The Influence of Corporate Governance on Disclosure of Corporate

Social Responsibility and Corporate Financial Performance as

Intervening Variable

Ivo Maelina Silitonga and Arthur Simanjuntak

Accounting Department Universitas Methodist Indonesia Medan, Indonesia

Keywords: Corporate Governance, Corporate Social Responsibility, Corporate Financial Performance

Abstract: The objective of the research was to determine and analyze the influence of Corporate Governance

(Managerial ownership, Institutional Ownership, Audit Committee, Independent Commissioner), On

Disclosure of Corporate Social Responsibility simultaneously and partially on manufacturing companies

listed on the Indonesian Stock Exchange 2014 - 2018. The study also tested the influence of intervening

Corporate Financial Performance for Corporate Governance (Managerial Ownership, Institutional

Ownership, Audit Committee, Independent Commissioner), On Disclosure of Corporate Social

Responsibility. Total population of this research was 136 manufacturing companies. Samples were selected

using purposive sampling method amounted to 83 companies, the data is processed by using residual test

using SPSS. Result of the research showed that the variables of Corporate Governance (Management

Ownership, Institutional Ownership, Audit Committee and Independent Commissioner) direct positive

influence on Corporate Social Responsibility. Corporate Governance (Audit Committee and Independent

Commissioner) direct positive influence on Corporate Social Responsibility. Corporate Governance

(Management Ownership and Institutional Ownership) indirect positive influence on Corporate Social

Responsibility. The variables of Corporate Financial Performance as intervening variables to explain

influence Corporate Governance (Management Ownership and Institutional Ownership) on Corporate Social

Responsibility.

1 INTRODUCTION

Elkington packs CSR into three focus 3Ps, namely

Profit, Planet, and People. A good company does not

only hunt for economic profit (profit), but also has

concern for the preservation of the environment

(planet) and the welfare of the people (people). In line

with the rapid development of the business sector as

a result of economic liberalization, various private

sector community organizations and education have

sought to formulate and promote the social

responsibility of the business sector in relation to

society and the environment, and Corporate

Responsibility Disclosure is one part of the principles

of Good Corporate Governance (GCG)).

(www.info.ekonomi.com ).

In this case, reporting on environmental

responsibility in the annual report is still voluntary

because previously the obligation to report on

environmental impacts stipulated by the Indonesian

Ministry of the Environment was only a non-public

disclosure (specifically to relevant government

institutions). This should not only be the case because

when viewed companies in developed countries

reporting environmental and social responsibility is

the main thing in reporting the company's

performance in addition to being seen from its

financial statements. Increasingly the mining industry

in Indonesia resulted in many areas that had been

isolated began to be opened for mining areas, not least

for manufactured. This is what makes each region

have a more advanced life.

In case there are cases of environmental damage

caused by PT. Nusa Halmahera Mineral (NHM) is

engaged in gold mining which causes the spread of

waste in Kao Bay, Ternate, North Maluku, which

causes the surrounding community to suffer lumps

upfront. It is unfortunate due to the pollution of the

waste in addition to harming the surrounding

community besides that the rivers are contaminated

Silitonga, I. and Simanjuntak, A.

The Influence of Corporate Governance on Disclosure of Corporate Social Responsibility and Corporate Financial Performance as Intervening Variable.

DOI: 10.5220/0009203203310337

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 331-337

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

331

with limbar even though Kao Bay is the largest

anchovy producing area in Indonesia.

Criminal sanctions regarding CSR Disclosure are

also contained in Law of Republic Indonesian

Number 23 year 1997 concerning Environmental

Management (UUPLH) Article 41 paragraph (1)

which states: "Whoever violates the law intentionally

commits acts that result in environmental pollution

and/or damage, face a maximum prison sentence of

ten years and a maximum fine of five hundred million

rupiah". Furthermore Article 42 paragraph (1) states:

"Anyone who for his negligence does an act which

results in environmental pollution and/or damage, is

threatened with a maximum imprisonment of three

years and a maximum fine of one hundred million

rupiah" (Sutopoyudo, 2009).

Based on the explanation above, the importance of

the influence of the concept of economic performance

in influencing company policy, the authors are

interested and intends to do the research to establish

the title: " The Influence of Good Governance

(Managerial Ownership, Institutional Ownership,

Audit Committee, Independent Commissioner) on

Disclosure of Corporate Social Responsibility to

Corporate Financial Performance as variabel

intervening on the Company Manufacturing listed

in Indonesia Stock Exchange ".

