Analysis of Financial Stability of the Insurance Market in

Novosibirsk Region

Mikhail K. Chernyakov

a

, Olesya V. Usacheva

b

and Natalia I. Aksenova

c

Novosibirsk State Technical University, Novosibirsk, Russia

Keywords: Insurance, Financial Stability, Analysis, Risks.

Abstract: The current state of the insurance market is characterized by a high degree of instability. The financial stability

of insurance companies is influenced by a large number of factors, such as the number of contracts, payout

ratio, capital structure, profitability and underwriting risk. The insurance industry acts as a protective barrier

for the country's economy from the effects of various risks, at the same time, the financial stability of insurance

companies is also subject to the influence of risks. The volume of scientific publications indicates the presence

of a steady interest in this problem. However, there is no methodology to establish the relationship between

financial stability and multiple factors influencing it. Our research is aimed at identifying links and

determining the influence of factors on the financial stability of insurance companies. We assumed that the

factors that change the financial stability of the insurance market can be identified and assessed using a

forward-looking analysis of the paradoxical theory of regulation. Based on this analysis, a regression model

was formed for the insurance market of the Novosibirsk region, which can form the basis for predicting the

financial stability of insurance companies.

1 INTRODUCTION

Insurance is a significant part of the country's

financial and credit mechanism, and sustainable

development of this segment contributes to the

development of the economy as a whole and allows

to raise the level of financial activity of the population

and the level of its social protection. The most

important strategic task is to comprehensively

promote the development of the insurance industry

and make it a strategically important Russian

economy sector. Regional insurance markets

represent integral elements of the national insurance

market. Even in the Strategy of development of

insurance activity in the Russian Federation until

2020, the expansion of regional programs for the

development of certain types of insurance was

specified as a measure to ensure sustainable

development of the voluntary insurance sphere.

Ensuring sustainable development of regional

insurance markets is a primary task in ensuring the

development of the insurance industry as a whole.

a

https://orcid.org/0000-0002-9837-4849

b

https://orcid.org/0000-0002-2625-8988

c

https://orcid.org/0000-0001-7487-9722

The insurance market's financial stability is its

main fundamental value since the insurer's ability to

timely and fully fulfill its obligations is significant for

all market participants, from the insurer to the

insurance supervisory authorities. As noted by

Konstantinova E. A., Trezorova O. Yu. as a factor

creating the relationship between economic entities

and insurance companies, scientists consider the

maintenance of financial stability of the insurance

organization within the given limits (Konstantinova

and Trezorova, 2016). Problems of estimation of

insurance organizations financial stability cause

steady both scientific and practical interest. In doing

so, scholars reveal different relationships between

industry regulation and insurers' financial stability

(Gavira-Durón et al., 2020), between capital structure

and financial stability (Rubio-Misas, 2020), between

financial stability and risk (Moreno et al.,2020),

between risk and digitalization (Bryzgalov et al.,

2020), between capital and risk (Dacorogna, 2018),

etc.

Chernyakov, M., Usacheva, O. and Aksenova, N.

Analysis of Financial Stability of the Insurance Market in Novosibirsk Region.

DOI: 10.5220/0010588802410250

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 241-250

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

241

Thus, Rubio-Misas, M. investigated the effect of

ownership concentration on risk taking by insurance

companies using Z-score as a validity criterion and

applying a two-step GMM framework. His study

results showed that insurers with a more concentrated

ownership structure tend to have lower levels of

financial stability (Rubio-Misas, 2020).

A study of the performance of Spanish insurance

companies during the economic crisis, based on a

dynamic panel data model, made it possible to

establish a direct relationship between actual

solvency margins and profitability, underwriting risk

and an inverse relationship with size, use of

reinsurance, long-term business and life insurance

specialization. Lower insurance market concentration

also leads to lower solvency margins (Moreno et al.,

2020).

The link between profitability and financial

stability of insurance companies is also discussed in

the article by scientists from Kazakhstan. They

investigated the profitability of insurance companies

by constructing an econometric linear multivariate

regression model and proved that it is influenced by

three indicators, firm size (its assets), fixed

production assets, and financial leverage and

substantiated the possibility of using these indicators

further to predict the profitability and financial

stability of insurance companies. Debt-to-asset ratio

characterizes the extent to which the company fulfills

its current obligations, so the paper focuses on the

need for adequate reflection of liabilities in the

financial statements as the main source of information

for interested users (Kulustayeva et al., 2020).

Insurance companies are the primary means of

protecting the country's economy from various risks

while being affected by risks that reduce their

financial sustainability. Financial globalization has

led to an accelerated growth of financial flows, which

has influenced the state and further the development

of the insurance sector of the economy. The security

of the insurance sector depends on the economic

security of the country as a whole. Palestinian

researchers see the need to study insurance

companies' financial conditions and identify the key

factors affecting their solvency and establish a close

relationship between them (Abdel and Ayyash,

2019).

