Social and Economic Security in the Field of Housing Construction in

the Context of the Regional Sustainable Development

Aigul I. Sadykova

a

Ufa Branch of the Financial University under the Government of the Russian Federation, Ufa, Russia

Keywords: Social and Economic Security, Housing Construction, Unemployment Rate, Real Income of the Population,

Primary Housing Market, Housing Demand, Housing Affordability.

Abstract: The solution of the housing problem for citizens is one of the main ones, and housing is one of the basic needs

of a person. This paper considers the main provisions of the management of social and economic security in

the field of housing construction. Social and economic security has a multifaceted nature, since its analysis

includes both housing construction and social indicators. Moreover, the management of social and economic

security involves the participation of the state, application of the whole range of measures aimed at both the

development in the field of the housing construction and related areas, and the social sphere in terms of

increasing the level of housing affordability for the population. The management of this field is especially

relevant in the context of economic shocks that arise both in the country and in the whole world.

1 INTRODUCTION

One of the basic human needs is the housing demand.

It is located at the base of A. Maslow's pyramid of

needs and refers to physiological needs along with

food, water and sleep. The housing affordability for

the population is one of the main social and economic

indicators reflecting the demographic, social, and

economic characteristics of current living standards.

At the same time, periodically arising economic

shocks lead to an aggravation of the problem of social

and economic security in the field of housing

construction (Sadykova, 2020).

Social and economic security in the field of

housing construction is multifaceted, since it affects

not only economic, but also social aspects. On the one

side, the development of housing construction

contributes to the development of not only the

construction industry, but also related areas

(production of building materials, metal structures,

etc.), on the other side, the growth of housing being

commissioned should be supported by effective

demand from the population. The latter is directly

related to the analysis of the level of real income of

citizens, employment and poverty, availability of

mechanisms for financing the purchase of housing in

a

https://orcid.org/0000-0003-2807-9577

the primary market (government support, mortgage

lending, etc.). Obviously, in this aspect, the economy

cannot be regulated independently and the

participation of the state is necessary.

2 RESEARCH METHODOLOGY

This study uses the method of analyzing indicators of

social and economic security in the field of housing

construction. Statistical data from official sources are

analyzed, as well as expert opinions.

The following indicators were identified for the

analysis:

the amount of housing commissioning;

the average actual cost of building one square

meter of housing;

the average price for 1 sq. m of housing in the

primary and secondary markets;

the level of real income of the population;

the average per capita income of citizens;

the level of the subsistence minimum;

the unemployment rate;

the share of the population with monetary

incomes below the subsistence level.

Sadykova, A.

Social and Economic Security in the Field of Housing Construction in the Context of the Regional Sustainable Development.

DOI: 10.5220/0010591904330438

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 433-438

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

433

One of the main indicators for assessing social and

economic security in the field of housing construction

is the housing affordability index, which reflects the

number of years it takes an average family to acquire

accommodation. This indicator is primarily

influenced by the level of per capita income of the

population.

3 RESEARCH RESULTS

According to experts, “an increase in housing

affordability is possible only due to an increase in the

real level of income of the population by at least 5%

per year in the period 2020-2024. At the same time,

the achievement of such a result is possible only by

accelerating the potential growth rates of the

economy.” (Akhmetov et al., 2020).

