The Financial Inclusion and Its Impact on Society Welfare in

Indonesia

Paidi Hidayat

1

, Raina Linda Sari

1

, Herfita Rizki Hasanah Gurning

1

Department of Development Economics, Universitas Sumatera Utara, Jl. Prof. T.M Hanafiah, SH, Kampus USU, Medan,

Indonesia

Keywords: Financial Incluscion, Welfare, Generalized Least Squares.

Abstract: This study aims to analyze the level of financial inclusion and its impact on the welfare of society in Indonesia

using provincial data for 2015-2018. The method used is based on the dimensions of accessibility, availability,

and use of financial services developed by Sarma (2012) to calculate the Index of Financial Inclusion (IFI)

and the generalized least square (GLS) method for estimating panel data. The analysis shows that financial

inclusion in Indonesia is determined by the dimensions of the use and availability of financial services, while

the dimensions of accessibility have a relatively small proportion. Based on the financial inclusion index,

there are 25 provinces included in the category of low financial inclusion, 8 provinces included in the medium

category, and only DKI Jakarta Province included in the category of high financial inclusion. Meanwhile, the

panel data estimation results show that the financial inclusion index has a positive and significant effect on

the welfare of the Indonesian people, which is proxied by the human development index.

1 INTRODUCTION

Since the 2000s, financial inclusion has been widely

used as the main focus of policy in many countries

and central banks, to accelerate the development

process. Many empirical studies show a significant

relationship between strengthening the financial

sector, especially formal finance with economic

growth and improving people's welfare. This is

because the financial system can reduce information

costs and transaction costs, increase the allocation of

capital and asset liquidity, and can encourage

investment in activities that have high added value

(Levina, 2007).

To achieve these objectives, must be supported by

a good financial system. Because, a good financial

system will play an important role through the

intermediation function. The role of banks as

intermediaries cannot yet be said to be successful

when the availability of access and financial services

is inadequate. This can be seen from the size of the

financially excluded population. According to Mohan

(2006), financial exclusion signifies lack of access in

the accuracy, affordable costs, fair and safe financial

products and services of service providers. The

causes of financial exclusion or low use of formal

financial products and services include the limited

access to financial service products and services, the

socio-cultural community, and the low level of

financial literacy (OJK, 2016).

The availability of financial services and ease of

access is one of the important aspects to enhance the

role of the financial sector and public involvement in

the economic system in a country. How big is the

opportunity for the community to be able to access

and use financial services that can reflect the level of

financial inclusion in an economy.

Based on the results of surveys and research

conducted by national and international institutions,

it shows that financial inclusion in Indonesia is still

relatively low compared to several countries in

ASEAN. According to the global financial inclusion

index made by the World Bank (2015), only about 40

percent of Indonesians have access to formal financial

institutions and this condition is still lower than

Thailand and Malaysia, which almost reached 80

percent.

OJK survey results (2016) are quite encouraging,

where the level of financial literacy has increased

from 21.84 percent in 2013 to 29.66 percent in 2016.

While the financial inclusion rate also improved from

59.74 percent to 67.82 percent in same period. This

shows that financial inclusiveness in Indonesia is still

Hidayat, P., Sari, R. and Hasanah Gurning, H.

The Financial Inclusion and Its Impact on Society Welfare in Indonesia.

DOI: 10.5220/0009314105310536

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 531-536

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

531

low and mutually supportive that Indonesian people's

financial access to formal financial institutions is still

relatively low so that Indonesia's population still has

limited access to the financial services system.

Therefore, given the very important role of financial

inclusion as an effort to accelerate the process of

economic development in Indonesia, studies related

to financial inclusion and its impact on the welfare of

the community are interesting to study.

2 LITERATURE REVIEW

In Indonesia, financial inclusion or financial inclusion

becomes a national strategy to encourage economic

growth through equitable distribution of income,

poverty reduction, and financial system stability

(Hadad, 2010). The right of every individual is

guaranteed to be able to access the entire range of

quality financial services at an affordable cost. The

target of this policy is very concerned about the poor

low-income, productive poor people, migrant

workers, and people living in remote areas (Bank

Indonesia, 2014).

