Digital Banking, Customer Experience and Islamic Bank Financial

Performance in Indonesia

Vera Vebiana

1

1

Post Graduate Program of Islamic Finance and Banking , Politeknik Negeri Bandung, Bandung, Indonesia

Keywords:

Digital Banking, Customer Experience, Loyalty, Customer Satisfaction, Financial Performance.

Abstract:

This research aims to look at the relationship between Convenience, Functional Quality, Digital Banking

Service Quality, Brand/ Trust, Employee Customer Engagement, Digital Banking Innovation, Customer Ex-

perience, Customer Satisfaction, Customer Loyalty, and Financial Performance of Islamic Banks.Customer

experience in digital banking can be determined through the service quality so the uses and risks can be expe-

rienced directly. This study used primary data taken directly by using questionnaire with 229 respondents. The

analysis technique used was path analysis with Partial Least Square Structural Equation Model (PLS-SEM).

The results of this study indicate that Convenience, Brand / Trust, Employee Customer Engagement, and digi-

tal banking innovation have an influence on customer experience, but not with Functional Quality and Digital

Banking Service Quality. The results of this study can be used as consideration for companies to improve the

bank performance in serving customers and bank employees must have a friendly attitude for customers to

feel comfortable.

1 INTRODUCTION

In fulfilling customer needs in enhancing the growth

of banking and financial banking, the bank seeks to

maximize the services through digital banking, which

in the modern era can become the main alternative

for mobile banking users. In implementing this digi-

tal banking, Islamic banks must be able to change the

marketing and management model of Islamic banks.

The challenge for Islamic banks in developing digital

banking is customer reluctancy caused by bad expe-

riences. For this reason, the development of service

marketing theory in digital banking requires an under-

standing of customer preferences which can be seen

from customer satisfaction and loyalty (Mbama and

Ezepue, 2018).

Customers choose the service providers based on

importance ratings and after enjoying the service they

tend to compare it with what they expect previously

(Suhartanto, 2008). If the services they get are far be-

low their expectation, the customer will leave the ser-

vice providers. Therefore, increasing customer needs

will increase the bank’s financial performance and

will have a positive impact on the bank itself.

Service quality can be interpreted as customer’s

assessment of the superiority or privilege of a prod-

uct or service as a whole. Service quality is a com-

prehensive customer evaluation process regarding the

perfection of service performance (Assauri, 2015). It

includes the sense of security and comfort for the

customers. Banks can improve this service by im-

plementing Digital Banking (DB). Digital Banking

is a service provided by banks with the development

of electronic banking services in order to serve cus-

tomers easily, quickly, and comfortably according to

customer needs (customer experience), so as to facili-

tate customers to conduct banking activities indepen-

dently (POJK, 2018).

Based on a survey conducted on various bankers

in Indonesia, around 66% of them have developed

digital banking as a strategy for banking companies.

It proves that digital influences in the banking world

have increasingly developed and made digital banking

a part of the company’s strategy (Indonesia, 2018).

However, there is only a small proportion of banks in

Indonesia which has implemented digital banking, of

80 banks only two of them actually implement a to-

tal digital banking system. The rest still apply only a

small part of the program. (Kompas, 2018).

Vebiana, V.

Digital Banking, Customer Experience, and Islamic Bank Financial Performance in Indonesia.

DOI: 10.5220/0009868002490255

In Proceedings of the International Conference on Creative Economics, Tourism and Information Management (ICCETIM 2019) - Creativity and Innovation Developments for Global

Competitiveness and Sustainability, pages 249-255

ISBN: 978-989-758-451-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

249

2 LITERATURE REVIEW

2.1 Digital Banking

Rapid technological developmentleads banks to fur-

ther improve their services by forming digital bank-

ing. It aims so that banks can maximize their services

to customers and improve their operational quality.

It is expected that banks can develop their own dig-

ital banking. Digital banking is designed so that cus-

tomers can carry out transactions independently, such

as: opening an account, obtaining information, doing

transactions, closing accounts and conducting other

needs of customers (OJK, 2018).

