Simultaneity Analysis between Portfolio Investment and

Macroeconomic Variables in Indonesia

Lia Nazliana Nasution

1

, Tiur Malasari Siregar

2

, Isfenti Sadalia

3

1

Department of Economic Development, Universitas Pembangunan Panca Budi,

Jl. Jendral Gatot Subroto Km 4,5 Medan, Indonesia

2

Department of Mathematics Education, Universitas Negeri Medan,

Jl. Willem Iskandar Pasar V, Medan, Indonesia

3

Department of Management, Universitas Sumatera Utara, Jl. Prof. T.M Hanafiah,

SH, Kampus USU, Medan, Indonesia

Keywords: Portfolio Investment, ER, IR, Growth, Inflation.

Abstract: Macroeconomic variables play an essential role in determining portfolio investment inflows in a country. If

one macroeconomic variable changes, investors will react positively or negatively depending on whether the

changes in the macroeconomic variables are positive or negative in the eyes of investors. The objective of this

study analyzes the effect of macroeconomic variables on portfolio investment in Indonesia. Suspected

economic variables are influential, namely the exchange rate (ER), interest rate (IR), inflation, and economic

growth (growth) sourced from the World Bank. With a 30-year observation period from 1989 to 2018, and

the method used simultaneous regression analysis, the findings show that ER, IR, and growth have a positive

effect on demand for portfolio investment in Indonesia while inflation and portfolio investment has a

significant negative impact on growth.

1 INTRODUCTION

Investment assets can be classified into broad assets,

for example, stocks, bonds, commodities, real estate,

and others. A collection of investment assets is called

a portfolio investment. Portfolio investment can also

be options, derivatives, and futures. Portfolio

investment is an investment in the financial sector,

which is classified as the highest risk and the highest

rate of return. However, this high rate of return also

allows for significant losses if not managed properly

(Suhendra & Istikomah, 2016).

The high risk of portfolio investment is

inseparable from general macroeconomic risks such

as inflation, interest rates, exchange rates, etc. Even

though company specific risks can be a risk for

portfolio investment. Several previous studies have

found that inflation, interest rates, economic growth,

and exchange rates significantly affect portfolio

investment in Indonesia (Suhendra & Istikomah,

2016). (Korap, 2010) Found that the behavior of

portfolio inflows in Turkey was influenced by

economic shocks. In India, exchange rates, interest

rates, domestic capital market performance, and local

output growth are determinants of portfolio inflows

(Garg & Dua, 2014).

