A Study of Consumer Buying Behaviour in Delhi NCR towards

FMCG Products

Krishana Kumar Saraswat

1

, Charu Dutta

2

and Taruna Saxena

3

1

Department of MBA, IILM, Academy of Higher Learning, Greater Noida, India

2

Department of MBA, ShriVenkateshwara University, Gajraula, India

3

College of Management, GNIT, Greater Noida, India

Keywords: FMCG, online and traditional purchase, NCR, hybrid consumers, living standards.

Abstract: FMCG is the fourth largest sector in the economy of India. FMCG has a high consumption rate and provides

high turnover. FMCG market in India includes toothpaste, cosmetics, toiletries, detergents, snacks, and even

pharmaceuticals. Initially, online FMCG consumers were only youngsters especially teenagers but with the

passage of time, development of technology and change in living standards, senior citizens are also relying

on online FMCG purchase. Hindustan Unilever, Dabur, Patanjali and RP-SanjivGoenka group are also

major players in FMCG production. Revenue of the FMCG sector in the financial year 2018 reached

US$ 52.75 bn and it is expected to touch 103.7 bn in the financial year (India FMCG report, 2020). The

trend of purchasing FMCG online in Delhi-NCR is increasing in all age groups due to various factors and

this paper is an effort to understand the factors which are responsible for online FMCG purchase. While

researching about FMCG it has come to the notice that notwithstanding an increase in online purchase of

FMCG consumers has a liking towards the traditional purchase that is by visiting nearby shops and malls.

This paper will help in understanding the behavior of FMCG consumers in online as well as traditional

purchase.

1 INTRODUCTION

As one of the significant sectors in India, FMCG is

highly consumer-centric and fulfils daily consumer

needs. Due to affordable rates and wide availability,

these products are sold fast; hence the name is given

fast-moving consumer goods (FMCG). FMCG is

one of the important contributors in the Indian

economy. FMCG sector is highly attractive because

of its low cost, proper distribution network, and

large number of consumers. The presence of

multinational and national companies and industries

has made the FMCG sector extremely competitive.

More than 50% of the FMCG products have cost

less than ₹10 and this low cost has been a reason

behind huge turnover (P.H. Pahl, 2016) and

domestic companies are giving tough time to the

multinational companies. Out of total FMCG urban

areas consume 66% while rural areas consume 34%.

The main factors in the growth of the FMCG market

are changing life style, ease in access, and enhancing

awareness. Apart from these India’s regulatory

framework and policies played added drivers to the

growth of the FMCG market. FMCG market has a

pivotal role in daily life and it has great significance

(R. Jayanthi , 2017) due to strong MNC presence,

competition between unorganized and organized

sectors, cheap labor cost, easily available raw

material, and a big market. The online FMCG

market is growing rapidly. The main reason is an

increase in the number of internet users which is

expected to cross 850 million by 2025. Further retail

marketing is going to increase from US$ 672 bn in

2016 to 1.1 tn in 2020 with 20-25% modern trade

growth, which will eventually increase the FMCG

revenue. Since the last few years, with the efforts of

Patanjali, consumers have started consuming

Ayurvedic products with a market capitalization of

14.94bn. The Indian government is playing a pivotal

role in promoting online FMCG trade by allowing

100 percent FDI in the online retail of goods and

services. The government has also planned to train

500 million workers by 2022 which will encourage

domestic as well as multinational companies’

investment in the FMCG market in India.

Consumers in Delhi and NCR have adopted online

varying commerce in different categories which

depends on the need and the dynamics of the market.

Saraswat, K., Dutta, C. and Saxena, T.

A Study of Consumer Buying Behaviour in Delhi NCR towards FMCG Products.

DOI: 10.5220/0010562800003161

In Proceedings of the 3rd International Conference on Advanced Computing and Software Engineering (ICACSE 2021), pages 73-80

ISBN: 978-989-758-544-9

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

73

There are many factors that influence the online

FMCG purchase like economic conditions, cultural

differences, new technologies. In the last decade, the

online FMCG purchase has been grown by 40% for

mainly electronic goods and accessories like

watches, goggles, etc., and growing gradually in

many fields. Traditional consumers for FMCG are

gradually turning to online consumers, but due to

certain restrictions, such consumer prefers

traditional purchase. The main reason behind this

may be their economic condition or very little need.

For example medicines for seasonal flu, cough and

fever are generally preferred to be purchased from

nearby medical stores; most of the consumers have

believed in purchasing from their known vendors for

a little extra discount or timely and trustful services

in case of any problem in the product. Clothes are

still purchased in the traditional way due to fitting or

if any alteration is required. But if a person has to

take long-term medicine for blood pressure,

diabetes, or any such incurable disease, the bulk-

online purchase is preferred due to heavy discounts

and other facilities for long-term consumers.

