The Effect of Accrual Quality, Real Earnings Management, and

Corporate Governance on Credit Rating in Indonesia

Indra Kusumawardhani and Windyastuti

Universitas Pembangunan Nasional Veteran, Yogyakarta, Indonesia

Keywords: Accrual Quality, Real Earnings Management, Corporate Governance, Credit Rating, The Board Size,

Independent Board, Audit Committee

Abstract: This research examined whether accrual quality, real earnings management, and corporate governance affect

the firm's credit rating in Indonesia. Specifically, investigation on whether real earnings management

components, represented by AbnCFO, AbnDisExp, and AbnPROD, together with corporate governance

components, which are represented by board size, independent board, and audit committee affect the firm's

credit rating. This research used several corporate governance mechanisms developed by Bursa Efek

Indonesia and credit rating classification developed by PEFINDO. Multiple regression model is selected to

test the research problem. This research found that accrual quality, ABnCFO, ABnPROD, and board size

affected the firm's credit rating, while the independent board and audit committee did not affect credit rating.

1 INTRODUCTION

Rating agencies play an important role in financial

and economic markets, as was done during the 2008

crisis. Rating agencies use the information provided

by the management of companies that are ranked and

the financial statements of companies that are ranked

to produce ratings (ratings) concerning the company's

creditworthiness as a whole and for the purpose of

issuing certain debts. This ranking accurately

represents the rating agency's opinion regarding a

company's creditworthiness, conditioning their

ability to interpret properly the information presented

in the company's financial statements.

The theoretical relationship between the quality of

accounting information with credit ratings can be

determined by the understanding or purpose of credit

ratings. Reputable rating agencies such as Standard

and Poor's (rater/rating) define the domestic long-

term issuer credit rating as an opinion of the ability of

the overall rate (the company ranked) to meet its

financial obligations. The ability of the ranked party

to generate current and future cash flows is likely the

most important factor in assessing the ability of the

ranking party to pay the loan principal and current and

future debt interest. One of the main sources of

information from cash flow information is the

company's financial statements. Standards and Poor's

(S&P) states that they base on the company's financial

statements that are ranked in determining ratings.

The accounting literature identifies real earnings

management as one of the methods employed by

managers to be able to manipulate financial statement

information. Zang (2012) states that real earnings

management has been seen as an act of substitution

for accrual-based earnings management. Real

earnings management is measured by abnormal cash

flows from operations, abnormal production costs,

abnormal discretionary expenditures

(Roychowdhury, 2006; Cohen & Zarowin, 2010;

Zang, 2012; Zhao, Chen, Zhang, & Davis, 2012;

Siriviriyakul, 2013).

The quality of accounting information can also be

influenced by good corporate governance. Corporate

governance at the company level offers a general

view of the environment in which financial

statements are prepared and where accounting

choices are made. Companies with poor governance

will be more willing to engage in unethical behavior

or may lack good internal control at the top to reduce

earnings management in the form of accruals or real

activities. As a result, rating agencies can see

companies with poor governance as riskier and have

less creditworthiness. Rating agencies can also

consider the governance environment when assessing

earnings management behaviour (Geiszler, 2014).

Kusumawardhani, I. and Windyastuti, .

The Effect of Accrual Quality, Real Earnings Management, and Corporate Governance on Credit Rating in Indonesia.

DOI: 10.5220/0009964902870295

In Proceedings of the International Conference of Business, Economy, Entrepreneurship and Management (ICBEEM 2019), pages 287-295

ISBN: 978-989-758-471-8

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

287

The rating of a company is determined by the

rating of a rating agency that looks at the probability

distribution of future cash flows. Credit is determined

by assessing the likelihood that future cash flows will

be sufficient to cover the cost of principal payments

and repayment capacity. Then it can be seen that the

average cash flow distribution of the company shifted

downwards. The rating also experiences changes in

each company, with the change in rank can be one of

the factors that influence the direction of investment.

The rating is not a recommendation to sell, buy, or

hold, nor is it a comment like the stock analysis.

Ratings are formed based on information provided by

rating agencies or information obtained from other

reliable sources. The ratings may change, be

withdrawn, or be delayed due to changes in the

company's debt repayment capacity.

A credit rating agency, or also called a credit

rating agency (Credit Rating Agency), is a company

that issues credit ratings for bond issuers. Rating

agencies function as information intermediaries and

play a role in improving capital market efficiency by

increasing the transparency of securities, so as to

reduce information asymmetry between investors and

bond issuers. Therefore, rating agencies provide more

efficient services (Beaver et al., 2006). The issuer of

bonds that can be traded on the secondary market is

usually a company, city, institution, non-profit, or

government of a country. Credit Rating measures

creditworthiness and the ability to repay debt and

affects the interest rates charged on the debt.

