Innovation in Corruption Risk Mapping using a Value Chain Map

and Its Application in the Upstream Oil and Gas Industry in

Indonesia

Budi Ibrahim

1,2

, Tony Robey

1

, Haris Wahyudi

3

1

Independent Researcher

2

Advisor Development & Technology, Pertamina UTC

3

Mechanical Engineering Department, Faculty of Engineering, Universitas Mercu Buana, Jakarta

Keywords: Value Chain Map, Corruption Risk, Business Risk, Oil, And Gas Upstream Industry

Abstract: Risk management is perceived as an indivisible part of good management and governance. Identifying risk

and communicating that information is important to all risk management frameworks but at present traditional

frameworks use the perception-based and traditional heat map approach. A corruption risk map of upstream

oil and gas industry integrated with a business risk map, designed on Value Chain Map (VCM) and Value

Chain Analysis (VCA) principals, and combined with a non-geographical map, spatial analysis, and evidence-

based material, are considered an innovation forming part of deliverables from the research entitled Research

on Corruption Risk in Indonesian Upstream Oil & Gas Industry - Mitigation Policy Analysis - Evidence-

Based Approach that is granted by ACE (Anti-Corruption Evidence Research Consortium) led by SOAS

University of London and funded by the Department for International Development (DFID) from the UK

Government. The corruption risk mapping that has been developed is expected to map corruption risks in line,

and integrated with shareholder value, easily communicated and visually apprehensible. The proposed VCM

could be collectively used not only as a risk map by stakeholders but also as a multi-dimensional database to

store and analyze evidence-based data/information, enabling the collaboration and synergy in risk mitigation.

To further ensure the potential use of this VCM-based risk map, both by the upstream oil and gas industry

and by law enforcement, the Special Task Force for Upstream Oil and Gas Business Activities (SKK Migas),

the Corruption Eradication Commission (KPK) and the Financial Transaction Reports and Analysis Center

(PPATK), as related stakeholders, collaborated and supported the development. We conclude that the

proposed VCM can serve as an application and utility of the value chain architecture for cost advantage

purposes.

1 INTRODUCTION

The concept of the value chain (VC) was introduced

by Porter (Porter, 1985) to show activities that a firm

operating in a specific industry can introduce to

deliver a valuable product or service, helping the

company position itself in the pursuit of competitive

advantage against its competitor. Value Chain

Map/Mapping (VCM) is a method that defines the

primary and supporting operations related to the

service or product line of a company and is often used

in management policy to define potential

performance improvement. VCM is the initial process

in value chain analysis to identify main and

supportive business activities and all related

components. The benefit of implementing VCM can

be summarized as follows: a) provides a platform for

communication and discussion with stakeholders, b)

reveals missing information including needs,

impacts, and gaps for each entity in the value chain,

c) expands the perspective of an organization's

external environment; d) helps organizations

prioritize activities and provides stakeholders with a

more tangible description of activities (Mooney,

2014).

Value chain analysis (VCA) is a method in which

a company defines its main activities and supports

activities that contribute value to its final product and

then evaluate these activities to decrease expenses or

boost differentiation. Analysis of the value chain has

been implemented in different areas from the moment

Ibrahim, B., Robey, T. and Wahyudi, H.

Innovation in Corruption Risk Mapping using a Value Chain Map and Its Application in the Upstream Oil and Gas Industry in Indonesia.

DOI: 10.5220/0009442002950302

In Proceedings of the 1st International Conference on Anti-Corruption and Integrity (ICOACI 2019), pages 295-302

ISBN: 978-989-758-461-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

295

it was introduced. It has some advantages to reduce

operational costs, optimize efforts, eliminate waste,

improve health and safety, and increase profitability

(Reese, Waage, Gerwin, & Koch, 2016). There are

two distinct approaches, depending on what sort of

competitive benefit a business wishes to achieve: cost

advantage and differentiation advantage (Jurevicius,

2013). Analysis of the value chain allows

organizations to assess business processes in order to

provide the greatest opportunity to decrease operating

costs, optimize efforts, eliminate waste, enhance

health and safety and boost profitability (Reese et al.,

2016).

Value chains in the oil and gas industry have been

developed to describe business processes in upstream,

midstream, and downstream activities (Elsaghier,

2017; MOGA, 2018; OECD, 2016; Shqairat &

Sundarakani, 2018). OECD describes the process of

value chains in extractive industries from the decision

to extract revenue spending and social investment

projects (OECD, 2016). UNCTAD (UNCTAD, 2012)

and IBEF (Ibef, 2014) classified value chains into

upstream, midstream, and downstream. Sub activities

under each process are divided in more detail by

Olesen (Olesen, 2016) to Upstream (Tender &

Concession, Exploration, Installation, Production,

Field Abandoning); Midstream (Processing, Storage,

Transportation) and Downstream (Sales,

Distribution).

