The Influence of Inflation, Interest Rate, Exchange Rate, and Gross

Domestic Products (GDP) on Joint Stock Price Index (CSPI) in

Indonesia Stock Exchange (BEI) Period 2009-2018

Triani Pujiastuti, Agung Satmoko and Erry Kurnia Nugraha

Universitas Pembangunan Nasional Veteran Yogyakarta

Keywords: Inflation, Interest Rates, The Exchange Rate, GDP, And CSPI

Abstract: This investigation means to decide and break down the impact of macroeconomic factors, including

expansion, loan costs, the swapping scale of the rupiah against the US dollar, and GDP on the CSPI time

frame 2009 - 2018. This investigation is utilized auxiliary information and incorporated into information

time arrangements gathered by archiving information of expansion, loan fees, the conversion standard of the

rupiah against the US dollar, GDP, and the CSPI for the period 2009-2018. The investigative instrument

utilized in this examination is different relapse investigation and speculation testing utilizing the f-test to

discover to decide the impact of all the while free factors on the reliant variable and t-test to decide the

impact of incompletely the autonomous factors on the needy variable. The results of this study are inflation,

interest rates, the exchange rate of the rupiah against the US dollar, and GDP jointly affect the CSPI with a

significance level of 5%. In part, swelling and loan costs do not influence the CSPI, while the conversion

scale of the rupiah against the United States dollar negatively affects the CSPI and GDP positively affect the

Index CSPI.

1 INTRODUCTION

The capital market is important for a country's

economy. According to Jones (2000: 74), the capital

market is vital for the functioning of the capitalist

economy because it functions to channel funds from

investors to borrowers. Furthermore, the capital

market provides an vital allocation role through

linking funds to who can use it optimally. Dandelion

(2017) states that the capital market is a gathering

point between gatherings who have abundance

reserves and the individuals who need assets by

exchanging protections. Capital markets can fill in

as a delegate.

Data about securities exchange execution is

frequently condensed in a record called financial

exchange files. The securities exchange list is a

pointer that mirrors the presentation of stocks in the

market since it is a marker that depicts the

development of stock costs, the financial exchange

list is additionally called the stock value file. In

Indonesia Stock Exchange (IDX) stock price index

called Composite Stock Price Index (CSPI). As per

Moraga and Pakarti (2001), CSPI is a file that

demonstrates the development of stock costs as a

rule recorded on the stock trade as a kind of

perspective for the advancement of exercises in the

capital market. CSPI can be used to assess the

general market situation or measure whether stock

prices have increased or decreased. CSPI also

involves all share prices listed on the exchange. The

stock price index has three main benefits, such as:

1. Market direction markers.

2. Level of profit.

3. Benchmark portfolio performance.

The estimation of the Composite Stock Price

Index changes as per the degree of stock exchanging

action on the IDX. The movement of the CSPI can

be related to the macroeconomic environment in

Indonesia. Tandelilin (2017) states that economic

analysis is one of the three analyzes that investors

need to do in determining their investment decisions.

Economic analysis needs to be done because of the

tendency for a strong relationship between what

happens in the macroeconomic environment and the

performance of a capital market. Jones (2000: 342)

mentions that estimates of good economic

conditions have significant value for investors

Pujiastuti, T., Satmoko, A. and Nugraha, E.

The Influence of Inflation, Interest Rate, Exchange Rate, and Gross Domestic Products (GDP) on Joint Stock Price Index (CSPI) in Indonesia Stock Exchange (BEI) Period 2009-2018.

DOI: 10.5220/0009966903590366

In Proceedings of the International Conference of Business, Economy, Entrepreneurship and Management (ICBEEM 2019), pages 359-366

ISBN: 978-989-758-471-8

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

359

because economic conditions and capital markets are

tightly bound, estimates of good macroeconomic

variables will be very useful. Sunariyah (2011: 23)

states that several macroeconomic variables affect

the equity market, including GDP growth, industrial

production growth, inflation, interest rates, the

rupiah exchange rate, unemployment, and budget

deficits.

