A Scalable Bitcoin-based Public Key Certificate Management System

Chloe Tartan

1

, Craig Wright

1

, Michaella Pettit

2

and Wei Zhang

1

1

nChain Ltd., London, U.K.

2

nChain AG, Zug, Switzerland

Keywords: Bitcoin, Blockchain, Public Key Infrastructure, Certificate Management, Certificate Transparency.

Abstract: The main challenges with traditional public key infrastructures arise from the detection of fraudulent public

key certificates and the timely retrieval of an up-to-date record of revoked certificates. While Certificate

Transparency logs help to detect falsified certificates in circulation, they do not address the prevailing issues

with certificate revocation. Public blockchains such as Bitcoin can be used to create a transparent, tamper-

proof log of events secured by the cryptographic work carried out by nodes in the network. In this paper, we

present a Bitcoin-based certificate management system that exploits the scalability and low-cost features of

its underlying blockchain infrastructure, while preserving user privacy. Based on a feasibility analysis, we

estimate the capability to support 9000 certificate issuances, revocations, or updates per second at a cost of

less than 0.005 USD per event. The immutability and auditability of records stored on the blockchain provides

a universal view of public key certificates. A comparative analysis shows that our solution can significantly

reduce the overhead endured by live certificate status retrievals and offers flexibility in certificate revocation.

The revocation of a public key certificate is as simple as spending a Bitcoin transaction.

1 INTRODUCTION

Public key infrastructure (PKI) underpins the security

of most public key cryptosystems. PKI schemes

typically consist of a certificate authority (CA) that

verifies the identity of a user and signs their public

key certificate. The certificate binds the identity to the

public key. It ensures that the public key used in a

cryptosystem indeed belongs to the expected user.

Traditional PKI models are often centralised with

a hierarchical structure. Certificate logging (Blagov

& Helm, 2020) was introduced to bring more

transparency to the CA process, and has become

mandatory for web PKIs on account of CA

misbehaviour and several security breaches (Van der

Meulen, 2013) (Langley, 2015). Google’s Certificate

Transparency is the most widely deployed public log

of SSL/TLS certificates (Scheitle, et al., 2018). Other

alternatives to PKI include identity-based

cryptography (Boneh & Franklin, 2001) (Boneh,

Lynn, & Shacham, 2001) and certificateless public

key cryptography (Al-Riyami & Paterson, 2003).

Both alternatives require an implementation of a

bilinear map, which is difficult due to its complexity

(Galbraith, Paterson, & Smart, 2008).

One of the most challenging tasks for any PKI

model is certificate revocation, which necessitates the

timely retrieval of up-to-date records of revoked

certificates compounded by the additional effort

required to check any such records. One approach to

handle revocation checks is to consult public

certificate revocation lists (CRLs) (Cooper, et al.,

2008), which are signed by CAs to ensure their

integrity. This creates a significant overhead for

certificate verification while also introducing

potential implementation-related vulnerabilities

(Hoogstraaten, 2012). Some web browsers default to

not checking CRLs in order to gain performance

efficiency (CERT Division, 2001).

Another approach is to use the Online Certificate

Status Protocol (OCSP) (Santesson, et al., 2013) in

which the status of a certificate is maintained on a

dedicated server that facilitates status queries via a

request-response mechanism. OCSP Stapling and

Must-Staple (Wazan, et al., 2020) are extensions that

address network latency and user privacy issues (Zhu,

Amann, & Heidemann, 2016). However, several

major browsers have opted for proprietary revocation

mechanisms e.g., Google’s CRLSets (Langley, 2012)

and Firefox’s CRLite (Larisch, et al., 2017) both of

which crawl CRL servers and certificate logs

548

Tartan, C., Wright, C., Pettit, M. and Zhang, W.

A Scalable Bitcoin-based Public Key Certificate Management System.

DOI: 10.5220/0010556805480559

In Proceedings of the 18th International Conference on Security and Cryptography (SECRYPT 2021), pages 548-559

ISBN: 978-989-758-524-1

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

periodically to update their list of valid certificates.

While these browsers support traditional OCSP

checks, failure to determine a certificate’s status

within an acceptable timeframe results in a soft-fail

revocation check, where the certificate is accepted by

default when its status is indeterminable. An

adversary can therefore simply suppress the OCSP

response in a denial-of-service (DoS) attack.

In recent years, blockchain technology has offered

a promising future for PKI. The immutability and

transparency of data stored on a blockchain (on-

chain) offers a single source of truth for the PKI

ecosystem, while the consensus mechanism secures

and timestamps the on-chain data. The Certcoin

protocol by Fromknecht, Velicanu, & Yakoubov

(2014) defines a pure blockchain-based PKI that

publicly links identities to public keys in the

Namecoin network

, while the work by Axon &

Goldsmith (2017) adapts Certcoin to provide privacy

to its users. However, neither of these methods

propose an adequate solution for the reclamation of

an identity in the case of key compromise (Kubilay,

Kiraz, & Mantar, 2019).

Yakubov, Shbair, Wallbom, Sanda & State (2018)

use Ethereum to design smart contracts that automate

certificate management. While the solution benefits

from the transparency of data stored on a public

blockchain, it is not suitable for large-scale

applications. This is due to the fundamental scaling

limitations arising from Ethereum’s account-based

transactional model, where each user account is

updated sequentially by a generalised state transition

function (Wood, 2014). As a result, large transaction

volumes cause congestion in the network that

translates to higher transaction fees for its users

(Etherscan, 2020). Ethereum-based certificates may

therefore be difficult and expensive to manage.

Applications that require fast processing can instead

be realised with UTXO-based transactional models

(Zhang, Xue, & Liu, 2019) such as Bitcoin, where

parallel processing is supported.

1.1 Our Contributions

In this paper, we propose a Bitcoin-based certificate

management system that can be readily implemented

and addresses ongoing issues with certificate

verification and revocation. We show how a public

key certificate can be published in a Bitcoin

transaction, which allows us to create a link between

a certified public key and a Bitcoin transaction

outpoint. To verify the certificate, a verifier checks

whether the corresponding transaction outpoint is

unspent. To revoke a certificate, one simply spends

the transaction outpoint. The main contributions of

the paper are:

• a low-cost blockchain-based system that can

manage large volumes of certificates,

• a single source of truth for certificates and

their status,

• a transparent and auditable log of

timestamped certificates,

• an immutable record of certificates that is

secure even when keys are compromised,

• a flexible revocation mechanism using

Bitcoin’s Script language that can

accommodate different revocation

requirements and key updates,

• an atomic verification mechanism that

integrates large-value payments and identity

verification into one Bitcoin transaction, and

• an obfuscating technique that preserves user

privacy.

The paper is organised as follows: Section 2

provides an overview of Bitcoin along with relevant

PKI standards and practices. In Section 3, we outline

certificate issuance, revocation, verification, and key

updates, together with the assignment of revocation

rights. In addition, we describe the immutability of

historical records, user privacy and atomic certificate

verification. Section 4 contains empirical data to

show the scalability and low-cost of our solution.

Section 5 provides comparisons with other PKI

solutions, and Section 6 concludes the paper.

2 PRELIMINARIES

This section describes preliminaries on Bitcoin, along

with relevant PKI standards and practices.

