The Reality amidst Pandemic on Trust and Morality of Tax Payer:

Tax Payment and Tax Compliance in a Suburban Area in Indonesia

Irwan Sugianto

1

, Sarah Yuliarini

1a

and Eva Wany

2

1

Magister Accounting of Economics And Business Faculty in Universitas Wijaya Kusuma Surabaya, East Java, Indonesia

2

Accountancy Study Program of Economics And Business Faculty in Universitas Wijaya Kusuma Surabaya, Indonesia

Keywords: Trust, morality, willingness, compliance

Abstract: This research aimed to examine the determinant model of trust and morality in explaining the willingness to

pay tax and taxpayer compliance. This research also examines the contingent effect of trust and morality to

explain tax compliance through willingness to pay tax. The prediction model based on slippery slope theory

and theory of planned behavior. The respondent of this survey research are the small and medium enterprises

(SME’s) taxpayer that listed on a tax authority office in West Sidoarjo district. The result of determinant

model test showed that trust and morality have significant influences on the willingness to pay tax and

taxpayer compliance. Those result also showed that willingness to pay tax has significant influence on

taxpayer compliance. Furthermore, the contingent model test indicates that the willingness to pay tax only

has mediating effect on the influence of morality toward taxpayer compliance. Meanwhile, the willingness

to pay tax hasn’t mediating effect on the influence of trust on taxpayer compliance.

1 INTRODUCTION

Horrific pandemic caused delaying civilization in

millennium era. All aspects are to be come hostile for

health allocation. Considering for supporting

operational, the government try to maximize tax

revenue to provide flexibility in determining the

direction of the country's development policies. On

the other hand, the taxpayer considers that the

payment of taxes can reduce the income received.

Payment of taxes to the state is considered to reduce

personal economic benefits when they are still

struggle in calamity.

The basic problem in optimizing tax revenue is the

existence of an expactation gap between the

government and taxpayers (Mujaddid, 2019). The

government builds a system that encourages optimal

tax revenue, meanwhile taxpayers tend to be reluctant

to pay taxes (Torgler, 2008). Citizens will tend to be

reluctant to pay taxes when the system presented by

the government is considered corrupt, pertinently in

Indonesia (Mujaddid, 2019). Tax payer in Indonesia

are given the right to calculate, pay and report all their

tax obligations themselves. Therefore, the state can

only hope for the compliance and willingness of

a

https://orcid.org/0000-0003-2170-3859

taxpayers to fulfill their tax obligations (Benk et al.,

2016).

This needs to be studied in a narrow sub-urban

area that represents a variety of people's backgrounds.

The level of trust and encouragement based on moral

values, is it still maintained when citizens face

unfavorable conditions during the pandemic.

The purpose of this research is to examine two

forms of subjective norms emerge as trust and

morality in explaining taxpayer compliance and

willingness to pay taxes. Based on the framework of

the Slippery Slope Theory and Theory of Planned

Behavior (TPB) from Kirchler et al., (2007), (2008);

Muehlbacher & Kirchler, (2010) and Ajzen (1991)

researchers tried to test the premise of subjective

norms in explaining these two issues.

This study focuses on internal factors, considering

that the tax system in Indonesia depends on the

activity of taxpayers (Nazaruddin, 2019). Torgler's

(2008) literature study states that the factors of belief

(faith) and trust (trust), which are derivations from the

premise of subjective norms (subjective norms) are

important predictors of compliance and willingness.

Sugianto, I., Yuliarini, S. and Wany, E.

The Reality Amidst Pandemic on Trust and Morality of Tax Payer: Tax Payment and Tax Compliance in a Suburban Area in Indonesia.

DOI: 10.5220/0010798300003317

In Proceedings of the 2nd International Conference on Science, Technology, and Environment (ICoSTE 2020) - Green Technology and Science to Face a New Century, pages 131-139

ISBN: 978-989-758-545-6

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

131

2 THEORETICAL FRAMEWORK

2.1 Trust and Tax Morale to

Compliance Behaviour

Several studies related to taxpayer compliance found

empirical evidence that morality (tax morale) and

religiosity showed a positive association (Benk et al.,

2016; Cummings et al., 2009; Lhoka & Sukartha,

2020; Richardson, 2006; Torgler, 2003, 2003). 2006).

Then, the trust variable can also empirically increase

taxpayer compliance (Gobena & Van Dijke, 2017;

Muehlbacher & Kirchler, 2010). It comes from the

individual's understanding of obligations, which

instinctively prioritizes the needs of his life. External

disposition comprise to regulatory influences and

social pressures can affect individuals to shift

priorities.

Theory of Planned Behavior (TPB) is a basic

theory to explain the association between trust and

morality on willingness to pay taxes and taxpayer

compliance. The TPB is the development of Theory

of Reasoned Action (TRA). Both TRA and TPB have

been widely used as predictors of behavioral intention

and actual behavior (Madden et al., 1992).

The TRA contains two elements comprise to

attitude (attitude toward behavior) and subjective

norms (Trongmateerut & Sweeney, 2013).

Meanwhile, TPB expands the predictor of intention

by adding a third factor, reveal as perceived

behavioral control (Ajzen, 1991). The TPB can

explain immense of actual intention and behavior

regard on complex psyhological processes, however

there is difficult to predict actual behavior (Gundlach,

Michael J. Douglas, Scott C. Martinko, 2003). The

TPB provides an explanation that the three factors

previously mentioned can influence an individual's

behavioral intention (Ajzen, 1991). However, the

theory can explain most on ex-post happened than

determine explanation of ex-ante.

