Value Networks and Monetization Strategies for C-ITS Safety Use

Cases

Pol Camps-Aragó

a

, Simon Delaere

b

and Ruben D’Hauwers

imec-SMIT, Vrije Universiteit Brussel (VUB), Brussels, Belgium

Keywords: C-ITS, Value Network, Supply Chain Management, Monetization Strategies, Business Models.

Abstract: C-ITS safety use cases promise to reduce road accidents. However, deploying the necessary system elements

that enable such use cases entails challenges in terms of value network coordination, return on investments in

infrastructure and in-vehicle devices, and monetization of services. In short, this paper aims at contributing to

overcome these economic challenges by (i) clarifying the overall value network and interactions amongst key

stakeholders, (ii) proposing how to incentivise the fulfilment of bottleneck value network roles, (iii) providing

recommendations on how to incentivise investments and the monetization of C-ITS services, and (iv) arguing

for a data exchange and governance model based on regulatory and business model aspects.

1 INTRODUCTION

Cooperative Intelligent Transport Systems (C-ITS)

enable vehicles to communicate with each other and

coordinate their actions, and to interact and

coordinate with road infrastructure as well, thereby

enhancing the intelligence of current roads and

transport systems. C-ITS covers a broad range of

safety and traffic efficiency use cases: in this paper,

we focus on safety-related ones, such as road works

and hazards warnings and cooperative emergency

braking. These specific use cases were tested within

the CONCORDA European project, in the context of

which our analysis was performed.

C-ITS is expected to contribute to substantial

increases in road safety and traffic efficiency across

Europe (European Commission, 2016). Moreover,

the Commission views C-ITS technology as

complementary to automated driving, and hence as a

pillar of the EU’s long-term strategy on mobility.

However, in order for C-ITS to deliver its

expected societal benefits, several elements need to

be widely adopted, since these systems exhibit strong

direct network effects: from a single vehicle’s point

of view, nearby vehicles and roads must also be

equipped with telecommunications technology, and

digital information services must be provided without

a

https://orcid.org/0000-0003-4521-4064

b

https://orcid.org/0000-0003-3775-6592

interruption. Therefore, a key business requirement is

the deployment of connected roadside infrastructure

and in-car hardware elements, investments that face a

‘chicken and egg’ problem (C-ITS Platform, 2016).

In addition, the business case for isolated,

individual safety-related C-ITS use cases is far from

certain. Based on current and proposed European

regulation, we assume that safety-related services,

such as road hazards warnings, will be provided free

of charge at the point of use. More specifically, both

the Delegated Regulation 886/2013 and the proposed

C-ITS Regulation (European Commission, 2019)—

which was later rejected by the European Council due

to disagreements on connectivity protocols—mention

this approach. Therefore, we argue that monetizing C-

ITS safety-related use cases will entail alternative

revenue sources, more specifically offering them

bundled with other data-based services.

Consequently, another important aspect is access

to in-vehicle and user data by third parties. C-ITS

systems will collect, process and aggregate large

amounts of real-time traffic data, but enabling

alternative revenue sources from data-based services

may also require the sharing of commercially-

sensitive data beyond safety-related information, and

this sharing would need to be done in a standardised

and timely manner.

Camps-Aragó, P., Delaere, S. and D’Hauwers, R.

Value Networks and Monetization Strategies for C-ITS Safety Use Cases.

DOI: 10.5220/0010404103410349

In Proceedings of the 7th International Conference on Vehicle Technology and Intelligent Transport Systems (VEHITS 2021), pages 341-349

ISBN: 978-989-758-513-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

341

Moreover, as digital technologies and services

converge with the automotive industry, supply chains

are becoming more complex, requiring an overall

business ecosystem perspective. This is especially the

case in C-ITS, where multiple actors from different

sectors are required to cooperate and/or compete with

each other (C-ITS Platform, 2017; Lang et al., 2019).

Delivering the added value of C-ITS will also require

the fulfilment of several crucial roles and

responsibilities, which in this paper we identify and

allocate to specific stakeholders.

Main challenges to C-ITS adoption are thus

clarifying the value network, incentivising

investment in the necessary infrastructure,

monetizing the provision of C-ITS safety-related

services, and having a trustworthy, efficient, and

timely data sharing system in place. Furthermore,

another business requirement for certain stakeholders

is the transfer of part of the liability in case of

accidents. Successfully addressing these issues will

determine whether a sustainable business ecosystem

that enables a wide adoption of C-ITS emerges. In

addition, it will determine whether the associated

deployment costs will have to rely mostly (or even

entirely) on public funding or, on the contrary, on

private investment.

The aim of this paper is therefore to provide

recommendations in order to help overcome the

economic challenges identified above. In section 2,

we map the overall value network for C-ITS services

and the necessary interactions between the main

stakeholders involved. In section 3, we suggest

strategies that will enable sustainable business

models for C-ITS. Finally, section 4 provides

recommendations based on the entire analysis.

2 VALUE NETWORK ANALYSIS

In order to enable market uptake of C-ITS safety use

cases, a main challenge is to clarify the system’s

underlying complex structure of roles and

responsibilities, and understand how different players

must cooperate and exchange resources in the market.

