Policy Analysis of Non-collected Value Added Tax on Import of

Taxable Goods for Geothermal Utilization Activities

Nimas Setia Ningsih, Adang Hendrawan, and Milla Sepliana Setyowati

Department of Fiscal Administration Science, Faculty of Administration Science, Universitas Indonesia,

Keywords: Tax Facilities, Value Added Tax, Geothermal Utilization

Abstract: Value Added Tax is not collected on imports of Taxable Goods for geothermal utilization activities is a policy

to support government programs related to electricity availability. Previously, the import had been given a

free facility. The mining industry that gets this facility is only a geothermal industry. Based on this

background, the researcher wants to analyze the facility's policy in terms of the principle of neutrality and the

principle of justice and analyze the implications that the facility has for the Income Tax burden and tax

administration for the old and new regime's geothermal businesses. The research method used in this thesis is

a qualitative research method. The data used was obtained by conducting in-depth interviews with several

speakers who were considered relevant to the issues raised. Based on the results of the analysis, the Value

Added Tax facility is not in accordance with the principle of neutrality and the principle of fairness because

it distorts the choice of industry in importing goods, there is a possibility that goods imported by geothermal

businesses are not really used for geothermal operations, and cause different treatments with other mining

industries. The implication of this facility is an increase in the Corporate Income Tax for the old regime and

a decrease in the Corporate Income Tax for the new regime, as well as more time and cost savings in the

process of filing the facility compared to the Value Added Tax facility being waived.

1 INTRODUCTION

Energy is a global issue that has a significant

influence on people's life activities. Energy plays an

important role in supporting various social and

economic activities of the community, including

electricity generation. Indonesia is the country with

the largest energy consumption in the Southeast

Asian region and ranks fifth in the Asia Pacific in

primary energy consumption, after China, India,

Japan and South Korea (BPPT, 2018). The high GDP

growth, reaching an average of 6.04% per year over

the 2017-2050 period, is expected to further

encourage an increase in Indonesia's energy needs in

the future by 5.3% per year (BPPT, 2018).

The majority of meeting the world's energy needs,

including Indonesia, still relies on energy derived

from fossil fuels. The high rate of consumption of

fossil energy results in an imbalance between the rate

of use of fossil resources (petroleum, natural gas, and

coal) with the speed of finding new reserves, so it is

estimated that in the near future fossil energy reserves

will run out, and Indonesia will be very dependent on

energy imports (EBTKE, 2017). One source of

energy derived from fossil fuels that are widely used

by various countries in the world, including Indonesia

is oil and gas and currently to meet oil and gas

consumption, Indonesia is dependent on imports.

Based on BPS data, oil and gas imports from January

to October 2018 amounted to 24,968.20 million US

$, an increase of 27.72% from the January-October

2017 period which only amounted to 19,548.60

million US $. Then it can be seen from Indonesia's

trade balance in the period of October 2018 that

experienced a fairly steep deficit of USD 1.82 billion

and oil and gas became the main component causing

the deficit.

Based on BPS data, the oil and gas trade balance

deficit of USD 1.4 billion is greater than the non-oil

and gas trade balance deficit of only USD 393 million

(www.ekbis.sindonews.com, 2018). Therefore, new

sustainable energy is needed that can create resilience

for the future. The high demand for energy derived

from oil and gas fuels not only causes an increase in

imports and a trade balance deficit but also causes

environmental damage and is difficult to achieve

Indonesia's greenhouse gas emission reduction

246

Ningsih, N., Hendrawan, A. and Setyowati, M.

Policy Analysis of Non-collected Value Added Tax on Import of Taxable Goods for Geothermal Utilization Activities.

DOI: 10.5220/0009402602460256

In Proceedings of the 1st International Conference on Anti-Corruption and Integrity (ICOACI 2019), pages 246-256

ISBN: 978-989-758-461-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

commitments listed in First Nationally Determined

Contribution.

Based on the 1987 Conceptual Report entitled

"Our Common Future" presented by The World

Commission on Environment and Development, to

address global issues such as economic growth,

environmental protection, and social justice, there

needs to be "Sustainable Development" as a general

solution to these three global problems (Brundtland,

1987). Therefore, the Government is carrying out

sustainable development by developing new and

renewable energy (hereinafter referred to as EBT in

Indonesia). To accelerate the development of EBT, in

2014 the Government issued Government Regulation

Number 79 of 2014 concerning the Kebijakan Energi

Nasional or National Energy Policy (hereinafter

referred to as KEN) and in line with the policy, the

Government also issued Indonesian Presidential

Regulation Number 5 of 2006 concerning KEN to

develop alternative energy sources as a substitute for

fuel oil (Hermanto, 2018).

In addition, the Government issued a policy

related to the development of Indonesian energy

which is regulated in Perpres No. 22 of 2017

concerning the National Energy General Plan

(hereinafter referred to as RUEN which stands for

Rencana Umum Energi Nasional) promulgated on

March 13, 2017. For electricity supply, the Ministry

of Energy and Mineral Resources is tasked with

carrying out conservation on the downstream side of

carrying out the construction of renewable energy

power plants. One focus in the RUEN Presidential

Regulation is related to electricity. This is due to the

large energy needs of the final type of electricity.

Renewable energy becomes an alternative energy to

replace fossil fuel energy, especially oil and gas.

Renewable energy sources include energy from the

sun, water, wind, waves, tides, and geothermal. Of the

several energy sources, the main concern is

geothermal energy because geothermal is effective

enough to be converted into electrical energy.

Indonesia's geothermal energy potential has been

estimated at 28,617 MW, which is around 40% of the

world's geothermal potential (Bina, Jalilinasrabady,

Fujii & Pambudi, 2018). However, only about 4.5%

is used as a supply of electrical energy in the country.

