Assessment of the Region Investment Attractiveness in Complex

Relationship with Sustainable Development on the Basis of the

Balanced Scorecard

Vladimir N. Myakshin

1a

and Irina V. Grishina

2,3 b

1

Northern (Arctic) Federal University named after M. V. Lomonosov, Severnaya Dvina embankment 17, Arkhangelsk,

Russian Federation

2

Russian Foreign Trade Academy, Vorobyevskoe Shosse St. 6A, Moscow, Russian Federation

3

Russian Academy of National Economy and Public Administration, Prosp. Vernadskogo 82 Bld. 1, Moscow, Russian

Federation

Keywords: Investment Policy, Investment Attractiveness, Region, Balanced Scorecard, Balanced Estimation.

Abstract: The purpose of the article is to justify the need for possible applying the balanced scorecard for identifying

the region investment problems. Investment attractiveness of the regional economic system of the

Arkhangelsk region of the Russian Federation is taken as a research object. It should also be noted that over

a long period of time the balanced scorecard has been applied as the efficiency management tool of certain

organizations. However, no attempts were made to develop valuation techniques for the investment

attractiveness of economic systems using the balanced scorecard. Besides the balanced assessment

methodology has not been applied for studying regional issues before. The authors of the present research

improved the integrated approach to the assessment of the investment environment (that was implemented by

means of methodology of Council for the Study of Productive Forces) by supplying it with achievements of

the balanced approach which was suggested by R. Kaplan and D. Norton. The article proves the importance

of developing a mechanism for coordinating the interests of various participants of the investment process.

The authors show the opportunity of creating that sort of mechanism based on the balanced scorecard for

assessment of the region investment attractiveness taking into consideration the information needs of every

group of participants. The application of the balanced score card may become the basis for developing an

effective strategy of improving investment attractiveness of the region.

1 INTRODUCTION

The regional investment policy capable of providing

the rise in the investment attractiveness of every

Russian region for its development should become an

indispensable structural unit of the integral legislated

system of investment activity government regulation

that reflects peculiarities of the federal structure of the

country.

From our point of view, the regional

investment policy should be understood as the system

of measures that is carried out by the regional public

authorities responsible for the mobilization and

effective use of domestic and outward investment

a

https://orcid.org/0000-0002-3989-7367

b

https://orcid.org/0000-0003-0743-7232

resources of all forms of ownership in order to

guarantee the stable economic growth of the region.

The authors of the article conducted the study on

investment attractiveness of regional sectoral

economic systems which is one of the key

development challenges of the regional economy and

their research is based on a wide range of theories and

practices. A large number of different methods of

interregional investment comparison are used both in

Russia and abroad. Foreign rating valuation

techniques for investment environment and

investment attractiveness such as «Doing Business»,

valuation techniques of expert agencies like

«Moody's», «Standard&Poor's», «Fitch Ratings» and

388

Myakshin, V. and Grishina, I.

Assessment of the Region Investment Attractiveness in Complex Relationship with Sustainable Development on the Basis of the Balanced Scorecard.

DOI: 10.5220/0010591103880395

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 388-395

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

others have become best known in Russia for being

included into various scientific reviews. The

development of an entrepreneurship toolkit for region

investment attractiveness assessment is based on the

analysis and generalization results of both foreign

(specifically pointing out the elements that can be

adopted within the economy of Russia) and domestic

experience in attracting investments (Hoque, 2000).

The domestic methodology of interregional

investment comparison has come a long way by now.

The challenges faced in assessing investment

attractiveness have been studied by such scientists as

A. Folomiev, I. Grishina, I. Royzman, A.

Shakhnazarov (Grishina, 2013; Hoque, 2000). In

accordance with the majority of approaches, the main

factors that differentiate territories in terms of

investment attractiveness are not only non-specific

factors (shared for all regions) but also specific

regional factors. T. Rakhimov suggests classifying

the present investment environment valuation

according to the set of characteristics including:

technique origin; technique application area;

coverage of investment environment elements; a

number of levels in investment environment

assessment; a presentation form of results; investment

environment valuation techniques employed;

dynamism of the set of specific indicators; scope of

investment environment assessment.

In our opinion the availability of a great number

of valuation techniques is also determined by the

difference between goal setting in research and

approaches to the interpretation of the concept

«investment attractiveness» and «investment

environment», determination of relations, and

structure of these categories. The concept «business

environment» is mainly used in foreign researches

(Becker, 2012; Belitski, 2016; Berkowitz, 2015;

Besley, 2015; Fernandes, 2015; Myakshin, 2019).

