, providing a basis for

equity participation (Parr, 2007).

The discounted cash-flow method when tested

with the On-sample T-test for a Test-value equal to

4, the null hypothesis is rejected, the average

frequency is not equal to 4, meaning that the

discounted cash-flows is not very frequently used by

the TTOs.

4.6 Valuation Rules of Thumb

The 25% rule divides the value of technology into

four parts, according to Razgaities (2003): (1) the

creation of the invention, (2) the preparation of the

invention for its industrial reproduction, (3) the

industrial reproduction of the invention, and (4) the

sale of the invention by itself or incorporated into a

larger product or platform. Each of these parts

represents a quarter of the value of the invention, in

this sense, the creation of the invention is one of four

parts (25%) through which the value and the

commercialisation process of the invention is

distributed. If the invention is ready to be reproduced

on an industrial scale, it makes sense to define a value

of 33% or higher, this argument is that the technology

has already reached a portion of the production

component, in this way, the production itself and the

marketing-sales yet to be made are the two big steps

out of three that must be taken, so the technology is

two-thirds of the way. In the case of software, these

values can ascend to 50%, if the technology is ready

for commercialization (Grandstrand, 2006).

ICE-B 2021 - 18th International Conference on e-Business

140

The 25% rule is usually applied to the EBIT –

Earnings before interests and taxes (Kemmerer &

Jiaquing, 2008), suggesting that the licensee pays a

fee equivalent to 25% of the invention contribution to

the operational results obtained by the product that

embodies the technology.

The 25% rule when tested with the On-sample T-

test for a Test-value equal to 4, the null hypothesis is

rejected, the average frequency is not equal to 4,

meaning that the use of the 25% rules is not a very

frequently used by the TTOs.

4.7 Real Options and Monte Carlo

Valuation

The real options method evaluates multiple

assumptions involved in a cash-flow projection,

having each assumption different levels of

uncertainty for which risk-adjusted hurdle rates are

defined. This is a complex and time-consuming

approach, but it contributes to a more complete

analysis of the investment return (Soares, et al., 2007;

Lazzolino, 2015). Other authors like Speser, 2006

tells us that real options make the evaluation process

unnecessarily complicated, and they do not provide

an accurate and precise assessment regarding the

profitability of the technology. The author adds that

real options work better for planning R&D or

developing IP strategies, than they do for preparing

deal making processes. The Monte Carlo simulation

is a probabilistic model that generates multiple

scenarios regarding the profitability of the investment

and the probability of attaining a predefined critical

value.

The real options and the Monte Carlo simulation

method are not frequent methods in use by the TTOs:

both methods when tested with the One-sample T-test

for Test Value equal to 4, the tests present a p-

value=0,000 with a t=-9,354, and their average

frequency of use is 1,5 which means that we do have

evidence to reject the null hypothesis, real options and

the Monte Carlo simulation method are not frequently

used by the TTOs.

4.8 Valuation through Auctions

Patent auctions are used to transfer the technology by

interacting with multiple investors on a bidding

process. Patent auctions are gaining increasing

importance on technology transfer processes (Jarosz,

2010). Auctions may be a quick way to

commercialize patents, provided they are of high

quality (EPO, 2008). Auctions can be a way to license

patents that otherwise would fall for absence of

payments of patent fees. The planning of auction

events requires a considerable organization and

advertising effort and it is not easy to have several

bids for just one piece of technology (Perchorowicz

et al, 1991).

Patent auctions are not frequent: when tested with

the one-sample T-test for Test Value equal to 4, the

test presents a p-value=0,000 with a t value of -

16,803, and their average frequency of use is 1,25

which means that we do have evidence to reject the

null hypothesis, patent auctions are not frequently

used by the TTOs.