There are several incidents that raise the question

of whether the ratings assessed by rating agencies in

Indonesia are accurate. According to (Chan et al.,

1995), one of the reasons why the rating issued by the

rating agency is biased because the rating agency

does not monitor the company's performance every

day, and the rating agency only assesses the

occurrence of an event. In addition, there is no further

explanation from the rating agency how financial

statements and non-financial factors can be used in

determining ratings. According to Matthies (2013),

determinants of credit ratings are three main

categories. The first is financial ratios and financial

data. These variables are proxy for company-specific

factors such as leverage, liquidity, and company size

(for example, Ederington (1985); Blume et al.,

(1998); Kamstra (2003); The second category is the

corporate governance mechanism. Here, factors such

as ownership structure and board of commissioners

are measured (Bhojraj & Sengupta (2003);

Ashbaugh-Skaife et al. (2009).

The company's ability to repay loans is a

determining factor used by creditors to provide loans.

Bankruptcy experienced by large companies triggers

companies to pay more attention to the company's

financial condition before issuing investment

decisions. Credit Rating is one indicator that shows

how well a company is managing economic problems

experienced by the company. Company Credit Rating

can provide information about the state of the

company, especially regarding loan payments made

by the company. The company's credit rating reflects

the opinions held by the rating agency regarding the

company's creditworthiness and the issuance of

bonds. The rating agency uses the information

provided by the company management that is ranked

and the financial statements of the company that is

ranked to produce a rating of the company's overall

creditworthiness and for the purpose of issuing

certain debts. This ranking accurately represents the

rating agency's opinion of a company's

creditworthiness, conditioning their ability to

interpret well the information presented in the

company's financial statements.

Previous research has examined the relationship

between corporate governance and the amount and

quality of information disclosure made by companies

(Eng & Mak, (2003); Ajinkya et al. (2005); Davidson

et al. (2005); Karamanou and Vafeas (2005); Baxter

and Cotter (2009); Wang and Hussainey (2013) The

results of the study found that good corporate

governance will lead to higher quality disclosures in

mandatory and voluntary disclosures and lead to

higher profit forecasting. Related to the lack of

earnings management actions and lower fraud

incidents (Beasley (1996); Peasnell et al. (2000);

Klein (2002); Dechow et al. (2012)) The effect of

corporate governance on financial statement users

such as financial analysts (Byard et al., 2006) and

agency credit ratings have also been tested (Ball et al.

(2012); Bradley & Chen (2015); Kent and Stewart

(2008)). This elitian wants to test whether real

earnings management and corporate governance

influence credit rating in Indonesia?

2 LITERATURE REVIEW AND

HYPOTHESES

2.1 Accrual Quality and Credit Rating

Research on accrual quality shows that investors

cannot fully detect the existence of earnings

management and cannot fully understand the

implications of accrual accounting (Sloan, 1996).

This study shows that investors tend to overestimate

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

288

the importance of the accrual component of earnings

and underestimate the cash flow component of

earnings. Rating agencies are likely to be

sophisticated users of financial statements compared

to other market participants. Geiszler (2014) states

that rating agencies are able to identify and assess the

quality of a company's accruals and are presented in

the ratings they make. Rating (rating) can interpret the

income smoothing behavior and discretionary versus

non-discretionary decisions with a GAAP construct

that is profitable for companies with high ratings.

On the other hand, the rating agency as a potential

sophisticated user of financial statements and is able

to observe the company's financial condition that

actually can punish earnings management made by

managers and use discretionary accruals or ignore

these problems in valuation relating to the ability to

detect earnings management. This leads to the first

hypothesis:

Hypothesis 1: Accrual quality influences credit

ratings

2.2 Real Earnings Management and

Credit Rating

Geiszler (2014) examined the relationship between

accrual quality, real activity earnings management,

corporate governance, and credit ratings in the United

States using three models to measure accrual quality,

namely the modified Jones model, the cash flow

model, and the revenue model. Real activity earnings

management was tested using the Roychowdury

model. Another thing tested is whether the Credit

Rating Agency Reform Act of 2006 and the Dodd-

Frank Act of 2010 affect the relationship between the

quality of accounting information with credit ratings.

The results indicate that at the company level, accrual

quality is a significant factor in influencing the rating

received by the company. Companies with lower

accrual quality also receive lower credit ratings. Real

activity earnings management also affects credit

ratings at the company level.

John (2016) tests whether companies that lack

earnings management strategies to achieve credit

ratings are expected after the implementation of the

Sarbanes-Oxley Act (SOx) and the Dodd-Frank Wall

Street Reform Consumer Protection Act (Dodd-

Frank). As expected, the results of the study indicate

that fewer accrual-based earnings management

strategies were used after SOx, and there was an

increase in real-activity-based earnings management

strategies in the period before the occurrence of a

large corporate scandal.

