Investor Decisions with Pecking Order Theory Method: Strategy of an

Investor to Get Right Issue

I Ketut Mangku

1

, Bambang Jatmiko

2

and Titi Laras

1

1

Economic Faculty of Janabadra University, Jln. Tentara Rakyat Mataram 55-57, Yogyakarta, Indonesia

2

Economic Faculty of Muhammadiyah University, Jln.Brawijaya,Geblagan, Bantul,Yogyakarta,Indonesia

Keywords:

Investor Decision, Pecking Order, Right Issue, Operating cash flow ratio, debt to equity, Return on Assets,

Net Profit Margin, Assets turnover, Price earnings ratio.

Abstract:

The purpose of the study is: (1) to tempt and prove empirically Investor strategy on Operating Cash Flow

Ratioof company before and after right issue; (2) on Debt to Equity Ratio ; (3) on Return on Asset ; (4) on

Net Profit Margin ; (5) on Asset Turnover; (6) to tempt and prove empirically Investor strategy about Price

Earning Ratio . This study method implemented purposive sampling. The results showed : (a) there is no

difference on Operating Cash Flow Ratio between before and after right issueto performance improvement

of Cash Flow Ratio is insignificant; (b) there is no diference onDebt Equity Ratio between before and after

right issue to decreasing Debt Equity Ratio performance is insignificant; (c) there is no difference onReturn

on Asset between before and after right issue to improvement of Return on Asset performance is insignificant;

(d) there is no difference onNet Profit Margin between before and after right issue toinsignificant improved

performance; (e) there is a difference onAsset Turnover between before and after right issue to significant

decrease.

1 INTRODUCTION

Capital Market Law Number 8 Year 1995 has ex-

plained about the mechanism of trading in the capi-

tal market. According to the Decision of the Chair-

man of the Capital Market Supervisory Agency no.

KEP-26 / PM / 2003 describes Rights Issue is an ad-

ditional share capital of a company that has conducted

a Public Offering of shares or Public Company. This

capital increase activity through Preemptive Rights or

Public Offering of Warrants or Conversion Securities.

Investors will be more strategic with pecking order

theory to gain maximum profit.

Pecking Order Theory states that companies tend

to choose funding that comes from internal rather than

external companies (Ghosh, 2011) which explains

that corporate priorities have a main role in choosing

funding. The priority begins with internal funding as

the first option, if internal funding is considered less,

both companies will propose a debt.For the last op-

tion, if the debt is considered less, the company will

issue shares. issuing some shares can be done through

action one of which is a right issue. The last option

is what is the explanation of why the company should

issue a stock back or right issue.

Right issue is a right that is purposed to the current

shareholders to buy shares which will be reissued by

the company (Dewi and Rahyuda, 2014). When in-

vestors buy rights issue shares then the company get

capital for the issuance of their shares. There are sev-

eral important dates around the right issue; 1) Cum

date is the date the investor can register to earn their

right issue, 2) Ex date is the date if an investor is no

longer registered, 3) Rec date is the date of recording

and 4) Distribution date is the date of the right issue

is distributed. This theory can be explained why com-

panies are able to gain high profit with low debt. An

investor who gets the rights to a right issue should

have several options that must be done. There are

three options: (a). Use or exploit the right whereveran

investor will buy them which offered in the right is-

sue by filling out the form or purchasing mechanism

provided by the securities; (b). Sell right issue rights

wherever investors have no more rights to purchase

shares which offered by the company; (c). Investors

should ignore the right to right issue wherever this ac-

tion will result loss of rights after the distribution date

passes.

122

Mangku, I., Jatmiko, B. and Laras, T.

Investor Decisions with Pecking Order Theory Method: Strategy of an Investor to Get Right Issue.