The advantage that banks can take to advance dig-

ital banking is to utilize the huge penetration of cell-

phones. Up until now, mobile users in this coun-

try have reached 95% of the total population of In-

donesia, while those who can access banking facilities

are only at 20% (Zahiruddin, 2015). Digital banking

allows banks to develop services to customers, pro-

vide an alternative to give information directly to cus-

tomers and reduce direct interaction at branch offices.

Today customers expect the same level of interaction

through digital banking and social media (Dootson

et al., 2016). Digital banking is an orientation of

service, it makes the theory of service marketing im-

portant in its conceptualization (Mbama and Ezepue,

2018).

In line with technological development in the

banking sector, it is also important to consider about

24 hours banking services. One of them is the Auto-

mated Teller Machine (ATM) service. Customers ex-

pect to get information or consult through telephone

or e-mail as soon as possible. It proves the role of ser-

vice quality in the bank so that people feel satisfied

with the bank services (Yilmaz et al., 2018).

2.2 Convenience

Convenience arises as a result of individual’s per-

ception about happiness in using the services pro-

vided. It makes convenience becomes an important

factor to consider by the banks before providing dig-

ital banking services that meet customers expectation

(Paganta, 2015). Convenience can be seen from the

extent to which banks can provide simple, easy to use

and intuitive access for customers (Larsson and Vi-

itaoja, 2017). Convenience can also be felt directly

by the customers, judging by how well the bank pro-

vides services in the form of location (Wu, 2011)

and parking spaces so as to give comfort and avoid

customer dissatisfaction (Culiberg and Roj

ˇ

sek, 2010).

H1: There is a positive relationship between Conve-

nience and customers experience.

2.3 Functional Quality

Functional quality is the process of presenting

services by the service providers to customers

(Gr

¨

onroos, 2007). Functional quality is an attitude /

behavior that shows intelligence, responsiveness, hos-

pitality, professionalism carried out by bank employ-

ees in serving customers (Mulyanti, 2011). It is re-

lated to customers’ judgment toward the services pro-

vided in order to reach customers satisfaction. Func-

tional quality is considered good if it can exceed cus-

tomer expectations. Functional quality also measures

how efficiently banks operate and can be accepted by

customers (Keisidou et al., 2013).

H2: There is a positive relationship between func-

tional quality and customer experience.

2.4 Digital Banking Service Quality

Service is not just about serving but also feeling.

The feeling felt by the customer will open customers’

heart share and it leads to customer loyalty toward the

company’s products (Zainal et al., 2017). The main

services provided through digital banking are online

balance checks and fund transfers. These services can

provide boost for banks in conducting strategic ser-

vice marketing (Mbama and Ezepue, 2018). Banks

must also be able to guarantee customer satisfaction

in order to encourage them to buy other products (Yil-

maz et al., 2018).

H3: There is a positive relationship between Dig-

ital Banking Service Quality and Customer Experi-

ence.

2.5 Brand/Trust

If customers have good expectation toward the brand

of a company, they then believe that the products and

company are also good. This brand trust can increase

customer trust in the company. This arises from the

experience felt by the previous customers so that it

can affect the sales. Brand credibility is considered

reliable if the level of proposition information can

be trusted by customers (Keisidou et al., 2013). The

tendency of consumers towards a brand as a psycho-

logical function is a perspective of customers attitude

(Senjaya, 2013).

H4: There is a positive relationship between

Brand/ Trust and Customer Experience.

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

250

2.6 Employee Customer Engagement

Employee engagement is an employee’s involvement

in meeting organization’s goals in the form of ef-

fort, initiative and perseverance (Macey et al., 2011).

The existence of employee customer engagement in a

company will improve relationships and close phys-

ical involvement between employees and customers.

It can bring positive attitudes / behavior towards the

company from both employees and customers. The

thing that must be considered in the service and pro-

curement of complaints is that a good interaction be-

tween customers and bank employees the can create

good connection between the two (Karatepe and Aga,

2016).

H5: There is a positive relationship between Cus-

tomer Engagement Employees and Customer Experi-

ence.

