The Mechanism of Corporate Governance, Financial Performance and

Corporate Values in Sharia Companies in Indonesia

Rizky Fadhillah

1

and Dian Imanina Burhany

1

1

Islamic Finance and Banking, State Polytechnic Bandung, Bandung, Indonesia

Keywords:

Corporate governance mechanism, financial performance, corporate value, sharia company.

Abstract:

Building corporate value is a right step to attract investors in sharia companies. Good corporate value can

be obtained with good corporate governance. Good governance also improves the company’s financial per-

formance. This study aims to determine the effect of corporate governance mechanism, which consist of

institutional ownership, managerial ownership, independent boards, and board size, on financial performance

and corporate value. The research population were companies listed on the JII (Jakarta Islamic Index) for the

period of 2010-2017. The research used purposive sampling which resulted on obtaining 23 companies. The

method of data analysis was SEM-PLS. The results of the direct influence test show that commissioners, di-

rectors, independent commissioners, and institutional ownership influence financial performance, while audit

committees and managerial ownership do not. The test results also show that independent commissioners and

financial performance have an effect on corporate value, while the size of the board, institutional and manage-

rial ownership do not. The test results of indirect influence indicate that financial performance is capable of

mediating the size of commissioners, directors, independent commissioners, and institutional ownership with

the corporate value, but unable to mediate the audit committees and managerial ownership.

1 INTRODUCTION

Sharia companies in Indonesia have begun to develop

since several decades ago. The development of sharia

companies can be seen from the emergence of Islamic

financial institutions such as Islamic banks, sharia in-

surance, Islamic mutual funds, baitul mal wat tamwil,

and sharia property developers. The rapid develop-

ment of sharia companies is due to the conscious re-

alization of the community that sharia companies are

better than conventional companies and certainly in

accordance with their beliefs as Muslims.

The reputation of sharia companies is the initial

asset to compete with their conventional competitors.

The competition is not only to attract people to shop

but also to invest. The development of sharia com-

panies certainly requires a source of funds to support

their capital. For this reason, there is a need to con-

duct studies on building good corporate values to at-

tract investors to invest in sharia companies.

To obtain good corporate value, sharia companies

need to implement a corporate governance system to

achieve a good and relevant system. It underlies the

emergence of agency theory, which states that good

companies must be run under the same goals between

principals and agents. If both have the same purpose,

then the agent will implement and support whatever

ordered by the principal. Good corporate governance

practice isproven to be able to build an optimistic

market reputation in the capital market (Tong and Ju-

narsin, 2013).

Increasing the value of sharia companies is a mat-

ter that needs to be considered because high corporate

value will be followed by high level of prosperity of

principals (Ehrhardt and Brigham, 2016). The mea-

sure of corporate value is reflected through the value

of shares of the company (Fama and French, 1998).

By paying attention to this, it is expected that later the

sharia corporate governance system can improve the

company’s reputation and attract investors to invest in

sharia companies.

Some researchers raise questions about the pos-

itive relationship between corporate governance and

corporate value due to the high costs of implementing

effective corporate governance mechanisms in com-

panies that can offset the benefits (Mai et al., 2017).

Responding to this, the authors are interested in ob-

serving the extent to which the Sharia corporate gov-

ernance mechanisms influence the building of corpo-

rate value.

22

Fadhillah, R. and Burhany, D.

The Mechanism of Corporate Governance, Financial Performance and Corporate Values in Sharia Companies in Indonesia.

DOI: 10.5220/0009857500220034

In Proceedings of the International Conference on Creative Economics, Tourism and Information Management (ICCETIM 2019) - Creativity and Innovation Developments for Global

Competitiveness and Sustainability, pages 22-34

ISBN: 978-989-758-451-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Law theory and corporate governance state that

board independence, management ownership, and

shareholder ownership are important elements of the

overall corporate governance system (Jentsch, 2019).

The theories put forward predict that there is a relation

between the mechanism of corporate governance and

the value of the company. Corporate governance is

a mechanism that aims to convince investors to carry

out the company management which is in accordance

with their interests (Handriani and Robiyanto, 2019).

The relationship between the mechanism of cor-

porate governance and value building in sharia com-

panies is an interesting phenomenon to observe. This

is because, in sharia perspective, the mandate given

from investment activities between principals and

agents must not be mistreated.

The practice of corporate governance can increase

corporate value (Johl et al., 2016). The application of

effective governance practices is expected to increase

corporate value and reduce vulnerable conflicts of in-

terest between principals and agents, prevent infor-

mation asymmetry and improve managerial efficiency

(Utama and Musa, 2011).

Seeing from the perspective of sharia, conflict that

occurs in the practice of corporate governance is a

form of breach of trust given to the agent. Hadiths

say that trust breaking is a forbidden action is said to

be one of the characteristics of hypocrites, as narrated

by Abu Hurairah ”There are three signs of the hyp-

ocrites; lie when he speaks, deny when he promises,

and betray when he is trusted”.

Several studies have been conducted to examine

the effect of institutional ownership, the composi-

tion of independent commissioners, and the size of

commissioners board toward companies in Indonesia.

However, the results are inconclusive and depend on

the specific conditions of each company. The inter-

esting thing about this current research is that the re-

searchers tried to see the effect of those variables to-

ward Sharia companies in Indonesia. Therefore, the

purpose of this study is to determine the effect of

the corporate governance mechanisms on the value of

Sharia companies in Indonesia.

2 LITERATURE REVIEW AND

DEVELOPMENT OF

HYPOTHESES

2.1 Corporate Governance and Practice

in Indonesian Companies

The Indonesian Institute for Corporate Governance

defines corporate governance as a process, structure,

and mechanism applied in running a company, the

main goal is to increase shareholder value in the

long term while also paying attention to the interests

of other stakeholders . Whereas Tong and Junarsin

(2013) define corporate governance as a concept that

is based on agency theory and is expected to function

as a tool to convince investors that they will receive

refund of what they have invested (Tong and Junarsin,

2013).

Corporate governance was born from the momen-

tum of the collapse of several companies in the world,

such as Enron and WorldCom, and also the finan-

cial crisis in Asia that occurred in 1998. This has

previously been discussed in the theories of Jensen

and Meckling (1976) which describe the impact and

importance of implementating corporate governance

(Jensen and Meckling, 1979). Even long before,

Islam has advocated implementing corporate gover-

nance system as stated in QS. Al-Baqarah: 282-283.

Explicitly the separation between company own-

ership and company control is important to consider.

When the company control is not carried out by the

owner but left to other parties (to manage company

resources), it will potentially create problems be-

tween the owner (principal) and the manager ( agent),

which is often referred to as agency problem (Means,

2017). Agency theory explains the relationship be-

tween shareholders (principals) who instruct other

people (agents) to do a service in the name of the prin-

cipals and authorize them to make the best decision

for the principals (Jensen and Meckling, 1979). More

specifically, the concept of corporate governance is

a set of rules that form relationships between share-

holders, managers, creditors, governments, employ-

ees, and other interested parties both internally and

externally with regard to their rights and responsibili-

ties (Djanegara, 2008).

