What Drives Firm-level Anti Corruption and Bribery Mechanism in

Indonesia?

Miranda Tanjung

Graduate School of International Development, Nagoya University, Nagoya, Japan

Keyword: Anti-Corruption, Anti Bribery, Corporate Governance, Compliance, Indonesia, Logistic Regression

Abstract: The article seeks to provide empirical findings on the determinants of anti-bribery and corruption efforts in

the context of the Indonesian market. Datasets are collected between 2003 and 2013 from companies listed

in the Indonesia Stock Exchanges. By applying a logistic model, this study predicts that the key factors of

the implementation of anti-bribery and anti-corruption systems are the size of the firm, age and the positive

influence of the firm’s supervisory board (board of commissioners). Further evidence reveals that foreign

firms and state-owned companies are more likely to engage in bribery and corruption prevention than

family-run businesses. In particular, the most interesting finding in this paper is the empirical evidence that

firms are less likely to employ anti-corruption and bribery mechanism during the financial crisis.

1 INTRODUCTION

Anti-bribery and corruption principles have been

integrated into the global corporations` strategy in

recent years. Since the beginning of the 1990s, the

development of newer provisions and the adoption

by many countries have become increasingly rapid.

Past literature and surveys by think-tanks (e.g.,

ADB, OECD) and plenty of private firms have been

exploring and rating anti-bribery and corruption

mechanisms, including the extensive cross-country

studies and firm-level research.

The recent increase of interest of the

international governments and institutional investors

in corporate governance provisions should be

welcomed as good news in the global campaign

against corruption and bribery. To add, more

attention should be paid to bribe payers rather than

focus solely to bribe-takers, or the demand side.

While research that focuses on-demand aspect of

corruption provides a fairly pessimistic perspective

on the global actions to deter bribery (Beets, 2005),

the assessment of corruption and bribery in this

article provides a reason to be more optimistic. It is

in the interests of the key actor, the firms, to

improve their efforts in curbing corruption and

bribery and adopting the values of corporate

governance. Corporate governance provisions, in the

form of anti-corruption and anti-bribery measures,

can also play well in the strategy to end the violent

cycle of bribery and corruption in Indonesia seeing

that corporations are the main contributors of the

supply side (Wu, 2005).

The consequences and implications of bribery

and corruption have been extensively discussed in

the past literature. Most of the studies highlight the

cost of corruption and bribery for corporations (Cai,

Fang, & Xu, 2005; Gaviria, 2002) and countries

(Asiedu and Freeman, 2009; Beuselinck et al., 2017;

Hakimi and Hamdi, 2017). Even though findings

and implications vary and inconclusive in many

ways (Quah, 1999), we should not neglect the fact

that corruption and bribery are among the top

governance issues since the early 20s. For Indonesia,

the cost of bribery and corruption are associated

with excessive firm production costs and higher

business risks (Kuncoro, 2004, 2006), poor public

service quality and social costs (Alatas et al., 2009),

and natural resources damage and environmental

issues (Palmer, 2001). In the financial sector, corrupt

practices are linked to lower firm valuations, poor

governance, and higher cost of capital (Ng, 2006).

It is apparent that the qualities of anti-bribery and

corruption compliance vary among countries and the

micro-level of inter-firm basis. Do family-owned

firms comply with less than widely-held or foreign-

owned firms? What possible key factors contribute

to high governance and transparent business

practices? The set of questions are intriguing.

Unfortunately, we cannot find adequate literature

Tanjung, M.

What Drives Firm-level Anti Corruption and Bribery Mechanism in Indonesia?.

DOI: 10.5220/0009401801870196

In Proceedings of the 1st International Conference on Anti-Corruption and Integrity (ICOACI 2019), pages 187-196

ISBN: 978-989-758-461-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

187

and empirical findings to satisfactorily address them,

especially in the context of the large Indonesian

corporations. The inconclusive answers and

empirical findings pose a challenge to scientifically

supporting applicable and non-biased evidence.

Challenged by data availability and accessibility,

Indonesia is relatively under-researched with only

minor empirical works which focused on the specific

subject of anti-bribery and corruption and the micro-

level actual implementation by the key actors. Since

studies on this specific topic are still, results from

this paper are expected to expand knowledge about

how anti-corruption and bribery mechanisms to

operate and converge in a unique institutional setting

such as Indonesia.

2 DETERMINANTS OF ANTI

BRIBERY AND CORRUPTION

The main objective of this study is to identify and

investigate the determinants of micro-level anti-

bribery and anti-corruption implementation in the

Indonesian public listed corporations. Indonesia is

relatively under research with only minor empirical

works which focused on the specific subject of

corporate governance elements and the effective

implementation by the business community.

What are the consequences of rampant corruption

and bribery offenses for Indonesia? Previous papers

identified that economic growth, political stability,

business, and public sector are severely threatened by

corruption and bribery (Gaviria, 2002; Hakimi and

Hamdi, 2017; Jain, 2001). For this reason, in order to

deter and prevent the offenses, the Indonesian

government introduced Corruption Law No.20 Year

2001. Anti-corruption and bribery policies for public

companies had also been published by the Indonesia

Financial Service Authority. This paper argues that it

is crucial for the corporation to have an internal anti-

corruption and bribery policy as it sends signals that

any misconduct will be punished in compliance with

regulations and the applicable laws. To add, frauds

and severe conflict of interests also can be deterred

by the firm.

