Financial Analysis of the Activities of Medical Institutions of the

Republic of Tatarstan

Guzel H. Zinurova

1a

, Guzel M. Kashipova

2b

and Venera F. Aglieva

1c

1

University of management "TISBI", Kazan, Russia

2

Kazan Innovative University named after V. G. Timiryasov (IEML), Kazan, Russia

Keywords: Income and Expense Estimates, Healthcare, Financial Management, Financing.

Abstract: The article considers the current problem of optimization of financial management in state budgetary

institutions of health care. In the framework of the current state policy, it is necessary to clearly define the

limit of social guarantees provided at the expense of budgets and create new social protection mechanisms.

The implementation of this task largely depends on the state and sustainability of public and municipal

finances, which are the main funding source. When discussing the quality of cost management of health care

facilities, we need to be very careful and correct. Unlike commercial structures, where the effectiveness of

their work is assessed by the level of profitability and the dynamics of positive financial result, in health care,

it is impossible to assess its effectiveness through the level of profit or the size of cost reduction in the

provision of services. In this vitally important area, the number of costs incurred for providing certain types

of health services should not be a determining factor. These costs' social importance comes to the fore, which

many theorists and practitioners are trying to assess, but this problem has not been solved to the end.

1 INTRODUCTION

Subjects of the Federation and municipalities are

independent in determining the list of target programs

due to different socio-economic development

priorities, differences in public authorities, and local

governments' structure. When forming the procedure

for the development, implementation, and evaluation

of the effectiveness of target programs, the subjects

of the Federation and municipalities must find a

balance between the approaches of the federal level

of government, the specifics of the territory, and the

features of the existing system of state (municipal)

management of its socio-economic development.

Authorities at different levels are forced to limit

the growth of budget expenditures against the

backdrop of unfavorable economic conditions. The

most important condition for the development of the

budget system of the Russian Federation in this

situation is to improve the efficiency of budgetary

funds. Health care expenditures occupy about a

quarter of territorial budgets' expenditures. Therefore,

a

https://orcid.org/0000-0002-4772-9574

b

https://orcid.org/0000-0002-0748-0305

c

https://orcid.org/0000-0002-2409-4457

one of the most important issues of financing public

medical budget-funded institutions is financing from

the funds received from the provision of paid services

through active cooperation with insurance

companies.

The structure of financial flows was analysed,

trends and deviations from the planned values were

identified. The effect of cooperation of a treatment

facility with insurance companies was analyzed. The

cooperation is based on the variation of two main

variables - the discount and the expected increase in

demand for services - which makes it possible to

determine the efficiency of project implementation,

both for individual groups of services and the

hospital's entire commercial activity as a whole.

2 RESEARCH METHODOLOGY

The theoretical study of methods for assessing the

income and expenditure of treatment and preventive

care institutions, research literature was used in the

172

Zinurova, G., Kashipova, G. and Venera, A.

Financial Analysis of the Activities of Medical Institutions of the Republic of Tatarstan.

DOI: 10.5220/0010587801720177

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 172-177

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

preparation of this paper. The study is based on the

application of a comprehensive analysis of revenues

and expenditures of health care subjects using data

from official statistics and financial statements.

3 RESEARCH RESULTS

The problem of optimizing financial flows is faced by

the management of virtually any company. In this

context, it is very relevant for municipal health care

entities to increase revenues from paid services taking

into account the demand for these services and their

affordability in terms of pricing.

4 DISCUSSION OF RESULTS

The results will determine the effectiveness of project

implementation, both for individual groups of

services and for the entire commercial activity of the

hospital as a whole.

Socio-economic problems in our country are

aggravated by the crisis. In the framework of the

current state policy, it is necessary to clearly define

the limit of social guarantees provided at the expense

of budgets and create new social protection

mechanisms. The implementation of this task largely

depends on the state and sustainability of public and

municipal finances, which are the main source of

financing the state's tasks and functions (Schilperoort

and Wierts, 2012).