Some studies state that there is a positive relation-

ship between corporate governance practices and cor-

porate value (Black et al., 2006). Despite the fact

that good corporate governance will increase corpo-

rate value, Iskander and Chamlou (2000) argue that

the success of corporate governance practices, which

leads to increase in corporate value, can be influenced

The Mechanism of Corporate Governance, Financial Performance and Corporate Values in Sharia Companies in Indonesia

23

by external and internal factors (Iskander and Cham-

lou, 2000).

The internal factors are related to board gover-

nance issues, such as board size, board composi-

tion, board leadership, board compensation, company

size, financial condition, leverage, product unique-

ness, and ownership structure (Adams and Mehran,

2008)(Barnhart and Rosenstein, 1998)(Gillan and

Starks, 2003)(Hermalin and Weisbach, 2001). Mean-

while the external factors refer to corporate gover-

nance mechanisms in the form of legal systems, gov-

ernment policies and the role of the community in

building good corporate governance (Love and Klap-

per, 2002).

Based on agency theory, the purpose of corpo-

rate governance is to minimize conflicts of interest,

not only between agents and principals but also be-

tween all internal and external stakeholders, so as to

create and increase shareholder wealth (Farrar, 2008).

Therefore the effective application of corporate gov-

ernance will result in efficient use of company re-

sources, thus support the company’s growth (OECD,

2004).

In Indonesia the implementation of the corporate

governance system is very important to prevent the

occurrence of economic crisis as in 1998. For this rea-

son the government in collaboration with the National

Committee of Governance Policy creates guidelines

for businesses in implementing corporate governance

(Governance, 2006).

In 2011 the National Committee of Governance

Policy issued guidelines for sharia corporate gover-

nance. This guideline was made because of the de-

velopment of sharia companies in Indonesia. This

guideline explains how the corporate governance sys-

tem for sharia companies should be in operational and

spiritual perspective.

From spiritual point of view, sharia companies are

required to commit to devotion by emphasizing the

moral aspects as shown by the Prophet Muhammad.

Whereas from the operational point of view, sharia

companies are required to function as four pillars;

the country, the scholars, the sharia business people

and the communities that work together synergisti-

cally and continuously to realize the role of humans

the mandate of the caliphate and leadership in man-

aging all resources on earth .

Capulong, Edwards, Webb and Zhuang (2000)

find that Indonesia has less developed capital mar-

ket and weak legal and regulatory framework (Zhuang

et al., 2001). This condition will also impact the in-

ternal mechanisms of corporate governance. There-

fore, in emerging markets such as Indonesia, where

the external governance is less effective and legal pro-

tection is weak, the internal governance mechanisms,

such as governance boards, are important for reducing

conflicts of interest among stakeholders (Young et al.,

2008).

The concept of corporate governance according to

the Forum for Corporate Governance in Indonesia is

a system that directs and controls a company. There-

fore FCGI considers that there are five basic prin-

ciples of GCG implementation; Transparency, Ac-

countability, Responsibility, Independence, and Fair-

ness, which are actually adopted from Islamic values.

Sharia principles contained in GCG are expected to be

able to maintain the management of sharia economic

and financial institutions professionally and maintain

economic, business and social interactions to run in

accordance with applicable game rules and best prac-

tices (Dejavu, 2011).

2.2 Corporate Governance and

Corporate Value

The implementation of corporate governance is a mat-

ter that must be applied in every company. The system

and structure of corporate governance greatly help to

increase shareholders values and accommodate var-

ious stakeholders such as creditors, suppliers, busi-

ness associations, consumers, workers, the govern-

ment and the wider community (Handriani and Ro-

biyanto, 2019). This concept is very well accepted by

the public. Even the performance of the company’s

shares is now determined by the extent of its serious-

ness in implementing corporate governance (Utama

and Utama, 2005). In sharia companies, corporate

governance emphasizes the aspects of Islamic law

about leadership, trust and attitude in managing the

company. There are several studies that support this

theory which state that there is a relationship between

the structure of corporate governance, mechanisms

and corporate values (Singh et al., 2018). However,

there are different research results which show that

there is no significant relationship between the struc-

ture of corporate governance, mechanisms, and finan-

cial performance (Balasubramanian et al., 2008). This

is interesting to study further, especially in Sharia

companies in Indonesia.

2.3 Board Size and Corporate Value

The company’s board as a top management is very

influential in building the corporate value. The prac-

tice of the board has an important role in mobilizing

a company, because of its function as manager and

director of management. In this role, the company

board must monitor the separation between ownership

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

24

and control of the company (Jensen and Meckling,

1979). In emerging markets, the board becomes an

important tool that complements inefficient external

corporate governance mechanisms to reduce conflicts

of interest among all parties involved in the company

(Young et al., 2008). There are three main character-

istics for a proportional board related to composition,

size and structure of leadership (Van den Berghe and

Levrau, 2004).

Board size can influence the dynamics of board

functions within a company. For example, if a com-

pany has a large number of councils, it will potentially

increase the board performance in terms of knowl-

edge and skills. However, the large size of the board

also has the potential to face group dynamics prob-

lems which in turn can make the board less effective

(Van den Berghe and Levrau, 2004).

Corporate boards in sharia companies have differ-

ent structure compared to those in conventional com-

panies. Sharia companies require the function of the

Sharia Supervisory Board. The Sharia Supervisory

Board functions to review the sharia aspects of the

company products. In addition, it also supervises

and provides advice related to preventive actions, im-

provements, and proposals for temporary termination

of activities if there is indication sharia rule breaking.

However, it is very unfortunate that based on ob-

servation, all Sharia companies in Indonesia which

are included in the Jakarta Islamic Index category

have not had Shariah Supervisory Board yet. There-

fore, this variable cannot be included in the research

even though the function of this board is important

to differentiate the sharia companies and the conven-

tional one. It is also interesting to find out how influ-

ential the Shariah Supervisory Board is towards the

corporate value of sharia companies.

Jaafar and El-Shawa (2009) state that the board

size affects corporate value (Jaafar and El-Shawa,

2009). However, other studies state the opposite, that

there is no influence of board size on corporate value

(Nuryanah and Islam, 2011). This difference in the-

ory can occur because the implementation of corpo-

rate governance varies across countries as it is influ-

enced by the economic system, law, ownership struc-

ture, as well as social and cultural condition.

In this study, the board size is measured based on the

number of directors, commissioners, and audit com-

mittees. Therefore, the hypotheses proposed are:

Hypothesis 1a: The size of the commissioner influ-

ences financial performance

Hypothesis 1b: The size of the commissioner influ-

ences the value of the company

Hypothesis 1c: The size of the commissioner influ-

ences the value of the company mediated by financial

performance

Hypothesis 2a: The size of directors influences finan-

cial performance

Hypothesis 2b: The size of directors influences the

value of the company

Hypothesis 2c: The size of directors influences the

value of a company mediated by financial perfor-

mance

Hypothesis 3a: The size of the audit committee influ-

ences financial performance

Hypothesis 3b: The size of the audit committee influ-

ences the value of the company

Hypothesis 3c: The size of the audit committee influ-

ences the value of the company mediated by financial

performance

2.4 Independent Board and Corporate

Value

The composition of the board in a company is im-

portant to consider. Many theories suggest the ideal

composition of the size of the board in a company.

