User-adaptable Natural Language Generation for Regression Testing

within the Finance Domain

Daniel Braun

a

, Anupama Sajwan and Florian Matthes

Technical University of Munich, Department of Informatics, Munich, Germany

Keywords:

Natural Language Generation, Regression Testing, Finance.

Abstract:

Reporting duties and regression testing within the financial industry produce huge amounts of data which has

to be sighted and analyzed by experts. This time-consuming and expensive process does not fit to modern,

agile software developing practices with fast update cycles. In this paper, we present a user-adaptable natural

language generation system that supports financial experts from the insurance industry in analysing the results

from regression tests for Solvency II risk calculations and evaluate it with a group of experts.

1 INTRODUCTION

Companies within the finance industry, like banks and

insurance companies, have to fulfil many regulatory

requirements. Some of the most prominent directives

within the European Union (EU) include “Basel III”

for banks and “Solvency II” for insurance companies.

In order to fulfil the requirements introduced by these

legislations, companies have to continuously report

risk relevant corporate results and investments to their

respective regulatory authority. These reports deter-

mine how much money companies have to put aside

as a security.

From a company’s perspective, it is desirable to

keep this amount as low as possible, because they

only can create profit from money which they can

actively invest. Therefore, big insurance companies

use tailored internal risk models instead of the stan-

dard risk model provided by Solvency II. The soft-

ware which runs these internal risk models has to be

updated regularly, in order to meet the regulatory re-

quirements and the company’s interests. Before a new

version of such a software is put into production use,

regression testing is used to ensure proper behaviour.

A single run of such regression tests produces thou-

sand of numbers which have to be compared to pre-

vious results and interpret by financial experts, which

then have to report back to developers. This is a cost

and time-intensive process which also hinders com-

panies to deploy updates more often.

In this paper, we present a natural language gener-

a

https://orcid.org/0000-0001-8120-3368

ation (NLG) system which creates textual reports for

the results from regression tests for Solvency II risk

capital calculations. By identifying and highlighting

salient patterns within the results, we want to support

the work of financial experts and speed up the process.

Moreover, the system is built in a way which aims to

empower expert users, which are non-programmers,

to adapt the system regarding the analysis which is

conducted but also regarding the textual representa-

tion of the results of the analysis. The system was

designed and evaluated with financial experts from a

major international insurance company.

2 RELATED WORK

Most transactions on the international financial mar-

kets are nowadays not only executed but also trig-

gered by machines. (Banulescu and Colletaz, 2013)

Therefore, the relevant data is available in a machine-

readable format and, due to the nature of the domain,

mostly numerical. Given these circumstances, it is no

surprise that the finance domain is of great interest to

the NLG community, from a scientific and a commer-

cial perspective.

One of the most prominent applications of NLG

within the finance domain today is robot journalism.

Together with weather, traffic, and sports, finance is

one of the most popular domains for robot journal-

ism. (D

¨

orr, 2016) Examples for such systems were

build by Kukich (1983), and more recently Liu et al.

(2004), Haarmann and Sikorski (2015), Murakami

Braun, D., Sajwan, A. and Matthes, F.

User-adaptable Natural Language Generation for Regression Testing within the Finance Domain.

DOI: 10.5220/0009563306130618

In Proceedings of the 22nd International Conference on Enterprise Information Systems (ICEIS 2020) - Volume 1, pages 613-618