2.7 Digital Banking Innovation

Banks get benefit from digital banking innovation in

improving their performance. This innovation can be

used by customers so that it is beneficial for both par-

ties. Although this innovation is important for bank

services, customers use the innovation independently.

It shows that digital banking innovation must focus

on what customers feel and the impact of innovation

on customers will be a benefit for the banks (Mbama

and Ezepue, 2018). The latest innovations offered by

banks in technology must be able to improve the qual-

ity of services that are equipped with speed, safety

and comfort (Kennedy and Harefa, 2018).

H6: There is a positive relationship between Dig-

ital Banking Innovation and Customer Experience.

2.8 Customer Experience

A new model is always needed in digital banking be-

cause the customers may not get direct services such

as courtesy, friendliness, and personal care. There-

fore, there is a measurement of new service quality

that moderates customer satisfaction in digital bank-

ing (Jun and Palacios, 2016). This study uses sev-

eral measures of service quality (experience, satisfac-

tion, and loyalty). It allows a significant relationship

between digital bank marketing and financial perfor-

mance. Customer experience is a series of interac-

tions between customers, products and companies, or

parts of the organization that give rise to reactions

(e.g. rational, emotional, sensoric, physical, and spir-

itual) (Meyer et al., 2007). H7: There is a relationship

between Customer Experience and Customer Satis-

faction. H8: There is a relationship between Cus-

tomer Experience and Customer Loyalty.

2.9 Customer Loyalty and Financial

Performance

Loyalty is the customer’s trust in a service provider

or service company that allow them to give recom-

mendation to others and give benefit to the company

(Haryeni et al., 2017). The existence of loyal cus-

tomers is needed by the company. Customer loyalty

will greatly help the company’s growth, especially in

the current market competition. Loyal customers are

those who will continually repurchase goods and ser-

vices from the company and will try to recommend

them to others (Hastuti and Nasri, 2014). Loyalty

refers to the customers behavior of making repeated

purchases of goods and services chosen from a com-

pany (Griffin and Herres, 2002).

Financial performance is the result obtained by

management through cooperation with certain par-

ties to collect funds and use them efficiently. Finan-

cial performance is a subjective measure of how well

a company uses existing assets to generate revenue

(Prakarsa, 2016). Financial performance can be mea-

sured by using financial ratios. One of the bank’s fi-

nancial ratios is profitability. The profitability ratio

aims to find out the ability of banks to generate profits

for a certain period (Indonesia, 2014). The ratios re-

lated to earnings are Return on Assets (ROA), Return

on Equity (ROE), and Net Interest Margin (NIM).

H9: There is a positive relationship between Cus-

tomer Experience and Financial Performance H10:

There is a positive relationship between Customer

Satisfaction and Financial Performance. H11: There

is a positive relationship between Customer Loyalty

and Financial Performance.

2.10 Customer Satisfaction

Customer satisfaction is customer’s feeling towards

the impression or performance given by the company

which relates to customer expectations of a product.

If the reality is better than the expectations, the service

provided is considered very satisfying and vice versa

(Febriana, 2016).

Customer satisfaction is the overall customer ex-

perience. Positive customer experience depends on

customer satisfaction that is felt directly and raises

customer loyalty towards the bank (Mbama and

Ezepue, 2018) Customer satisfaction is the main thing

that must be considered by banking service providers

because customer satisfaction is an important aspect

Digital Banking, Customer Experience, and Islamic Bank Financial Performance in Indonesia

251

of the company’s image. Customer gives a large con-

tribution to the bank’s income, both directly and indi-

rectly, so as to support the existence of the company

(Febriana, 2016).

Researchers who study customer satisfaction and

loyalty do not always consider customer experience

(Mbama and Ezepue, 2018). Some previous studies

discuss the influence of customer loyalty with cus-

tomer satisfaction as a moderator and gives positive

relationship (Saleem et al., 2016). H12: There is a

positive relationship between Customer Satisfaction

and Loyalty.