The global trend shows an increase in systemic

risk due to insurance companies' sensitivity to

changes in interest rates (increasing aggregate risk)

and increased cyber threats (Gómez et al., 2018). The

digitalization of the insurance market creates new

opportunities for market participants, but on the other

hand, it also creates additional risks, such as

cyberattacks. The insurance market's financial

stability is also affected by high competition from the

banking sector, which offers insurance services along

with purely banking products. In doing so, banks

adapt their products to the trends and dynamics that

characterize the global insurance industry (Marzai,

2018). Another factor affecting the insurance industry

and carrying risk is the decline in purchasing power,

as most insurance products are designed for the mass

consumer. Nesterenko E.V. talks about the

interrelation of risks and financial stability of an

insurance company. In particular, it points to the

existence of two types of risks in the insurance

sphere: risks arising directly from the activities of the

insurance organization as an object of economic

activity, as well as risks transferred from the insured

(Nesterenko, 2018). Some authors consider the

presence of losses as a factor affecting insurance

companies' financial stability, which represents an

integral element of economic security in the insurance

sector (Pavlova et al., 2017). They consider the

necessity of risk assessment when accepting a facility

for insurance as an unconditional priority.

Eling, M. et al investigate the possibility of using

artificial intelligence by insurance companies to

improve the quality of loss probability prediction and

reduce asymmetric information. Researchers note

that artificial intelligence can significantly change the

risk landscape by transforming risks, requiring

insurance companies to rethink traditional insurance

coverage and develop adequate insurance products

(Eling et al., 2021).

Russian scientist D.V. Bryzgalov and his

colleagues devoted their research to the consideration

of transformational processes taking place in the

insurance market under conditions of digitalization of

the economy in the context of insurance theory. The

authors identified two indicators to assess the

insurance market's digitalization (the coefficient of

use of new digital technologies and the level of

penetration (digitalization)). They found

heterogeneity in the use of digital technologies across

different insurer business processes: from the

maximum in the organization of sales of insurance

services to the minimum in the risk management of

insurance companies themselves (Bryzgalov et al.,

2020).

The problems of efficiency evaluation of

insurance organizations are studied by the Swiss

scientist Michel Dacorogna. In particular, he points to

the inadequacy of existing performance indicators to

current trends in global insurance development and

notes a gradual shift towards introducing such

indicators as risk-adjusted return on equity, which

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

242

allows assessing the proportionality of profits earned

on a particular insurance contract to the risks

incurred. Central to this is the concept of risk capital

and the need to manage it in maintaining the solvency

of insurance operations (Dacorogna, 2018).

The current state of the Russian insurance market

is characterized as unstable, as evidenced by low

demand for insurance services: the share of insurance

premiums in domestic GDP is 1.4%, which is more

than 4 times lower than the global average. The ratio

of claims paid to premiums paid in 2019 was 41.4%,

i.e., for every ruble paid, the consumer receives 41

kopecks. The slowdown in the insurance market's

development is due to the lack of in-demand

insurance products and their low attractiveness for

consumers (Sukhorukova et al., 2016).

Thus, we can state the undoubted interest of

researchers from different countries to assess

financial stability in the insurance sector. We will try

to identify the parameters affecting financial

sustainability and establish the presence or absence of

relationships between them. As we see it, the research

results will be interesting both for insurance market

regulators and its main subjects: policyholders and

insurers, as well as scientists researching this and

related scientific fields.

2 RESEARCH METHODS

The research is performed using the prospective

analysis of the paradoxical theory of regulation

proposed by M.M. Chernyakova and tested on the

dairy industry's example (Chernyakova, 2019).

3 RESULTS OF RESEARCH

As a regional insurance market, the insurance market

of Novosibirsk region (NSR) was investigated in the

context of factors influencing its financial

sustainability. The peculiarities of the insurance

market infrastructure in the NSR have been

identified, which consists of the prevalence of

branches of federal-level insurance companies in the

market. While only three regional insurers (registered

in NSR) are active, providing a share of 6.15% of the

total premiums collected in NSR in 2019. One insurer

specializes in compulsory health insurance. The other

two, one of which is a mutual insurance company,

specialize in insuring means of land transport (except

for railway transport).