Subjects of the Federation and municipalities are

independent in determining the list of target programs

due to different socio-economic development

priorities, differences in public authorities, and local

governments' structure. When forming the procedure

for the development, implementation, and evaluation

of the effectiveness of target programs, the subjects

of the Federation and municipalities should find a

balance between the approaches of the federal level

of power, the specifics of the territory, and the

features of the existing system of state (municipal)

management of its socio-economic development

(Denisova and Rukina, 2013)

State Autonomous Health Care Institution "City

Polyclinic No. 3" of Naberezhnye Chelny is a state

autonomous health care institution of the Volga

Federal District, whose founder is the Ministry of

Health of the Republic of Tatarstan.

Analysis of the financial management of the state

healthcare institution (SHI) "City Polyclinic No. 3" is

carried out in the following sequence:

1.Comparative analysis of the results of

Treatment-and-prophylactic institution activities for

2017-2019 (Table 1) by sources of funds and costs

incurred.

Table 1: Dynamics of revenues and expenditures of the SHI "City Polyclinic No. 3" for 2017-2019.

It follows from the data in Table 1 that revenues

and expenditures, in general, tend to decrease.

Despite the increase in revenues in 2018 (increased

by 3.67% or RUB 4,826.3 thousand to RUB

136,243.6 thousand, they decreased by 4.33% or

RUB 5,895.4 thousand to RUB 130,348.2 thousand

in 2019 against 2018.

Revenue from services (works) in general has an

upward trend, which is evaluated positively. In 2018

it increased by 6.23% or RUB 7,811.7 thousand and

amounted to RUB 1,332,131.2 thousand; in 2019,

their increase against 2017 was 2.83% or RUB

3,555.4 thousand to RUB 128,974.9 thousand.

At the same time, there is a steady tendency of

decrease in expenses from RUB 139,657 thousand to

RUB 133,059,2 thousand. Thus, in 2018 they

decreased by 0.24% or RUB 335.5 thousand. In 2019,

there is a decrease in total expenses by 4.49% or RUB

6,262.3 thousand.

Income and expense items

2017 2018 2019

Amount,

thousand

rubles

Amount,

thousand

rubles

Growth

rate to

2017, %

Change,

thousand

rubles

Amount,

thousand

rubles

Growth

rate to

2018, %

Change,

thousand

rubles

Income, including 131,417.3 136,243.6 103.67 4,826.3 130,348.2 95.67 -5,895.4

Income from rendering

services (works)

125,419.5 133,231.2 106.23 7,811.7 12,8974.9 96.81 -4,256.3

Ex

p

enses, includin

g

139,657.0 139,321.5 99.76 -335.5 133,059.2 95.51 -6,262.3

Expenses from rendering

services

(

works

)

137,851.7 136,454.4 98.99 -1,397.3 129,221.9 94.70 -7,232.5

Net operating result -8,242.7 -3,077.90 37.34 5,164.8 -2,711.0 88.08 366.9

Financial Analysis of the Activities of Medical Institutions of the Republic of Tatarstan

173

Reduction of expenses from rendering services

(works) should be positively assessed. Thus, in 2018

they decreased by 1.01% or 1,397.3 thousand rubles

to RUB 136,454.4 thousand. In 2019, there is a

decrease in expenses from rendering services by 5.3%

or RUB 7,232.5 thousand to 129,221.9 thousand.

The excess of revenues over expenditures in

2017-2019 should be assessed negatively. As a

consequence, the net operating result is negative. In

2017 it was RUB 8,242.7 thousand, in 2018 it

increases to RUB 3,077.9 thousand, despite the

negative value. As of the end of 2019, the negative

net operating result of the institution was RUB 2,711

thousand.