Apart from those theories, there needs to be an in-

dependent council in the corporate governance mech-

anism that contributes to increasing the value of the

company (Nuryanah and Islam, 2011).

The National Committee of Governance Policy

(KNKG) hints in the General Guidelines for Sharia

Business Goood Governance (GGBS) that sharia

business companies must have an independent com-

missioner who functions on the behalf of minority

shareholders, who becomes the chairperson of the

committees, who is formed by the commissioners by

supervising and providing advice to directors. Lead-

ership and the size of independent commissioners is

a significant predictor of corporate value (Nuryanah

and Islam, 2011). This supports Berle and Means the-

ory (1932) which states that the independent commis-

sioner increases the effectiveness of supervision and

the role of board strategic plan that lead to better com-

pany performance (Means, 2017).

This study takes the size of the independent board of

commissioners as the variable under study. Therefore,

the hypotheses proposed are:

Hypothesis 4a: The size of independent commission-

ers influences financial performance

Hypothesis 4b: The size of independent commission-

ers influences the value of the company

Hypothesis 4c: The size of independent commission-

ers influences the value of the company mediated by

financial performance

The Mechanism of Corporate Governance, Financial Performance and Corporate Values in Sharia Companies in Indonesia

25

2.5 Institutional Ownership and

Corporate Value

This research is based on agency theory. The concept

of agency problems by Jensen and Meckling (1976)

states that agency problems will occur if the propor-

tion of institutional ownership of company shares is

less than 100%, which makes managers become self-

ish and the implementation is not based on maximiz-

ing corporate value in making investment decisions

(Jensen and Meckling, 1979).

At a very high level of ownership, there is a ten-

dency for institutional investors to enforce certain

policies that are not optimal, regardless of minor-

ity shareholders interests through their voting rights

(Handriani and Robiyanto, 2019). This is the rea-

son why institutional ownership must exist in each

company, to help encourage more optimal supervision

which will have an impact on ensuring the prosperity

of the shareholders.

Institutional ownership in management has a role

to minimize agency conflicts that often occur between

principals and agents (Demsetz and Lehn, 1985).

Shleifer and Vishny (1997) argue that the level of

institutional ownership in proportion will substan-

tially affect the company’s market value (Shleifer and

Vishny, 1997). This is in line with the research con-

ducted by Handriani and Robiyanto (2019) which

states that there is a positive influence between in-

stitutional ownership and corporate value (Handriani

and Robiyanto, 2019). The basis of this argument

is the greater institutional ownership, the more effec-

tive control mechanisms toward management perfor-

mance which result in reducing risk of agency con-

flict.

Institutional ownership is one of the proxy vari-

ables of the corporate governance structure that acts

as a control mechanism in mobilizing the company so

that it has an impact on maximizing the company’s

performance on profitability and corporate value. The

ability to produce good profitability will affect the

value of the company (Modigliani and Miller, 1959).

Therefore, the level of institutional ownership of a

company can be a determinant to achieve good cor-

porate governance.

Consistency in implementing the corporate gover-

nance system is part of the control mechanism to

maintain the value of the company. Then hypothe-

ses 1a, 1b, and 1c are formulated as follows:

Hypothesis 5a: Institutional ownership influences fi-

nancial performance

Hypothesis 5b: Institutional ownership influences the

value of the company

Hypothesis 5c: Institutional ownership influences the

value of a company mediated by financial perfor-

mance

2.6 Managerial Ownership and

Corporate Value

In emerging markets the impact of managerial own-

ership cannot be ignored. It is due to the fact that

the problem of alignment of interests is always a ma-

jor problem between agents and principals (Ahmed

et al., 2019). In the hypothesis of interest alignment,

the problem of aligning interests between agents and

principals decreases by increasing managerial owner-

ship (Chen and Chuang, 2009).

Managerial ownership is regarded as one of the

important instruments in the implementation of cor-

porate governance. This is due to its effectiveness

which can help resolve conflicts between agents and

principals (Brickley et al., 1988). According to No-

radiva and Parastou (2016), managerial ownership

motivates managers to monitor company performance

positively in order to increase their return on own-

ership in the company (Noradiva et al., 2016). Pre-

vious studies have clearly demonstrated that higher

level of managerial ownership contributes to higher

level of corporate performance and corporate value

(Sun et al., 2016).

By considering the importance of managerial owner-

ship in a company, the hypothess proposed are as fol-

lows:

Hypothesis 6a: Managerial ownership influences fi-

nancial performance

Hypothesis 6b: Managerial ownership influences the

value of the company

Hypothesis 6c: Managerial ownership influences the

value of a company mediated by financial perfor-

mance

2.7 Financial Performance and

Corporate Value

Financial performance is a description of financial

conditions that can be a benchmark for the success of

a company. It can be said to have correlation with cor-

porate value because there is a reciprocal relationship

that the change in financial performance will affect

the value of the company. Bhat et al (2018) explaine

that there is a positive influence between financial per-

formance and corporate value (Bhat et al., 2018). In

addition, another theory also says that financial per-

formance can mediate corporate governance on cor-

porate value (Jentsch, 2019).

This study focuses on measuring financial perfor-

mance with the proxy Return on Assets (ROA) as a

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

26

mediating variable and corporate value with Tobins’

Q as the dependent variable. Therefore, the hypothe-

sis proposed is:

Hypothesis 7a: Financial performance influences the

value of the company.

3 METHOD

The population in this study were all companies in-

cluded in the category of the Jakarta Islamic Index

on the Indonesia Stock Exchange, period of 2010-

2017. The research used purposive sampling method

with company criteria are: (1) companies listed as

sharia shares in JII (Jakarta Islamic Index) from 2010

to 2017; (2) having an annual report during the ob-

served period; (3) recorded for 4 years at JII during

the observation period; and (4) having data and in-

formation that can be accessed relating to the value

of all variables studied. This study used path analysis

with a combined regression model approach. The data

used in this study were quantitative using panel data

which is a combination of time series (lots of time)

and Cross Sectional (many companies).