The obstacle in developing the second geothermal

business is the low investment. Therefore the

government provides tax facilities in the form of

Value Added Tax (VAT) not levied on the import of

taxable goods for geothermal utilization activities

regulated in PMK Number 137 / PMK.010 / 2018.

This facility is only provided for geothermal

businesses, this causes a reduction in the portion of

VAT neutrality and does not meet the principle of tax

justice, and reduces the potential revenue that can be

obtained by the state. Not only that, to get this non-

collected VAT facility, geothermal entrepreneurs

must submit a non-collected VAT request to DJBC

by attaching an RKBI that has been verified by the

Ministry of Energy and Mineral Resources.

Based on the background of the problem, the

author decided to raise the policy analysis of the VAT

facility not being levied on the import of taxable

goods for geothermal business utilization activities

into a study. Thus, the main research questions can be

formulated as follows:

1. How is the imposition of non-collected VAT

facilities on taxable goods imports for

geothermal utilization activities in terms of the

principle of neutrality and the principle of tax

justice?

2. How are the implications of the imposition of

VAT facilities not being levied on taxable

goods imports for geothermal utilization

activities on the burden of Income Taxes and

tax administration for geothermal businesses of

the old and new regimes?

2 THEORETICAL REVIEW

2.1 Fiscal Policy

According to Mansury (1999), fiscal policy can be

interpreted in broad and narrow terms. Fiscal policy,

in a broad sense, is a policy to influence public

production, employment opportunities, and inflation.

While the fiscal policy in the narrow sense is tax

policy.

Fiscal policy objectives include (John F Due in

Rahayu, 2010):

1. To increase GDP and economic growth or

improve economic conditions;

2. To expand employment opportunities and

reduce unemployment or seek employment

opportunities and maintain prices stable in

general;

3. To stabilize the prices of goods in general,

especially overcoming inflation.

2.2 Tax Policy

Tax policy is not only related to the determination of

the tax base, tax subjects, tax objects, the amount of

tax owed, and the procedure for carrying out the tax

liability, but more than that the tax policy must

represent the government's commitment to the

Policy Analysis of Non-collected Value Added Tax on Import of Taxable Goods for Geothermal Utilization Activities

247

welfare of the community, encourage the

development of the business world, and the

achievement of programs other government programs

(Rosdiana & Irianto, 2011).

According to Rosdiana & Irianto, 2014, p. 85-102

important issues in tax policy are supply-side tax

policies which are divided into two forms, namely tax

cut policy (reduction of tax burden) and tax

expenditure (loss of potential taxation). Tax policy

has two functions, namely the budget and regulated

functions (Mansury, 1999).

2.3 Value Added Tax

According to David Williams in Rosdiana, Irianto,

Putranti (2011), the term VAT is preferred to 'goods

and services tax.' Therefore, VAT is more directed to

taxes on goods and services. The VAT is basically

VAT collected several times (multiple stage levies) or

the basis for added value arising on all production and

distribution lines (Rosdiana, Irianto, Putranti, 2011).

The application of VAT must meet the

requirements including:

1. It must be neutral and not distort people's

choices;

2. the distortion caused by choice is an overload

of taxation;

3. Don't let the tax reduce the efficiency of the

national economy..

2.4 Legal Character of VAT

The legal character of VAT is the same as the legal

character of the sales tax, which is expanded

(Rosdiana, Irianto, and Putranti, 2011):

1. General, This means that VAT is imposed on

all or a large number of goods (and including

services).

2. Indirect means that VAT is an indirect tax that

has the following characteristics:

a. do not differentiate from taxpayers such as the

amount of income, but will only be taxed if at

any time there is an event or act such as the

delivery of goods;

b. the tax burden can be delegated either in whole

or in part to another person or party, which may

be in the form of forward-shifting or backward-

shifting.

3. On Consumption, means that VAT is a levy on

expenses for consuming all kinds of goods,

including services. The VAT is imposed on the

consumption of goods and/or services in the

country, so that if not abroad taxed.

2.5 VAT Neutrality Principle

According to Nightingale in Mahardhika (2014) that:

“a tax is said to neutral if it does not distort

economic choices; this distortion of economic choice

is known as the excess burden of taxation, causing

substitution effect resulting in economic inefficiency."

The principle of VAT neutrality means that taxes

must be free from distortions, both distortion of

consumption and production as well as other

economic factors. The VAT should not affect the

choice of producers to produce goods and services

(Sukardji, 2012). According to Terra (1988), one

aspect of internal neutrality is legal neutrality which

means that VAT must be levied on "general tax on

consumption" which is imposed on individual

consumer expenditure (last consumer) in the country.

Based on the OECD (2015a) to overcome tax

distortions, the design of tax policies must meet the

principles/principles of neutrality and fairness.

Taxation must be neutral and fair for all forms of

business activity. With the principle of neutrality, tax

policy becomes non-distorting and economic

efficiency (Leijon, 2015). The principle of justice is

the most widely recognized tax principle and covers

how the tax burden is distributed as evenly as possible

(Oestreicher & Spengel, 2007). The principle of

universality requires equal treatment of all taxpayers

or taxes must involve all members of the community

without exception (Seligman, 1895).

2.6 VAT Taxation Jurisdiction

There are two principles relating to the jurisdiction or

authority of tax collection, which includes (Rosdiana,

Irianto, and Putranti, 2011):

a. Origin Principle means that a country that is

entitled to tax is the country where the goods

were produced or where the goods originated.

b. Destination Principle means that a country that

has the right to impose a tax is the country

where the goods are produced or where the

goods are consumed.

2.7 VAT Facilities

PPN facilities There are two PPN facilities provided

by the Government, namely:

a. Examption, Tait (1988) explains the exemption

as follows:

“exemption actually means that the exempt trader

has to pay VAT on his inputs without being able to

claim any credit for this tax paid on his input.”

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

248

b. Zero Rate, Tait (1988) explains the exemption

as follows:

“Zero-rating means that a trader is fully

compensated for any VAT he pays on inputs and

genuinely is exempt from VAT."

