The Mediating Role of Corporate Governance on Corporate Social

Responsibility and Shareholder Wealth Maximisation

Farah Diyana Abdul Aziz, and Suresh Ramakrishnan

1

Azman Hashim International Business School, Universiti Teknologi Malaysia, 81310 Skudai, Johor, Malaysia

Keywords: Corporate Social Responsibility (CSR), Shareholder Wealth Maximisation, Corporate Governance.

Abstract: Corporate social responsibility has been a popular topic for these past few years. As far as the knowledge of

the author, there is no study that examines the relationship of corporate social responsibility and shareholder

wealth maximisation mediate by corporate governance. The main purpose of this paper is to provide a review

of how corporate governance can mediate the relationship between corporate social responsibility and

shareholder wealth maximisation. Moreover, this study refers to stakeholder theory as the underpinning theory

for drawing up the conceptual framework of the relationship between corporate social responsibility,

shareholder wealth maximisation, and corporate governance. There is plenty of research investigated the

relationship between corporate social responsibility and shareholder wealth where most of it focuses on the

developed and some of the developing countries. However, very minimum research that uses corporate

governance as a mediator variable especially for this relationship. Therefore, this review forms a concept of

corporate governance as a mediating variable for corporate social responsibility and shareholder wealth

maximisation.

1 INTRODUCTION

The notion of corporate social responsibility varies

across different nations and sectors which depends on

the context of the culture, religion, law, society,

economic condition and some factors (Ahmad and

Crowther, 2013). CSR can be defined as a self-

regulating business that helps an organization to be

socially accountable to the public and shareholders.

As the development of CSR is getting stronger, it able

to promote business strategies by making profits to

the firms. Customer awareness of CSR is noticeably

elevated when they actively seek products from

businesses that operate ethically. A business that

implements CSR proves that it takes an interest in

wider social issues which bring many benefits. Some

of the benefits of implementing CSR are it improves

the public image, increase brand awareness and

recognition, cost savings in terms of packaging, and

increase customer engagement (Collier, 2018).

CSR effects on shareholder wealth have been

studied by focusing on corporate donations as a proxy

of CSR (Hall and Rieck, 1998) and proved corporate

donations evoked the highest rise in share return. As

the years go by, scholars started to focus on empirical

analysis for the impact of CSR on shareholders’ value

in the capital market (Becchetti et al, 2009). The study

highlights a significant upward trend of abnormal

returns and a significant negative effect on abnormal

returns. As CSR consists of few aspects, there were

few scholars conducted studies that focus on the

environmental program specifically to reduce

greenhouse gas emissions to know its effect on

shareholder’s value (Fisher-Vanden and Thorburn,

2011; Guenster et al, 2011). This empirical evidence

shows that CSR did contribute to maximise

shareholder wealth.

Corporate governance has been recognized as one

of the elements of organizational performance

(Kyerehoah-Coleman, 2007). Standard & Poor’s

(S&P’s) corporate governance score has few

components that assess the policy of a company based

on ownership structure and influence, financial

stakeholders’ rights and relations, financial

transparency and information disclosure, and board

structure and process. Previous studies proved that

various proxies of corporate governance show a

positive, negative and insignificant relationship with

shareholder wealth maximisation. Therefore, it is

compulsory to collect more studies in this area that

focus on the mediating role of corporate governance.

Abdul Aziz, F. and Ramakrishnan, S.

The Mediating Role of Corporate Governance on Corporate Social Responsibility and Shareholder Wealth Maximisation.

DOI: 10.5220/0010354402630269

In Proceedings of the 2nd International Conference on Applied Economics and Social Science (ICAESS 2020) - Shaping a Better Future Through Sustainable Technology, pages 263-269

ISBN: 978-989-758-517-3

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

263

2 CONCEPTUAL FRAMEWORKS

Stakeholder theory suggests firms to use CSR to solve

the conflicts existed between managers and non-

existing stakeholders. Stakeholders can be defined as

“any group or individual who can affect or is affected

by the achievement of the organization’s goals”

(Freeman, 1984). Stakeholder theory is a concept

where it is about what the organization should be and

how an organization should be conceptualized

(Fontaine and Schmid, 2006). The main type of

stakeholders are customers, employees, local

communities, shareholders, suppliers and

distributors. The involvement of shareholders,

employees, customers, suppliers, governments,

organizations of non-governmental, organizations of

international and stakeholders are a main component

of CSR. In 2005, organizations recognised three main

categories of stakeholder which are investors,

customers and suppliers, employees and social

environmental groups Papasolomou-Doukakis et al,

2005).