DOI: 10.5220/0009879301220129

In Proceedings of the 2nd International Conference on Applied Science, Engineering and Social Sciences (ICASESS 2019), pages 122-129

ISBN: 978-989-758-452-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 RESEARCH PROBLEMS

(Wijaya, 2015) explains the company’s financial per-

formance before and after the occurrence of corpo-

rate action by issuing a right issue, through observing

six company financial performance variables, namely:

Operating cash flow ratio (OCR), Debt to equity ratio

(DER), Return on Assets (ROA), Net profit margin

(NPM), Assets turnover (AT), and Price earnings ratio

(PER) on the Indonesia Stock Exchange, are differ-

ent. Of the 12 companies that issued a rights issue in

2011 on the Indonesia Stock Exchange, if described

in a graph of financial performance based on these

six variables, it appears that some fluctuated sharply,

some experienced changes but were not significant,

some were not so influenced by the existence of issue

rights issue.

The strategies alternative for investors in respond-

ing to the issuance of rights issues for new shares are:

(1) using the right issue to buy new shares, or (2) sell-

ing rights on the right issue, or (3) ignoring the rights

on the rights issue. The choice of an alternative strat-

egy depends on whether or not there is an improve-

ment in the company’s financial performance after the

issuance of a rights issue. Based on the results of (Wi-

jaya, 2015) research, the writer is interested in con-

ducting further research with the title ”Investor Deci-

sion with Pecking Order Theory Method: Investor’s

Strategy to Get Rights on Right Issues”

The problem formulations of this study are as fol-

lows: (1) How the Investor’s strategy with the com-

pany’s Operation Cash Flow Ratio performance be-

fore and after the rights issue; (2) How the Investor’s

strategy with the company’s Debt to Equity Ratio per-

formance before and after the rights issue; (3) How

the Investor’s strategy with Return on Asset perfor-

mance before and after the rights issue; (4) How the

Investor’s strategy towards the Net Profit Margin be-

fore and after the rights issue; (5) How the Investor’s

strategy with Asset Turnover performance before and

after the rights issue; (6) How the Investor’s strategy

with Price Earning Ratio performance before and af-

ter the rights issue.

The purposes of the study are : (1) to tempt and to

prove empirically Investor strategy on Operating Cash

Flow Ratioof company before and after right isuue;

(2) to tempt and to prove empirically Investor strat-

egy on Debt to Equity Ratio of a company before and

after right isuue; (3) to tempt and to prove empiri-

cally Investor strategy onReturn on Asset before and

after right issue; (4) to tempt and to prove empirically

Investor strategy on Net Profit Margin before and af-

ter right issue; (5) to tempt and to prove empirically

Investor strategy on Asset Turnover before and after

right issue; (6) to tempt and to prove empirically In-

vestor strategy on Price Earning Ratio before and after

right issue.

3 LITERATURE REVIEW

Pecking Order Theory: The Pecking Order The-

ory was first presented by Modigliani and Miller in

1958 (Sheikh et al., 2012). Pecking Order Theory

states that companies tend to choose funding that

comes from internal rather than external companies

(Ghosh, 2011). In this theory it is explained that there

are corporate priorities in choosing funding. The pri-

ority begins with internal funding as the first option,

then if internal funding is still considered less then the

choice of both companies is debt and the last option if

the debt is still considered less then the company will

issue shares. Issuing shares can be done through cor-

porate action one of which is a right issue. The last

option is what explains why the company is issuing

a stock back or right issue. Pecking Order Theory:

Pecking Order Theory differs from the trade-off the-

ory where in trade-off theory it is explained that com-

panies must achieve their debt targets. Target debt is

a balance target which the benefits can be taken and

debt should be balanced with the costs incurred in the

presence of such debt. One of the benefits of the debt

is to disminish taxes. However, this theory simply ex-

plains the funding needs based on the priority order

only. Therefore, there should be an explanation why

companies can have high profitability with low debt.

Company Performance: Performance is the result

of work in quality and quantity achieved by an em-

ployee in carrying out its duties in accordance with

the responsibilities that have been given (Nazaruddin

and Basuki, 2015). Quality work can be presented in

a narrative or descriptive way. The quantitative work

can be mathematically analyzed. Performance can be

interpreted as a result or output obtained from the ex-

istence of a process. The value of a process can be

seen in the performance of the process itself. Perfor-

mance appraisal requires analysis of a process. Per-

formance is either a result or a process undertaken

by the organization. There are three types of per-

formance that are: (a) Strategic performance as the

result obtained from the strategy made by corporate

managers; (b) Administrative performance relating to

the relationships among work units; (c) The opera-

tional performance of the company is related to the

effectiveness of organization in using the resources.