5 VALORIZATION ROUTES

The valuation methods to be used are also linked to

the routes of valorization that are defined for the

technical solution. Those routes include the

establishment of licensing agreements, the sale of

intellectual property rights, the creation of spin-offs

or joint ventures and the establishment of research

and cooperation agreements, that might include

CRADAS – Cooperation Research and Development

Agreement, MTAs – Material Transfer Agreements

and NDAs – Non-disclosure Agreements, which

allow the University to keep control of the technology

and at the same time access the resources, knowledge

and technology from other Research, Development

and Innovation parties to continue or to develop new

R&D+I projects.

A licensing agreement creates contractual rights,

duties and obligations between the University and the

licensor, which regulate their relationship in a legally

binding manner. Exclusive licensees may be granted,

for use (purpose and application) and for territorial

exploitation. Alternatively, non-exclusive licenses

can be granted for any scope of use or territory, and

the University may, in any case, reserve the right of

exploitation for himself, provided that this possibility

is explicit in the transfer agreement.

The sale of a technology or patent must be

considered as an option when this asset is peripheral

to the University or firm activities and is not

necessary to further develop new knowledge and

technology. Selling the technology or patent should

also be considered when there is no intention on

creating a spin-off company to gain profit from it.

The creation of a spin-off company is the right

option when there is a proof-of-concept, and

particularly when it is possible to develop a full

product that can demonstrate its worth and

applicability. The creation of a spin-off company is a

good option when licensing is a less profitable

A Preliminary Analysis of the Use of Valuation Methods by Technology Transfer Offices

141

strategy and when it is not likely to be found a suitable

licensor to value the technology applications.

After reviewing the valorization routes, decisions

must be taken to protect or not to protect the technical

solution and to devise a roadmap to make it valuable.

The good use of information available in patent

directories can reduce the costs and time of R&D

projects and gives access to information about the

changes that have occurred in the field of the

invention and information about patents with the

same purpose of the invention, if existent (Smith,

2005).

6 CONCLUSIONS

Valuation methods can be used in different stages of

the evaluation process. At an initial stage, preparatory

to file a patent application, patent databases are

extensively used, to understand the invention and the

state of the art, scoring matrices and rapid report

models are used to understand the invention technical

and market potential. At a later stage, usually when

there is a manifestation of interest from a company,

technology transfer professionals, tend to use market

and economic value assessment methods, to prepare

negotiations.

This article provides a comprehensive assessment

of the valuation methods used by Portuguese

technology transfer offices, which lead us to conclude

that rating/ranking methods to determine valuation

are the most frequent methods in use, followed by

market value assessment methods, such as looking for

comparable technical solutions, and making market

forecasts for the technology at hands.

Previous agreements and discounted cash-flow

projections are mainly used when a spin-off firm is

under consideration or when there is a manifestation

of interest from a company.

Royalty standards may be used to support the

definition of the agreement payment structure and

figures.

Rules of thumb are hardly ever used, since there

are doubts regarding its reliability, and because every

agreement is unique values can vary according to the

rights granted, the invention development stage,

production and distribution requirements and other

constraints. Real options and Monte Carlo simulation

are also hardly ever used. Technology transfer

professionals prefer valuation methods that are

simple and faster to assess the technology value.

To reinforce these conclusions, and to overcome

one of the main limitations of this study, one avenue

of research would be to expand it by including not

only technology transfer offices from Portuguese

universities but also from other countries.

Furthermore, the study of the value created by

licensing agreement should be explored in search of a

possible correlation between technology licensing

and its impact over research teams and technology

transfer offices performance and financial

profitability. These research lines would create the

opportunity to better understand the application of

technology valuation methods and the overall impact

of university-industry relations on the outcomes of

research teams and technology transfer offices.

ACKNOWLEDGEMENTS

This work has been supported by FCT – Fundação

para a Ciência e Tecnologia within the R&D Units

Project Scope: UIDB/00319/2020.

REFERENCES

CWUR (2019). Center for World University Rankings.

https://cwur.org/2018-19.php

Dodds, J. and Somersalo, S. (2007). Practical

Considerations for the Establishment of a Technology

Transfer Office. In A. Krattiger, R.T. Mahoney, L.

Nelsen & A. B. Bennett, Satyanarayana, K., Graff, G.

