Some Factors Influencing IPO Underpricing: Evidence from

Indonesian Firms

Firman Syarif and Nurzaimah

Faculty of Economic and Business, Universitas Sumatera Utara, Medan, Indonesia

Keywords: Reputation Auditors and Underwriters, Percentage of Stock Offer and Industry Specialization, Indonesia

Abstract: The purpose of this paper is to investigate some factors influencing the underpricing of initial public

offerings (IPOs). The intention is to determine whether IPO firms –particularly those in certain firms of the

market where information asymmetry is likely to be greatest can benefit from significantly better IPO

pricing by engaging the services of differentiated reputation parties. The paper examines a broad sample of

initial public offerings made between 2014-2017. It also conducts multivariate tests to assess the influence

of percentage of stock offer, industry specialization, Auditor reputation and underwriter reputation on IPO

underpricing. The paper finds that IPOs audited by big 4 firms and underwriter reputation experience affect

significantly negative on underpricing but Industry specialization and percentage of stock offer don’t

influence at all. The results in this paper may not be generalizable to different countries. They do, however,

appear to be robust in Indonesia throughout the four-year sample period. The paper shows that it may not be

feasible for all clients in certain firms of the market. However, if they can the results suggest that they could

benefit from better IPO pricing.

1 INTRODUCTION

One of the most heavily investigated areas of

research in the IPO literature involves the persistent

underpricing of equity securities (e.g. Ibbotson,

1975; Ritter, 1984; Loughran and Ritter, 2004).

Several papers have attempted to identify factors

that are responsible for the underpricing

phenomenon; however, Indonesia's economic

growth certainly cannot be separated from the

development of business in Indonesia. Business

development in Indonesia has the highest potential

in Southeast Asia. This growing business

environment encourages the creation of conditions

where each business sector experiences intense

competition. To survive or grow in conditions like

this, of course, the company needs to do expansion

or improvement of its business. For embodying

these efforts, the company requires substantial

funds.

As for fulfill the needs for these funds,

companies can get them from within the company

and/or outside the company. However, companies

frequently find it difficult to fulfill their own

funding needs. Therefore, the company will try to

fulfill it with the help of outsiders. Fulfillment of

funds from outside the company can be achieved by

applying for interest-bearing loans from banks or

selling company shares to the public (go public)

through the capital market. Companies that sell their

shares to the public are called issuers, those who

buy stocks are called investors and their

underwriters are called underwriters.

Going public brings benefits for many parties,

that is not only for companies but also for

management and society. The act of going public

will certainly benefit the company because it is able

to obtain an injection of fresh funds from the public

without having to be burdened by an obligation,

because the company only needs to provide returns

to the community in the form of dividends

according to the portion of profits derived from the

company's operations. For management side, going

public encourages it to work professionally. For the

community, going public provides an opportunity to

be able to channel excess funds in the community

into more productive domain, namely the capital

market than saving it in the form of savings in a

bank. In addition to being able to avoid a decline in

currency value due to the threat of eroded by

inflation, the public can also get benefit in the form

of dividends and rising stock prices (capital gains)

Syarif, F. and Nurzaimah, .

Some Factors Influencing IPO Underpricing: Evidence from Indonesian Firms.

DOI: 10.5220/0009206504130426

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 413-426

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

413

and voting rights at the General Meeting of

Shareholders.

Based on the transaction time, the capital market

is divided into two, that is the primary market and

the secondary market. Transactions that occur on

the primary market are transactions when the first

time securities are offered by issuers through

underwriters to investors who are usually willing to

buy large amounts of securities with an Initial

Public Offering (IPO) mechanism. Whereas

transactions that occur on the secondary market are

when securities have been listed on the exchange.

This transaction occurs if there is an offer from the

investor who has bought securities on the primary

market and there is a demand from new investors

who want to buy securities on the stock exchange,

so that any amount of transactions in this market

will not affect the issuer's finances.

Determining the initial offering price at the time

of the IPO is the most main thing. The challenge

that must be faced by prospective issuers at this time

is to determine the offering price of shares. This is

difficult because this is the first time the shares have

been offered to the public and the issuer is not

aware of the market situation. If the issuer is unable

to make proper judgment and proper handling, the

challenge has the potential to cause problems. The

problem that can arise is that the issuer's share price

in the initial public offering will go to underpricing.

Underpricing is a condition where there is a

positive difference that comes up because the

issuer's share price on the primary market is set

significantly lower than the closing price of the first

day's stock on the secondary market. The

underpricing condition certainly inflicts a financial

loss to the issuer who need funds, because the funds

received are not optimum at the time of the IPO

process. However, for investors who buy shares

during IPO, this condition is very beneficial because

investors get an initial return. Initial return obtained

by investors for being able to sell shares in the

secondary market with a higher price than the price

when he bought it in the primary market.

The strategy used in dealing with challenges and

avoiding losses that might occur during the IPO

mechanism is that the issuer requests assistance to

the underwriter (underwriter) as a party that better

understands the market situation. The underwriter

offers shares to investors by providing information

about the issuer and convincing investors to buy

shares offered. The contract between the issuer and

the underwriter is made in the interests of the issuer

with or without the obligation to buy the remaining

unsold shares. However, each party has different

interests especially if the contract made is a full

commitment type contract.

Share prices in the primary market are

determined through an agreement between the

company as the issuer and the underwriter. One

side, the issuer as the party who wants the optimum

fund acquisition will offer shares at a high price.

However, on the other hand, if the type of full

commitment is used, namely the underwriter must

buy the remaining unsold shares, the underwriter

will set a lower initial share price than the issuer

expects. The aim is to be able to minimize the risks

they bear if they fail to sell all of the issuer's shares

in the primary market.

Table 1.1.

Graph of the number of companies that are

experiencing underpricing

The phenomenon of underpricing in companies

doing IPO often occurs in almost all countries in the

world. Although theoretically, underpricing is

detrimental to the issuers because it fails to get the

optimum additional funding, but this still happens

every year and even increases. In Indonesia, if

calculated using a percentage, there is a significant

increase in terms of the number of companies that

experienced underpricing at the time of the IPO on

the Indonesia Stock Exchange between 2014 -2017,

as illustrated in the previous chart. Table 1.1 pointed

out that in 2014 there were 87% of companies

experiencing underpricing of the total number of

companies conducting IPOs on the IDX and

continued to increase in percentage throughout

2015, 2016, and 2017 in order of 89%, 93%, and

94%. This has led researchers to raise the subject of

research on the phenomenon of underpricing in

Indonesia.

The large percentage of shares offered to the

public is one of the factors that influence

underpricing because this shows how liquid the

shares are to be traded on the secondary market. The

0

50

100

2014 2015 2016 2017

Persen (%)

EBIC 2019 - Economics and Business International Conference 2019

414

smaller the percentage of shares offered to the

public, the smaller the level of liquidity of the

shares. Therefore, the greater the risk that must be

borne by investors and will result in a higher level

of underpricing. This is in line with the results of

research conducted by Putro and Priantinah (2015).