3 METHODS AND EQUIPMENT

This research aims to look at the relationship between

Convenience, Functional Quality, Digital Banking

Service Quality, Brand / Trust, Employee Customer

Engagement, Digital Banking Innovation, Customer

Experience, Customer Satisfaction, Customer Loy-

alty, and Financial Performance of Islamic Banks.

Customer experience in digital banking can be de-

termined through the quality of service so the uses

and risks can be experienced directly. This study used

primary data by distributing questionnaires to sharia

bank customers who use digital banking. The pop-

ulation in this study were customers of 13 Islamic

Commercial Banks in Indonesia, with 229 respon-

dents. This study used accidental sampling. Acci-

dental Sampling is a technique of sampling by chance

(Sugiyono, 2017).

Data analysis technique used in this study was

path analysis by applying PLS-SEM (Partial Least

Square-Structural Equation Modeling) method. This

study was processed by using WarpPLS 6.0 which

was run using computer media.

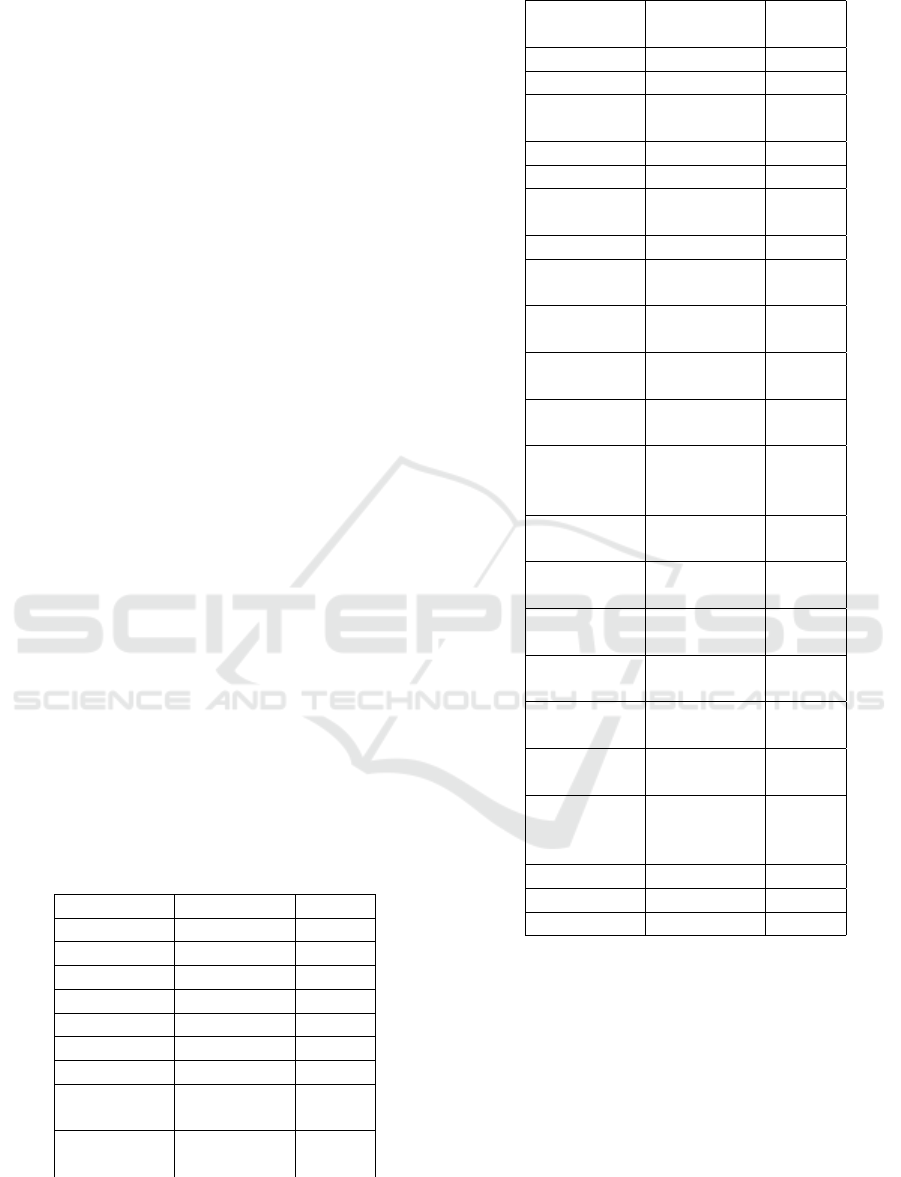

Table 1: Respondent demographic character

Respondent demographic character

Gender Male 66

Female 163

Age 20-24 185

25-29 24

30-34 9

35-39 6

>40 5

Educational

level

High

School

71

Bachelor/

Diploma

142

Post gradu-

ate

16

Job Civil Servents 15

Enterpreneur 22

Private em-

ployees

71

Student 98

Others 23

Customers

by Bank

BSM 83

Muamalat 20

BRI

Syariah

28

Aceh

Syariah

4

Victoria

Syariah

0

Bukopin

Syariah

1

Panin

Dubai

Syariah