Another theory can explain interaction on

individual cognizance and implication on their

welfare. Slippery slope theory was developed to

provide a theoretical review based on aspects of

economic psychology by examining the factors of

perception of taxpayers' trust to and power from tax

authorities (Kirchler et al., 2007, 2008; Muehlbacher

& Kirchler, 2010). Slippery slope theoretical

framework stems from the premise that building a tax

compliance climate in the community can be done in

two forms, comprises as an antagonistic climate and

a synergistic climate.

The antagonistic climate is intended by the tax

authorities to build a coercive climate, this role is

formed because the tax authority has a full juridical

mandate to claim its legitimacy. Taxpayers have no

other situation than to comply, apart from sanctions

and their condition is at stake in maintaining

economic viability. A different concept occurs in a

synergistic climate. A synergistic climate requires

trust from the public to the tax authorities. Trust is

considered to be an important element that must be

built to create voluntary tax compliance (Wahl et al.,

2010). A synergistic climate has two essential

characteristics, namely that the tax authorities provide

services to taxpayers and they represent themselves

as equal parts of society (Kirchler et al., 2008). The

approach that should be used is to consider the

taxpayer as a partner of the authority. The concrete

form of this approach can be given an immaterial

policy of providing services as a customer and a

material policy in the form of tax incentives. The

implication of the synergistic approach is to reduce

social distance between the authorities and taxpayers.

In addition, the expectation gap between taxpayers

and the state (in this case the tax authorities with an

interest in tax revenues). Voluntary compliance can

be built on such a synergistic climate. Efforts to evade

taxes tend to be low, even taxpayers can be more

aware and open about their obligations as taxpayers.

2.2 The Effect of Social Trust on

Disposition to Pay Taxes

Trust in the context of tax compliance leads to

taxpayers' trust in state administrators and tax

authorities. Taxpayer trust can be built when there is

public trust in the government system that is

presented. The public (in this case the taxpayer) will

only consider the implementation of the tax system to

be trustworthy when it gets support from the

government (Chong & Arunachalam, 2018).

The perception of trust in the government in

allocating tax revenues for national development can

encourage the creation of social trust. The assumption

that tax management has been carried out efficiently

can foster obedient behavior towards tax regulations.

The emergence of trust from taxpayers can reduce the

tendency of taxpayers taking against applicable rules

(Chong & Arunachalam, 2018).

The behavior can be explained by slippery slope

theory emphasize on economic psychology by

examining the factors of perception of taxpayers' trust

to and power from tax authorities (Kirchler et al.,

2007, 2008; Muehlbacher & Kirchler, 2010). This

theory endeavour by Allingham & Sandmo (1972) as

causal tax compliance with the economic in empirical

evidence. This concept can accept by taxpayer as

ICoSTE 2020 - the International Conference on Science, Technology, and Environment (ICoSTE)

132

willingness to pay. Willingness to pay is the value at

which individuals are willing to pay, exchange or

sacrifice anything to obtain goods or services. The

willingness to pay taxes can be interpreted as an

action that reflects the moral values of the taxpayer,

which is motivated as a form of social and economic

contract between the taxpayer and the tax authority.

2.3 Intrinsic Motivation as Morality

Conduct

The morality factor has become an important issue

that has received much attention in empirical research

on taxation topics since 1990 (Cummings et al., 2009;

Feld et al., 2006; Horodnic, 2018; Torgler, 2006,

2008). Morality is a social factor which is a derivation

of subjective norms that should be considered in

predicting taxpayer compliance. The definition of

morality in the context of tax (tax morale) is defined

as intrinsic motivation to pay taxes (Horodnic, 2018).

Intrinsic motivation leads to a tendency to be honest

taxpayers and will not evade taxes on some taxpayers

(Cummings et al., 2009; Feld et al., 2006; Torgler,

2006).

Individual tax morality is shaped by a set of

subjective attitudes and norms (Torgler, 2006). The

attitude of the taxpayer to his tax obligations has

implications for the evaluation of the taxpayer to pay

or not pay taxes. The attitude itself results from the

taxpayer's knowledge of the tax concept and its

derivation (Farrar & Hausserman, 2016; Fishbein &

Ajzen, 2011; Torgler, 2006). The minimum measure

to justify voluntary compliance or intrinsic

motivation is present when law enforcement for tax

violations is at a low level (Cummings et al., 2009).

Whether law enforcement for tax violations is low, it

can be concluded that there is an indication of tax

compliance. This is based on low law enforcement

also shows that taxpayers are aware of taxes as their

obligations, this is a form of intrinsic motivation

(Richardson, 2006; Taing & Chang, 2020).

3 RESEARCH METHOD

The hypothesis was developed based on the premise

of attitudes, subjective norms and behavioral control

in relation to explaining the intentions of individual

behavior.

Words like “is”, “or”, “then”, etc. should not be

capitalized unless they are the first word of the

subtitle.

Figure 1. Internal and external exposures to tax compliance

Testing empirical facts based on the theoretical

framework of Picture 1 can be done using path

analysis techniques. The population in this study is

234 micro, small and medium enterprises registered

at the West Sidarjo Taxation Center by simple

random sampling technique. The number of

respondents is determined using the formula from

Roscoe (2014) where the number of respondents is at

least equal to ten times the number of variables this is

4 x 10 = 40 respondents.