2.1 Bitcoin

The Bitcoin blockchain can be viewed as a distributed

platform service that offers scalability, transparency,

immutability, and the availability of data. Data can be

published on the blockchain and retrieved in the form

of Bitcoin transactions. There are different

blockchain implementations with a shared history

tracing back to the original Bitcoin genesis block,

such as Bitcoin Core (BTC), Bitcoin Cash (BCH) and

Bitcoin SV (BSV). When implemented on Bitcoin

SV, the solution in this paper benefits from

scalability, the lowest cost, and data integrity. The

Bitcoin SV protocol offers high transaction

throughput, with over 2000 transactions per second

(tps) on the main net (Blockchair, 2020) and 9000 tps

A Scalable Bitcoin-based Public Key Certificate Management System

549

on the scaling test net (Southurst, 2021). In what

follows we will present the solution in accordance

with the Bitcoin SV protocol for transactions, but it is

understood that it can be easily adapted to any

UTXO-based blockchain. Table 1 shows a simplified

format of a Bitcoin transaction.

Table 1: Bitcoin Transaction Format.

Transaction ID

Version Locktime

Inputs

Outpoint Unlocking Script Sequence

N

umbe

r

Outputs

Value Lockin

g

Scrip

t

We would like to highlight a few fields in the

transaction format.

• Outpoint: a concatenation of a transaction

identifier (TxID) and an index that identifies the

output from the previous transaction.

• Unlocking Script: a script that contains data

only (no operational codes). It is combined with

the corresponding locking script for script

execution, which is part of the transaction

validation process. It usually contains a digital

signature and a public key.

• Locking Script: a script that contains the

conditions to spend the output. It usually

contains a hash value check on a public key and

a verification of a signature, which is known as

Pay-To-Public-Key-Hash (P2PKH) script. The

script can also be more complex to

accommodate for more complicated spending

conditions. In addition to its primary

functionality, a locking script can be used as a

data carrier, where a data payload can be

appended to the opcode OP_RETURN.

A transaction outpoint can be either spent or

unspent. The set of unspent transaction outpoints is

called UTXO set. A static UTXO set can be derived

from the history of the blockchain for a given block

height. A live UTXO set also accounts for the

transactions in the mempool (a set of validated

transactions that are to be published on-chain). As a

result, a live UTXO set can vary from one Bitcoin

node to another.

A block consists of a set of Bitcoin transactions

and a block header, which is of a fixed size of 80 bytes

regardless of the number of transactions in that block.

A Merkle tree (Merkle, 1979) is derived from the set

of transactions in a block where the leaves consist of

the transaction identifiers. The Merkle root is then

included in the block header. It provides an efficient

mechanism to prove transaction inclusion. Given a

transaction and its Merkle proof, one can compute the

Merkle root and compare it with the Merkle root in a

block header. If they match, one can be convinced

that the transaction has been validated and the

transaction data has not been tampered with. This

integrity and inclusion proof is referred to as

simplified payment verification (SPV), a terminology

coined in the original Bitcoin white paper. This

lightweight mechanism makes Bitcoin applications

low cost and scalable, since they can ignore other

transactions and only maintain block headers,

application-specific transactions and their Merkle

proofs. As a result, applications built on the Bitcoin

system can operate without hindrance from the ever-

growing size of the blockchain.

The consensus mechanism in Bitcoin is based on

proof of work. Each block header contains a 4-byte

number that allows iterative hashing of the block

header. The goal is to find a hash value that is less

than a set value derived from the difficulty level

specified in the block header. This allows the proof of

work on a block header to be verified independently.

Each block header also contains the previous block

header hash and forms a chain of block headers. To

change a historical block, one must redo the proof of

work on all the following blocks. The earlier the

block, the more proof of work is required to change

it. This results in the immutable nature of historical

data on-chain.

The Bitcoin network consists of Bitcoin nodes,

also loosely known as miners. Their services include,

but are not limited to, transaction validation and

propagation, block construction and publication, and

responding to queries for Merkle proofs and

transaction status. The majority of Bitcoin nodes are

incorporated businesses and can be identified via

coinbase transactions. An initiative to establish miner

IDs led by the Bitcoin SV community allows miners

to build their reputation over time based on proof of

work (nChain, 2020). This brings more transparency

to the network and therefore leads to more overall

trustworthiness.

2.2 Relevant Standards and Practices

In this section, we describe two standards that share

similarities with our solution, namely OCSP Stapling

(Eastlake, 2011) (Pettersen, 2013) and CT logs

SECRYPT 2021 - 18th International Conference on Security and Cryptography

550

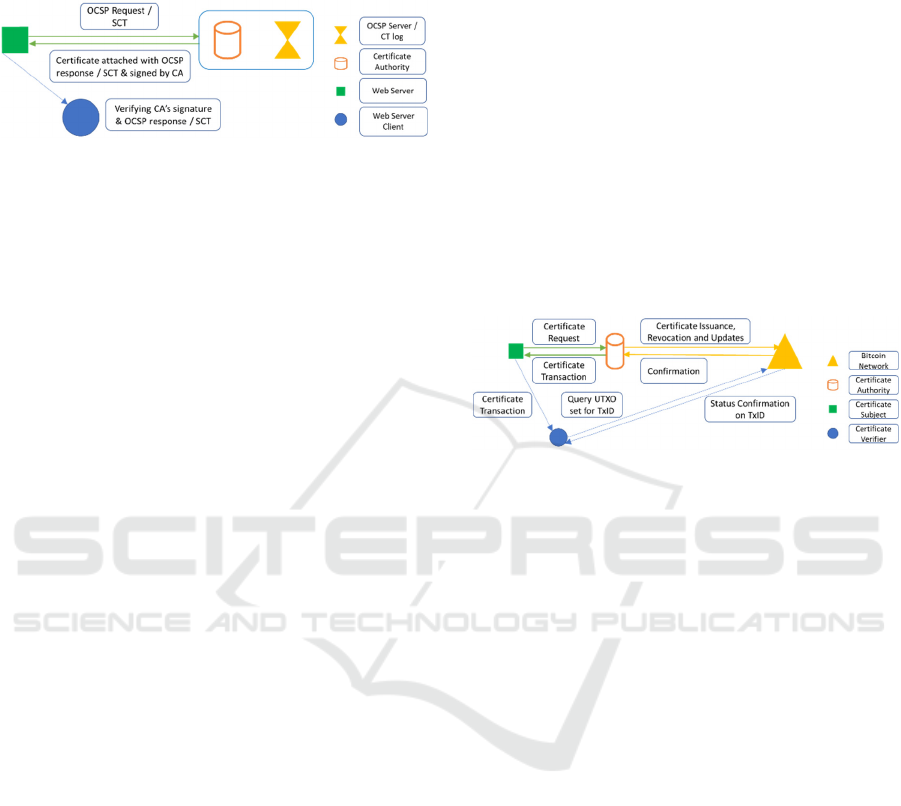

(Laurie, Langley, & Kasper, 2013). The high-level

architecture of these two approaches is the same, as

shown in Figure 1.

Figure 1: High-Level Architecture of OCSP Stapling / CT

Logs.

OCSP Stapling describes a way to append or

‘staple’ the short-term status of a certificate to the

certificate itself. The CA signs the certificate status in

the same way that it signs the certificate, both of

which are cached on the web servers frequently.

During certificate checks, OCSP stapling shifts the

onus from the client (browser) to the web server,

mitigating potential breaches of user privacy and

reducing network latency as a result. OCSP Must-

Staple (Hallam-Baker, 2015) is an advancement that

addresses DoS attacks by ensuring that an OCSP

response must be included with a certificate request

for the public key to be deemed valid. However, its

adoption among browsers remains limited.

Certificate transparency (CT) logs are append-

only Merkle trees that provide a public record of

certificates issued by different CA organisations to

support the detection of falsified certificates. While

Google’s CT is the most widely deployed log in the

web PKI ecosystem, any CA can choose to maintain

their own log. It is recommended that CAs also

publish their certificates to third-party logs (Laurie,

Langley, & Kasper, 2013). A central authority

monitors and audits each CA’s log to ensure that the

information is consistent.

