A Production Model with Continuous Demand for Imperfect Finished

Items Resulting from the Quality of Raw Material

Abdul-Nasser El-Kassar, Manal Yunis and Mohammad Nasr El Dine

Information Technology & Operations Management Department, Lebanese American University, Lebanon

Keywords: Inventory, Economic Order Quantity, Economic Production Quantity, Quality, Imperfect Quality, Raw

Material Inventory, Continuous Demand for Imperfect Quality.

Abstract: The purpose of this paper is to present a production process in which the quality of a single type of raw

material used to produce the finished product is considered. The common modeling approach followed by

previous research is based on discarding the imperfect quality items of raw material. In this paper, we consider

the case where both perfect and imperfect quality items of raw are used in the production process resulting in

two types of qualiy of the finished product. It is assumed that both perfect and imperfect quality items of the

finished product have continuous demand. This modeling approach has yet to be deployed. Two models that

depend on the length inventory cycle of each type of the finished product are developed. Numerical examples

are provided to illustrate the determination of the optimal production quantity. Theoretical and practical

implications are discussed, and recommendations are presented.

1 INTRODUCTION

Production control and inventory management are

two important business functions with the objective

of controlling the materials used in manufacturing

and trading. The importance of these functions lies in

the fact that keeping the right amount of inventory

with a good quality level will help organizations

avoid excess inventory and shortages, while

satisfying customers’ demand. This is crucial in an

era of globalization, where customer demand for

products has been increasing, and where

organizations should have the agility required to

respond to different demand preferences sufficiently

and on time.

In these two functions, the two models, economic

production quantity (EPQ) and the economic order

quantity (EOQ), are used to identify the optimal

quantities to order or produce to meet the demand for

a certain product.

The EOQ and EPQ models are simple to apply

and built on a number of simplifying assumptions.

For instance, the classical EPQ model ignores the cost

and quality of raw material used in the production

process. Also, the classical EPQ model views the

manufacturing process as failure free, implying that

items produced have perfect quality. This contrasts

with real life production environment, where

defective items are generated due to defective raw

materials or defective production processes (Pal et al,

2016). This study concurs with this view, and argues

that the inventory and production policy guided by

the conventional EPQ model is inappropriate as it

does not reflect what usually happens in production

processes.

Several researchers addressed this unreliable

assumption. Recently, a number of research studies

have worked on EPQ/EOQ models, taking imperfect

quality raw materials or imperfect product items into

consideration. This research direction was initiated by

Salameh and Jaber (2000), who developed an EPQ

model that counted for the imperfect items delivered

by a supplier with a known probability density

function.

Moreover, several recent studies have considered

the effects of the quality of the raw material used in

the production process (El-Kassar et al., 2012;

Yassine 2016; Yassine & AlSagheer, 2017; Yassine et

al., 2018; Yassine & El-Rabih, 2019). Yassine (2018)

presented a sustainable EPQ model with quality. In

fact, corporations have been engaging in responsible

and environmentally friendly activities that enhance

performance (El-Kassar & Singh, 2019; Singh et al.,

2019, El-Khalil & El-Kassar, 2018; El-Khalil & El-

Kassar, 2016). Such activities have been shown to lead

to other positive outcomes such as higher level of

El-Kassar, A., Yunis, M. and El Dine, M.

A Production Model with Continuous Demand for Imperfect Finished Items Resulting from the Quality of Raw Material.

DOI: 10.5220/0009181702630269

In Proceedings of the 9th International Conference on Operations Research and Enterprise Systems (ICORES 2020), pages 263-269

ISBN: 978-989-758-396-4; ISSN: 2184-4372

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

263

corporate governance (ElGammal et al., 2018) and

favorable employee attitude and behavior (El-Kassar

et al. 2017). Firms are also employing information and

communication technologies and innovation to

improve their competitiveness level (Singh et al.,

2019; Balozian et al., 2019; Yunis et al., 2018;

Balozian & Leidner, 2017; Yunis et al., 2017).

Recently, these factors have been incorporated into the

classical EPQ model (Lamba et al., 2019; Yassine,

2018).

Salameh and El-Kassar (2007) extended the EPQ

model to account for the raw material used in

production. Chan et al. (2003) presented an EPQ

model where the imperfect products are reworked or

rejected. El-Kassar (2009) presented an EOQ model

with quality in which the imperfect items have a

continuous demand for both perfect and imperfect

quality items. In other directions, several studies

considered a supply chain approach was considered

(Khan et al., 2011; Khan & Jaber, 2011; Bandaly et

al. 2014; Bandaly et al. 2016), while Bandaly &

Hassan (2019) considered an integrated production

and inventory taking into consideration deterioration

and limited storage capacity.

