Comparative Study of e-Commerce Ventures: Copycat Enablers

in Business Models

Christian Haertel, Matthias Pohl, Sascha Bosse, Robert H

¨

ausler, Abdulrahman Nahhas,

Daniel Staegemann, Matthias Volk and Klaus Turowski

VLBA-Lab, Otto-von-Guericke University, Magdeburg, Germany

abdulrahman.nahhas@ovgu.de, daniel.staegemann@ovgu.de, matthias.volk@ovgu.de, klaus.turowski@ovgu.de

Keywords:

Copycats, e-Commerce, Rocket Internet, Entrepreneur, Business Model Canvas.

Abstract:

The copycat approach - replicating proven business models - presents an alternative to following the classic

entrepreneurial path in venture creation which is highly contested due to the common perception of being

non-innovative and of low-risk. However, existing literature contradicts this conception. This paper features a

case study of German e-commerce copycats and their American originals, showing that success of imitating

firms cannot be guaranteed despite the utilization of proven business models. From this, potential crucial

features influencing the destiny of these copycats are extracted. The outlined enablers are the served markets,

post-imitation learning and the usability of the platform. Furthermore, possible useful other tendencies that

could be examined in future research are provided.

1 INTRODUCTION

Potential benefits of founding a business range from

“being one’s own boss” and the resulting self-

determination to facing new and unique challenges

to steadily reinvigorate motivation. Especially young

adults tend to pursue these advantages in contrast to

mere monetary compensation (ADP Research Insti-

tute, 2016). Obviously, becoming an entrepreneur

that runs a prosperous venture does not represent a

trivial task at all. According to Gompers et al., only

18% of first-time innovative entrepreneurs achieve

success in their undertaking which the authors define

as the business “going public” (Gompers et al., 2008).

In Germany, another approach of founding is pur-

sued by Rocket Internet. Baumann and K

¨

ohler char-

acterize the organization as an “incubator and in-

vestment firm” or “startup factory” (Baumann et al.,

2018). Rocket Internet’s track record boasts more

than 100 companies launched since its establishment

in 2007. As opposed to the entrepreneurial method,

Rocket Internet does not rely on creating innovative

business ideas. In reality, this translates to copy-

ing auspicious business models (especially from e-

commerce) and applying them to a local, potentially

untapped market (Baumann et al., 2018). The result-

ing organizations are so-called “copycats” because

their construction based on an already existing busi-

ness concept. Accordingly, this idea of founding com-

panies is highly contentious and possesses a bad repu-

tation (Shenkar, 2010). However, according to Posen

and Martignoni, the plain imitation of market lead-

ers without any improvements or adaptations does

not resolve to success (Posen and Martignoni, 2018).

Therefore, the goal persists in “executing better on

the same idea”. This so-called “post-imitation learn-

ing” helps remaster known practices to close possible

knowledge gaps to achieve higher performance levels

(Posen and Martignoni, 2018).

Copycats are able to rely on lots of experiences

from their examples and thus, are more likely to be

successful initially in comparison to “classic” en-

trepreneurs (Toft-Kehler et al., 2014). Nevertheless,

not many copycats show that they sustain their pros-

perity in the long run (e.g. MyVideo, DaWanda or

studiVZ). Therefore, the following question occurs:

Which features of a copycat’s business model serve

as enablers for its success?

Using other words, the goal is to find aspects who are

potentially critical to the existence of these firms. In

order to achieve the completion of this task, the paper

utilizes a Case Study analysis in which the business

models of different German copycats from Rocket In-

ternet and their originals from the e-commerce sec-

80

Haertel, C., Pohl, M., Bosse, S., Häusler, R., Nahhas, A., Staegemann, D., Volk, M. and Turowski, K.

Comparative Study of e-Commerce Ventures: Copycat Enablers in Business Models.

DOI: 10.5220/0009348200800090

In Proceedings of the 2nd International Conference on Finance, Economics, Management and IT Business (FEMIB 2020), pages 80-90

ISBN: 978-989-758-422-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

tor are compared argumentatively. In this process, we

use the Business Model Canvas for providing a lucid

summary of the example’s business idea. The find-

ings within the case study will help to answer which

points of the business concepts can be regarded as

pivotal for the prosperity of these copycat examples.

The engagement in this field of research might pro-

vide useful insights for potential founders as well as

for associates of copycats or Rocket Internet. There-

fore, Section 2 presents necessary prerequisites for

the above-mentioned case study that is described in

the third section. The findings are accumulated in the

fourth section where the results of the case analysis

are discussed. The work concludes with limitations

of the study while providing an outlook on potential

future research that could be added or extend the find-

ings.

2 PREREQUISITES

As briefly indicated in the introduction, the case study

involving copycats and their examples from the e-

commerce sector requires some foundations. There-

fore, this section contains the examination of the po-

sition of copycats in the business world resulting in

the analysis of Rocket Internet. Finally, this section

closes with the presentation of the Business Model

Canvas which serves as a template for summarizing

business models of the companies in the regarded

cases of the third section.

2.1 The Role of Copycat Organizations

in Today’s Business World

Next to the generic copycat definition (including e.g.

copycat crime) (wiktionary, 2019)

1

, one can clarify

such entity from an economic context as an orga-

nization which copies another one’s business model

from another market (Gr

¨

underszene Lexikon, 2019)

2

.

Many well-known representatives of this concept can

be found in Germany with mainly American ex-

amples: studiVZ (Facebook), Zalando (Zappos) or

MyVideo (YouTube) fit this category. But not only

business models pose the subject of potential trans-

fers. For instance, imitators are keen to adapt vi-

sual aspects of the original to their own brand (e.g.

products or logo). According to Loken and Ward,

these similarities possibly facilitate the acceptance as

1

URL: https://en.wiktionary.org/wiki/copycat (last check:

June 9, 2019).

2

URL: https://www.gruenderszene.de/lexikon/begriffe-

/copycat?interstitial (last check: June 9, 2019).

feasible alternatives for new market players (Loken

and Ward, 1990). Generally speaking, Collins-Dodd

and Zaichkowsky state that copycats may present a

threat to established firms because of their ability to

offer cheaper prices leading to potential loss of mar-

ket shares (Collins-Dodd and Lynne Zaichkowsky,

1999). Therefore, copycats pose a quite significant

challenge to these companies.

However, the paper focuses on the cloning of

business models. This methodology’s aim persists

in minimizing the required investment for brand and

market development (Miceli and Pieters, 2010) lead-

ing to the reduction of inconvenient R&D expenses

due to an experienced and field-tested basis (Shenkar,

2010). Theoretically, copycats seek to operate faster

with a lower risk than classic teams of entrepreneurs

(Baumann et al., 2018). Due to this and allegedly

presenting a low effort strategy, criticism obviously

arises (Posen and Martignoni, 2018). Critiques range

from “having nothing original to offer” over “non-

innovative” to “theft of ideas”. Even the connota-

tion of the term copycat is adverse. On first glance,

this bad reputation seems justified to a certain degree.

From an intuitive point of view, imitated firms have

every right to be frustrated when their costly elab-

orated business model is cloned. In the opinion of

Friestad and Wright, customers are even opposed to

“blatant” cloning (Friestad and Wright, 1993).

Another point of critique persists in the commonly

assumed fact that the copycat approach represents

a low-risk strategy (Posen and Martignoni, 2018).