4 RESULTS AND DISCUSSION

4.1 Statistical Analysis

The results of descriptive statistical tests can be

described by the characteristics of the data. The

distribution of the value of the confidence variable

which is the independent variable in this research,

obtained the lowest value of 3.00. The highest value

is 5.00. The average value of this variable is 3.88. The

standard deviation value or the value gap between the

data is 0.53.

Table 1. Descriptive Result

Variable N Min

.

Max

.

Mea

n

Std.D

ev

Trust (X1) 79 3.00 5 3.88 0.53

Morality

(X2)

79 4.00 5 4.51 0.35

Willingnes

s to pay

taxes (I)

79 1.83 5 3.49 0.93

Taxess

Complianc

e (Y)

79 3.90 5 4.46 0.37

Next, it is known the value distribution of the

morality variable. From the table, it is known that the

lowest value of the morality variable is 4.00.

Trust

Tax

Morali

ty

Willingnes

s to

p

a

y

Tax

Complianc

e

The Reality Amidst Pandemic on Trust and Morality of Tax Payer: Tax Payment and Tax Compliance in a Suburban Area in Indonesia

133

Meanwhile, the highest value for this variable is 5.00.

The average research respondents answered this

variable statement of 4.51. The standard deviation

value of this variable is 0.35. Furthermore, the general

description of the research data is for the variable of

willingness to pay taxes. Data on the variable of

willingness to pay taxes received the lowest response

with a value of 1.83. The highest score of respondents'

answers from this study was 5.00. The average

respondent answered this statement item at an interval

of 3.49. The value of the gap between respondents'

answers for this variable is 0.93. Finally, the general

description of the research data is for the taxpayer

compliance variable. The lowest response from

respondents to statements on this variable is 3.90. The

highest score of respondents' answers from this study

was 5.00. The average respondent answered this

statement item at an interval of 4.46. The value of the

gap between respondents' answers for this variable is

0.37.

4.1.1 Affiliations Partial Test Results: t Test

This test is conducted to test whether each

independent variable has a significant effect on the

dependent variable. The partial test in this study was

used to analyze the direct effect of the trust and

morality variables on taxpayer compliance without

going through the willingness to pay taxes. This

partial test is also useful for analysing the effect of

willingness to pay taxes on taxpayer compliance. To

find out which independent variable has a significant

effect, then a partial hypothesis test is carried out. The

following are the results of the partial hypothesis test:

Table 2. Multiple Regression Result- Model I

Variable Coeficien

t

Si

g

. Resul

t

Trust

(X1)

1.227 0.000** H1

Accep

t

Morality

(X2)

-0.532 0.021** H2

Accep

t

Significant 5%**

Based on the table of partial hypothesis test results

for the first model, it is indicated that the variables of

trust and morality affect taxpayer compliance. This

indication can be seen by referring to the significance

value (p value) which shows a number that is smaller

than the specified significance level, namely 0.000

and 0.021. For the confidence variable, it can explain

the willingness to pay taxes variable at a level of

confidence level of 0.01 (1%). Meanwhile, the

morality variable has a significant effect on the

willingness to pay taxes at a significance level of 0.05

(5%).

Furthermore, the researcher tested the second,

third and fifth hypotheses. This model is separated

into a second model. This second model contains a

predictive model of trust and morality variables on

taxpayer compliance. The test of this model is

intended to analyze the direct effect of the variables

of trust and morality on taxpayer compliance.

Meanwhile, the second model also examines the

variable of willingness to pay taxes which is

positioned as an independent variable and contingent.

It is a contingent nature by representing the element

of mediation (intervening) which mediates the

influence of trust and morality variables on taxpayer

compliance. To predict the nature of the contingency,

it is necessary to analyse the effect of the variable of

willingness to pay taxes as an independent variable

on taxpayer compliance. The following is a table of

test results for the second model:

Table 3 Multiple Regression Test Result- Model II

Variable Co-

efficient

Sig. Result

Trust (X1) 0.032 0.011** H3 Accept

Morality

(

X2

)

1.038 0.000*** H4 Accept

Willingness

to pay taxes

(I)

-0.019 0.006*** H5 Accept

Significant 1%*, 5%**, 10%***

Table 3. contains the results of testing the research

hypothesis partially. Based on the table, the

significance values for the three independent

variables are 0.011, 0.000 and 0.006, respectively. By

looking at the significance value of each independent

variable in the table, several conclusions are obtained.

First, the trust variable has a significant effect on

taxpayer compliance. This is evidenced by the

significance value of the confidence variable showing

a value of 0.011. Based on the significance value (p

value), it can be said that the confidence variable can

explain taxpayer compliance at a significance level of

0.05 (5%).

The morality variable is stated to have an effect

on taxpayer compliance. This indication can be seen

by referring to the significance value of the morality

variable, which is 0.000. This shows that the morality

variable is able to explain the taxpayer compliance

variable with a significance level of (0.01) 1%.

The variable of willingness to pay taxes shows a

significant effect on taxpayer compliance. This

indication can be seen based on the significance value

ICoSTE 2020 - the International Conference on Science, Technology, and Environment (ICoSTE)

134

of the variable willingness to pay taxes, which is

0.006. The purpose of this figure is that the variable

of willingness to pay taxes can be a determinant of

taxpayer compliance at a significance level of (0.01)

1%.