Many studies have been conducted which aim to

examine the effect of macroeconomic variables on

the CSPI. The aftereffects of research led to

macroeconomic factors on the CSPI changed, and

there were irregularities. Research on the impact of

swelling on the CSPI directed by Astuti et al. (2013)

produces proof that expansion has a negative and not

massive impact on the CSPI. Another investigation

directed by Wijaya (2013) found that the expansion

variable had no significant impact on the CSPI.

Simbolon and Purwanto (2018) led an investigation

of macroeconomic factors on stock costs and found

that swelling rates had a positive and critical impact

on stock costs.

Research on the impact of loan costs on the CSPI

led by Astuti et al. (2013) found that the loan cost

(SBI) had a negative and massive impact on the

CSPI. In a similar report, directed by Wijaya (2013)

found that financing costs did not fundamentally

impact the CSPI.

Research on the impact of variable trade rates on

the CSPI led by Astuti et al. (2013) brings about the

finding that the Rupiah conversion standard has a

negative and critical impact on the CSPI. Another

study conducted by Mulyani (2012) found that

exchange rates hurt the Jakarta Islamic Index.

Another study conducted by Simbolon and Purwanto

(2018) found that exchange rates had a positive

effect on the CSPI.

Research conducted by Simbolon and Purwanto

(2018) found that GDP growth did not affect the

CSPI. In a study conducted by Mulyani (2012), it

was found that GDP had a positive effect on the

Jakarta Islamic Index.

Considering the importance of the CSPI in

relation as an indicator of stock trading activities on

the IDX that has a relationship with macroeconomic

variables in Indonesia and the existence of research

gaps on research into the influence of

macroeconomic factors on the CSPI, conducted

research aimed to test the effect of macroeconomic

variables on the CSPI. The research conducted aims

to determine the effect of inflation, interest rates,

exchange rates, and GDP on the CSPI on the IDX

for the 2009-2018 period.

2 LITERATURE REVIEW AND

HYPOTHESES

2.1 Inflation

According to Sukirno (2015), inflation can be

defined as a process of rising prices prevailing in an

economy. According to Samuelson and Nordhaus

(2011), inflation shows an increase in the general

price level. The swelling rate is the pace of progress

in the general cost, and can be estimated as pursues:

The rate of inflation (year t)=

1

1

100

(Samuelson and Nordhaus, 2011)

2.2 Interest Rates

According to Samuelson and Nordhaus (2011),

interest rates are payments made for the use of

money. Financing cost is the measure of intrigue

paid per unit time. In macroeconomics, there are two

kinds of loan fees, to be specific, the ostensible

financing cost and the original financing cost.

Samuelson and Nordhaus (2011) express that the

ostensible loan cost is the financing cost in cash

esteem, while the genuine loan fee is an amendment

to expansion and is characterized as the ostensible

loan fee less the swelling rate. Mathematically the

calculation of nominal and real interest rates is as

follows:

Nominal interest rate = real interest rate + inflation

rate

Real interest rate = nominal interest rate - inflation

rate

(Mankiw, 2018: 177)

Indonesian Central Bank has fortified the

working system money related approach by

executing a benchmark intrigued rate or a new

approach rate, BI 7 Day (Turn around) Repo Rate,

which has been compelling since Admirable 19,

2016, replaces the BI Rate. Strengthening the

framework of the monetary operation is a common

practice in various central banks and is a best

practice internationally in the conduct of monetary

operations. The monetary operating framework is

constantly being refined to strengthen the

effectiveness of policies in achieving the set

inflation targets. The BI 7-instrument day (Reverse)

Repo Rate used as a new policy rate because it can

quickly affect the money market, banking, and the

real sector. The 7-BI instrument day Repo Rate as

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

360

another reference has a more grounded relationship

to currency market loan fees, is value-based or

exchanged available, and energizes budgetary

market developing, explicitly the utilization of repo

instruments.

2.3 Currency Exchange

According to Sukirno (2015), foreign exchange rates

indicate the price or value of a country's currency

expressed in the value of another country's currency.

Foreign exchange rates can also be defined as the

amount of domestic money needed, i.e., the amount

of rupiah needed to obtain one unit of foreign

currency. Foreign exchange rates, according to

Samuelson and Nordhaus (2011), are prices of

foreign currencies in domestic currency units.

