Barriers for the Advancement of an API Economy in the German

Automotive Industry and Potential Measures to Overcome these Barriers

Gloria Bondel, Sascha N

¨

agele, Fridolin Koch and Florian Matthes

Chair for Software Engineering for Business Information Systems, Faculty of Informatics,

Technical University of Munich, Boltzmannstrasse 3, Garching, Germany

Keywords:

API Economy, Service Ecosystem, Web APIs, Automotive Sector.

Abstract:

The API Economy is a type of service ecosystem that emerged due to organizations using Web APIs to provide

third parties with access to their resources, i.e., functionality or data. It is argued that participation in the

API economy creates value and offers strategic advantages to API providers. However, there are sectoral

differences within the API Economy, with specific sectors being more advanced than others. Since there are

currently no explanations for these differences between sectors, this research aims at providing insights into

barriers inhibiting the advancement of the API Economy as well as potential measures to overcome these

barriers for a specific sector, the automotive industry. We apply a Grounded Theory Methodology approach

based on interviews with 21 experts from OEMs, automotive suppliers, consultants, mobility start-ups, and

insurance firms. As a result, we present 14 legal, economic, social, technological, and organizational barriers.

Furthermore, we derive five measures to overcome these barriers.

1 INTRODUCTION

An ecosystem perspective is increasingly applied in

research and literature, enabling organizations to ana-

lyze the progressively more complex and dynamically

changing environment they operate in (Basole, 2019;

Adner, 2016). The ecosystem metaphor has been in-

troduced by (Moore, 1996), who defined a business

ecosystem as ”An economic community supported by

a foundation of interacting organizations and individ-

uals – the organisms of the business world.” Within a

business ecosystem, organizations create value sym-

biotically (Basole, 2019).

A type of service ecosystem that is currently draw-

ing attention is the API Economy (Basole, 2019; Ba-

sole, 2016; Evans and Basole, 2016). At the heart of

the API Economy are Web Application Programming

Interfaces (Web APIs), which are machine-readable

interfaces that make resources, i.e., functionality or

data, accessible via the public internet. The providers

of Web APIs aim at directly or indirectly monetiz-

ing the exposed resources. At the same time, Web

API consumers use the newly available resources as

a foundation to develop new applications or services.

The resulting new resource constellations enable the

realization of new business models.

From a provider perspective, the provision of APIs

creates value, increases productivity, and offers strate-

gic advantages (Evans and Basole, 2016). Neverthe-

less, previous research shows that Web APIs are dis-

tributed unevenly across organization types and in-

dustry sectors (Basole, 2019). However, to the best

of the authors’ knowledge, there are currently no ex-

planations why these differences in the advancement

of the API Economy in different sectors exist. There-

fore, the goal of this research paper is to provide in-

sights into barriers hampering the advancement of the

API Economy as well as potential measures to over-

come these barriers.

We investigate the automotive sector with a fo-

cus on vehicle-generated data, which is data gener-

ated by sensors mounted in- and outside of vehicles

(Abdelhamid et al., 2015). Vehicle-generated data

is a valuable resource since it provides the basis for

new services that improve the security and comfort

of a driver (Bertoncello et al., 2016) and is highly

requested by third parties (EC, 2016). Also, a re-

cently published ISO standards series defines speci-

fications for Web APIs providing access to vehicle-

generated data (Smethurst, 2017; McCarthy et al.,

2017). Therefore, prerequisites for providing vehicle-

generated data using Web APIs to enable a flourishing

service ecosystem seem to be met. Nevertheless, the

API Economy is only slowly emerging in the automo-

Bondel, G., Nägele, S., Koch, F. and Matthes, F.

Barriers for the Advancement of an API Economy in the German Automotive Industry and Potential Measures to Overcome these Barriers.

DOI: 10.5220/0009353407270734

In Proceedings of the 22nd International Conference on Enterprise Information Systems (ICEIS 2020) - Volume 1, pages 727-734

ISBN: 978-989-758-423-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

727

tive sector.

Therefore, we aim at providing insights into the

reasons for sectoral differences in the API Economy

by addressing the following two research questions:

RQ1: What are barriers to the provision of vehicle-

generated data using Web APIs in the German auto-

motive sector?

RQ2: What are potential measures to overcome

barriers for the provision of vehicle-generated data

using Web APIs in the German automotive sector?

To address these research questions, we conducted

19 interviews with 21 interviewees from Original

Equipment Suppliers (OEMs), automotive suppliers,

automotive associations, consulting firms, mobility

start-ups, and insurance firms. We analyzed the col-

lected data using a Grounded Theory Methodology.

