Quality of OPD Financial Reports from Internal Auditor’s

Perspective

Nurlinda

Department of Accounting, Politeknik Negeri Medan, Jl.Almamater Nomor 1, Kampus USU, Medan, Indonesia

Keywords: Internal Auditor Perspective, Financial Statements, Internal Control, Government Accounting Standards,

Mangement Commitment

Abstract: North Sumatra Province has so far obtained unqualified (WTP) opinion, but the opinion obtained is still

leaving findings that lead to recommendations for improvement from BPK RI. In general, when the

financial statements have been well monitored by internal auditors, of course the financial reports are

already good but the audit results by the BPK found that there are still quite a lot of findings such as assets

not presented at fair value, cash shortages, unrecorded expenses, administration of receivables and

inventories inadequate, inadequate presentation of receivables and allowances and the realization of goods

and services spending that cannot be believed to be reasonable due to inflated revenues to achieve targets

and others. The purpose of this study was to find out the factors that influence the quality of OPD financial

statements through the auditor's internal point of view of the OPD financial statements that they have

reviewed. This research is a quantitative study using primary data sources. Data collection techniques using

questionnaires and data analysis techniques using descriptive statistical analysis with SmartPLS tools. The

results show from the auditor's perspective that the reviewed OPD financial statements indicate that the

quality of the OPD financial statements is not influenced by the application of the government's internal

control system, the adoption of government accounting standards, and management commitment. Other

results show that management's commitment can strengthen the effect of the application of internal control

systems on the quality of OPD's financial statements, management's commitment can strengthen the effect

of applying government accounting standards to the quality of OPD's financial statements.

1 INTRODUCTION

The financial statements contain information that is

very important as a form of accountability for the

entity. The importance of the information presented

in the financial statements certainly requires the

availability of quality financial statements. Quality

financial statements must contain information that is

free from material misstatements, is accurate and

can be accounted for Mutiana, Diantimala, &

Zuraida (2017). The financial statements are

prepared through an adequate control mechanism, in

accordance with the standards and compliance with

applicable regulations and adequate disclosure of

information (Suwanda, Wiratmoko, & Lindri, 2017)

and the financial statements have reviewed the audit

process carried out by external auditors by obtaining

an opinion good (Yusniar, Darwanis, & Abdullah,

2016). According to Guy, Alderman and Winters

(1996) when the auditor believes the relationship

between economic data assertions with specified

criteria and then communicates these results to

interested users of the financial statements, it can be

stated that the financial statements have met the

audit criteria (Tandiontong, 2016) . Financial

statements that have been examined externally

contain relevant policies and procedures related to

audits concerning the ability of entities to record,

process, summarize and report financial data based

on those contained in the financial statements

(Tandiontong, 2016). Tandiontong further stated that

the transaction cycle approach the examiner is

usually used to assess control risk.

In the regional government entity, the financial

statements are produced by the Regional Apparatus

Organization (OPD) as a reporting entity through

internal supervision of the auditor (inspectorate) and

then must be reported to the Republic of Indonesia

Financial Examination Board (OPD) as the auditing

entity. From 32 Regional Government Financial

404

Nurlinda, .

Quality of OPD Financial Repor ts from Internal Auditor’s Perspective.

DOI: 10.5220/0009206404040412

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 404-412

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Reports (LKPD) ) 94% or 32 LKPD of them are of

unqualified status (WTP) and the remaining 6% or 2

LKPD get fair with an exception (DPR RI, 2019).

North Sumatra Province has so far obtained WTP

opinion, but the opinion obtained is still leaving

findings that lead to recommendations for

improvement from BPK RI. In general, when the

financial statements have been well monitored by

internal auditors, of course the financial reports are

already good but the audit results by the BPK found

that there are still quite a lot of findings such as

assets not presented at fair value, cash shortages,

unrecorded expenses, administration of receivables

and inventories inadequate, inadequate presentation

of receivables and allowances and the realization of

goods and services spending that cannot be believed

to be reasonable due to inflated revenues to achieve

targets and others (http://medan.bpk.go.id, 2018).

The data description shows that there are still

problems in the financial statements of the local

government. This problem eventually raises

questions about the role of control of the internal

auditor. The internal auditor (inspectorate) has a

supervisory and consultative function. Routine

monitoring will help the WTO to improve the

quality of the financial statements produced.