However, not with the results of Pahlavi's research

(2014), which stated that there was no significant

effect of the percentage of share offerings on the

level of underpricing.

The risk or level of uncertainty of each industry

will vary depending on the type of industry. These

differences affect investors in making decisions

when investing and setting bid prices because the

expected level of profits will be different for each

type of industry. Therefore, industrial type factors

may be another reason for underpricing. Following

the results of the study of Islam et al. (2010) which

states the type of industry significantly influences

the level of underpricing. However, it is different

from the results of Junaeni and Agustian's (2013)

research which shows that there is no influence of

industry type on the level of underpricing.

The use of reputable auditors in the preparation

of financial statements and prospectuses will

demonstrate the quality of the issuer. If the issuer

uses the services of a quality auditor, the investor

will judge it as a positive signal because the issuer is

considered intending to provide non-misleading

information about the condition of the

company.Therefore, the auditor's quality also

influences the success of the IPO as indicated by the

absence of underpricing. This is reinforced by the

results of research Razafindrambinina and Kwan

(2013) which shows the significant influence of the

auditor's reputation on the level of underpricing.

While the results of the Purbarangga and Yuyetta

(2013) research which revealed no significant effect.

Underwriters have an important role to assist

prospective issuers in dealing with the IPO

mechanism. Prospective issuers, in general, will

tend to have underwriters who have a good and

reliable reputation. The acquisition of underwriter

reputation can be caused by its success in selling

large volumes of shares. The sale of large volumes

of shares often occurs when shares offered by

underwriters to investors are shares issued by

quality issuers at underpriced prices, thus allowing

investors to get an initial return. So, there is a

possibility that issuers deliberately choose

underwriters who are reputable to be able to offer

their shares underpriced. Purwanto and Rokhimah

(2017) conducted a study that resulted in the

conclusion that the underwriter's reputation had a

significant effect on the level of underpricing.

However, it is different from Pahlavi's research

(2014) which shows the results of the absence of

influence caused by the underwriter's reputation.

2 PRIOR LITERATURE

In this section, we will explain the theories that

underlie research. Besides, the following theory is

also used as a reference in the formulation of

hypotheses and conceptual frameworks. This is

done to help researchers to analyze the results of the

research obtained.

Alteza (2010) Based on the assumption of an

efficient model market, the price of shares formed in

the market should reflect all relevant information so

that it matches the actual value. In this condition, all

participants in the market have the same

expectations (homogeneous expectation). However,

if information asymmetry occurs, then there will be

various expectations in the market (heterogeneous

expectation). The more diverse the expectations of

participants in the market, the greater the level of

uncertainty about future share prices or ex-ante

uncertainty so that the greater the cost of

information must be compensated through

underpricing. Following the context of this research,

there are two forms of development of information

asymmetry, namely the regulation hypothesis and

signal theory.

According to signal theory, to minimize the

information asymmetry that occurs between issuers,

underwriters, and investors, financial statements and

prospectuses can be published (Bini et al., 2011).

The information contained in the prospectus

consists of financial and non-financial information.

Investors will look for information relating to the

company's performance to find out the company's

prospects in the future.

The auditor's reputation is non-financial

information that is presented in a prospectus and can

be considered by investors in making decisions.

Issuers that entrust their financial statements are

audited by a reputable auditor indicate that the

information provided by the company is not

misleading. This will reduce the level of uncertainty

in the value of the company so that the possibility of

underpricing can be reduced (Yanti and Yasa,

2013).

Besides, the underwriter's reputation is also

included in the non-financial information presented

in the prospectus. The selection of underwriters who

have a good reputation by the issuer has the aim to

Some Factors Influencing IPO Underpricing: Evidence from Indonesian Firms

415

give a signal to investors. Carter and Manaster

(1990) suggested that underwriters with a good

reputation will use their private information to filter

out companies that will conduct an IPO and only

choose to guarantee issuers that are not at high risk.

This means that the better the underwriter's

reputation, the smaller the level of ex-ante

uncertainty that must be borne by investors.

Alli et al. in Alteza (2010) developed a theory of

information asymetry by formulating a regulation

hypothesis to explain the causes of further

underpricing. The government generally sets more

specific regulations and is accompanied by close

supervision of some companies or industrial sectors

in a country. The existence of these regulations

requires companies to convey more precise and

accurate information to the public or investors to

reduce the occurrence of information asymmetry.

The more even distribution of information will

certainly reduce the possibility of underpricing.

The reason for underpricing can be explained

through the theory developed by Ellul and Pagano

(2003). This theory is a development of the

seasoned securities liquidity theory in the secondary

market which has expanded its application to the

primary market. For underwriters, liquid shares

reduce the cost of price stabilization. Meanwhile,

liquid stock investors will reduce trading costs and

reduce stock volatility in the aftermarket. Issuers as

issuers of shares will also benefit because selling

liquid shares will facilitate access to the capital

market.

In trading shares, investors must bear liquidity

costs that refer to the ability of a stock to be quickly

converted into cash. The importance of stock

liquidity to be traded in the secondary market

(aftermarket liquidity) is one thing that is

sufficiently considered by investors in the primary

market. Based on various relevant information

obtained by investors both from the prospectus and

other publications, he will make expectations

regarding the liquidity of these shares later when

traded on the secondary market (Alteza, 2010). If

the investor turns out to be expecting more illiquid

shares, it means he will require greater

compensation in purchasing shares in the form of a

higher expected initial return. Therefore, issuers

must offer shares with a higher level of

underpricing.

The capital market is a market for a variety of

long-term financial instruments that can be traded,

both in the form of debt (bonds), equity (stocks),

derivative instruments, and other instruments

(Syahyunan, 2015). According to the Law of the

Republic of Indonesia Number 8 of 1995, Chapter I

Article 1 Item 13 Concerning Capital Market states

that: "Capital market is an activity which is

concerned with public offering and trading of

securities, public companies relating to the issuance

of their securities and related institutions and

professions. with effect ". Summarizing the two

meanings, it can be concluded that the capital

market is similar to the market in general, namely,

where the buying and selling activities take place,

the difference is certainly the object being traded.

Based on the time of the transaction, the capital

market is divided into two namely: the primary

market (primary) and the secondary market. The

primary market is a market where securities are

traded for the first time, before being listed on the

Stock Exchange. Actors in this market are issuers

accompanied by underwriters and investors,

securities offered to investors by underwriters, this

process is called an Initial Public Offering (IPO).

On this occasion, investors can only buy, not sell.

Purchase time is also limited, i.e. only within the

offer period. To buy in this market, investors must

buy it through an intermediary Brokerage company

appointed as an agent by the underwriter. The

quantity and the high and low prices of share sales

in this market will affect the total funds obtained by

the issuer.

The secondary market is a market where

securities have been listed on the Stock Exchange

for trading. The secondary market provides an

opportunity for investors to buy or sell securities

listed on the exchange. So, the secondary market is

a continuation of the primary market. The buying

and selling process in this market no longer has to

go to a brokerage company appointed as an

underwriter agent, but it can go to any brokerage

company. In this market, the issuer is not a market

participant, so how high or low the price of shares

formed in the secondary market will not affect the

total funds obtained by the issuer.

