The Effectiveness of Zakat in Alleviating Poverty and Inequalities in

Indonesia: A Measurement using a Newly Developed Technique

Weni Hawariyuni

1

, Sharifah Al-Balushi

2

, and Naziruddin Abdullah

3

1

Fakultas Ekonomi dan Bisnis, Universitas Sumatera Utara, Medan, Sumatera Utara, Indonesia

2

Researcher, Former Director of Quality Assurance at Ministry of Higher Education, Oman

3

Business School, Universiti Kuala Lumpur, Malaysia

Keywords: Zakat, ZEIN, Poor Families, Indonesia, Government

Abstract: Zakat is one of important tools in eradicating poverty in Indonesia. Zakat will be collected from fortunate

people and delivered to unfortunate people. This is obligation for Muslim people to contribute a certain

amount of their wealth for unfortunate people as written in the Holy Al-Qurán. The concept of zakat is

concentrate on social and economic justice in Muslim countries with the purpose to reduce the gap between

rich and poor. As far as we know that poverty is still big matters in Indonesia. Thus, the role of zakat is very

crucial in helping the Indonesia government in reducing poverty level in Indonesia. Furthermore, half of the

Indonesian population remained within the national poverty line which is capped at Rp 292,951/month or

USD 24.4 (World Bank, 2015). This situation is quite consistent with the Gini coefficient for Indonesia that

was reported to have increased from 0.36 in 2005 to 0.42 in 2015, implying that the gap between the rich and

the poor families had broadened. This study aims to measure the effectiveness of zakat institution in Indonesia

by applying new technique measurement called Zein (Zakat Effectiveness Index). This study is expected to

provide solution for policy maker, especially for zakat Institution and Government in Indonesia.

1 INTRODUCTION

Poverty is still one of the biggest issues in Indonesia.

There was a population of around 28 million out of

252 million Indonesians whose standard of living was

below the poverty line. Furthermore, half of the

Indonesian population remained within the national

poverty line which is capped at Rp 292,951/month or

USD 24.4 (World Bank, 2015). This situation is quite

consistent with the Gini coefficient for Indonesia that

was reported to have increased from 0.36 in 2005 to

0.42 in 2015, implying that the gap between the rich

and the poor families had broadened. As a result, the

Indonesian government has taken some measures to

address this issue, one of which includes creating job

opportunities for the poor people. By doing so, it is

expected that the standards of living of the poor can

be improved.

Such measures taken by the government have

been fruitful. For instance, the World Bank (2016)

has indicated that the poverty rate had declined by 1%

annually from the year 2007 to 2011. It then has

continued to decline with an average of 0.3 % since

2012 until now. Given that the recently published

figures show the poverty line at Rp 330,776/capita or

USD 22.60, approximately 40% of the Indonesian

population remained defenceless as their earnings are

floating just above the national poverty line (World

Bank, 2016). At the same time, as the population

growth is higher than the employment growth, there

are around 1.7 million youths who have entered the

labor force but are left unemployed. That, by itself,

has further aggravated the poverty problem.

Meanwhile, even though the Indonesian government

has provided basic public services to the people, the

quality of health clinics and schools is below par for

lower income standards. This has resulted in 126

maternal deaths per 100,000 live births, which is

higher than the Millennium Development Goal

(MDG) of 102 maternal deaths per 100,000 live

births.

In contrast, most developed countries provide

social security funds to eradicate poverty. In a way,

this has enhanced the standard of living of the poor

and eased the rate of unemployment in the country.

Although not all developing countries, and Muslim

countries in particular, have a similar system of social

security fund, the establishment of zakat institution in

Hawariyuni, W., Al-Balushi, S. and Abdullah, N.

The Effectiveness of Zakat in Alleviating Poverty and Inequalities in Indonesia: A Measurement using a Newly Developed Technique.

DOI: 10.5220/0009259304850492

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 485-492

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

485

various Muslim countries, including Indonesia, can

be regarded as a socio-economic strategy to overcome

poverty as well as enhance the well-being of the poor

people.

Poverty from the conventional perspectives

Most scholars define poverty based on per capita

income measures. While some of them define poverty

within the political context, some others define it in

terms of economic and psychological contexts or

more specifically in terms of basic needs context.

There are numerous discussions and debates centered

on the definition of poverty over the past several

decades. These scholars have contradicted each other

on how poverty should be appropriately-defined. The

disagreement was mainly due to the definition of

poverty that runs deep and is closely-associated with

disagreements over both the causes of and solutions

to it. In stark contrast to it, in practice all issues related

to the definition, measurement, cause and solution are

bound together and an understanding of poverty

requires an appreciation of the interrelationship

among all of them.

In this relation, Alcock (1993) states that poverty

is a complex problem and is a product, in part at least,

of political process and policy development. It is also

a political and moral concept. As such, it requires

action. He further suggests that poverty is, to some

extent, created by or at least recreated by social and

economic policies which have been developed over

time to respond to or control poverty and those who

are poor. Macpherson et al. (1998) argued that

poverty is about exclusion. It is a wide ranging and

complex phenomenon, profoundly affecting

individuals and households. The emphasis on

exclusion directs us to the heart of poverty. That is to

say, the lack of resources prevents participation in the

normal life of the community. Sinha et al. (2003)

defines poverty as a multifaceted condition that

combines the income/expenditure factors with many

other dimensions of well-being, namely basic needs.