ISBN: 978-989-758-423-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

613

O

O

O

Market data

Investment

data

Internal risk model new

Rule engine

Rule set

Internal risk model old

NLG system

Relevant values

Risk figures

Textual report

Financial experts

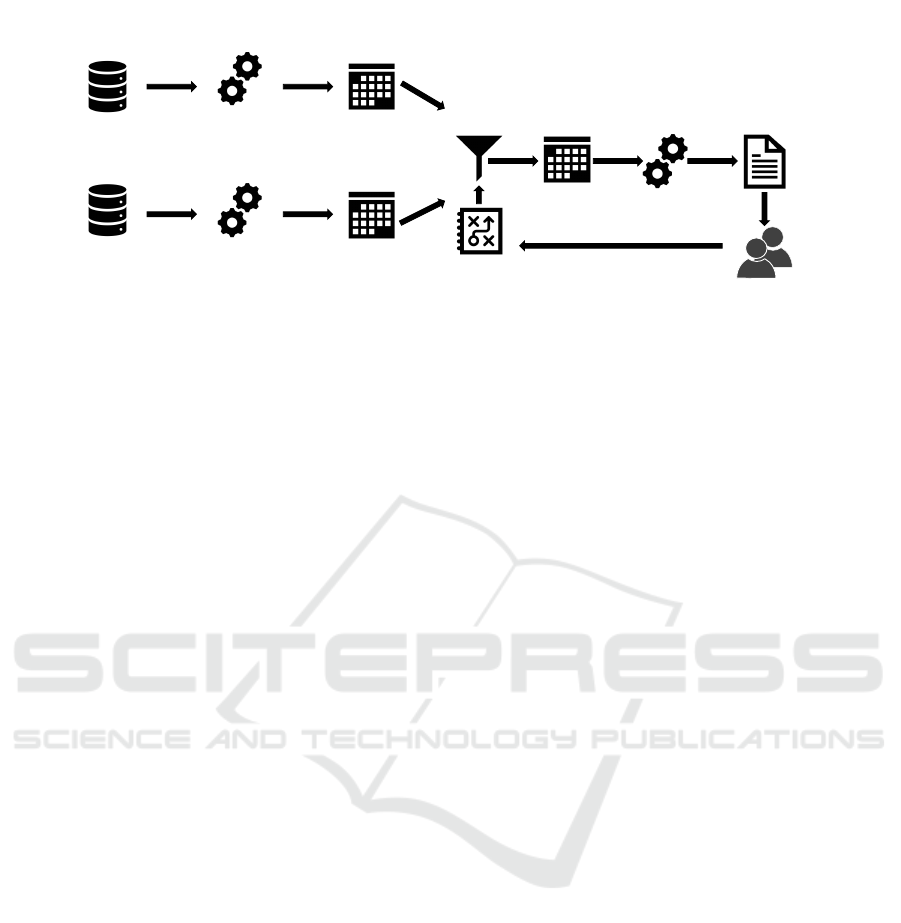

Figure 1: Worfklow.

et al. (2017), and many others. Another popular use

case for NLG within the finance domain is question

answering. Plachouras et al. (2016) e.g. presented a

generic approach for English and Altinok (2018) fo-

cused on questions regarding financial products and

services in German language. A similar system in

Japanese was presented by Okuda and Shoda (2018).

3 WORKFLOW

As mentioned before, the goal of the system is to sup-

port financial experts in their daily work. Hence, we

did not only try to build an isolated NLG system but

to integrate it into the existing workflow at our part-

ner company. In order to achieve this, we first inter-

viewed financial experts from the relevant division, in

order to find out how they work. The current work-

flow is a mostly manual process: once a new version

of the software for risk capital calculations is ready

for testing, both versions, the current one and the new

one, are run on the same data. Each of the versions

produces an Excel file with risk figures as output. Fi-

nancial experts will go manually through these sheets

afterwards and report relevant deviations for calcu-

lation instruments to the developers. If and when a

deviation is classified as “relevant” is a non-codified

process which is based on the knowledge and experi-

ence of the experts.

Based on the current worlflow, we deloped a goal

workflow, which we wanted to implement (cf. Fig-

ure 1). Instead of manually checking the output of the

regression testing runs, relevant patterns should be de-

tected automatically. In order to make this possible,

the knowledge about how to identify these patterns,

which was previously non-codified, has to be made

explicit. In the interviews with the experts, we found

out that these rules are not stable, but develop over

time and also might need to be adapted depending on

the current run.

