Analysis of the Effect of Internal and External Factors on the Efficiency

toward Profitability of Islamic Banking Industry in Indonesia

Muhammad Asril Maulana

1

1

Post Graduate Program of Islamic Finance and Banking, Politeknik Negeri Bandung, Bandung, Indonesia

Keywords:

Bank Size, Non Performing Finance, Inflation, Efficiency, Profitability, Islamic Banking Industry.

Abstract:

Getting profits is the main goal of establishing a business entity, one of which is Islamic banking. One of the

ways to increase the profitability of Islamic banking is efficiency. This study aims to examine the internal and

external factors that affect Islamic banking industry inefficiencies which consist of internal factors, namely

Non-Performing Finance (NPF) and bank size, as well as external factors, namely inflation, and the impact of

Islamic banking inefficiency on the profitability of Islamic banking. Every bank needs to maintain a level of

bank operational efficiency. Islamic banking needs to know how to control it so that bank operations remain

efficient with the aim of banks being able to increase profits. The populations of this study are all Bank Umum

Syariah (BUS) and Unit Usaha Syariah (UUS) in Indonesia. The sample used in this study is all BUS and

UUS in Indonesia with research time limits of the period 2007-2018. The data analysis technique used is

path analysis. The results of the analysis shown that Non Performing Finance (NPF), and bank size have a

significant impact on Islamic banking inefficiency, and the results of data analysis show that inflation does

not have a significant impact on Islamic banking inefficiency, and Islamic banking industry inefficiency has a

negative and significant impact on profitability. The results of this study can be used as a consideration for the

Islamic banking industry management to increase efficiency in bank operations, because of efficiency can be

a positive signal to encourage increased profits earned by Islamic banking industry.

1 INTRODUCTION

As a country with the largest Muslim populations in

the world, Indonesia has great potential to become

a center of development of the Islamic Finance In-

dustry (OJK, 2018a). The growth of Islamic banking

in Indonesia is indicated by the increasing number of

BUS, UUS, and BPRS. From 1992 to October 2018,

the number of BUS in Indonesia reached 14 banks,

UUS reached 34 units and BPRS reached 168 banks

(OJK, 2018b).

Obtaining profits is the main goal of the estab-

lishment of a business entity, both business entities in

the form of Perseroan Terbatas (PT), foundations and

other forms of business entities (Sintiya, 2018), and

one of them is Islamic banking. The growth of Islamic

banking industry in Indonesia can be seen from the

growth net profit both BUS, UUS, and BPRS which

have increased every year (OJK, 2018b).

One of the ways to increase the profitability of Is-

lamic banking industry is efficiency. Efficiency mea-

surements are used to analyze bank performance (Ma-

jeed and Zainab, 2017). Efficiency in the banking

system is very important because the efficiency of a

bank shows the progress of the bank. If the bank does

not operate efficiently, it will cause problems for the

bank. Therefore the efficiency of the banking system

is emphasized because of the efficiency of the bank-

ing system will cause banks to get high profits (Hus-

sain et al., 2012). The current measure of efficiency

of Islamic banking is the percentage of BOPO (Biaya

Operasional dan Pendapatan Operasional).

Despite increasing profits, the percentage of Is-

lamic banking BOPO fluctuated. This can be seen

from the percentage of BOPO, Bank Umum Syariah

until 2018 which is still at the level of 89.36%. Judg-

ing from the BOPO percentage, the operations of

Bank Umum Syariah are still inefficient. Even though

the lower the BOPO percentage, that is better because

it shows an increasingly efficient bank. BI continues

to press the BOPO percentage to be 60% -70%. This

aims to approach BOPO of Southeast Asian banks

which reach 40-60% (Sutaryono, 2013).

With these conditions, the challenges of Islamic

banking in carrying out their activities are also get-

ting bigger. Islamic banks industry need to improve

Maulana, M.

Analysis of the Effect of Internal and External Factors on the Inefficiency Toward Profitability of Islamic Banking Industry in Indonesia.

DOI: 10.5220/0009868502830287

In Proceedings of the International Conference on Creative Economics, Tourism and Information Management (ICCETIM 2019) - Creativity and Innovation Developments for Global

Competitiveness and Sustainability, pages 283-287

ISBN: 978-989-758-451-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

283

their efficiency in operational activities (Puteh et al.,

2017). The efficiency of Islamic banking is influenced

by internal and external factors. Efficiency describes

performance in producing the desired maximum out-

put from a number of inputs provided with available

technology. Efficiency is said to increase when maxi-

mum output is produced without changes in inputs or

with fewer inputs (Wahab and Rahman, 2012).