Problem Formulation

Based on the background above, the problems in

this study can be formulated as follows:

1. Does Corporate Governance (Managerial

Organization, Institutional Ownership, Audit

Committee, Independent Commissioner)

influence the partial and simultaneous disclosure

of Corporate Social Responsibility to

Manufacturing Companies that are listed on the

Indonesian Stock Exchange?

2. Does Corporate Governance (Managerial

Ownership, Institutional Ownership, Audit

Committee, Independent Commissioner) the

influence on Disclosure of Corporate Social

Responsibility through Corporate Financial

Performance in Company Manufacturing is listed

on the Indonesian Stock Exchange?

2 LITERATURE REVIEWS

2.1 Disclosure of Corporate Social

Responsibility

Corporate Social Responsibility (CSR) is a natural

mechanism for a company to 'clean' big profits. As is

known, the company's ways to obtain profits

sometimes harm others, both unintentional or

intentional. It is said to be a natural mechanism

because CSR is a consequence of the impact of

decisions or activities made by the company, so the

obligation of the company is to reverse the situation

of the people experiencing the impact to a better

situation (Prastowo and Huda 2011: 17).

Corporate social responsibility or commonly

referred to as Corporate Social Responsibility is a

concept that the organization, in this case is more

specified to the company, is having a responsibility to

consumers, employees, shareholders, the community,

and the environment in all aspects of the company's

operations.

2.2 Corporate Financial Performance

Financial Performance is the level of performance of

a business in a certain time period, which is

manifested in profit and loss in the relevant time

period. Thus, it can be concluded that financial

performance is a measure of how well a company can

use its assets in running a business and earning

revenue. Financial Performance is also a term to

compare several companies engaged in the same

industry or field.

Financial performance is a picture of the

company's success in the form of results that have

been achieved thanks to various activities that have

been carried out. Financial performance is an analysis

to assess the extent to which a company has carried

out activities according to the rules of financial

implementation (Fahmi, 2012).

2.3 Corporate Governance

The term Corporate Governance itself was first

introduced by Cadbury Committee in 1992 which

uses the term. In their report known as the Cadbury

Report , this report is seen as a turning point that is

crucial for corporate governance practices around the

world . Cadbury Report defines corporate governance

as: "A system that functions to direct and control the

organization". Another definition from the Cadbury

Report sees Corporate Governance as managers,

creditors, the government, employees and other

interested parties both internal and external with

respect to their rights and responsibilities. "

Kaen (2003) defines Corporate Governance as

something about who controls the company and why

it controls. The Cadburry Committee in 1992 defined

Corporate Governance as a principle that guides and

controls the company in order to achieve a balance

EBIC 2019 - Economics and Business International Conference 2019

332

O

O

C

C

Corporate

Governance

(X)

Corporate

Financial

Performanc

e (Z)

Disclosur of

Corporate

Social

Responsibil

ity(Y)

between strength and authority of the company in

order to achieve a balance between the strengths and

authority of the company in providing accountability

to shareholders and stakeholders in general.

Meanwhile the Forum for Governance in Indonesia

(FCGI) defines Corporate Governance as a system

that directs and controls the company. Shleifer and

Vishny (1997) define Corporate Governance as ways

to provide assurance to suppliers of corporate funds

that a return on their investment will be obtained

(Darmawati, 2006).

2.4 Managerial Ownership

Managerial ownership is a situation where the

manager owns the company's shares or the manager

as well as the company's shareholder as indicated by

the percentage of company share ownership by the

manager. Conflicts of interest between managers and

owners become greater when ownership between

managers and the company gets smaller. In this case

the manager will try to maximize his interests

compared to the interests of the company. Conversely

the greater the manager's ownership in the company,

the more productive the manager's actions in

maximizing the value of the company.

Managerial ownership is a situation where the

manager owns the company's shares or in other words

the manager is also a shareholder (Tjeleni, 2013).

2.5 Institutional Ownership

Institutional ownership is the percentage of share

ownership by institutional investors such as

investment companies, banks, insurance companies

and ownership of other institutions and companies.

Institutional ownership will encourage more optimal

supervision of company performance. This means

that the greater the percentage of shares owned by

investors.