0

BNI

Syariah

86

BJB

Syariah

3

BCA

Syariah

1

Mega

Syariah

0

BTPN

Syariah

3

MayBank

Syariah

0

Length of

time being

customer

< 1 year 67

1-2 years 72

3-4 years 48

> 4 years 42

4 RESULT

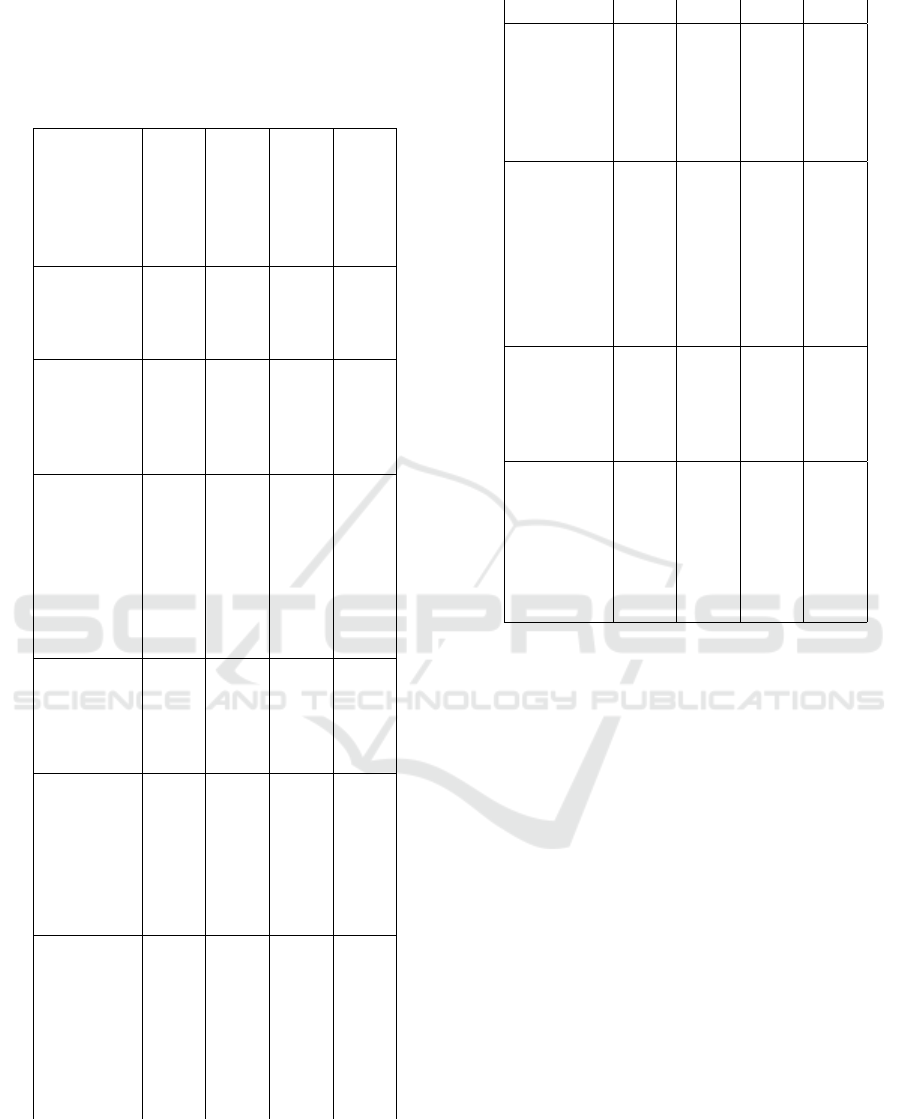

The validity and reliability assessment refers to the

value of the loading factor with the calculation results

at > 0.5. The rule of thumb used is if the value of

the loading factor is greater and equal to 0.5, it is con-

sidered sufficient for fulfilling the criteria (Haryono,

2017). The reliability assessment of all items or ques-

tions in this study used the Cronbach Alpha coeffi-

cient formula. The value of Cronbach Alpha used was

0.6 with the assumption that the questionnaire instru-

ment is considered reliable if the value of Cronbach

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

252

Alpha ≥ 0.6 (Imam, 2005) composite reliability value

≥ 0.70 and AVE value > 0.50 (Widarjono, 2015). Ta-

ble 2 shows that all variable indicators have met the

criteria and can be said to be valid and reliable.

Table 2: Validity and Reliability Value

Indicator Load

ing

Fac-

tors

Comb

rach

α

Comp

osite

Re-

lia-

bil-

ity

AVE

Convenience 0.695 0.831 0.621

Q1 0.783

Q2 0.811

Q3 0.770

Functional

Quality

0.818 0.892 0.733

Q1 0.853

Q2 0,877

Q3 0.839

Digital

Banking

Service

Quality

0.902 0.932 0.773

Q1 0.900

Q2 0.895

Q3 0.823

Q4 0.896

Brand/Trust 0.864 0.907 0.711

Q1 0.803

Q2 0.829

Q3 0.881

Q4 0.857

Employee

Customer

Engage-

ment

0.899 0.937 0.831