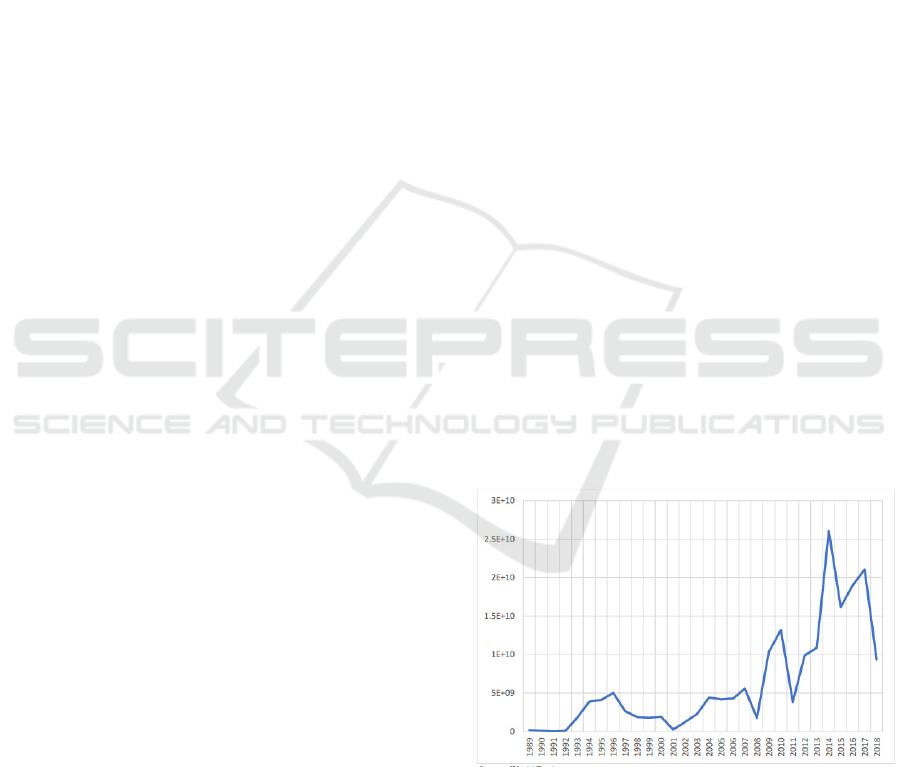

Source: World Bank

Figure 1: Trends of Portfolio Investment in Indonesia,

1989 – 2018

Based on Figure 1 above, it can see that portfolio

investment in Indonesia fluctuates annually by

showing an overall increasing trend. The most

substantial portfolio investment in 2014 is 26 billion

USD. In 2018 portfolio investment has decreased

Nasution, L., Siregar, T. and Sadalia, I.

Simultaneity Analysis between Portfolio Investment and Macroeconomic Variables in Indonesia.

DOI: 10.5220/0009326505490554

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 549-554

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

549

compared to 2017, from 21 billion USD to 9 billion

USD. The fluctuating value is due to Indonesia still

dependent on external financing sources from

portfolio investment inflows (WorldBank, 2019).

Even though in 2018, Indonesia's portfolio

investment decreased, but the Capital and Financial

Transaction (TMF) balance has been surplus

throughout 2018. One of the components forming the

TMF balance sheet came from foreign portfolio

investment inflows in the form of stocks, government

bonds, corporate bonds, and other investments

(cnbcindonesia, 2019). It means that foreign investor

confidence in the Indonesian economy is still quite

high. To maintain investor trust, stakeholders in

Indonesia need to continue to provide the latest

information on the Indonesian economy so that that

portfolio investment can increase again in 2019.

From the description above, the influence of

macroeconomic variables is quite considerable on

portfolio investment in Indonesia. This study was

conducted to see the effect of the economic shock

factor seen from the exchange rate variable, the

interest rate factor as the magnitude of the rate of

return, and economic growth on portfolio investment

in Indonesia simultaneously.

2 LITERATURE REVIEW

2.1 Portfolio Investment

Portfolio investment is an investment in securities

that expects returns and is not free from possible

risks. These securities are, for example, stocks,

government bonds, corporate bonds, and other

derivative products. The greater the expected rate of

return, the higher the risk that will be faced.

Different from direct investment, portfolio

investment expects a high return on target companies

and can be involved with daily management. In

purchasing portfolio investments, a tactical approach

and strategy are needed that are mature in a short

time.