Since studies on this specific topic are still

limited in Indonesia, this study is expected to expand

knowledge about how anti-corruption and bribery

mechanisms, as part of corporate governance

principles, operate and converge in a unique

institutional setting such as Indonesia. To meet the

objective, the article proposes the following research

questions:

1. What are the determinants of firm-level anti-

bribery and anti-corruption compliance in

Indonesia?

2. In times of crisis, do firms more engage in

anti-corruption and bribery prevention?

The article identifies variables that can be

considered as determinants of high governance

compliance. These variables are grouped into 4

clusters: (1) firm type and ownership structures, (2)

family control, (3) financial characteristics, and (4)

financial crisis. Next sections will further explore

the key elements of this study. The author identifies

each element or variable that is highly correlated

with the firm's motivation to comply with corporate

governance requirements and principles set by the

financial market regulator.

2.1 Firm Types and Ownership

Structures

Agency theory was developed from the original

work of Jensen and Meckling (1976). This theory

has been able to explain various issues that arise

concerning the separation of corporate ownership,

control, and management. The effect of the

separation of ownership and management was the

subject of debate by Berle and Means in 1932

(Stigler and Friedland, 1983). The literature states

that agency cost is the result of a contract made by

the owner of the firm (the principals) who hire

outsiders (the agent) to perform services for the firm

on behalf of the owner, a contract which includes an

arrangement of delegation and power-sharing in the

firm’s decision-making (Jensen and Meckling,

1976). This contract was designed as a measure of

the owners’ decision to improve corporate values by

delegating authority to managers.

The study gathers ownership data from firms’

financial and corporate information. Datasets are

extracted from the Indonesian TICMI, firm annual

reports and financial filings, and other publicly

available data. The author identifies the ownership

structure by retrieving the company's shareholder

information and disclosure in the annual reports and

financial statements. By using these data, the author

can identify the controlling shareholder(s) of the

firms and how much voting rights they hold. In this

study, the controlling shareholders are grouped into

family and non-family firms. Non-family firms can

be identified further as (1) state-owned companies,

(2) foreign-owned companies, and (3) widely-held

firms with dispersed ownership. In this paper, the

family firm is defined as a business owned and run

by the founding family.

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

188

Ownerships which are concentrated into blocks

of majority stakeholders play an important role in

the firm’s operational and strategic goals. The

majority shareholders have better positions and

chance to access the company’s information; and, in

fact, the majority shareholders also have the power

to remove managers with poor performance and to

hire new agents to maximize shareholders’ wealth.

According to past studies, the presence of large

shareholders and concentrated ownerships has its

costs and benefits. Management control is effective

when ownership is concentrated as block holders

might control managers and help to foster value-

maximizing resource allocation (Demsetz and Lehn,

1985; Shleifer and Vishny, 1986). However, other

studies indicate a negative relation between

concentrated ownership and agency costs. A large or

block shareholder might be likely to expropriate the

wealth of minority shareholders, by committing

frauds, theft, and other business misconducts,

particularly in an environment where legal

protection for the minority shareholders is weak,

which mainly occurs in the developing capital

market. Therefore, this study employs ownership

structures and firm type as key variables in

examining the determinants of anti-corruption and

bribery compliance.

The author argues that high family ownerships

are detrimental to the adoption and application of

anti-corruption and bribery policies. The work by

Ricardo et al. (2016) highlights that there is an

inverse U-shape relationship between compliance

quality and family stake ownerships. In line with this

view, this study aims to find evidence that non-

family firms’ compliance level is lower than that of

family firms, as a side-effect of agency costs. Family

firms are plagued with high agency conflicts

(conflicts between owner-manager and owner-

minority shareholder), and the controlling families

are reluctant to enforce good governance, for

example, by providing better financial and non-

financial disclosures.

Ownership structures are defined as the

percentages of stakes owned by the family, the

block-holder, and the minority shareholders or the

public. Firstly, family ownerships are the percentage

of voting rights retained by the founding families.

Secondly, block-holder shares are the ratio of the

largest shares held by a party/person (e.g., a firm

may have the largest shareholder who owns 50% of

the firm’s stakes). The expected influence from each

of these variables on firm-level governance quality

is presented in Table 1. Lastly, the expected

coefficient signs of family ownerships, block-

holders and free float ratio are "-," "-," and "+"

respectively. For those reasons, this study develops

hypothesis:

H1: There is a negative association between

family ownerships and anti-corruption and bribery

mechanism.

H2: Non-family firms are more likely to have an

anti-corruption and bribery mechanism.

H3: There is a negative association between

block-holders ownerships and anti-corruption and

bribery mechanism.

2.2 Family Control

The author defines family control following

previous governance literature (Isakov and

Weisskopf, 2014; Saito, 2008). Family control is a

measurement of the representation of the controlling

family members in the firm’s management and

boards. As the founders of the firms and the

controlling family members do not want to give full

control of the firm to the outsiders, they retain some

of the power and control by appointing themselves

into the firm’s board and executive positions. Here,

the author employs a dichotomous variable as a

proxy to measure the active family control, CRONY.

CRONY represents family members who serve as

director or commissioner in the firm boards. Ricardo

et al. (2016) argued that family attachment increases

with higher ownership under the influence of socio-

emotional wealth of the family firms. Consequently,

the adoption of compliance with more stringent

governance practices could limit family interests and

benefits owing to higher family-related control costs.

Following the arguments, the proposed hypothesis as

follows:

H4: There are associations between family

controls and anti corruption and bribery

mechanism.