This paper focuses on the trends of consumer

behavior in Delhi-NCR regarding online as well as

traditional FMCG purchase for this purpose the

author has visited and collected primary data about

the consumers and in some cases secondary data has

also been used. The secondary data has been

collected from already published work such as

journals, books, periodicals, newspapers, and

magazines. The primary aim of this article is to

understand purchase trends for FMCG by the

consumers of Delhi and NCR and the shift and cause

from traditional to the online process. A

mathematical analysis has also been provided in an

attempt to formulate the consumer behavior for

FMCG. This study is useful in understanding the

way to promote FMCG and to find a way for

optimizing the turnover keeping in mind the hybrid

consumers (the consumers who are involved in

online as well as traditional purchasing).

2 LITERATURE REVIEW

According to ASSOCHAM report, 2020 India

contributes only 0.68 percent of the world FMCG

market and it is expected to grow in the next five

years. Most of the FMCG companies are shifting

towards e-commerce because of the increasing

penetration of mobile and the internet. In 2015

FMCG products globally accounted for 5 percent of

the online share, while in India the same accounted

for 1-2 percent. The decelerating global economic

growth in the developed countries offers an

advantage to India due to its better economic

situation. In 2015 FMCG market constituted 46

percent food and beverages, 23 percent personal

care, 11 percent household care, and others 20

percent. One of the main reasons for the FMCG

market in India is the organized retail sector’s

growing share.

(IBE report, 2018) has laid stress on the growth

opportunities in the FMCG market of India. The

rural market is gradually becoming vital for FMCG

products due to the presence of a strong distribution

network of industries and it is expected to touch US$

220 bn by the year 2025. FMCG market in India has

a great opportunity for growth due to the high

adaptability of consumers for innovative products

like gel-based facials, sugar-free products, men’s

cosmetics, etc. Other factors that can provide an

opportunity for FMCG growth in India are

inclination towards premium products, leverage to

India a sourcing hub for products that are cost-

competitive and increasing penetration in the rural

market.

FMCG sector is one of the best performing (A.

Singhi, N. Jain, 2018). This sector has delivered

shortly as well as long term high return. Since

variation in volume growth is having little

correlation with GDP growth rate, hence FMCG

growth rate less dependent on macro-economic

factors. By 2025, household income of 22 million

more people will become nearly ₹10 Lakh per

annum which will eventually add to the growth of

the FMCG market. A transformational change is

taking place in the FMCG industry because of

demographic shift due to the increase in the use of

digital media. Hence to exploit this opportunity for

FMCG growth the companies must re-engineer the

methods to operate.

The future perspective of FMCG industry trends

(Indian FMCG growth snapshot, 2018) can be

explained on the basis of the growth trajectory of

GDP, rural income boost, the trend in private

consumption, consumer confidence, and inflation. It

has been observed that FMCG companies of Indian

descent performed far better than multinational

companies. In 2016, seven out of ten companies

were of Indian origin whose FMCG annual turnover

was more than ₹1000 crore.

3 ONLINE FMCG MARKET IN

DELHI – NCR

In the last decade, consumer trust and confidence

have increased in online purchasing for FMCG in a

broader range and categories (Economic times

ICACSE 2021 - International Conference on Advanced Computing and Software Engineering

74

report, 2018). Due to the high average income and

living cost of the population of Delhi in comparison

to the other cities in India, the FMCG market is

highly developed. The major cities in Delhi-NCR in

which FMCG dominates are New-Delhi, Gurugram,

Noida, and Ghaziabad. Gurugram is considered to be

one of the IT capital in India and due to increasing

employment opportunities, the FMCG sector is

growing very fast. Noida (New Okhla Industrial

Development Authority) is a highly developed

industrial hub in India and manufacturing units of

various industries are contributing to the growth of

online FMCG consumers. Ghaziabad is also

gradually catching up with online FMCG purchases

because most of the employees working in Delhi are

residing in Ghaziabad but they have to up and down

from Ghaziabad to Delhi, hence the shortage of time

for personal life residents rely mostly on the online

purchase of FMCG. The major players for FMCG in

Delhi-NCR are Dabur India Ltd., Colgate-Palmolive

India, ITC Kitchen of India, TCL, Sony, IFB,

Godrej, Videocon, Haier, LG, Cadbury India Ltd.,

Pepsi Co., Marico, Parle Foods Pvt. Ltd., Proctor,

and Gamble, Nestle, Nirna Ltd., etc. Due to the

availability of online FMCG nowadays senior

citizens have got great relief in most of their

purchases related to daily utility especially in the

cases where children are working in other cities or

abroad.

