FinTech and Commercial Banks' Performance in China:

The Current Status and Lessons Learned from Our Data Analysis

Xihui Chen

a

, Xuyuan You and Victor Chang

b

1

Teesside University Business School, Teesside University, U.K.

2

University of Leeds, Leeds, U.K.

3

Artificial Intelligence and Information Systems Research Group, School of Computing and Digital Technologies,

Teesside University, Middlesbrough, U.K.

Keywords: FinTech, Commercial Banks, Customer Satisfaction, Customer Expectation, Service Quality, Work

Efficiency, Firm Performance.

Abstract: As the impacts of the COVID-19 pandemic play out globally, the banking industry has been affected in both

positive and negative ways, with the crisis creating both opportunities and threats for the collaborations

between FinTech and banks. The aim of this study is to investigate the impact of FinTech products (FTPs) on

commercial bank’s performance in China. Required data are collected with a quantitative approach and two

self-designed questionnaires were distributed to customers and employees of commercial banks in China. The

gathered data were examined using the structural equation modeling technique. The results of this study reveal

that the perceived usefulness (PU) of FTPs has positive and significant impacts on customer satisfaction, low

expectation of bank employee assistance, bank’s service quality and employee work efficiency. Additionally,

the perceived difficulty of use (PD) of FTPs has negative and significant impacts on customer satisfaction and

low expectation of assistance. Interestingly, there is a positive and significant relationship between PD and

banks' service quality and work efficiency, meaning that the service quality and work efficiency can reduce

some shortcomings of using FTPs. This study recognizes the need to enhance the understanding of FTPs on

non-financial firm performance.

1 INTRODUCTION

*

There is an ever-increasing use of financial technology

(FinTech) products to attain greater profits. Especially,

Following the Financial Stability Board (FSB, 2017),

this study defines FinTech as an array of financial

technology providers that enables seamless and better

financial services (e.g., new applications, products,

business models and processes) for businesses to even

individual users. Ky et al. (2019) found that the

successful implementation of FinTech products

(hereafter, FTPs) in banks increases bank profitability

and efficiency and enhances customer interactions and

develops new customer segments. This is particularly

important as a collaboration between banks and FTPs

is the key to provide solutions in the "new normal"

business environment that the COVID-19 pandemic

a

https://orcid.org/0000-0003-0723-4574

b

https://orcid.org/0000-0002-8012-5852

*

Corresponding author

has brought about. Wang et al. (2020) concluded that

FTPs play a vital role in facilitating a bank’s risk-

taking behavior to achieve that bank's main corporate

objectives, absorbing and maintaining customers by

providing quality and timely service, as well as

reducing customer costs and increasing bank

profitability.

Apart from this bright side of FinTech, its

implementation is time-consuming, and there are high

costs in maintenance, upgrading and training for both

customers and employees, and the possible risk of

failures. Considering the imperative of engaging and

building strong relationships to serve the customers

best, obtaining a positive culture regarding

technology among employees in the competitive

environment, and considering the possible investment

risks in FinTech, it is important that business

Chen, X., You, X. and Chang, V.

FinTech and Commercial Banks’ Performance in China: The Current Status and Lessons Learned from Our Data Analysis.

DOI: 10.5220/0010483500330044

In Proceedings of the 3rd Inter national Conference on Finance, Economics, Management and IT Business (FEMIB 2021), pages 33-44

ISBN: 978-989-758-507-4

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

33

activities related to FTPs be handled with care (Alt et

al., 2018). Although COVID-19 is transforming how

businesses use digital technology overnight, which

will make an investment in FTPs more attractive

(Wójcik and Ioannou, 2020), a holistic and integrated

approach between the components of business

processes, people and technology is required for

maximizing investment return and successful

corporate performance (Yang et al., 2009).

FTPs and their impact on bank performance have

been the focus of many researchers (e.g., Odawa,

2016; Phan et al., 2020; Rega, 2017; Wang et al.,

2020). A review of the literature has shown that many

studies have empirically investigated the impacts of

FTPs on organizational performance. For example,

studies tested FTPs on internet banking and mobile

banking (Ky et al., 2019; Okiro & Ndungu, 2013);

self-service and machine learning (e.g., Odawa, 2016;

Gomber et al., 2018; Noor et al., 2019), and

cybersecurity (Chang et al., 2020; Meng et al., 2019;

Ng & Kwok, 2017). Additionally, empirical studies

measured bank performance differently, but ROA

(return on assets, Ky et al., 2019), ROE (return on

equity, Phan et al., 2020) and survey (Kianto et al.,

2013) are the most commonly used methods. More

studies have been published and called for an

investigation of the impacts of COVID-19 on the

relationship between FTPs and organizational

performance (e.g., Wójcik and Ioannou, 2020; Akpan

et al., 2020). This study use survey to measure banks'

non-financial performance for two key reasons. First,

it helps establish a connection between banks'

strategies and daily tasks among the customers and

employees. Second, there are non-controllable

external risks (e.g., COVID-19) that would affect the

revenue and expenses if a bank faces that. In such

circumstances, looking at the financial measures

might only give a dismal picture of a bank. Therefore,

measuring banks' performance non-financially

provides a more holistic view. For example, having a

high customer satisfaction rate and employees

worked efficiently would mean that bank would be on

track soon after the COVID-19 pandemic with the

help of FTPs implementation.

