The Structural Equation Modeling for the Deposits of Microfinance

Institutions in Indonesia

Iskandar Muda, Erlina, Aulia Abdhy Abdans, and Agung Wahyudi Atmanegara

Universitas Sumatera Utara, Dr. T Mansur no. 9, Medan, Indonesia

Keywords: Structural Equation Modeling, Microfinance, Deposit

Abstract: The purpose of this study is to examine the structural effects of assets and liabilities on Deposits of

Microfinance Institutions in Several Provinces in Indonesia with Structural Equation Modeling. This type of

research is quantitative. The data used is data from 3 quarters in the period 2018 to 2020. The analysis tool

uses Structural Equation Modeling (SEM) with Partial Least Square (PLS). The results conclude that there

is an effect of Fund Placement and Financing Loans on Microfinance Institution Deposits in Several

Provinces in Indonesia. The originality of this research explains that Micro Finance Institutions (MFIs) in

Indonesia are responsible for raising cheap funds. The Rural Bank in Indonesia, both sharia and

conventional, carry out business activities conventionally or based on sharia principles, which in their

activities do not provide services in payment traffic. The role of placement of assets and liabilities to

deposits funds is essential for Microfinance Institutions in Indonesia.

1 INTRODUCTION

Micro Finance Institutions (MFIs) are responsible

for raising cheap funds. People's Credit Banks, both

sharia and conventional, carry out their duties to

carry out conventional business activities or based

on sharia principles, which in their activities do not

provide services in payment traffic. BPR activities

are much narrower than commercial banks because

BPRs are prohibited from accepting demand

deposits, foreign exchange activities, and insurance.

There are people's credit banks that the Deposit

Insurance Corporation liquidates for years. The

bank's internal improvement includes human

resources (HR) both in terms of their integrity and

capacity. Internal strengthening of BPRs by

determining e-Banking security risks equivalent to

commercial bank e-Banking handling, in accordance

with concerning information technology risk

management. Three basic principles must be

fulfilled in strengthening the BPR ICT system,

namely prevent, detect, and recover. Security

standards cover the issuer/acquirer ecosystem, e-

money, banking systems, communication channels,

devices, and the user side. BPR security standards

should encourage to increase of the security of the e-

Banking system.

The resulting impact is an increase in Assets and

Liabilities of Islamic and Conventional Cooperative

Microfinance Institutions. The development of

assets and liabilities certainly had an impact on the

Indonesian economy.

Related research was conducted by Afonso, who

examined the performance of Microfinance

Institutions in Pakistan (Afonso, et al., 2020). The

results concluded that the performance of

microfinance institutions is growing rapidly,

especially in terms of assets. Research conducted by

Armendariz and Szafarz concluded that

Microfinance Institutions have their own role and

mission as an institution (Armendáriz and Szafarz,

2011). In addition, this research is also to strengthen

the research conducted by Aziz (Aziz, et al., 2020),

Beisland (Beisland, et al., 2020), Berguiga

(Berguiga, et al., 2020), Bishev (Bishev, et al.,

2020), Bondinuba (Bondinuba, et al., 2020), Fianto

(Fianto, 2020), Ghosh (Ghosh and Das, 2020),

Gudjonsson (Gudjonsson, et al., 2020), Hermes

(Hermes, et al., 2011), Lam (Lam, et al., 2020),

Moya-Davila (Moya-Davila and Rajagopal, 2020),

Nair (Nair and Njolomole, 2020), Suesse (Suesse

and Wolf, 2020), Uddin (Uddin, et al., 2020), Abduh

(Abduh and Jamaludin, 2020). The specific

objectives that you want to know from this research

are (1) knowing the development of Assets and

Muda, I., Erlina, ., Abdans, A. and Atmanegara, A.

The Structural Equation Modeling for the Deposits of Microfinance Institutions in Indonesia.