Basic needs in turn consists of several items. They are:

food, water, shelter, physical capital or access to

infrastructures such as pave road, electricity, clinic,

schools, and police office. Others are capabilities,

which consists of human capital, health, education,

employment, social capital or access to local

networks and institutions. Finally, the last item

included is vulnerability or the ability to cope with

risk.

Meanwhile, the Swedish International

Development Cooperation Agency or SIDA (2002)

defines poverty from many perspectives. It says that

poverty is widespread but dynamic where its pattern

changes over time. Besides, the agency continues to

argue that poverty also deprives people of the

freedom to decide and shape their own lives.

Moreover, poverty robs them of the opportunity to

choose matters of fundamental importance to

themselves. As such, the essence of poverty is not

only that it lacks material resources but also lacks the

power and choice. Indeed, it is because of lack of

power and choice that often makes it difficult for the

poor to obtain adequate material resources. SIDA also

defines poverty as a manifestation in different ways

such as hunger, ill-health, denial of dignity, etc. In

particular, it argues that poverty is context-specific,

its precise features are derived from and prevailed

under varying (but each case is unique) political,

economic, environmental and socio-cultural

situations.

In the early 1970s, two broader definitions of

poverty, namely absolute and relative poverty were

coined. Absolute poverty is defined in terms of

subsistence and is concerned with the provision of the

minimum needed to maintain health and working

capacity. The primary focus is meeting basic human

needs. Meanwhile, Steidmeier (1987) defined three

definitions of relative poverty. They are:

a. Policy definition that defines poverty line based

on income

Policy definition of poverty represents a

pragmatic effort to set social priorities and to

implement policies that is meant to meet the set of

social goals. Such policies represent what is

desired by those who exercise an effective social

voice and they usually result in the establishment

of poverty lines which serve as guideposts to

various social welfare benefits.

b. Relative disparities between income groups

Poverty is defined in terms of inequalities

between income groups. Specifically, it is

concerned with the relative position of the income

groups. The composition of society is seen as a

strata of income layers, and relative poverty

compares how those on the bottom fare with

respect to those who are on the top. In this case,

the focus is in social inequalities rather than on

basic human needs.

c. The dynamically changing nature of human needs

The relative notion of poverty is that human

needs are dynamic, changing, and always

reconstituting themselves. It follows that what is

considered necessary or adequate to meet those

needs is also always in flux.

EBIC 2019 - Economics and Business International Conference 2019

486

Poverty from the Islamic perspective

The Islamic point of view of poverty does not only

represent deprivation of goods and services, but also

lack richness and poverty in spirit (Mannan, 1988, as

cited in IDB reports). Furthermore, according to

Rahman (1974, as cited in IDB reports), individuals

can improve their spiritual lives by improving their

material life. Poverty makes people unable to

perform their individual, social and moral obligations

and, therefore, man is asked to seek Allah’s

protection from poverty, scarcity and ignominy. In

fact, poverty is declared undesirable as much as Kufr

(apostasy) is abhorred (Sadeq, 1987).

As far as the causes of poverty are concerned,

there are eight, all of which exist in present-day

Muslim countries (Mannan, 1986). They are: (1)

colonial exploitation in the past; (2) colonial legacy

(the continuation of unsuitable development policies

in the post-independence period); (3) Regional

disparities and discrimination; (4) Neglect of human

resources; (5) Economic dualism; (6) Financial

dualism; (7) Inadequacies of the market system; and

(8) low labor productivity. In this case, Mannan

suggests some policies to eradicate poverty such as

restructuring development policies to fulfill the needs

of the rural population, providing extension services

and necessary credit facilities to the farmers, land

reforms and progressive taxation in addition to

reactivating the tools of the Islamic redistributive

policy.

The Development of Zakat in Indonesia

Zakat is one of the five pillars of Islam. There are

eight (8) categories of zakat recipients, namely:

fuqara (needy), masakin (poor), amilin (the zakat’s

manager), muallafat al-qulub (the person whose heart

is being tamed), fi al-riqab (freed slaves), gharimin

(people who are in debt), Fi sabilillah (fighting in

Allah’s way), and ibn al-sabil (people who are on the

way).

In Indonesia, zakat is significantly considered as

the best tool to eradicate poverty. This is evident

because with a total population of 216.66 million, and

of which 85% are Muslims, (BPS, 2015), Indonesia

can easily utilize the zakat fund to eradicate poverty.

Table 1 illustrates the development of zakat, infaq,

sadaqah or ZIS collection funds from 2002 to 2015.

