The Influence of Corporate Social Responsibility and Return on

Assets against Tax Aggressiveness in Mining Companies Listed on the

Indonesia Stock Exchange for the 2014-2017 Period

Dimita H. P. Purba and Christina Verawaty Situmorang

Universitas Methodist Indonesia, Jl.HangTuah 8, Medan, Indonesia

Keywords: Tax Aggressiveness, Corporate Social Responsibility, Return on Assets

Abstract: The purpose of this study is to examine and analyze how the influence of corporate social responsibility and

return on assets to tax aggressiveness. This research was conducted on companies listed on the Indonesia

Stock Exchange during the period 2014-2017. The type of data used in this study is secondary data. Research

data comes from annual reports of mining companies listed on the IDX. This study uses purposive sampling

in determining the sample. Of the 42 companies that became the population in this study that met the criteria

of only 16 companies. The results show that corporate social responsibility and return on assets affect tax

aggressiveness. Simultaneously corporate social responsibility and return on assets have a significant effect

on tax aggressiveness. The results of this study indicate that corporate social responsibility and return on

assets are only 34.9% affecting the tax aggressiveness and the remaining 65.1% are influenced by other

factors.

1 INTRODUCTION

Sources of tax in Indonesia come from individual and

corporate taxpayers, from various industrial sectors.

The greater the income earned by the company,

means the greater the tax burden that must be paid by

the company. The high tax payable must be paid to

make the company try to minimize the tax burden

owed.

For companies, taxes can be used as a motivating

factor in various corporate decisions, such as tax

aggressiveness activities that are common in the

corporate world throughout the world (Lanis and

Richardson, 2011). According to Balakrishnan,

Blouin, and Guay (2011), tax aggressiveness is a

specific activity where the main objective is to reduce

corporate tax obligations. By carrying out tax

aggressiveness, the direct impact is on state revenue

which is reduced from the amount it should.

According to Lanis and Richardson (2011) the

public's view of companies that carry out aggressive

actions is considered to have formed an activity that

is not socially responsible and illegitimate.

In UU RI No. 40 of 2007 article 74 concerning

social and environmental responsibility, it is written

that "the Company which carries out its business

activities in the fields and / or related to natural

resources is required to carry out Social and

Environmental Responsibility", or as another name is

Corporate Social Responsibility (Suharto, 2010: 12).

There are several previous studies that discuss the

relationship between CSR disclosure and tax

aggressiveness. Previous research on CSR with tax

aggressiveness carried out by Watson (2012) found

that there was a negative relationship between CSR

and tax aggressiveness using the applicable tax rate

proxy. This research is the same as conducted by

Lanis and Richardson who examined the effect of

CSR on tax aggressiveness in 2011.

Other researchers, Jessica and Toly (2014),

conducted research on 56 companies on the Indonesia

Stock Exchange (BEI) in 2012-2013, showing that

disclosure of Corporate Social Responsibility,

company size and Return On Assets had no

significant effect on tax aggressiveness, while

leverage significantly influence the tax

aggressiveness.

Based on the above explanation researchers are

interested to see the condition of the tax

aggressiveness in Mining Companies Listed on the

Indonesia Stock Exchange in the 2014-2017 Period.

Does Corporate Social Responsibility and Return on

Purba, D. and Situmorang, C.

The Influence of Corporate Social Responsibility and Return on Assets against Tax Aggressiveness in Mining Companies Listed on the Indonesia Stock Exchange for the 2014-2017 Period.

DOI: 10.5220/0009202102430252

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 243-252

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

243

Assets jointly have a significant effect on Tax

Aggressiveness in Mining Companies ?

2 LITERATUR REVIEW

2.1 Agency Theory

Agency theory explains the existence of a relationship

between the authority provider (the principal) and the

party that is given the authority (agent) (Nugraha,

2015). Luayyi (2010) states that in agency or agency

theory there is a contract or agreement between the

owner of the resource and the manager to manage the

company and achieve the company's main goal of

maximizing the profit to be obtained, thus allowing

the manager to share a number of ways to achieve

these goals both in a good way or ways that hurt many

parties.

The difference in interests between principle and

agent can affect various things related to company

performance, one of which is the company's policy

regarding corporate tax. the taxation system in

Indonesia that uses a self assessment system

authorizes companies to calculate and report their

own taxes. The use of this system can provide an

opportunity for agents to manipulate lower taxable

income so that the tax burden borne by the company

gets smaller (Ardyansyah, 2014)

.

2.2 Signal Theory

In terms of information, there is what is referred to as

symmetric information (symmetric information),

where both investors and managers have the same

information about a company's prospects. however, in

reality managers often have better information

compared to outside investors. This is referred to as

asymmetric information and it has an important

influence on optimal capital structure. Accounting

information is used to show how the company's value

and claims will change.

This hypothesis regarding accounting information

is closely related to signaling theory, where managers

use accounts to signal their expectations and goals in

the future. Brigham and Houston (2011) define signal

theory as an action taken by company management

that can provide investors with clues about how

management views the company's prospects.

Complete, relevant and accurate company

information is needed by investors in making

decisions. With the theory of signals. The company's

management must convey information to investors,

so that they can provide information about the

company's circumstances and prospects. from

information received by investors, investors can

determine which companies have good corporate

value, which will bring profits to investors.

2.3 Tax Aggressiveness

Tax aggressiveness can be defined as all efforts made

by management to reduce the amount of tax burden

than the company should pay (Lanis and Richardson,

2011). Hlaing (2012) in Jessica and Toly (2014: 5)

defines tax aggressiveness as the tax planning activity

of all companies involved in efforts to reduce the

effective tax rate.