2.8 Import Concept

According to Purwito (2006), import is an activity of

entering goods into customs areas, whether carried

out by individuals or legal entities. Import activities

must be followed by fulfilling customs obligations,

such as the submission of customs declarations,

payment of import duties and taxes in the framework

of import which includes import PPh (Article 22),

VAT and Luxury Sales Tax and the completeness of

the required documents.

3 RESEARCH METHODS

The research approach used in this study is a

qualitative approach. A qualitative approach is an

approach to explore and understand the meaning of

individuals or groups related to existing social

problems (Cresswell, 2014). The author uses

description research because the author tries to

present a complete picture of a social phenomena by

exploring and clarifying, so that a deeper and

comprehensive understanding of the imposition of the

non-collected VAT facility is reviewed from the

principle of neutrality and the principle of fairness

and the implications of the imposition of the facility

on the facility PPh burden and tax administration for

the old and new regime's geothermal business. Data

collection techniques used by researchers are as

follows:

a. Qualitative Document

b. Qualitative Interviews / Field Research, in-

depth interviews were conducted with

Directorate General of Taxation (DGT), Badan

Kebijakan Fiskal (BKF) / Fiscal Policy

Agency, the Ministry of Energy and Mineral

Resources, PT PGE, DJBC, and academics.

4 DISCUSSION

4.1 The Application of Non-collected

Value Added Tax Facilities on

Imports of Taxable Goods for

Geothermal Utilization Activities

from the Principle of Neutrality

and the Principle of Tax Justice

The provision of VAT facilities must be in

accordance with the mandate of article 16B of the

VAT Law, which is to encourage high-priority

economic sectors on a national scale, encourage

business economy, and increase competitiveness, and

others. The VAT facility is provided to Taxable

Person with the aim of encouraging the growth of the

business sector concerned, helping the liquidity of the

company or to support Government programs that

concern the lives of many people (Sukardji, 2006).

As a manifestation of the Government's support to

realize the acceleration of the 35,000 megawatts

(MW) power plant development program which aims

to meet electrification targets in Indonesia by up to

100% and also to achieve the target of renewable

energy mix in 2025 by 23% in accordance with what

is mandated in the KEN. The government provides an

non-collected VAT facility for taxable goods imports

for geothermal utilization activities regulated in PMK

137 / PMK.010 / 2018 concerning the sixth

amendment to the Decree of the Minister of Finance

number 231 / KMK.03 / 2001 concerning the

treatment of Value Added Tax and Sales Tax on

Goods Luxury for taxable goods imports exempt from

the import duty levied in effect on November 1, 2018.

Previously, facilities for geothermal exploration and

exploitation activities had been provided in PMK 196

/ PMK.010 / 2016. This non-collected VAT facility

does not stand alone but is followed by the exemption

of import duty. In addition to VAT and Import Duties,

for importing taxable goods for geothermal business

activities, there is also a facility to exempt 22 import

income tax.

Through the free collection of VAT facilities

realized in PMK 137 / PMK.010 / 2018, it is expected

to be a solution to the problems faced by the

geothermal industry, one of which is related to

investment, because the geothermal industry requires

a large investment in exploration and exploitation

activities. In fact, this facility cannot fully overcome

the problems faced by geothermal businesses,

because geothermal problems are so complex, not

only related to investment, but there are other

problems including the certainty of the selling price

Policy Analysis of Non-collected Value Added Tax on Import of Taxable Goods for Geothermal Utilization Activities

249

of electricity, difficulties in licensing, legal certainty

related to the land status, and social issues.

The granting of VAT facilities is free from the

background of the demand for tax facilities carried

out by the geothermal industry itself through its

ministry, the Ministry of Energy and Mineral

Resources, which then sends a letter to the Ministry

of Finance to be granted VAT facilities for import of

taxable goods for geothermal utilization activities.

In addition, there are a number of factors behind

the provision of the non-collected VAT facility,

which includes:

a. There is a different treatment or not equal

treatment between JOC and PT PGE and PT

Geo Dipa Energi, both of which are the old

regime geothermal industry which is

operationally treated equally and should be

treated the same in terms of taxation. The

difference between the Joint Operating

Contract (hereinafter referred to as JOC) with

PT PGE and PT Geo Dipa Energi is only the

presence or absence of the contract. JOC is a

cooperation contract between Pertamina and

the contractor. Whereas PT PGE and PT Geo

Dipa Energi are the old regimes that do not use

contracts.

b. There is a change in the Geothermal Law,

namely Law 21 of 2014, which was previously

regulated in Law 27 of 2003. The difference in

the Act is that Law 27 of 2003 has not been

regulated related to the utilization. The Act

only regulates related to exploration and

exploitation. Whereas Law 21 of 2014 has been

regulated in relation to utilization, where there

are two uses of geothermal energy, namely

direct use and indirect use. Indirect use itself is

divided into three stages, namely exploration,

exploitation, and utilization. So it can be said

that there is an additional categorization in the

new geothermal law, namely Law 21 of 2014.

With the regulation related to the indirect

utilization activities contained in Law 21 of

2014, the government provides a VAT facility

not to be levied on imports of taxable goods for

geothermal utilization activities regulated in

PMK 137 / PMK.010 / 2018 because basically

the purpose is to provide tax facilities for

Geothermal is supporting electricity or

electricity generation.

c. To attract investors, because the geothermal

business is a business that requires a high cost

and has a large risk or risk of failure at the

exploration stage, so it makes investors hesitant

in investing in geothermal businesses.

In the process of formulating the non-collected

VAT facility that is regulated in PMK 137 / PM.010

/ 2018, the actors involved are relevant stakeholders

including BKF, the Ministry of Finance, namely

DGT, Legal Bureau, DJBC, MEMR. The Minister of

Economy and Industry concerned is the Geothermal

Association (API), PT Geo Dipa Energi, and PT PGE.