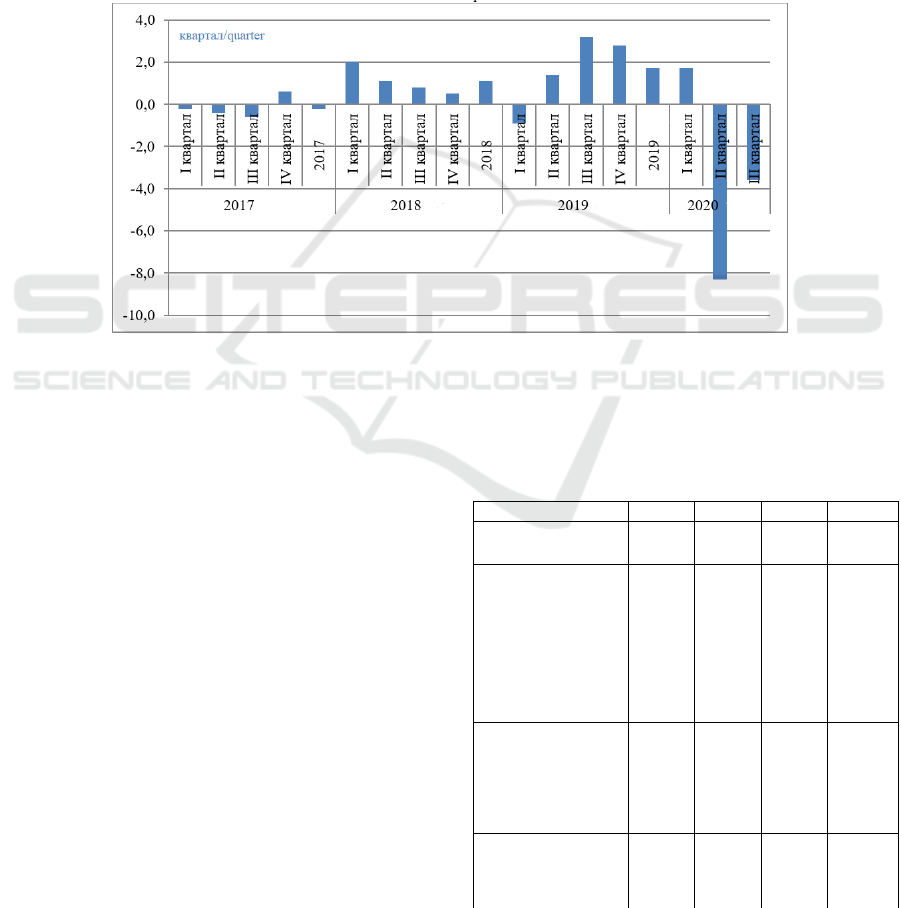

In the second quarter of 2020, there was a record

decline in the level of real income of the population

by 8%. In the third quarter of 2020, the decline in real

incomes of the population continued. Figure 1 shows

data on the dynamics of the real income level of the

population in Russia for the period of 2017-2020. In

general, for the analyzed period, the maximum

growth in real income was observed only in the third

quarter of 2019 and amounted to 3%.

Figure 1: Dynamics of the real income level of the population in the RF, in % to the corresponding period (Federal State

Statistics Service).

Table 1 shows the main indicators for the analysis

of social and economic security in the field of housing

construction.

During the analyzed period, the maximum rate of

housing commissioning was observed in 2019. In

2020, probably due to the pandemic of the new

coronavirus infection and the temporary suspension

of construction sites, housing commissioning

decreased by 1.7% and amounted to 80.6 mln. sq. m.

At the same time, the volumes of housing

commissioning in 2020 are the result of the received

building permits 2-3 years ago. Thus, it can be

assumed that the consequences of the pandemic will

affect the work of the construction industry in the next

2-3 years. Note that, according to the national project

“Housing and Urban Environment”, it is expected

that the volume of housing construction will grow by

about 1.5 times, up to 120 million sq. m. by 2024.

Table 1: Indicators of social and economic security in the

field of housing construction in Russia for the period of

2017-2020.

Indicators

2017 2018 2019 2020

Housing

commissioning

79.2 75.7 82 80.6

The average actual

cost of construction

of one square meter

of the total area of

residential premises,

in rubles.

41,459 41,358

42,55

1

44,142

The average price of

1 sq. m of the total

area of apartments

in the secondary

housing market, in

rubles.

52,350 54,924

58,52

8

61,712

The average price of

1 sq. m of the total

area of apartments

in the primary

56,882 61,832

64,05

9

79,003

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

434

housing market, in

rubles.

Continuation of Table 1.

The average per

capita income of the

population, total,

rubles per month

31,897 33,178

35,24

9

35,043

The subsistence

minimum level, in

rubles.