4.1.2 Mediation Detection Test Results: Path

Analysis

Three models are be tested using Sobel test as results

shown in Table 4. The first model is the result of a

regression test between two independent variables,

comprises as trust and morality to the willingness to

pay taxes as mediating variable. The results of

hypothesis testing in the first model indicate that the

two independents can show a significant consequence

on willingness to pay taxes.

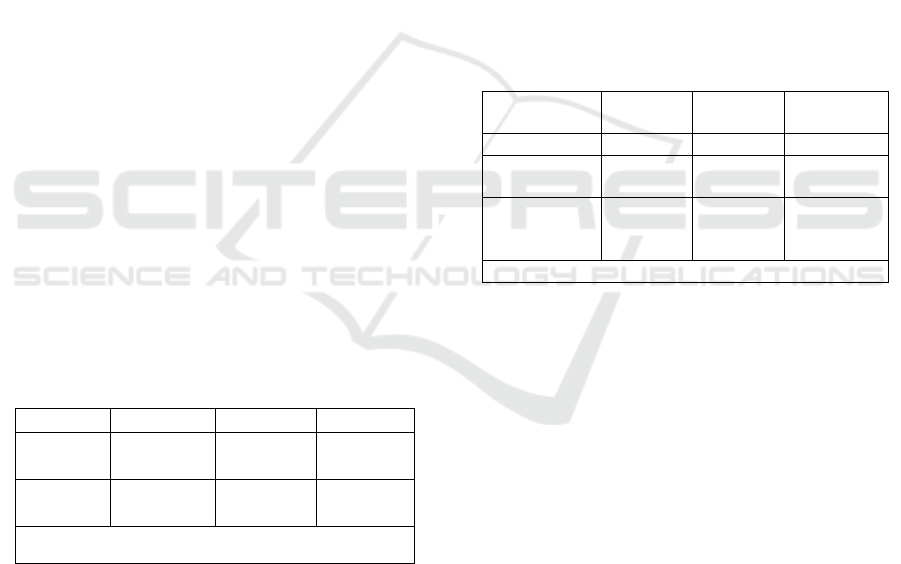

Table 4 Path Analysis Result

Variables

Path Coeficient

Model 1 Model 2 Model 3

X1- I 1.227

X2- I -0.532

X1 - Z 0.032

X2 - Z 1.038

I - Z -0.019

X1

–

I - Z 0.009

X2 – I - Z 1.048**

*

Path model is significant if *** Model III >

Model II

The second model uses partial test (t test) reveal

trust, morality, and willingness to pay taxes consistent

explaining taxpayer compliance. Here, the

willingness to pay taxes conducts as mediating

variable.

Next is an analysis of the results of testing the

third model, herein trust and morality factors on

taxpayer compliance through the variable of

willingness to pay taxes. In the Table 4 shown the

path coefficient value or the value of the indirect

influence coefficient is obtained using the Sobel test.

The path coefficients for the two independent

variables are 0.009 and 1.048.

The results of the Sobel test indicate that

empirically the variable of willingness to pay taxes

can only mediate the effect of morality on taxpayer

compliance. Meanwhile, the variable of willingness

to pay taxes cannot mediate the effect of trust on

taxpayer compliance. The indication that willingness

to pay taxes can only mediate the effect of morality

on taxpayer compliance is by referring to the path

coefficient value of the indirect effect which is greater

than the coefficient of direct influence (See table 4.

Models II and III: -0.434 < -0.484). This indicates that

the mediation model of the variable of willingness to

pay taxes is stronger in predicting the effect of

morality on taxpayer compliance.

Meanwhile, the predictive model for the variable

of trust in taxpayer compliance is stated not to be

stronger when mediated by the variable of willingness

to pay taxes. This model obtains a path coefficient

value which is not greater than the direct effect

coefficient ((See table 4.10 Models II and III: 0.032 >

0.009). Based on this analysis, the seventh hypothesis

is accepted (H7: Accepted). Meanwhile, the sixth

hypothesis is rejected. (H6: Rejected). The decision

obtained is that there is a significant effect of the

morality variable on taxpayer compliance mediated

by the willingness to pay taxes. The following are the

test results of this research model:

Figure 2. Path analysis test result

4.1.3 Determinant Coefficient

The coefficient of determination can be seen in the

Adjusted R Square value which shows how much the

independent variable can explain the independent

variable. The magnitude of the coefficient of

determination is 0 to one. The higher the Adjusted R

Square value, the better the regression model used

because it indicates that the ability of the independent

variable to explain the dependent variable is also

greater, and vice versa. The following are the results

of the coefficient of determination from the first and

second models:

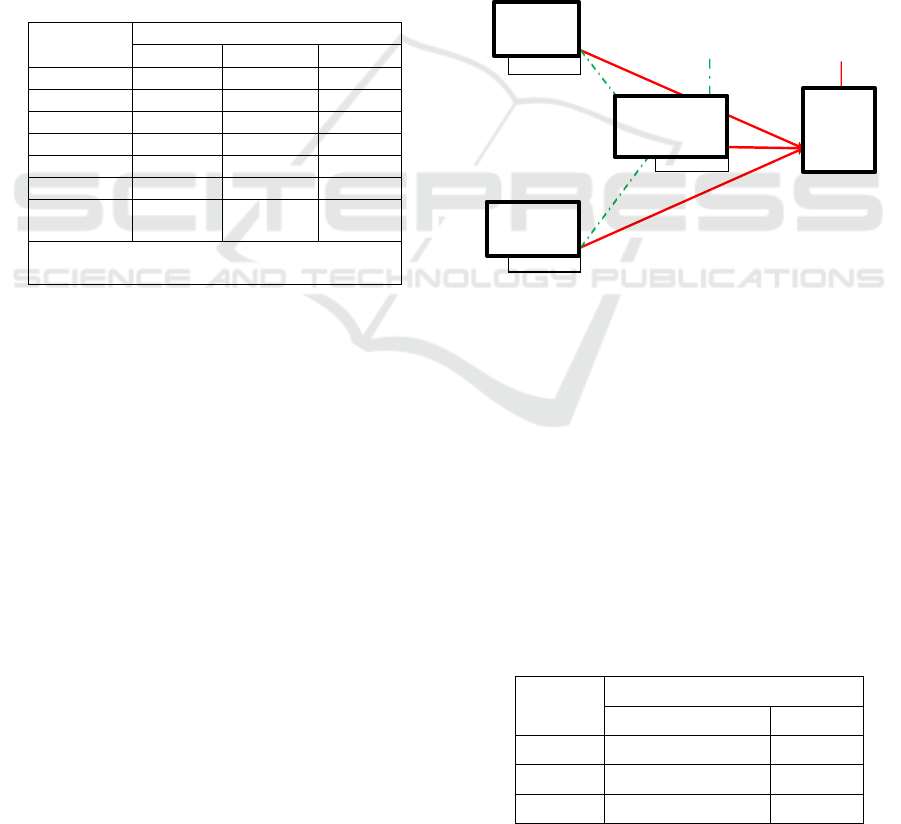

Table 5. Coefficient of Determination test results

Determination Coefficient

Adjusted R Square %

Model I 0.459 46

Model II 0.988 99

Kepercayaan

Moralitas

Kemauan

Membayar Pajak

Kepatuhan Wajib

Pajak

0,106

0,032

1,038

1,227

-0,532

e1=0,735

e1=0,109

Trust

Morality

Willingness

Comp

liance

The Reality Amidst Pandemic on Trust and Morality of Tax Payer: Tax Payment and Tax Compliance in a Suburban Area in Indonesia

135

Table 4. is the result of the coefficient of

determination test. In the table, the adjusted r-square

values for model one and model two are 0.459 and

0.988. These results indicate that the variables of trust

and morality can explain the willingness to pay taxes

with an influence intensity of 45.9%. While the

residual of 54.1% is explained by other predictors.

Meanwhile, for the second model, the adjusted r

square value obtained is 0.988. This indicates that the

intensity of the variables of trust, morality and

willingness to pay taxes can explain taxpayer

compliance with a percentage of 98.8%.

4.2 Findings

4.2.1 The Effect of Trust on Willingness to

Pay Taxes

The results of the first hypothesis test show that trust

can explain willingness to pay taxes. The indication

that can be seen from this result is that public trust in

the tax authority is an important determinant or factor

in presenting the willingness of the public to pay

taxes. That is, to ensure that the public (taxpayers) are

willing to pay taxes, the tax authorities need to build

a system and present a synergistic climate to increase

public trust (Wahl et al., 2010). There are two

perspectives that can be used to view trust as an

important element in encouraging willingness to pay

taxes, namely based on the theoretical framework of

the theory of planned behavior and slippery slope

theory.

Based on the framework of the theory of planned

behavior, trust is a form of subjective norm or

something that seems to be agreed upon by the

community (Mujaddid & Ramadan, 2019). The trust

in question is a sense of trust from the public to the

tax authorities or state administrators that they have

worked well and have presented a trusted system with

a service orientation to the community. When the

public considers that (there is a subjective norm of

trust in authority) the tax management system

presented is an effective system and is oriented to the

interests of the community, then this belief can reduce

the tendency of taxpayers to take actions that violate

the applicable rules (Chong & Arunachalam, 2018).

Instead of using authority as the authority to

conduct inspections and prioritize law enforcement, it

is better to use a partnership approach. Based on

slippery slope theory, such efforts will only increase

the gap in expectations and the distance between the

tax authorities and taxpayers and/or the public. These

results confirm the premise of trust from the slippery

slope theory and the premise of subjective norms

from the theory of planned behavior (Kirchler et al.,

2007, 2008; Muehlbacher & Kirchler, 2010). These

results are also consistent with the results obtained in

several previous studies that trust can be a

determinant of willingness to pay taxes (Farrar &

Hausserman, 2016; Gobena & Van Dijke, 2017;

Kirchler et al., 2007, 2008; Muehlbacher & Kirchler,

2010; Wahl et al., 2010).

4.2.2 The Influence of Morality on

Willingness to Pay Taxes

The results of the second hypothesis test indicate that

morality can explain willingness to pay taxes.

Taxpayer morality is an external factor from the

perspective of the tax authority which is also an

important element in determining the willingness to

pay taxes. The willingness to pay taxes depends on

the morality of the taxpayer itself.

Morality is a form of "behavioral norms" which is

the intrinsic motivation of taxpayers to pay taxes

(Torgler, 2006). This intrinsic motivation leads to the

tendency of taxpayers to be honest taxpayers and not

show the intention to evade taxes (Cummings et al.,

2009; Feld et al., 2006; Horodnic, 2018; Torgler,

2006). Morality in the context of tax compliance is

the presence of the value of honesty and awareness of

taxpayers that paying taxes is a good action. At the

same time, taxpayers believe that tax evasion is

something that is not right and immoral (Torgler,

2003).