2.3 Financial Characteristics

Financial characteristics of the firm consist of 16

variables including: firm size (in terms of assets and

revenues/sales), firm age (older firm versus younger

firm issue), firm profitability and values, and firm

leverage ratio. Thus, the hypothesis to test the

relationships between firm’s financial characteristics

and governance compliance is:

H5: There are associations between firm’s

financial characteristics and anti corruption and

bribery mechanism.

What Drives Firm-level Anti Corruption and Bribery Mechanism in Indonesia?

189

2.4 Financial Crisis

The article will test whether during crises firms are

likely to be more or less compliant compared with

non-crisis periods. The author opines that firms

might be more motivated to comply during crisis

periods as a response to secure business and to

maintain investor confidence level. Mitton (2002)

reported that firms which practice accounting

disclosure quality (proxied by the use of the six top

audit agencies) and have higher outside ownership

concentration are rewarded with superior

performance. The results provide a firm-level

evidence which consistent with the view that

corporate governance helps explain firm

performance during a financial crisis. Thus, this

paper posits hypothesis:

H6: There is positive association between

financial crisis and anti corruption and bribery

mechanism.

3 METHODOLOGY AND DATA

3.1 Data Sample

The anti-bribery and corruption in this study are

binary variables of "1" if the firm complies with the

governance principle or fulfills the requirement or

“0” otherwise. The sample consists of 135

Indonesian public listed companies and the

observation period spans from 2003 to 2013 (11

years). Since the Indonesian firms’ corporate

governance data are not readily available, samples

data were collected manually from corporate annual

reports and financial statements, websites of the

Indonesian Stock Exchange, the Indonesia Capital

Market Institute, and other publicly available

documents. Firms with missing data on financial

reports and the financial sector are excluded from

the dataset. Finally, this generates a total of 1,485

firm observations. Hence, the estimate of the anti-

bribery and corruption mechanism is as follows:

Anti-Corruption and Bribery,t= Dummy of “1”

or "0" to represent firm compliance in enacting anti-

corruption and bribery policies, "0" otherwise.

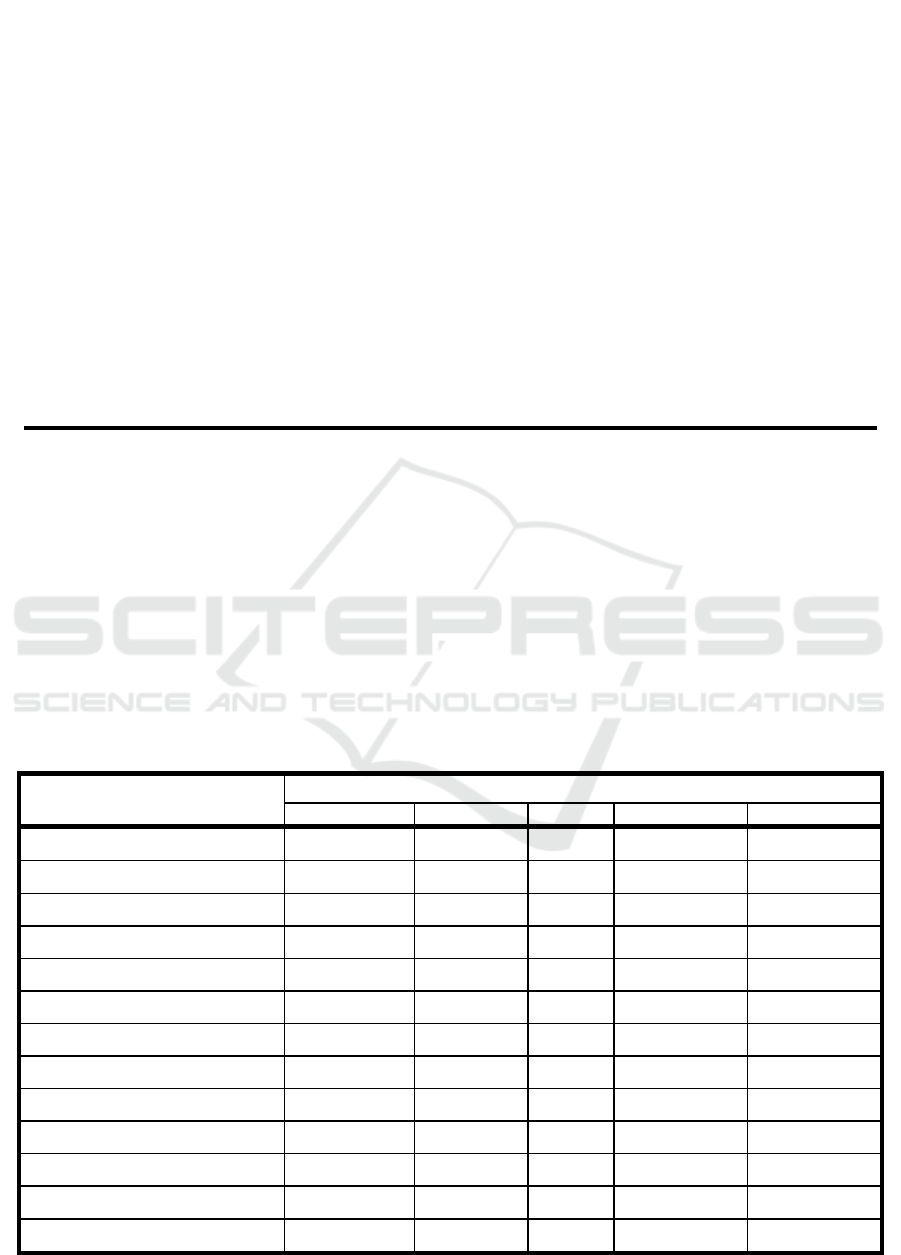

Table 1 presents the definition of the variables

employed in this study. Independent variables are

progressively divided into four categories: firm type

and ownership structures, firms’ financial

characteristics, family control, and binary variables

of the crisis years (2008-2009).