DOI: 10.5220/0010798900003317

In Proceedings of the 2nd International Conference on Science, Technology, and Environment (ICoSTE 2020) - Green Technology and Science to Face a New Century, pages 161-166

ISBN: 978-989-758-545-6

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

161

Liabilities of Sharia Cooperative Microfinance

Institutions and (2) knowing the development of

Assets and Liabilities of Conventional Cooperative

Microfinance Institutions.

2 RESEARCH METHODS

The population in this study is the number of LKM

actors in conventional and sharia forms in the form

of cooperatives and PT. This study uses data

analysis methods using SmartPLS version 3.0

software, which is run by computer media with

hypothesis testing with predictive models and paired

sample testing. The data used includes the annual

financial reports of micro-financial institutions in

Indonesia during 2018-2020.

3 RESULTS AND DISCUSSION

3.1 Development of Assets and

Liabilities of Sharia Cooperative

Microfinance Institutions

The development of Assets and Liabilities of Sharia

Cooperative Microfinance Institutions in Indonesia

during the 2018-2020 period is presented in the

following table:

Table 1. Development of Assets and Liabilities of Islamic

Microfinance Institutions 2018-2020 (in 000)

Quartl

y

Province Assets Liabilit

y

De

p

osits

Aceh 4,258809 0,001886 3,92

Banten 12,7014 0,061309138 10,79

Ben

g

kul

u

21,53403 10,58622328 7,83

D

.I.Yo

gy

akart

a

14,67944 0,012800215 13,52

Jambi 4,293854 0 3,74

Jawa Barat 61,03573 6,817863909 40,03

Jawa Ten

g

ah 203,6357 43,40304977 87,61

Jawa Timu

r

67,52296 0,357800215 57,15

Kalimantan

Selatan 4,251758 0 3,86

2020

Kalimantan

Timu

r

4,359151 0,01 3,96

Quartl

y

Lam

p

un

g

6,691816 2,189170848 3,87

Maluk

u

4,281345 0,0278415 3,84

N

usa Tenggara

Barat 4,265283 0,0031485 3,88

Pa

p

ua 4,32091 0 4,00

Ria

u

8,577353 0,055883 7,70

Sulawesi

Selatan 4,414876 0,002 4,02

Sumatera Bara

t

5,14665 0,073798127 4,03

Sumatera

Selatan 4,255475 0,00005 3,88

S

umatera Utar

a

5,657388 0,041891367 4,69

Aceh 4,258222 0,019014 3,90

Banten 12,70771 0,003704138 10,73

Bengkul

u

20,6481 9,424461072 7,72

D

.I.Yo

gy

akart

a

15,02468 0,013667365 13,45

Quartl

y

Province Assets Liabilit

y

De

p

osits

Jambi 4,279522 0 3,93

Jawa Barat 57,91102 11,34035861 36,23

Jawa Ten

g

ah 210,8957 40,9739525 103,90

2019 Jawa Timu

r

67,83977 0,451192788 58,06

sem 3

Kalimantan

Timu

r

4,342409 0

3,96

Lam

p

un

g

6,636058 2,093003306 3,89

Maluk

u

4,271068 0,0278415 3,87

NTB 4,255911 0,0031485 3,74

Pa

p

ua 4,31684 0 4,06

Ria

u

8,583428 0,055883 7,46

Sulawesi

Selatan 4,40849 0,002

3,99

Sumatera Bara

t

5,167446 0,079398127 3,88

S

umatera Utar

a

5,651605 0,041891368 4,69

Banten 12,81645 0,004997538 10,85

Ben

g

kul

u

20,81487 12,26189149 10,41

D

.I.Yo

gy

akart

a

14,92236 0,0082563 13,50

Jambi 4,266106 0 3,83

Jawa Barat 55,73144 10,05027399 35,85