In Delhi-NCR the main factors in the increase of

online FMCG consumers are (I.G.Varma, 2016):

i. 4G internet services,

ii. Wide product range availability

iii. Grow in living standard

iv. Lack of time due to busy lifestyle

v. Increase in the number of online shops

vi. Introduction to mobile applications

Online FMCG consumption has been increasing

continuously since 2009. According to IAMAI, PwC

Analysis and Industry (2020) experts the total

FMCG trade in 2009 was 3.8 billion USD, while it

creased to 5.3 billion USD in 2010 and subsequently

reached 12.6 billion USD in 2013. It has been

projected that between 2017-20 the total FMCG

trade-in Delhi-NCR is going to touch more than 35

billion USD. This can be depicted as per the

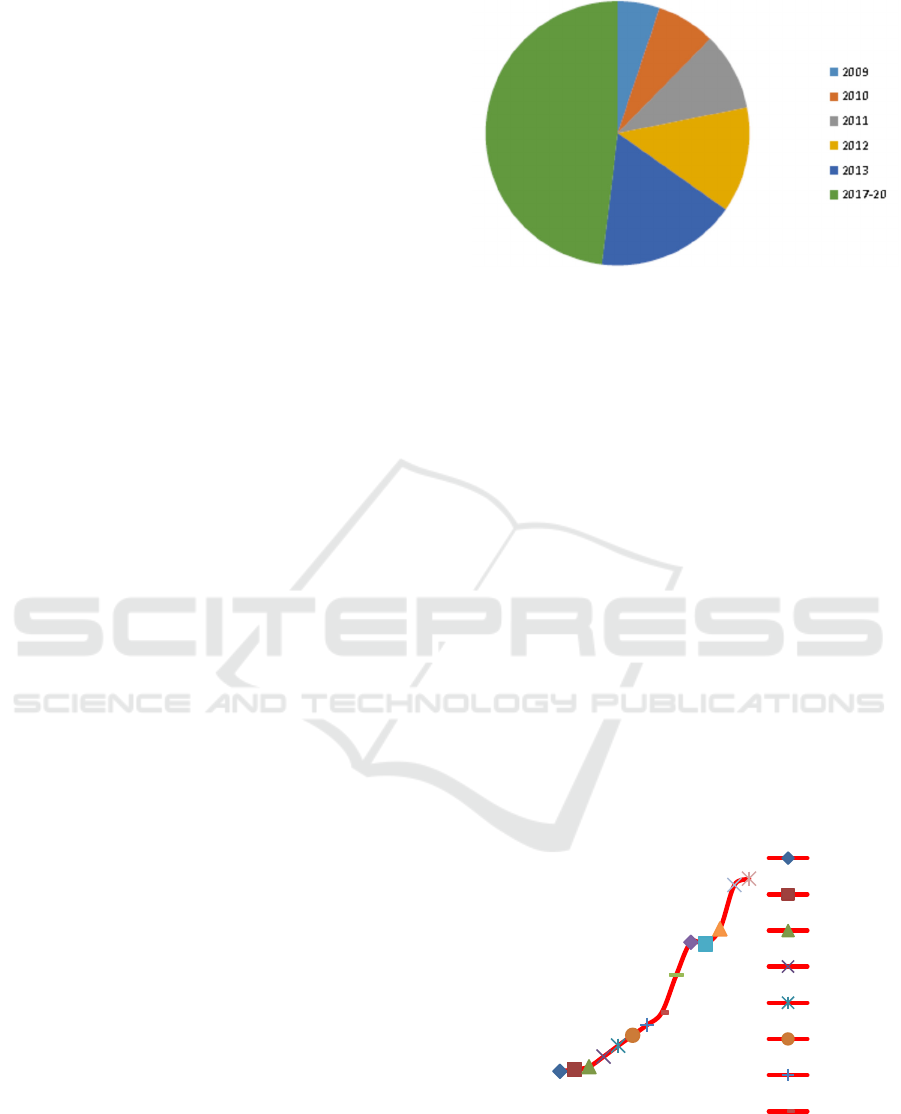

following graph (Fig. 1):

Figure 1: Increase in online FMCG trade

The graph shows that from 2009 to 2010n the net

increase in the online FMCG trade was nearly 39%

while between 2010-11 it was approximately 32%.

Between 2011-12 the increase in the online FMCG

trade was 35% and that between 2012-13 the growth

was 32.6%. Thus an average growth rate of 58%

took place from 2009 to 2013.

The growth of online FMCG consumers can be

attributed to the increase in the internet penetration

rate in India from 4% in 2007 to nearly 50% in

2020. Due to more and more internet penetration

consumers are inclined towards online purchase.