The urgency or importance of the VAT facility is

not collected on imports of taxable goods for

geothermal utilization activities regulated in PMK

137 / PMK.010 / 2018 given to the geothermal

industry is because it is a renewable energy that can

produce electricity and Indonesia has a large

geothermal potential but has not yet maximally

utilized.

According to Nightingale (in Mahardhika, 2014)

that:

“a tax is said to neutral if it does not distort

economic choices; this distortion of economic choice

is known as the excess burden of taxation, causing

substitution effect resulting in economic

inefficiency.”

The imposition of VAT on imports of taxable

goods for geothermal utilization activities will

hamper the Indonesian economy, particularly from

the geothermal industry sector which incidentally is

aimed at producing electricity which is one of the

main needs of the Indonesian people. The imposition

of VAT will also reduce the growth of the geothermal

industry, with the existence of the VAT being a

burden for the geothermal industry because it has to

pay more to pay VAT at the time of taxable goods

import. In addition, the imposition of VAT can reduce

investment interest in investors in the geothermal

industry, because assessing the costs that must be

incurred to conduct geothermal utilization is quite

high.

Based on the consideration of the principle of

VAT neutrality put forward by Nightingale and the

conditions occurring in the geothermal industry in

Indonesia, the Government decided that for the

import of taxable goods for geothermal utilization

activities a VAT facility was not collected, because if

imposed VAT would result in reduced investment and

non-operation government programs related to

electricity availability.

One of the principles of VAT is neutrality. Ben

Terra (1988) argues that there are three internal

neutralities, one of which is Legal Neutrality, in

which VAT must be imposed on "general tax on

consumption" that is imposed on the expenditure or

expenditure of individual consumers (last consumers)

in the country. So it can be said that if there is

consumer spending or expenditure that is not subject

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

250

to VAT, then this means it has deviated from legal

neutrality. In line with this, according to Gunadi

(1997), the characteristic of VAT neutrality is formed

one of them by the VAT factor imposed on the

consumption of goods and/or services.

Therefore, based on the neutrality theory put

forward by Ben Terra and Gunadi, the granting of the

VAT facility is not levied on imports of taxable goods

for geothermal utilization activities that do not meet

or deviate from the principle of VAT neutrality. This

is because with the act of consumption of goods or in

this case the import of goods that are not subject to

VAT is the goods used for geothermal utilization

activities such as generators, turbines, and others.

According to Sukardji (2012), The principle of

VAT neutrality means that taxes must be free from

distortions, both distortion of consumption and

production as well as other economic factors. This

means that VAT should not influence the choice of

producers to produce goods and services. Therefore,

it can be said that the application of the principle of

VAT neutrality aims not to distort people's choices

and not reduce the efficiency of the national

economy. To overcome tax distortion, the design of

tax policies must meet the principle of

neutrality/fairness (OECD, 2015a). Taxation must be

neutral and fair for all forms of business activity.

Taxation is considered neutral and unjust when it is

only imposed on certain business activities. With the

principle of neutrality, tax policy becomes non-

distorting and economic efficiency (Leijon, 2015).

Based on the results of in-depth interviews with

Rega Irawan Daniarto as the Implementer of Aneka

Tambang, DJBC that the Government's policy not to

collect VAT is not in accordance with the principle of

VAT neutrality stated by Sukardji and Leijon because

of the geothermal industry which is capital intensive

and has high prices for spare parts, so it is not maybe

the geothermal industry doesn't use facilities. With

the existence of this free PPN facility, it distorts or

influences the geothermal industry to use the PPN

facility. This is due to the benefits obtained from

geothermal businesses compared to if they do not use

the VAT facility at all or use the released VAT

facility, which must go through the SKB application

in advance.

Then based on the results of an interview with

Andry Irwanto as Implementer of the Industrial VAT

Regulations Section 1, the DGT that this VAT facility

is not collected can be considered neutral if it is

actually used by the geothermal industry in

geothermal operations and its application does not

deviate from the aim of the VAT facility. This is

levied on increasing investment, developing the

geothermal industry so that it can provide electricity

for the community. So it can be said that the

government's policy not to collect VAT on the import

of taxable goods for geothermal utilization activities,

can be considered to meet the principle of neutrality

as long as it does not deviate from the explanation in

Article 16B of the VAT Law.

The VAT neutrality principle is applied to achieve

justice, or it can be said that the VAT neutrality

principle is applied with the aim that the same

treatment occurs for all WP. Based on the results of

an interview with Andry Irwanto as Implementer of

the Industrial VAT Regulations Section 1, the DGT

that the principle of neutrality is explained in Article

16B of the VAT Act which states that one of the

principles that must be upheld in the taxation law is

to apply and apply the same treatment to all WP (not

object, but subject), or to cases in the field of taxation

which are in essence the same as holding fast to the

provisions of the legislation.

The principle of justice is the most widely

recognized tax principle and covers how the tax

burden is distributed as evenly as possible

(Oestreicher & Spengel, 2007). This principle of

justice relates to the distribution of an equitable tax

burden to all people. According to Seligman (1895),

the principle of universality requires equal treatment

of all taxpayers or taxes must involve all members of

the community without exception. The VAT facility

must cover all taxpayers and may not only be

intended or enjoyed by a group or group of taxpayers,

whether based on ethnicity, race, religion, social

class, or nationality.

The provision of the non-collected VAT facility is

not in accordance with the principle of justice

proposed by Seligman, this is in accordance with the

results of an interview with Ami Muslich as Head of

Services and PTLL VAT Subdivision, BKF which

states that the VAT Facility is not collected can distort

and cause injustice to other industries in addition to

geothermal in importing because other industries not

getting VAT facilities are not levied on the import of

the taxable goods. Then Prianto Budi S., as a Lecturer

in Taxation of Fiscal Administration also stated the

same thing that the PPN facility is not collected is not

in accordance with the principle of justice proposed

by Seligman because this facility distorts the oil and

gas industry. The oil and gas industry only gets VAT

facilities and is not levied on taxable goods imports

for exploration and exploitation activities. It is thus

distorting the oil and gas industry in importing

taxable goods for utilization activities. This different

treatment also creates injustice. This means that it can

be said that the granting of the non-collected VAT

Policy Analysis of Non-collected Value Added Tax on Import of Taxable Goods for Geothermal Utilization Activities

251

facility that is given only to geothermal businesses

deviates from the principle of justice.

