Financial Services Authority Policy in Increasing Investment Indonesian

Capital Market in the Disruption Era

Sudiyana

1

and Dyah Permata Budi Asri

1

1

Faculty of Law Janabadra University Jalan Timoho II No 40 Yogyakarta

Keywords:

Legal Policy, Financial Services Authority, Increasing Investment, Disruption Era

Abstract:

Based on the Article 55 paragraph (1) of Law Number 21 of 2011 concerning the Financial Services Authority,

the duties and functions of the Capital Market Supervisory Agency have been taken over by the Financial

Services Authority. The assignment and function of the capital market watchdog are aimed at increasing the

effectiveness and efficiency of capital market watchdog. This is evident that the growth of the capital market

has increased both in terms of the number of issuers, number of investors, market capitalization, transaction

volume, average transaction value, but can only contribute less than 3%, from the target of 3.3% of the total

investment needs of Indonesia. Legal policies are needed which must be carried out by the Financial Services

authority so that investments in the capital market can increase and meet the government’s targets. Normative

legal writing with a normative juridical approach aims to analyze the legal policies of what should be done

by the authorities and the Self Regulatory Organization (SRO) so that investments in the capital market can

increase significantly and can meet Indonesia’s investment needs. In this disruption era, each Organizational

Self Regulatory (SRO) has made a new policy, by applying the latest generation of each main system. Through

the coordination of the Institutional Self Regulatory Institution (SRO) and the Financial Services Authority

(OJK) legal policy, the Indonesian capital market is expected to be more efficient in terms of securities trading

support systems and can increase investment in Indonesia

1 INTRODUCTION

The Capital Market aims to support the implementa-

tion of national development in order to increase eq-

uity, growth and national economic stability towards

improving people’s welfare. In order to achieve this

goal, the Capital Market has a strategic role as one

of the sources of financing for the business world,

including medium and small businesses for business

development, while on the other hand the Capital

Market is also an investment vehicle for the com-

munity, including small and medium-sized investors.

Fundraising through the capital market is indeed very

large, which can be used to contribute to investment

needs.

According to the records of the Financial Ser-

vices Authority, throughout 2018, the collection of

funds amounting to Rp 166 trillion from the capital

market through a total of 168 public offers, while

raising funds in the capital market until May 2019

had reached Rp 54.71 trillion from 52 public offer-

ings.(Grace Olivia, 2019) According to data on the In-

donesia Stock Exchange the stock trading recapitula-

tion as of July 6, 2019 is as follows:(Rina Anggraeni,

2019)