Zang (2012) found that managers use real activity

earnings management as a substitute for accrual

earnings management. Real activity earnings

management is an effort to direct or present the

company's financial condition better than the actual

condition. As a result, it is conditioned on the ability

of the rating agency to detect real earnings

management; it must be linked to credit ratings. This

leads to the second hypothesis:

Hypothesis 2: Real earnings management

influences credit ratings

2.3 Corporate Governance and Credit

Rating

The results of testing corporate governance variables

using a proxy for the size of the board of

commissioners, the composition of the board of

commissioners, the independence of the board of

commissioners, the independence of the audit

committee and the Index based on the 24 provisions

used by the Investor Responsibility Research Center

by Geiszler (2014) show different results. The size of

the board of commissioners and the independence of

the board and the composition of the board of

commissioners affect the credit rating, while the audit

committee does not affect the credit rating. Corporate

governance at the company level provides an in-depth

look at the overall reporting environment (Gompers

et al. (2003); Brown & Caylor (2006); Grinstein &

Chhaochharia (2007).

The results show that corporate governance has an

indirect influence on information reported by the

company. For example, companies with poor

corporate governance may lack internal control over

financial reporting or may employ managers with less

binding ethical codes, weak corporate governance can

reduce the reliability of financial statement

information, and financial information that is

inherently unreliable will make decisions or

assessments. Undertaken becomes riskier, companies

with greater risk should get a lower credit rating than

companies that are less risky, so it makes sense that

corporate governance at the company level is a factor

that influences the credit rating process. This leads to

the third hypothesis:

Hypothesis 3: Corporate governance influences

credit ratings

The Effect of Accrual Quality, Real Earnings Management, and Corporate Governance on Credit Rating in Indonesia

289

3 RESEARCH METHOD

3.1 Population and Sample

The population in this study are all non-financial

sector companies listed on the Indonesia Stock

Exchange in 2015-2017. Determination of the sample

using a purposive sampling method with criteria:

companies that get credit ratings from PT PEFINDO

and have complete real earnings management and

corporate governance data, so as to obtain 46

company samples with a total of 107 observations.

3.2 Variable Measurement

The independent variables in this study are:

3.2.1 Accrual Quality

Accrual earnings management is done by

changing the accounting method or estimation used in

companies in recording a transaction that will affect

the income reported in the financial statements (Zang

2012). In this study, the accrual quality is measured

using the modified Jones model (Dechow et al.,

1995). To measure discretionary accruals, first

calculate the total accruals by:

TAit= Net Income – Cash Flow From Operation

Note: TAit = Total Accrual in period t

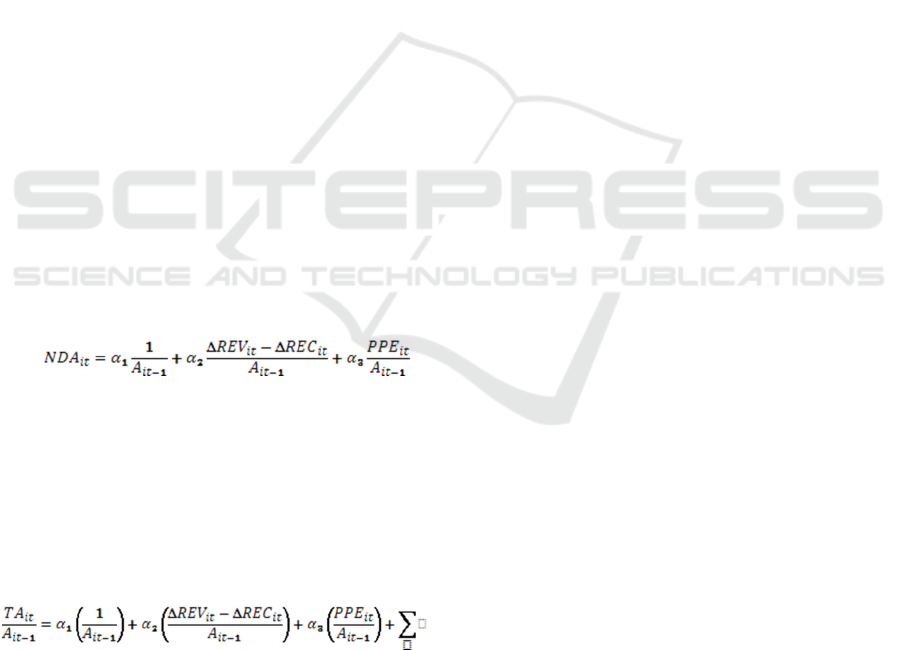

With Jones's empirical model, discretionary

accruals are done by first calculating the value of

nondiscretionary accruals. With the formula:

Note: ∆REVit = year t income minus period t-1

income ECRECit: company trade receivables i in

period t reduced period T-1 accounts receivable

PPEit: fixed assets (gross) of company i in period t

At-1 = Total Assets of period t-1 α1α2α3 = Firm-

specific parameters Estimates α1, α2, α3, are

calculated during the estimation period using the

following model:

Then calculate discretionary accruals, which is the

difference between total accruals (TAit) and

nondiscretionary accruals (NDA). Discretionary

accruals are a proxy for earnings management.