In addition, stakeholder theory also stated that

CSR investing is one of a way to keep a good

relationship with company stakeholders. The

activities of CSR were used to satisfy stakeholders’

interest (Odriozola and Baraibar-Dier, 2017). CSR

investing is profitable, improve the satisfaction of

customers and suppliers, enhance employee

relationship, corporate financial performance and

corporate reputation (Gelb and Strawser, 2001;

Baron, 2001; Chih et al, 2008; Ghoul et al, 2011;

Dhaliwal et al, 2014).

Stakeholder theory also provides a base to the

connection between CSR and corporate governance.

According to Freeman (1994), firms should use CSR

as a mechanism to extend the effectiveness of

corporate governance. Effective corporate

governance should give a positive impact on CSR

engagement and thus CSR positively related to

corporate financial performance. This is because CSR

will minimize the conflicts of interest between

managers and stakeholders which will improve

financial performance.

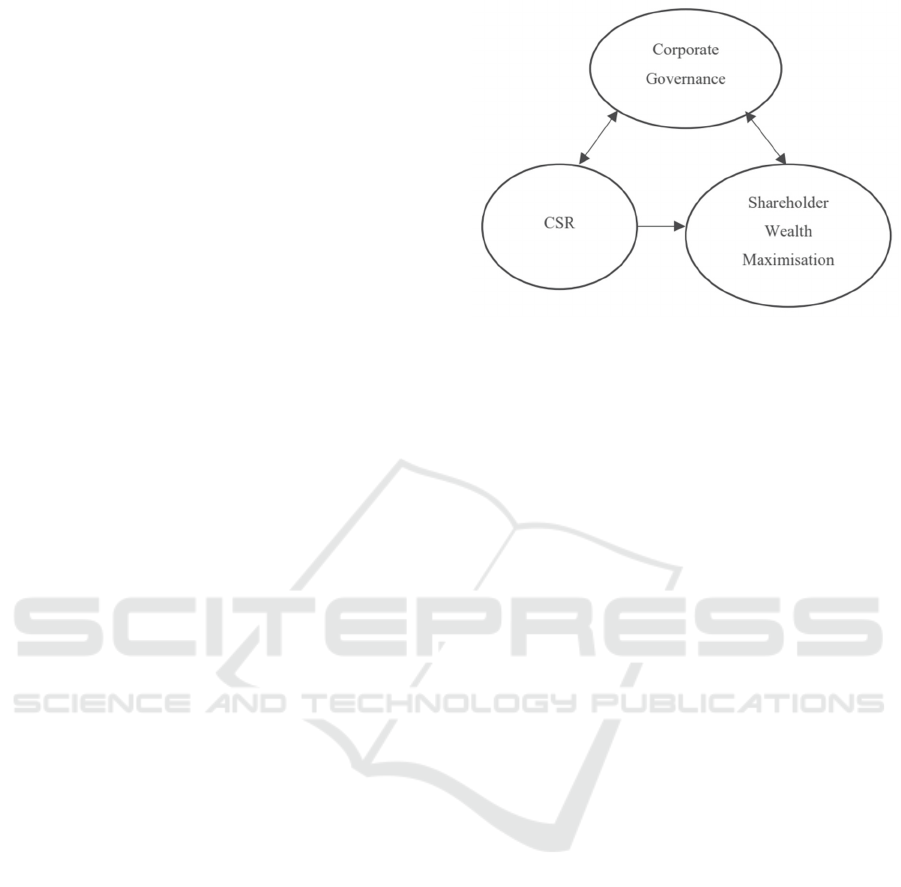

Figure 1: Conceptual framework of the relationship

between CSR and shareholder wealth maximisation

mediate by corporate governance.