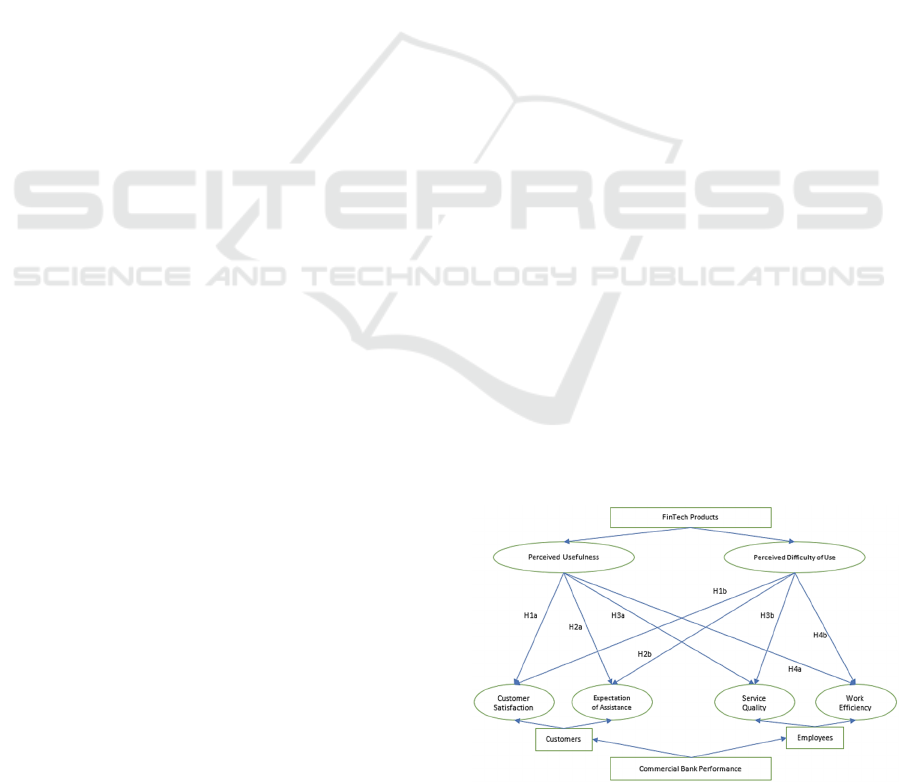

Considering the perceived usefulness (PU) and

the perceived difficulty of use (PD) of FTPs (David,

1989) and their effects on firm performance (from

both customer and employee perspectives), to the best

knowledge of the authors, no study has as yet focused

on the perceptions of both the customers and

employees, especially in the context of commercial

banks in China. This study addresses the gap using

David’s (1989) technology acceptance model to

understand the PU and PE of FinTech and their

impact on bank performance via banking and FinTech

cooperation literature review. Moreover, this study

seeks to build an FTPs-Performance conceptual

framework (Figure 1) with the ability to measure the

FTPs and performance factors and test the framework

empirically.

This study used several non-financial performance

measures to gauze banks' performance in non-

monetary terms, such as customer satisfaction, the

expectation of employee assistance, bank service

quality and employee work efficiency. Two question-

naires were self-designed, one for customers and the

other for bank employees. There were 307 customers

who participated in the customer questionnaire and 94

bank employees who participated in the employee

questionnaire. The structural equation modeling

method was used to test the conceptual framework.

The customer questionnaire results revealed that high

levels of perceived usefulness of FTPs are associated

with high customer satisfaction and low expectation of

bank employee assistance. The results also showed that

the difficulty of using FTPs causes low customer

satisfaction and requires more assistance from bank

employees. In the employee questionnaire, we found

that the perceived usefulness of FTPs has positive and

significant impacts on banks' service quality and

employee work efficiency. Interestingly, a positive and

significant relationship showed the difficulty of FTPs'

use and service quality and work efficiency, meaning

that service quality and work efficiency can overcome

the difficulty of using FTPs.

This study extends the current literature on

banking and FinTech and makes several

contributions. First, most empirical studies tackling

FinTech focus mainly on its impacts on society,

customers, organizational risk behaviors and

cybersecurity (Alt et al., 2018; Noor et al., 2019;

Wang et al., 2020). To our knowledge, this is the first

study to examine and conduct an analysis of FTPs

implemented in commercial banks in China.

Specifically, we intend to examine the PU and PE of

FTPs from the perspectives of both the customers and

bank employees. Second, this study adds to the

literature examining the FTPs and bank performance

relationship. Following Kianto et al. (2013) and

Odawa (2016), instead of using the proxies (e.g.,

ROA, ROE, and net interest margin) traditionally

considered in the empirical studies on banking

literature, this study used a survey and measured bank

performance from a non-financial perspective to

investigate the impact of FTPs on customers

(satisfaction and expectation) and employees (service

quality and work efficiency). Third, this study

complements the banking and FinTech literature that

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

34

explores the determinant of bank performance using

non-financial measures in Chinese commercial banks

with a possible impact of the COVID-19 pandemic.

This study is structured as follows. Section 2

presents the FinTech revolution and its application in

the financial industry. Section 3 discusses the

literature review on FinTech, bank performance and

conceptual framework specification. Section 4

provides the research method and data. Research

results and practical implications are discussed in

Section 5 and Section 6 concludes the paper.

2 FinTech REVOLUTION AND ITS

APPLICATION IN THE

FINANCIAL INDUSTRY

FinTech has always been associated with the terms

“advanced” and “competitive” in the financial industry

(Acar & Çıtak, 2019; Gai et al., 2018; Wójcik and

Ioannou, 2020). Gai et al. (2018) stated that the

purpose of FinTech is to enhance service quality and

work efficiency of financial services by using

information technology applications. Fintech can also

be used in P2P (peer-to-peer) lending, distributed

ledger technology and third-party payments (Acar &

Çıtak, 2019). The Financial Stability Board (FSB)

(2019) defined FinTech as new frontier technologies,

including AI (artificial intelligence), blockchain and

big data that promote emerging business models, new

technology applications and advanced product

services. Following this definition, FinTech products

(FTPs) are one form of FinTech leading the financial

sector towards digital banking and suppressing the

traditional banks. It is certain that the agnostic to

COVID-19’s severity will change the face of the

banking sector globally (Wójcik and Ioannou, 2020).

This section will introduce the FinTech revolution and

its applications in the financial industry and the

Chinese banking sector.

2.1 The Worldwide Application of

FinTech

FinTech makes the world more inclusive (Gupta &

Mandy, 2018). Regardless of whether transactions are

C2C (customer-to-customer) or B2B (business-to-

business), FinTech innovation has made international

money transfers easier than ever (Par, 2015). Thus,

FinTech companies attract enormous venture capital

investment worldwide to develop and create new

FTPs. According to Accenture (2016), in the first

quarter of 2016, the global investment in FinTech

rose to $5.3 billion, which is a 62% increase from the

same period in 2015. Moreover, based on the 2017

statistics report on BCG FinTech Regulatory Tower,

$130 billion was invested in 12,000 FinTech

companies globally in equity financing, more than the

GDP of Angola, according to the World Bank.

Studies (e.g., Gupta & Mandy, 2018; Ng & Kwok,

2017) recognized that FinTech provides companies

with cutting-edge technology and helps them thrive in

the fast-changing competitive business environment.

Richard Lumb, the Accenture Group’s chief

executive, commented that companies across the

world are chasing the tide of industry 4.0, as

inventions and new service models merge FinTech

into the traditional financial service industry

(Accenture, 2016). Akpan et al. (2020) commented

that such digital transformation is considered a

vehicle for exceeding customer demands – a

competitive advantage most companies require to

survive the COVID-19. It also changes the way

companies interact with their customers. For

example, in the wake of the COVID-19, customers of

all ages quickly learned to use online banking

services when the bank branches closed with short

notice. Many customers are digitally savvy,

especially the millennials and Generation Z.

