The Effect of Financial Constraints on

Cash Tax Savings

Arni Yulvia and Wika Arsanti Putri

Managerial Accounting Department, Politeknik Negeri Batam, Ahmad Yani Street, Batam, Indonesia

Keywords: Financial Constraints, Cash Tax Savings, Tax Avoidance

Abstract: This study aims to empirically examine the effect of financial constraints on cash tax savings. The object

under study is manufacturing sector companies listed on the Indonesia Stock Exchange in the 2014 -

2018 period with a total sample of 185 companies over 5 years obtained by purposive sampling. The

research method used is a quantitative method with a panel data regression analysis approach fixed effect

model with the help of Eviews application version 11. The results of the study found that changes

in financial constraints did not significantly influence the cash tax savings that was proxied by

∆GAAP ETR. This shows that companies with increased financial constraints do not obtain additional

internal funds with a cash tax savings strategy. Companies pay more attention to the risks they will face if

using this strategy.

1 INTRODUCTION

The main revenue for Indonesia is mostly sourced

from the tax sector. The tax revenue will then be

used to finance the needs of the country so that all

taxpayers both individuals and entities are expected

to meet their tax obligations following applicable

taxation provisions. Based on data obtained from

the Ministry of Finance, the amount of state

revenue through the tax sector targeted by the

government as a source of funding for State

Expenditure Budget in 2018 reached 85.40 percent

of the total state revenue of Rp 1,894.72 trillion or

around Rp 1,618.10 trillion. The government must

optimize tax revenue so that it can be realized

according to the targets set to encourage economic

growth (Wiratmoko, 2018).

One of the efforts made by the government to

realize the goals of a nation in financing the

country's development is to explore sources of

funding from the tax sector. The government

continues to be determined to carry out tax reforms

to increase tax revenue. The government is trying to

increase the tax ratio gradually as one indicator to

assess the government's ability to collect tax revenue

(www.kemenkeu.go.id).

Minister of Finance, Sri Mulyani, based on a

quote from wartaekonomi.co.id (January 3, 2019)

revealed that Indonesia's tax ratio in 2018

experienced a significant increase to 11.5 percent.

However, when viewed from a comparison of

ASEAN countries, Indonesia's tax ratio from 2014-

2018 is still far behind. The comparison of the

tax ratio between Indonesia and ASEAN countries

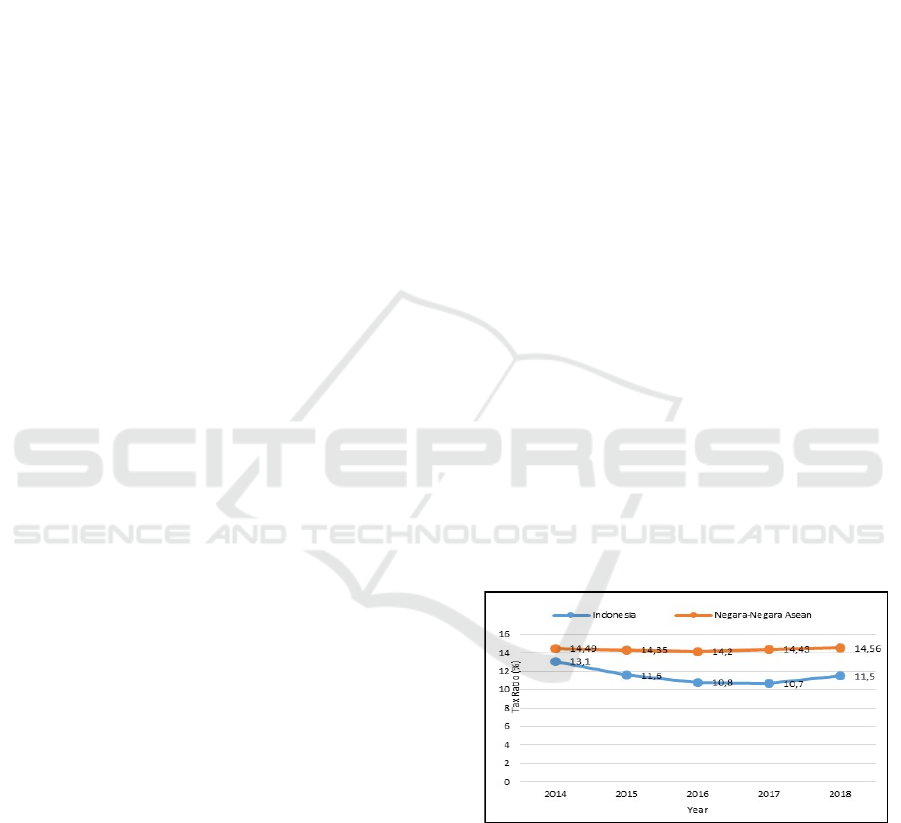

can be seen in Figure 1.

Figure 1: Comparison of Tax Ratio between Indonesia and

ASEAN countries

Source : World Bank, Kementerian Keuangan (2019)

According to Darussalam (2017), a fundamental

problem in the Indonesian taxation sector that has

not yet been fully resolved to date, one of which is

the leakage of tax revenue caused by tax avoidance

activities. Taxpayers will try to do tax avoidance as

a form of tax planning strategy to minimize the

amount of tax paid against the state without

174

Yulvia, A. and Putri, W.

The Effect of Financial Constraints on Cash Tax Savings.

DOI: 10.5220/0010355601740185

In Proceedings of the 2nd International Conference on Applied Economics and Social Science (ICAESS 2020) - Shaping a Better Future Through Sustainable Technology, pages 174-185

ISBN: 978-989-758-517-3

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

violating taxation laws (Mardiasmo, 2018).

According to Koester, Shevlin, & Wangerin (2016),

one tax avoidance strategy includes an effort to cash

tax savings.

Tax avoidance strategies with tax savings by

companies can cause huge losses for the

government. Therefore, the government needs to

learn more about the characteristics of companies

that utilize tax savings as a way to do tax avoidance.

It is intended that the government can consider and

make it easier to assess whether transactions that

occur by companies are still within reasonable limits

or not. Most companies prefer to increase tax savings

to maintain corporate profits to avoid bankruptcy.

