Causality between Financial Inclusion and Economic Development:

Lesson from the Emerging Indonesia Economy

Asmalidar

1

and Wahyu Ario Pratomo

2

1

Politeknik Negeri Medan, Indonesia

2

Universitas Sumatera Utara, Indonesia

Keywords: Financial Inclusion, Economic Development, Panel Granger Causality.

Abstract: Our study aims to determine the causality between financial inclusion and economic development in

Indonesia. This research uses the panel data set for 33 provinces from Indonesia for a period of 2013 to 2017.

To estimate panel Granger Causality test, this study implements Pedroni’s cointegration test, and Panel Vector

Auto Regression Model. This study finds that there is no significant causality relationship between the

financial inclusion and economic development indicators. The results show that some indicators of economic

developments such as income per capita and poverty have significant correlation to financial inclusion in

Indonesia. Nevertheless, financial inclusion does not have an impact to economic development in Indonesia.

1 INTRODUCTION

Nowadays, Indonesia's economic growth increases

steadily, and it is followed by a reduction in poverty

and income inequality. This situation indicates that

Indonesia's economic growth becomes more

inclusive. The real GDP (Gross Domestic Product) of

Indonesia has grown to 5.02 percent in 2016 and

picked up to 5.07 percent in 2017. Subsequently, the

poverty rate reduced from 10.70 percent in 2017 to

9.80 percent in the following year.

The financial sector plays an essential role in

economic growth. Demirgüç-Kunt, Beck and

Honohan (2008) point out a poorly matured financial

development system may increase the persistence of

inequality. In addition, Levine (1997) argues that

there is a positive relationship between financial

functions with economic growth in the long term.

Ismail and Pratomo (2006) also note that financial

intermediation has a positive relationship to the

economic growth of Indonesia. The financial

liberalization of Indonesia since the year 1983 gives

a positive impact on the real sector improvement.

Another research conducted by Cheng et al (2006)

also finds that the development of the financial sector,

particularly the banking sector, can increase

economic growth. The banking sector contributes a

positive impact on the real sectors.

The development of the financial sector,

especially banking, increases access and the use of

banking services by the public. Thus, the public can

utilize banking products and services to encourage

their productive investments. The difficulty in

accessing banking products and services causes

public only rely on the limited capital resources. As a

result, the economy will grow slowly, and poverty

and inequality may still persist. Although the efforts

of financial services develop rapidly, the level of

financial literacy of Indonesia is still quite low. Based

on Demirguc-Kunt et al., (2015) reveals that in the

Global Financial Index (Findex) in 2014, there was

still 36.1 percent of the adult population of Indonesia,

who has accounts in the Bank, and this achievement

below the average performance of East Asian

countries at 69.0 percent.

The low level of financial literacy of Indonesia is

caused by several factors such as the low level of

income, the over prudential regulation of banks, the

lack of finance and banking education, the high

administration cost of banks and the limited number

of bank's branches in rural areas. This leads to the low

level of financial literacy and also low financial

inclusion. Regarding the important role of financial

inclusion to the economic growth of Indonesia, This

research will analyze the nexus between financial

inclusion and the economic growth, poverty rate, and

inequality.

Asmalidar, . and Pratomo, W.

Causality between Financial Inclusion and Economic Development: Lesson from the Emerging Indonesia Economy.

DOI: 10.5220/0009326805730578

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 573-578

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

573

2 LITERATURE REVIEW

2.1 Financial Inclusion Development

Several studies have shown a positive impact of the

financial inclusion on the economic growth and the

poverty reduction in developing countries.

Sarma (2012) defines financial inclusion as a

process that ensures the ease of access, availability,

and usage of the formal financial systems for the

whole economy members. Subsequently, Demirgüç-

Kunt and Klapper ( 2012) points out that financial

inclusion as providing board access to financial

services without a price or nonprice barriers.

