Good Corporate Governance, Earnings Management and Profit

Optimization to increase the Competitiveness of Sharia Commercial

Banks Industry

Hilman

1

1

Bandung State Polytechnic, Bandung, Indonesia

Keywords:

Good Corporate Governance, Earnings Management, Profit.

Abstract:

This study was conducted to determine the effect of Good Corporate Governance (GCG) on earnings man-

agement and profit as an effort to improve the competitiveness of Islamic banks in Indonesia. The study was

conducted on 11 Islamic public banks registered with Financial Services Authority using data from the period

2013-2017. Methods of data analysis are using PLS-SEM with WrapPLS 6.0 statistical tools. The results

of the study showed that the GCG elements of the sharia supervisory board and the board of commissioners

did not affect earnings management, while the audit committee element affected earnings management. This

condition shows that the shariah supervisory board and board of commissioners have not optimally influenced

the practice of earnings management and supported the increase in the competitiveness of Islamic banks in

Indonesia, but the audit committee contributed to controlling the practice of earnings management. GCG ele-

ments of the sharia supervisory board and audit committee have no effect on the increase in company profits

while the board of commissioners has an influence on increasing corporate profits. This condition shows that

the shariah supervisory board and audit committee have not optimally influenced corporate profits to support

the increase in the competitiveness of Islamic banks in Indonesia while the board of commissioners contributes

to optimizing corporate profits. The test results also show that earnings management has a positive effect on

increasing corporate profits. The GCG element of the audit committee is able to play a role in encouraging

the implementation of earnings management so that it influences the increase in corporate profits. Profit op-

timization through increasing the role of GCG can increase the competitiveness of Sharia Commercial Banks

in Indonesia.

1 INTRODUCTION

Today, the business world is increasingly dynamic.

The development of the company’s ability is very im-

portant in order to survive in the global market. So it

is not surprising that now companies are competing to

increase their competitiveness in various fields. One

of the company’s efforts to improve the quality of the

company is by implementing good corporate gover-

nance (Wicaksono and Raharja, 2014). The essence

of increasing the competitiveness of banking institu-

tions as reviewed by (Priyanto, 2006) is a decrease in

costs with indicators of increasing company profits.

Banking will also see it through market share indica-

tors because it is a reflection of customer confidence

in using banking services.

Earnings management and banking industry oper-

ational systems have been widely studied by various

parties. The study (Amertha, 2013) shows that profit

is an indicator of company management in managing

company assets. Profit functions as a tool to mea-

sure the operational effectiveness and performance of

business entities. According to (Fatimah et al., 2019)

profit is used by management to assess the company’s

operational and financial performance. Profit is used

as a reference for the use of resources and consider-

ation in financing assets. In practice, managers of-

ten take action on ’earnings management’ which is

related to the level of sales, assets, and share capi-

tal. According to (Healy and Wahlen, 1999) earnings

management occurs when managers manipulate com-

pany performance. Manipulation is done by chang-

ing contracts and accounting reports with the aim of

changing stakeholder perceptions of company perfor-

mance.

Earnings management seems to be something that

is usually practiced by several world companies in the

past decade (Agustina et al., 2018). Earnings manage-

48

Hilman, .

Good Corporate Governance, Earnings Management and Profit Optimization to Increase the Competitiveness of Sharia Commercial Banks Industry.

DOI: 10.5220/0009857800480053

In Proceedings of the International Conference on Creative Economics, Tourism and Information Management (ICCETIM 2019) - Creativity and Innovation Developments for Global

Competitiveness and Sustainability, pages 48-53

ISBN: 978-989-758-451-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

ment is a phenomenon that is difficult to avoid as an

impact of the use of accrual basis in preparing finan-

cial statements. According to (Setiawati and Naim,

2001) deviations in the allocation of funds are a re-

sult of the manipulation of financial statements by

management. Earnings information is a major con-

cern for assessing management performance or per-

formance. Earnings management actions are known

to have raised several cases of accounting reporting

scandals widely, including Enron, Merck, WorldCom,

and the majority of other companies in the United

States (Tehranian et al., 2006). Some cases also oc-

cur in Indonesia, such as PT. Kimia Farma Tbk and

PT. Lippo Tbk also involve financial reporting starting

from the detection of engineering (Boediono, 2005).

