The Effect of Financial, Attitude, and Financial Knowledge

on the Personal Finance Management of

College Collage Students

Raras Risia Yogasnumurti, Isfenti Sadalia, and Nisrul Irawati

Department of Magister Management, Universitas Sumatera Utara, Jl. Sivitas Akademika Kampus USU, Medan, Indonesia

Keywords: Financial Attitude, Financial Knowledge, and Personal Financial Management

Abstract: College collage studentss are one part of the community involved in the use of finance to be used in the level

of daily consumption. Collage studentss of the Faculty of Economics and Business of Islam, North Sumatra

State Islamic University (UINSU) - Medan who have indeed studied matters relating to economics and finance

that should have added value better than other circles. Therefore, it is very important for collage studentss to

know and apply the meaning of personal financial management to be able to become collage studentss who

are good at managing finances and living more prosperously in the future. Researchers are interested in

knowing whether there is an influence between the level of financial knowledge of a collage students on

personal financial management. The study was conducted at the Faculty of Economics and Islamic Business

UINSU-Medan by taking collage studentss as the population. The sample of respondents as many as 98

collage studentss. By applying method using the SPSS Version 23 tool, it can be concluded that Financial

Attitude has a positive and significant effect on Personal Financial Management. Financial Knowledge has a

positive and significant effect on Personal Financial Management. Financial Attitude and Financial

Knowledge have a positive and significant effect on Personal Financial Management.

1 INTRODUCTION

The increasing needs and desires of Indonesian

people caused by the development of human

civilization that is increasingly advanced. Working

and earning income is one way to fulfill it. After

getting it, individuals also need to manage income

well so that they can use it with their respective

portions. One intelligence that must be possessed by

modern humans is financial intelligence, which is

intelligence in managing personal financial assets.

Some people tend to store a lot of information,

some want to gather information before making a

purchase, and some people want to follow their

instincts. By applying the correct way of financial

management, the individual is expected to get the

maximum benefit from the money he has. Collage

studentss as young people not only face increasing

complexity in financial products, services and

markets, but they are more likely to have to bear

greater financial risks in the future.

Many people who do not understand about

finance cause them to suffer losses, either due to a

decline in economic conditions and inflation or

because the development of an economic system that

tends to be wasteful because people are increasingly

consumptive. Many people who use home loans and

credit cards, but because of lack of knowledge, not a

few who suffer losses or often occur differences in

calculations between consumers and banks. Many

people are still unable to invest or access the capital

market and money market, because people do not

have the knowledge enough about it. Meanwhile,

education about finance (financial education) is still a

big challenge in Indonesia. Financial education is a

long process that spurs individuals to have financial

plans in the future in order to obtain prosperity in

accordance with the patterns and lifestyles they live (

Nababan and Sadalia, 2013).

Understanding financial attitude (financial

attitude) according to Pankow (2003) as quoted by

Ningsih and Rita (2010), namely financial attitude is

defined as a state of mind, opinion, and assessment of

finance. Personal financial attitude is an important

contributor to the success or failure of consumer

finance. thus, several studies have been carried out to

Yogasnumurti, R., Sadalia, I. and Irawati, N.

The Effect of Financial, Attitude, and Financial Knowledge on the Personal Finance Management of College Collage Students.

DOI: 10.5220/0009329206490657

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 649-657

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

649

examine the management of collage students finances

either from one's own financial attitude or in

conjunction with financial knowledge and financial

behavior. So it can be interpreted that a person's

attitude refers to how they feel about personal

financial problems that can be measured by responses

to a statement or opinion (Marsh, 2006). Financial

attitude will help individuals in determining their

attitudes and behavior both in terms of financial

management, financial budgeting and making

decisions.

In a simple sense personal finance consists of 2

(two) parts. "Finance" relating to finance, or money,

or can also be interpreted as the science of managing

money. "Personal" means a person, or someone. In

this context, personal finance can be defined as the

financial management of individuals or families

needed to get a budget, savings, and spend resources

over time, taking into account various financial risks

for the future.

Good personal financial management is not

enough for collage studentss and collage studentss in

planning, budgeting, examining, managing,

controlling, searching and storing daily financial

funds properly. Therefore financial education is

needed for the introduction of financial knowledge so

that collage studentss and collage studentss can get to

know and know how financial management actually

takes a responsible decision. Financial knowledge

(financial knoeledge) at this time is needed, because

the community at the time nowadays tend to buy

something in accordance with their wishes. To have

financial knowledge it is necessary to develop

financial skills and learn to use financial tools. Setting

up a budget, choosing an investment, choosing an

insurance plan and using credit are examples of

financial skills. Financial skills are a technique for

making decisions in personal financial management.

Financial tools are forms and charts used in making

personal financial management decisions (such as

checks, credit cards, debit cards) (Ida and Chintia

Yohana Dwinta, 2010).

Collage studentss are one part of the community

involved in the use of finance to be used in the level

of daily consumption. Consumptive and instant life

style makes collage studentss often spend money to

buy what they really don't need. Moreover, nowadays

technology is increasingly developing, so they can

easily buy anything they want through online shop.