In addition, based on the results of in-depth

interviews with Prianto Budi S., that the VAT policy

is not collected is also not in accordance with the

principle of justice stated by Oestricher & Spengel;

this is because Geothermal investors obtain facilities,

while other mining investors such as minerba do not

get facilities. This means that it is unfair. The

definition of justice is the existence of equal treatment

of all taxpayers. Therefore, at the macro level, the

mining industry is equally treated differently.

4.2 Implications of Non-collected Value

Added Tax Facilities for the Import

of Taxable Goods for Geothermal

Utilization Activities

There are differences in tax treatment between the old

regime, in this case, PT PGE with the new regime.

The difference in treatment in terms of business

licenses between the old and new regimes is in

accordance with Law No. 21 of 2014 concerning

Geothermal Energy, which for new geothermal

entrepreneurs is required to have a Geothermal

Business License.

Based on the results of in-depth interviews with

Deddy Mulia Syahputra as Assistant Accounting Tax

Manager and Talent Novianti as Analyst Tax Payable

at PT PGE that the old regime's geothermal business

namely PT PGE was treated as a specialist lex where

there was an obligation to deposit the government's

portion of 34% in lieu of payment PPh. Then in the

case of VAT, the old regime did not apply credit Input

Tax. The system adopted is reimbursement, so the

deposit of VAT to the country will be reimbursed.

Whereas the new regime's geothermal business for

the tax system is not a specialist, meaning that it uses

the normal taxation system with normal tariffs, both

VAT and PPh. Another difference between the old

and new regimes is in terms of audits, for the old

regime the audits are carried out by the DJA, while

the new regime is by the KPP.

Different taxation systems between the old and

new regimes have an effect on the imposition of both

Income Taxes. The differences in the taxation system

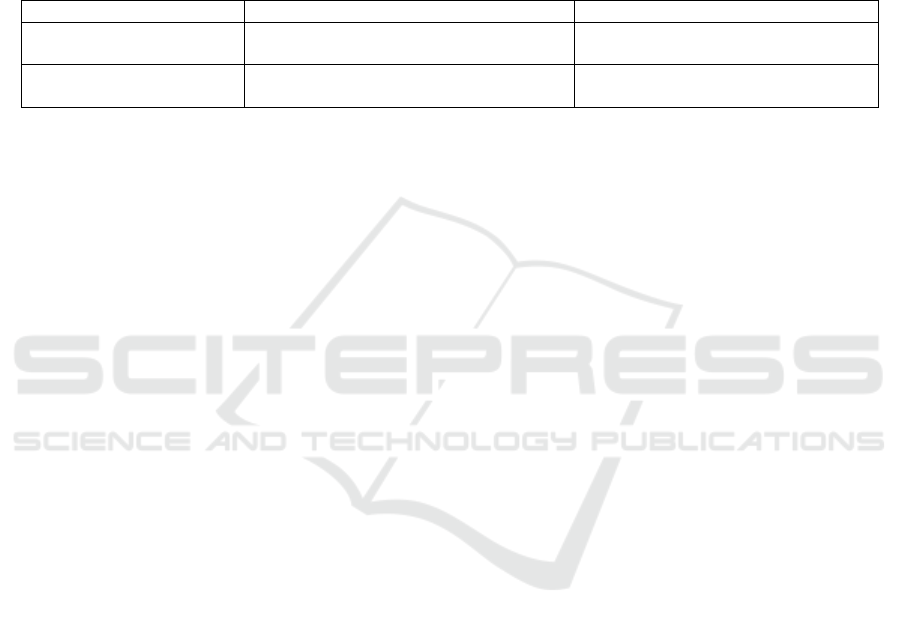

can be seen in Table 1 below:

Table 1. PT PGE Transaction Scheme and New Regime Geothermal Business Imposed by VAT

Old Regime Geothermal Business (PT PGE) The New Regime Geothermal Business

Electricity Sales = VAT exempted (PP 81 of 2015)

a. Import of Taxable Goods = zero-rate VAT (PMK

137 2018)

b. Obtaining Taxable Goods and/or Taxable Services =

subject to VAT without facilities

Pajak Keluaran (Penjualan Listrik) = PPN dibebaskan

(PP 81 Tahun 2015)

Pajak Masukan

Import taxable goods = PPN tidak dipungut (PMK 137

Tahun 2018)

Perolehan taxable goods dan/Atau JKP = dikenakan

PPN Tanpa fasilitas

Source: processed by the researcher (2019)

Based on table 1, it can be seen that PT PGE with

Lex specialist treatment cannot credit input tax. So

that the payment of VAT to the country can be

reimbursed as long as the tax invoice used as proof of

tax collection is considered related to geothermal

operations. If the PPN reimbursement request is

rejected, then the VAT paid listed in the Tax Invoice

cannot be charged or the term is not deductable

expenses, and this affects the Corporate Income Tax

of PT PGE. The tax that has been paid to the country

when it cannot be charged, then this can cause the

corporate income tax to increase or be greater. This is

because the costs or in this case the tax paid to the

state cannot be charged or cannot be deducted from

gross income, causing a greater Taxable Income and

this causes a domino effect, i.e., the Corporate

Income Tax Income is also greater or increased.

