Financial Literacy, Childhood Consumer Experience, and Investment

Decision in Milennial Housewives

Lisa Marlina

1

, Nisrul Irawati

1

and Suri Mutia Siregar

2

1

Department of Management, Universitas Sumatera Utara, Jl. Prof. T.M Hanafiah, SH, Kampus USU, Medan, Indonesia

2

Faculty of Psychology, Universitas Sumatera Utara, Medan, Indonesia

Keywords: Financial Literacy, Childhood Consumer Experience, Investment Decision, Millennial Housewives.

Abstract: Millennial housewives are women aged between 24 and 39 years who organize various household activities.

The increasing demands in social life and economic leads every housewife to be skilled in managing finances.

Financial literacy and childhood consumer experience contribute to financial management and affect financial

decisions, one of which is the investment decision. This study aimed to describe financial literacy, childhood

consumer experience, and investment decision in millennial housewives. The study was conducted on 260

housewives from Banda Aceh, Medan, Pekanbaru, Jakarta and Bandung. The results showed that 20.38% of

respondents had low financial literacy, 65.76% had moderate financial literacy, and 13.85% had high financial

literacy. For the variable of childhood consumer experience, the analysis showed that 5.38% of respondents

were classified in the low category, 25% were classified in the moderate category, and 69.61% were classified

in the high category. Moreover, the results for investment decisions found that 50.3% of respondents invested

in gold, 46.1% in saving money, 27.3% invested in property, 26.9% invested in land, 7.6% invested in shares,

6.9% in mutual fund, and 3.85% invested in bonds.

1 INTRODUCTION

Millennials are people born between 1980 and 1995.

Millennials are often referred to as millennial

generation or baby boom echo. The term millennials

arise because this generation has experienced

technological developments and the turn of the

millennium (Panjaitan and Prasetya, 2017).

Millennial housewives are women aged 24 to 39

years who do not work in the office and have the

responsibility of organizing various kinds of

household activities. Millennial housewives are

different from housewives in the previous generation

because they live in a digital era and obtain various

conveniences by using it.

Howe and Strauss (in Ng and Johnson, 2000)

stated that millennials are spoiled generation, have

high expectations for life (Bishop in Lusardi and

Oggero, 2017), are more easily bored (Sonet and

Hood, 2000 in Rifaie and Respati, 2014), have

unrealistic expectations and often feel disappointed

with the income they have (Taylor in Lusardi and

Oggero, 2017).

Yuswohadi (2019) stated that millennials are the

generation that prefers access to ownership.

Furthermore, millennials are the driving force for

sharing economy. For example, millennials prefer

traveling by online transportation than having their

vehicles and taking care of them. They prefer to

subscribe to pay television channels than collecting

DVD movies. In addition, they also prefer to use a

shared office (co-working space) than having their

shops for offices.

For millennials, ownership of houses, new cars,

and expensive jewelry is no longer a symbol of

success and achievement. Yuswohadi (2019) stated

that there were several reasons the millennials prefer

access to goods or services than owning them, namely:

(1) The millennials are a generation that lives amid

uncertainty and in an era of technological disruption

that makes various industries irrelevant. Furthermore,

most of the millennials think that having something is

not a wise decision, whereas renting, subscribing, or

sharing have lower risk decisions; (2) The millennials

assume that having something will trigger the

complexity of life that makes them unhappy. For

example, when they have a car, there will be a series

of follow-up needs such as needing a garage,

obtaining a vehicle registration and driver's license,

purchasing gasoline, paying for parking, and others;

Marlina, L., Irawati, N. and Siregar, S.

Financial Literacy, Childhood Consumer Experience, and Investment Decision in Milennial Housewives.

DOI: 10.5220/0009327205910595

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 591-595

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

591

and (3) The millennials are a generation who want

freedom. No ownership lifestyle means a life with

more freedom. Not having things, such as houses or

cars makes them have more freedom in life.

Differences in the perspective on the millennials

are expected to change financial decisions taken by the

millennial housewives. The increasing demands of

life, both socially and economically, results in the

status of women, which are not only as housewives,

but they must be able to manage finances well. A wise

housewife must be able to manage her income and

finances appropriately to suit their designation.