R. Anderson offers to differentiate the notions of

«investment environment» and «business

environment». He gives his preference to the second

notion because in the author’s opinion the notion

«investment environment» may create a

misconception about the contribution of the private

sector into economic growth (Anderson, 2004).

In our view, the evolving of domestic valuation

techniques for investment attractiveness has followed

the path of differentiation and complexity of the

assessment scorecard, and the introduction of mainly

qualitative (static) indicators. Nevertheless,

methodological approaches to investment

attractiveness assessment, factors influencing the

assessment, the structure of assessment indicators are

reconsidered by their authors on a time basis

according to objectives of conducted researches and

a change in conditions of economic development. It

should be noted that the indexes of the assessment of

the region investment attractiveness currently applied

in economic studies do not fully meet the needs of

different groups of participants of regional

investment processes to the above-mentioned

assessment. The new methodological approach is

based on the scorecard of indexes independent from

dynamics of investment attractiveness of other

regions and would allow meeting initially different

information needs of various participants of the

investment process.

The major conceptual innovation of the suggested

balanced approach allows for a shift in priorities

towards achieving compliance of the assessment

results with the interests of all parties (i.e. investors,

population, state administration bodies) when

assessing the investment attractiveness.

2 METHODOLOGY AND

METHODS OF RESEARCH

In order to reflect current economic conditions more

precisely and to take into consideration the present

improvement of the static observing system, the

authors have participated in modifying the

methodology of integrated comparative assessment

of investment attractiveness of Russian regions that

has been developed at the Council for the Study of

Productive Forces (CSPF). Moreover, the new system

of assessment indicators for two main elements of

investment attractiveness (investment potential of a

region and a regional investment risk) has been

presented. Despite the change in the structure of

specific indicators and their valuation techniques, the

most important feature of the integrated

methodological approach of CSPF has been

preserved. The feature consists of considering

regional investment attractiveness in complex

relationship with investment activity within the

regions (Grishina, 2013). On the results of the

experimental assessment of investment attractiveness

of the constituent entities of the Russian Federation

that were obtained with the application of the

suggested method (on the basis of the statistical

accounting for 2010), investment attractiveness of the

Arkhangelsk region has been estimated at 0,754

(i.e. 0,25 percentage points below the Russian

average, because the Russian average was considered

to be 1,00). According to the calculated results, the

Arkhangelsk region held the 56

th

place out of 83

Assessment of the Region Investment Attractiveness in Complex Relationship with Sustainable Development on the Basis of the Balanced

Scorecard

389

studied constituent entities of the Russian Federation

in terms of investment attractiveness (Hoque, 2000).

Moreover, pursuant to the conducted research on the

investment activity level of regional private investors

(according to the data from 2012, that was done in

order to keep the time lag for investment

attractiveness realization described in 2010), the

Arkhangelsk region was assessed to be of the third

group of regions with middle investment activity

level (0,985). The following level is just a little below

the Russian average and provide the relatively high

31

st

place among all Russian constituent entities. It

shows us the influence of unaccounted factors on the

investment attractiveness valuation technique and

consequently the presence of reserves for its further

development towards ensuring compliance with

investment attractiveness assessment and investment

activity assessment of every region. The balanced

scorecard (BSC) that originated at the beginning of

the 90s of the XX century as an evaluation system,

has turned into an efficiency management tool owing

to long-term improvements in the works of R.

Bhagwat, E. Daniel, F. Figge, Z. Hoque, D. Kaplan,

R. Norton, P. Niven, N. Olve (Bhagwat, 2007;

Daniel, 2012; Figge, 2002; Kaplan, 1996, 1998, 2000;

Martinsons, 1999; Niven, 2011; Olve, 2011).

Therefore researches that are aimed to develop the

practice-oriented balanced scorecard for investment

attractiveness assessment of the region could be

ranked as new ones on setting. In developing the BSC

to assess the region's investment attraction, we used

the basic principles outlined above, which belong to

the correct methodological approach of the CSPF.

The basis for the formation of the BSC is the

relationship of the key factors of investment

attractiveness with the key indicators that have been

selected with the use of the criterion «maximal

representation and investment value». The

opportunity of quantitative identification of

indicators on the ground of the current assessment

was taken into account while making maximum use

of the data from government statistics. The integral

indicators of investment attractiveness are suggested

to be estimated with the help of the multivariate

average formula. However, regional target values of

indicators are offered to be used as the basis for

rationing values of the individual indicators in

preference to the national averages estimated

throughout the Russian Federation that are followed

by many studies. The matrix of integral indicators is

formed on the ground of the calculations carried out.