DA = TAit – NDA

3.2.2 Real Earnings Management.

Real earnings management is management actions

that deviate from normal business practices carried

out with the main goal of achieving profit targets

(Roychowdhury, 2006; Cohen and Zarowin, 2010).

Real earnings management is calculated using the

approach used by Roychowdhury (2006), which is as

follows:

a. Abnormal CFO

tttttttt

ASASAACFO

)/()/()/1(/

13121101

CFOt = company's operating cash flow i in year t

At-1 = total assets of the company i year t-1

St = total sales of the company I in ¬ ¬-1

For each year's observation, the cash flow of

abnormal operating activities (ABN_CFO) is the

residual value of the estimated regression equation

model above.

b. Abnormal Discretionary Expenses

tttttt

ASAADISEXP

)/()/1(/

1121101

DISEXPt = discretionary expenses, namely research

and development costs plus advertising costs plus

sales, administration, and general costs.

Abnormal production costs (ABN_PROD) are the

residual values from the estimated regression

equation model above.

c. Abnormal Production Costs

tttttttttt

ASASASAAPROD

)/()/()/()/1(/

11313121101

PRODt = production cost, which is the cost of goods

sold plus changes in inventory.

Discretionary costs are defined as the sum of

advertising costs, research and development costs,

and sales costs, and general and administrative costs.

Abnormal discretionary costs (ABN_DISEXP) are

obtained from the residual value of the estimated

regression equation model above.

2. Corporate Governance

Corporate governance is a series of structured

processes used to manage and direct or lead a

business or corporate business venture with the aim

of enhancing the values of the company and the

business community. In this study, corporate

governance is proxied by the size of the board of

commissioners, independent commissioners, and

audit committees (Byard et al., 2006).

The dependent variables in this study are:

3.2.3 Credit Rating

Credit Rating is a standardized assessment of the

ability of a country or company to pay its debts.

Rating of a company can be compared with other

companies so that it can be distinguished who has

better and less ability. Ratings are issued by rating

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

290

companies, and usually, to become a rating company

must obtain official permission from the government.

According to Karyani and Manurung (2008), rating is

one of the variables that is considered by investors

when deciding to invest in a company. The

information contained in the rating will indicate the

extent of a company's ability to pay its obligations on

the funds invested by investors. In this study, credit

ratings are measured by the ratings made by

PEFINDO, namely AAA, AA, A, BBB, BB, B, CCC,

D on a nominal scale.

Data analysis technique

This research uses secondary data. Data were

analyzed with multiple linear regression techniques to

determine whether the variables of accrual quality,

real earnings management, and corporate governance

affect the credir rating. Hypothesis testing uses

multiple regression analysis with the following

models:

Y = α + β1DA + β2ABNCFO + β3ABNDISCEXP+

β4ABNPROD+β5BSIZE + β6IndB + β7AC+ε

Where:

Y = credit rating

α = intercept

DA=Discretionary Accruals

ABNCFO = Abnormal Operating Cash Flow

ABNDISCEXP = Abnormal Discretionary Fees

ABNPROD = Abnormal Production Costs

DK = Board of Commissioners

KI = Independent Commissioner

KA = Audit Committee

Before conducting a regression test, the classical

assumptions are tested, namely normality,

multicollinearity, autocorrelation, and

heteroscedasticity.

4 RESULTS

4.1 Descriptive Statistics and Classical

Assumption Test

Descriptive statistics are statistical analyses that

provide a picture of the distribution of data without

generalizing or drawing conclusions on the data. The

classic assumption test is a test conducted to obtain

adequate confidence that the linearity assumption in

the model used in this study is not disturbed by bias

arising from the disruption of data distribution

(normality), correlation between observational

variables (autocorrelation), interference between

observational periods (multicollinearity) and data

characteristics (heteroscedasticity).

Descriptive statistics of this study are presented in

table 4.1 as follows:

Results of multiple regression analysis in this

study are summarized in the following table:

Table 4.1: Descriptive Statistic

N Min Max Mean St.Dev

CR

107 1.00 10.00 5.710 2.014

DA 107 -0.13 0.33 0.051 0.076

ABN

CFO

107 -0.33 0.24 -0.014 0.099

ABN

PROD

107 -0.93 0.62 -0.038 0.241

DK

107 2.00 10.00 4.962 1.821

KI 107 1.00 4.00 1.831 0.679

KA 107 0.00 6.00 3.233 0.708

This study fulfills the classic assumptions

required in the use of multiple linear regression

models after removing the Abnormal Discretionary

Expenditure variable from the research model.

Abnormal Discretionary Expenditure variables are

excluded because they contain high multicollinearity

symptoms with a Variance Inflation Factor value

greater than the allowed threshold value (VIF£10).

Sample normality testing is done using the

Kolmogorov-Smirnov One-Sample test,

autocorrelation testing with the Durbin Watson

coefficient test, multicollinearity testing by testing the

Variance Inflation Factor, and heteroscedasticity

testing using the Gleijser test.