2019 Jawa Ten

g

ah 192,0506 38,6997814 82,21

sem 2 Jawa Timu

r

46,24388 0,287010478 38,80

Kalimantan

Timu

r

4,319233 0

3,96

Lam

p

un

g

6,53463 1,938971902 3,97

Maluk

u

4,262512 0,0279415 3,88

Pa

p

ua 4,306307 0 3,99

Ria

u

8,554549 0,0279415 7,64

Sulawesi

Selatan 4,373575 0,002

3,99

Sumatera Bara

t

5,067841 0,102304044 3,93

S

umatera Utar

a

5,645902 0,03988625 4,69

Banten 12,86599 0,0042623 10,74

Ben

g

kul

u

14,1113 5,866404636 4,66

D

.I.Yogyakart

a

14,8462 0,0040762 13,46

Jambi 4,260131 0,006 3,83

Jawa Barat 52,19997 10,28851328 31,25

2019 Jawa Ten

g

ah 172,4325 28,80172684 70,88

sem 1 Jawa Timu

r

37,78527 0,314218945 31,68

Kalimantan

Timu

r

4,278242 0,001

3,90

Lam

p

un

g

6,341525 1,87676442 4,27

Pa

p

ua 4,267382 0 3,96

Sulawesi

Selatan 4,340563 0,002

3,96

Sumatera Bara

t

5,067841 0,102304044 3,93

S

umatera Utar

a

5,631331 0,03988625 4,68

Banten 8,830633 0,00270265 7,50

Ben

g

kul

u

14,25085 5,137289688 6,78

D

.I.Yo

gy

akart

a

10,53358 0,001315 9,68

2018 Jawa Barat 46,68278 8,81969236 28,39

Quartly

3JawaTen

g

ah 151,1587 23,59493012

64,47

Jawa Timu

r

37,73718 0,344212945 32,28

Lam

p

un

g

0,100875 0 0,10

Sulawesi

Selatan 0,25 0

0,25

Sumatera Bara

t

1,032227 0,094804044 0,28

S

umatera Utar

a

1,373484 0,03988625 0,74

Banten 8,80 0,00 7,78

Ben

g

kul

u

16,08 7,73 10,36

D

.I.Yo

gy

akart

a

4,24 0,00 3,80

2018 Jawa Barat 42,42 8,81 24,35

Quartly

2

Jawa Tengah 145,51 23,69 60,34

Jawa Timu

r

25,24 0,30 20,74

Lampung 0,10 0,00 0,10

Sulawesi

Selatan

0,00 0,00 0,00

Sumatera Bara

t

0,78 0,09 0,03

S

umatera Utar

a

1,37 0,04 0,74

Banten 4,77 0,00 4,32

ICoSTE 2020 - the International Conference on Science, Technology, and Environment (ICoSTE)

162

Ben

g

kul

u

13,75 6,93 7,64

Quartl

y

Province Assets Liabilit

y

De

p

osits

D

.I.Yo

gy

akart

a

4,24 0,00 3,80

2018 Jawa Barat 38,68 10,13 19,98

Quartly

1

Jawa Tengah 79,90 18,73 27,81

Jawa Timu

r

13,16 0,31 9,82

Lam

p

un

g

0,10 0,00 0,10

Sumatera Bara

t

0,78 0,09 0,03

S

umatera Utar

a

1,37 0,04 0,74

Source: Data from the Financial Services Authority of the

Republic of Indonesia for the 2018-2020 period.

Based on data in the first quarter of 2020, the

most significant asset development was in Central

Java Province and due liabilities in Central Java

Province. For the development of fund placement,

the most dominant is Central Java Province. Based

on data in the third quarter of 2019, the most

significant asset development was in Central Java

Province and liabilities that were due also in Central

Java Province. For the development of fund

placement, the most dominant is Central Java

Province. Based on data in the second quarter of

2019, the most significant asset development was in

Central Java Province and liabilities that were due

also in Central Java Province. For the development

of fund placement, the most dominant is Central

Java Province.