This research is intended to discuss the factors that

influence inefficiency in Islamic banks which consist

of problematic financing (NPF), bank size, and infla-

tion, and the impact of Islamic bank inefficiency on

profit. The identified model can help understand the

factors that influence the inefficiency of Islamic banks

and their impact on profit.

2 LITERATURE REVIEW

2.1 Profitability

Profitability is one way to assess a company’s man-

agement ability to make a profit (Sintiya, 2018). Prof-

itability is an indicator of the company’s success,

especially its ability to generate profits by utilizing

its resources such as assets or equity (Mubarok and

Rohman, 2013). Some measures for calculating the

level of profitability include ROE (Return on Equity),

ROA (Return on Assets) and Net Profit Margin. Com-

panies with high profitability will reveal more infor-

mation. This is because high profitability indicates

how companies can manage risk well. The ratio com-

monly used to measure the performance of profitabil-

ity or rentability is ROA. ROA shows the ability of

bank management to generate income from the man-

agement of assets owned (Sintiya, 2018).

2.2 Efficiency

performance (Majeed and Zainab, 2017). Efficiency

in the banking system is very important because the

efficiency of a bank shows the progress of the bank

in performance that will have an impact on increasing

profits (Hussain et al., 2012). Banking efficiency can

be observed from two sides, namely in terms of costs

(cost efficiency) and profitability (Suseno, 2008). In

terms of costs (cost efficiency), banks are compared

with other banks to find out the management of costs

and production with the same output and technol-

ogy. Whereas in terms of profit (profit efficiency),

the ability of banks to generate profits in each input

unit is used to measure the level of banking efficiency

(Suseno, 2008).

2.3 Non-Performing Finance to

Inefficiency

High Non-Performing Financing (NPF) will increase

the cost so that it has the potential for bank losses.

The higher the ratio, the worse the quality of bank fi-

nancing that causes the number of problematic financ-

ing to increase, and therefore the bank must bear the

losses in its operational activities so that it affects the

decrease in the level of efficiency and the decrease in

profits obtained by the bank (Wahab, 2015).

NPF causes the potential profit to be obtained to

be smaller, because the bank will allocate funds to

form Penyisihan Aktiva Produktif (PPAP). Therefore,

the bank needs to reserve it as an attitude to deal with

it by charging a certain percentage of the financing

disbursed. This Penyisihan Aktiva Produktif (PPAP)

in the balance sheet of Islamic banking has the char-

acter of reducing earning assets, thus influencing effi-

ciency and profitability (Kasmir, 2003). Based on the

explanation above can be drawn a hypothesis:

H1: Non-Performing Financing (NPF) has a posi-

tive and significant effect on inefficiency

2.4 Bank Size (Assets) to Inefficiency

Bank size is a description of the size of a company.

The size of the bank can be expressed by total assets,

financing, and market capitalization (Amran et al.,

2009). Bank size is one of the characteristics that

are specific to banks that are generally and are deter-

minants and efficiency of banks (Sari and Saraswati,

2017). Banks with relatively large total assets will

have a better level of efficiency because they have

relatively large total revenue as a result of increased

product sales. With the increase in total revenue,

it will increase the company’s profit (Wahab, 2015).

Based on the explanation above can be drawn a hy-

pothesis:

H2: Bank size has a negative and significant effect

on inefficiency

2.5 Inflation to Inefficiency

purchasing power accompanied by a decrease in the

ability to save funds in banks (Endri, 2015). The de-

crease in the amount of funds deposited in banks due

to high inflation rates has an impact on the perfor-

mance of banks burdened with high operational costs,

while their income from interest is reduced so that

the bank becomes inefficient in its operational activ-

ities. Inflation has the potential to hinder the growth

of credit itself. While income from the credit sector

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

284

will be small. This affects the profitability of the bank

concerned (Wibowo and Syaichu, 2013).