3.2 Econometric Methodology

Following previous studies, this study applies the

logistic regression model to assess the link between

the governance index and its determinants (Aren et

al., 2014; Samaha et al., 2012; Stone and Rasp,

1991). The logistic model has become more critical

in recent financial management and corporate

governance literature, especially when the

researchers need to examine binary or dichotomous

dependent variable (Hoetker, 2007). Hence, the

present study formulates the dependent variable as

firms with high index scores or low scores. The

probability of a firm complies with the principles

(y=1) can be written as follows:

=

′

′

[1]

Following the model, the function of the

probability that a firm discloses an in anti-bribery

and anti-corruption mechanisms are as follows:

Anti-Bribery and Anti-Corruption = α + β1 Firm

Type and Ownership Structure it + β2 Crony it + β3

Financial Characteristics it + β 4 Crisis + є it [2]

The objectives of this study are divided into two

parts, as follows: (1) to examine the determinants of

high ICGI score, and (2) to examine the

determinants of high sub-index score in the family-

controlled firms and non-family firms.

Table 1 Definition of Variables.

Variables Acronym Explanation

Expected

Sign

Anti Corruption and Bribery

Policy

ANTICOR A dummy variable that equals one if the firm has internal

anti-corruption and bribery mechanisms, 0 otherwise

Family Firm FAMFIRM Dummy variable that equals one if the family holds a

minimum of 10% (or 30%) stakes and the family members

hold any position in the boards, and zero otherwise

-

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

190

Family members in the

boards

CRONY Total number of family shareholders generations in the

board of directors and board of commissioners

+/-

Age of the firm AGE The observation period minus the date of the establishment

of the firm (in years)

+

Size SIZE Book value of total assets (in IDR billion) +

Tobin`s q TQ The market value of common equity plus the book value of

total assets minus common equity and deferred taxes divided

by book value of total assets (market valuation of a firm's

assets)

+

Return on Assets ROA Net income divided by total assets +

Price to Book Value PBV Price to book value ratio +

Age of the firm AGE Years since inception +

Size of the firm SIZE Assets per IDR 1 trillion +

Sales SALES Annual sales (revenue) per IDR1trillion +/-

Operating Expense OPEX The ratio of total operating expenses to sales +/-

Debt to Equity Ratio

Block holders

DER The ratio of total debt to equity +

BLOCKSHARE The percentage of shares in the hand of the largest

shareholders

-

Family Shareholders FAMSHARE The ratio of the total shares owned by the controlling family -

Financial crisis CRISIS Dummy variable that equals one for the year 2008 and 2009,