However, this negative perception is contradicted by

Posen and Martignoni. They theorized imitation as

being more adventurous than widely regarded under-

lined by “bifurcated performance outcomes” of copy-

cats (Posen and Martignoni, 2018). The authors rea-

son this with the limited observability of the exam-

ple’s practices as a protection which means that the

copycat has to recreate the remaining ones through

so-called “post-imitation learning” (Nelson and Win-

ter, 1982). Here exists the possibility that example

and copy diverge from one another in terms of per-

formance followed by the risk for imitators. Their

choice of emphasis on certain practices for post-

imitation learning in the business model determines

whether the venture becomes a success (Posen and

Martignoni, 2018). Accordingly, Noailles-Sim

´

eon re-

gards copycats as entrepreneurs because one-to-one

copies are both not feasible and reasonable (Noailles-

Sim

´

eon, 2017). This means that imitation also pos-

sesses a “generative effect” referring to the refinement

of certain copied business model’s aspects in order

to differentiate or improve in contrast to the original

firm (“filling remaining knowledge gaps”) (Posen and

Comparative Study of e-Commerce Ventures: Copycat Enablers in Business Models

81

Martignoni, 2018). This clearly shows the potential of

copycats for innovation when trying to adapt on pos-

sibly lackluster facets of original practices.

Ultimately, copycats present a phenomenon in the

business world which is contentious. Nonetheless, as

imitation is a popular mechanism of organizational

learning, it is unlikely to disappear and therefore must

be taken into account (Posen and Martignoni, 2018).

Although copycats may not be as riskless and as easy

to build successful as initially thought, it is fair to

assume that classic entrepreneurship involves more

danger of failure. The same logic applies for inno-

vation aspects. A potential benefit of copycats per-

sists in the development of new and untapped mar-

kets which the original firm disregarded so that the

product or service becomes accessible to more con-

sumers (Baumann et al., 2018). As previously men-

tioned, not every copycat organization is able to grow

and sustain success. This goes against the perception

of experienced entrepreneurs creating more prosper-

ous ventures because of learning effects (Toft-Kehler

et al., 2014). Toft-Kehler et al. argue that merely hav-

ing experience does not necessarily “trigger increased

performance” when “incorrect inferences are drawn

(Levitt and March, 1988). On the contrary, founders

who draw the right conclusions are labeled “expert-

entrepreneurs” (Toft-Kehler et al., 2014). This relates

to the requirement of having these in leadership of

copycats. Consequently, Rocket Internet values itself

as experts engaging with effectively creating and run-

ning copycats (Baumann et al., 2018).

2.2 Rocket Internet - A Startup Factory

The purpose of this section persists in exploring how

a copycat firm is created in Rocket Internet’s realm.

For further details regarding the company, the paper

“Rocket Internet: Organizing a Startup Factory” by

Baumann et al. discusses this topic comprehensively.

The initial step represents the careful selection of aus-

picious business concepts (Baumann et al., 2018). Af-

terwards, Rocket Internet assigns a team to the project

mostly consisting of “ambitious business school grad-

uates” in contrast to freedom-loving entrepreneurs.

Funding presents the third pillar for a new venture.

Furthermore, offices and associated infrastructure as

well as customized IT assets are provided to enable

the business to start their operations in a quick fash-

ion. These features already suggest a strong parental

control of Rocket Internet on their startups (Baumann

et al., 2018). Obviously, the incubator firm expects

results in return for their investments which the asso-

ciates communicate aggressively.

Not every business idea is of interest for Rocket.

The copycat factory focuses on internet business mod-

els because offline ventures require more effort to

be put in information research. Basically, these e-

commerce examples represent easier to clone enti-

ties since the degree of observable activities is re-

duced in comparison (Baumann et al., 2018). Ac-

cordingly, high-tech business models are inapplica-

ble as well. Moreover, Rocket Internet seems to be

opposed to copy enormous ventures such as Ama-

zon. This is reasoned by the huge brand value which

adds to the quality of products or services which a

copycat could never replicate successfully (Baumann

et al., 2018). However, the last section outlined the

ineptitude of exact imitations (Posen and Martignoni,

2018). Following this principle, Rocket Internet seeks

“specialization on execution” facilitated by its cen-

tralized functions (Baumann et al., 2018).

Rocket Internet follows a low-risk approach in

venture establishment. Consequently, the company

aims to reduce technology risk, market risk and team

risk (Baumann et al., 2018). According to Preston,

the technology risk almost equals zero as the origi-

nal firm already proved its functionality. Rocket In-

ternet tries to decrease market problems by avoiding

competition with the examples on the same market.

Therefore, the goal persists in scaling the new ven-

ture into market leading companies rather in Europe

than where most imitated business models originate

from (Baumann et al., 2018). Thirdly, Rocket Inter-

net minimizes team risk by their mentioned team as-

sembling approach. However, adequately to the find-

ings of the previous subsection, pursuing the copycat

path for business creation does not guarantee success

shown by Rocket Internet’s losses in 2015 and 2016

(Baumann et al., 2018). Moreover, it should be noted

that the incubator firm did not produce any world-

famous brands.

2.3 Business Model Canvas

The Business Model Canvas (BMC) was first intro-

duced by Osterwalder and Vigneur serving as a “one-

page strategy or business model” (Osterwalder and

Pigneur, 2013). Its purpose persists in both the com-

munication and implementation of a company’s busi-

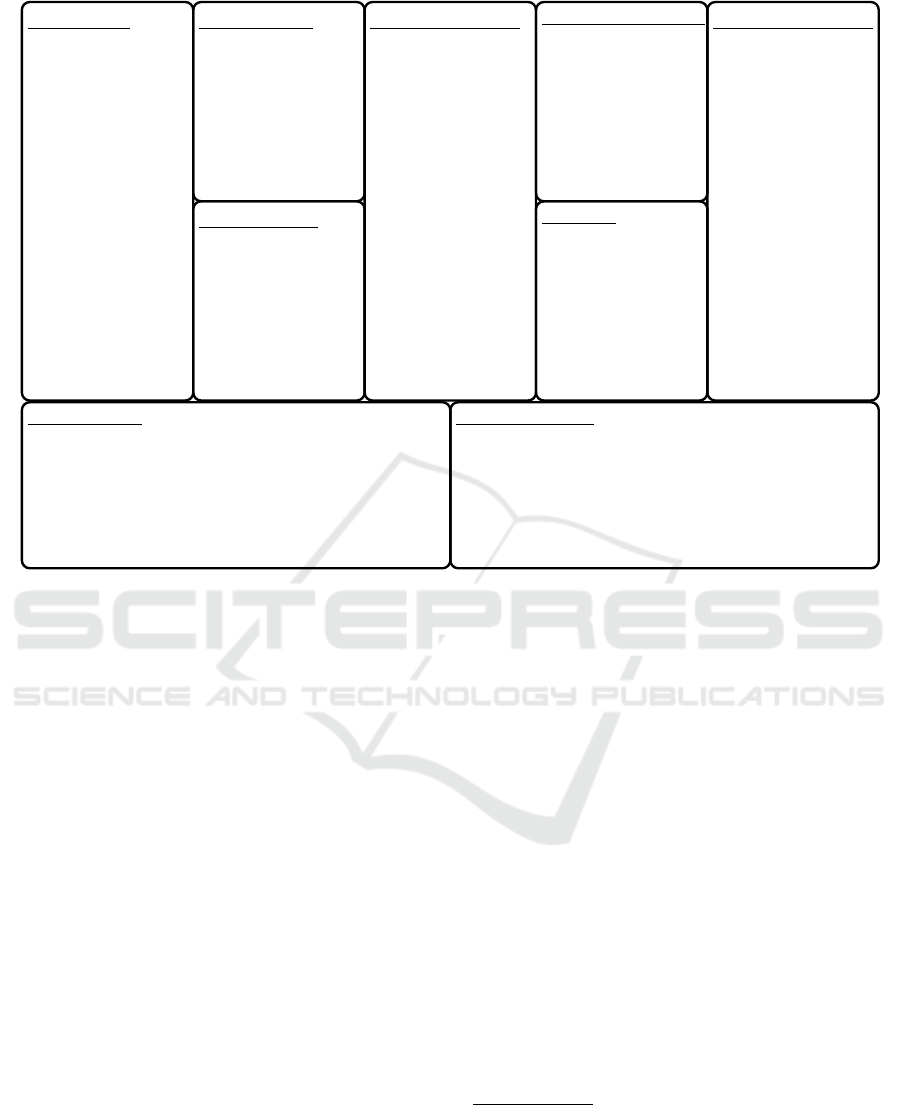

ness model (Frick and Ali, 2013). Figure 1 depicts

a template for the canvas showing its composition of

nine different sections that try to describe a venture’s

business concept. When answering shown questions,

one is able to provide a comprehensive overview.