The conversion scale or likewise called the

swapping scale in different exchanges or purchasing

and selling of outside monetary standards, there are

known four sorts, to be specific (Kewal, 2012):

2.1.1. Selling rate, which is the rate controlled by

a bank for the clearance of certain outside

monetary standards at a specific minute.

2.1.2. The average rate, for example, the center

rate between the selling rate and the outside

conversion scale of purchasing against the

national cash, which is dictated by the Central

Bank at some random minute.

2.1.3. Buying rate, which is the conversion scale

controlled by a bank to buy certain outside

monetary standards at a specific time.

2.1.4. Flat rate, the conversion standard is

winning in the purchasing and selling of

banknotes and voyager check, in which the

swapping scale has considered the advancement

and different costs-other.

2.4 Gross Domestic Product (GDP)

Samuelson and Nordhaus (2011) argue that GDP /

GDP is the total output produced within a country's

borders for one year. Simbolon and Purwanto (2018)

express that GDP is a proportion of all monetary

yield inside a nation's fringes for a specific period,

typically yearly or quarterly. Gross domestic product

is determined by including the complete estimation

of the yearly yield of a nation's merchandise and

enterprises.

According to Sukirno (2015), gross domestic

product (GDP) can be interpreted as the value of

goods and services produced in the country in one

year. In the economy, in developed and developing

countries, goods and services are produced not only

by companies owned by the residents of these

countries but by residents of other countries.

National production is always invented by factors of

production originating from abroad.

Theoretically the formula for calculating GDP is:

GDP = C + G + I + NX

(Mankiw, 2018: 10)

Where:

C = Private (public) consumption,

G = Government expenditure,

I = Investment,

NX = Country's net exports (total exports -

total imports).

Using the GDP equation, GDP growth can be

formulated as follows:

GDP growth =

Where:

GDPn = Growth of domestic products in year n,

GDPn-1 = GDP one year before year n.

2.5 Composite Stock Price Index

(CSPI)

Composite Stock Price Index (CSPI) describes a

series of historical information about the movement

of the combined share price of all shares, up to a

specific date. Composite Stock Price Index of all

offers is a worth used to gauge the joined

presentation of all offers recorded on a stock trade

(Sunariyah, 2011).

According to Sunariyah (2011: 142), there are

two methods of calculating the Composite Stock

Price Index (CSPI), namely:

2.5.1 The Average Method

In this method, the market price of the shares

included in the calculation of the index is added up

then divided by a dividing factor certain. The

Composite Stock Price Index (CSPI) formula with

the common method is:

CSPI =

∑

∑

where:

CSPI = Composite Stock Price Index

PS = Stock market price

∑Pbase = A divisor value

The Influence of Inflation, Interest Rate, Exchange Rate, and Gross Domestic Products (GDP) on Joint Stock Price Index (CSPI) in

Indonesia Stock Exchange (BEI) Period 2009-2018

361

∑Pbase is a divider value factor where this

dividing factor must be able to adapt to changes in

theoretical stock prices because there are actions of

issuers such as the right issues, stock dividends,

bonus shares, and so on. As with other index

calculations, the CSPI is determined based on the

index calculation. On the base day, the base price is

the same as the market price, so the index is 100%.

2.5.2 The Weighted Average Method

In this method, the index adds weighting in addition

to the stock market price and the base price of the

stock. Two experts propose this method:

2.5.3 PaascheMethod

CSPI=

∑

∑

where:

CSPI = Composite Stock Price Index

PS = Market price of shares

SS = Number of shares issued (outstanding

shares)

Pbasebase =price of shares

2.5.4 The Laspeyres Method

CSPI=

∑

∑

CSPI = Composite Stock Price Index

PS = Market price of shares

SO = Number of shares issued on the base

day

Please = Stock price Base

2.6 Hypothesis

The theory can be characterized as a coherently

unsurprising connection between at least two factors,

which is expressed in the structure or definition of

explanations that can be tried. The hypothesis in this

study are as follows:

H1: inflation, interest rates, the exchange rate of

the rupiah against the US dollar, and the GDP effect

together on CSPI at the IDX in the period 2009-

2018.

H2: inflation negatively affects CSPI at the IDX

in the period 2009-2018.

H3: interest rates harm the CSPI on the IDX for

the period 2009-2018.

H4: The exchange rate of the rupiah against the

US dollar has a negative effect on the CSPI on the

IDX for the period 2009-2018.