The oil and gas value chain may have a strong

impact on businesses that operate in this sector

because technology is high cost and sophisticated;

exploration is uncertain; there are legal and social

challenges; and transportation and storage needs. In

Indonesia, the oil and gas sector is the economy's

primary player and is strategically important in

promoting future economic viable growth plans. This

industry is one of many sectors that has received a

great deal of attention when it comes to risk

management because the risk exists in every single

operation in upstream, midstream, and downstream

activity. The oil and gas industry in Indonesia is a

significant source of national revenue in tax receipts

and through production sharing contracts (PSCs)

under which a contractor is entitled to a share of total

oil and gas produced to cover exploration and

development costs, while the remaining oil and gas

produced is spilled between the contractor and the

government. This approach has been replicated in

several oil and gas producing countries. However,

PSCs have been at greater risk of corruption than

other systems of extracting value from oil and gas

production. The results and findings of this research

may, therefore, have far-reaching benefits to the anti-

corruption initiatives of other oil-producing nations.

Mitigating risk in the oil and gas industry

commences with effective communication, the same

way as other risk management programs begin.

However, visualization in risk management is not

easy since the risk is extremely difficult to visualize

and describe. One method is by implementing

Enterprise Risk Management (ERM).

ERM has gained organizational attention due to

globalization in the business environment,

technological advancement, innovation in business

operations, and pressure from regulatory bodies to

manage risk in a holistic manner (COSO, 2017). It is

a popular structure employed by businesses to

recognize future occurrences that may influence the

enterprise, handle related hazards and possibilities

and provide reasonable assurance that the goals will

be met (COSO, 2004; Johnson & Johnson, 2018).

However, not all studies about ERM and businesses

have disclosed important beneficial relationships

(Agustina & Baroroh, 2016; Pagach & Warr, 2011;

Quon, Zéghal, & Maingot, 2012). The currently

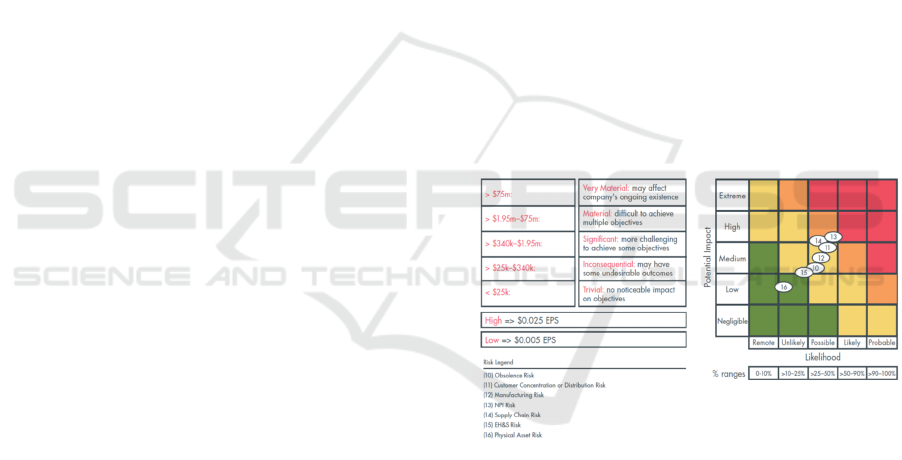

available risk mapping method using the traditional

two axis chart can be seen in Figure 1 (CGMA, 2012).

Figure 1. Risk heat map (CGMA, 2012)

Using this risk heat map in risk mitigation has

caused some difficulties in visualizing and analyzing

risks and interpreting the results. This paper will

suggest these difficulties can be overcome by the

development of a VCM for the upstream oil and gas

industry in Indonesia. We believe that the proposed

VCM is an innovation for both corruption risk and

business risk and would have significant potential

usage for the business environment and law

enforcement. The study will focus on private sector

corruption/ bribery in the industry of upstream oil and

gas in Indonesia.

The research project seeks not only to deliver a

VCM specifically for the upstream oil and gas

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

296

industry of Indonesia but will also be of benefit to

similar operations in other countries. A VCA

consisting of Management Cockpit, DEA (Data

Envelopment Analysis), Benford’s Analysis, House

of Risk, Corruption Risk Map (evidence-based) will

be the initial proof of concept for the developed

VCM.