In Islamic banking, the application of earnings

management is considered to be contrary to moral and

ethical values. Earnings management is the practice

of accounting information manipulation and Islamic

banks must avoid it (Bukhari et al., 2013). Study of

(Taktak, 2011) revealed that the practice of earnings

management in Islamic banks is done by manipulat-

ing the use of reserve funds to regulate the value of

their desired income. (Mujib, 2018) revealed that in

the 2013-2017 period there were earnings manage-

ment practices in several Islamic banks in Indone-

sia. Fraud conducted through earnings management

practices on Islamic banks has an impact on declining

profits and the competitiveness of companies. There

needs to be intervention from the government to im-

prove company performance, one of which is through

increasing the supervision and control processes both

externally and internally.

Financial reporting quality of Islamic banks is ex-

pected to be able to be achieved properly if imple-

mented internal control over effective financial report-

ing. The implementation of internal control over ef-

fective financial reporting requires the application of

the role of the Sharia Supervisory Board, the Board

of Commissioners, and the Audit Committee. This

research was conducted to discuss Good Corporate

Governance, Earnings Management and Profit Op-

timization to increase the competitiveness of Sharia

Commercial Banks in Indonesia. Based on the prob-

lems faced by Islamic banks in Indonesia, the formu-

lation of the questions in this study is 1) How does

the role of the shariah supervisory board, board of

commissioners and audit committee influence earn-

ings management 2) How does the role of the shariah

supervisory board, board of commissioners and au-

dit committee affect profit 3) What is the effect of

earnings management on profits at Sharia Commer-

cial Banks in Indonesia.

2 LITERATUR REVIEW

In order to improve the performance and competitive-

ness of national banks, the government needs to in-

tervene. It is necessary to supervise banks with high

concentration to be able to control operational activi-

ties. Banks are expected to be more efficient towards

high competitiveness and avoid potential moral haz-

ard practices (Tobing et al., 2013). Good corporate

governance is a reference for companies to improve

the competitiveness of companies (national and inter-

national). Improving competitiveness increases mar-

ket confidence, encourages continuous investment

flows and national economic growth (Wicaksono and

Raharja, 2014).

Indonesia has experienced a financial crisis. Ac-

cording to (Solla et al., 2010), one of the factors

that triggered the financial crisis in Indonesia was

due to the weak factor of Good Corporate Gover-

nance (GCG). Financial reports fail to convey real

facts about the economic condition of the company

so that users of financial statements do not obtain real

information from company profits. According to (Sun

et al., 2010) Good Corporate Governance deals with

compensation received by the directors and managers.

The purpose of GCG is to provide motivation to man-

agers in determining the best attitude for shareholders

and management monitoring to reduce agency con-

flict.

The study from (Mujib, 2018) revealed that in the

2013-2017 period fraud occurred which was the prac-

tice of earnings management in Islamic banking.