In order to figure out the level of financial

inclusion Sarma and Pais (2011) developed the

financial inclusion index which based on three

dimensions, namely the banking penetration, the

availability of banking services, and the use of

banking services. Meanwhile, Demirgüç-Kunt, Beck

and Honohan (2008) and Chandran (2011) mention

the financial inclusion as follows out of range

(outreach), benefits (usage), and quality (quality) of

financial services.

2.2 Financial Inclusion and Inclusive

Growth

Many empirical studies find that there is a positive

relationship between financial system development

and economic growth. The research conducted by

Beck, Demirg??-Kunt and Levine (2007) shows the

impact of financial intermediation development on

poverty rate and inequality. The growth of the

financial sector gives a positive impact on (i) the

decline in income inequality (gini coefficient), (ii) an

increase in the income of poor people, and (iii) a

decrease in the percentage of the population that lives

under the poverty line. The same results are found by

Demirgüç-Kunt, Beck and Honohan (2008). They

revealed opening the access to the poor will reduces

income disparity and poverty rate more quickly.

Furthermore, research that explains in the

theoretical foundations of growth and financial

inclusive is conducted by Chandran (2011) . Their

research reveals a descriptive analysis in enhancing

financial inclusion, which is always associated with

poverty alleviation which in turn create an inclusive

growth. They mention that the financial inclusion will

encourage economic growth by empowering

individuals and families to cultivate economic

opportunities.

Regarding to inclusive growth, Anand, Tulin and

Kumar (2014) find that macroeconomic stability,

human resources, and structural change are the

primary basis for inclusive growth. In their study,

Anand, Tulin and Kumar (2014) point out that the

development of the financial and macroeconomic

sectors had a significant influence on inclusive

economic growth.

3 RESEARCH METHOD

This research focuses on the causality between the

financial inclusion and economic development in

Indonesia. The data used in this research are provided

by Indonesia’s Central Bureau of Statistics. The

financial inclusion variable used in this study refers

to the financial inclusion index created by Sarma

(2012). Financial inclusion index covers three

dimensions, namely the banking penetration

dimension, the availability of banking services, and

the use of banking services. The economic

development indicators in this study consists of

economic growth, income percapita, income

inequality, poverty, and unemployment.

This study measures the levels of financial

inclusion index in 33 provinces of Indonesia from

2013 to 2017. It covers three dimensions, i.e. the

banking penetration dimension, the availability of

banking services, and the use of banking services.

The index of each dimension, 𝑑i, is calculated using

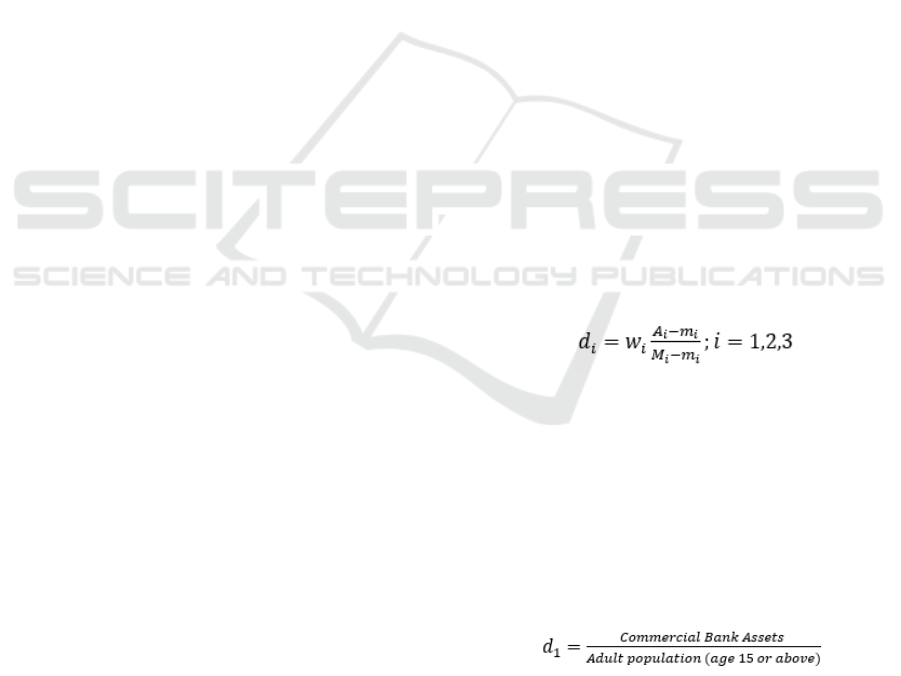

the following equation:

where:

w_i= weight for dimension i, 0 ≤ w_i ≤ 1

A_i = current value of variabel i

m_i= lower limit of vathe riable i

M_i = upper limit of variable i

The first dimension, banking penetration covers

the users of banking services. In this study, the

indicator used for the banking penetration dimension

is the assets of commercial banks in each province in

Indonesia divided by the number of adult populations

of each province.

The second dimension, the availability of banking

services describes the outreach of commercial

banking service. The number of branch offices of

commercial banks in each province divided by the

number of adult population points out as the variable.

EBIC 2019 - Economics and Business International Conference 2019

574

The third dimension, the use of banking services

describes the benefits of banking services that are

perceived by the community. The indicators used in

this research are the total of bank deposits and

commercial bank loans in each province and divided

by the province's GRDP (Gross Regional Domestic

Product).

The weights used for the whole dimension are

equal (wi = 1). Referring to the method used by Sarma

(2012), this study assumes that all dimensions have

the same priority, so each dimension weight is wi = 1

for all i. The index of financial inclusion from

province K can be calculated as follows:

The financial inclusion index (IFI) is between 0

and 1. The IFI equals to 1 indicates that the province

has the best financial inclusion conditions among

provinces. The financial inclusion rate is high when

the value of the financial inclusion index is 0.6 or

above. The level of financial inclusion is moderate if

the value of the financial inclusion index is 0.3 ≤ d ≤

0.6. Finally, the financial inclusion rate is low if the

index value below 0.3.

The first stage in our empirical study is

represented by the analysis of stationarity. We used

Levin, Lin & Chu (LLC) method to conduct unit root

test. This to analyze whether the data used in this

research is stationary or not. In addition, this study

conducts cointegration test. This test used to examine

the existence of a long-term relationship between the

variables analyzed. The next stage of the test is the

causality analysis between the variables with using a

panel vector auto regression (PVAR) – Granger

Causality model. The PVAR Granger Causality

model employed to examine the causality relationship

between financial inclusion and economic

development which are formulated as follow:

where:

IFI = financial inclusion index

EC = GRDP percapita (Rupiah)

UN = Open Unemployment Rate (percent)

POV = poverty rate (percent)

GR = Gini Ratio (index)

i = cross section provinces in Indonesia

t = time series (2013 until 2017)

To examine the causality relationship between

variables, this research uses PVAR-Granger causality

method. It will be able to identify which of the earlier

variables appear. That is, whether financial inclusion

leads to economic development indicators or vice

versa.

4 RESULT AND DISCUSSION

The calculation of the Financial Inclusion Index was

performed following the method introduced by Sarma

(2012) as indicated in equation (5). Basically, the

financial inclusion level of provinces in Indonesia is

low. Only Jakarta province is in a moderate category

and fairly stable every year. The various levels of

financial inclusion level among provinces in

Indonesia shows inequality in access to inter-

provincial banking services. The bigger GRDP, the

higher financial inclusion in that province.