Problems with the Government's Internal Control

System (SPIP) are weak, financial reports that are

not in accordance with Government Accounting

Standards (SAP) and low management commitment

ultimately impact on the low quality of reports

financials generated. Previous research found that

the application of SPIP did not significantly

influence LKPD (Suwanda, 2015). In contrast to

Suwanda, Harlinda (2016); Upabayu, Mahaputra, &

Putra (2014), found that the Internal Control System

significantly affected the quality of financial

statements. Regarding the suitability of financial

statements in government accounting standards it

was found that there was a significant positive effect

on SAP implementation on the quality of local

government financial reports (KLKPD) (Upabayu et

al., 2014). Different results were found by

Gamayuni (2017) where the application of SAP had

no significant effect on LKPD. Other important

efforts to improve the quality of financial statements

are inseparable from strong management

commitment. In the public sector, management

commitment refers to the commitment of regional

heads. Mahlil & Yahya (2017) and Silviana (2012)

state that the heads of local authorities and

accounting knowledge affect the quality of financial

statements. regional government. The role of

management's commitment to improve the quality of

financial statements is logically quite strong,

because no matter how good a standard and system

is applied if without commitment management is

unable to achieve the expected goals. Referring to

the explanation above, this research is to see the

extent of the internal auditor's views on the financial

statements The review is reviewed in terms of the

application of SPIP, SAP Application and

management commitment.

2 LITERATURE REVIEW

Quality of Financial Statements

Quality is defined as "conformity to standards,

measured based on the degree of non-conformity,

and is achieved through inspection" [(Mulyana,

2010: 96); PP No. 71 of 2010]. Qualitative

characteristics that must be fulfilled in financial

statements so that quality consists of "relevant,

reliable, comparable, understandable" (PP Number

71, 2010).

Internal Control System

Referring to PP No. 60/2008, internal control is an

"integral process of actions and activities carried out

continuously by the leadership and all employees to

provide adequate confidence in achieving

organizational goals through effective and efficient

activities, financial reporting reliability, security of

assets. state and obedience to laws and regulations ".

The elements of the Internal Control System in

Republic of Indonesia Regulation Number 60 Year

2008 include "Control Environment. Risk

Assessment, Control, Information and

Communication, Monitoring Activities.

Several studies have found that the internal

control system has a significant effect on the quality

of financial statements [Erviana (2017); Kesuma,

Anwar, & Darmansyah (2017); Mailoor, Sondakh, &

Gamaliel (2017)]. These findings can be interpreted

as the application of adequate internal control that

will have an impact on the quality of the financial

statements produced.

Government Accounting Standards

It is the application of "accounting principles in

preparing and presenting Government Financial

Statements in the framework of transparency and

accountability and improving quality" LKPD [(PP

No. 71 Year, 2010); (Permendagri No. 61 of 2013),

(Erlina et al., 2017). The indicators used are 8

(eight) accounting principles and financial reporting

consisting of, "accounting basis, historical value,

Quality of OPD Financial Reports from Internal Auditor’s Perspective

405

realization, substance involving formal forms,

reality, consistency, disclosure, fair presentation".

The results showed the application of accounting

standards had a significant positive effect on the

quality of financial statements [Yusniar et al. (2016);

Rahman, Hardi, & Diyanto (2015); Nelia K (2015);

(Eriadi, Erlina, Muda, & Abdullah, 2018)].

Referring to the results of this study it can be

concluded that if the preparation of financial

statements using appropriate and adequate

accounting standards will produce quality financial

reports.

Management Commitment

Management's commitment is a commitment in

following up the findings of BPK RI's audit results

[(Silviana, 2012), (BPK Regulation No. 9 of 2009].

This construct indicator refers to RI Law Number 15

of 2004 concerning the Audit of State Financial

Management and Responsibility article 20 consisting

of "Officials must follow up the recommendations in

the audit report, the official must provide an answer

to the explanation to the BPK about the follow-up to

the recommendations in the audit report, the answer

or explanation referred to in paragraph (2) is

submitted to the BPK no later than 60 (sixty) days

after report on audit results is received, the BPK

monitors the implementation of the follow-up of

audit results as referred to in paragraph (1) ”

The obligation of regional heads is reaffirmed by

the enactment of Government Regulation No. 12 of

2019 concerning Regional Financial Management.

Based on PP No. 12 (2019) article 192, it states that

"the regional head gave a response and made

adjustments to the report on the audit results of the

Supreme Audit Board over the Regional

Government's Financial Statements. Officials known

to have not carried out the obligations referred to in

paragraph (1) may be subjected to administrative

sanctions in accordance with the provisions of the

legislation in the field of employment and or

criminal sanctions ”. Silviana (2012); Tambingon,

Yadiati, & Kewo (2018); Kibet (2016) found a

positive effect on the commitment of regional heads

on the quality of financial statements. These findings

indicate a high commitment from management /

management that will increasingly have an impact

on improving the quality of financial statements

[(Fitriani, 2017); (Tambingon et al., 2018)].