Housewives of any generation are expected to be able

to invest to meet their short-term and long-term needs.

Satria (2016) stated that housewives tend to save gold

with the aim of financial protection and as an

investment.

An investment decision is a person's decision to

place funds in a particular type of investment. Factors

that influence investment decisions in housewives are

quite diverse. Sanu (2016) explained several things

that influence investment decisions, namely: (1)

gender, in which men are more daring to take risks in

investing than women; (2) age, in which the older the

age, investors are increasingly afraid of risks; (3)

education, in which the higher one's education, they

are more careful in making investment decisions; (4)

income; (5) employment, in which the higher one's

position in work, the more confident that person will

be in making investment decisions.

Al Tamimi and Kalli (2009) stated that financial

literacy has a positive relationship with investment

decisions. Financial literacy is the ability to use one's

knowledge, skills, and experiences to make effective

decisions regarding financial management to meet

one's financial securities. Lusardi and Oggero (2017)

claimed that millennials tend to be less skilled in

making financial decisions, so they need

encouragement through training that can increase their

financial literacy.

In addition to financial literacy, childhood

consumer experience is also estimated to have

contributed to investment decisions in the millennial

housewives. Sabri, MacDonald, Hira, and Masud

(2010) in their study stated that childhood consumer

experience included the experience of saving in

childhood and the experience of discussing finances

with the family. A good childhood consumer

experience will increase a person's financial

satisfaction and encourage him to invest.

2 RESEARCH PURPOSES

This study aimed to describe financial literacy,

childhood consumer experience, and investment

decisions in millennial housewives. Investment

decisions will be reviewed in seven sectors, namely

savings in banks, property, land, shares, mutual

funds, bonds / sukuk, and gold.

3 THEORETICAL REVIEW

3.1 Investment Decision

The term investment comes from Latin, which is

investire (use), whereas it is named investment in

English. In Indonesian, the meaning of investment is

“penanaman modal”. Susanti et al. (2018) stated that

investment is an investment made by investors to

obtain profits. The aim of investors, in general, is to

meet the needs and expected desires.

An investment decision is a person’s decision to

place funds in a particular type of investment. The

investment decision is related to the selection of

investment alternatives that are beneficial to a

company or individual, such as saving in a bank,

property, land, shares, mutual funds, bonds / sukuk,

and gold.

3.2 Financial Literacy

Mihalcova, Csikova, and Antosova (2014) define

financial literacy as the ability to use one’s

knowledge, skills, and experience to make effective

decisions regarding financial management to meet

one’s financial securities.

Financial literacy is the knowledge and

understanding of financial concepts, risks, skills,

motivation, and confidence to use that knowledge and

understanding in making financial decisions. Irawati

and Marlina (2017) in their research explained that

financial literacy can be measured using three

concepts, namely: (1) capacity to do calculations; (2)

understanding of inflation; and (3) understanding of

risk.

3.3 Childhood Consumer Experience

Falahati and Sabri (2012) suggest that childhood

consumer experience is a child’s experience related to

financial activities provided by parents. One example

is holding discussions with parents about money. The

earlier the age of a child to gain financial experience,

EBIC 2019 - Economics and Business International Conference 2019

592

the more financial knowledge that the child has to use

in managing finances properly. Good financial

management will also have a good impact on

financial conditions so that financial satisfaction is

met. Childhood consumer experience can help

children to understand better how to manage and

make financially appropriate decisions.

Chatton (2017) states that by introducing children

to financial management, parents indirectly prepare

for a child’s better life. Therefore, the challenge for

parents now is how to teach children to manage

finances. Managing finances will become a habit that

forms a healthy financial character of children in

adulthood later. Childhood consumer experience is a

child’s experience related to financial activities

provided by parents.

4 RESEARCH METHODS

This research was conducted on 260 millennial

housewives (aged 24 to 39 years) who live in five

major cities in Indonesia, namely Banda Aceh,

Medan, Pekanbaru, Jakarta, and Bandung. Data was

collected using an online questionnaire involving a

guide for each participant.

The method used in this research was descriptive.

Johnson and Christensen (2004) suggest that

descriptive methods are a method that aims to present

a picture of the status or characteristics of a situation

or phenomenon.