Performance is the result of the quality and quan-

tity achieved by a person or organization in carrying

out the responsibility given (Mangkunegara and Ha-

Investor Decisions with Pecking Order Theory Method: Strategy of an Investor to Get Right Issue

123

sibuan, 2009). Performance according to the above

definition can be interpreted that performance has two

types, namely: (a) Financial performance related to

the performance of a measurable individual or or-

ganization of economic activities that can be quan-

tified. For example comparison of sales level from

year to year; (b) Non-financial performance relates

to the performance of an individual or organization

that can not be measured by numbers. For example,

customer satisfaction over services provided by em-

ployees. In (Ediningsih and Yacobus, 2009) explained

that the performance of the company is an evaluation

of how the company is considered successful or not

in running its business. In evaluating the financial of

company performance required tool called the ratio.

Subramanyam and (Subramanyam et al., 2010) ex-

plain that there are ratios that can be used to measure

the performance of a company such as liquidity ratio,

capital structure ratio and leverage, investment rate re-

turn ratio, operating performance ratio, asset utiliza-

tion ratio, and size ratio market. Each ratio has its

own usability and interpretation.

4 HYPOTHESIS

4.1 Operating Cash Flow Ratio before

and after Right Issue

Operating cash flow is the cash flow generated from

the core activities of company (Amuzu, 2010). This

ratio shows the cash received by the company from

customers. Cash in operating cash flows is the cash

flow received from customers from the core activi-

ties of company. Each company has different core

activities. Debt payments will increase the value of

the operating cash flow ratio (Amuzu, 2010). Cash

earned from operating cash flows will not be too used

to pay off corporate debt. Operation Cash Flow Ratio

is derived from total operating cash flows divided by

total current liabilities (Subramanyam et al., 2010).

The value of the operating cash flow ratio is derived

from dividing the operating cash flow to current lia-

bilities. If the cash flow is higher, the value will be

higher. (Simanullang and Daljono, 2013) stated that a

company uses the funds obtained from the right issue

in order to reduce their debt level. If current liabili-

ties are less, the value will be high. The data is used

to calculate the cash flow ratio which is obtained in

the financial statements. Information on the operating

cash flow of the company can be obtained in the finan-

cial company statements in the cash flow statement.

Meanwhile, information on current liabilities can be

obtained in the financial of company statements in the

consolidated statements of financial position. If the

cash flow from operating activities increases then the

operating cash flow ratio will be better with a fixed

obligation record. If the right issue is used by the

company to settle the obligation, the amount of cor-

porate liabilities is reduced, the ratio will be better

with the record of operating cash flow remains. Re-

searchers have conducted international and national

online and offline journal surveys, but have not found

any research which using the ratio of cash flow oper-

ations as a measure of the financial performance of a

company doing a right issue. The theory development

of these variables uses theories derived from Subra-

manyam and (Subramanyam et al., 2010), (Amuzu,

2010). Considering the theory described by (Amuzu,

2010) and the logic of thought, hypotheses have one

direction. From the description above, it can be de-

rived hypothesis as follows;

H1: Suspected there are differences in operating

cash flow ratio before and after right issue

4.2 Differences Debt to Equity Ratio

(DERR) before and after

Distribution Date Right Issue

Debt to Equity Ratio (DER) is a ratio that measures

the capital structure of company derived from to-

tal liabilities divided by shareholder equity (Subra-

manyam et al., 2010). This ratio shows the ratio

between liabilities and corporate equity. The assets

owned by the company come from their own capital

and debt or loans. Given the Debt to Equity Ratio

(DER) ratio the proportion between capital and debt

will be seen clearly. Another theory mentions the re-

lationship between debt with the right issue. Research

conducted by (Simanullang and Daljono, 2013) states

that companies tend to use funds obtained from rights

issue activities in order to reduce the level of corpo-

rate debt. However, in practice the company not only

uses the funds from the rights issue to pay off the

debt alone, but also to conduct an expansion or buy

assets. Research conducted by (Ediningsih and Ya-

cobus, 2009) states that there are differences in Debt

to Equity Ratio (DER) before and after the Right Is-

sue. The sample used by the research is as many as

14 companies doing Right Issue. In the research the

significant value for the Debt to Equity Ratio (DER)

