Financial Sustainability of the Region after the Pandemic and Factors

Affecting Its Characteristics

Lyuza Z. Bayguzina

a

, Zilya Z. Safina

b

and Asatur A. Sukyasyan

c

Bashkir State University, Karl Marx street 3/4, Ufa, Russian Federation

Keywords: Financial Sustainability, Region, Banking Sector, Pandemic, Evaluation Indicators, Innovation Products,

Biometric USB Tokens.

Abstract: The article reveals the theoretical essence of the category «financial stability of the region», has detected

distinctive features of the financial system in conjunction with the economic growth of the region. In the

authors' opinion, the most significant factors influencing the financial stability of the region after the pandemic

are highlighted. On the example of the subject of the Russian Federation - the Republic of Bashkortostan, the

banking factor and its recovery after the pandemic are considered. The authors cite domestic experience in

the development and implementation of banking services for remote customer service in the Republic of

Bashkortostan. The pandemic turned out to be the push that activated their internal mechanisms and launched

those processes that can no longer be stopped. In connection with the digitalization of the banking sector and

the development of digital technologies, society has a natural demand for new and modern banking products

and services. The emergence of new banking opportunities for the population and business that meet the needs

of the digital world increases the competitiveness of the country's economy in its entirety.

1 INTRODUCTION

The purpose of the article is to consider the factors

affecting the financial stability of a region after a

pandemic using the example of a certain region.

The issues of regional financial stability and the

role of state regulation in the processes of financial

stability have attracted great attention of the scientific

world community, which is reflected in numerous

studies of domestic and foreign academic economists.

First of all, two categories should be identified:

the first is sustainability and the second is financial.

2 RESEARCH METODOLOGY

Methodological approaches are complemented by

special methods of economic science: statistics,

methods of regression analysis, factor assessment of

the main directions of development of the financial

system, financial stability. A certain place supposed

a

https://orcid.org/0000-0002-7830-8633

b

https://orcid.org/0000-0002-9364-1311

c

https://orcid.org/0000-0001-6389-8899

to be allocated to mathematical modeling associated

with the calculations of the banking factor to identify

financial stability.

Consider several definitions of «sustainability»

given by the following authors A. Bryachikhin

(Bryachikhin, 1997) defines that «the stability of the

region is connected with the restoration of a normal

social, economic and political situation in it. For this,

it is necessary that the territorial authorities more

fully and effectively identify local opportunities,

implement the needs, interests and expectations of

residents, firmly and consistently protect them from

negative influences, including competition, elements

and abuse of the wild market».

The author N. Timchuk (Timchuk, 1980) sees the

stability of the territorial system in the invariability of

its behavior until new goals appear. According to the

researcher, in hierarchical territorial systems,

subsystems of the lower levels are most susceptible to

changes for a number of reasons. At the upper levels,

due to diffusion and some mutual smoothing of the

292

Bayguzina, L., Safina, Z. and Sukyasyan, A.

Financial Sustainability of the Region after the Pandemic and Factors Affecting its Characteristics.

DOI: 10.5220/0010589602920297

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 292-297

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

unstable parameters of the lower structures, a

relatively high stability is achieved.

V. Leksin and A. Shvetsov (Leksin and Shvetsov,

1997) proposed an interdisciplinary interpretation of

sustainability. They believe that its most important

feature is «ong-term preservation of conditions for the

reproduction of the potential of the territory in the

mode of balance and social orientation».

Now let's look at the category «financial stability»

and try to identify the factors that affect it. Today

there is no clear interpretation of the category

«financial stability of the region” and many are trying

to associate it with «financial potential», «financial

attractiveness», «inancial condition», «budget», etc.

Author Zenchenko S.V. (Zenchenko, 2008)

«Financial sustainability refers to the balance of cash

incomes and expenditures of the region and their

proportional change under the influence of external

and internal factors in order to ensure the powers of

the regional government, its socio-economic and

political development in the current and long-term

conditions».