2.1 Corporate Social Responsibility

Corporate social responsibility has no single

universal definition that can be used by firms and

researchers. So, it has many different definitions that

focus on different perspectives. CSR is “the

continuing commitment by business to behave

ethically and contribute to economic development

while improving the quality of life of the workforce

and their families as well as of the local community

and society at large” (World Business Council, 1999).

The European Union defined CSR as a “concept

whereby companies integrate social and

environmental concerns in their business operations

and their interaction with their stakeholders

voluntarily” (Verma and Kumar, 2012).

However, another scholar (Friedman and Miles,

2006) wrote that the social responsibility of business

is to increase the profits as high as it can by

consuming the resources and staying in activities.

Firms’ main objective is to earn profit without any

criminal deceiving or personal gain (Younkins,

2006). The increase of the profit is for shareholders,

stakeholders and society as profit can improve

employee’s life and firms’ sustainability, and

provides a higher return to shareholders (Friedman,

1962). Social responsibilities have been expanded in

business into a pyramid of four dimensions which are

economic, legal, ethical and philanthropic (Carroll,

1979; 1991).

2.2 Shareholder Wealth Maximisation

The firm’s main goal is to generate a profit from the

business. Firm gains profit when the revenue of the

business exceeds the expenses of the firm. Hence,

ICAESS 2020 - The International Conference on Applied Economics and Social Science

264

shareholder wealth maximisation is used to measure

business sustainability as it is can be considered as the

most appropriate measurement (Khan and Hussaine,

2018). Shareholder wealth is the value enjoyed by a

shareholder by owning shares of a particular firm

(The Economic Times, n.d.). According to Blair

(2003), the company makes the right social goal by

maximising shareholder value as it maximises the

overall value of the company as well. The profits gain

by a firm through maximising the value help it to

survive in business and prevent it from getting

replaced by others.

Financial advisors have concluded that the owner

of the companies are shareholders. So, it is

compulsory for a company to please shareholders by

maximising their wealth. Shareholder wealth

maximisation brings meaning maximising the price

of a firm’s common stock to provide a maximum

return to shareholders (Lea, 2018).

2.3 Corporate Governance

Corporate governance focuses on the impact of

corporate activities on all stakeholders of the

corporation. Based on the stakeholder theory, officers

and directors that act as corporate managers should

consider the interest of each stakeholder in each of the

governance processes (Gordon, 2015).

Corporate governance helps to reduce the

conflicts of interest among internal and external

stakeholders. So, in the CSR context, a previous study

disclosed that CSR and corporate governance have

the same mechanisms which look for larger

equilibrium and consistency between profit and

ethics. Furthermore, corporate governance is

positively related to the company’s environmental

activities which add proves that corporate governance

is related to CSR (Stuebs and Sun, 2010). Another

study adds that corporate governance can only

improve the reputation of a firm with the presence of

social responsibility practices (Chalise, 2014).

3 DEVELOPMENT OF

HYPOTHESIS

3.1 Corporate Social Responsibility &

Shareholder Wealth Maximisation

The capabilities of corporate play a crucial role in

creating shared value for the long term of success of

the firms which encourage the value of the economy

and indirectly create the society value (Porter and

Kramer, 2006; 2011). Shareholder wealth

maximisation is different from short term profit

maximisation. Creating shareholder wealth is the

same to satisfy the stakeholders’ interests (Gennari

and Salvioni, 2017).

Long term investors choose to maximise

shareholder wealth by lowering the risk of cash flow

rather than increase the cash flow (Nguyen et al,

2017). This study proved that CSR activities can

create value for shareholders but on one condition

where managers of each firm need to be monitored by

long term investors. In particular, managers that have

been monitored by long term investors tend to have

an extra 5% stock valuations but that firms

experienced low volatility of profitability and lower

future stocks return. Another recent study tests the

impact of CSR on shareholder wealth maximisation

by performing an event analysis method as it is an

effective tool to identify the perception of investors

of corporate social responsibility. This is because the

Efficient Market Hypothesis stated that the effect on

share return should immediately be incorporated with

the market. The authors found that positive CSR

activities show positive effects on shareholder wealth

to firms that relate to donations and environmentally-

friendly activities. However, recycling and social

policy activities are statistically insignificant to

shareholder return. More than 2720 of CSR proposals

have been examined (Elammer, 2013), which cover

both social and environmental performance in the

United States publicly traded firms. This study found

that firms that implement CSR able to increase

shareholder wealth by 0.92%. Hence, the following

hypothesis is built:

H1: CSR has a positive relationship with

shareholder wealth maximisation.