Regarding financial inclusion, Bank Indonesia

(2014) defines financial inclusion as an effort to

increase public access to financial services by

removing all forms of barriers both price and non-

price. Hannig and Jansen (2010) revealed that

financial inclusion is an effort to include unbankable

people in the formal financial system so that they

have the opportunity to enjoy financial services such

as savings, payments, and transfers.

In addition, according to Sarma (2012) financial

inclusion is a process that guarantees the ease of

access, availability, and benefits of the formal

financial system for all economic actors. So it can be

concluded that financial inclusion is an effort to

increase public access, especially unbankable people,

into formal financial services by reducing various

kinds of obstacles to access them.

The results of research conducted by Hannig and

Jansen (2010) found that financial inclusion in

addition to addressing income inequality also has the

potential to improve financial stability. This is

because poor people's access to savings from formal

financial institutions can increase the capacity of

households to manage financial vulnerability caused

by the adverse effects of the crisis, diversify the

funding base of financial institutions that can reduce

shocks during a global crisis, increase economic

resilience by accelerating growth, facilitating

diversification, and reducing poverty.

Meanwhile, related to research on the impact of

financial inclusion on development has been carried

out by Sarma and Pais (2011) using the OLS method

and the results of his study found that the level of

human development and financial inclusion has a

positive relationship for several countries in the

world. While the results of the study by Gupta et. al.

(2014), which measures the Index for Financial

Inclusion (IFI) in 28 states and 6 regions in India

using dimensions of penetration, availability and

usage of banking services, empirically found that

financial inclusion indexes and human development

index as a proxy for people's welfare in India have

positive relationship (correlation).

3 METHOD

3.1 Data and Variables

This study uses panel data for the period 2015-2018

at 34 provinces in Indonesia sourced from the Central

Statistics Agency (BPS), the Financial Services

Authority (OJK), and Bank Indonesia (BI). This study

uses the Index of Financial Inclusion (IFI) method

developed by Sarma (2012) in analyzing and

measuring financial inclusion in Indonesia. The

research variables used refer to the IFI measurement

dimensions, namely accessibility (d1), availability

(d2), and usage (d3). Related to the analysis of the

impact of financial inclusion on welfare proxied by

the human development index (HDI), this study uses

several variables as control variables, namely the

number of poor people (PM) and population density

(KP). For operational definitions of all these variables

are as table 1.

3.2 Analysis Method

This study adopts the measurement Index of Financial

Inclusion (IFI) developed by Sarma (2012), in which

to calculate Index of Financial Inclusion (IFI) using

three dimensions, namely accessibility (d1),

availability (d2), and the use of (d3). Accessibility

indicators illustrate the penetration of formal

financial institutions and availibilitas indicator is

indicated by the number of bank branches. While the

usage indicators include the volume of bank lending

to the public. This method is used because it provides

a robust and comprehensive measurements can be

compared between provinces.

Furthermore, this study also uses Data panel to see

the impact of financial inclusion on the welfare of

society, proxied by human development index using

EBIC 2019 - Economics and Business International Conference 2019

532

Table 1. Definitions and indicators variable operational research

No. Variables Definition Indicator

Calculation of Financial Inclusion Index (IFI)

1 Accessibility

(d1)

Measuring banking

penetration through the

many users of banking

services

The ratio of the number of bank accounts per 1,000 total

population of adults.

d

1

=(Amount of Bank Account)/(Amount of Adults)

2 Availability (d2) Measuring ability in the use

of formal financial services

The ratio of the number of bank service offices per

100,000 adult population number.

d

2

=

(

Amount of Bank Office

)

/

(

Amount of Adults

)