Customers have increased their expectations – they

prefer greater convenience, lower costs, rapidity and

reliability when choosing financial services. Indeed,

many FinTech products have made an incredible

impact on people’s daily life activities, such as low-

cost and real-time remittance, real-time payment and

loan approval, and remote account opening. In more

detail, the use of video and face recognition

technology in the remote account opening function

allows customers to open bank accounts on mobile

devices without visiting a branch (Gupta & Mandy,

2018). The experience with COVID-19 teaches the

world that digital banking is the way forward.

2.2 The Use of FinTech in the Financial

Industry

2.2.1 Transaction Processing

Transaction processing practice focuses on helping

companies find, develop and maintain best-in-class

service by using FinTech products. With the help of

FinTech, transaction processing becomes swifter and

more cost-effective (Gupta & Mandy, 2018). Banks

can also continue their services during the COVID-19

crisis. For example, the blockchain cuts down on the

need for trusted third-party banks to verify

transactions and, therefore, lower or avoid the banks’

FinTech and Commercial Banks’ Performance in China: The Current Status and Lessons Learned from Our Data Analysis

35

charge fees in a transaction (Nguyen, 2016).

Additionally, the invention of FTPs for digital

payment methods (i.e., Alipay, WeChat and Apple

Pay) has become the public domain trend. Perhaps

unsurprisingly, such digital payment methods

appealed to generations with cash flow and raised on

cell phones. Not to mention how COVID-19 sped up

the adoption of digital payments.

2.2.2 Investment and Risk Management

Regardless of the type of investment, there will always

be some risk involved. Fintech can help banks improve

risk management significantly through big data (Gai et

al., 2018). Big data allows banks to collect and analyze

data to identify customer behavioral patterns, thus

allowing them to personalize responses, products and

services through a tailored marketing experience. In

responding to the COVID-19 challenge, the growth of

remote working implies that an incredible amount of

online data and information are being collected and

shared across networks. Data analytics can be used to

explore and analyze big data to mitigate risks and

inform better investment decisions with consistent

returns for banks. Big data can also be used to enhance

cybersecurity, detect fraud and prevent potential

malicious actions (Gupta & Mandy, 2018). In

principle, FTPs should provide further opportunities

for banks while their services are in higher demand

during COVID-19.

FinTech has had a huge impact not only on

financial activities (e.g., transactions, investments,

risk management, insurance, financing and budget

applications) but also on regulations and compliance

processes. The bigger the data, the higher the risk the

companies will face (Noor et al., 2019). The COVID-

19 is creating a need for banks to process personal

data for a variety of specific purposes (e.g., managing

and protecting their workforce, customers and the

public) while accumulating user data. Data security

regulations are, therefore, becoming more stringent.

For example, the European Parliament approved and

introduced the GDPR (general data protection

regulation) to place certain restrictions on businesses

worldwide that want to collect and apply users’ data.

Council of Europe issued a Data Protection Report

(2020) to ensure greater respect of the rights to

privacy and data protection in the use of digital

contact tracing applications and monitoring tools

during the fight of COVID-19. Additionally, in

China, selling personal data can be punished by fines

and up to seven years in prison, while personal

information buyers can be sentenced to up to three

years in jail and a fine (Dentons, 2020).

2.2.3 Compliance Processes

The 2008 financial crisis impacted the financial

industry by spawning new regulatory actions

internationally to improve and strengthen the

resilience of the financial system. The real-name

financial transaction system is one of the tools that

can effectively prevent money laundering because it

allows the source of funds to be traced. Traditionally,

all financial institutions manually verified the real

name of an individual customer or legal entity. This

system was subject to human error and bribery.

However, with the emergence of FinTech, big data,

AI and facial recognition make the verification

process more reliable with less human error, thus

boosting the bank’s transaction volumes and saving

time for both the bank and customers (Noor et al.,

2019). More importantly, such a verification process

helps banks maintain "business as usual" during

COVID-19 even the branches have reduced hours or

closures.

2.2.4 Mobile Banking

Mobile banking is the most mature FTP in internet

finance, but its demand and growth for financial

services among Chinese customers are far from

slowing. Customer interaction and affinity are

expanding, and online-to-offline mobile banking

functions through smartphones have become another

combat zone where banks are competing fiercely for

market shares, including traditional financial

institutions. In 2019, mobile banking sites averaged

326 million visits per month in China (CIW Team,

2019) – a 10.9 percent increase compared to 2018.

There was a 200 percent jump in new mobile banking

registrations. In comparison, mobile banking traffic

rose 85 percent when the government-imposed

lockdown in April 2020 due to COVID-19, according

to Fidelity National Information Services (FIS).

Laukkanen (2017) commented that mobile banking

allows customers to access various financial services

via smartphones. For example, in the Bank of China

mobile app overseas version, apart from the common

services (e.g., branch finder, balances, transfer and

remittance and accounts overview), the app also

provides lifestyle services (e.g., prime student

service, financial consultation, mortgage information

and tips to avoid coronavirus scams) and wealth

management (e.g., global accounts and currency

converters). These services provide opportunities for

customers to understand their financial position and

tips for managing their funds and hunting for higher

investment returns internationally (Giovanis et al.,

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

36

2019; Wang et al., 2020). Moreover, customers can

interact with their banks via mobile banking, regardless

of time and location. Customers can also access details

of their accounts whenever and wherever necessary.

Mobile banking is rapidly becoming the preferred

digital channel. Both Giovanis et al. (2019) and Ky et

al. (2019) see that mobile banking will replace

traditional banking – it is just a matter of time.

Furthermore, the way to log in on mobile banking is

fairly secure – a password, a one-time e-token

password and verification code are required to log in.

In fact, there are more banking services available

on phone apps in the Chinese market. In the same

Bank of China mobile banking app, aside from the

banking services available in the overseas version,

other daily life services are also available in the

Chinese version. For example, a customer can use

live chat, manage utility bills, select and top-up social

media memberships, call a taxi, check medical

insurance, do differentiated product matching,

purchase restaurant vouchers and more.

Although FinTech has steadily evolved to become

a part of our everyday life, customer expectations are

changing, and the financial services industry is not

immune to these new demands. Moser (2015) found

that people’s expectation for mobile banking is higher

than their penetration rate. Moser (2015) stated that

mobile banking is still at the developmental stage in

its life cycle. The COVID-19 shock has certainly put

an increased emphasis on mobile banking.

