Life Cycle of Software Development Design in European Structured

Economic Reports

Ignacio Santos

1a

, Elena Castro

2b

, Dolores Cuadra

2c

and Harith Aljumaily

1d

1

Carlos III University of Madrid, Computer Science Department, Madrid, Spain

2

King Juan Carlos University, Technical School of Computer Engineering, Madrid, Spain

Keywords: Model Driven Architecture (MDA), Multidimensional Data Model (MDM), Data Point Model (DPM),

eXtensible Business Reporting Language (XBRL), Semantic Financial Reports, Concept and Logic Data

Model.

Abstract: This proposal presents the complete life cycle of software development for semantic economic reports using

the MDA paradigm. A panoramic view of the development of these reports using the MDM and the DPM in

Europe is shown. Stock market, financial institutions and others are using these reports. Companies,

organizations and agencies need to exchange accounting reports. A very high percentage of reports are

published and transmitted through the internet. These reports are structured and semantic. In general, the

XBRL specification, based on XML, is used as a de facto standard. This research work examines the evolution

of this design and analyses the Conceptual Model in detail. Regulators through different Central Banks and

European Agencies have established a modelling tool in the context of the European Union (EU), the DPM,

which is a European standard. Moreover, a minimum set of consistent definitions and rules based on the MDM

using the MDA will be proposed. This paper will analyse the DPM methodology. Finally, it is hoped that this

study will help to make the design of reports easier.

1 INTRODUCTION

The world’s main economic/financial institutions and

agencies, as well as many companies and state or

local agencies, actively use semantic reports using the

XBRL specification. In the USA, Canada, Europe,

China, etc. all financial entities and companies quoted

on the stock market have to report compulsorily to the

supervisory and regulatory authority using the XBRL

specification. Financial statements are regulated by

strict requirements, such as the International

Financial Reporting Standard (IFRS, 2020) or

Generally Accepted Accounting Principles (GAAP).

XBRL is actively used by the Board of Governors of

the Federal Reserve System (FED), the Securities and

Exchange Commission (SEC), the ShenZhen Stock

Exchange (SZSE), the Shanghai Stock Exchange

(SSE) (JiMei et al., 2012; Jimei et al., 2013), the

European Central Bank (ECB), the European

a

https://orcid.org/0000-0002-3374-4271

b

https://orcid.org/0000-0002-0652-8848

c

https://orcid.org/0000-0002-0652-8848

d

https://orcid.org/0000-0001-5084-2626

Banking Authority (EBA), the European Insurance

and Occupational Pensions Authority (EIOPA), the

Deutsche Börse, the Deutsche Bundesbank,

Companies House and HM Revenue & Customs

(UK) and the Australian Prudential Regulation

Authority (APRA), among many other institutions

and agencies. Recently, in the EU, the European

Securities and Markets Authority (ESMA, 2020)

began using structured reports.

The authors of this paper show the application of

the Model Driven Architecture (MDA) that belongs

to Object Management Group (OMG, 2020) and

analyse the software development life cycle of this

type of document, (Santos et al. 2016). OMG is a

common portable and interoperable object model

with methods and data that works using all types of

development environments on all types of platforms.

To do this it is very important to understand the

design of semantic reports in relation to the real world

Santos, I., Castro, E., Cuadra, D. and Aljumaily, H.

Life Cycle of Software Development Design in European Structured Economic Reports.

DOI: 10.5220/0009954001590169

In Proceedings of the 16th International Conference on Web Information Systems and Technologies (WEBIST 2020), pages 159-169

ISBN: 978-989-758-478-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

159

and away from its physical implementation, because

this will help with understanding the difficulties

presented. When a financial institution, company, etc.

fills out a report, before sending this to another entity,

agency, etc., it has to be validated (at origin), to

ensure that it is syntactically correct (Debreceny et

al., 2010).

This paper shows a metadata design for semantic

economic reports. Moreover, the approach of

European Regulators to the Data Point Model (DPM)

is studied. The MDA provides a good framework for

the automatic generation of code for application

development (MDA, 2020). The MDA focuses on

using models as approaches to cover the life cycle of

software development. Heterogeneity and

interoperability problems between systems with

different implementation platforms are resolved by

using this approach. The MDA stratifies the design

into three phases or levels to allow for easier

development. The levels of the MDA are:

Computation Independent Model (CIM). The

business or domain model. In this level, the real

world is analysed, including concepts, data and

rules.

Platform Independent Model (PIM). This

focuses on high-level business logic without

considering the features of the implementation

technology of the system. In this level, the real

world is mapped to a conceptual model, using

a star model of the MDM.

Platform Specific Model (PSM). This

represents the detail of using a specific

platform for a system. In this level, the DPM is

used, because at the end, the implementation is

in an XML-based format (XBRL, iXBRL (an

HTTP of an XBRL).

The MDM is a model for databases (Kimball,

1996-2004; Inmon, 2005; Jarke et al., 2003).

Dimensional modelling defines the concepts of facts

(measures), and dimensions (contexts), and the

authors and the European regulators believe that it is

a concept model perfectly adapted to this modelling

in Europe (Boixo and Flores, 2005; Felden, 2007;

Santos, 2013; Santos and Castro, 2010, 2011, 2011a,

2011b; Santos et al., 2013). The DPM was originally

proposed and led by the Bank of Spain. This model

started using the taxonomies of Balance Sheet Items

and Interest Rates Monetary Financial Institutions

(BSI-MIR 2010) and they were implemented by the

Polish financial software company, BR-AG (2020).

After, with this model was developed COREP (it

focuses on the consolidated, sub-consolidated and

solo reporting of capital requirements and capital and

reserves based on EU directives) and FINREP

(consolidated and sub-consolidated financial

reporting for supervisory purposes based on IAS

(International Accounting Standards)/IFRS)

taxonomies (Eurofiling 2020). The DPM was

developed using two taxonomies for respectively

Cayman Islands Monetary Authority and Bermuda

Monetary Authority.

The next section studies the use and necessity of

this type of report, and its historical evolution.

Section 3 is divided into five subsections. In 3.1 the

CIM is analysed. In the next subsection, 3.2, the rules

and definitions in the PIM are shown. The metadata

design in the PIM and its validation is shown in

section 3.3. The PSM is presented in subsection 3.4.

In 3.5 a complete example is displayed. Finally,

section 4 presents the conclusion of this research and

explores future works.

2 BACKGROUND

In a company, organization or agency, there is always

an exchange of accounting reports. Since the late

1990s, this exchange of reports has started to

increase. Companies needed to know the status of

their orders as soon as possible, and to perform a

calculation of presales, sales and future product

availability (Lee et al., 1997). If these reports are not

semantic, they cannot be directly automated in the

internal or external processes of the company through

Information Systems (IS) (Wagenhofer, 2003;

Williams et al., 2006).