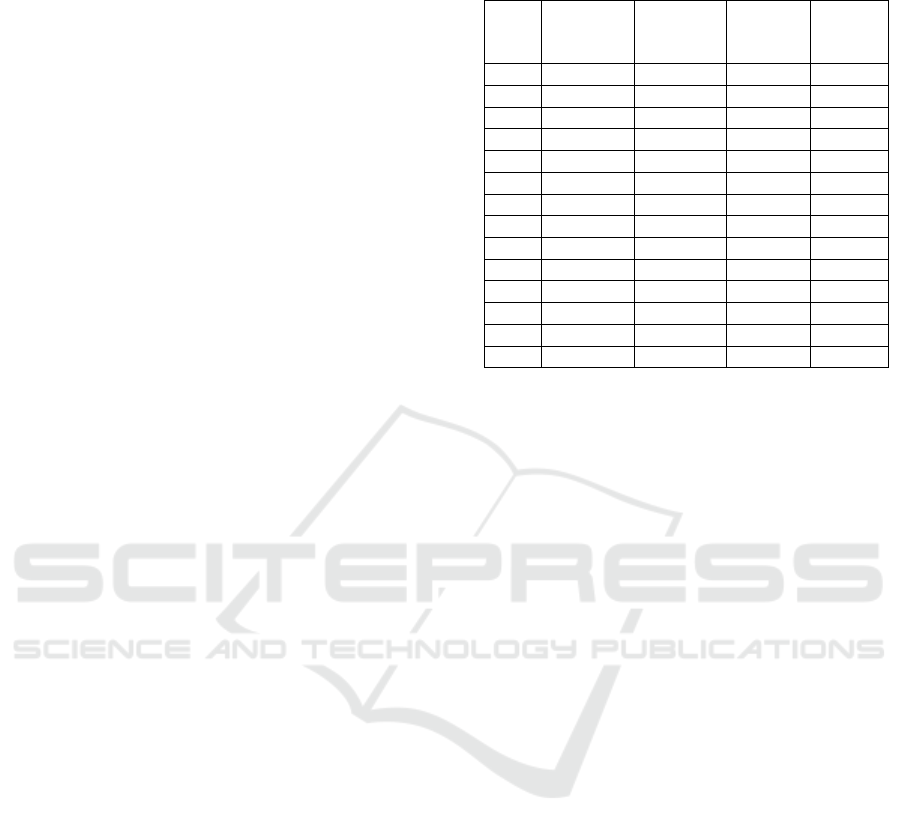

Table 1 Indonesia: Collection of Zakat, Infaq and Sadaqah

in 2002-2015

Year Rupiah

(million)

USD

(million)

Growth

(%)

Growth

GDP

(%)