This research paper examines an EPQ model that

takes into consideration the situation where a single

type of raw material with a percentage of imperfect

items is all used in a production process. This EPQ

model is material-dependent and hence will yield

finished products with a proportion being defective.

The model assumes continuous demand for both the

good quality and the defective products, making it

essential to incorporate both product types in the

production model. Two models that depend on the

inventory cycle length of each type of finished

product are presented. The remaining of this paper is

organized as follows. Section 2 presents a review of

related work. The mathematical model is developed

in section 3. A numerical example is given in section

4 to illustrate the proposed model. Finally, section 5

presents a conclusion and future research

recommendations.

2 MATHEMATICAL MODEL

Consider the case where items of raw material

received from a supplier are of perfect and imperfect

quality. Both types are used in the production process

resulting in perfect and imperfect finished products.

It is assumed that both types of finished product have

continuous demand.

2.1 Notation

The following notation is used for this model are:

− Q: Number of units per order (units)

− Q*: Optimal number of units per order (units)

− D

p

: Demand rate for perfect finished products

(units/unit time)

− D

i

: Demand rate for imperfect finished products

(units/unit time)

− D: Demand rate (units/unit time): D

p

+D

i

− C: Purchasing cost per unit ($/unit)

− C

p

: Unit production cost ($/unit)

− K

o

: Ordering cost of raw material ($)

− K

s

: Set-up cost of production ($)

− C

s

: Unit screening cost ($/unit)

− C

hr

: Holding cost of raw material ($/unit/unit

time)

− C

hf

: Holding cost of finished products

($/unit/unit time)

− q: Percentage of perfect quality of raw material

− S

p

: Selling price of perfect quality products ($)

− S

i

: Selling price of imperfect quality products ($)

− S

d

: Discounted selling price of imperfect quality

products ($)

− T: Inventory cycle length (unit time) = Q/D

− T

p

: Perfect items inventory cycle (unit time)

− T

i

: Imperfect items inventory cycle (unit time)

− X: Screening rate (unit/unit time)

− P

p

: Production rate of perfect products (units/

unit time)

− P

i

: Production rate of imperfect products (units/

unit time)

− P: Production rate (units/ unit time) = P

p

+P

i

− T

s

: Screening time (unit time) = Q/X

− T

pr

: Production period (unit time) = Q/P

The decision variable is the order quantity Q and the

aim is to determine the optimal order quantity Q* that

maximizes the total profit per unit time function.

2.2 The Case Tp ≤ Ti

The objective of this model is to find the optimal

number of units per order Q* that maximizes the

expected value of the total profit per unit time

function.