Another important concept is the economic space

of territories, its heterogeneity. Therefore, the authors

believe that «when considering economic systems,

economic ties, various processes in the economic

space, within the framework of regional studies, can

seen connection with geographic coordinates. The

geographical basis, due to the differences in the

geographical size of the units under consideration,

requires taking into account not only absolute

changes in indicators, but also operating with the

concept of density. So, analyzing indicators (total

income of the population, production and

investment), scientists often correlate their values

with the areas of these territories or population in

order to bring them into a comparable form (Grishin

et al., 2020).

Thus, the concept of «financial stability» can be

presented in the form of a comparative characteristic

in table 1.

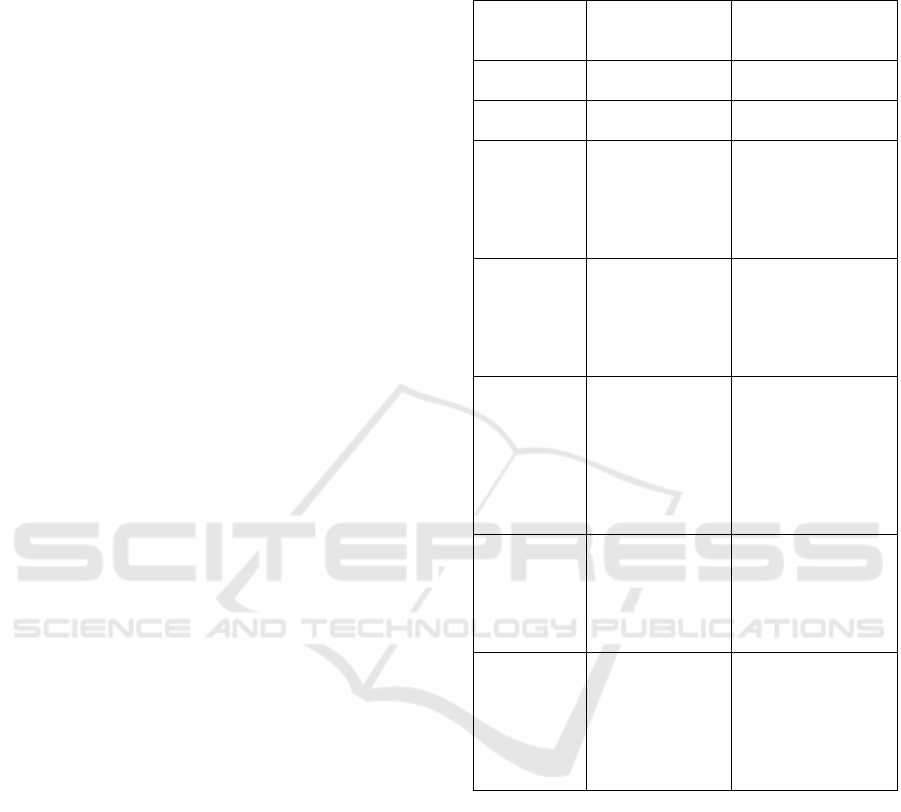

Table 1: Differences between the concepts of «financial

stability of the region» and «stability of the regional

financial system».

Сomparison

signs

Financial stability

of the region

Stability of the

regional financial

system

Category

conten

t

financial social-economical

Concept general economic

equilibrium

sustainable

developmen

t

Subject

(sphere)

formation and use

of financial

resources of the

region

systemic signs and

structural and

functional

characteristics of

financial relations in

the region

An object financial position

of the region

(financial

resources, their

sources, result of

use)

integral property of

the financial system

as a driver of

economic growth

and development of

the regio

n

Subjects of

management

Central Bank of

the Russian

Federation,

Ministry of

Finance in the

region and others

a special body for

monitoring and

systemic

management within

the regional Ministry

of Economy and

Investment

Developmen

t

Criteria for

evaluation

effective

functioning and

development of

local financial

subsystems of the

region

socio-economic,

budgetary and tax,

investment,

structural and

functional

Assessment

indicators

quantitative and

qualitative

indicators of

various financial

sub-systems

(banking, fiscal,

insurance, etc.)