The research data obtained were processed and

analyzed qualitatively using SPSS 16.0, and the

basics of the theory previously studied to explain the

picture of the object under study.

5 RESULTS AND DISCUSSION

5.1 Financial Literacy in Millennial

Housewives

The financial literacy of respondents was measured

using a measurement of financial knowledge. The

instrument consisted of 9 item questions with 2

answer choices, which were right and wrong. The

number of items answered correctly by the

respondents was then converted to a scale of 100 so

that the highest possible score of respondents was

100, while the lowest score was 0. Based on the

calculation results, it is found that the average score

was 76 with a standard deviation of 16. The

categorization of scores for financial literacy is as

follows:

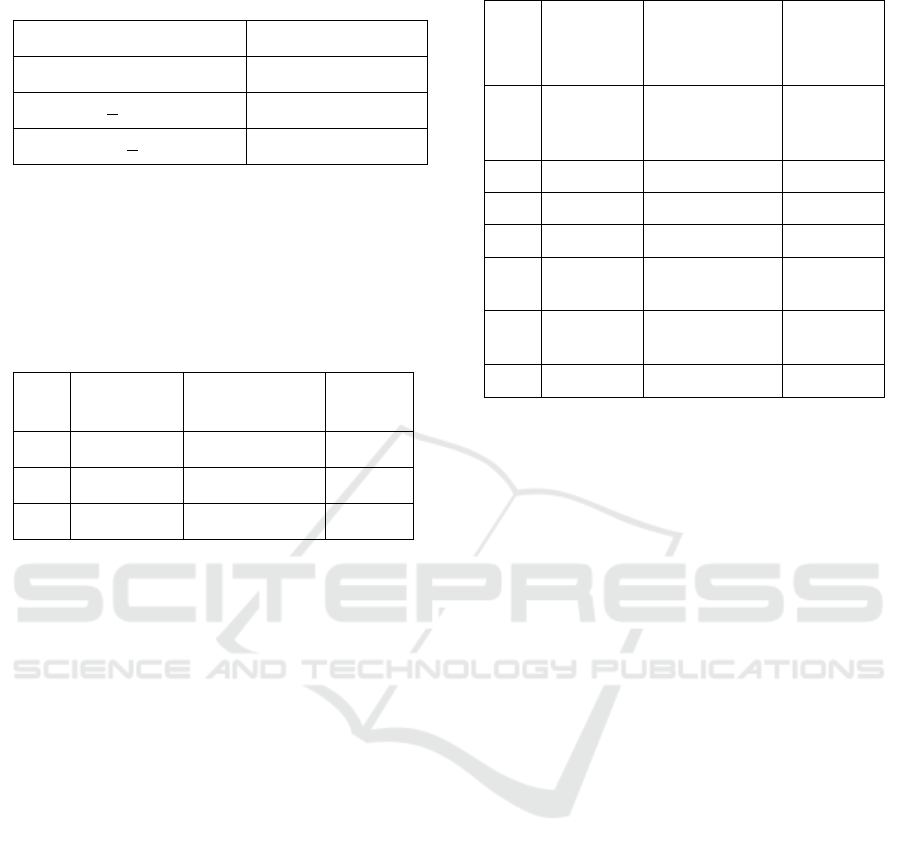

Table 1. The Score Categorization of Financial Literacy

Categorization of Score Interpretation

X < 60 Low

60 < X < 92 Moderate

92 < X High

Based on the measurement results, the financial

literacy of 53 respondents was classified as low, 171

respondents were classified as moderate, and 36

respondents were classified as high.

Table 2. Financial Literacy of Respondents

No. Category

Number of

Respondents

Percentage

1. Low 53 20.38%

2. Moderate 171 65.76%

3. High 36 13.85%

Based on Table 4.1.2, most housewives (65.76%)

had financial literacy in the moderate category. This

indicates that millennial housewives had sufficient

ability to use their knowledge, skills, and experience

to make effective decisions regarding financial

management to meet their financial securities.

Yuswohady (2019) stated that millennials are

critical and rational so that they are trained to live

efficiently and not to waste time and money on less

necessary things. These characters encourage

millennial housewives to increase their knowledge

more actively in the financial sector.