Increasing the activity of collage studentss in

searching for goods through online shop will certainly

increase the use of pulsadi compared to those who are

not online. While problems in holding money most

experienced by collage studentss, especially those

who are not at home with their parents. This is

because collage studentss are in a transition from

dependence to financial independence.

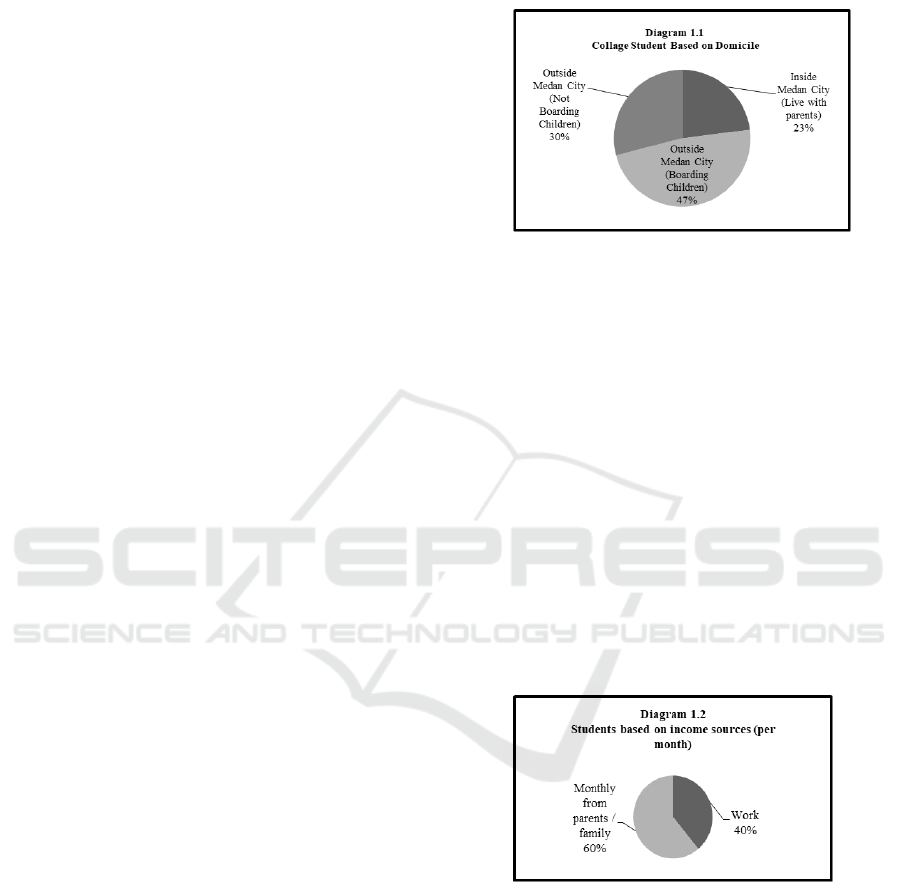

Figure 1.

Most of the collage students of the Faculty of

Economics and Business Islam, North Sumatra State

Islamic University Medan are overseas collage

studentss and far from parents, in meeting the

necessities of life, always waiting for parental

deliveries of 14 people (47%). In addition there are

also those who are outside the city of Medan (Binjai,

Stabat, Perbaungan, Lubuk Pakam and Belawan) but

not as many as 9 boarders (30%). They use private

and public transportation to access universities that

are not nearby. And the category in Medan (living

with parents / guardians) is 7 people (23%). The

attitude of collage studentss in allocating money from

parents / guardians depends on their individual

behavior. Some groups of collage studentss spend all

remittances from their parents, even they always ask

for additional transfers.