Q1 0.911

Q2 0.911

Q3 0.914

Digital

Banking

Innova-

tion

0.884 0.916 0.685

Q1 0.812

Q2 0.836

Q3 0.886

Q4 0.793

Q5 0.807

Customer

Experi-

ence

0.867 0.919 0.790

Q1 0.864

Q2 0.886

Q3 0.916

Customer

Satisfac-

tion

0.898 0.925 0.711

Q1 0.886

Q2 0.846

Q3 0.790

Q4 0.848

Q5 0.843

Customer

Loyalty

0.855 0.912 0.775

Q1 0.874

Q2 0.918

Q3 0.848

Bank

Financial

Perfor-

mance

0.707 0.843 0.653

ROA 0.833

ROE 0.982

NIM 0.549

5 DISCUSSION

The validation of the structural model is carried out

to see the R-square value (ARS) which is equal to

0.463, with P <0.001. Average block VIF (AVIF)

with a value of 2.371, this value is acceptable because

it is ≤5, ideally ≤3.3. Average full collinearity VIF

(AVIF) with a value of 2.818 is also accepted because

it is ≤5, ideally 3.3. Furthermore, the value of Tenen-

haus GoF (GoF) is 0.581. Sympson’s paradox ratio

(SPR) has a value of 1,000 which can be accepted be-

cause the value is greater than ≥ 0.7 ideally = 1. The

R-square contribution ratio (RSCR), Statistical sup-

pression ratio (SSR) and nonlinear bivariate causal-

ity direction ratio (NLBCDR) values is = 1,000 each

which is also acceptable.

The final results of conclusions obtained from the

results of data processing using WarpPLS are shown

below

From the results of testing model above, it can

be seen that Convenience, Brand / Trust, Employee

Customer Engagement, and digital banking innova-

tion have a positive and significant influence on cus-

tomer experience with a significance value of 0.05.