H5: GDP has a positive effect on the CSPI on the

IDX for the period 2009-2018.

3 RESEARCH METHOD

Sort of research led in this examination is a causal

report. The reliant variable in this examination is the

CSPI, while the autonomous factors utilized are

swelling, financing costs, the conversion scale of the

rupiah against the US dollar, and the GDP.

The kind of information utilized in this

investigation is optional information. Information

sources utilized in this examination are auxiliary

sources gotten from the site. The information

utilized in this examination is observational

information from 2009 to 2018.

Information accumulation strategies are done by

reporting expansion information, loan fees, the

swapping scale of the rupiah against the US dollar,

Gross domestic product, and the CSPI during the

2009-2018 period acquired through related locales

on the web. The type of time-recurrence of

information gathered is resolved in the quarterly

structure, so the information for every factor will be

gathered in the measure of 40 observational

information.

The systematic device utilized in this

investigation is various relapse examination and

theory testing utilizing the f test to discover to

decide the impact of at the same time autonomous

factors on the reliant variable and t-test to decide the

impact of halfway free factors on the needy variable.

4 RESULTS

4.1 Research Result

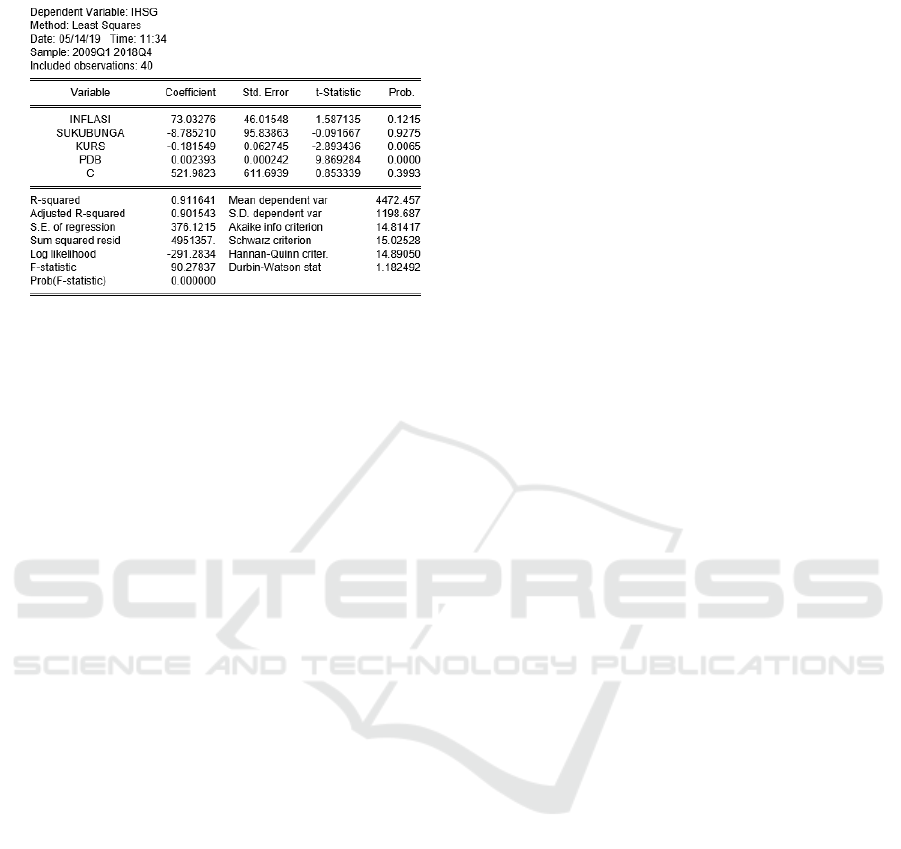

Results of multiple regression analysis in this study

are summarized in the following table:

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

362

Table 1. Table of Results of Multiple Regression Analysis

Based on table 1.1 the regression equations are

prepared using the formula as follows:

Y = a + b1X1 + b2X2 + b3X3 + b4X4 + e

Resulting in a regression equation as follows:

CSPI = 521.9823 + 73.032756 (Inflation) - 8.785210

(Interest Rate) - 0.181549 (Exchange Rate) +

0.002393 (GDP)

Hypothesis testing is done with the F test and test

t. The F test was carried out to determine the effect

of the independent variables together on the

dependent variable. In table 1.1, it can be seen that

the statistical F value is 90.277837, with a

probability value of 0.000000. Based on these results

it can be said that H1 is accepted because the

significance value of the results <α = 5%

(Widarjono, 2015), thus it can be concluded that

there is a simultaneously effect of inflation, interest

rates, exchange rates of rupiah against the dollar The

United States, and GDP against the Composite Stock

Price Index (CSPI). In other words, H1 in this study

is "proven."