and zeroes otherwise

+

Size of the BoC COMSIZE

Total members of the board of commissioners +

Size of the BoD DIRSIZE

Total members of the board of directors +/-

Independent Commissioner INDCOM

Total number of independent commissioner(s) +

Independent Director INDDIR

Total number of independent director(s) +

4 EMPIRICAL FINDINGS AND

ANALYSIS

4.1 Descriptive Statistics and Logistic

Model Results

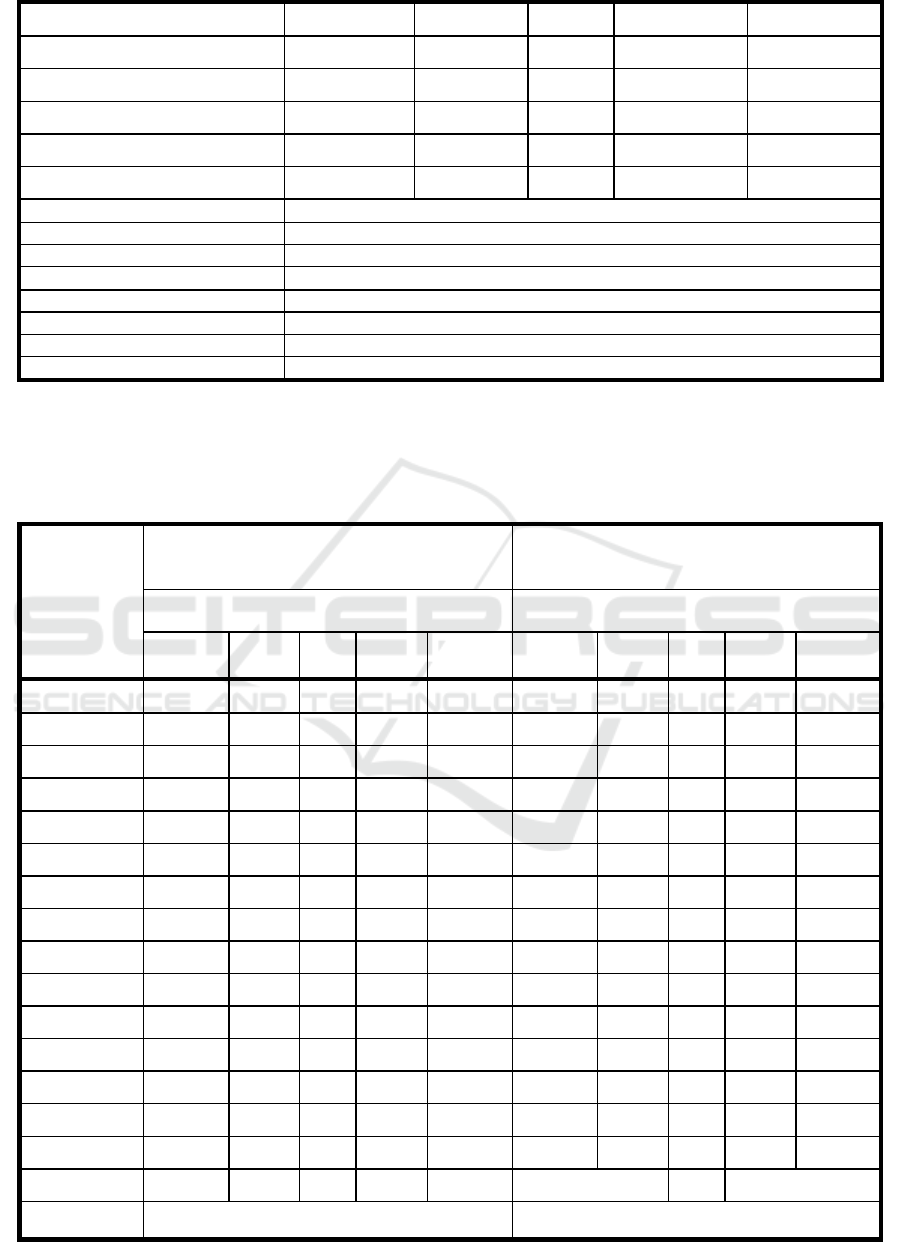

Table 2 summarizes statistics descriptive for

Indonesia listed firm-samples. The mean of the total

firm-samples is 5.7%, indicating a very low

compliance ratio of the firms.

The first research question is, "What are the

determinants of firm-level anti-corruption and

bribery mechanism in Indonesia?" Positive impacts

of the firm's financial characteristic in Table 2 are

represented by price to book value ratio, firm size,

and age. These variables correspond significantly

with higher anti-corruption and bribery policy.

Corporate governance mechanism, as shown by the

board of commissioner (supervisory boards), also

presents a positive and significant coefficient. This

finding highlights the importance of supervisory

board roles and function in monitoring the organs of

the firms and the application of corporate

governance provisions by the management of the

firms.

Conversely, the size of the firm, and leverage

ratio negatively influences the firm's behavior to

comply with the governance provision. In addition,

the independent commissioner also correlates

negatively with the likelihood of the firm to set and

manage anti-bribery and corruption policy. In

addition, another important note taken from this

article is that financial crisis negatively affects

firms’ efforts to introduce and enforce corruption

and bribery prevention measures.

Table 3 summarizes results for three dummy

variables of firm types (widely held firm, foreign

firm, and state-owned firm). Results of these

variables provide confirmation of the poor

compliance by family-controlled companies. On the

other note, coefficients of the foreign firm and state-

owned firms are positive and significant, showing

What Drives Firm-level Anti Corruption and Bribery Mechanism in Indonesia?

191

that these two institutions are more likely to engage

in the active anti-bribery and corruption

implementation.

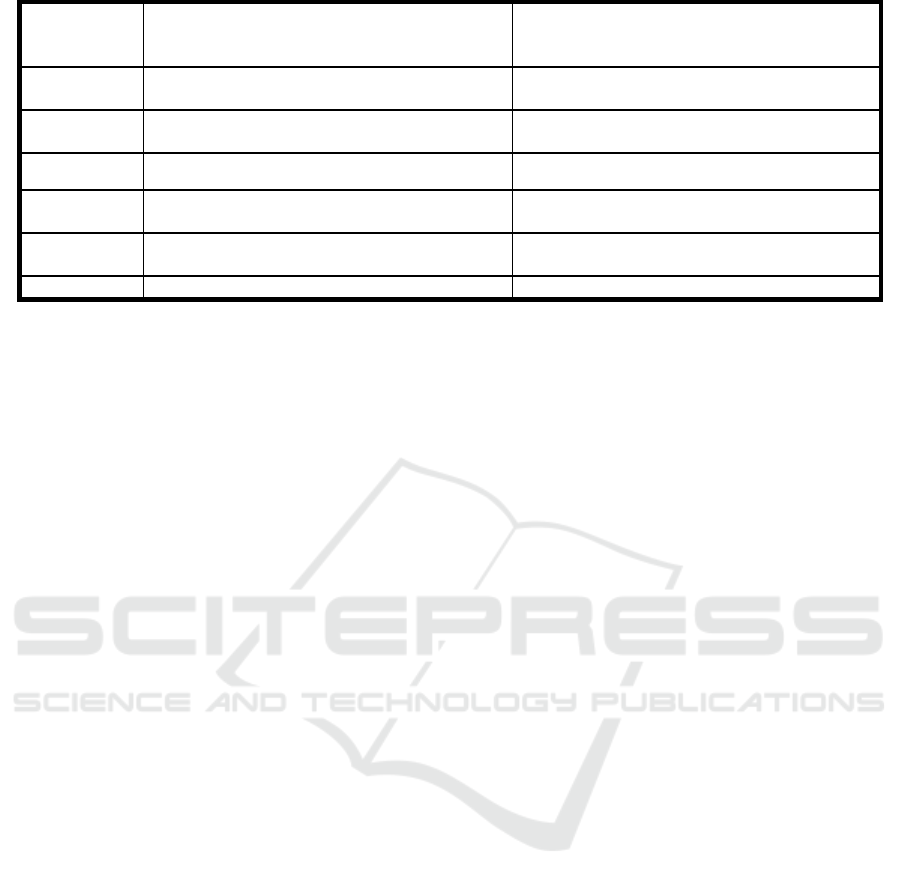

Findings from two sample groups (non-family

versus family firms) are summarised in Table 4. In

terms of family firms, the most important factor for

high compliance to governance provisions is the

firm size. This may translate into a conclusion that

adherence to corporate governance may be costly;

thus, bigger sized firms might be more resourceful to

set up and manage anti-corruption and bribery

prevention mechanisms. The negative influences

come from family ownerships and revenues.