4.2 Multiple Linear Regression

Analysis

Multiple linear regression has several types of

analytical models that can be used to get the best

coefficient estimation based on the characteristics of

the data used in the study. The data used in this study

is panel data that combines cross-section data and

time series data as observation units. A summary of

the results of the multiple linear regression of this

study is presented in table 4.2 as follows:

Table 4.2: Result Summary of Multiple Regression

Analysis

Model Coefficient

Constanta

2.306

DA

7.119**

Abn CFO

11.014**

Abn Prod

-1.488*

B size

0.506**

IndBoard

-0.097

The Effect of Accrual Quality, Real Earnings Management, and Corporate Governance on Credit Rating in Indonesia

291

AC

0.247

F

18.769**

R

2

0.529

Adj R

2

0.501

The results of the multiple linear regression

analysis in table 4.2 show that the independent

variable AbnCFO and the Board of Commissioners

influence the Credit Rating variable, while the

AbnPROD variable, Independent Commissioner (KI)

and Audit Committee (KA) have no effect on Credit

Rating. The coefficient of determination (R-Square

and Adjusted R-Square) are 0.490 and 0.464. This

value indicates that the independent variable used in

the model is able to explain the variation in the value

of the dependent variable (Credit Rating) of 46.4%. F

test results in the research model have significance

below the specified threshold (5%). These results

indicate the suitability of the model (Model Fit) used

in this study.

5 DISCUSSION

5.1 The Effect of Accrual Quality on

Credit Rating

The results of this study indicate that the first

hypothesis of the study, which states that the quality

of accruals affects the Credit Rating is supported

statistically. These results indicate that the rating

agency (Credit Rating Agency) pays attention to the

quality of the company's accruals. Accrual quality as

measured by the content of discretionary accruals is a

concern in rating a company's debt because accrual

quality provides an adequate predictive picture of the

certainty of future cash flows used as the basis for a

Credit Rating Agency in determining a company's

debt rating

5.2 The Effect of Real Earnings

Management on Credit Rating

The results of the linear regression analysis of this

study indicate that the first hypothesis stating that real

earnings management for the Abn CFO proxy affects

statistically supported Credit Rating. In line with

researchers' allegations that companies tend to shift

from accrual earnings management to real earnings

management, real earnings management is a method

that can be used by company management to show

the company's performance to users of financial

statements. Real earnings management is a concern of

credit rating agencies (Credit Rating Agency),

considering that the components used in real earnings

management directly affect the company's cash flow.

Certainty about the nature, amount, and availability

of cash flows in the future of a company is a

determinant used by rating agencies in determining

the debt rating of a company. This result is also

consistent with Geiszler (2014), John (2016), and

Zang (2012), who state that real activity earnings

management also affects credit ratings at the

company level.

While the AbnPROD Real Profit Management

proxy shows negative coefficient results and has no

effect on Credit Rating, according to Geiszler (2014),

this is related to overproduction or increased

production to artificially reduce the cost of goods sold

(COGS) which affects the lower credit rating. Gunny

(2010) found that companies that did real earnings

management to achieve their profit targets relatively

displayed better company performance compared to

companies that failed to achieve predetermined profit

targets. If bondholders assess that real earnings

management is a desirable business activity by them,

the relationship that will emerge between real

earnings management and the costs of issuing

corporate bonds is a negative relationship. The reason

given is in accordance with the results of the study of

Graham et al. (2005) That through real earnings

management activities, managers are more difficult

for investors to detect related to the earnings

management strategy used. With the increasingly

limited access and ability of investors and bond rating

agencies, in providing an actual assessment of the risk

of the bonds, they are judging that the operating

activities carried out by the company are in normal

condition. Furthermore, the reasons for the

differences in the results of this study with Ge and

Kim (2014) can also be strengthened by the results of

the study of Bhojraj et al. (2009). Bhojraj et al.'s

research (2009) indicates that the stock market has

misjudged the practice of real earnings management

in the year of manipulation. In the short term,

financial markets value companies that manage real

earnings at prices higher than they really are.

5.3 The Effect of Corporate

Governance on Credit Rating

The results of this study indicate that corporate

governance affects Credit Rating on the Board of

Commissioners' Size component. While the two other

components (Independent Commissioner and Audit

Committee) do not affect the company's credit rating.

Regression results for the first hypothesis in this study

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

292

showed a board size coefficient of 0.473 and a

significant effect at the level of 0.001, so the first

hypothesis was supported. Previous literature states

that the size of the board of commissioners is less

effective, but the results of this study indicate that the

size of the board of commissioners is apparently also

associated with a higher credit rating. This study is

consistent with Geiszler's (2014) study, which states

that board size is positively related to credit rating.

This indicates that when corporate governance

increases, the credit rating is also higher.

This study does not support the statement of the

first hypothesis that the existence of an independent

commissioner has an influence on credit rating.