3 RESULTS

According to the data of the authors’ empiric research

on the investment attractiveness level of the

Arkhangelsk region that has been carried out with the

help of the developed balanced scorecard, principal

directions of improving investment attractiveness

have been analyzed (Table 1, Figure 1). The results of

such researches could be required by the current

practice of state regulation of the economy.

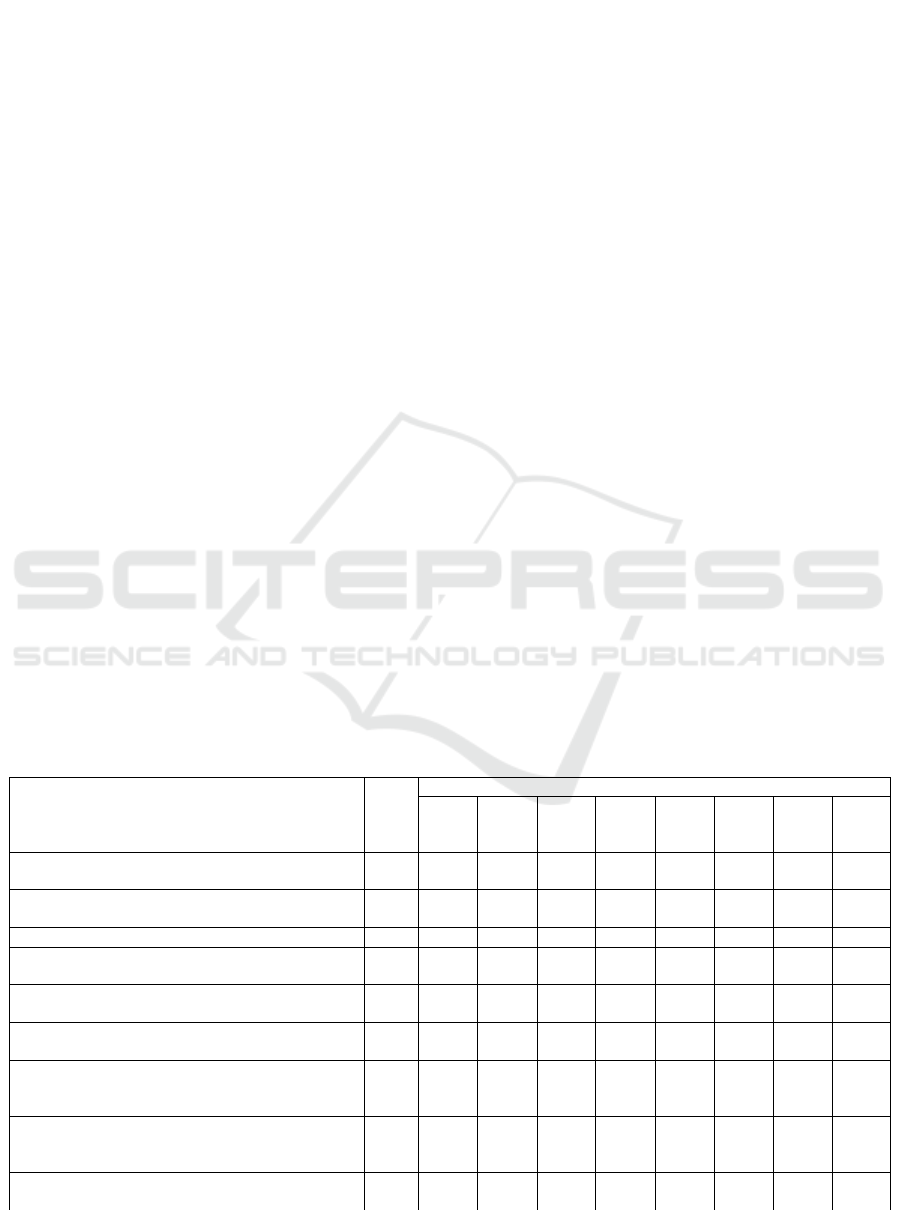

Table 1: Composition of the balanced scorecard for the investment attractiveness assessment of Arkhangelsk region* (2011-

2018).