However, fitting the often complex structure of an

enterprise’s concept into the BMC does not always

present a trivial assignment (Frick and Ali, 2013).

Joyce and Paquin extended the document to three

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

82

Key Partners

• Who are the key

partners?

• Which are our key

suppliers?

Key Activities

• What key activities do

the value propositions,

distribution channels,

customer relationships

and revenue streams

require?

Key Resources

• What key resources do

the value propositions,

distribution channels,

customer relationships

and revenue streams

require?

Value Propositions

• What value is

delivered to the

customer?

• Which one of the

customer’s problem is

helped to be solved?

• Which customer needs

are satisfied?

Customer Relations.

• What type of

relationship does each

of the customer

segments expect to be

established and

maintained with them?

• Which ones are

established?

Channels

• Through which

channels do the

customer segments

want to be reached?

• How are they reached

now?

Customer Segments

• For whom is value

created?

• Who are the most

important customers?

Cost Structure

• What are the most

important costs

inherent in the

business model?

• Which key resources

and key activities are

most expensive?

Revenue Streams

• For what value are the

customers willing to

pay?

• For what do they pay?

• How are they currently

paying?

Figure 1: Business Model Canvas Template (Osterwalder and Pigneur, 2013).

layers by adding both an environmental and a social

tier to the already existing economic view (Joyce and

Paquin, 2016). While the environmental layer ap-

pends the life cycle perspective, the social template

focuses on stakeholders. In the scope of this paper,

this version of the template is sufficient for present-

ing the examined business models. With the help of

the BMC, the concept of the evaluated companies can

be neatly introduced and the comparison with the re-

spective copycat is made more understandable to the

reader.

3 CASE STUDY

For extracting potential enablers of copycats in busi-

ness models, this section argumentatively contrasts

three American e-commerce ventures with their re-

spective German imitator. Accordingly, based on

available information about the firms and associated

papers, the six corresponding business models were

derived. Due to page limitation and similarity of the

copycat in various aspects, only the BMCs represent-

ing the original enterprises are illustrated for better

overview. The comparison focuses on key differences

and important aspects for the discussion in Section

4. The observed cases are the online fashion retail-

ers Zappos and Zalando, the internet shops for hand-

crafted products Etsy and DaWanda and lastly the on-

line retailers for furniture Wayfair and home24.

3.1 Zappos and Zalando

The online fashion company Zappos

3

was founded

back in 1999 to compensate the lack of large on-

line retailers for shoes (Summary-Smith, 2017). In

2001, one of the initial investors, Tony Hsieh, who

significantly defined Zappos’ business concept, took

over the CEO position (Kopelman et al., 2012). Un-

til 2008, following a troublesome start, the firm cata-

pulted its revenue from $1.6 million to more than $1

billion, leading to the acquisition through Amazon in

early 2009 (Kopelman et al., 2012).

In Germany, the copycat of Zappos was founded

in 2008 through investor capital of Rocket Internet

Zalando

4

(Wassink, 2012)

5

. Nowadays, the ven-

ture currently views itself as “Europe’s leading online

3

Website Zappos: https://www.zappos.com/ (last check:

July 2, 2019).

4

Website Zalando: https://www.zalando.de/ (last check:

July 2, 2019).

5

URL: https://www.abendblatt.de/wirtschaft/article1077-

31137/Zalando-mischt-den-Internethandel-auf.html (last

check: June 13, 2019).

Comparative Study of e-Commerce Ventures: Copycat Enablers in Business Models

83

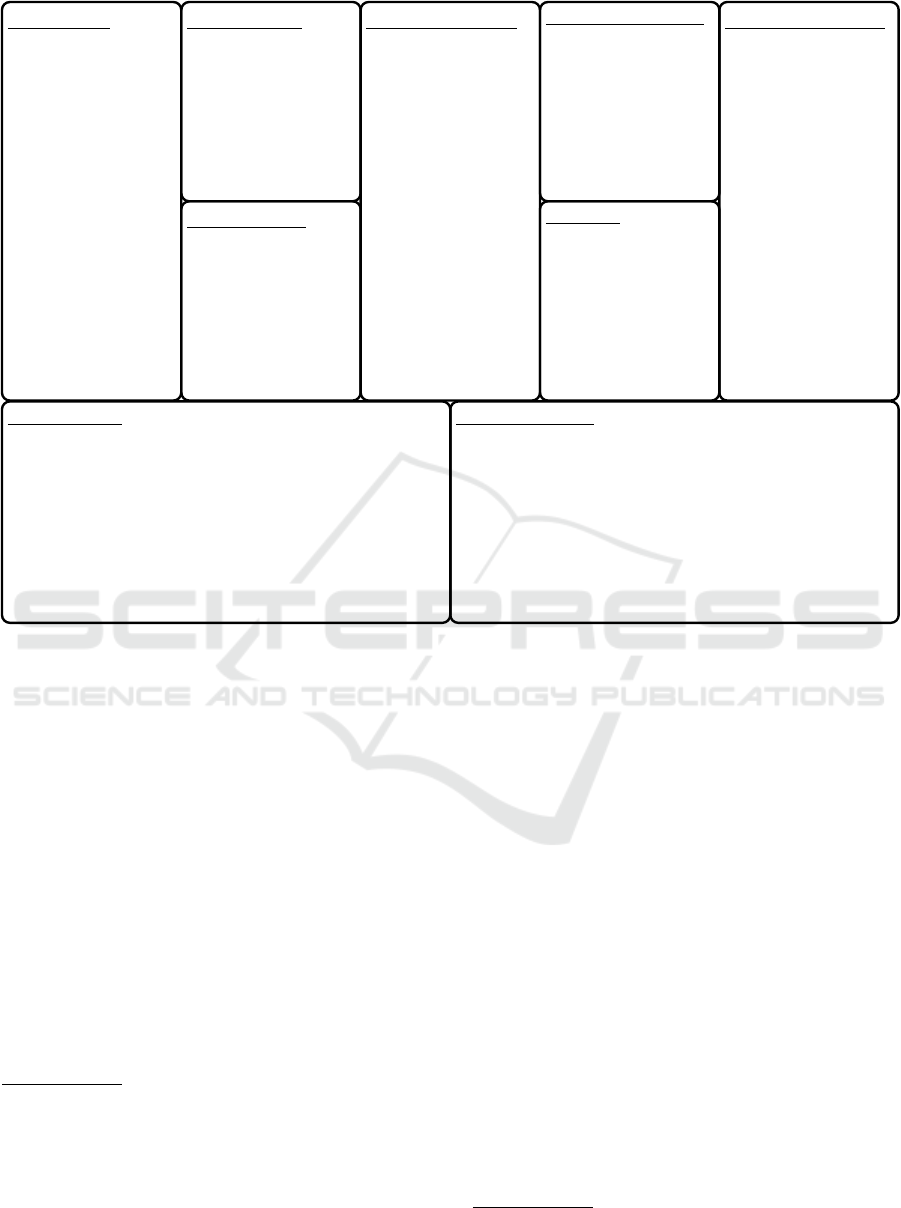

Key Partners

• Amazon (Warrick et al.,

2016)