3 The use (d3) Measuring the extent of use

of banking services by the

community through

financin

g

The ratio of the amount of financing provided banking

to the regional gross domestic product (GDP) in billion

Rupiah.

d

3

=

(

Amount of Bank Financin

g)

/PDRB

Calculating the Impact of Financial Inclusion of the Public Welfare

1 Index of

Financial

Inclusion (IFI)

The index value calculation results of financial inclusion among the provinces in

Indonesia

2 Human

Development

Index

(

HDI

)

The value of the human development index among the provinces in Indonesia as a proxy

to measure the level of social welfare

Source: Sarma

(

2012

)

, BI and CPM

Generalized Least Square (GLS). The research model

specification is:

IPM

it

= α

0

+ α

1

IFI

it

+ α

2

PM

it

+ α

3

KP

it

+µ

it

(1)

HDI is Human Development Index, IFI is Index of

Financial Inclusion, the PM is the number of poor,

and KP is Population Density.

This GLS method can be analyzed through two

models, namely the fixed effects model (FEM) and

the random effects model (REM). Furthermore, from

the two models, the best model was chosen by

conducting the Hausman test (Gujarati, 2008). The

condition is that if the null hypothesis (H0) is

accepted, the model used is the random effect model

(REM). Conversely, if the null hypothesis (H0) is

rejected, the model used is the fixed effect model

(FEM). To process the data in this study, Eviews

Program version 10 was used.