3.2 Corporate Social Responsibility &

Corporate Governance

There is growing literature regarding the conflict-

resolution hypothesis (Zubeltzu et al, 2018; Jo and

Harjoto, 2011; 2012). This hypothesis tests the

positive and significant relationship between CSR

practices and corporate governance policies where it

stated that CSR acts as a tool on behalf of corporate

governance that makes the resolution of conflicts

between managers and non-investing stakeholders

easier (Jensen, 2010), and allows for a more

sustainable form of business (Zubeltzu et al, 2018).

According to Zubeltzu et al (2018), corporate

governance aims to enhance the protection rights of

corporate stakeholders. This study was conducted to

analyse and compare the existing relationship

The Mediating Role of Corporate Governance on Corporate Social Responsibility and Shareholder Wealth Maximisation

265

between corporate governance, CSR and financial

performance. Statistics of the econometric model

show that 79% of previous studies proved that CSR

and corporate governance have a positive relationship

while 14% of previous studies show a negative

relationship. Based on the reviews, CSR and

corporate governance are compulsory in business

models to fulfil the needs of stakeholders and

shareholders and thus improve the value of the firm.

In 2011, the relationship of CSR and corporate

governance have been studied (Jo and Harjoto, 2011)

by using few corporate governance proxies such as

board independence, insider block holder ownership,

outsider institutional ownership and number of

analysts from the year 1993-2004. The finding from

this study is CSR positively correlated to corporate

governance. Then, they (Jo and Harjoto, 2012)

furthered their previous study by examining corporate

governance and CSR to know the causal effects.

Finding from this study revealed that CSR does not

give any impact on corporate governance but

corporate governance positively correlated with CSR.

Corporate governance variables in this study are

board leadership, independent boards, institutional

investors and security analysis where all of these

positively significant to CSR activities.

A recent study suggests that to increase the

disclosure of CSR, managers should focus to improve

the quality of corporate governance (Chan et al,

2014). This study referred to stakeholder theory and

annual reports of 222 listed firms. This is the first

study that examines corporate governance as an

overall measure and proved that firms with good

corporate governance tend to have good CSR

compare to firms with poor CSR. Another empirical

study (Kolk and Pinkse, 2010) focused on the effect

of corporate governance in CSR disclosure for

multinational enterprises. Multinational enterprises

have various activities in many contexts which force

them to be more transparent and disclose more

information about CSR issues due to higher demand

from around the world. This study proved firms that

report their internal CSR information on a wider

range have more privilege to link corporate

governance to CSR issues. Furthermore, another

study examined the differences between corporate

governance in the United States and the United

Kingdom. It stated that the differences in CSR

disclosure in United States and United Kingdom will

give different impacts on corporate governance in

these two countries Aguilera et al, 2006). Fund

managers and investment consultants in United

Kingdom increase in collaboration to develop

corporate governance and CSR. This is supported by

an earlier study which stated that the CSR issue in

United Kingdom is more advanced in United States

(William and Conley, 2005). However, CSR

activities in both countries, United States and United

Kingdom are positively related to corporate

governance. Based on the studies mentioned, the

hypothesis will be written:

H2: CSR has a positive relationship with

corporate governance.

3.3 Corporate Governance &

Shareholder Wealth Maximization

Corporate governance has a significant relationship

between firms’ management and shareholder wealth

maximisation. It is also crucial in speeding the firms’

performance and the growth of the economy

(Aggarwal et al, 2011; Hasan et al, 2014).