3 METHOD

This research is a quantitative study with primary

data. The data collection technique uses

questionnaires. All instrument statements in this

study were measured using a Likert scale.

Measurement of variable indicators in this study

used weighting assessment using score 1 to 5 for

each respondent's answer to the statement. The

selection of the right measuring instrument will

determine the validity or validity of a research result.

Mistakes in choosing a measuring instrument will

cause the results obtained will not describe the real

situation. Sekaran (2010) states "to overcome this,

two types of tests are needed, namely the test of

validity (validity or validity test) and the test of

reliability used to test the sincerity of respondents'

answers". Data processing devices in the equation

model in this study use PLS. The research model

looks like the following Figure 1:

Figure 1.

4 RESULTS AND DISCUSSION

Based on the results of the calculation of the sample

of this study were 77 respondents. Of the 100

questionnaires distributed by returning

questionnaires, only 78 questionnaires, respondents

were executors of the review in the financial

statements of the North Sumatra Provincial

Government, Namely Inspectorate Level 1.

Distribution of the questionnaire is explained in

table 5.1 below:

Table 1 Distribution of Questionnaires

Questionnaires were distributed 100

Questionnaires returned 78

Questionnaires completed 1

Questionnaires not completed 77

Source : research data processed (2019)

EBIC 2019 - Economics and Business International Conference 2019

406

The return rate of the questionnaire was 77%,

this amount was sufficient because it was in

accordance with the number of samples needed in

this study. This research model uses a Likert scale of

1 to 5 so if the maximum total respondent answers

then the maximum total score obtained is 5 x 77

questionnaire = 382.

Research Respondent Demographics

The information presented in table 2 below shows

that of the 77 respondents working with positions as

First, Intermediate and Young Auditor, Supervisory

Auditor, P2UPD and government supervisors. As

many as 31 Auditors or as much as 40.25% have the

position of Expert Audit, as many as 3 people or as

much as 3.9% work with positions as supervisory

audits. Internal auditors who work in PU2PD

positions are 17 people or 22.07% and the rest hold

positions as government supervisors as many as 26

people or as much as 33.77%. More complete

information about the position of the respondent is

explained in table 2 below:

Table 2 Demographics of Respondents by Position

Position Total %

First Auditor 17 22,07

Intermediate Auditor 3 3,90

Young Auditor 11 14,29

Supervisory Auditor 3 3,90

P2UPD 17 22.07

Government Supervisors 26 33,77

Total 77 100.00

Source: 2019 research results (data processed)

Related to the education level of business

people, it can be seen in table 3. Information about

the education level of respondents in the level 1

inspectorate of North Sumatra Province is available.

From the level of S1 to S3, it is obtained that the

majority of respondents in this sample have a

Bachelor Degree (S1) education, namely 49 people

or 63.64% of the amount of education is sufficient

for an auditor to assume the position. other data

shows as many as 27 people or 35.06% of them have

a Bachelor's Degree (S2) education and only 1

person or 1% have a Bachelor's Degree (S3)

education.

Table 3 Demographics of Respondents by Education

Level

Education Total %

S2 49 63,64%

S1 27 35,06%

S3 1 1,3%

Total 77 100%

Source: 2019 research results (data processed)

From a total of 77 respondents it was found that

46 respondents came from an economic background.

Although the auditor's education level is adequate,

but from the total respondents obtained data of 1

person or 1.3% who have an accounting education

background. This is quite surprising considering that

these internal auditors function to oversee the OPD

and provide consultations on financial governance.

Referring to the lack of auditors with accounting

education backgrounds while in the Province of

North Sumatra there are 34 Regional Apparatus

Organizations (OPDs) certainly very inadequate.

respondents showed management background of 17

people or 22.1%. Other information shows that as

many as 28 respondents or 36.4% are staff auditors

with economic education backgrounds. A fairly high

number indicates that the majority of auditors have

an economic background. The rest of the data shows

that auditors with non-economic backgrounds are 31

people or 40.23%. In total, 31 people were scattered

in the legal background of 11 people or 14.3%,

Agriculture as many as 2 people or 2.6%, Social as

many as 9 people or 11.7% and Engineering as

many as 9 people or 11.7%. Seeing from the many

education it is natural that internal auditors must be

equipped with different educational backgrounds

given the scope of audits needed will also vary.

However, with the lack of respondents with

accounting backgrounds deserves attention. More

complete distribution of respondents' data about

educational background can be seen in table 4

below.