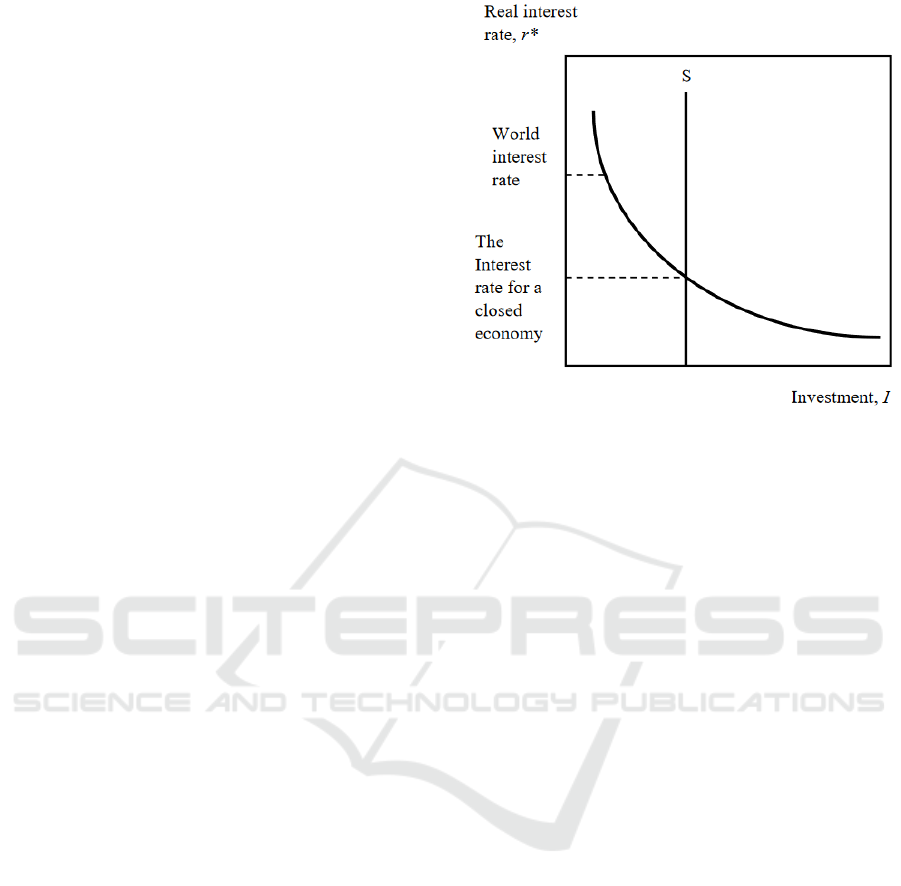

2.2 Investment Theory

The investment I is negatively related to the real

interest rate r. Its functions are as follows:

I = I (r) (1)

In a closed economy, the real interest rate adjusts

to balance the value of the investment, i.e. the real

interest rate is at the intersection of the investment

curve. However, in a small open economy, the real

interest rate is equal to the world real interest rate.

Source: (Mankiw, 2007)

Figure 2. Investment

2.3 Investment Allocation

It is an action in determining the investment weight

or the proportion of risk-free asset financial

instruments and risky asset financial instruments.

Risk-free asset financial instruments can be

interpreted as an investment instrument that is not

likely to experience default payments and investment

principals such as Bank Indonesia Certificates (SBI).

While risky asset financial instruments are interpreted

as financial instruments that contain the risk of not

getting results or the principal of investment does not

return, in part or whole, for example, stocks and

bonds. In determining the weight of investment both

at risk andat risk, investors will consider market

conditions, the ongoing economic cycle at the time

the investment will be decided.

2.4 Investment Risk

Portfolios can be interpreted as investments in various

financial instruments that can be traded on the Stock

Exchange or Money Market to spread the results of

profits and possible risks. Financial instruments in

question, for example, stocks, bonds, real estate, and

other derivative products.

To reduce investment risk, investors must be

familiar with the types of investment risks. The first

type of risk is a systematic risk. Examples are the rise

in inflation, interest rates, and destructive economic

cycles. Systematic risk is more classified into

macroeconomic variables. The second type of risk is

the unsystematic risk. This risk only affects a

particular stock or sector, for example, the existence

EBIC 2019 - Economics and Business International Conference 2019

550

of government regulations regarding the ban on

export or import of cement, which will affect the price

of cement stocks or derivative products such as

property.

2.5 Macroeconomic Factor

Macroeconomics is a factor that comes from outside

the company but has a significant influence on the

increase or decrease in investment demand both

directly and indirectly. Some macroeconomic factors

that can directly influence investor decisions are as

follows:

a) Interest rate

b) Inflation rate

c) Exchange rates

d) Interest rates on foreign loans

e) Economic conditions

f) Tax regulations

g) Economic cycle

h) Circulation of money

2.6 Empirical Study

(Waqas, Hashmi, & Nazir, 2015) Investigated the

relationship between macroeconomic factors and the

volatility of foreign portfolio investment in South

Asian countries, namely China, India, Pakistan, and

Sri Lanka. Using monthly data from 2000 to 2012

because monthly data is ideal for measuring portfolio

investment inflows. This study uses the GARCH

model, with the findings showing that there is a

significant relationship between macroeconomic

factors and the volatility of foreign portfolio

investment. Lower volatility in international portfolio

flows is associated with high-interest rates, currency

depreciation, foreign direct investment, lower

inflation, and higher GDP growth rates than the host

country. This shows that international portfolio

investors focus on a stable macroeconomic

environment in the country.