Taxpayers who are oriented towards moral action

tend to be willing to pay taxes because paying taxes

is something moral (Taing & Chang, 2020). The

association between taxpayer morality and

willingness to pay taxes can be explained because

moral considerations will underlie (Fishbein & Ajzen,

2011). Morality can encourage taxpayers to have a

willingness to pay taxes because taxpayers think that

by paying taxes, they have shown behavior that

reflects the values of honesty and kindness.

The results of this study confirm that taxpayer

morality which is a form of behavioral norms can

predict willingness to pay taxes. The results of this

study also support the results of several previous

studies, namely Cummings et al., (2009), Benk, et.al.,

(2016), Torgler (2006), Mohdali & Pope (2014),

Mujaddid & Ramadan (2019) and Setyonugroho &

Sardjono (2013) which proves empirically that

taxpayer morality is an important element in

predicting willingness to pay taxes.

ICoSTE 2020 - the International Conference on Science, Technology, and Environment (ICoSTE)

136

4.2.3 Titles Trust Encourages on Taxpayer

Compliance

The results of the third hypothesis test obtain

empirical evidence that trust can explain taxpayer

compliance. To build a voluntary compliance factor

is needed from the public to the tax authorities. Based

on the indications obtained from the results of this

study, taxpayer trust can be seen as a form of strategic

approach to create a voluntary compliance.

The ability of trust to explain taxpayer compliance

confirms the premise of slippery slope theory. The

confirmed premise is the premise of trust or trust from

the public, in this case the taxpayer. The perception

of public trust in the system presented by the

government in managing tax revenues for national

development can encourage the creation of social

trust. The subjective norm that tax management has

been carried out efficiently can foster obedient

behavior towards tax regulations. The presence of

trust from the public has implications for the

decreasing tendency of taxpayers to take actions that

violate applicable rules (Chong & Arunachalam,

2018).

The theory of planned behavior framework sees

that trust which is a form of subjective norm must be

presented massively. The premise of subjective

norms positions trust as a form of taxpayer's

perception of the effectiveness and efficiency of the

presented tax management system. That is, the

government and tax authorities should be able to

convince taxpayers that tax management has been

carried out transparently and accountably.

The concrete form of efforts to foster public trust

is for example by shifting the approach which

originally started from a law enforcement approach to

a partnership approach. An example is presenting a

synergistic climate, but at the same time not forgetting

law enforcement to those who violate or do not negate

the elements of an antagonistic climate (Wahl et al.,

2010). The results of this research also support the

results obtained from the research of Gobena & Dijke

(2017), Muehlbacher & Kichler (2010) and Chong &

Arunachalam (2018) which state that public trust is the

essence of voluntary tax compliance. High taxpayer

trust followed by high government support can

increase taxpayer compliance.

4.2.4 The Effect of Morality on Taxpayer

Compliance

The results of the fourth hypothesis test indicate that

morality can affect taxpayer compliance. Tax

compliance will not be created without the moral

behavior of taxpayers. The element of morality

represents the determination of the taxpayer itself.

Taxpayer morality talks about behavior that reflects

honesty values to taxpayers in the context of fulfilling

their tax obligations.

The premise of the Theory of Planned Behavior

views that taxpayer morality is a subjective norm.

Morality in the context of the premise of subjective

norms reflects a certain measure of moral and

immoral behavior in the context of tax compliance

which seems to be agreed upon by many people in a

particular context. The measure of moral behavior in

fulfilling tax obligations leads to the views of people

in that context. If a context upholds the values of

honesty, then these values will be embraced and

demonstrated by someone in that context. When the

general view is present in the community that paying

taxes is a moral act, then the individuals in it will tend

to show moral behavior, namely paying taxes.

Based on the premise of subjective norms, the

important point that must be pursued is to present a

value to the community that paying taxes is an

obligation as a citizen and reflects moral behavior.

This is intended so that there is a massive view in the

community that paying taxes is doing something good

and oriented to helping realize social interests. The

way that can be done to present this subjective norm

is by showing the public that tax management by the

authorities is carried out in a transparent and

accountable manner. The results of this study are

consistent with empirical evidence from previous

research that the intrinsic motivation of taxpayers,

namely morality, is an essential factor in building tax

compliance (Cummings et al., 2009; Lhoka &

Sukartha, 2020; Richardson, 2006; Taing & Chang,

2020; Torgler, 2003, 2006).

4.2.5 The Influence of Willingness to Pay

Taxes on Taxpayer Compliance

The results of the fifth hypothesis test empirically

prove that willingness to pay taxes can affect taxpayer

compliance. The willingness to pay taxes represents

the taxpayer's awareness of his tax obligations. The

willingness to show that the taxpayer has a

commitment to all forms of obligations to the state. In

addition, willingness to pay taxes also shows respect

for the state.

The premise used to explain the effect of

willingness to pay taxes on taxpayer compliance is the

premise of attitude (attitude toward behavior) and

intention (behavioral intention) (Ajzen, 1991). The

willingness to pay taxes in this study uses one

indicator of the willingness to know the procedures

The Reality Amidst Pandemic on Trust and Morality of Tax Payer: Tax Payment and Tax Compliance in a Suburban Area in Indonesia

137

and procedures for fulfilling tax obligations

(Mujaddid & Ramadan, 2019). Willingness arises

because of the taxpayer's knowledge of the procedures

and procedures for fulfilling tax obligations. This

knowledge is then understood by taxpayers and

determines their attitude towards these obligations.