Based on evidence by Law & Mills (2015) and

Edwards, Schwab, & Shevlin (2016) shows that

companies tend to increase cash tax savings to

generate internal funds in response to increased

financial constraints.

Financial constraints are conditions where

companies have difficulty in accessing funding from

external sources. The existence of financial

constraints can be caused by several conditions both

from internal and external factors. Internal factors

occur if the company experiences liquidity problems

caused by the failure of the company in achieving

sales targets, causing the company to not be able to

finance the company's operations until in the end the

situation causes bankruptcy for the company

(Altman, 1968) and if the company faces difficulties

in financing its investment (Kaplan & Zingales,

1997; Whited & Wu, 2006). External factors occur

due to macroeconomic shocks, such as the economic

crisis, inflation, and the banking crisis

4

.

This study is the adoption of research by

Edwards, Schwab, & Shevlin (2016). The difference

that supports from previous research lies in several

parts, including (1) Using GAAP changes in the

Effective Tax Rate (∆GAAP ETR) to measure cash

tax savings as the dependent variable. (2) Using

secondary data in the form of annual reports on

manufacturing sector companies listed on the

Indonesia Stock Exchange (IDX) within five years

starting from 2014-2018.

This research was conducted to test whether

companies facing financial constraints tend to

generate internal funds through tax avoidance

activities. This study will use financial constraints

and cash tax savings variables which have been

tested in previous studies with inconsistent results.

The results of research by Edwards, Schwab, &

Shevlin (2016) argue that the increases financial

constraints measured by firm-specific and

macroeconomic shocks has positive effect on cash

tax savings. Different from previous studies, the

results of research in Indonesia conducted by

Hermawan & Riandoko (2018) conclude that the

increases in financial constraints measured by firm-

specific levels has significant positive effect on cash

tax savings, but not significant if measured by

macroeconomic shocks. Based on the background of

the problems outlined above, the title of this study is

"The Effect of Financial Constraints on Cash Tax

Savings".

2 THEORETICAL

FRAMEWORK AND

HYPOTHESIS

DEVELOPMENT

2.1 Theoretical Framework

2.1.1 Theory of Constraints

Theory of Constraints (TOC) is the development of

Optimized Production Technology (OPT). This

theory was first introduced by Dr. Eliyahu M.

Goldratt in 1986. OPT is a technique for optimizing

production scheduling that aims to increase the

overall output of products sold (Throughput), reduce

inventory (Inventory), and reduce operational costs

(Operational expense). Goldratt (1986) has made a

concept in OMO by incorporating management

philosophy in improvement based on identifying

obstacles to increasing profit.

The basic concept of TOC is that every

organization has at least one obstacle that prevents

management from achieving its operational goals.

These constraints should be identified to improve

performance. If an obstacle is solved then the next

obstacle can be identified and updated.

2.1.2 Pecking Order Theory

Pecking Order Theory was first introduced by

Donaldson in 1961 with the theory naming done by

Steward C. Myers and Nicholas S. Majluf in 1984.

This theory states that companies tend to prioritize

funding from internal sources to pay dividends and

fund investment. If the use of internal funds is

insufficient, the company will use external funds

besides. Internal funding is obtained from the

company's operating results in the form of retained

earnings, cash flow, and depreciation. Whereas

external funding in the form of bond issuance takes

precedence over the issuance of new shares. The

The Effect of Financial Constraints on Cash Tax Savings

175

results of Donaldson's research (1961) state that

bond issuance is carried out by companies to avoid

issuance costs (floatation costs) that are tied to

external funding because the cost of issuing bonds is

cheaper than issuing new shares.

2.1.3 Financial

Financial is defined as the availability of money

needed to maintain the company. According to

Jatmiko (2017), finance is the art and science of

managing money that influences every organization

to achieve its goals. Howard & Upton (1952) in

Jatmiko (2017) defines finance as an "administrative

area" in a company that deals with how to manage

cash flow so that the company has the means to

carry out its objectives as efficiently as possible and

at the same time fulfill the obligations that must be

paid. If the company's finances are inadequate then

the company will not be able to achieve its goals.

2.1.4 Tax Law Tax Avoidance

Tax avoidance through cash tax savings is one type

of strategy that companies pay attention to because it

aims to minimize the amount of tax paid to the

government (Whited & Wu, 2006). Companies that

always try in various ways to make cash, can be said

that the company is in a state of financial

constraints. But they don't always make cash

through tax avoidance as a result of financial

constraints. When macroeconomic shocks occur like

an economic crisis, all companies will be affected.

This will tend to encourage companies to generate

cash through tax avoidance.

2.2 Hypothesis Development

2.2.1 Effects of Changes in Financial

Constraints on Cash Tax Savings

Research by Edwards, Schwab, & Shevlin (2016)

states that the increases in financial constraints both

measured by firm-specific and macroeconomic

shocks have positive effect on cash tax savings.

Contrary to the results of previous studies,

Hermawan & Riandoko (2018) found that the

increases in financial constraints measured by firm-

specific levels has significant positive effect on cash

tax savings, but not significant if measured by

macroeconomic shocks

According to Edwards, Schwab, & Shevlin

(2016), companies that face increasing financial

constraints will tend to generate additional internal

funds through a tax avoidance strategy rather than

accessing external funding. This is because external

funding is far riskier because of the emergence of

greater external funding that must be borne by the

company. The formulation of the hypothesis that

will be tested by researchers based on the above

hypothesis development path is:

H1: Changes in financial constraints has positive

effect on cash tax savings

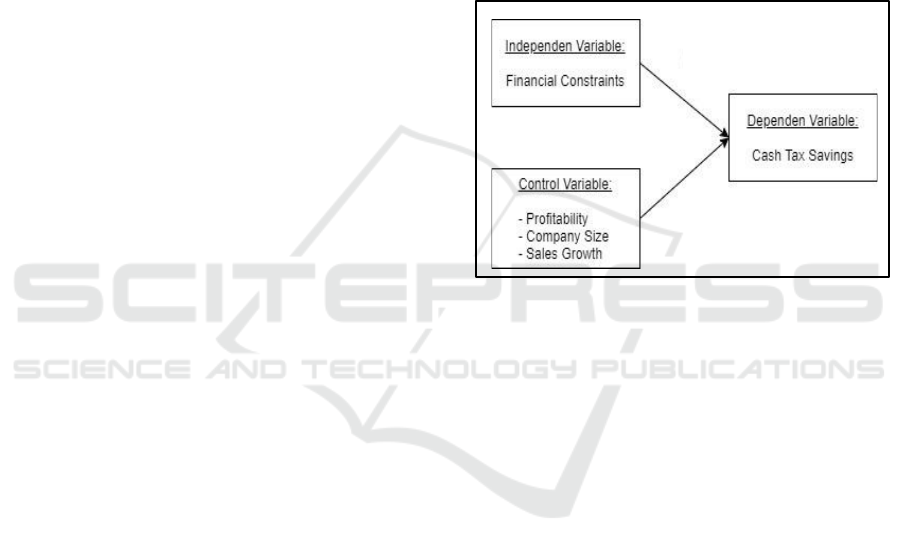

Based on the development of the hypothesis

that the researcher has described above, the

description of the research model adopted by the

researcher, namely:

H1

(+)

Figure 2: Research Model

3 RESEARCH METHOD

3.1 Data Types and Sources

The type of data used is quantitative data with data

sources used, namely secondary data in the form of

figures from annual reports on manufacturing sector

companies obtained through the official website of

the IDX during 2014-2018 period. Based on the time

of collection, cross-section data and time series will

be used in this study.

3.2 Variable Operational Definitions

and Measurements

3.2.1 Dependent Variable

The dependent variable defined in this study is cash

tax savings. A proxy that will be used to measure

cash tax savings is ∆GAAP ETR. GAAP ETR is

represented by a percentage of the amount of cash

paid for tax costs divided by profit before tax.

Researchers measure ∆GAAP ETR in t + 1 year

period (starting from 2015-2018) because companies

ICAESS 2020 - The International Conference on Applied Economics and Social Science

176

generally need time to plan and implement tax

avoidance strategies (Edwards, Schwab, &

Shevlin, 2016). The formula used to calculate

∆GAAP ETR according to Hanlon & Heitzman

(2010) is:

Total income tax expense t+1

∆GAAP ETRt+1 =

Total Pretax accounting income t+1

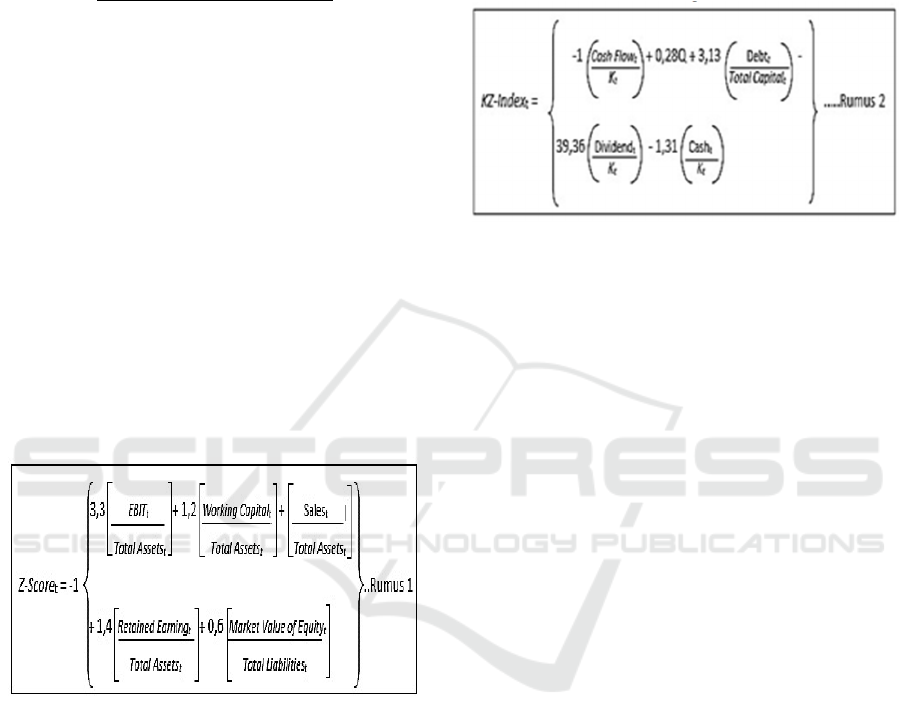

3.2.2 Independent Variable

The independent variable determined in this study is

the change in financial constraints (Constraints).

This variable is represented by two proxies, namely

∆Altman Z-Score and ∆KZ-Index. Researchers

measured ∆Constraints in the period t-1 to t years

(starting from 2014-2017) but the effect of changes

in the dependent and control variables began in

2015-2018. Higher ∆Constraints represent increased

financial constraints.

∆Altman Z-Score is intended to know the

prediction of financial distress and ∆KZ-Index to

find out the constraints related to corporate

investment. The formulas used to calculate the

∆Altman Z-Score and ∆KZ-Index according to

Altman (1968) and Kaplan & Zingales (1997) are:

Where:

t =

Annual financial statements

for 2014-2017 period

EBIT =

Earning Before Interest and

Taxes

Working

Capital = Current assets - Current

liabilities

Sales = Net sales

Retained

Earning = Appropriated +

Unappropriated

Market Value of

Equity = Stock price x Share

outstanding

Total Assets = Current Assets + Fixed

Assets

Total Liabilities = Short-term liabilities +

Long-term liabilities

Where:

t = Annual financial statement for

2014-2017 period

Cash flow = Net profit before extraordinary

items + Depreciation &

Amortization

Tobin’s Q = Market value of equity + Debt) /

Total asset (Lindenberg & Ross,

1981)

Debt = Total Long-term debt + Debt

in current liabilities

Total Capital = Total Long-term debt + Debt

in current liabilities +

Stockholders’ equity

Dividend = Total Cash Dividends

Paid (common and preferred)

Cash = Cash and short-term investments

K = Property, plant & equipment

All proxies used to measure the level of financial

constraints are multiplied by -1 so that the higher

values represent an increase in financial constraints.