2 METHODOLOGY

The VCM was developed for the purpose of

mitigating corruption risk, but at the same time, can

be used to reduce business risks in the upstream oil

and gas sector in Indonesia. The VCM model is based

on geospatial mapping to display layers containing

different information and data. VCA can then be

performed on VCM layers containing data and

information in the form of numbers. Based on the

output of the VCA assessment, color gradations are

presented to show a risk map that can be used to map

corruption risks, where this method is commonly

used in the ERM technique.

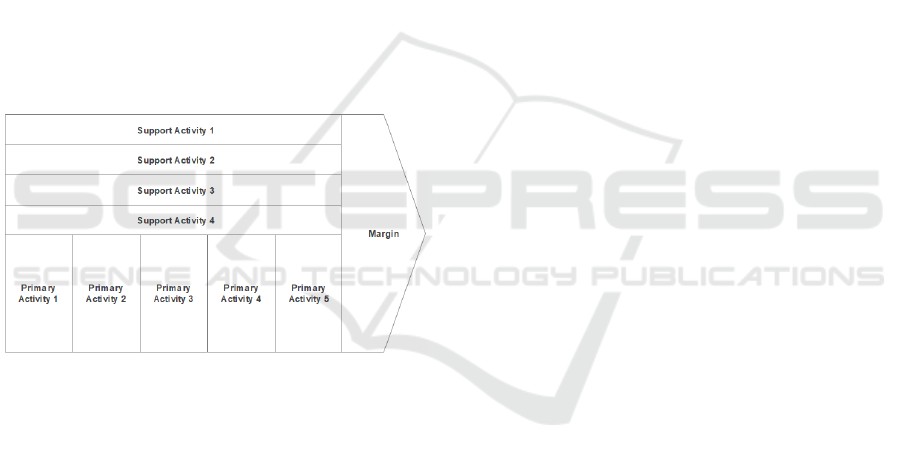

Figure 2. VC Model by Porter (Porter, 1985)

To understand the primary and supporting

activities, related studies were reviewed, following

which these studies, regulatory framework, and

current practice in the context of the upstream oil and

gas industry in Indonesia were evaluated. It is

intended that the value chain conforms with business

processes that have been implemented in upstream oil

and gas in Indonesia, mainly by businesses in the

private sector, such as contractors, vendors, and

traders.

The development of VCM is carried out based on

Porter's value chain method, as shown in Figure 2.

The upper and lower part is defined as supportive and

primary activities, respectively. The primary activity

is considered the successive steps that flow through

the operations process in upstream oil and gas in

Indonesia depicted as the vertical box going from left

to right while support activities in the form of

horizontal boxes are activities that support the process

in the primary activity.

In the process of identifying the business process,

data extraction, and discussion were carried out with

SKK Migas to understand and compile the activities

of each box in the value chain. The processes were

also determined from the regulatory framework in the

context of Indonesia (Undang-Undang RI No. 22,

2011) and SKK Migas Decree Number: KEP-

0078/SKKMA0000/2018/S0 about Proses Bisnis Skk

Migas (SKK Migas, 2018). Current upstream oil and

gas business activities in Indonesia are regulated by

relevant legislation such as Law (Undang-Undang RI

No. 22, 2011), Government Regulation (PP RI No.

59, 2007), Minister of Energy and Mineral Resources

Regulation (Permen ESDM RI No. 52, 2018; Permen

ESDM RI No. 59, 2007), and Governance

Regulations in SKK Migas (PTK, Pedoman Tata

Kerja) (SKK Migas, 2013, 2017, 2019).

Discussions and brainstorming were then

conducted with stakeholders, particularly the Special

Task Force for Upstream Oil and Gas Business

Activities (SKK Migas), The Corruption Eradication

Commission (KPK) and the Financial Transaction

Reports and Analysis Center (PPATK) to ensure that

the process flow in the primary and supporting

activities represented the business processes in the

upstream oil and gas in Indonesia. This step is crucial

in order to have the agreement of VCM business

processes.

For the purpose of analysis, Tableau software was

used to display VCM in the geospatial mode. It was

then used to sketch VCM based on coordinates as a

spatial function. Each box has its own identity

according to the name-value chain attached to it.

Then, Tableau read the Excel file containing financial

data and types of activities. The data was visualized

in the form of a heat map. Values that deviate from

the expected result could be indicators of fraud.

Analysis of data will then be strengthen using Data

Envelopment Analysis (DEA), Benford analysis, and

House of Risk (HoR).

DEA is used to measure the relative efficiency of

each value chain. It can be used to identify whether

the value chain has efficiency (I, S, V, P, & A, 2013;

Putra & Adinugraha, 2018). Any inefficiency could

be caused by corruption (Ashoori, N.A., Mozaffari,

2013).