3.2 Development of Assets and

Liabilities of Conventional

Cooperative Microfinance

Institutions

Based on data presented, the development of assets

and liabilities of conventional cooperative

microfinance institutions is as follows:

Table 2. Development of Assets and Liabilities of

Conventional Microfinance Institutions 2018-2020

Qualit

y

Province Assets Liabilit

y

De

p

osits

2020-

Quartly

1

Banten 57,07 24,40 6,24

D.I. Yo

gy

akarta 2,15 1,56 0,29

Jawa Barat 247,52 161,03 11,82

Jawa Ten

g

ah 144,45 89,20 31,75

Jawa Timu

r

67,72 15,06 17,28

NTB 1,01 0,34 0,10

2019-

Quartly

3

Banten 72,26 36,85 8,60

D.I. Yo

gy

akarta 2,01 1,40 0,33

Jawa Barat 268,79 181,10 23,75

Jawa Ten

g

ah 108,26 69,16 20,72

Jawa Timu

r

56,59 9,97 13,05

NTB 1,57 0,28 0,46

2019-

Quartly

2

Banten 71,36 37,83 8,86

D.I. Yo

gy

akarta 1,88 1,29 0,24

Jawa Barat 220,79 148,90 22,09

Jawa Ten

g

ah 82,12 54,77 11,78

Jawa Timu

r

54,97 10,05 11,33

NTB 1,25 0,21 0,38

2019- Banten 69,96 36,19 5,26

Qualit

y

Province Assets Liabilit

y

De

p

osits

Quartly

1

D.I. Yo

gy

akarta 1,80 1,23 0,26

Jawa Barat 190,07 120,60 21,19

Jawa Tengah 82,82 58,92 14,62

Jawa Timu

r

57,84 13,07 14,19

NTB 1,12 0,11 0,38

2018-

Quartly

3

Banten 69,49 33,19 9,32

D.I. Yogyakarta 3,94 2,30 0,93

Jawa Barat 187,35 122,20 33,85

Jawa Tengah 64,02 43,63 14,10

Jawa Timu

r

55,69 9,80 14,52

NTB 1,14 0,27 0,37

2018-

Quartly

2

Banten 60,86 28,81 4,83

D.I. Yogyakarta 3,76 2,23 0,68

Jawa Barat 154,54 109,24 12,89

Jawa Ten

g

ah 58,45 38,91 12,24

Jawa Timu

r

51,44 8,26 10,72

NTB 1,12 0,26 0,37

2018-

Quartly

1

Banten 60,10 27,06 6,10

D.I. Yo

gy

akarta 2,19 1,26 0,66

Jawa Barat 153,46 107,89 14,44

Jawa Ten

g

ah 51,42 32,31 16,01

Jawa Timu

r

0,00 0,00 0,00

Nusa Tenggara

Barat

1,07 0,27 0,37

Source: Data from the Financial Services Authority of the

Republic of Indonesia for the 2018-2020 period.

Based on the data summarized, the development

of Assets and Liabilities of Conventional

Microfinance Institutions in the first quarter of 2020

in West Java Province. Likewise, in terms of

obligations that are due, West Java Province is the

largest. For the most prominent placement of funds

is Central Java Province. Based on the data

summarized, the development of Assets and

Liabilities of Conventional Microfinance Institutions

in the third quarter of 2019 in West Java Province.

Likewise, in terms of obligations that are due, West

Java Province is the largest. For the most prominent

placement of funds is West Java Province. Based on

the data summarized, the development of Assets and

Liabilities of Conventional Microfinance Institutions

in the second quarter of 2019 in West Java Province.

Likewise, in terms of obligations that are due, West

Java Province is the largest. For the most prominent

placement of funds is West Java Province.

Based on the data summarized, the development

of Assets and Liabilities of Conventional

Microfinance Institutions in the first quarter of 2019

in West Java Province. Likewise, in terms of due

obligations, West Java Province is the largest, the

largest placement of funds is West Java Province.