arterial indicators of

stability of the

regional financial

system, comparison

with threshold values

*compiled by the author (Zotova, 2015)

As noted by the author A.I. Zotova (Zotova, 2015)

the financial system of the region should be

considered as a single entity, and not just a union of

various (banks, budget) subsystems, albeit

interconnected, as their real interaction aimed at

effective and sustainable development of the territory

in the interests of solving social and economic

problems. We fully adhere to the opinion of the

author.

Thus, in our opinion, one of the qualitative

properties of the financial system of the country and

the regions is stability, which in general is interpreted

as the ability of the system to maintain its structure

under the influence of disturbing factors or return to

its previous state after a violation.

Financial Sustainability of the Region after the Pandemic and Factors Affecting its Characteristics

293

3 MAIN PART RESEARCH

RESULTS

In our opinion the financial stability of the region

depends on the following factors:

The tax factor shows the role of budgetary and tax

policy in the region. In this factor, on the one hand,

there are enterprises, small and medium-sized

businesses that generate financial resources, which

are the main taxpayers. On the other hand, business

entities influence the formation of the financial

system of the region and the processes taking place in

it, there are government bodies that create a

regulatory framework, mechanisms and incentives

for the development of financial potential, public-

private partnership, the real sector of the economy,

including getting rid of tax mechanisms. Improving

the efficiency of the functioning of the financial

system of the region largely depends on the budgetary

system of the region, the volume of fiscal powers of

state authorities and local self-government, as well as

the efficiency and effectiveness of spending budget

funds, including financial.

In support of the above, we present the arguments

of the authors (Mol-Gomez-Vazquez et al., 2020) The

promotion of a more stable European banking system

has become a priority which, not doubt, will bring

important benefits to firms. However, bank stability

comes with stronger regulations that could harm the

access to finance of small and medium-sized

enterprises (SMEs), which are highly dependent on

bank financing. We provide new evidence on the

association between the stability of a country's

banking system and SMEs access to finance through

the study of borrower discouragement. We analyze

20,207 observations gathered among 16,382 firms

operating in the EU-28 during the period 2011-2018.

Applying multilevel methodology, our results show

that SMEs operating in countries with more stable

banking systems are less likely to be discouraged

from applying for a loan. Working to achieve a more

stable banking system does not seem to harm the

access to finance of SMEs.

The investment factor shows the level of

investment activity in the region, the role of financial

and non-financial organizations in this process.

Relative financial self-sufficiency and independence

as attributes of the regional financial system are

directly related to the system's ability to

independently generate the required volumes.

As part of the article, we will consider the

investment factor and highlight the banking sector.

The first factor influencing financial stability is

the banking sector.

The decrease in the number of commercial banks

and the weakening of competitive positions in the

regional banking market are signals of the crisis state

of the region as an integral developing system.

However, how much effective a bank-supported

economic recovery will be depends on the soundness

and health of the commercial banks themselves.

Losses from loan defaults and increases in risk-

weighted assets will deplete banks' capital. The extent

will depend on the spread of COVID-19 and the

effectiveness of the public health response and

mitigation measures.

The crisis which was caused by coronavirus has

highlighted the shortcomings of the European Union

(EU), which manifested itself after the global

financial crisis. It should be highlighted that self-

imposed restrictions within the EU have prevented

recovery over the past decade. However, the

suspension of the Stability and Growth Pact and

recent measures by the European Central Bank have

broken the shackles. We recommend national

governments use the restored sovereignty within the

EMU and not wait for common European decisions.

In addition, we provide policy suggestions in line

with EU's current structure (Ehnts and Paetz, 2020).

Reinders, H. J., Schoenmaker, D., & Van Dijk, M.