10,088 10,287

10,89

0

11,301

The unemployment

rate, in %

5.2 4.8 4.6 6.4

The share of the

population with

monetary income

below the

subsistence

minimum

12.9 12.6 12.3 13.5

Source: Federal State Statistics Service

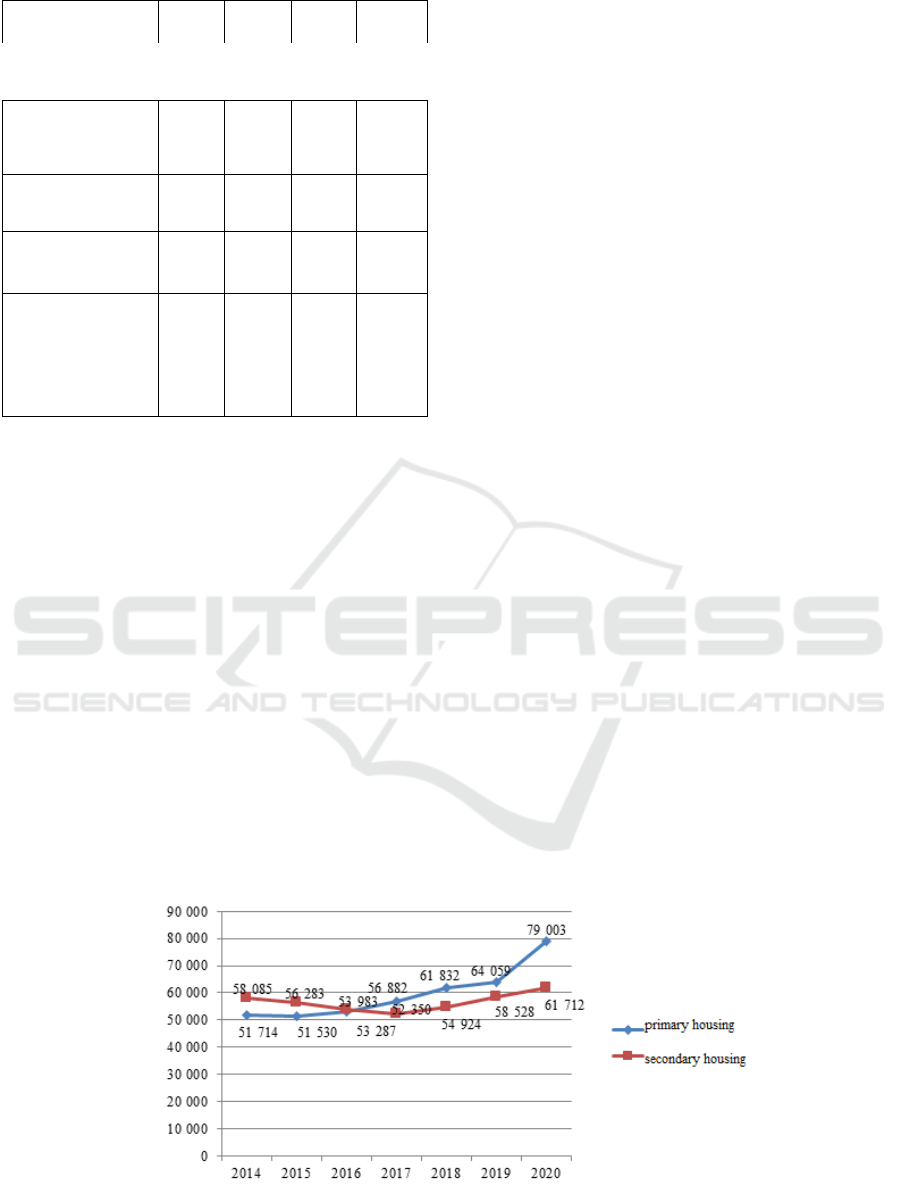

During the analyzed period, there was also an

increase in the average actual cost of housing

construction. For the period of 2017-2020 it increased

by 6%. The average price for primary housing

increased by 40% during the analyzed period and

averaged 79 thousand rubles/sq.m., and for secondary

housing by 18% and amounted to 61.7 thousand

rubles/sq.m. At the same time, if the increase in the

secondary housing market was gradual, then in the

primary housing market, a sharp increase occurred

over the period of 2019-2020 (23%). This change, to

a greater extent, was influenced by the introduction of

a concessional mortgage lending program at a rate of

6.5% for the purchase of primary housing, which was

intended not only to increase the level of housing

affordability for the population, but also to support

the housing construction industry.

It is noteworthy that up to 2016, housing prices in

the primary market were lower than in the secondary

market. Secondary housing attracted buyers, first of

all, because there was no need to wait for it, after

property registration, you can immediately move in,

while the apartment has already been renovated.