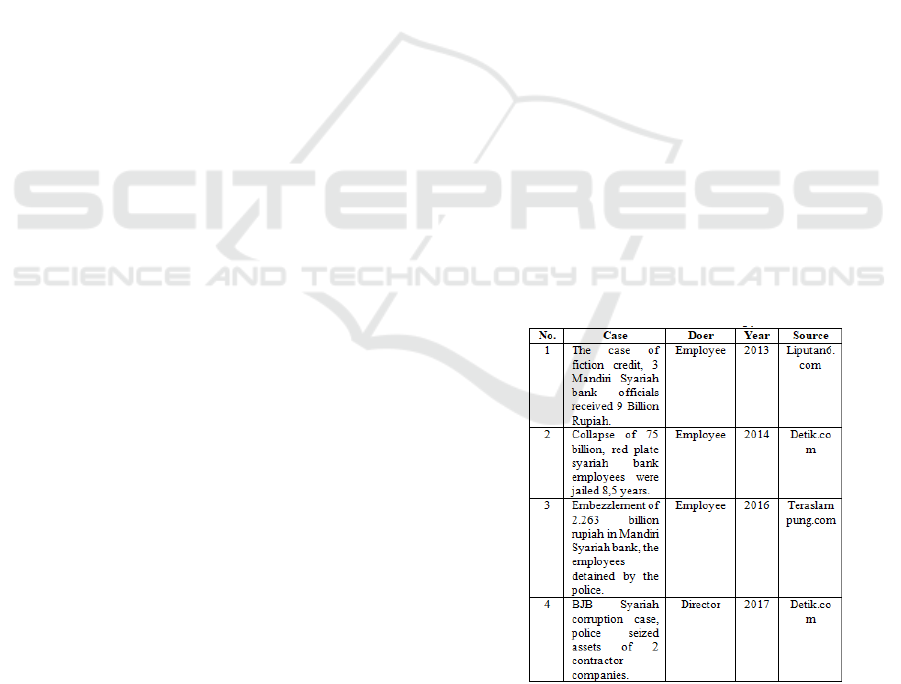

Figure 1: Fraud in Sharia Banking year 2013-2017(Mujib,

2018).

Earnings management can make financial presen-

tations less transparent. In the Sharia Banking system,

the concept of earnings management is different from

the moral and ethical values on which this institution

Good Corporate Governance, Earnings Management and Profit Optimization to Increase the Competitiveness of Sharia Commercial Banks

Industry

49

is run based on Islamic sharia based on honesty and

transparency, therefore accounting manipulation and

other discretionary behaviors are considered unethi-

cal practices in Islam banks.

Earnings management is thought to appear or be

carried out by managers or financial statement makers

in the financial reporting process of an organization

because they expect a benefit from the actions they

take (Gumanti, 2000). In addition, earnings informa-

tion is also used by investors or interested parties as an

indicator of the ability to use funds that are embedded

in the company and manifested in the rate of return as

well as indicators for increasing welfare (Chariri and

Ghozali, 2007). With good Good Corporate Gover-

nance, it is expected that the quality of financial state-

ments will be properly assessed by investors. There-

fore, the relationship that arises from the existence of

strong Good Corporate Governance in a company is

thought to affect the relationship of earnings manage-

ment and earnings quality (Rifani, 2013).

Corporate governance is an attraction that has al-

ways been questioned by regulators, financial insti-

tutions, investors, and the media. governance prob-

lems arise from different incentives and asymmet-

ric information between shareholders and managers

(Niu, 2006), because the relationship between man-

agement, the board of directors, shareholders and cor-

porate stakeholders can be seen and realized through

the achievement of systematic corporate governance.

This is the scope of the rules and procedures that

must be followed through the stated company goals

(Ahmed, 2017).

In Islamic banking, the sharia supervisory board

(SSB), board of commissioners (BOC) and audit

committee (AC) play an important role to limit earn-

ings management practices. The Shariah Supervisory

Board is an entity that has the authority to provide

oversight of products or any form of implementation

of National Sharia Board – Indonesia Ulema Coun-

cil decisions in Islamic financial institutions. SSB

can carry out its duties after being appointed / ap-

pointed through the SSGM (Sharia Supervisory Gen-

eral Meeting) after obtaining a recommendation from

the National Sharia Board, and can be dismissed in

carrying out its duties and authorities through the

SSGM after obtaining recommendations from the Na-

tional Sharia Board. This Sharia Supervisory Board is

located under the Sharia Supervisory General Meet-

ing or parallel to the Board of Commissioners in the

structure of a Sharia Bank or Islamic financial institu-

tion (Wisnumurti and YUYETTA, 2010).

The board of commissioners has a certain influ-

ence on the performance of the company. In a lit-

erature, it is explained that the increasing number of

personnel who become board of commissioners can

result in the worse performance of the company. This

can be explained by the existence of agency problems,

which states that the more members of the board of

commissioners, the institution will experience diffi-

culties in carrying out its role, while the difficulties

that are intended include difficulties in communicat-

ing and coordinating the work of each member of the

board itself, difficulties in monitoring and controlling

the actions of management, as well as difficulties in

making decisions that are useful for the company (Na-

sution and Setiawan, 2007).