The Novosibirsk Region ranks 8th among Russian

regions (Table 1) and 1st in the Siberian Federal

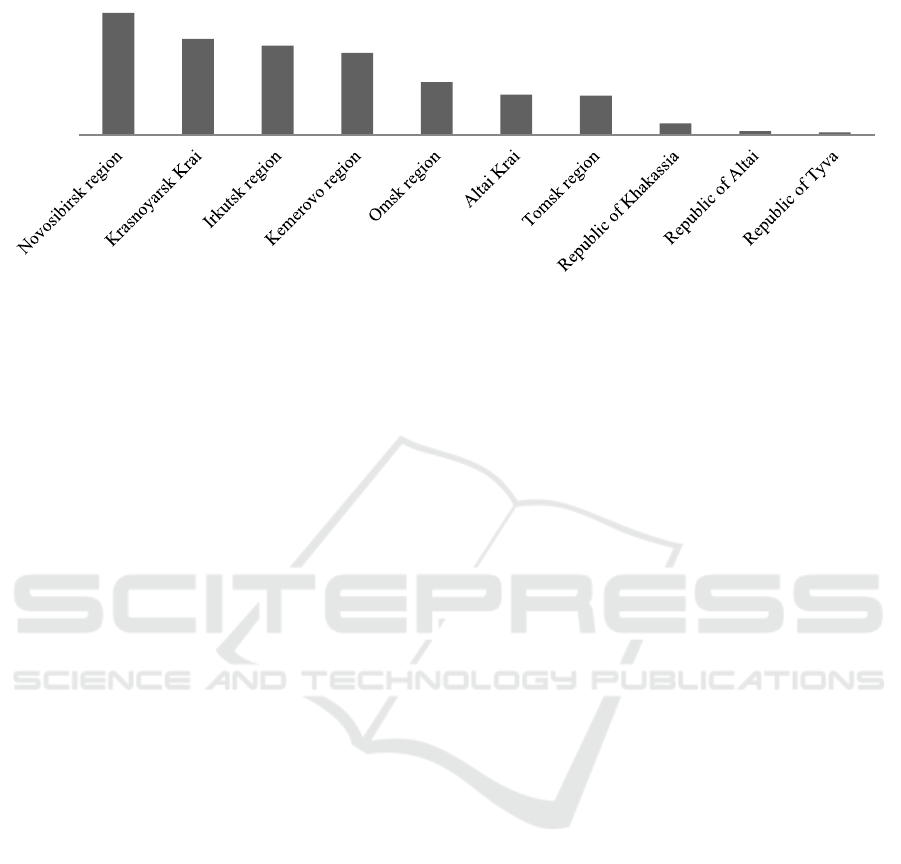

District (Figure 1).

Table 1: Top 10 constituent entities of the Russian Federation in terms of premiums collected in 2019.

Region

Volume of insurance

premiums,

RUB bln

Number of contracts,

million

Volume of

premiums/contract,

thousand roubles

Moscow

727.6 100.4 7.2

St. Petersburg

123.8 8.6 14.4

Moscow region

58.9 6.2 9.5

Re

p

ublic of Tatarstan

27.9 3.6 7.8

Krasnodar Territor

y

26.9 3.9 6.9

Sverdlovsk re

g

ion

26.8 4.2 6.4

Samara region

25.1 2.8 9.0

Republic of Bashkortostan

18.9 2.5 7.6

Chelyabinsk region

18.3 3.2 5.7

Novosibirsk re

g

ion

17.9 2.8 6.4

Analysis of Financial Stability of the Insurance Market in Novosibirsk Region

243

Figure 1: Insurance payments in 2019 by regions of the Siberian Federal District (as % of total).

Nearly 50% of the NSR insurance market in terms

of premiums collected in 2019 is held by 3 financial

groups:

1. 20% - SOGAZ Group - RUB 3.6 billion

(SOGAZ, SOGAZ-Life, VTB Insurance, VTB Life

Insurance)

2. 14% - "Sberbank insurance" - RUB 2,6 billion

("Sberbank Insurance", "Sberbank Life Insurance")

3. 13% - Alfastrakhovanie Group - RUB 2.4

billion ("Alfastrakhovanie", "Alfastrakhovanie -

life".

In 2019, 82 companies were active in the

insurance market of the Novosibirsk region (3

companies more than in 2018). In 2019, 9 new

insurance companies entered the regional market and

6 left the market. The new companies' main product

directions in the market are life insurance, travel

insurance, voluntary medical insurance, and property

insurance of enterprises and individuals.

The Novosibirsk Region's voluntary and

compulsory insurance market, excluding OMI,

amounted to RUB 17.8 billion (+13.3%) in 2019. The

voluntary insurance segment (life insurance, personal

insurance, property insurance) accounted for RUB

13.5 billion or 76%, and the compulsory insurance

segment (MTPL, hazardous facility liability

insurance, carrier liability insurance) accounted for

24%. As the key drivers of 2019 in the Novosibirsk

region market participants note - growth of premiums

in OSAGO, CASCO - insurance of legal entities, in

personal insurance high dynamics in accident and

illness insurance, in particular in bank insurance;

insurance of property of legal entities - cargoes,

means of air transport, insurance of business and

financial risks.

In the voluntary insurance market in the

Novosibirsk region in 2019, life insurance and

pension insurance amounted to RUB 6.03 billion,

which corresponds to 44.6% of the market (+8.2%

compared to 2018). Life insurance (99%) makes the

main contribution to the formation of insurance

premiums in this segment of the insurance market.

Property insurance segment in the voluntary

insurance market in Novosibirsk region increased by

26.4% compared to 2018 and took 31% (RUB 4.2

billion) by the end of 2019. 85% of the property

insurance segment accounts for property insurance

(of which RUB 1.4 billion are premiums under hull

insurance contracts) and 15% for voluntary civil

liability insurance.

Personal insurance reached 24.3% (RUB 3.2

billion) of the voluntary insurance market in the

Novosibirsk region in 2019 (+18.7% vs. 2018).

Accident insurance accounts for 71% (+33.4% vs.

2018 or RUB 2.3 billion). The remaining share is

accounted for by AMI (-6.6% vs. 2018).

In the compulsory insurance market in the

Novosibirsk region, OSAGO is the leader - 98.4%

(+6% vs. 2018) out of 4.4 billion rubles.

The payout rate in Novosibirsk region in terms of

insurance premiums in 2019 was 44% (+5%) or RUB

7.8 billion in absolute values (+25%). In life

insurance, the level of payments from the collected

insurance premiums amounted to 39% or 2.3 billion

rubles (+74%). The level of payments under CASCO

is 57%. Accident insurance - 12%. The level of

OSAGO insurance payouts in 2019 was 80%.

The Novosibirsk Region ranks 10th after federal

cities and 7 regions in terms of premiums collected in

2019 (Table 1). A total of 2.8 million insurance

contracts were concluded; each contract amounted to

an average of 6.5 thousand rubles. For comparison,

among the top 15 regions of the country in terms of

premiums collected, the highest indicator of

premiums collected to the number of contracts is in

22,6%

17,8%

16,5%

15,2%

9,8%

7,5%

7,3%

2,1%

0,7%

0,5%

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

244

St. Petersburg - 14.4 thousand rubles, the lowest one

- in the Rostov region.