Based on this data, we identify 14 barriers hamper-

ing the advancement of the API Economy in the auto-

motive sector clustered into the categories legal, eco-

nomic, social, technological, and organizational. Ad-

ditionally, five potential measures to overcome these

barriers are derived. With these findings, we con-

tribute to a better understanding of challenges in the

advancement of the API Economy in the automotive

industry. Future work will investigate barriers in other

sectors to allow for cross-case conclusions.

In the following, we describe relevant concepts,

present our research approach, present, and discuss

the findings.

2 FOUNDATIONS

2.1 Web APIs and API Economy

Application Programming Interfaces (APIs) are

machine-readable interfaces that enable applications

and databases to share assets like functionalities and

data while encapsulating implementation details (Ja-

cobson et al., 2011). Different technologies and pro-

tocols can be used to implement APIs, but we focus

on Web APIs, which expose their resources over the

public internet and are accessed using the HTTP pro-

tocol (Bermbach and Wittern, 2016).

From a provider perspective, APIs can be catego-

rized into different types depending on their intended

user group and goals. In general, APIs are either pri-

vate or public. An API is private if it is only accessible

for a predefined group of developers, which can be in-

ternal (internal API) or external (partner API) to the

API providers organization. Internal APIs are usu-

ally used to foster interoperability and reuse, while

partner APIs regularly aim at facilitating integration

with external partners, generally in the context of spe-

cific business processes. Public APIs, on the other

hand, can be accessed by everyone interested in the

resources offered. The goal of providing open APIs

is usually to generate additional profits through direct

or indirect monetization of the API (Jacobson et al.,

2011).

In the past, the research focus has been primar-

ily on private APIs, with the goal of enabling inte-

gration and reuse. However, recent developments in

mobile devices, decreasing data storage costs, and in-

creasing economic value of data, lead to a dramatic

growth in the number of public Web APIs in the

last couple of years (Basole, 2019), with currently

over 23,000 public APIs across different industry sec-

tors registered in the most extensive public API reg-

istry, ProgrammableWeb

1

. Furthermore, organiza-

tions like Salesforce and eBay generate more than

half of their revenue via APIs (Iyer and Subramaniam,

2015). This abundance of APIs allows third parties

to access newly available resources, enabling the cre-

ation of new applications or services (Evans and Ba-

sole, 2016).

Web APIs enable the realization of new busi-

ness models for API providers as well as consumers,

enabling a type of service ecosystem, the so-called

API Economy (Basole, 2019). A service ecosys-

tem is defined as: ”A relatively self-contained, self-

adjusting system of mostly loosely coupled social and

economic (resource-integrating) actors connected by

shared institutional logics and mutual value creation

through service exchange.” (Lusch and Nambisan,

2015). Thus value is created by organizations form-

ing relationships (Basole, 2019; Rouse and Basole,

2010) using digital connectors, e.g., Web APIs. In

the context of digital platforms for third party devel-

opment, these digital connectors are sometimes also

referred to as boundary resources (Eaton et al., 2015;

Ghazawneh and Henfridsson, 2013; Ghazawneh and

Henfridsson, 2010).

Even though the provision of public Web APIs

supposedly creates value, increases productivity, and

offers strategic advantages, APIs are distributed un-

evenly across organization types and industry sec-

tors (Evans and Basole, 2016; Basole, 2016; Basole,

2019). First of all, ecosystem analysis revealed that

mainly young, digital organizations actively provide

public Web APIs, e.g., Amazon and Google, com-

pared to more traditional, established organizations

1

https://www.programmableweb.com/, accessed on

12/09/2019.

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

728

(Evans and Basole, 2016). Additionally, there are dif-

ferences across sectors, with mapping, e-Commerce,

and social APIs being most relevant in the API Econ-

omy ecosystem (Basole, 2019). Thus, organizations

choose different API strategies to influence their po-

sition within the ecosystem as well as the health of

the ecosystem as a whole (Basole, 2019). However,

the best of the authors’ knowledge, currently no ex-

planations for the differences between sectors within

the API Economy exist.

2.2 Status Quo of the API Economy in

the Automotive Sector

The automotive sector provides an appealing indus-

try for analyzing barriers for the advancement of the

API Economy since it is a sector characterized by tra-

ditional organizations. Additionally, prerequisites for

providing access to data seem to be met, but the API

Economy nevertheless advances only slowly.