In carrying out its duties and responsibilities the

audit committee works independently. The audit

committee involved has at least three members from

independent commissioners and parties outside the

company. The audit committee is required to make a

report to the board of commissioners for the tasks as-

signed and make an annual report on the implementa-

tion of the activities of the audit committee’s activity

committee which are disclosed in the company’s an-

nual report. The existence of formal communication

between the audit committee, internal audit and exter-

nal audit will ensure that the internal and external au-

dit processes are carried out properly. A good internal

and external audit process will improve the accuracy

of financial statements and then increase confidence

in financial statements (Anderson et al., 2003).

Based on the literature review above and the prob-

lems that have been presented, the researcher presents

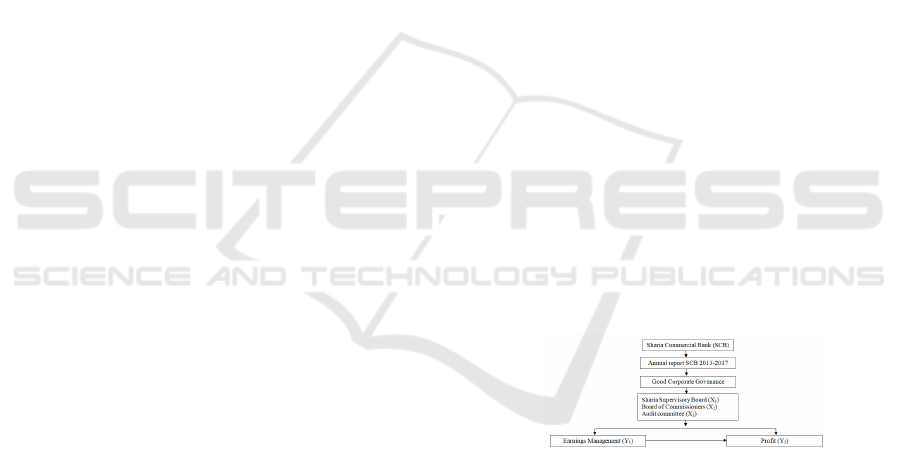

a framework that is poured into the model in Figure 2

below:

Figure 2: Thinking Framework

3 METHOD

The object of research used is the Sharia Commer-

cial Bank in Indonesia during the period 2013-2017.

Where in 2013 the number of Islamic public banks

was only 11 and had complete report data in 2017.

The sample is part of the number and characteris-

tics possessed by the population (Sugiyono, 2008).

The sampling technique was carried out by purpo-

sive sampling with the aim of getting a representa-

tive sample according to the specified criteria (Sugiy-

ono, 2008). Among others are as follows: Available

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

50

data is complete (overall data is available in the pub-

lication of Sharia Commercial Bank financial state-

ments for 2013-2017), both data on corporate gov-

ernance (Sharia Supervisory Board, Board of Com-

missioners, and Audit Committee) banking and data

needed for detect earnings management and profit op-

timization. Data measurement is calculated based on

surveys or observations used to collect primary data,

but calculations are also obtained from secondary

databases(Hair Jr et al., 2016).

The data analysis technique used in this study

is path analysis (analysis path) using the PLS-SEM

(Partial Least Square Structural Equation Modeling)

method with the WarpPLS 6.0 program. According

to (Santoso, 2011) that SEM is used to explain certain

phenomena involving two or more variables, either la-

tent or not. This method is applied because it is con-

sidered quite relevant and has been tested as a strong

method for predicting relationships between variables

with small samples when the data is not normally dis-

tributed (Hair Jr et al., 2016).