A. (Reinders et al., 2020). It should be clear that a

quick return to pre-COVID-19 policies in the EU

would have devastating consequences for economic

and political reasons. If governments would try to

consolidate their budgets, as they did during the years

after the financial crisis, a long-lasting depression is

the most likely outcome.

Southern European countries have already been in

a bad economic shape before COVID-19. The

unemployment rates in 2019 for Spain (14.1%), Italy

(10.0%) and Greece (17.3%) were in the double

digits, with a recession in Germany looming at the

end of the year. In Greece and Italy, real GDP per

capita was still lower in 2019 than in 2007. If this

countries would be forced to return to austerity

measures, they might prefer to leave the Euro.

Austerity policy cannot be successful within the next

few years for the same reason it has not been

successful in the past decade: It exacerbates the

economic downturn and the substantial fall in income

increases both public deficits and debt-to-GDP ratios

(Saez and Zucman, 2020).

According to the review of the banking sector of

the Bank of Russia for May 2020, the profit of

Russian banks fell to 45.4 billion rubles from 51.2

billion rubles in April and from 218.5 billion rubles

in March. At the same time, there was a significant

increase in deductions to reserves from 47 billion

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

294

rubles to 106.5 billion rubles, which, possibly, was

one of the main reasons for the decline in profit.

However, it should be noted that the growth of

overdue debt was not catastrophic (plus 22 billion

rubles only due to the retail sector).

Currently, the situation in the Russian financial

sector has begun to improve compared to the

beginning of the pandemic. However, the economic

downturn, decrease in the income of organizations

and the population led to an increase in credit risks.

Regulatory measures have facilitated loan

restructuring and allowed borrowers to improve their

financial position. A significant part of the Bank of

Russia's measures in connection with the pandemic

was planned for the period from March 1, 2020 to

September 30, 2020. At the same time, it is planned

that the way out of the emergency situation will be

gradual, so that banks adapt and are not forced to

reduce lending to the economy.

Compared to the beginning of the pandemic, the

liquidity situation in the banking sector has begun to

improve. In June and July 2020, the number of

citizens' ruble deposits began to increase

(Sokolinskaya and Zinov'yeva, 2020).

The volume of highly liquid assets participating in

the calculation of the short-term liquidity ratio on the

balance sheets of systemically important credit

institutions increased from March 1, 2020 to July 1,

2020 by 1.3 trillion rubles and amounted to 8.9 trillion

rubles. The Bank of Russia switched to a soft

monetary policy, lowering the key rate to 4.25%, as a

result of which banks have the opportunity to reduce

interest rates on loans, including for small and

medium-sized businesses.

The coronavirus pandemic served as a kind of

catalyst for the digital transformation of the banking

sector. Judging by the experience of recent months, it

is digital transformation that sets the vector for the

development of their business processes for banks.

During the pandemic, many citizens are convinced of

the benefits of remote services and plan to use them

after it ends.

Consider the banking factor at the regional level

of the Republic of Bashkortostan (Bayguzina et al.,

2019).

One of the innovations is the calculated economic

benefits of implementing multi-factor authentication

based on biometric USB tokens. Nevertheless, there

are still restrictions and some drawbacks of such

systems. Even interfaces of the best Russian Internet

banks come up with some absurd solutions with

regard to the end user, which is mainly imposed by

various severe restrictions of software modules and

platforms.

It is essential to present some statistical data in

order to make the study verifiable. The paper presents

economic benefits from multifactor authentication

based on biometric USB-tokens. Initially, it is

suggested to introduce such systems only for legal

entities since they represent the target group when

dealing with cyberattacks due to large sums of money

available in accounts. The study of the market of

biometric USB-tokens was carried out. According to

its results, a solution of ISBC group - ESMART

Token GOST - was selected. This represents a

cryptographic protection of information with

hardware support of Russian cryptographic

algorithms based on domestic MIK 51 chip

manufactured by JSC NIIME and Mikron Plant.