To address this, in section 2.1 we discuss the roles

that will need to be fulfilled. Subsequently, in section

2.2 we map the main required interactions in terms of

financial and liability flows.

For simplicity, we focused on two types of

illustrative safety C-ITS use cases for inter-urban

roads and highways: first, Day 1 information services,

such as ‘road hazards warning’ (RHW), which notify

drivers of a safety-related traffic event; second, the

more advanced ‘cooperative emergency braking’,

where a vehicle automatically ‘hits the brakes’

immediately after receiving a communication that

another vehicle in front of it is performing a sudden

break. In both cases, a vehicle or roadside unit (RSU)

notices the road ‘event’ and communicates it to

nearby vehicles via ITS-G5 or C-V2X protocols.

Next, a receiving vehicle processes the message and

either warns the driver via an HMI or performs the

braking function.

2.1 Value Network Roles

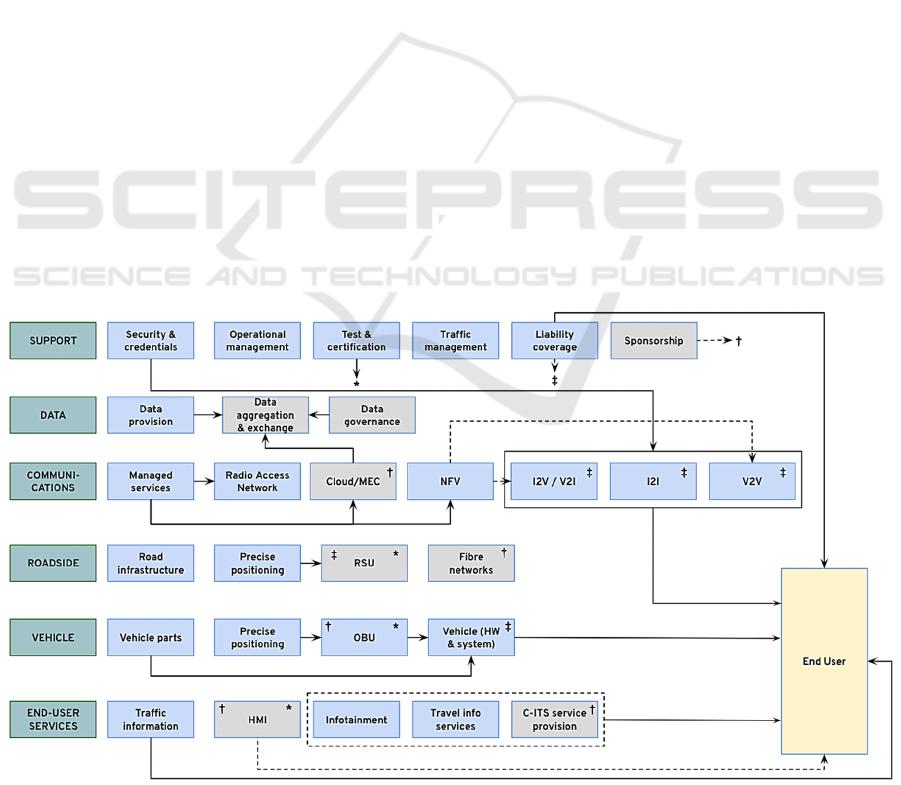

Figure 1 identifies six different layers of roles

involved in the overall C-ITS ecosystem. In grey, we

highlight those roles for which the actor best poised

to fulfil them remains unclear. Key roles remaining

empty represents a bottleneck for C-ITS adoption;

hence, our analysis in section 3 will discuss options

and provide recommendations regarding these roles.

First, the ‘Support’ layer includes those roles that

will make the use cases feasible both at the technical

and the financial level. First, testing and certification

will ensure the quality of the RSUs and vehicle on-

board units (OBUs). Such homologation role might

be performed by a public authority or an industry

association like the OmniAir consortium. Second,

operational management deals with controlling that

maintenance happens and technical operations run

smoothly. Third, the security and credentials role is

based on the concept of Public Key Infrastructure

(PKI), in which a cybersecurity services provider

issues digital certificates that are used to encrypt

telecommunications messages. Additionally, the

financial coverage of liability by insurance

companies in case of system underperformance and

the financial support or ‘sponsoring’ of C-ITS system

components will help create a positive business case

for other actors.

Second, the ‘Data’ layer contains those roles

revolving around the huge amounts of vehicle, user

and traffic data that need to be gathered, processed

and distributed. The data governance role aims at

enforcing data ownership and sharing rules, including

the definition of standardised formats. While

regulators at the European and Member State level

have set principles for the processing of personal and

safety-related data, several questions remain, such as

what data are made openly accessible and under what

terms. A related, crucial aspect concerns which

platforms will play the role of data aggregation and

exchange, which may or may not be the same that

gather and/or process data. We will discuss these

aspects in section 3.3.