variable is 0.023 or below 0.05 alpha level. Research

conducted by (Simanullang and Daljono, 2013) states

that there is no significant difference of Debt to Eq-

uity Ratio (DER) before and after right issue. The

population of the study used a company listed on the

Indonesia Stock Exchange 2008-2010. Research con-

ICASESS 2019 - International Conference on Applied Science, Engineering and Social Science

124

ducted by (Ediningsih and Yacobus, 2009) states that

there is difference of Debt to Equity Ratio (DER) be-

fore and after right issue. This indicates that funds

obtained from the rights issue are used to pay off the

liabilities of company. Debt repayment by the com-

pany will affect the value of Debt to Equity Ratio

(DER). Less debt will increase the proportion of capi-

tal to debt. Therefore, if the company tends to use the

cash earned from the right issue to pay off the debt of

company, the Debt to Equity Ratio (DER) value will

tend to decrease. From the description above, it can

be derived hypothesis as follows;

H2 : Suspected there is difference Debt to Equity

Ratio before and after Right Issue

4.3 The Defferences between Return on

Assets (ROA) before and after Right

Issue

Return on Assets (ROA) is a financial ratios used

tomeasure the relationship between profits and asset

investment needed to generate profit. Companies use

their assets to generate income. They are machines,

buildings, and intangible assets such as brands. Re-

turn on Assets (ROA) is derived from net income di-

vided by the average total assets of the company (Sub-

ramanyam et al., 2010). It will be higher if the value

of denominator (net profit) is greater than the value of

the numerator (average total assets). The informations

are required to calculate the Return on Asset ratio can

be found in the Financial Statements. Net income can

be found in the Income Statement. The value of the

company’s assets can be found in the Financial Posi-

tion Report. Research conducted by (Ediningsih and

Yacobus, 2009) states that the value of Return on As-

sets (ROA) is significantly different between before

and after the right issue. This study uses the company

population listed on the Indonesia Stock Exchange in

2001-2003. From the description above, it can be de-

rived from hypothesis as follows:

H3: Suspected There are difference in Return on

Assets before and after Right Issue

4.4 Differences Net Profit Margin

before and after Right Issue

Net Profit Margin (NPM) is the ratio used to mea-

sure the level of a company’s operating performance

derived from net income divided by sales (Subra-

manyam et al., 2010). This ratio reveals how much net

profit can be generated from the sales / revenue earned

by the company. Research conducted by (Ediningsih

and Yacobus, 2009) states that there is no significant

difference between Net Profit Margin before and after

Right Issue. The population of the research are com-

panies listed on the Indonesia Stock Exchange from

1997 to 2001. Research conducted by (Khajar, 2010)

states that there is no significant difference in the ra-

tio of Net Profit Margin before and after the right is-

sue. Research conducted by (Ediningsih and Yacobus,

2009) states that there is a difference Net Profit Mar-

gin (NPM) before and after right issue. From the de-

scription above, it can be derived hypothesis as fol-

lows.

H4: Suspected There Are Difference Between Net

Profit Margin before and after Right Isuue

4.5 Defferences in Assets Turnover

before and after Right Issue

Asset Turnover (ATO) is the ratio used to measure the

efficiency of companies in using their assets (Hofs-

trand., 2013). It assesses ability of a company in uti-

lizing assett to generate sales. ROA assesses the re-

turn on investment on assets viewed from net income.