Following the bankruptcy of Enron Corporation

in December 2001, stock market regulators began to

demand the reporting of much more business

information and reduce the amount of time in which

this reporting had to be processed. In April 1998 the

automation of the exchange of financial information

through XBRL was proposed (Hamscher and

Kannon, 2000). XBRL is an XML-based standard for

semantic financial reporting (Engel et al., 2008). The

financial statements of credit institutions, for

example, are specific statements defined by one or

more taxonomies, including their structures and

semantics. As accounting directives are subject to

continuous modification, versioning and changes of

location (e.g. of a country, state or region), problems

often arise. There are three important groups of

semantic reports in Europe: COREP (Common

Reporting Framework), FINREP (Financial Reports),

both of the EBA, and Solvency II of the EIOPA. In

the U.S.A. and Canada one of the main taxonomies is

the US-Generally Accepted Accounting Principles

(US-GAAP). Another specification for semantic

WEBIST 2020 - 16th International Conference on Web Information Systems and Technologies

160

reports is the Statistical Data and Metadata Exchange

(SDMX, 2020). This is often used by the ECB and the

Bank for International Settlements (BIS), among

other agencies and institutions.

In 2008, the European regulator had the necessity

of developing reports for each country or jurisdiction.

In the first meetings, each national regulator

presented a set of spreadsheets with a heap of cells

that gathered data from the supervised entities.

Moreover, a unification of criteria was necessary.

Where originally they were just a small set of

countries, presently there are almost 30. The main

problem was that these data (Data Points) didn’t

match with each other. Firstly, IS analysts and expert

users looked for data points with the same

dimensions. Many cells coincided with the

dimensions of the time period, the currency and/or the

entity. Then IS and expert users obtained more

dimensions, such as liabilities, assets, etc. From these

meetings the related data points were gathered, using

dimensions. The question remains, when these

dimensions are not commons, whether each expert

user can use different dimensions for defining the

same data point or measure.