Shareholder wealth maximisation can improve

almost everything in the firm such as workers,

consumers, suppliers and distributors while the

problem that prevents shareholder value creation is

because of self-serving among managers for their

benefits (Lazonick and O’Sullivan, 2000). Corporate

governance also suggests more transparency and

ethics to outline the leaders’ responsibilities. A stable

corporate governance structure in one particular

institution is needed to build a corporate environment

that deterrent the personal intention of corporate

insiders and managers which will give a bad impact

on firms. The categories of corporate governance that

famous among researchers to test its relationship with

shareholder wealth are ownership structure, board

independence, the board size, CEO duality, or

presence of outside directors and audit committee

independence. Another empirical study (Maroun and

Moez, 2015) investigated whether the separation of

ownership in management is significant to

shareholder wealth creation or not by using agency

theory. This study used a sample of 30 Tunisian listed

companies from the year 1997 to the year 2006 and

corporate governance proxies that have been used are

ownership structure, capital concentration and

presence of outside directors. The result shows that

managerial ownership is significant in enhancing

shareholder wealth creation. This is because the

presence of institutional investors in ownership

structure plays an effective role to control managers.

There is a study that proved board characteristics,

auditor’s quality, ownership structure and

compensation mix also contribute in creating

shareholder wealth (Mir and Seboui, 2008).

Corporate governance is important to minimize the

cost of the conflicts that occurred. Another study

ICAESS 2020 - The International Conference on Applied Economics and Social Science

266

(Cunat et al, 2010) mentioned that board

independence is positively significant in enhancing

shareholders' return but the effects are weak. Thus,

firms’ corporate governance that removes anti-

takeover provisions enhances shareholder value

maximisation by implementing the discipline of

management and reducing the agency cost. Firms

with better governance associated with higher

shareholders' wealth.

A study conducted by Aggarwal et al (2011)

compared the United States firms with foreign firms

such as Canada, Japan and United Kingdom by using

board independence and audit committee as proxies

for corporate governance. United States and United

Kingdom put a lot more focus to maximise

shareholders wealth rather than firms in other

countries which they focus to maximise the welfare

of stakeholders. The findings revealed that companies

with board independence and audit committees

enhance shareholders’ wealth. After comparison has

been made, the result shows that governance in other

countries is significantly lower than the governance

of United States firms in enhancing shareholders'

value maximisation except for Canada and United

Kingdom. Apart from that, few scholars (Kusi et al,

2018) take this opportunity to test the effect of

corporate governance on shareholder wealth of

African banks. Corporate governance proxies in this

literature are CEO duality, size of the board, non-

executive members, audit independence and gender.

Based on the findings, audit independence and the

size of the board are positively significant to

shareholder wealth maximisation in African banks.

This is because a large number of people on board

adds more skills, experience, capabilities and increase

competition among the board of directors which

increases shareholders' wealth. Hence, the following

hypothesis is built:

H3: Corporate governance has a positive

relationship with shareholder wealth maximisation.

3.4 Mediating Effect of Corporate

Governance between CSR &

Shareholder Wealth Maximization

To analyse mediator, scholars are most often adopted

the procedures and guidelines by Baron and Kenny

(1986). Scholars connected corporate governance

with various variables to study its significance. In this

research, corporate governance is adopted as a

mediating variable between CSR and shareholder

wealth maximisation.

According to Hayes (2013), mediation is the order of

a causal relationship where the independent variable

shows its effect on the dependent variable through the

impact of the third variable. The latter assists to

evaluate the total effect (the direct effect and indirect

effect). So, this study adopts four steps by Baron and

Kenny (1986) that help to justify corporate

governance as a mediator.

There should be a significant relationship between

independent and dependent variables. Based on

the literature review mentioned above, CSR and

shareholder wealth maximisation have a

significant relationship (Hall and Rieck, 1998;

Nguyen et al, 2017; Elammer, 2013).

There should be a significant relationship between

independent and mediator variables. Based on the

review of past studies mentioned above, CSR and

corporate governance have a significant

relationship (Zubeltzu et al, 2018; Jo and Harjoto,

2011; 2012; Chan et al, 2014; Kolk and Pinkse,

2010).