• fashion brands

Key Activities

• huge investments in HR

(4-week orientation

program) (Warrick et al.,

2016)

• careful selection of

applicants

• customer service

Key Resources

• ambitious and motivated

employees through

organizational culture

(Holacracy) (Warrick et al.,

2016) + highly qualified

service personnel

• Amazon’s logistics network

Value Propositions

• exceptional,

individualized customer

service (Summary-Smith,

2017)

• wide selection of

products

• fast, accurate product

delivery

• deliver WOW (Warrick

et al., 2016)

• emotional impact

Customer Relations

• open, frequent and

honest relationship

(Warrick et al., 2016)

• encouragement to

provide feedback

• ensure customer loyalty

Channels

• multi-dimensional

communication (email,

website, video, blogs,

tweets, Facebook,

YouTube) (Warrick

et al., 2016)

• large call-center

Customer Segments

• fashion-interested mass

market

• markets: North America

Cost Structure

• customer service esp. call

center, HR (training,

complete welfare) (Warrick

et al., 2016)

• fees for merchants,

warehouses and inventory,

delivery & return freights,

advertising (low)

• IT infrastructure

Revenue Streams

• service

• Zappos Insights

• fashion

Figure 2: Zappos’ Business Model.

fashion platform” (Zalando, 2019a)

6

. Zalando origi-

nally gained attention due to its television advertising

(Horizont, 2012)

7

. Following both immense increase

of revenue and notable losses in the first of years of

activity, the online fashion company achieved 5.4 bil-

lion e of revenue and 173 million e of profit in 2018

(Zalando, 2019b)

8

.

For comparing both fashion retailers, Figure 2 dis-

plays Zappos’ Business Model Canvas. In terms of

proposed value, Zappos represents an interesting en-

tity. A large retailer for clothing must be able to of-

fer a wide selection of products bundled with a fast

and accurate delivery. Zalando poses no exception to

this (Zalando, 2019a). But Zappos unique attitude al-

most makes this aspect fade into the background. The

Southern Nevada-based venture promises an emo-

tional impact associated with the online purchase

6

URL: https://corporate.zalando.com/en/company/our-

business-fields (last check: June 13, 2019).

7

URL: https://www.horizont.net/marketing/nachrichten/-

Zalando-zieht-nach-Verlusten-die-Werbebremse-105812

(last check: June 13, 2019).

8

URL: https://corporate.zalando.com/de/investor-relations/

de/pressemitteilungen/zalando-schliesst-2018-erfolgreich

-ab-undsetzt-weiter-auf (last check: June 13, 2019).

of clothing items on their platform (Warrick et al.,

2016). In order to enable this, Zappos offers an ex-

ceptional and personal customer service (Summary-

Smith, 2017). Relatively similar, Zalando aims to

provide a unique shopping experience, offering the

feature of free delivery and return within 100 days

(Zalando, 2019a).

How does Zappos enable its value propositions?

The fashion retailer applies the Holacracy concept

which spreads the power within the whole company

(Summary-Smith, 2017). This approach intends to

improve performance of employees through higher

motivation because of the staff’s ability to contribute

to decisions (Warrick et al., 2016). Accordingly, Zap-

pos places importance on a careful screening of appli-

cants with the execution of a four weeks long orien-

tation for new colleagues. On that note, various pa-

pers engaged with examining Zappos’ working cul-

ture. In contrast, Zalando has faced negative press in

this area (Wikipedia, 2019)

9

. Besides online chan-

nels, Zalando also established several outlets in addi-

tion to their web presence. While Zappos primarily

9

URL: https://de.wikipedia.org/wiki/Zalando (last check:

June 15, 2019).

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

84

focuses on its domestic market in North America, Za-

lando currently serves 17 countries all over Europe

(Hannoversche Allgemeine, 2018)

10

. When pursuing

an approach like Zappos, including the call center and

complex HR training programs paired with welfare

benefits, huge expenses are necessitated to enable the

demanded infrastructure. In terms of marketing, Za-

lando definitely caused immense costs, seeing their

expensive TV appearance. Consequently, the fashion

retailer reduced their TV presence drastically in 2012

(Horizont, 2012).

Ultimately, the analysis shows different ap-

proaches and market focus. Since Zappos’ acquisition

through Amazon, official information on the financial

situation of Hsieh’s firm remain private. As Amazon

itself pursues their own fashion branch, this hints that

the importance of Zappos for Jeff Bezos’ giant is not

valued in dizzying heights (Graf, 2017b)

11

. On the

other side, Zalando finally turned profitable following

a rough start and most probably overtook Zappos in

terms of revenue (Zalando, 2019b). The copycat is

expected to continue its growth as the largest online

fashion retailer in Europe.

3.2 Etsy and DaWanda

Since its establishment in 2005, Etsy

12

(Etsy, 2019)

offers an online marketplace for unique and creative

goods where sellers can present their products to po-

tential buyers while paying Etsy both a listing fee and

a percentage of the sale price in a completed trans-

action (Etsy, 2019). The steady-growing handcraft-

loving community (40 million members) and the ad-

dition of new markets helped the American firm ac-

cumulating an annual revenue of approximately $600

million in 2018 (statista, 2019)

13

. Using Etsy as an

example, DaWanda was founded in 2006 (Kl

¨

asgen

and Alves, 2018)

14

. Supported financially by Rocket

Internet, this copycat became the leading platform for

DIY products in the DACH

15

region at its peak. Dur-

10

https://www.haz.de/Nachrichten/Wirtschaft/Deutschland-

Welt/Zalandoexpandiert-nach-Tschechien-und-Irland

(last check: June 13, 2019).

11

URL: https://www.kassenzone.de/2017/08/03/was-wurde

-eigentlich-auszappos/ (last check: June 15, 2019).

12

Website Etsy: https://www.etsy.com/ (last check: June

11, 2019).

13

URL: https://de.statista.com/statistik/daten/studie-/

151149/umfrage/onlineumsatz-von-etsy-inc/ (last check:

June 13, 2019).

14

URL: https://www.worldcrunch.com/business-finance/

how-english-andetsy-killed-germany39s-online-crafts-

leader (last check: May 31, 2019).

15

The region representing Germany, Austria and Switzer-

land.

ing these days, the business achieved around 380,000

sellers with six million offered products, representing

140 million euros in sale value (Kl

¨

asgen and Alves,

2018). However, since the business failed to generate

profit while also experiencing a stagnation in revenue,

the dismissal of one fourth of its 230 employees oc-

curred in 2017 (Graf, 2017a)

16

. Failing to reach the

desired effect, DaWanda decided to terminate its op-

erations at the end of August 2018, much to the shock

of its community (Marquart, 2018)

17

.