Third, the ‘Communications’ layer describes the

necessary components to enable and provide short-

VEHITS 2021 - 7th International Conference on Vehicle Technology and Intelligent Transport Systems

342

and long-range communications. We assume a future

hybrid scenario in which both ITS-G5 and C-V2X

protocols will co-exist for short-range messages, and

interoperability will be legally required. We consider

the sending of messages between vehicles and

infrastructure (i.e., V2I/I2V) and between these

elements themselves (V2V and I2I). The actors that

will take up these roles are connectivity service

providers, such as mobile (virtual) network operators

(MNOs and MVNOs). In addition, the role

‘Cloud/MEC’ includes the provision of (edge) cloud

computing infrastructure and solutions, and the

‘network function virtualisation (NFV)’ role includes

dynamic network slice provision and management.

This role and the remaining ones will be played by

MNOs or network equipment and solutions vendors.

Fourth, the ‘Roadside’ layer covers the ‘smart’ or

connected infrastructure that is deployed along the

physical road infrastructure. At both roadside and

vehicle levels, the role to provide precise positioning

is played by an equipment manufacturer that provides

Global Navigation Satellite System (GNSS)

receivers, which are integrated into OBUs and RSUs.

Fifth, the ‘Vehicle’ layer covers the advanced on-

board systems as well as traditional hardware

elements. In particular, on-board units will be

integrated in cars by vehicle manufacturers, who will

likely acquire components from different suppliers

and assemble them into their final products. Besides

the mentioned positioning sensors, OBUs also

contain processing units, antennas and SIM cards.

Finally, the ‘End-user services’ layer covers

information services provided to end users (i.e.

passengers or drivers of personal and freight vehicles)

and the devices through which they are provided. The

human-machine interface (HMI) through which the

end user receives these services—e.g., visual or

auditory warnings of road hazards ahead—can be

added in the form of a personal device, such as a tablet

or mobile phone, or be incorporated in the vehicle.

These devices can be interoperable with the OBU by

default and be connected to it ex post. Therefore, a

service provider or the OEM can control this HMI

role, depending on which element is used to present

information to the user. Moreover, C-ITS and end-

user service providers can be mobility or connectivity

service providers, vehicle OEMs, or even public

entities.

2.2 Value Network Interactions

Next, we investigate the necessary transactions

amongst stakeholders that will collectively enable C-

ITS use cases and their added value. We considered

various types of interactions, namely financial,

qualitative (i.e., meeting societal goals), liability and

data flows. For simplicity, we only plot financial and

liability flows. Since C-ITS-based liability shifts will

likely only arise in the case of automated actions, the

liability flows only apply to the (automated)

coordinated emergency braking use case.

In the following lines, we summarise those

Figure 1: Revenue flows within the value network of safety-related C-ITS use cases.

Value Networks and Monetization Strategies for C-ITS Safety Use Cases

343

economic transactions made in exchange for a

financial compensation, although data and qualitative

benefits may be present in parallel. We review the

main ones and plot them in Figure 1. Dotted lines

indicate the interaction is uncertain.

End users are the receiving entity for the

following transactions (from top to bottom in the

figure): (a) insurance policies with potentially lower

premiums due to a lower risk of accidents; (b) a

connectivity subscription, either coming with the

vehicle or acquired separately from a connectivity

service provider; (c) C-ITS-enabled vehicles in the

form of a sale or lease; (d) an HMI device, acquired

from a technology company or service provider, in

case it is not incorporated in the vehicle (thus plotted

as uncertain); (e) C-ITS information services,

delivered by either a traffic management authority, a

vehicle manufacturer or a (connectivity) service

provider, possibly bundled with other data-based

services in exchange for the purchase of or

subscription to an app; and (f) traffic information.

IT security services providers issue digital

certificates (security and credentials) for

communications messages, based on the mentioned

PKI. Furthermore, network solutions providers offer,

besides managed services, cloud and virtualization

infrastructure to connectivity service providers. Even

though who will provide cloud services is unclear,

data aggregation and exchange servers will be hosted

at these edge or central clouds. Further, an MNO may

issue a dedicated network slice for vehicle-to-

everything (V2X) communications: in case vehicle

manufacturers play the role of providing V2V

connectivity, they would be the customers of this

service, hence the dedicated possible transaction.

In the transactions represented by the symbol ‡,

insurance companies receive financial compensation

for the potential transfers of liability discussed later.

It can also be that no financial compensation is

included if the expected overall lower risk of

accidents (thus lower costs) compensates the extra

liability taken (premiums remaining equal). An

alternative is that they re-invest these benefits to

provide financial support to deploy different

infrastructure and in-vehicle elements and services,

i.e. playing the role of a sponsoring entity, which is

represented by the symbol †, and which may be

played by other entities as well. Likewise, tests and

certifications of RSUs and OBUs, involving a fee in

return, are represented by an asterisk in Figure 1.

Other interactions are not plotted because the

financial benefit arises from the overall system, i.e.,

the safety use cases, being in place. Besides

intangible societal gains, public authorities benefit

from reductions in expenses from lower accidents

(e.g., from awareness campaigns and healthcare).

Furthermore, the added value for road operators

resides mainly in the replacement of physical

infrastructure by digital messaging in order to bring

information to road users.