This has become possible because internet is

available from high-income groups to daily wage

earners. (Statistical S. Diwanji, 2020), India is

second in the world in terms of active internet users

and half the population has the access to the internet

in 2020. The low-income population is basically

involved in purchasing travel tickets, television

subscriptions of various channels, gadgets like

watches, and sometimes goods for small celebrations

in their family. The graphical representation of

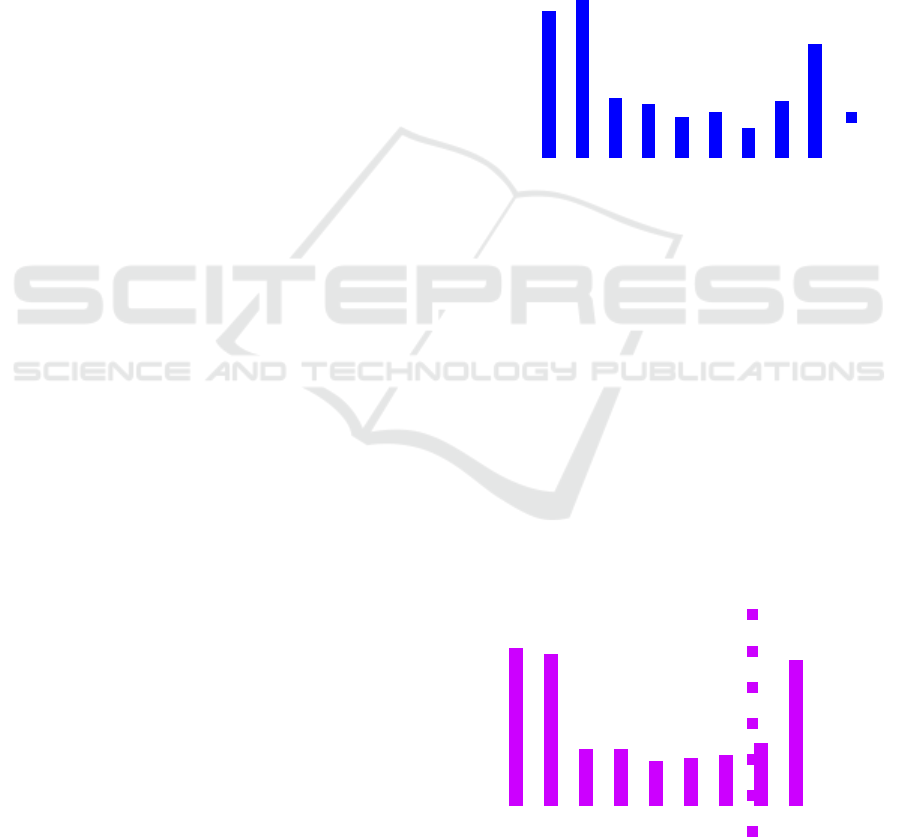

internet penetration in India is depicted in Fig. 2.

Figure 2: Internet Penetration Rate in from 2007 to 2020

The increasing internet use and decreasing

broadband prices have empowered Delhi-NCR

consumers for buying groceries to furniture, apparels

2007

2008

2009

2010

2011

2012

2013

2014

Year

Internet

PenetrationRate

A Study of Consumer Buying Behaviour in Delhi NCR towards FMCG Products

75

to accessories, jewelry, beauty products, ticketing,

etc. Not only in Delhi-NCR but in all parts of India

the online FMCG consumers are increasing because

of embedded advantages in online commerce: (1)

Online stores are available 24 by 7 at home as well

as at the workplace, (2) Instructions of use and

demonstrations are available online, (3) Price

selection facility is also provided on online stores.

Apart from these advantages online consumers also

face some disadvantages like hands-on inspection,

privacy issues, and credit or debit card frauds.

Despite these disadvantages (for which various

companies are working day and night), online

purchase is becoming popular day by day due to

time-saving and efforts by industries to maintain

trust and quality.

4 TRADITIONAL FMCG

MARKET IN DELHI – NCR

The Traditional FMCG market in Delhi-NCR is

equally effective as the online FMCG market. There

are many factors that affect traditional FMCG

consumption. For example age of the consumer,

medical condition of the consumer, life-style of the

consumer, location of the consumer, and financial

condition of the consumer. Among teenagers, the

snacks are on the top for traditional purchases

instead of going online purchase. Such impulsive

buying is an important phenomenon in retail

business and marketing (P. M. M. Ferraze, 2013).

These impulsive products are also known as

convenience goods. They are characterized as

frequently purchased and low-cost products. Such

products demand little cognitive effort from the

consumers (D.W. Rook, 1985), L.P. Buonklin

(1963), H.Winzar (1992). In Delhi-NCR a sample of

260 male and 260 female consumers were taken to

study the various products they purchase by

traditional methods and the questions asked were:

Q1. Which product would you like to purchase by

directly going to shops or malls or superstores?

Q2. Whether they consider brads in a particular

product for traditional shopping?

Q3. If they purchase traditionally keeping in mind

the price of the product?

Q4. Why they prefer buying traditionally instead of

online purchases?

Q5. How frequently they go to shops/ malls/

supermarkets?

Q6. How much time do you spend in traditional

shopping?

Q8. What excites you for traditional shopping?

Q9. On a scale of 1-10, how would you rate

traditional shopping?