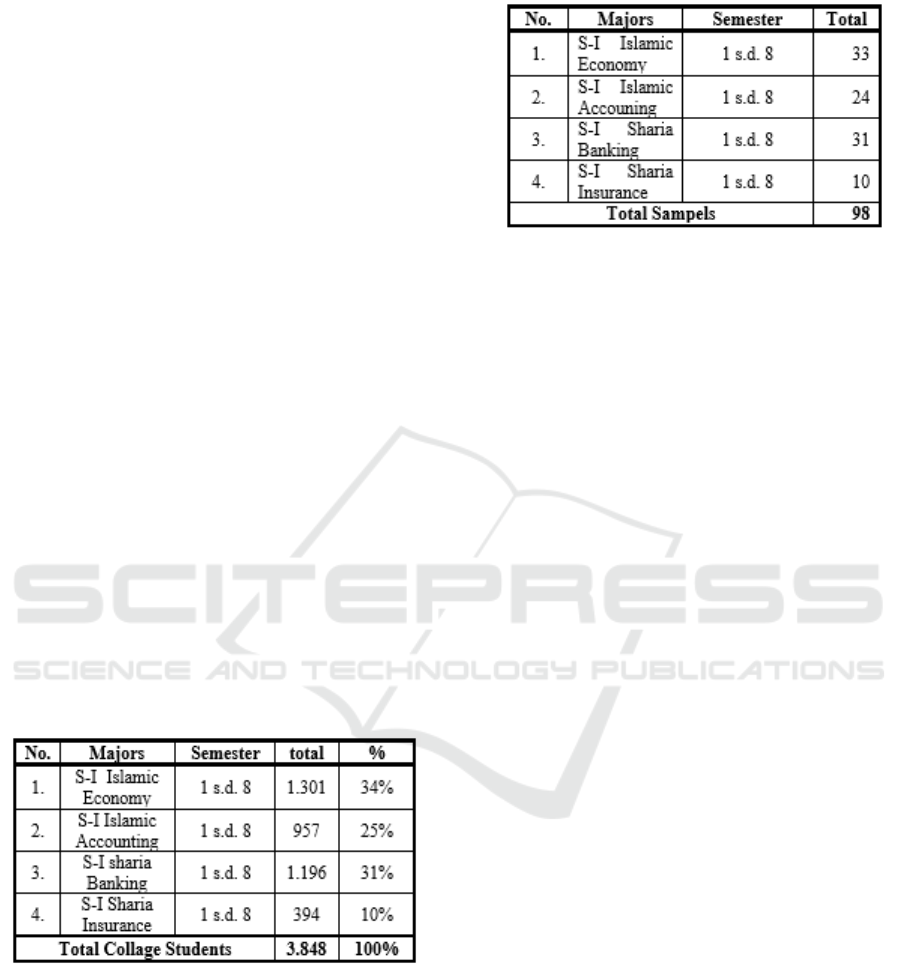

Figure 2.

Diagram 1.2. shows of 30 collage studentss 12

people who already have jobs such as opening an

online business, teaching private tutoring, working in

restaurants, opening a culinary business, working in a

workshop and others. Eighteen people who only rely

on monthly money from parents / family without

work, if they are not good at managing their finances,

the funds prepared for a month can be used up within

a week. Managing collage students finances that has

worked in contrast to collage studentss who have not

EBIC 2019 - Economics and Business International Conference 2019

650

yet worked because they can value money more. They

better understand how difficult it is to get money,

different from collage studentss who get money only

by asking parents / guardians.

For collage studentss, personal financial

management is not an easy thing to do because there

are only difficulties faced, one of which is the

phenomenon of consumer behavior that develops.

Consumptive behavior encourages people to

consume goods or services excessively without

paying attention to the scale of priorities. / guardian,

or monthly money that is untimely, due to the

depletion of funds due to unexpected needs, or due to

wrong personal financial management (no

budgeting), as well as lifestyles and wasteful

consumption patterns.

Figure 3.

Collage studentss who do not make a monthly

budget get 73% (22 people), this shows that there are

still few collage studentss who routinely make a

budget as shown in diagram 1.3, which is as much as

27% (8 people). This makes it difficult for collage

studentss to apply personal financial management,

because they do not make financial details every

month. Collage studentss of the Faculty of Economics

and Business of Islam, North Sumatra State Islamic

University (UINSU) - Medan who have indeed

studied matters relating to economics and finance that

should have added value that is better than other

circles. Therefore, it is very important for collage

studentss to know and apply the meaning of personal

financial management to be able to be a collage

students who is good at managing finances and living

more prosperously in the future. Researchers are

interested in knowing whether there is an influence

between the level of financial knowledge of a collage

students on personal financial management.

1.1 Formulation of the Problem

Based on the background, the main problem that will

be resolved from this research is how financial

attitudes and financial knowledge that have been done

by collage studentss in conducting personal financial

management of the Faculty of Economics and Islamic

Business UINSU - Medan.

In connection with this problem, several questions

need to be answered:

1) Does financial attitudes have a significant effect

on personal financial management?

2) Does financial knowledge have a significant

effect on personal financial management?

3) Does financial attitude and financial knowledge

have a significant effect on personal financial

management?

4) Does gender moderate the effect of financial

attitude and financial knowledge on personal

financial management?

1.2 Research Purposes

Referring to the above research problem formulation,

the purpose of this study is to obtain a policy / formula

design and an effective strategy implemented to

improve collage students personal financial

management. For this we need to analyze:

1) Analyzing financial attitude has a significant

effect on personal financial management.

2) Analyzing financial knowledge has a significant

effect on personal financial management.

3) Analyzing financial attitude and financial

knowledge has a significant effect on personal

financial management.

4) Analyzing gender moderates the effect of

financial attitude and financial knowledge on

personal financial management.

2 LITERATURE REVIEW

2.1 Description of Theory

2.1.1 Financial Attitude

Financial attitude is a state of a person towards

finance that is applied to attitude. Attitudes are part of

beliefs, feelings-assessed feelings and intentional

behavior towards people, objects, and events (an

attitude object) (Taufiq Amir, 2017: 31). Attitudes are

evaluative statements both pleasant and unpleasant

toward objects, individuals , and events (Robbins &

Judge, 2008).