The market of insurance services is dominated by

organizations registered in other regions and only 3

organizations and two branches - in NSO

(Gorshkova, 2020). The insurance companies of the

Novosibirsk region almost completely provide

services of voluntary insurance only (Tab. 2). The

insurance fund financial strength ratio was calculated

using the formula:

X19=(X2+X8+X12+X17)/(X3+X18) (1)

Table 2: Activities of insurers - legal entities registered in the Novosibirsk Region in 2015-2019.

X1 Time period, year 2015 2016 2017 2018 2019

X2 Insurance premiums by insurance types, RUB bln 0.885 0.509 0.691 0.772 0.917

X3 Insurance payments by types of insurance, RUB bln 0.303 0.088 0.044 0.036 0.030

X4 Insurance proceeds, RUB bln 0.582 0.421 0647 0.736 0.887

X5

Number of contracts concluded by type of insurance, mln.

units

0.306 0.179 0.229 0.209 0.437

X6

Sum insured under the concluded contracts by types of

insurance, RUB bln

93.724 70.255 67.485 56.362 93.426

X7 Payout ratio by insurance types, % 36.300 18.000 6.500 4.700 3.300

X8 Investment income, RUB bln 1.285 0.048 0.427 1.306 0.339

X9 Share capital, RUB bln 0.969 0.638 0.657 0.657 0.657

X10 Net profit (loss "-"), RUB bln 0,137 0.023 0.064 0.0002 0.158

X11 Equity capital, RUB bln 1.107 0.661 0.720 0.657 0.814

X12 Insurance reserves, RUB bln 1.625 0.271 0.708 0.796 0.916

X13 Leverage 1.468 0.410 0.983 1.212 1.125

X14 Accounts receivable (end of period), RUB bln 0.948 0.769 0.810 0.840 0.901

X15 Accounts payable (end of period), RUB bln 0.242 0.045 0.753 0.847 0.888

X16 Ratio of AR to AP 3.920 17.012 1.076 0.992 1.014

X17 Other income from insurance activities, RUB bln 3.502 0.00317 0.00592 0.00034 0.000

X18 Case Management Costs (CMC), RUB bln 5.693 5.693 0.562 0.659 0.744

X19 Insurance fund financial strength ratio 1.214 0.144 3020 4.137 2.804

According to the data presented in the table,

insurance payouts and business expenses of insurers

tended to decrease during the period under review,

which was reflected in an increase in the insurance

fund financial sustainability ratio. One of the factors

affecting insurers' financial stability is the payout

ratio (X7), the decrease of which in the specified

period was also contributed by the decrease in the

amounts of insurance payouts by insurance types.

Since 2017, there has been a significant decrease in

the accounts receivable (AR) to accounts payable

(AP) ratio. Based on the fact that the value of the

insurance company's AR should roughly correspond

to the value of its AP, we regard this trend as positive.