Name of the indicator

Targ

et

valu

e

Indicator value

2011 2012 2013 2014 2015 2016 2017 2018

Integral indicator for production and financial

perspective

0,51 0,31 0,46 0,38 0,68 0,64 0,65 0,86

1. Integral indicator for the section “Financial

development”

0,60 0,62 0,60 0,60 0,69 0,76 0,75 0,77

1.1. Share of profitable enterprises, percentage 0,9 0,63 0,63 0,65 0,64 0,6

7

0,71 0,66 0,68

1.2. Indicator of balancing budget revenues and

expenditures of the region, percentage

1 0,92 0,93 0,93 0,91 0,97 0,93 0,99 1,04

1.3. Share of overdue accounts payable in the total

amount of external accounts payable, percentage

0,01 0,06 0,04 0,06 0,06 0,03 0,02 0,02 0,02

2. Integral indicator for the section

“Environmental safety”

0,74 0,63 0,77 0,73 0,84 0,76 0,75 0,77

2.1. Share of the detected and detoxified pollutants

in their total number from all stationary pollution

s

ources, percentage

0,8 0,75 0,76 0,77 0,72 0,74 0,73 0,73 0,76

2.2. Share of environmental protection investments

in total investment amount as a percentage of the

region's investment capita, percentage

0,02 0,01 0,00 0,01 0,01 0,01 0,01 0,01 0,10

2.3. Forest reproduction indicator of forest

reserves, percentage

1 0,78 0,76 0,85 0,98 0,94 0,64 0,67 0,64

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

390

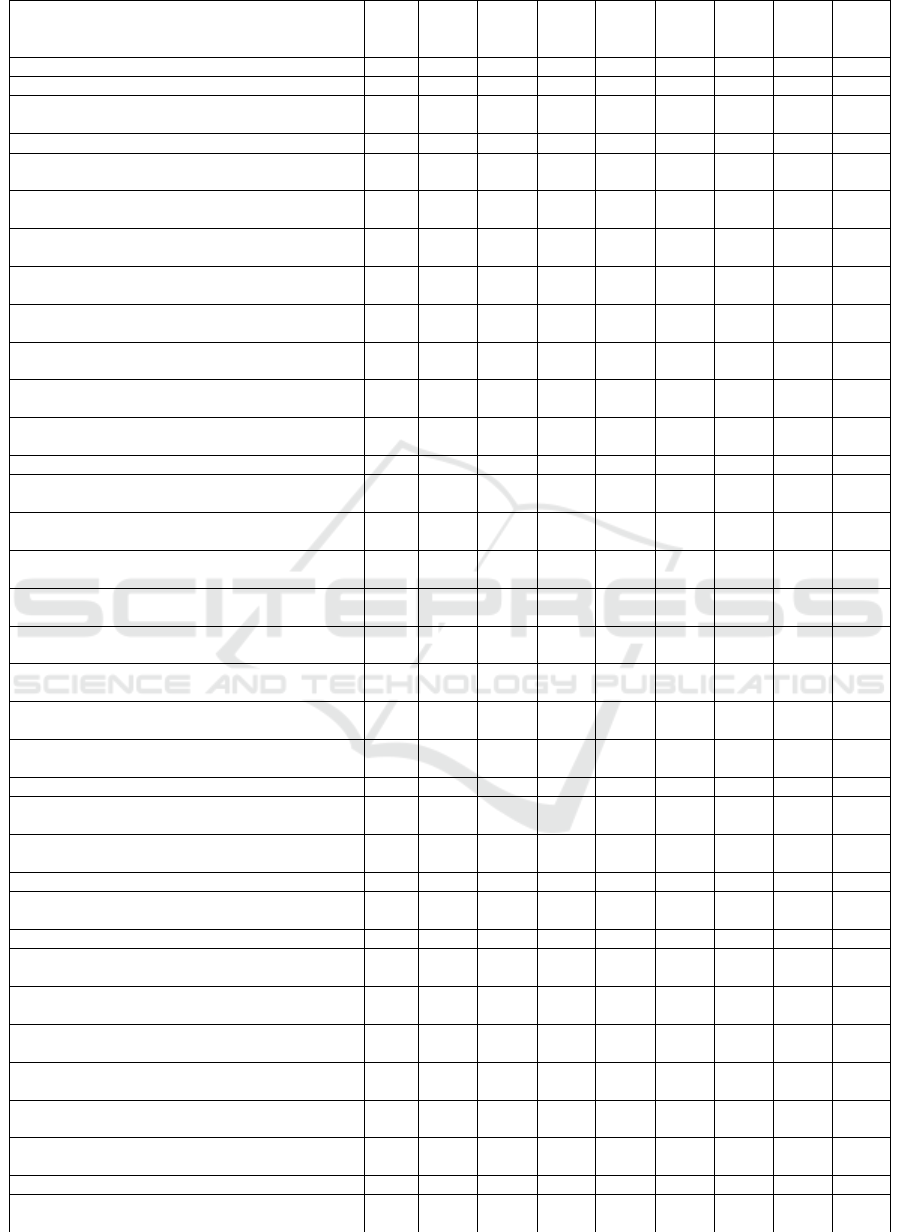

Continuation of table 1.