2002 68.39 4,98 - 3.7

2003 85.28 6,21 24.70 4.1

2004 150.09 10,92 76,00 5.1

2005 295.52 21,51 96.90 5.7

2006 373.17 27,16 26.28 5.5

2007 740 53,86 98.30 6.3

2008 920 66,96 24.32 6.2

2009 1200 87,34 30.43 4.9

2010 1500 109,17 25.00 6.1

2011 1729 125,84 15.30 6.5

2012 2200 160,12 27.24 6.23

2013 2700 196,51 22.73 5.78

2014 3300 240,17 22.22 5.02

2015 3700 269,29 21.21 4.79

Table 1 depicts that the amount of ZIS collected

has increased from Rp53.30 million in 2002 to Rp 3,7

billion in 2015. It shows as well that the amount of

ZIS collected has increased to approximately 39.28

per cent since year 2002. Hence, we could conclude

that as people’s consciousness on the religious

obligation to pay zakat improved, the amount of ZIS

collected had also simultaneously increased

significantly. In one way or the other, this could also

mean that the society continues to put their trust in

zakat institution (BAZNAS - Badan Amil Zakat

Nasional) to manage the zakat fund. As can also be

seen from the table, the yearly growth of zakat fund

is higher than the GDP growth. Specifically, the

growth of zakat fund reached around 39.28% in 2002

to 2015 compared to the growth in GDP which was

only 5.42%. Zakat institutions in Indonesia have been

recognised not only nationally but also globally. At

the national level, the zakat institution through

BAZNAS (National Board of Zakat) has a great

potential to fund national development, while at the

international level, the zakat institution in Indonesia

has been well recognized as one of the best

performers in terms of zakat collection and

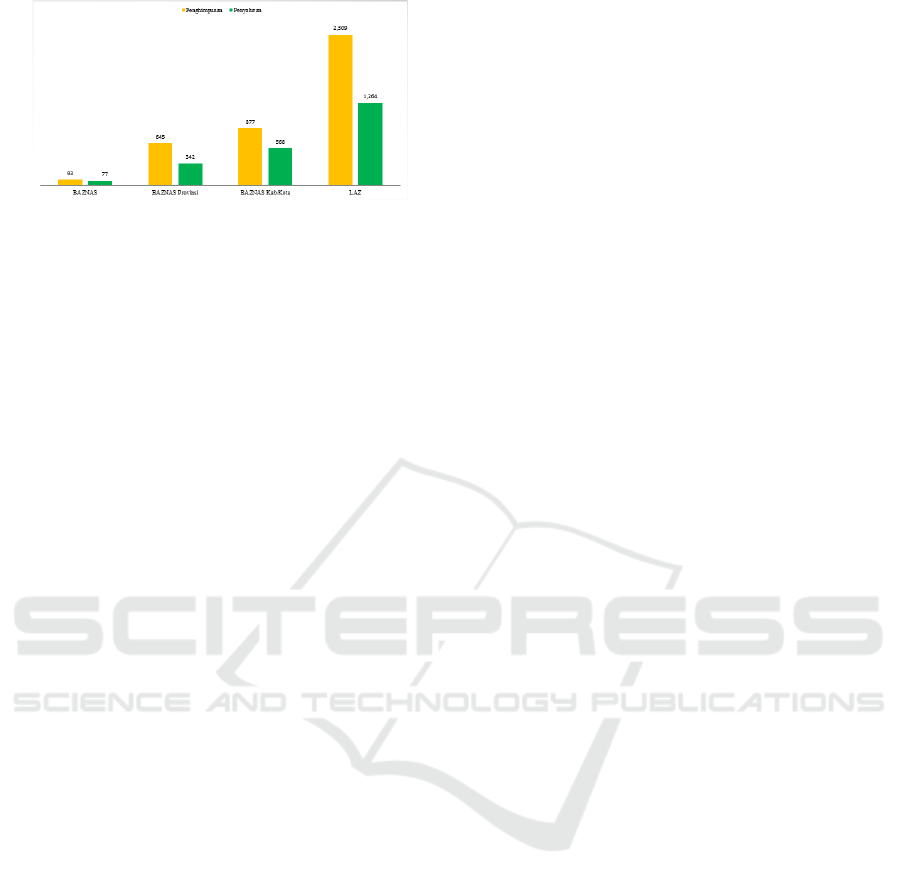

distribution (IZDR, 2012). Figure 1 shows the

collection and disbursement of the zakat fund

increase from year 2014 to year 2015.

The Effectiveness of Zakat in Alleviating Poverty and Inequalities in Indonesia: A Measurement using a Newly Developed Technique

487

Figure 1: Collection and Disbursement of ZIS in Indonesia

Owing to the initiative taken by the government

to replace the Zakat Act No.38/1999 with the Zakat

Act No.23/2011, all private zakat collectors are

placed under one single management called the

National Board of Zakat (BAZNAS). In fact, the

Zakat Act No.23/2011 acts as the centre for the whole

zakat operation in Indonesia with the sole purpose to

“improve the effectiveness and efficiency of the

management of zakat services, and to optimise the

benefits of zakat for public welfare and poverty

alleviation”. There are two main responsibilities of

BAZNAS, namely, (1) to manage the zakat system

including planning, implementation, controlling the

process of collection, distribution and use of zakat

and reporting the operational performance of zakat

management; and, (2) to coordinate all zakat

institutions in the country.

The other regulations are PP No. 14/2014 and

Inpres No. 3/2014. These regulations required

BAZNAS’s new Board members to be appointed by

the President. It is interesting to note here that (1) the

Inpres No.3/2014 has clearly specified that the zakat

collection from the ministries, Indonesian state-

owned enterprises, and other government bodies have

to pay their zakat dues through BAZNAS; and, (2) the

decision of the Minister of Religion Affairs

(Keputusan Menteri Agama) No. 333/2015 states that

LAZ is the Amil. It classifies three categories of LAZ

such as the national LAZ (if the zakat collection fund

reaches Rp 50 billion), the province LAZ (if the zakat

collection fund exceeds Rp 20 billion), and the

regional LAZ (if the zakat collection fund reaches Rp

3 billion).

2 LITERATURE REVIEW

There are various studies focusing on the role and the

impact of zakat on zakat recipients (asnaf),

particularly on poor asnaf. Nurzaman (2016)

indicated that zakat can improve the welfare of the

zakat recipients in Indonesia. He employed the HDI

(Human Development Index) measurement. Due to

the fact that the zakat recipients (the poor and needy)

used the zakat fund that they received from the zakat

institutions for productive consumption, which in

turn has enabled them to fulfil the basic needs, obtain

the proper training, send their children to schools and

be involved in empowerment programs for female,

the HDI has improved quite significantly.

Meanwhile Saidurahman (2013) showed that

there are many opinions raised on the status of private

and semi-governmental zakat management. The

findings show that private zakat management has

performed better in terms of reaching the target

groups (the poor and needy) as compared to the semi-

governmental zakat management. Hence, he

suggested that zakat institutions in Indonesia need to

be run efficiently regardless of the status of the zakat

institutions. Sari et Al. (2013) argued that there are

two main dimensions of the objective of zakat,

namely, (1) spiritually (individually); and, (2) social-

economically, to empower and improve the status of

the ummah (community). As far as the zakat

collection and disbursement is concerned, the study

has segregated the Indonesia’s zakat institution into,

namely government approach and non-government

approach. While the government approach is

composed of Badan Amil Zakat (BAZ) and Baitul

Mal, the non-governmental approach is composed of

Lembaga Amil Zakat (LAZ) such as Dhuafa Wallet

and Zakat home, Mosques, Islamic Boarding School

(pesantren) and individuals.

Febianto et Al. (2010) showed that the

performance of the zakat institution in managing the

zakat fund in Indonesia has improved. In particular,

according to them, the approach has changed from

what was used to be known as individual-traditional

approach to what is known as collective-professional

approach. As a result, it gives a positive impact on the

development of the Indonesian economy in terms of

job creation. They observed that if the amount of

zakat collected and distributed is efficient, the

Marginal Propensity to Consume (MPC) of the poor

people will improve, especially the percentage that is

spent on basic needs.