Data generated by sensors mounted inside and

outside of a vehicle, e.g., odometer or ambient tem-

perature, is called vehicle-generated data (Abdel-

hamid et al., 2015). Vehicle-generated data is a valu-

able resource since it provides the basis for digital

connectivity between vehicles, between vehicles and

the transportation infrastructure (EC, 2016), and be-

tween cars and third-party service providers. Con-

nectivity is the foundation for new services improv-

ing road safety, traffic efficiency, and driving comfort

(EC, 2016). An analysis conducted in 2016 revealed

that in general, customers are interested in services

based on vehicle-generated data, which increases the

safety and convenience of mobility (Bertoncello et al.,

2016). The same study estimated the overall rev-

enue pool for monetization of vehicle-generated data

to reach 450 – 750 billion USD by 2030. Also, for

almost a decade, there have been calls from vari-

ous stakeholders within and outside of the automo-

tive industry requesting to make vehicle-generated

data available (McCarthy et al., 2017). Finally,

(Evans and Basole, 2016) observed a rapid increase

of transportation-related APIs, which goes beyond

vehicle-generated data, including, e.g., public trans-

portation APIs. This leads to the assumption that an

API Economy in the automotive sector should flour-

ish.

However, the implementation of vehicle-

generated data using public APIs progresses only

slowly, since the growth and shape of a new market

for these services depends on the question who can

access the data, and under which condition it can be

accessed (McCarthy et al., 2017). Currently, data

generated by sensors of a vehicle is transferred to

a backend server of an OEM via a mobile network.

Thus, the OEMs are in a powerful position since

they decide which parties get access to the data

and which approach for data access they provide.

However, reacting to the market pressure, OEMs

have committed themselves to provide a data server

platform to grant access to vehicle-generated data

to third parties per the standardization project Ex-

tended Vehicle (ExVe) which resulted in the ISO

20077, ISO 20078 and ISO 20080 standards and

the Neutral Extended Vehicle for Advanced Data

Access (NEVADA) approach. The goal of these

standardization projects is to provide third-parties

with standardized and non-discriminatory access to

vehicle-generated data by granting them access to the

backend server of the OEM, where vehicle-generated

data is stored. In this research paper, we will focus

on the provision of access to vehicle-generated data

via data server platforms following the ExVe and the

NEVADA concepts.

As of November 2019, German OEMs that have

implemented the ExVe and NEVADA approaches are

BMW

2

for specific BMW and Mini cars and Daimler

3

for certain Mercedes Benz cars. Each implementation

consists of an API platform enabling third parties to

access vehicle-generated data of a customer as well

as a customer-facing portal providing vehicle owners

with the possibility of releasing or withdrawing data

access rights for respective third parties. Also, both

APIs can be accessed via neutral car data platforms

like Otonomo

4

and HIGH MOBILITY

5

.

However, the number of services realized based

on vehicle-generated data provided via the Web APIs

is currently still minimal. Existing use cases, e.g.,

pay-as-you-drive insurances or driver logbooks, are

predominantly realized using data collected via mo-

bile apps or the in-vehicle on-board diagnosis (OBD)

connector. An OBD interface is a mandatory and pre-

cisely specified physical connector in a vehicle that

provides access to specific data, e.g., error messages

for diagnosis purposes. However, data access via mo-

bile apps or the OBD connector is very limited.

Summarizing, while there is high potential to cre-

ate value through new services based on vehicle-

generated data as well as high pressure to release the

data, which even culminated in corresponding stan-

dards, the API Economy is only slowly advancing in

the automotive sector. Therefore, the automotive in-

dustry provides an interesting case study for analyz-

2

https://www.bmwgroup.com/de/innovation/technologie

-und-mobilitaet/cardata.html

3

https://developer.mercedes-benz.com/

4

https://otonomo.io/

5

https://about.high-mobility.com/

Barriers for the Advancement of an API Economy in the German Automotive Industry and Potential Measures to Overcome these Barriers

729

ing barriers for the advancement of an API Economy

and measures to overcome these barriers.

3 RESEARCH APPROACH

This research paper aims at identifying barriers and

measures to overcome these barriers for the API

Economy in the automotive sector. To achieve these

goals, we apply a Grounded Theory Methodology,

which is suitable for research on technological change

and socio-technical behavior for which limited prior

research exists (Wiesche et al., 2017). The Grounded

Theory Methodology approach that we applied com-

prises data collection, open coding, and selective cod-

ing.