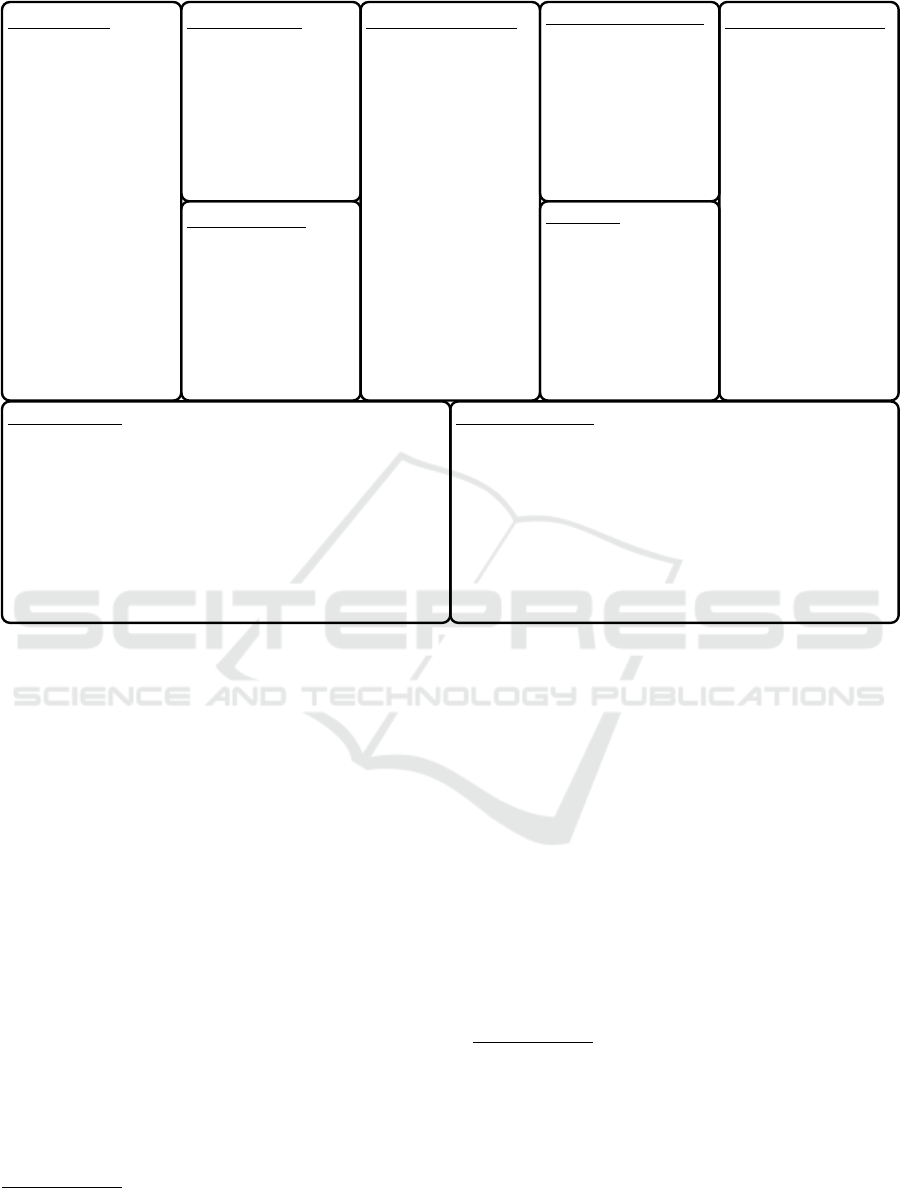

The fact that DaWanda suggested its commu-

nity to migrate to Etsy implies both business mod-

els equaling each other to a high degree. Figure 3

displays Etsy’s concept in the Business Model Can-

vas template. Regarding key activities, Etsy neces-

sitates the development of its platform and market-

ing operations (Kubacki et al., 2015). The platform

stands for more than just a marketplace, it is rather in-

tended to serve as a forum where people with the same

hobby connect to support each other (Kubacki et al.,

2015). Although information about DaWanda seem

to be limited in this area, it is fair to assume that the

company pursues akin activities. However, sources

report bad user experiences with the platform (Graf,

2017a) due to lacking technical standards (Kl

¨

asgen

and Alves, 2018). Referring to value propositions,

Etsy provides help for entrepreneurs through educa-

tion of its sellers via social media channels. As the

sellers support each other by exchanging experiences

on the platform, the goal is to gain more humanity and

sustainability in business (Kubacki et al., 2015). De-

spite using other wording for its value propositions,

DaWanda primarily offered similar aspects to its cus-

tomers (Helming, 2013)

18

.

First clear conflicts between the DIY platforms

appear in the supplied customer segments (Krugh,

2014). While Etsy mainly operated in North Amer-

ica, DaWanda focused on Germany and Europe. This

changed in 2010 when Etsy decided to expand onto

Europe (Marquart, 2018). From this point on, Etsy

and DaWanda stood in direct competition. Lastly, the

question remains how the DIY marketplaces gener-

ate income. In Etsy’s case, sellers must pay $0.20 for

each listing and 3.5% of the item’s prize when com-

pleting a transaction (Etsy, 2019). Furthermore, Etsy

and DaWanda gain additional turnover through seller

16

URL: https://www.kassenzone.de/2017/09/06/hausge-

machte-problemebei-individuell-bestickten-topflappen-

etsy-dawanda-analyse/ (last check: May 31, 2019).

17

URL: https://www.spiegel.de/wirtschaft/unternehmen/-

dawanda-onlinemarktplatz-geht-offline-etsy-will-

kunden-uebernehmen-a-1215822.html (last check:

May 31, 2019).

18

URL: https://de.slideshare.net/NOAHAdvisors/da-wanda

-noah13-london-28919455 (last check: May 31, 2019).

Comparative Study of e-Commerce Ventures: Copycat Enablers in Business Models

85

Key Partners

• sellers (Etsy, 2019)

• production partners

• third-party (developers

and payment

processors)

Key Activities

• marketing (Kubacki

et al., 2015)

• platform development

• seller services

• customer support

Key Resources

• 700+ employees

(Marquart, 2018)

• global community

(items, buyers and

sellers)

Value Propositions

• creative, global

commerce platform

(Etsy, 2019)

• unique products

• supporting

entrepreneurs (Kubacki

et al., 2015)

• more humanity in

business

Customer Relations

• create platform where

consumers establish

peer-to-peer

relationships (Etsy,

2019)

• educational → network

effects (Kubacki et al.,

2015)

Channels

• mainly through social

media to establish B2B

within large selling

community and help

each other (Etsy, 2019)

Customer Segments

• largely young and

female (88%) (Krugh,

2014)

• markets: North

America, Europe

(Marquart, 2018)

Cost Structure

• employees (customer

service)

• marketing expenses (seller

education) (Kubacki et al.,

2015)

• overhead (e.g. shipping,

importing, exporting)

• development + platform

maintenance

Revenue Streams

• $0.20 listing fee

• 3.5% fee for completed

sales (Etsy, 2019)

• seller services

Figure 3: Etsy’s Business Model.

services where a shop can pay extra for special pro-

motion of items and payment processing. Originally,

DaWanda’s commission for sales amounted to 9.5%

(formerly 5%) on top of the varying listing fee (0.10-

0.30 euro) (Melchior, 2016)

19

. With Etsy as a strong

competitor, the German copycat could not survive on

long-term (Marquart, 2018). Etsy’s benefits were the

English language, its solidified base market position

in North America and lower fees than DaWanda of-

fered (Kl

¨

asgen and Alves, 2018). With already stag-

nating growth and the need to release employees to

reduce costs, DaWanda was “destined to die a slow

death”. Due to the acquisition of many of DaWanda’s

customers, Etsy is sure to increase its momentary rev-

enue of $600 million in the future.

3.3 Wayfair and Home24

The next case to be examined involves online retail-

19

https://www.internetworld.de/e-commerce/online-

marktplatz/dawandaerhoeht-verkaufsprovision-um-90-

prozent-1179345.html (last check: June 14, 2019).

ers for furniture. The American example, Wayfair

20

,

was founded in 2002 in Boston and turned into “one

mega destination for the home” after merging the

standalone platforms in 2012 (Wayfair, 2019)

21

(sin-

gle platform strategy (Graf, 2018)

22

). Hereinafter, the

retailer rapidly grew in regards of engaged markets,

products, customers, suppliers and revenue. Accord-

ing to its website, the online furniture giant achieved

$7.3 billion in net revenue in the twelve months

prior to March 31, 2019 ($2 billion growth compared

to 2017) (Graf, 2018). Additionally, the company

boasts enormous figures in terms of products on offer

(14 million), employees (13,300) and suppliers (over

10,000) (Wayfair, 2019).