Table 4 Demographics of Respondents by Department of

Education

Department of Education Number %

Accountin

g

1 1,3%

Management 17 22,1%

Econom

y

28 36,4%

Law 11 14,3%

Agriculture 2 2,6%

Social 9 11,7%

En

g

ineerin

g

9 11,7%

Total 77 100%

Source : research data processed (2019)

Quality of OPD Financial Reports from Internal Auditor’s Perspective

407

Table 5 shows the distribution of respondents'

data on length of service. Of the 77 respondents

indicated they had worked from zero to past 30

years. As many as 22 people or 28.57% have worked

for 10-15% and 12 people or 15.58% have worked

for 16-20 years. Other data shows that as many as 13

people or 16.88% worked for 21-25 years, and the

rest 17 or 22.08% respectively and 13 or 16.88%

worked for 26-30 years and> 30 years respectively .

This data illustrates that respondents actually have

quite experienced considering they have worked for

more than 10 years.

Table 5 Demographics of Respondents by Length of Work

Length of Work Total %

10-15 Years 22 28.57%

16-20 Years 12 15.58%

21-25 Years 13 16.88%

26-30 Years 17 22.08%

> 30 Years 13 16.88%

Total 77 100.00%

Source: 2019 research results (data processed)

Data Quality Testing

Data is processed using Structural Equiation

Modeling (SEM) with the Partial Least Square

(PLS) altrenative method. Quantitative data analysis

using statistical analysis with SEM-PLS tools

consists of two stages. The first stage is carried out

to see the validity and the reliability of the

measuring instrument that is manifested by the data

collected. After these two things are fulfilled, the

second stage is carried out to analyze the data in

accordance with the proposed hypothesis. According

to Barclay, Higgins, & Thomson (1995) in SEM-

PLS the first stage is called the measurement model

or outer model testing and the second stage is called

the structural model or inner model testing.

Testing the Outer Research Model (Outer Model)

Assessing Outer Loading

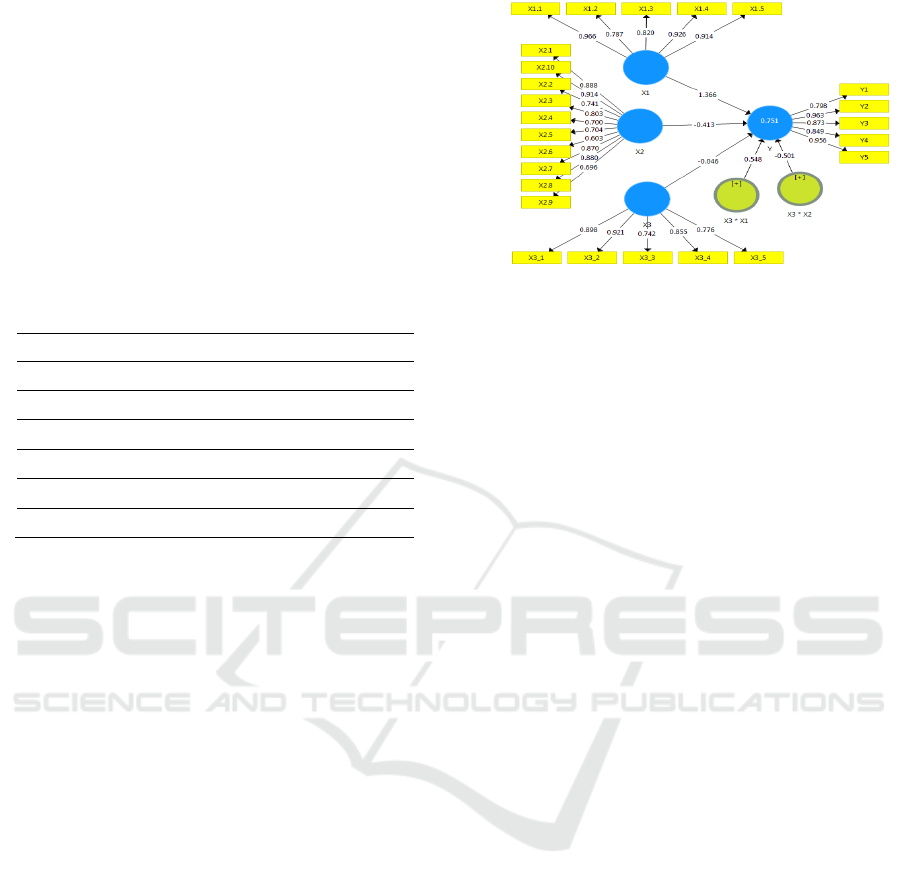

Figure 2: Full Model Path Diagram with Moderating

Variables

Checking the loading value of each

corresponding latent variable indicator can be done

in two ways, namely by looking at the path diagram

or by selecting the final result outer loadings menu

(Sentosa, 2018). Through the calculation using

SmartPLS, a full model path diagram is obtained

which shows the path diagram display along with

the latent variable complete with the indicators

The magnitude of the outer loading of each

indicator that forms the variables of Y, X1, X2, and

X3. All indicators of variables Y (Quality of

Regional Financial Statements), X1 (Application of

Internal Control Systems), X2 (Application of

Government Accounting Standards), and X4

(Management Commitment ) refers to the opinion

above, then all indicators meet the reliability and

validity requirements and can be used for further

analysis.