3 DESCRIPTION OF THE

DESIGN AND PROPOSAL

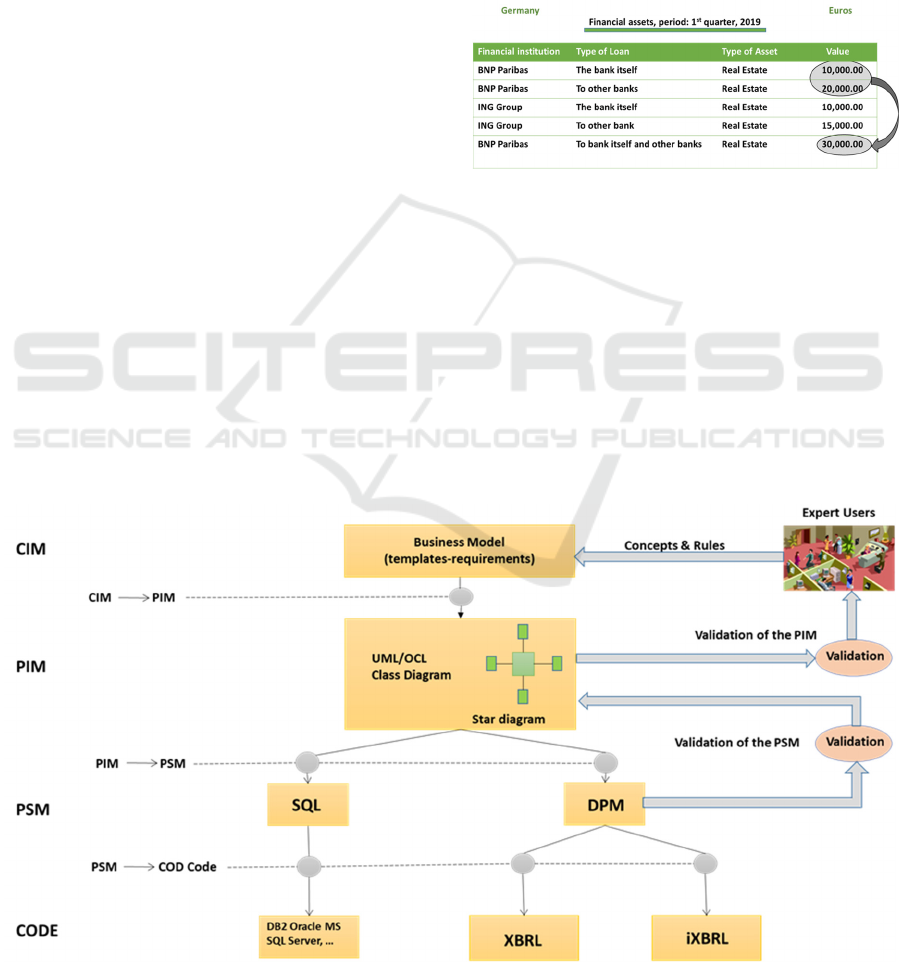

In this section the metadata model drivel engineering

approach in accounting semantic reports will be

analysed using the authors’ approach (Ñustes et al.,

2016). The first step is to define an economic

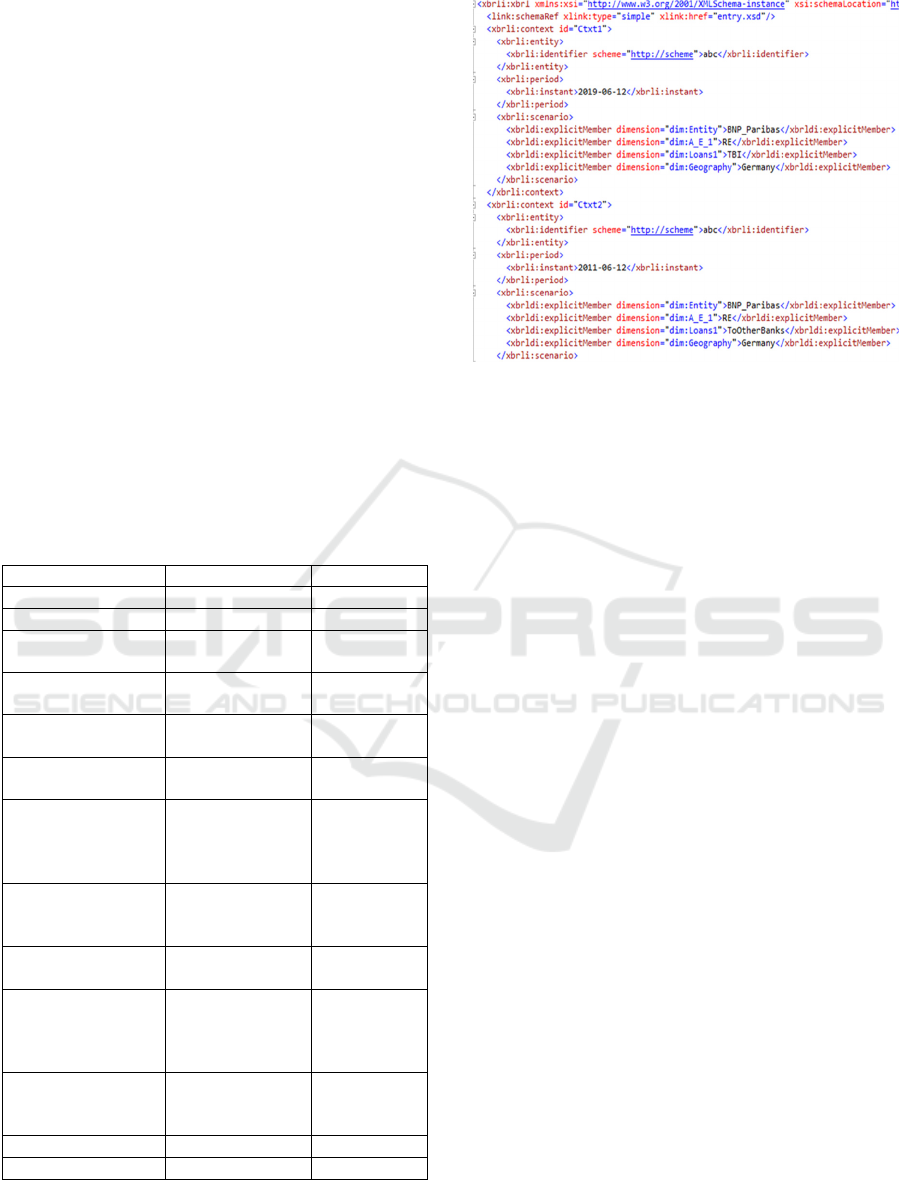

semantic report (Figure 1). However, this approach is

different of the Semantic Web, is a definition

economic. This figure 1 just it is only an example, it

is not a real example. Nevertheless, we use real

names, because so the example could be more

pedagogic. In this example, the Financial Assets in a

period in a country is shown. With specific rules, such

as that the real estate loans of the bank must be equal

to the sum of the real estate loans to the bank itself

and other banks (Santos, I., 2016).

Figure 1: Example of financial sematic report.

Firstly, the following definition of an economic

semantic report is proposed: An economic/financial

report is semantic if it is composed of a set of

interconnected concepts, and values are assigned to

these concepts or groups of concepts. Also, the values

must comply with certain rules and/or constraints

among other values and concepts.

Figure 2 diplays the design of sematic reports

using the MA paradigm. The regulators, agencies, etc.

need to gather a series of data. These expert users,

with the help of IS, build a set of templates, through

Figure 2: Design of sematic reports using the MDA paradigm.

Life Cycle of Software Development Design in European Structured Economic Reports

161

one or more spreadsheets. Therefore, the real world

consists of a set of accounting rules, laws, directives,

etc., defined by a set of required data in a report (the

CIM), through templates. According to the MDA

paradigm, the PIM is obtained from the CIM. In the

PIM, the set of definitions and user rules are analysed.

A mapping from the CIM to the PIM is shown. The

model used in the MDM is the star model that is used

by European regulators. The PSM (in this case the

DPM) consists of a set of definitions, rules and

transformations.

In Europe the design makes extensive use of

dimensions (Boixo and Flores, 2005; Felden, 2007).

This use of dimensions makes the design process

easier, since if the number of dimensions in the

conceptual model is high, it is semantically richer,

and the mapping to a database is easier.

This section has been divided into five

subsections in order to explain the definition of the

CIM, the analysis of the PIM, its rules and definitions,

the design of the metadata in the PIM, the PSM and a

complete example.

3.1 The Computation Independent

Model (CIM)

An economist-accountant wants only to obtain a set

of data (Santos, 2016). In certain cases, these

specialists design a report as in Figure 1. However, in

most cases, they want to collect data independently of

its presentation. A generalized method is to generate

one or more spreadsheets or templates with the data

that are needed. In this way, the presentation of the

data is separated from its definition. According to the

business logic, the user will create one or more

spreadsheets, each sheet having a group of cells.

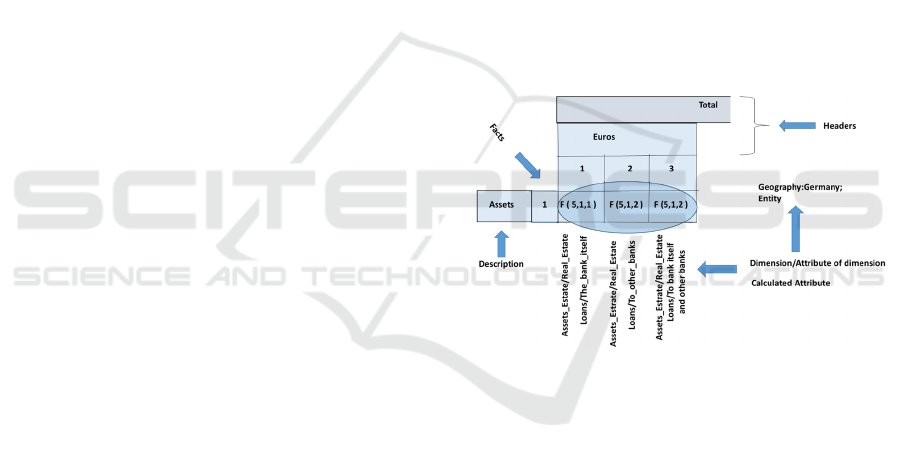

Figure 3 shows a simplified example with three cells,

based on the report of Figure 1, where F(5.1.1) shows

row 1 in Figure 1, F(5,1,2) shows row 2 and F(5, 1, 3)

could be row 5.

From these templates or sheets, the IT analyst,

together with the business user, extracts the metadata.

In these templates, the business users show the data

they need to gather. The analyst may find a set of

Excel sheets with a large number of cells unconnected

with each other and with a high degree of redundancy.

Each template has a different meaning for the

business user. The template will consist of a set of

cells where each cell is a fact to be gathered, this

being determined by a set of dimensions and

dimension attributes, among other things. For

example, F5 (5, 1, 1) is real estate assets, with a loan

from the bank, for an entity, in euros. In this figure 3,

if the fields are crossed out, they are considered not

allowed by the business user. On the other hand, a fact

can be represented by more than one triplet (template,

row, column), because a fact can be in more than one

template. The proofs of concepts (hereinafter POCs)

of this paper are based on the reports that must be sent

from financial institutions to European regulators

(Openfiling, 2020). These POCs use the draft of the

FINREP 2012 taxonomy (EBA, 2011; Eurofiling,

2012; Eurofiling, 2020), published on the internet,

with extensive use of dimensions.

3.2 The Platform Independent Model

(PIM): Rules and Definitions

This subsection analyses the PIM of this model. UML

is used to show all necessary definitions and rules of

this platform (the PIM). The star model of the MDM

is used in this level. Table 1 summarises the set of

definitions. Column 1 defines the name of the concept

in the MDM and column 2 its description. However,

these definitions are based on the XBRL Data Model

(XBRLDM).

Figure 3: Star model in the PIM.

The first definition, according to Table 1, is the

definition of a business concept or item. In the Figure

1, the concepts are {‘Entity_Financial’, ‘BNP

Paribas’, ‘ING Group’, ‘Royal Bank of Scotland’,

Commerzbank, ‘Real estate’, ‘No real estate’, ‘Real

estate and no real estate’, Assets, Liabilities, …}. A

basic concept is a primary item, in the XBRLDM

(Hernández-Ros and Wallis, 2006; Santos and Castro,

2011a, b). All concepts of a domain have the same

type of time period. A domain is formed of a set of

concepts, and each concept belongs to a single

domain. In this example the basic concepts are Type

of Asset: Real Estate, No Real Estate and ‘Real estate

and no real estate’. As will be seen later, ‘Real estate

and no real estate’ is a hierarchy within a dimension,

and is specific to this type of report. They have type

monetary, their period is instant and they can be

positive or negative (balance). All concepts of a

WEBIST 2020 - 16th International Conference on Web Information Systems and Technologies

162

domain have the same type of time period. In the

example the set of domains are DEntity,

DAssets_Estate, DLoans, and DGeography. The

domain DEntity consists of the next concepts

{‘Entity_Financial’, ‘BNP Paribas’, ‘ING Group’,

‘Royal Bank of Scotland’, Commerzbank} and so on.