4 RESULTS AND DISCUSSION

4.1 Index of Financial Inclusion (IFI)

in Indonesia

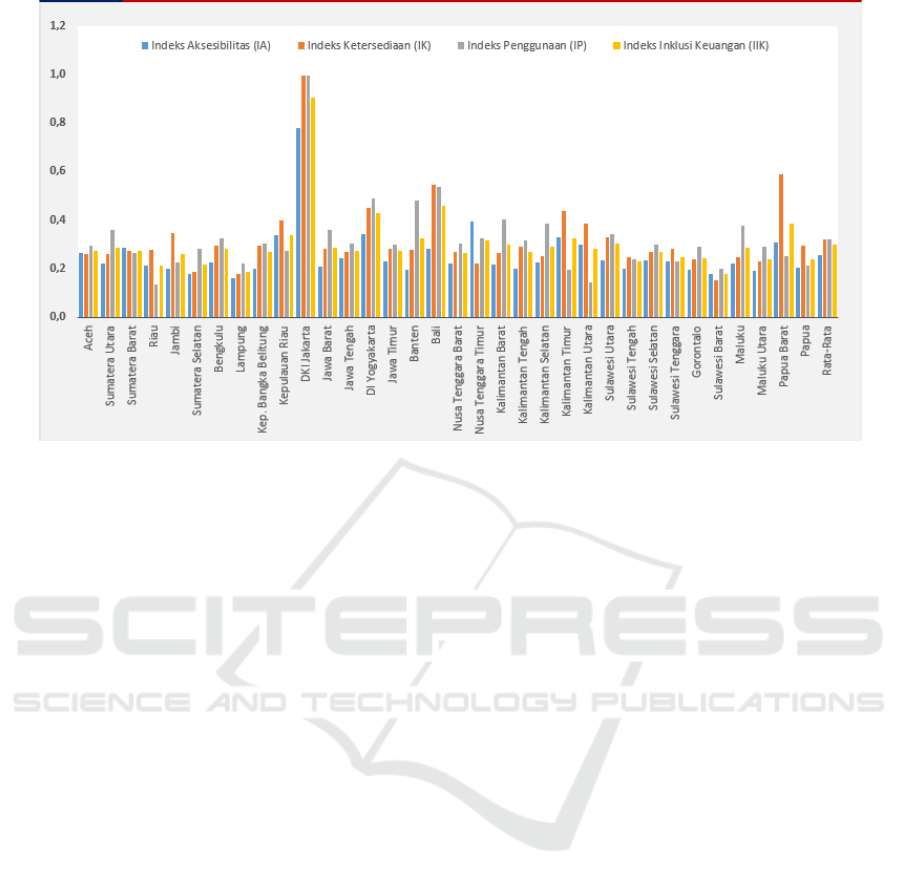

Based on the average value of the Index of Financial

Inclusion (IFI), Indonesia is included in the category

of "moderate" financial inclusion because, having an

average value of the financial inclusion index above

0.3 during the study period. For the grouping between

provinces in Indonesia, there are 25 provinces that fall

into the category of "low" financial inclusion (index

values below 0.3). While there are 8 provinces that

are included in the category of "moderate" financial

inclusion (index value between 0.3-0.6). Only DKI

Jakarta Province is included in the high financial

inclusion category (index value above 0.6, that is,

0.9052).

Provinces in the category of medium financial

inclusion index are Riau Islands Province, DI

Yogyakarta, Banten, Bali, East Nusa Tenggara, East

Kalimantan, North Sulawesi, and West Papua

Province. While the provinces in the category of low

financial inclusion were 25 provinces with the lowest

financial inclusion index, namely West Sulawesi

(0.1782) and Lampung (0.1884).

The relatively low financial inclusion index in

Indonesia shows that the distribution and utilization

of banking services is still low. Likewise the

difference in financial inclusion index between

provinces in Indonesia also shows that there is still an

imbalance or inequality for access to banking services

between provinces. This condition occurs in the

provinces of Banten, Bali, and North Sulawesi which

have relatively high of the Index of Financial

Inclusion (IFI) values but the index value of

accessibility dimensions (IA) is relatively low. This

indicates that there are still obstacles in the three

provinces in terms of accessing banking institutions

despite the relatively high availability and use of

banking services.

The Financial Inclusion and Its Impact on Society Welfare in Indonesia

533

Source: Bank Indonesia & BPS (2019)

Figure1: The Average of Index of Financial Inclusion (IFI) on 3 dimensions in Indonesia

Meanwhile, there are also a number of provinces

that have relatively high Index of Financial Inclusion

(IFI) but the index of usage dimension (IP) is

relatively low. This condition occurs in the Riau

Islands, East Kalimantan and West Papua Provinces,

which indicate that the use and use of banking

services is not optimal, although the accessibility and

availability of banking services are relatively good.

This is because in the three provinces the number of

adult residents who have accessed and used banking

services is still relatively small but tends to have more

than 1 bank account.

In addition, it was also found that the province

had a relatively high index of financial inclusion

index but the value of the index of the availability

dimension (IK) of its banking services was relatively

low and this occurred in the Province of East Nusa

Tenggara (NTT). These findings indicate that in East

Nusa Tenggara Province still faces the problem of the

existence of limited bank branch offices in the

regions.

However, there are two provinces that have a

financial inclusion index value and a dimension index

that tends to be relatively evenly distributed, namely

DKI Jakarta Province and DI Yogyakarta Province.

This shows that the people in the two provinces have

a level of financial inclusion that tends to be evenly

distributed, both in terms of the dimensions of

accessibility, the dimensions of availability, and the

dimensions of the use of banking services during

2015-2018. In contrast, provinces that have relatively

low financial inclusion index values and dimensional

indexes occur in Lampung Province and West

Sulawesi Province. These findings indicate that

people in these two provinces are still experiencing

obstacles to accessing and utilizing and using banking

services in the area.

Based on these findings, the average dimension of

banking availability tends to be higher compared to

the dimensions of banking accessibility or

penetration. This means that the number of bank

branch offices is relatively more, but the number of

adult residents who have accounts is still very low.

The low accessibility or penetration of banks can be

made possible even though banks do not have many

customers, but relatively few customers make

transactions with relatively large volumes. The large

transaction volume can be seen from the dimensions

of usage that tend to be large.

In addition, these findings also prove that the low

value of the accessibility dimension with the high

value of the availability and usage dimensions

indicates that the public has not optimally utilized

formal financial services as the main source of

financing. People are more likely to use informal

financial services, such as cooperatives and

moneylenders, rather than formal banking facilities.