There should be a significant relationship between

the dependent and mediator variables. The

literature review shows that there is a significant

relationship between corporate governance and

shareholder wealth maximisation (Anggarwal and

Ferreira, 2011; Hasan et al, 2014; Maroun and

Moez, 2015; Cunat et al, 2010).

There must be the inclusion of corporate

governance that makes the direct relationship

between CSR and shareholder wealth

maximisation turns to zero. Then, perfect or

complete mediation is said to have occurred

(James and Brett, 1984). If the direct relationship

turns not to zero, partial mediation is said to have

occurred.

Based on the previous studies mentioned above, it

proved that corporate governance can be a mediator

for the relationship between CSR and shareholder

wealth. This is because it is significant with

independent and dependent variables. Hence, the

following hypothesis is built:

H4: The impact of CSR on shareholder wealth

maximisation is mediated by corporate governance.

4 CONCLUSIONS

This review study has provided a theoretical

relationship between CSR and shareholder wealth

maximisation and the mediating factor of corporate

governance between CSR and shareholder wealth

maximisation. The fact that this area of study is still

new and lack of related literature, it is expected to

make a contribution to the body of knowledge of

corporate governance practices.

The Mediating Role of Corporate Governance on Corporate Social Responsibility and Shareholder Wealth Maximisation

267

For future studies, this model can be applied by

using a sample from other developed and developing

countries. This is because as far to the knowledge of

the author, no study uses corporate governance to

mediate the relationship between CSR and

shareholder wealth.

REFERENCES

Aggarwal, R., Erel, I., & Ferreira, M. (2011). Does

Governance Travel Around the World? Evidence from

Institutional Investors. Journal of Financial Economics,

100(1), 154-181.

Aguilera, R. V., Williams, C. A., Conley, J. M., & Rupp, D.

E. (2006). Corporate Governance and Social

Responsibility: A Competitive Analysis of the UK and

the US. Journal Compilation, 14(3), 147-158.

Ahmad, J., & Crowther, D. (2013). Education and

Corporate Social Responsibility International

Perspectives. Emerald Group Publishing Limited.

Baron, D. P. (2001). Private Politics, Corporate Social

Responsibility, and Integrated Strategy. Journal of

Economics & Management Strategy, 10(1), 7-45.

Baron, R. M., & Kenny, D. A. (1986). The Moderator-

mediator Variables Distinction in Social Psychological

Research: Conceptual, Strategic and Statistical

Considerations. Journal of Personality & Social

Psychology,51, 1173-1182.

Becchetti, L., Ciciretti, R., & Hasan, I. (2009). Corporate

Social Responsibility and Shareholder's Value: An

Empirical Analysis. Monetary Policy and Research

Department.

Blair, M. M. (2003). Shareholder Value, Corporate

Governance and Corporate Performance: A Post-

Enron Reassessment of the Conventional Wisdom. In P.

K. Cornelius, & B. Kogut, Corporate Governance and

Capital Flows in a Global Economy (pp. 53-82). Oxford

University Press.

Carroll, A. B. (1979). A Three-Dimensional Conceptual

Model of Corporate Performance. Academy of

Management Review, 4(4), 497-505.

Carroll, A. B. (1991). The Pyramid of Corporate Social

Responsibility: Toward the Moral Management of

Organizational Stakeholders. Business Horizons,

34(4), 39-48.

Chalise, M. (2014). Impact of Corporate Social

Responsibility on Corporate Governance and

Reputation in Nepalese Commercial Banks. Nepal

Journals, 22(1-2), 27-36.

Chan, M. C., Watson, J., & Woodliff, D. (2014). Corporate

Governance Quality and CSR Disclosures. Journal of

Business Ethics, 125, 59-73.

Chih, H.-L., Shen, C.-H., & Kang, F.-C. (2008). Corporate

Social Responsibility, Investor Protection, and

Earnings Management: Some International Evidence.

Journal of Business Ethics, 79(1), 179-198.

Collier, E. (2018, January 26). The Importance of

Corporate Social Responsibility for Your Business.