Non-family firms, on the other note, are more

inclined to have anti-corruption and bribery

mechanisms if they were highly valued, older, and

bigger sized institutions. Higher valuations from the

market have a positive influence on non-family

firms to fully comply with the governance

provisions set by the market regulator.

4.2 Robustness Test

The objective of the article is to find contributing

factors of anti-corruption and bribery mechanism by

utilizing the logistic regression. Logistic regression

was selected to minimize the classic econometric

problems found in the corporate governance studies,

such as endogeneity and reverse causality. Previous

literature has tested several robustness checks for

logistic and probit models, and the results showed

that bias and misspecification from both models are

considered minimal or insignificant; thus, the results

of logit and model can be regarded as quite robust

(Cramer, 2007).

In addition, unlike the linear mode, the

robustness tests for non-linear probability model

such as logit and probit are hard to construct since

the coefficients of the logit and probit may change

with the variation of the models. The interpretations

of the coefficients of the logit are also different from

the linear model (e.g., OLS, fixed-effect). To ensure

model specification and the fitness of each model,

the author runs several tests, e.g., link test,

goodness-of-fit test (estat gof), and the classification

statistics (estat classification) in the STATA

operations.

Moreover, the author argues that there are

significant characteristic differences between family

and non-family businesses. It seems that non-family

firms are concerned with market (equity) values than

the family firms. Higher equity, a proxy of a firm’s

market value, positively influences non-family firms

to comply more with the market regulations and

policies. This study suggests that non-family firms

are motivated to send a positive signal to investors

and markets by adopting anti-corruption and bribery

codes. In return, the market is willing to give a

higher or premium price to the firm's share prices

and assets. In the family companies, the level of

concentrated ownerships owned by the family

negatively correlates with anti-corruption provisions.

During financial distress and higher market

uncertainties, family firms are also less likely to

engage in corruption and bribery preventive

measures.

Table 2 Statistics Descriptive

Dependent Variable Mean St. Dev Min Max

Anti-Corruption and Bribery Policy

0.057 0.231 0.000 1.000

Independent Variables Mean St. Dev Min Max

Tobin’s q 1.338 0.893 0.142 4.465

RoA 0.062 0.087 -0.310 0.310

PBV 2.040 5.472 -0.834 167.556

Age 33.985 19.455 4.000 154.000

Size 5.569 14.949 0.017 213.994

Sales 0.239 2.503 -0.862 95.380

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

192

5 IMPLICATIONS OF THE

FINDINGS

The logistic regression models presented in Table 3

shows the determinants of anti-bribery and

corruption mechanism in the firm-level dataset.

Taking into account the findings, the author argues

that the key factors of governance are firm size, age,

and the size of the board of commissioners. Bigger

and older firms (probably also the market leader in

the industry) are more likely to comply with the

regulations than smaller-sized corporations.

Profitable and healthy firms also comply more, as

shown by the coefficient of price-to-book value

(PBV) ratio. In contrast to these results, sales, debt,

financial crisis, and independent commissioners

negatively influence firm’s decision to be in

compliant with the good governance provision.

Table 3 Logistic Regression Results of the Anti Bribery and Corruption

VARIABLE

Y=1 if a firm has anti-bribery and anti-corruption mechanisms, "0" otherwise

Coeff. Std. Err. Sig. Odds Ratio Std Err.

Widely-held Firm

0.0699 0.9317 1.0724 0.9991

Foreign Firm

1.8408 0.8473 ** 6.3015 5.3390

State-owned Firm

4.3548 0.8926 *** 77.8527 69.4893

Tobin’s q

0.2209 0.2036 1.2471 0.2539

RoA

-1.9757 2.0487 0.1387 0.2841

PBV

0.0309 0.0109 *** 1.0314 0.0112

Age

0.0199 0.0073 *** 1.0201 0.0074

Size

0.1333 0.0227 *** 1.1426 0.0260

Sales

-0.1574 0.0256 *** 0.8543 0.0219

Opex

-0.0408 0.8022 0.9600 0.7701

Debt

-0.1315 0.0604 ** 0.8768 0.0529

Blockholder

-0.0120 0.0085 0.9881 0.0084

Family shares

0.0135 0.0091 1.0136 0.0092

Opex 4.900 13.143 0.000 193.880

Debt 0.259 2.337 0.008 89.400

Blockholder 1.616 2.531 0.000 27.547

Family shares 50.052 21.665 3.130 99.740

Crony 30.255 31.218 0.000 98.000

Crisis 4.422 1.944 2.000 14.000

Comsize 4.924 2.104 2.000 13.000

Dirsize 1.537 1.050 0.000 7.000

Indcom 0.127 0.535 0.000 7.000

Inddir 1.338 0.893 0.000 4.465

What Drives Firm-level Anti Corruption and Bribery Mechanism in Indonesia?