Independent Commissioners have no effect on Credit

Rating with a significance level of 0.834. This

happens because of the possibility of the lack of

dominant independent commissioners from the

outside so that their existence is not enough to play a

role as a balancing decision in the composition of the

board of commissioners and balance the strength of

management, consistent with Utami's study (2012)

which states that the minimum requirement of 30% of

the total members the board of commissioners issued

by Bapepam may not be high enough to make

independent commissioners dominate in terms of

policies taken by the board of commissioners. The

composition of the board of commissioners is still

low, so that collectively, the independent

commissioners do not have the power to influence all

decisions made by the board of commissioners. If an

independent commissioner has a majority of votes of

more than 50%, it is possible that an independent

commissioner will be more effective in oversight

activities within the company. Rasyid and Kostaman

(2013) also stated that this could be caused by the

appointment of an independent commissioner by a

company that might only be done to fulfill regulations

but not intended to uphold Good Corporate

Governance. Maybe even the independent

commissioners appointed by the company are not

competent in the field of accounting or finance.

The Audit Committee does not affect the Credit

Rating with a significance level of 0.092. This can

occur because members of the audit committee are

appointed by a board of commissioners who are more

dominated from within the company, resulting in a

conflict of interest within the company. Sihotang

(2011) and Utami (2012) explained that the existence

of an audit committee by a company might only be

carried out to fulfill regulations but was not intended

to uphold good corporate governance within the

company. According to Mariana (2016), this

insignificant result was made possible because the

audit committee formed by the board of

commissioners was not able to play as it should. In

general, this committee functions as the supervisor of

the process of making financial reports and internal

controls. The audit committee is expected to act more

efficiently, but it can also have weaknesses, namely

the lack of member experience in finance or the level

of independence is still questionable. So the audit

committee is not able to significantly influence bond

ratings. The responsibility of the Audit Committee in

the field of Corporate Governance is to ensure that the

company has been run according to applicable laws

and regulations, conducts its business ethically,

carries out its supervision effectively against conflicts

of interest and fraud committed by company

employees. The role of the Audit Committee is to

supervise and provide input to the Board of

Commissioners regarding the creation of a

supervisory mechanism. But in reality, many

members of the Audit Committee do not have

sufficient knowledge in internal control matters, and

not even a few who lack accounting background.

(FCGI) It is stated in the FCGI that the Audit

Committee must consist of individuals who are

independent and not involved in the day-to-day tasks

of management who manage the company, and who

have experience to perform the supervisory function

effectively. This is so that integrity and views can be

objective in the report and preparation of

recommendations submitted by the Audit Committee

to the Board of Commissioners. The number of

members of the Audit Committee is adjusted to the

extent of the organization and responsibilities. But

usually three to five members is a pretty ideal

number. The Audit Committee usually needs to hold

meetings three to four times a year to carry out its

obligations and responsibilities concerning the

financial reporting system. (The Institute of Internal

Auditors, Internal Auditing, and The Audit

Committee in FCGI.

6 CONCLUSION

This research was conducted to determine the effect

of Earnings Quality, Real Earnings Management, and

Corporate Governance on Credit Rating. The results

of this study indicate that that Real Profit

Management, which is proxied by ABnCFO, affects

The Effect of Accrual Quality, Real Earnings Management, and Corporate Governance on Credit Rating in Indonesia

293

the supported Credit Rating. While the ABnPROD

proxy did not have an impact on Credit Rating. In the

corporate governance variable, only the Board of

Commissioners' proxy shows a significant influence

on Credit Rating. Other Corporate Governance

Proxies, namely Independent Commissioners and

Audit Committees, did not affect Credit Rating.

7 SUGGESTION

This research produces the following suggestions:

Advice for Companies. The results of this study

can be used by company management to consider the

content of accrual quality and earnings management

actions that affect cash flow (real earnings

management) in the company's financial statements.

Both of these are proven to be considered by debt

rating agencies in determining the rating (Credit

Rating) of a company. A good rating provides an

opportunity for management to expand access to

corporate finance and reduce the company's capital

costs.

For Further Researchers. The results of this

study can be used as a reference in subsequent

studies. Future studies can add a longer observation

period to prove the consistency of the theory,

especially those related to the use of corporate

governance components. Subsequent researchers can

develop using the continued contribution of the

corporate governance mechanism that is disclosed in

the company's annual report as additional information

that can be considered by a rating agency (Credit

Rating Agency) in rating a company's debt.

REFERENCES

Ajinkya, B., Bhojraj, S., & Sengupta, P. (2005). The

association between outside directors, institutional

investors and the properties of management earnings

forecasts. Journal of Accounting Research, 43(3), 343–

376. https://doi.org/10.1111/j.1475-679x.2005.00174.x

Ashbaugh-Skaife, H., Collins, D. W., Kinney, W. R., &

Lafond, R. (2009). The effect of SOX internal control

deficiencies on firm risk and cost of equity. Journal of

Accounting Research, 47(1), 1–43.

https://doi.org/10.1111/j.1475-679X.2008.00315.x

Ball, R., Shivakumar, L., Tsalavoutas, I., André, P., Evans,

L., Dechow, P., … Hail, L. (2012). the Influence of

Institutional Factors on the Value Relevance of

Accounting Information : Evidence From Jordan Dhiaa

Shamki Jabar Doctor of Philosophy Universiti Utara

Malaysia. Journal of Accounting and Economics, 21(1),

85–108. https://doi.org/10.1016/S0031-

9422(00)89647-8

Baxter, P., & Cotter, J. (2009). Audit Committees and

Earnings Expectations Management. Accounting and

Finance, 49(225), 267–290.