The group of companies known as Mikron created

the entire production chain from design to production

of the ultimate product, which allows producing the

whole range of high-tech products and solutions

aimed at the mass market: RFID chips and tags, SIM

cards, transit and bank cards with a chip, protected

microchips for social cards and state identification

documents. Mikron annually produces more than 400

million RFID tags, 50 million bank chips, 30 million

bank cards, more than 5 million chips for the

production of biometric passports and electronic

documents. Mikron is also the largest Russian

exporter of industrial microchips - more than 500

million microchips manufactured by Mikron are

annually exported to Europe and South-East Asia for

enterprises that produce various electronic

equipment. The choice of tokens based on

microelectronics produced by Mikron is justified by

its ability to provide the necessary volume of

production, without purchasing ready-made foreign

solutions and technologies. Moreover, it eliminates

the need to purchase an expensive license for their

production and use, which is especially complicated

under sanctions. This token exemplifies how

biometrics allows effectively solving different tasks

related to information security and protection. The

advantages of such tokens include low cost, ability to

be used as an electronic signature, and, in comparison

with smart cards, there is no need for special readers,

the cost of which is several times higher than the cost

of USB-Tokens, with the same level of security

provided. The secure controller, embedded in

ESMART Token GOST, provides protection against

attacks such as SPA, DPA, DFA. The intrusion

sensors, light, impulse noise, voltage, temperature, as

well as hardware integrity control sensors and

erasability of EEPROM secure key information to

protect against breaking the chip and unauthorized

access. EEPROM is an electrically erasable

Financial Sustainability of the Region after the Pandemic and Factors Affecting its Characteristics

295

reprogrammable permanent storage device and one of

the types of nonvolatile memory.

Bashsomsnabbank accounts for 5% or from 500

million to 30 billion rubles. This indicator was

calculated on the basis of data obtained from

Marswebb lnternet Banking 2016 concerning the

level of penetration of the Internet banking among

legal entities and data of Bashkomsnabbank, which

indicate approximately 5% (formula 1) of legal

entities.

(75318/4.5 *0.35)*100=4.79 (1)

where 75138 – number of clients (mln) – legal

entities, using remote banking services of

Bashkomsnabbank;

4.5 mln – number of registered legal entities in

Russia;

0.35 – level of penetration of the Internet banking

amongst legal entities in Russia.

Based on the estimates of Group-IB and the

Sberbank of Russia for 2018-2019, the legal entities

in Russia suffered losses from cyberattacks making

from 10 to 400 billion rubles, depending on

evaluation as such. Proceeding from this assumption,

one assumes that the distribution of cyberattacks in

general will coincide with the number of users of the

Internet banking and will make from 500 million to

20 billion rubles for Rosselkhozbank.