Correlation value / path coefficient between

latent variables with other variables (β) according to

the hypothesis that was built. The path coefficient

column in the table shows the values of each

hypothesis (H), while the value of the tcount column

shows how significant the relations are among the

latent variables and can be said to be a significant

relation if the t-value of the value of table 1.993. For

H1, it shows a path coefficient of 0.370 and a

calculated value of 0.942. for H2 shows a path

coefficient of 0.518 and a calculated value of 1.462.

H3 shows the path coefficient of -0.037 and t value

of tcount at the value of 0.178, while testing the path

coefficient (β) and Value of tcount by entering the

management commitment variable as a moderating

variable shows the results according to the data seen

in table 7.

The results of calculations for Hypothesis 1 (H1)

in tables 6 and 7 can be seen a decrease in the value

of β and the value of the t-value before and after

moderation by the variable management

EBIC 2019 - Economics and Business International Conference 2019

408

commitment. For H1, where the β value before

moderation was 0.370, it dropped to -0.413, while

the t-value value before being moderated was 0.942,

but after being moderated by management

commitment, the t-value value increased to 2.704.

The calculation for Hypothesis 2 (H2) where a

decrease in the value of β and the value of the t-

value before and after moderation by the variable

management commitment. For H2, where the β

value before moderation was 0.518, it rose to -0.413

while the value of t-count before being moderated

was 1.462, but after being moderated by

management commitment, the t-value dropped to

0.744. For Hypothesis 3 (H3) there are also

differences in calculations before and after

moderation by the Management commitment

variable. The β value for H3 before being moderated

is -0.037 and after being moderated by the

management commitment variable to be -0.046,

while the value of t-value before being moderated is

0.178, but after being moderated by management

commitment the t-count value rises to 0.271. The

path coefficient for multiplication variable

multiplication (KM x SPI) gets a value of 0.548 with

a value of tcount of 2.457 and the path coefficient

for multiplication of a moderating variable (KM x

SAP) gets a value of -0.5001 with a value of tcount

of 2.070

In addition to the path coefficient, the structural

model also needs to be calculated the coefficient of

determination (R2) of each endogenous latent

variable. Through the coefficient of determination

(R2) it can be seen that the Implementation of the

Government Internal Control System (X1), the

Application of Government Accounting Standards

(X2), Management Commitments (X3)

simultaneously have an effect of 69.8% on the

Quality of Regional Government Financial

Statements. Then testing (R2) by involving the

Management Commitment variable as a moderating

variable obtained a simultaneous result of 73.3% of

the Quality of Financial Statements. The value (R2)

without the moderating variable is 69.8% and the

moderating variable (R2) becomes 73.3%.

Cronbach alpha values indicate compliance with

standards> 0.7 (George & Mallery, 2003). Cronbach

alpha value> 0.7, while for the value of construct

reliability and validity> 0.7. Referring to the

Cronbach alpha value and construct reliability and

validity means that it can be stated that the data has

good and reliable internal consistency. Valid AVE

root value if AVE value> 0.5. The AVE root column

shows the value that matches the entered criteria,

thus it can be concluded that the data is valid for

further processing.

4.1 Discussion

To enforce the hypothesis in addition to seeing the

path coefficient must also see the value of t

arithmetic. The value of tcount obtained must be

tested again by comparing the value of tcount with

ttable. The value of ttable can be obtained by

looking at student-t. If the tcount> ttable then the

hypothesis can be accepted. a total of 231 data then

the value of the table is 1,993. Table 6 shows the

results of the hypothesis.

Table 6 shows hypothesis testing by including

management commitment variables as moderating

variables. The results of multiplication of

management commitment variables with the variable

implementation of the internal control system shows

the effect on the quality of financial statements.

With management commitment as a moderating

variable on the effect of management processes on

the quality of financial statements, it shows that

management commitment strengthens the

relationship between internal control systems and

commitment.