Beasley, M. S. (1996). Beasley 1996.pdf. 443–465.

Beaver, W. H., Shakespeare, C., & Soliman, M. T. (2006).

Differential properties in the ratings of certified versus

non-certified bond-rating agencies. In Journal of

Accounting and Economics (Vol. 42).

https://doi.org/10.1016/j.jacceco.2006.06.002

Bhojraj, S., Hribar, P., Picconi, M., & Mcinnis, J. (2009).

Making Sense of Cents.An Examination of Firms.pdf.

LXIV(5).

Bhojraj, S., & Sengupta, P. (2003). Effect of Corporate

Governance on Bond Ratings and Yields: The Role of

Institutional Investors and Outside Directors. Journal of

Business, 76(3), 455–475.

https://doi.org/10.1086/344114

Blume, M. E., Lim, F., & Mackinlay, A. C. (1998). The

declining credit quality of U.S. corporate debt: Myth or

reality? Journal of Finance, 53(4), 1389–1413.

https://doi.org/10.1111/0022-1082.00057

Bradley, M., & Chen, D. (2015). Does board independence

reduce the cost of debt? Financial Management, 44(1),

15–47. https://doi.org/10.1111/fima.12068

Brown, L. D., & Caylor, M. L. (2006). Corporate

governance and firm valuation. Journal of Accounting

and Public Policy, 25(4), 409–434.

https://doi.org/10.1016/j.jaccpubpol.2006.05.005

Byard, D., Li, Y., & Weintrop, J. (2006). Corporate

governance and the quality of financial analysts’

information. Journal of Accounting and Public Policy,

25(5), 609–625.

https://doi.org/10.1016/j.jaccpubpol.2006.07.003

Chan, L; Jegadeesh, N; Lakonishok, J. (1995). Mometum

Strategies. In National Bureau of Economic Reserach.

Cohen, D. A., & Zarowin, P. (2010). Accrual-based and real

earnings management activities around seasoned equity

offerings. Journal of Accounting and Economics, 50(1),

2–19. https://doi.org/10.1016/j.jacceco.2010.01.002

Davidson, R., Goodwin-Stewart, J., & Kent, P. (2005).

Internal governance structures and earnings

management. Accounting and Finance, 45(2), 241–267.

https://doi.org/10.1111/j.1467-629x.2004.00132.x

Dechow, P. M., Sloan, R. G., Sweeney, A. P., Sloan, R. G.,

& Sweeney, A. P. (1995). Detecting Earnings

Management. 70(2), 193–225.

Ederington, L. H. (1985). Classification Models and Bond

Ratings. Financial Review, 20(4), 237–262.

https://doi.org/10.1111/j.1540-6288.1985.tb00306.x

Eng, L. L., & Mak, Y. T. (2003). Corporate governance and

voluntary disclosure. Journal of Accounting and Public

Policy, 22(4), 325–345. https://doi.org/10.1016/S0278-

4254(03)00037-1

Ge, W., & Kim, J. B. (2014). Real earnings management

and the cost of new corporate bonds. Journal of

Business Research, 67(4), 641–647.

https://doi.org/10.1016/j.jbusres.2013.01.021

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

294

Geiszler, M. (2014). The Effect of Accrual Quality, Real

Activities Earnings Management and Corporate

Governance on Credit Ratings. Kent State University,

(July).

Gompers, P. A., Ishii, J. L., & Metrick, A. (2003). Financial

Institutions Corporate Governance and Equity Prices.

Quarterly Journal of Economics, Forthcoming.

Graham, J. R., Harvey, C. R., Rajgopal, S., Balachandran,

S., Berger, P., Bowen, R., … Ronen, J. (2005).

Shivakumar and seminar participants at the 2005 ASSA

annual conference.

https://doi.org/10.1016/j.jacceco.2005.01.002

Grinstein, Y., & Chhaochharia, V. (2007). Corporate

Governance and Firm Value: The Impact of the 2002

Governance Rules. Journal of Finance, 62(4), 1789–

1825. https://doi.org/10.1007/s10551-011-0869-y

Gunny, K. A. (2010). The relation between earnings

management using real activities manipulation and

future performance: Evidence from meeting earnings

benchmarks. Contemporary Accounting Research,

27(3), 855–888. https://doi.org/10.1111/j.1911-

3846.2010.01029.x

John, R. J. (2016). Corporate Credit Ratings , Earnings

Management and the passage of SOx and. Erasmus

School of Economics, (299775).