We conducted a total of 19 semi-structured inter-

views with 21 experts in the time between October

2018 and February 2019. We targeted experts from

the automotive industry, using existing contacts of our

chair. We deliberately chose experts with different

perspectives, including OEMs, automotive suppliers,

automotive associations, mobility startups, consulting

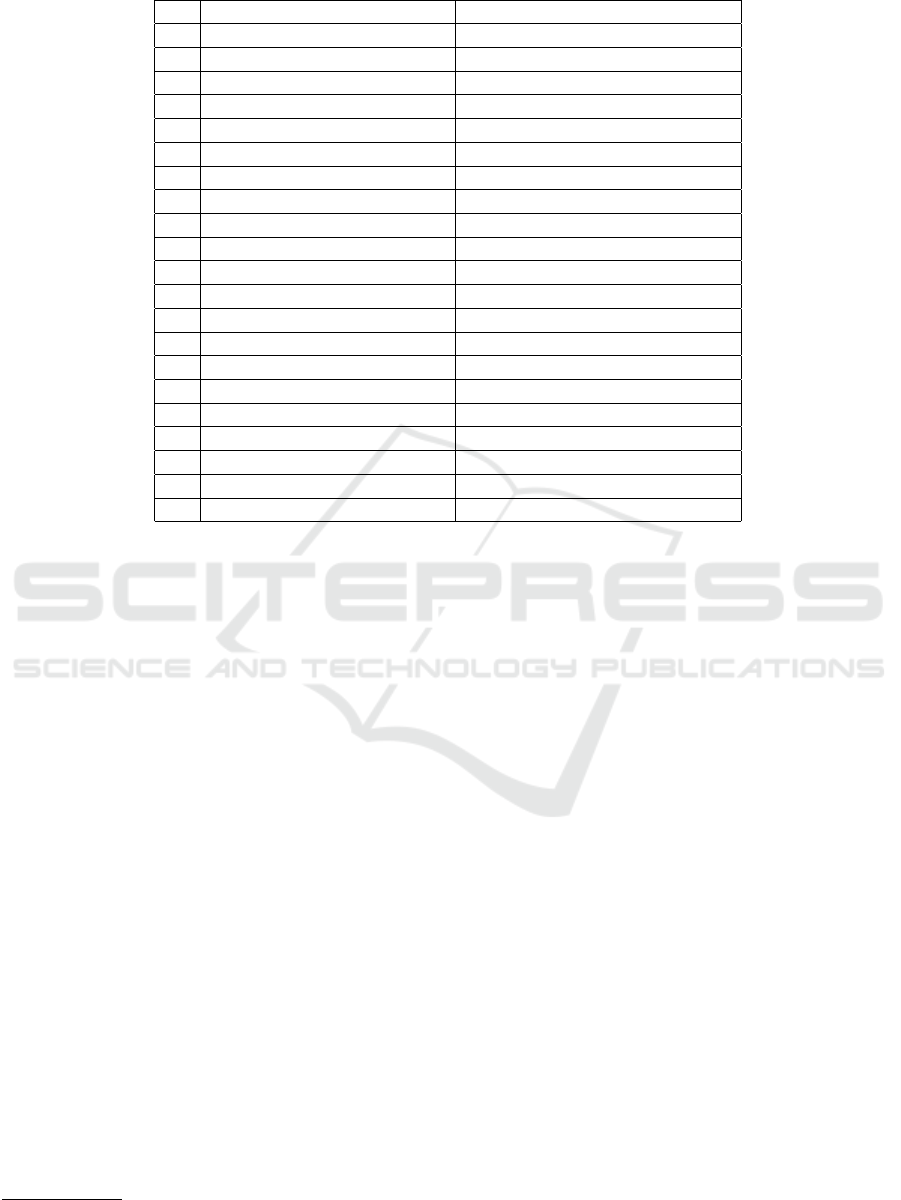

firms, and insurances. Tab. 1 provides an overview of

all interview partners. The semi-structured interviews

comprised seven open-ended questions and took 34

minutes on average. We recorded and transcribed

each interview.

To analyze the collected data, we applied open

coding to the interview transcripts resulting in 641

codes across 286 categories. This first analysis step

was conducted to gain a better understanding of the

use case domain and provided a basis for selective

coding. During selective coding, we focused on bar-

riers and measures to overcome these barriers. Over-

all, we identified 14 barriers categorized into legal,

economic, social, technological, and organizational

barriers. Furthermore, we derived five potential mea-

sures to overcome these barriers. We used the tool

MAXQDA to support the coding process.