3.2.3 Control Variable

The control variables in this study are used to

complete or control the causal relationship between

the independent variable and the dependent variable,

to get more complete empirical model. Control

variables are measured together with changes in

∆GAAP ETR in t + 1 year period (starting from

The Effect of Financial Constraints on Cash Tax Savings

177

2015-2018). The control variables used in this study

related to cash tax savings are:

Profitability

Profitability can be measured by proxy for changes

in Return On Assets (∆ROA), ie changes inthe ratio

of profit before tax to the level of assetincome. The

formula used to calculate ∆ROA basedon the proxy

model by Adhikari, Derashid, & Zhang

(2006) is:

∆ROAt+1 = Profit before tax t+1

Total Assets t+1

Company Size

This variable is calculated through the ∆LnSales

proxy, using a change in the natural logarithm ratio

of total sales. This variable can directly influence the

level of GAAP ETR. The formulas used to measure

∆LnSales according to Belkaoui & Karpik (1989)

are:

∆LnSales

t+1

= Log natural of sales

t+1

Sales Growth

Sales growth can be measured by the ∆SalesGrowth

proxy, which is a change in the ratio of total sales in

the following year after deducting sales in the

previous year against sales in the previous year. The

formula used to measure ∆SalesGrowth according to

Poernawarman (2015):

∆SalesGrowth = Sales (t) – Sales (t-1)

Sales (t-1)

3.3 Research Object

The research object used is financial constraints and

their influence on cash tax savings in manufacturing

sector companies listed on the Indonesia Stock

Exchange during 2014-2018 period.

3.4 Population and Sample

The research sample used was companies in the

manufacturing sector listing on the Indonesia Stock

Exchange from 2014-2018 with a determined

population of 165 companies, but the total

population had been reduced according to

established criteria so that the number of samples

taken was 37 companies with 185 observations

during 5 years.

3.5 Sampling Technique

The sampling technique in this study is a non-

probability sampling (non-random) in the form of

purposive sampling with criteria based on judgment

sampling. The criteria used are companies in the

manufacturing sector that are listed on the IDX and

publish financial reports consistently from 2014-

2018, companies that publish financial statements

for the period of January 1 to December 31, present

financial statements in currencies in rupiah, has

complete financial data related to the research

variables, companies that obtain positive profit

before tax and companies whose transactions are

subject to final income tax (PPh) are exempted from

the sampling criteria considering the final PPh is

different in terms of the level and administration of

the Corporate Income Tax.

3.6 Data Collection Technique

Data collection techniques related to research to

be carried out is the archive data in the database.

This technique is used to determine secondary data

from related sources, namely the Indonesia Stock

Exchange which can be accessed through the

website www.idx.co.id.

3.7 Data Processing Techniques

The data processing technique used is data

tabulation. This technique is done by placing the

data in the financial statements according to the

needs of analysis into a table that has been made

with the Microsoft Excel program to facilitate

researchers in the process of data analysis. Data that

have been analyzed are then processed statistically

using the Eviews 11 application.

3.8 Data Analysis Technique

The data analysis technique used in this study is a

panel data regression analysis technique to examine

the effect of financial constraints on cash tax

savings (Hermawan & Riandoko, 2018). Panel data

is a combination of time series data and cross-

section data (Basuki & Prawoto, 2017). The data

obtained in this study were processed using panel

data regression models, namely the simple effect

model (common effect), fixed effect model (fixed

effect), and the random effect model (random effect)

ICAESS 2020 - The International Conference on Applied Economics and Social Science

178

with the selection of panel data regression models

based on the chow test, test Hausman, and the

Lagrange multiplier (LM) test.

4 RESULTS AND DISCUSSION

4.1 Descriptive Statistics

Descriptive statistical analysis is used to find out

the mean, minimum, maximum, median, and

standard deviation of ∆GAAP ETR, ∆Z-Score,

∆KZ-Index, ∆ROA, ∆LnSales, and ∆SalesGrowth as

control variables. The results of the analysis can be

seen in table 1

Table 1: Results of Descriptive Statistics Analysis

Variabel n Mean Min Max Median Std.

Dev.

∆GAAP ETR 185 0.2153 0.0000 0.5809 0.2498 0.1281

∆Z-Score 185 378.430 1.649.791 0.0000 -46.748 2.134.653

∆KZ-Index 185 0.2039 -789.307 3.508.786 -16.824 494.702

∆ROA 185 0.1109 0.0000 0.7091 0.0830 0.1268

∆LnSales 185 185.702 0.0000 30.8116 207.575 105.509

∆

S

al

e

s

Growth 185 0.0635 -0.4376 0.8437 0.0457 0.1190

Note: This table displays descriptive statistical test results.

Dependent Variable: Cash Tax Savings (∆GAAP ETR).

Independent Variable: Financial Constraints (∆Z-Score, ∆KZ-

Index). Control Variables: Profitability (∆ROA), Company

Size (∆LnSales), Sales

G

r

owth (∆Sales

G

r

owth).

Source: Data processing results in Eviews 11

Based on the descriptive statistical test results in

table 1, the number of samples used in this study

was 185 samples. The dependent variable in the

form of cash tax savings as measured by the ∆GAAP

ETR proxy has an average value of 0.2153 which

shows the average ability of the company to make

cash tax savings. Companies that have a cash tax

savings index value exceeding 1 indicate that

the level of companies that use cash tax savings

strategies is very high. The lowest (minimum)

value of cash tax savings of 0.0000 is owned by

PT. Mandom Indonesia Tbk in 2015 while the

highest value (maximum) of 0.5809 is owned

by PT. Argha Karya Prima Industry Tbk in

2017. The median value is 0.2498 and the

standard deviation is 0.1281.

The independent variables in this study are

financial constraints as measured by the proxy ∆Z-

Score and ∆KZ-Index. The index value of financial

constraints with ∆Z-Score proxy has an average

value of 37.8430 which shows the average ability of

a company to predict financial distress. The lowest

value of ∆Z-Score of 1,649.791 is owned by PT.