A signed certificate timestamp (SCT) is generated

by a CT log when the certificate is submitted for

publication at the point of issuance. The SCT acts as

proof of a certificate’s existence in a log. It is possible

to fetch an SCT using an OCSP request (DigiCert,

2021). While there is no minimum number of proofs

required, Google currently recommends including at

least three such proofs with a certificate to account for

any misinformation arising from compromised or

misbehaving logs (Google, 2013).

The general operation of a CT log is complex and

requires a high degree of availability to fulfil client

requirements. As logs grow, they become more

expensive and difficult to operate (Matsumoto,

Szalachowski, & Perrig, 2015). Temporal sharding

can be used to address these scaling issues by limiting

the date range of CT logs. This results in multiple logs

per CA, each of which is typically limited to one-year

segments (Lynch, 2018). However, increasing the

number of CT logs increases the cost of monitoring

for domains and auditors (Google, 2013).

3 CERTIFICATE MANAGEMENT

ON-CHAIN

The proposed solution aims to address the issues of

certificate revocation in PKI and offers an all-in-one

set of features including transparency, privacy,

auditability, and immutability of historical records.

The high-level architecture of the solution is shown

in Figure 2.

Figure 2: High-Level Architecture of a Bitcoin-Based

Certificate Management System.

Our solution does not require a new blockchain.

It adapts the existing PKI practices and utilises the

Bitcoin network infrastructure. A certificate authority,

say Charlie, connects to the Bitcoin network by

connecting to a Bitcoin node or a group of nodes, say

Natalie. A user, say Alice, submits a certificate

request to Charlie and is issued a certificate in the

form of a Bitcoin transaction. A certificate verifier,

say Bob, queries the Bitcoin network for the status of

the outpoint in the certificate transaction. If it is

unspent, then the certificate is valid. Otherwise, it is

invalid. All certificates and their change of status are

recorded in Bitcoin transactions and published on the

blockchain for transparency and auditability. The

verification of certificates requires interactions with

the Bitcoin network.

The detail of the process is described in the next

section, followed by other features and extensions

such as flexibility in revocation, immutability of

historical records, privacy enhancements, and atomic

certificate verification.

3.1 Certificate Life Cycle

In this section, we describe how to issue, revoke,

update and verify certificates using Bitcoin

transactions. The mechanisms can be applied to any

certificate type that links an identity to a public key.

A Scalable Bitcoin-based Public Key Certificate Management System

551

3.1.1 Issuance

Alice submits a certificate request to the CA, Charlie.

After verifying Alice’s identity, Charlie creates a

Bitcoin transaction that can be viewed as a certificate

for Alice’s public key.

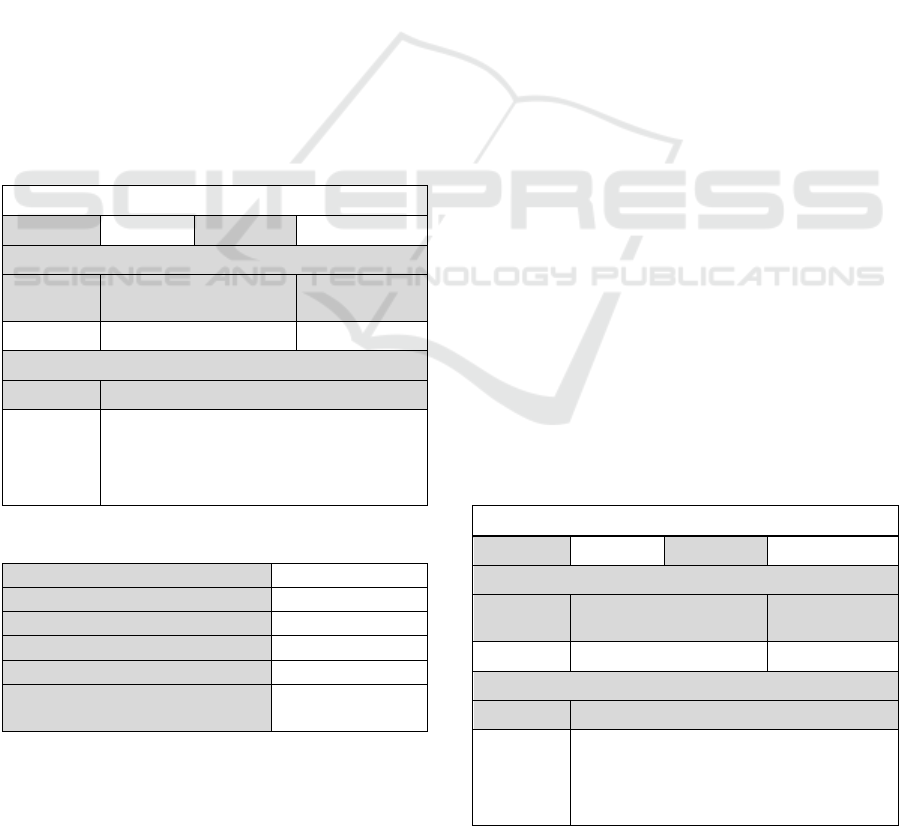

Table 2 shows an example of a certificate issuance

transaction. Charlie assigns 𝑥 satoshis to himself

(𝑃𝐾

) from the outpoint 𝑇𝑥𝐼𝐷

||0 and embeds an

issuance message for 𝑃𝐾

as an OP_RETURN data

payload. This OP_RETURN does not invalidate the

script in accordance with the Bitcoin SV

implementation (Bitcoin SV, 2021).

Table 3 shows an example of the issuance

message format. Note that the data payload can be an

X.509 V3 certificate in its entirety, which would

provide great interoperability. It also can be of any

other format, e.g., OpenPGP (Callas, Donnerhacke,

Finney, Shaw, & Thayer, 2007). In the extension

field, Charlie adds some identification evidence,

which can be the hash digest of documents that Alice

has provided to verify her identity. This would be

used to prove that Charlie has conducted the

identification due diligently.

Table 2: Certificate Issuance Transaction.

𝑇𝑥𝐼𝐷

Version

1

Locktime

0

Inputs

Outpoint Unlocking Script Sequence

N

umbe

r

𝑇𝑥𝐼𝐷

||0 <𝑆𝐼𝐺

> <𝑃𝐾

>

0xFFFFFFFF

Outputs

Value Locking Script

𝑥

OP_DUP OP_HASH160

<𝐻(𝑃𝐾

)> OP_EQUALVERIFY

OP_CHECKSIG OP_RETURN

<Issuance Message 𝑃𝐾

>

Table 3: Issuance Message.

Messa

g

e T

y

pe Issuance

Issuer Name Charlie

Sub

j

ect Name Alice

Subject Public Key

𝑃𝐾

Sub

j

ect Public Ke

y

Al

g

orith

m

ECDSA

Extensions (optional) Identification

Evidence

The digital signature (𝑆𝐼𝐺

,𝑃𝐾

) from Charlie in

the unlocking script not only signs the transaction but

also attests to the issuance message for 𝑃𝐾

as it is

part of the signed message. This implies that there is

no need to include an explicit signature in the

issuance message.

Charlie then sends the transaction to the Bitcoin

node Natalie for publication to the blockchain.

Charlie can wait for the next block to be published

before passing on the transaction to Alice as her

public key certificate. This often takes around ten

minutes, occasionally more. However, Bitcoin nodes

can implement an API (nChain, 2021) that allows

users to request for instant confirmation of the

acceptance of their transactions. Nodes with this

capability are the ideal candidates to connect to.

The transaction 𝑇𝑥𝐼𝐷

effectively binds the

validity of the certificate of public key 𝑃𝐾

to the

Bitcoin outpoint 𝑇𝑥𝐼𝐷

||0. If 𝑇𝑥𝐼𝐷

||0 is unspent,

then 𝑃𝐾

is a valid public key that belongs to Alice.