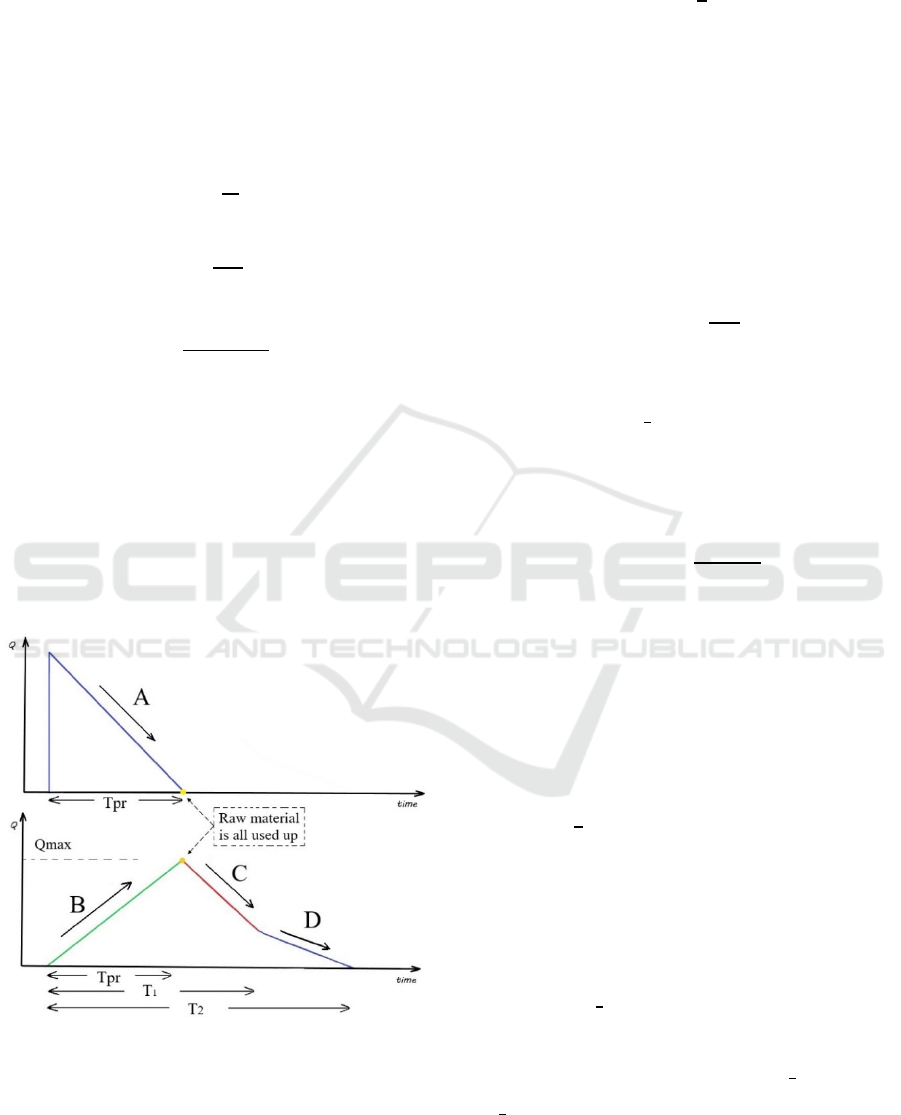

Figures 1a and 1b depict the inventory levels of

raw material and the finished goods. The raw material

are screened for imperfect quality items. The

percentage q of perfect quality raw material is a

random variable having a known probability

distribution with an expected value of E[q]. After

screening, the perfect quality items of raw material

ICORES 2020 - 9th International Conference on Operations Research and Enterprise Systems

264

are used to produce qQ perfect quality finished items.

The remaining imperfect quality items of raw

material are also used in the production process

resulting in (1-q)Q imperfect quality finished items.

A linear relationship in the production of the two

types of items is assumed.

The combined production period as well as the

inventory cycle for the perfect and imperfect finished

items are:

T

pr

=

Q

P

(1)

T

p

=

qQ

𝐷

(2)

T

i

=

(1 − q)Q

𝐷

(3)

Let T

1

= min{T

p

, T

i

} and let T

2

= max{T

p

, T

i

}.

Assuming that T

p

> T

i

, we have T

1

= T

i

and T

2

= T

p

.

The total cost per cycle function, TC(Q),

comprises the following costs: Ordering cost, Set-up

cost, Purchasing cost, Production cost, Cost of

holding raw material, Cost of holding finished

products, and Screening cost. Hence,

TC(Q) = K

o

+ K

s

+ CQ + C

p

Q + C

s

Q + C

hr

× (Area

under curve of figure 1a) + C

hf

× (Area under curve

of figure 1b).

Figure 1a: Raw material inventory (top) Figure 2b: Finished

product inventory (bottom) Tp ≥ Ti.

First, we determine the area under curve of figure 1a.

It is worth noting that the inventory level of the raw

material is used at the production rate P. Hence, the

slope A = -P.

The area under curve of figure 1a is given by:

A

triangle

=

1

2

T

𝑄

To find the area under curve of figure 1b, we note that

during the production period, finished items are

produced at a rate of P and consumed at a rate of D =

D

p

+ D

i

. To avoid shortages, it is assumed that P > D.

Thus, finished product inventory is accumulated

at a rate of P

− (D

p

+D

i

) until a maximum inventory

level Q

max

is

reached the end of the production period.

Hence, the slope B = P

− (D

p

+D

i

) and

Qmax = T

pr

[P − (D

p

+D

i

)].

First the arear under the green curve is determined as

follows:

A

triangle

=

b×h

2

where b = T

pr,

h = Qmax, and the slope of the

hypotenuse is P

− (D

p

+D

i

). Hence,

A

triangle

=

1

2

Tpr

2

[P − (D

p

+D

i

)]

Next, the area under the red curve is determined as

follows. Note that, at the end of the production period

and until time T

1

, the finished items inventory is

depleted at a rate of

− D

= − (D

p

+D

i

). Hence,

A

trapezoid

=

(b

1

+b

2

)×h

2

b

1

= T

pr

[P − (D

p

+D

i

)]

h = T

1

− T

pr

But the slope of the hypotenuse is C = -(D

p

+D

i

) so

that the equation of that line would be:

Q = -(D

p

+D

i

)t + Q

o.