An excess of AR over AP, as was the case in 2017,

may have as negative consequences the insurance

company's failure to meet regulatory requirements for

the placement of its insurance reserves, which will

result, accordingly, in a lower investment income and

reduced financial stability. This dependence is

confirmed by the data in Table 2 (X8 and X19). There

is also a trend of rapid growth in the profitability of

NSO insurance organizations, due to an increase in

insurance premiums (on average 10% annually) and

a 10-fold decrease in insurance payouts in 2019

relative to 2015. These results were achieved by

changing the proportions of personal and property

insurance - growth of personal and reduction of

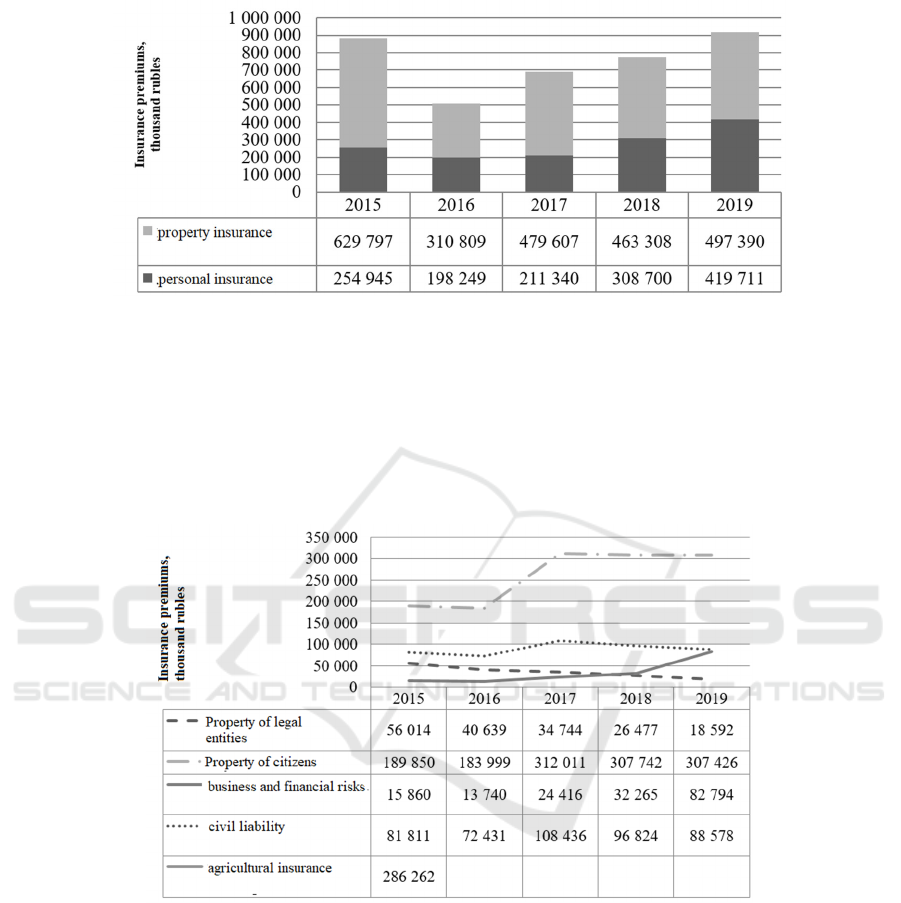

property insurance (Fig. 2). It is worth noting that the

growth in insurance premiums occurred against the

backdrop of a decline in the number of insurers from

five to three in 2016.

Analysis of Financial Stability of the Insurance Market in Novosibirsk Region

245

Figure 2: Changes in the structure of voluntary insurance.

The sharp decline in property insurance in 2016

(fig. 2) is associated with the exclusion of high-risk

agricultural insurance from the list of services of

insurers - legal entities registered in the Novosibirsk

Oblast (fig. 3) (Gorshkova, 2020). This was a

consequence of an erroneous management decision to

include state support for agricultural insurance in the

"single subsidy". The resulting management risk led

to an increase in psychological risk, which led to the

mass abandonment of insurance by economic entities

of the agricultural sector (Chernyakov and

Chernyakova, 2021), (Chernyakov and Chernyakova,

2019).

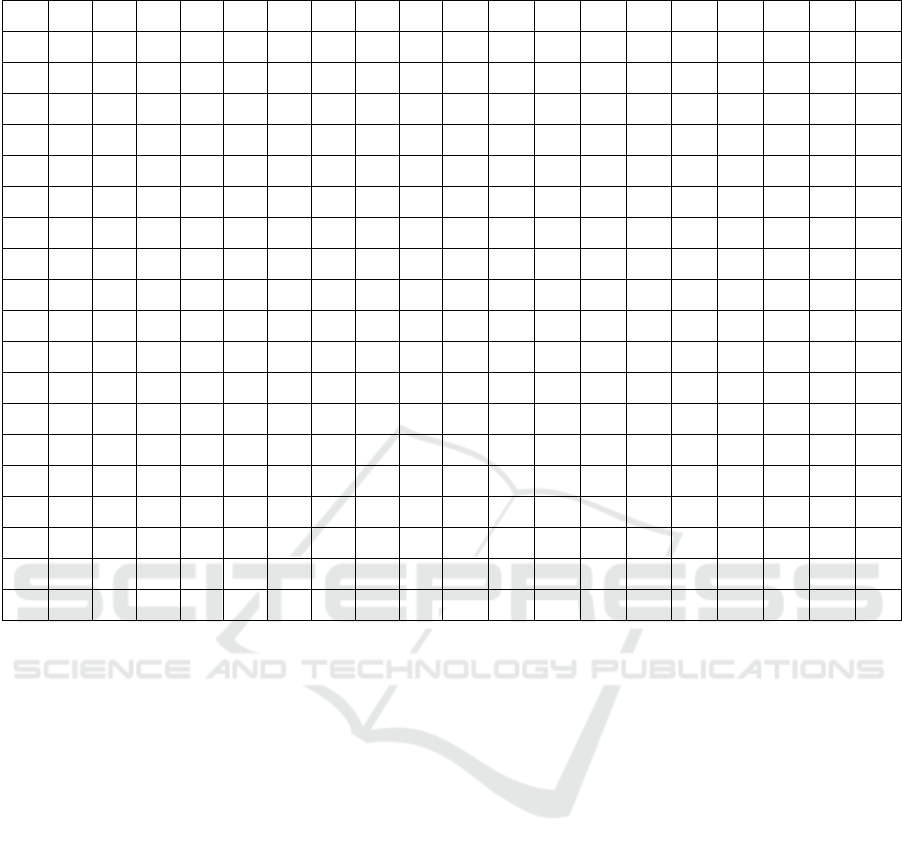

Figure 3: Change in the structure of voluntary insurance by individual types of insurance.

The correlation analysis of the table 2 shows the

possible direct close to linear relationship (R>0,7) of

time period (X1) with 8 of 18 insurance market

parameters (table 3): insurance payments (X3),

earnings (X4), payout ratio (X7), authorized capital

(X9), accounts payable (X15), other income from

insurance activities (X17), costs of doing business

(X18) and insurance fund financial stability

coefficient (X19). According to the paradoxical

theory of regulation (Chernyakova, 2019), other

parameters can be related to the time period only

indirectly, through parameters of direct influence.

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

246

Table 3: Correlation analysis of insurers - legal entities registered in the Novosibirsk region in 2015-2019.