4 RESULT

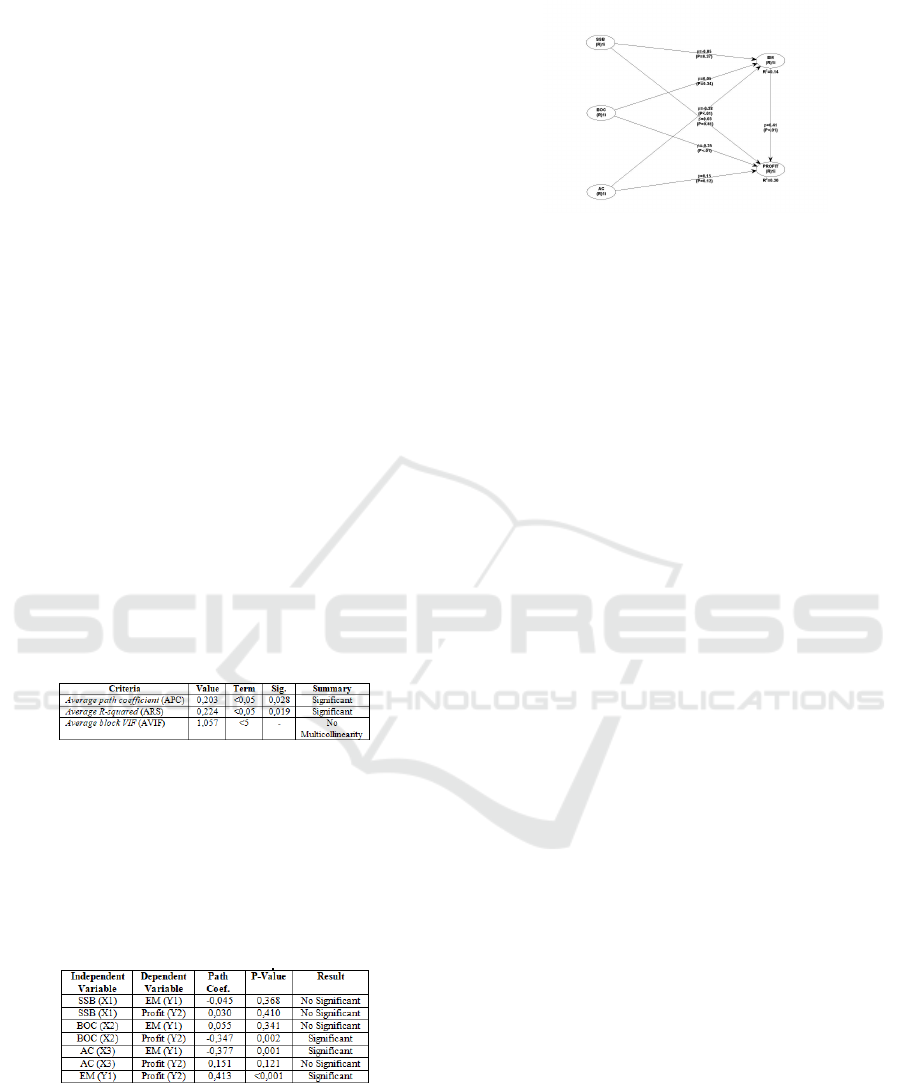

Based on the results of testing with WarpPLS 6.0, the

calculation of the fit model can be obtained which is

to evaluate whether the model fit is appropriate or sup-

ported by the following data:

Figure 3: Fit Model Analysis.

The output results show APC of 0.203 and ARS

of 0.224 and the criteria for the goodness of model fit

have been fulfilled which is significant (p value meets

the requirements <0.05). The AVIF value of 1.057

also fulfills the criteria of less than 5 which indicate

that there is no multicollinearity in the model.

Complete results of testing the hypothesis of di-

rect influence can be seen in Figure 4, below.

Figure 4: The Resume of the Direct Effect Hypothesis Test.

Furthermore, the results of the complete path anal-

ysis are also presented in the form of images as shown

in the following Figure 5,

In accordance with Figure 4 and Figure 5, we can

explain the results of testing the hypothesis of a direct

influence between variables as follows:

Figure 5: The Result of PLS-Path Analysis

1. Hypothesis 1 (H1) states that the shariah supervi-

sory board (SSB) (X1) has an effect on earnings

management (EM) (Y1). The test results show

path coefficients or path coefficients of -0.045 (p

= 0.368). This means that H1 is rejected or SSB

(X1) has no effect on EM (Y1).