Difference Between the Primary Market and the

Secondary Market

Primar

y

marke

t

Secondar

y

Marke

t

Fixed share price

Stock prices fluctuate

according to the strength of

supply an

d

deman

d

No commission is

charge

d

Commission charged

Only for stock

p

urchases

Applies to buying or selling

shares

Orders are made

throu

g

h realtors

Orders are made through

exchan

g

e members

(

broker

)

Limite

d

p

erio

d

of time Unlimite

d

p

erio

d

of time

EBIC 2019 - Economics and Business International Conference 2019

416

To meet the funding requirements for its

operations, companies can issue securities or

securities such as stocks and bonds. For companies

that want to offer their shares to the public for the

first time (going public) must pass a stage, namely

IPO. Initial Public Offering or also known as initial

public offering is a processor initial stage that must

be done by the company. According to Law No. 8

of 1995 concerning the Capital Market is defined

that "Public Offering is a securities offering activity

carried out by an issuer to sell securities to the

public based on the procedures stipulated in the

Capital Market Law and its implementing

regulations."

Before offering shares in the primary market,

the company will issue a prospectus, which is

detailed information about the company, which will

be announced briefly in the mass media. This

prospectus serves to provide information about the

condition of the company and the planned allocation

of IPO funds to potential investors. Prospectus helps

investors to more easily make investment decisions

and look at the company's prospects going forward.

The series of IPOs that will be carried out by issuers

can be described succinctly as follows:

1. Due Diligence Meeting. Here the issuer as a

party who will release shares holds a meeting with

the designated underwriter. This is done by the

procedures of the Capital Market Supervisory

Agency (BAPEPAM) that the underwriter must be

an intermediary between the issuer and the investor.

In the meeting, the underwriter helped the issuer to

follow all the regulations required for issuers who

wanted to be traded on the exchange. Parties

involved: underwriters (securities), independent

auditors, appraisers (asset assessors) and legal

consultants. The point is that each party must ensure

that all regulations are met and the information

presented is clear and true.

2. Public Expose and Roadshow. Through the

roadshow, issuers who want to release their shares

can present future developments and growth to

potential investors. Generally prioritized by large

prospective investors or institutions. Roadshows are

held in various places and even to foreign investors.

So with this roadshow, there will be more investors

familiar with the condition of the issuer so that they

can make an offer for book building

3. Book Building. At this stage the response of

prospective investors is visible, prospective

investors order how many IPO shares to buy and at

what price they want to buy. Every proposed price

offer will be recorded and used as a reference for

determining the price of shares at the IPO. The

process is called book building. Here the investors

will analyze the company's condition, prospects and

also compete with other investors, at this stage the

price will be formed. At the time of this book

building oversubscribe can also occur, ie when the

number of shares ordered by prospective investors is

more than that offered by issuers, of course this is

good news for companies and usually results in IPO

share prices reaching a maximum level. But it can

also be vice versa the number of shares ordered less

than offered, which is bad news for issuers.

4. Determination of Initial Price and Allotment.

After going through the book building stage, then

the underwriter agrees with the issuer to determine

the final price. The basis for determining the IPO

price is based on notes from investors. Allotment or

allocation will be conducted if the number of shares

ordered is more than the offering (oversubscribe)

but the order is less than the offered offering, then

the underwriter will absorb according to the initial

agreement between the underwriter and the issuer.

Underpricing is a situation where the offering

price of shares in the primary market is significantly

lower than the closing price of shares in the

secondary market on the first day. The level of

underpricing can be measured by initial return.

Initial return is the initial profit gained by investors

due to a positive difference from the stock price in

the secondary market at the close of the first day to

the stock price in the primary market.

Aryapranata and Adityawarman (2017) suggest

that underpricing occurs due to information

asymmetry and differences in interests between

issuers, underwriters and investors. The process of

determining stock prices during the first public

offering is quite difficult because there is no

historical value that can be a reference. Therefore,

public offerings on the primary market are often

faced with the challenge of underpricing. From an

issuer's point of view, underpricing is certainly

detrimental because the funds obtained during the

Initial Public Offering (IPO) are not optimum. If

examined from the perspective of investors,

underpricing is certainly very beneficial because it

provides benefits in the beginning. Likewise for

underwriters, underpricing is a favorable situation

because it minimizes the risk they face, namely the

less likely the shares will not be sold out.

However, it is not impossible for a company to

deliberately offer its shares underpriced to attract

Some Factors Influencing IPO Underpricing: Evidence from Indonesian Firms

417

investors. The rationale for companies to offer

shares with an underpriced situation would have

been carefully considered. Issuers have a hunch that

offering an underpriced offer can give a good

impression to investors. As a result, if the issuer

offers shares again in the future, investors will buy

again in the hope that they will get the same profit

as when buying the issuer's shares in the primary

market. This is what an issuer wants to achieve that

intentionally offers underpriced shares.

However, in general, only financially qualified

companies can carry out this strategy. Because of

course underpricing will result in material losses for

the issuer. However, if the issuer has prepared a

plan properly and calculated it carefully, the losses

suffered may be covered by the profits that will be

obtained later. Because, based on the data collected

it can be seen that most companies in Indonesia

adopted underpricing at the time of the Initial Public

offering. Although it seems that the underpricing

that occurred was not intentional, it is possible that

the issuer did it deliberately.

2.1 Factors Influencing Underpricing

The present study will discuss some non-financial

factors that are thought to have a significant effect

on the level of underpricing in companies

conducting Initial Public Offering. These non-

financial factors include, among others, the stock

offer percentage, the type of industry, the auditor's

reputation, and the reputation of the underwriter.

Each of these factors will be described in more

detail below:

2.1.1 Stock Offer Percentage

Company capital is the amount of capital mentioned

in the deed of establishment of the company and is

the maximum amount of shares authorized for the

issuance of shares. The company's capital is a fixed

amount. Addition or reduction is done by enlarging

or reducing capital through changes in the deed of

establishment.

The stock offer percentage shows how much the

percentage of shares offered by the issuer to the

public compared to the number of shares listed on

the deed of establishment. Generally, at the initial

public offering, an issuer will retain at least fifty

percent of its shares so that the company's control is

still fully held. The number of shares offered to the

public at the time of the initial public offering was

around twenty percent. The issuer's point of view is

not to release too many shares during the initial

public offering, but to release them in stages.

Determination of the percentage of shares to be

offered to the public is quite crucial. Pahlevi (2014)

states that the greater the number of shares offered

to the public, the less private information a company

has, as a result, the greater the uncertainty borne by

investors. However, there is another perspective,

namely if the shares released by the issuer to the

public are considered too small, then that will cause

shares to be considered illiquid and as a result the

shares will not sell in the market. That is why

investors will consider the percentage of stock offer

as a factor in making investment decisions and

determining the price to be set during the book-

building process.