Retrieved from High Speed Training:

https://www.highspeedtraining.co.uk/hub/importance-

of- corporate-social-responsibility/

Cunat, V., Gine, M., & Guadalupe, M. (2010). The Vote is

Cast: The Effect of Corporate Governance on

Shareholder Value. Journal of Finance, American

Association,67(5), 1943-1977.

Dhaliwal, D., Li, O. Z., Tsang, A., & Yang, Y. G. (2014).

Corporate Social Responsibility Disclosure and the

Cost of Equity Capital: The Roles of Stakeholder

Orientation and Financial Transparency. Journal of

Accounting and Public Policy, 33(4), 328-355.

Fisher-Vanden, K., & Thorburn, K. S. (2011). Voluntary

Corporate Environmental Initiatives and Shareholder

Wealth. Journal of Environmental Economics and

Management, 62, 430-445.

Flammer, C. (2013). Does Corporate Social Responsibility

Lead to Superior Financial Performance? A

Regression Discontinuity Approach.

Fontaine, C., Haarman, A., & Schmid, S. (2006). The

Stakeholder Theory. Research Paper.

Friedman, A. L., & Miles, S. (2006). Stakeholders: Theory

and Practice. Oxford: Oxford University Press.

Friedman, M. (1962). Capitalism and Freedom: With the

Assistance of Rose D. Friedman. Chicago: University

of Chicago Press.

Freeman, R. E. (1984). Strategic Management: A

Stakeholder Approach. Massachusetts: Pitman

Publishing Inc.

Gelb, D. S., & Strawser, J. A. (2001). Corporate Social

Responsibility and Financial Disclosures: An

Alternative Explanation for Increased Disclosure.

Journal of Business Ethics, 33(1), 1-13.

Gennari, F., & Salvioni, D. (2017). Corporate Social

Responsibility and Shareholder Relations. Economics

and Business, 21-24.

Ghoul, S. E., Guedhami, O., Kwok, C. C., & Mishra, D. R.

(2011). Does Corporate Social Responsibility Affect the

Cost of Capital? Journal of Banking & Finance, 35(9),

2388-2406.

Gordon, J. M. (2015, January 13). Stakeholder Theory of

Corporate Governance. Retrieved February 27, 2020,

from The Business Professor:

https://thebusinessprofessor.com/knowledgebase/stake

holder- theory-of-corporate-governance

Guenster, N., Derwall, J., Bauer, R., & Koedijk, K. (2011).

The Economic Value of Corporate Eco-efficiency.

European Financial Management, 17.

Hall, P. L., & Rieck, R. (1998). The Effects of Positive

Corporate Social Actions on Shareholder Wealth.

Journal of Financial and Strategic Decisions, 11(2), 83-

89.

Hasan, I., Hoi, C. K., Wu, Q., & Zhang, H. (2014). Beauty

in in the Eye of the Beholder: The Effect of Corporate

Tax Avoidance on the Cost of Bank Loans. Journal of

Financial Economics, 113(1), 109-130.

Hayes, A. F. (2013). Introduction to Mediation, Moderation

and Conditional Process Analysis: A Regression-

Based Approach. New York: The Guilford Press.

ICAESS 2020 - The International Conference on Applied Economics and Social Science

268

James, L. R., & Brett, J. M. (1984). Mediators, Moderators

and Tests for Meditation. Journal of Applied

Psychology, 69, 307-321.

Jensen, M. C. (2010). Value Maximisation, Stakeholder

Theory, and Corporate Objective Function. Journal of

Applied Corporate Finance, 22(1), 32-42.

Jo, H., & Harjoto, M. A. (2011). Corporate Governance

and CSR Nexus. Journal of Business Ethics,100(1), 45-

67.

Jo, H., & Harjoto, M. A. (2012). The Causal Effect of

Corporate Governance on Corporate Social

Responsibility. Journal of Business Ethics, 106, 53-72.

Khan, Z. A., & Hussanie, I. (2018). Shareholders Wealth

Maximisation: Objective of Financial Management

Revisited. International Journal of Enhanced Research

in Management & Computer Application, 7(3), 739-

741.