2.6 Audit Committee

In accordance with Kep. 29/PM/2004, the audit

committee is a committee formed by the Board of

Commissioners to help carry out its duties and

functions. The Audit Committee has a separate task

in assisting the Board of Commissioners to fulfill

their responsibilities in providing overall oversight

(FCGI, 2002).

2.7 Independent Commissioner

The function of an independent commissioner is

intended to encourage and create a more independent

and objective climate for public companies. As the

name implies, an independent commissioner must be

independent in the sense that the commissioner is not

involved in the management of the company and is

expected to be able to carry out his duties as an

independent party, and carry out his duties solely for

the benefit of the company and regardless of the

influence of various parties who have conflicting

interests with other parties.

2.8 Conceptual Framework

Conceptual Framework Based on the above

theoretical basis and problem formulation, the

researchers develop the research framework. The

conceptual framework to be studied by the researcher

is as the following.

2.9 Research Hypothesis

Based on the previous problem formulation, the

hypothesis of this study are:

H

1

: Corporate Governance (Managerial Ownership,

Institutional Ownership, Audit Committee,

Independent Commissioner) simultaneously

and partially and significantly influence the

Disclosure of Corporate Social Responsibility in

Manufacturing Companies listed on the

Indonesia Stock Exchange.

H

2

: Corporate Governance (Managerial Ownership,

Institutional Ownership, Audit Committee,

The Influence of Corporate Governance on Disclosure of Corporate Social Responsibility and Corporate Financial Performance as

Intervening Variable

333

Independent Commissioner) simultaneously

and partially and significantly influence the

Disclosure of Corporate Social Responsibility

with Corporate Financial Performance as an

intervening variable on Manufacturing

Companies listed on the Indonesia Stock

Exchange .

3 RESEARCH METHODS

3.1 Types of The Research

This research is a causal research (Causal Influence),

namely research that is intended to reveal the causal

relationship between related variables (Sularso, 2004:

13). The purpose of causal research is to investigate

the possibility of a causal relationship in a manner

based on observations of existing the influences and

re-search for factors that might have caused the cause

through certain data.

3.2 Research Location

The location of this research was conducted on the

IDX through the sites www.idx.co.id and

www.bi.go.id, namely Manufacturing Companies

listed on the Indonesia Stock Exchange in the period

2014 - 2018 .

3.3 Population and Sample

3.3.1 Population

Population is "a generalization area consisting of

objects or subjects which become certain quantities

and characteristics determined by researchers to be

studied and then conclusions can be drawn". (Erlina,

2011). The population in this study were 136

companies.

3.3.2 Sample

The sample according to Erlina (2011) is "part of the

population used to estimate population

characteristics". Sampling is done by purposive

sampling method, which is sampling based on certain

criteria (Ghozali, 2013) . The samples in this study

were 83 companies. So the number of observations is

415 observations with details (83 companies X 5

years of observation)

.

3.4 Data Analysis Model

Model data analysis used is multiple linear regression

analysis aimed to test and analyze the the influence of

Good Governance (Managerial Ownership,

Institutional Ownership, Audit Committee,

Independent Commissioner) on Disclosure of

Corporate Social Responsibility in Corporate

Financial Performance as Variabel intervening on the

Company Manufacturing registered on the Indonesia

Stock Exchange . The form of the regression equation

is:

Y = b

0

+ b

1

X

1

+ b

2

X

2

+ b

3

X

3

+ b

4

X

4

+ b

5

Z + є

Z= b

0

+ b

1

X

1

+ b

2

X

2

+ b

3

X

3

+ b

4

X

4

4 FINDINGS

In the Descriptive Statistics indicates the description

of the research variables that shows the minimum

value, maximum value, average value and standard

deviation. In this study the standard deviation value is

smaller than the average value so it can be concluded

that the study is distributed normally.