According to Ersha Amanah, Dadan and Aldila

(2016), attitude is a measure, opinion and rating of a

person towards the world in which they live. And

according to Pankow (2003), attitude is a measure of

a person's state of mind, opinion and assessment of

the world he lives in. So that financial attitude is a

The Effect of Financial, Attitude, and Financial Knowledge on the Personal Finance Management of College Collage Students

651

person's condition, opinion or assessment of money

that is applied or applied to attitude. Based on the

research of Hayhoe, et al (1999), the financial attitude

possessed by a person will influence and assist the

individual in behaving and behaving towards

finances. Both in managing, budgeting and decisions

to be taken. Financial attitudes can be influenced by

family, school and so on. If an individual is in a good

financial management environment, then the

individual will automatically be able to manage

finances well too.

Financial attitudes can be reflected by the

following six concepts (Furnham, 1984), namely:

a. Obsession, refers to a person's mindset about

money and their perception of the future to

manage money well.

b. Power, which refers to someone who uses money

as a tool to control others and according to him

money can solve problems.

c. Effort, refers to someone who feels worthy of

having money from what he has done.

d. Inadequacy, refers to someone who always feels

that he doesn't have enough money.

e. Retention, refers to someone who has a tendency

not to want to spend money.

f. Security, referring to someone's very old-

fashioned view of money as the assumption that

money is better to be kept alone without saving in

a bank or for investment.

The instrument used in financial attitude research

adopted a study conducted by Zahroh (2014). The

indicators used are:

a. Orientation towards personal finance: habits in

planning financial budgets.

b. Debt philosophy: The negative attitude used when

collage students financial security is limited.

c. Money security: Collage studentss will feel secure

in their financial condition.

d. Assessing personal finance: Personal finance

that reflects the nature of collage studentss.

2.1.2 Financial Knowledge

Knowledge refers to what individuals know about

personal financial matters, as measured by their level

of knowledge about various personal financial

concepts. According to Kholilah and Iramani,

Financial Knowledge, is one's mastery of various

things about the world of finance (2013). Youth learn

about money mostly from school and parents, with an

emphasis on savings (Chowa, et.al, 2012). In its

development, knowledge about finance began to be

introduced to various levels of education.

To handle personal finance systematically and

successfully, knowledge is needed. Financial

knowledge hasa relationship with financial literacy

and financial education. Financial literacy is

knowledge of facts, concepts, principles, and

technological tools to find out about finance (Garman

and Gappinger, 2008). Mason and Wilson (2000),

financial literacy is the process by which individuals

use skills, resources, and knowledge to process

information and make decisions with knowledge

about financial decisions. Meanwhile, according to

Lusuardi (2008), financial literacy is defined as

knowledge of basic financial concepts including

multiple knowledge, differences in nominal values

and real values, basic knowledge about risk

diversification, time value of money and others.

Financial knowledge is important to know the

financial knowledge that is used for daily needs and

long-term needs. Many collage studentss do not

understand finance so that it can cause collage

studentss to experience wasteful or tend to be

wasteful of collage studentss who are increasingly

consumptive.

2.1.3 Personal Financial Management

Financial management is management that regulates

all matters related to financial or funding issues. So,

financial management is often defined as a way of

planning, budgeting, checking, managing,

controlling, finding and saving funds or money for an

institution or company. For personal financial

management, of course the understanding can be

more concise, namely how to manage income,

expenses, spending on basic needs and personal

savings.

Humans have needs and desires. Meeting the

needs of life is the main goal of personal financial

management. Then, after various needs are met, then

you fulfill your desires. The following are some types

of needs according to the level that needs to be met

first:

a. Primary needs are basic needs that absolutely

must be met by humans. This need is very

important. Usually, humans will work to be able

to meet their primary needs first. Included in

primary needs are food, drink, clothing and

shelter.

b. Secondary needs are supporting human primary

needs. Secondary needs are only thought of by

humans when their primary needs have been met.

Examples are nutritious food and drink, clean and

neat clothes, owning a home, health and seeing a

doctor when sick, having a vehicle, schooling

EBIC 2019 - Economics and Business International Conference 2019

652

education, simple entertainment and saving

money.

c. Tertiary needs are supporting primary and

secondary needs. These needs can be met if the

primary and secondary needs have been met.

Examples are eating and drinking in luxury

restaurants, dressed in boutique or well-known

brands, owning luxury homes, seeing doctors and

the best hospitals, owning luxury vehicles,

education in elite schools, entertainment abroad,

saving and investing.

The Following are some source of personl finance

is like works, Running a business, Giving, and

investmen. According to Luqyan and Murniati

(2018), there are several parts in managing personal

finances, namely:

a. Managing Income

Revenue management (managing income) is

the most important part in financial planning

because without income and a clean source, any

good financial planning will be in vain. One of the

good things about planning is the return of

financial control to our own hands. It said 'back'

because it was a habit when it came to money,

often leaving it out of control, especially for

expenses. The ability to control finances is the key

to being able to live in peace and blessings.

b. Managing Needs

A simple definition of needs is anything

without these items that will suffer, generally

called very basic needs, such as food, clothing and

shelter. Revenue allocated for several expenses

can be grouped in several important items

according to the desired priority scale.

c. Managing Dreams / Wants

Desires or dreams are things that are desired to

complete life can be due to provide comfort or

beautify the environment around us. Simply wants

are all needs that have a secondary dimension.