193

Crony

0.0350 0.0964 1.0356 0.0998

Crisis

-2.4955 0.6478 *** 0.0825 0.0534

Comsize

0.3008 0.1179 ** 1.3510 0.1592

Dirsize

-0.0928 0.1044 0.9113 0.0952

Indcom

-0.4051 0.2051 ** 0.6669 0.1368

Inddir

-0.1423 0.2698 0.8674 0.2340

Year dummy Included

Log Likelihood function -168.8384

Prob (Chi2>value) 0.0000

Pseudo r-squared 0.4633

Chi-square 231.36

Number of obs 1350

Goodness of fit Yes

Link test Yes

Note: The table represents results of the logistic

regression, showing variables that have significant

influences on anti-bribery and corruption mechanism. Y

equals 1 if the firm has an internal mechanism to prevent

and deter corruption and bribery offenses.

Table 4 Differences between Non-Family Firms and Family Firms

VARIABLE

Model 1: Family Firms

Model 2: Non-Family Firms

Y=1 if a firm has anti-bribery and anti-

corruption mechanisms, "0" otherwise

Y=1 if a firm has anti-bribery and anti-

corruption mechanisms, "0" otherwise

Coeff.

Std.

Err. Sig.

Odds

Ratio Std Err. Coeff.

Std.

Err. Sig.

Odds

Ratio Std Err.

Tobin’s q

0.386 0.215 1.472 0.317 0.378 0.276 1.460 0.402

RoA

-0.009 2.397 0.991 2.376 -3.364 3.959 0.035 0.137

PBV

0.003 0.030 1.003 0.031 0.042 0.016 ** 1.043 0.017

Age

0.010 0.007 1.010 0.007 0.047 0.011 ** 1.048 0.012

Size

0.080 0.021 *** 1.084 0.023 0.330 0.063 * 1.391 0.088

Sales

-0.080 0.025 *** 0.923 0.023 -0.359 0.071 * 0.698 0.049

Opex

-0.015 0.048 0.986 0.047 -3.769 2.389 0.023 0.055

Debt

-0.107 0.080 0.899 0.072 -0.589 0.425 0.555 0.236

Blockholder

0.013 0.008 1.013 0.008 0.010 0.012 1.010 0.012

Family shares

-0.012 0.006 ** 0.988 0.006

Crony

-0.091 0.085 0.913 0.077

Crisis

-1.693 0.847 ** 0.184 0.156 -0.913 1.472 0.401 0.590

Comsize

0.349 0.144 ** 1.417 0.204 -0.019 0.208 0.981 0.204

Dirsize

-0.010 0.120 0.990 0.119 0.010 0.154 1.010 0.155

Indcom

-0.364 0.228 0.695 0.158 -0.520 0.404 0.595 0.240

Inddir

-0.272 0.337 0.762 0.257 Omitted omitted

Year dummy Included Included

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

194

Log

Likelihood

function -124.85144 -49.137038

Probability

(Chi2>value) 0.0000 0.0000

Pseudo R-

squared 0.3412 0.5894

Chi-square 140.55 74.78

Number of

observation 887 411

Goodness of

fit Yes Yes

Link Test Yes Yes

In contrast, there is no evidence that financial

performance (such as negative income or loss) might

lower the probability of the firm to comply with

market governance regulations. Regarding firm size,

the finding depicts a positive relationship between

firm size and compliance quality.

This study also identifies that impacts of family

share ownerships and the block-holders are not

significant, as well as the involvement of family

shareholders (CRONY) in the boards.

The results of this study offer some policy

implications for the academic community and

policymakers. The short-term national agenda might

be started by policymakers and regulators; they can

design policies or specific anti-corruption and

bribery programs for small-sized and young firms.

The author expects that firm-level governance issues

will soon be more vital; thus, a designated body or

task force to monitor and evaluate governance

practices and to design specific benefits for high-

compliant companies will be beneficial in the long

run.

6 CONCLUSIONS

The incidence of corporate failures and economic

crisis in the past decades possibly was the major

reason for the emerging phenomenon of ethical and

transparent business practices in the global market.

Scholars and large corporations have seen good

governance as an effective mechanism to restore

confidence and trust from the market and key

stakeholders.

Thıs study constructs a test to observe the

determinants of firm-level anti-corruption and

bribery mechanism. The anti-corruption and bribery

index is constructed using the Indonesian public

listed firms’ datasets comprising 11 observation

periods. The logistic regression model has been

chosen since the tested dependent variables are

dichotomous or binary variables.

The purpose of this study is to present empirical

findings on the determinants of firms’ anti-

corruption and bribery efforts in the context of the

emerging Indonesian market. The author believes

that this study will be beneficial for various parties,

including policymakers, market regulators, and

corporations in strategic decision making. Empirical

results from the present study suggest that firm size,

age, and supervisory board have sizeable and

significant influences on bribery and corruption

prevention system.

Results of the study support theoretical

arguments that family businesses are plagued with

issues of poor governance compliance. In the

meantime, market and regulatory authority should

design effective methods to promote and

compensate for high compliance and engagement in

a sound and transparent business environment. The

author expects that the findings and discussion from

this study to enhance the understanding of anti-

corruption and bribery development and the actual

adoption in Asia as the region with the most rapid

corporate governance adoption.

REFERENCES

Alatas, V., Cameron, L., Chaudhuri, A., Erkal, N. and

Gangadharan, L. (2009), "Subject pool effects in a

corruption experiment: A comparison of Indonesian

public servants and Indonesian students,"

Experimental Economics, Vol. 12 No. 1, pp. 113–132.

Aren, S., Kayagil, S.Ö. and Aydemir, S.D. (2014), "The

Determinants and Effects of Corporate Governance

Level: Evidence from Istanbul Stock Exchange,"

Procedia - Social and Behavioral Sciences, Vol. 150,

pp. 1061–1070.