(Haider, Khan, & Abdulahi, 2016) Observe the

impact of FPI determinants on the Chinese economy.

The data used are Foreign Portfolio Investment (FPI),

GDP, Foreign Direct Investment (FDI), foreign debt,

and the population was taken from the world bank.

GDP and external debt have a strong influence on

FPI. Exchange rates and population indicate that

these two variables have a significant impact on FPI.

(Garg & Dua, 2014) Analyzed the factors that

influence the inflow of foreign portfolio investment

to India. The results of the analysis show that lower

exchange rate volatility and higher risk

diversification opportunities are conducive to

portfolio flows. However, higher returns on equity

from other emerging markets hamper this flow.

Common determinants of portfolio flows are the

performance of domestic equity, exchange rates,

differences in interest rates, and local output growth.

Disaggregated portfolio flow analysis shows that the

determinants of FII are similar to aggregate portfolio

flows, while ADR / GDR is only significantly

affected by returns on domestic equity, exchange

rates, local output growth, and foreign output growth.

(Suhendra & Istikomah, 2016) Examine the

contribution of various macroeconomic variables that

are suspected of being able to influence portfolio

investment in Indonesia. Using multiple regression

analysis, the results of the study indicate that an

increase in inflation and economic growth will

significantly increase portfolio investment, while a

rise in interest rates and exchange rates will

significantly reduce portfolio investment in

Indonesia.

(Korap, 2010) identified determinants of capital

flow based on portfolios for the Turkish economy.

The method used by SVAR. The estimation results

show that the 'push' factor based on external

developments for the Turkish economy has a

dominant role in explaining the behavior of portfolio

flows. Furthermore, domestic real interest rates as one

of the main 'pull' factors have been found in negative

dynamic relationships with portfolio flows. This

result is associated with that the progressive journey

of portfolio flows should not be associated with the

possibility of excessive returns from the real interest

structure of the Turkish economy.

3 METHOD

To identify the effect of macroeconomic variables on

portfolio investment in Indonesia, data for the period

1989 to 2018 were used. The macroeconomic

variables studied were exchange rates, interest rates,

and economic growth, sourced from the World Bank.

The method used in this study is simultaneous

regression analysis, with the equation model as

follows:

Portfolio Investment = a

0

+

a

1ER + a

2

IR +

a

3

Growth

Growth = b

0

+ b

1

Inflation + b

2

Portfolio Investment

Where:

ER = Exchange Rate

IR = Interest Rate

Then identification of simultaneity is carried out,

which aims to find out whether the equation is under

conditions identified, exactly identified, or over-

Simultaneity Analysis between Portfolio Investment and Macroeconomic Variables in Indonesia

551

identified. The identification of simultaneity in the

equation of this study are as follows:

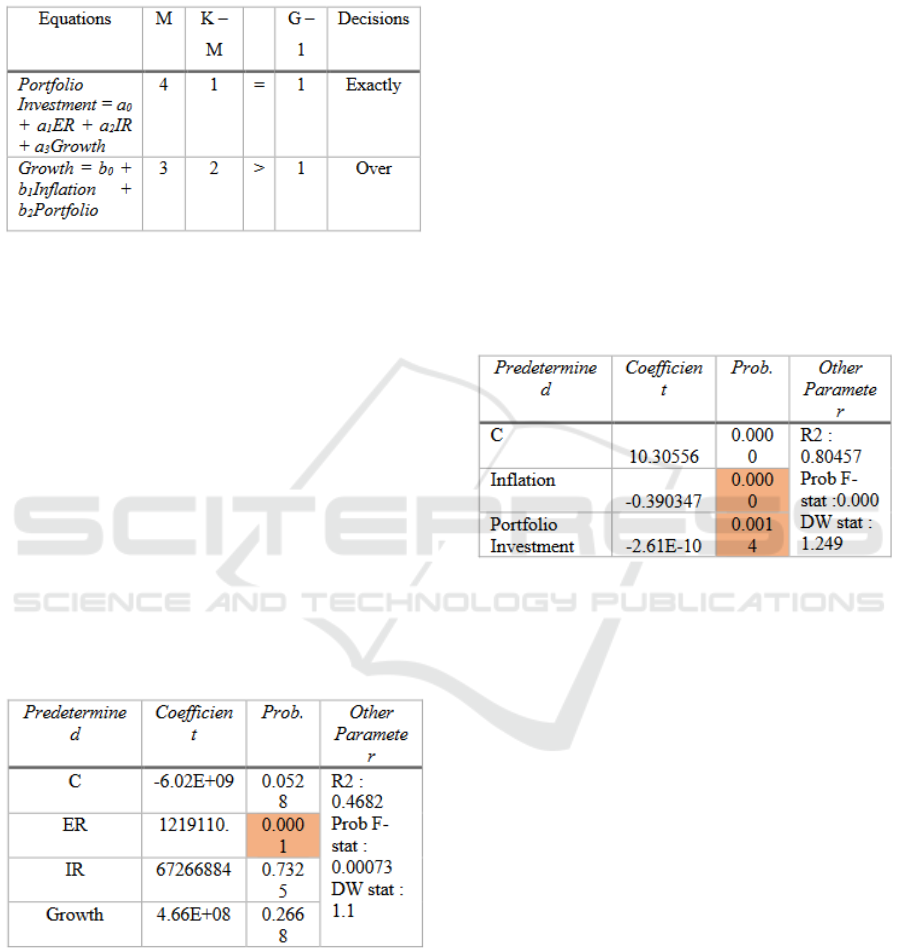

Table 1: Model Identification Test

From the table above, it can be seen that the first

equation is exactly identified, while the second

equation is over-identified. Thus it can be decided to

solve this simultaneous model that has been built

using the 2SLS method (Two-Stage Least Square).

The classic assumption test used is the data normality

test.

4 RESULTS AND DISCUSSION

4.1 Results of Simultaneous Regression

Analysis

The results of system estimation equations with Two-

Stage Least Square for endogenous portfolio

investment variable are as follows:

Table 2: TSLS for Portfolio Investment Variable

Source: Eviews 10 result, 2019

The R-square value is 0.4682, which means that

together, the ER, IR, and growth variables can explain

the portfolio investment variable by 46.82%, and the

remaining 53.18% is explained by other variables not

included in the estimation model. The F-statistical

probability value is 0.00073 < 0.05, so there is a

significant effect simultaneously.

Partial interpretation:

a) The ER variable has a significant positive

effect on portfolio investment with a

coefficient of 1219110. At a 95% confidence

level. The coefficient is 1219110. It means that

if the ER variable increases by 1%, it will

increase portfolio investment by 1219110.%

(ceteris paribus).

b) The IR variable has a not significant positive

effect on portfolio investment at a 95%

confidence level.

c) The economic growth variable has a positive

and insignificant effect on portfolio

investment at a 95% confidence level.

The results of system estimation equations with

Two-Stage Least Square for endogenous economic

growth variable are as follows:

Table 3: TSLS for Economic Growth Variable

Source: Eviews 10 result, 2019

The R-square value is 0.80457, which means that

together, the inflation and portfolio investment

variables can explain economic growth of 80.457%,

and the remaining 19.543% is explained by other

variables not included in the estimation model. The

F-statistic probability value is 0,000 <0.05, so there is

a significant effect simultaneously.