Table 1: Definitions and rules in the MDM (the PIM).

Name in the

MDM

Description

Concept

The definition of a business concept or

item. Each concept is associated with a

time period type attribute (Instant,

P

eriod, and

F

oreve

r

).

Basic Concept

A special concept that has an associated

data type, time period type, and balance

type (if it is monetary).

Domain

A group of concepts belonging to a field

or scope of knowledge or activity. In

this model a domain can contain basic

concepts or non-basic concepts but not

b

oth.

Base

Dimension

A domain with only basic concepts.

Dimension

A set of concepts of a domain. These

concepts have a tree-like structure.

Dimension

(explicit /

implicit)

This is explicit if the attributes are

defined. It is implicit if they are not

defined. Dimension → Domain.

Domain → → Dimension.

Dimension

Group

Group of dimensions of a domain.

Calculated

attribute

An aggregate of dimension attributes of

a dimension, and/or calculated

attributes.

Attribute of

dimensions

Not an aggregate.

Attribute by

default

Each domain has a concept by default.

Hierarchical

Constraint

Concepts in a dimension have a tree-

like structure. Validation is between a

leaf and its leaves below, that is to say,

it is used for the calculated attributes.

References

References to directives or laws of the

concepts.

Fact::=<Dimen

sion/Dimensio

n attribute>-

Basic concept-

Calculated

attribute

A fact is a value representing a

particular measurement provided by the

reporting entity.

Allowed fact User constraint.

Forbidden fact User constraint.

In the MDM or the XBRL specification one cannot

have more than one dimension attribute of a

dimension that refers to a fact. However, in the real

world there can be more than one concept for a

domain that makes references to a fact. The solution

in the XBRLDM is to create as many dimensions of

the same domain as is possible, so that each fact has

a dimension attribute (member-domain in

XBRLDM), without overlapping dimension

attributes of a dimension in a fact. Dimensions of a

domain with overlapped are created in the MDM.

This means, a dimension determines a domain. Then,

in the example it is possible to define the domain

DLoans, the dimension Loans_1={’The bank

itself’+‘To other banks’}, etc. A calculated attribute

determines a domain and a dimension. For example,

in the domain DLoans the concept ‘The bank itself

and other banks’ is a calculated attribute of Loans_1,

where ‘The bank itself and other banks’=’The bank

itself’+‘To other banks’. A dimension attribute

determines a single concept from a domain, but

dimension attributes determine from 1 to n

dimensions. In XBRLDM a dimension consists of

domain-member, and does not differentiate between

dimension attributes and calculated attributes. On the

other hand, in the XBRLDM, all defined domains

must have a concept by default with semantic content

(Hernández-Ros and Wallis, 2006; Eurofiling, 2011).

Also in this data model, every dimension should have

a concept by default of the domain to which the

dimension belongs.

In the XBRLDM a domain consists of dimensions

and these dimensions consist of domain-members. In

the MDM a domain consists of dimension attributes

and the calculated attributes or measures of

dimensions belong to a domain. These concepts are

hierarchical (Hernández-Ros and Wallis, 2006;

Schmehl, 2009). In this data model, the hierarchies

can be used for different validations of the concepts,

and with a business perspective for IS. This means,

that in the MDM the concepts (dimension attributes

and measures) of a dimension are organized into an

interconnected hierarchy tree. In the example the

concept ‘Real estate and no real estate’ of the domain

DAssets_Estate is a root of the concepts ‘Real estate’

and ‘No real estate’. Each concept can have an

associated a comparison operation (the root) and an

operation, “+” or “-“(the leaves). Unlike the

XBRLDM, the MDM uses calculated attributes to

obtain a fact, but the XBRLDM does not calculate the

facts, only their validations. Therefore, to obtain a

mapping between the two models, a fact must carry

out a certain validation rule defined with respect to a

calculated attribute. The validations from the

XBRLDM hierarchies are used to take advantage of

the Linkbase calculation (operation in the XBRL

specification with only one dimension) (Engel et al.,

Life Cycle of Software Development Design in European Structured Economic Reports

163

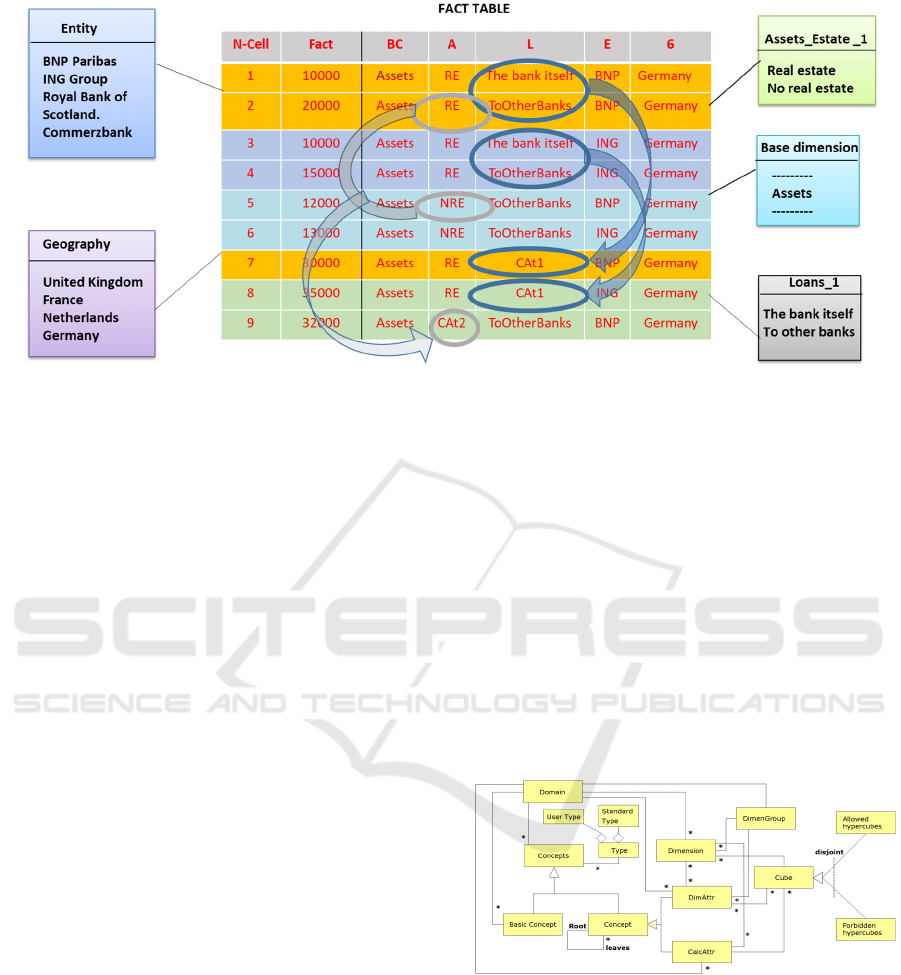

Figure 4: Example of fact table with calculated attributes, from Figure 1.