Kolk, A., & Pinkse, J. (2010). The Integration of Corporate

Governance in Corporate Social Responsibility

Disclosures. Corporate Social Responsibility

Environment Management, 17, 15-26.

Kusi, B. A., Gyeke-Dako, A., Agbloyor, E. K., & Darku, A.

B. (2018). Does Corporate Governance Structures

Promote Shareholders or Stakeholders Value

Maximisation? Evidence from African Banks.

Corporate Governance International Journal of

Business in Society, 18(2), 277-288.

Kyereboah-Coleman, A. (2007). Corporate Governance

and Shareholder Value Maximisation: An African

Perspective. African Development Review, 19(2), 350-

367.

Lazonick, W., & O'Sullivan, M. (2000). Maximising

Shareholder Value: A New Ideology for Corporate

Governance. Economy and Society, 29(1), 13-35.

Lea, D. R. (2018). Shareholder Wealth Maximization. In R.

W. Kolb, The SAGE Encyclopaedia of Business Ethics

and Society (Vol. 1, pp. 3087-3092). Thousand Oaks,

California: SAGE Publications.

Maroun, K., & Moez, D. (2015). Impact of Corporate

Governance on Shareholder Value Creation: Evidence

from Tunisian Context. International Business

Research, 8(5), 262-270.

Mir, A. E., & Seboui, S. (2008). Corporate Governance and

the Relationship between Economic value Added and

Created Shareholder Value. Corporate Governance

International Journal of Business in Society, 8(1), 46-

58.

Nguyen, P.-A., Kecskes, A., & Mansi, S. (2017). Does

Corporate Social Responsibility Create Shareholder

Value? The Importance of Long-Term Investors.

Journal of Banking and Finance, 15(42), 1-21.

Odriozola, M. D., & Baraibar-Dier, E. (2017). Is Corporate

Reputation Associated with Quality of CSR Reporting?

Evidence from Spain. Corporate Social Responsibility

and Environmental Management, 24(2), 121-132.

Papasolomou-Doukakis, I., Krambia-Kapardis, M., &

Katsioloudes, M. (2005). Corporate Social

Responsibility: The Way Forward? Maybe Not! A

Preliminary Study in Cyprus. European Business

Review, 17(3), 263-279.

Porter, M. E., & Kramer, M. R. (2006). Strategy Society:

The Link Between Competitive Advantge and

Corporate Social Responsibility. Harvard Business

Review, 84, 78-92.

Porter, M. E., & Kramer, M. R. (2011). Creating Shared

Value: How to Reinvent Capitalism and Unleash a

Waze of Innovation and Growth. Harvard Business

Review, 89,62-77.

Stuebs, M., & Sun, L. (2010). Business Reputation and

Labor Efficiency, Productivity and Cost. Journal of

Business Ethics, 96(2), 265-283.

The Economic Times. (n.d.). Definition of Shareholder

Value. Retrieved from The Economic Times:

https://economictimes.indiatimes.com/definition/share

holder- value

Verma, D. P., & Kumar, R. (2012). Relationship between

Corporate Social Responsibility and Corporate

Governance. Journal of Business and Management,

2(3), 24-26.

Williams, C., & Conley, J. (2005). An Emerging Third

Way? The Erosion of the Anglo-American Shareholder

Value Construct. Cornell International Law Journal, 38,

493-551.

World Business Council for Sustainable Development.

(1999). Corporate Social Responsibility. Geneva:

WBCSD.

Younkins, E. W. (2006, April 23). Milton Friedman's

Pragmatic and Incremental Libertarianism. Retrieved

from Le Quebecois Libre:

http://www.quebecoislibre.org/06/060423-5.htm

Zubeltzu-Jaka, E., Andicoechea-Arondo, L., & Etxeberria,

I. A. (2018). Corporate Social Responsibility and

Corporate Governance and Corporate Financial

Performance: Bridging Concepts for a More Ethical

Business Model. Wiley Business Strategy and

Development, 1, 214-222.

The Mediating Role of Corporate Governance on Corporate Social Responsibility and Shareholder Wealth Maximisation

269