Unlike PT PGE, the New Regime Geothermal

Business applies a credit tax input system. Based on

the table above, Input Tax consists of VAT payments

on imports of taxable goods for geothermal utilization

activities regulated in PM 137 / PMK.010 / 2018

provided the PPN facility is not collected, this means

there is no tax paid by the New Regime Geothermal

Business for taxable goods that can be imported. And

payment of VAT on the acquisition of taxable goods

and/or JKP subject to VAT without tax facilities.

Therefore, because the Output Tax is given a released

VAT facility, the VAT paid on imports, and the

acquisition of taxable goods and/or JKP cannot be

credited in accordance with Article 16B of the VAT

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

252

Law. Therefore, the VAT deposited on taxable goods

imports for geothermal utilization activities and the

acquisition of taxable goods and/or JKP from within

the customs area cannot be credited and cannot be

compensated, so the VAT payment can be borne by

the company or called deductible expenses. Input Tax

that has been paid to the country when it can be

charged, this can cause the corporate income tax to

decrease or be smaller. This is because the cost or in

this case the input tax that has been paid to the country

can be charged or can be deducted from gross income,

causing Taxable Income to be smaller due to

increased costs and this has a domino effect, i.e., the

Corporate Income Tax is also smaller or decreasing.

The implications of VAT not collected against this

PPh burden are illustrated in Table 2 below:

Table 2 Impact or Implication of Zero-Rate VAT on Imported Goods for Geothermal Utilization Activities Against Income

Tax Burden

Category / Regime Old Regime (PT PGE) New Regime

Crediting Mechanism Does not apply input tax crediting, but

VAT Reimbursement

Implement credit input credit

Impact of VAT that cannot

be reimbursed

Nondeductible Expense

CIT Increases

Deductible Expenses

CIT Decreases

Sumber: processed by the researcher (2019)

In addition, the VAT facility not collected, which

is regulated in PMK 137 / PMK.010 / 2018 also

affects the tax administration system, namely in the

process of filing the VAT facility. Before this non-

collected VAT facility was provided to the old and

new regime's geothermal businesses, both facilities

were provided free facilities regulated in PP 81 of

2015. For the import of taxable goods for geothermal

utilization activities prior to the enactment of PMK

137 / PMK.010 / 2018, the industry gets the PPN

facility freed by first applying for a VAT SKB on the

import of taxable goods for geothermal utilization

activities. The VAT exemption facility for the import

of taxable goods is regulated in PP 81 of 2015, which

the procedure is regulated in PMK 268 of 2015.

The import VAT exemption facility stipulated in

PP 81 of 2015 can not only be used by the geothermal

industry, but for any taxable person that carries out

strategic delivery and/or import of taxable goods.

This means that the scope of PP 81 of 2015 is broader

and more general compared to PMK 137 / PMK.010

/ 2018. Pursuant to Article 1 paragraph (1) letter a

certain strategic taxable goods upon import are

exempt from the imposition of VAT, which is factory

machines and equipment which are a single unit, both

installed and detached, which are used directly in the

process of producing taxable goods by taxable person

which produces taxable goods, not including spare

parts.

PP 81 of 2015 is further regulated in Regulation

of the Minister of Finance of the Republic of

Indonesia Number 268 / PMK.03 / 2015 concerning

the procedure for granting facilities to be exempt

from the imposition of VAT on the import and / or

delivery of certain strategic taxable goods and the

procedure for paying certain taxable goods VAT

strategic nature that has been freed and the imposition

of sanctions. Pursuant to article 4 paragraph (1) of

PMK 268 2015, the taxable person conducting

imports and/or receiving delivery of certain strategic

taxable goods must have a VAT SKB prior to import

and/or surrender. Where to obtain the VAT SKB, the

taxable person must submit the application for the

VAT SKB to the Director-General of Tax c.q. Head

of KPP where the taxable person is registered and

attach supporting documents.

Upon requesting the VAT SKB, the Head of the

Tax Office on behalf of the Director-General of Taxes

can issue the VAT SKB no later than five working

days after the complete SKB PPN application is

received. The VAT SKB is issued on certain strategic

taxable goods which are approved to be given a VAT

exempt facility either partially or wholly by the Head

of the Tax Office on behalf of the Director-General of

Taxes. The Head of the Tax Office on behalf of the

Director-General of Taxes can cancel the VAT SKB

in the event of a written error and/or a calculation

error in the issuance of data and/or information

obtained indicating that the taxable person is not

entitled to obtain the VAT SKB. But also the

Director-General of Taxes can also refuse the

submission of requests for import VAT SKB made by

the geothermal industry.

Then for certain strategic taxable goods which

have been granted a facility exempt from the

imposition of VAT, if within 4 years from the time of

import and / or acquisition is used not in accordance

with the original purpose or transferred to other

parties either partially or completely, then the VAT

has been exempt from the import and / or acquisition

of said taxable goods must be paid.

Policy Analysis of Non-collected Value Added Tax on Import of Taxable Goods for Geothermal Utilization Activities

253

Unlike the exempted VAT facility, the free-

collected VAT facility regulated in PMK 137 /

PMK.010 / 2018 is of a special nature, given one of

them to the geothermal business. In PMK 137 /

PMK.010 / 2018, the types of goods provided with

facilities do not have any limitations, namely opening

wide as long as they meet the provisions stipulated in

Article 2 paragraph (4), namely as follows:

a. These goods have not been produced

domestically

b. The goods have been produced domestically

but have not met specifications

c. The goods have been produced domestically

but have not met the needs

Then there is no requirement for the

geothermal industry to apply for the non-collected

VAT facility, but there are conditions that must be

met when submitting the exemption of the import

duty. As in applying for a VAT exempted, to apply

for a VAT facility not to be levied on the import of

taxable goods for geothermal utilization activities,

there are also procedures or steps that must be

followed, namely at first the geothermal industry

submits the Need for Imported Goods (RKBI) in

advance to the Directorate Geothermal, EBTKE.