Based on the data summarized, the development of

Assets and Liabilities of Conventional Microfinance

Institutions in the first quarter of 2019 in West Java

Province. Likewise, in terms of obligations that are

due, West Java Province is the largest. For the

largest placement of funds is West Java Province.

The Structural Equation Modeling for the Deposits of Microfinance Institutions in Indonesia

163

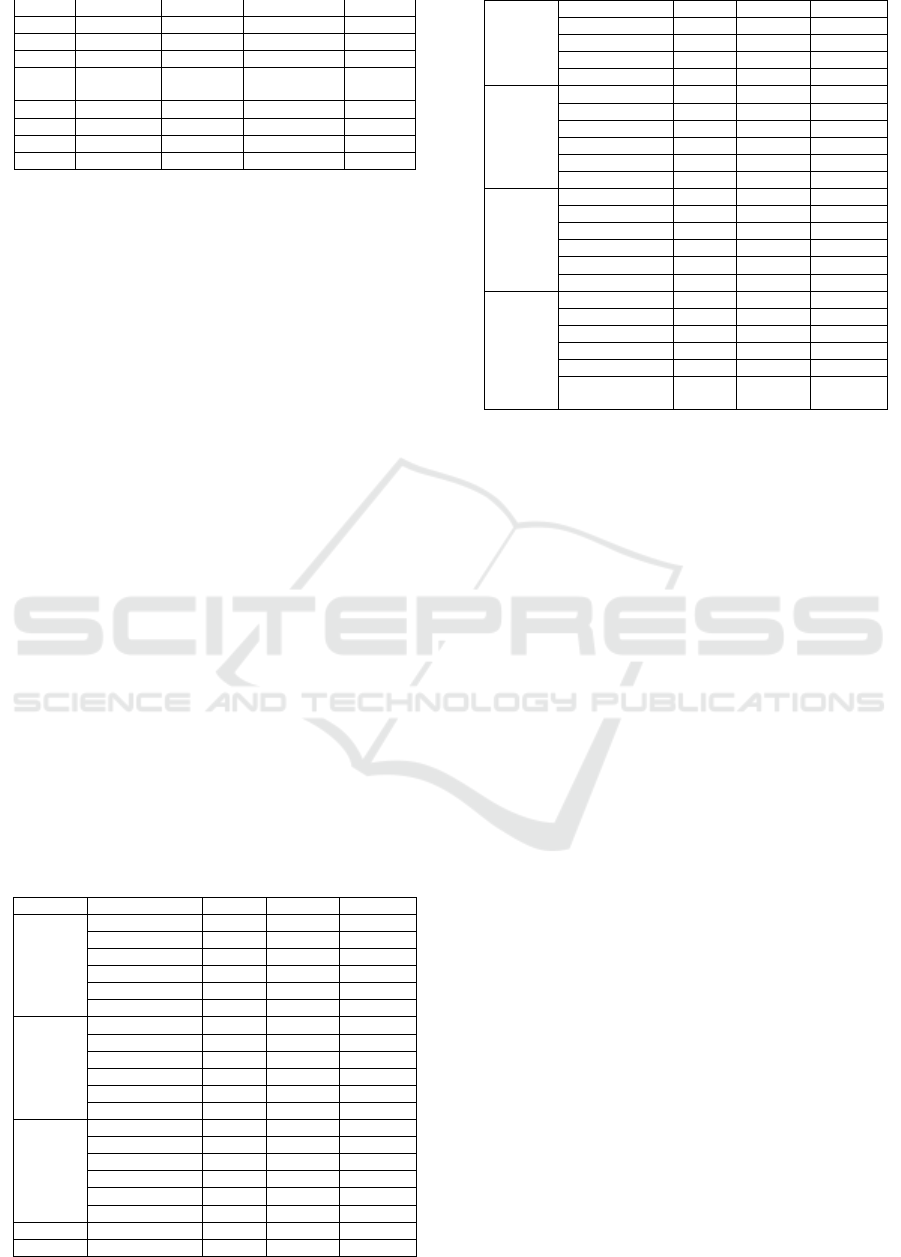

3.3 Sharia Model

The resulting model is shown in Figure 1:

Sources: SmartPLS 3.0 Software (2020).