When buying a housing during the construction

phase, it was possible to save up to 30% of the entire

apartment cost. Primary housing was more affordable

if there was housing for the construction period,

although it assumed the expectation of transferring it

into operation within 1-2 years. It should be noted that

the purchase of accommodation in the primary market

was also accompanied by a number of risks, such as:

the developer's possible bankruptcy, as a result of

which the housing could not be completed, and the

equity holders could be left without an apartment and

money already invested in construction (Kurmanova

and Sadykova, 2018).

Since the end of 2019, after the introduction of

project financing for housing construction, the risks

of construction in progress have been removed from

equity holders, since now developers will attract

financing from banks, and not from equity holders

directly. At the same time, the funds of equity holders

are accumulated on special escrow accounts, from

where they are transferred to the developer only after

the completion of construction and commissioning of

housing (Sadykova, 2019).

At the end of 2016, prices in the primary and

secondary markets leveled off, and, starting in 2017,

the price for 1 sq.m. primary housing already

outstripped prices in the secondary market. Probably,

such a change occurred in connection with the

implementation, starting in 2015, of programs to

subsidize mortgage rates for the purchase of primary

housing, which stimulated demand for it and pushed

up prices (see Figure 2) (Federal State Statistics

Service).

Figure 2: Dynamics of prices in the primary and secondary housing markets for the period of 2014-2020

Social and Economic Security in the Field of Housing Construction in the Context of the Regional Sustainable Development

435

With regard to social indicators, the average per

capita income of the over the past 2 years has

remained practically unchanged, although the real

level, as noted earlier, has been declining throughout

2020. At the same time, it should be noted that the

level of per capita income does not reflect the actual

state. For a more detailed analysis, it is necessary to

additionally consider the median and modal levels of

per capita income. The income level most often found

in the country (modal income) is slightly higher than

the subsistence level established in the region. In fact,

it is difficult for such families to acquire their own

housing even in the long term.

In 2020, the share of citizens with income below

the subsistence minimum, established in the region,

increased up to 13.5% (Rosstat recorded an increase

in poverty at the peak of the pandemic, 2020). Note

that, according to experts' estimates, during the

pandemic, 4.5 million individual entrepreneurs, as

well as small and medium businesses, have ceased to

exist. About 60% of enterprises were forced to reduce

their turnover during the pandemic (The number of

enterprises that went bankrupt during the pandemic in

the Russian Federation is named, 2020).

The unemployment rate for the analyzed period

increased by almost 2%. This is due to close-downs

and staffing cuts (Ajupov et al., 2017).

4 DISCUSSION OF RESULTS

The housing affordability index in Russia averages 5-

6 years, in some regions it reaches 10-12 years.

According to the methodology of the United Nations

Human Settlements Development Program (UN-

Habitat), there is a generally accepted classification

of housing markets according to the criterion of

affordability, according to which housing in Russia is

substantially inaccessible (UN-Habitat International

Urban and Territorial Planning Guidelines, 2015).

Moreover, for citizens with an average per capita

income below the subsistence level established in the

region, the purchase of accommodation is impossible

even in the long term, i.e. about 13-14% of the

population does not have the opportunity to improve

their living conditions in the future.

In this context, it is necessary for the state to

intervene in the processes, since the solution of the

housing problem has not only a positive effect on the

construction and related industries but also on the

social climate: the demographic situation relieves

social tension (Kurmanova and Sadykova, 2020).

One of the ways to lower the level of mortgage

interest rates for end borrowers is to subsidize rates

from the budget. This method is relevant if the

development of housing construction and financing

of purchases through mortgages create a significant

amount of externalities. There are already several

programs for subsidizing mortgage rates (Family

Mortgage, Far Eastern Mortgage, etc.) in Russia, but,

as in many countries, these programs are aimed at

supporting certain social groups.

Expansion of subsidy programs can, on the one

side, lead to a decrease in the average mortgage rate

in the economy, even without changing the level of

market (unsubsidized) rates, and on the other, require

an increase in budget expenditures. Besides, the

introduction of programs to subsidize interest rates

for the purchase of, for example, primary housing,

leads to rapid demand for it, and, as a result, to an

increase in prices. As a result, the initial effect of

increasing the availability of debt financing for the

purchase of accommodation is offset by a decrease in

its affordability.