Jaelani (2015) focused on zakat management for

poverty alleviation in Brunei and Indonesia. His study

found that poverty is one of the main economic

development problems faced by the Indonesian

government mainly due to the large population. Thus,

zakat institution that is managed by the stakeholders,

and under the government regulations, is a solution to

overcome this poverty problem. This is in stark

contrast to Brunei Darussalam which has a small

population and large government revenues, and the

disbursement of zakat in terms of cash grants, capital

EBIC 2019 - Economics and Business International Conference 2019

488

of commerce, and others has significantly resolved

the poverty problem.

A study done by Firdaus et Al. (2012) indicated

that the potential total amount of zakat collected in

Indonesia from numerous sources is around Rp 217

trillion. This number is equal to 3.4% of Indonesia’s

2010 GDP. Their findings also indicated that

education, occupation and income are crucial factors

which influence respondents or zakat payers’

frequency and choice of place when paying zakat.

Furthermore, Athoilah (2008) and Alim (2015)

claimed that zakat can be used for productive

purposes (i.e. related to loans or revolving funds) and

hence, is capable of enhancing the standard of living

of the poor.

Lastly, Lessy (2013) focused on the perception of

zakat recipients on Rumah Zakat (charitable

institution) located in Yogyakarta. He showed that

many zakat recipients were benefiting from health

care services and learning facilities that resulted in

positive impacts on their economies, health, and

social lives. Thus, the integrative program of zakat

with the assistance of microcredit, healthcare, food

security, and education can enhance the lives of the

poor and destitute.

Mathematical Expositions of the ZEIN

The index, ZEIN, is a pioneering work of Abdullah

and Al-Malkawi (2009) and further refined by

Abdullah et al. (2012). While a detailed description

of how the index is derived is available in previously-

mentioned articles, in this paper, we will only

reproduce the modified version of the mathematical

model with most of the important equations

remaining intact.

To begin with, the Zakat Effectiveness Index is

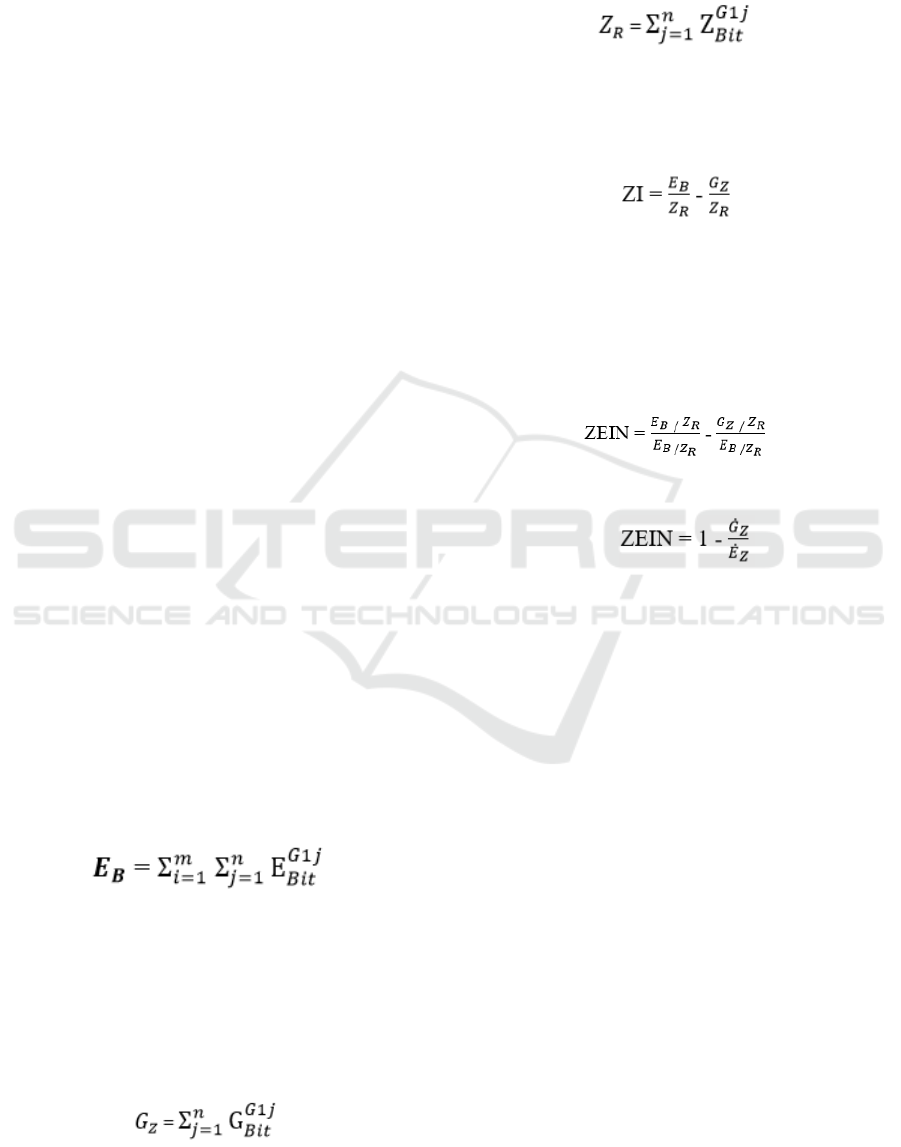

derived as follows: first, the expenditures on basic

needs (𝜠

𝜝

) of the poorest population of a Muslim

country (which in this case is Indonesia) Group 1

(G1-the needy), are mathematically expressed as:

(1)

where: i = (1,2,…m) are the basic needs (𝜝,

which, in this study, include food, clothing, shelter,

medical and education; j = (1,2,…n) are states or

provinces or regions or countries; and, t = time period.