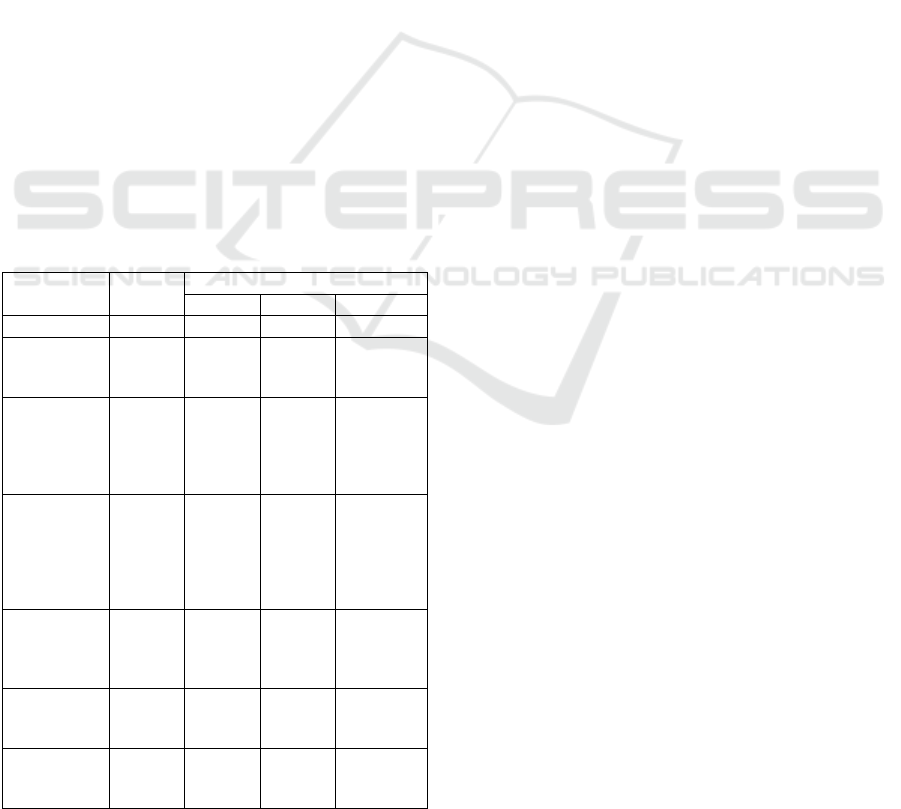

Table 2: Intended economic effect from introducing USB-

tokens ESMART Token GOST with biometrics.

Indicator Total

Scope of introduction

2018 2019 2020

1 2 3 4 5

Number of

connected

clients

75,138

USB token

ESMART

Token

GOST/USB,

pcs.

80,000 25,000 25,000 30,000

Price per unit

of USB token

ESMART

Token

GOST/USB,

rubles

- 1,486 1,545 1,607

License value

per software

unit (for 3

years)

- 1,634 1,699 1,767

Expenses on

potential

losses (7%)

1,822,371 5,460,000 5,677,770 7,085,941

Total

expenses,

rubles

2,785,629 8,346,000 8,678,870 108,313,669

*Developed by the author

The above calculations allow concluding that the

share of costs related to the transition of legal entities

to the system of multifactor authentication, including

biometrics, makes from 55.7% to 1.4% of potential

losses on 50 cyberttacks. Therefore, it seems

advisable and reasonable to install this system.

In this regard, the development of RBS protection

systems is aimed at the maximum possible cost and

time associated with attacks. Such strategy excludes

those people who cannot afford organizing and

implementing attacks due to their poor financial

potential. Maintaining the adequate level of

information security requires a systematic approach

and investments from a particular bank. Otherwise, a

bank puts trustworthiness and loyalty of its customers

at risk, since the latter ones perceive the Internet

banking as a necessary tool of any bank they are

dealing with.

At present, in terms of security of individuals,

Bashsomsnabbank provides its customers with

reliable security of remote banking operations, which

is continuously ensured through leading domestic

developments

4 THE DISCUSSION OF THE

RESULTS

Currently, the banking sector is focused on customer

focus. All current transformations and innovations,

first of all, take place for clients, for the convenience

of providing them with services, for increasing their

confidence in the banking sector.

The pandemic turned out to be the push that

activated their internal mechanisms and launched

those processes that can no longer be stopped. In

connection with the digitalization of the banking

sector and the development of digital technologies,

society has a natural demand for new and modern

banking products and services. The emergence of

new banking opportunities for people and businesses

that meet the needs of the digital world increases the

competitiveness of the country's economy as a whole.

The rapid development of the banking sector,

building ecosystems, digitalization and globalization

at all levels of the system are what awaits us in the

near future.

The pandemic has become a factor pushing the

digitalization of banking services and the transition to

online. With the introduction of the self-isolation

regime, banks were forced to more actively improve

their digital capabilities, although before that this

process was quite intense. Back in 2019 (compared to

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

296

2018), the number of bank customers who used online

services increased by more than one and a half times.