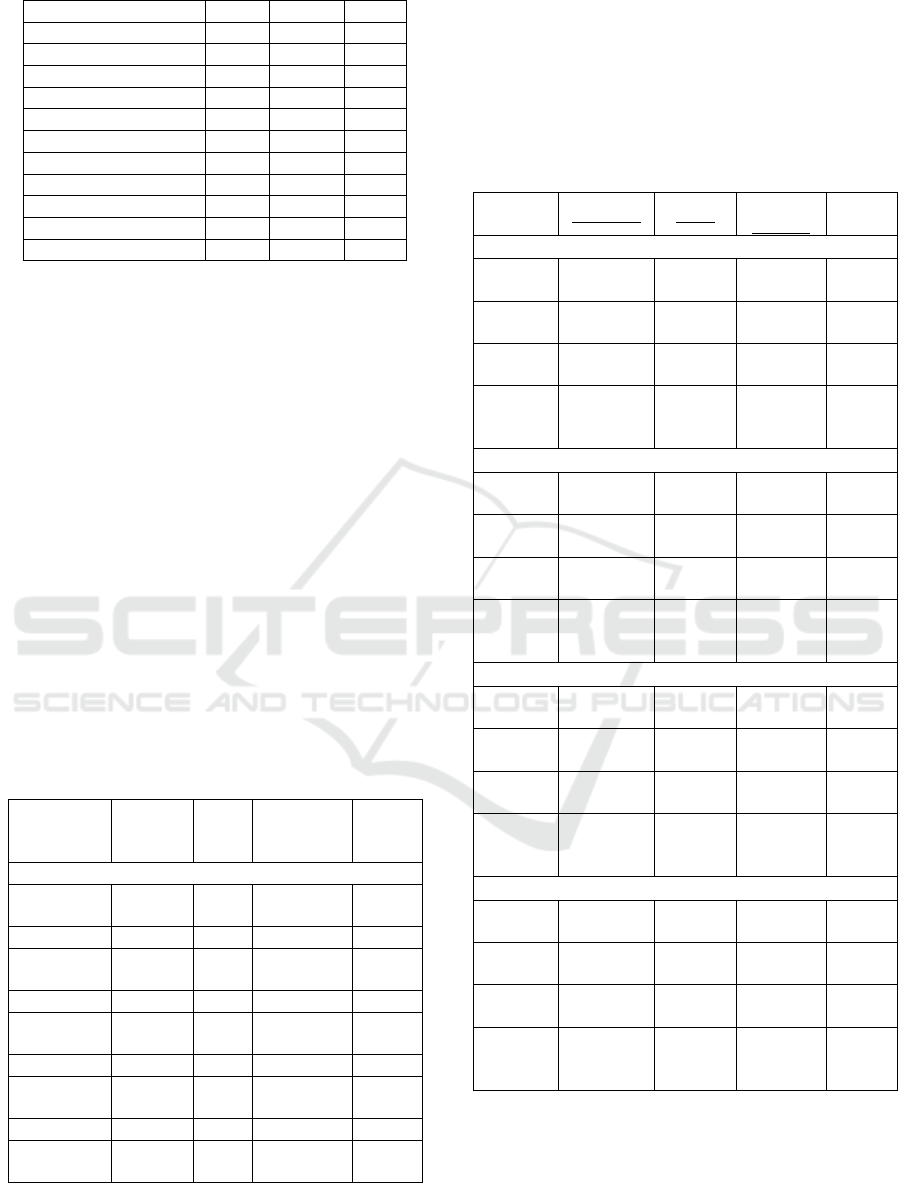

Table 1. Financial Inclusion Index of Provinces in

Indonesia (2013-2017)

Provinces 2015 2016 2017

Aceh 0.137 0.237 0.264

Sumatera Utara 0.488 0.292 0.294

Sumatera Barat 0.135 0.234 0.233

Riau 0.055 0.200 0.203

Jambi 0.105 0.195 0.197

Sumatera Selatan 0.141 0.294 0.289

Ben

g

kulu 0.161 0.242 0.251

Lampung 0.155 0.427 0.424

Kep. Bangka Belitung 0.126 0.189 0.231

Kep. Riau 0.112 0.132 0.133

Dki Jakarta 0.620 0.620 0.620

Jawa Barat 0.215 0.449 0.453

Jawa Ten

g

ah 0.171 0.390 0.387

Di Yogyakarta 0.302 0.355 0.370

Jawa Timu

r

0.169 0.364 0.362

Banten 0.265 0.518 0.514

Bali 0.291 0.336 0.333

Nusa Ten

gg

ara Barat 0.150 0.342 0.350

Nusa Tenggara Timu

r

0.176 0.326 0.381

Kalimantan Barat 0.207 0.308 0.306

Kalimantan Tengah 0.150 0.230 0.248

Kalimantan Selatan 0.198 0.268 0.277

Causality between Financial Inclusion and Economic Development: Lesson from the Emerging Indonesia Economy