3 LITERATURE REVIEW

3.1 FTPs and Bank Performance

FinTech has always been associated with Digital

innovation and FTPs (e.g., ATM, VTM, and mobile

banking) that promote inclusive financial services

and provide a new impetus to the banking sector to

improve its performance in several ways. For

example, to improve the relationship with customers'

satisfaction and expectation, staff service quality and

work efficiency, and profitability. Performance is

important to all companies, and there are two

directions to measure organizational performance:

one is financial performance and the other one is non-

financial performance. Studies (e.g. Ky et al., 2019)

have examined the implications for banks in the use

of FTPs and how it affects their profitability using a

wide range of financial variables traditionally

considered in the banking literature (e.g., operational

performance, risk profile, and leverage, net interest

margin, ROE and ROA). Non-financial performance

is related to corporate social responsibility, customer

satisfaction and expectation, service quality, and

work efficiency (Richard et al., 2009). Odawa (2013)

found the self-service technologies can improve

service efficiency, increasing customer satisfaction,

market shares and the customer base among

commercial banks in Nairobi.

According to Yang et al. (2009), FinTech is one

of the important elements and tools in shaping and

evolving financial innovation. Financial innovation

has some risk, but its value is evident in both

theoretical and empirical literature (Gomber et al.,

2018; Ng & Kwok, 2017; Wang et al., 2020; Wójcik

and Ioannou, 2020). In other words, customers should

be satisfied if the FinTech products are useful and

easy to use. Meanwhile, a successful FinTech

implementation in a bank should make employees’

work serving customers easier and maintain the

services while working remotely during COVID-19.

David (1989) built a technology acceptance model

(TAM) to test the potential users’ motivation to use

the information system. Ha and Stoel (2009) used the

TAM to explain the relationship between the causes

of users’ attitudes, beliefs, intentions and behaviors.

They found that the capability of a technology to be

used advantageously and to create freedom from

difficulty or great efforts affected users’ attitudes

towards accepting a new technology (David, 1989).

In turn, these attitudes will affect intention and

behavior accordingly (Lee and Lehto, 2013). Using

both TAM and perceived risk theory, Kansal (2016)

found the financial risk is negatively associated with

both the users’ satisfaction and expectations of self-

service banking service, and the increased

performance risks reduced the customers’ intention to

use and trust technology. Additionally, Kim and Woo

(2016) investigated consumers’ expectations and

acceptance of QR (quick response) codes in food

traceability systems. Their results showed that the

ease of use of QR codes encouraged customers’

purchases. In this context, we assume that the effects

of FTPs implementation on banks' performance may

depend on the usefulness and usage difficulties of

FTPs among the users (e.g., customers and

employees).

3.2 The Perceived Usefulness (PU) of

FTPs

3.2.1 Processes Automation

Automation is the focus of intense interest in the

global banking sector. Banks are prone to offer

partially or totally automated machine services and

FinTech and Commercial Banks’ Performance in China: The Current Status and Lessons Learned from Our Data Analysis

37

move away from the labor-intensive business

operational models. This improves the convenience

and accessibility of bank services. The emergence of

FTPs enables customers to access the services 24

hours a day and seven days a week (Mazana et al.,

2016). Many financial professionals gave high ratings

to FTPs – Paul Volcker (2009) is one of the former

chairpersons in charge of the US Federal Reserve

(1979-1987).

Volcker commented that ATMs are the most

important financial innovation that he has ever seen

in the past 20 years because ATMs enable customers

to handle the most routine, in-branch transactions.

This advantage offers customers who prefer not to

visit a local bank branch or interact directly with bank

staff, particularly when this is the only option during

COVID-19. Furthermore, ATMs reduce the human

resource costs of bank staff and branch establishment

costs because customers can self-complete services

(e.g., deposit or withdrawal and opening and closing

bank accounts), which traditionally were done with

the help of staff.

3.2.2 Customer Satisfaction

FTPs help banks attract more customers. There were

2.5 billion adults who did not have bank accounts in

2010. This was either because they had no network

signal at their remote location or because the

geographical environment did not meet the

construction standard for bank branches (Mazana et

al., 2016). However, this group of people can still be

considered as potential customers for banks.

There are fewer costs in solving information

asymmetry issues. Information is much more

accessible for people in general, especially for

customers who have always been with disadvantages

in this regard (Gupta & Mandy, 2018). FinTech

products enable customers to handle banking

business with a self-service function, thus enhancing

their participation and experience. Transparency of

information decreases the perceived risks and

improves customer trust (Kaushik et al., 2020).

FTPs are cost-effective, too. For example, unlike

in the traditional banking process, in which customers

in China pay for the cost of opening a new account,

with the help of FTPs, customers can complete the

account opening process for free. The exemption of

these expenses in the transaction process reduces the

costs to customers and should increase customers’

preference for using FTPs to make banks more

competitive during the COVID-19 challenges.

3.2.3 Competitive Advantages

After 2010, FinTech start-ups developed rapidly –

consider, for example, Alibaba with its innovative

financial product, Alipay. These third-party payment

platforms threaten the monopoly of traditional

commercial banks by providing customers with lower

costs and higher efficiency (Temelkov, 2018).

According to the financial statistics report from the

People’s Bank of China, RMB deposits in January

2014 decreased by 940.2 billion yuan. Most of the

people admitted that they feel safe and prefer to save

money on a third payment platform, such as WeChat

and Alipay (Yan, 2015).

However, FTPs help commercial banks regain

competitive advantages and boost market shares by

increasing the number of customers and providing

additional services. Sannes (2008) found that in

America, one in every three banks reported increased

numbers of customers who started registering in their

banks when they introduced FTPs. In China,

commercial banks are launching mobile banking apps

one after another and are constantly updating their

systems to provide cutting-edge services to

customers. For example, the mobile banking app of

the China Merchants Bank has been upgraded to an

eighth-generation version since 2010 (CMB, 2020).

Its services cover basic banking business and meet the

demands of most individual customers and corporate

clients. Additionally, their mobile banking also

cooperates with third-party customers, such as Didi

Taxi and Starbucks, to provide value-added services

to customers (Guo, 2019). China Merchants Bank is

the second-largest bank in terms of the number of

users on their own mobile banking app. By 2019, the

number of users on the China Merchants Bank’s

mobile banking app has reached 114 billion, with a

19.1 percent market share. Although many phone

apps are introduced to customers by online finance

companies (e.g., Alipay), nearly all commercial

banks in China have now introduced FTPs, which has

diluted the market share. This phenomenon gives the

banks a foundation for moving online and staying

competitive to cope with COVID-19. Therefore,

FTPs have become a useful tool for balancing

traditional banks and online financial companies.