There are no special restrictions that govern wants

because the desires of each individual are very

relative and vary according to the times, where

they live, or the socioeconomic conditions of

each. That must be considered are excessive signs

and redundant.

3 METHOD

3.1 Research Type

This type of research is descriptive and associative

research. Descriptive and associative research is

carried out because of the variables to be examined in

relation to and the purpose of presenting a structured,

factual and accurate picture of the facts and the

relationships between the variables studied.

Descriptive according to Sugiyono (2014: 53), which

is a problem statement regarding the question of the

existence of an independent variable, whether only on

one or more variables (the independent variable is a

standalone variable, not an independent variable

always paired with the dependent variable).

This descriptive method is a method that aims to

find out the nature and deeper relationship between

two variables by observing certain aspects more

specifically to obtain data in accordance with existing

problems with research objectives, where the data is

processed, analyzed, and processed furthermore with

the basic theories that have been studied so that the

data can be drawn a conclusion. In this research,

descriptive is used to explain the influence of

financial attitude, financial knowledge, personal

financial management, and gender on the collage

studentss of the Faculty of Economics and Islamic

Business UINSU-Medan.

While associative according to Sugiyono (2014:

55) is associative research is a study of two or more

variables. In this research, a theory can be built that

can serve to explain, predict and control a

phenomenon. In this study, the associative method is

used to explain the effect of financial attitude,

financial knowledge, personal financial management,

and gender (moderating variables) on collage

studentss of the Faculty of Economics and Islamic

Business UINSU-Medan.

3.2 Data Collection Methods

3.2.1 Population

Population is a whole individual or a certain object or

size obtained from all certain individuals or objects to

be studied that have certain characteristics, clear and

complete. The population in this study are all collage

studentss who are still actively studying at the Faculty

of Economics and Islamic Business, State Islamic

University of North Sumatra (UINSU) - Medan. The

collage students population used as a reference is the

total number of collage studentss who are still active

in college starting from the first semester to the last

semester, active collage studentss were recorded from

2015 to 2018 as many as 4,363 people.

3.2.2 Sample

The reason for selecting samples by using purposive

sampling technique is because not all samples have

criteria in accordance with this study, namely by

The Effect of Financial, Attitude, and Financial Knowledge on the Personal Finance Management of College Collage Students

653

setting certain criteria that must be met by the sample

used in the study. As for the criteria in selecting the

research sample are respondents who have made

repeat purchases at least 2x for the past 3 years.

The research uses the Slovin formula because in

sampling, the numbers must be representative so that

the results of the study can be generalized and the

calculation does not require a table of the number of

samples but can be done with formulas and simple

calculations.The Slovin formula for determining

samples is as follows:

n = N / (1 + N 〖(e)〗 ^ 2)

Where:

N = Number of population

n = Number of samples

e = error rate

Obtained:

n = 4,363 / (4,363 (〖10%)〗 ^ 2 + 1)

n = 97, 759 = 98 respondents

So that the number of samples to be used in this

study were 98 respondents. The sampling technique

uses purposive sampling, namely the taking technique

with certain considerations (Sugiyono, 2010).

Respondents are limited by the following inclusion

criteria:

a. Collage students taking Bachelor Degree (S-1).

b. Collage studentss who have studied financial

management courses.

3.2.3 Data Sources

Table 3.1 Total of FEBI UINSU Collage students 2015 to

2018

Then to determine the number of respondents

from each group are as follows:

1. S-I Islamic Economy = 98 x 34% = 33.13 = 33

Respondents

2. S-I Islamic Accounting = 98 x 25% = 24.37 = 24

Respondents

3. S-I Sharia Banking = 98 x 31% = 30.45 = 31

Respondents

4. S-I Sharia Insurance = 98 x 10% = 10.03 = 10

Respondents

Table 3.2 Total Research Samples Per Departement

4 RESULTS AND DISCUSSION

Based on the research results and the discussion. Has

been carried out in this study, Then the researcher

takes the conclusion as follows:

a. Financial Attitude has a positive and significant

effect on Personal Financial Management. This

study proves that the financial attitude of the

students of the Faculty of Economics and Islamic

Business UINSU - Medan influences personal

financial management. This is indicated by the

results of the t-test used to measure whether

financial attitude influences personal financial

management. The t-test shows that the

significance value is below 0.05 which is 0.000.