The story of the German Copycat Home24

23

com-

20

Website Wayfair: https://www.wayfair.com/ (last check:

July 2, 2019).

21

URL: https://www.wayfair.com/about/history.php (last

check: June 13, 2019).

22

URL: https://www.kassenzone.de/2018/03/06/ist-wayfair

-wirklich-derdurchbruch-im-onlinemoebelhandel-und-

vorbild-fuer-home24/ (last check: June 4, 2019).

23

Website home24: https://www.home24.com/websites/-

homevierundzwanzig/English/0/home-24.html (last

check: June 5, 2019).

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

86

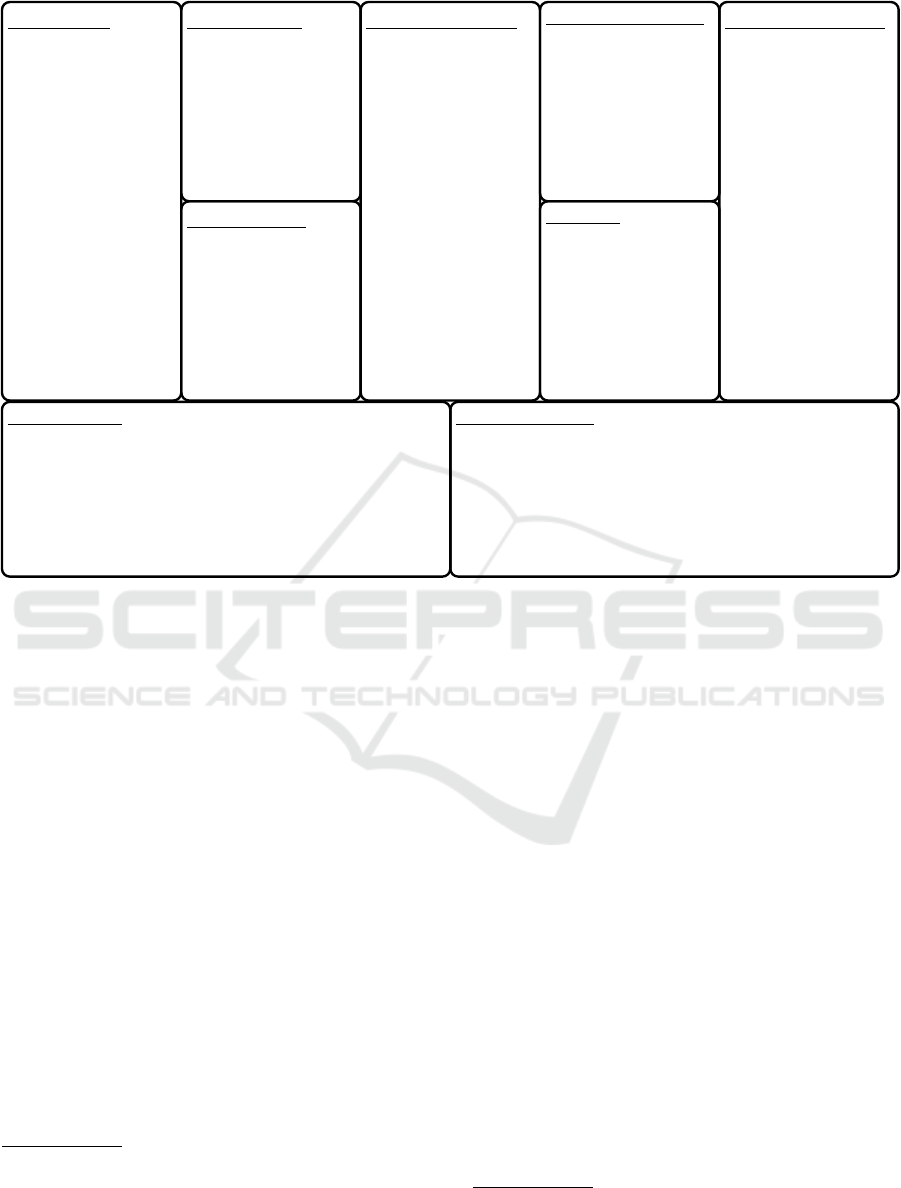

Key Partners

• manufacturer (Cronin,

2014)

• suppliers (Graf, 2018)

• own brands

• UPS, Fed-Ex, DHL

(Graf, 2015)

Key Activities

• customer service (Graf,

2015)

• development of

platform (Graf, 2018)

• data-driven decision

making (Cronin, 2014)

• brand aquisition

Key Resources

• brands (Graf, 2018)

• technology + platform

(data)

• millions of products,

thousands of suppliers

• employees (data scientists)

(Cronin, 2014)

Value Propositions

• vast selection of

products with no own

inventory (Cronin,

2014)

• for suppliers: offer

products

• for customers: finding

the right piece for

home online

Customer Relations

• pure-play online

(Cronin, 2014)

• achieving existing

clients (Graf, 2018)

Channels

• website

• social media

• app

• TV advertising (Graf,

2015)

Customer Segments

• online furniture-affine

customers

• advertisers (Graf, 2018)

• markets: North

America, Europe,

Australia (Wayfair,

2019)

Cost Structure

• fees for merchants

• marketing (Graf, 2015)

• platform & technology

(Graf, 2018)

• customer service

• HR

Revenue Streams

• product sales (Cronin,

2014)

• Wayfair Media

Solutions (advertising)

(Graf, 2018)

Figure 4: Wayfair’s Business Model.

menced relatively similar as Wayfair’s establishment

(home24, 2019). After combining the niche stores

in 2012, the home24 brand was created. Just as the

other examined imitators, home24 relied on capital

of Rocket Internet for enabling its operations (Graf,

2015)

24

. Following its growth and market expansions

onto eight countries, home24 states being the “lead-

ing pure-play home & living e-commerce platform in

continental Europe and Brazil” (home24, 2019). Of-

fering both third-party furniture and own brand prod-

ucts, the company possesses more than 100,000 prod-

ucts in its online store which are provided by approx-

imately 500 suppliers (home24, 2019). In financial

terms, home24 was able to strengthen its revenue to

313 million euro in 2018 (Schnor, 2019)

25

.

Figure 4 depicts the Business Model Canvas of

Wayfair. Both apply the so-called “dropshipping”

which means that the products presented on the plat-

form are directly delivered from the manufacturer to

the customer while minimizing own inventory risks

(Graf, 2018). For customers, the retailers grant the

24

URL: https://www.kassenzone.de/2015/01/24/moebel-

online-wergewinnt-wayfair-home24-westwing-ikea-co/

(last check: June 4, 2019).

25

URL: https://www.gruenderszene.de/business/home24-

verpasstumsatzziel-2018 (last check: June 13, 2019).

possibility to find the right item for their homes in

an “amazing experience” excluding the bothersome

traits from a visit to the furniture store (home24,

2019). In contrast to Wayfair, home24 states a timely

and convenient delivery within their value proposi-

tions (Graf, 2015). Wayfair’s key activities include

customer service (Graf, 2015) and the development

of the platform (Graf, 2018). The firms pursue data-

driven decision making based on the collection of

information from every purchase and every vendor

(home24, 2019)(Cronin, 2014).

In terms of key resources, in connection with tech-

nology and the platform, beneficial decision-making

improving “performance and growth” can be made

through the assembled information (Cronin, 2014).