At t =T

pr

, Q = Qmax = T

pr

[P − (D

p

+D

i

)]. Hence,

T

pr

[P − (D

p

+D

i

)] = -(D

p

+D

i

) T

pr

+ Q

o

Thus Q

o

= T

pr

P, and hence Q = -(D

p

+D

i

) t + T

pr

P.

When t = T

1

, Q = -(D

p

+D

i

) T

1

+ T

pr

P. Thus,

A

trapezoid

=

(T

pr

(P−(D

p

+D

i

)) + T

pr

P −(D

p

+D

i

)T

1

)

(T

1

− T

pr

)

Finally, the area under the blue curve is calculated.

Note that from time T

1

until the end of the inventory

period, at time T

2

, only perfect quality finished items

are left in inventory. These items are depleted at a rate

−D

p

so that the slope is −D

p

. Thus,

A

triangle

=

1

2

(T

pr

P − (D

p

+D

i

) T

1

)(T

2

− T

1

).

Therefore,

TC(Q) = K

o

+ K

s

+ CQ + C

p

Q + C

s

Q +

1

2

C

hr

× (T

pr

Q)

+

1

2

C

hf

× T

(P (D

+D

) + T

[P (D

+

D

)] + T

P T

(D

+D

)( T

T

) +

T

P T

(D

+D

)( T

T

) (4)

A Production Model with Continuous Demand for Imperfect Finished Items Resulting from the Quality of Raw Material

265

Since T

p

> T

i

, T

1

= min{T

p

, T

i

}=T

i

and T

2

=

max{T

p

,T

i

} = T

p

. Substituting T

pr

=

Q

P

, T

1

= T

i

=

(1q)Q

, and T

2

= T

p

=

qQ

, the TC(Q) function

becomes:

TC(Q) = K

o

+ K

s

+ CQ + C

p

Q + C

s

Q +

1

2

C

hr

×

Q

2

P

+

1

2

C

hf

×

Q

P

2

P (D

p

+D

i

) +

Q

P

[P

(D

p

+D

i

)] + Q

(1-q)Q

D

i

(D

p

+D

i

)

(1-q)Q

D

i

Q

P

+

Q

(1-q)Q

D

i

(D

p

+D

i

)

qQ

D

p

(1-q)Q

D

i

(5)

After simplification, we have:

TC(Q) = K

o

+ K

s

+ CQ + C

p

Q + C

s

Q +

1

2

C

hr

×

Q

2

P

+

1

2

C

hf

×

Q

2

D

i

−

qQ

2

D

i

−

Q

2

P

+

qQ

2

D

p

−

D

p

+D

i

qQ

2

D

p

D

i

+

D

p

+D

i

q

2

Q

2

D

p

D

i

(6)

Next, the total revenue and total profit for this model

are:

TR(Q) = S

p

qQ + S

i

(1−q)Q

TP(Q)=S

p

qQ+S

i

(1−q)Q −

K

o

+ K

s

+ CQ + C

p

Q + C

s

Q +

1

2

C

hr

×

Q

2

P

+

1

2

C

hf

×

Q

2

D

i

−

qQ

2

D

p

−

Q

2

P

+

qQ

2

D

p

−

D

p

+D

i

qQ

2

D

p

D

i

+

D

p

+D

i

q

2

Q

2

D

p

D

i

(7)

The expected value of TP(Q) is

E[TP(Q)] = S

p

Q ∙ E[q] + S

i

Q ∙ E[1−q] − K

o

−K

s

− CQ − C

p

Q − C

s

Q −

1

2

C

hr

×

Q

2

P

−

1

2

C

hf

×

Q

2

D

i

−

Q

2

P

−

1

2

C

hf

×

Q

2

D

p

−

Q

2

D

i

−

D

p

+D

i

Q

2

D

p

D

i

∙

E[q] −

1

2

C

hf

×

D

p

+D

i

Q

2

D

p

D

i

∙ E[q

2

]

Applying the renewal reward theorem, E[TPU(Q)] =

[()]

[]