These questions were asked from a wide range of

age groups from 5 years to 70 years and genders. For

children of ages 5-10 years, the questions were asked

from parents or guardians who were accompanying

them. In response to the question, 1 male did

maximum traditional shopping for clothes (nearly

22%) followed by snacks (21%) and medicine

(16.5%). Males did minimum traditional shopping

for cosmetics. The data for male behavior for Q1 can

be understood by the following column-graph

(Fig.3).

Figure 3: Percentage Traditional Purchase by Male

Consumers

The female consumer behavior about the traditional

purchase of the types of products is shown in Fig. 4.

The trend of female consumers in traditional

shopping is the same as that of male consumers but

the percentage of medicine and cosmetics is high as

compared to the male consumers. Fig. 3 and 4 also

show that female's requirement of medicine is high

as compared to the male traditional FMCG

consumers. Hence the availability of medicines,

snacks, and cosmetics in nearby shops and malls will

surely increase consumption.

Figure 4: Percentage Traditional Purchase by Female

Consumers

S

…

Percentage

Product

Type

Snacks

Clothes

Gadgets

Stationary

Decorations

Xerox

Cosmatics

Product

Percent

age

ICACSE 2021 - International Conference on Advanced Computing and Software Engineering

76

In response to Q2, both male and female consumers

asserted that they prefer to use the brands which are

mostly used in their family tradition. For example,

suppose a family prefers tea brand A then most of

them use the same brand and the consumer rarely

differ from their family choice. And because the

products like tea are purchased either on a monthly

or weekly basis the consumers prefer traditional

purchasing because they can change the product

immediately if any defect is detected and they

cannot wait for days to change in such cases. In

traditional purchasing, many products are before

their eyes in the racks so they can compare prices

with other family members. In the Delhi-NCR

region generally, traditional shopping is done with

family so every member can select the product of

their choices at the same time which saves time.

This was the response of consumers in response to

the Q3 and Q4. In response to the Q5, most of the

consumers go for traditional purchase monthly and

in few cases fortnightly or weekly, but maximum

traditional shopping takes place on monthly basis,

and generally, the day is fully dedicated for

traditional purchase in the Delhi-NCR region. On

average, a Delhi-NCR consumer has much less time

for traditional FMCG purchase as compared to the

non-metro cities due to rush. Hence they have to

plan for the traditional shopping either fortnightly or

monthly and they spend 3-4 hours on this day hence

on an average Delhi-NCR consumer gets only 12

minutes per day for traditional purchase. Even due to

lack of time Delhi-NCR consumer is sometimes not

able to buy vegetable and fruits on daily basis.

Hence despite the availability of nearby shops and

malls, consumer behavior is gradually shifting from

traditional to online behavior.

5 TRENDS OF CONSUMER

BEHAVIOUR FOR FMCG:

According to V. Jadhav et al (2016), India in online

retailing is in its initial stage although it has shown

tremendous growth in recent years. According to the

KPMG Advisory Services Private Limited (KPMG

report, 2018), youth (mainly students) play a major

role in online FMCG consumer. Of total internet

users, 29% are only college-going students IAMAI

report (2018), which is increasing day by day. One

of the major factors in the shift from traditional

purchase to online purchase is the exposure to mass

media and the rising of social network applications

targeting youths (mainly college going students).

Delhi-NCR is a hub of educational institutions as

well as a number of companies due to which the

population density is quite high. There are many

local services which provide their own apps to be

used by the residents of Delhi-NCR and made their

life easy. For example, Swiggy is a food delivery

app that has benefitted consumers as well as owners

of restaurants due to lack of manpower. Delhi metro

app is helpful to especially those passengers who are

new to the metro or rarely use the metro. Uber/Ola

apps are useful in booking shared or solo taxi

booking 24×7 from any point in Delhi-NCR. Now

passengers don’t have to wait for long in case of

emergency. Also, passengers can choose the vehicle

of their choice as per their pocket or need. CRED is

also a popular app among Delhi-NCR consumers

although it is a member-only app that gives rewards

for paying the bill by credit cards. Urban company

app provides you the facility of professionals from

industries at your doorstep. For stressed persons,

Headspace is an app to keep you calm and helpful

even in anxiety disorders. Walnut keeps track of

expenses and can suggest how to expend wisely.

There are many more apps floating in Delhi-NCR

which are trying to make the life of consumers easy

and smooth. Hence these apps and the busy lifestyle

of Delhi-NCR consumers are shifting from

traditional FMCG consumers to online FMCG

consumers.

6 MATHEMATICAL ANALYSIS

According to the reports published in Statistical the

internet penetration rate in Delhi NCR in the year,

2019 was 69 percent. The data of IBEF (FMCG

Report, 2019) shows that the revenue of the FMCG

market has increased from 17.8 bn US$ in 2007 to

83.3 bn US$ in 2019 and by the end of 2020 it is

expected to reach 103.7 bn US$. This study can be

correlated to the increase in internet penetration with

the conclusion that due to internet penetration the

FMCG market has also flourished at a great pace.