2. Hypothesis 2 (H2) states that the shariah super-

visory board (SSB) (X1) has an effect on profit

(Y2). The test results show path coefficients or

path coefficients of 0.030 (p = 0.410). This means

that H2 is rejected or SSB (X1) does not affect

profit (Y2).

3. Hypothesis 3 (H3) states that the board of com-

missioners (BOC) (X2) influences earnings man-

agement (EM) (Y1). The test results show path

coefficients or path coefficients of 0.055 (p =

0.341). This means that H3 is rejected or BOC

(X2) has no effect on EM (Y1).

4. Hypothesis 4 (H4) states that the board of com-

missioners (BOC) (X2) has an effect on profit

(Y2). The test results show path coefficients or

path coefficients of -0,347 (p = 0,002). This

means that H4 is accepted or BOC (X2) has an ef-

fect on profit (Y2). The path coefficient value of

-0,347 indicates that BOC (X2) has a significant

negative effect on profit (Y2).

5. Hypothesis 5 (H5) states that the audit commit-

tee (AC) (X3) affects earnings management (EM)

(Y1). The test results show path coefficients or

path coefficients of -0,377 (p = 0.001). This

means that H5 is accepted or AC (X3) has an ef-

fect on EM (Y1). The path coefficient value of -

0,377 indicates that AC (X3) has a significant neg-

ative effect on EM (Y1).

6. Hypothesis 6 (H6) states that the audit committee

(AC) (X3) has an effect on profit (Y2). The test

results show path coefficients or path coefficients

of 0.151 (p = 0.121). This means that H6 is re-

jected or AC (X3) has no effect on profit (Y2).

7. Hypothesis 7 (H7) states that earnings manage-

ment (EM) (Y1) affects profit (Y2). The test re-

Good Corporate Governance, Earnings Management and Profit Optimization to Increase the Competitiveness of Sharia Commercial Banks

Industry

51

sults show path coefficients or path coefficients of

0.413 (p = ¡0.001). This means that H4 is ac-

cepted or EM (Y1) has an effect on profit (Y2).

The path coefficient value of 0.413 indicates that

EM (Y1) has a significant positive effect on Profit

(Y2).

The results of the study showed that the GCG ele-

ments of the sharia supervisory board and the board

of commissioners had no effect on earnings man-

agement. This is not in accordance with the re-

search(Mersni and Othman, 2016). Based on this

study, the shariah supervisory board and board of

commissioners have not optimally influenced the

practice of earnings management and support the im-

provement of the competitiveness of Islamic banks in

Indonesia. Audit committee GCG influences earn-

ings management. These results are consistent with

the research(Agustina et al., 2018) which shows that

audit committees contribute to controlling earnings

management practices that have an impact on corpo-

rate profits. GCG elements of the sharia supervisory

board and audit committee have no effect on increas-

ing company profits. The shariah supervisory board

and audit committee have not optimally influenced

corporate profits to support the increase in the com-

petitiveness of Islamic banks in Indonesia. This is not

in line with research (Sunarwan, 2015). However, in

his research it was revealed that the sharia supervisory

board had an effect when measured by the number of

sharia supervisory board meetings. Board of Com-

missioners’ GCG influences the increase in company

profits. This condition shows that the board of com-

missioners contributes to optimizing company profits.

The test results also show that earnings management

has a positive effect on increasing corporate profits.

This result is in accordance with the study (Salim,

2015) that the higher the practice of earnings man-

agement is carried out, the higher the value of corpo-

rate profits. The GCG element of the audit committee

is able to play a role in encouraging the implemen-

tation of earnings management so that it influences

the increase in corporate profits. Profit optimization

through increasing the role of GCG can increase the

competitiveness of Sharia Commercial Banks in In-

donesia.

5 CONCLUSION, IMPLICATION,

FUTURE RESEARCH

This study aims to determine the effect of good cor-

porate governance on earnings management and its

impact on profit optimization by using SEM-PLS.