Figure 1. Sharia Model

Figure 1 shows that the original sample value

of assets and liabilities is a maximum of 24.4%.

3.3.1 Path Coefficient

Based on the test results, the p-value of each

variable is shown in Table 3 below:

Table 3. Path Coefecient for Sharia Microfinance

Original

Sample

Sample

Mean

Standard

Devia

tion

T

Statis

tics

P

Values

X1 ->Y -0,047 -0,044 0,092 0,516 0,606

X2 ->Y 0,244 0,253 0,125 1,952 0,051

Sources : SmartPLS 3.0 Software (2020).

Based on table 3, it shows that the effect of

assets and liabilities does not play a dominant role

on deposits in microfinance institutions in Indonesia.

3.3.2 Adjusted R Square

The results of testing the Adjusted R Square value

are presented in Table 4 below:

Table 4. Adjusted R Square for Sharia Microfinance

R Square R Square Adjusted

Y 0,061 0,040

Sources: SmartPLS 3.0 Software (2020).

Based on the table shows the variation of the

independent variable explains the dependent by 4%.

3.3.3 Predictive Value

The Predictive Value presented in Table 4 below:

Table 5. Predictive Value for Sharia Microfinance

SSO SSE Q² (=1-SSE/SSO)

X1 92,000 92,000

X2 92,000 92,000

Y 92,000 90,227 0,019

Sources : SmartPLS 3.0 Software (2020).

Based on the table, it shows that the Predictive

value is only 1.9%.

3.4 Conventional Model

Based on the test results, the overall model is as

follows:

Sources: SmartPLS 3.0 Software (2020)

Figure 2. Conventional Model

Based on Figure 2, the original sample value

reaches 1, which means the sample is sufficient for

the resulting model.

3.4.1 Path Coefficient

Based on the test results, the p-value of each

variable is shown in Table 6 below:

Table 6. Path Coefficient for Conventional Microfinance

Original

Sample

Sample

Mean

Standard

Deviation

T

Statistics

P

Values

X1-> Y 0,948 0,975 0,131 7,245 0,000

X2-> Y -0,283 -0,285 0,209 1,355 0,176

Sources: SmartPLS 3.0 Software (2020)

Based on table 6 shows that the effect of assets

has a significant impact. At the same time, the

liability variable does not play a dominant role on

deposits in Conventional Microfinance Institutions

in Indonesia.