The relation of internet penetration and growth in

FMCG can be understood by regression line in

which the rate of internet penetration can be taken as

the independent variable (x) while revenue

generated can be taken as a dependent variable (y)

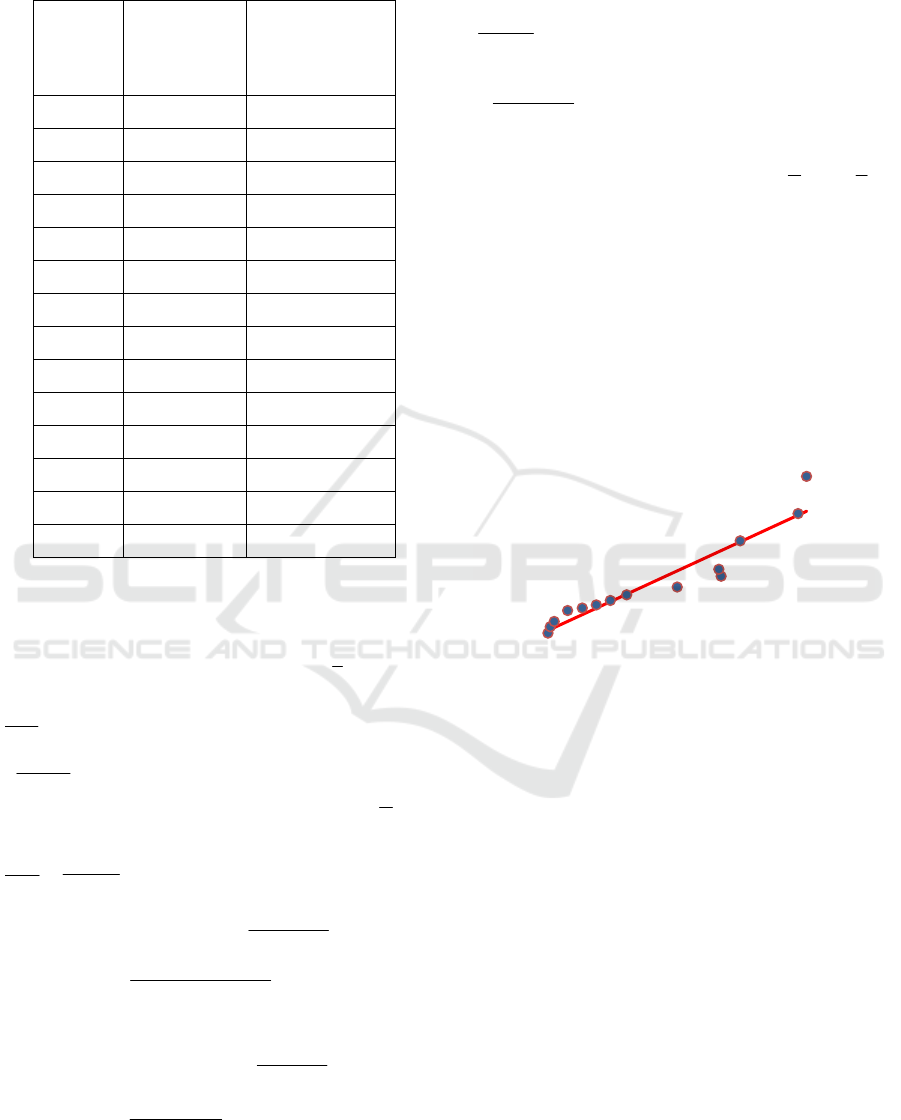

(Table 1).

A Study of Consumer Buying Behaviour in Delhi NCR towards FMCG Products

77

Table 1: Internet Penetration versus FMCG Revenue

Generated

Year

Internet

Penetration

Rate (in

%)(x)

Revenue of

FMCG in billion

US$ (y)

2007 4 17.8

2008 4.4 21.3

2009 5.1 24.2

2010 7.5 30.2

2011 10.1 31.6

2012 12.6 33.3

2013 15.1 35.7

2014 18 38.8

2015 27 43.1

2016 34.8 49.0

2017 34.4 52.8

2018 38.2 68.4

2019 48.48 83.3

2020 50 103.7

To determine the regression line of FMCG revenue

generated on the internet penetration rate following

steps would be included:

Average of the internet penetration rate (

x

) =

n

x

=

14

68.309

=

12.22

Average of the FMCG revenue generated (

y

) =

n

y

=

14

2.633

=

22.45

Calculation of

S

xy

=

n

yx

xy

=

14

2.63368.309

53.19012

= 5006.12

Calculation of

S

xx

=

n

x

x

2

2

=

14

70.95901

35.10363

=

23.3513

Slope of the regression line is given by,

1

=

S

S

xx

xy

=

23.3513

12.5006

=

42.1

Intercept of the regression line,

0

=

xy

1

=

12.2242.122.45

=

7.13

Hence the regression line of FMCG revenue

generated on the internet penetration rate is given by

7.1342.1

xy

The plot of this regression line is shown in the Fig. 5

Plot of Regression Line of Internet Penetration Rate

versus FMCG Revenue Generation

Figure 5.