, where T= T

p

=

qQ

. Hence,

E[TPU(Q)] =

S

p

Q ∙ E[q] + S

i

Q ∙ E[1-q] - K

o

-K

s

- CQ - C

p

Q - C

s

Q -

1

2

C

hr

×

Q

2

P

-

1

2

C

hf

×

Q

2

D

i

-

Q

2

P

-

1

2

C

hf

×

Q

2

D

p

-

Q

2

D

i

-

D

p

+D

i

Q

2

D

p

D

i

× E[q]

-

1

2

C

hf

×

D

p

+D

i

Q

2

D

p

D

i

∙ E[q

2

]

Q

D

p

∙ E[q]

Setting the derivative of the above expression equal

to zero and solving for Q, we get:

Q*=

K

o

+K

s

1

2

C

hr

×

1

P

+

1

2

C

hf

×

1

D

i

1

P

+

1

2

C

hf

×

1

D

p

1

D

i

D

p

+D

i

D

p

D

i

∙ E[q] +

1

2

C

hf

×

D

p

+D

i

D

p

D

i

∙ E[q

2

]

(8)

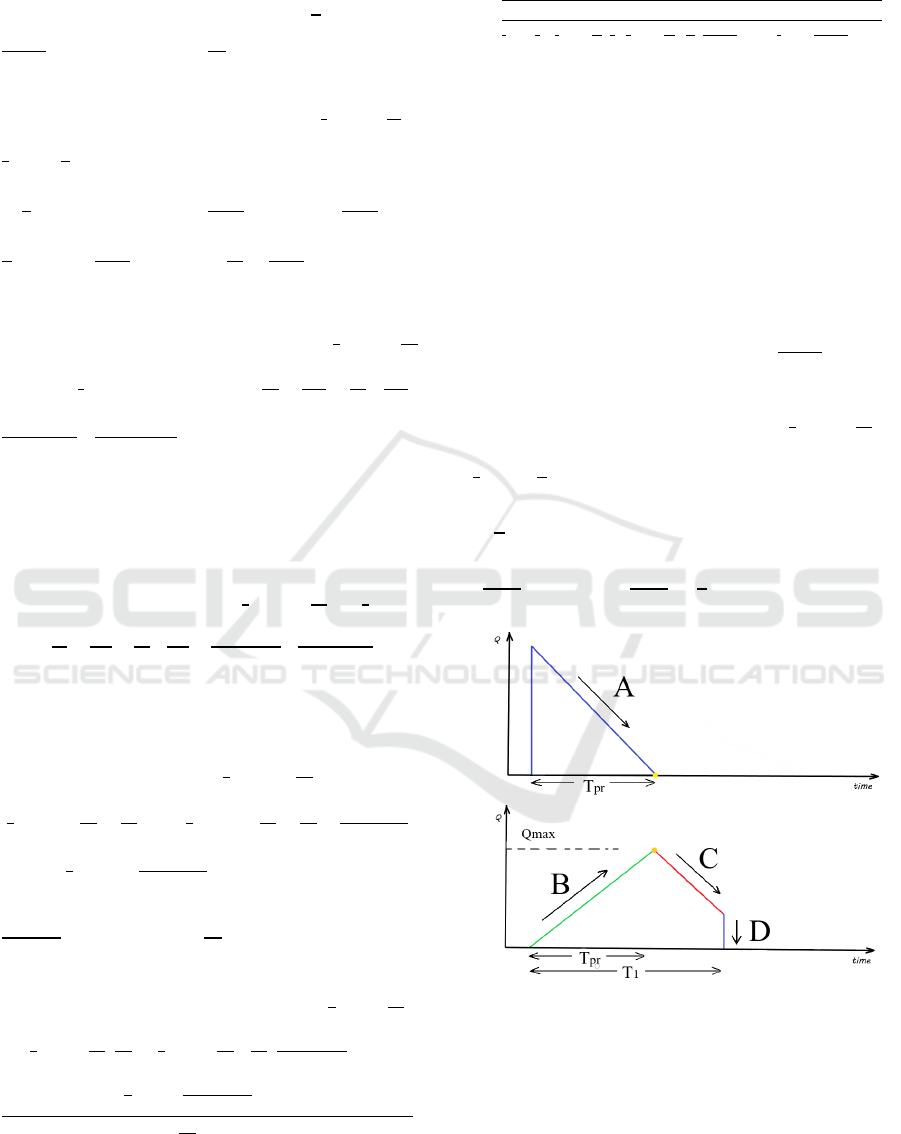

2.3 The Case Tp < Ti

In this case, we assume that the inventory cycle for

imperfect quality items is longer than that of perfect

quality items. Thus, the inventory cycle terminates

when the perfect quality items are depleted. We

assume that the remaining imperfect quality items are

sold in one batch at a lower price of S

d

, where S

p

> S

i

> S

d

. Figures 2a and 2b depict the inventory levels of

the raw material and the finished product.