2.1.2 Industrial Type

The type of industry is categorized as a factor that

influences underpricing because each industry has

different characteristics. This difference in

characteristics can lead to differences in risk and

inherent uncertainty. The expected level of return of

investors will also be different for each chosen

sector. Investors certainly consider this to take

investment decisions and to set demanding prices

during the book-building process.

The types of industries in this study are

classified into 2 categories, namely financial and

non-financial industries. In Gwenyth and Panjaitan

(2016) it is stated that in the financial industry,

companies face many regulations issued by various

institutions that regulate the financial sector. In

Indonesia, the regulatory agencies are the Ministry

of Finance, Bank Indonesia, and the Financial

Services Authority (OJK). The monitoring is

expected to reduce the uncertainty of financial

companies compared to non-financial companies so

that it is expected that the level of underpricing in

the financial industry will be smaller than in other

sectors.

2.1.3 Auditor's Reputation

The auditor's reputation is the good name and image

owned by the auditor in the community arising from

the auditor's work such for example unbiased and

independent auditing results. Issuers will hire the

services of independent auditors at the time of the

initial public offering as explained earlier. The

independent auditor has to assess the financial

statements by the principles of financial accounting

and provide his opinion on the company's financial

statements. Financial reports expected by the market

EBIC 2019 - Economics and Business International Conference 2019

418

are financial statements that are free of any bias or

things that can mislead users.

The company will choose a reputable public

accounting firm because the auditor's reputation

affects the credibility of financial statements when a

company goes public. The credibility of financial

statements will be very useful for investors for

information in determining their investments.

Highly reputed auditors have a greater commitment

to maintain the quality of audits they produce so that

company reports that have been given by high-

reputed auditors will provide investors with greater

confidence about the quality of information

presented in the prospectus and financial statements

of the company.

2.1.4 Underwriter Reputation

Underwriter is a private company or BUMN that is

responsible for selling the issuer’s securities to

investors (Syahyunan, 2015). Underwriter

reputation is a name of the image obtained as a

result of being able to carry out its duties and

obligations as it should be able to sell all the shares

it guarantees at the time of the IPO. Underwriters or

commonly referred to as an emission guarantor are

parties who sell securities, while issuers only issue

them. Furthermore, the underwriter will service

purchases by brokerage firms, which represent

investors or for their portfolios. Thus, the

underwriter helps the interests of the issuer more

than the interests of investors. Based on the type of

guarantee capability, there are four types of

underwriter contracts, namely:

a. Full Firm Commitment

Under this contract the underwriter takes full risk if

the shares/bonds are sold out, the underwriter will

buy all the unsold shares/bonds at the same price, at

the bid price to the investor in general. Guarantor of

full commitment like that applies the order of

selling and buying because new underwriters are

required to buy the remaining shares/bonds only if

they are unable to sell until they run out.

b. Best efforts commitment

In this contract, the underwriter is only required to

try his best to sell the shares/bonds issued in full.

There is no obligation for the underwriter to buy

shares that are not sold. so, if at the end of the sale

period there are still unsold shares/bonds, the

shares/bonds will be returned to the issuer.

c. Standby commitment

According to this type of contract, if some

stocks/bonds do not sell until the specified sales

deadline, the underwriter will be willing to buy

shares/bonds that are not selling. it's just that the

purchase price by the underwriter is not the same as

the price of the public offering.

d. All of none commitment

The underwriter will try to sell the issuer's

shares/bonds until they sell well. If the offered

shares/bonds do not sell well, then the shares/bonds

that have been ordered, the transaction was

canceled. So, all shares/bonds are not sold, returned

to the issuer and the issuer does not get any funds.

This commitment arises from the background that

companies need capital on a certain scale. if the

amount is not reached, then the company's

investment is less useful. because it's better not to

publish shares at all.

2.2 Prior Research

Purwanto and Rokhimah (2016) examined the effect

of independent variables on auditor reputation,

underwriter reputation, ROA, and financial leverage

on the dependent variable, namely the level of

underpricing in companies with an IPO from 2006 to

2014 on the IDX using multiple linear regression

tests. The sample picker uses a purposive sampling

technique, so that 110 companies are selected as

research objects. the results of this study indicate that

partially the underwriter's reputation has a significant

negative effect on the level of underpricing,

meanwhile, company size, ROA, and financial

leverage do not influence the level of underpricing.

Putro and Priantinah (2015) used a multiple

linear regression test in examining the influence of

the independent variables of company age, company

size, percentage of stock offerings, earnings per

share (EPS), and market conditions on the dependent

variable, namely the level of underpricing in

companies that were IPO from 2012 to with 2015 on

the IDX. Obtained a sample of 66 companies using

purposive sampling technique. The results of this

research show that EPS partially and the percentage

of shares offered have a significant positive effect

and firm size has a significant negative effect on the

level of underpricing. However, the age of the

company and market conditions proved to have no

significant effect on the level of underpricing. if

tested simultaneously, company age, company size,

percentage of company offer, earnings per share

(EPS), and market conditions are proven to have a

significant effect on the level of underpricing.

Some Factors Influencing IPO Underpricing: Evidence from Indonesian Firms

419

Pahlevi (2014) examined the effect of

independent variables on auditor reputation,

underwriter reputation, percentage of stock offerings,

financial leverage, ROA, NPM, current radio,

company size, company age and type of industry on

the dependent variable namely the level of

underpricing in companies with IPO from 2000 to by

2012 on the IDX using multiple linear regression

test. The results of this study indicate that partially

financial leverage has a significant positive effect

and ROA, NPM, current ratio, company size, and

age of the company have a significant negative effect

on the level of underpricing. However, the auditor's

reputation, the reputation of the underwriter, the

percentage of share offerings, and the type of

industry does not influence the level of underpricing.

Junaeni and Agustian (2013) used multiple linear

regression tests in examining the effect of the

independent variable underwriter reputation,

proceeds, financial leverage, and type of industry on

the dependent variable, namely the level of

underpricing in companies whose IPO from 2006 up

to 2010 in BEL A purposive sampling technique was

used in setting samples, totaling 26 samples from the

existing population of 57 companies. The results of

this research show that only partially the reputation

of the underwriter has a significant negative effect

on the level of underpricing, while the proceeds,

financial leverage. And the type of industry does not

have a significant effect on the level of underpricing.

While tested simultaneously, the reputation of the

underwriter, proceeds, financial leverage, and type of

industry have a significant influence on the level of

underpricing.

Purbarangga and Yuyetta (2013) use multiple

linear regression tests in examining the influence of

independent variables Auditor's Reputation,

Company Size, Company Age, ROE, and Percentage

of Stock Offer on the dependent variable that is the

level of underpricing in companies that are 1PO in

BEL Obtained a sample of 91 companies from 132

companies using a purposive sampling technique.

The results of this study indicate, partially both the

auditor's reputation, company size, company age,

ROE, and the percentage of share offerings none

influence the level of underpricing.