Asiedu, E. and Freeman, J. (2009), "The Effect of

Corruption on Investment Growth: Evidence from

What Drives Firm-level Anti Corruption and Bribery Mechanism in Indonesia?

195

Firms in Latin America, Sub-Saharan Africa, and

Transition Countries," Review of Development

Economics, Vol. 13 No. 2, pp. 200–214.

Beets, S.D. (2005), "Understanding the Demand-Side

Issues of International Corruption," Journal of

Business Ethics, Vol. 57 No. 1, pp. 65–81.

Beuselinck, C., Cao, L., Deloof, M. and Xia, X. (2017),

"The value of government ownership during the global

financial crisis," Journal of Corporate Finance, Vol.

42, pp. 481–493.

Cai, H., Fang, H. and Xu, L.C. (2005), Eat, Drink, Firms

and Government: An Investigation of Corruption from

Entertainment and Travel Costs of Chinese Firms, No.

w11592, National Bureau of Economic Research,

Cambridge, MA, available

at:https://doi.org/10.3386/w11592.

Cramer, J.S. (2007), "Robustness of Logit Analysis:

Unobserved Heterogeneity and Misspecified

Disturbances," Oxford Bulletin of Economics and

Statistics, Vol. 69 No. 4, pp. 545–555.

Demsetz, H. and Lehn, K. enneth. (1985), "The Structure

of Corporate Ownership: Causes and Consequences,"

Journal of Political Economy, Vol. 93 No. 6, pp.

1155–1177.

Gaviria, A. (2002), "Assessing the effects of corruption

and crime on firm performance: evidence from Latin

America," Emerging Markets Review, Vol. 3 No. 3,

pp. 245–268.

Hakimi, A. and Hamdi, H. (2017), “Does corruption limit

FDI and economic growth? Evidence from MENA

countries”, International Journal of Emerging Markets,

Vol. 12 No. 3, pp. 550–571.

Hoetker, G. (2007), "The use of logit and probit models in

strategic management research: Critical issues,"

Strategic Management Journal, Vol. 28 No. 4, pp.

331–343.

Isakov, D. and Weisskopf, J. (2014), “Are founding

families special blockholders ? An investigation of

controlling shareholder influence on firm

performance”, Vol. 41, pp. 1–3.

Jain, A.K. (2001), “Corruption: A Review”, Journal of

Economic Surveys, Vol. 15 No. 1, pp. 71–121.

Jensen, M.C. and Meckling. (1976), “Theory of the Firm:

Managerial Behavior, Agency Costs and Ownership

Structure”, Journal of Financial Economics, Vol. 3 No.

4, p. 78.

Kuncoro, A. (2004), “Bribery in Indonesia: some evidence

from micro-level data”, Bulletin of Indonesian

Economic Studies, Vol. 40 No. 3, pp. 329–354.

Kuncoro, A. (2006), "Corruption and Business

Uncertainty in Indonesia," Asean Economic Bulletin,

Vol. 23 No. 1, pp. 11–30.

Mitton, T. (2002), “A cross-firm analysis of the impact of

corporate governance on the East Asian financial

crisis”, Journal of Financial Economics, Vol. 64 No. 2,

pp. 215–241.

Ng, D. (2006), “The impact of corruption on financial

markets”, Managerial Finance, Vol. 32 No. 10, pp.

822–836.

Palmer, C. (2001), “The extent and causes of illegal

logging: an analysis of a major cause of tropical

deforestation in Indonesia”, (CSERGE Working

Papers ). Centre for Social and Economic Research on

the Global Environment (CSERGE): London, UK.

(2001), Working / discussion paper, , available at:

http://www.cserge.ucl.ac.uk/publications.html

(accessed 14 August 2019).

Quah, J.S.T. (1999), “Corruption in Asian Countries: Can

It Be Minimized?”, Public Administration Review,

Vol. 59 No. 6, p. 483.

Ricardo, L., Castro, K. De and Aguilera, R. V. (2016),

“Family Firms and Compliance : Reconciling the

Conflicting Predictions Within the Socioemotional

Wealth Perspective”, available

at:https://doi.org/10.1177/0894486516685239.

Saito, T. (2008), “Journal of The Japanese and Family

firms and firm performance : Evidence from Japan”,

Journal of The Japanese and International Economies,

Elsevier Inc., Vol. 22 No. 4, pp. 620–646.

Samaha, K., Dahawy, K., Hussainey, K. and Stapleton, P.

(2012), “The extent of corporate governance

disclosure and its determinants in a developing

market: The case of Egypt”, Advances in Accounting,

Vol. 28 No. 1, pp. 168–178.

Shleifer, A. and Vishny, R.W. (1986), “Large

Shareholders and Corporate Control”, The Journal of

Political Economy, Vol. 94 No. 3, pp. 461–488.

Stigler, G.J. and Friedland, C. (1983), “The Literature of

Economics: The Case of Berle and Means”, The

Journal of Law and Economics, Vol. 26 No. 2, pp.

237–268.

Stone, M. and Rasp, J. (1991), “Tradeoffs in the Choice

between Logit and OLS for Accounting Choice

Studies”, The Accounting Review, Vol. 66 No. 1, pp.

169–187.

Wu, X. (2005), “Corporate Governance and Corruption: A

Cross-Country Analysis”, Governance, Vol. 18 No. 2,

pp. 151–170.

ICOACI 2019 - International Conference on Anti-Corruption and Integrity

196