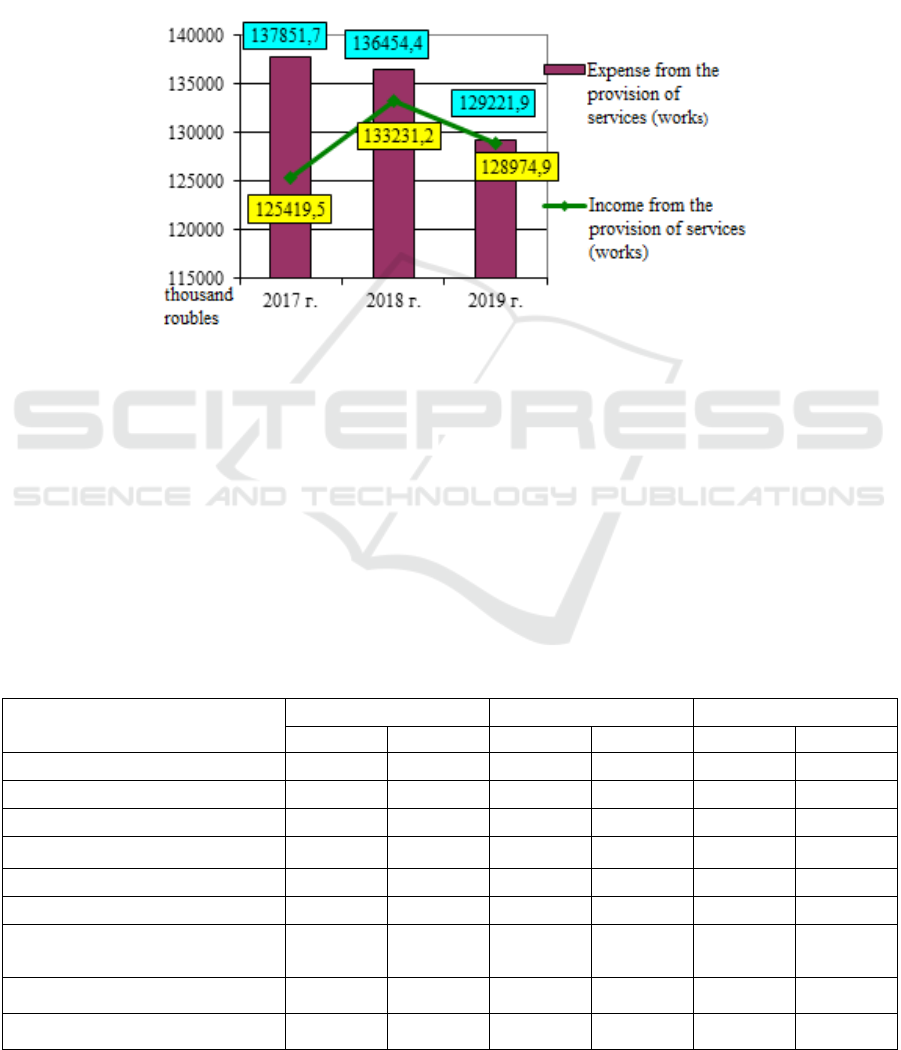

The dynamics of revenues and expenditures from

the provision of paid services (works) by health care

facilities for 2017-2019 is presented in Fig. 1.

Figure 1: Dynamics of revenues and expenses from provision of paid services (works) in the SHI "City Polyclinic No. 3" in

2017-2019.

The figure shows that in 2019, compared with

2017, an increase in the growth rate of revenues from

paid services (works) (increased by 2.83%) is

achieved against a decrease in the growth rate of

expenses from paid services (works) (decreased by

6.26%).

Negatively, the excess of expenses over revenues

from the provision of services in 2017-2019 by RUB

12,432.2 thousand, 3,223.2 thousand and 247

thousand, respectively, should be assessed as

negative. At the same time, the decrease in excess of

expenditures over revenues from services should be

assessed positively;

2. analysis and control of the actual

implementation of the planned indicators of financial

and economic activities of the institution.

The dynamics of the planned indicators of TPI for

2017-2019 is presented in Table 2.

Table 2: Planned and actual indicators of financial and economic activity of the SHI "City Polyclinic No. 3" for 2017-2019,

thous.

Indicators

2017 2018 2019

planned actual planned actual planned actual

Total revenue 116,960.5 131,417.3 117,675.2 136,243.6 119,857.7 130,348.2

OMI 115,496.3 129,953.1 117,675.2 136,243.6 118,657.7 129,148.2

Budget funds transferred to OMI 1,464.2 1,464.2 - 1,200.0 1,200.0

Total expenses 116,960.5 139,657.0 117,675.2 139,321.5 119,857.7 133,059.2

Execution result - -8,242.7 - -3,077.90 - -2,711.0

Sources of deficit financing - 8,242.7 - 3,077.90 - 2,711.0

Net income from rendering paid

services (works)