When inflation is at a normal level, the economic

enthusiasm will increase the bank’s profitability, so

banks can improve their efficiency. Preferably, when

economic conditions are depressed and on the other

hand inflation is higher, it will increase the risk of

profitability and / or decrease bank efficiency, unless

the bank is able to race faster to increase interest (for

conventional banks) or for Islamic banks to increase

bank service revenues or rent from sharia products

(Asngari, 2013). Based on the explanation above can

be drawn a hypothesis:

H3: Inflation has a positive and significant effect

on inefficiency

2.6 Inefficiency to Profitability

The efficiency of the banking system needs to be con-

sidered because the efficiency of the banking sys-

tem will cause banks to get high profits (Hussain

et al., 2012). The current measure of efficiency of

Islamic banking is the percentage of BOPO. Biaya

Operasional dan Pendapatan Operasional (BOPO) is

a comparison between operating costs and operating

income. The operational cost ratio is used to mea-

sure the level of efficiency and ability of banks in

conducting operations. The lower BOPO means the

more efficient the bank is in controlling its operational

costs, with the existence of cost efficiency, the prof-

its obtained by the bank will be even greater (Sintiya,

2018). Based on the explanation above can be drawn

a hypothesis:

H4: inefficiency has a negative and significant ef-

fect on the profitability of Islamic banking

3 METHODS AND EQUIPMENT

This study is intended to discuss the factors that influ-

ence inefficiency in Islamic banking industry which

consists of Non-Performing Finance (NPF), Bank

Size, and inflation, and the impact of Islamic bank-

ing inefficiency on Islamic banking profit. The re-

search method used is quantitative, because the re-

search data in the form of numbers and analysis us-

ing statistics. The population in this study is the

Bank Umum Syariah (BUS) and Unit Usaha Syariah

(UUS) which publishes monthly reports to Bank In-

donesia (BI) or the Otoritas Jasa Keuangan (OJK) for

the period 2009-2018, so this research uses time se-

ries data. In other words, the method used in this re-

search is the census method. Refers to the opinions

of experts(Hair Jr et al., 2016)(SUHARTANTO et al.,

2018), Data analysis techniques used in this study

are path analysis (analysis path) using the PLS-SEM

(Partial Least Square Structural Equation Modeling)

method. Data processing is done using WarpPLS 6.0

software (Hair Jr et al., 2016)(SUHARTANTO et al.,

2018).

4 RESULT

The results of data processing carried out showed

that the percentage of goodness of fit (GoF) was

0.885, and indicated that the suitability of the ideal

model. Furthermore, Average block VIF (AVIF) has

an acceptable percentage of 2.076 and Average full

collinearity VIF (AFVIF) also has an acceptable and

ideal percentage at a value of 4.978 as well as Symp-

son’s paradox ratio (SPR) which has an acceptable

percentage of 0.667 . Finally, the R-squared contribu-

tion ratio (RSCR) shows an acceptable percentage as

well at 0.960 and a Statistical suppression ratio (SSR)

of 1,000 can fulfill the model match. As per the indi-

cators that must be fulfilled in WarpPLS, the models

compiled in this study are appropriate.