Table 6 Pathway Coefficients with Moderation Variables

(β) T

count

Value

t

table

Value

P

Values

Informa

tion

X1

Y

1,366 2,704

1,993

0.007

Signific

antly

positive

effect

X2

Y

-0,413 0,744

1,993

0.457

No

effect

X3

Y

-0,046 0,271

1,993

0.787

No

effect

X3*

X1

Y

0,548 2,457

1,993

0.014

Signific

antly

positive

effect

X3*

X2

Y

-0,501 2,070

1,993

0.039

Signific

antly

positive

effect

Source: SmartPLS Output Attachment

The result can be seen from the tcount of 2.457>

1.993 which means that there is a positive and

significant influence on the implementation of the

internal control system on the quality of the financial

statements. Management's commitment is also able

Quality of OPD Financial Reports from Internal Auditor’s Perspective

409

to strengthen the effect of the application of

government accounting standards on the quality of

the financial statements where the tcount of 2,070>

1,993 can be interpreted there is a positive and

significant effect of the application of government

accounting standards to the quality of financial

statements.

Internal Auditor's Perception on the Quality of

Financial Statements based on the

Implementation of the Internal Control System

Statistical test results without including moderating

variables indicate that the quality of financial

statements is not influenced by the application of the

internal control system. This is in line with the

results of BPK audits in 2017 and 2018 which state

that the financial statements have not met the

elements of adequate internal control. Although the

opinion obtained by the Government of the Province

of North Sumatra is reasonable without scrutiny, this

is not accompanied by a lack of recommendations

received. This inconsistency is also seen in the level

of maturity. If the opinion obtained is fair without

exceptions (WTP), the minimum level of maturity is

at level 3 "undefined". However, due to the low

implementation of policies and procedures, as well

as incomplete relevant documents and inadequate

communication of policies and procedures and the

not yet fully implemented written policies and

procedures, making the achievement of the maturity

level of the North Sumatra Provincial Government is

at level 2 "developing". This unsynchronization

ultimately led to the internal control system not

affecting the quality of financial statements.

Internal Auditor's Perception on the Quality of

Financial Statements based on the Application of

government accounting standards

Statistical test results show that the quality of

financial statements is not influenced by the

adoption of government accounting standards.

Referring to these results indicate that government

accounting standards do not improve the quality of

financial statements. The enactment of government

accounting standards based on PP No. 71 of 2010

which gave birth to an accrual basis of accounting

may still confuse OPD where financial managers are

not entirely educated in accounting. The enactment

of Permendagri number 64 of 2013 which regulates

reports that must be compiled is an obstacle for

OPD. Lack of training and technical guidance for the

staff preparing the financial statements in the end the

resulting financial statements are not adequate.

Weak coordination between subsections, between

PPTK in the end consolidation of financial

statements becomes slow to do. The level of PPTK

education that does not all understand accounting

problems becomes a problem where recognition of

the value of assets, liabilities, opinions, expenses

and expenditure is finally reflected. related to assets.

The assets presented have not shown fair value and

there are still assets with zero value. Referring to the

Government Accounting Standards, the governance

of financial transactions and the accounting basis

that must be carried out must be standardized. Thus,

recognition, measurement and disclosure all refer to

Government Accounting Standards.

Internal Auditor's Perception on the Quality of

Financial Statements based on the Application of

government accounting standards

The results of the study without including

moderation variables also indicate that the quality of

financial statements is not influenced by

management commitment. From the perspective of

the internal auditor, even though management

commitment is good if there is no internal control

system in the OPD environment and the application

of accounting standards is still not good, of course

there is no benefit. strong management commitment,

but in the entity there are no sanctions and reward

mechanisms that ultimately cause working

conditions to be not conducive. No matter how

strong a commitment is, if it is not regulated, a

sanction and reward mechanism will eventually

become a mere formality session.

Management's commitment strengthens the

influence of the internal control system on the

quality of financial statements.

Statistical test results without including

management commitment as a variable show the

results that there is no influence between the internal

control system with the quality of the financial

statements. that the inspectorate believes that the

OPD financial statements that they reviewed have

been prepared through an adequate internal control

system if management's commitment is strong

enough. The Inspectorate believes that committed

management is able to maximize the dimensions of

internal control such as the control environment,

application of risk, control activities, information

and communication, monitoring to be effective in

EBIC 2019 - Economics and Business International Conference 2019

410

controlling the process of preparing financial

statements adequately.

Management's commitment strengthens the

influence of Auditing Accounting Standards on

the Quality of Financial Statements.

Hypothesis test results indicate that management

commitment is able to strengthen the effect of the

adoption of government accounting standards on the

quality of financial statements, where government

accounting standards are a standard for determining

the appropriateness or appropriateness of a financial

statement preparation mechanism in which

government accounting standards are binding

regulatory regulations and their application is forced

( mandatory). This research also found data that the

understanding of the recognition of revenue,

expenses, assets and liabilities on an accrual basis is

still quite low in OPD. The results of this

achievement are relevant to data showing that staff

who deal with financial statements have accounting

education of only 13.4%. The lack of HR with

accounting competence is a problem in itself.