4 VARIABLE DEFINITIONS AND

OPERATIONS

This study used internal corporate governance mecha-

nisms proxied by institutional ownership, managerial

ownership, and independent boards, as well as board

size that is proxied by the size of commissioner, board

of directors and the audit committee. Meanwhile, the

dependent variable is corporate value, proxied in To-

bins’ Q, and financial performance variable with the

proxy Return on Assets (ROA) as an intervening vari-

able. The independent variable in this study describes

the corporate governance policy in the structure of

good corporate governance, which consists of; first,

institutional ownership proxied by using the percent-

age indicator of the number of shares held by the insti-

tution; second, managerial ownership proxied by us-

ing the percentage indicator of the number of shares

held by company managers; third, the composition of

the independent commissioners proxied by using in-

dicators of the number of independent commission-

ers in the company, and fourth, the size of the board

proxied by using indicators of the number of commis-

sioners board members, directors board members and

audit committee of a company.

space

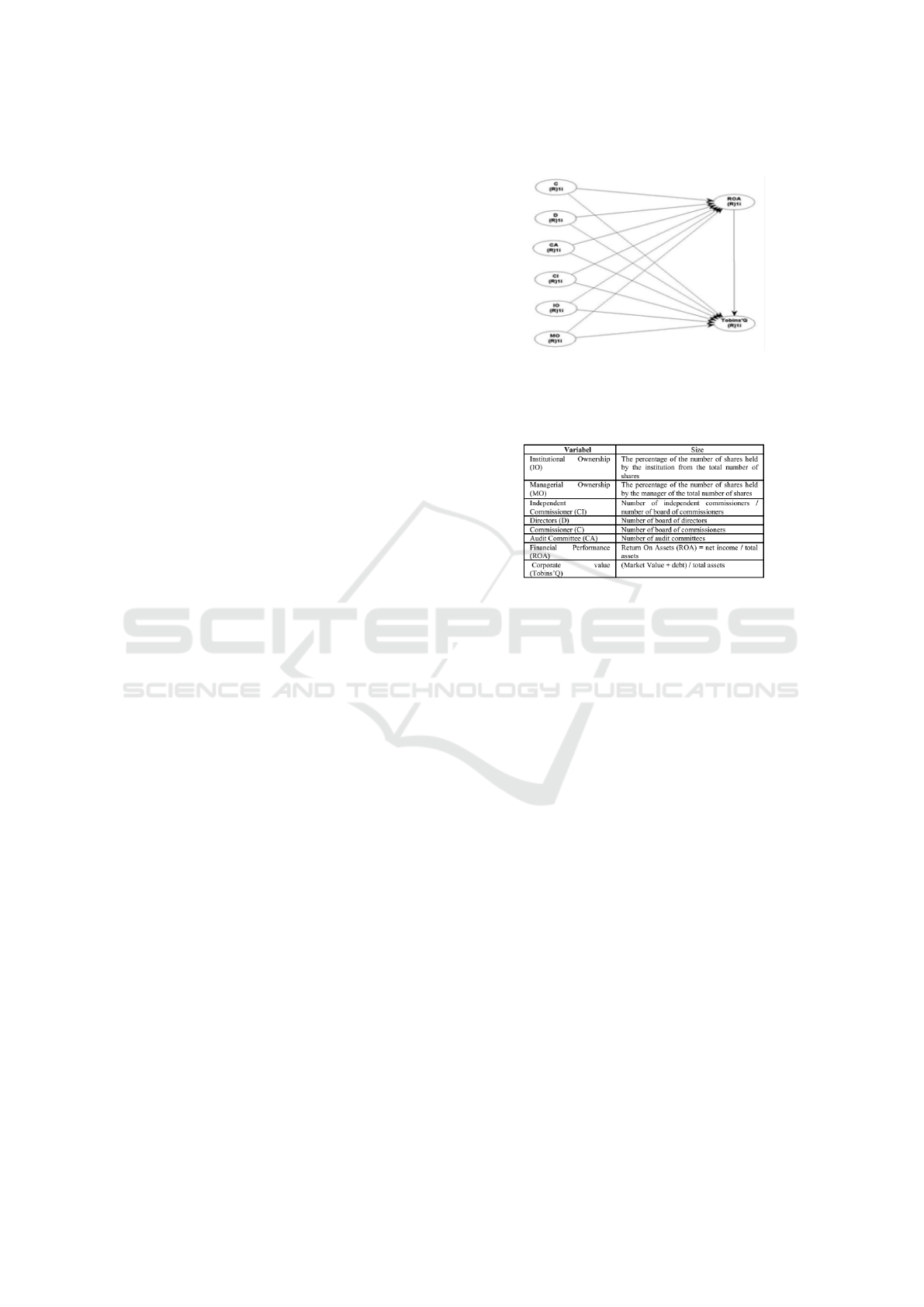

Figure 1: Relationship between variables in the PLS model

Further explanation of the measurement of various

research variables and indicators used in this study is

presented in Figure 2.

Figure 2: Research variable. Source: WarpPLS 6.0 results

(data processed in 2019)

5 STATISTICS RESULTS AND

SUMMARY

5.1 Fit Model

Based on the results of testing using WarpPLS 6.0

(based on WarpPLS User Manual: Version 6.0 (Kock,

2017)), it is possible to obtain a fit model calculation

to evaluate whether the model fit is appropriate or sup-

ported by the following data :

The Mechanism of Corporate Governance, Financial Performance and Corporate Values in Sharia Companies in Indonesia

27

space

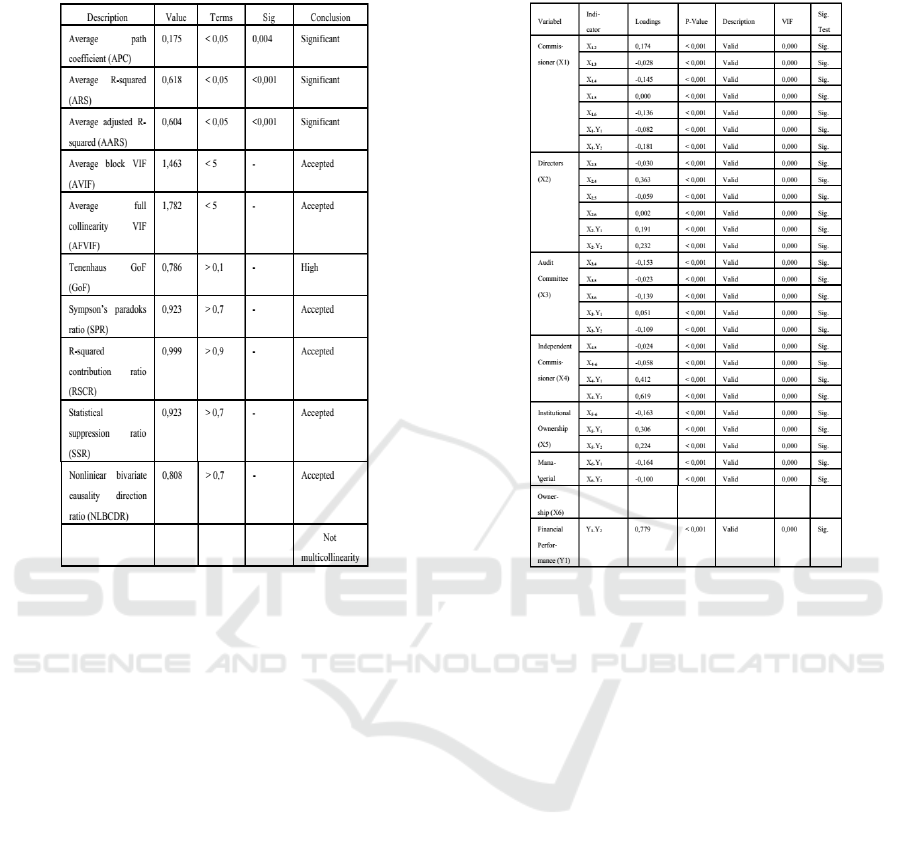

Figure 3: Model Fit Analysis. Source: WarpPLS 6.0 results

(data processed in 2019)

The output results show that APC, ARS and

AARS are significant so that they meet the criteria

of goodness of fit model (p value meets the require-

ments <0.05). AVIF and AFVIF values have also met

the accepted conditions of less than 5 which indicates

the absence of multicollinearity in the model.