Hence, we propose the following hypotheses:

H1a – There is a positive relationship between the

perceived usefulness (PU) of FTPS and customer

satisfaction.

H2a – There is a positive relationship between PU

of FTPS and customer expectations of employee

assistance.

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

38

H3a – There is a positive relationship between PU

of FTPS and service quality.

H4a – There is a positive relationship between PU

of FTPS and work efficiency.

3.3 The Perceived Difficulty of Use

(PD) of FTPs

The emergency of FinTech has created both threats

and opportunities in the banking sector. FTPs rely on

intelligent data processing and deep learning to create

value for financial services (Gai et al., 2018).

However, this process involves issues, for example,

those of data security and information privacy.

Therefore, financial service institutions are constantly

experiencing cyberattacks. The Cybersecurity report

(SVB, 2015) highlighted that only 35 percent of

companies think they can overcome the cyber threat

and do better in business with FTPs implementation.

Morgan (2015) predicted that global investment in

cybersecurity would reach $170 billion by 2020.

Following the attack of COVID-19, this predicted

figure will only grow. Indeed, more companies are

seeking to conduct data collection, processing and

storage through the cloud (SVB, 2015). However,

according to Ng et al. (2017), regulation on the cloud

is still developing. When companies use public cloud

data, it is difficult to find the physical location of the

data. Also, the cross-cutting service modes in the

network leave opportunities for improper use of

information by hackers and criminals (Gai & Sun,

2018).

Data breaches, cyber ransomware and system

intrusion, are the three commonly seen cybersecurity

issues (Ng and Kwok, 2017). For example, Capital

One is the seventh-largest bank in America and the

fifth-largest credit card issuer in the world. In 2019,

Capital One informed the public that its database was

hacked, and about 106 million bank card users and

applicants' information was stolen (Sohu, 2020).

Additionally, in 2017, many sectors – and particularly

the financial sector – were affected by the Armada

Collective cybercriminals. Companies received

malicious emails and were asked to pay ransoms of

10 bitcoins (the market value of around $30,000) as

protection fees. In the same year, a hacking gang

abused the SWIFT (Society for Worldwide Interbank

Financial Telecommunications) banking network.

Consequently, $60 million worth of funds were stolen

from the Far Eastern International Bank in Taiwan

(Sohu, 2020). There is also evidence that remote

working increases the risk of a successful

ransomware attack significantly due to the effect of

lockdown on the spread of COVID-19 (Ferbrache,

2020).

Customers have less information and expertise in

financial technology than banks, and this can lead to

their uneasiness about using FTPs. According to the

perceived risk theory perspective (David, 1989),

customers will reduce purchasing when they cannot

predict the consequences or value of the purchasing

behavior. Factors such as security, performance and

time may affect customers’ satisfaction and

expectations of the product or business service (Lee,

2013). Phan et al. (2020) stated that FTPs provide

new transaction methods and uncertainties to both the

businesses and the users. These uncertainties can be

hacker attacks, identity disclosures and internet fraud.

These uncertainties can easily threaten the safety of

customers’ information and property and bring usage

risk to banks. Financial e-fraud is an emerging

problem to be tackled in the FinTech industry (Meng

et al., 2019) and the COVID-19 sparks an upward

trend in cybercrime (Akpan et al., 2020; Ferbrache,

2020). Therefore, customers will consider the safety,

individual information privacy and performance

efficacy of FTPs before using them. In turn, affected

customers will expect more help and assistance from

the bank.

Hence, based on our analysis and literature

review, we propose the following hypotheses:

H1b – There is a negative relationship between the

perceived difficulty of use (PD) of FTPS and

customer satisfaction.

H2b – There is a positive relationship between PD

of FTPS and customer expectations of employee

assistance.

H3b – There is a negative relationship between

PD of FTPS and service quality.

H4b – There is a negative relationship between

PD of FTPS and work efficiency.

Figure 1 presents the conceptual framework based

on the proposed hypotheses.

Figure 1: Conceptual framework.

FinTech and Commercial Banks’ Performance in China: The Current Status and Lessons Learned from Our Data Analysis

39

4 RESEARCH METHOD

4.1 Questionnaire and Sampling

We self-designed two questionnaires, one for bank

employees and the other for bank customers. Both

questionnaires were composed based on the five-

point Likert scale, strongly disagree (one point) to the

strongly agree (five points) continuum.

For the customer questionnaire, there were 26

questions divided into three sections.

• Section A: Fifteen items related to the FinTech

products characteristics, including eight items for PU

and eight items for PD of FTPs.

• Section B: Four items related to bank

performance, including two items for customer

satisfaction and two items for customer expectations

of employee assistance.

• Section C: Four items related to the demography

of the respondents. Demographic information

includes the customer’s age, gender, the number of

years holding a bank account, and the knowledge of

the respondents about FTPs in the bank.

For the employee questionnaire, there were 23

questions divided into three sections.

• Section A: Eleven items related to the FinTech

product characteristics, including seven items for PU

and four items for PD of FTPs.

• Section B: Eight items related to bank

performance, including five service quality items and

three work efficiency items.

• Section C: Four items related to the demography

of the respondents. Demographic information

includes the employee's age, gender, the number of

years working in the bank, and FTPs in use in the

bank.

Both questionnaires were originally designed in

English and then translated from English to Chinese

by a native Chinese speaker, an undergraduate

studying at an anonymous UK University and back-

translated into English by a professional translator.

An online survey tool (i.e., WeChat) was used for

survey distribution between July to September 2020.

The customers and employees were accustomed to

regular use and access to WeChat and the internet.

In total, 400 completed questionnaires (307

customers and 93 employees) were submitted and

used for the statistical analysis of this study. Bollen

(1989) recommended researchers using a multiplier

of a minimum of five to determine the sample size

(Rahi et al., 2019). That means a minimum of 95

respondents in each survey should be determined. We

received a good sample size in both the customer and

employee surveys. Although the employee survey

was short for 2 respondents, the 100 percent

completion rate helped the test be statistically valid.

First, we conducted descriptive statistics and tested

the reliability and validity. Second, the structural

equation modeling method was used to investigate the

impacts of FinTech products on bank performance.

4.2 Reliability and Validity

We used Cronbach’s alpha to test the reliability

coefficient of the questionnaires (Hair et al., 2017).

Individual items were greater than the 0.70 thresholds

suggested by Hair et al. (2017). This result indicated

that there was no reliability issue in the data. The

internal consistency of items was tested by item-total

correlations. All results were above 0.4 levels

(Loiacono et al., 2002), indicating that both

questionnaires demonstrate a strong discrimination

validity. Additionally, we conducted an exploratory

factor analysis. The result indicated that the

distribution of values on questionnaires was adequate.