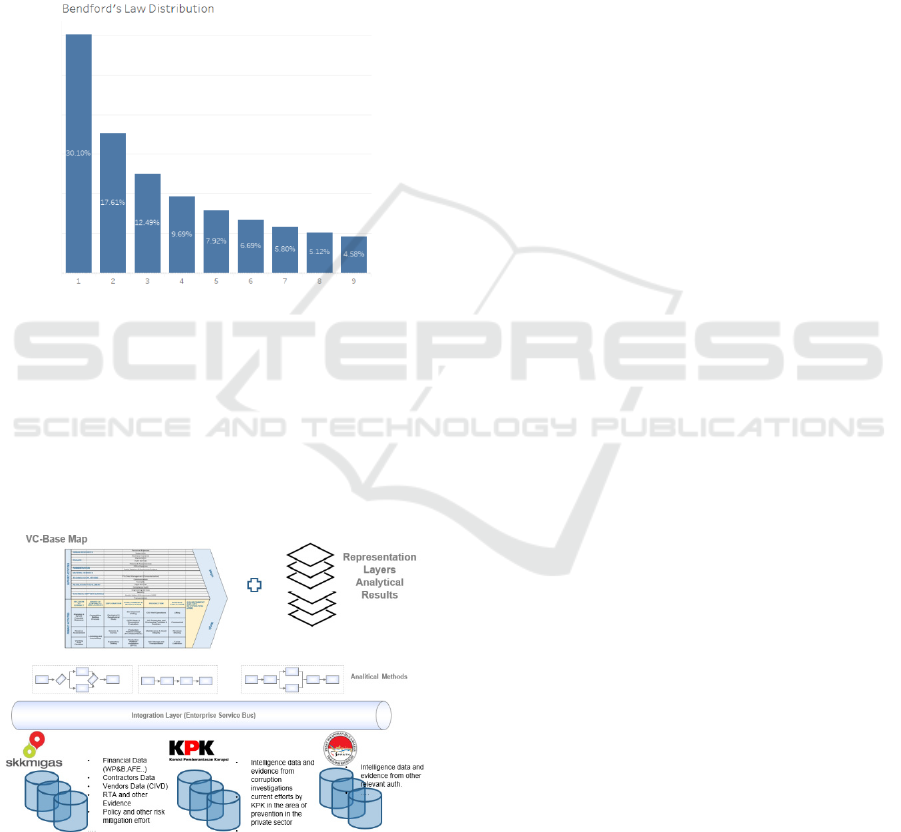

Detection of anomalies can be implemented in

various ways. One of the techniques for analyzing

anomalies is Benford’s law, a well-known method of

detection. When applied to value chainsets, the law of

Benford can be used as a screening tool for fraud

detection. The law defines the first digit frequency

Innovation in Corruption Risk Mapping using a Value Chain Map and Its Application in the Upstream Oil and Gas Industry in Indonesia

297

distribution in data sets and compares the

distributions anticipated and observed. Since number

1 most frequently appears as the first digit in

information progressions and subsequent numbers

less frequently, powerful deviations from the

anticipated frequencies or anomalies may show that

the information is suspect or manipulated. If an

authorization limit is $10,000; then frequent first two

digits will be identified in the region of 99, 98, and 97

if an effort is made to maximize authorizing

expenditures. Figure 3 shows Benford’s law

distribution embedded in Tableau software.

Figure 3. Benford’s law distribution

House of Risk (HoR) has been historically used

for identifying supply chain risk (Pujawan &

Geraldin, 2009). In this research, HoR is used to

identify corruption risks based on VCM. The

corruption risks used in HoR were based on evidence

obtained from the Right to Audit activities at SKK,

investigative data from KPK, and analysis of

suspicious financial transaction reports from PPATK.

Figure 4. VCM Conceptual and data/information

integration model

The developed VCM is then supported by VCA

so that it can be used to mitigate both corruption risk

and business risk. Data collaboration design for this

purpose is illustrated in Figure 4. Integrated data and

information from SKK Migas, KPK, and PPATK can

be included in the VCM. The distribution of value or

information will be displayed in layers in the form of

a heat map. Therefore, this VCM will be used for the

purpose of mitigating corruption risk and business

risk.