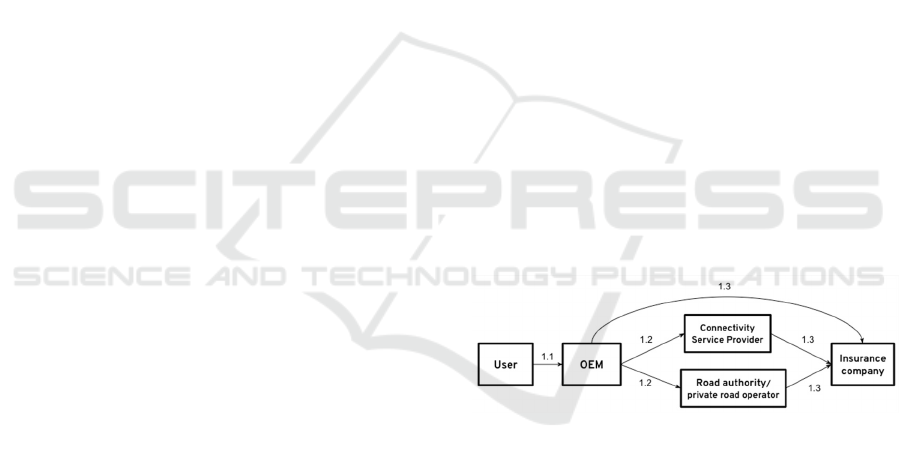

Subsequently, Figure 2 presents the liability

transfers that would arise in the case of automated

functions, in which the driver would not take action

(e.g., in the case of an emergency brake), and thus

may not be held liable in case of accident. Interactions

#1.1 and #1.3 imply a financial compensation in

return for the liability transfer to another party. On the

contrary, #1.2 flows entail no financial compensation,

since they refer to the shift in liability in case there is

an accident for which the vehicle manufacturer is not

to blame because the failure or underperformance

happened at the connectivity or the data processing

level (except in the case where the OEM is

responsible for V2V communication).

Connectivity or managed service providers will

be subject to a higher risk in the future, as they may

be held responsible in certain situations, such as when

an accident happens due to a failure in connectivity.

This might lead to standard contractual arrangements

providing security to each party by identifying their

liability in advance. Furthermore, it may also lead to

higher costs due to a higher redundancy of the

network, in order to increase reliability. Of course, it

will be subject to future legal mandates as well.

Figure 2: Liability shifts in case of automated braking.

3 MONETIZING C-ITS

The challenge of fulfilling certain roles arises from

the uncertainty about earning a return on

infrastructure investments and monetizing C-ITS

service provision. This uncertainty is not only due to

the costs associated with deployment and the lack of

a standalone business case for safety services, but also

about the risk of all the other required, enabling

system elements not being concurrently in place.

Therefore, the question of which actors will be able

to take care of the necessary infrastructure and service

deployment is of key importance. In turn, enabling

the monetization of services requires having a time-

VEHITS 2021 - 7th International Conference on Vehicle Technology and Intelligent Transport Systems

344

sensitive and sustainable data sharing system in place.

Consequently, the present section provides a

discussion on how to address these aspects.

3.1 Deployment of Key Components

For C-ITS to yield its expected safety benefits,

several elements should be pervasively deployed,

both in terms of geographic reach and vehicles

covered. However, since a given actor’s decision to

invest is contingent on its expectations regarding the

investment actions of authorities and competitors and

the market penetration of C-ITS use cases, there

exists a ‘chicken-egg’ conundrum: a lack of a clear

business case disincentivizes investment, while

insufficient investment makes the prospective

business case financially infeasible. This would cause

firms to take a reactive approach. In addition, the

prospect of competitors taking advantage of

interoperability obligations would disincentivise

potential first-movers to bear the initial costs and

risks. Similarly, if public authorities were to signal

that they would take responsibility for all investments

in case private companies do not, this would reinforce

the passive approach of firms. All these scenarios

would be detrimental, due to a resulting under-

provision of C-ITS services or a delay in their

introduction. In the sections below, we discuss

strategies to incentivise the investment and

deployment of specific, crucial system elements.

3.1.1 On-board Units and HMIs

While the cost of an individual on-board unit may be

low compared to the overall price of a car, OBUs and

aftermarket devices represent most of the incremental

investment required for C-ITS (C-ITS Platform,

2016).

We can expect European regulation to mandate

that all new vehicles incorporate OBUs, as the current

‘eCall’ regulation does for SIM cards. However,

customer willingness to pay for the extra costs, and

thus the timely replacement of current vehicles, is a

challenge. A traditional strategy is to partly subsidize

vehicle sales, while a complementary option is for

OEMs to monetize the extra costs of OBUs by selling

vehicle-generated data to third parties.

Furthermore, aftermarket devices can be attached

to current vehicles and used as HMIs to deliver C-ITS

information services. They could be bought from

service providers, and complementary services

(location-based, infotainment, etc.) would be

provided through them as well. Regulation would

require that C-ITS safety information be given

priority over any other service provided via the same

interface (as established by Delegated Regulation

886/2013 for non-safety-related traffic information),

and these devices would need to be designed in a way

that avoids distracting drivers. In addition, they would

need to be certified to ensure reliability, since adding

an extra data processing element would increase the

risk of a message being communicated to drivers with

delay. Since shifts of liability away from the driver

are not expected for warning use cases (C-ITS

Platform, 2016), homologation would limit such a

risk by making sure HMI devices conform to

minimum requirements.