575

Provinces 2015 2016 2017

Kalimantan Timu

r

0.080 0.094 0.076

Sulawesi Utara 0.180 0.214 0.211

Sulawesi Ten

g

ah 0.129 0.244 0.237

Sulawesi Selatan 0.161 0.267 0.259

Sulawesi Ten

gg

ara 0.100 0.195 0.195

Gorontalo 0.159 0.241 0.258

Sulawesi Barat 0.092 0.259 0.267

Maluku 0.191 0.252 0.254

Maluku Utara 0.124 0.191 0.197

Pa

p

ua Barat 0.223 0.255 0.253

Pa

p

ua 0.062 0.141 0.140

The low level of financial inclusion in Indonesia

indicates that a huge number of people who cannot

access banking. The community cannot access banks

due to the geographical barriers as Indonesia is an

archipelago country so that the cost of establishing a

branch office is quite expensive. In addition, strict

requirements, complex processes, and high formality

become obstacles for people to access banking.

Furthermore, to analyze the financial inclusion

relationship and economic development is conducted

by the Granger Causality Panel test. These analysis

procedures begin with unit root testing, cointegration

test, and Granger Causality Panel test. A critical

condition before the causality analysis is carried out,

the research variable must be stationary or not have

unit roots. This study conducts Panel Unit Root Test

using Levin, Lin, and Chu Test (Levin, et.al., 2002).

The results of processing data show that both

variables are declared stationary.

Table 2. Panel Unit Root Test Results Using Levin, Lin &

Chu Test

Method Statistics Prob Total

(Balanced)

observation

Cross-

section

Series: IFI

Levin, Lin

& Chu t

-9.759 0.000 128 32

Series : EC

Levin, Lin

& Chu t

-16.249 0.000 132 33

Series : UN

Levin, Lin

& Chu t

-8,853 0.000 132 33

Series : POV

Levin, Lin

& Chu t

-4,886 0.000 132 33

Series : GR

Levin, Lin

& Chu t

-10,539 0.000 132 33

The results of the unit root test indicate that the

two variables are stationary variables. Therefore, the

analyzes can be followed by a cointegration test. The

cointegration test used in this study is the Pedroni

Residual Cointegration test (Pedroni, 1999). The

estimated result shows that there is a cointegration

among variables.