The dominant role of non-formal financial

institutions in Indonesia, especially in remote areas

shows that the formal financial market in Indonesia is

not functioning properly.

EBIC 2019 - Economics and Business International Conference 2019

534

4.2 Panel Data Estimation Results

To see the effect of financial inclusion in the welfare

of society proxied by the human development index

(HDI), the estimate for the panel data methods is

Generalized Least Squares (GLS), Here are the

results estimated using GLS for fixed effect model

(FEM) and random effect model (REM) as shown in

the table 2.

Table 2: Estimation results using the GLS Method.

De

p

endent Variable: Welfare

(

LIPM

)

2015-2018

Independent

Variable

FEM Prob. REM Prob.

C 25.662 0.0000 42.690 0.0000

II

K

0.0898 0.0000 0.1449 0.0000

LPM -0.0366 0.0021 -0.0422 0.0000

LKP 0.3848 0.0000 0.0375 0.0000

Ad

j

. R

2

0.9914 0.4498

Fstat 434.66 37.791

DW

test

13.910 0.9102

Furthermore. to choose the best statistical model

between FEM and REM models for the Generalized

Least Square (GLS) method. it can be done by

Hausman test (Gujarati. 2008) and the results can be

seen based on the chi-square value as shown in the

table 3.

Table 3: The results of Hausman Test.

Test Summary

Chi-Sq.

Statistic

Chi-Sq.

d.f.

Prob.

Cross-section

rando

m

149.13899 3 0.000

Based on the Hausman test results in table 3. the

chi-square value of 149.139 was obtained with a

probability value of 0.0000 which means the null

hypothesis (H0) was rejected. Thus. the best model in

this study is the fixed effects model (FEM). From the

estimation results with FEM model shows that the

coefficient of determination (R2) of 0.9914 which

means that overall the independent variables in the

model (IFI. PM. KP) are quite able to explain

variations in public welfare (HDI) in Indonesia of

99.14 percent and the rest are explained by other

variables not contained in the equation model.

Table 4: Estimation results using Fixed Effects Model

(FEM).

Depvar: LIPM FEM t-stat

C 25.662 13.611

II

K

0.0898 6.053***

LPM -0.0366 -3.160***

LKP 0.3848 12.115***

Ad

j

. R

2

0.9914

Fstat 434.66

DW

test

13.910

Note: *** significant at α = 0,01

The estimation results in table 4 show that the

Index of Financial Inclusion (IFI) has a positive and

significant impact on the level of community welfare

(HDI) in Indonesia at a 99% confidence level. The

coefficient value of 0.089 indicates that every time

there is an increase in the financial inclusion index in

Indonesia by 1 point, ceteris paribus, it will increase

the welfare of the Indonesian people by 0.089 points.

These empirical results support a study by Sarma and

Pais (2011), where the level of human development

and financial inclusion has a positive relationship for

several countries in the world. Likewise the results of

research conducted by Gupta et. al. (2014) where the

index of Financial Inclusion and the Human

Development Index as a proxy for community

welfare in India have a positive correlation.

The estimation results on the variable number of

poor people (PM) show a negative and significant

effect on the level of community welfare (HDI) in

Indonesia at a 99% confidence level. The coefficient

value of 0.037 means that every 1% increase in the

number of poor people in Indonesia, ceteris paribus,

will cause the level of welfare of the Indonesian

people to decrease by 0.037 points. While the

population density variable (KP) has a positive and

significant effect on the level of community welfare

(HDI) in Indonesia at a 99% confidence level. The

coefficient value of 0.385 indicates that every time

there is an increase in population density in Indonesia

by 1 point, ceteris paribus, it will result in an increase

in the welfare of the Indonesian people by 0.385

points. The results of this estimation are not in line

with the hypothesis which states that there is a

negative and significant effect between population

density and the level of social welfare in Indonesia.