As Bitcoin transactions allow a large number of

outputs, Charlie can combine multiple issuances into

one issuance transaction. Each certificate can be

independently identified by the transaction outpoint.

The “Locktime” and “Sequence Number” can be used

to schedule the issuance of certificates (Bitcoin SV,

2021). Both batching and scheduling mechanisms are

also applicable to both revocation and key updates.

3.1.2 Revocation

In the case that the certificate corresponding to

Alice’s public key 𝑃𝐾

needs to be revoked, Charlie

can spend 𝑇𝑥𝐼𝐷

||0 to invalidate the certificate.

Charlie creates a Bitcoin transaction as shown in

Table 4. Charlie assigns 𝑥

satoshis to himself (𝑃𝐾

)

from the outpoint 𝑇𝑥𝐼𝐷

||0 whose spending status is

tied to the validity of the certificate on 𝑃𝐾

. Charlie

also embeds a revocation message in the output as the

OP_RETURN data payload. The revocation message

may take the format in the example shown in Table 5.

Table 4: Certificate Revocation Transaction.

𝑇𝑥𝐼𝐷

Version

1

Locktime

0

Inputs

Outpoint Unlocking Script Sequence

N

umbe

r

𝑇𝑥𝐼𝐷

||0

<𝑆𝐼𝐺

> <𝑃𝐾

>

0xFFFFFFFF

Outputs

Value Locking Script

𝑥

OP_DUP OP_HASH160

<𝐻(𝑃𝐾

)> OP_EQUALVERIFY

OP_CHECKSIG OP_RETURN

<Revocation Message>

SECRYPT 2021 - 18th International Conference on Security and Cryptography

552

Table 5: Revocation Message Example.

Revocation Messa

g

e

Issuer Name Charlie

Reason for Revocation Ke

y

Compromise

d

Extension (optional)

Note that it is not critical to include 𝑃𝐾

in

𝑇𝑥𝐼𝐷

, since the revocation transaction is not for

users to check. The purpose of this transaction is to

ensure that any check on the certificate transaction

fails, as the validity of the certificate is bonded to the

spending status of the certificate transaction outpoint.

However, the data payload may be an X.509 V2

revocation message to provide interoperability. While

it is more informative and auditable to include a

revocation message, the absence of one also works.

Charlie signs the revocation transaction and sends

it to the Bitcoin node Natalie. When Charlie obtains a

confirmation from Natalie, it can be viewed as a

confirmation that the revocation is successful. As for

certificate issuance, this can take around 10 minutes

and occasionally more, while it would take a matter

of seconds or less if Natalie has implemented an API

that offers instant confirmations.

3.1.3 Update

It is good practice to update cryptographic keys

regularly and is a necessity if they are compromised

or lost. An ideal key update mechanism would be low

cost and take effect in a short time. In our solution,

key updates are done by combining revocation and

issuance into a single Bitcoin transaction. Suppose

Alice needs to update her public key 𝑃𝐾

to 𝑃𝐾

,

Charlie spends the certificate transaction outpoint for

𝑃𝐾

to create a certificate transaction for 𝑃𝐾

as

shown in Table 6.

Table 6: Certificate Update Transaction.

𝑇𝑥𝐼𝐷

Version

1

Locktime

0

Inputs

Outpoint Unlocking Script Sequence

N

umbe

r

𝑇𝑥𝐼𝐷

||0

<𝑆𝐼𝐺

> <𝑃𝐾

>

0xFFFFFFFF

Outputs

Value Locking Script

𝑥

OP_DUP OP_HASH160

<𝐻(𝑃𝐾

)> OP_EQUALVERIFY

OP_CHECKSIG OP_RETURN

<Update Message 𝑃𝐾

>

The update message in the output can take the format

shown in Table 7, and for interoperability, an X.509

V3 certificate can be used as an alternative.

Table 7: Updated Public Key Data Payload.

Certificate for 𝑃𝐾

Issuer Name Charlie

Sub

j

ect Name Alice

Subject Public Key

𝑃𝐾

Sub

j

ect Public Ke

y

Al

g

orith

m

ECDSA

Extension (optional)

𝑃𝐾

updated

Note that we do not need to have an explicit output

to represent revocation. It is the action of spending

𝑇𝑥𝐼𝐷

||0 that invalidates the certificate. On the other

hand, spending 𝑇𝑥𝐼𝐷

||0 requires Charlie’s signature,

which implies that it can be used as an input to issue

a new certificate as described in Section 3.1.1. In this

case, the output can be utilised to represent the

issuance of the certificate for 𝑃𝐾

.

Charlie signs the transaction and sends it to the

Bitcoin node Natalie. After receiving confirmation

from Natalie, Charlie passes on 𝑇𝑥𝐼𝐷

to Alice as the

new certificate reference for her public key 𝑃𝐾

. If

Natalie offers instant confirmation service, then the

key update can take effect immediately.

3.1.4 Verification

To verify the certificate of Alice’s public key, Bob

needs to conduct three checks:

1. the integrity of the transaction data,

2. the relevant information embedded in the

transaction data, and

3. the status of the transaction outpoint.

Bob can either obtain the transaction data and its

Merkle proof from Alice or retrieve both from the

Bitcoin network by referencing the transaction ID

𝑇𝑥𝐼𝐷

. Bob must have an up-to-date copy of the

block headers to verify the Merkle proof and ensure

the integrity of the transaction data. Any attempt to

modify the data will invalidate the Merkle proof.

After being convinced that the transaction data

has not been tampered with, Bob parses the data to

read the locking script and the unlocking script. The

locking script should contain a data payload

indicating that the public key 𝑃𝐾

belongs to Alice

and is certified by Charlie.

The unlocking script should contain Charlie’s

public key 𝑃𝐾

. We assume that 𝑃𝐾

is certified in

the same way as 𝑃𝐾

. If Charlie is a root CA or a

subordinate CA, Bob may conduct regular checks on

the certificate of 𝑃𝐾

instead of every time it appears

A Scalable Bitcoin-based Public Key Certificate Management System

553

in an unlocking script. In this case, we assume that

Bob has a list of trusted certified public keys to look

up 𝑃𝐾

. Otherwise, Bob must conduct the same

verification on the certificate of 𝑃𝐾

and follow the

chain of certificates until he reaches a certified public

key that is on his list. One criterion for a certificate to

be maintained in the trusted list can be its expected

lifetime, for example, at least 10 years (IdenTrust

Services, 2021).

The last step is for Bob to query the Bitcoin

network on whether the certificate transaction

outpoint is unspent. In this step, we assume that

Bitcoin nodes are trusted. More precisely, we assume

that their response to the query is genuine and

authenticated. The assumption is particularly

important when the response is unspent. Verifying

whether a transaction outpoint is spent involves

pinpointing the spending transaction and verifying its

validity, which is relatively easy. Verifying that a

transaction is unspent would require verifying all

transactions that come after it, which is far more

computationally costly for users. Nevertheless,

knowing that there is a way to check their response, it

is reasonable to assume that Bitcoin nodes are honest

and trusted.

Bob can either make a static query or a live query.

A static query is to ask for the status of the outpoint

at a time in the past, either using block height or date

and time. As the response is based on the published

blocks, a static query can be made to any Bitcoin

node. A live query reflects the status in a timely

manner. In addition to published transactions, it takes

the transactions that are validated and have not yet

published into account. It is available if Bob connects

to one of the Bitcoin nodes to which Charlie connects.

For Bob, a live query would generally be

preferred as it provides the real-time status of the

certificate. There are scenarios, such as auditing

historical usage of certificates, where static queries

may be more appropriate.

For Natalie, responding to a live query is more

costly since it requires a snapshot of the dynamic

UTXO set that is continuously updated by incoming

transactions, while responding to a static query only

requires a look up on a static data set.