Razafindrambinina and Kwan (2013) examined

the effect of the independent variable auditor's

reputation and the reputation of the underwriter on

the dependent variable namely the level of

underpricing. The research was conducted on

companies whose IPO from 2004 to 2009 on the

IDX used multiple linear regression tests. The results

of this study indicate partially the reputation of the

auditor and the reputation of the secondary writer

have a significant negative effect on the level of

underpricing.Islam et al (2010) in his research using

independent variables of company age, company

size, type of industry, percentage of stock offerings,

and time of offer to be tested for influence on the

dependent variable namely the level of underpricing

in the company.

The IPO from 1995 to 2005 on the Chittagong

Stock Exchange used a multiple linear regression

test. The results of this study indicate partially

company age d company size has a significant

positive effect and the type of industry and the

percentage of share offerings have a significant

negative effector while the time of offering does not

influence the level of underpricing.

Occur to give rise to a hypothesis. This research

begins by ascertaining whether companies that

conduct IPOs on the Indonesia Stock Exchange in

2014-2017 experience underpricing. Observations

were made by comparing the offering price of IPO

shares in the primary market and the price of shares

at the close of the first day on the market in the

secondary.

Companies that experience underpricing are

those whose bid prices at the time of the IPO on the

primary market are significantly lower than the

stock price at the close of the first day on the

secondary market. Companies that are underpricing

are then tested using multiple linear regression

analysis to determine whether the percentage factor

of the stock offering, the type of industry, auditor's

reputation and the reputation of the underwriter

partially have a significant effect on the level of

underpricing. Based on the purpose of the research

to be carried out as outlined previously, then the

above has been proposed an overview of the

conceptual framework of this research.

3 HYPOTHESIS DEVELOPMENT

Hypothesis is a temporary allegation of a study that

would be done so that it can be empirically tested.

Hypotheses are based on theoretical foundations,

research reviews previously, and the conceptual

framework with goals can be a temporary answer to

see the process of analyzing research. The

hypotheses formulated in the study are as follows:

EBIC 2019 - Economics and Business International Conference 2019

420

3.1 Effect of Percentage of Stock

Offering on the Level of

Underpricing

The percentage of shares offered to the public

indicates private information and the level of

liquidity owned by a company. The greater the

percentage of shares offered to the public, the

greater the level of uncertainty in the future. This is

because old shareholders will have smaller private

information, so the level of uncertainty or ex-ante

uncertainty borne by the new shareholders is even

greater. However, on the other hand, the smaller the

percentage of shares offered will cause a low level

of liquidity and have an impact on the increasing

liquidity risk faced by investors during the

aftermarket (Alteza, 2010).

The greater ex ante uncertainty will affect the

decline in investor interest in conducting investment

and encourage investors to set the asking price (bid)

below the fair price of the book-building process

because, by taking a large risk the investor hopes to

obtain compensation in the form of an initial profit

that is the initial return that is possible if

underpricing occurs. The smaller the percentage of

the stock offering will bring greater uncertainty as

well and encourage a greater level of underpricing.

The results of research from Putro and Priantinah

(2015) show that there is a significant influence of

the percentage of share offerings on the level of

underpricing. Based on the explanation above, the

authors propose a hypothesis:

Ha

1

: Percentage of share offerings influences the

level of underpricing

3.2 The Influence of the Type of

Industry on the Level of

Underpricing

Different types of industries carry different risks so

that they can influence investors in making

investment decisions and setting asking prices(bid)

at book building. The financial industry is a

company that faces many regulations and

supervision issued by institutions that regulate the

financial sector. In Indonesia, monitoring is

conducted by Bank Indonesia to reduce the

uncertainty of financial companies compared to

non-financial companies. Thus, the level of

underpricing in the financial industry should be

smaller than other sectors or there is no

underpricing at all due to the small risk faced in

investing in this sector. Research by Islam et al.

(2010) shows the type of industry has a significant

influence on the level of underpricing. Based on the

explanation above, the authors propose a

hypothesis:

Ha₂: The type of industry influences the level of

underpricing.

3.3 The Effect of the Auditor's

reputation on the Level of

Underpricing

An auditor who has a reputation will be considered

reliable and trustworthy results of the audit, so that

investors will believe that the financial statements

and prospectuses presented by the issuer show the

real situation. This reduces the uncertainty that

exists and reduces the risk that must be borne by

investors. Investors in this situation dare to set a bid

price above the fair price if the issuer concerned has

a good performance and has the opportunity to

succeed in the future. Therefore, the determination

to use the services of auditors who have a reputation

or will not affect the level of underpricing that

occurs. In line with the results of the study of

Lestari et al. (2015) shows that the auditor's

reputation has a significant influence in minimizing

the level of underpricing because auditors in good

standing can make the public feel confident about

the truth of the company's financial statements, so

that the accounting information needed by the

public to assess the company is considered more

reliable. Based on the explanation above, the

authors propose a hypothesis:

Ha₃: The auditor's reputation influences the level

of underpricing

3.4 The Influence of Underwriter

Reputation on the Level of

Underpricing

The underwriter holds an important influence in the

issuer's IPO process so that the selection of the right

underwriter is expected to be able to realize the

issuer's IPO goals. Deciding to use underwriters

who have a good reputation will increase investor

interest in the shares offered. This is because in

general underwriters who are reputed to be more

selective in choosing the company that they will

guarantee to minimize the risk that must be borne.

The benchmark of underwriter's reputation in

this study is the large number of shares that can be

sold at an IPO. Investors are generally interested in

investing in the primary market in quality issuers

with good prospects going forward and hoping to

obtain an initial return as a result of the price of

Some Factors Influencing IPO Underpricing: Evidence from Indonesian Firms

421

shares offered underpriced. Assumptions in making

this hypothesis, the issuer will choose a reputable

underwriter to give a signal to investors that the

shares offered by the guaranteed issuers are quality

issuers and are offered underpriced. Following the

results of research conducted by Aryapranata and

Adityawarman (2017) shows the results of the

underwriter reputation have a significant effect on

the level of underpricing. Based on the explanation

above, the authors propose a hypothesis:

Ha₄: Underwriter's reputation influences the

level of underpricing

4 SAMPLE

Based on the formulation of the problem and the

purpose of the study, this research is included in the

type of associative research to determine the

relationship between two or more variables. The

relationship to be investigated is a causal

relationship that is a causal relationship. One

variable (independent) affects other variables

(dependent). Where the dependent variable is

underpricing and the independent variable is the

percentage of the stock offering, type of industry,

auditor's reputation and underwriter reputation.

This research was conducted at the Indonesia

Stock Exchange with the help of internet

media.Sites that are used to obtain variable data

related to IPO include www.idx.co.id,

www.rti.co.id, and www.ebursa.com. The site

contains information about the IPO by the period to

be investigated, namely 2014-2017. The study

period starts from September to December 2018.

4.1 Dependent Variable

The dependent variable in this study is underpricing.