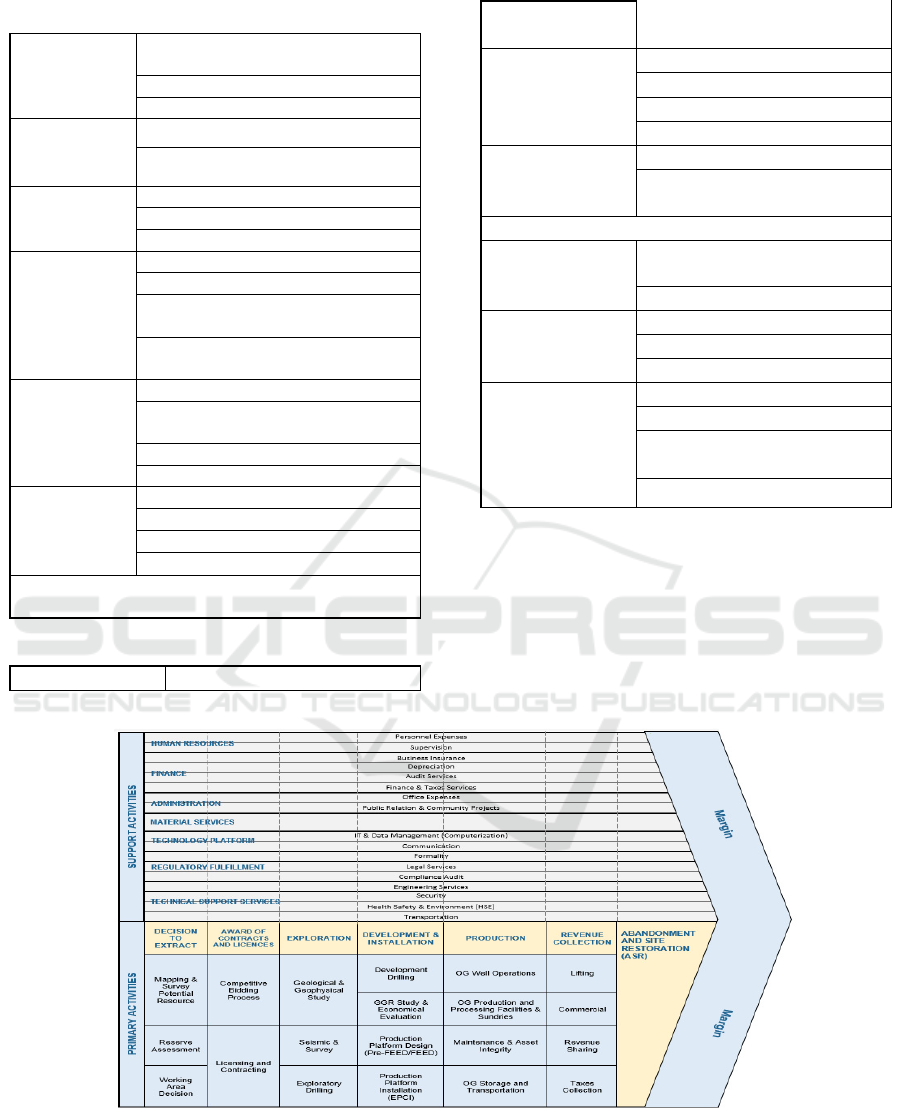

3 RESULT AND DISCUSSION

The literature on business processes, conducted in

accordance with appropriate legislation, was studied

and conclusions shown in Table 1 for primary

activities and Table 2 for supporting activities. The

decision to extract and Award of Contracts and

Licenses, the first two activities, were included in the

value chain to show complete sequences in upstream

oil and gas in Indonesia. These activities were not

evaluated for current VCM and VCA but will be used

in the future.

Then the value chain was developed, as shown in

Figure 5. The primary activities, sequential, begin

with Decision to Extract, Award of Contract and

Licenses, Exploration, Development & Installation,

Production, Revenue Collection, Abandonment, and

Site Restoration. These activities are referred to as

Level 1 and sub-activities under Level 1 labeled

Level 2.

The activity in the Decision to Extract involves

assessing the potential for oil and gas resources that

have not been discovered and determining the

feasibility of oil or gas production. Evaluations are

carried out using one or a combination of the

following methods: volumetric, well-performance,

mathematical modeling, and analogy comparing

reservoirs with similarities in geology and/or

performance. Award of Contracts and Licenses are

activities aimed at offering the right company to

manage a working area (Wilayah Kerja, WK)

containing oil & gas. Exploration is to evaluate the

suitability of oil and gas projects and to conduct

geological and geotechnical research. Development

& Installation are activities to construct underground

and surface equipment to securely and effectively

produce oil and gas. Production includes activities to

extract, process, and export oil & gas as per contract

agreement. Revenue Collection involves taxation on

profit from oil or gas lifting and subsequent

commercial opportunities. Abandonment and Site

Restoration are activities to permanently plug wells,

remove surface equipment, and restore the block

according to the initial contract conditions.