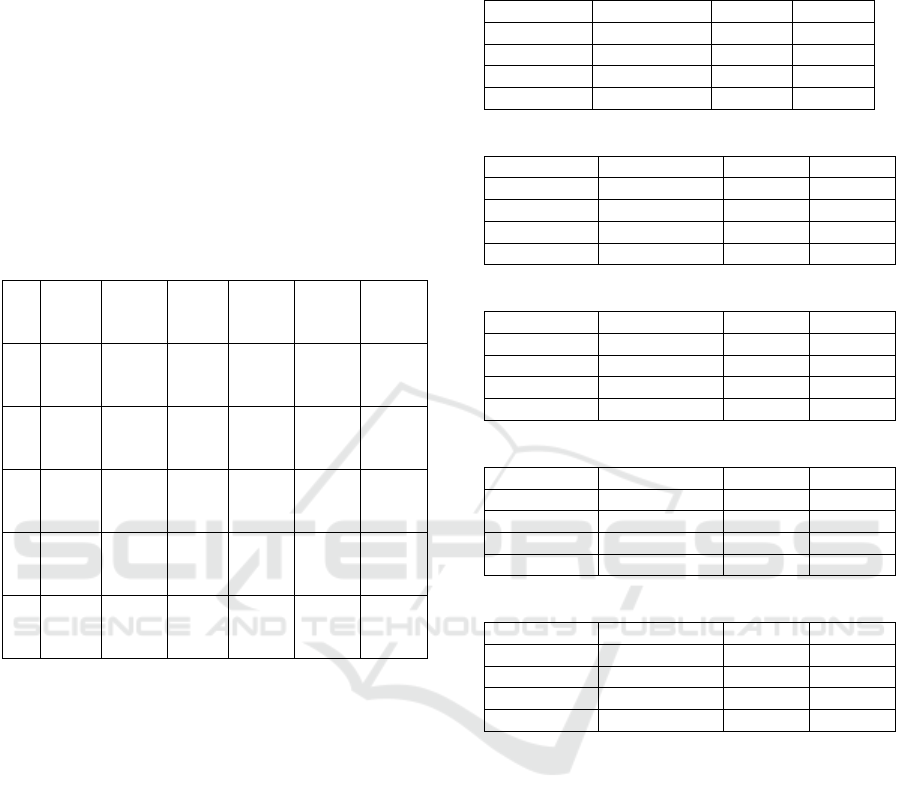

Table 3. Cointegration Test Results Using Pedroni Residual

Cointegration Test

t-Statistic Prob.

Weighted

Statistic

Prob.

Cointegration: IFI and EC

Panel v-

Statistic

-47.47893 1.0000 -2.605182 0.9954

Panel rho-

Statistic

0.114855 0.5457 0.037042 0.5148

Panel PP-

Statistic

-

6.126532***

0.0000 -6.744810 0.0000

Panel

ADF-

Statistic

-

5.784282***

0.0000 -6.268550 0.0000

Cointe

g

ration: IFI and UN

Panel v-

Statistic

-66.73856 1.0000 -0.278074 0.6095

Panel rho-

Statistic

0.637672 0.7382 0.527411 0.7010

Panel PP-

Statistic

-

5.110519***

0.0000 -4.216713 0.0000

Panel

ADF-

Statistic

-

4.835073***

0.0000 -4.167942 0.0000

Cointegration: IFI and POV

Panel v-

Statistic

0.567534 0.2852 0.317260 0.3755

Panel rho-

Statistic

1.289416 0.9014 1.664561 0.9520

Panel PP-

Statistic

-3.527668** 0.0002 -1.864925 0.0311

Panel

ADF-

Statistic

-3.604684** 0.0002 -1.856084 0.0317

Cointe

g

ration: IFI and GR

Panel v-

Statistic

-54.01402 1.0000 -0.773321 0.7803

Panel rho-

Statistic

0.161344 0.5641 0.120381 0.5479

Panel PP-

Statistic

-

4.452373***

0.0000 -4.673994 0.0000

Panel

ADF-

Statistic

-

4.431585***

0.0000 -4.635997 0.0000

Note: *** indicates the rejection of null hypothesis at

1% significant level; ** at 5% significant level and *

at 10% significant level

The null hypothesis in the cointegration test is that

there is no cointegration between financial inclusion

and economic development indicators, i.e. income

EBIC 2019 - Economics and Business International Conference 2019

576

percapita, unemployment, poverty and income

inequality. Conversely, the alternative hypothesis is

that the two variables are cointegrated. The

acceptance of these hypothesis considers to the level

of significant or p-value. When p-value > 0.05, then

the null hypothesis is accepted, conversely, when p-

value < 0.05, the alternative hypothesis is not

rejected. The results of Pedroni’s panel residual-

based cointegration test shows that Panel PP-Statistic

and Panel ADF-Statistic are significant. Thus, it

reveals that the existence of long-run cointegrations

between financial inclusion and economic

development in Indonesia.

Table 4. Result of Lag Length Criteria Test

L

a

g

Log

L

LR FPE AIC SC HQ

0 -

99.8

8402

NA 0.00

0397

6.356

607

6.583

351

6.432

900

1 234.