For Charlie, connecting to multiple Bitcoin nodes

in different geolocations and sending the transactions

to each of them simultaneously would reduce the

latency of transaction propagation in the Bitcoin

network. This would allow Bob to have a wider

choice of Bitcoin nodes to connect to, which would

be especially useful if Bob has limited access to

Bitcoin nodes. Charlie may choose to shift the extra

cost to Alice as an optional feature. However, any

business model for Alice, Charlie or Natalie is beyond

the scope of this paper.

3.2 Rights to Revoke

As described in Section 3.1.2, revoking a certificate

for a public key is achieved by spending a transaction

outpoint. The right to spend the transaction outpoint

gives the right to revoke the certificate. The locking

script in a Bitcoin transaction can accommodate

different spending conditions and therefore different

revoking requirements.

As of now, we assume that the CA Charlie can

revoke certificates. This reflects the current setup in a

general PKI model. However, the locking script can

be adapted to allow any designated entity to revoke

the certificate. For example, by replacing the hash

value 𝐻

(

𝑃𝐾

)

with 𝐻(𝑃𝐾

) in the output of the

certificate issuance transaction shown in Table 2,

Charlie effectively assigns Alice the right to revoke

her own certificate. This is advantageous when Alice

needs to revoke the certificate of her public key

because her private key has been compromised. She

does not have to communicate with Charlie and wait

for his response to her revocation request. She can

spend the certificate transaction outpoint immediately

to revoke her public key certificate.

On the other hand, Charlie may want to revoke

Alice’s public key on account of misbehaviour. To

accommodate both requirements, a 1-out-of-2 multi-

signature can be used, in which case either Alice’s

signature or Charlie’s signature will be able to spend

the outpoint. An example locking script can be

constructed as:

OP_DUP OP_HASH160 OP_DUP

<H(PK_A)> OP_EQUAL

OP_IF

OP_DROP

OP_ELSE

<H(PK_C)> OP_EQUALVERIFY

OP_ENDIF

OP_CHECKSIG

OP_RETURN

<Issuance Certificate PK_A>.

This can be generalised further to 𝑚 -out-of- 𝑛

scenarios for any integer 𝑚≥1 and 𝑛≥2. If 𝑚≥2,

ECDSA threshold signature schemes (Gennaro &

Goldfeder, 2018) can be used, in which case the

locking script would have the same format as in Table

2 with a single public key hash. Multi-party

revocation is useful in increasing the robustness of the

revocation mechanism. For example, a regulatory

body can be introduced as part of a 2-out-of-3

SECRYPT 2021 - 18th International Conference on Security and Cryptography

554

revocation scheme. In this case, Charlie cannot

unilaterally decide on Alice’s misuse of her public

key. He requires approval from the regulatory body in

order to revoke Alice’s public key.

3.3 Mitigating Compromised CAs

When a CA is compromised, it may require revoking

all the certificates issued by that entity. This can be

done by spending all the certificate transactions

originating from the CA. In Section 4, we show how

the Bitcoin network has the capability to handle this

scale of large volume transactions in a relatively short

timeframe. On the other hand, if the verification of

the certificate of the compromised CA can be

triggered remotely, then spending the corresponding

certificate transaction outpoint would serve the

purpose of revoking all certificates issued by the CA.

Another feature offered by our solution is the

integrity of the historical records even after the

private key of a CA is compromised. In traditional

PKI, when the private key of a CA is compromised,

actions can be taken to prevent any new certificate

from being issued. However, it is possible for the

attacker to use the private key to create a certificate

that would be deemed valid in the past. Because of

this possibility, the entire history of certificates from

that CA becomes non-trustworthy. The damage done

to the historical record becomes irreversible. This

problem does not exist with our solution. As all the

certificates and their status are recorded on the

blockchain, any changes made to the history would

require redoing all the proof of work, which is

economically inviable and computationally infeasible.

3.4 User Privacy

The privacy issue with OCSP stems from the fact that

a user’s browsing history is exposed by their

certificate status queries, since all the queries are

directed at the OCSP server instead of each individual

web server. OCSP Staple solves the problem by

shifting the burden of status queries to the CA and

back to the web servers. Our solution can adopt the

same approach to protect user privacy. In our case,

the Bitcoin network replaces the OCSP server. Only

the CA interacts with the Bitcoin network, and the

transaction statuses are signed and passed on to the

web servers with a limited lifetime. While this

approach offers great interoperability, it does not

utilise the benefits of our revocation mechanism.

An alternative approach is to hide the link

between a certificate and the corresponding

transaction outpoint by using a cryptographic hash

function. Charlie can replace the issuance message in

the certificate transaction with a hash value derived

from the message. Both Alice and Charlie can keep a

copy of the issuance message. When Bob makes a

query to the Bitcoin node Natalie, Natalie would not

be able to identify which certificate the query is about.

By obtaining the issuance message from Alice,

Bob can verify its integrity by checking whether the

message leads to the same hash value in the certificate

transaction. To enhance user privacy, the certificate

can be updated frequently, preventing any traffic

analysis that attempts to establish the hidden link.

When updating the certificate, the CA could combine

the revocation of a certificate of one entity with the

issuance of a certificate of another as well as

combining several updates into one transaction. This

would further obfuscate the link between a certificate

and its transaction outpoint. Note that recording hash

values on-chain represents a series of certificate

events that cannot be altered, and the transparency of

these commitment-like records ensures that our

solution facilitates trustworthy auditing.

3.5 Atomic Certificate Verification

In Section 3.1.4, we assume that Bitcoin nodes are

trusted in the sense that their response to a query on

whether a transaction is unspent is genuine and

authenticated. This assumption can in fact be omitted

by designing each certificate to be single use whereby

we attempt to “spend the certificate” instead of

querying the Bitcoin nodes for a spending status.

A transaction outpoint can be spent only if it is

unspent. If the accepted validity of a certificate leads

to an action, for example, accepting a payment, then

that action will be executed at the same time as the

verification of the certificate, thereby making the

exchange atomic. This verification mechanism

implies that the certificate can only be verified once,

but multiple certificates for the same identity can be

issued and combined into the same transaction.

This solution integrates with the Bitcoin system at

its protocol level by utilising the double spending

prevention mechanism for certificate verification.

The trust on the Bitcoin system can be inherited by

the certificates. As a result, an atomic solution may

not be practical for certificates with high verification

demands, i.e., domain certificates, but could be of use

for secure user identification in online payments.

Consider as an example that Bob would like to

make an online payment to Alice for purchasing an

item that is of large value. To comply with AML5

(Council of EU, 2018), Alice must verify Bob’s

identity. Alice can require that the payment

A Scalable Bitcoin-based Public Key Certificate Management System

555

transaction includes a transaction outpoint

corresponding to Bob’s public key certificate that

represents his identity. If the transaction is accepted

by the Bitcoin network, then Alice knows that Bob’s

certificate is valid at the time of payment.

Let us assume that Bob has a certificate outpoint

𝑇𝑥𝐼𝐷

||0 that can be spent by either Bob or the issuer

Charlie (Section 3.2). He also has an unspent outpoint

containing the funds for payment in 𝑇𝑥𝐼𝐷

||0.

Bob creates a transaction that spends one of the

outpoints in his certificate transaction. He also

includes an input that enables payment to be given to

Alice. He sends the transaction shown in Table 8 to

Alice together with 𝑇𝑥𝐼𝐷

.

Table 8: Atomic Verification Transaction.