3. Integral indicator for the section “Efficiency

of the production and financial activity of the

region”

0,26 -0,17 0,13 -0,05 0,54 0,32 0,38 0,65

3.1. Depreciation level of fixed assets, percentage 0,15 0,48 0,4

7

0,46 0,45 0,48 0,50 0,51 0,53

3.2. Return on total assets, % 10 0,40 -1,30 0,40 0,40 2,80 0,46 0,3

7

0,73

3.3. Profitability of sold goods, products

(services), %

10 6,50 -4,30 0,00 -7,10 5,00 0,84 0,79 0,60

3.4. Profitability of labour forces, % 10 0,28 -4,50 1,3

7

1,3

7

10,76 14,66 13,79 14,69

Integral indicator for the development

perspective

0,66 0,68 0,62 0,51 0,55 0,39 0,37 0,40

1. Integral indicator for the section “Intellectual

potential”

0,57 0,65 0,61 0,65 0,65 0,40 0,39 0,40

1.1. Share of employees with higher education,

p

ercentage

0,4 0,23 0,26 0,24 0,26 0,26 0,28 0,27 0,27

1.2. Indicator of advanced staff training,

p

ercentage

0,5 - - - - - 0,01 0,01 0,01

2. Integral indicator for the section “Innovative

capacity”

0,70 0,71 0,65 0,47 0,53 0,44 0,42 0,46

2.1. Research and Technological Development cost

component, percentage

0,1 0,00 0,00 0,00 0,00 0,00 0,00 0,00 0,00

2.2. Technological innovations cost component,

p

ercentage

0,05 0,01 0,02 0,02 0,01 0,00 0,00 0,00 0,01

2.3. Use of information technology indicator,

p

ercentage

1,5 1,44 1,11 0,77 0,77 2,31 1,03 0,60 1,03

2.4. Indicator of replacement of fixed assets 0,15 0,10 0,11 0,11 0,08 0,05 0,06 0,06 0,06

2.5. Indicator of investment requirement of sold

p

roducts

0,2 0,33 0,33 0,29 0,22 0,13 0,21 0,23 0,21

3. Integral indicator for the section

“Infrastructural capacity”

0,50 0,52 0,53 0,53 0,53 0,08 0,08 0,08

3.1. Communication lines density, km/ thousand sq

km

60 30,00 31,00 32,00 32,00 32,00 59,00 59,00 59,00

Integral indicator for natural resource

perspective

0,67 0,66 0,67 0,69 0,74 0,74 0,79 0,82

1.Integral indicator for the section “Resource

provision”

0,70 0,70 0,71 0,73 0,81 0,69 0,76 0,80

1.1. The economic activity of the population level,

p

ercentage

0,75 0,55 0,53 0,53 0,52 0,52 0,51 0,51 0,50

1.2. Deposits of natural hydrocarbon (gas and oil),

million equivalent tons

3000

2954,

70

2954,

70

2954,

70

2954,

70

2954,

70

2954,

70

2954,

70

2954,

70

1.3. Deposits of mineral resources (except for

hydrocarbon deposits), million equivalent tons

2000

1039,

60

1039,

60

1039,

60

1039,

60

1063,

50

1063,

50

1063,

50

1063,

50

1.4. Forest reserves area, million hectares 35 28,82 28,83 29,29 29,29 29,31 29,31 29,31 29,31

1.5. Indicator of provision enterprises of the region

with their own financial resources, percentage

0,5 0,23 0,24 0,25 0,32 0,50 0,39 0,39 0,44

2. Integral indicator for the section “Geographic

location”

0,71 0,71 0,71 0,71 0,71 0,71 0,71 0,71

2.1. Region geographic location

7

5 5 5 5 5 5 5 5

3. Integral indicator for the section “Climatic

conditions”

0,43 0,43 0,43 0,43 0,43 0,43 0,43 0,43

3.1. The level of region favorable climate

7

3 3 3 3 3 3 3 3

Integral index for political - economic and social

perspective

0,64 0,57 0,60 0,59 0,60 0,49 0,51 0,52

1. Integral indicator for the section “Economic

growth potential of the region”