For achieving long-term customer relationships, both

firms suffer enormous expenses: home24’s spending

here is numbered at 46 million euro which is huge in

context to the obtained revenue (Deutsch, 2019)

26

. In

terms of customer segments, the Boston-based com-

pany tapped on the European and Australian market in

addition to its North American home territory, mean-

ing the direct competition with home24 which is ac-

26

URL: http://www.deraktionaer.de/aktie/horror-perform

ance-bei-home-24-aktie-brutal-vermoebelt-457800.htm

(last check: June 15, 2019).

Comparative Study of e-Commerce Ventures: Copycat Enablers in Business Models

87

tive in both Europe and South America (Brazil).

The bulk of the furniture market remains primar-

ily static at the moment (Graf, 2015). This implies the

potential of vast growth for online retailers. However,

the issue persists in the high degree of competition.

Especially IKEA and Amazon pose a threat because

of their already well-established logistics network and

existing infrastructure which can guarantee proper de-

livery times and acceptable prizes (Graf, 2015). Ac-

cordingly, Wayfair and home24 need to find a balance

between lowering costs and also acquiring additional

customers while improving delivery times. Consider-

ing Wayfair’s already enormous size and growth, the

American company appears to occupy a workable po-

sition. On the other side, home24 struggles: Despite

increasing revenue, the share price collapsed by 78%

after failing the accomplishment of its growth fore-

cast (Deutsch, 2019). Additionally, a failed expansion

into the Asian market presents further negative news

around home24 (Regina, 2012)

27

.

4 DISCUSSION AND RESULTS

With the case study being completed, the first aspect

to discuss is related to customer segments. While the

examined pairs did not present any glaring differences

between served consumer bases, the view should be

extended on the markets the firms operate on. Log-

ically, all Etsy, Zappos and Wayfair pursue their do-

mestic North American market. On the other hand,

the German copycats are solely present on the Euro-

pean market apart from home24’s further expansion

to Brazil. Rocket Internet specifically intended for

their firms to avoid any direct competition with the

original organizations and rather serve untapped mar-

kets (Baumann et al., 2018). Seeing size and benefits

of a far more developed infrastructure of the imitated

companies, the copycats would be in a much weaker

position comparatively. Self-evidently, Rocket Inter-

net cannot ensure that their examples will not ex-

pand onto the European market which happened in

the cases of Etsy and Wayfair. In both instances, their

respective rivals, DaWanda and home24, find them-

selves in a quite poor state. On the contrary, Zappos

remained on “home soil” while Zalando continued

to grow in Europe, overtaking its example in terms

of revenue (Zalando, 2019b). The reasoning behind

Zappos neglecting the European market might persist

in their relationship with Amazon but a definite an-

swer cannot be drawn from the available information.

However, these observations imply that the copycats

27

URL: https://www.techinasia.com/rocket-internet-shuts-

down-home24 (last check: June 15, 2019).

are dependent on their competitors to stay away from

direct confrontation by avoiding expansion on “their”

European market.

The study of the business models revealed that the

copycats do not differ in many aspects from their orig-

inals. Intuitively, this does not present any ground-

breaking discovery since the intention of the dis-

cussed founding approach literally persists in repli-

cating proven venture concepts. Nevertheless, Posen

and Martignoni state that exact copies are not feasible

and adaptations should be performed through “post-

imitation learning” (Posen and Martignoni, 2018).

Following this, the copycats require at least some in-

novative aspects to contend, specifically when being

in direct competition with the imitated examples. The

predominant similarity of compared business models

showed that the examined copycats lack such unique-

ness which could prove an advantage in contrast to the

superior American firms. On that note and consid-

ering the differences in organizational culture (“Ho-

lacracy”), it would have been intriguing to monitor

what would have happen to Zalando if Zappos had

decided to expand on the European market.

Continuing with innovation aspects, another en-

abler in e-commerce copycat business models is the

platform. Apart from technological aspects, e.g.

for enabling more effective decision-making which

Rocket Internet weighs highly, the usability of the

websites where products and services are offered rep-

resents a crucial factor for the customer’s experience

and thus, the success of the venture (Kurosu et al.,

2009). In regards of this paper, DaWanda struggled

with keeping up with technical standards and provid-

ing a proper usability of its platform (Kl

¨

asgen and

Alves, 2018). These shortcomings proved to be a se-

vere detriment in competition with Etsy. Moreover,

there are factors which were just briefly regarded in

this paper due to either lack of insights or time re-

strictions. Nonetheless, these facets could still present

potential enablers for copycat success. For instance,

further studies could explore the influence of orga-

nizational culture. While the considered American

firms mainly pursued an informal approach to im-

prove employee performance and motivation, Rocket

Internet rather applied strong influence to their sub-

sidiary companies. Accordingly, it would be interest-

ing to comprehend the consequences on the staff in

terms of devotion and efficiency in the copycat ven-

tures.

A part of DaWanda’s downfall also persisted in

significantly higher fees for sellers in comparison to

Etsy. If information for other copycat cases could

be acquired in this area, additional investigations for

gaining further findings are certainly possible. This

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

88

aspect also relates to startup culture. While the USA

provides the most entrepreneur-friendly environment,

Germany lags behind (Nilsen, 2013)

28

. The case

study showed the pressure of becoming profitable for

the German copycats which seems to be a reason for

the risk adversity of Germans when it comes to found-

ing (Geibel and Manickam, 2015). On that note, addi-

tional discussion is required to potentially narrow the

gap to the USA in this regard. Finally, it was outlined

that the online furniture retailers Wayfair and home24

see themselves as well as offline giants such as IKEA

that are increasingly expanding their channels to the

e-commerce, as strong rivals (Graf, 2018). With that

in mind, the danger of these long-established players

for e-commerce copycats can be explored, too.

5 LIMITATIONS AND FURTHER

WORK

Section 4 outlined potential enablers of copycat suc-

cess based on the findings within the case study

of three pairs of e-commerce companies. It states

the competition on served markets, innovation (post-

imitation learning) and the usability of the respective

platform as important features. However, there are

some limitations to this paper that require reference.

First of all, the examination merely featured three

pairs of organizations due to time and page restric-

tions. Therefore, the discussed findings in the previ-

ous section cannot be held as valid facts. Nonetheless,

the results should be rated as useful tendencies for fur-

ther investigation in the course of other and a higher

amount of cases.

Considering the used examples here, both quantity

and quality of information potentially pose an object

of contestability to gained insights. While there are

dedicated scientific papers discussing the American

originals, the German copycats lack such academic

engagements. Accordingly, the necessary informa-

tion had to be collected from associated websites,

blogs or news. With the inclusion of such literature,

the danger of obtaining untrustworthy or conflicting

statements rises. In order to minimize this risk, em-

phasis was put on featuring various sources with sim-

ilar assertions about a topic. Despite that, slight errors

or inaccuracies possibly influencing the validity of re-

sults cannot be completely preempted due to the lack

of reliable scientific literature. Thus, further research

should be pursued in the discussed field.

28

URL: https://www.businessinsider.com/best-country-to-

be-an-entrepreneur-2013-8?IR=T#!IJHsb (last check:

August 21, 2019).

Additionally, the previous section already men-

tioned further potential enablers that could be exam-

ined in future works. As Rocket Internet mainly fo-

cuses on replicating relatively simple business models

(Baumann et al., 2018), the question arises whether

certain extracted copycat enablers would still be vi-

able and if new ones would occur in more complexly

structured ventures. Another restriction of this paper

persists in its focus on e-commerce enterprises. Con-

sequently, it would be interesting to explore different

types of such organizations. Alternatively, the influ-

ence of the type of e-commerce firm (B2C, B2B and

C2C) on the success in direct competition scenarios

might be worth examining.