Meanwhile, the Functional Quality and Digital Bank-

Digital Banking, Customer Experience, and Islamic Bank Financial Performance in Indonesia

253

Figure 1: Result of Testing Model

ing Service Quality variables do not have a significant

effect on customer experience. Customer experience

has a positive and significant influence on Customer

Satisfaction and Customer Loyalty with a significance

value of ≤0.01. On the other hands, Customer Ex-

perience, Customer Satisfaction, and Customer Loy-

alty variables do not have a significant effect on Is-

lamic Bank Financial Performance, with a signifi-

cance value of 0.05 0.10 and 0.07 respectively. It

shows that the Customer Experience, Customer Satis-

faction and Customer Loyalty do not affect the Bank’s

Financial Performance.

6 CONCLUSION, LIMITATION

AND FUTURE RESEARCH

The results of the entire study show that Convenience,

Brand / Trust, Employee Customer Engagement, and

digital banking innovation have an influence on cus-

tomer experience, but not with Functional Quality

and Digital Banking Service Quality. It proves that

the functional quality and Digital Banking Service

Quality cannot provide a separate experience for cus-

tomers who do transaction in Islamic banks. Even

so, banks need to improve the convenience in ser-

vice. The bank employees must have a friendly at-

titude for customers to feel comfortable. On the other

hands, Customer Experience, Customer Satisfaction,

and Customer Loyalty variables have no influence on

the Financial Performance of Islamic Banks.However,

the bank must still give a good impression to the cus-

tomers so that the customer remains loyal to the Is-

lamic bank.

This study was only limited to certain time and

place, in which it is aimed at customers of Islamic

banks. Due to this research, the researcher was only

able to collect data from sharia bank customers in sev-

eral regions in Indonesia such as Medan, Bandung,

Jakarta, Semarang, and Kalimantan. Therefore, it is

expected that further researchers can conduct a direct

survey to some other regions in Indonesia so that a

comparison can be obtained.

REFERENCES

Assauri, S. (2015). Manajemen pemasaran (empat belas).

Jakarta: Rajawali Pers.

Culiberg, B. and Roj

ˇ

sek, I. (2010). Identifying service qual-

ity dimensions as antecedents to customer satisfac-

tion in retail banking. Economic and business review,

12(3):151–166.

Dootson, P., Beatson, A., and Drennan, J. (2016). Finan-

cial institutions using social media–do consumers per-

ceive value? International Journal of Bank Market-

ing, 34(1):9–36.

Febriana, N. I. (2016). Analisis kualitas pelayanan bank ter-

hadap kepuasan nasabah pada bank muamalat indone-

sia kantor cabang pembantu tulungagung. An-Nisbah:

Jurnal Ekonomi Syariah, 3(1):145–168.

Griffin, J. and Herres, R. T. (2002). Customer loyalty: How

to earn it, how to keep it. Jossey-Bass San Francisco,

CA.

Gr

¨

onroos, C. (2007). Service management and marketing:

customer management in service competition. John

Wiley & Sons.

Haryeni, Mulyati, Y., Laoli, E. F., et al. (2017). Kuali-

tas pelayanan, kepercayaan dan kepuasan nasabah dan

pengaruhnya terhadap loyalitas nasabah pada tabun-

gan bank rakyat indonesia (persero) tbk kantor cabang

khatib sulaiman. Jurnal Ekonomi dan Bisnis Dharma

Andalas, 19(2):189.

Haryono, S. (2017). Metode sem untuk penelitian manaje-

men dengan amos lisrel pls. Luxima: Jakarta.

Hastuti, T. and Nasri, M. (2014). Kualitas pelayanan,

kepuasan, dan loyalitas nasabah: Aplikasi servqual

model pada lembaga keuangan mikro syariah kota

malang. Jurnal Manajemen dan Akuntansi, 3(3).

Imam, G. (2005). Aplikasi analisis multivariate dengan pro-

gram spss. Semarang: Badan Penerbit Universitas

Diponegoro.

Indonesia, I. B. (2014). Memahami bisnis bank syariah.

Gramedia Pustaka Utama.

Indonesia, P. (2018). Pwc survey: Digital banking in in-

donesia 2018. PWC.

Jun, M. and Palacios, S. (2016). Examining the key di-

mensions of mobile banking service quality: an ex-

ploratory study. International Journal of Bank Mar-

keting.