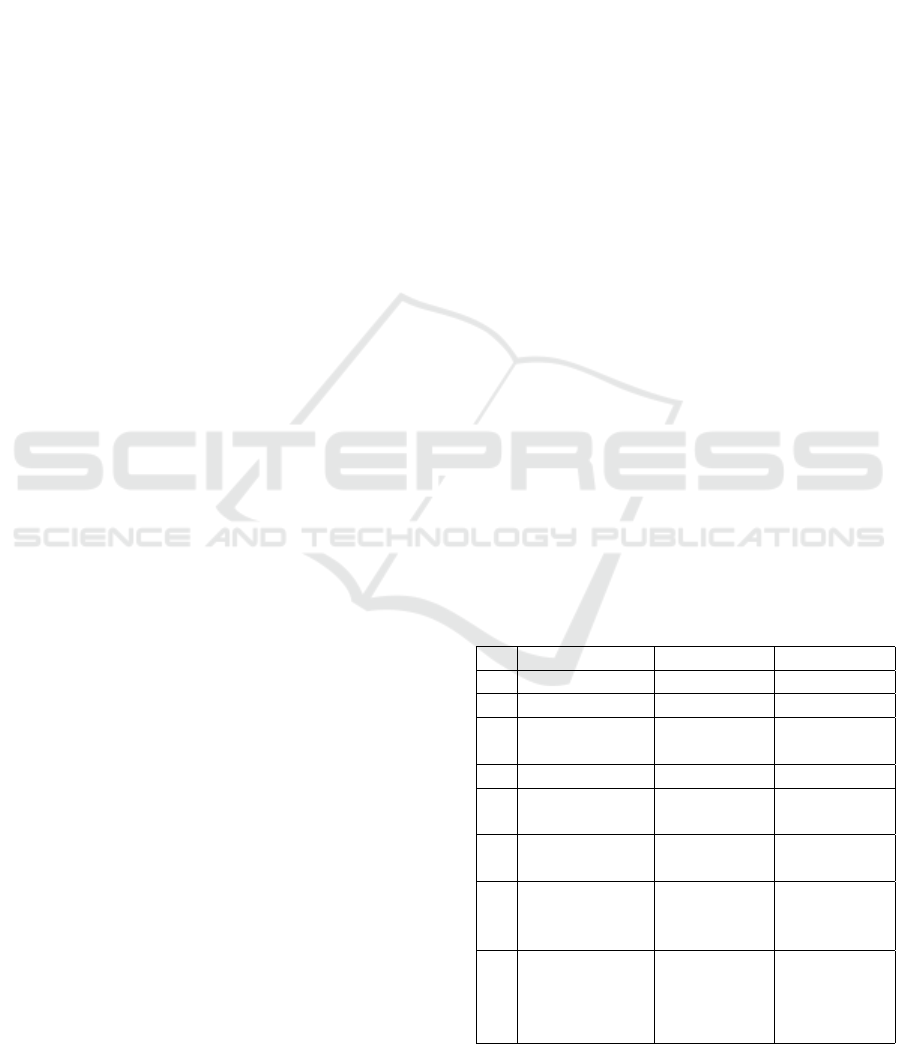

Table 1: Stock trades on the indonesia stock exchange.

No Jumlah 2018 Juli 2019

1 Investor 1.61O.00 0 1.676.606

2 Emiten 609 627

3 market capi-

talizati on

6.986,67 7.268,404

4 Indek HSG 6.163,60 6.373,477.

5 Transaction

volume

14,39 18,278

6 Average daily

transaction

380,54 484,227

7 Average daily

transaction

volume

10,13

triliun

8,060

triliun

8 fund raising 166 trilun

of 168 ini-

tial public

offering

54,71 trilun

of 52 ini-

tial public

offering

Initially foreign investors were limited to only

74

Sudiyana, . and Asri, D.

Financial Services Authority Policy in Increasing Investment Indonesian Capital Market in the Disruption Era.

DOI: 10.5220/0009878400740078

In Proceedings of the 2nd International Conference on Applied Science, Engineering and Social Sciences (ICASESS 2019), pages 74-78

ISBN: 978-989-758-452-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

49%, and based on the Republic of Indonesia Min-

ister of Finance Decree number 455 / KMK.01 / 1997

foreign investors were finally given freedom without

restrictions.

In accordance with the principle of nondiscrimina-

tion in investment, freedom for foreign investors is a

strategic policy in the capital market in order to obtain

foreign funds through the capital market. The devel-

opment of the capital market at the end of this decade

experienced a significant increase, both seen from the

various aspects, for example: aspects of the number

of investors, number of issuers, market capitalization,

funds raised, and so on. But compared to the total in-

vestment needs, the contribution of funds from capital

market investments has only reached 3%.

The Financial Services Authority, target in raising

funds through the capital market in 2020 is IDR 192

trillion, which is estimated to only contribute 3.3%

of the total investment needs. What is the legal pol-

icy that must be done by the Financial Services Au-

thority so that investment can increase. This problem

will be analyzed and assessed by a normative juridi-

cal approach, by describing the capital market regu-

lations as secondary data, and supported by primair

data through field research by observation and inter-

views with officials in the financial services authority

in Jakarta.

According to the Financial Services Authority, the

opportunities and challenges in driving capital invest-

ment are increasing Human Resourse in the capital

market, capital market instruments, new technology,

transparency of securities prices, global macroeco-

nomic conditions, political conditions, literacy and fi-

nancial inclusion.

2 METHODOLOGY

This writing is the result of normative legal research,

through legislation and conceptual approaches. As

the material is secondary data, in the form of: 1) pri-

mair legal materials; which consists of various capi-

tal market law literature, scientific journals and other

articles or writings related to capital market law. 2)

secondary legal materials consisting of capital mar-

ket regulations and tertiary legal materials consisting

of various legal dictionaries and capital market dic-

tionaries, and various news related to capital markets.

The data is taken from libraries, websites by means of

study documents, and analyzed concretively by pro-

viding exposure to the Financial Services Authority’s

legal policies in increasing investment in the capital

market.