In this case, T

1

= min {T

p

,T

i

} = T

p

=

(1q)Q

D

i

. Similar

steps followed in the previous case result in:

TC(Q) = K

o

+ K

s

+ CQ + C

p

Q + C

s

Q +

1

2

C

hr

×

Q

2

P

+

1

2

C

hf

×

Q

P

2

P (D

p

+D

i

) +

Q

P

[P

(D

p

+D

i

)] + Q

(1-q)Q

D

i

(D

p

+D

i

)

(1-q)Q

D

i

Q

P

(9)

Figure 2a: Raw material inventory (top) Figure 2b: Finished

product inventory (bottom) Tp < Ti.

After T

1

, the remaining products are of imperfect

quality and are to be sold in a single batch at an even

lower selling price S

d

. Thus, the amount of remaining

finished products is T

pr

P − (D

p

+D

i

) T

1

. Hence

ICORES 2020 - 9th International Conference on Operations Research and Enterprise Systems

266

TR(Q) = S

p

qQ + S

i

(qQ)

D

p

D

i

+S

d

Q

qQ

D

p

(D

p

+D

i

)

(10)

The total profit is simply TP(Q) = TR(Q) – TC(Q)

Hence TP(Q) is:

TP(Q)=S

p

qQ+S

i

(qQ)

D

p

D

i

+S

d

Q

qQ

D

p

(D

p

+D

i

) − K

o

− K

s

− CQ − C

p

Q −

C

s

Q −

1

2

C

hr

×

Q

2

P

−

1

2

C

hf

×

Q

P

2

P (D

p

+D

i

) +

Q

P

[P

(D

p

+D

i

)] + Q

(1-q)Q

D

i

(D

p

+D

i

)

(1-q)Q

D

i

Q

P

(11)

The expected total profit is

E[TP(Q)] =

QE(q)+S

i

QD

p

D

i

E(q)

+S

d

Q Sd

Q

D

p

(D

p

+D

i

) E(q) − K

o

− K

s

− CQ −

C

p

Q − C

s

Q −

1

2

C

hr

×

Q

2

P

−

1

2

C

hf

×

−

−

+

−

E

(

q

)

−

E

(

q

)

(12)

Using E[TPU(Q)] =

[()]

[]

with T= T

p

=

qQ

, we

have

E[TPU(Q)] =

S

QE

(

q

)

+ S

QD

D

E

(

q

)

+S

Q S

Q

D

D

+D

E

(

q

)

−Ko − Ks − CQ − CpQ − CsQ

−

1

2

C

×

Q

P

−

1

2

C

Q

2

×

2

𝐷

−

𝐷

𝐷

−

1

𝑃

+

2𝐷

𝐷

−

2

𝐷

E

(

q

)

−

𝐷

𝐷

E

(

q

)

Q

𝐷

∙ E[q]

The optimal order quantity is

Q*=

K

o

+K

s

1

2

C

hr

×

1

P

+

1

2

C

hf

×

2

D

i

-

(D

i

+D

p

)

D

i

2

-

1

P

+

2(D

i

+D

p

)

D

i

2

-

2

D

i

∙ E[q] -

(D

i

+D

p

)

D

i

2

∙ E[q

2

]

(13)

3 NUMERICAL EXAMPLES

To illustrate the two models developed in section 2,

consider the situation where a closet manufacturer

sells wooden tables to retailers. The manufacturer

orders wooden boards and assembles them as single

door closets. The percentage of perfect quality boards

ranges between [70% → 90%]. However, after

screening, which is 0.03$ per item, it turns out that

some boards are 180cm and others are 160cm of

height. The 180cm boards are considered of perfect

quality and the 160cm boards are the imperfect

quality. The manufacturer can produce 300 perfect

quality closets per day, and 100 imperfect quality

closets per day, with a production cost of $10 per

product. The purchasing cost is 4$ per wooden board,

and the ordering cost is 1,000$, and the setup cost for

production is $250. The retailers demand 100 units of

180cm closets per day, and 50 units of 160cm closets

per day. Each 180cm closet costs the retailer 450$ and

300$ for the 160cm closets. The holding cost of raw

material is 0.01$ per unit per day and for the finished

products is 0.02$ per unit per day. Find the optimal

number of wooden boards per order Q*, then find the

total profit per cycle. E[q] = 𝜇=

0.7+0.9

2

= 0.8 and E[q

2

]