X1 X2 X3 X4 X5 X6 X7 X8 X9 X10 X11 X12 X13 X14 X15 X16 X17 X18 X19

X1 1.0 0.3 -0.8 0.8 0.4 -0.1 -0.9 -0.2 -0.7 0.0 -0.5 -0.3 0.0 -0.1 0.9 -0.5 -0.7 -0.9 0.7

X2 0.3 1.0 0.3 0.8 0.8 0.6 0.1 0.5 0.5 0.7 0.6 0.8 0.9 0.9 0.5 -0.8 0.4 -0.3 0.4

X3 -0.8 0.3 1.0 -0.4 0.1 0.5 1.0 0.5 1.0 0.4 0.9 0.8 0.4 0.6 -0.6 0.1 1.0 0.8 -0.5

X4 0.8 0.8 -0.4 1.0 0.7 0.2 -0.6 0.2 -0.2 0.4 0.0 0.3 0.5 0.5 0.9 -0.8 -0.2 -0.8 0.8

X5 0.4 0.8 0.1 0.7 1.0 0.8 -0.1 0.0 0.2 0.9 0.5 0.5 0.5 0.7 0.4 -0.5 0.2 -0.2 0.2

X6 -0.1 0.6 0.5 0.2 0.8 1.0 0.5 0.0 0.6 1.0 0.8 0.6 0.4 0.8 -0.2 -0.1 0.6 0.3 -0.4

X7 -0.9 0.1 1.0 -0.6 -0.1 0.5 1.0 0.3 0.9 0.3 0.8 0.6 0.2 0.4 -0.8 0.3 0.9 0.9 -0.7

X8 -0.2 0.5 0.5 0.2 0.0 0.0 0.3 1.0 0.6 0.0 0.5 0.7 0.8 0.6 0.2 -0.5 0.6 0.0 0.4

X9 -0.7 0.5 1.0 -0.2 0.2 0.6 0.9 0.6 1.0 0.5 0.9 0.9 0.7 0.8 -0.4 -0.1 1.0 0.6 -0.3

X10 0.0 0.7 0.4 0.4 0.9 1.0 0.3 0.0 0.5 1.0 0.8 0.7 0.5 0.8 0.1 -0.4 0.5 0.1 -0.1

X11 -0.5 0.6 0.9 0.0 0.5 0.8 0.8 0.5 0.9 0.8 1.0 0.9 0.7 0.9 -0.3 -0.2 0.9 0.5 -0.3

X12 -0.3 0.8 0.8 0.3 0.5 0.6 0.6 0.7 0.9 0.7 0.9 1.0 0.9 0.9 0.0 -0.5 0.9 0.2 0.1

X13 0.0 0.9 0.4 0.5 0.5 0.4 0.2 0.8 0.7 0.5 0.7 0.9 1.0 0.9 0.4 -0.8 0.6 -0.2 0.5

X14 -0.1 0.9 0.6 0.5 0.7 0.8 0.4 0.6 0.8 0.8 0.9 0.9 0.9 1.0 0.2 -0.5 0.7 0.1 0.1

X15 0.9 0.5 -0.6 0.9 0.4 -0.2 -0.8 0.2 -0.4 0.1 -0.3 0.0 0.4 0.2 1.0 -0.8 -0.5 -1.0 0.9

X16 -0.5 -0.8 0.1 -0.8 -0.5 -0.1 0.3 -0.5 -0.1 -0.4 -0.2 -0.5 -0.8 -0.5 -0,8 1.0 -0.1 0.7 -0.8

X17 -0.7 0.4 1.0 -0.2 0.2 0.6 0.9 0.6 1.0 0.5 0.9 0.9 0.6 0.7 -0.5 -0.1 1.0 0.6 -0.4

X18 -0.9 -0.3 0.8 -0.8 -0.2 0.3 0.9 0.0 0.6 0.1 0.5 0.2 -0.2 0.1 -1.0 0.7 0.6 1.0 -0.9

X19 0.7 0.4 -0.5 0.8 0.2 -0.4 -0.7 0.4 -0.3 -0.1 -0.3 0.1 0.5 0.1 0.9 -0.8 -0.4 -0.9 1.0

Table 2 shows that income (X4) has a direct

relationship (R>0.7) with insurance premiums (X2)

and the number of concluded contracts (X5), while

the latter is directly related (R>0.8) to the sum insured

on concluded contracts (X6) and net profit (X10).

Table 2 also shows that statutory capital (X9) has

a direct relationship (R>0.7) with equity (X11),

insurance reserves (X12), leverage (X13), and

accounts receivable (X14), while the penultimate is

directly related (R>0.8) to investment income (X8).