4 IDENTIFIED BARRIERS

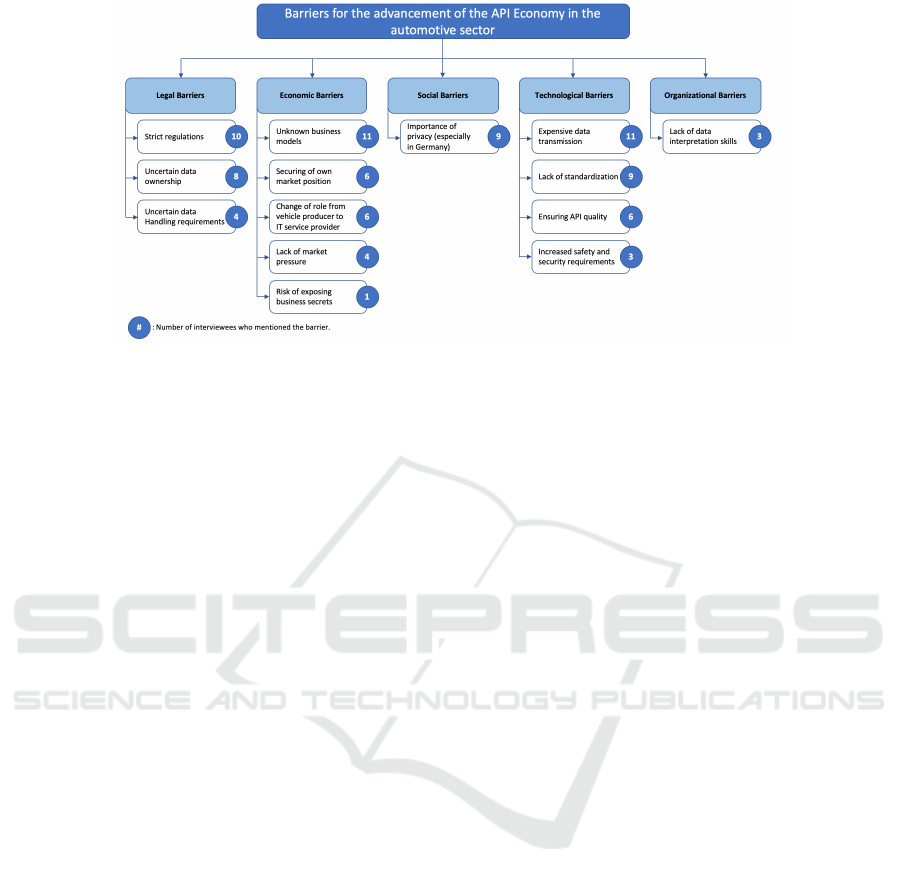

This chapter presents 14 identified barriers for open

vehicle-generated data clustered into the categories

legal, economic, social, technological, and organiza-

tional. Figure 1 provides an overview of the barriers.

In the following, we will describe each of the identi-

fied barriers in more detail.

4.1 Legal Barriers

The category legal barriers comprises three barriers

that are related to German or international legislation.

Strict Regulations. Strict privacy regulations, espe-

cially the GDPR, can hamper the implementation of

open vehicle-generated data projects. While the inter-

viewees deem the need to get the explicit consent of

the consumer as solvable, purpose limitation and the

right to delete personal data are obstacles. However,

the right to delete personal data is only applicable to

data that has is not anonymized.

Uncertain Data Ownership. Some interviewees

stated that it is currently not clear who owns vehicle-

generated data. Data protectionists argue that the data

belongs to the drivers of a car and their passengers

since they produce the data. Here, a clear distinction

has to be made between the driver of a vehicle and

the owner of a car, especially since shared mobility

concepts like car sharing lead to the fact that the own-

ership and use of cars often no longer coincide. Even

though no interviewee argued that the data should be-

long to the owner of a car, a court decision exists,

where the course of a car accident was reconstructed

based on data collected by the car-sharing provider

(Breitinger, 2016). Furthermore, some OEMs argue

that specific data should belong to them since they

carry the cost of data collection and storage. Finally,

one could also argue that governmental institutions

should have the right to specific data concerning the

well-being and safety of society, i.e., the information

on the condition of the infrastructure.

Uncertain Data Handling Requirements. Another

barrier is concerned with uncertainty regarding how

data should be stored and processed by the data col-

lectors. There are currently no guidelines or prece-

dents regarding the classification of data into different

data categories (e.g., personal/non-personal), the pri-

vacy requirements for each data category, and the def-

inition of access rights for various parties (e.g., private

organizations/the government). Furthermore, the lia-

bility of organizations storing data providing safety-

relevant information is not clear. As one interviewee

reported, an entity collecting data could be liable for

not forwarding safety-relevant information that this

entity could theoretically derive from stored data.

4.2 Economic Barriers

Business considerations cause economic barriers, of

which we identified a total of five.

Unknown Business Models. The collection and pro-

vision of vehicle-generated data requires considerable

financial effort, as the OEM must create and main-

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

730

Table 1: Overview of interview partners.

ID Organisation Classification Role

1 Consulting Technical Architect

2 Mobility Startup CTO

3 Consulting Head of Department Automotive

4 Consulting Digital Innovation Officer

5 Mobility Startup Senior Partner Manger

6 Insurance Technical Architect

7 Automotive supplier Business Development

8 Automotive supplier Business Development

9 Automotive Association Head of Department IT

10 Consulting Head of Department IT

11 Automotive supplier Head of Department IT

12 OEM Technical Architect

13 Mobility Startup Head of Department IT

14 OEM Business Analyst

15 Automotive Association Product Manager

16 Mobility Startup Data Analyst

17 Finance Managing Director

18 Insurance Technical Architect

19 OEM Technical Architect

20 OEM IT Project Manager

21 OEM Business Project Manager

tain the appropriate infrastructure. Potential revenues

offsetting these efforts are difficult to quantify in ad-

vance. The difficulty in defining the value of data is

because it is not known which use cases, and therefore

which data, is relevant for third parties. First experi-

ences have shown that rather simple data is requested,

which could also be collected by a mobile phone.