In addition, by providing a direct contact with the

end user, the role of the HMI will yield a valuable

commercial relationship and knowledge of the

customer. On the one hand, OEMs may be reluctant

to let others gain access to in-vehicle data, and

subsequently choose to install their own HMI in

vehicles. On the other hand, third-party deployment

of an HMI device would shift costs away from OEMs.

Moreover, since the device has more applications

outside the car, this cost would be easier for

(connectivity or app) service providers to monetize.

3.1.2 Telecommunications Infrastructure

Regarding roadside telecommunications

infrastructure, the need for pervasive and timely

deployment, together with the societal gains in safety

and traffic efficiency, justifies public investment. In

addition, early commitment by public authorities to

deploy enabling infrastructure will be crucial to

trigger industry investment in other elements and

services, as it would lower uncertainty regarding

other enabling system elements not being in place.

However, financing these investments through a

kind of premium toll for C-ITS enabled vehicles runs

the risks of disincentivizing user adoption. An

alternative is that connectivity providers contribute to

densely deploy RSUs. MNOs will be able to split the

costs of radio access networks across many use cases,

beyond automotive ones. Therefore, they will benefit

from economies of scale by also using their

infrastructure for (enabling) C-ITS use cases.

However, given the recent experience of having had

to write off the value of assets from previous

generation networks, MNOs will be risk-averse when

assessing these investment decisions. To counteract

that, regulators may exceptionally allow active

network sharing among different MNOs.

Moreover, the use of network slicing technology

(i.e., the role of NFV), can further incentivise the

deployment of telecommunications infrastructure by

Value Networks and Monetization Strategies for C-ITS Safety Use Cases

345

MNOs. Network slicing would reduce capital

expenditures by enabling multiple virtual network

‘slices’ to run on top of a shared physical

infrastructure. These slices would be tailored to the

distinct requirements of different use cases. For

instance, C-ITS and content distribution for in-car

entertainment differ in terms of their latency,

reliability and bandwidth needs. Therefore, network

slicing would allow to launch communications

services in a more agile and cost-efficient manner

(NGMN Alliance, 2015; Afolabi et al., 2018).

3.1.3 Multi-access Edge Computing

As C-ITS increases the need to aggregate and process

real-time data, it will in turn increase QoS

requirements in terms of ultra-low latencies, as well

as big data analysis (Knieps, 2019). The reliance of

C-ITS functions on time-sensitive data raises the

question of where to locate data aggregation and

processing functions within the network, and thus

about the relative use of centralized cloud

architectures versus multi-access edge computing

(MEC) nodes (Satyanarayanan, 2017).

MEC provides cloud computing capabilities at the

edge of the network, which can be located within the

radio access network next to base stations, thus closer

to users and road infrastructure, thereby lowering

latency (Hu et al., 2015; Beck et al., 2014).

While a centralized cloud architecture can cost-

efficiently provide computation and storage at scale,

distributed computing architectures are more

expensive in comparison, since multiple data centres

need to be deployed (Chang et al., 2014). On the other

hand, edge cloud computing allows to perform tasks

such as storing and processing content on local

datasets at the edge of the network; by doing so, MEC

servers provide an increased QoS and can enhance

privacy (Satyanarayanan, 2017; Beck et al., 2014).

However, some open questions remain, for

example regarding who will set up, own and manage

the infrastructure of MEC nodes. MNOs could deploy

both private or public edge cloud servers within their

own networks, possibly contracting network

equipment and solutions vendors for maintenance and

operation of the cloud hosting environment.

Alternatively, more open ownership approaches

exist, such as the one described by Ai, Peng & Zhang

(2018)—consisting of an open RAN where MNOs

host third-party applications and content at the MEC

level—or the one described in Satyanarayanan

(2017), which is based on an open-source platform.

Both authors argue that these open models would

incentivise investment and the quick and competitive

deployment of innovative solutions.

3.2 Bundling of Services

The lack of a stand-alone business case for C-ITS

safety services is a bottleneck for private provision.

For service providers, MNOs, or OEMs, these C-ITS

services will likely be valorised only when bundled

with other services or solutions across their portfolio.

Therefore, delivering safety C-ITS services in

combination with complementary services—i.e.,

those also based on digital interfaces, mobility data

and connectivity—incentivises investment from

private firms. Examples of such services include

navigation, travel planning, truck tolling, mobile

connectivity, infotainment, etc. Real-life examples of

this business model already exist, such as the mobility

apps of Be-Mobile.

Furthermore, if service providers adopt the C-ITS

service provision role they will alleviate the need of

traffic authorities to do complex data processing, as

the service provider will integrate real-time traffic

data collected by roadside infrastructure. Moreover,

from the perspective of users, bundling enhances the

value of C-ITS services in front of a potential stand-

alone delivery, thereby increasing user willingness to

pay to deploy external HMIs in cars.