The significance value of this test is the basis for

making a decision to reject Ho and accept H1 so

that it can be concluded that there is an influence

between financial attitude on personal financial

management. Financial attitude that affects

personal financial management makes students of

the Faculty of Economics and Islamic Business

UINSU-Medan to be able to do better financial

management of personal finance. This will

influence students and students to be able to

determine what kind of actions they should take

which they then apply to attitude. Students and

students who have a good financial attitude will

become a habit for students and will become

behavior that will be difficult to change. If the

financial attitude is good, the financial behavior in

managing personal finances is also good. Students

can reduce their difficulties if they are able to

manage their personal finances with attitudes that

should be applied in life so that it can facilitate

financial decision making. Inversely related to

that, if they do not have a good financial attitude

then they themselves are making it difficult to

manage their finances. Finally there are no good

habits so it is very difficult to respond to matters

EBIC 2019 - Economics and Business International Conference 2019

654

concerning personal finances. Financial attitude is

a state of mind, opinion, and assessment of

someone's personal finances, which are then

applied to the attitude. A person's thoughts,

opinions and judgments about their personal

financial situation will determine what actions

they will take. For example savings, if someone

has thoughts, judgments, and opinions that saving

is not important. Then the person will not save. If

these thoughts, opinions, and judgments

(attitudes) continue, it will become a habit /

behavior (behavior) that will be very difficult to

change. Financial Attitude influences personal

financial management supported by the concept

proposed by Furnham, namely the concept of

obsession and retention. The concept of obsession

has a meaning in a person's mindset about money

and his perception of the future to manage his

personal finances well while the concept of

retention refers to someone who has a tendency

not to want to spend money in the sense of

managing his personal finances The results of this

study are supported by previous studies such as in

the research of Ersha Amanah, Dadan Rahadian

and Aldila Iradianty (2016) states that Financial

attitude has a greater t value than t table. Because

the value of t arithmetic> t table (2,367> 2,258),

then H0 is rejected. So financial attitude partially

influences personal financial management

behavior

b. Financial Knowledge has a positive and

significant effect on Personal Financial

Management. This research proves that the

financial knowledge of UINSU-Medan Islamic

Economics and Business Faculty influences

personal financial management. This is indicated

by the results of the t-test used to measure whether

financial knowledge influences personal financial

management. The t-test shows that the

significance value is below 0.05, 0.003. The

significance value of this test is the basis for

making a decision to reject Ho and accept H2 so

that it can be concluded that there is an influence

between financial knowledge on personal

financial management. Financial knowledge that

affects personal financial management makes

students of the Faculty of Economics and Islamic

Business UINSU - Medan to understand financial

management. This will influence students and

students to be able to determine what behavior

they must do to make it easy in making decisions.

Students and students who have good financial

knowledge will be able to use money wisely and

can provide benefits to their lives. If students have

high financial knowledge, they are better able to

understand how financial management should be

and make their personalities more controlled. If

they have a low level of knowledge, it is very

difficult to manage finances or make decisions

and in the end it affects the use of money

according to the level of knowledge they have.

One of the factors that can increase financial

knowledge is education. The more a person

receives education the financial knowledge of that

person will also increase. This is caused by

educated people who will choose various

financial tools (credit cards, debits, pay checks,

bonds, stocks, etc.) that make it easy for them to

make transactions or investments. People who

have higher education will also be more vigilant

about their future. So they will find out more

about ways to save their assets. Financial

Knowledge influencing personal financial

management is supported by the concept put

forward by Hilgret & Jeanne namely, the lack of

knowledge of financial management principles

and financial matters can explain why some

individuals do not follow recommended financial

practices. To have financial knowledge it is

necessary to develop financial expertise and learn

to use financial tools. Financial expertise is a

technique for making financial management

decisions. This research is in line with research

conducted by Ersha Amanah, Dadan Rahadian

and Aldila Iradianty (2016); Financial knowledge

has a greater t value than t table. Because the value

of t arithmetic> t table (9,085> 2,258), then H0 is

rejected. So it can be concluded that financial

knowledge partially influences personal financial

management behavior and Herma Wiharno

(2018) states that there is a significant relationship

between financial knowledge and personal

financial management. This shows that the three

variables namely financial knowledge, financial

behavior and financial attitude partially have a

positive effect on personal financial management.

Statistical test results show the sig or p-value for

the three variables namely financial knowledge,

financial behavior and financial attitude is smaller

than the alpha value (0.001 <0.05 for financial

knowledge, 0.018 <0.05 for financial behavior,

and 0.00 <0.05 for financial attitude). Thus it can

be said that the variables of financial knowledge,

financial behavior and financial attitude partially

have a significant positive effect on personal

financial management.

c. Financial Attitude and Financial Knowledge have

a positive effect on Personal Financial

The Effect of Financial, Attitude, and Financial Knowledge on the Personal Finance Management of College Collage Students

655

Management. This research proves that the

financial attitude and financial knowledge of

UINSU-Medan Faculty of Economics and Islamic

Business in Medan influences personal financial

management. This is indicated by the results of

the F test used to measure whether financial

attitude and financial knowledge affect personal

financial management. In the F test shows that a

value of 34,346 with a significance value is 0,000.