Astra International Tbk in 2016 while the highest

value of 0.0000 is owned by PT. Argha Karya Prima

Industry Tbk in 2015. The mean value is -

4.6748 and the standard deviation value is 213.4653.

The index value of financial constraints with a

Proxy ∆KZ-Index has an average value of 0.2039,

which indicates the average ability of a company to

know constraints related to investment. The lowest

value of the ZKZ-Index of -78.9307 is owned by PT.

Merck Tbk in 2015 while the highest value of

350.8786 was owned by PT. Astra International Tbk

in 2016. The mean value is -1.6824 and the standard

deviation value is 49.4702.

This study uses three control variables, namely

profitability, company size, and sales growth.

Profitability as measured by the ∆ROA proxy shows

an average value of 0.1109 meaning that 11% of

manufacturing companies show efficiency in

utilizing assets owned by companies with the lowest

value of 0.0000 owned by PT. Asahimas Flat Glass

Tbk in 2018 while the highest value of 0.7091 is

owned by PT. Multi Bintang Indonesia Tbk in 2017.

The mean value is 0.0830 and the standard deviation

value is 0.1268.

Company size is measured by performing a natural

logarithm of the total sales obtained by the company

showing an average value of 18.5702 with the

lowest value of 0.0000 owned by PT. Astra

International Tbk in 2016 while the highest value of

30.8116 is owned by PT. Mayora Indah Tbk in

2018. High and low sales values by companies

greatly affect the level of company size. The middle

value of the company size is 20.7575 and the

standard deviation is 10.5509. The level of sales

growth is measured by taking into account the level

of sales in the following year after deducting the

total sales in the previous year divided by total sales

in the previous year having an average value of

0.0635 meaning that 6% of manufacturing

companies can meet their financial obligations with

a high level of sales growth. The lowest value of the

sales growth rate is -0.4376 owned by PT. Merck

Tbk in 2017 while the highest value of 0.8437 is

owned by PT. Impack Pratama Industri Tbk in 2015.

The middle value of the sales growth rate is 0.0457

and the standard deviation value is 0.1190.

The Effect of Financial Constraints on Cash Tax Savings

179

Table 2: Panel Data Regression Results

Variable Coefficient Std. Error t-Statistic Prob.

C 0.0144 0.0129 1.1144 0.2669

∆Z-Score 4.9908 0.0001 0.3922 0.6954

∆KZ-Index 6.6857 0.0005 0.1228 0.9024

∆ROA -0.0293 0.0747 -0.3918 0.6958

∆LnSales 0.0112 0.0006 16.818 0.0000

∆SalesGrowth -0.0497 0.0473 -1.0506 0.2952

R-Squared 0.7874

Adjusted R-squared 0.7265

Prob(F-statistic) 0.0000

N 185

Hausman Test Result

F

ixed

E

f

f

ect

*** Significant at level 1%, ** Significant at level 5%,

* Significant at level 10%

Note: This table displays the results of testing the hypothesis.

Dependent Variable: Cash Tax Savings (∆GAAP ETR).

Independent Variable: Financial Constraints (∆Z-Score, ∆KZ-

Index). Control Variables: Profitability (∆ROA), Company Size

(∆LnSales), Sales

G

r

owth (∆Sales

G

r

owth).

Source: Data processing results in Eviews 11

Based on the results of the regression analysis of

the fixed-effect model panel data in table 2, using a

significant level of 5%, the regression equation is

obtained as follows:

∆GAAPETR

i,t+1

= 0.0144+4.9908∆Z‐Score

i,t

+

6.6857∆KZ‐Indexi,t–0.0293

∆ROA

i,t+1

+0.0112∆LnSales

i,t+1

–

0.0497∆SalesGrowth

i,t+1

+e

i,t

The regression equation above shows the effect

between the independent and control variables on

the dependent variable. The definition of the

equation is that there is a constant value of 0.0144,

meaning that if financial constraints, profitability,

and company size and sales growth are constant,

then the average cash tax savings in the company is

0.0144. The regression coefficient of the financial

constraints variable measured at the prediction level

of financial distress and the constraints level related

to investment is 4.9908 and 6.6857, meaning that if

financial constraints increase by 1 unit, an increase

in cash tax savings will be increased by 4.9908 and

6.6857. Profitability variable regression coefficient

of -0.0293, meaning that if profitability increases by

1 unit it will be followed by a decrease in cash tax

savings of -0.0293. The regression coefficient of the

company size variable is 0.0112, meaning that if

company size increases by 1 unit, it will be followed

by an increase in cash tax savings of 0.0112.

Furthermore, the regression coefficient of the

variable sales growth of -0.0497, meaning that if

sales growth increases by 1 unit, it will be followed

by a decrease in cash tax savings of -0.0497.

4.3 Hypothesis Testing Results

Hypothesis testing is done using panel data

regression analysis. The selection of an appropriate

regression model is carried out using the Hausman

test through the Eviews 11 data processing

application. Based on the Hausman test, the best

regression model used is the Fixed Effect Model.

4.3.1 The Effect of Changes in Financial

Constraints on Cash Tax Savings

The hypothesis proposed in this study states that

changes in financial constraints has positive effect

on cash tax savings. This hypothesis can be

supported if the level of significance (α) <0.05. Here

are the results of the hypothesis test based on

prediction level of financial distress in this study can

be seen in table 3.

Table 3: Hypothesis Test Results (Prediction Level of

Financial Distress)

Variable Coefficient Std. Error t-Statistic Prob.

C 0.0135 0.0110 1.2323 0.2198

∆Z-Score 3.5534 4.9769 0.7139 0.4764

∆ROA -0.0293 0.0745 -0.3943 0.6939

∆

L

nSa

l

e

s

0.0112 0.0006 17.187 0.0000

∆SalesGrowth -0.0494 0.0471 -1.0487 0.2960

R-Squared

0.7874

Adjusted R-square

d

0.7283

Prob(F-statistic)

0.0000

N

185

Hausman Test Result Fixed Effect

*** Significant at level 1%, ** Significant at level 5%,

* Significant at level 10%

Note: This table displays the results of testing the

hypothesis.