At the same time, according to experts, as a result

of the implementation of the program to subsidize the

rate on mortgage loans for the purchase of primary

housing, which started in April 2020, the share of

families for whom the purchase of a standard

apartment in the primary housing market using

mortgage lending will increase from 40% to 53.4%,

or by 13.4 percentage points (Kosareva and Polidi).

It should also be noted that the measures taken to

introduce “mortgage vacations” also have a positive

effect on the situation of citizens since it allows for 6

months not to make payments on the mortgage loan

completely or to reduce their size. Such a measure is

applicable to citizens who have previously issued a

mortgage loan, whose financial situation has

deteriorated. At the same time, credit institutions in

the course of the implementation of this program may

encounter problems associated with the failure to

receive regular payments on mortgage loans and will

be forced to form additional reserves.

“According to Rosstat, the potential sources of

funds for the purchase (construction) of housing by

the population traditionally include: sale of existing

housing, maternity capital funds, subsidies for the

purchase of housing, other sources (including own

funds) and mortgage loans.”

In the country as a whole, the share of own funds

in the structure of financing transactions for the

acquisition of housing at the end of 2018, according

to Rosstat estimates, was about a half. According to a

survey by AO Raiffeisenbank, at the end of 2019,

almost 62% of future mortgage borrowers have

independently saved or continue to save funds for an

initial payment.

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

436

About 38% of Russians wishing to take out a

mortgage did not have free funds for an initial

payment on such a loan. The citizens planned to

collect funds for the initial payment on the loan

through the following mechanisms (one or more):

“23% expected to receive funds on the security of

“old” housing, 20% of the respondents planned to

spend the maternity capital on the initial payment on

the mortgage, 13% were preparing to sell the

property, and 10% to take a consumer loan.”

In general, future mortgage borrowers save up for

an initial payment from 2 to 4 years, 6% of

respondents can accumulate funds for a period of less

than 1 year, another 17% in 1 year, 29% of

respondents need 5 years to accumulate funds.

Approximately 35% of respondents who are ready to

save up for an initial payment save money every

month, and, more often than not, resort to deposits.

Also, among the respondents, there were citizens who

keep funds at home or invest them until the required

amount is accumulated. Among the popular means

were debit cards with interest on the balance.

Also, according to a number of experts, the

development of the social rental market could

increase the housing affordability. This instrument,

on the one side, would contribute to solving the

housing problem of citizens who do not have the

financial ability to purchase their own housing, and

on the other side, to increase the mobility of the able-

bodied population and reduce the unemployment rate.

At the same time, the social rental market today is

only at the beginning of its development.

Another way to increase the housing affordability,

noted by experts, is to reduce the cost of construction,

which can restrain the rise in housing prices or even

lead to their decline. The prime cost can be reduced

by removing the costs of developers that are not

directly related to the housing construction. For

example, to remove obligations for the construction

of social infrastructure (kindergartens, schools),

which are imputed to developers upon approval of

projects. At the same time, it is necessary to build the

necessary infrastructure, therefore, a decrease in these

costs for developers (and, ultimately, for a housing

buyer) will have to be compensated by an increase in

the corresponding budgetary costs.

On the one side, such a measure, indeed, could

lead to a decrease in the cost of housing, on the other,

it will require the search for additional funds to

replenish the budget. Also note that, according to

statistics, the excess of the market value of housing

over its average actual cost at the end of 2020 is, on

average, almost 80% across the country, which

indicates a possible overstatement of prices by

developers and the availability of a reserve for their

reduction.

5 CONCLUSIONS

Thus, as a result of the analysis, some conclusions can

be drawn.

Firstly, the level of real incomes of citizens

continues to decline. A record decline was recorded

in the second quarter of 2020. This was largely due to

the pandemic of the new coronavirus infection,

resulting in a large number of enterprises were closed

and workers were laid off. For the same reason, there

was an increase in the unemployment rate and the

share of the population with the level of per capita

income below the subsistence minimum.

Secondly, the volume of housing commissioning

decreased by the end of 2020, but prices both in the

primary and secondary markets continue to increase.

At the end of 2020, prices in the primary housing

market increased by 23% (compared to 2019), and in

the secondary housing market by 18%, respectively.