0,47 0,46 0,50 0,49 0,50 0,56 0,59 0,60

1.1. Volume of the Gross Regional Product, billion

rubles

320

273,6

9

315,4

0

326,9

2

356,4

3

399,5

2

377,9

9

418,4

6

464,9

1

1.2. Dynamics of the Gross Regional Product,

p

ercentage

110

110,1

0

104,0

0

102,0

0

101,1

0

100,1

0

99,20

103,8

0

102,9

0

1.3. Inflation rate in the consumer sector, %

0,5 5,50 6,00 6,80 13,00 13,00

104,8

0

101,5

0

104,0

0

1.4. Inflation rate in the industrial sector, %

0,5 3,60 6,50 2,10 4,60 21,10

105,6

0

109,8

0

112,6

0

1.5. Indicator of property relations in the region 0,8 0,48 0,49 0,50 0,51 0,51 0,29 0,30 0,3

7

1.6. Indicator of the entrepreneurial development

degree

0,3 0,13 0,11 0,11 0,12 0,12 0,13 0,15 0,14

Assessment of the Region Investment Attractiveness in Complex Relationship with Sustainable Development on the Basis of the Balanced

Scorecard

391

Continuation of table 1.

1.7. Openness of the economy, thousand dollars per

p

erson

8 1,37 1,20 1,99 2,02 1,81 1,86 2,17 2,69

2. Integral indicator for the section “Social

security”

0,48 0,48 0,48 0,48 0,48 0,30 0,30 0,32

2.1. Overall morbidity rate, the number of disease

incidences per one thousand people

100

1061,

10

1041,

31

1047,

4

7

1013,

30

995,1

9

1015,

90

1002,

20

998,5

0

2.2. Job safety level

1 0,99 1,00 1,00 1,00 1,00

118,9

0

122,4

0

122,0

0

2.3. Number of recorded crimes per one thousand

p

eople

7 20,43 20,51 20,71 20,90 21,07 17,76 17,31 15,18

3. Integral indicator for the section “Employee

satisfaction”

1,05 0,84 0,86 0,86 0,87 0,51 0,53 0,52

3.1. Social sector financing 0,5 0,66 0,66 0,6

7

0,66 0,6

7

48,03 49,55 56,39

3.2. Number of inhabitants with income above the

p

overty line

0,99 0,89 0,86 0,87 0,86 0,86 0,86 0,86 0,88

3.3. Unemployment rate, percentage 0,02 0,02 0,06 0,06 0,06 0,08 0,0

7

0,06 0,06

3.4. Indicator of the ration between growth rates of

labour productivity and growth rates of average

wages

1,1 1,07 0,95 0,96 1,01 1,10 0,93 0,98 0,91

IN THE BALANCED SCORECARD IN

TOTAL

0,61 0,54 0,58 0,54 0,64 0,55 0,57 0,64

*

The Balanced Scorecard has been developed and the calculation has been carried out by the authors

Figure 1: Diagram for key indicators of investment attractiveness of the Arkhangelsk region from different perspectives for

2011-2018*

*

The diagram has been developed by the authors

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

392

While implementing practical assessment of the

investment attractiveness level of the Arkhangelsk

region, the reality check of the developed method

confirms the possibility of using the balanced

scorecard as an instrument of quantitative

identification of the investment attractiveness factors.

The results of the assessment would be advisable to

use when developing a strategy for improving the

region's investment attractiveness.

4 DISCUSSION

It should be noted that the factors of financial

development produced a positive effect on the

investment attractiveness growth of the Arkhangelsk

region. The research identified the increase of 28 p.p.

(percentage points) in the financial development

indicator due to similar growth of the share of

profitable enterprises. The indicator of balancing

budget revenues and expenditures has grown by 13

p.p., while the indicator value is close to the target one

(1,04) which can be viewed as the positive aspect.

From 2011 to 2014 there was an obvious tendency of

a decrease in the indicators characterizing the

efficiency of production and financial activity.

However, 2,5 times increase of the integral indicator

of this section was observed in 2018 in comparison to

2011. It happened due to an increase of the indicator

«Return on total assets» by 1,8 times, a considerable

increase of the indicator «Profitability of labour

forces» that exceeded some certain target value

(14,69). It is important to note positive dynamics in

the integral indicator values of environmental safety

of production facilities (growth is 4 p.p.) which is the

result of increasing such indicators as «Forest

reproduction indicator of forest reserves» and the

conservative value of the indicator «Share of

environmental protection investments». The stated

factors have made a positive impact on the investment

attractiveness of the Arkhangelsk region. Analysis of

the integral indicator complex by four perspectives of

the developed balanced scorecard has shown that the

maximum value is the integral indicator value for

natural resource perspective (0,80) under positive

dynamics (increase constituted 14 p.p. over 5 years).