ATO is a ratio that shows the activity of the company

obtained from dividing sales by total assets (Khajar,

2010). This ratio is used to measure the level of firms

in utilizing their assets. In addition, this ratio explains

the ability of firms in utilizing their assets to generate

revenue. The research conducted by (Khajar, 2010)

states that there is no significant difference in turnover

assets before and after the company exercises a right

issue. The study examined the differences in the fi-

nancial performance of firms by using two pre- and

postperiods to measure differences. Research con-

ducted by (Ediningsih and Yacobus, 2009) states that

there is no difference in Asset Turnover (ATO) before

and after the right issue. This is because the funds ob-

tained from the rights issue are not invested to buy as-

sets but are used to pay off the liabilities of company.

If the company can effectively utilize its assets to gen-

erate sales then the value of Asset Turnover (ATO)

will improve. Companies with multiple assets may

not necessarily produce decent sales when compared

to their asset holdings. From the description above, it

can be derived hypothesis as follows.

H5: Suspected there is sifference between Assets

Turnover before and after Right Issue

4.6 Differences Price Earnings Ratio

(PER) before and after Right Issue

Price Earning Ratio (PER) shows the stock price that

the investor is willing to pay for the profit of company.

PER is the ratio of the firm’s stock price to earnings

per share of the company. Price Earning Ratio (PER)

Investor Decisions with Pecking Order Theory Method: Strategy of an Investor to Get Right Issue

125

is the ratio used to show the stock performance of a

company obtained from share price divided by earn-

ings per share (Khajar, 2010). The greater the value of

PER then the more expensive the price of a stock. Pre-

vious research conducted by (Khajar, 2010) showed

a significant difference in Price Earning Ratio (PER)

before and after the Right Issue. This shows that there

is a difference in the company’s stock performance. If

the company’s stock price is high while earnings per

share is low, it will produce a high Price Earning Ratio

(PER) value. High Price Earning Ratio (PER) marks

the value of an expensive company’s stock in other

words investors do not like it. If the firm price is low

with high earnings per share, it will result in low Price

Earning Ratio (PER). From the description above, it

can be derived hypothesis as follows:

H6: Suspected there is difference between Price

Earnings Ratio (PER) before and after right issue

5 REAEARCH METHOD

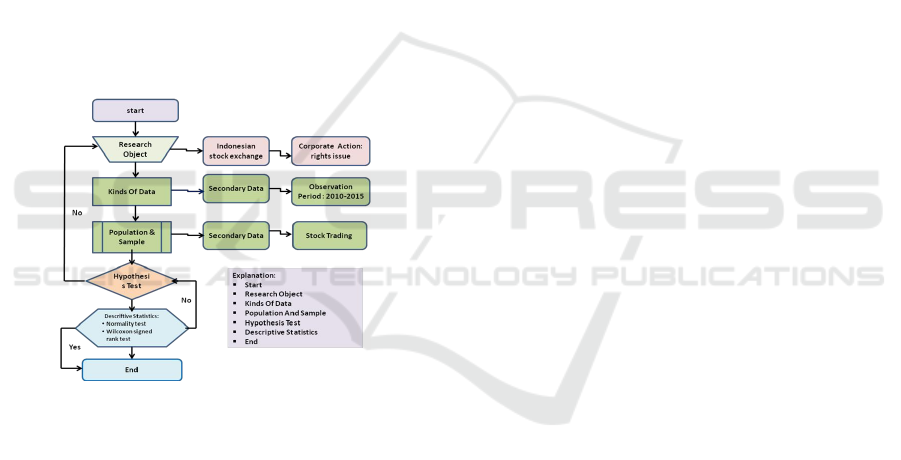

Figure 1: Flowchart Of Research Methods and Processes

The object of this research is all companies listed

on the Indonesia Stock Exchange that carry out corpo-

rate actions issue a rights issue during the observation

period, namely in 2010-2015(Indonesia, 2015). The

type of data used is secondary data about the com-

pany’s financial performance seen from six variables,

namely: Operating Cash Flows Ratio, Debt to Equity

Ratio, Return on Assets, Net Profit Margin, Assets

Turnover, and Price Earnings Ratio. This research is

an Event Study that is by looking at the impact of

corporate action issuing rights issues on stock trad-

ing 25 days before and 25 days after corporate ac-

tion. The analytical method used to prove the hypoth-

esis proposed in this study is the normality test and

the Wilcoxcon signed test. By comparing the value

of each variable before and after the company carries

out a corporate action issue a rights issue. The con-

clusions obtained will also be an alternative strategy

that should be chosen by investors according to the

variables tested.