The lowest eigenvalue for customer (2.26) and

employee (2.84) questionnaires were significant at

above 1.00.

Table 1: Test of the Hypothesized Model.

Note: *p<0.10; **p<0.05; ***p<0.01

5 RESULTS DISCUSSIONS AND

IMPLICATIONS

5.1 Testing Hypotheses and Results

Discussion

The hypothesized relationships were examined (see

Table 1), and the results from path coefficients and t-

value demonstrated that FTPs affect bank

performance significantly. Consistent with Kansal

(2016), our results show that a high level of

usefulness of FTPs causes high customer satisfaction

Hypothe

ses

Direction

Path

coefficient

Standard error of

estimate

t value

Result

s

H1a PU to customer satisfaction 0.797 0.036

22.371

***

Accept

ed

H1b PD to customer satisfaction -0.058 0.032

-

1.787*

*

Accept

ed

H2a

PU to customer expectation of

assistance

-2.93 0.051

-

5.76**

*

Accept

ed

H2b

PD to customer expectation of

assistance

0.791 0.046

17.083

***

Accept

ed

H3a

PU Advantages to service

quality

0.787 0.058

13.574

***

Accept

ed

H3b PD to service quality 0.129 0.062

2.069*

*

Reject

ed

H4a PU to work efficiency 0.818 0.065

12.537

***

Accept

ed

H4b PD to work efficiency 0.131 0.070

1.860*

*

Reject

ed

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

40

and low expectations of employee assistance on using

FTPs; thus, H1a and H2a are supported. Additionally,

the results also show that a high level of difficulty in

using FTPs will lead to low customer satisfaction and

high levels of demands requesting help from

employees; therefore, H1b and H2b are supported. In

the past, FinTech primarily referred to the support of

bank end systems of banks, but the new developments

in FinTech and the cooperation between FinTech and

banks have changed how the financial services

support its customers (Phan et al., 2020). In general,

FTPs have seeped into individual users’ everyday

life. Whether it is mobile banking, reading and

investing, wealth management, and overseas

transactions, FinTech has steadily evolved to become

a part of people's daily activities, and more areas are

expected to be influenced. Due to the ease of

managing and accessing banking without time and

location restrictions, more customers are willing to

accept FinTech and view it as a cost-effective way to

interact with the bank. With the onset of the ongoing

COVID-19 pandemic worldwide, there has been a

huge change in how people run their businesses and

how they live. FTPs enables bank customers to

manage their accounts and funds and facilitate their

payments through their smartphone or any other

portable devices with less need to rely on brick and

mortar services (Ky et al., 2019). Gone are the days

when customers had to physically go to a bank branch

to open an account or complete a transaction.

From the employee perspective, this study found

a high level of usefulness of FTPs leads to high

service quality and work efficiency; therefore, H3a

and H4a are supported. We also found that although

it might be hard to accept FTPs due to the difficulty

of use and cybersecurity threats, employees are still

confident in the service quality and their work

efficiency. Therefore, H3b and H4b are rejected. This

is in line with the findings of Wang et al. (2020) that

most of the processes of financial services are

handled with the help of FinTech. Therefore, having

a technology-supported organizational culture (i.e.,

employee perspective) will facilitate the FTPs’

implementation. The involvement of employees in

implementing financial innovation strategies will

result in better organizational performance.

Furthermore, banks usually have enormous customer

bases. Not every bank or bank branch has enough

workforce or the time to troubleshoot problems daily

for every customer. However, this has changed with

the help of FTPs. FTPs help banks leverage their big

data to suggest relevant services, deals and products

to their customers. The customization is a tool to

engage the customers in direct and open

conversations. It allows the bank employees to focus

on strategic initiatives rather than poring over

paperwork or other mundane work.

5.2 Recommendations

Our findings presented novel insights into the

convenience of FTPs for both customers and

employees. More specifically, when customers and

employees perceived the usefulness of the FTPs and

ease of use at work and their daily activities, they are

more willing to accept FTPs. With the help of FTPs,

banks can then collect large data and offer

personalized products and services based on

customers' financial behaviors and personal

preferences, building trust in society and growing

customer loyalty. Revenue will then automatically

follow. These massive personalization tasks can be

accomplished if banks are looking towards a third-

party collaboration strategy, for example, by teaming

up with FinTech and software companies to provide

different types of technological capabilities that

traditional banks do not possess. In the post-COVID-

19 scenario, banks should continue their commitment

to strengthening ties with the FinTech ecosystem,

from which new opportunities for the financial and

banking sector will keep emerging.

Nevertheless, our conceptual framework points

out that service quality and work efficiency could

potentially reduce FTPs’ shortcomings. In other

words, banks should continue considering the

increased use of FinTech in their employees' work

routine. In fact, because of the COVID-19 pandemic,

when many activities have ground to a halt,

innovation has been happening at a faster pace with

technology to find solutions quickly (Akpan et al.,

2020). Managers in banks should adjust the

management measures to transform the bank from the

traditional bank to the digital bank. For example, the

bank should hire excellent talents with scientific and

technological backgrounds to help improve the

technical level of the banking system. Moreover,

given the perennial negative stimulus that regulations

always lag behind innovation, hacking and

identifying theft are unavoidable. R&D departments

should monitor the occurrence of cyber-attacks in

real-time and take reasonable measures to strengthen

the cybersecurity system. Echoing Chang et al.

(2020), this study recommends that the banks

improve the system supervision to the financial

technology with the reasons for fraud prevention and

illegal data sharing avoidance due to one FinTech

company serving multiple banks. For example, the

banks should act promptly to stop long-term security

FinTech and Commercial Banks’ Performance in China: The Current Status and Lessons Learned from Our Data Analysis

41

stagnation and set up a separate department for cloud

storage systems to make the data traceable and

manage digital identities. Otherwise, cyber-attacks

can open chinks (e.g., rogue and biased programs) in

the armor of banks' cyber defense, thus compromising

the reliability of FTPs.

Furthermore, society should develop more

talented leaders who have tech fluency, drive

innovation to transform technologies, and inspire

change with a forward-looking and innovative vision.

For example, the government or education authority

should encourage and facilitate schools setting up

FinTech-related courses, thus enabling people to

understand and use FinTech at a younger age. This

will also contribute to future FinTech inventions.