Partial interpretation:

a) The inflation variable has a significant

negative effect on economic growth with a

coefficient of -0.3903 at a 95% confidence

level. The coefficient of - 0.3903 means that if

inflation increases by 1%, it will reduce

economic growth by 0.3903% (ceteris

paribus).

b) The portfolio investment variable has a

significant negative effect on economic

growth with a coefficient of -2.61E-10 at a

95% confidence level. The coefficient of -

2.61E-10 means that if portfolio investment

increases by 1%, it will reduce economic

growth by 2.61E-10% (ceteris paribus).

EBIC 2019 - Economics and Business International Conference 2019

552

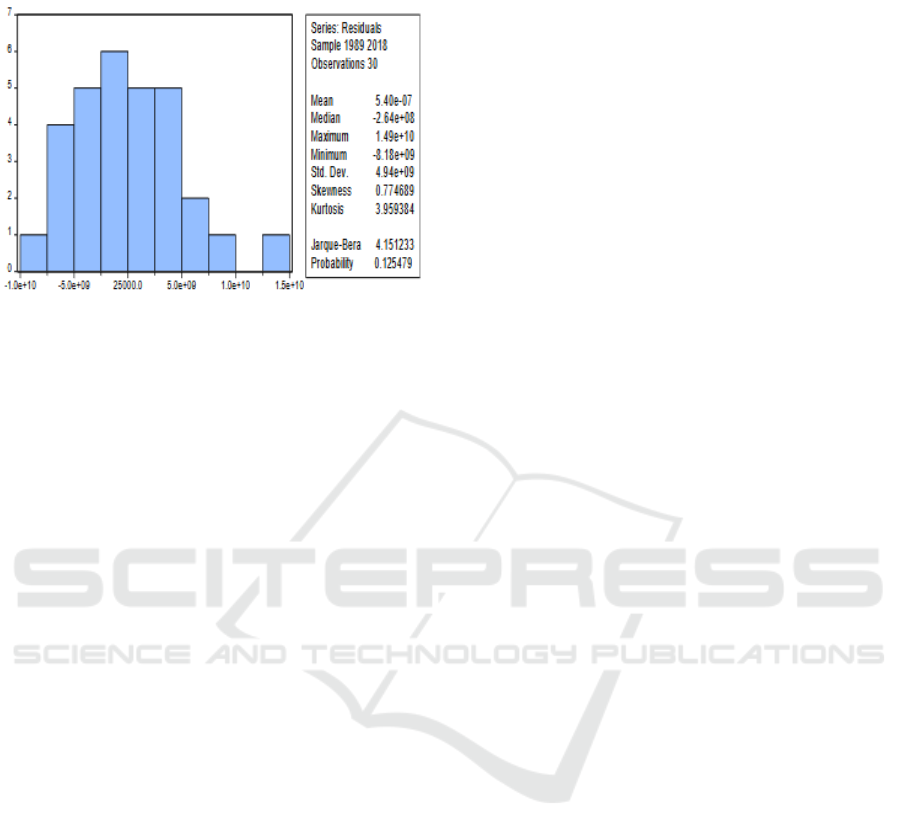

4.2 Results of Normality Test

Source: Eviews 10 result, 2019

Figure 3: Jarque-Bera Normality Test

From the figure above, the Jarque-Bera value is

4.15123 with a probability of 0.125479 > 0.05 which

means the data for all variables are normally

distributed

4.3 Discussion of Portfolio Investment

Simultaneity Analysis based on

Macroeconomic Variables

From the findings above, the exchange rate has a

positive and significant effect on portfolio investment

in Indonesia during the observation period. This

shows that the appreciation of the domestic exchange

rate encourages portfolio investment flows received

by Indonesia. These findings are consistent with the

research conducted by (Garg & Dua, 2014), (Waqas,

Hashmi, & Nazir, 2015), which found that the

exchange rate has a positive effect on portfolio

investment demand. But it is not consistent with the

research conducted by (Haider, Khan, & Abdulahi,

2016), (Suhendra & Istikomah, 2016), which state

that the exchange rate harms portfolio investment

demand.