6 RESEACH RESULTS AND

DISCUSSION

6.1 There is No Difference between

Operting Cash Flow Ratio before

and after Right Issue

Operating Cash Flow Ratio is the ratio used to as-

sess the financial performance of company in paying

off current liabilities by using cash obtained from the

company’s operating activities. Right issue is the is-

suance of stock returns by the company to increase

the company’s capital. Wilcoxon Signed Ranks test

results show that there is no difference in Operating

Cash Flow ratio before and after the right issue with

a non-significant performance increase. This shows

that there is no change in the company’s ability to pay

off current liabilities by using cash obtained from op-

erating activities between before and after the right is-

sue. According to Amuzu (2010) states that corporate

liability payments will increase the value of Operating

Cash Flow Ratio. Therefore, the payment of liabili-

ties has not been done significantly by the company.

The lack of performance difference in Operating Cash

Flow Ratio is caused when the cash obtained from the

right issue has not been used significantly to improve

the company’s operating performance. In addition,

the cash earned from the right issue has not been used

significantly by the company to pay its current liabil-

ities. PT Indoritel Makmur International / DNET is

one of the samples of this study that has not focused

on the right issue proceeds to increase sales. The news

reported on the web britama.com explains that DNET

or PT Indoritel Makmur International uses the right

issue proceeds for investments in several companies

6.2 There is No Difference between

Debt to Equity Ratio before and

after Right Issue

Debt to Equity Ratio (DER) is a ratio that measures

the capital structure of company derived from to-

tal liabilities divided by shareholder equity (Subra-

manyam et al., 2010). This ratio shows the propor-

tion between liabilities and corporate equity. Right

issue is the issuance of stock returns by the com-

pany to increase the capital of company. Wilcoxon

Signed Ranks test results show that there is no dif-

ICASESS 2019 - International Conference on Applied Science, Engineering and Social Science

126

ference of Debt to Equity Ratio before and after right

issue although there is a significant decrease. This

indicates that before and after right issue there is no

change of capital structure of company. The com-

parison between shareholder liabilities and equity did

not change significantly. According to Sunarjanto

in (Simanullang and Daljono, 2013) stated that the

change of Debt to Equity Ratio is not significant due

to the proceeding rights issue funds are not used to

pay off the debt. The results are not conducted by

(Ediningsih and Yacobus, 2009) states that there is

difference on Debt Equity Ratio before and after right

issue. This makes sense because in research of (Edin-

ingsih and Yacobus, 2009) that companies are more

likely to use funds from the rights issue to pay the ma-

tured obligations. However, the results of this study

should support (Fahmi and Saputra, 2013) states that

there is no difference in solvency before and after the

right issue. The absence of a Debt to Equity Ratio

difference is caused when the company does not sig-

nificantly use funds from the rights issue to pay cor-

porate liabilities. Therefore, the composition of lia-

bilities does not change significantly compared to eq-

uity although the composition of equity changes due

to capital increase through right issue.

6.3 There is No Difference between

Return on Assets before and after

Right Issue

Return on Assets (ROA) is the financial ratios used

to measure the asset investment relationship used to

generate profit (Lindo in Diminica et al, 2012). Right

issue is the issuance of stock returns by the company

to increase the company’s capital. Wilcoxon Signed

Ranks test results show that there is no difference

in Return on Assets before and after the right issue

and there is no significant increase in performance.

This shows that before and after right issue there is

no change in the increase in profits resulting from the

use of company assets. The results are not supported

by research conducted by (Ediningsih and Yacobus,

2009) states that there is no difference in ROA before

and after the right issue. This makes sense due to the

research (Ediningsih and Yacobus, 2009) , companies

are more inclined to invest the proceeds of rights issue

to buy company assets such as machinery, buildings

and other equipment to increase the company’s net

profit. The absence of a difference in ROA is caused

when the firm does not significantly use data from a

rights issue to invest in assets. If the company invests

its assets in order to increase the company’s produc-

tivity, its net profit will increase as it is followed by

revenue and production efficiency.