2008; Santos and Castro, 2011, b). However, the

Eurofiling group in its guide of best practices

recommends the use of the XBRL formula Linkbase

(Morilla, 2008; XBRL International, 2009; Fischer,

2011).

The XBRLDM Dimension Taxonomy (XDT)

defines two types of dimensions (Hernández-Ros and

Wallis, 2006; Schmehl, 2009). The dimensions can be

explicit or implicit. Explicit dimension attributes of a

dimension are defined in an explicit way in the

metadata model. Dimension attributes are implicit

(according to XBRLDM) when they are not explicitly

defined in the metadata model, however they belong

to a particular domain. In the MDM an implicit

dimension’s dimension attributes will be defined at

run-time. Each concept is associated with 0 or an

unknown number of references. The references are

indications of legal texts (Engel et al., 2008; Santos

and Castro, 2011, b). In the XBRL specification,

tuples or arrays of data are allowed. However, the best

practices guide developed by the Eurofiling group

does not recommend them (CEN, 2013; Eurofiling,

2020; Santos et al., 2016). In the MDM an array is

considered as another dimension.

In the XBRLDM, a fact is defined as a set of pairs

(dimension / domain-member) and a basic concept

(primary item). In the MDM a table of facts consists

of a set of facts, and these facts are determined by a

set of pairs <dimension/dimension attributes>,

including the base domain as an additional

dimension, and with or without calculated attributes.

For example, if in Figure 1 “BNP Paribas - The bank

itself - Real Estate - 10,000.00” is chosen, this is

equivalent to F(5,1,1) in Figure 3. Then, the fact F(5,

1,1) is the union of <Entity, “BNP Paribas”>,

<Assets_Estate_1,”Real estate”>, <Loans_1, “The

bank itself”>, <Geography, Germany> and <Base

dimension, Assets>. The hypercubes in the XBRLDM

are constraints on facts in the XDT (XBRL

Dimensional Taxonomies), which indicate the valid

combinations of pairs <dimension, attributes of

dimension>. A hypercube in MDM is a set of pairs

<dimension, attributes of dimension> and calculated

attributes defining one or more facts.

An allowed hypercube is defined as a hypercube

associated with a basic concept that determines a fact.

A forbidden hypercube is defined as a hypercube

associated with a basic concept that cannot determine

any fact, because the expert user considers this fact to

be impossible or erroneous. Figure 4 shows the MDM

of this example.

Figure 5: UML summary of the artefacts of the data model

in the PIM.

As it is explained in Figure 4, in this model there are

two calculated attributes. CAt1=(‘To bank itself’+

‘To other banks’), dimension Loans_1, CAt2=(‘Real

Estate’ + ’No Real Estate’), dimension Assets

Estate_1 . Finally, it is possible to analyse that Fact 7

is correct, and 8 is wrong. Moreover, it is possible to

see an allowed hypercube as Fact 7 that is defined as

{(BD, Assets), (Assets Estate_1, Real Estate), CAt1,

(Entity, BNP), (Geography, Germany)}.

WEBIST 2020 - 16th International Conference on Web Information Systems and Technologies

164

So far the structure, definitions and user

constraints of the PIM have been shown. In the next

subsection, it is necessary to validate some

constraints of the design in this platform.

3.3 Design of Metadata in the PIM

In this section, it is ensured that the transformation of

the CIM to PIM is correctly performed. In this phase

the result of this transformation is validated, i.e., if the

resulting PIM (or UML star model) is correct.

According to Gogolla et al. (2007), the validation of

conceptual models at early phases of their development

can help correct faults in the design at a point where

they may still be corrected with relative ease.

The validation involves testing that the data

obtained in the development of this research work

match up with expert users’ requirements. In this

validation FINREP (Eurofiling 2012) and Solvency II

is used. The number of concepts to gather is so large

(there were only 4500 in FINREP in 2012 and 45000

in 2015 (Weller, 2015)), with COREP presently 95742

(EBA, 2018) that it makes it impossible to work

directly with the report of Figure 1. In the initial

development (in the CIM) these templates have a large

number of unconnected cells and a high level of

redundancy. In the first phase, according to Algorithm

1, the different elements of the original templates

(Figure 3) are entered into the relational model of

Figure 5. By applying this algorithm repeatedly, the

unconnected and redundant cells are analysed.

Algorithm 1 uses the definitions and rules from

the above sections. It is this process that really makes

the structural validation (Santos and Nieto, 2014,

2015), verifying if hierarchies of concepts are valid in

a domain, with regard to dimensions, dimension

attributes and calculated attributes (if dimension

attributes belong to one domain rather than two at a

time, etc.).

Algorithm 1: Extraction of the metadata model.

start

read data type, domains, concepts,

basic concepts;

read dimensions, dimension groups;

verify the hierarchies of the

concepts and dimensions;

obtain dimension attributes,

calculated attributes;

obtain allowed cubes, forbidden

cubes;

obtain UML star model

create dimension tables from

dimensions and dimension attributes in

the star model;

create stored procedure with

calculated attributes;

create base dimension;

create facts from allowed cubes;

end

Next, the UML star model is obtained, as in

Figure 5. To achieve the transformation in the Proof

of Concept (POC), this paper uses SQL Server

Integration Services (SSIS), an ETL (Extract,

Transform and Load data) product of Microsoft

(Openfiling, 2020a). Table 2 shows, after which, it is

verified whether the output is as expected. This

process is based on the EBA and EIOPA taxonomies

(more than 20 modules), in that each concept is

analysed, for example, as to whether the hierarchy of

the concepts in a domain is correct.

Table 2 verifies a set of validation tests for the

proposal, only a summary, due to lack of space, more

information in Santos (2016) and Santos and Nieto

(2014, 2015). Column 1 shows the test number.

Column 2 shows the test to validate. This column

shows the test case, for example, test number 1: “3

repeated concepts” means that it is impossible to

repeat 3 concepts. Columns 3, 4 and 5 are inputs to

the test. These columns display the set of correct

objects and the set of incorrect objects to test. For

example, test number 1 shows 187 concepts + 3

repeated concepts. Finally, the last column gives

the test output. In test number 1, in the three samples

Table 2: Validation tests belonging to the UML star model.

n

Test to

validate

Input

FINREP

2014

Input

Solvency

II

Test

output

1

3

concepts

repeated

1632

concepts+3

concepts

repeate

d

145

concepts+

3 concepts

repeate

d

3

conce

pts

repeat,

2

2

domains

repeated

35

domains+2

repeated

domains

1

domain+2

repeated

domains

2

repeat.

Dom.

9

Creation

of

calcul.

attrib.

4 dimen., 18

calcul.

attributes+1

incorrect

dimension

attribute

2 dimen.,

2 calcul.

attributes+

1 incorrect

dimension

attribute

1

incorr.

dim.

attribu

te

10

The

concepts

of a dim.

has 1

onl

y

root

92 dimen.,

1632

concepts. 2

roots in a

dimension

2 dimen.,

4

concepts.

2 roots in a

dimen.