Dependent Variable: Cash Tax Savings

(∆GAAP ETR).

Independent Variable: Financial Constraints

(∆Z-Score). Control Variables: Profitability (∆ROA), Company

Size (∆LnSales), Sales Growth (∆SalesGrowth).

Source: Data processing results in Eviews 11

ICAESS 2020 - The International Conference on Applied Economics and Social Science

180

Table 4: Hypothesis Test Results (Constraints Level

Related to Investment)

Variable Coefficient Std. Error t-Statistic Prob.

C 0.0116 0.0108 1.0773 0.2831

∆KZ-Index -0.0001 0.0002 -0.6079 0.5442

∆ROA -0.0294 0.0745 -0.3946 0.6937

∆LnSales 0.0113 0.0006 17.182 0.0000

∆SalesGrowth -0.0481 0.0470 -1.0236 0.3077

R-Squared 0.7872

Adjusted R-squared 0.7281

Prob(F-statistic) 0.0000

N 185

Hausman Test Result

F

ixed

E

f

f

ect

*** Significant at level 1%, ** Significant at level 5%,

* Significant at level 10%

N

o

t

e: This table displays the results of testing the hypothesis.

Dependent Variable: Cash Tax Savings (∆GAAP ETR).

Independent Variable: Financial Constraints (∆KZ-Index).

Control Variables: Profitability (∆ROA), Company Size

(∆LnSales), Sales

G

r

owth (∆Sales

G

r

owth).

Source: Data processing results in Eviews 11

Based on the results of hypothesis testing in table

3 and table 4 above shows the value of prob. Of ∆Z-

Score of 0.4764> 0.05 and ∆KZ-Index of

0.5442> 0.05 which means that the hypothesis is not

supported. This shows that changes in financial

constraints both measured at the level of prediction

of financial difficulties and the level of constraints

related to corporate investment does not have

significantly effect on cash tax savings, meaning

companies that face an increase (decrease) in

financial constraints do not necessarily carry out

cash tax savings strategies to obtain funds additional

internal company and an increase (decrease) in

financial constraints that occur in the company will

not limit the way investors to invest when the

company is increasing cash tax savings to obtain

additional internal company funds. This can happen

because cash tax savings are not classified as illegal

tax evasion.

The results of hypothesis testing based on the

prediction level of financial difficulties show the

value of profitability and sales growth as a control

variable has a significant value of 0.6939 and 0.2960

greater than the three significance levels of 1%, 5%,

and 10% while the significant value of company size

is 0.0000 less than the three levels of significance,

namely 1%, 5%, and 10%. The R-Square value from

the analysis above shows that the variation of the

dependent variable can be explained by the

independent variable, namely financial constraints

by 79% (0.7874), and the rest is explained by other

variables outside this research model.

Hypothesis testing results based on the level of

constraints related to investment show the value of

profitability and sales growth as a control variable

has a significant value of 0.6937 and 0.3077 is

greater than the three levels of significance that are

equal to 1%, 5%, and 10% while the significant

value of company size is 0.0000 less than the three

levels of significance, namely 1%, 5%, and 10%.

The R-Square value from the analysis above shows

that the variation of the dependent variable can be

explained by the independent variable, namely

financial constraints by 79% (0.7872), and the rest is

explained by other variables outside this research

model.

4.4 Data Analysis

Based on the results of hypothesis testing between

independent variables, control variables, and the

dependent variable then the summary of the

hypothesis test results can be seen in Table 5

Table 5: Summary of Hypothesis Test Results

Hypothesis Prob. t Result

Changes in

financial

H1: constraints has

positive effect on cash

tax savings

0.4764

0.7139

Hypothesis

is not

supported

0.5442

-0.6079

Description: α = 5%

Source: Self-processed

4.4.1 The Effect of Changes in Financial

Constraints on Cash Tax Savings

Based on the results of testing the hypothesis that

has been described in tables 3 and 4, the results

show that changes in financial constraints does not

have significantly effect on cash tax savings so the

hypothesis is not supported. The existence of tax

avoidance determinants also supports the results of

this study by testing based on the average

profitability of manufacturing companies listed on

the Stock Exchange with a graph that can be shown

in Figure 3

The Effect of Financial Constraints on Cash Tax Savings

181

Figure 3: Average Profitability (ΔROA) in 2014 – 2018

Source: Self-processed

Based on the graph above, it can be seen that the

value of profitability in manufacturing companies on

the Indonesia Stock Exchange during the five years

of observation mainly has increased with an average

percentage reaching 68%. This means that these

companies generally try to reduce operational costs

or reduce unnecessary costs and maximize the use of

assets owned by companies to increase profits.

Besides, the company's ability to increase profits is

also influenced by the size of the company. With the

increasing size of the company, there will be more

availability of resources that can be utilized by

managers, so that it can help the company in

optimizing the achievement of company profits.

One of the utilization of the availability of

resources by managers to determine the level of

company size is to increase sales volume. If

illustrated in graphical form, it can be seen the

average value of company size as shown in Figure 4

Figure 4: Average Company Size (ΔLnSales) in 2014 -

2018

Source: Self-processed

Based on the graph above, the value of the size

of the manufacturing companies listed on the Stock

Exchange during the five years of observation

mainly has increased with an average percentage

reaching 59%. This means that these companies

generally try to obtain greater profits by increasing

the sales the volume of a company each year. The

sales volume in the company's operational activities

can increase revenue which in turn can support the

higher the profitability of the company so that the

company will be able to determine the level of

company size.

The company's ability to increase sales growth is

also influenced by a higher level of profitability and

company size. Sales growth reflects the success of

past investment periods and can be used as a

prediction of future growth. If illustrated in

graphical form, it can be seen the average value of

sales growth as shown in Figure 5

Figure 5: Sales Growth Rate (ΔSalesGrowth)

Source: Self-processed

Based on the graph above, the value of sales

growth in manufacturing companies listed on the

Stock Exchange mainly has increased every year.