Referring to the above data when management's

commitment is strong, management will endeavor to

improve the competence of financial management

whether through ASN recruitment as needed or

conduct adequate training and technical guidance so

that ASN related to financial management has a

strong understanding of SAP adoption. often the

rules change so that it causes OPD to be difficult to

understand the new rules while the old rules have

not been well implemented. Understanding of

accounting standards is still inadequate, lack of

understanding of respondents on weak accrual

assumptions, and staff lack of understanding of the

mechanism of recording on an accrual basis,

especially PPTK, resulting in inadequate financial

statements. Weakness of understanding on the basis

of Accounting, Historical Cost (Realization),

Realization, Substance Over Form, Periodicity,

Consistency, Full Disclosure, Fair Presentation be a

cause of misstatement in the financial statements,

determination of the value of assets that are not fair,

disclosure of the value of inventory that is not

relevant.This weakness is often the finding of an

examination conducted both internal and external.

5 CONCLUSIONS

The results of this study can be concluded from the

auditor's point of view on the OPD financial

statements reviewed as follows:

1. The quality of OPD financial statements is not

influenced by the implementation of the

government's internal control system.

2. The quality of OPD financial statements is not

influenced by the adoption of government

accounting standards.

3. The quality of OPD financial statements is not

influenced by management commitment.

4. Management's commitment can strengthen the

influence of the implementation of internal

control systems on the quality of OPD financial

statements.

5. Management's commitment can strengthen the

effect of applying government accounting

standards to the quality of OPD financial

statements.

ACKNOWLEDGEMENTS

The authors gratefully acknowledge that the present

research is supported by Politeknik Negeri Medan.

REFERENCES

Barclay, D., Higgins, C., & Thomson, R. (1995). The

Partial Least Squares (PLS) Approach to Casual

Modeling: Personal Computer Adoption and Use as

An Illustration. Technology Studies, 2(2), 285–309.

Eriadi, Erlina, Muda, I., & Abdullah, S. (2018).

Determinant analysis of the Quality of Local

Government Financial Statements in North Sumatra

With the Effectiveness of Management of Regional

Property As A Mediator. International Journal of

Civil Engineering and Technology (IJCIET), 9(5),

1334–1346.

Erlina, Rambe, O. S., & Rasdianto. (2017). Akuntansi

Keuangan Daerah Berbasis Akrual. Jakarta: Salemba

Empat.

Erviana. (2017). Pengaruh Implementasi Sistem Informasi

Manajemen Daerah dan Kegiatan Pengendalian

Terhadap Kualitas Laporan Keuangan Pemerintah

Daerah (Survey Pada Satuan kerja Perangkat Daerah

(SKPD) Kota Palu). E Journal Katalogis, 5(4), 182–

193.

Fitriani, A., Budiman, A., & Fauzi, A. (2017). Pengaruh

Komitmen Pimpinan dan Lingkungan Pengendalian

Internal Terhadap Kualitas Laporan Keuangan

(Survei Pada SKPD Provinsi Sulawesi Tengah). e

Jurnal Katalogis. Retrieved from

Quality of OPD Financial Reports from Internal Auditor’s Perspective

411

https://media.neliti.com/media/publications/212457-

pengaruh-komitmen-pimpinan-dan-lingkunga.pdf

Gamayuni, R. R. (2017). The Effect of Internal Audit

Function Effectiveness and Implementation of Accrual

Based Government Accounting Standard on Financial

Reporting Quality. Review of Intergrative Business &

Economics Research, 7(1), 46–58. Retrieved from

http://buscompress.com/uploads/3/4/9/8/34980536/rib

er_7-s1_sp_h17-021_46-58.pdf

George, D., & Mallery, P. (2003). SPSS for Windows Step

by Step: A Simple Guide and Reference. Boston: Allyn

& Bacon.

Harlinda. (2016). Analisis Faktor-faktor yang

Mempengaruhi Kualitas Informasi Laporan Keuangan

Pemerintah Daerah ( Studi Empiris pada Pemerintah

Kabupaten / Kota di Provinsi Riau ). Jurnal Sorot,

11(2), 127–144.

Kesuma, D. P., Anwar, C., & Darmansyah. (2017).

Pengaruh Good Governance, Penerapan Standar

Akuntansi Pemerintah, Sistem Pengendalian Internal

Pemerintah dan Kompentensi Aparatur Pemerintah

Terhadap Kualitas Laporan Keuangan Pemerintah

Pada Satuan Kerja Kementerian Pariwisata. Jurnal

Ilmiah WIDYA Ekonomika, 1(2), 141–146.