Underpricing is proxied by calculating the initial

return of the companies that make the Initial Public

Offering. Initial Return is the difference between the

stock price at the IPO (Offering Price) and the

closing price of the first day on the secondary

market.

4.2 Independent Variable

4.2.1 Percentage of Stock Offer (X1)

Percentage of share percentage : (Percentage of

Offer Level offered) Denotes the ratio of shares

offered to the public (Offer Size) compared to the

total shares valid for sale by the issuer or with us

another total shares sent in the deed (Authorized

Stock).

4.2.2 Industry Type (X2)

Measurement of industrial-type variables using

dummy variables. Determination of industrial-type

is given a value of 1 for companies included in the

financial sector and for the non-financial sector

Financial industry industries consist of bank sub-

sectors, financing institutions, sub-sectors insurance

sector, and other financial sub-sectors.

4.2.3 Auditor Reputation (X3)

The auditor's ownership variable uses a dummy

variable. This variable discusses by looking at

whether the auditors used by the issuer are included

in the KAP category of the Big Four Indonesia. Big

Four in Indonesia include KAP Tanudiredja,

Wibisana & Partners (PwC), KAP Osman Bing

Satrio (Deloitte), KAP Purwantono, Suherman &

Surja (EY)and KAP Sidharta &Widjaja (KPMG). If

an issuer uses the services of an auditor who is a

member of the Big Four KAP in Indonesia, then it is

given a value of 1, conversely if the issuer uses the

services of an auditor who is not included in a Big

Four KAP member in Indonesia, then given a value

of 0. Measurements with the same method were also

carried out in Pahlevi's research (2014)

4.2.4 Reputation Underwriter (X4)

The writer's reputation in this survey was measured

using varicose punitive methods. This was also

carried out in the Aryapranata and Adityawarman

search (2017). Underwriter reputation is measured

by the ranking of the Indonesia Stock Exchange

(IDX) “The Most Active IDX Members in Total

Trading Volume” published on IDX Fact Book.

Given a value of 1 for issuers that use the services

of underwriters included in The Most Active IDX

Members in Total Trading Volume, if the issuer

uses the services of writers outside of the Top 10 the

list will be given a value of 0.

4.3 Population and Samples

The population in this study are companies that

carry out Initial public offering (IPO) for the period

2014-2017. Based on these limitations, a population

of 91. companies was obtained, determining the

sample in this study using a purposive sampling

technique.

EBIC 2019 - Economics and Business International Conference 2019

422

4.4 Data Sources

Sampling Types of data used in this study are

quantitative and qualitative data with secondary data

sources. According to Kuncoro(2013), quantitative

data is data measured on a numerical scale

(numbers) while qualitative data is data that cannot

be measured using a numerical scale. However,

because in statistics all data must be in the form of

figures, qualitative data a generally quantified by

classifying them. The data used was obtained from

the financial statements of the prospectus of each

company conducting an IPO on the Indonesia Stock

Exchange for the 2014-2017 period.

The data collection method used in this research

is the documentation study method by collecting

documented data such as financial reports,

prospectuses, and other supplementary data

obtained from websites such as www.idx.co.id,

www.rti.co.id, and o.

Researchers process data and research using the

SPSS (Statistical Package for Social Science)

application 23.0. The model used in this study is a

multiple linear regression model. Before processing

data using multiple linear regression analysis

methods, the data to be used must be tested first to

assess whether or not there is a bias in this study.

after that will do a hypothesis test.

5 EMPIRICAL MODEL AND

VARIABLES

According to Gozali (2016) regression analysis is

used to measure the strength of the relationship

between two or more variables, also shows the

direction of the relationship between the dependent

and independent variables. Multiple linear

regression analysis is a linear relationship between

two or more independent variables (X) with the

dependent variable (Y). This analysis predicts the

value of the dependent variable if the value of the

independent variable increases or decreases and to

determine the direction of the relationship, between

the independent variable and the dependent variable

whether each independent variable is positively or

negatively related. The linear regression equation

model in this study is as follows :

Y = α + β1X1 + β2X2 + β3X3 + β4X4 + Ꜫ

Y = Underpricing

α = Constant

β1 = A supply of stocks the regression

coefficient

X1 = The percentage a supply of stocks

Β2 = Regression coefficient type of industry

X2 = Type of industry

Β3 = The regression coefficient reputation an

auditor

X3 = The reputation of the auditors

Β4 = The regression coefficient reputation

underwriter

X4 = The reputation of an underwriter

ε = Term of Error

The use of a fundamental weakness

determination is biased towards a variable quantity

that is included in the model. Every addition of one

independent, R

2

would increase regardless of

whether the variable had an impact in a significant

way or not (Ghozali, 2016). Hence adjusted R

2

is

more recommended to use because unlike R

2

, the

value of adjusted R

2

can increase or decrease if one

independent variable is added to the model.

6 RESULTS

6.1 Descriptive Statistic

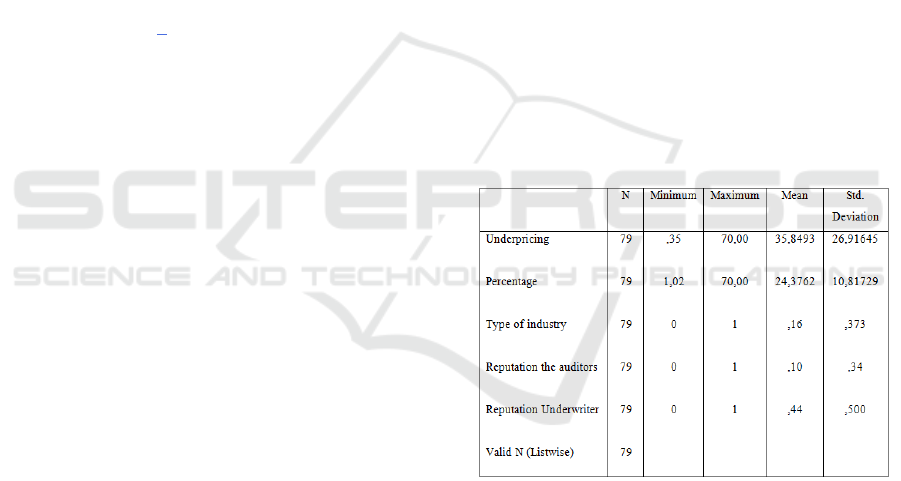

Descriptive Statistics

1. Underpricing Variable (Y) has an average value

of 35,8%. This shows that those companies

were selling stocks on the main market with the

price lower than the price they gave when they

were selling them at the secondary market

reaching 35,8%. Bond issuers that experienced

the highest underpricing level by 70% are Bank

Agris Tbk, Sitara Propertindo Tbk, Bank Dinar

Indonesia Tbk, Mitra Komunikasi Nusantara

Tbk, Bintang Oto Global Tbk, Sillo Maritime

Perdana Tbk, Asuransi Jiwa Syariah Jasa Mitra

Abadi, Kapuas Prima Coal Tbk, Mallaca Trust

Wuwungan Insurance Tbk, Ayana Land

International Tbk, Megapower Makmur Tbk,

Terregra Asia Energy Tbk, and Pelayaran

Some Factors Influencing IPO Underpricing: Evidence from Indonesian Firms

423

Tamarin Samudra Tbk. Meanwhile, the

company that experienced the lowest

underpricing by 1,02% is Golden Plantation

Tbk. The standard deviation level from

underpricing variable is 26,9.