Securing of Own Market Position. The German au-

tomotive market is a market with few but large OEMs,

which traditionally compete against each other. Al-

though there were already first cooperations between

these OEMs, e.g., the joint acquisition of the naviga-

tion system developer HERE

6

by Daimler, Audi, and

BMW, each OEM tries to protect its market position.

This also hinders the development of a common plat-

form.

Change of Role From Vehicle Producer to IT Ser-

vice Provider. The classic business model of OEMs

is the production and sale of vehicles, as well as

the subsequent absorption of profits on the aftermar-

ket. This traditional business model is now increas-

ingly threatened by new trends such as Mobility-as-

a-Service and Shared Mobility. Thus, the automotive

ecosystem changes as well as the OEMs role within

that ecosystem. The OEMs new role creates chal-

lenges such as building new skills in software engi-

neering and changes in mindset. Besides, the com-

6

https://www.here.com/

petition is expanded from a small number of other

OEMs to include also mobility start-ups and large dig-

ital companies such as Google and Apple. Also, the

new business models are deemed to be less profitable

for OEMs. OEMs are therefore trying to exploit ex-

isting business models for as long as possible before

disrupting their business model.

Lack of Market Pressure. A further aspect is miss-

ing market pressure from customers. End customers

do not actively request new features and services in

cars, and therefore there is no market pressure on the

OEM to use or share data to enable new services.

Risk of Exposing Business Secrets. The provision

of vehicle-generated data could enable far-reaching

analyses of the vehicle itself. These analyses could

provide insight into the technologies used or reveal

deficiencies of individual vehicle models. Concerns

that third parties might gain access to these business

secrets relating to the OEM’s core products, therefore,

hamper the provision of specific data.

4.3 Social Barriers

Social barriers arise due to consumers’ sentiments re-

lated to the sharing and value of vehicle-generated

data. One social barrier has been identified.

Importance of Privacy (Especially in Germany).

Customers fear that third parties could gain insight

into their driving behavior based on collected data.

Barriers for the Advancement of an API Economy in the German Automotive Industry and Potential Measures to Overcome these Barriers

731

An example mentioned was that a driver’s mood could

be recognized, which could be relevant for insurance

in case of an accident. Thus, customers often asso-

ciate negative feelings with the sharing of data with

third parties. Interviewees often mention that this bar-

rier is especially relevant for the German market due

to the traditionally conservative attitude in Germany

towards data sharing. As a result, the high importance

of privacy hampers customers’ willingness to share

data with the OEM. Furthermore, it also influences

OEMs willingness to share data with third parties as

they fear that data sharing could lead to a negative im-

age, even when they meet the legal requirements.

4.4 Technological Barriers

The limitations of current technologies cause techno-

logical barriers. We identified four such barriers.

Expensive Data Transmission. The sensors of the

car generate vehicle-generated data, which the car

then transfers to a backend server via a mobile net-

work. This architecture creates a technical challenge

with regards to the data transfer between the vehicle

and the backend server due to the significant amounts

of data that can be generated by vehicle sensors. Ex-

isting mobile networks are not capable of transferring

these amounts of data, and even the 5G network may

not be sufficient in some instances, e.g., when a foot-

ball match ends and several thousand cars try to leave

the car park simultaneously. Besides, using mobile

networks is particularly expensive in Germany com-

pared to other countries.

Lack of Standardization. Standardization is a sig-

nificant barrier for the advancement of an API Econ-

omy in the automotive sector since each OEM pro-

vides its proprietary platform for vehicle-generated

data. The platforms realize different implementations

of web services concerning data protocols, architec-

ture paradigms used (e.g., REST, GraphQL), SLAs,

billing models, etc. Also, the data differs in type

and quality not only between different OEMs but also

for various vehicle models, different configurations

of a model, and the year of production. Although

ExVe and Nevada already provide standardization ap-

proaches defining which resources a data platform in-

terface should provide, the standards do not describe

implementation details, since too high a degree of

standardization could inhibit innovation. However,

the remaining degree of freedom in the design of

web services still leads to high efforts for third party

providers when integrating vehicle-generated data of

OEMs.

Ensuring API Quality. To enable third-party

providers to build business models based on vehicle-

generated data provided via an API, the API has to be

of acceptable quality with regards to function as well

as non-functional requirements. However, to guaran-

tee the quality of an API, OEMs have first to ensure

the quality of data internally, which can be cumber-

some.