D., Fernandez, C., & Kowalski, S. P. (Eds.),

Intellectual Property Management in Health and

Agricultural Innovation: A Handbook of Best Practices,

Vol. 1 and 2 (pp. 575-579). MIHR and PIPRA.

EPO (2008). Patents up for auctions. European Patent

Office.

Grandstrand, O. (2006). Fair and reasonable royalty rate

determination. When is the 25% rule applicable? Les

Nouvelles, September, 179-181.

Heiden, V. and Petit, N. (2017). Patent Trespass and the

Royalty Gap: Exploring the Nature and Impact of

“Patent Holdout”. Hoover Institution Working Group

on Intellectual Property, Innovation, and Prosperity,

Stanford University.

Jarosz, J., Heider, R., Bazelon, C., Bieri, C. and Hess, P.

(2010). Patent Auctions: How Far Have We Come?

Patent auctions. Les Nouvelles, September.

Kemmerer, J. E. and Lu, J. (2008). Profitability and Royalty

Rates Across Industries: Some Preliminary Evidence.

KPMG Global Valuation Institute. https://ssrn.com/

abstract=1141865 or http://dx.doi.org/10.2139/ssrn.11

41865

Lagrost, C., Martin, D., Dubois, C. and Quazzotti, S.

(2010). Intellectual property valuation: how to

approach the selection of an appropriate valuation

method. Journal of Intellectual Capital, 11(4), 481-

503.

ICE-B 2021 - 18th International Conference on e-Business

142

Lazzolino, G. and Migliano, G. (2015). The Valuation of a

Patent through the Real Options Approach: A Tutorial.

Journal of Business Valuation and Economic Loss

Analysis, 10(1), 1-18.

Nabulsi, B. and Belt, E. (2015). The patent is dead; long

live the royalties!. VIVO – The business and Medicine

Report. Informa Business information Inc.

Parr, R. L. (2007). Royalty Rates for Licensing Intellectual

Property. John Wiley & Sons.

Pressman, L., Planting, M., Yuskavage, R., Okubo, S.,

Moylan, C. and Bond, J. (2017). The Economic

Contribution of University/Nonprofit Inventions in the

United States. Association of University Technology

Managers and Biotechnology Innovation Organization.

Razgaities, R. (2003). Valuation and Pricing of

Technology-Based Intellectual Property. John Wiley &

Sons.

Razgaitis, R. (2007). Pricing the Intellectual Property of

Early-Stage Technologies: A Primer of Basic Valuation

Tools and Considerations. In (A Krattiger, R.T.

Mahoney, L. Nelsen & A. B. Bennett), Intellectual

Property Management in Health and Agricultural

Innovation: A Handbook of Best Practices, Vol 1 (pp.

813-860). MIHR and PIPRA.

Rocha, A.M.S. (2009). Avaliação e Licenciamento de

Tecnologia em Universidades. [Unpublished master’s

thesis]. Universidade do Minho.

Smith, H. (2005). What innovation is – How companies

develop operating systems for innovation. CSC White

Paper. European Office of Technology and Innovation.

Speser, S. (2006). The Art and Transfer of Technology

Transfer. John Wiley & Sons.

Soares, I., Moreira, J., Pinho, C., & Couto, J. (2007).

Decisões de Investimento. Análise Financeira de

Projectos. Edições Sílabo.

Stevens, A. (2016). Intellectual property valuation manual

for academic institutions. WIPO – World Intellectual

Property Organization. https://www.wipo.int/meetings/

en/doc_details.jsp?doc_id=332588.

Perchorowicz, J. T., Dakin, K. J., & Lindsey, J. (1991).

Technology transfer: Financing and commercializing

the high tech product or service from research to roll

out. Journal of Technology Transfer, 16(3), 62-63.

WIPO/ITC (2005). Exchanging value: negotiating

technology licensing agreements. A training Manual.

World intellectual Property Organization.

A Preliminary Analysis of the Use of Valuation Methods by Technology Transfer Offices

143