3 RESULTS AND DISCUSSION

3.1 Capital Market System

3.1.1 Primary Market

The activities on the primary market will begin with

public offering activities by the issuer. Requirements

for initial public offering, the issuer must submit an

application statement to The Financial Services Au-

thority . According to the law, those who can make

initial public offering are only Issuers who have sub-

mitted a Registration Statement to The Financial Ser-

vices Authority to offer or sell Securities to the pub-

lic and the Registration Statement has been effec-

tive.(Indonesia, 1995) To be able to make purchases

on the primary market or initial public offerings, the

prospective buyer in addition to filling out a securi-

ties purchase order form and entering into an account

opening contract and funding consignment on the un-

derwriter or sales agent, it must be ensured that a

buyer has read the prospectus. The law confirms that

no Party can sell Securities in a Initial Public Offer-

ing, unless the buyer or buyer states in the Securities

order form that the buyer or buyer has received or has

the opportunity to read the Prospectus regarding the

Securities before or when the order is made.

Public offering activities are carried out within 3

days and delivered within 60 days of the registration

statement being declared effective, with the submis-

sion of securities and or the remaining consignment

funds by the securities underwriter to the ordering

party. The purpose of the issuer is to provide a pub-

lic offer, of course so that the securities (shares) can

be listed on the Exchange. Listing activities on the

Exchange are carried out after the completion of the

public offering with the listing on the Exchange, the

issuer’s securities (shares) can be traded on the trad-

ing floor (Secondary Market).

3.1.2 Secondary Market

Securities trading activities or often referred to as ex-

change transactions, are carried out entirely by mem-

bers of the exchange, namely the intermediaries of se-

curities traders (Brokers), which are located on the

Stock Exchange. Prospective investors who will in-

vest their funds in the secondary market must con-

tract with securities companies that are licensed as

securities brokers. The contract includes an account

opening contract, a debit authorization contract, a se-

curities deposit / fund contract, and a Single Investor

Identication (SID). The position of investors in rela-

tion to securities brokers is as customers. After having

Financial Services Authority Policy in Increasing Investment Indonesian Capital Market in the Disruption Era

75

an SID, investors through their brokers can then make

exchange transactions according to their ability.

3.2 The Role of the Financial Services

Authority in Capital Market

Activities

Based on article 55 paragraph (1) Law Number 21

of 2011 concerning the Financial Services Authority,

the duties and authority of the Capital Market Super-

visory Agency were taken over by the Financial Ser-

vices Authority, and effectively took effect since Jan-

uary 2013. What is the duty and authority of the Cap-

ital Market Supervisory Agency is regulated in Law

Number 8 of 1995 concerning Capital market.

According to Article 3 of Law Number 8 of 1995

concerning the Capital Market, the task of the Capital

Market Supervisory Agency is to provide guidance,

regulation and daily supervision of capital market ac-

tivities. While the authority of the Capital Market Su-

pervisory Agency is regulated in Article 5 of the Capi-

tal Market Law. Like Supervisory in America, Capital

Market Supervisition has three functions, namely;

1. Quasi Legislative Power: is the authority to make

regulations in capital market activities.

a Give licenses to each party that will conduct ac-

tivities in the capital market and give approval

to the Custodian Bank;

b Require registration of capital market support-

ing professionals and trustees;

c Establish requirements and procedures for

nominating and temporarily dismissing com-

missioners and or directors and appointing

temporary management of the Securities Ex-

change, Clearing and Guarantee Institution,

and the Depository and Settlement Institu-

tion until new commissioners and directors are

elected;

d Establish requirements and procedures for the

statement of registration and declare, delay, or

cancel the effectiveness of the registration state-

ment;

e Establish fees for licensing, approval, registra-

tion, inspection and research as well as other

costs in the context of capital market activities;

f Provide further technical explanations for the

Capital Market Law or its implementing regu-

lations;

g Determine other instruments as Securities other

than those prescribed by the Capital Market

Law.

2. Quasi Investigation Power: the authority to con-

duct investigations and investigations into alleged

violations in the capital market.

a Conducting checks and investigations on each

party in the event of an event that is suspected

to be a violation of the Law and / or its imple-

menting regulations;

b Require each party to:

i. Stop or correct advertisements or promotions

related to activities in the capital market; or

ii. Take the steps needed to overcome the conse-

quences arising from the intended advertise-

ment or promotion;

c Examine:

i. Every issuer or public company that has or is

required to submit a registration statement to

Capital Market Supervisition; or

ii. The party that is required to have a business

license, permission for individuals, approval,

or professional registration under the law.

d Appoint other parties to carry out inspections in

the framework of implementing the authority of

Financial Services Authority;

e Inspect objections submitted by parties sanc-

tioned by the Stock Exchange, the Clearing

Guarantee Institution, or the Depository and

Settlement Institution and provide a decision to

cancel or strengthen the sanction.