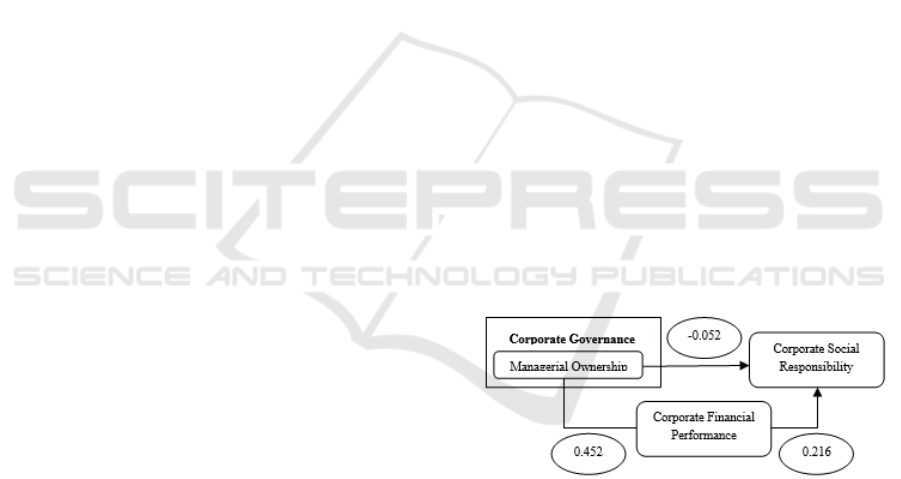

4.1 The Influence of Corporate

Governance (Managerial

Ownership) on Corporate Social

Responsibility through Corporate

Financial Performance

From the data and research concept framework

above, it can be interpreted that the direct and indirect

influences of Corporate Governance (Managerial

Ownership) on Corporate Social Responsibility

through Corporate Financial Performance using path

analysis can be calculated as follows:

Direct

Influence:

- MO to CSR = - 0,052

Indirect Influence :

- MO to CSP to CSR = 0,452 x 0,216 = 0,098

Total Influence = 0,046

From the results above, the influence of Corporate

Governance (Managerial Ownership) on Corporate

EBIC 2019 - Economics and Business International Conference 2019

334

Social Responsibility through Corporate Financial

Performance is greater than the value of indirect

influence rather than direct influence. Therefore the

Corporate Financial Performance variable is a good

intervening variable. It can be concluded that the

influence of Corporate Governance (Managerial

Ownership) influences Corporate Social

Responsibility through Corporate Financial

Performance .

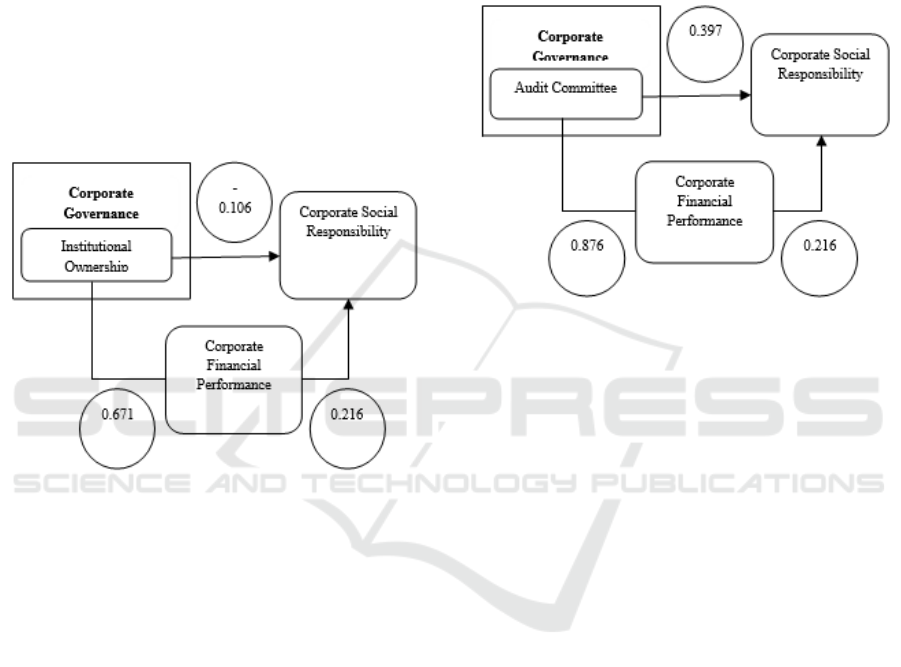

4.2 The Influence of Corporate

Governance (Institutional

Ownership) on Corporate Social

Responsibility through Corporate

Financial Performance

From the data and research concept framework

above, it can be interpreted that the direct and indirect

influences of Corporate Governance (Institutional

Ownership) on Corporate Social Responsibility

through Corporate Financial Performance using path

analysis can be calculated as follows:

Direct Influence

:

- IO to CSR = - 0,106

Indirect Influence:

- IO to CSP to CSR = 0,671 x 0,216 = 0,145

Total Influence = 0,039

From the results above, the influence of Corporate

Governance (Institutional Ownership) on Corporate

Social Responsibility through Corporate Financial

Performance is greater than the value of indirect

influence rather than direct influence. Therefore the

Corporate Financial Performance variable is a good

intervening variable. Then it can be concluded that

the influence of Corporate Governance (Institutional

Ownership) influences Corporate Social

Responsibility through Corporate Financial

Performance.