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

298

Table 1. Primary activities

Decision to

Extract

Mapping & Survey Potential

Resource

Reserve Assessment

Working Area Decision

Award of

Contracts and

Licenses

Competitive Bidding Process

Licensing and Contracting

Exploration

Geological & Geophysical Study

Seismic & Survey

Exploratory Drilling

Development &

Installation

Development Drilling

GGR & Economical Evaluation

Production Platform Design (Pre-

FEED/FEED)

Production Platform Installation

(EPCI)

Production

OG Well Operations

OG Production and Processing

Facilities & Sundries

Maintenance & Asset Integrity

OG Storage and Transportation

Revenue

Collection

Lifting

Commercial

Revenue Sharing

Taxes Collection

Abandonment and Site Restoration

T

able 2. Supporting activities

Personnel Expenses

Human

Resources

Supervision

Finance

Business Insurance

Depreciation

Audit Services

Finance & Tax Services

Administration

Office Expenses

Public Relations &

Community Projects

Material Services

Technology

Platform

IT & Data Management

(Computerization)

Communication

Regulatory

Fulfillment

Formality

Legal Services

Compliance Audit

Technical

Support Services

Engineering Services

Security

Health Safety &

Environment (HSE)

Transportation

In the support activity section, Level 1 is Human

Resources, Finance, Administration, Material

Services, Technology Platform, Regulatory

Fulfillment, and Technical Support Services. Similar

to the above convention, the sub-activities were

labeled as Level 2, as depicted in an elongated

horizontal box. Margins were created to show the

efficiency indicator in the value chain

.

Figure 5. Value chain map in upstream oil and gas Indonesia

Innovation in Corruption Risk Mapping using a Value Chain Map and Its Application in the Upstream Oil and Gas Industry in Indonesia