T-test was conducted to determine the effect of

partially independent variables on the dependent

variable. The rule in this test is that if the probability

value of p is smaller than α, then the hypothesis of

each variable is accepted, and vice versa if the

probability value of p is greater than the value of α,

then the hypothesis of each variable is rejected

(Widarjono, 2015). In light of these outcomes,

acknowledgment or dismissal of the speculation is

made for every theory of each proposed variable.

The decision to reject and accept the hypothesis

in this study is as follows:

4.1.1 Influence of Inflation on the CSPI on

the IDX for the period 2009-2018.

Based on the results of the t-test, inflation has a

value t of 1.587135 with a probability value

amounted to 0.1215, greater than the significance

level of 0.05 (5%). This shows that the hypothesis is

rejected, meaning that inflation has no effect on the

Composite Stock Price Index (CSPI) for the period

2009 - 2018. Thus, H2 in this study is "not proven."

4.1.2 Effect of Interest Rates on the

Composite Stock Price Index (CSPI)

on the Indonesia Stock Exchange

(IDX) for the period 2009-2018

Based on t-test results, interest rates have a t-statistic

value of -0.091667 with a probability value of

0.9275, greater than the level significance of 0.05

(5%). This suggests that the hypothesis is rejected,

meaning that the interest rate does not affect the

Composite Stock Price Index (CSPI) in the period

2009 - 2018. Thus, the H3 in the study "not proven."

4.1.3 Effect of Exchange Rates of Rupiah

against the US Dollar on the CSPI on

the IDX for the period 2009-2018

In light of the consequences of the t-test, the

conversion scale of monetary forms against the US

of America had a t-measurement estimation of - 2,

893436 with a likelihood estimation of 0.0065, littler

than the essentialness level of 0.05 (5%). This

suggests that the hypothesis is accepted, which

means the exchange rate of the rupiah against the US

dollar negatively affects Composite Stock Price

Index (CSPI) in the period 2009 - 2018. Thus, H4 in

this study "proved." This means that if the variable

value of the rupiah exchange rate against the US

dollar increases, the value of the CSPI will decrease.

4.1.4 Effect of GDP on the CSPI on the IDX

for the period 2009-2018.

Based on the results of the t-test, GDP has a t

statistic value of 9.869284 with a probability value

of 0.0000, smaller than the significance level of 0,

05 (5%). This suggests that the hypothesis is

accepted, meaning that is GDP positive influence on

Stock Price Index (CSPI) in the period 2009 - 2018.

Thus, H5 in this study "proved." This means that if

the value of the GDP variable increases, the value of

the CSPI variable will increase.

The Influence of Inflation, Interest Rate, Exchange Rate, and Gross Domestic Products (GDP) on Joint Stock Price Index (CSPI) in

Indonesia Stock Exchange (BEI) Period 2009-2018

363

5 DISCUSSION

5.1 Influence of Inflation on CSPI

The results show that inflation does not affect the

Composite Stock Price Index (CSPI) for the period

2009 - 2018. The aftereffects of this examination are

in accordance with the consequences of research

directed by Kewal (2012), which found that half the

swelling rate did not significantly affect the CSPI.

The results of this study are also in line with the

results of research conducted by Wijaya (2013), who

found that inflation did not affect the CSPI. The

consequences of different examinations that are

following the aftereffects of this investigation are the

consequences of research led by Astuti et al. (2013),

who found that expansion did not influence the

CSPI.