Fig. 5 represents the regression line of FMCG

revenue generation on the internet penetration rate.

The graph shows that with an increase in the

penetration rate the revenue of FMCG also increases.

According to the reports by 2025 the internet

penetration rate will grow by 64% and hence as per

the regression line equation the revenue may

approach 104.58 US$ bn. But the actual plot shows

that in 2020 the FMCG revenue is 103.7 bn

US$ which is higher than that calculated using the

regression line. This change can be attributed to

public awareness and other factors. Hence it can be

safely predicted that by the year 2025 the FMCG

revenue generation will be nearly 123.58 bn

US$ which is 19 bn US$ more and equal to the

difference of 2020 prediction and actual revenue

generated.

Internet penetration rate (in %)

FMCG revenue

ICACSE 2021 - International Conference on Advanced Computing and Software Engineering

78

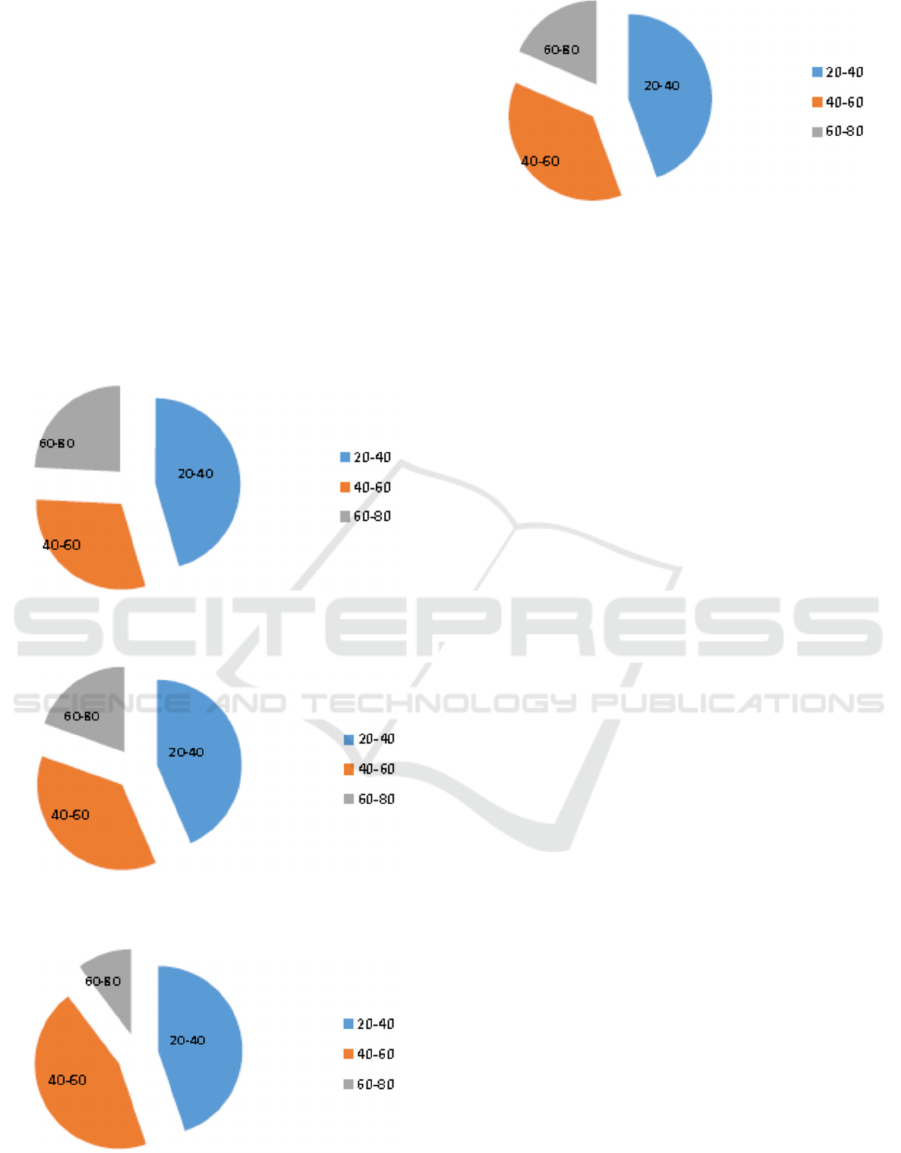

A survey of 150 consumers in various parts of

Delhi-NCR was conducted between 15 February

2020 and 29th February 2020 including students and

senior citizens to assess the consumer behavior in

terms of online and traditional FMCG purchase. The

study has been divided into three categories

according to the age of consumers (in years) viz.20-

40, 40-60, and 60-80. The study was conducted in the

Karolbagh area of Delhi, the Knowledge Park area in

Greater Noida, and Ghaziabad. In All three regions,

the maximum number of users is of the age group of

20-40 and the least number of online FMCG is of the

age group 60-80. In the Karol bagh area the

percentage of the 60-80 group is much higher as

compared to the other two regions. The trend can be

understood by the following graphs (Fig.5a, 5b, 5c,

and 5d):

Figure 5(a): Distribution of Online FMCG Consumers in

Karol Bagh

Figure 5 (b): Distribution of Online FMCG Consumers in

Greater Noida

Figure 5(c): Distribution of Online FMCG Consumers in

Ghaziabad

Figure5 (d): Overall Distribution of Online FMCG

Consumers

7 CONCLUSION

The study shows that although the consumers are

still involved in traditional purchasing due to

changing lifestyle and the penetration of internet and

social media app is gradually converting traditional

FMCG consumers into online FMCG consumer.

Industries are trying hard to generate trust and

confidence in their products by providing online

details of their goods. In short, it can be said that in

coming years a majority of FMCG consumers will

move towards online purchasing but traditional

FMCG consumers will also play important role in

the economy due to Indian tradition. For example in

festivals people still believe in traditional purchasing,

not because of availability but because they love to

do so. Hence in coming years hybrid (online plus