5.2 The Evaluation of Measurement

Model (Outer Model)

The summary of combined loading and cross-loading

output in the WarPLS 6.0 program used for the

indicators of each variable under study is presented

in Figure 4 below.

space

Figure 4: Output Combined Loadings and Cross-Loadings

& Indicator Weight. Source: WarpPLS 6.0 results (data pro-

cessed in 2019)

Based on Figure 4, it can be described that the in-

dicator results of weight variableof institutional own-

ership, managerial ownership, board size, commis-

sioner size, audit committee size, independent com-

missioner size, financial performance and corporate

value are significant. This means that these indica-

tors are significant to measure the variables used in

the study. Then, the VIF value is less than 2.5. It is

concluded that there is no multicollinearity.

5.3 The Evaluation of Structural Model

(Inner Model)

The evaluation of structural model relates to evalu-

ating the relationship between latent variables by as-

sessing the coefficient determination, instrument re-

liability, discriminant validity, full colliniearity test,

and predictive validity. Figure 5 presents the various

results needed to evaluate the structural model (inner

model).

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

28

space

Figure 5: Structural Model Testing Results (Inner Model).

Source: WarpPLS 6.0 results (data processed in 2019)

construct variance / criterion can be explained by

the construct hypothesized to influence it (exogenous

/ predictor). R value (squared) 0.75; 0.50; and 0.25

for each endogenous latent variable in the structural

model can be interpreted as substantial, moderate,

and weak. R (squared) construct of financial perfor-

mance with proxy ROA of 0.399 shows that the vari-

ance of financial performance can be explained by

39.9% by the variance in the size of the board of com-

missioners, directors, audit committees, independent

commissioners, institutional ownership and manage-

rial ownership. This shows the strong ability of the

board of commissioners, directors, audit committees,

independent commissioners, institutional ownership

and managerial ownership in explaining the variance

of financial performance. R (squared) construct of

corporate value with Tobins’Q proxy of 0.837 shows

that the variance of corporate value can be explained

by 83.7% by the variance of board of commission-

ers, directors, audit committees, independent com-

missioners, institutional ownership, managerial own-

ership and financial performance.

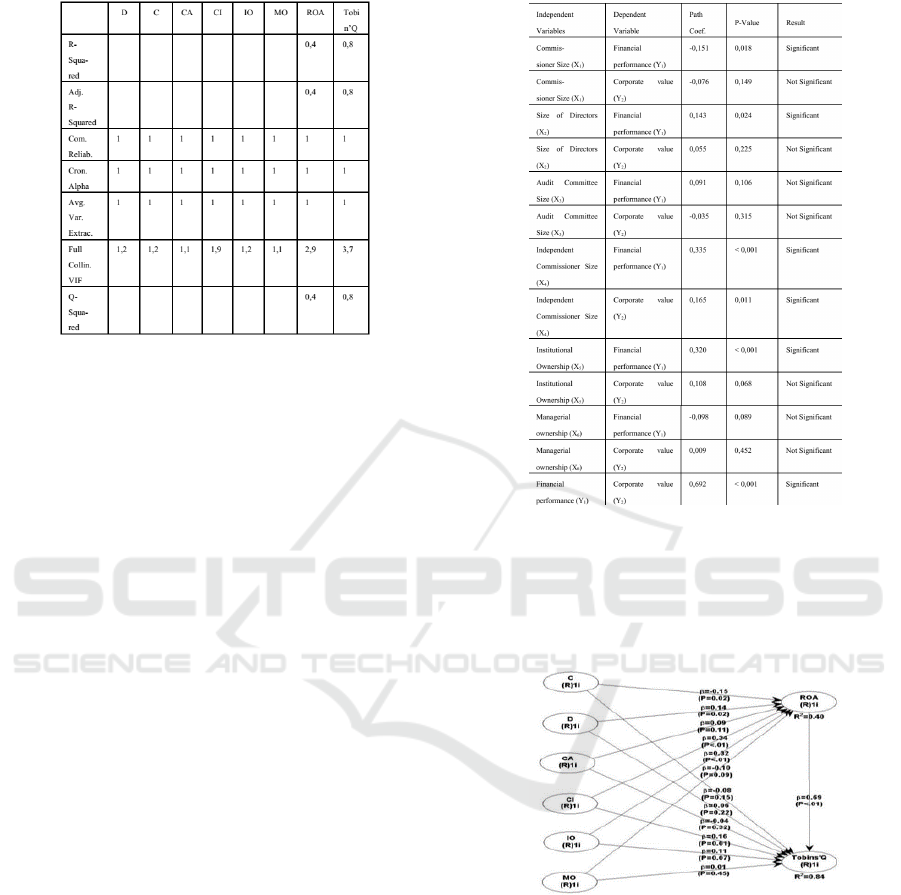

5.4 Hypotheses Testing Results

Complete hypotheses testing results of direct influ-

ence can be seen in Figure 6 below.

space

Figure 6: Summary of Results of Direct Influence Hypothe-

sis Testing.Source: WarpPLS 6.0 results (data processed in

2019)

Furthermore, the results of the complete path anal-

ysis are also presented in the form of image as shown

in the following Figure 7.

Figure 7: Results of PLS-Path Analysis

In accordance with Figure 5 and Figure 7, the re-

sults of hypotheses testing can be explained directly

from the variables as follow:

1. Hypothesis 1a states that commissioner size in-

fluences financial performance. The test result

shows path coefficients of -0.151 (p = 0.018). This

means that H1a is accepted; the size of the com-

missioner (X1) has an effect on financial perfor-

mance (Y1). The path coefficient value of -0.151

shows that the size of the commissioner (X1) has

a significant negative effect on financial perfor-

mance (Y1).

The Mechanism of Corporate Governance, Financial Performance and Corporate Values in Sharia Companies in Indonesia

29

2. Hypothesis 1b states that the size of the commis-

sioner influences the value of the company. The

test result shows path coefficients of -0.076 (p =

0.149). This means that H1b is rejected; the size

of the commissioner (X1) does not affect the value

of the company (Y2).

3. Hypothesis 2a states that the size of directors in-

fluences financial performance. The test result

shows path coefficients of 0.143 (p = 0.024). This

means that H2a is accepted; the size of the board

of directors (X2) has an effect on financial perfor-

mance (Y1). The path coefficient value of 0.143

indicates that the size of the board of directors

(X2) has a significant positive effect on financial

performance (Y1).