𝑇𝑥𝐼𝐷

Version

1

Locktime

0

Inputs

Outpoint Unlocking Script Sequence

N

umbe

r

𝑇𝑥𝐼𝐷

||0 <𝑆𝐼𝐺

> <𝑃𝐾

>

0xFFFFFFFF

𝑇𝑥𝐼𝐷

||0 <𝑆𝐼𝐺

> <𝑃𝐾

>

0xFFFFFFFF

Outputs

Value Locking Script

𝑥

OP_DUP OP_HASH160

<𝐻(𝑃𝐾

)> OP_EQUALVERIFY

OP_CHECKSIG

Upon receiving 𝑇𝑥𝐼𝐷

and 𝑇𝑥𝐼𝐷

from Bob,

Alice checks that 𝑇𝑥𝐼𝐷

indeed contains Charlie’s

signature and Bob’s public key. She then sends

𝑇𝑥𝐼𝐷

to the Bitcoin node Natalie. After receiving

confirmation from Natalie, Alice is convinced that

Bob’s certificate is valid, and she has been paid. The

compliance of the regulation and the acceptance of

payment are integrated into one action, which is the

validation of the transaction by the Bitcoin nodes.

This offers Alice a significant computational saving.

4 FEASIBILITY ANALYSIS

In general, one of the main issues with blockchain-

based solutions relates to high transaction fees. A

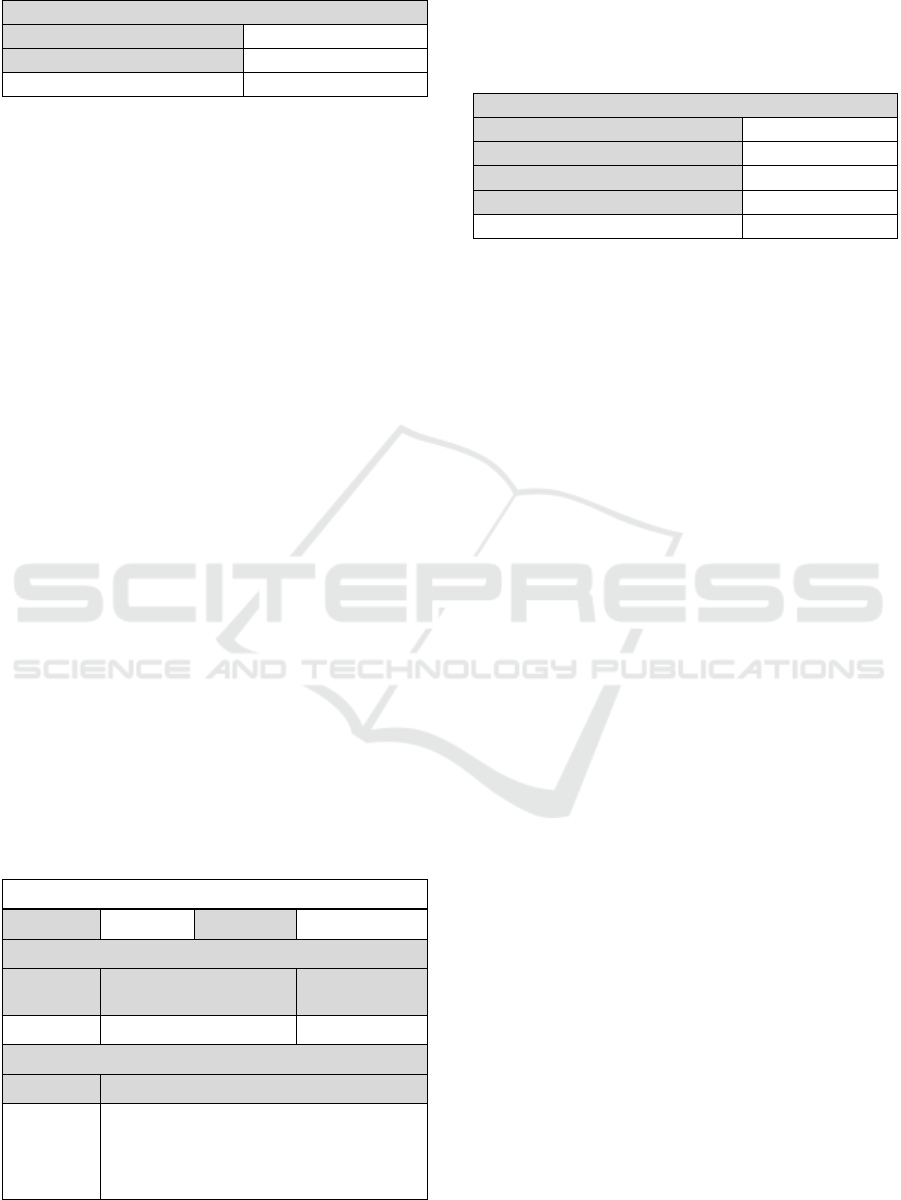

justification for choosing Bitcoin SV arises from its

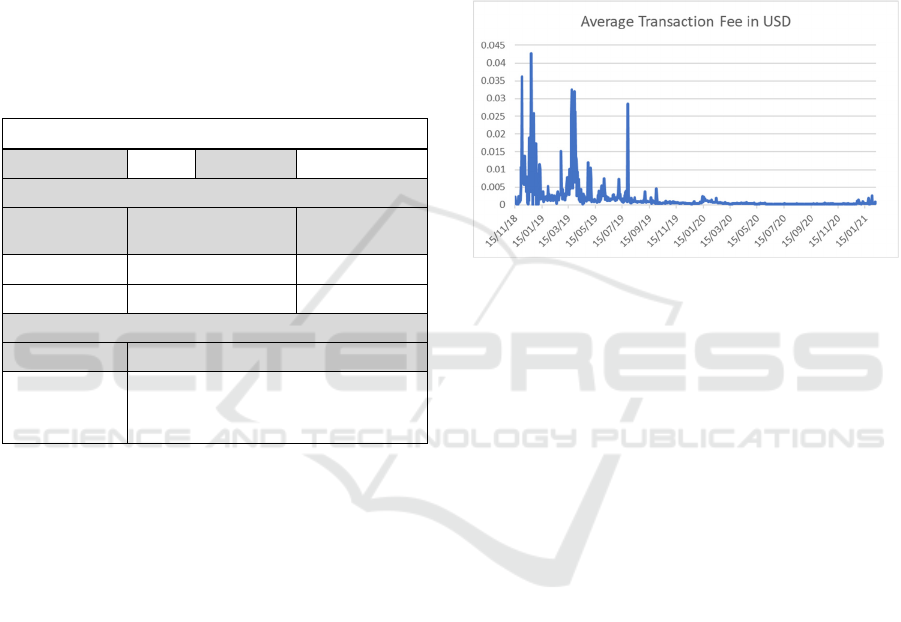

extremely low transaction cost. As shown in Figure 3

(Blockchair, 2021), the average fee per Bitcoin SV

transaction has been much lower than 0.005 USD

since October 2019. According to the Bitcoin SV

(2021) node implementation, nodes can configure the

minimal acceptance and relay fee rates themselves,

which is currently set to 0.5 satoshi per byte and 0.25

satoshi per byte, respectively. Assuming a certificate

transaction 1000 bytes in size and a price of 200 USD

for 1 BSV, the transaction fee to issue a certificate is

roughly 0.001 USD. Note that 1 BSV is 10

satoshis.

The cost goes up linearly with the price of BSV, but

even at a price of 10,000 USD for 1 BSV, the cost of

issuing a certificate is under 0.05 USD. Note that the

price for an SSL/TLS certificate can range from

around 10 USD to over 300 USD per year.

Figure 3: Average Transaction Fee in USD for Bitcoin SV.

In addition to low transaction fees, the blockchain

also offers high transaction throughput via bigger

block sizes. The estimated capability is 2GB per

block (Southurst, 2021) at the time of writing, which

equates to 9,000 transactions per second. It would

take only one week to issue 4 billion certificates on

the blockchain, which is the number of certificates

currently included in Google (2021) CT logs.