One of the reasons for primary housing price rise

include the introduction of a program of subsidizing

interest rates on mortgage loans for the purchase of

primary residence. This measure was intended to

support not only the construction industry, but also to

increase the housing affordability and instruments for

financing its purchase by the population. As a result,

sustained demand for primary housing pushed up

prices. Note that 13.5% of citizens below the poverty

line do not have the opportunity to purchase

accommodation even in the long term.

Thirdly, housing in Russia is significantly

inaccessible, since for its acquisition, even in times of

austerity, a family needs to save more than 5 years,

and in some regions up to 10-12 years. In Russia, on

average, there are 25-27 sq.m. of housing per

inhabitant, but this figure is far from the level of the

USA and European countries. Purchase of

accommodation with an area of 43-77 sq.m. per

person is not available for Russian citizens

(Kurmanova and Sadykova, 2020).

Fourthly, the indicator of housing affordability is

primarily influenced by the level of income of the

population. Accordingly, to increase the housing

affordability, it is necessary to ensure the rise of the

real income of the population. On the other side, the

market price for 1 sq.m. housing at the end of 2020 is

80% higher than the cost of its construction, which

may indicate a reserve for reducing the market value,

which, in turn, will favorably affect the affordability

index.

Social and Economic Security in the Field of Housing Construction in the Context of the Regional Sustainable Development

437

Thus, there are ways to increase the level of

housing affordability for citizens, provided that the

development of housing construction continues, but it

requires the participation of the state. To ensure social

and economic security in the field of housing

construction, it is necessary to use an integrated

approach that solves problems, both in each

individual region and in the country as a whole.

REFERENCES

Akhmetov A., Morozov A., Saul S., Ushakova Y. and

Chernyadyev D. (2020). Mortgage and housing

affordability, Policy Brief March 2020, 17 p.

Housing construction number 1 (2), April 2020: Policy

Brief, p. 40.

Kurmanova L.R. and Sadykova A.I. (2020). Assessment of

the level of socio-economic security in the field of

housing construction. Innovative development of the

economy, 6 (60): 290-300.

Kurmanova L.R. and Sadykova A.I. (2018). Project

financing of the residential real estate market:

development problems. Economics and Management, 4

(142): 100-103.

UN-Habitat International Urban and Territorial Planning

Guidelines, 2015. - 39 p.

Sadykova A.I. (2020). Housing affordability: problems and

ways to solve them. Modern aspects of the

transformation of the financial and credit C56 system:

materials of the II All-Russian scientific and practical

conference (Ufa, November 18-19, 2020) / otv. ed.

G.A. Galimova. Ufa: RITs BashGU, pages 240-242.

Federal State Statistics Service: Average, median and

modal level of monetary income of the population as a

whole in Russia and in the constituent entities of the

Russian Federation -

https://rosstat.gov.ru/free_doc/new_site/population/be

dnost/tabl/tab-bed1-2- 6.htm.

Federal State Statistics Service: The annual volume of

housing commissioning -

https://www.fedstat.ru/indicator/43537.

Federal State Statistics Service: The average actual cost of

building one square meter of the total area of residential

premises in residential buildings commissioned without

extensions, superstructures and built-in premises -

https://fedstat.ru/indicator/31456.

Federal State Statistics Service: The average price of 1

square meter of the total area of apartments in the

housing market -

https://www.fedstat.ru/indicator/31452.

Federal State Statistics Service: Unemployment rate

(according to methodology (ILO) -

https://www.fedstat.ru/indicator/43062.

Rosstat recorded an increase in poverty at the peak of the

pandemic -

https://www.rbc.ru/economics/18/09/2020/5f64ba649a

7947 07f1dd59d1.

The number of enterprises that went bankrupt during the

pandemic in the Russian Federation is named -

https://www.rosbalt.ru/business/2020/

12/10/1877457.html.

Kosareva N.B. and Polidi T.D. Housing affordability in

Russia and abroad. Economic portal -

https://institutiones.com/general/3399-dostupnost-

zhilya-v-rossii-i-za-rubezhom.html.

Ajupov A.A., Kurmanova L.R., Khabibullin R.G. and

Kurmanova D.A. (2017). Evaluation of financial

stability of Russian companies. Journal of Engineering

and Applied Sciences, 12 (19): 4905-4907.

Sadykova A.I. (2019). Role of transition to project

financing of real estate market in Russia. The European

Proceedings of Social & Behavioral Sciences, pages

1519-1528.

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

438