299

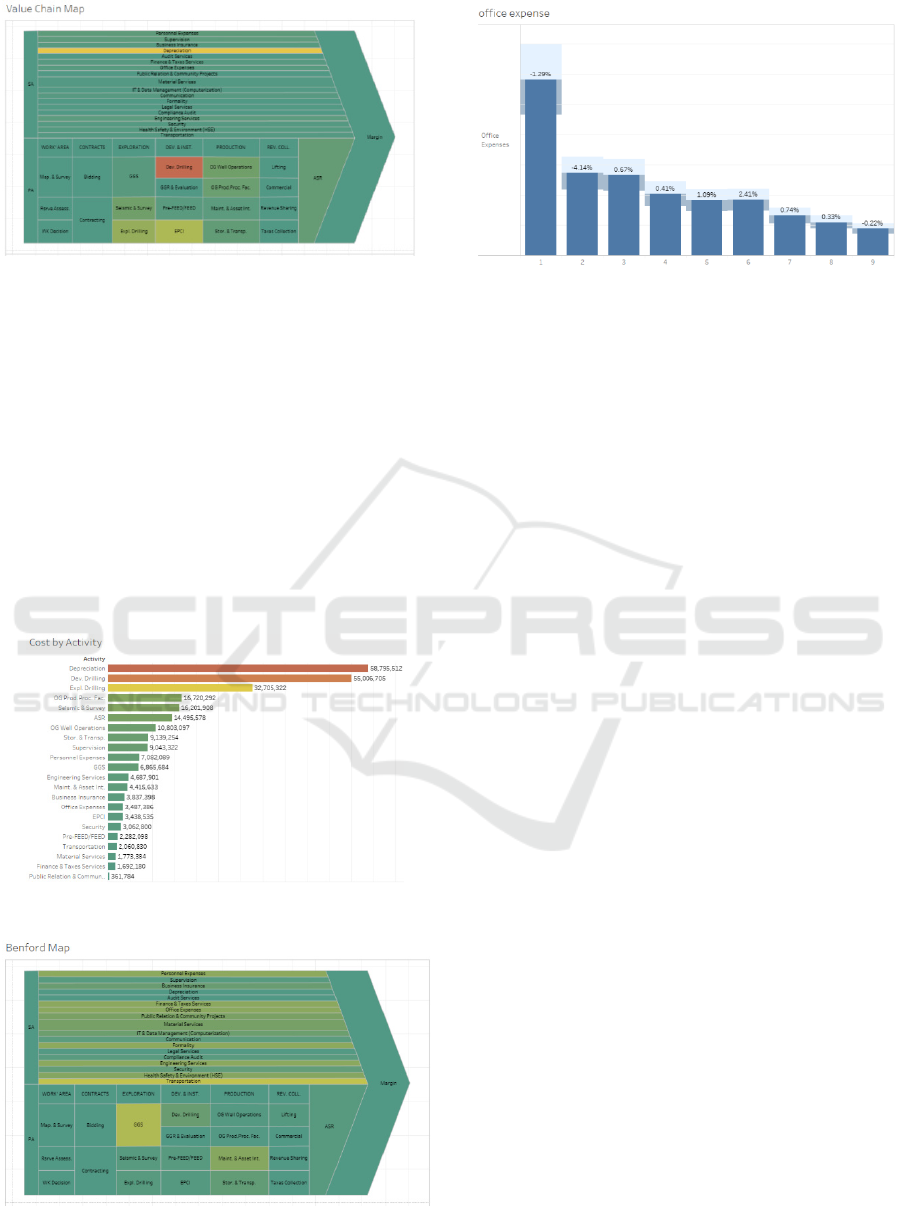

Figure 6. VCM expenditure analysis

Visual analysis can be performed by presenting a

layer that has been generated by Tableau software.

VCA was undertaken on the data represented by a

particular layer. The layer can be in the form of

financial data, activities of contractors or vendors as

well as some audit findings.

Figure 6 shows the distribution of financial data

that has been carried out for each activity in the value

chain. This figure shows which activities have the

smallest scale to the largest. The color in Figure 6

representing the amount of financial expenditure, the

higher showing red, and the lower in green. The result

can also be displayed in the form of a bar chart, as

shown in Figure 7.

Figure 7. Financial report for activities in VCM

Figure 8. VCM showing Benford analysis

Figure 9. Example of Benford analysis for Office Expense

The financial map will later be supplemented by

the Benford analysis map, as shown in Figure 8. Both

layers provide information which has potential

irregularities. Other layers, such as the number of

contractors or vendors, PPATK data, and even the

KPK information, work together to show indications

of potential risks. Therefore, this VCM can be used as

a Cockpit Management/ Strategic Management and

Planning Tool.

4 CONCLUSIONS

The Value Chain Map for the upstream oil and gas

industry in Indonesia was successfully developed and

considered as an innovative risk mitigation method

for both corruption and business risk and had the

potential for use by the business environment as well

as law enforcement prevention and investigation. We

conclude that the proposed VCM can be served as an

application and utility of the value chain architecture

for cost advantage purposes. VCM can be adopted as

a tool and utility of the value chain map for corruption

risk and business risk. VCM can be used to improve

the business processes in the upstream oil and gas

industry in Indonesia.

ACKNOWLEDGEMENTS

This paper is an output of the SOAS Anti-Corruption

Evidence (ACE) research consortium funded by UK

aid from the UK Government. The views presented in

this publication are those of the author(s) and do not

necessarily reflect the UK government's official

policies or the views of SOAS-ACE or other partner

organizations. For more information on SOAS-ACE

visit www.ace.soas.ac.uk.

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

300

We would also like to show our gratitude to SKK

Migas for the support, time, and relevant

data/information relating to the upstream oil and gas

Indonesia and to KPK and PPATK for relevant

information about corruption.

REFERENCES

Agustina, L., & Baroroh, N. (2016). The relationship

between Enterprise Risk Management (ERM) and firm

value mediated through financial performance. Review

of Integrative Business and Economics Research.

Ashoori, N.A., Mozaffari, M. R. (2013). Prioritizing

Contractors Selection Using DEA-R and AHP in

Iranian Oil Pipelines and Telecommunication

Company. International Journal of Data Envelopment

Analysis, 1(4), 259-.

CGMA. (2012). How to communicate risks using a heat

map. Retrieved from

https://web.actuaries.ie/sites/default/files/erm-

resources/communicate-risks-using-heat-map.pdf

COSO. (2004). COSO Enterprise Risk Management —

Integrated Framework. Committee of Sponsoring

Organizations of the Treadway Commission.

https://doi.org/10.1504/IJISM.2007.013372

COSO. (2017). Enterprise Risk Management Integrating

with Strategy and Performance. The Committee of

Sponsoring Organizations of the Treadway

Commission.

Elsaghier, E. H. (2017). Planning and Optimising of

Petroleum Industry Supply Chain and Logistics under

Uncertainty (Sheffield Hallam University). Retrieved

from

https://search.proquest.com/docview/2035748288?acc

ountid=188395

I, M., S, M.-C., V, A., P, B., & A, R. T. (2013). Assessment

of Industrial Cluster with Value-Chain DEA model.

European Journal Of Operational Research, 1(1), 43–

48.