Bitcoin as a blockchain is subject to

reorganisation, which is triggered when more than

one Bitcoin node finds a valid block around the same

time. Our solution does not rely on any consensus to

be reached on the most up-to-date chain tip or block

headers, but on the perspective of the Bitcoin nodes

that both the CA and certificate verifier are connected

to. Provided those Bitcoin nodes as a group remain

honest and share the same view of the status of

certificate transactions among themselves, then

reorganisation will have no impact on our solution.

Taking advantage of the scalability and low cost

offered by Bitcoin SV means that our certificate

management system can be readily implemented.

5 COMPARATIVE ANALYSIS

In this section, we analyse two different PKI solutions

to frame the comparative advantages and

disadvantages of our system. We confine each

SECRYPT 2021 - 18th International Conference on Security and Cryptography

556

discussion to the features of our solution with

reference to a given benchmark solution.

In our first analysis, we choose the scheme

proposed by Yakubov, Shbair, Wallbom, Sanda, &

State (2018) as our benchmark blockchain-based PKI

since it explicitly supports certificate revocation. The

authors propose a PKI management framework that

uses Ethereum smart contracts for the registration,

verification, and revocation of on-chain X.509 (v3)

certificates. As with our solution, the framework

takes advantage of an existing network infrastructure

that makes it readily implementable and uses a

permissionless ledger that is secured by large-scale

networks of nodes. However, the Ethereum

blockchain upon which Yakubov et al.’s framework

is implemented cannot support the level of scalability

needed for a large volume of certificate transactions

as demonstrated by our chosen Bitcoin

implementation. The transaction fees are also higher

in the Ethereum network. The authors quote a 70

USD fee to publish a CA-issued certificate on-chain,

which is significantly more expensive than our

estimated cost of under 0.005 USD per certificate.

An in-depth analysis by Kubilay, Kiraz, & Mantar

(2020) reveals several privacy and security issues in

Yakubov et al.’s proposal, highlighting a critical

security flaw with their revocation scheme in the case

that a CA is compromised or corrupted. The

flexibility of our solution means that revocation is not

constrained by CAs, since our users can be bestowed

with the rights to revoke their own certificates.

Our second analysis uses log-based PKIs

(Matsumoto, Szalachowski, & Perrig, 2015) as a

benchmark for certificate transparency. There are

several notable similarities between our solution and

CT logs. Both architectures are inherently distributed.

Both solutions bring transparency to the CA process

by creating a publicly verifiable store of issued

certificates. Both solutions use cryptographically

secure hash functions to create an append-only,

tamper-proof record of certificates.

The necessity to provide multiple proofs (i.e.,

SCTs) highlights that a CT log alone does not

represent a single source of truth. Using our system,

certificates are timestamped and stored on a unified

distributed data set that acts as a single source of truth

since it is securely backed by proof of work. Our

solution addresses the longstanding issue of

certificate revocation, while log-based PKIs do not

handle revocation themselves (Google, 2013).

Although the transparency of both solutions

disincentives misbehaving or compromised CAs, it

does not prevent the production of fraudulent

certificates. Thus, auditing and monitoring is

necessary for both solutions. However, this cost

could be minimised using our system by publishing

certificates on a unified blockchain database instead

of in multiple logs. CAs could reduce the burden of

running their own CT logs by exploiting the existing

and reliable network of densely connected Bitcoin

nodes. Our low-cost solution also meets the scaling

requirements of unbounded certificate logs without

any added complexity and the creation of data silos

i.e., via temporal sharding (Lynch, 2018).

The comparison table below summarises our

findings for each analysis. For brevity, ‘Y’ refers to

Yakubov et al.’s scheme; ‘L’ refers to log-based

PKIs; and ‘B’ represents our Bitcoin-based certificate

management solution.

Table 9: A Comparative Analysis of our System.

PKI Solution Y L B

Public/Permissionless

Economies of Scale

User Privac

y

Certificate Transparenc

y

Sin

g

le Source of Truth

Immutabilit

y

of Histor

y

Revocation Mechanis

m

Flexible Revocation Ri

g

hts

Ke

y

Update Mechanis

m

Atomic Certificate Verification

6 CONCLUSIONS

In this paper, we have proposed a Bitcoin-based

certificate management system that addresses

ongoing issues with certificate revocation in PKI and

preserves the features of existing solutions that

support transparency and user privacy. Our solution

can be readily implemented on Bitcoin SV, a scalable

and low-cost implementation of the Bitcoin protocol,

while maintaining a high degree of compatibility with

established PKI models. It offers a single source of

truth with transparency of public key certificates,

their status, and their event logs. The distributed

nature of the blockchain offers availability of the

data; the proof of work consensus mechanism secures

the immutability of the data; and the data structure of

the blockchain supports third-party audits of the

certificate logs. Our solution can achieve instant

revocation under the assumption that both the

certifying entity and the certificate verifying entity

connect to the same Bitcoin node or group of nodes.

While the assumption that Bitcoin nodes are trusted

offers a general certificate verification mechanism, an

A Scalable Bitcoin-based Public Key Certificate Management System

557

atomic verification mechanism integrated with the

Bitcoin system at the protocol level inherits the trust

from the system. The limitation that a certificate can

only be verified once is mitigated by having multiple

outpoints representing the same certificate.

The commonalities between a certificate

management system and the Bitcoin system allow us

to delegate a significant amount of work to the

Bitcoin system and achieve great savings for the

certificate management system. The extra gain is the

security that is induced by the proof of work, which

prevents the history from being malleated even when

CA’s private key is compromised.

ACKNOWLEDGEMENTS

The authors would like to thank K. Molloy, M. S.

Kiraz and O. Vaughan for their invaluable

contributions to the paper. In addition, the authors

gratefully acknowledge the reviewers of the

SECRYPT conference for their insightful feedback.

C. Tartan would like to thank T. Tartan and E. Parry

for the fruitful discussions. W. Zhang would like to

thank J. Zhang and A. Zhu for their sweet support.

REFERENCES

Al-Riyami, S. S., & Paterson, K. G. (2003). Certificateless

Public Key Cryptography. International Conference on

the Theory and Application of Cryptology and

Information Security (pp. 452-473). Springer.

Axon, L., & Goldsmith, M. (2017). PB-PKI: A Privacy-

Aware Blockchain-Based PKI. Proceedings of the 14th

International Joint Conference on e-Business and

Telecommunications (pp. 311-318). SECRYPT.

Bitcoin SV. (2021). Bitcoin SV node software. Retrieved

from Github: https://github.com/bitcoin-sv/bitcoin-sv

Blagov, N., & Helm, M. (2020). State of the Certificate

Transparency Ecosystem. Network Architectures and

Services, 43-48.

Blockchair. (2020). Bitcoin SV block with over 1.3 millions

transactions. Retrieved from Blockchair:

https://blockchair.com/bitcoin-sv/block/635141

Blockchair. (2021). Bitcoin SV Average Transaction Fee.

Retrieved from Blockchair: https://blockchair.com/

bitcoin-sv/charts/average-transaction-fee-usd

Boneh, D., & Franklin, M. (2001). Identity-Based

Encryption from the Weil Pairing. Annual International

Cryptology Conference (pp. 213-229). Springer.

Boneh, D., Lynn, B., & Shacham, H. (2001). Short

Signatures from the Weil Pairing. International

Conference on the Theory and Application of

Cryptology and Information Security (pp. 514-532).

Springer.

Callas, J., Donnerhacke, L., Finney, H., Shaw, D., &

Thayer, R. (2007, November). RFC 4880: OpenPGP

Message Format. Retrieved from Request for

Comments. IETF.: https://tools.ietf.org/html/rfc4880

CERT Division. (2001). 2001 CERT Advisories. Software

Engineering Institute, Carnegie Mellon University.