Jorion, P. (2009). Risk management lessons from the credit

crisis. European Financial Management, 15(5), 923–

933. https://doi.org/10.1111/j.1468-

036X.2009.00507.x

Kamstra, M. (2003). Pricing firms on the Basis of

Fundamentals. Economic Review Federal Reserve

Bank of Atlanta, 88(1), 49–70. Retrieved from

http://www.frbatlanta.org/filelegacydocs/erq103_kams

tra.pdf

Karamanou, I., & Vafeas, N. (2005). The association

between corporate boards, audit committees, and

management earnings forecasts: An empirical analysis.

Journal of Accounting Research, 43(3), 453–486.

https://doi.org/10.1111/j.1475-679X.2005.00177.x

Karyani, Etikah; Manurung, A. H. (n.d.). Pengaruh

Pengumuman Perubahan Bond Rating Thd Return

Saham Perusahaan.pdf.

Kent, P., & Stewart, J. (2008). Corporate governance and

disclosures on the transition to International Financial

Reporting Standards. Accounting and Finance, 48(4),

649–671. https://doi.org/10.1111/j.1467-

629X.2007.00257.x

Klein, J. (2002). Beyond competitive advantage. Strategic

Change, 11(6), 317–327.

https://doi.org/10.1002/jsc.606

Manurung, A; Silitonga; Tobing, W. (n.d.). Hubungan

rasio-rasio keuangan dengan rating obligasi. 1–12.

Mariana, M. (2016). Pengaruh Mekanisme Corporate

Governance Terhadap Peringkat Obligasi Yang

Tercatat Di Bursa Efek Indonesia Periode Tahun 2008

– 2010. AKRUAL: Jurnal Akuntansi, 7(2), 104.

https://doi.org/10.26740/jaj.v7n2.p102-119

Matthies, A. B. (2013). Empirical research on corporate

credit ratings: A literature review. 1–26. Retrieved from

http://sfb649.wiwi.hu-

berlin.de/papers/pdf/SFB649DP2013-003.pdf

Peasnell, K. V., Pope, P. F., & Young, S. (2000). Detecting

earnings management using cross-sectional abnormal

accruals models. In Accounting and Business Research

(Vol. 30).

https://doi.org/10.1080/00014788.2000.9728949

Rahardjo, Sapto (2004). Panduan Investasi Obligasi.

PT.Gramedia Pustaka Utama.Jakarta

Rasyid, Rosmita; Kostaman, E. J. (2013). ANALISIS

PENGARUH MEKANISME GOOD CORPORATE

GOVERNANCE DAN PROFITABILITAS

PERUSAHAAN TERHADAP PERINGKAT

OBLIGASI. Jurnal Akuntansi UKRIDA, No.1(April

2013), 1–25.

Roychowdhury, S. (2006). Earnings management through

real activities manipulation. Journal of Accounting and

Economics, 42(3), 335–370.

https://doi.org/10.1016/j.jacceco.2006.01.002

Siallagan, H., & Machfoedz, M. (2006). Mekanisme

Corporate Governance, Kualitas Laba dan Nilai

Perusahaan. ProsidingSIMPOSIUM NASIONAL

AKUNTANSI 9 PADANG, (061), 23–26.

Sihotang, D. T. (2011). Pengaruh Corporate Governance

Terhadap Peringkat Obligasi Dan Yield Obligasi.

Jurnal Riset Manajemen Dan Bisnis (JRMB) UNIAT,

6(1), 11–30.

Siriviriyakul, S. (2013). A Detailed Analysis of Empirical

Measures for Real Activities Manipulation. Ssrn.

https://doi.org/10.2139/ssrn.2359813

Susiana; Herawaty, A. (n.d.). ANALISIS PENGARUH

INDEPENDENSI, MEKANISME CORPORATE

GOVERNANCE, DAN KUALITAS AUDIT

TERHADAP INTEGRITAS LAPORAN

KEUANGAN. Prosiding SNA X, 2007, 1–31.

Utami, A. G. (2012). MEKANISME CORPORATE

GOVERNANCE TERHADAP. Accounting Analysis

Journal, 1(2).

Wang, M., & Hussainey, K. (2013). Voluntary forward-

looking statements driven by corporate governance and

their value relevance. Journal of Accounting and Public

Policy, 32(3), 26–49.

https://doi.org/10.1016/j.jaccpubpol.2013.02.009

Zang, A. Y. (2012). Evidence on the trade-off between real

activities manipulation and accrual-based earnings

management. Accounting Review, 87(2), 675–703.

https://doi.org/10.2308/accr-10196

Zhao, Y., Chen, K. H., Zhang, Y., & Davis, M. (2012).

Takeover protection and managerial myopia: Evidence

from real earnings management. Journal of Accounting

and Public Policy, 31(1), 109–135.

https://doi.org/10.1016/j.jaccpubpol.2011.08.004

The Effect of Accrual Quality, Real Earnings Management, and Corporate Governance on Credit Rating in Indonesia

295