5.2 Childhood Consumer Experience in

Millennial Housewives

Childhood consumer experience was measured

through 6 questions on the questionnaire with 2

answer choices (Yes/No). The higher the score

obtained by respondents, the better the financial

experience in childhood. Conversely, the lower the

score obtained by respondents, the less financial

experience in childhood. The score obtained was

converted to a scale of 100. Based on the calculation

of the theoretical mean, the average score was 50, and

the standard deviation was 25. The categorization of

scores for childhood consumer experience is as

follows:

Financial Literacy, Childhood Consumer Experience, and Investment Decision in Milennial Housewives

593

Table 3. The Score Categorization of Childhood Consumer

Experience

Categorization of Score Interpretation

X < 25 Low

25 < X < 75 Moderate

75 < X High

Based on the measurement results, it was found

that 14 respondents had childhood consumer

experience in the low category, 65 respondents had

childhood consumer experience in the moderate

category, and 181 respondents had childhood

consumer experience in the high category.

Table 4. Childhood Consumer Experience Respondents

No. Category Number of

Respondents

Percent

age

1. Low 14 5.38%

2. Moderate 65 25%

3. High 181 69.62%

As seen in Table 4.2.2, the majority of millennial

housewives had high childhood consumer experience

(69.62%). This indicates that respondents had many

financial experiences in their childhood such as being

taught to save money, saving their allowances,

discussing money with parents, and being given the

confidence to be independent in managing

allowances.

Chatton (2017) suggests that children who are

introduced to financial management will have a better

future life. Financial management will become a habit

that forms a healthy financial character for children in

the future. Childhood consumer experience will

increase their financial satisfaction and encourage

them to invest.

5.3 Investment Decision in Millennial

Housewives

Investment decisions were measured through

questions on the questionnaire asking respondents to

choose the forms of investment that have been made,

including investments by saving money at the bank,

property, land, stocks, bonds / sukuk, mutual funds,

and gold.

Table 5. Investment Decisions

No. Investment

Sector

Number of

Respondents

Percentage

1. Saving

money in

banks

120 46.1%

2. Property 71 27.3%

3. Land 70 26.9%

4. Stocks 20 7.6%

5. Bonds /

Sukuk

10 3.8%

6. Mutual

funds

18 6.9%

7. Gold 131 50.3%

If the data in Table 4.2.3 was sorted from the

highest to lowest, millennial housewives invested in

(1) gold (50.3%); saving at the bank (46.1%); (3)

property (27.3%); (4) land (26.9%); (5) shares

(7.6%); (6) mutual funds (6.9%); and (7) bonds /

sukuk (3.8%). Most of the research respondents chose

to invest by saving in banks and gold.

The study results are in line with Satria (2016)

who stated that housewives tend to save gold for

financial protection and as a means of investment.

The decision to save money in the bank and buy gold

as an investment can also be explained through the

results obtained by the Manulife Investor Sentiment

Index (in Maximizer CRM, 2016) that millennials are

conservative investors. Millennials tend to be more

interested in making money and protecting existing

assets than developing the money they have. The

Global Investor Study conducted by Schroders (2017)

also stated that millennials are less prepared to face

risks than previous generations and prefer to save

money in cash.

6 CONCLUSIONS AND

RECOMMENDATIONS

6.1 Conclusions

After conducting a descriptive analysis of financial

literacy, childhood consumer experience, and

investment decisions, several conclusions can be

obtained, namely:

1. The analysis of the financial literacy scores

showed that 20.38% of respondents were in a low

EBIC 2019 - Economics and Business International Conference 2019

594

category, 65.76% of respondents were in the

moderate category, and 13.85% of respondents

were in the high category.

2. The analysis of the childhood consumer

experience scores depicted that 5.38% of

respondents were in a low category, 25% of

respondents were in the moderate category, and

69.62% of respondents were in the high category.

3. Based on the analysis of investment decisions,

millennial housewives invested in: (1) gold

(50.3%); (2) saving at the bank (46.1%); (3)

property (27.3%); (4) land (26.9%); (5) shares

(7.6%); (6) mutual funds (6.9%); and (7) bonds /

sukuk (3.8%).