3. Quasi judicial Power: is the authority to take ac-

tion on violations in the capital market, such as

the authority of a judicial body.

a Announce the results of the examination;

b Freeze or cancel the recording of a Securities

on the Stock Exchange or stop the Exchange

Transaction for certain securities for a certain

period of time in order to protect the interests

of investors;

c Stop the Stock Exchange’s trading activities for

a certain period of time in the event of an emer-

gency;

d Doing other things given by law.

3.3 Financial Services Authority Legal

Policies in the Capital Market

Development of capital markets that were re-

established from the start of the early 1990s in CEE

countries is driven by numerous forces. The most im-

portant determinants are: (1) Legal and institutional

framework (2) Political and macroeconomic stability

(3) Broadening the investors’ base.(Olgi

´

c Dra

ˇ

zenovi

´

c

ICASESS 2019 - International Conference on Applied Science, Engineering and Social Science

76

and Kusanovi

´

c, 2016) From the regulatory aspect Fi-

nancial Services Authority has issued many Regula-

tions for regulate capital market activities. Some poli-

cies that need to be carried out, in an effort to increase

investment in Indonesian, namely:

a Maintain investor confidence.

Investors are the backbone of investment activi-

ties in the capital market, without investors there

will be no capital market activities. Judging from

the nationality of capital market investors or of-

ten called public investors (minority shareholders)

can be classified as foreign investors and domes-

tic investors in terms of the number of investors

can be qualified as individual investors and insti-

tutional investors. In terms of objectives, investors

are divided into pure investors and speculative in-

vestors. One aspect to encourage investor interest

in the capital market is investor confidence. Some

of the things that form the basis of investor confi-

dence in capital markets include:

(a) legal certainty, the existence of laws and regu-

lations governing investment activities;

(b) Investor legal protection; one of the weaknesses

in investment activities is the problem of in-

vestor legal protection. Juridically, the gov-

ernment only guarantees the Full Disclosure

principle,(Nasution, 2001) where investors are

guaranteed to obtain material information re-

lated to the capital market. This guarantee is

only carried out in a formal form through re-

search on document sufficiency, clarity of in-

formation and completeness of documents. The

government does not substantially conduct due

diligent and / or legal review of documents in

the capital market.(Fuady, 1996)

(c) Ensuring benefits for investors. This policy is

intended to make every investor get the maxi-

mum benefit from securities ownership in the

capital market. The ones who get the most at-

tention are stock investors, and therefore what

benefits are obtained by investors in the share

ownership.Many views that dividends are the

main benefit for stock investors. Therefore,

the Financial Services Authority must have the

courage to make regulations that require issuers

to pay dividends to investors. According to

La Porta, mandatory dividend laws are a reme-

dial measure designed to compensate minority

shareholders in the event that their aforemen-

tioned rights are weak or non-existent.(Cyrus

et al., 2006) That is, compulsory dividend law

is a remedial step designed to provide compen-

sation to minority shareholders if their rights at

the general meeting of shareholders, the anti-

directors’ rights are weak or nonexistent.

b Providing diverse instruments, the aim can be

used to support government needs in various pri-

ority sectors.

The object of trading in capital markets or often

called the capital market instrument is in the form

of securities. According to Securities law, secu-

rities are debt securities, commercial securities,

shares, bonds, debt proofs, Participation Units of

collective investment contracts, futures contracts

for Securities, and any derivatives of Securities.

The capital market instrument which has been

widely traded is shares and every derivative of

shares such as proof of right, warant, option.

c Encourage regional bonds, green bonds and

perpetual bonds. Local governments need to be

encouraged to issue bonds, in order to get funds

for development.

Local governments need to be encouraged to issue

bonds, in order to get funding for development.

According to the Financial Services Authority, the

proceeds from debt securities will be used to fi-

nance investment activities and infrastructure to

generate revenues for the Regional Revenue and

Expenditure Budget. Not only that for investors,

the issuance of regional bonds also became the in-

strument of the new investment portfolio.(Kontan,

2019) The issuance of municipal bonds is cer-

tainly not an easy matter, because it must require

an assestment from the Ministry of Finance and

there must be approval from the Regional Rep-

resentative Council concerned. At present three

provinces are said to have the potential to issue

these bonds, including West Java, East Java and

South Kalimantan. In fact, South Kalimantan said

that it needed funds to reach Rp 10 trillion-Rp

20 trillion for infrastructure development, which

could be covered by bonds other than the Regional

Budget.(Monica Wareza, 2019)

d Issue Financial Services Authority Regulation

(a) Regulations concerning issuers’ offerings with

small and medium scale assets.