1468

546.5

958

2.97

e-12

-

12.37

253

-

11.01

207*

-

11.91

478

2 267.

0963

43.93

272*

2.05

e-12

-

12.85

432

-

10.36

014

-

12.01

511

3 296.

6811

30.48

133

2.13

e-12

-

13.13

219

-

9.504

292

-

11.91

151

4 341.

0803

32.29

030

1.34

e-

12*

-

14.30

790*

-

9.546

281

-

12.70

576*

Notes:* denotes lag order optimum by the criterion.

(each test at 5% level). LR: sequential modified LR

test statistic. FPE: Final prediction error. AIC: Akaike

information criterion. SC: Schwarz information

criterion. HQ: Hannan-Quinn information criterion.

This research also attempts to determine the

optimal lag-length to the detect the fit lag for Vector

Autoregressive (VAR) model. There are several

criterias that commonly used to determine the optimal

lag length in the VAR model. The criteria consist of

the Akaike information criterion (AIC), Hannan-

Quinn (HQ), and Schwarz information criterion (SC).

The results reveals some differences in optimal lag

length. The AIC and HQ indicate the optimal lag

length of 4, while LR indicates the optimal lag length

of 2.

Table 5: Estimated VAR Granger Panel Causality/Block

Exogeneity Wald Test

Dependent variable: IFI

Exclude

d

Chi-sq df Prob.

EC 0.874028 2 0.6460

GR** 7.120055 2 0.0284

POV* 5.073717 2 0.0791

UN 0.742667 2 0.6898

Dependent variable: EC

Exclude

d

Chi-s

q

df Prob.

IFI 2.656863 2 0.2649

GR 3.142527 2 0.2078

POV 0.080019 2 0.9608

UN 3.832015 2 0.1472

Dependent variable: GR

Exclude

d

Chi-s

q

df Prob.

IFI 4.431864 2 0.1091

EC 4.554433 2 0.1026

POV*** 13.51105 2 0.0012

UN 2.073878 2 0.3545

Dependent variable: POV

Exclude

d

Chi-sq df Prob.

IFI 0.811811 2 0.6664

EC 3.101273 2 0.2121

GR 0.808440 2 0.6675

UN 0.589400 2 0.7448

Dependent variable: UN

Exclude

d

Chi-sq df Prob.

IFI 0.210226 2 0.9002

EC 1.415067 2 0.4929

GR* 5.706669 2 0.0577

POV 3.750756 2 0.1533

Note: *** indicates the rejection of null hypothesis at

1% significant level; ** at 5% significant level and *

at 10% significant level

Based on the estimated result, it reveals that the

income percapita causes the financial inclusion in

Indonesia at 5% significant level. The poverty also

causes the financial inclusion at 10% significant

level. On the other hand, there are no causality

relationship among the variables. This can be

concluded that an increase in Indonesia's income

percapita has a contribution to increase the financial

inclusion. The people who earn more income tends to

be connected to banks and involving in financial

activities such as saving, lending and other bank

services. Moreover, poverty has a weak contribution

to the financial inclusion, since it has a significant

relationship with income inequality. The government

in Indonesia attempts to reduce the poverty by giving

Causality between Financial Inclusion and Economic Development: Lesson from the Emerging Indonesia Economy

577

more access to the poor people to be connected to

banks. Since 2007, the government has launched the

credit program called Kredit Usaha Rakyat (KUR).

The objective of this program is to increase the poor

people income through a credit scheme with a low

interest rate (7,0% annually) policy. Until year 2018,

the Government of Indonesia has delivered around

Rp120 trillion for KUR. This policy contributes an

impact in increasing the financial inclusion in

Indonesia.