Furthermore, the case study utilizes the one-

layered BMC for presenting the firms which might be

too close-minded to cover all aspect of an organiza-

tion’s value generation. Joyce and Paquin already ex-

panded the template to three layers (Joyce and Paquin,

2016). With this contribution, the authors helped cre-

ating a more holistic and integrated grasp of how an

organization adds “multiple types of value” (Joyce

and Paquin, 2016). Therefore, it would be intrigu-

ing to see if additional findings could be made visible

when also including the other tiers. Another limita-

tion presents the focus on German copycats of Rocket

Internet. On this note, examining different companies

of this sort outside of Germany and this startup fac-

tory could enrich the results. In their paper, Baumann

et al. already hinted at the existence of other incuba-

tor firms (Baumann et al., 2018). Ultimately, the goal

of this work persisted in exploring business models of

copycats and their originals to gain findings for en-

ablers of the imitators’ success within a case study,

possibly posing an object of interest to entrepreneurs

or concerned parties of copycats. Due to the explained

limitations, the extracted enablers should not be val-

ued as generally valid facts. However, the work can

still be regarded as successful with the discovery of

the three potential key features to provoke further dis-

cussion.

REFERENCES

ADP Research Institute (2016). Die Entwicklung der Ar-

beitswelt: Der Wandel der globalen Belegschaft.

Baumann, O., Bergenholtz, C., Frederiksen, L., Grant,

R. M., K

¨

ohler, R., Preston, D. L., and Shane, S.

(2018). Rocket Internet: organizing a startup factory.

Journal of Organization Design, 7(1):13.

Collins-Dodd, C. and Lynne Zaichkowsky, J. (1999). Na-

tional brand responses to brand imitation: retailers

versus other manufacturers. Journal of Product &

Brand Management, 8(2):96–105.

Comparative Study of e-Commerce Ventures: Copycat Enablers in Business Models

89

Cronin, M. J. (2014). The Challenge of Innovation. In

Cronin, M. J., editor, Top down innovation, Springer-

Briefs in Business, pages 1–12. Springer International

Publishing, Cham and s.l.

Deutsch, A. (2019). Horror-Performance bei Home24: Ak-

tie brutal verm

¨

obelt.

Etsy (2019). Website Etsy.

Frick, J. and Ali, M. M. (2013). Business Model Canvas as

Tool for SME. In Prabhu, V., Taisch, M., and Kirit-

sis, D., editors, Advances in Production Management

Systems. Sustainable Production and Service Supply

Chains, volume 415 of IFIP Advances in Informa-

tion and Communication Technology, pages 142–149.

Springer Berlin Heidelberg, Berlin/Heidelberg.

Friestad, M. and Wright, P. (1993). The Persuasion Knowl-

edge Model: How People Cope with Persuasion At-

tempts.

Geibel, P. R. C. and Manickam, M. (2015). The startup

ecosystems in Germany and in the USA Explorative

analysis and comparison of the startup environments.

Gompers, P. A., Kovner, A., Lerner, Josh, and Scharf-

stein, D. S. (2008). Performance Persistence in En-

trepreneurship.

Graf, A. (2015). M

¨

obel online - wer gewinnt? Wayfair,

Home24, Westwing, IKEA & Co.

Graf, A. (2017a). Hausgemachte Probleme bei individuell

bestickten Topflappen: Etsy & DaWanda Analyse.

Graf, A. (2017b). Was wurde eigentlich aus Zappos?

Graf, A. (2018). Ist Wayfair wirklich der Durchbruch im

Onlinem

¨

obelhandel und Vorbild f

¨

ur Home24?

Gr

¨

underszene Lexikon (2019). Copycat.

Hannoversche Allgemeine (2018). Zalando expandiert nach

Tschechien und Irland.

Helming, C. (2013). DaWanda - NOAH13 London.

home24 (2019). Website home24.

Horizont (2012). Zalando zieht nach Verlusten die Werbe-

bremse.

Joyce, A. and Paquin, R. L. (2016). The triple layered busi-

ness model canvas: A tool to design more sustain-

able business models. Journal of Cleaner Production,

135:1474–1486.

Kl

¨

asgen, M. and Alves, M. (2018). How English (And Etsy)

Killed Germany’s Online Crafts Leader.

Kopelman, R. E., Chiou, A. Y., Lipani, L. J., and Zhu, Z.

(2012). Interpreting the success of Zappos.com, Four

Seasons, and Nordstrom: Customer centricity is but

one-third of the job. Global Business and Organiza-

tional Excellence, 31(6):63–78.

Krugh, M. (2014). Joy in Labour: The Politicization of

Craft from the Arts and Crafts Movement to Etsy.

Canadian Review of American Studies, 44(2):281–

301.

Kubacki, K., Blanchflower, T. M., and Hodges, N. N., ed-

itors (2015). Understanding Etsy: Social Media and

Marketing within a Community of Sellers: Ideas in

Marketing: Finding the New and Polishing the Old.

Springer International Publishing.

Kurosu, M., Hasan, L., Morris, A., and Probets, S., edi-

tors (2009). Using Google Analytics to Evaluate the

Usability of E-Commerce Sites: Human Centered De-

sign. Springer Berlin Heidelberg.

Levitt, B. and March, J. G. (1988). Organizational Learn-

ing.

Loken, B. and Ward, J. (1990). Alternative Approaches to

Understanding the Determinants of Typicality. Jour-

nal of Consumer Research, 17(2):111.

Marquart, M. (2018). Dawanda geht offline.

Melchior, L. (2016). DaWanda erh

¨

oht Verkaufsprovision

um 90 Prozent.

Miceli, G. N. and Pieters, R. (2010). Looking more or less

alike: Determinants of perceived visual similarity be-

tween copycat and leading brands. Journal of Busi-

ness Research, 63(11):1121–1128.

Nelson, R. R. and Winter, S. G. (1982). The Schumpeterian

Tradeoff Revisited. The American Economic Review,

72(1):114–132.

Nilsen, M. (2013). The US Is By Far The Best Place In The

World To Be An Entrepreneur.

Noailles-Sim

´

eon, P. (2017). Entrepreneurship Policy.

Osterwalder, A. and Pigneur, Y. (2013). Business Model

Generation: A Handbook for Visionaries, Game

Changers, and Challengers. Wiley.

Posen, H. E. and Martignoni, D. (2018). Revisiting the imi-

tation assumption: Why imitation may increase, rather

than decrease, performance heterogeneity. Strategic

Management Journal, 39(5):1350–1369.

Regina, G. (2012). Rocket Internet shuts down Singapore

outfit of furniture portal Home24?

Schnor, P. (2019). Home24 w

¨

achst – aber verpasst Um-

satzziel f

¨

ur 2018.

Shenkar, O. (2010). Copycats: How smart companies use

imitation to gain a strategic edge.

statista (2019). Umsatz von Etsy weltweit bis 2018.

Summary-Smith, J. J. (2017). Zappos.

Toft-Kehler, R., Wennberg, K., and Kim, P. H. (2014). Prac-

tice makes perfect: Entrepreneurial-experience curves

and venture performance. Journal of Business Ventur-

ing, 29(4):453–470.

Warrick, D. D., Milliman, J. F., and Ferguson, J. M. (2016).

Building high performance cultures. Organizational

Dynamics, 45(1):64–70.

Wassink, M. (2012). Zalando mischt den Internethandel

auf.

Wayfair (2019). Our Story.

Wikipedia (2019). Zalando: Kritik und Kontroversen.

wiktionary (2019). copycat.

Zalando (2019a). Corporate Strategy: Our Business Fields.

Zalando (2019b). Zalando schließt 2018 erfolgreich ab und

setzt weiter auf starkes Wachstum.

FEMIB 2020 - 2nd International Conference on Finance, Economics, Management and IT Business

90