Second, government spending on safety nets (G),

which, in this study, is confined to zakat disbursement

(Z), to the poorest population of the country, G1, can

be computed as follows:

(2)

where: j = (1,2,…,n) and t remain as in equation (1).

Third, the number of zakat recipients (

𝑍

)

associated with G1 can be expressed as:

(3)

where: j = (1,2,…,n) and t remain as in equation

(1).

Fourth, Zakat Index (ZI) is obtained by

subtracting equatioN (2) from (1) and then dividing

IT with equation (3), as shown below:

(4)

While, the first term of the right side of equation

(4) implies the average expenditures of the zakat

recipients are associated with G1 on basic needs, the

second term implies the average government

spending in terms of zakat to G1.

Finally, the Zakat Effectiveness Index (ZEIN) is

derived by dividing equation (4) with the first term of

the right side of the equation. Specifically:

(5)

A further refinement to equation (5) will give rise

to equation (6), the final equation:

(6)

In general, 𝐺

is smaller than 𝐸

, otherwise

poverty would not be a problem or there is no zakat

deficiency. As such, the index measures the shortfall

of the amount of government spending devoted to

zakat as compared to the total

consumption/expenditure on basic needs that is

required for people in poverty to have a decent

minimum livelihood. As in the case of other indices,

the ZEIN has a wide-range scale. It ranges from

negative, zero, one and positive values. While a large

index implies poor performance, a small index

indicates the opposite. Perhaps, a simple example

using four different hypothetical cases may illustrate

the point at hand more distinctly. We note in passing

that the same steps but with different notations can be

used to compute the ZEIN for Group 2, namely the

poor.

Case 1: If 𝐺

= 1 and 𝐸

=1, then the ZEIN is 0,

which implies that there is no deficiency in zakat, and

that the amount of zakat received by the poor and

needy is just sufficient to cover their basic needs.

Case 2: If 𝐺

< 0 and 𝐸

=1, then ZEIN is > 0,

which implies that the zakat deficiency exists. In this

case, not only did they not receive any amount of

zakat from the government but they also had to

The Effectiveness of Zakat in Alleviating Poverty and Inequalities in Indonesia: A Measurement using a Newly Developed Technique

489

borrow money to make their ends meet (to meet the

basic needs).

Case 3: If 𝐺

> 0 and 𝐸

=1, then ZEIN is < 0,

which implies that the zakat deficiency does not exist

where the amount of zakat received by the poor and

needy is more than sufficient to cover their basic

needs.

Case 4: If 𝐺

= 0 and 𝐸

=1, then ZEIN is = 1,

which implies that the government is not extending

any (zero) amount of zakat to the zakat recipients with

the consequence that they had to rely fully on the

income earned from doing odd jobs or “begging” to

make their ends (the basic needs) meet.

As such, the ZEIN stretches from negative to zero

(0), one (1) and any positive values. In addition to the

data published by BAZNAS, this study relies on

sources of other publications, which include, but not

limited to, unpublished theses, journal papers, reports

and discussion, seminar and conference papers. It is

thought necessary to widen the sources of data as:

The officially published data are insufficient to

meet our data requirements; and

to avoid inconsistencies in poverty trends caused

by the use of one data set that is not comparable

in terms of sample size or survey period and

location.

To construct the ZEIN for the period 2008 till

2015, data that are related to several variables

associated with poverty in Indonesia are gathered.

They are:

Total expenditure on basic needs of the poor

households. In this study, the basic needs refer to

an amount of money used by a poor household,

which will be confined to Group 1 (G1 – the

needy) and Group 2 (G2 – the poor) to maintain a

minimum livelihood for its members. This will

include expenditures on food, shelter (rental),

clothing, health care and education.

Government institution spending on poverty

alleviation programs, i.e. the safety nets, and its

sources. It is the source of fund used to alleviate

poverty, and in this study, It is the zakat collected

at the national/regional levels. The amount

collected in turn will be distributed to the poor and

needy zakat recipients in the respective states.

Specifically, two provinces, namely Jakarta and

North Sumatra, were selected for data collection

purposes and consequently used to compute the

ZEIN. The data collected were from 2000 to 2015 for

Jakarta and 2011 to 2015 for North Sumatra. To

construct the ZEIN for the provinces of Jakarta and

North Sumatra, data that are related to several

variables associated with poverty in Indonesia are

compiled. They are:

Total expenditure on basic needs of the poor

households. In the case of Indonesia, we combine

the basic needs which refer to an amount of

money used by a poor household from Group 1

(G1 – the needy) and Group 2 (G2 – the poor) to

maintain a minimum livelihood for its members.

This will include expenditures on food, shelter

(rental), clothing, health care and education.