Knowledge and attitudes of taxpayers that represent

the consequences of their behavior that encourage the

intention or intention of taxpayers to pay taxes.

Chong & Arunachalam (2018) state that

compliance is preceded by behavior that leads to a

will. Based on this premise, it can be confirmed that

taxpayer compliance can be explained by willingness

to pay taxes. The willingness of taxpayers can

encourage them to fulfill their tax obligations in an

orderly and disciplined manner.

4.2.6 The Effect of Trust on Taxpayer

Compliance through Willingness to

Pay Taxes

The results of the sixth hypothesis test indicate that

willingness to pay taxes cannot mediate the effect of

trust on taxpayer compliance. The contingent nature

of the variable willingness to pay taxes does not

strengthen the predictive model in the sixth

hypothesis. The direct effect of the trust variable on

taxpayer compliance is stronger than the indirect

effect.

The predictor model of the taxpayer compliance

variable with the trust predictor variable with the

mediation of the willingness to pay taxes has not

confirmed the contingency nature. The results of this

research do not support the results of previous

research regarding the contingency nature of the

variable of willingness to pay taxes (Benk et al., 2016;

Mas'Ud et al., 2019; Mujaddid, 2019). The indirect

effect cannot be confirmed due to the fairly high

variation of respondents' answers to the statement of

willingness to pay taxes. This can be seen based on the

value of the standard deviation which is quite high.

Predictions about willingness to pay taxes that can

mediate the relationship between trust and taxpayer

compliance are stronger in the linear model. Public

trust is a primary element that can directly explain

taxpayer compliance. Trust and willingness to pay

taxes are not unrelated to tax compliance.

4.2.7 the Influence of Morality on Taxpayer

Compliance through Willingness to

Pay Taxes

The results of the seventh hypothesis test obtain

empirical evidence that morality affects taxpayer

compliance through willingness to pay taxes. The

mediation model of willingness to pay taxes is

empirically stronger in explaining the determination

of trust in taxpayer compliance. Morality which is the

intrinsic motivation of taxpayers can encourage a

desire to pay taxes. Willingness to pay taxes can then

mediate trust in explaining taxpayer compliance.

The tax morality factor means that someone

considers the values of honesty and awareness of

obligations as a taxpayer in everyday life, for example

in the process of making decisions and fulfilling tax

obligations. Morality can affect willingness to pay

taxes based on the premise that when a person

considers the value of honesty and awareness in

fulfilling his tax obligations, there will be an incentive

to take choices and actions that are in accordance with

the subjective norms he believes.

The association model between morality and

taxpayer compliance empirically has a contingency

nature. Mujaddid & Ramadan (2019) found that

religiosity which is a behavioral norm can affect

willingness to pay taxes. Meanwhile, several other

studies such as research by Mohdali & Pope (2014),

Nazaruddin (2019), Benk, et.al., (2016), Cummings

et al., (2009), Horodnic (2018), and Torgler (2006)

states that morality is a form of subjective norm that

can determine taxpayer compliance.

ACKNOWLEDGEMENTS

We appreciate to the Faculty of Economics and

Business, Wijaya Kusuma University, Surabaya, and

the Master of Accounting Study Program for

providing us with the opportunity to conduct this

research.

REFERENCES

Ajzen, I., 1991. The theory of planned behavior.

Orgnizational Behavior and Human Decision

Processes, 50, 179–211.

Ajzen, I., 2005. Attitudes, Personality and Behaviour. In

Mapping Social Psychology.

Allingham, M. G., & Sandmo, A.,1972. Income Tax

Evasion: Theoretical Analysis. Journal of Public

Economics, 1, 323–338.

Benk, S., Budak, T., Yüzba, B., & Mohdali, R. (2016). The

Impact of Religiosity on Tax Compliance among

Turkish Self-Employed Taxpayers. Religions, 7(4), 1–

10.

Chong, K. R., & Arunachalam, M. (2018). Determinants of

enforced tax compliance: Empirical evidence from

malaysia. Advances in Taxation, 25, 147–172.

ICoSTE 2020 - the International Conference on Science, Technology, and Environment (ICoSTE)

138

Cialdini, R. B., & Goldstein, N. J. (2004). Social Influence:

Compliance and Conformity. Annual Review of

Psychology, 55(1), 591–621.

Cummings, R. G., Martinez-Vazquez, J., McKee, M., &

Torgler, B. (2009). Tax morale affects tax compliance:

Evidence from surveys and an artefactual field

experiment. Journal of Economic Behavior and

Organization, 70(3), 447–457.

Diamastuti, E. (2012). Ke ( Tidak ) Patuhan Wajib Pajak :

Potret Self Assessment System. Ekonomi Dan

Keuangan, 20(80), 280–304.

Eiya, O., Ilaboya, O. J., & Okoye, A. F. (2016). Religiosity

and Tax Compliance: Empirical Evidence From

Nigeria. Igbinedion University Journal of Accounting,

1, 27–41.

Farrar, J., & Hausserman, C. (2016). An Exploratory

Investigation of Extrinsic and Intrinsic Motivations in

Tax Amnesty Decision-Making. Journal of Tax

Administration, 2(2), 47–66.

Feld, L. P., Frey, B. S., & Torgler, B. (2006). Rewarding

Honest Taxpayers ? Evidence on the Impact of Rewards

from Field Experiments. Center for Research in

Economics, Management and the Arts, 16.