According to Kewal (2012), inflation does not

have a significant effect on the Jakarta Composite

Index (CSPI) due to inflation that occurs in

Indonesia, not including the inflation rate that is too

high, so it does not affect the stock price. Based on

inflation data on descriptive statistics, the average-

average inflation rate during the study period

amounted to 4.9315%, with a maximum value was

8.4%. The market can still accept if the inflation rate

is below 10% (Kewal, 2012). However, if inflation

breaks the 10% mark, the capital market will be

disrupted. If inflation exceeds the 10% level, the

Indonesian Central Bank will increase the BI rate,

which causes investors to tend to shift their capital in

the banking sector.

5.2 Effect of Interest Rates on the CSPI

The outcomes demonstrated that loan costs had no

impact on the CSPI for the period 2009 - 2018. The

aftereffects of this investigation are following the

consequences of research directed by Wijaya (2013),

who found that loan costs do not influence the CSPI.

The aftereffects of this examination are likewise in

accordance with the consequences of research led by

Kewal (2012), who found that the SBI financing cost

did not influence the CSPI. Astuti et al. (2013), in

their examination, likewise found similar outcomes.

To be specific, the conversion scale negatively

affected the CSPI.

In several theories, it states that high-interest

rates will undoubtedly have an impact on the

investment fund allocation of investors. Investments

in bank products such as deposits or savings are less

risky than investments in shares. The investor will

sell his shares and will then save the funds in the

bank. The simultaneous sale of shares will have an

impact on a significant decline in share prices

(Arifin, 2007:).

The interest rate in the 2009-2018 period

experienced a change that was not too large from

quarter one to another quarter. The maximum value

of the interest rate for the period 2009-2018 is

7.75%. The interest rate does not affect the CSPI due

to the low-interest rates prevailing in Indonesia

during the period 2009-2018, which is still below

10%, so it does not cause a shift in investor funds to

investments in the form of savings or time deposits.

5.3 Effect of Exchange Rates of Rupiah

against the US Dollar on the CSPI

The outcomes demonstrated that the conversion

scale of the rupiah against the United States dollar

had a critical negative impact on the CSPI for the

period 2009 - 2018. The consequences of this

examination are in accordance with the discoveries

in an investigation directed by Wijaya (2013), which

found that the swapping scale negatively affected the

CSPI. Research conducted by Kewal (2012) also

found the same results as this study, namely, the

exchange rate harms the CSPI. The reinforcing of

the United States dollar swapping scale will cause a

decrease in the estimation of the CSPI. Then again,

if the estimation of the US dollar conversion

standard debilitates, it will build the estimation of

the CSPI.

Simorangkir and Suseno (2004) state that

three main factors affect foreign exchange demand.

First, import payment factors. The higher the import

of goods and services, the greater the demand for

foreign exchange so that the exchange rate will tend

to weaken and vice versa.Second, the capital outflow

factor. The greater the capital outflow, the greater

the demand for foreign exchange and will further

weaken the exchange rate. Capital outflows include

payment of the debt of Indonesian citizens (both

private and government) to foreign parties and

placement of funds of Indonesian citizens abroad.

Third, speculation activities. The more outside cash

hypothesis exercises completed by examiners, the

more noteworthy the interest for remote trade to

debilitate the conversion scale of the nearby money

against outside monetary standards.

Meanwhile, the foreign exchange supply is

influenced by two main factors. First, the factor of

export revenue. The greater the volume of receipts

from exports of goods and services, the greater the

amount of foreign currency owned by a country and

in the continued exchange rate of foreign currencies

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

364

tends to strengthen or appreciate and vice versa.

Second, the factor of capital inflow (capital inflow).

The greater the capital inflow, the exchange rate will

tend to get stronger. The capital inflow can be in the

form of foreign debt receipt, placement of short-term

funds by foreign parties (portfolio investment), and

foreign direct investment.

Judging from foreign exchange demand

factors, the capital outflow from Indonesia which

causes the US dollar to strengthen will have an

impact on the decline in the Composite Stock Price

Index (CSPI) because the funds used to invest in the

Indonesia Stock Exchange (IDX) are reduced due to

capital outflow. A large capital inflow will cause the

US dollar exchange rate to weaken and will cause

the CSPI to strengthen due to investment funds

entering the Indonesia Stock Exchange. The

weakening of the value of the US dollar exchange

rate has reduced investor interest in investing in

foreign currencies and tends to divert funds to the

capital market.