- 8,242.7 - 3,077.90 - 2,711.0

Increase in fund balances - -133,318.3 - -135,499.4 - -131,046.8

Decrease in fund balances - 141,561.0 - 138,577.3 - 133,757.8

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

174

As shown in Table 2, the actual funding in 2017-

2019 is lower than the approved planning targets. At

the same time, as a result of excess of actual expenses

over revenues, there was a decrease in financing

deficit of RUB 8,242.7 thousand, RUB 3,077.9

thousand and RUB 2,711 thousand accordingly. It

should be noted that in 2018 the planned financing of

the SHI "the City Polyclinic No. 3" was 100% from

the OMI budget. Financing of the institution's deficit

is carried out at the expense of the net income from

the provision of paid services (works).

Based on Table 3, let us assess the implementation

of the planned indicators of financial performance of

TPI for 2017-2019.

Table 3: Actual fulfillment of planned indicators for

financial activity of the SHI "City Polyclinic No. 3" for

2017-2019, %

Indicators

Fulfillment of the plan

2017 2018 2019

Total revenue 112.36 115.78 108.75

Total expenses, including 119.41 118.40 111.01

OMI 112.52 115.78 108.84

Budget funds transferred

to OMI 100.00 - 100.00

Tables 2-3 show that the revenue and expenditure

targets for 2017-2019 are generally not met.

In terms of revenues, there is an excess of actual

revenues over the plan. In 2017, the excess was

112.36% of the budgeted targets, in 2018 - 115.78%,

in 2019 - 108.75%.

The increase in current indicators is compensated

by the increase in funding from the OMI and at the

expense of the provision of paid services for core

activities. Thus, in 2017, RUB 14,456 thousand were

covered due to the increase in OMI (increased by

12.52%) and 8,242.7 thousand were covered due to

paid services. In 2018 - RUB 18,568.4 thousand and

3,077 thousand, at the end of 2019 - additional RUB

10,490.5 thousand were received from the OMI.

(increased by 8.84%) and 2,711 thousand due to paid

services.

Execution of actual expenditures exceeded the

approved planned expenditures and amounted to

119.41%, 118.4% and 111.01%, respectively. The

dynamics is mainly due to an increase in expenses for

utilities and other expenses.

So, the planned estimates of expenses have only

partial financial provision and the size of allocations

for the maintenance of the SHI "City Polyclinic No.

3" depends on the state of the local budget and the

funds of the OMI.

Currently, one of the pressing problems of public

(municipal) institutions is the lack of budget

financing. Lack of funds does not allow full

rehabilitation of fixed assets, much less the

development of the institution. All this confirms the

inability of the budget institution to provide a

sufficient number of free services.

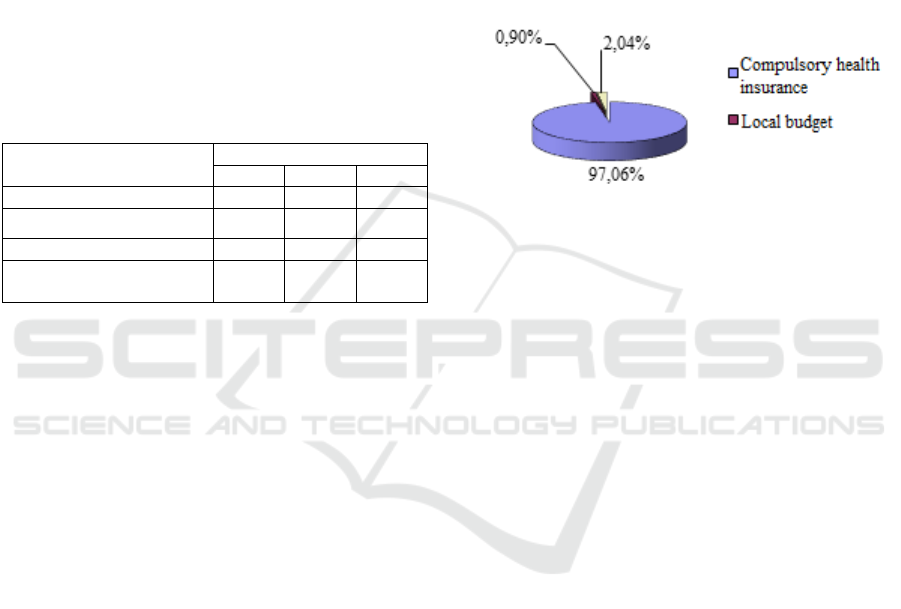

In 2019, expenses of the SHI "City Polyclinic No.