An alternative monetization strategy is

sponsorship. A sponsor is a third-party stakeholder

that has an indirect monetary interest in the adoption

of C-ITS, and is therefore willing to provide financing

for the C-ITS service. Insurance companies could

fulfil this role, since an increase in road safety would

lower their expected future costs from claims.

Next, one aspect to specifically consider is the

communications service. While traffic messages are

to be delivered for free at the end user’s point of use,

this does not imply they are not priced somewhere

else, for example within a connectivity subscription.

The subscription to the connectivity service could

be incorporated and priced in the vehicle. In that case,

the OEM would pay the connectivity service provider

(CSP). On the contrary, the subscription could be

purchased independently by each individual user.

Only in the second case the user would directly

choose the CSP or even be aware of it. However, that

scenario would add the risk that the user is not willing

to pay for the connectivity subscription. As a result,

public authorities may prefer making the connectivity

service provision mandatory for either the vehicle

manufacturer or the user; and comparatively, the first

option would limit the risk of non-compliance. If

connectivity subscriptions were mandatory, ceiling

prices or rules to limit price-fixing by CSPs could be

used to compensate for the increased bargaining

power given to them. In case customers must buy the

VEHITS 2021 - 7th International Conference on Vehicle Technology and Intelligent Transport Systems

346

subscription, M(V)NOs would be able to maintain

customer ownership, and could bundle the C-ITS

connectivity provision with subscriptions for

handsets and other services (e.g., audio-visual content

provided through the external HMI).

If MNOs deploy MEC architectures they could

also bundle connectivity services with MEC services,

for instance offering them to data exchange platforms

(discussed in the next section), likely via intermediary

cloud hosting providers. Therefore, MNOs can find

multiple revenue sources from C-ITS services by

providing connectivity (including network slices),

complementary services, and MEC hosting.

Furthermore, since these complementary services

strongly rely on real-time traffic, vehicle and user

data, service providers will need constant access to it.

Therefore, the question of what data are open and

accessible and what remain under control of private

parties becomes relevant. To address this issue, the

following section discusses the unclear value network

roles of data aggregation, exchange and governance.

3.3 Data Exchange and Governance

Both to address the challenges of monetizing C-ITS

and encouraging coordination, a main aspect is data

sharing. To evaluate options regarding the

governance and exchange of data, we first analysed

existing and proposed regulations. Next, we reviewed

extant literature about data platforms for traffic-

related use cases. In addition, we organised an

internal consultation with a subset of nine of our

project partners, including central C-ITS stakeholders

such as telecommunications, automotive and research

organizations. While not representative, it provided

valuable insights about their views and preferences

with regard to data sharing and governance options.

Regarding mandatory data sharing, legal ground

is found under the ITS Directive 2010/40/EU and the

delegated regulations that supplement it. These

supplementing regulations—DR 2017/1926, DR

885/2013, DR 2015/962, and DR 886/2013—have a

different scope in terms of the data types covered, but

overall it can be concluded that: (i) Member States are

to set up National Access Points (NAPs), where (ii) at

least the most ‘fundamental’ safety-related data shall

be accessible for exchange and reuse; moreover, that

(iii) such access must be provided under fair,

standardised and non-discriminatory terms; (iv) that

such data sharing must be timely and meet quality

requirements; and finally, (iv) that the role of

assessing compliance with these rules falls under an

independent national (or supranational) body. In

addition, recent documents (European Parliament,

2018; European Commission, 2019) confirm this

approach.

However, while we can assume that prospective

regulation will mandate the sharing of safety-related

data, the question still remains on how much data (if

any), and in what terms, is made accessible with

regard to other, less ‘fundamental’ data types.

In order to develop a profitable business model, it

may also be necessary to allow the access and reuse

of data by third parties beyond the ‘fundamental’

safety types, for example to enhance predictive

maintenance, travel advice or insurance services. The

surveyed project partners agreed with the basic

premise that offering profitable C-ITS services will

require the sharing of in-vehicle proprietary data

among different stakeholders, although the specific

data types would depend on each service. However,

as also identified elsewhere (e.g., see C-ITS Platform,

2016; Vantomme, 2018), a business requirement by

OEMs is to receive a fair return for sharing the in-

vehicle data they own. This is also in line with our

previous point about the sale of data being an

alternative revenue source for OEMs to monetize

their investments in OBUs.

We distinguish between three different types of

relevant data, namely traffic, in-vehicle (e.g.,

location, speed) and user data (e.g., driving

behaviour). In-vehicle and user data are gathered by

OBUs and HMI devices, subsequently sent to

proprietary servers, and shared on the basis of

bilateral market agreements subject to market pricing.

Moreover, while Belgian NAPs offer open access to

aggregated traffic data, they consist of rather static

databases, plus they do not include all the above data

types. Therefore, we expect the relevant sharing that

enables complementary services to be done through

other, alternative data platforms.

Data platforms are access points, or digital

interfaces, where data are made available to third

parties. The C-ITS Platform (2016; 2017) project

identified several types of relevant data platforms for

C-ITS, differing in terms of location and ownership.