Ibef. (2014). Oil & Gas. Retrieved from www.ibef.org

Johnson & Johnson. (2018). Enterprise Risk Management

Framework. Retrieved from

https://www.jnj.com/application/pdf:

92/01/4efd5ba54bc09c6eb227db00da8a/jnj-erm-

framework-2018-update.pdf

Jurevicius, O. (2013). Value Chain Analysis | Strategic

Management Insight. Retrieved from Strategic

Management Insights website:

https://www.strategicmanagementinsight.com/tools/va

lue-chain-analysis.html

MOGA. (2018). Oil & Gas Value Chains. Retrieved from

p://moga.saoga.org.za/resources/oil-gas-value-chains

Mooney, C. L. (2014). 5 reasons CR professionals need a

value chain map. Retrieved June 25, 2019, from

https://www.greenbiz.com/blog/2014/01/09/5-reasons-

cr-professionals-need-value-chain-map

OECD. (2016). Corruption in the Extractive Value Chain -

Typology of Risks, Mitigation Measures and

Incentives. The Report, Secretary-General of the

OECD 2016.

Olesen, T. (2016). Offshore Supply Industry Dynamics.

Retrieved from www.cbs.dk/maritime

Pagach, D. P., & Warr, R. S. (2011). The Effects of

Enterprise Risk Management on Firm Performance.

SSRN Electronic Journal.

https://doi.org/10.2139/ssrn.1155218

Permen ESDM RI No. 52. (2018). Peraturan Menteri

Energi Dan Sumber Daya Mineral Republik Indonesia,

Nomor 52 Tahun 2018 Tentang Perubahan Atas

Peraturan Menteri Energi Dan Sumber Daya Mineral

Nomor 29 Tahun 2017 Tentang Perizinan Pada

Kegiatan Usaha Minyak dan Gas Bumi.

Permen ESDM RI No. 59. (2007). Peraturan Menteri

Energi Dan Sumber Daya Mineral Republik Indonesia,

Nomor 17 Tahun2017 Tentang Organisasi dan Tata

Kerja Satuan Kerja Khusus Pelaksana Kegiatan Usaha

Hulu Minyak dan Gas Bumi.

Porter, M. E. (1985). Competitive Strategy: Creating and

Sustaining Superior Performance. In Creating and

Sustaining Competitive Advantage.

https://doi.org/10.1007/978-3-319-54540-0

PP RI No. 59. (2007). Peraturan Pemerintah Republik

Indonesia, Nomor 59 Tahun 2007, Tentang Kegiatan

Usaha Panas Bumi.

Pujawan, I. N., & Geraldin, L. H. (2009). House of risk: A

model for proactive supply chain risk management.

Business Process Management Journal.

https://doi.org/10.1108/14637150911003801

Putra, I. S., & Adinugraha, D. (2018). Factors Affecting

Efficiency of Oil and Gas Companies in Indonesia Two

Stage DEA Analysis. Proceedings of the DEA40:

International Conference of Data Envelopment

Analysis, 93–100. Aston Business School.

Quon, T. K., Zéghal, D., & Maingot, M. (2012). Enterprise

risk management and business performance during the

financial and economic crises. Problems and

Perspectives in Management.

Reese, J., Waage, M., Gerwin, K., & Koch, S. (2016). Value

Chain Analysis: Conceptual Framework and

Simulation Experiments. Nomos Verlagsgesellschaft.

Shqairat, A., & Sundarakani, B. (2018). An empirical study

of oil and gas value chain agility in the UAE.

Benchmarking. https://doi.org/10.1108/BIJ-05-2017-

0090

SKK Migas. (2013). Pedoma Tata Kerja, Nomor: PTK-

053/SKO0000/2013/S0, Tentang Pengelolaan

Teknologi Informasi Komunikasi pada Kontraktor

Kontrak Kerja Sama (KKKS).

SKK Migas. (2017). Pedoma Tata Kerja, Nomor: PTK-

063/SKKMA0000/2017/S0, Tentang Financial Budget

and Reporting Manual of Production Sharing Contract

dan Chart of Account.

SKK Migas. (2018). Surat Keputusan Nomor:KEP-

0078/SKKMA0000/2018/S0 Tentang Proses Bisnis

SKK Migas.

SKK Migas. (2019). Pedoman Tata Kerja, Nomor: PTK-

066/SKKMA0000/2019/S0, Tentang Penyusunan Dan

Innovation in Corruption Risk Mapping using a Value Chain Map and Its Application in the Upstream Oil and Gas Industry in Indonesia

301

Pelaporan Kegiatan Usaha Hulu Minyak Dan Gas Bumi

Dengan Skema Gross Split.

UNCTAD. (2012). Extractive Industries: Optimizing Value

Retention in Host Countries. UNCTAD XIII, Qatar

2012.

Undang-Undang RI No. 22. (2011). Undang-Undang

Republik Indonesia, Nomor 22 Tahun 2001 Tentang

Minyak dan Gas Bumi.

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

302