Given the existing system of relationships

according to the paradoxical theory of regulation

(Chernyakova, 2019), a regression model can be

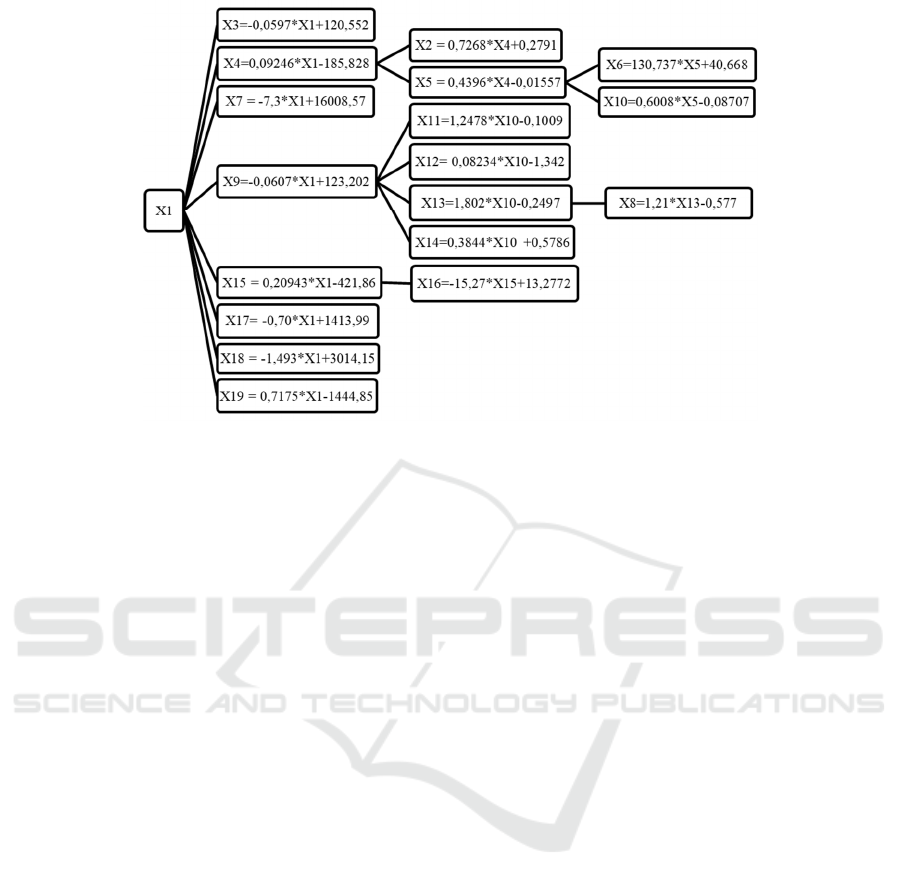

built. The algorithm of such a three-level model is

shown in Figure 4.

Analysis of Financial Stability of the Insurance Market in Novosibirsk Region

247

Figure 4: Algorithm of the mathematical model of the insurance market in the Novosibirsk Region.

4 RESULTS AND DISCUSSION

The correlation analysis showed that the closest

directly proportional relationship, which is close to

functional, exists between the financial stability

coefficient of the insurance fund and the amount of

accounts payable (X15, correlation coefficient R =

0.9) as well as the amount of income from insurance

(X4, correlation coefficient R = 0.8). Close inverse

correlation was revealed between the insurance fund

financial stability coefficient and the cost of doing

business (X18, R = - 0.9), and the RS/CA ratio (X16,

R = - 0.8). Also, an inversely proportional

dependence was revealed between financial stability

and payout ratio by types of insurance (X7, R = - 0.7).

This means that a decrease in the share of insurance

claims has a positive impact on financial stability.

This finding is consistent with the results of the study

(Komen, 2012), but contrary to the research (Abdel

Jawad, 2019). The value of the correlation coefficient

below 0.7 suggests that there is no close relationship

between the performance indicator and the

parameters. We found that there is no explicit

relationship between insurance fund financial

strength and leverage (X13, R = 0.5) and return on

investment (X8, R = 0.4). At the same time, we allow

for the possibility of indirect influence of these

factors on financial stability.

Second-order factors were identified, through

which it is possible to influence the financial stability

of the insurance fund with the help of the first-order

factors we established earlier. The highest correlation

is established between the coefficient of payments by

insurance types and other income from insurance

activities (X17, R = 0.9), as well as costs of insurers'

case management (X18, R = 0.9). A linear functional

relationship is established between the size of

accounts payable and the cost of doing business (R =

-1.0), a relationship that is close to a functional one

between the size of accounts payable and insurance

income (X4, R = 0.9).

The analysis also revealed that there is a close

correlation between the time period and the amount

of insurance payments, the amount of income and the

payout ratio, which is close to a functional

relationship (correlation coefficient R >0.7).

Moreover, between the period of time and the amount

of insurance payments (R = - 0.82), as well as the

payout ratio (R = - 0.90) the dependence is inversely

proportional, i.e. with growth of the period of time the

values of these indicators will decrease. There is no

linear dependence between the period of time and

such factors as: insurance premiums, number of

concluded contracts by insurance types and sum

insured (the relation is weak, R is less than 0.5). We

assume that we cannot abstract from the influence of

the last named factors, as they affect the time period

indirectly through those parameters with which a high

correlation is established. We also found a high

relationship between the income indicator and

premiums (R = 0.77) and the number of contracts

signed (R = 0.74) and between the number of

contracts signed and the sum insured (R = 0.81). The

established relationships made it possible to form a

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

248

regression model for insurance companies of the

Novosibirsk region.

The obtained results confirm our hypothesis and

allow us to speak about the existing dependence

between the financial indicators characterizing the

activities of insurance companies and affecting their

financial stability.

5 CONCLUSION

The article reveals a comprehensive systematic

approach to assessing the impact of factors on

insurance companies' financial stability on the

example of economic entities of the Novosibirsk

region.

The research results indicate the presence of

common patterns and correlations between the

indicators characterizing the activities of insurance

companies and the financial stability of insurers. The

conducted analysis allows us to state that there are

direct and inverse proportional relationships between

certain financial indicators. Simultaneously, the lack

of correlation does not reject the fact of influence on

the financial stability of insurance organizations. We

concede that this influence is manifested indirectly

through other parameters.