6.4 No Net Profit Margin Differences

before and after Right Issue

Net Profit Margin is a ratio that measures the ratio

of net income to sales. This ratio measures the ef-

fectiveness of the company in generating net income

by minimizing the cost. Right issue is the issuance

of stock returns by the company to increase the com-

pany’s capital. Wilcoxon Signed Ranks test results

showed no difference Net Profit Margin before and af-

ter the right issue significant increase in performance.

This shows that before and after the right issue does

not change the company’s ability to minimize costs.

The results of this study supported research conducted

by (Ediningsih and Yacobus, 2009) which states that

there is no significant difference Net Profit Margin be-

fore and after right issue. The results of this study

also supported research conducted by (Khajar, 2010)

which states that there is no significant difference Net

Profit Margin before and after right issue. The ab-

sence of a difference in Net Profit Margin is due to the

fact that the company does not use the funds obtained

from the rights issue to minimize costs. These costs

represent costs incurred when the company generates

revenue

6.5 Differences in Assets Turnover

before and after Right Issue

Asset Turnover is a ratio that shows the level of abil-

ity of a company to use assets to generate sales (Hof-

strand., 2013). Company assets that are rarely used

or even unused but still recognized are called null as-

sets. Right issue is the issuance of stock returns by the

company to increase the company’s capital. Wilcoxon

Signed Ranks test shows that there is a difference in

Asset Turnover before and after the right issue and a

significant decrease in performance. This shows that

before and after the right issue there is a change in

the company’s ability to use assets to generate sales.

The results of this study are not supported by research

conducted by (Khajar, 2010) which states that there is

no significant difference in asset turnover before and

after right issue. The results of this study are also not

supported by research conducted by (Ediningsih and

Yacobus, 2009) states that there is no difference in

asset turnover before and after the right issue. The

difference in the decrease in Asset Turnover is be-

cause the company has not used the funds from the

right issue to increase sales. The company is still fo-

cusing funds from the rights issue for other things.

PT Indoritel Makmur International is one of the sam-

ples of this study that has not focused the right issue

proceeds to increase sales. The news reported on the

Investor Decisions with Pecking Order Theory Method: Strategy of an Investor to Get Right Issue

127

web britama.com explains that DNET or PT Indori-

tel Makmur International uses the right issue proceeds

for investments in several companies.

6.6 No Price Earnings Ratio Differences

before and after Right Issue

Price Earning Ratio (PER) is the ratio used to show

the stock performance of a company obtained from

the share price divided by earnings per share (Kha-

jar, 2010). Investors tend to choose or buy compa-

nies with low PER Right issue is issuing of shares

re-done by the company to increase the company’s

capital. Wilcoxon Signed Ranks test shows there is

no difference Price Earning Ratio before and after the

right issue increase Price Earning Ratio is insignifi-

cant. This indicates that right issue is not a good in-

dicator for investors to buy shares of the company.

Although the company does a right issue, investors

tend to avoid the stock of the company. The results of

this study are unsupported by previous research con-

ducted by (Khajar, 2010) states that there is no dif-

ference in Price Earning Ratio before and after the

right issue. Differences in results are possible due to

the use of different time periods. The absence of dif-

ferences in Price Earning Ratio is because the mar-

ket does not call the right issue. Therefore investors

will tend to avoid companies doing the right issue.

PT Lipppo Karawaci is one of the company’s samples

of research avoided by investors. The news reported

in Kontan.co.id by (Taqiyyah, 2010) explains that the

related rights issue plan of PT Lippo Karawaci shares

decreased by -16.18% to Rp 570 per share.

7 CONCLUSIONS

Based on this data analysis and testing, the conclu-

sions are:

a There is no difference of Operating Cash Flow

Ratio between before and after right issue with

performance improvement of Operating Cash

Flow Ratio is insignificant; Investor’s strategy

does not use the right to buy shares in a rights is-

sue.

b There is no difference of Debt Equity Ratio be-

tween before and after right issue with decreasing

Debt Equity Ratio performance is insignificant.