Increased Safety and Security Requirements. The

malfunction of a vehicle, whether caused by a fault

within the system or triggered by an attacker, can

have devastating consequences. Safety and security,

therefore, play a particularly important role in the au-

tomotive sector. The provision of a web service to

access vehicle-generated data is associated with high

requirements in terms of safety and security to avoid

penetration of systems running in the vehicle.

4.5 Organizational Barriers

Organization barriers capture barriers caused by cur-

rent organizational structures in data collecting and

data processing organizations.

Lack of Data Interpretation Skills. A further chal-

lenge based on the significant amount of data is miss-

ing experiences and expertise with regards to data in-

terpretation. Currently, OEMs, as well as startups, are

missing these skills.

5 POTENTIAL MEASURES

In this section, potential measures to overcome some

of the barriers for advancing the API Economy in

the automotive sector will be presented. Overall, five

measures have been derived based on the analysis of

the interviews.

End-user Empowerment. Eleven interviewees men-

tioned end-user empowerment as a measure that could

help overcome mainly social barriers. On the one

hand, end-user empowerment aims at providing data

owners with the power to control how their data is

processed and by whom, including the option of not

sharing data at all. Additionally, providers have to

educate end-users on their data-related rights and the

implications of both sharing data or not. Thus, end-

user empowerment aims at creating trust on the side

of the end-user.

Market Pressure. Nine interviewees mention market

pressure, which can be exerted by different stakehold-

ers. First, end users are changing their behavior and

adapting to new digitized services in various domains,

e.g., digitized health care apps. This trend leads to the

end-users requesting integrated solutions also in the

automotive sector, e.g., they want to access data gen-

erated by two cars of different brands belonging to

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

732

Figure 1: Overview of barriers for the advancement of the API Economy in the automotive sector.

the same household using a single platform. Further-

more, some interviewees expect that foreign competi-

tors will start making vehicle-generated data available

and realize associated business models, thus exerting

pressure on the German automotive industry. Finally,

several experts expect a significant first-mover advan-

tage, with new business models, with new business

models often being introduced by startups.

Clear and Legally-binding Government Regula-

tion. Mentioned by eight interviewees, a further po-

tential measure are clear and legally binding govern-

ment regulations. On the one hand, clear means that

new regulations should define a standard for the API

design. On the other hand, clearness refers to the

removal of uncertainties with regards to data owner-

ship and data handling requirements. Furthermore,

new regulations should be legally binding since only a

few OEMs implemented the ExVe and the NEVADA

standards, to which the OEMs commitment them-

selves. During the interviews, several comparisons

with other domains have been drawn, e.g. the PSD2

in the banking sector or the HIPAA Privacy Rule for

medical data in the US, which should be monitored

and could be used as templates for a regulation for

vehicle-generated data.

Edge Computing. Addressing technological barri-

ers, especially the expensive data transmission, five

interviewees suggested edge computing as a useful

solution approach. The increasing amount of data

generated in a vehicle could be preprocessed in the

vehicle to reduce the amount of data before transfer-

ring it over the mobile network. However, preprocess-

ing requires mounting expensive hardware in the car,

e.g., powerful CPUs. Therefore, OEMs have to care-

fully consider the amount of logic implemented in the

vehicle.

Collaboration between OEMs. Collaboration be-

tween OEMs was mentioned by three interviewees,

who believe that OEMs should work together to pro-

vide a neutral server as suggested by the NEVADA

standard. This measure would address the barrier

of lacking standardization between data providers.

However, the German automotive market is very com-

petitive, and it was not detailed how OEMs should be

motivated to collaborate.

6 CONCLUSION

The API Economy is a type of service ecosystem that

promises value generation for organizations partici-

pating in it. However, there are sectoral differences

within the API Economy, with specific sectors being

more advanced than others. These observations lead

to the question of what causes these differences. Ad-

dressing this research gap, we provide insights into

barriers hampering the advancement of the API Econ-

omy for vehicle-generated data in the German auto-

motive sector. To identify these barriers, we applied

a Grounded Theory Methodology approach based on

interviews with 21 experts. Overall, we identified 14

barriers. Furthermore, we derive five potential mea-

sures to overcome these barriers. Our findings con-

tribute to the identification of barriers and drivers for

the emergence of the API Economy. Furthermore,

our results provide a starting point for analyzing the

reasons for differences in the advancement of an API

Economy between different sectors.