traditional) consumers will prevail and industries

have to plan accordingly so as to boost the market.

Finally, companies and government as well should

enhance public awareness, build-up strong public

confidence and provide better internet facilities with

a strong distribution network to promote online

FMCG products.

REFERENCES

D. W. Rook and S. J. Hoch (1985), “Consuming Impulses”

Advances in Cosumer Research, Vol. 12, pp. 23-27.

E-commerce share in India’s FMCG retail sales triples in

two years: Nielson, Economic Times, December 18,

2018.

Fast moving consumer goods (2018), India Brand equity

Foundation, www.ibef.org

H. Winzar (1992), “Product classification and Marketing

strategy”, Journal of Marketing Management, Vol. 8,

pp. 259-268.

https://www.statista.com/statistics/1115129/india-internet-

penetration-by-state/ FMCG (2019), www.ibef.org

I. G. Varma and R. Ravindran(2016), Online behavior of

homemakers in Mumbai and Delhi, International

A Study of Consumer Buying Behaviour in Delhi NCR towards FMCG Products

79

Journal of Current Research in Multidisciplinary, Vol.

1, Page 1-16.

IAMAI Report (2013), “Internet in India 2013”, retrieved

from report,

http://www.imrbint.com/downloads/Report-

BB55685%20IAMAI%20ICUBE_2013-Urban+Rural-

C1.pdf

IAMAI, PwC Analysis and Industry, Report 2020.

India FMCG growth snapshot (2018).

https://www.nielsen.com/wp-

content/uploads/sites/3/2019/04/nielsen-fmcg-

snapshot-india-q2.pdf

Indian FMCG industry in India Industry Report (2020),

India Brand Equity Foundation,

https://www.ibef.org/industry/fmcg.aspx

KPMG Advisory Services Private Limited (2014),

“Emerging consumer segments in India, Retail

Leadership Summit 2014 pp. 21

L. P. Bucklin (1963), “Retail Strategy and classification of

consumer goods”, Journal of Marketing, Vol. 27, pp.

50-55.

P. Duarte, M. Raposo and M. Ferraz, “Drivers of snack

food impulse buying behavior among young

consumers”(2013), British Food Journal, Vol. 115, pp.

1233-1254.

P. H. Patil (2016), An overview of Indian FMCG sector,

Management Science, Vol. 5, Page 171-173.

R.Jayanthi (2017), Fast moving consumer goods (FMCG)

sector in India: A study, International Journal of

Multidisciplinary Research and Development, Vol. 4,

Page 91-97.

S. Diwanji (2020), “Internet penetration Rate in India from

2007 to 2020”, Statistica.

Singhi, N. Jain and N. Puri (2015), Re-Imaging FMCG in

India, CII National FMCG Summit: 2015,

https://media-publications.bcg.com/india/Re-

Imagining-FMCG-in-India.pdf

The Indian FMCG market 2020, ASSOCHAM and

TechSci Research, Page 1-42.

V. Jadhav and M. Khanna (2016), “Factors influencing

online buying behavior of college students: A

qualitative analysis”, The Qualitative Report, Vol. 21,

pp. 1-15.

ICACSE 2021 - International Conference on Advanced Computing and Software Engineering

80