4.3 The Influence of Corporate

Governance (Audit Committee) on

Corporate Social Responsibility

through Corporate Financial

Performance

From the data and research concept framework

above, it can be interpreted that the direct and indirect

influences of Corporate Governance (Audit

Committee) on Corporate Social Responsibility

through Corporate Financial Performance using path

analysis can be calculated as follows:

Direct

Influence :

- AC to CSR = 0,397

Indirect Influence :

- AC to CSP to CSR = 0,876 x 0,216 = 0,189

Total Influence = 0,586

From the results above, the influence of Corporate

Governance (Audit Committee) on Corporate Social

Responsibility through Corporate Financial

Performance is smaller than the indirect influence

value. Therefore the Corporate Financial

Performance variable is not a good intervening

variable. Then it can be concluded that the influence

of Corporate Governance (Audit Committee) has a

direct influence on Corporate Social Responsibility.

The Influence of Corporate Governance on Disclosure of Corporate Social Responsibility and Corporate Financial Performance as

Intervening Variable

335

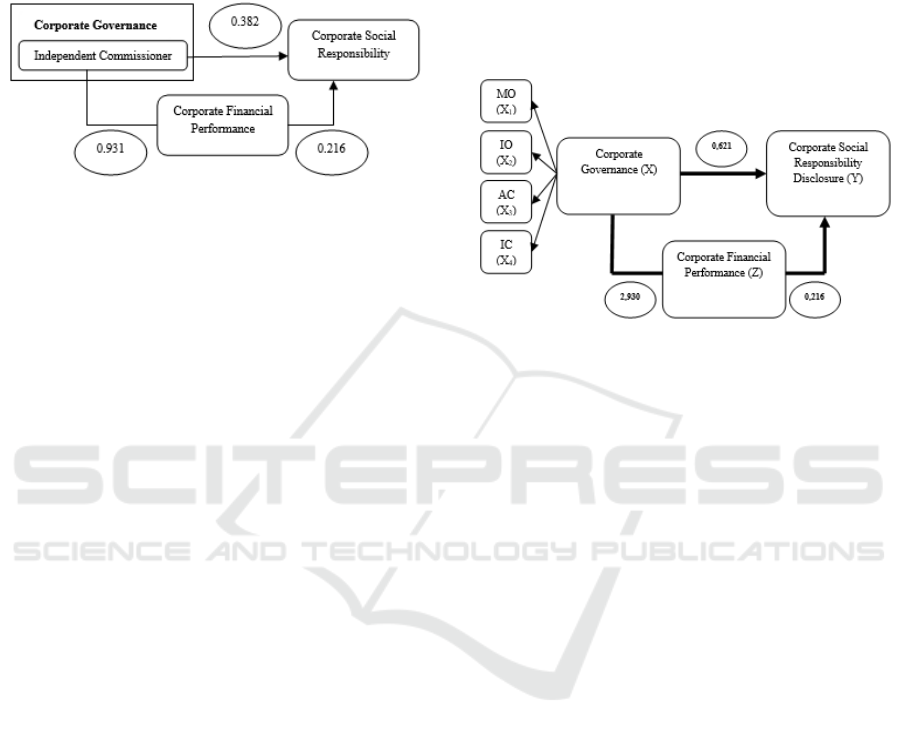

4.4 The Influence of Corporate

Governance (Independent

Commissioner) on Corporate Social

Responsibility through Corporate

Financial Performance

From the data and research concept framework

above, it can be interpreted that the direct and indirect

influences of Corporate Governance (Independent

Commissioner) on Corporate Social Responsibility

through Corporate Financial Performance using path

analysis can be calculated as follows:

Direct

Influence :

- IO to CSR

= 0,382

Indirect Influence :

- IO to CSP to CSR = 0,931 x 0,216 = 0,201

Total Influence

= 0,583

From the results above the influence of Corporate

Governance (Independent Commissioner) on

Corporate Social Responsibility through Corporate

Financial Performance is smaller than the value of

indirect influence rather than direct influence.