5 CONCLUSION AND POLICY

IMPLICATION

This study aims to analyze the causality between

financial inclusion and economic development in

Indonesia. Using the panel data set for 33 provinces

from Indonesia for a period of 2013 to 2017, this

research applies Panel Vector Autoregressive (P-

VAR) Granger Causality test to analyze the

relationship among the variables. The main

conclusion of this study are as follows: firstly, there

is a cointegration among the variables which means

there is a long-run and short-run relationship between

financial inclusion and economic development.

Secondly, the estimation results reveal that the

income percapita and poverty has a unidirectional

causality to financial inclusion. In other words, an

increase in Indonesia's income percapita has an

influence on increasing financial inclusion. Poverty

also has a positive contribution to financial inclusion

as the government has distributed a huge number of

credit program to poor people so that they can have

more access to financial institutions and increase their

financial literacy. However, since Indonesia have

approximately 25,0 million of poor people, the credit

program policy still does not make a significant

impact to financial inclusion.

Based on the estimation results above, increasing

financial inclusion in Indonesia is needed to be able

to encourage higher income percapity, elevating

poverty and reducing income inequality. The

Government of Indonesia should continue the credit

programs and monitoring the effectiveness of the

credit in order to increase income percapita of poor

people.

ACKNOWLEDGMENTS

This research was supported by Polytechnic of Medan

grant. We would like to express gratitude to Director

of Polytechnic of Medan and to all of our colleagues

to support and give valuable guidance for this paper.

REFERENCES

Anand, R., Tulin, V. and Kumar, N. (2014) ‘India: Defining

and Explaining Inclusive Growth and Poverty

Reduction’, IMF Working Papers, 14(63), p. 1. doi:

10.5089/9781484354230.001.

Beck, T., Demirg??-Kunt, A. and Levine, R. (2007)

‘Finance, inequality and the poor’, Journal of Economic

Growth, 12(1), pp. 27–49. doi: 10.1007/s10887-007-

9010-6.

Chandran, D. S. (2011) ‘Financial Inclusion Strategies for

Inclusive Growth in India’, Ssrn, pp. 1–12. doi:

10.2139/ssrn.1930980.

Cheng, X. et al. (2006) ‘The Impact of Bank and Non-Bank

Financial Institutions on Local Economic Growth in

China* by’, pp. 1–45. doi: 10.1007/s10693-009-0077-

4.

Demirguc-Kunt, A. et al. (2015) ‘The Global Findex

Database 2014: Measuring Financial Inclusion around

the World’, (April). doi: 10.1596/1813-9450-7255.

Demirgüç-Kunt, A., Beck, T. and Honohan, P. (2008)

Policies and Pitfalls in Expanding Access, Finance. doi:

10.1596/978-0-8213-7291-3.

Demirgüç-Kunt, A. and Klapper, L. (2012) ‘Eine Methode

zum gleichzeitigen Nachweis von Fluor und

Fluorwasserstoff’, World Bank Policy Research

Working Paper 6025. doi: 10.1007/BF00511170.

Levine, R. (1997) ‘Economic Development and Financial

and Agenda Growth: Views and Agenda’, Journal of

Economic Litearture, 35(2), pp. 688–726. doi:

10.1007/s001220100668.

Levin, A., Lin, C.F., and Chu., C.S.J., 2002. Unit Root Test

in Panel Data: Asymptotic and Finite Sample

Properties, Journal of Econometrics, 108, pp. 1-24.

Pedroni, P. 1999. Critical values for cointegration tests in

heterogeneous panels with multiple regressors.Oxford

Bulletin of Economics and Statistics, 61(1), pp. 653–

670

Peng, G. et al. (2018) ‘A spatial-temporal analysis of

financial literacy in United States of America’, Finance

Research Letters. Elsevier Inc., 26, pp. 56–62. doi:

10.1016/j.frl.2017.12.003.

Sarma, M. (2012) Index of Financial Inclusion – A measure

of financial sector inclusiveness.

Sarma, M. and Pais, J. (2011) ‘Financial Inclusion and

Development’, Journal of International Development,

pp. 613–628. doi: 10.1002/jid.1698.

EBIC 2019 - Economics and Business International Conference 2019

578