Regarding location, they can be distinguished based

on whether they are external to the vehicle (i.e. off-

board) or in-vehicle (i.e. on-board). Regarding

ownership, the platforms may be proprietary to the

party who gathers data, or alternatively be owned and

operated by a neutral entity, such as a public entity, a

public-private partnership or a private entity

controlled by a consortium of C-ITS stakeholders.

Common concerns about on-board platforms

relative to off-board ones involve their being more

expensive to develop and requiring more time to be

implemented, while relative concerns about off-board

platforms include their ability to support all real-time

use cases (C-ITS Platform, 2016; McCarthy et al.,

Value Networks and Monetization Strategies for C-ITS Safety Use Cases

347

2017). Similarly, proprietary platforms triggered

concerns of impaired competition and innovation in

terms of services, while OEMs argue that proprietary

solutions could offer reduced time to market (C-ITS

Platform, 2016; McCarthy et al., 2017). In any case,

it is estimated that providing access to in-vehicle data

would bring higher socio-economic benefits from the

enabling of added services than the costs of

implementing any of these data platform architectures

(McCarthy et al., 2017).

Most of the consulted project partners expressed a

preference for the data governance role being done by

a third party, and among these the average feeling was

of being “somewhat more comfortable” with that

party being a public entity. Nevertheless, in spite of a

slight majority also preferring the data exchange

being done through a public agency’s platform, there

was no consensus in this regard.

In conclusion, based on our understanding of the

value network, monetization challenges, the relevant

regulations and data platform types, and our project

partners’ preferences, we argue in favour of a specific

data platform and data sharing arrangement, which

would provide clarity to the unclear, bottleneck value

network roles of ‘data aggregation and exchange’ and

‘data governance’.

We argue that the closest fit—in the context of the

CONCORDA project—would be a neutral

marketplace platform. This server would aggregate

vehicle, traffic, and travel-related user data from

multiple proprietary servers and offer a standardised

interface for third parties (such as connectivity and

information service providers, OEMs and public

authorities) to access the data and gather it for reuse

in their own servers and the NAPs of different

countries. It would be owned by a consortium of

public and/or private C-ITS stakeholders, thereby

being neutral to any specific entity, and it would be

operated independently. In addition, it would be

located off-board of vehicles, but close to them at the

edge of the telecommunications network, i.e., in MEC

servers. As mentioned before, this would address the

issues of latency of C-ITS messages and of privacy of

personal data. Privacy is another issue to take into

account, since based on the General Data Protection

Regulation 2016/679 (GDPR), C-ITS messages

contain personal data, hence its processing for

commercial exploitation requires the consent of the

data subject (FIA, 2017; Art 29 DP WP, 2017).

Data subject to commercial interest would be

subject to market pricing and exchanged for a fee,

with defined access price ceilings. Compared to ad

hoc bilateral agreements, by giving access to a

broader pool of potential service providers, we argue

such a sharing arrangement would increase

efficiency, competition and service innovation.

Furthermore, this platform could finance its

operational costs through transaction fees, possibly

complemented by public subsidies and private

sponsorship as well.

This arrangement would have to be

complemented by rules that mandate open sharing of

more than safety-fundamental traffic and in-vehicle

data based on fair and non-discriminatory terms, and

would be subject to user consent. The consulted

project partners differed in their views regarding how

to enforce such sharing. While their answers indicate

clear support for certain explicit rules around data

sharing, the preferred extent of regulation depends on

the objective of such rules. Most answered that rules

should be established to ensure data are shared in a

standardised manner; however, establishing rules to

ensure data are made available unaggregated or with

a minimum quality was not a majority opinion.

4 CONCLUSIONS

C-ITS safety-related use cases are expected to bring

high societal value by contributing to reduce road

accidents. However, creating this value relies on a

series of investments in infrastructure and in-vehicle

equipment, which in turn will depend on the ability of

private actors to monetize them. We argue that the

following aspects make this monetization

challenging: (i) the lack of stakeholder involvement

and coordination within the overall ecosystem, (ii) the

costs of deploying equipment and infrastructure, (iii)

the lack of a standalone business case for C-ITS

safety service delivery, and (iv) the issue of data

exchange and governance models. Therefore, to help

enable the creation of value from C-ITS safety

services and overcome this investment problem, we

provide several suggestions.

First, stakeholder coordination and involvement

must be encouraged. Coordination is an increased

challenge in an ever-expanding mobility ecosystem

with complex value networks. In this paper, we plot

the overall C-ITS value network, its bottleneck roles

that will have to be fulfilled, and its interactions in

terms of financial and liability flows. Such

involvement depends on each role’s specific business

requirements (in the form of the discussed

interactions and monetization strategies) being

covered. For policymakers, encouraging involvement

and coordination means the use of regulatory actions

to guide deployment and competition (e.g.,

VEHITS 2021 - 7th International Conference on Vehicle Technology and Intelligent Transport Systems

348

mandating on-board units in vehicles and the sharing

of certain data).