This means that these companies generally try to

increase total sales from year to year. The higher the

sales growth, the less tax avoidance activity of a

company because a company with a relatively large

level of sales makes it possible for the company to

obtain large profits and be able to pay taxes.

Companies with high sales growth will be able to

meet their financial obligations if the company funds

its investment activities with debt.

These results also support research conducted by

Putri & Chariri (2017) which states that financial

distress does not have significantly effect on tax

avoidance, meaning that the greater the

manufacturing sector companies listed on the IDX

are involved in financial distress, then it will be

smaller to the company for doing tax avoidance. In

other words, companies with large financial distress

tend to report higher taxes or obey paying taxes

(Putri & Chariri, 2017).

The results of this study differ from the results of

research conducted by Richardson, Taylor, & Lanis

ICAESS 2020 - The International Conference on Applied Economics and Social Science

182

(2015) by taking a sample of companies in Australia

stating that the financial distress has significant

positive effect on tax avoidance. This increase in

financial constraints causes the tax payments made

by companies to increase. This is because managers

more consider the risks and costs that will arise

when doing tax avoidance. When companies are in

financial constraints, investors will view tax

avoidance activities as a high-risk action. As a

result, investor concerns arise if the possibility of the

company is bankrupt or liquidated in the future,

which in turn will spend money invested by

investors in the company. If tax evasion is illegal

and known to the tax authority, it will lead to

sanctions that are even more burdensome to the

company's finances.

Companies that if declared bankrupt by the court,

the curator must settle their tax obligations first. The

tax rules applicable in Indonesia in the Law of the

Republic of Indonesia Number 16 of 2009

concerning the Fourth Amendment to the Law of the

Republic of Indonesia Number 6 of 1983 concerning

General Provisions and Tax Procedures Article 21

paragraph 1 define the position of the state as a

creditor preferring to have a prior right to debt tax

on goods owned by the Taxpayer to be auctioned in

public, while payments to other creditors are settled

after the tax debt is paid. This tax debt includes tax

principal, administrative sanctions in the form of

fines, interest, increases, and tax collection costs.

In Article 32 it is stated that the Taxpayer is

represented one of them in the case of a body

declared bankrupt by the curator, where the

representative of the Taxpayer is personally and/or

specially responsible for the payment of the tax due,

the Taxpayer is represented in terms of the body by

the management, namely, the person has the

authority to participate in determining policies

and/or making decisions in running a company, this

provision also applies to commissioners and

majority or controlling shareholders. When viewed

from these rules, the higher the risk obtained from a

tax audit if there are findings of a lack of tax

payments in the past so that the risk to be borne by

the manager, shareholders, and creditors will also be

higher.

To minimize the high level of risk, companies

must settle their tax debts to the state when the

company is nearing bankruptcy. The use of funding

from internal sources is preferred to fulfill its tax

obligations. If the use of internal funds is

insufficient, the company will use external funds

also. One form of external funding is bond issuance.

Modigliani & Miller (1963) in theory argue that the

value of a company with debt will be higher than the

value of a company without debt. The higher the

level of use of debt by companies, the level of profit

required will also increase. The existence of high-

interest costs obtained from the use of debt can

reduce the amount of tax paid.

5 CONCLUSIONS AND

SUGGESTIONS

5.1 Conclusion

Based on the results of the research conducted, the

authors can conclude that changes in financial

constraints experienced by company does not have

significantly effect on cash tax savings so that the

hypothesis is not supported. This is because the way

to obtain additional internal funds when financial

constraints occur is not to avoid taxes or save taxes.

The company will prioritize paying off all of its tax

debt to the state when the level of financial

constraints faced by the company is very high and

avoids a high level of risk if the company takes cash

tax savings.

Based on the results of the research conducted,

the authors can conclude that changes in financial

constraints experienced by company does not have

significantly effect on cash tax savings so that the

hypothesis is not supported. This is because the way

to obtain additional internal funds when financial

constraints occur is not to avoid taxes or save taxes.

The company will prioritize paying off all of its tax

debt to the state when the level of financial

constraints faced by the company is very high and

avoids a high level of risk if the company takes cash

tax savings.

5.2 Limitation

The limitation in this study is the sample in this

study is only limited to manufacturing sector

companies so it does not cover all industrial sectors

listed on the IDX. The sample data only uses 185

observations over the five years, namely from 2014-

2018 so it does not represent the existing

population. The author only uses financial

constraints as an independent variable to test its

effect on cash tax savings. This study only uses the

∆GAAP ETR proxy to measure changes in cash tax

savings and ∆Z-Score and ∆KZ-Index to measure

changes in financial constraints. Time series data

and cross- section writer use in statistical testing.

The Effect of Financial Constraints on Cash Tax Savings

183

REFERENCES

Adhikari, A., Derashid, C., & Zhang, H. (2006). Public

policy, political connections, and effective tax rates:

Longitudinal evidence from Malaysia. Journal of

Accounting and Public Policy, 25, 574–595.

Altman, E. I. (1968). Financial Ratios, Discriminant

Analysis and the Prediction of Corporate Bankruptcy.

The Journal of Finance, 23(4), 589-609.

Barbee, W., Mukherji, S., & Raines, G. (1996). Do Sales

Price and Debt Equity Explain Stock Returns Better

than Book-Market and Firm Size? Financial Analysts

Journal, 56-60.

Basuki, A. T., & Prawoto, N. (2017). Analisis Regresi

Dalam Penelitian Ekonomi & Bisnis : Dilengkapi

Aplikasi SPSS & EVIEWS. PT. Rajagrafindo Persada.

Belkaoui, A., & Karpik, P. G. (1989). Determinants of the

Corporate Decision to Disclose Social Information.

Accounting, Auditing and Accountability Journal, 36-

51.

Darussalam. (2017). Tren, Outlook, dan Tantangan Pajak

2017. IAI Global. Retrieved September 2019, 08, from

http://www.iaiglobal.or.id/v03/files/file_publikasi/Tre

n,%20Outlook,%20dan%20Tantangan%20Pajak%202

017.pdf

Donaldson, G. (1961). Corporate Debt Capacity: A Study

of Corporate Debt Policy and the Determination of

Corporate Debt Capacity. Boston: Harvard Business

School.