2. The percentage variable of stocks offering

having an average of 24,4%. The lowest

percentage of stocks offering is 1% done by

MAP Boga Adiperkasa Tbk. Meanwhile, the

highest percentage of stocks offering done by

Magna Investama Mandiri Tbk by 70%. The

standard deviation level from stocks offering

variable percentage is 10,8.

3. The variable on type of industry(X2) has a

minimum of 0, a maximum score of 1, and the

average value of 0,16 where there are 13

companies which included as the types of the

financial industry and the rest 66 companies are

included as non-financial industrial companies.

The standard deviation level for the industrial

variable is 0,37.

4. Variable of the reputation of auditor (X3) has a

minimum of 0, maximum score 1, and average

value of 0,1 where only 6 companies are using

the service of public accountant with high

reputation (KAP the big four) and the rest 73

companies. Public accounting firm with a low

reputation. The standard deviation of the

auditor's reputation variable is 0,3.

5. The underwriter reputation variable (X4) has a

minimum value of 0, a maximum value of 1,

and an average value of 0,44. Where 35

companies use underwriter services of highly

reputable authors (underwriter who enter the

top 10 in the 50 most active IDX members in

total trading volume based on the IDX

factbook) and the remaining 44 companies use

the services of underwriter with low reputation.

The standard deviation level of industry type

variables is 0,5.

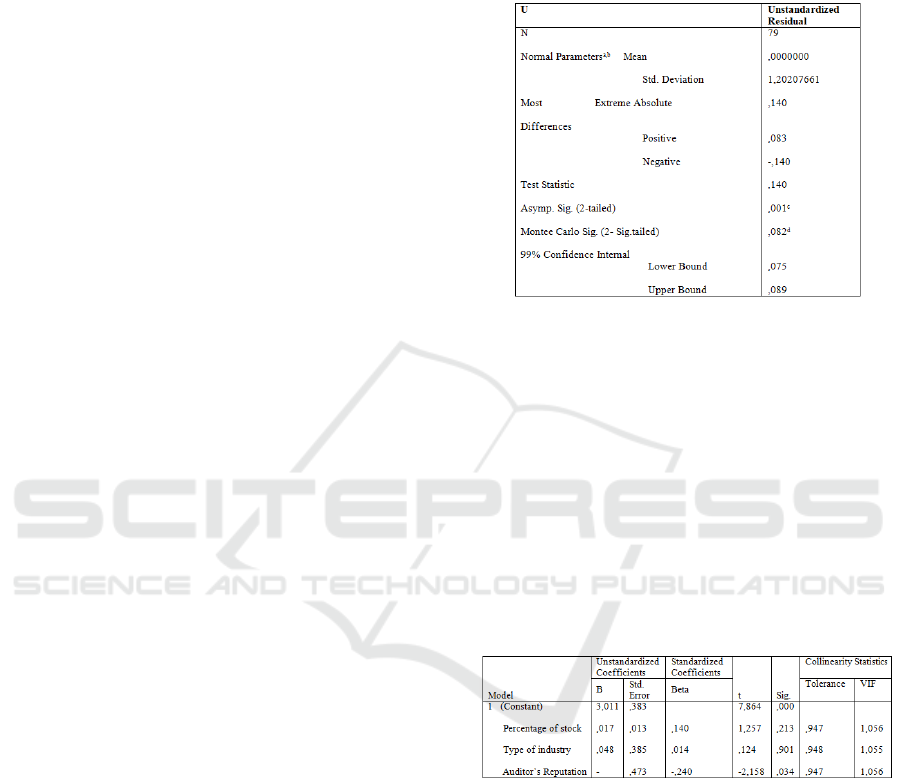

6.2 Normality Statistical Test

Multivariate Analysis

Normality Statistical Test Results

One-Sample Kolmogorov-Smirnov Test

a. Test distribution is Normal.

b. Calculated from data

c. Lilliefors Significance Correction.

d. Based on 10000 sampled tables with starting

seed 92208573

It can be seen that value test statistic

Kolmogorov-Smirnov 0.014 with significance

Monte Carlo sig of 0,082. So it can be concluded

that the research data residual model is normally

distributed, it can be seen k-s and significance of the

value of greater than 0,05.

6.3 Multicollinearity Coefficientsa Test

Multicollinearity Coefficientsa Test Results

Dependent Variable: LnUNDERPRICING

Source: SPSS 23.0 output, researchers'

processed data (2018)

The table above shows that the result of the

Tolerance value calculation indicates no

Independent variable that has a value of tolerance <

0.10 which means there is no correlation between an

independent variable whose value is more than

95%. The result of Variance Inflation value

calculation Factor (VIF) also demonstrates the same

thing, not an independent variable that Has the value

of VIF 10. So it can be concluded that there is no

multicollinearity between variables Independent in

EBIC 2019 - Economics and Business International Conference 2019

424

the regression model of this research.

Autocorrelation test Results.

6.4 Autocorrelation Test

Autocorrelation Test Results

Model Summary

b

Model R R S

q

uare

Adjusted

R S

q

uare

Std. Error o

f

the Estimate

Durbin-

Watson

1

,429

a

,184 ,140 24,96749 1,864

a. predictors : (constant), underwriter reputation,

percentage, type of industry, auditor reputation

b. dependent variable: LnUNDERPRICING

source: output SPSS 23,0, researcher processing

data

The results of the SPSS output table 4.3 above

show the regression model DW value of 1.864. This

value will be compared with the value of the Durbin

Watson test bound table using a 5% confidence

level, the number of research statistics (n) = 79 and

the number of independent variables (k) = 4.

because the DW value of 1.864 is greater than the

upper limit (du) 1.7423 and less than 4-1.7423 (4-

du), it can be concluded that there is no positive or

negative autocorrelation or it can be concluded that

there is no autocorrelation in the model of this

research regression .

Heteroscedasticity test is performed to test

whether in the regression model there is an unequal

variance of the residuals from one observation to

another observation. If the variance from one

observation residual to another observation is fixed,

then it is called homoscedasticity and if different, it

will be calledheteroscedasticity. In this research,

heteroscedasticity test is performed by looking at

the plot graph (scatter plot) and the Glejser test.

7 CONCLUSION

Based on the results of this study and the discussion,

the researcher draws the following conclusions:

1. Percentage of shares offering does not have a

significant effect on the level of underpricing in

companies conducting an initial public offering

(IPO) on the Indonesia Stock Exchange in

2014-2017.

2. The type of industry does not have a significant

effect on the level of underpricing in companies

conducting an initial public offering (IPO) on

the 2014-2017 IDX.