The logical consequence of the pandemic has

become the intensification of competition in the

development of digital services: the overwhelming

majority of banks have taken measures to expand the

functionality of mobile applications, which have

become the main element of the digital

transformation of banking services. The emphasis is

placed on the maximum use of innovative

technologies, as well as on constant renewal and

modernization, which directly affects the

competitiveness of the bank. The functionality of

applications began to include not only the possibility

of remote registration of banking products, but also

the receipt of certificates, statements, transaction

histories. The quality and usability of apps began to

seriously affect the quality of customer service.

5 CONCLUSION

According to the results of calculations, it can be

concluded that the share of the costs of transferring

clients - legal entities to multifactor authentication

systems including biometrics - will be from 55.7% to

1.4% of possible losses from 50 hacker attacks. Based

on this, we can conclude that the introduction of this

system is advisable.

In this regard, the development of RBSprotection

systems is aimed at making the cost and time spent on

carrying out attacks as high as possible. Such a

strategy excludes those for whom the cost of

organizing and conducting an attack on the remote

banking system is higher than their financial

capabilities.

Maintaining a sufficient level of information

security requires a systematic approach and

investment on the part of the bank, otherwise the bank

risks losing the trust and loyalty of its customers, who

refer Internet banking to the list of necessary services

provided by the bank in which they are served.

In the field of Internet banking security for

individuals, to date, Bashkomsnabbank provides high

security of operations in the RBS system, ensured by

constant improvement of the current system and the

use of leading domestic developments.

REFERENCES

Analysis of methods for assessing the financial potential of

the region (2008). Collection of scientific works of

SevKav GTU. Ser. "Economy, 8.

Bayguzina, L.Z., Galimova, G.A., Nurdavlyatova, E.F. and

Ponomareva, L.N. (2019). Globalization of financial

system and its synergetic effect at regional levelsocial

and cultural transformations in the context of modern

globalism. European Proceedings of Social and

Behavioural Sciences, 58: 209-216.

Bryachikhin, A. (1997). Western Administrative.

Economics Institute Public Policy Brief, 133.

Ehnts, D. and Paetz, M. (2020). COVID-19 and its

economic consequences for the Euro Area. Eurasian

Economic Review.

Grishin, K.E., Kazakova, O.B., Kuzminykh, N.A. and

Timeryanova N.A. (2020). Economic space:

approaches to research and the form of presentation.

Economics and Management: scientific and practical

journal, 3(153): 4-11.

Leksin, V.N. and Shvetsov, A.N. (1997). State and regions.

Theory and practice of state regulation of territorial

development, pages 27-28.

Mol-Gomez-Vazquez, A., Hernandez-Canovas, G. and

Koeter-Kant, J. (2020). Banking stability and borrower

discouragement: a multilevel analysis for SMEs in the

EU. Small Business Economics.

Reinders, H. J., Schoenmaker, D. and Van Dijk, M. A.

(2020). Is COVID-19 a threat to fnancial stability in

Europe? CEPR, DP14922

Saez, E. and Zucman, G. (2020). The triumph of injustice—

taxes and inequality in the 21st century. New York:

Norton and Company.

Sokolinskaya, N. E. and Zinov'yeva, Y. A. (2020).

Bankovskiy sektor do i posle pandemii. Finasovvyy

rynok i banki.

The Bank of Russia made a decision on regulatory

concessions and macroprudential measures. [Electronic

resource]. URL:

https://cbr.ru/press/pr/?file=10082020_163109pr_0.ht

m17.

Timchuk, N.F. (1980). City and region. Regulation of

integrated development, 19.

What is happening in the Russian banking sector after the

pandemic. [Electronic resource]. URL:

https://2stocks.ru/2.0/russian/stocks/ news / chto-

proishodit-v-rossiyskom-bankovskomsektore-posle-

pandemii.

Zotova, A.I. and Kirichenko, M.V. (2015). Financial

system of the region: structural and functional aspect.

Modern science: actual problems of theory and

practice. Series: Economics and Law, 11–12: 82–86.

Financial Sustainability of the Region after the Pandemic and Factors Affecting its Characteristics

297