2 roots

in a

dim.

(FINREP 2014 and Solvency II) three repeated

concepts are inserted, respectively, so the test output

Life Cycle of Software Development Design in European Structured Economic Reports

165

is three errors with three repeated concepts,

respectively.

The validation in the POCs in the PIM performed

on each sample (FINREP 2014, Solvency II) depicts

all structural validations in a 95%.

This proposal produces well-built metadata for

semantic economic reports because it is a structural

validation. However, it is necessary to continue the

validation with expert users, in order to validate the

semantically-complete design. To achieve this, an

economic study of the concept domains, hierarchies,

etc. is necessary, and that is left for future work.

3.4 Design of Metadata in the PSM

This section analyses the transformation from PIM to

PSM, using UML/MDM as the PIM and the DPM

used in the financial supervision as the PSM.

The Data Point Metamodel is a way to help to

design the reports for financial regulators (Weber et

al., 2013). Table 3 shows the mapping between both

levels:

Table 3: Mapping between the MDM and DPM models.

MDM DPM Comments

Domain Domain

Dimension Dimension

Dimension

attribute

DomainMember

Dimension

attribute b

y

default

DefaultMember Assertion

Set of dimension

attributes

EnumerableDim

ension

Defined

values

Set of dimension

attributes

NonEnumerable

Dimension

Defined in

run time

Group of

dimensions

belonging to the

same domain.

Family of

dimensions

Assertion

Dimension

attribute with data

t

yp

e and time

Basic concept or

primary item

Base Dimension

Set of Primary

Item

s

Assertion

Calculated

attributes

Hierarchy

and/or

validation of

domain-membe

r

Assertion

Set of <dimension /

dimension

attributes>

Context

Metric or Fact Data Point

Schema Taxonom

y

Figure 6: Context in XBRL, from Figures 1,3 and 4.

A Domain Member is an element that belongs to a

domain and it can be in 0..n dimensions. A dimension

attribute by default in a dimension is used when a

program does not select the dimension attribute of a

dimension. An example of

NonEnumerableDimension is Entity, that at one

instant in the time its values can be Bank A, Bank B

and Bank C but one year after, there are Bank A, Bank

C and Bank D. A Base Dimension in the DPM is the

set of Basic concepts or Primary Items (defined in the

XBRL specification). Hierarchy used in dimensions

is a set of relationships parent-child; in the MDM

these are calculated attributes. The Context is not

defined in the DPM, because it is more associated

with the presentation of the report. However, the

authors of this paper think that it is better to include it

here. The context is the set of dimension attributes

without a Base dimension that allow the existence of

a fact or measure.

A Metric or Fact is a is a real world measurement

and the Data Point is a cell in a table of a spreadsheet

that is measuring some aspect of economic data in the

report to gather it for the regulator. A Fact in the DPM

is associated with a Base Dimension. The Data Point

is associated with a period and a type of data. Then,

this is associated with a Primary Item or Basic

Concept (dimension attribute of the Base Domain). It

consists of the cell identifier or Data Point, the

decimal precision, the identifier of the context, the

unitRef, and the value of the Data Point (the fact or

thing measured). A Schema is a description of the

model.

From here a taxonomy is built, but this topic will

be analysed in future work due to lack of space in this

paper.

WEBIST 2020 - 16th International Conference on Web Information Systems and Technologies

166

3.5 Example

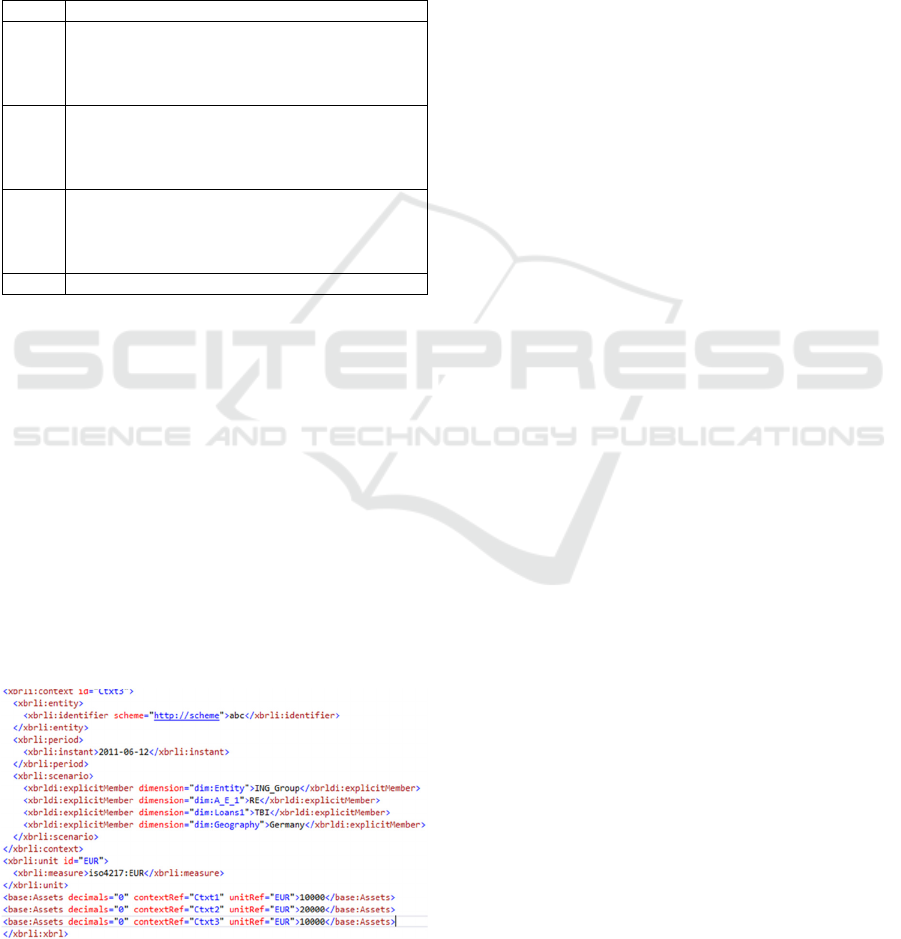

This section shows the example of Figure 1 to present

this methodology in an easily understandable way.

From the PIM (Figure 3) Table 1 is filled out as can be

seen in Figure 4, although this is only a summary. In

the PIM, the constraints, allowed facts with its contexts

are defined. Table 3 has to be resolved. In Table 4 only

a small set of contexts from Figure 3 are shown.

Table 4: Contexts of figures 1, 3 and 4.

Ctx Descri

p

tion

Ctxt1

<Entity/ BNP Paribas>+

<Assets_Estate _1(A_E_1)/Real estate(RE)>

+<

Loans_1(Loans1) /The bank itself (TBI)>

+<

Geo

g

ra

p

h

y

/

German

y

>

Ctxt2

<Entity/ BNP Paribas>+

<Assets_Estate _1(A_E_1)/Real estate(RE)>

+<

Loans_1(Loans1)/To other banks

(Tootherbanks)>+<

Geography

/

Germany>

Ctxt3

<Entity/ ING Group>+

<Assets_Estate _1(A_E_1)/ Real estate(RE)>

+<

Loans_1(Loans1) /The bank itself (TBI)>

+<

Geography

/

Germany>

… …

The Base dimension = {Assets (Monetary (credit),

Instant),…} In this example, the basic concept is

Assets, the data type is monetary and positive (credit),

and its value at an instant in time is defined. Until here

the metadata (data set required) of the reports are

defined. If the report is defined, the facts or values are

gathered and next the Instance Document is obtained,

Figures 6 and 7.