4. Hypothesis 2b states that the size of directors in-

fluences the value of the company. The test result

shows path coefficients of 0.055 (p = 0.225). This

means that H2b is rejected; the size of the board of

directors (X2) does not affect the corporate value

(Y2).

5. Hypothesis 3a states that the size of the audit com-

mittee influences financial performance. The test

result shows path coefficients of 0.091 (p = 0.106).

This means that H3a is rejected; the size of the

audit committee (X3) has no effect on financial

performance (Y1).

6. Hypothesis 3b states that the size of the audit com-

mittee influences the value of the company. The

test result shows path coefficients of -0.035 (p =

0.315). This means that H3b is rejected; the size

of the audit committee (X3) does not affect the

value of the company (Y2).

7. Hypothesis 4a states that the size of independent

commissioners influences financial performance.

The test result shows path coefficients of 0.335 (p

= ¡0.001). This means that H4a is accepted; the

size of an independent commissioner (X4) has an

effect on financial performance (Y1). The path

coefficient value of 0.335 indicates that the size

of the independent commissioner (X4) has a sig-

nificant positive effect on financial performance

(Y1).

8. The 4b hypothesis states that the size of indepen-

dent commissioners influences the value of the

company. The test result shows path coefficients

of 0.165 (p = 0.011). This means that H4b is ac-

cepted; independent commissioner size (X4) has

an effect on corporate value (Y2). The path coef-

ficient value of 0.165 indicates that the size of the

independent commissioner (X4) has a significant

positive effect on corporate value (Y2).

9. Hypothesis 5a states that institutional ownership

affects financial performance. The test result

shows path coefficients of 0.320 (p = ¡0.001). This

means that H5a is accepted; institutional owner-

ship (X5) has an effect on financial performance

(Y1). The path coefficient value of 0.320 indicates

that institutional ownership (X5) has a significant

positive effect on financial performance (Y1).

10. Hypothesis 5b states that institutional ownership

affects the value of the company. The test result

shows path coefficients of 0.108 (p = 0.068). This

means that H5b is rejected; institutional owner-

ship (X5) has no effect on corporate value (Y2).

11. Hypothesis 6a states that managerial ownership

influences financial performance. The test result

shows path coefficients of -0.098 (p = 0.089). This

means that H6a is rejected; managerial ownership

(X6) does not affect financial performance (Y1).

12. Hypothesis 6b states that managerial ownership

affects the value of the company. The test result

shows path coefficients of 0.009 (p = 0.452). This

means that H6b is rejected; managerial ownership

(X6) does not affect corporate value (Y2).

13. Hypothesis 7a states that financial performance

has an effect on corporate value. The test result

shows path coefficients of 0.692 (p = ¡0.001). This

means that H7a is accepted; financial performance

(Y1) has an effect on corporate value (Y2). The

path coefficient value of 0.692 indicates that fi-

nancial performance (Y1) has a significant posi-

tive effect on corporate value (Y2).

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

30

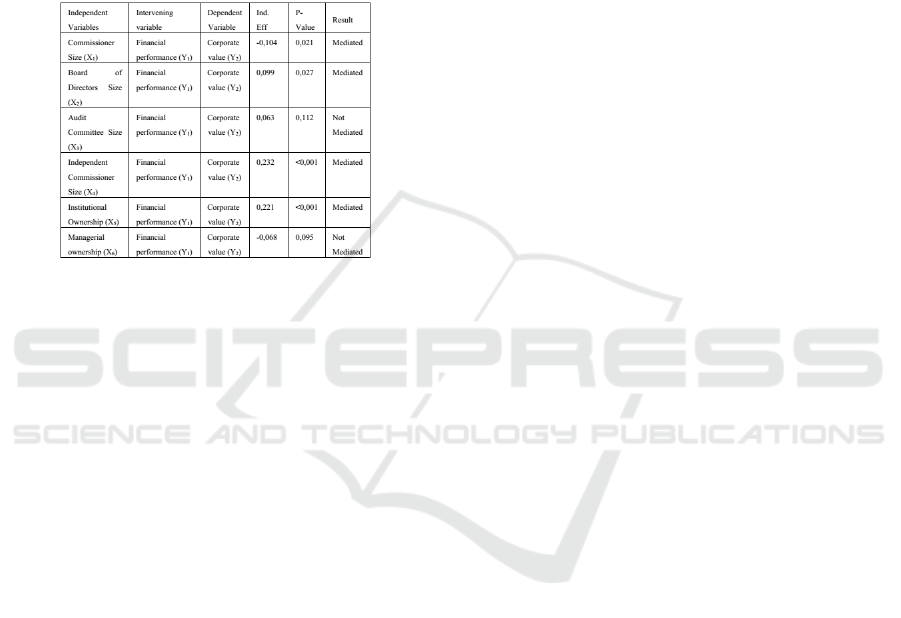

Furthermore, there are results of testing indirect ef-

fects as a follow-up of testing the direct effect be-

tween the variables. The test is related to financial

performance (Y1) as an intervening variable from the

direct influence between variables, which are the in-

fluence of size of board of commissioner (X1), direc-

tors (X2), audit committee (X3), independent com-

missioner (X4), institutional ownership ( X5), man-

agerial ownership (X6) toward corporate value (Y2).

In summary, the results of mediation testing are pre-

sented in Figure 8 as follows:

Figure 8: Summary of Hypothesis Testing Results Indirect

Effects of Intervening Variables. Source: WarpPLS 6.0 re-

sults (data processed in 2019)

In accordance with Figure 8, the results of testing

the hypotheses of direct influence between variables

are as follows:

1. The 1c hypothesis states that the size of the com-

missioner influences the value of the company

mediated by financial performance. The test result

shows indirect effects of -0.104 (p = 0.021). This

means that H1c is accepted; the size of the com-

missioner (X1) affects the value of the company

(Y2) mediated by financial performance (Y1).

2. Hypothesis 2c states that the size of directors in-

fluences the value of the company mediated by

financial performance. The test result shows in-

direct effects or an indirect effect of 0.099 (p =

0.027). This means that H2c is accepted; the size

of the board of directors (X2) affects the value of

the company (Y2) mediated by financial perfor-

mance (Y1).

3. The 3c hypothesis states that the size of the audit

committee affects the value of the company me-

diated by financial performance. The test result

shows indirect effects or indirect effects of 0.063

(p = 0.112). This means that H3c is rejected; the

size of the audit committee (X3) does not affect

corporate value (Y2) mediated by financial per-

formance (Y1).

4. The 4c hypothesis states that the size of indepen-

dent commissioners influences the value of the

company mediated by financial performance. The

test result shows indirect effects of 0.232 (p =

¡0.001). This means that H4c is accepted; inde-

pendent commissioner size (X4) influences corpo-

rate value (Y2) mediated by financial performance

(Y1).

5. The 5c hypothesis states that institutional owner-

ship affects the value of a company mediated by

financial performance. The test result shows in-

direct effects of 0.221 (p = ¡0.001). This means

that H5c is accepted; institutional ownership (X5)

affects corporate value (Y2) mediated by financial

performance (Y1).