Determinants of good corporate governance include

variable sharia supervisory boards, board of commis-

sioners, and audit committees. The specialty of us-

ing accrual accounting is to give management space

to inform their private information through earnings

management. However, if the application of earnings

management is too opportunistic, it will disrupt the

quality of financial statements. To achieve this goal,

the company is required to manage various resources

properly to grow the value added for the company it-

self. So that the better the company in managing re-

sources, the better the output will be. In addition to

financial aspects, the performance of a business entity

or business management is also seen based on the suc-

cess of a company implementing GCG and increas-

ing company profits to be able to compete with other

companies.

The results of this study have implications for

Sharia Commercial Banks. They are good at threat-

ening dismissals, threats of expropriation, and struc-

turing manager incentives. This is to prevent the con-

tract between Corporate Governance and agency the-

ory and earnings management. Because if there are

managers using valuation in financial reporting by

manipulating several stakeholders about the underly-

ing economic performance of the company or chang-

ing the outcome of the contract based on reported ac-

counting figures. Accountants are the most important

parties to overcome practices in the business world.

While earnings management is the most important

moral problem for the accounting profession.

Although this paper reveals several important

findings, this paper has limitations. First, due to lim-

ited access to data, the data used in this study were

only from 11 Islamic banks from 13 Islamic public

banks available in 2017. Second, it can be seen from

the factors that influence earnings management only

audit committees that influence earnings management

are therefore advised to enter or add new variables

that are identified as variables of good corporate gov-

ernance.

REFERENCES

Agustina, A. et al. (2018). Pengaruh peran komite audit

dan dewan pengawas syariah terhadap earnings man-

agement perbankan syariah di indoensia tahun 2012-

2015. Master’s thesis, Jakarta: Fakultas Ekonomi dan

Bisnis UIN Syarif Hidayatullah Jakarta.

Ahmed, I. E. (2017). The impact of corporate governance

on islamic banking performance: The case of uae is-

lamic banks. J. Bank. Financ, 2017(9):1–10.

Amertha, I. S. P. (2013). Pengaruh return on asset pada

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

52

praktik manajemen laba dengan moderasi corporate

governance. E-Jurnal Akuntansi, pages 373–387.

Anderson, K. L., Gillan, S., and Deli, D. (2003). Boards of

directors, audit committees, and the information con-

tent of earnings. Weinberg Center for Corporate Gov-

ernance Working Paper, (2003-04).

Boediono, G. S. (2005). Kualitas laba: Studi pengaruh

mekanisme corporate governance dan dampak man-

ajemen laba dengan menggunakan analisis jalur. Sim-

posium Nasional Akuntansi VIII, 8(9):172–194.

Bukhari, K. S., Awan, H. M., and Ahmed, F. (2013). An

evaluation of corporate governance practices of is-

lamic banks versus islamic bank windows of conven-

tional banks: A case of pakistan. Management Re-

search Review, 36(4):400–416.

Chariri, A. and Ghozali, I. (2007). Teori akuntansi. Se-

marang: Badan Penerbit Universitas Diponegoro.

Fatimah, F., Mardani, R. M., and Wahono, B. (2019). Pen-

garuh good corporate governance terhadap nilai pe-

rusahaan dengan kinerja keuangan sebagai variabel

intervening (studi kasus pada perusahaan manufaktur

sektor barang. Jurnal Ilmiah Riset Manajemen, 8(15).

Gumanti, T. A. (2000). Earnings management: Suatu telaah

pustaka. Jurnal Akuntansi dan Keuangan, 2(2):104–

115.

Hair Jr, J. F., Hult, G. T. M., Ringle, C., and Sarstedt, M.

(2016). A primer on partial least squares structural

equation modeling (PLS-SEM). Sage publications.

Healy, P. M. and Wahlen, J. M. (1999). A review of the

earnings management literature and its implications

for standard setting. Accounting horizons, 13(4):365–

383.

Mersni, H. and Othman, H. B. (2016). The impact of corpo-

rate governance mechanisms on earnings management

in islamic banks in the middle east region. Journal of

Islamic Accounting and Business Research.

Mujib, F. (2018). PENGARUH SHARIA COMPLI-

ANCE, ISLAMIC CORPORATE GOVERNANCE DAN

INTERNAL CONTROL TERHADAP FRAUD PADA

BANK UMUM SYARIAH. PhD thesis, Universitas Per-

adaban.