Fishbein, M., & Ajzen, I. (2011). Predicting And Changing

Behavior The Reasoned Action Approach. In Taylor &

Francis.

Ghozali, I. (2016). Aplikasi Analisis Multivariete dengan

Program IBM SPSS 23.

Gobena, L. B., & Van Dijke, M. (2017). Fear and caring:

Procedural justice, trust, and collective identification as

antecedents of voluntary tax compliance. Journal of

Economic Psychology, 62, 1–16.

Gundlach, Michael J. Douglas, Scott C. Martinko, M. J.

(2003). The decision to blow the whistle: A Social

Informatin Processing Framework. Academy of

Management Review, 28(1), 1–19.

Horodnic, I. A. (2018). Tax morale and institutional theory:

a systematic review. International Journal of Sociology

and Social Policy, 38(9–10), 868–886.

Kirchler, E., Hoelzl, E., & Wahl, I. (2008). Enforced versus

voluntary tax compliance: The “slippery slope”

framework. Journal of Economic Psychology, 29(2),

210–225.

Kirchler, E., Muehlbacher, S., Kastlunger, B., & Wahl, I.

(2007). Why pay taxes?: A review of tax compliance

decisions. In International Studies Program Working

Paper (Vol. 7).

Lhoka, N. L. P. D. P., & Sukartha, I. M. (2020). Pengaruh

E-SPT, Sanksi, Sosialisasi, Pengetahuan Perpajakan,

dan Moralitas pada Kepatuhan Wajib Pajak. E-Jurnal

Akuntansi, 30(7), 1699.

Madden, T. J., Ellen, P. S., & Ajzen, I. (1992). A

Comparison of The Theory of Planned Behavior and

The Theory of Reasoned Action. Personality and Social

Psychology Bulletin, 18(1), 3–9.

Mas’Ud, A., Manaf, N. A. A., & Saad, N. (2019). Trust and

power as predictors to tax compliance: Global

evidence. Economics and Sociology, 12(2), 192–204.

Muehlbacher, S., & Kirchler, E. (2010). Tax compliance by

trust and power of authorities. International Economic

Journal, 24(4), 607–610.

Mujaddid, A. (2019). Faktor Religiusitas dalam Membayar

Pajak & Zakat. InFestasi, 15(2), 98–110.

Nazaruddin, I. (2019). The Role of Religiosity and

Patriotism in Improving Taxpayer Compliance. Journal

of Accounting and Investment, 20(1).

Park, H., & Blenkinsopp, J. (2009). Whistleblowing as

planned behavior - A survey of south korean police

officers. Journal of Business Ethics, 85(4), 545–556.

Ramadan, G. R., & Afiqoh, N. W. (2018). Menyingkap

Tabir Realitas Tax Amnesty. InFestasi, 14(1), 11.

Ratmono, D. (2014). Model kepatuhan perpajakan

sukarela: peran denda, keadilan prosedural, dan

kepercayaan terhadap otoritas pajak. Jurnal Akuntansi

& Auditing Indonesia, 18(1), 42–64.

Richardson, G. (2006). Determinants of tax evasion: A

cross-country investigation. Journal of International

Accounting, Auditing and Taxation, 15(2), 150–169.

Setyonugroho, H., & Sardjono, B. (2013). Factors

Affecting Willingness To Pay Taxes On Individual.

The Indonesian Accounting Review, 3(1), 77–88.

Sujarweni, V. W. (2015). Metode Penelitian Bisnis dan

Ekonomi.

Taing, H. B., & Chang, Y. (2020). Determinants of Tax

Compliance Intention : Focus on the Theory of Planned

Behavior Determinants of Tax Compliance Intention :

Focus on the Theory of Planned. International Journal

of Public Administration, 00(00), 1–12.

Taylor, M. K., Pietrobon, R., Taverniers, J., Leon, M. R., &

Fern, B. J. (2013). Relationships of hardiness to

physical and mental health status in military men: a test

of mediated effects. Journal of behavioral medicine,

36(1), 1-9.

Torgler, B. (2003). Tax Morale: Theory and Empirical

Analysis of Tax Compliance. PhD Thesis Universität

Basel Zur, 1–668.

Torgler, B. (2006). The importance of faith : Tax morale

and religiosity. Journal of Economic Behavior &

Organization, 61, 81–109.

https://doi.org/10.1016/j.jebo.2004.10.007

Torgler, B. (2008). What Do We Know about Tax Fraud?

An Overview of Recent Developments. Social

Research, 75(4), 1239–1270.

Trongmateerut, P., & Sweeney, J. T. (2013). The Influence

of Subjective Norms on Whistle-Blowing : A Cross-

Cultural Investigation. J Bus Ethics, 437–451.

Wahl, I., Kastlunger, B., & Kirchler, E. (2010). Trust in

authorities and power to enforce tax compliance: An

empirical analysis of the “slippery slope framework.”

Law and Policy, 32(4), 383–406.

Widuri, R., Jie, M., & Christie, A. (2019). Individual Tax

Compliance: Trust versus Power. Advances in

Economics, Business and Management Research,

103(Teams 19), 82–88.

Zhang, N., Andrighetto, G., Ottone, S., Ponzano, F., &

Steinmo, S. (2016). Willing to Pay? An Experimental

Analysis of Tax Compliance in Britain and Italy. PLOS

ONE, 11(2), 1–46.

The Reality Amidst Pandemic on Trust and Morality of Tax Payer: Tax Payment and Tax Compliance in a Suburban Area in Indonesia

139