Retrieved from https://resources.sei.cmu.edu/

asset_files/WhitePaper/2001_019_001_496192.pdf

Cooper, D., Santesson, S., Farrell, S., Boeyen, S., Housley,

R., & Polk, W. T. (2008, May). RFC 5280: Internet

X.509 Public Key Infrastructure Certificate and

Certificate Revocation List (CRL) Profile. Retrieved

from Request for Comments. IETF.:

https://tools.ietf.org/html/rfc5280

Council of EU. (2018). Factsheet - 5th Anti Money

Laundering Directive . Retrieved from Official Website

of European Union: https://ec.europa.eu/info/files/

factsheet-main-changes-5th-anti-money-laundering-

directive_en

DigiCert. (2021). SCT Delivery. Retrieved from Certificate

Transparency: https://www.digicert.com/faq/

certificate-transparency/enabling-ct.htm

Eastlake, D. 3. (2011, January). RFC 6066: Transport

Layer Security (TLS) Extensions: Extension

Definitions. Retrieved from Request for Comments.

IETF.: https://tools.ietf.org/html/rfc6066

Etherscan. (2020). Ethereum Average Gas Price Chart.

Retrieved from Etherscan: https://etherscan.io/

chart/gasprice

Fromknecht, C., Velicanu, D., & Yakoubov, S. (2014,

May). CertCoin: A NameCoin Based Decentralized

Authentication System. Retrieved from Technical

Report MIT: https://courses.csail.mit.edu/6.857/

2014/files/19-fromknecht-velicann-yakoubov-

certcoin.pdf

Galbraith, S., Paterson, K., & Smart, N. (2008). Pairings for

Cryptographers. Discrete Appl. Math. 156 (16), 3113-

3121.

Gennaro, R., & Goldfeder, S. (2018). Fast Multiparty

Threshold ECDSA with Fast Trustless Setup.

Conference on Computer and Communications

Security (pp. 1179-1194). ACM SIGSAC.

Google. (2013). Retrieved from Certificate Transparency:

https://sites.google.com/site/certificatetransparency/

Google. (2021). Working together to detect maliciously or

mistakenly issued certificates. Retrieved from

Certificate Transparency: https://certificate.

transparency.dev/

Hallam-Baker, P. (2015, October). RFC 7633: X.509v3

Transport Layer Security (TLS) Feature Extension.

Retrieved from Request for Comments. IETF.:

https://tools.ietf.org/html/rfc7633

Hoogstraaten, H. (2012). Black Tulip Report of the

investigation into the DigiNotar Certificate . Technical

Report. Fox-IT BV.

IdenTrust Services. (2021, March). IdenTrust Global

Common Certificate Policy. Page 91. Retrieved from

https://www.identrust.com/sites/default/files/resources

/IGC-CP-v1.5.3_03012021.pdf

Kubilay, M. Y., Kiraz, M. S., & Mantar, H. A. (2019).

SECRYPT 2021 - 18th International Conference on Security and Cryptography

558

CertLedger: A New PKI model with Certificate

Transparency Based on Blockchain. Computers and

Security, 85, 333–352.

Kubilay, M. Y., Kiraz, M. S., & Mantar, H. A. (2020).

KORGAN: An Efficient PKI Architecture Based on

PBFT Through Dynamic Threshold Signatures. The

Computer Journal, 1-23.

Langley, A. (2012, January). CRL Set Tools. Retrieved

from GitHub: https://github.com/agl/crlset-tools

Langley, A. (2015, March). Maintaining digital certificate

security. Retrieved from Google Security Blog:

https://security.googleblog.com/2015/03/maintaining-

digital-certificate-security.html

Larisch, J., Choffnes, D., Levin, D., Maggs, B. M., Mislove,

A., & Wilson, C. (2017). CRLite: A Scalable System

for Pushing All TLS Revocations to All Browsers. 2017

IEEE Symposium on Security and Privacy (SP) (pp.

539-556). IEEE.

Laurie, B., Langley, A., & Kasper, E. (2013, June). RFC

6962: Certificate Transparency. Retrieved from

Request for Comments. IETF.: https://tools.ietf.org/

html/rfc6962

Lynch, V. (2018, April). Scaling CT Logs: Temporal

Sharding. Retrieved from DigiCert: https://www.

digicert.com/dc/blog/scaling-certificate-transparency-

logs-temporal-sharding/

Matsumoto, S., Szalachowski, P., & Perrig, A. (2015).

Deployment Challenges in Log-Based PKI

Enhancements. Proceedings of the Eighth European

Workshop on System Security (pp. 1-7). ACM.

Merkle, R. C. (1979). US Patent No. US4309569A.

nChain. (2020). BRFC-Miner ID. Retrieved from Bitcoin

SV Specs: https://github.com/bitcoin-sv-specs/brfc-

minerid

nChain. (2021). BRFC-mAPI. Retrieved from Bitcoin SV

Specs: https://github.com/bitcoin-sv-specs/brfc-

merchantapi

Pettersen, Y. (2013, June). RFC 6961: The Transport Layer

Security (TLS) Multiple Certificate Status Request

Extension. Retrieved from Request for Comments.

IETF.: https://tools.ietf.org/html/rfc6961

Santesson, S., Myers, M., Ankney, R., Malpani, A.,

Galperin, S., & Adams, C. (2013, June). X.509 Internet

Public Key Infrastructure Online Certificate Status

Protocol - OCSP. Retrieved from Request for

Comments. IETF.: https://tools.ietf.org/html/rfc6960

Scheitle, Q., Gasser, O., Nolte, T., Amann, J., Brent, L.,

Carle, G., Wählisch, M. (2018). The Rise of Certificate

Transparency and Its Implications on the Internet

Ecosystem. Internet Measurement Conference (pp.

343-349). Boston: ACM SIGCOMM.

Southurst, J. (2021, January). Interview with Brad

Kristensen. Retrieved from CoinGeek:

https://coingeek.com/its-over-9000-tps-bitcoin-sv-hits-

new-transactions-per-second-record/

Van der Meulen, N. (2013). DigiNotar: Dissecting the First

Dutch Digital Disaster. Journal of Strategic Security,

6(2), 46-58.

Wazan, A. S., Laborde, R., Chadwick, D., Venant, R.,

Benzekri, A., Billoir, E., & Alfandi, O. (2020). On the

Validation of Web X. 509 Certificates by TLS

Interception Products. IEEE Transactions on

Dependable and Secure Computing, 1-1.

Wilson, D., & Ateniese, G. (2015). From Pretty Good to

Great: Enhancing PGP using Bitcoin and the

Blockchain. International Conference on Network and

System Security (pp. 368–375). Springer.

Wood, G. (2014). Ethereum: A Secure Decentralised

Generalised Transaction Ledger Petersburg. Retrieved

from https://ethereum.github.io/yellowpaper/paper.pdf

Yakubov, A., Shbair, W. M., Wallbom, A., Sanda, D., &

State, R. (2018). A Blockchain-Based PKI

Management Framework. The First IEEE/IFIP

International Workshop on Managing and Managed by

Blockchain (Man2Block) colocated with IEEE/IFIP

NOMS (pp. 1-6). IEEE.

Zhang, R., Xue, R., & Liu, L. (2019). Security and Privacy

on Blockchain. ACM Computing Surveys, 52(3), 1-34.

Zhu, L., Amann, J., & Heidemann, J. (2016). Measuring the

Latency and Pervasiveness of TLS Certificate

Revocation. International Conference on Passive and

Active Network Measurement (pp. 16-29). Springer.

A Scalable Bitcoin-based Public Key Certificate Management System

559