Figures 6 and 7 show an XBRL Instance

Document, that is to say, the economic report that, for

example, a financial entity sends to a regulator. In

Figure 5 the contexts or allowed hypercubes used in

this report are defined. The Figure 6, at the end, the

facts or Data Points are presented. These three facts

are equivalent to the first three lines of the report in

Figure 1.

Figure 7: Data Points or Facts.in XBRL, from Figures 1,3

and 4.

4 CONCLUSIONS

This paper analyses and shows a panoramic view of

the development stages of the creation of economic

report metadata using the XBRL specification. In this

paper the MDA paradigm is proposed. The MDM is

chosen as the PIM, because this model is adapted to

the development of European metadata. The DPM is

used as the PSM, because it is used in European

regulation (not only financial), for its implementation

in XML, XBRL or iXBRL. By means of the MDM

the definitions and rules are formalised and the

semantics of the XBRL Data Model (XBRLDM) are

audited. The automation of this mapping is also

proposed and implemented in the DPM Architect

(Morales, 2017). The aim of this research is to clarify

the XBRL and multidimensional data models, as well

as the mapping from XBRL to the MDM and vice

versa.

The DPM is the logical model used in Europe

(EBA, ECB, EIOPA, etc.) and a CEN standard

(2013). This is very close to end-user applications,

and is oriented exclusively to development using the

XBRL specification (Díaz, 2012; DPM, 2020). At

present, the IS departments of regulatory bodies with

very large taxonomies have an important challenge,

because taxonomies and their validations are created

without public test cases. The approach of this paper

provides a way forward for the generation of these

test sets.

The DPM is a logical model very adapted to the

expert user and the design is presently almost

automated. In Europe it is very widely used, and a

group that specialises in the modelling of this type of

report wish it to become an ISO standard (Piechocki,

2014). The DPM is very extended for the EBA, SRB

(Single Resolution Board), ECB and EIOPA. An

example of the EBA is the Reporting framework 2.10,

31/12/2020 https://eba.europa.eu/risk-analysis-and-

data/reporting-frameworks/reporting-framework-

2.10, with 74726 concepts, 259 dimensions, 49

domains, etc. Another example is the SRB v.4.0.3

31/12/2019, https://srb.europa.eu/en/content/2020-

resolution-reporting. EIOPA, for example v2.6.0,

15/7/2021, https://www.eiopa.europa.eu/tools-and-

data/supervisory-reporting-dpm-and-xbrl_en. The

European Agencies provide all the definitions of their

DPMs and detail the taxonomy that forms them,

including its mapping. However, since they are real

taxonomies, they are much more complex than the

example shown in this article. The DPM

methodology has remained practically stable since its

first iteration/formalization at CEN (2013). However,

it is in mind by users, its evolution in the

Life Cycle of Software Development Design in European Structured Economic Reports

167

short/medium term, incorporating it as an ISO

(International Organization for Standardization)

standard and with some revision. In particular, the

review should improve certain aspects such as the

best coverage of different use cases, both to better

cover certain financial cases (statistical and

transactional) and non-financial cases.

ACKNOWLEDGEMENTS

This article was made possible thanks to XBRL Spain

especially I. Boixo and M. T Sainz Ph. D. affiliated

with XBRL Spain and Bank of Spain, and the support

of A. Azcoaga from EIOPA. Finally, my deep thanks

to my assistant, A. Forner, who passed away last May.

Since, without their work and effort, this research

work would not have been carried out.

REFERENCES

Boixo, I., Flores, F., 2005. New Technical and Normative

Challenges for XBRL: Multidimensional in the COREP

Taxonomy. July 18

th

, 2005. The International Journal

of Digital Accounting Research, Vol. 5, N. 9, 2005,

pages 79-104. ISSN: 1577-8517.

BR-AG, 2020. Business Reporting. http://www.br-ag.eu/.

BSI-MIR (2010). Balance Sheet Items (BSI) and Monetary,

Financial Institutions (MFI). Interest Rates (MRI).

Date: January 27

th

, 2010. www.eurofiling.info/bsi-

mirTaxonomies/Taxonomy.Shtml.

CEN, 2013. Workshop Agreement CWA,

http://cen.eurofiling.info/, 11

th

December 2013.

Debreceny, R., Farewell, S., Piechocki, M., Felden, C.,

Gräning, A., 2010. Does it add up? Early evidence on

the data quality of XBRL filings to the SEC. Journal of

Accounting and Public Policy, volume 29, issue 3, June

2010. Pages 296-306.

Díaz A., 2012 Opening & Welcome (XBRL Week in

Madrid hosted by Bank of Spain and Business Register,

9th XBRL Europe Day), May 11

th

, 2012.

http://www.eurofiling.info/15th_worksop/presentation

s/AnselmoDiaz-welcome.pdf.

DPM, 2020. Data Point Model (DPM) References.

Eurofiling. “http://www.eurofiling.info/dpm/”.

EBA, 2011. EBA BS 180 (CP50 ITS on reporting – Annex

III to V FINREP templates and instructions). November

30

th

, 2011.

https://eba.europa.eu/file/33721/download?token=eqd

QEiuw.

EBA, 2018. Reporting framework 2.7.

“https://eba.europa.eu/risk-analysis-and-

data/reporting-frameworks/reporting-framework-2.7”.

Engel, P., Hamscher, W., Shuetrim, G., Kannon, D. vun,

Wallis, H., 2008. Extensible Business Reporting

Language (XBRL) 2.1. July 2

nd

, 2008. Published by

XBRL International. http://www.xbrl.org,

“http://www.xbrl.org/Specification/XBRL-2.1/REC-

2003-12-31/XBRL-2.1-REC-2003-12-31+corrected-

errata-2013-02-20.html”..

ESMA, 2020. The European Securities and Markets

Authority (ESMA): https://www.esma.europa.eu/.

Eurofiling, 2011. Proof-of-concept sample, Eurofiling data

modelling and taxonomy architecture. June 12

th

, 2011.

Copyright © 2005-2011 European Banking Authority

using European Union Public Licence.

http://www.eurofiling.info/dpm/,

http://www.eurofiling.info/finrepTaxonomy/taxonomy

2012.shtml.

Eurofiling, 2012. Eurofiling: New, 2012. FINREP

Taxonomy.

http://www.eurofiling.info/Finreptaxonomy/Taxonom

y2012.shtml.

Eurofiling, 2020. http://www.eurofiling.info.

Felden, C., 2007. Multidimensional XBRL (New

Dimensions of Business Reporting and XBRL). DUV

Deutscher Universiäts-Verlag. Pages: 191-209,

November 18

th

, 2007.

Fischer, H., 2011. XBRL Formula Overview 1.0, Public

Working draft, 21 December 2011. XBRL

International. Public Working Draft.