5 CONCLUSIONS

The results of this study indicate that Indonesia in the

category of financial inclusion index was during the

study period. Generally. financial inclusion in

The Financial Inclusion and Its Impact on Society Welfare in Indonesia

535

Indonesia tends to be determined by the dimensions

of use and availability. while the dimensions of

accessibility has a relatively smaller proportion.

Proportion of dimensions of use in supporting

financial inclusion in Indonesia is shown by the

ability of people to take advantage of and use of

banking services as savings and financing sources.

For the dimensions of availability (availability)

may be indicated by the increasing number of

branches existing banking area but the existence of

the branch office has not been able to serve all

existing community area. This condition causes the

dimensions of accessibility has a lower index value

than the other dimensions and limitations of this

accessibility that makes many people still can not

access due to geographic barriers banking Indonesian

archipelago so the cost is relatively expensive

establishment of branch offices.

Furthermore. based on the results of the panel data

estimates show that variabel Index of Financial

Inclusion (IFI) positive and significant impact on the

level of social prosperity proxy for the human

development index (HDI). Likewise the population

density variable (KP) positive and significant impact

on the level of welfare in Indonesia. While variable

number of poor (PM) a significant negative effect on

the level of welfare in Indonesia during the study

period.

ACKNOWLEDGEMENTS

We gratefully acknowledge that the present research

is supported by Ministry of Research and Technology

and Higher Education Republic of Indonesia. The

support is under the research grant TALENTA USU

2019.

REFERENCES

Berg. H. Van Den. (2001). Economic Growth and

Development. New York: MCGraw-Hill.

Ang JB. (2010). Finance and Inequality: The Case of India.

Shouthern Economic Journal. 76 (3): 738-761.

Bank Indonesia. (2014). Financial Inclusion. Jakarta: Bank

Indonesia.

Beck T. Demirguc-Kunt A. R. Levine. (2007). Finance.

Inequality and the Poor. J Econ Growth. 12: 27-49.

Demirgüç-Kunt. A. And L. Klapper. (2012). Measuring

Financial Inclusion: The Global FINDEX Database.

Policy Research Working Paper. 6025.

Demirgüç-Kunt. A.. T. Beck and P. Honohan. (2008).

Finance for All? Policies and Pitfalls in Expanding

Access. Washington: A World Bank Policy Research

Report.

Gujarati. (2008). Basics of Econometrics. Jakarta: Erland.

Gupta. Anurag. et al. (2014). Financial Inclusion and

Human Development: A State-Wise Analysis From

India. International Journal of Economics. Commerce

and Management. United Kingdom Vol. II. Issue 5.

2014.

Hannig. Alfred and Jansen. Stefan. 2010. Financial

Inclusion and Financial Stability: Current Policy

Issues.Asian Development Bank Institute Working

Paper.

Levine. R. (2007). Financial Development and Economic

Growth: Views and Agenda. Journal of Economic

Literature XXXV p.688-726.

Financial Services Authority (FSA). (2016) National

Survey of Literacy and Financial Inclusion.

Sarma. M. (2008). Index of Financial Inclusion. Icrier

Working Paper. 215.

Sarma. M and Pais. J. (2011). Financial Inclusion and

Development: A Cross Country Analysis. Journal of

International Development 23. 613-628.

Sarma. M. (2012). Index of Financial Inclusion - A measure

of financial sector inclusiveness. Berlin Working

Papers on Money. Finance. Trade and Development. 7.

p.1-34.

Ummah. Bintan Badriatul. (2013). Analysis of Financial

Linkages an inclusive development in Asia. Thesis:

Department of Economics Faculty of Economics and

Management. Bogor Agricultural University.

World Bank. 2015. Financial Inclusion Data/Global

FINDEX.

http://datatopics.worldbank.org/financialinclusion/cou

ntry/indonesia

EBIC 2019 - Economics and Business International Conference 2019

536