Kibet, A. J. (2016). Effects of Management Commitment

on Financial Performance of Private Schools : A

Survey of Selected Schools in Trans-Nzoia County,

Kenya. European Journal of Business and

Management, 8(30), 1–5.

Mahlil, & Yahya, M. R. (2017). Pengaruh komitmen

kepala daerah dan pengetahuan akuntansi terhadap

kualitas laporan keuangan pemerintah daerah di

provinsi aceh. Jurnal Ilmiah Mahasiswa Ekonomi

AKuntansi (JIMEKA), 2(2), 21–29.

Mailoor, J. H., Sondakh, J. J., & Gamaliel, H. (2017).

Pengaruh Sistem Akuntansi Pemerintahan , Budaya

Organisasi , Kinerja Aparatur Pemerintah Daerah ,

Peran APIP , Dan Sistem Pengendalian Intern

Pemerintah Terhadap Penerapan Good Governance (

Studi Empiris Di Kabupaten Kepulauan Talaud ).

Jurnal Riset Akuntansi Dan Auditing “Goodwill,”

8(2), 82–94.

Mutiana, L., Diantimala, Y., & Zuraida. (2017). Pengaruh

sistem pengendalian intern, teknologi informasi,

kualitas sumber daya manusia dan komitmen

organisasi terhadap kualitas laporan keuangan. Jurnal

Perspektif Ekonomi Darusaslam, 3(2), 151–167.

Nelia K, M. (2015). The Effect Of Adoption Of

International Public Sector Accounting Standards On

Financial Reporting In The Public Sector In Kenya.

PP, N. 12. Peraturan Pemerintah Republik Indonesia

Nomor 12 Tahun 2019 Tentnag Pengelolaan

Keuangan Daerah, Pub. L. No. Nomor 12 Tahun 2019

(2019). Indonesia.

PP Nomor 71 Tahun 2010 (2010).

Rahman, D., Hardi, & Diyanto, V. (2015). Pengaruh

Pemanfaatan Teknologi Informasi, Penerapan Sistem

Akuntansi Keuangan Daerah, Dan Penerapan Standar

Akuntansi Pemerintahan Terhadap Kualitas Laporan

Keuangan Daerah (Studi Empiris Pada SKPD Provinsi

Riau). Jom Fekon, 2

(2), 1–15.

Sentosa, P. I. (2018). Metode Penelitian Kuantitatif

(Pengembangan Hipotesis dan Pengujiannya

Menggunakan SmartPLS). Yogyakarta: Andi Offset.

Silviana. (2012). Pengaruh Komitmen Kepala Daerah

Terhadap Kualitas Laporan Keuangan Pemerintah

Daerah di Provinsi Jawa Barat. In Seminar NAsional

Akuntansi & Bisnis (SNAB) (pp. 862–869).

Suwanda, D. (2015). Factors Affecting Quality of Local

Government Financial Statements to Get Unqualified

Opinion (WTP) of Audit Board of the Republic of

Indonesia (BPK). Research Journal of Finance and

Accounting, 6(4), 139–157.

Suwanda, D., Wiratmoko, & Lindri, I. (2017). Panduan

Penerapan “Reviu Laporan Keuangan” Pemerintah

Daerah. Bandung: PT Remaja Rosdakarya.

Tambingon, H. N., Yadiati, W., & Kewo, C. L. (2018).

Determinant Factors Influencing the Quality of

Financial Reporting Local Government in Indonesia.

International Journal of Economics and Financial

Issues, 8(2), 262–268.

Tandiontong, M. (2016). Kualitas Audit dan

Pengukurannya (Cetakan ke). Bandung: Alfabeta, CV.

Upabayu, I. P., Mahaputra, R., & Putra, I. W. (2014).

Analisis Faktor-Faktor yang Mempengaruhi Kualitas

Informasi Pelaporan Keuangan Pemerintah Daerah. E-

Jurnal Akuntansi Universitas Udayana, 8(2), 230–

244.

Yusniar, Darwanis, & Abdullah, S. (2016). Pengaruh

Penerapan Sistem Akuntansi Pemerintahan dan

pengendalian Intern Terhadap Good Governance dan

Dampaknya Pada Kualitas Laporan Keuangan (Studi

Pada SKPA Pemerintah Aceh). Jurnal Magister

Akuntansi Pascasarjana Universitas Syiah Kuala,

5(2), 100–115.

APPENDIX

If any, the appendix should appear directly after the

references without numbering, and not on a new

page.

EBIC 2019 - Economics and Business International Conference 2019

412