Then when the RKBI has been processed, the

exemption sketch will be submitted to the DJBC

facility directorate, where the submission to the

Facility Directorate will already use an application

system called the soft fast application. If for the

submission of the exemption regulated in PMK 78 of

2005 the service promise is for five days, while for

the submission of the exemption regulated in PMK

177 of 2007 the service promise is for 15 days.

Based on the explanation above, it can be seen that

for the activities of importing taxable goods for

geothermal utilization activities before 2018 or before

PMK 137 / PMK.010 / 2018 are published, and there

are no regulations that specifically regulate the import

of taxable goods VAT facilities for geothermal

utilization activities. Therefore, the geothermal

industry can apply for imported VAT facilities on the

basis of general rules not only for the geothermal

industry or EBTKE, namely PP 81 of 2015. Where to

obtain import VAT exemption facilities for taxable

goods used for these indirect utilization activities

must first submit a SKB to the Director-General of

Taxes. Whereas VAT facilities are not levied on the

import of taxable goods for geothermal utilization

activities regulated in PMK 137 / PMK.010 / 2018,

there is no need to apply for SKB.

Therefore, PT PGE considers that the process of

filing PPN facilities on imports using the SKB

requires time and fiscal cost, so now the geothermal

industry prefers to use the non-collected VAT

regulated in PMK 137 / PMK.010 / 2018.

Submission of VAT is exempt for the import of

taxable goods used for indirect geothermal utilization

activities with the SKB in the implementation of

burdening PGE because for example in the PGE

project in Paraha to obtain the VAT facility the first

step is to registered KPP which takes a long time, i.e.,

up to the letter accepted according to the results of an

in-depth interview with PGE for 5-7 days. PGE must

also go directly to the Tax Office in applying for the

VAT to be released. After that, PGE must take the

SKB itself and then submit it to DJBC to get VAT

exemption. The total time taken is estimated to be one

and a half weeks or 10-11 working days.

In addition to having an impact on time costs, the

filing of VAT exempted also has an impact on fiscal

costs. Within the time period for filing VAT

exemptions, the goods are stored in the customs

warehouse, so PGE must pay the warehouse rent.

Then if more than the retention period is subject to a

fine, this is detrimental to PGE in terms of cost or

fiscal cost. Therefore, the exemption facility for

importing taxable goods used for this indirect

geothermal utilization activity regulated in PP 81 of

2015 requires time and costs or it can be said that the

released VAT has an impact on time cost and fiscal

cost. So that PGE prefers to use the VAT facility not

to be levied on the import of taxable goods that are

used for indirect geothermal utilization activities.

Even though PGE and the new regime's

geothermal effort assume that the VAT facility is

exempt from importing taxable goods, it takes a long

time and is a high cost, but actually, the DJBC itself

has tried to accelerate the submission of the PPN

exemption process.

PGE and the New Regime Geothermal Business

prefer to use PPN facilities free of taxable goods

imports for geothermal utilization activities because

the non-collected PPN facilities have an impact on a

simpler submission process. In accordance with the

results of in-depth interviews with Deddy Mulia

Syahputra as Assistant Tax Accounting Manager and

Talenta Novianti as Analyst Tax Payable at PT PGE

which stated that the implication of the existence of

VAT facilities is not levied on the import of taxable

goods for this utilization activity is to carry out import

of taxable goods will be more effective, more

efficient and more timely. The impact or implication

of the non-collected VAT on the tax administration is

illustrated in Table 3 below:

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

254

Table 3 Impact or Implications of Non-Collected VAT on the Import of Taxable Goods for Geothermal Utilization Activities

on Tax Administration

Category/Tax Facility VAT Exempted Zero-Rate VAT

Duration of Facility Submission - Proposing VAT facilities in the field for

approximately 10-11 days

- Flying for BM facilities for 15 days

The total submission is approximately 25-26

days

- There is no requirement and

procedure for applying for a

VAT facility

-Flying for BM facilities for 15

days

Total 15 days submission

Costs Required - Customs warehouse rental fee

- Penalty for exceeding the retention period

Customs warehouse rental fee

Sumber : processed by the researcher (2019)

Therefore, based on table 3 it can be concluded

that the VAT facility is not levied on the importation

of taxable goods for geothermal utilization activities

regulated in PMK 137 / PMK.010 / 2018, which has

an impact on the tax administration system, which is

in the process of filing VAT facilities that are

becoming shorter and lower costs or the presence of

VAT facilities have an impact on fiscal and time costs

that must be incurred by geothermal businesses.

Although the VAT facility is not levied on the

import of taxable goods for geothermal utilization

activities, it has a positive impact on the

administration in obtaining these facilities, but until

now these facilities have not been utilized either by

PT PGE or by the new regime's geothermal business,

because there is no activity import of taxable goods

for geothermal utilization activities.

5 CONCLUSION

The VAT facility is not levied on import of taxable

goods for geothermal utilization activities regulated

in PMK 137 / PMK.010 / 2018 does not meet the

principle of neutrality and the principle of tax justice

because the VAT facility not levied on the import of

taxable goods distorts the choice of the industry in

importing taxable goods for utilization activities and

the possibility of taxable goods imported by the

geothermal industry not really being used for

geothermal operations, and the PPN facility is not

collected, it is given only to the geothermal mining

industry, so there is a different treatment from other

mining industries.

The implication or impact of the existence of the

VAT facility is not levied on the import of taxable

goods for the old regime geothermal business is the

increase in CIT, this is because the tax paid to the

country for the import of taxable goods cannot be

charged due to the rejection of the filing of VAT

reimbursement and for the new regime is a decrease

in CIT, this is because the PM deposited to the

country for the import of taxable goods can be

charged or reduce income and have an impact on the

decrease in taxable income. The impact on the tax

administration system is that the process of filing

VAT facilities will be more time-saving and cost

compared to the exempt VAT facilities that were

previously applied.