While the experts are familiar with mathematical

formalisms and abstract thinking, they are usually not

“programmers”, i.e. they are usually maybe famil-

iar with e.g. Excel formulas, but not Java or other

complex programming languages. In order to create

a workflow which empowers these experts to conduct

the analysis on their own, we want to make use of a

rule engine which enables them to modify the rules

for the analysis without the help of developers. More-

over, this makes the rules more transparent and com-

prehensible to the experts, which will hopefully in-

crease their trust in the system. Once the relevant

patterns have been identified by the rule engine, the

NLG system should generate a comprehensive report

of the identified patterns. It is important to point out

that the goal of the system is not a complete automa-

tion. I.e. the target audience of the generated reports

are not developers but the financial experts. In this

way, instead of having to browse through the whole

table, financial experts can focus their valuable time

on analysing and assessing identified patterns. The

goal of the company is not only to save time and hence

money, they also want to change their development to

a more “agile” practice, which will lead to more fre-

quent updates. With the old workflow, it would sim-

ply not be possible for the experts to keep up with the

new development practice. With the proposed new

workflow and the NLG system as support, we want to

enable the financial experts to do so.

4 ARCHITECTURE

In order to make the system flexible and its parts

reusable, we adopted a service-oriented architecture.

The rule engine and the NLG system operate indepen-

dently from each other. Moreover, we implemented

an independent converter which pre-processes the in-

put for the rule engine, e.g. from the Excel format.

One of the decisions we had to make was which

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

614

Figure 2: Sequence Diagram for Camunda.

rule engine to use. One of the most popular avail-

able rule engines is the open source software Drools

(Proctor, 2012). In interviews with different employ-

ees from the insurance company, we found out that

there had been previous unsuccessful attempts to use

Drools in the department. People were mostly hostile

towards Drools, because of its complexity and steep

learning curve. Therefore, we decided to use an alter-

native.

The Camunda BPMN Workflow System (cf. e.g.

Lammert (2015)) is already used at the department

and offers a Decision Model and Notation (DMN)

engine, which is expressive enough for our applica-

tion and offers a graphical user interface which can

be used to create, delete or edit rules. Moreover, we

can use the Camunda BPMN Workflow System to or-

chestrate and connect our services with a web inter-

face. The sequence diagram in Figure 2 shows in

which order the different services are called by Ca-

munda. Once the execution of the DMN engine is

finished, the result is passed on to the NLG system in

JSON format. A more detailed description of the rules

and their output is given in Section 5. The NLG sys-

tem itself internally follows the three-stage pipeline

architecture described by Reiter and Dale (1997) and

uses SimpleNLG (Gatt and Reiter, 2009) as surface

realiser.

While the system currently only produces English

output, it could be easily adapted to other languages

for which SimpleNLG is available: German (Braun

et al., 2019), French (Vaudry and Lapalme, 2013),

Italian (Mazzei et al., 2016), Spanish (Ramos-Soto

et al., 2017), Dutch (de Jong and Theune, 2018), Man-

darin (Chen et al., 2018), and Galician (Cascallar-

Fuentes et al., 2018).

5 USER-ADAPTABLE RULES

1 {

2 ” c a t e g o r y ” : ” i n t e r e s t −r e l a t e d ” ,

3 ” number ” : 300 ,

4 ” a f f e c t e d ” : 100 ,

5 ” q u a n t i f i e r ” : ” some ” ,

6 ” s t a t e ” ’ : ” a f f e c t e d ” ’ ,

7 ” m a x d e v i a t i o n ” : 120

8 }

Listing 1: Example result from rule execution.

The first and most important goal of the user-

generated rules is the identification of relevant pat-

terns of deviation within the results of the regression

testing runs. Each calculation which is performed by

the risk calculation algorithm has different categori-

sations, like “interest-related” or “Monte Carlo sce-

nario”. Patterns of interest are in general multiple de-

viations within the same category. With the Camunda

DMN engine, the experts are e.g. able to set tolerance

thresholds for deviations in different categories or de-

fine the minimum number of affected values which

constitute a pattern. Moreover, the experts are also

able to influence the language generation on a limited

level. They can e.g. use the DMN annotation to define

quantifiers, like the phrase “a few” will be used if up

to 15% of the values in one category are affected, “all”

if 100% are affected and so on. They could also use it

to express the state of affection, e.g. if the deviation is

more than 5% it could be defined as “affected”. List-

ing 1 shows an example of how the output of a rule

execution could look like. For each category which is

defined as part of a rule, such a JSON object will be

created.