Investor’s strategy does not use the right to buy

shares in a rights issue.

c There is no difference of Return on Asset between

before and after right issue with performance in-

crease Return on Asset is insignificant. Investor’s

strategy does not use the right to buy shares in a

rights issue.

d There is no difference in Net Profit Margin be-

tween before and after right issue with insignifi-

cant performance improvement. Investor’s strat-

egy does not use the right to buy shares in a rights

issue.

e There is a difference between the Asset Turnover

before and after the right issue with a significant

decrease. Investor’s strategy does not use the right

to buy shares in a rights issue.

f There is no difference in Price Earning Ratio be-

tween before and after right issue with the in-

crease of Price Earning Ratio is insignificant. In-

vestor’s strategy does not use the right to buy

shares in a rights issue.

REFERENCES

Amuzu, M. S. (2010). Cash flow ratio as a measure of per-

formance of listed companies in emerging economies:

The ghana example. Unpublished PhD dissertation.

Retrieved from http://stclements. edu/grad/gradmaxw.

pdf.

Dewi, A. T. and Rahyuda, H. H. (2014). Studi empiris

abnormal return sebelum dan sesudah pengumuman

right issue pada perusahaan go public di bursa efek

indonesia. E-Jurnal Manajemen, 3(11).

Ediningsih, S. I. and Yacobus, A. (2009). Pengaruh right is-

sue terhadap kinerja keuangan pada perusahaan yang

terdaftar di bursa efek indonesia. In Proceeding

Call For Paper Seminar Hasil-Hasil Penelitian Dosen

dan Seminar Nasional” Peran Inovasi dan Corpo-

rate Culture Guna Meningkatkan Sustainabilitas Bis-

nis Dalam Menghadapi Era Globalisasi” ISBN: 978-

979-3100-28-9, pages 323–341.

Fahmi, I. and Saputra, M. (2013). Analysis of profitabil-

ity ratio in publishing right issue decision at indonesia

stock exchange. International Journal of Business and

social science, 4(4).

Ghosh, A. (2011). Capital structure and firm performance.

Transaction Publishers.

Hofstrand., D. (2013). Financial ratios.

Indonesia, P. B. E. (2015). Idx fact book 2015.

Khajar, I. (2010). Pengaruh right issue terhadap kinerja

keuangan perusahaan. Jurnal Dinamika Manajemen,

1(1).

Mangkunegara, M. A. P. and Hasibuan, M. M. S. (2009).

2.2 manajemen sumber daya manusia.

Nazaruddin, I. and Basuki, A. T. (2015). Analisis statistik

dengan spss. Yogyakarta, Danisa Media.

Sheikh, J., Ahmed, W. A., Iqbal, W., and Masood, M. M.

(2012). Pecking at pecking order theory: Evidence

from pakistan’s non-financial sector. Journal of Com-

petitiveness, 4(4).

ICASESS 2019 - International Conference on Applied Science, Engineering and Social Science

128

Simanullang, P. F. and Daljono, D. (2013). ANALI-

SIS KINERJA KEUANGAN DAN KINERJA SAHAM

SEBELUM DAN SESUDAH RIGHT ISSUE (Studi

Empiris pada Perusahaan yang Terdaftar di Bursa

Efek Indonesia 2008–2010). PhD thesis, Fakultas

Ekonomika dan Bisnis.

Subramanyam, K., Wild, J. J., et al. (2010). Analisis laporan

keuangan. Jakarta: Salemba Empat.

Taqiyyah, B. (2010). Right issue di bawah harga pasar, sa-

ham lpkr terjun.

Wijaya, T. (2015). Cepat menguasai spss 19 untuk olah dan

interpretasi, cahaya atma, kelompok penerbit univ. At-

majaya Yogyakarta. Cetakan ke-5.

Investor Decisions with Pecking Order Theory Method: Strategy of an Investor to Get Right Issue

129