6. The 6c hypothesis states that managerial owner-

ship affects the value of a company mediated by

financial performance. The test result shows in-

direct effects of -0.068 (p = 0.095). This means

that H5c is rejected; managerial ownership (X6)

does not affect corporate value (Y2) mediated by

financial performance (Y1).

6 DISCUSSION

This study aims to determine the effect of commis-

sioner size, board size, audit committee size, inde-

pendent commissioner size, institutional ownership,

and managerial ownership toward corporate value

with financial performance as an intervening variable.

Based on the results of the study it is known that the

size of the board of commissioners, directors, and au-

dit committee which include in the board size cate-

gory do not affect financial performance optimally.

The board size and commissioner size influence the

financial performance while the size of the audit com-

mittee does not. However, this can be considered as

enough because the commissioners and directors are

the top management in the company who have major

influence on the performance of the company. There-

fore, these two functions need to work together so that

the achievement of better corporate performance can

be achieved. The function carried out by the directors

and commissioners is the mandate given to both. It

is not easy because these two functions act as super-

visors and decision makers in the company. Keep in

mind that each position given is a mandate from the

principal and must be accounted later. In the perspec-

tive of sharia, every mandate given should be properly

fulfilled as stated in the surah An-Nisa: 58. It is im-

portant to keep the mandate, because the one who is

not keeping it can be categorized as a hypocrite as

mentioned in the hadith of the Prophet Muhammad.

The Mechanism of Corporate Governance, Financial Performance and Corporate Values in Sharia Companies in Indonesia

31

Regarding the audit committee that does not have

a direct influence on financial performance, it is in

line with previous research conducted by Nuryanah

and Islam (2011) which states that there is no signif-

icant effect of audit committee size toward company

performance in developing countries such as Indone-

sia, where capital markets are still developing and cor-

porate governance systems are still weak (Nuryanah

and Islam, 2011), even though the function of audit

committee can reduce the emergence of internal con-

trol problems (Krishnan, 2005). The audit commit-

tee is formed to assist the supervisory function of the

directors board in order to increase financial disclo-

sures (Nuryanah and Islam, 2011). In the corporate

governance system in Indonesia the audit committee

is a support committee of the commissioners board .

Therefore, the results of the research test which states

that there is no influence of the audit committee on the

company’s performance is still acceptable, because of

its role in the corporate governance system as support-

ing the board of commissioners.

Other test result in this study indicates that board

size proxied by commissioner size, director size, and

audit committee size do not affect corporate value.

The same result is also shown by Nuryanah and Is-

lam (2011) which also states the insignificant results

of board size toward corporate value (Nuryanah and

Islam, 2011). These results can be interpreted that no

matter how large the size of the board is, it cannot

improve the company’s reputation.

This study also examines the indirect influence be-

tween board size and corporate value mediated by fi-

nancial performance. The results of this test show that

the size of the board with the proxy size of commis-

sioners and directors influences the value of the com-

pany mediated by financial performance. Meanwhile,

the audit committee has no effect on the value of the

company mediated by financial performance. These

results are interpreted that companies with board size

must focus on financial performance to obtain good

corporate value in the eyes of investors.

This study also shows that the size of an inde-

pendent board proxied by independent commission-

ers has a significant effect on financial performance

and corporate value. This result supports the theory

of Berle and Means (1932) who argue that an inde-

pendent commissioner can improve the effectiveness

of supervision and the role of board strategic plann

that leads to better company performance (Means,

2017). The independent board in the corporate gov-

ernance system is an important attribute that can im-

prove company performance, because leadership and

the size of independent commissioners are significant

predictors of corporate value (Nuryanah and Islam,

2011). In line with these results, the other research

result also says that there is an indirect influence be-

tween independent board of commissioners and cor-

porate value mediated by financial performance.

This study also presents the result of the influence

of institutional ownership and managerial ownership

on financial performance and corporate value. The

result claims that institutional ownership has a signif-

icant effect on financial performance but does not af-

fect the value of the company. Meanwhile, manage-

rial ownership does not affect financial performance

and corporate value. Institutional ownership has an

influence on financial performance because principals

can monitor and discipline the company agents. In-

stitutional principals who do not have a large busi-

ness relationship are likely to provide better moni-

toring which can then increase the company’s output

and value (Huddart, 1993). This type of ownership

will provide independent monitoring activities which

then ensure management to carry out company oper-

ations in the principal’s best benefits (Nuryanah and

Islam, 2011). However, in testing the indirect effects,

it is obtained that institutional ownership influences

the value of the company mediated by financial per-

formance. This explains that financial performance is

an important proxy in the company to maximize cor-

porate value.

Managerial ownership does not affect financial

performance and corporate value. In addition, the re-

sults of the indirect influence test show that manage-

rial ownership does not affect the value of the com-

pany through financial performance. It can be inter-

preted as one of the effects of the weak implemen-

tation of corporate governance in Indonesia, because

there are still many companies in the JII category that

do not implement managerial ownership in the com-

pany. There are a lot of literatures that show that some

aspects of management ownership will increase the

sense of ownership of the company which motivates

the managers to run the company optimally. There-

fore, this aspect, if applied optimally, can suppress

the occurrence of corporate conflicts and information

asymmetry, because the agent feels that they own the

company and minimize the excess agency cost.

7 CONCLUSION

Increasing corporate value is an important thing that

must be conducted to attract investors to invest their

capital in the company. A good corporate value can

be formed by implementing a corporate governance

system. The corporate governance system in this

study is represented by corporate governance mech-

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

32

anisms, namely the board of commissioners, board

of directors, audit committees, independent commis-

sioners, institutional ownership and managerial own-

ership. The results obtained from the direct effect

test in the form of all mechanisms influence the finan-

cial performance, except for the audit committee and

managerial ownership. In another test it was found

that all mechanisms, except for independent commis-

sioners, do not influence the value of the company.

Whereas in the indirect effect test it is found that all

governance mechanisms, except the audit committee

and managerial ownership, have an effect on the value

of the company with mediated financial performance.

8 LIMITATIONS AND

IMPLICATIONS

This research is limited to the internal mechanism of

corporate governance towards the value of the com-

pany by not involving external mechanisms that might

obtain more varied and relevant results from exist-

ing research. In addition, the internal mechanism of

sharia corporate governance in this study does not in-

volve the Sharia Supervisory Board which is the hall-

mark of sharia companies. This is because all sharia

companies that are the object of the research do not

yet have a Sharia Supervisory Board.

The implication of this research is that the func-

tion of the audit committee in sharia companies still

has little role in building financial performance and

corporate value. Therefore it does not need too many

audit committees,, but the sharia companies only need

to maximize their performance. Besides, the manage-

rial ownership should be a motivation for managers to

improve financial performance so that it has an impact

on increasing the value of Sharia companies. sharia

companies need to add to the function of the Sharia

Supervisory Board is the right step to strengthen a

positive view of sharia companies.

REFERENCES

Adams, R. B. and Mehran, H. (2008). Corporate perfor-

mance, board structure, and their determinants in the

banking industry. FRB of New York staff report, (330).