While the value of 𝐹𝑡𝑎𝑏𝑒𝑙 in the degree of

freedom df (N1) is 2.36. It can be concluded that

𝐹ℎ𝑖𝑡𝑢𝑛𝑔> 𝐹𝑡𝑎𝑏𝑒𝑙 (34,346> 2.36) and the

significance value is smaller than the significant

level α = 0.10 (0,000 <0.10). The significance

value of this test is the basis for making a decision

to reject Ho and accept H3 so that it can be

concluded that there is an influence between

financial attitudes and financial knowledge on

personal financial management. Financial

Attitude and financial knowledge that affect

personal financial management make the students

of the Faculty of Economics and Business Islamic

UINSU - Medan to be able to understand attitudes

and knowledge in managing personal finances.

This will influence students and students to be

able to determine what behavior they must do for

decision making. Students who have good

financial attitude and financial knowledge will be

able to use money wisely and be able to benefit

their lives. And make details in managing their

finances. This study is in line with research

conducted by Herma Wiharno (2018) states that

there is a significant relationship between

financial knowledge and personal financial

management. Statistical test results show the sig

or p-value for the three variables namely financial

knowledge, financial behavior and financial

attitude is smaller than the alpha value (0.001

<0.05 for financial knowledge, 0.018 <0.05 for

financial behavior, and 0.00 <0.05 for financial

attitude). Thus it can be said that the variables of

financial knowledge, financial behavior and

financial attitude partially have a significant

positive effect on personal financial management.

Based on the results and discussion of the material

and some suggestions that can be conveyed:

1. For the Faculty of Economics and Islamic

Business of UINSU-Medan

It is expected to be able to increase knowledge

about personal financial management, so that

collage studentss can implicate it in their daily

lives. So that the public's view of FEBI UINSU-

Medan can improve because collage studentss can

and are able to manage their personal finances.

2. Share the Next Researcher

It is expected that this will be a continuous

reference and develop this research. This research

uses Financial Attitude and Financial Knowledge

as free variables, Gender as a moderating variable

and Personal Financial Management as bound

variables. For further research, we can replace

variables in the research with other variants in

order to find new variables in the discussion about

Personal Financial Management.

REFERENCES

Abraham Ansong and Michael Asiedu Gyensare.2012.

"Determinats of University Working Studies' Financial

Literacy at the University of Cape Coast, Ghana",

International Journal of Business and Management 7,

No.8.

Alexano, Poppy. 2014. Financial Management for

Beginners and Laymen, Jakarta: Literacy Literacy.

Amaliyah, RiskidanWitiastuti, Rini. 2015. "Factor Analysis

That Affects Financial Literacy Levels among Tegal

City SMEs," Management Analysis Journal 4 (3), 2015,

252-257.

Andrew, Vincentius and Linawati, Nanik. 2014.

"Relationship between Demographics and Financial

Knowledge with Financial Behaviors of Employees in

Surabaya," Finesta, Vol.02 No.02,2014,35-39.

Badar, Gus. 2010. How to Get Rich Since You're a Collage

students, Yogyakarta: Gara Knowledge

Bowen, Cathy. 2003. Financial Knowledge of Teens and

Their Parents. Financial Counseling and Planning 13

(February): 93-102.

Budiono, Tania. 2014. The Relationship between Financial

Attitude, Financial Behavior & Financial Knowledge

for Strata 1 Collage studentss at Atmaajaya University

Yogyakarta. Yogyakarta: Atmajaya University.

Campbell, John. 2006. Household Finance. Journal of

Finance61 (August): 553-1604.

Chen, Haiyang, and Ronald P. Volpe. 1998. An Analysis of

Personal Financial Literacy among College Collage

studentss. Financial Services Review 7: 107-128

ChowaG. A. N., M. Despard, and O. AkotoIsaac. 2012.

Financial Knowledge and Attitudes of Youth in Ghana,

Youth Save Res.

Cole, Shawn, Thomas Sampson, and Bilal Zia. 2008.

Money or knowledge? What drives the demand for

financial services in developing countries? Harvard

Business School Working Paper, No. 9-117.

Courchane, Marsha J., Adam Gailey and Peter Zorn. 2008.

Consumer Credit Literacy: What Price Perception?

Journal of Economics and Business60 (January-

February): 125-138.

Eagly, A. & Chaiken, S. 1993. The psychology of attitudes.

Toronto: Harcourt Brace Jovanovich College.

EBIC 2019 - Economics and Business International Conference 2019

656

Gitman, Lawrence. 2011. Principles of Managerial

Finance: 13th Edition. Boston: Pearson Education.

Ghozali, Imam. 2002. Non-Parametric Statistics.

Semarang. Diponegoro University Publisher.

Guiso, Luigi, and TullioJappelli. 2008. Financial literacy

and portfolio diversification. CSEF Working Paper, No.

212

Herdjiono, Irined and Danik, Lady Angela. 2016.