6.2 Recommendations

Family welfare is strongly influenced by financial

decisions, one of which is the investment decision.

Millennial housewives need encouragement in the

form of socialization about various investments that

can provide more profitable returns so that they are

no longer conservative investors.

Future studies should analyze factors that

influence investment decisions in millennial

housewives so that variables influencing investment

decisions can be identified.

REFERENCES

Al-Tamimi, Hussein & Anood Bin Kalli, Al. 2009.

Financial literacy and investment decisions of UAE

investors. Journal of Risk Finance, The. 10. 500-516.

10.1108/15265940911001402

Chatton, A.N. 2017. Strategi Membentuk Mental

Entrepreneur pada Anak. Yogyakarta : Laksana

Falahati and Sabri. 2012. Estimating a Model of Subjective

Financial Well-Being among College Students.

International Journal of Humanities and Social

Sciences Vol.2 No. 18; October 2012

Irawati and Marlina. 2017. Financial Literacy of SME’S in

Medan City: A Descriptive Analysis. Proceedings of

the 1st Economics and Business International

Conference 2017 (EBIC 2017)

Johnson and Christensen. 2004. Educational Research:

Quantitative, Qualitative, and Mixed Approaches.

Boston: Pearson Education

Lusardi and Oggero. 2017. Millenials and Financial

Literacy: A Global Perspective. Global Financial

Literacy Center: The George Washington University

School of Business.

Maximizer CRM. 2016. Reaching the Millennial Investor:

a Guide for Financial Advisor. [online] Available at:

https://cdn2.hubspot.net/.../Reaching%20the%20Mille

nnial%20Investors_ebook.pdf [diunduh tanggal 19

Februari 2019]

Mihacolva, B., Csikova A., dan Antosova, M., (2013).

Financial Literacy – The Urgent Need Today. Procedia

– Social and Behavioral Sciences, 109 (2014), pp. 317

-321

Ng and Johnson. 2015. Millenials : Who are they, how are

they different, and why should we care?. The Multi-

generational and Aging Workforce: Challenges and

Opportunities. 121-137. 10.4337/9781783476589

Panjaitan and Prasetya. 2017. Pengaruh Social Media

terhadap Produktivitas Kerja Generasi Millenial (Studi

pada Karyawan PT. Angkasa Pura I Cabang Bandara

Internasional Juanda). Jurnal Administrasi Bisnis (JAB)

Vol. 48 No. 1 Juli 2017.

Rifaie and Respati. 2014. Perbedaan Kesejahteraan

Psikologis Ant Generasi X dan Generasi Y. [online]

Available at : lib.ui.ac.id > naskahringkas [diunduh

tanggal 19 Februari 2019]

Satria, A.S. 2016. Sikap Ibu Rumah Tangga terhadap Emas

di Kecamatan Kutoarjo. Jurnal EKSIS Vol. XI No.1,

2016.

Sabri, MacDonald, Hira, and Masud. 2010. Childhood

Consumer Experience and The Financial Literacy of

College Students in Malaysia. Family and Consumer

Sciences Research Journal, Vol. 38, No. 4. June 2010

pp. 455 – 467

Sanu, Jaqualine M.K. 2016. Pengambilan Keputusan

Investasi di Pasar Modal Berdasarkan Perspektif

Demografi. Artikel Ilmiah Sekolah Tinggi Ilmu

Ekonomi PERBANAS Surabaya

Scroders. 2017. Global Investor Study 2017: Investor

Behavior from Priorities to Expectations. [Online]

Available at :

https://www.schroders.com/en/.../pdf/...investor.../schr

oders_report-2__eng_master.pdf [diunduh tanggal 19

Februari 2019]

Susanti, Hasan. Ahmad, and Marhawati. 2018. Faktor –

Faktor yang Mempengaruhi Minat Mahasiswa

Berivestasi di Galeri Investasi Universitas Negeri

Makassar. Prosiding Seminar Nasional Pendidikan

Ekonomi 2018

Yuswohady. 2019. Millennials Kill Everything. Jakarta: PT

Gramedia Pustaka Utama

Financial Literacy, Childhood Consumer Experience, and Investment Decision in Milennial Housewives

595