Nasution, M. and Setiawan, D. (2007). Pengaruh corpo-

rate governance terhadap manajemen laba di industri

perbankan indonesia. simposium nasional akuntansi

x,(juli), 1–26.

Niu, F. F. (2006). Corporate governance and the quality of

accounting earnings: a canadian perspective. Interna-

tional Journal of Managerial Finance, 2(4):302–327.

Priyanto, W. J. (2006). Analisis Pengaruh Kesehatan Dan

Efisiensi Bank Hasil Merger Terhadap Daya Saing:

Studi Kasus PT. Bank Permata Tbk. PhD thesis, Mag-

ister Manajemen.

Rifani, A. (2013). Pengaruh good corporate governance

terhadap hubungan manajemen laba dan kualitas laba

(studi empiris pada perusahaan go public yang terdaf-

tar di cgpi). Jurnal Akuntansi, 1(2).

Salim, H. (2015). Analisis pengaruh manajemen laba ter-

hadap profitabilitas perusahaan dengan good corpo-

rate governance sebagai variabel moderasi: Studi pada

perusahaan manufaktur yang terdaftar di bursa efek

indonesia periode 2010-2012. Jurnal Manajemen,

12(1):68–92.

Santoso, S. (2011). Structural Equation Modeling. Elex

Media Komputindo.

Setiawati, L. and Naim, A. (2001). Bank health evaluation

by bank indonesia and earning management in bank-

ing industry. Gadjah Mada International Journal of

Business, 3(2001).

Solla, A. H. et al. (2010). Pengaruh Mekanisme Corporate

Governance Terhadap Kualitas Laba Dengan Mana-

jemen Laba Sebagai Variabel Intervening Pada Per-

bankan Yang Terdaftar Di Bursa Efek Indonesia Se-

jak 2003-2008. PhD thesis, UNIVERSITAS AIR-

LANGGA.

Sugiyono (2008). Metode penelitian pen-

didikan:(pendekatan kuantitatif, kualitatif dan R

& D). Alfabeta.

Sun, N., Salama, A., Hussainey, K., and Habbash, M.

(2010). Corporate environmental disclosure, corpo-

rate governance and earnings management. Manage-

rial Auditing Journal.

Sunarwan, E. (2015). Pengaruh good corporate governance:

Gcg terhadap kinerja keuangan perbankan syariah:

studi kasus pada bank umum syariah dan unit usaha

syariah di indonesia periode 2010-2013.

Taktak, N. B. (2011). The nature of smoothing returns prac-

tices: the case of islamic banks. Journal of Islamic

Accounting and Business Research.

Tehranian, H., Cornett, M. M., Marcus, A. J., and Saunders,

A. (2006). Earnings management, corporate gover-

nance, and true financial performance. Corporate

Governance, and True Financial Performance (Jan-

uary 2006).

Tobing, A., Arkeman, Y., Sanim, B., Nuryartono, N., et al.

(2013). Pengaruh penerapan good corporate gover-

nance terhadap tingkat kesehatan dan daya saing di

perbankan indonesia. Jurnal Manajemen Teknologi,

12(3):298–318.

Wicaksono, T. and Raharja, R. (2014). PENGARUH GOOD

CORPORATE GOVERNANCE TERHADAP PROF-

ITABILITAS PERUSAHAAN (Studi Empiris pada Pe-

rusahaan Peserta Corporate Governance Perception

Index (CGPI) Tahun 2012). PhD thesis, Fakultas

Ekonomika dan Bisnis.

Wisnumurti, A. and YUYETTA, E. N. A. (2010). Analisis

Pengaruh Corporate Governance terhadap Hubungan

Asimetri Informasi dengan Praktik Manajemen Laba

(Studi pada Perusahaan Perbankan yang Terdaftar di

Bei). PhD thesis, UNIVERSITAS DIPONEGORO.

Good Corporate Governance, Earnings Management and Profit Optimization to Increase the Competitiveness of Sharia Commercial Banks

Industry

53