3" amounted to RUB 130,348.2 thousand. The

structure of the institution's funding sources for 2019

is shown in Figure 2.

Figure 2: Structure of sources of financing of the SHI "City

Polyclinic No. 3" in 2019, %

As shown in Figure 2, the largest part of the

hospital's income in 2019 was from compulsory

health insurance - 97.06%. This is explained by the

implementation of the project on transition to single-

channel financing of health care in Tatarstan through

the system of obligatory health insurance (OMI),

designed to ensure financing of all items of costs and

types of medical care provided at the expense of OMI

funds. For this purpose, the types of assistance that

were previously financed at the expense of the local

budget are gradually transferred to financing at the

expense of compulsory medical insurance.

Only 0.9% of the outpatient clinic costs are

funded from the budget; in 2019, these costs are

100% related to utility bills.

The second place is occupied by funds received

from paid activities of the outpatient clinic, they

account for 2.04%. All paid medical services

provided by the SHI "City Polyclinic No. 3" can be

divided into 4 enlarged groups depending on the areas

of medical care and types of hospital costs:

outpatient care (including general therapeutic

manipulations, nursing care manipulations,

therapeutic manipulations of the physiotherapy

department, etc.);

examinations (including general diagnostic

examinations of the departments of functional

diagnostics, ultrasound diagnostics, etc.);

surgeries (abortions, mini-abortions);

hospital.

Financial Analysis of the Activities of Medical Institutions of the Republic of Tatarstan

175

Long-term and short-term financial planning and

financial management in the SHI "City Polyclinic No.

3" should be carried out exactly for these groups of

services.

So, the analysis and assessment of financial

management of the SHI "City Polyclinic No. 3" for

2017-2019 revealed the following problems:

The share of revenue settlements decreases from

0.41% in 2017 to 0.12% in 2019. Such dynamics is

associated with a decrease in both settlements on

income from the provision of paid services and

settlements with payers on property income (received

from the lease of the organization's premises);

Expenditures from services in 2017-2019 exceed

revenues by RUB 12,432.2 thousand, 3,223.2

thousand and 247 thousand, respectively;

Planned estimates of expenditures have only

partial financial support and the amount of allocations

for the maintenance of the SHI "City Polyclinic No.

3" depends on the state of the local budget and funds

of the OMI;

Actual funding in 2017-2019 is higher than the

approved planning targets. Revenue and expenditure

targets for 2017-2019 are generally not met. In terms

of revenues, the Company achieved 112.36% in 2017,

115.78% in 2018, 108.75% in 2019. This is due to

additional funding of planned funds from the OMI.

The execution of actual expenditures exceeds the

approved expenditures by 119.41%, 118.4% and

111.01%, respectively. This is mainly due to an

increase in utility bills and other expenses of the

institution.

It should be noted that the practice of foreign

companies providing voluntary health insurance

policies to their employees as part of the social

package is becoming widespread in Russia.

Undoubtedly, insurance companies, providing AMI

services, cooperate with various public and private

medical institutions, with the SHI "City Polyclinic

No. 3" has a significant competitive advantage in the

market of medical services, especially in the sector of

research and operations.

One of the directions for implementing marketing

policy in the SHI "City Polyclinic No. 3" is to

increase revenues for paid services by stimulating

demand and active cooperation with insurance

companies that provide voluntary health insurance.

To assess the effectiveness of the proposed project, a

matrix scenario modeling method was used, taking

into account negative, positive, and weighted average

scenarios. The advantage of the applied model as a

method of assessment of efficiency of investment

projects is that it allows, by varying the two main

variables (discount and expected growth in demand

for services), to determine the effectiveness of

projects for both individual groups of services and for

commercial activities of the outpatient clinic as a

whole.

The project was planned on a monthly basis for

2020, which allowed for the seasonality of demand

for some services. It is supposed that conditions of

cooperation between the SHI "City Polyclinic No. 3"

and insurance companies provide for 15% discount

for outpatient and polyclinic services, 13% discount

for in-patient services, 7% discount for examinations

and surgeries.