"Influence of Financial Attitude, Financial Knowledge,

Parental Income on Financial Management Behavior,"

Journal of Agency Management and Application, Year

9 No.3, December 2016, 226-241.

Herdjiono, Irine. "Gender Gap in Financial Knowledge,

Financial Attitude and Financial Behavior". Journal of

Advances in Social Science, Education and Humanities

Research, volume 226. Merauke: Atlantis Press. 2018.

Herlindawati, Dwi. "The Effect of Self-Control, Gender,

and Income on Personal Financial Management of

Postgraduate Collage studentss at Surabaya State

University". Journal of Economics and Education and

Entrepreneurship. Surabaya: Postgraduate Unesa. 2015.

Hilgert, M. A., Hogarth, J. M., & Beverly, S. G. 2003.

Household financial management: The connection

between knowledge and behavior. Federal Reserve

Bulletin (July), 309-322.

Hogarth, Jeanne M., and Kevin H. O'Donnell. 1999.

Banking Relationships of Lower-income Families and

the Governmental Trend toward Electronic Payment.

Federal Reserve Bulletin86 (July): 459-473.

Humaira, Iklima. "The Influence of Financial Knowledge,

Financial Attitudes, and Personality Against Financial

Management Behavior in the SMEs of Batik Craft

Center in Bantul Regency". Nominal Journal Vol. VII

No. I. Yogyakarta: Yogyakarta State University. 2018.

Jodi L. Parrotta and Phyllis J. Johnson.1998. The impact of

financial attitudes and knowledge on financial

management and satisfaction of recently married

individuals. Association for Financial Counseling and

Planning, Vol. 9 (2).

Jogiyanto. 2008. Information Systems Research

Methodology. Yogyakarta: ANDI.

Joo, S., Grable, J. E., & Bagwell, D. C. 2003. Credit card

attitudes and behaviors of college collage studentss.

College Collage students Journal, 37, 405–419.

K. Prent, J. Adisubrata, and WJS Purwadarminto. 1969.

Indonesian Dictionary, Yogyakarta: Kanisius.

Laily, Nujmatul.2013. Effect of Financial Literacy on

Behavior of Collage studentss in Managing Finance.

Malang: Universitas Negeri Malang

Lusardi, A., Mitchell, O. S., and Curto, V. 2010. Financial

Literacy among the Young. The Journal of Consumer

Affairs, 44 (2), pp. 358-380.

Mankiw, N Gregory. 2003. Introduction to Economics, 2nd

Edition Volume 2, Jakarta: Erlangga.

Mansour Fakih. 1999. Gender Analysis and Social

Transformation, Yogyakarta: Collage students Library.

Manurung, Adler Haymans. 2012. Investment Theory:

Concepts and Empiricism. PT Adler Manurung Press.

Margaretha, Farah and Tambudhi, Reza Arief. 2015.

"Financial Literacy Levels at the Faculty of Economics

undergraduate collage studentss," Journal of

Management and Entrepreneurship, Vol.17 No.1,

March 2015, 76-85.

Marsh, Brent A.2006. Examining the personal finances,

behaviors and knowledge levels of first-year and senior

collage studentss at Baptist University in the State of

Texas. Bowling Green State University

Mayer Susan E.2002.The Influence of Parental Incomeon

Children’s Outcomes. Knowledge Management Group,

Ministry of Social Development,

TeManatuWhakahiatoOra.

Nababan, DarmandanSadalia, Isfenti.2013. Analysis of

Personal Financial Literacy and Financial Behavior,

Strata I Collage studentss, Faculty of Economics, North

Sumatra University. Medan: North Sumatra.

Nidar, S. R and B. Password. 2012. Personal Financial

Literacy Among University Studies (Case Study At

Padjajaran University Collage studentss, Bandung,

Indonesia). World Journal of sciences, 2 (4), 162-171.

Ningsih, RetnoUtamidan Maria Rio Rita "Financial

Attitudes and Family Communication on Pocket

Money Spending: Judging from Gender Differences"

Journal of Informatics & Business Institute Darmajaya

JMK, Vol. 8, No. 2, September 2010.

Nugroho, Riant. 2008. Gender and Public Administration,

Yogyakarta: Collage students Library

Putri, Ayuni Riska and Asrori. "Determinants of Financial

Literacy with Gender as Variable Moderation". Journal

of Economic Education Analysis Journal 7 (3)

Semarang: Unnes. 2018.

Rasyid, Rosyeni. 2012. "Analysis of the Literacy Level of

the Collage studentss of Management Study Program

Faculty of Economics Economics of the State of

Padang," Journal of Business Management Study

Volume 1, Number 2, September 2012, 91-106.

Riduwan.2010. Scale of Measurement Variables Research.

Bandung: Alfabeta.

O’Neill, Prawitz et al. 2008. Changes in Health, Negative

Financial Events, and Financial Distress / Financial

Well-Being for Debt Management Program Clients.

Association for Financial Counseling and Planning

Education Vol. 17, Issue 2.

The Effect of Financial, Attitude, and Financial Knowledge on the Personal Finance Management of College Collage Students

657