3. The auditor's reputation has a significant

negative effect on the level of underpricing in

companies conducting an initial public offering

(IPO) on the Indonesia Stock Exchange in

2014-2017.

4. The underwriter's reputation has a significant

negative effect on the level of underpricing in

companies conducting an initial public offering

(IPO) on the Indonesia Stock Exchange in

2014-2017.

5. Simultaneously the percentage of shares

offering, type of industry, auditor's reputation

and underwriter reputation has a significant

effect on the level of underpricing in companies

conducting initial public offering (IPO) on the

Stock Exchange in 2014-2017.

8 SUGGESTION FOR FUTURE

RESEARCH

Based on the results of the study, researchers tried

to provide advice and input for several parties,

namely:

8.1. For prospective investors who will invest by

buying shares of companies that are IPO, should

consider several factors that have been proven to

significantly influence the level of underpricing in

this study, namely the underwriter's reputation and

the auditor's reputation. So that later can anticipate

the risks that will be faced and can formulate

strategies in such a way with the aim of optimizing

the benefits of investment.

8.2. Issuers should estimate the objectives to be

achieved when making decisions during the IPO

preparation process, such as whether they want to

get optimum funds at the same time during an IPO

or want to make an IPO just as a start in offering

company shares to the public so that they do not

expect to obtain funds the optimum at the time of

the IPO but expect it at the time of the issue.

Determination of the objectives to be achieved will

help the issuer in making decisions regarding the

selection of auditor services, underwriter services,

the amount of shares to be offered and so on.

8.3. For further researchers, because the value of

Adjusted R

2

of this research is relatively small at

14%, it is better to be able to examine other

independent variables that are expected to influence

the level of underpricing of shares in companies that

conduct IPOs. Because this research intentionally

focuses on factors from the non-financial point of

view, because researchers believe that financial

Some Factors Influencing IPO Underpricing: Evidence from Indonesian Firms

425

factors will definitely affect the level of

underpricing, but there are other factors that are

suspected to have contributed to the underpricing as

well as non-financial factors. Therefore, the next

researcher is recommended to add other non-

financial factors such as exchange rates or behavior

or excessive reactions from individual investors to

IPO shares.

REFERENCES

Alteza, Muniya, 2010. “Underpricing of Initial Stock

Emissions: A Critical Review”, Management Journal,

Volume 9 Number 2.

Aryapranata, Eliezer and Adityawarman, 2017. “The

Effect of Auditor Reputation, Underwriter Reputation,

and Percentage of Free Float Against the Level of

Underpricing in Initial Public Offering (Empirical

Study of Companies that Go Public in Indonesia

Stock Exchange Period 2012-2014)”, Diponegoro

Journal of Accounting, Volume 6 Number 1988, pp.

1-9.

Bini, Laura, Francesco Dainelli, and Francesco Giunata,

2011. “Signalling Theory and Voluntary Disclosure to

The Financial Market (Evidence from the Profitability

Indicators Published in the Annual Report)”. Paper

presented at the 34th EAA Anual Congress, 20-22

April 2011.

Carter, Richard B. and Steve Manaster, 1990. “Initial

Public Offering and Underwriter Reputation”, Journal

of Financial Economics, Volume 45 Number 4, pp.

1045-1067.

Ellul, Andrew and Marco Pagano, 2003. “IPO

Underpricing and Aftermarket Liquidity”, Working

Paper Centre for Studies in Economics and Finance.

Pages 1-49.

Ghozali, Imam, 2016. Multivariate Analysis Application

with IBM SPSS 23 Program, Diponegoro University

Publisher Agency, Semarang.

Gwenyth, Devina and Yunia Panjaitan, 2016. “The

Influence of Underwriter's Reputation, Auditor's

Reputation and Industry Type on the Level of

Underpricing in Companies Doing IPOs on the IDX”,

Atma Jaya Catholic University of Indonesia.

Islam, Aminul, Ruhani Ali and Zamri Ahmad, 2010. “An

Empirical Investigation Of The Underpricing Of

Initial Public Offerings In The Chittagong Stock

Exchange”, International Journal Of Economics &

Finance, Volume 4 Number 8, pp. 83-92.

Junaeni, Irawati and Rendi Agustian, 2013. “Analysis of

Factors Affecting the Level of Underpricing of

Company Shares Conducting an Initial Public

Offering on the IDX”, WIDYA Scientific Journal,

Volume 1 Number 1, pp. 52-59.

Kristiantari, I Dewa Ayu, 2012. Analysis of Factors

Affecting Underpricing of Initial Public Offering on

the Indonesia Stock Exchange. Thesis. Udayana

University.

Kuncoro, Mudrajad, 2013. Research Methods for

Business and Economics, Issue 4.

Lestari, Anggelia Hayu, Raden Hidayat and Sri

Sulasmiyati, 2015. “Analysis of Factors That

Influence Stock Underpricing in Initial Public

Offering on the Indonesia Stock Exchange Period

2012-2014 (Study of Companies Conducting IPOs on

the Indonesia Stock Exchange 2012-2014 Period)”,

Journal of Business Administration Brawijaya

University, Volume 25 Number 1.

Pahlevi, Reza Widhar, 2014. “Underpricing of Shares in

Initial Public Offering”, CXC Business Strategy

Journal, Volume 18 Number 2, pp. 219-232.

Purbarangga, Ade and Etna Nur Afri Yuyetta, 2013.

“Factors That Influence Underpricing in Initial Public

Offering”, Diponegoro Journal of Accounting,

Volume 2 Number 1, pp. 133-141.

Purwanto and Rokhima Mahyani, 2016. “Factors Causing

IPO Underpricing in Indonesia ", Journal of

Management and Entrepreneurship in Managerial

Focus of Sebelas Maret University, Volume 14

Number 1, pp. 67-76

Putro, Herbnu and Denies Priantinah, 2015. “Effect of

Company Age, Company Size, and Market

Conditions on Underpricing of Shares At the Initial

Public Offering (IPO) on the Indonesia Stock

Exchange (BEI) in 2012-2015 The Effect of Company

Size, Company Age, Percentage of Share, Earning”,

Profita Journal , Volume 3 Number 4, pp. 1-16.

Razafindrambinina, Dominique and Tiffany Kwan, 2013.

“The Influence Of Underwriter And Auditor

Reputations on IPO Under-Pricing”, European Journal

of Business And Management, Volume 5 Number 2,

pp. 2222-2839.

Republic of Indonesia. RI Law Number 8 of 1995

concerning Capital Markets.

Syahyunan, 2015. Financial Management, USU Press,

Medan.

www.e-bursa.com (November 06, 2019)

www.idc.co.id (November 11, 2019)

www.idnfinancials.com (November 29, 2019)

www.rti.co.id (November 22, 2019)

Yanti, Emi and Gerianta Wirawan Yasa, 2016.

“Determinants of Underpricing of Go Public

Company Shares 2009-2013”, E-Journal of Udayana

University Accounting, Volume 16 Number 1, pp.

244-274.

EBIC 2019 - Economics and Business International Conference 2019

426