So, the weighted average annual net cash flow of

the project under consideration equals to RUB 260.5

thousand. Net cash flow for the project varies from

RUB 7.65 thousand in July for the negative scenario

to RUB 41.52 thousand in November for the

optimistic scenario.

When implementing the considered project with

the given variables (the value of the discount for

voluntary health insurance and the expected increase

in demand for services) the SHI "City Polyclinic No.

3" in the forecast for 2020, without actually making

any direct costs, due to cooperation with insurance

companies and using its competitive advantages in

comparison with other medical institutions

(availability of modern equipment and highly

qualified specialists), both public and private, can get

from (RUB 2,711 thousand) by 9.61% compared to

2016.

It should be taken into account that the

calculations used rather low indicators of average

monthly and average annual growth in demand for

paid services (about 9% for the weighted average

scenario), while the actual increase in demand in

long-term cooperation with large insurance

companies on voluntary health insurance can be much

higher. This cooperation can become a significant

additional source of profit for the outpatient clinic

from the provision of paid medical services due to the

increased demand for them while providing discounts

on various groups of services.

5 CONCLUSIONS

Thus, increase of cash inflow in the studied

organization, as well as in similar local structures of

health care system of RT, is possible only due to

increase of demand for paid medical services of the

hospital, with relatively constant, adjusted for

inflation, price level. One of the ways to stimulate the

growth of demand for paid medical services is the

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

176

cooperation of polyclinics with insurance companies

that provide voluntary medical insurance.

REFERENCES

Baranov, A.A. and Lapin, Y.E. (2016). Formation of public

health policy in the Russian Federation: problems and

solutions. Voprosy sovremennoi pediatriiia, 6: 5-7.

Batievskaya, V.B. and Shabashev, V.A. (2013).

Transformation of approaches to state regulation of

Russian health care. Bulletin of Omsk State University.

Ser. Economics, 2: 66-72.

Denisova, I.P. and Rukina, S.N. (2013). Estimation of

efficiency and effectiveness of target programs in the

transition to a "program budget". Fundamental'nye

issledovanie, 8-2: 399-404.

Diaghileva, N.V. (2014). Efficiency of public spending on

health services. Proceedings of the Orenburg State

Agrarian University, 6: 205-208.

Fedorova, E.A. (2016). Development of critical threshold

values of macroeconomic indicators for crisis

prediction. Finance and Credit, 22: 17-26

Kalashnikov, K.N. (2015). Resource provision of Russian

health care: problems of territorial differentiation.

Economic and social changes: facts, trends, forecast, 1:

72-87.

Popova, G.V. (2010). Methodological bases of assessment

and optimization of resource provision of health care

institutions on the basis of budgeting model. FES:

Finance. Economics. Strategy, 3: 7-13.

Pulay, G., Máté, J., Németh, I. and Zelei, A. (2013).

Budgetary Risks of Monetary Policy with Special

Regard to the Debt Rule. Public Finance Quarterly,

58(1): 11-34.

Shchepin, O.P. (2014). Regional aspects of health care

development. Problems of Social Hygiene, Health and

History of Medicine, 5: 3-7.

Schilperoort, W. and Wierts, P. (2012). Illuminating

Budgetary Risks: the Role of Stress Testing. OECD

Journal on Budgeting, 12(3): 1-18.

Shubina. T.V. (2017). Estimation of budgetary organization

performance in the process of audit. Audit Bulletins, 1:

38-50.

Vaslavskaya, I.Y., Zinurova, G.H. and Kashipova, G.M.

(2020). Study and assessment of the identified

problems in the implementation of state programs to

support health care. Economics: yesterday, today,

tomorrow, 10.

Volkova, N.S. (2015). Modernization of health care and

improvement of the status of its institutions. Journal of

Russian Law, 4: 54-61

Yashina, N.I. (2016). Improvement of financial

management of public health institutions. Economic

Analysis, 5: 85-98.

Zinurova, G.Kh. and Safargaliev, E.R. (2020). Methods and

techniques of cost management in health care.

International Research Journal, 5(95): 35-38.

Financial Analysis of the Activities of Medical Institutions of the Republic of Tatarstan

177