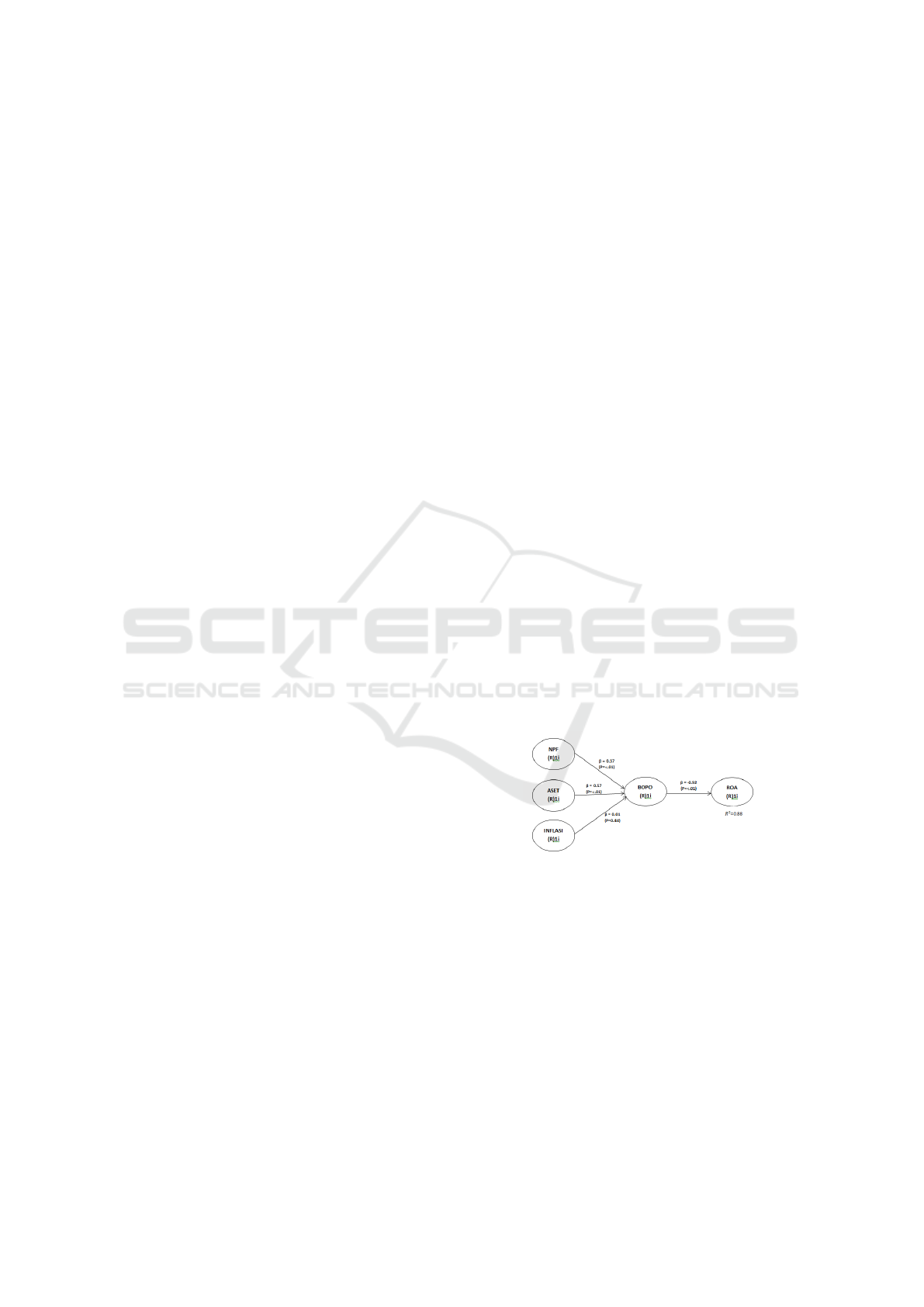

4.1 Path Analysis

Based on the conditions that must be fulfilled in the

PLS-SEM analysis using the WarpPLS analysis tool,

it can be concluded through the final results which

will be shown in the figure below:

Figure 1: Result of Testing The Model

Non-Performing Finance (NPF) and Bank Size

have a positive and significant effect on sharia bank-

ing inefficiencies with coefficients of 0.37 with sig-

nificance ¡0.01 and 0.57 with significance ¡0.01. This

shows the greater the Non-Performing Finance (NPF)

and the greater the size of the bank, the higher the

bank inefficiency. This shows that the management

of Islamic banks must maintain that the percentage of

Non Performing Finance (NPF) and bank size is al-

ways maintained. In addition, inflation does not have

a significant effect on bank inefficiency. This shows

that the rise and fall of inflation does not affect the

level of bank inefficiency at all. This is influenced by

Analysis of the Effect of Internal and External Factors on the Inefficiency Toward Profitability of Islamic Banking Industry in Indonesia

285

the majority of Islamic bank financing is murabahah

which requires banks to first buy goods in full, so that

the rising and falling percentage of inflation does not

affect the inefficiency of Islamic banks. This shows

that the rise and fall of inflation does not affect the

level of efficiency of the bank. Inefficiency has a neg-

ative and significant effect on bank profit with a co-

efficient of -0.92 with a significance of ¡0.01. Based

on the results of this study, it can be seen that bank

inefficiencies affect bank profits, the higher bank in-

efficiencies it will reduce bank profits.

5 CONCLUSION, LIMITATION

AND FUTURE RESEARCH

The main of this study was to examine the effect of

Non-Performing Finance (NPF), bank size, and in-

flation on Islamic banking industry inefficiencies and

the effect of Islamic banking industry inefficiencies

on profitability. Overall, the results of this study indi-

cate that non-performing finance internal factors and

bank size have a significant effect on Islamic bank-

ing industry inefficiency, although this study also re-

vealed that inflation external factors have no signifi-

cant effect on inefficiencies. Other results reveal that

inefficiency has a significant effect on the profitability

of Islamic banking industry.