Therefore the Corporate Financial Performance

variable is not a good intervening variable. Then it

can be concluded that the influence of Corporate

Governance (Independent Commissioner) has a

direct influence on Corporate Social Responsibility.

4.5 The Influence of Corporate

Governance (Management

Ownership, Institutional

Ownership, Audit Committee and

Independent Commissioner) on

Corporate Social Responsibility

through Corporate Financial

Performance

From the data and research concept framework

above, it can be interpreted that the direct and indirect

influences of Corporate Governance (Management

Ownership, Institutional Ownership, Audit

Committee and Independent Commissioner) on

Corporate Social Responsibility through Corporate

Financial Performance by using path analysis can be

calculated as follows:

Direct Influence :

-

(

MO, IO, AC, and IC

)

to CS

R

= 0,621

Indirect Influence :

-

(MO, IO, AC, dan IC) to CSP to CSR = 2,930 x 0,216

= 0,633

Total Influence = 1,254

From the results above, the influence of Corporate

Governance (Management Ownership, Institutional

Ownership, Audit Committee and Independent

Commissioner) on Corporate Social Responsibility

through Corporate Financial Performance is smaller

than the indirect influence value. Therefore the

Corporate Financial Performance variable is a good

intervening variable. So it can be concluded that the

influence of Corporate Governance (Management

Ownership, Institutional Ownership, Audit

Committee and Independent Commissioner) has a

direct influence on Corporate Social Responsibility.

EBIC 2019 - Economics and Business International Conference 2019

336

5 CONCLUSIONS

The result of the research showed that the variables of

Corporate Governance (Management Ownership,

Institutional Ownership, Audit Committee and

Independent Commissioner) direct positive influence

on Corporate Social Responsibility. Corporate

Governance (Audit Committee and Independent

Commissioner) direct positive influence on

Corporate Social Responsibility. Corporate

Governance (Management Ownership and

Institutional Ownership) indirect positive influence

on Corporate Social Responsibility. The variables of

Corporate Financial Performance as intervening

variables to explain influence Corporate Governance

(Management Ownership and Institutional

Ownership) on Corporate Social Responsibility.

REFERENCES

Darmawati, Deni (2006): "The Influence of Company

Characteristics and Regulatory Factors on the Quality

of Implementation of Good Corporate Governance".

National Symposium on Accounting IX.23-26 August

2006. Padang.

Erlina. 2011. Research Methodology: For Accounting .

USU PRESS. Field.

Fahmi, Irham. 2012. Analysis of Financial Statements . 2nd

printing. Bandung: Alfabeta .

Forum For Corporate Governance (FCGI), 2002. Corporate

Governance Series - Corporate Governance (Vol. I, II,

& III) Second Edition . Jakarta.

Ghozali, Imam. 2013. Multivariate Analysis Application

with SPSS Program . Seventh Edition. Semarang:

Diponegoro University Publisher Agency.

Kaen, Fred. R, 2003. A Blueprint for Corporate

Governance: Strategy, Accountability, and the

Preservation of Shareholder Value . USA: AMACOM.

Prastowo, Joko and Miftachul Huda. 2011. Key Corporate

Social Responsibility Achieve Business Glory .

Yogyakarta: Blue Ocean.

Shleifer, A and RW Vishny. 1997. A Survey of Corporate

Governance. Journal of Finance . 52 (2), 737-783.

Sularso, Kiyokatsu Suga, (2004). Basic Planning and

Selection of Machine Elements . Jakarta: Pradya

Paramita .

Sutopoyudo. 2009. The influence of Application of

Corporate Social Responsibility (CSR) on Company

Profitability . s utopoyudo.wordpress.com.

Tjeleni, Indra E. 2013. Managerial Ownership and Its

Impact on Debt Policy in Manufacturing Companies on

the Indonesia Stock Exchange. Emba Journal , Vol.1

No.3, Pg. 129139. Faculty of Economics and Business,

University of Ratulangi Manado.

The Influence of Corporate Governance on Disclosure of Corporate Social Responsibility and Corporate Financial Performance as

Intervening Variable

337