Government spending on poverty alleviation

programs, i.e. safety nets, and its sources. It is the

source of fund used to alleviate the poverty, which

in this study, is the zakat collected at the provinces

of Jakarta and North Sumatra. The amount

collected in turn will be distributed to the poor and

needy zakat recipients in the respective provinces.

As such, Province DKI Jakarta and North Sumatra

are taken to be the representatives of Indonesia.

3 RESULTS AND ANALYSIS

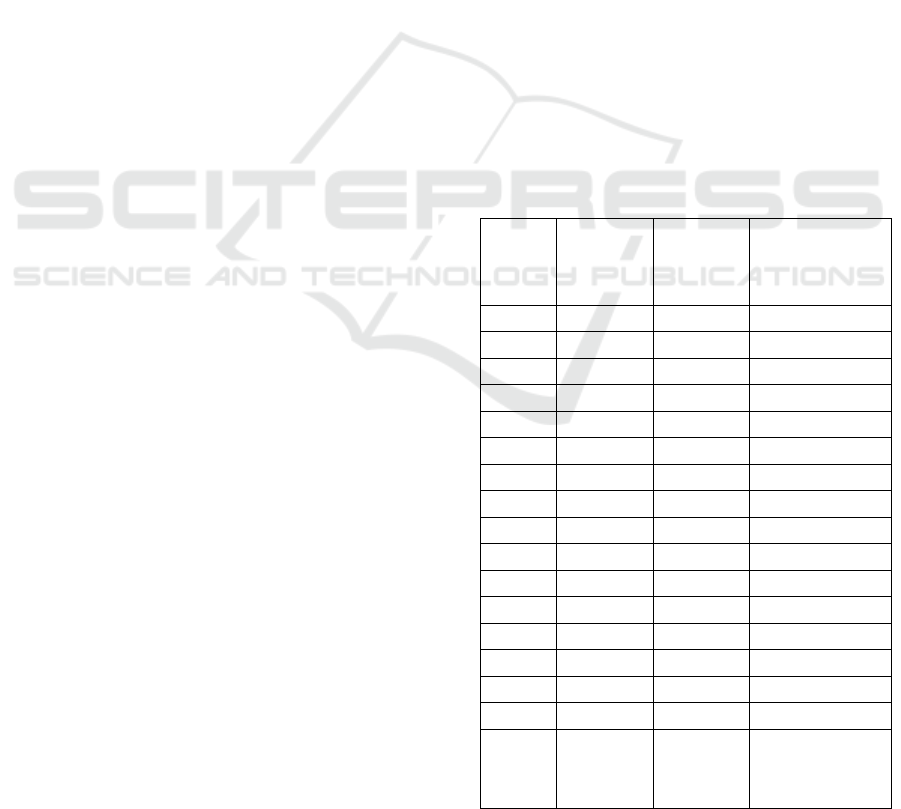

The results of the ZEIN for DKI Jakarta and North

Sumatra provinces are shown in Table 2 below.

Table 2: ZEIN for Jakarta and North Sumatra

Province/

Year

DKI

JAKARTA

(G1 + G2)

NORTH

SUMATRA

(G1 + G2)

SIMPLE

AVERAGE FOR

INDONESIA

(G1 + G2)

2000 2.64 0.91 1.77

2001 -0.75 0.85 0.05

2002 -0.68 0.85 0.08

2003 0.06 0.96 0.51

2004 0.03 1.00 0.51

2005 0.57 0.57

2006 0.57 0.57

2007 0.79 0.79

2008 0.92 0.92

2009 0.96 0.96

2010 0.97 0.97

2011 0.97 0.97

2012 0.97 0.97

2013 0.96 0.96

2014 0.95 0.95

2015 1.00 1.00

Simple

Average

(by

Province)

0.68 0.91 0.78

EBIC 2019 - Economics and Business International Conference 2019

490

The analysis is based on two observations: by the

group of zakat recipients, years, and provinces

(average), and by country (average).

By Group, Year and Province (average)

Table 2 above shows the results of ZEIN for two (2)

provinces, namely DKI Jakarta and North Sumatra,

over the sixteen (16) year period (2000-2015). From

the table above, we can see that the provinces of DKI

Jakarta and North Sumatra obtained the ZEIN value

that is greater than 0. However, if we compare the

provinces of DKI Jakarta and North Sumatra, we

found that the ZEIN for the province of North

Sumatra is not as good as the province of DKI Jakarta

as the ZEIN VALUE for the former province was

generally close to 1, implying that the amount of

zakat received by the poor group (poor and needy)

was not sufficient to cover their expenses on basic

needs.

In this regard, the Indonesian government needs

to address this issue by improving the collection and

disbursement of zakat. By doing so, the poor people

can get positive benefits from zakat, hence enabling

them to fulfil their basic needs. The finding is in

contrast to other findings based on a case study of

Indonesia which are done by Nurzaman (2016),

Saidurahman (2013), Febianto et al (2010), Jaelani

(2015), and Lessy (2013). As the present study is just

investigating two (2) out of 34 provinces in Indonesia,

the finding is far from conclusive. Thus, we reserve

it for our future research undertakings where more

data will be collected from as many provinces as

possible from Indonesia.

By Country-Indonesia (average)

In general, the results for ZEIN in the Indonesian

context are consistent with the individual provinces.