User-adaptable Natural Language Generation for Regression Testing within the Finance Domain

615

Asset type: Synthetic Instrument

No pattern found.

Asset type: Equity Forward

No pattern found.

Asset type: Market Index

There are 10 market indexes in the database.

10 market indexes are affected. This amounts

to 100.00% of all market indexes. Maximum

deviation observed is 101.41%.

Figure 3: Example report from system version 1.

6 REPORT GENERATION

These JSON objects are the input for the NLG compo-

nent. A first version of the system just naively created

a document with a separate section for each of the

JSON objects. An example output from this first ver-

sion can be seen in Figure 3. This first, rather clunky

version was mainly used to evaluate the contained in-

formation with financial experts (cf. Section 7). After

their feedback was taken into account, a second ver-

sion was developed which focused on making the text

more “natural” and readable. This second version was

evaluated with non-experts. Figure 4 show the output

of the second version for the same input data. The

new version mainly reduces redundancies by merging

sentences and different categories and removing rep-

etition of the same information.

7 EVALUATION

We ran two separate evaluations with the two different

versions of the system. They only differ in the text re-

alisation as shown in Figure 3 and 4. The first version

was evaluated with a paper-based questionnaire and

professionals and students from the partner company

(“expert evaluation”). The second evaluation was an

open online evaluation which was advertised through

social media accounts (“online evaluation”). While

the first evaluation focused on the tool and its utility,

the second evaluation focused on the quality of the

produced texts.

To the experts, the tool was presented in individual

sessions, the functionality was explained and they had

a chance to try the tool. Afterwards, they were shown

example reports generated by the system. They were

18 participants in this evaluation which were asked

to rate three statements about the shown texts on a

7 point Likert scale from “completely disagree” to

Asset types: Synthetic Instrument and Equity

Forward

No patterns were found.

Asset type: Market Index

There are 10 market indexes in the database,

all of them are affected. The results deviate

up to 101.41%.

Figure 4: Example report from system version 2.

“completely agree”:

• “The text is easy to read and understandable.”

(Q1)

• “The text is helpful for the data analysis.” (Q2)

• “I would like to see more variation in the text.”

(Q3)

Subsequently, participants were asked to rate three

statements about the system which they just saw:

• “The tool is helpful” (Q4)

• “The tool will help me to decide which data

should be analysed deeper” (Q5)

• “I would like to use the tool for future analyses.”

(Q6)