Gogolla M., Büttner F., Richters M., 2007. USE: A UML-

Based Specification Environment for Validating UML

and OCL. Science of Computer Programming, volume

69, Issues 1–3, 1 December 2007, Pages 27-34

Hamscher, W., Kannon, D., 2000. Extensible Business

Reporting Language (XBRL) Specification. July 31st,

2000. Published by XBRL International.

Hernández-Ros, I., Wallis, H., 2006. XBRL Dimensions

1.0. April 26

th

, 2006. XBRL International.

http://www.xbrl.org/Specification/XDT-REC-2006-

09-18.htm.

IFRS, 2020. International Financial Reporting Standard

(2019):” https://www.ifrs.org/”.

Inmon, W.H., 2005. Building the Data Warehouse. 4

th

Edition. John Wiley & Sons 2005.

Jarke, M., Lenzerini, M., Vassiliou, Y., Vassiliadis, P.,

2003. Fundamentals of Data Warehouses, 2nd Ed.

Springer.

JiMei. L., HuiZhou, Z., MeiJie, D., 2012. Analyzing

Semantic Heterogeneity in XBRL Taxonomies: an

Ontology Perspective. Proceeding ICMECG '12,

Proceedings of the 2012 International Conference on

Management of e-Commerce and e-Government.

Jimei, L., Yuzhou, H., Meijie, D., 2013. XBRL in the

Chinese Financial Ecosystem. IT Professional

Magazine (Dec 2013): 36.

Lee, H.L., Padmanabhan, V., Whang, S., 1997. The

bullwhip effect in supply chains. Sloan Management

Review, 38(3)-93-102, year 1997.

MDA, 2020. Model Driven Architecture.

https://www.omg.org/mda/

Morales, M., 2017. DPM Architect - Relational Database

Back-End. June 8

th

, 2017. IX Eurofiling XBRL week in

Frankfurt.

Morilla, V., 2008. XBRL Formulae Tutorial. September

WEBIST 2020 - 16th International Conference on Web Information Systems and Technologies

168

29

th

, 2008. IX European Banking Supervisors, XBRL

Workshop, Paris.

Ñustes, S. A., Hurtado, J. L., Rengifo, Y. P., 2016.

MDDCLOUD: Framework MDD para Aplicaciones

Web Empresariales según Especificación Requisitos de

Software. Revista Amazonía Investiga. Vol 5, No 8

(Año 2016)

OMG, 2020. Object Management Group, Inc:

http://www.omg.org/mda/.

Openfiling, 2020. http://www.openfiling.info.

“http://www.openfiling.info/academy/”.

Piechocki, M., 2014. DPM as ISO standard. XBRL week in

Brussels, 14

th

XBRL EU Day & 20

th

Eurofiling

Workshop,

Kimball, R., 1996-2004. The Data Warehouse Toolkit

series. John Wiley & Sons 1996-2004

Santos, I., 2013. Data Point Model (DPM) versus

Multidimensional Data Model (MDM). Contribution

for DPM Chapter in CEN WS XBRL Plenary Session,

Dublin, April 19

th

, 2013. Hosted by the Central Bank of

Ireland.

Santos, I., 2016. Framework for multidimensional

definition of the data model, structure, taxonomies and

rules of the XBRL specification. Doctoral Thesis, in the

Carlos III University of Madrid, Computer Science

Department, Leganés (Madrid), Spain, February 10

th

,

2016.

Santos, I., Castro, E., 2010. XBRL, UML and Database:

State of the Art. November 24

th

, 25

th

, 2010. XIII

European Banking Supervisors, XBRL Workshop,

Luxembourg. Organized by the XBRL Operational

Network of the Committee of European Banking

Supervisor, and hosted by Commission de Surveillance

du Secteur Financier of Luxembourg.

Santos, I., Castro, E., 2011. XBRL and the

Multidimensional Data Model. In Proceedings of the 7

th

International Conference on Web Information Systems

and Technologies, WEBIST 2011, pages 161-164,

Noordwijkerhout, The Netherlands, May 6

th

-9

th

, 2011.

Santos, I., Castro, E., 2011a. Proof of Concept of mapping

a XBRL report versus a RDBMS, September 5

th

, 2011.

XBRL Openfiling 1st, General Assembly, organized by

XBRL Operational Network of the European Banking

Authority, and hosted by the Banca D’Italia. September

5

th

, Banca d’Italia, Rome, Italy.

http://www.openfiling.info/?page id=286.

Santos, I., Castro, E., 2011b. XBRL Interoperability

through a Multidimensional Data Model. IADIS

International Conference on Internet Technologies &

Society (ITS 2011). Shanghai, China, December 8

th

-

10

th

, 2011.

Santos I, Castro E, Velasco M (2016). XBRL Formula

Specification in the Multidimensional Data Model.

Journal: Information Systems, volume 57, April 2016,

pages 20–37. Doi:10.1016/j.is.2015.11.001

Santos, I., Hommes, R., Heinze K. 2013. Improving

transparency in financial and business reporting -

Harmonisation topics – Part 5: Mapping between DPM

and MDM. CEN WS XBRL.

http://cen.eurofiling.info/wp-content/upLoads/data/

WA_XBRL_WI001-5-E.pdf.

Santos, I., Nieto, A., 2014. Formal validation of Data Point

Model. XBRL week in Brussels, National Bank of

Belgium. November 26th, 2014.

http://www.eurofiling.info/201411/index.shtml.

Santos, I., Nieto, A., 2015 Validation of the DPM and

Database Implementation. XBRL week in Madrid,

Eurofiling Workshop, Madrid, 3

rd

June 2015. Business

Register and Bank of Spain, Madrid, Spain.

http://eurofiling.info/portal/data-point-model/.

Schmehl, K., 2009. Data Model and Matrix Schemas. XI

European Banking Supervisors XBRL Workshop,

November 16

th

-20

th

2009, Vienna, Austria.

SDMX, 2020. Statistical Data and Metadata Exchange,

https://sdmx.org/.

Wagenhofer, A., 2003. Economic consequences of Internet

financial reporting. Schmalenbach Business Review

(SBR), 55(4):262–279, year 2003.

Weber, A.-M, Declerck T.,Hommes, R., Santos, I. 2013.

Improving transparency in financial and business

reporting—Harmonisation topics — Part1: European

data point methodology for supervisory reporting. CEN

WS XBRL. http://cen.eurofiling.info/,

http://cen.eurofiling.info/wp-

content/upLoads/data/CWA_XBRL_WI001-1-E.pdf,

http://www.xbrlwiki.info/index.php?title=Guidelines_f

or_Data_Point_Modeling.

Weller, A (2015) EBA Taxonomies or “Benny the tomcat

serve to demonstrate the evolution in Regulatory

reporting in the financial sector”, 15

th

XBRL EU,

XBRL week in Madrid,

http://www.eurofiling.info/201506/index.html.

Williams, S.P., Scifleet, P.A., Hardy, C.A., 2006. Online

business reporting: an information management

perspective. International Journal of Information

Management, 26(2):91–101.

XBRL International, 2009. Formula 1.0, Recommendation

22 June 2009. http://www.xbrl.org/specification/

formula/rec-2009-06-22/formula-rec-2009-06-22.html.

Life Cycle of Software Development Design in European Structured Economic Reports

169