Currently, EU countries and America have more

advanced experience in FinTech. Countries that are

still in the developmental stages of FinTech should

learn from them, perhaps by sending overseas

students to study and exchange or encouraging

domestic companies to work on foreign projects

through investment.

5.3 Limitations and Future Work

One of the limitations of this study applies to the

survey approach because it is difficult to generalize

and expand the findings to a larger population. This

study was conducted for the banking sector, aiming to

investigate the impact of FinTech products on non-

financial performance. In this case, the statistical

results are valid based on commercial banks in China.

Future studies are suggested to investigate different

industries related to FTPs, such as hotels, hospitals,

transport, or other industries with a different or larger

sample. FinTech covers many aspects of these

industries, for example, blockchain, bitcoin and P2P

business operation modes. Future studies may

consider exploring these technologies and their

impacts on organizational performance. Additionally,

due to the limited access to bank employees, only 93

employees participated in the data sample for this

study. Researchers who have personal connections

with the bank employees might have the advantage of

access to a larger data sample size in future studies,

and the results might be different when compared to

this study.

6 CONCLUSIONS

The aim of this study was to examine the impact of

perceived usefulness and difficulty of use of FinTech

products on an organization's non-financial

performance (customer satisfaction and expectation,

service quality and work efficiency) among the

Chinese commercial banks by proposing eight

hypotheses. This study offered critical practical

implications and contributions to the debate on using

FTPs to galvanize the banking industry by enhancing

non-financial performance. One of the contributions

is the use of non-financial measures to boost banks'

competitiveness by offering important additional

knowledge that can indirectly reflect the PU and PE

of FTPs in the banking sector. Different from other

studies (Phan et al., 2020; Wang et al., 2020) that used

financial performance measures, this study

scrutinized the effects of PU and PE effects on bank

performance by capturing and analyzing the

perception of FTPs among the key stakeholders (i.e.,,

customers and employees) in the assessment of banks'

non-financial performance. As the COVID-19

pandemic accelerates front-end digitization, FTPs can

further extend into products and services that fulfill

customers' non-financial needs. Also, to combat the

challenges brought by COVID-19, FTPs allow the

bank to respond to a greater number of customer

demands and vital operations being performed at an

uncertain time. Therefore, four hypotheses were

developed in our conceptual framework and each of

them was identified and supported by the two

perspectives (i.e., customers and employees). Thus,

eight sub-hypotheses were tested. This approach has

been effective after statistically tested on the eight

sub-hypotheses and revealed a deeper structure of the

relationship between FinTech and bank performance.

In this paper, we can conclude that FTPs can be a leap

forward due to the acceptance by both customers and

employees, and also survival the fittest because FTPs

take a more significant role in the financial industry

given the ongoing provision of digital services during

the global COVID-19 crisis.

ACKNOWLEDGMENT

This work is partly supported by VC Research (VCR

0000108) for Prof. Chang.

REFERENCES

Acar, O., & Çıtak, Y. E. 2019. Fintech Integration Process

Suggestion for Banks. Procedia Computer Science,

15892019), 971-978.

Accenture Study, 2016 April 13. Global Fintech Investment

Growth Continues in 2016 Driven by Europe and Asia.

Newsroom.

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

42

https://newsroom.accenture.com/news/global-Fintech-

investment-growth-continues-in-2016-driven-by-

europe-and-asia-accenture-study-finds.htm

Akpan, I.J., Soopramanien, D. and Kwak, D.H., 2020.

Cutting-edge technologies for small business and

innovation in the era of COVID-19 global health

pandemic. Journal of Small Business &

Entrepreneurship, 1-11.

Alt, R., Beck, R., & Smits, M. T. 2018. FinTech and the

transformation of the financial industry. Electronic

Markets, 2018, 235-243.

Bollen, K. A. 1989. A new incremental fit index for general

structural equation models. Sociological Methods &

Research, 17(3), 303-316.

Chang, V., Baudier, P., Zhang, H., Xu, Q., Zhang, J. and

Arami, M., 2020. How blockchain can impact financial

services–The overview, challenges and

recommendations from expert interviewees.

Technological Forecasting and Social Change,

158(2020), 120166.

CIW Team, 2019. China Mobile Banking Overview 2019.

China Internet Watch.

https://www.chinainternetwatch.com/28776/shrinking-

mobile-banking-p2p/

CMB China, 2020 September 15. The 8th Generation

Mobile Banking Comes on Stage. CMB Official.

http://www.cmbchina.com/mbankweb/

Data Protection Report, 2020. Digital Solutions to Fight

COVID-19. Council of Europe.

https://rm.coe.int/prems-120820-gbr-2051-digital-

solutions-to-fight-covid-19-text-a4-web-/16809fe49c

David, F. D., 1989. Perceived usefulness, perceived ease of

use, and user acceptance of information technology.

MIS Quarterly, 13(3), 319-340.

Dentons, 2020. 2019 China Data Protection &

Cybersecurity Annual Report. Dentons.

file:///C:/Users/U0033542/Downloads/2019%20China

%20Data%20Protection%20Cybersecurity%20Annual

%20Report.pdf

Ferbrache, D., 2020. The rise of ransomware during

COVID-19: How to adapt to the new threat

environment. KPMG.

https://home.kpmg/xx/en/home/insights/2020/05/rise-

of-ransomware-during-covid-

19.html#:~:text=Ransomware%20isn't%20going%20a

nywhere&text=There's%20also%20evidence%20that

%20remote,emails%20given%20levels%20of%20anxi

ety

FSB., 2017. Financial Stability Implications from FinTech.

Financial Stability Board. https://www.fsb.org/wp-

content/uploads/R270617.pdf

FSB., 2019. Financial Stability Implications from Fintech.

Financial Stability Board. https://www.fsb.org/wp-

content/uploads/R270617.pdf

Gai, K., Qiu, M., & Sun, X., 2018. A survey on Fintech.

Journal of Network and Computer Applications,

103(2018), 262-273.

Giovanis, A., Athanasopoulou, P., Assimakopoulos, C., &

Sarmaniotis, C., 2019. Adoption of mobile banking

services. International Journal of Bank Marketing,

37(5), 1165-1189.

Gomber, P., Kauffman, R. J., Parker, C., & Weber, B. W.,

2018. On the fintech revolution: Interpreting the forces

of innovation, disruption, and transformation in

financial services. Journal of Management Information

Systems, 35(1), 220-265.

Guo. Q., 2019, November 18. China Merchants Bank

App8.0 Releases Open Ecology to Create New Wealth

Life. Tech Web. http://www.techweb.com.cn/it/2019-

11-18/2764590.shtm

Gupta, P. T., & Mandy, T., 2018. Fintech: The new DNA

of financial services. Journal of Services Marketing,

20(2), 125-135.