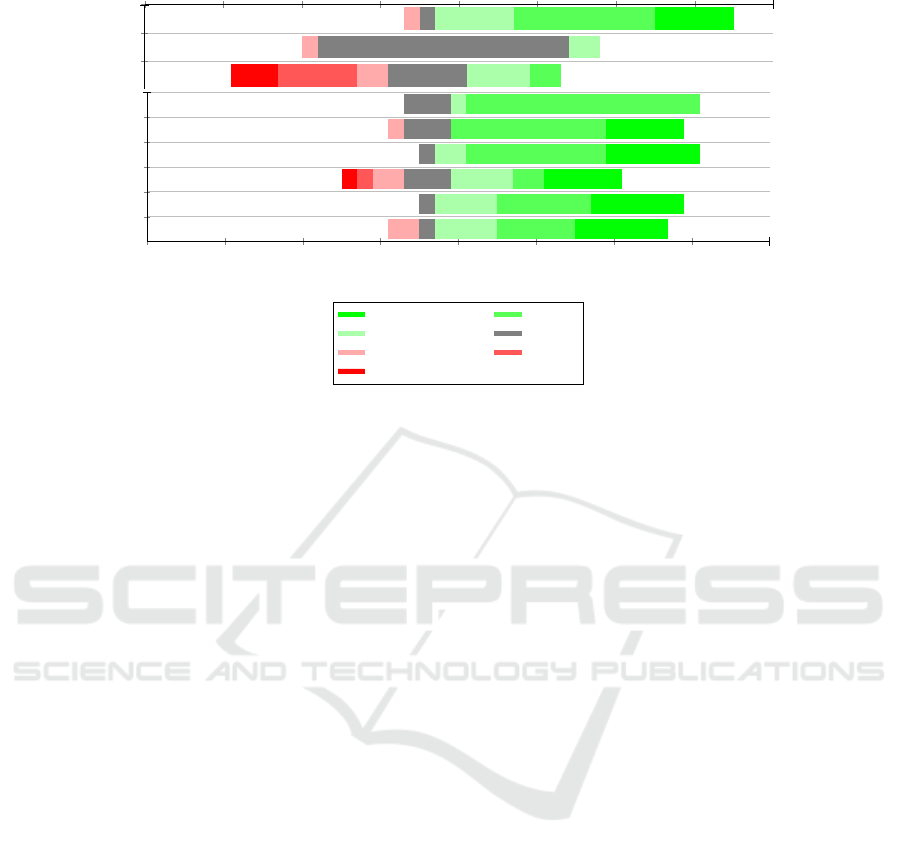

The results for all statements are shown in Figure 5.

In the online evaluation, participants were shown

example texts from the second version of the system

and three statements, which again could be rated on

a seven-point Likert scale. Moreover, there was also

a free text field for comments. The three statements

were:

• “The text is easy to read and understandable.”

(S1)

• “I would like to see more variation in the text.”

(S2)

• “The text is grammatically correct.” (S3)

In this evaluation, 21 people participated, the results

are also shown in Figure 5.

Overall, both evaluations have been very positive,

especially the expert evaluation. The only clear nega-

tive reaction was from the online evaluation, where

participants did not find the texts easy to read and

understandable. Five participants also mentioned in

the free text comment that they struggled to under-

stand the texts. Two participants mentioned that they

did not even understand the words which were used.

Looking at the example in Figure 4, it is not surpris-

ing that non-experts struggle to understand the texts

and it is not necessarily a shortcoming of the system.

While in general positive, the meaningfulness of the

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

616

20 15 10 5 0 5 10 15 20

S1

S2

S3

20 15 10 5 0 5 10 15 20

Q1

Q2

Q3

Q4

Q5

Q6

number of answers

completely agree

agree

slightly agree neutral

slightly disagree disagree

completely disagree

Figure 5: Likert scale results from the evaluation.

results for Q3 and S2 is rather limited, since partici-

pants only saw a few texts in a very short time and it

might still be that they get “tired” of repetitions when

using the system for a longer time.

8 CONCLUSION

In this paper, we presented a system that supports fi-

nancial experts from the insurance industry to evalu-

ate the results of regression testing runs for Solvency

II risk calculations. We integrated the system in the

existing workflows and empowered the users to adapt

the rules by which the system operates. A first evalu-

ation with expert users showed promising results. In

the future, we would like to conduct a task-based eval-

uation to check, whether the positive perception of the

system is also matched by a measurable improvement

in task solving.

REFERENCES

Altinok, D. (2018). An ontology-based dialogue manage-

ment system for banking and finance dialogue sys-

tems. arXiv preprint arXiv:1804.04838.

Banulescu, D. and Colletaz, G. (2013). High&frequency

risk measures.

Braun, D., Klimt, K., Schneider, D., and Matthes, F.

(2019). Simplenlg-de: Adapting simplenlg 4 to ger-

man. In Proceedings of the 12th International Con-

ference on Natural Language Generation, pages 415–

420, Tokyo, Japan.

Cascallar-Fuentes, A., Ramos-Soto, A., and Bugar

´

ın Diz,

A. (2018). Adapting SimpleNLG to Galician lan-

guage. In Proceedings of the 11th International Con-

ference on Natural Language Generation, pages 67–

72, Tilburg University, The Netherlands. Association

for Computational Linguistics.

Chen, G., van Deemter, K., and Lin, C. (2018).