This research shows that every bank needs to

know the steps so that the Islamic banking industry in

Indonesia remains efficient in carrying out bank op-

erations. Islamic Banking needs to reduce the level

of Non-Performing Finance (NPF) respectively, and

control asset variables to be efficient. Although the

results show that inflation does not have a significant

effect on the efficiency of Islamic banking industry,

Islamic banking industry management must remain

vigilant against various other external variables.

This study has several limitations. First, the vari-

ables that affect profitability in this study are only

one variable, namely the inefficiency indicated by the

BOPO percentage. For further research other vari-

ables that can affect profitability can be added, so that

a comparison of which variables can have a greater

impact on the Islamic banking industry can be made.

Second, further research is recommended to add vari-

ables that have not been studied in this study and add

internal factors and other external factors that influ-

ence inefficiencies, such as exchange rates, Islamic

finance, and overhead costs.

REFERENCES

Amran, A., Bin, A. M. R., and Hassan, B. C. H. M. (2009).

Risk reporting. Managerial Auditing Journal.

Asngari, I. (2013). Pengaruh kondisi ekonomi makro

dan karakteristik bank terhadap efisiensi industri per-

bankan syariah di indonesia. Jurnal Ekonomi Pem-

bangunan, 11(2):91–110.

Endri (2015). Variabel makroekonomi dan efisiensi per-

bankan di indonesia.

Hair Jr, J. F., Hult, G. T. M., Ringle, C., and Sarstedt, M.

(2016). A primer on partial least squares structural

equation modeling (PLS-SEM). Sage publications.

Hussain, N. E., Abdullah, H., and Shaari, M. (2012).

Efficiency and profitability of islamic banking in

malaysia. Journal of Applied Sciences Research,

8(11):5226–5241.

Kasmir (2003). Dasar-dasar perbankan.

Majeed, M. T. and Zainab, A. (2017). How islamic is is-

lamic banking in pakistan? International Journal

of Islamic and Middle Eastern Finance and Manage-

ment.

Mubarok, M. A. and Rohman, A. (2013). Pengaruh karak-

teristik perusahaan dan mekanisme Corporate Gover-

nance terhadap pengungkapan risiko dalam laporan

keuangan interim (studi empiris pada perusahaan-

perusahaan nonkeuangan yang terdaftar di Bursa

Efek Indonesia). PhD thesis, Fakultas Ekonomika dan

Bisnis.

OJK (2018a). Laporan perkembangan perbankan syariah

2017.

OJK (2018b). Statistik perbankan syariah oktober 2018.

Puteh, A., Rasyidin, M., and Mawaddah, N. (2017).

˙

Islamic

banks in indonesia: Analysis of efficiency. Proceed-

ings of MICoMS, pages 331–336.

Sari, P. Z. and Saraswati, E. (2017). The determinant of

banking efficiency in indonesia (dea approach). Jour-

nal of Accounting and Business Education, 1(2):208–

229.

Sintiya, S. (2018). Analisis Pengaruh BOPO, FDR dan

CAR terhadap Profitabilitas Bank Umum Syariah Pe-

riode 2012-2016 (Studi Kasus pada Bank Umum

Syariah di Indonesia Periode 2012-2016). PhD the-

sis, IAIN SALATIGA.

SUHARTANTO, D., FARHANI, N. H., MUFLIH, M., et al.

(2018). Loyalty intention towards islamic bank: The

role of religiosity, image, and trust. International

Journal of Economics & Management, 12(1).

Suseno, P. (2008). Analisis efisiensi dan skala ekonomi

pada industri perbankan syariah di indonesia. Jour-

nal of Islamic and Economics, 2(1):35–55.

Sutaryono, P. (2013). Menggagas indikator efisiensi.

Wahab, N. A. and Rahman, A. R. A. (2012). Productiv-

ity growth of zakat institutions in malaysia: An appli-

cation of data envelopment analysis. Studies in Eco-

nomics and Finance, 29(3):197–210.

Wahab, W. (2015). Analisis faktor-faktor yang mempen-

garuhi efisiensi bank umum syariah di indonesia den-

gan pendekatan two stage stochastic frontier aproach

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

286

(studi analisis di bank umum syariah). Economica:

Jurnal Ekonomi Islam, 6(2):57–76.

Wibowo, E. S. and Syaichu, M. (2013). Analisis pengaruh

suku bunga, inflasi, car, bopo, npf terhadap profitabili-

tas bank syariah. Diponegoro Journal of Management,

2(2):10–19.

Analysis of the Effect of Internal and External Factors on the Inefficiency Toward Profitability of Islamic Banking Industry in Indonesia

287