Ahmed, A., Khurshid, M. K., and Yousaf, M. U. (2019).

Impact of intellectual capital on firm value: the mod-

erating role of managerial ownership.

Balasubramanian, B. N., Black, B. S., and Khanna, V. S.

(2008). Firm-level corporate governance in emerging

markets: A case study of india. ECGI-Law Working

Paper, 119(2009):08–011.

Barnhart, S. W. and Rosenstein, S. (1998). Board compo-

sition, managerial ownership, and firm performance:

An empirical analysis. Financial Review, 33(4):1–16.

Bhat, K. U., Chen, Y., Jebran, K., and Bhutto, N. A. (2018).

Corporate governance and firm value: a comparative

analysis of state and non-state owned companies in

the context of pakistan. Corporate Governance: The

international journal of business in society.

Black, B. S., Jang, H., and Kim, W. (2006). Does cor-

porate governance predict firms’ market values? ev-

idence from korea. The Journal of Law, Economics,

and Organization, 22(2):366–413.

Brickley, J. A., Lease, R. C., and Smith Jr, C. W.

(1988). Ownership structure and voting on anti-

takeover amendments. Journal of financial eco-

nomics, 20:267–291.

Chen, Y.-R. and Chuang, W.-T. (2009). Alignment or en-

trenchment? corporate governance and cash hold-

ings in growing firms. Journal of Business Research,

62(11):1200–1206.

Dejavu, R. (2011). Penerapan gcg pada perbankan syariah.

Demsetz, H. and Lehn, K. (1985). The structure of corpo-

rate ownership: Causes and consequences. Journal of

political economy, 93(6):1155–1177.

Djanegara, M. S. (2008). Menuju good corporate gover-

nance: suatu kajian empiris. Kesatuan Press.

Ehrhardt, M. C. and Brigham, E. F. (2016). Corporate fi-

nance: A focused approach. Cengage learning.

Fama, E. F. and French, K. R. (1998). Taxes, financing

decisions, and firm value. The journal of Finance,

53(3):819–843.

Farrar, J. (2008). Corporate governance: theories, princi-

ples and practice. Oxford University Press.

Gillan, S. and Starks, L. T. (2003). Corporate governance,

corporate ownership, and the role of institutional in-

vestors: A global perspective. Journal of applied Fi-

nance, 13(2).

Governance, K. (2006). Pedoman umum good corporate

governance indonesia. Jakarta. www. governance-

indonesia. or. id.

Handriani, E. and Robiyanto, R. (2019). Institutional own-

ership, independent board, the board size, and firm

performance: Evidence from indonesia. Contadur

´

ıa

y administraci

´

on, 64(3):10.

Hermalin, B. E. and Weisbach, M. S. (2001). Boards of

directors as an endogenously determined institution:

A survey of the economic literature. Technical report,

National Bureau of Economic Research.

The Mechanism of Corporate Governance, Financial Performance and Corporate Values in Sharia Companies in Indonesia

33

Huddart, S. (1993). The effect of a large shareholder on

corporate value. Management Science, 39(11):1407–

1421.

Iskander, M. and Chamlou, N. (2000). Corporate gover-

nance: A framework for implementation. The World

Bank.

Jaafar, A. and El-Shawa, M. (2009). Ownership concen-

tration, board characteristics and performance: evi-

dence from jordan. Research in accounting in emerg-

ing economies, 9:73–95.

Jensen, M. C. and Meckling, W. H. (1979). Theory of the

firm: Managerial behavior, agency costs, and owner-

ship structure. In Economics social institutions, pages

163–231. Springer.

Jentsch, V. (2019). Board composition, ownership struc-

ture and firm value: Empirical evidence from switzer-

land. European Business Organization Law Review,

20(2):203–254.

Johl, S. K., Khan, A., Subramaniam, N., and Muttakin, M.

(2016). Business group affiliation, board quality and

audit pricing behavior: Evidence from indian compa-

nies. International Journal of Auditing, 20(2):133–

148.

Kock, N. (2017). Warppls user manual: Version 6.0. Script-

Warp Systems: Laredo, TX, USA.

Krishnan, J. (2005). Audit committee quality and internal

control: An empirical analysis. The accounting re-

view, 80(2):649–675.

Love, I. and Klapper, L. F. (2002). Corporate gover-

nance, investor protection, and performance in emerg-

ing markets. The World Bank.

Mai, M. U. et al. (2017). Mediation of csr and profitability

on the influences of gcg mechanisms to the firm value.

Jurnal Keuangan dan Perbankan, 21(2):178932.

Means, G. (2017). The modern corporation and private

property. Routledge.

Modigliani, F. and Miller, M. H. (1959). The cost of capital,

corporation finance, and the theory of investment: Re-

ply. The American Economic Review, 49(4):655–669.

Noradiva, H., Parastou, A., and Azlina, A. (2016). The ef-

fects of managerial ownership on the relationship be-

tween intellectual capital performance and firm value.

International Journal of Social Science and Human-

ity, 6(7):514.

Nuryanah, S. and Islam, S. M. (2011). Corporate gover-

nance and performance: Evidence from an emerging

market. Management and Accounting Review (MAR),

10(1):17–42.

OECD, O. (2004). The oecd principles of corporate gover-

nance. Contadur

´

ıa y Administraci

´

on, (216).

Shleifer, A. and Vishny, R. W. (1997). A survey of corporate

governance. The journal of finance, 52(2):737–783.

Singh, S., Tabassum, N., Darwish, T. K., and Batsakis, G.

(2018). Corporate governance and tobin’s q as a mea-

sure of organizational performance. British Journal of

Management, 29(1):171–190.

Sun, J., Ding, L., Guo, J. M., and Li, Y. (2016). Own-

ership, capital structure and financing decision: Evi-

dence from the uk. The British Accounting Review,

48(4):448–463.

Tong, S. and Junarsin, E. (2013). Do private firms outper-

form soe firms after going public in china given their

different governance characteristics? Gadjah Mada

International Journal of Business, 15(2):133–170.

Utama, C. A. and Musa, H. (2011). The causality between

corporate governance practice and bank performance:

Empirical evidence from indonesia. Gadjah Mada In-

ternational Journal of Business, 13(3).

Utama, S. and Utama, C. A. (2005). Corporate governance

practice and firm value creation: Empirical study in

jakarta stock exchange.

Van den Berghe, L. A. and Levrau, A. (2004). Evaluating

boards of directors: what constitutes a good corporate

board? Corporate Governance: an international re-

view, 12(4):461–478.

Young, M. N., Peng, M. W., Ahlstrom, D., Bruton,

G. D., and Jiang, Y. (2008). Corporate governance

in emerging economies: A review of the principal–

principal perspective. Journal of management studies,

45(1):196–220.

Zhuang, J., Edwards, D., Capulong, M. V. A., et al. (2001).

Corporate Governance & Finance in East Asia: A

Study of Indonesia, Republic of Korea, Malaysia,

Philippines and Thailand. Asian Development Bank.

ICCETIM 2019 - International Conference on Creative Economics, Tourism Information Management

34