SimpleNLG-ZH: a linguistic realisation engine for

Mandarin. In Proceedings of the 11th International

Conference on Natural Language Generation, pages

57–66, Tilburg University, The Netherlands. Associa-

tion for Computational Linguistics.

de Jong, R. and Theune, M. (2018). Going Dutch: Creat-

ing SimpleNLG-NL. In Proceedings of the 11th In-

ternational Conference on Natural Language Gener-

ation, pages 73–78, Tilburg University, The Nether-

lands. Association for Computational Linguistics.

D

¨

orr, K. N. (2016). Mapping the field of algorithmic jour-

nalism. Digital Journalism, 4(6):700–722.

Gatt, A. and Reiter, E. (2009). Simplenlg: A realisation en-

gine for practical applications. In Proceedings of the

12th European Workshop on Natural Language Gen-

eration, pages 90–93. Association for Computational

Linguistics.

Haarmann, B. and Sikorski, L. (2015). Natural language

news generation from big data. International Journal

of Computer, Electrical, Automation, Control and In-

formation Engineering, 9(6):1454–1460.

Kukich, K. (1983). Design of a knowledge-based report

generator. In Proceedings of the 21st annual meeting

on Association for Computational Linguistics, pages

145–150. Association for Computational Linguistics.

Lammert, J. (2015). Evaluation des camunda bpmn work-

flow systems. Master’s thesis, Universit

¨

at Magdeburg.

Liu, Q., Lu, X., Ren, F., and Kuroiwa, S. (2004). Au-

tomatic estimation of stock market forecasting and

generating the corresponding natural language expres-

sion. In Information Technology: Coding and Com-

User-adaptable Natural Language Generation for Regression Testing within the Finance Domain

617

puting, 2004. Proceedings. ITCC 2004. International

Conference on, volume 1, pages 241–245. IEEE.

Mazzei, A., Battaglino, C., and Bosco, C. (2016).

SimpleNLG-IT: adapting SimpleNLG to Italian. In

Proceedings of the 9th International Natural Lan-

guage Generation conference, pages 184–192, Edin-

burgh, UK. Association for Computational Linguis-

tics.

Murakami, S., Watanabe, A., Miyazawa, A., Goshima,

K., Yanase, T., Takamura, H., and Miyao, Y. (2017).

Learning to generate market comments from stock

prices. In Proceedings of the 55th Annual Meeting

of the Association for Computational Linguistics (Vol-

ume 1: Long Papers), volume 1, pages 1374–1384.

Okuda, T. and Shoda, S. (2018). Ai-based chatbot ser-

vice for financial industry. FUJITSU SCIENTIFIC &

TECHNICAL JOURNAL, 54(2):4–8.

Plachouras, V., Smiley, C., Bretz, H., Taylor, O., Leidner,

J. L., Song, D., and Schilder, F. (2016). Interacting

with financial data using natural language. In Pro-

ceedings of the 39th International ACM SIGIR Con-

ference on Research and Development in Information

Retrieval, SIGIR ’16, pages 1121–1124, New York,

NY, USA. ACM.

Proctor, M. (2012). Drools: A rule engine for complex

event processing. In Proceedings of the 4th Interna-

tional Conference on Applications of Graph Trans-

formations with Industrial Relevance, AGTIVE’11,

pages 2–2, Berlin, Heidelberg. Springer-Verlag.

Ramos-Soto, A., Janeiro-Gallardo, J., and Bugar

´

ın Diz, A.

(2017). Adapting SimpleNLG to Spanish. In Pro-

ceedings of the 10th International Conference on Nat-

ural Language Generation, pages 144–148, Santiago

de Compostela, Spain. Association for Computational

Linguistics.

Reiter, E. and Dale, R. (1997). Building applied natural

language generation systems. Natural Language En-

gineering, 3(1):57–87.

Vaudry, P.-L. and Lapalme, G. (2013). Adapting Sim-

pleNLG for bilingual English-French realisation. In

Proceedings of the 14th European Workshop on Natu-

ral Language Generation, pages 183–187, Sofia, Bul-

garia. Association for Computational Linguistics.

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

618