= Var(q) + (E[q])

2

= 0.00367+0.64= 0.64367. Hence,

Q*= 4,541.6 ≈ 4,542 units and the total profit per unit

time is TPUQ

*

=

TP(Q

*

)

T

=

TP(Q

*

)

qQ

D

p

= 53,013.2$.

Now suppose that the percentage of perfect quality

boards ranges between [60% → 80%]. The

manufacturer can produce 200 perfect quality tables

per day, and 150 imperfect quality tables per day,

with a production cost of $5 per product. The

purchasing cost is 1$ per wooden board, and the

ordering cost is 400$, and the setup cost for

production is $100. The retailers demand 100 units of

3cm thick tables per day, and 50 units of 2cm tables

per day. Each 3cm thick table costs the retailer 30$

and 20$ for the 2cm thick tables. The holding cost of

raw material is 0.01$ per unit per day and for the

finished products is 0.015$ per unit per day. It turned

out that the 3cm thick tables are sold out before the

2cm thick tables. Assume that the manufacturer sells

all the remaining 2cm thick tables at once at a

discounted price of 15$. Then Q* = 3,504.7 ≈ 3,505

units.

4 CONCLUSION

A mathematical function was developed to introduce

an EPQ model that uses both the perfect and

imperfect quality items of raw material in the

production of the finished product. The production

process results in two types of finished products,

perfect and imperfect. A continuous demand is

assumed for both perfect and imperfect quality

finished items. The mathematical model was

formulated for two cases that depend on the length of

the inventory cycles for the perfect and imperfect

quality finished items.

The variability of holding cost is a crucial

A Production Model with Continuous Demand for Imperfect Finished Items Resulting from the Quality of Raw Material

267

requirement, reflecting a realistic assumption in real-

life situations. In fact, in many situations, the holding

cost increases with longer storage periods, as the

extended storage may require more sophisticated, and

thus expensive, storage equipment and conditions. A

case in point could be the storage of food,

pharmaceutical products, and hazardous material that

require certain storage and quality dimensions to

avoid spoilage and/or risk.

The model was validated using a numerical

example. A practical case study will better

demonstrate real-life applications. The model should

also take into consideration the stock type, holding

time, holding cost, demand for perfect quality items,

and demand for imperfect quality items. Moreover,

the models should incorporate the pricing decisions

for both types, as well as the factors influencing the

demand for reach of the types.

Finally, future models should deal with a

coordinated supply chain, consider time value of

money, and incorporate the effect of emission tax.

REFERENCES

Balozian, P., Leidner, D., & Warkentin, M. (2019).

Managers’ and employees’ differing responses to

security approaches. Journal of Computer Information

Systems, 59(3), 197-210.

Balozian, P., & Leidner, D. (2017). Review of IS security

policy compliance: Toward the building blocks of an IS

security theory. ACM SIGMIS Database: the

DATABASE for Advances in Information Systems,

48(3), 11-43.

Bandaly, D. C., & Hassan, H. F. (2019). Postponement

implementation in integrated production and inventory

plan under deterioration effects: a case study of a juice

producer with limited storage capacity. Production

Planning & Control, 1-17.

Bandaly, D., Satir, A., & Shanker, L. (2016). Impact of lead

time variability in supply chain risk

management. International Journal of Production

Economics, 180, 88-100.

Bandaly, D., Satir, A., & Shanker, L. (2014). Integrated

supply chain risk management via operational methods

and financial instruments. International Journal of

Production Research, 52(7), 2007-2025.

Chan, W. M., Ibrahim, R. N., & Lochert, P. B. (2003). A

new EPQ model: integrating lower pricing, rework and

reject situations. Production Planning & Control,

14(7), 588-595.

ElGammal, W., El-Kassar, A. N., & Canaan Messarra, L.

(2018). Corporate ethics, governance and social

responsibility in MENA countries. Management

Decision, 56(1), 273-291.

El-Kassar, A. N. M. (2009). Optimal order quantity for

imperfect quality items. In Allied Academies

International Conference. Academy of Management

Information and Decision Sciences. Proceedings (Vol.