Small and Medium Enterprises and Micro

Business Units need to be encouraged to be

able to enter the capital market in order to ob-

tain funds to develop their businesses. There-

fore there is a need to regulate the problem. In

the Financial Services Authority Regulation re-

lated to the public offering procedure for Small

and Medium Enterprises and Micro, Issuers

Financial Services Authority Policy in Increasing Investment Indonesian Capital Market in the Disruption Era

77

with Small Scale Assets are companies with a

maximum total assets of Rp 50 billion, while Is-

suers with Middle Scale Assets are companies

with total assets of Rp 50 billion to Rp 250 bil-

lion . Financial Services Authority needs to de-

velop an information technology system-based

infrastructure used in the implementation of the

initial public offering of equity securities, as

well as debt and or sukuk securities, which in-

clude initial bidding activities (book building),

securities offering (offering), until the alloca-

tion, allotment and distribution of securities .

Through the development of these various sys-

tems, it is hoped that not only will the account-

ability and transparency of the public offering

process in the capital market increase, but also

inclusion in the Indonesian capital market.

(b) Regulations regarding Downhil Funds services

through information technology-based stock

offerings or equity crowd funding.

Financial Services Authority Regulation Num-

ber 37 / POJK.04 / 2018 dated 31 December

2018 concerning Funding Services. Regulates

the equity crowdfunding organizers, parties that

make public offerings, and investors who will

invest in the company. This share offering with

the Funding Service mechanism is organized by

the organizer of the equity crowfunding, in the

form of a limited liability company or cooper-

ative with minimum capital and paid-up capi-

tal of at least Rp 2.5 billion. These organiz-

ers will later be able to act as securities under-

writers, securities brokers and investment man-

agers. Companies that will offer shares with

this scheme may only have a maximum paid

up capital of Rp 30 billion with a minimum

amount of assets of Rp 10 billion.

4 CONCLUSIONS

Based on the analysis and discussion as outlined

above, it can be concluded that the Financial Services

Authority’s legal policy in increasing investment in

the capital market during the disruption era was to

maintain investor confidence through legal certainty,

legal protection and expediency in investment. Pro-

viding diverse instruments, issuing regulations on is-

suers’ offers with small and medium-scale assets and

regulations regarding fund services through informa-

tion technologybased stock offerings or equity crowd

funding. As a suggestion to the Financial Services

Authority is that the legal policy must be able to be

implemented and implemented and developed more

slowly so that investment in the capital market is in-

creasing, by immediately issuing regulations: 1) Re-

garding the bidding mechanism by the local govern-

ment; 2) About the issuance of shares by micro, small

and medium businesses.

REFERENCES

Cyrus, T. L.,

˙

Is¸can, T. B., and Starky, S. (2006). Investor

protection and international investment positions: An

empirical analysis. International Finance, 9(2):197–

221.

Fuady, M. (1996). Modern capital market (law review).

Grace Olivia, K. (2019). Ojk menargetkan pendanaan pasar

modal tahun depan mencapai rp 192 triliun.

Indonesia, P. R. (1995). Uu no. 8 tahun 1995 tentang pasar

modal. Sekretariat Negara. Jakarta.

Kontan (2019). Tiga pemerintah provinsi berminat merilis

obligasi daerah.

Monica Wareza, c. (2019). Ojk: Ada 10 daerah sudah

penuhi syarat terbitkan obligasi.

Nasution, B. (2001). Keterbukaan dalam pasar modal.

Universitas Indonesia, Fakultas Hukum, Program Pas-

casarjana.

Olgi

´

c Dra

ˇ

zenovi

´

c, B. and Kusanovi

´

c, T. (2016). Determi-

nants of capital market in the new member eu coun-

tries. Economic research-Ekonomska istra

ˇ

zivanja,

29(1):758–769.

Rina Anggraeni, S. N. (2019). Data perdagangan bei, nilai

kapitalisasi pasar saham naik 0,35

ICASESS 2019 - International Conference on Applied Science, Engineering and Social Science

78