Variable interest rates have a positive but not

significant effect on portfolio investment in Indonesia

during the observation period. These findings are not

consistent with the research conducted by (Garg &

Dua, 2014), (Waqas, Hashmi, & Nazir, 2015),

(Suhendra & Istikomah, 2016) which state that

interest rates affect portfolio investment negatively.

The variable economic growth has a positive and

not significant effect on portfolio investment in

Indonesia during the observation period. These

results indicate that increased economic growth has

boosted portfolio investment. In line with previous

studies conducted by (Garg & Dua, 2014), (Suhendra

& Istikomah, 2016), (Winona & Nuzula, 2016), and

(Haider, Khan, & Abdulahi, 2016). However, there is

no continuity between economic growth and portfolio

investment demand, which is characterized by

insignificant influence, by findings made by (Waqas,

Hashmi, & Nazir, 2015), in Pakistan, the GDP growth

rate has no continuity, and foreign investors are not

interested in the country's GDP.

The subsequent findings of inflation have a

negative and significant effect on economic growth in

Indonesia during the observation period. When prices

increase, people's purchasing power will decline, and

the country's economic growth will be obstructed. But

for the portfolio investment variable, it turns out that

the results are negative and significant for economic

growth. When portfolio investment increases, it will

reduce economic growth. This finding is not

consistent with the results of research conducted by

(Winona & Nuzula, 2016), which states that portfolio

investment affects economic growth positively and

significantly.

5 CONCLUSION

Indonesia still has the opportunity to attract portfolio

investment flows by maintaining macroeconomic

indicator stability, such as strong economic growth,

lower exchange rate movements, and price and

interest rate stability. The economic shock factor does

not significantly affect portfolio investment flow,

which means that investor confidence is still

tremendous enough for the Indonesian economy.

REFERENCES

cnbcindonesia. (2019, 02 09). www.cnbcindonesia.com.

Retrieved from www.cnbcindonesia.com:

https://www.cnbcindonesia.com/market/201

90209100114-17-54633/asing-betah-masuk- lewat-

portofolio-ini-kata-bank-indonesia

Garg, R., & Dua, P. (2014). Foreign Portfolio Investment

Flows to India: Determinants and Analysis. World

Development, 59, 16- 28.

doi:http://dx.doi.org/10.1016/j.worlddev.201 4.01.030

Haider, M. A., Khan, M. A., & Abdulahi, E. (2016).

Determinants of Foreign Portfolio Investment and Its

Effects on China. International Journal of Economics

and Finance, 8(12), 143-150.

doi:10.5539/ijef.v8n12p143

Korap, L. (2010). Identification of ‘pull’ & ‘push’ factors

for the portfolio flows: SVAR evidence from the

Turkish economy. Doğuş Üniversitesi Dergisi, 11(2),

223-232.

Mankiw, N. G. (2007). Makroekonomi (Keenam ed.).

Jakarta: Erlangga.

Simultaneity Analysis between Portfolio Investment and Macroeconomic Variables in Indonesia

553

Suhendra, I., & Istikomah, N. (2016). Faktor Penentu

Investasi Portofolio di Indonesia. Jurnal Riset

Akuntansi Terpadu, 9(2), 277-288.

Waqas, Y., Hashmi, S. H., & Nazir, M. I. (2015).

Macroeconomic factors and foreign portfolio

investment volatility: A case of South Asian countries.

Future Business Journal, 1, 65-74.

doi:http://dx.doi.org/10.1016/j.fbj.2015.11.0 02

Winona, A. A., & Nuzula, N. F. (2016). THE

RELATIONSHIP BETWEEN FOREIGN

PORTFOLIO INVESTMENT AND FOREIGN

DIRECT INVESTMENT ON

ECONOMIC GROWTH (Study at Indonesia Stock

Exchange and Bank of Indonesia period 2006-2014).

Jurnal Administrasi Bisnis (JAB), 39(2), 44-49.

WorldBank. (2019, 07 15). www.worldbank.org. Retrieved

from www.worldbank.org: https://data.worldbank.org

EBIC 2019 - Economics and Business International Conference 2019

554