The zakat fund received by the poor people is not

sufficient to cater to their basic needs. With a few

exceptions, the ZEIN results obtained indicated

greater than 0, suggesting that the Indonesian

government should improve the collection and

disbursement of zakat for every province in

Indonesia, if the poor people’s welfare is to be

improved. To sum up, the study using ZEIN as the

measurement of zakat effectiveness, has been able to

show that the distribution of zakat in Indonesia is still

unsatisfactory, in particular the one that is dedicated

to the poor people.

4 CONCLUSION AND POLICY

RECOMMENDATION

In conclusion, the ZEIN outcome has shown that the

zakat fund received by the poor people is not

sufficient to cater the basic needs of the poor people

in Indonesia. This study found that the ZEIN for the

province of North Sumatra is not good as the province

of DKI Jakarta where it’s ZEIN value was strongly

closed to 1.

It is suggested that Indonesian government should

improve the collection and disbursement of zakat for

every province in Indonesia. Thus, the poor asnaf can

enhance their standard of living and enable them to

cover their daily basic needs.

REFERENCES

Abdullah Naziruddin, Mat Derus Alias, & Husam-Aldin

Nizar Al-Malkawi (2015). The Effectiveness of Zakat

in Alleviating Poverty and Inequalities, A Measurement

Using A Newly Developed Technique, Humanomics,

Vol. 35, No.3, 2015. Pp. 314-329.

Alcock, Peter. (1993). Understanding Poverty. MacMillan,

1993. Great Britain.

Alim, Mohamad Nizarul. (2015). Utilization and

Accounting of Zakat for Productive Purposes in

Indonesia: A Review. ScienceDirect, Elsevier, Procedia

- Social and Behavioral Sciences 211 ( 2015 ) 232 –

236.

Athoillah.M. Anto. (2008). Zakat As An Instrument Of

Eradicating Poverty (Indonesian Case). Working Paper,

Sharia and Law Faculty, UIN Sunan Gunung Djati,

Bandung, West Java, Indonesia.

Febianto Irawan, Ashany Mardhila Arimbi, & Kautsar

Asrul. (2010). An Analysis on the Impact of Zakah

Programs in Poverty Alleviation: Case Study in

Bandung, Indonesia. Working Paper, University of

Padjajaran, Bandung, West Java, Indonesia.

Firdaus Muhammad, Syauqi Beik Irfan, Irawan Tonny, &

Juanda Bambang (2012). Economic Estimation and

Determinations of Zakat Potential in Indonesia, IRTI

Working Paper Series, 1433-0, IDB (Islamic

Development Bank).

Habib Ahmed (Islamic Development Bank Group &

Islamic Research and Training Institute, 2004). Role of

Zakah and Awqaf in Poverty Alleviation, 8, 1-157,

Jeddah, Saudi Arabia.

Indonesia Zakat Outlook (2017), BAZNAS (Badan Amil

Zakat Nasional), Indonesia.

Jaelani, Aan (2015). Zakah Management for Poverty

Alleviation in Indonesia and Brunei Darussalam.

Munich Personal Repec Archive (MPRA), Shari’ah

Faculty, UIN Maulana Malik Ibrahim, Malang, East

Java, Indonesia.

The Effectiveness of Zakat in Alleviating Poverty and Inequalities in Indonesia: A Measurement using a Newly Developed Technique

491

Lessy, Zulkipli. (2013). Philanthropic zakat for

empowering indonesia’s poor: a qualitative study of

recipient experiences at rumah zakat, Unpublished

Dissertation, Indiana University, United States.

Macpherson, Stewart & Brewer, Brian (1997). Poverty and

Social Security in Paul Wilding et al (eds), Social

Policy in Hongkong (Cheltenham: Edward Elgar,

1997).

Nurzaman, Soleh Muhammad. (2016), Evaluating the

Impact of Productive Based Zakat in the Perspectives

of Human Development Index: A comparative

Analysis. Kyoto Bulletin of Islamic Area Studies, 9, pp.

42-62

Saidurrahman (2013). The Politics of Zakat Management in

Indonesia, The Tension between BAZ and LAZ.

Journal of Indonesian Islam, Vol. 07, No 02, IAIN

(Islamic State University, North Sumatra, Medan,

Indonesia).

Sari, Dwi Mutiara, Bahari Zakaria & Hamat Zahri (2013).

Review on Indonesian Zakah Management and

Obstacles.Social Sciences, 2 (2), 76-89. Centre for

Islamic Development Management Studies, School of

Social Sciences, Universiti Sains Malaysia, 11800

Penang, Malaysia

Sinha, Frances & The Impact Assessment Team

(November, 2003). Understanding and Assessing

Poverty: Multi-dimensional Assessment versus

“Standard” Poverty Lines. Paper contributed to the

EDIAIS conference, University of Manchester, UK.

Steidlmeier, Paul (1987). The Paradox of Poverty, A

Reappraisal of Economic Development Policy. United

States of America: Ballinger Publishing Company.

Swedish International Development Cooperation Agency

or SIDA (2002). Shared Responsibility, Sweden’s

Policy for Global Development.

EBIC 2019 - Economics and Business International Conference 2019

492