5.4 Effect of GDP on the CSPI)

The outcomes demonstrated that GDP had a

noteworthy beneficial outcome on the CSPI for the

period 2009 - 2018. The aftereffects of this

examination were in accordance with the

consequences of research led by Neny Mulyani

(2012 ), which found that GDP negatively affected

JII. As indicated by Sukirno (2015), GDP is the

estimation of merchandise and ventures in a nation

created by components of generation claimed by the

natives of that nation and remote nations. Tandelilin

(2017) states that increasing GDP is a good

(positive) signal for investment and vice versa if

GDP decreases. The increase in GDP has a positive

influence on consumer purchasing power so that it

can increase demand for company products. These

conditions will increase the profitability of the

company so that it will affect stock prices and push

up the CSPI.

In line with the opinion of Tandelilin (2017),

according to Sunariyah (2011), an increase in GDP

will have a positive effect on consumer income

because it can increase demand for company

products, this will provide high optimism and also

spur positive market sentiment so that it has a

significant influence positive for the equity market.

The increase in GDP in the Indonesian economy will

encourage the creation of stock trading activities on

the IDX to be more excited so that it will push the

pace of the Composite Stock Price Index (CSPI)

towards an increase.

6 CONCLUSION

Based on the results of research in this research,

conclusions that can be produced are as follows:

Inflation, interest rates, the exchange rate of

the rupiah against the US dollar, GDP

simultaneously affect the CSPI period 2009 –

2018.

Inflation does not affect on the CSPI on the

IDX for the period 2009-2018.

Interest rates do not affect the CSPI on the

IDX for the period 2009-2018.

The exchange rate of the rupiah against the

United States dollar has a negative effect on

the CSPI on the IDX for the period 2009-

2018.

GDP has a positive effect on the CSPI on the

IDX for the period 2009-2018.

7 LIMITATION

7.1 Further Researchers

Based on the results of the coefficient of

determination (R2) in this study amounted to

90.1543%, which means that the variable inflation,

interest rates, exchange rates, and GDP can explain

changes in the CSPI of 90, 1543 %. Other variables

outside the model can explain the JCI change of

9.8457%.

Suggestions for the next researcher are expected

to be able to conduct research using variables

outside the research model such as the amount of

money in circulation, the balance of payments,

income per capita, employment opportunities, and

others, which can explain changes in the Composite

Stock Price Index.

7.2 For Investors

Advice that researchers can give to investors is in

investing in getting the maximum profit; investors

must pay attention to variables that affect trading

activities in the capital market, especially the GDP

variable.

GDP is an indicator of a country's economic

growth. The higher value of a country's GDP reflects

activities in the country's capital market that have

favorable prospects for investing. Conversely, if the

value of GDP decreases under these conditions,

trading activity in the country's capital market is not

conducive to investment.

The Influence of Inflation, Interest Rate, Exchange Rate, and Gross Domestic Products (GDP) on Joint Stock Price Index (CSPI) in

Indonesia Stock Exchange (BEI) Period 2009-2018

365

REFERENCES

Anoraga, PandjidanPijiPakarti, 2008, PengantarPasar

Modal, Semarang: RinekaCipta.

Ariefianto, Moch. Doddy, 2012,

EkonometrikaEsensidanAplikasidenganMenggunakan

EVIEWS, Jakarta: Erlangga.

Arifin, Ali, 2004, MembacaSaham, Yogyakarta: UPP

AMP YKPN.

Astuti, Ria, dkk, AnalisisPengaruh Tingkat SukuBunga

(SBI), NilaiTukar (Kurs) Rupiah, Inflasi, danIndeks

Bursa InternasionalTerhadap CSPI (StudiPada CSPI di

BEI Periode 2008-2012), Diponegoro Journal of

Social and Politic of Science, 2013, I: 1-8.

Atmadja, Adwin, S, Inflasi di Indonesia: Sumber-

SumberPenyebabdanPengendaliannya,

JurnalAkuntansidanKeuangan, 1999, Vol. 1 No. 1: 54-

67.

Clive Ganger, Bwo-Nung Huang dan Chin-Wei Yang, A

Bivariate Causality between Stock Prices And

Exchange Rates: Evidence from Recent Asian Flu,

The Quarterly Review Of Economics And Finance,

1998, Volume 40:337354.