Karatepe, O. M. and Aga, M. (2016). The effects of or-

ganization mission fulfillment and perceived organi-

zational support on job performance. International

Journal of Bank Marketing.

Keisidou, E., Sarigiannidis, L., Maditinos, D. I., and Tha-

lassinos, E. I. (2013). Customer satisfaction, loyalty

and financial performance. International Journal of

Bank Marketing.

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

254

Kennedy, P. S. J. and Harefa, A. A. (2018). Financial tech-

nology, regulation and banking adaptation in indone-

sia. Fundamental Management Journal, 3(1):1–11.

Kompas (2018). ojk baru 2 bank yang benar benar terapkan

digital banking.

Larsson, A. and Viitaoja, Y. (2017). Building customer loy-

alty in digital banking. International Journal of Bank

Marketing.

Macey, W. H., Schneider, B., Barbera, K. M., and Young,

S. A. (2011). Employee engagement: Tools for anal-

ysis, practice, and competitive advantage, volume 31.

John Wiley & Sons.

Mbama, C. I. and Ezepue, P. O. (2018). Digital banking,

customer experience and bank financial performance.

International Journal of Bank Marketing.

Meyer, C., Schwager, A., et al. (2007). Understand-

ing customer experience. Harvard business review,

85(2):116.

Mulyanti, K. (2011). Pengaruh kualitas teknis dan kualitas

fungsional terhadap kepercayaan nasabah (studi kasus

nasabah bank bukopin cabang bekasi). Optimal: Jur-

nal Ekonomi dan Kewirausahaan, 5(1):51–70.

OJK (2018). Panduan penyelenggaraan digital branch oleh

bank umum.

Paganta, D. R., H. . R. D. (2015). Pengaruh kepercayaan,

persepsi kemudahan, persepsi kegunaan, persepsi

kenyamanan, dan persepsi risiko terhadap minat

menggunakan internet banking. fakultas ekonomi, vol

7, no. 1.

POJK (2018). Peraturan otoritas jasa keuangan nomor

12/pojk.03/2018.

Prakarsa, L. M. (2016). Pengaruh kepuasan pelanggan ter-

hadap kinerja keuangan melalui loyalitas pelanggan

sebagai variabel intervening pada berbagai sektor pe-

rusahaan di indonesia. Business Accounting Review,

4(1):361–372.

Saleem, M. A., Zahra, S., Ahmad, R., and Ismail, H. (2016).

Predictors of customer loyalty in the pakistani banking

industry: a moderated-mediation study. International

Journal of Bank Marketing.

Senjaya, V. (2013). Pengaruh customer experience qual-

ity terhadap customer satisfaction & customer loyalty

di kafe excelso tunjungan plaza surabaya: Perspektif

b2c. Jurnal Strategi Pemasaran, 1(1).

Sugiyono, P. (2017). Metode penelitian bisnis: Pendekatan

kuantitatif, kualitatif, kombinasi, dan r&d.

Suhartanto, D. (2008). Perilaku konsumen: Tinjauan ap-

likasi di indonesia. Penerbit: Guardaya Intimarta.

Bandung.

Widarjono, A. (2015). Analisis multivariat terapan edisi ke-

dua. Yogyakarta: UPP STIM YKPN.

Wu, L.-W. (2011). Beyond satisfaction. Managing Service

Quality: An International Journal.

Yilmaz, V., Ari, E., and G

¨

urb

¨

uz, H. (2018). Investigating

the relationship between service quality dimensions,

customer satisfaction and loyalty in turkish banking

sector. International Journal of Bank Marketing.

Zahiruddin, I. (2015). Probank: Membangun perbankan

profesional. PBN (Perbanas), Ed., ed.

Zainal, V. R., Djaelani, F., Basalamah, S., Yusran, H. L., and

Veithzal, P. (2017). Islamiz marketing management,

mengembangkan bisnis dengan hijrah ke pemasaran

islam mengikuti praktik rasulullah. Jakarta: PT Bumi

Aksara.

Digital Banking, Customer Experience, and Islamic Bank Financial Performance in Indonesia

255