LIMITATIONS

A limitation in the study, entitled Analysis of the

VAT Facility Policy, Free of Importing Taxable

Goods for Geothermal Utilization Activities, was not

conducted interviews with the Geothermal

Association and the New Regime Geothermal

Business, because both parties were not prepared to

conduct in-depth interviews. This makes researchers

unable to explain comprehensively related to the

taxation system and problems in the field faced by the

new regime's geothermal effort.

REFERENCES

BOOKS:

Brundtland, G. H. (1987). Our Common Future: Report of

the World Commission on Environment and

Development. United Nations.

Cresswell, J. W. (2014). Research Design: Qualitative,

Quantitative, adn, Mixed Methods Approaches.

California: Sage Publications.

Mansury, R. (1999). Kebijakan Fiskal. Jakarta: Yayasan

Pengembangan dan Penyebaran Pengetahuan

Perpajakan.

Policy Analysis of Non-collected Value Added Tax on Import of Taxable Goods for Geothermal Utilization Activities

255

OECD. (2015a). Addressing the Tax Challenges of the

Digital Economy, Action 1 - 2015 Final Report,

OECD/G20 BEPS Project. Paris: OECD Publishing.

Purwito, M. A. (2006). Kepabeanan Konsep dan Aplikasi.

Jakarta: Samudra Ilmu.

Rahayu, A. S. (2010). Pengantar Kebijakan Fiskal. Jakarta:

Bumi Aksara.

Rosdiana, H., & Irianto, E. S. (2011). Panduang LengkaP

Tata Cara Perpajakan di Indonesia. Jakarta: Visi Media.

Rosdiana, H. D. (2010). Pengantar Ilmu Pajak: Kebijakan

dan Implementasi di Indonesia. Jakarta: Rajawali Press.

Rosdiana, H., Irianto, E. S., & Purwanti, T. M. (2011). Teori

Pajak Pertambahan Nilai Kebijakan dan

Implementasinya di Indonesia. Bogor: Penerbit Ghalia

Indonesia.

Sukarjadi, U. (2012). Pokok-Pokok PPN Pajak

Pertambahan Nilai Indonesia Edisi Revisi 2012.

Jakarta: Rajawali Persada.

Tait, A. A. (1988). Value Added Tax International Practice

and Problem. Washington DC: International Monetary

Fund.

Terra, B. (1988). Sales Taxation: The Case of Value Added

Tax in The European Community. Boston: Kluwer Law

and Taxation.

Seligman, E. R. A. (1895). Essays in Taxation. New York:

Macmillan & Co.

JOURNAL

Hermanto, A. (2018). Modeling of Geothermal Energy

Policy And Its Implications on Geothermal Energy

Outcomes in Indonesia. International Journal of Energy

Sector Management, 12(3), 449–467.

Leijon, L. H. af O. (2015). Tax Policy, Economic

Efficiency, And The Principle of Neutrality From a

Legal And Economic Perspective. Uppsala Faculty of

Law Working Paper 2015, 2, 1–24.

Mohammadzadeh Bina, S., Jalilinasrabady, S., & Fujii, H.

(2018). Classification of Geothermal Resources in

Indonesia by Applying Exergy Concept. Renewable

and Sustainable Energy Review, 93, 499–506.

Oestreicher, Andreas, Spengel, & Christoph. (2007). Tax

Harmonisation in Europe: The Determination of

Corporate Taxable Income in the EU Member States.

Center for European Economic Research, 1–34.

REGULATION

Republic of Indonesia. Law Number 42 of 2009 concerning

Value Added Tax and Sales of Luxury Goods Tax.

Republic of Indonesia. Law Number 21 of 2014 concerning

Geothermal Energy.

Republic of Indonesia. Law Number 27 of 2003 concerning

Geothermal Energy.

Republic of Indonesia. Republic of Indonesia Government

Regulation Number 7 of 2017 concerning Geothermal

for Indirect Use.

Republic of Indonesia. Republic of Indonesia Government

Regulation Number 81 Year 2015 concerning the

import and / or delivery of certain strategic taxable

goods that are exempt from the imposition of VAT.

Republic of Indonesia. Regulation of the Minister of

Finance Number 137 / PMK.010 / 2018 concerning the

Sixth Amendment to the Decree of the Minister of

Finance Number 231 / KMK.03 / 2001 concerning the

Treatment of VAT and PPnBM on the Import of

Taxable Goods Exempt from Import Duty.

Republic of Indonesia. Regulation of the Minister of

Finance of the Republic of Indonesia Number 268 /

PMK.03 / 2015 concerning the procedure for granting

facilities to be exempt from the imposition of VAT on

the import and / or delivery of certain strategic taxable

goods and the procedures for payment of certain

strategic taxable goods VAT that have been freed and

the imposition of sanctions.

ELECTRONIC PUBLICATION

Fajriah, L. R. (n.d.). Neraca Perdagangan Defisit USD1,82

Miliar. 2018. Retrieved from

https://ekbis.sindonews.com/read/1354856/33/oktober

-2018-neraca-perdagangan-defisit-usd182-miliar-

1542258269. Diakses 16 November 2018

THESIS

Mahardhika, Manggala. 2014. Implikasi Biaya Kepatuhan

Atas Fasilitas Pajak Pertambahan Nilai Pada Impor

Suku Cadang Pesawat Terbang di PT X. Universitas

Indonesia: Fakultas Ilmu Sosial dan Ilmu Politik.

SERIAL

Badan Pengkajian dan Penerapan Teknologi. (2018).

Outlook Energi Indonesia 2018 Energi Berkelanjutan

Untuk Transportasi Darat. Jakarta: Badan Pengkajian

dan Penerapan Teknologi.

Direktorat Jenderal Energi Baru, Terbarukan, Dan

Konservasi Energi. (2017). Laporan Kinerja Tahun

2017. Jakarta: Direktorat Jenderal Energi Baru,

Terbarukan, Dan Konservasi Energi.

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

256