The analysis of the data shows legal, economic,

social, technological, and organizational barriers. Le-

gal barriers arise due to legal restrictions and uncer-

tainty, which could be addressed with clear, legally

binding government regulations. Focusing on eco-

nomic aspects, barriers are concerned with unknown

Barriers for the Advancement of an API Economy in the German Automotive Industry and Potential Measures to Overcome these Barriers

733

business models and the changing role of OEMs

caused by current trends in the automotive industry,

hampering the OEMs willingness to make vehicle-

generated data accessible. These economic barriers

could be overcome by forcing OEMs to provide ac-

cess to vehicle-generated data using government reg-

ulations but also by building market pressure. An ad-

ditional finding regarding economic barriers that we

would like to mention is that several interviewees ex-

plained that the availability of a critical amount of

data would be necessary to gain experiences with

new business models. However, current legal reg-

ulations hamper the collection of data, i.e., purpose

limitation, and the competitive situation in the auto-

motive market. This creates a catch-22 situation, with

data not being made accessible due to missing expe-

riences and missing experiences due to missing data

availability. Barriers in the social category arise due

to a lack of trust of end-users in organizations han-

dling their data. A measure to overcome this barrier

could be end-user empowerment. Technological bar-

riers are mainly concerned with large amounts of data

that have to be transmitted, as well as a lack of stan-

dardization between data providers. Edge computing

could address the first of these barriers, while the lat-

ter would profit from increased collaboration between

OEMs. Even though we also identified organizational

barriers, we deem them as insignificant since intervie-

wees described them as easily solvable.

Limitations of the validity of the presented re-

search arises from the focus on the German automo-

tive market and the limited number of 21 intervie-

wees. Future work could address these limitations

by analyzing barriers and drivers for the emergence

of the API Economy in other sectors to enable cross-

case conclusions.

REFERENCES

Abdelhamid, S., Hassanein, H. S., and Takahara, G. (2015).

Vehicle as a resource (vaar). IEEE Network, 29(1):12–

17.

Adner, R. (2016). Ecosystem as structure: An actionable

construct for strategy. Journal of Management, 43.

Basole, R. C. (2016). Accelerating digital transformation:

Visual insights from the api ecosystem. IT Profes-

sional, 18(6):20–25.

Basole, R. C. (2019). On the evolution of service ecosys-

tems: A study of the emerging api economy. In Hand-

book of Service Science, Volume II, pages 479–495.

Springer.

Bermbach, D. and Wittern, E. (2016). Benchmarking Web

API Quality. pages 188–206.

Bertoncello, M., Camplone, G., Gao, P., Kaas, H.-W., Mohr,

D., M

¨

oller, T., and Wee, D. (2016). Monetizing car

data - New service business opportunities to create

new customer benefits. Technical report, McKinsey

& Company.

Breitinger, M. (2016). Geteiltes Auto, geteilte Daten.

https://www.zeit.de/mobilitaet/2016-07/carsharing-

drive-now-datenschutz-bewegungsprofil. Accessed:

12/11/2019.

Eaton, B., Elaluf-Calderwood, S., Sørensen, C., and Yoo, Y.

(2015). Distributed tuning of boundary resources: The

case of apple’s ios service system. MIS Q., 39(1):217–

244.

EC (2016). C-ITS Platform Final Report. Technical report,

European Commission.

Evans, P. C. and Basole, R. C. (2016). Revealing the api

ecosystem and enterprise strategy via visual analytics.

Commun. ACM, 59(2):26–28.

Ghazawneh, A. and Henfridsson, O. (2010). Governing

third-party development through platform boundary

resources. page 48.

Ghazawneh, A. and Henfridsson, O. (2013). Balancing plat-

form control and external contribution in third-party

development: The boundary resources model. Infor-

mation Systems Journal, 23.

Iyer, B. and Subramaniam, M. (2015). The Strate-

gic Value of APIs. https://hbr.org/2015/01/

the-strategic-value-of-apis. Accessed: 12/09/2019.

Jacobson, D., Brail, G., and Woods, D. (2011). APIs: A

Strategy Guide. O’Reilly Media, Inc.

Lusch, R. and Nambisan, S. (2015). Service innovation:

A service-dominant logic perspective. MIS Quarterly,

39:155–175.

McCarthy, M., Seidl, M., Mohan, S., Hopkin, J., Stevens,

A., and Ognissanto, F. (2017). Access to In-vehicle

Data and Resources. Technical report, European

Commission.

Moore, J. F. (1996). The death of competition: leader-

ship and strategy in the age of business ecosystems.

HarperCollins Publishers.

Rouse, W. and Basole, R. (2010). Understanding Complex

Product and Service Delivery Systems, pages 461–

480.

Smethurst, G. (2017). Zugang zum Fahrzeug und

zu im Fahrzeug generierten. Daten Das Konzept

“NEVADA-Share & Secure“*. Technical report, Ver-

band der Automobilindustrie (VDA).

Wiesche, M., Jurisch, M. C., Yetton, P. W., and Krcmar, H.

(2017). Grounded theory methodology in information

systems research. MIS Q., 41(3):685–701.

ICEIS 2020 - 22nd International Conference on Enterprise Information Systems

734