The detrimental effect of the low value of the

indicator which characterizes the climatic conditions

of the Arkhangelsk region (0,43) is offset by the

positive influence of the economic supportability

with raw material resources factor on investment

attractiveness. The volume indicators of forest

reserves area and natural hydrocarbon deposits

practically achieve the target values. The graphical

interpretation of the research results of production

and financial perspective of the BSC (Figure 1)

demonstrates minor deviations from the target values

of the following indicators: «Balancing budget

revenues and expenditures of the region», «Forest

reproduction of forest reserves», «The profitability of

labour forces». The diagram analysis shows that the

relatively low value of the integral indicator of

production and financial perspective is primarily

determined by significant deviations from the target

values of the indicators. On the ground of the analysis

of the diagram that has been created for the key

indicators of the natural resource perspective, it has

been discovered that the indicator «Economic

supportability of the region with raw material

resources» and the indicator «Level of the economic

activity of the population» are close to the target

values. The indicator «Provision enterprises of the

region with their own financial resources» almost

achieves the target value. However, there is a

negative impact of the factors of innovative social-

economic development on the investment

attractiveness of the Arkhangelsk region. In 2018 the

indicator of fixed assets replacement was decreased

by 1,7 times with a reduction of the indicator of

investment requirement by 1,6 times. At the same

time, the indicator of employee satisfaction was

decreased by 2 times due to 3 p.p. reduction in the

number of inhabitants with income above the poverty

line and the increase of unemployment rate by 1,3

times (comparing to 2015). In comparison with 2011,

the integral indicator of political-economic and social

perspective was lowered by 1,2 times.

The integral indicator for the section «Social

security» has a negative impact on the investment

attractiveness level due to the influence of the

following factors: the indicator «Number of recorded

crimes per one thousand people» exceeds the certain

target value by 2,2 times, while the indicator «Overall

morbidity rate» exceeds the target value by 10 times.

Negative dynamics of the integral indicator of the

development perspective seems to be alarming: there

is a 65 p.p. decrease in the integral indicator value

comparing to 2011 respective data. Negative

dynamics is primarily conditioned by 52 p.p. decrease

of the innovative capacity indicator while the

indicators for infrastructural capacity and intellectual

potential have grown. It should be noted that for a

long period of time the «Replacement of fixed assets»

issue continues to be a challenge. Firstly, it concerns

the assets component of fixed capital: the indicator

«Replacement of fixed assets» experienced a

reduction by 1,7 times while the depreciation of

equipment was 48%. It is necessary to upgrade

Assessment of the Region Investment Attractiveness in Complex Relationship with Sustainable Development on the Basis of the Balanced

Scorecard

393

production facilities of the region making it possible

to produce the goods competitive at the international

market. The important indicator of investment

attractiveness reduction is 1,6 times decrease in the

value of the indicator «Investment requirement of

sold products». The integral indicator for the

development perspective has got the lowest value

among the perspectives of the BSC (0,40). The

diagram of indicator values that are included into the

section «Development» makes it possible to fairly

demonstrate the deviation from the target values of

the following indicators: «Research and

Technological Development cost component»,

«Technological innovations cost component», «Index

of replacement of fixed assets», «Index of investment

requirement of sold products». Consequently, the

integral indicator profile for the Arkhangelsk region

shows that the integral indicator values for the

development perspective and the government and

social perspective are below the target values of

rights. This restricted the management of investments

in the Arkhangelsk region. The analysis of the results

of the investment attractiveness assessment of the

Arkhangelsk region on the basis of the balanced

scorecard allows identifying principal directions of

the investment policy of the Arkhangelsk region.

These directions include: development of market

institutions, specifically the creation of the conditions

for private entrepreneurship and small businesses;

improving the openness of the economy;

infrastructure development; improving innovative

capacity through cost increasing on Research and

Technological Development, technological

innovations, replacement of fixed assets; rising

population incomes in order to increase consumer

demand.

5 CONCLUSION

The elaboration and implementation of a balanced

scorecard-based performance evaluation system

represents an effective way for raising the investment

attractiveness of the projects being deployed in the

Arctic Zone of the Russian Federation. Further, the

BSC-based assessment of a region’s investment

attractiveness can be seen as a way of harmonizing

the interests of all stakeholders in an investment

process. Implementation of the balanced approach to

investment attractiveness assessment gives an

opportunity to identify the principal directions of the

regional investment policy. The suggested balanced

approach is aimed at improving the scientific basis of

state regulation of the investment sector at all levels.