This, in turn, indicates the possibility of managing

financial stability for given parameters based on a

mathematical model in the form of a system of

regression equations.

The research contributes to the development of

theoretical approaches to assessing insurance

companies' financial stability based on paradoxical

regulatory theory. The research's practical value lies

in the possibility of using the proposed approach to

assess and forecast financial stability taking into

account various parameters.

ACKNOWLEDGEMENTS

This work was supported by Novosibirsk State

Technical University (project TP-AUF-3-21).

REFERENCES

Abdel Jawad, Y. A. L. and Ayyash, I. (2019). Determinants

of the Solvency of Insurance Companies in Palestine.

International Journal of Financial Research, 10(6):

188. https://doi.org/10.5430/ijfr.v10n6p188

Bryzgalov, D. V., Gryzenkova, Y. V. and Tsyganov, A. A.

(2020). Prospects for Digitalization of the Insurance

Business in Russia. Financial Journal, 12(3): 76–90.

https://doi.org/10.31107/2075-1990-2020-3-76-90

Chernyakov, M. K., Chernyakova, M. M. (2021). A system-

inno-diversified approach to the development of

technologies for the effective transformation of

organizations of the agro-industrial complex into a

digital economy. IOP Conference Series: Materials

Science and Engineering, 1019: 11 p. DOI:

10.1088/1757-899X/1019/1/012026.

Chernyakov, M. K., Chernyakova, M. M. (2019)

Innodiversification model of the digital economy of the

agricultural sector. Advances in Social Science,

Education and Humanities Research, 240: 562-567.

DOI: 10.2991/sicni-18.2019.114.

Chernyakova, M.M. (2019). Paradoksal'naya teoriya

regulirovaniya: monografiya, 160 p.

Dacorogna, M. (2018). A change of paradigm for the

insurance industry. Annals of Actuarial Science, 12(2),

211–232. https://doi.org/10.1017/S1748499518000040

Eling, M., Nuessle, D. and Staubli, J. (2021). The impact of

artificial intelligence along the insurance value chain

and on the insurability of risks. The Geneva Papers on

Risk and Insurance, Issues and Practice.

https://doi.org/10.1057/s41288-020-00201-7

Gavira-Durón, N., Mayorga-Serna, D. and Bagatella-

Osorio, A. (2020). The financial impact of the

implementation of Solvency II on the Mexican

insurance sector. The Geneva Papers on Risk and

Insurance, Issues and Practice.

https://doi.org/10.1057/s41288-020-00196-1

Gómez, F. and Ponce, J. (2018). Systemic Risk and

Insurance Regulation. Risks, 6(3): 74.

https://doi.org/10.3390/risks6030074

Gorshkova, S.O. (2020). Strakhovoy rynok Novosibirskoy

oblasti v 2015-2019 godakh. Statisticheskiy sbornik, 28

p.

Konstantinova, Ye.A., Trezorova, O.YU. (2016). Problemy

i perspektivy razvitiya strakhovaniya v Rossii, Vestnik

Instituta ekonomiki i upravleniya Novgorodskogo

gosudarstvennogo universiteta im. Yaroslava

Mudrogo, 2(21):47-54.

Kulustayeva, A., Jondelbayeva, A., Nurmagambetova, A.,

Dossayeva, A. and Bikteubayeva, A. (2020). Financial

data reporting analysis of the factors influencing on

profitability for insurance companies.

Entrepreneurship and Sustainability Issues, 7(3):

2394–2406. https://doi.org/10.9770/jesi.2020.7.3(62)

Marzai, E. (2018). Bancassurance in a digital era.

Proceedings of the International Conference on

Business Excellence, 12(1): 601–611.

https://doi.org/10.2478/picbe-2018-0054

Moreno, I., Parrado-Martinez, P. and Trujillo-Ponce, A.

(2020). Economic crisis and determinants of solvency

in the insurance sector: new evidence from Spain.

Accounting and finance, 60(3):2965–2994.

https://doi.org/10.1111/acfi.12422

Nesterenko, Ye.V. (2018). Issledovaniye protsessov

ekonomicheskoy kontsentratsii na rossiyskom

strakhovom rynke. Korporativnaya ekonomika,

3(15):24-31.

Analysis of Financial Stability of the Insurance Market in Novosibirsk Region

249

Pavlova, T.A., Kosyakova, M.V., Shalimov, YA.O. (2017).

Protsedura anderraytinga i yeye rol' v ekonomicheskoy

bezopasnosti strakhovykh kompaniy. Aktual'nyye

problemy sotsial'no-gumanitarnykh nauk. Sbornik

nauchnykh trudov po materialam Mezhdunarodnoy

nauchno-prakticheskoy konferentsii, pp.92-99.

Reyting strakhovykh kompaniy Novosibirska (2021).

NSK.DK.RU URL: https://nsk.dk.ru/wiki/reyting-

strakhovykh-kompaniy

Rubio-Misas, M. (2020). Ownership structure and financial

stability: Evidence from Takaful and conventional

insurance firms. Pacific-Basin Finance Journal, 62,

101355. https://doi.org/10.1016/j.pacfin.2020.101355

Sukhorukova, N., Ivashchenko, T., Tsvyrko, A. (2016).

Current state of the insurance market in Russia. Central

Russian Journal of Social Sciences, 11(1): 138–144.

https://doi.org/10.12737/18240

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

250