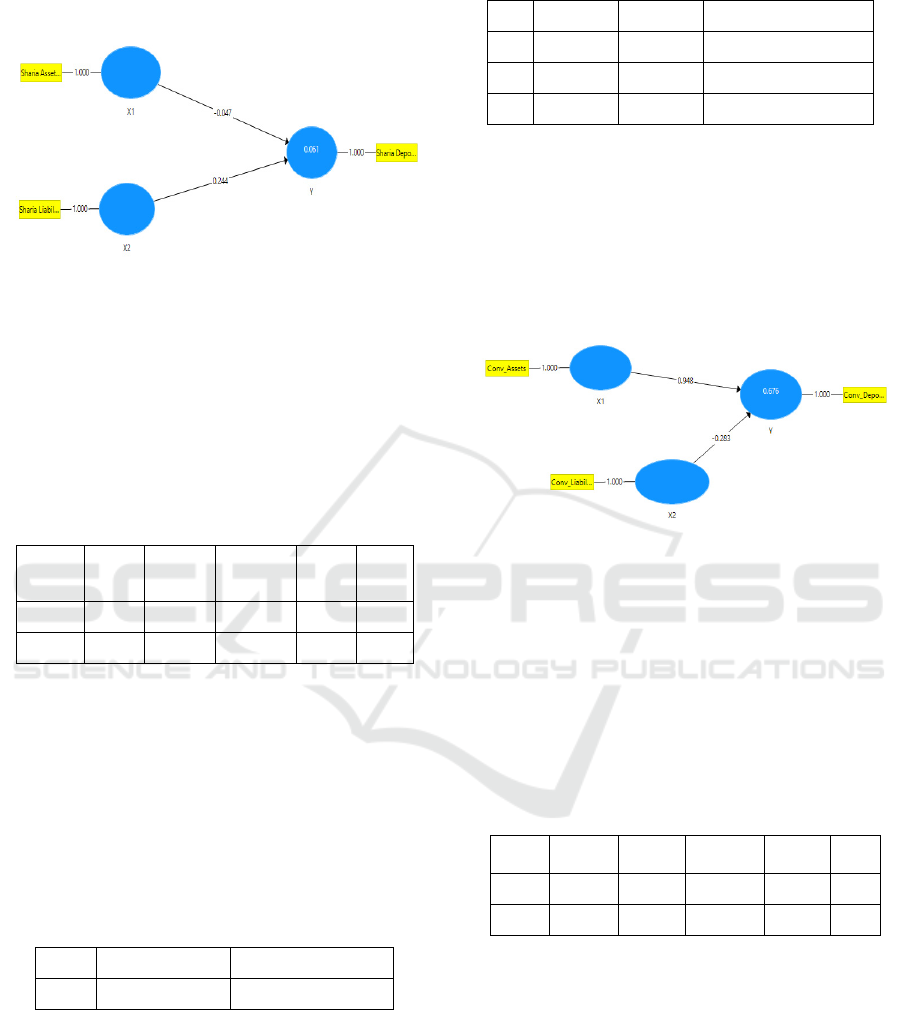

3.4.2 Adjusted R Square

The results of testing the Adjusted R Square value

are presented in Table 7 below:

ICoSTE 2020 - the International Conference on Science, Technology, and Environment (ICoSTE)

164

Table 7. Adjusted R Square for Conventional

Microfinance

R Square R Square Adjusted

Y 0,676 0,659

Sources: SmartPLS 3.0 Software (2020).

Table 7 shows that the variation of the

independent variable explains the dependent amount

of 65.9%.

3.4.3 Predictive Value

The Predictive Value can be presented in Table 8:

Table 8. Predictive Value for Conventional Microfinance

SSO SSE Q² (=1-SSE/SSO)

X1 41,000 41,000

X2 41,000 41,000

Y 41,000 13,111 0,680

Sources : SmartPLS 3.0 Software (2020).

The table shows that the Predictive value is only

68%.

Based on the analysis results above, it shows that

in Indonesia, the development of assets and

liabilities of Islamic Microfinance Institutions in

Indonesia is quite significant. It shows that the asset

value of Islamic MFIs continues to increase.

Generally, the existence of these MFIs is in rural

areas. It can improve the standard of living and

stretch the rural economy. From the liabilities side,

the amount exceeds the MFI's asset value. It shows

that the MFI can move dynamically without being

burdened by existing obligations. Generally, the

existence of these MFIs is in rural areas.

4 CONCLUSION

The test results show that the development of Assets

and Liabilities of Sharia Microfinance Institutions in

2018-2020 experienced a significant increase

compared to conventional MFIs. The development

of conventional and sharia MFIs is in Central Java

Province for Islamic MFIs, while the development

of conventional MFIs is concentrated in West Java

Province. It is a novelty in this research that

financial institutions based on sharia principles have

increased rapidly compared to conventional MFIs.

The government should provide policies, especially

in Islamic MFIs, because it has gained the trust of

the Indonesian people today. In addition, the results

show that the asset and liability variable cannot

increase the total deposit at Islamic Microfinance

Institutions. Conversely, in conventional MFIs,

variable assets can increase the total deposit, while

variable liabilities do not play a dominant role.