13, No. 1, p. 24). Jordan Whitney Enterprises, Inc.

El-Kassar, A. N., Salameh, M., & Bitar, M. (2012) EPQ

model with imperfect quality raw material.

Mathematica Balkanica, 26, 123-132.

El-Kassar, A. N., Yunis, M., & El-Khalil, R. (2017). The

mediating effects of employee-company identification

on the relationship between ethics, corporate social

responsibility, and organizational citizenship

behavior. Journal of Promotion Management, 23(3),

419-436.

El-Kassar, A. N., & Singh, S. K. (2019). Green innovation

and organizational performance: the influence of big

data and the moderating role of management

commitment and HR practices. Technological

Forecasting and Social Change, 144, 483-498.

El-Khalil, R., & El-Kassar, A. N. (2016). Managing span of

control efficiency and effectiveness: a case

study. Benchmarking: An International Journal, 23(7),

1717-1735.

El-Khalil, R., & El-Kassar, A. N. (2018). Effects of

corporate sustainability practices on performance: the

case of the MENA region. Benchmarking: An

International Journal, 25(5), 1333-1349.

Khan, M., Jaber, M.Y., Guiffrida, A.L., and Zolfaghari, S.

(2011) A review of the extensions of a modified EOQ

model for imperfect quality items, International

Journal of Production Economics 132 (1), 1-12.

Khan, M., and Jaber, M.Y. (2011) Optimal inventory cycle

in a two-stage supply chain incorporating imperfect

items from suppliers, Int. J. Operational Research

10(4), 442–457.

Lamba, K., Singh, S. P., & Mishra, N. (2019). Integrated

decisions for supplier selection and lot-sizing

considering different carbon emission regulations in

Big Data environment. Computers & Industrial

Engineering, 128, 1052-1062.

Pal, S., Mahapatra, G. S., & Samanta, G. P. (2016). A three-

layer supply chain EPQ model for price-and stock-

dependent stochastic demand with imperfect item under

rework. Journal of Uncertainty Analysis and

Applications, 4(1), 10.

Salameh, M. K., & El-Kassar, A. N. (2007, March).

Accounting for the holding cost of raw material in the

production model. In Proceeding of BIMA inaugural

conference (pp. 72-81).

Salameh, M. K., and Jaber, M. Y. (2000) Economic

production quantity model for items with imperfect

quality, International Journal of Production Economics

64, 59–64.

Singh, S. K., & El-Kassar, A. N. (2019). Role of big data

analytics in developing sustainable capabilities. Journal

of cleaner production, 213, 1264-1273.

Singh, S. K., Chen, J., Del Giudice, M., & El-Kassar, A. N.

(2019). Environmental ethics, environmental

performance, and competitive advantage: Role of

environmental training. Technological Forecasting and

Social Change, 146, 203-211.

ICORES 2020 - 9th International Conference on Operations Research and Enterprise Systems

268

Yassine, N. (2016) Joint Probability Distribution and the

Minimum of a Set of Normalized Random Variables,

Procedia - Social and Behavioral Sciences, 230 (12),

235–239.

Yassine, N. & AlSagheer, A. (2017). The optimal solution

of a production model with shortages and raw

materials. Int J Math Comput Methods, 2, 13-18.

Yassine, N. (2018). A sustainable economic production

model: effects of quality and emissions tax from

transportation. Annals of Operations Research, 1-22.

Yassine, N., AlSagheer, A., & Azzam, N. (2018). A

bundling strategy for items with different quality based

on functions involving the minimum of two random

variables. International Journal of Engineering

Business Management, 10, 1-9.

Yassine, N., & El-Rabih, S. (2019, May). Assembling

Components with Probabilistic Lead Times. In IOP

Conference Series: Materials Science and Engineering

(Vol. 521, No. 1, p. 012013).

Yunis, M., Tarhini, A., & Kassar, A. (2018). The role of

ICT and innovation in enhancing organizational

performance: The catalysing effect of corporate

entrepreneurship. Journal of Business Research, 88,

344-356.

Yunis, M., El-Kassar, A. N., & Tarhini, A. (2017). Impact

of ICT-based innovations on organizational

performance: The role of corporate

entrepreneurship. Journal of Enterprise Information

Management, 30(1), 122-141.

A Production Model with Continuous Demand for Imperfect Finished Items Resulting from the Quality of Raw Material

269