Ha, S., & Stoel, L., 2009. Consumer e-shopping

acceptance: Antecedents in a technology acceptance

model. Journal of Business Research, 62(5), 565-571.

Hair, J. F., Hult, G. T. M., Ringle, C. M., Sarstedt, M., &

Thiele, K. O., 2017. Mirror, mirror on the wall: A

comparative evaluation of composite-based structural

equation modeling methods. Journal of the Academy of

Marketing Science, 45(5), 616-632.

Kansal, P., 2016. Perceived risk and technology acceptance

model in self-service banking: A study on the nature of

mediation. South Asian Journal of Management, 23(2),

51.

Kaushik, A. K., Kaushik, A. K., Mohan, G., & Kumar, V.,

2020. Examining the antecedents and consequences of

customers’ trust toward mobile retail apps in India.

Journal of Internet Commerce, 19(1), 1-31.

Kianto, A., Andreeva, T., & Pavlov, Y., 2013. The impact

of intellectual capital management on company

competitiveness and financial performance. Knowledge

Management Research & Practice, 11(2), 112-122.

Kim, Y. G., & Woo, E., 2016. Consumer acceptance of a

quick response (QR) code for the food traceability

system: Application of an extended technology

acceptance model (TAM). Food Research International,

85(2016), 266-272.

Ky, S., Rugemintwari, C., & Sauviat, A., 2019. Is Fintech

good for bank performance? The case of mobile money

in the East African Community. The Case of Mobile

Money in the East African Community, June 5, 2019.

Hal-02155077.

Laukkanen, T., Lehto, M.R., 2017. Mobile banking.

International Journal of Bank Marketing, 35 (7), 1042–

1043.

Lee, D. Y., & Lehto, M. R., 2013. User acceptance of

YouTube for procedural learning: An extension of the

Technology Acceptance Model. Computers &

Education, 61(1), p193-208.

Loiacono, E. T., Watson, R. T., & Hoodhue, D. L., 2002.

WEBQUAL: Measure of web site quality. Marketing

Educators Conference: Marketing Theory and

Applications, 13(3), 432–437.

Mazana, R., Rupere, T. & Kabanda, G., 2016. An

assessment of the impact of self-service technology

(SST) on firm performance: Case study of a bank in

Zimbabwe (2009-13). Journal of Payments Strategy &

Systems, 10(1), 96-112.

FinTech and Commercial Banks’ Performance in China: The Current Status and Lessons Learned from Our Data Analysis

43

Meng, W., Zhu, L., Li, W., Han, J., & Li, Y., 2019.

Enhancing the security of FinTech applications with

map-based graphical password authentication. Future

Generation Computer Systems, 101(2019), 1018-1027.

Moser, F., 2015. Mobile Banking: A fashionable concept or

an institutionalized channel in future retail banking?

Analysing patterns in the practical and academic mobile

banking literature. International Journal of Bank

Marketing, 33(2), 162-177.

Morgan, S., 2015 December 20. Cybersecurity market

reaches $75 billion in 2015; expected to reach $170

billion by 2020. Gartner’s statistical reports.

https://www.gartner.com/en/products/special-reports.

Ng, A. W., & Kwok, B. K., 2017. Emergence of Fintech

and cybersecurity in a global financial centre. Journal

of Financial Regulation and Compliance, 25(4), 422-

434.

Nguyen, Q. K., 2016. Blockchain-a financial technology for

future sustainable development [Paper presentation].

3rd International Conference on Green Technology and

Sustainable Development (GTSD), 2016.

Noor, U., Anwar, Z., Amjad, T., & Choo, K. K. R., 2019.

A machine learning-based FinTech cyber threat

attribution framework using high-level indicators of

compromise. Future Generation Computer Systems,

96(2019), 227-242.

Odawa, C.A., 2016. Technology Enabled Banking Self

Services and Performance of Commercial Banks Listed

in The Nairobi Securities Exchange (Doctoral

dissertation, University of Nairobi).

Okiro, K., & Ndungu, J., 2013. The impact of mobile and

internet banking on performance of financial

institutions in Kenya. European Scientific Journal,

9(13), 146-161.

Par, D. D., 2015. Financial innovation and the state:

Lessons for 21st century climate finance from the 19th

century Railway Era. CEPII FRANCE. https://www.

strategie.gouv.fr/english-articles/financial-innovation-

and-state-lessons-21st-century-climate-finance-19th-

centur

Phan, D. H. B., Narayan, P. K., Rahman, R. E., &

Hutabarat, A. R., 2020. Do financial technology firms

influence bank performance? Pacific-Basin Finance

Journal, 62(2020), 101210.

Rahi, S., Alnaser, F.M. and Abd Ghani, M., 2019.

Designing survey research: recommendation for

questionnaire development, calculating sample size and

selecting research paradigms. Economic and Social

Development: Book of Proceedings, 1157-1169.

Rega, F. G., 2017. The bank of the future, the future of

banking-An empirical analysis of European banks.

Available at SSRN 3071742.

Richard, P. J., Devinney, T. M., Yip, G. S., & Johnson, G.,

2009. Measuring organisational performance: Towards

methodological best practice. Journal of Management,

35, 718– 804.

Sannes, R., 2008. Self-service banking: Value creation

models and information research agenda. Information

Science,12(2), 145-163.

Sohu., 2020. Disclosure, blackmail, invasion ... How

terrible is the security problem of financial technology?

Sohu. https://www.sohu.com/a/366035046_99960938

SVB., 2015. As Technology Evolves, New Risks Drive

Innovation in Cybersecurity. SiliconValley Bank.

https://www.svb.com/cybersecurity-report

Temelkov, Z., 2018. Fintech firms opportunity or threat for

banks? International Journal of Information, Business

and Management, 10(1), 137-143.

Wang, R., Liu, J., & Luo, H., 2020. Fintech development

and bank risk taking in China. European Journal of

Finance, 2020(13), 1-22.

Wójcik, D. and Ioannou, S., 2020. COVID ‐ 19 and

Finance: Market Developments So Far and Potential

Impacts on the Financial Sector and Centres. Tijdschrift

voor economische en sociale geografie, 111(3), 387-

400.

Yan, S. Y., 2015. Impact of internet finance on traditional

banks and countermeasures. People’s Forum, 8(1), 23.

Yang, J., Cheng, L., & Luo, X., 2009. A comparative study

on e-banking services between China and the USA.

International Journal of Electronic Finance, 3(3), 235-

252.

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

44