ACKNOWLEDGEMENT

This study is intended as an outcome of the

TALENTA Research Grant 2020.

REFERENCES

Abduh, M., Jamaludin, N., 2020, Baitul Maal wat-Tamwil

Services for SMEs: Evidence From Indonesia,

Handbook of Research on Theory and Practice of

Global Islamic Finance, IGI Global.

Afonso, J. S., Cox, J., Thorpe, A., 2020, Business

Performance and Heterogeneity among Islamic

Microfinance Clients: Evidence from Pakistan,

University of Portsmouth, Portsmouth.

Armendáriz, B., Szafarz, A., 2011, On Mission Drift in

Microfinance Institutions, The handbook of

microfinance, pp. 341-366.

Aziz, S., Husin, M., Ashfaq, M, 2020, Harmonising

Microfinance With Islamic Banking, Handbook of

Research on Theory and Practice of Global Islamic

Finance, IGI Global.

Beisland, L. A., Djan, K. O., Mersland, R., Randøy, T.,

2020, Measuring Social Performance in Social

Enterprises: A Global Study of Microfinance

Institutions, Journal of Business Ethics, Vol. 171, No.

1, pp. 1-21.

Berguiga, I., Said, Y. B., & Adair, P., 2020, Islamic and

Conventional Micro-Financing in the MENA Region:

A Performance Analysis, Handbook of Research on

Theory and Practice of Global Islamic Finance, IGI

Global.

Bishev, G., Odzaklieska, D., Berisha, M. S., 2020,

Development Trend of Microfinance Institutions in

Western Balkan Countries: Kosovo Case 2015-2018.

Bondinuba, F. K., Stephens, M., Jones, C., Buckley, R.,

2020, The Motivations of Microfinance Institutions to

Enter the Housing Market in a Developing Country,

International Journal of Housing Policy, Vol. 20, No.

4, pp. 1-21.

Fianto, B. A., 2020, Islamic Microfinance Institution:

Survey Data from Indonesia, Data in Brief, Vol. 28.

Ghosh, C., Das, A., 2020, Drivers of Performance of the

Microfinance Institutions in Selected South Asian

Countries, International Journal of Economics and

Accounting, Vol. 9, No. 2, pp. 155-179.

Gudjonsson, S., Kristinsson, K., Gylfason, H. F., &

Minelgaite, I., 2020, Female Advantage? Management

The Structural Equation Modeling for the Deposits of Microfinance Institutions in Indonesia

165

and Financial Performance in Microfinance, Business:

Theory and Practice, Vol. 21, No. 1, pp. 83-91.

Hermes, N., Lensink, R., & Meesters, A. (2011). Outreach

and efficiency of microfinance institutions. World

development, 39(6), 938-948.

Lam, S. S., Zhang, W., Ang, A. X., & Jacob, G. H. (2020).

Reciprocity Between Financial and Social

Performance in Microfinance Institutions. Public

Performance & Management Review, 43(1), 206-231.

Moya-Dávila, F. A., & Rajagopal, A. (2020). Managing

Microfinance Institutions: Analyzing How

Relationships Influence Entrepreneurial Behavior. In

Innovation, Technology, and Market Ecosystems (pp.

85-107). Palgrave Macmillan, Cham.

Nair, M., & Njolomole, M. (2020). Microfinance,

entrepreneurship and institutional quality. Journal of

Entrepreneurship and Public Policy.

Suesse, M., & Wolf, N. (2020). Rural transformation,

inequality, and the origins of microfinance. Journal of

Development Economics, 143, 102429.

Uddin, M. N., Hamdan, H., Kassim, S., Embi, N. A. C., &

Saad, N. B. M. (2020). Role of Islamic Microfinance

Institutions for Sustainable Development Goals in

Bangladesh. Journal of International Business and

Management, 3(1), 01-12.

ICoSTE 2020 - the International Conference on Science, Technology, and Environment (ICoSTE)

166