Second, coordinating the timing of initial

investments is key to overcome the ‘chicken and egg’

problem of investing in the infrastructure and

equipment necessary to set up the system. We argue

that public entities should lead initial investments in

roadside infrastructure to signal their commitment in

subsequent deployments and, in turn, acquire credible

commitments by more risk-averse actors.

Third, we discuss the challenge of monetizing on-

board units, telecommunications infrastructure and

(edge) cloud deployments, and provide some strategic

options available to different actors. For instance,

regulation may allow connectivity service providers

to maintain direct access to end customers instead of

mandating that a connectivity subscription be

included in the vehicle. Moreover, enabling to

monetize C-ITS safety services will be contingent on

enhancing value propositions through bundling

complementary services, which can incentivise the

uptake of the key service provision role. Bundling

allows to cross-subsidise across a firm’s service

portfolio, and leverage economies of scope.

Importantly, enabling these complementary services

will require the sharing of data.

Last, to encourage the rich sharing of data, we

argue in favour of a data marketplace platform owned

by a neutral entity—for instance a public or

consortium entity—as the best fitting option for the

Belgian context. To capture value from C-ITS safety

use cases, vehicle and traffic data with commercial

interest will need to be shared among multiple actors

in real-time. In this marketplace, such data would be

timely exchanged and traded in a standardised

manner. Complementarily, national access points

would contribute to the bottleneck data aggregation

and exchange role for less time- and commercially-

sensitive datasets, sharing them in a more open

manner. In addition, regulation would ensure access

to these data and sharing, thus contributing to the

‘data governance’ value network role.

Finally, further research is needed in order to

provide more comprehensive guidance. Several

aspects can be addressed, such as which specific data

types are covered by the proposed sharing

arrangements, and what specific regulation in terms

of access pricing would be optimal. In addition,

further research could also extend the present work to

other C-ITS use cases.

REFERENCES

Afolabi, I., Taleb, T., Samdanis, K., Ksentini, A. & Flinck,

H. (2018). Network slicing & softwarization: A survey

on principles, enabling technologies & solutions. IEEE

Communications Surveys & Tutorials, 20(3), 2429-2453.

Ai, Y., Peng, M., & Zhang, K. (2018). Edge computing

technologies for Internet of Things: A primer. Digital

Communications and Networks, 4(2), 77-86.

Article 29 Data Protection Working Party (2017). Opinion

03/2017 on Processing personal data in the context of

Cooperative Intelligent Transport Systems (C-ITS).

Beck, M. T., Werner, M., Feld, S., & Schimper, S. (2014).

Mobile edge computing: A taxonomy. In Proc. of the

Sixth International Conference on Advances in Future

Internet, 48-55.

Chang, H., Hari, A., Mukherjee, S., & Lakshman, T. V.

(2014). Bringing the cloud to the edge. In 2014 IEEE

Conf. on Computer Communications Workshops, 346-

351.

C-ITS Platform (2016). Final report. Retrieved from

https://ec.europa.eu/transport/themes/its/c-its_en.

C-ITS Platform (2017). Final report Phase II. Retrieved

from https://ec.europa.eu/transport/themes/its/c-its_en.

European Commission (2016). A European strategy on

Cooperative Intelligent Transport Systems, a milestone

towards cooperative, connected and automated

mobility. Brussels: COM(2016) 766 final.

European Commission (2019). Commission Delegated

Regulation (EU) …/... of 13.3.2019 supplementing

Directive 2010/40/EU of the European Parliament and

of the Council with regard to the deployment and

operational use of cooperative intelligent transport

systems. Brussels: C(2019) 1789 final.

European Parliament (2018). Report on a European strategy

on Cooperative Intelligent Transport Systems

(2017/2067(INI)). Committee on Transport and Tourism.

FIA (2017). What EU legislation says about car data: Legal

Memorandum on connected vehicles and data.

Hu, Y. C., Patel, M., Sabella, D., Sprecher, N., & Young,

V. (2015). Mobile edge computing—A key technology

towards 5G. ETSI white paper, 11, 1-16.

Knieps, G. (2019). Internet of Things, big data and the

economics of networked vehicles. Telecommunications

Policy, 43(2), 171-181.

Lang, N., von Szczepanski, K., & Wurzer, C. (2019). The

Emerging Art of Ecosystem Management. Boston

Consulting Group.

McCarthy, M., Seidl, M., Mohan, S., Hopkin, J., Stevens,

A., & Ognissanto, F. (2017). Access to in-vehicle data

and resources: Final report. European Commission.

NGMN Alliance (2015). 5G White Paper. A Deliverable by

the NGMN Alliance, version 1.0.

Sabella, D., Vaillant, A., Kuure, P., Rauschenbach, U., &

Giust, F. (2016). Mobile-edge computing architecture:

The role of MEC in the Internet of Things. IEEE

Consumer Electronics Magazine, 5(4), 84-91.

Satyanarayanan, M. (2017). The emergence of edge

computing. Computer, 50(1), 30-39.

Vantomme, J. (2018). Data sharing and re-use: Perspective

from the vehicle manufacturers. ACEA BITS –

Brussels Internet & Telecom Seminars.

Value Networks and Monetization Strategies for C-ITS Safety Use Cases

349