Dornbusch, R., Fischer, S., and Richard Starz, 2008,

MakroEkonomi, diterjemahkanoleh Roy

IndraMirazudin, Jakarta: PT Media Global Edukasi.

Gujarati, Damodar, 1997, Dasar-DasarEkonometrika,

diterjemahkanolehSumarnoZain, Jakarta: Erlangga

_______________, 2006, Dasar-DasarEkonometrika,

Edisi 3, Jilid 1, diterjemahkanoleh Julius Mulyadi,

Jakarta: Erlangga.

_______________, 2006, Dasar-DasarEkonometrika,

Edisi 3, Jilid 2, diterjemahkanoleh Julius

MulyadidanYelviAndri Jakarta: Erlangga.

Jones, Charles P, 2000, Investments Analysis and

Management, Edisi 7, USA: John Wiley & Sons, Inc.

Kewal, SuramayaSuci, PengaruhInflasi, SukuBunga, Kurs,

danPertumbuhan PDB

terhadapIndeksHargaSahamGabungan,JurnalEconomi

a, 2012, Vol 2: 53-64.

Mankiw, N. Gregory, 2007, Makro ekonomi,Edisi 6,

diterjemahkan oleh Fitria Liza dan Imam Nurmawan,

Jakarta: Erlangga.

________________, 2018, Makroekonomi, Edisi 7,

diterjemahkanolehChriswanSungkono, Jakarta:

SalembaEmpat.

Mulyani, Neni, 2012, AnalisisPengaruhInflasi,

SukuBunga, NilaiTukar Rupiah danProdukDomestik

Gross terhadap Jakarta Islamic Index, Thesis, Jakarta:

Universitas Terbuka.

Nurcholis, Irfan, 2018, PengaruhKurs, BI Rate,

danInflasiterhadapIndeksHargaSahamGabungan

(PeriodeJanuari 2013- Desember 2017), Skripsi,

Yogyakarta: UPN Veteran Yogyakarta.

Samuelsons, Paul A dan William D. Nordhaus, 2011,

Makroekonomi, Edisi 14,

diterjemahkanolehHarisMunandar, Freddy Saragihdan

Rudy Tambunan, Jakarta: Erlangga.

Sekaran, Uma dan Roger Bougie, 2017, Metode Penelitian

untuk Bisnis, Edisi.6 Jilid. 1, diterjemahkanoleh Kwan

Men Yon, Jakarta: SalembaEmpat.

Simbolon, LentinadanPurwanto, The Influence of

Macroeconomic Factors on Stock Price: The Case Of

Real Estate And Property Companies, Global Tensions

in Financial Markets Research in Finance, 2018,

Volume 34, 19–39.

Simorangkir, Iskandar dan Suseno, 2004, Sistem dan

Kebijakan Nilai Tukar, Jakarta: Pusat Pendidikan dan

Studi Kebanksentralan (PPSK) Bank Indonesia.

Sukirno, Sadono, 2015, MakroekonomiTeoriPengantar,

Edisi 3, Depok: Rajawali Pers.

Sunariyah, 2011, PengantarPengetahuanPasar Modal,

Edisi 6, Yogyakarta: STIE YKPN.

Tandelilin, Eduardus, 2017, Pasar Modal

ManajemenPortofolio&Investasi, Yogyakarta:

Kanisius.

Weston J. Fred, Eugene Foster Brigham, 2011, Dasar-

DasarManajemenKeuangan, Edisi 11,

diterjemahkanoleh Ali Akbar Yulianto, Jakarta:

SalembaEmpat.

Widarjono, Agus, 2015, AnalisisMultivariatTerapan, Edisi

2, Yogyakarta: UPP STIM YKPN.

Wijaya, Renny, Pengaruh Fundamental

EkonomiMakroTerhadapIndeksHargaSahamGabunga

nPada Bursa Efek Indonesia Periode 2002-2011,

Jurnal Ilmiah Mahasiswa Universitas Surabaya, 2013,

Vol. 2 No. 1.

Winarno, Wing Wahyu, 2011,

AnalisisEkonometrikadanStatistikadenganEViews,

Edisi 3, Yogyakarta: UPP STIM YKPN.

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

366