The approach can be applied for comparative

diagnosis of regions and developing directions of

state regulation of investment activity at the macro

level. At the meso level the approach can be used

while forming the regional balanced economic

system. Confirmation of the practical importance of

the research results is the direct use of the balanced

scorecard for investment attractiveness assessment of

the Arkhangelsk region. Using the balanced scorecard

as the information base of the study of public

statistical data accounts for the possibility of applying

the elaborations by public authorities of other regions.

The balanced scorecard can be used as a set of tools

for assessing the performance of government

investment policies and for managing the

administration of regional investment measures. The

suggested balanced scorecard could become the base

for the diagnostic system that could provide for

identification of main investment problems and

developing scientifically based investment policy in

the constituent entities of Russia.

ACKNOWLEDGEMENTS

The research has been conducted in the framework of

the R&D state assignment of the Russian Presidential

Academy of National Economy and Public

Administration

REFERENCES

Anderson, R.E. (2004). Just get out of the way: how

government can help business in poor countries.

Washington, D.C.: Cato Institute, 274.

Becker, J., Fuest, C., Riedel, N. (2012). Corporate tax

effects on the quality and quantity of FDI. European

Economic Review, 56 (8): 1495-1511.

Belitski, M., Chowdhury, F. and Desai, S. (2016). Taxes,

corruption, and entry. Small Business Economic, 47 (1):

201-216. doi:10.1007/s11187-016-9724-y

Berkowitz, D., Lin, C., Ma, Y. (2015). Do property rights

matter? Evidence from a property law enactment.

Journal of Financial Economics, 116 (3): 583-593. doi:

10.1016/j.jfineco.2015.04.003

Besley, T. (2015). Law, regulation, and the business

climate: The nature and influence of the World Bank

Doing Business project. Journal of Economic

Perspectives, 29(3): 99-120. doi:10.1257/jep.29.3.99

Bhagwat, R., Sharma, M.K. (2007). Performance

measurement of supply chain management: A balanced

scorecard approach. Computers & Industrial

Engineering, 53 (1): 43-62.

doi:10.1016/j.cie.2007.04.001

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

394

Daniel, E., Myers, A. and Dixon, K. (2012). Adoption

rationales of new management practices. Journal of

Business Research, 65 (3): 371-380.

Fernandes, A., Hillberry, R. andMendoza Alcantara, A.

(2015). Trade effects of customs reform: evidence from

Albania.

Figge, F., Hahn, T., Schaltegger, S. and Wagner, M. (2002).

The sustainability balanced scorecard–linking

sustainability management to business

strategy. Business strategy and the Environment, 11

(5): 269-284. doi:10.1002/bse.339

Grishina I.V., Marukhin I.N. and Shestopalova I.P. (2013).

Peculiarities of the methodology: Research

methodology and the experience of investment

attractiveness assessment of the regions of Russia.

Federalism.1: 39-56.

Hoque, Z. and James, W. (2000). Linking balanced

scorecard measures to size and market factors: impact

on organizational performance. Journal of management

accounting research 12 (1): 1-17.

Kaplan, R. S. and Norton, D. P. (1996). Strategic learning

& the balanced scorecard. Strategy & Leadership,

24(5): 18-24.

Kaplan, R. S. (1998). Innovation action research: creating

new management theory and practice. Journal of

management accounting research, 10: 89-118.

Kaplan, R.S. and Norton, D.P. (2000). Having trouble with

your strategy? Then map it. Harvard Business Review

78 (5): 167-176.

Martinsons, M., Davison, R. and Tse, D. (1999). The

balanced scorecard: a foundation for the strategic

management of information systems. Decision support

systems, 25(1): 71-88.

Myakshin, V. and Petrov, V. (2019). Evaluating The

Investment Attractiveness Of A Region Based On The

Balanced Scorecard Approach. Regional Science

Inquiry, 11 (1): 55-64.

Niven, P.R. (2011). Balanced scorecard: Step-by-step for

government and nonprofit agencies. John Wiley &

Sons.

Olve, N.G., Roy, J. and Wetter, M. (2011). Performance

drivers: A practical guide to using a balanced

scorecard. Chichester: John Wiley & Sons.

Assessment of the Region Investment Attractiveness in Complex Relationship with Sustainable Development on the Basis of the Balanced

Scorecard

395