Edwards, A., Schwab, C., & Shevlin, T. (2013). Financial

constraints and the incentive for tax planning. In 2013

American Taxation Association Midyear Meeting: New

Faculty/Doctoral Student Session, 1-60.

Edwards, A., Schwab, C., & Shevlin, T. (2016). Financial

Constraints and Cash Tax Savings. The Accounting

Review, 91(3), 859–881.

Frank, M. Z., & Goyal, V. K. (2008). Trade-off and

Pecking Order Theories of Debt. Handbook of

Corporate Finance: Empirical Corporate Finance, 2,

135-202.

Ghozali, I. (2018). Aplikasi Analisis Multivariate dengan

Program IBM SPSS 25 Edisi 9. Badan Penerbit

Universitas Diponegoro.

Goldratt, E. M., & Cox, J. (1986). The goal : a process of

ongoing improvement. New York: North River Press.

Gupta, S., & Newberry, K. (1997). Determinants of

the

Variability in Corporate Effective Tax Rates: Evidence

from Longitudinal Data. Journal of Accounting and

Public Policy, 16(1), 1-34.

Hanlon, M., & Heitzman, S. (2010). A review of tax

research. Journal of Accounting and Economics, 50,

127-178.

Hermawan, J. E., & Riandoko, R. (2018). Do Firms

Facing Increases in Financial Constraints Tend to

Generate Cash through Tax Avoidance? Empirical

Evidence from Indonesia Publicly Listed Firms. 1-12.

doi:10.13140/RG.2.2.29077.99049

Howard, B., & Upton, M. (1952). Introduction to business

finance.

Jatmiko, D. P. (2017). Pengantar Manajemen Keuangan.

Diandra Kreatif.

Jensen, M. C., & Meckling, W. H. (1976). Theory of The

Firm: Managerial Behavior, Agency Cost, and

Ownership Structure. Jurnal of Financial Economics,

3(4), 305-360.

Kaplan, S. N., & Zingales, L. (1997). Do Investment-Cash

Flow Sensitivities Provide Useful Measure of

Financial Constraints? The Quarterly Journal of

Economics, 169-215.

Koester, A., Shevlin, T., & Wangerin, D. (2016). The Role

of Managerial Ability in Corporate Tax Avoidance.

Management Science, Articles in Advance, 1–27.

Lang, L., Ofek, E., & Stulz, R. M. (1996). Leverage,

Investment, and Firm Growth. Journal of Financial

Economics, 40(1), 3-29.

Lanis, R., & Richardson, G. (2012). Corporate social

responsibility and tax aggressiveness: An empirical

analysis. J. Account. Public Policy, 86–108.

Law, K. K., & Mills, L. F. (2015). Taxes and Financial

Constraints: Evidence from Linguistic Cues. Journal

of Accounting Research, 53(4), 777-819.

doi:10.1111/1475-679X.12081

Lindenberg, E. B., & Ross, S. A. (1981). Tobin's q Ratio

and Industrial Organization. Journal of Business,

54(1), 1-32.

Mardiasmo. (2018). Perpajakan (2018 ed.). Yogyakarta,

Indonesia: Andi.

Modigliani, F., & Miller, M. H. (1963). Corporate Income

Taxes and the Cost of Capital: A Correction. The

American Economic Review, 53(3), 433-443.

Myers, S. C. (2001). Capital Structure. Journal of

Economic Perspectives, 15(2), 81-102.

Nachrowi, N. D., & Usman, H. (2006). Pendekatan

Populer dan Praktis Ekonometrika untuk Analisis

Ekonomi dan Keuangan. Jakarta: Lembaga Penerbit

FEUI.

Najmudin. (2011). Manajemen Keuangan dan Aktualisasi

Syar'iyyah Modern. Yogyakarta: ANDI.

Poernawarman. (2015). Pengaruh Return On Asset, Sales

Growth, Asset Growth, Cash Flow, Dan Likuiditas

Terhadap Dividend Payout Ratio Perusahaan

Perbankan Di Bursa Efek Indonesia Tahun 2009 -

2013. Jom Fekom, 2(1).

Putri, R. A., & Chariri, A. (2017). Pengaruh Financial

Distress dan Good Corporate Governance Terhadap

Praktik Tax Avoidance pada Perusahaan Manufaktur.

Diponegoro Journal of Accounting, 6(2), 1-11.

Rahman, S. (1998). Theory of constraints. International

Journal of Operations & Production Management,

18(4), 336-355.

Richardson, G., Taylor, G., & Lanis, R. (2015). The

impact of financial distress on corporate tax avoidance

spanning the global financial crisis: Evidence from

Australia. Economic Modelling, 44, 44–53.

Valensia, K., & Khairani, S. (2019). Pengaruh

Profitabilitas, Financial Distress, Dewan Komisaris

Independen dan Komite Audit Terhadap Nilai

Perusahaan Dimediasi oleh Tax Avoidance. Jurnal

Akuntansi, 9(1).

ICAESS 2020 - The International Conference on Applied Economics and Social Science

184

Warta Ekonomi. Penerimaan Naik, Rasio Pajak 2018 di

Level 11,5%. (2019). Retrieved September 08, 2019,

from

https://www.wartaekonomi.co.id/read210050/penerim

aan-naik-rasio-pajak-2018-di-level-115.html

Whited, T. M., & Wu, G. (2006). Financial Constraints

Risk. The Review of Financial Studies, 19(2), 531-

559. Wiratmoko, S. (2018). The Effect of Corporate

Governance, Corporate Social Responsibility, and

Financial Performance on Tax Avoidance. The

Indonesian Accounting Review, 8(2), 245 – 257.

World Bank. Tax revenue (% of GDP). (2014-2018).

Retrieved September 08, 2019, from

https://data.worldbank.org/indicator/GC.TAX.TOTL.

GD.ZS

The Effect of Financial Constraints on Cash Tax Savings

185