According to Frank et al (2009) in Suyanto and

Supramono (2012), corporate tax aggressiveness is an

act of manipulating taxable income made by

companies both in a legal (tax avoidance) and illegal

way (tax evasion). Meanwhile, according to Yoehana

(2013) tax aggressiveness is the desire of companies

to minimize tax burden through tax planning

activities with the aim of maximizing company value.

Tax planning according to Suandy (2011) is as

follows:

1. Tax avoidance

2. Tax evasion

Zuber (2013) in Jessica and Toly (2014) states

that between tax evasion and tax evasion, there is a

gray area that is potential for tax aggressiveness. This

gray area exists because there is a tax shelter (an effort

to minimize taxes that must be paid on current

income) outside of all tax transactions whether

permitted under taxation law or not. There is no clear

line between tax evasion and embezzlement because

there is not enough explanation for all transactions. In

addition, aggressive transactions and decision-

making can be potential for tax evasion or tax

evasion.

These conditions cause differences in perceptions

between one party and another. This condition

becomes an opportunity for taxpayers to avoid tax by

using legal weaknesses as justification arguments for

tax evasion (Hadi and Mangoting, 2014).

According to Hidayanti (2013) there are

advantages and disadvantages of tax aggressiveness.

The advantages of doing tax aggressiveness, namely:

1. Tax savings that will be paid by the company to

the state

2. Directly or indirectly the manager gets

compensation or bonuses from the owner /

shareholder for the tax aggressiveness actions

carried out.

While the losses from tax aggressiveness

measures include:

EBIC 2019 - Economics and Business International Conference 2019

244

1. The possibility of companies getting sanctions or

penalties from tax authorities.

2. Damage to the company's reputation due to an

audit of the tax authorities, which causes a decline

in the company's stock price.

From some of the opinions above, it can be

concluded that tax aggressiveness is one of the ways

undertaken by a company to minimize the tax burden

to be paid in a legal or illegal manner.

One way to measure companies that carry out tax

aggressiveness is to use the Effective Tax Rates

(ETR) proxy basically as a tax rate that is borne by

the company. Lanis and Richardson (2011) stated that

ETR is the most widely used proxy in previous

studies. The lower the ETR value the company has,

the higher the level of tax aggressiveness. A low ETR

indicates a smaller nominal income tax burden than

income before tax.

2.4 Tax Theory

Tax is a public contribution to the state (which can be

imposed) owed by those who are obliged to pay it

according to general regulations (the law) with no

achievement returned which can be directly

appointed and whose use is to finance public

expenditures due to state duties for holding

government (Sumarsan, 2014).

The definition of tax according to UU No 16 of

2009 concerning the fourth amendment to UU No 6

of 1983 concerning General Provisions and Tax

Procedures in article 1 paragraph 1 reads tax is a

compulsory contribution to the country owed by a

compelling individual or entity based on the Law, by

not getting a direct reward and used for the state for

the maximum prosperity of the people

.

2.4.1 Tax Function

There are two functions of taxes, namely the Budget

Function (budgetair), the tax functions as one source

of funds for the government to finance expenditures

and the Regulatory Function (cregulerend), the tax

functions as a tool to regulate or carry out government

policies in the social and economic fields.

2.4.2 Theories That Support Tax Collection

Insurance Theory

Theory of Interest

Magical Power Theory

Theory of Consecration

Theory of Purchasing Power Principle

2.4.3 Tax type

There are various types of taxes, which can be

grouped into three, namely grouping by class, by

nature, and according to the polling agency.

1. According to its category, Direct Tax is tax that

must be borne or borne by the Taxpayer himself

and cannot be delegated or charged to other

people or other parties. And Indirect Tax is a tax

that can eventually be charged or delegated to

other people or third parties.

2. By its nature, subjective tax is a tax that originates

or is based on the subject, in the sense of paying

attention to the state of the taxpayer and objective

tax is tax based on the object, regardless of the

state of the taxpayer.

3. According to its collection agency, central tax is

tax collected by the central government and used

to finance state households. And local taxes are

taxes collected by the regional government and

used to finance regional households.

2.5 Corporate Social Responsibility

(CSR)

Corporate Social Responsibility is the way a company

manages its business activities either partially or as a

whole has a positive impact on itself and the

environment (Hadi, 2011). Corporate social

responsibility or Corporate Social Responsibility

(CSR) is the commitment of the company or business

world to contribute to sustainable economic

development by taking into account corporate social

responsibility and emphasizing the balance between

attention to economic, social and environmental

aspects.

Conceptually, CSR is a form of disclosure that is

presented in financial statements. Technically,

disclosure is the final step in the accounting process,

namely the presentation of information in the form of

a full set of financial statements. The company's

financial statements are addressed to shareholders,

investors and creditors.

Corporate social responsibility is expressed in a

report called Sustainability Reporting. Sustainability

Reporting is reporting on economic, environmental

and social policies, the influence and performance of

an organization and its products in the context of

sustainable development.

The Influence of Corporate Social Responsibility and Return on Assets against Tax Aggressiveness in Mining Companies Listed on the

Indonesia Stock Exchange for the 2014-2017 Period

245

2.5.1 Benefits of Corporate Social

Responsibility (CSR)

According to Setianingrum (2015), in carrying out its

social responsibilities, the company focuses its

attention on three things, namely:

a) Profit

By earning profits, the company can provide

dividends for shareholders, allocate a portion of the

profits to finance future business growth and

development, and pay taxes to the government.

b) Environment

By paying attention to the surrounding

environment, companies can participate in efforts to

preserve the environment for the sake of preserving

the quality of human life in the long run. The

company also takes part in disaster management

activities. Disaster management here is not just

providing assistance to disaster victims, but also

participates in efforts to prevent disasters and

minimize the impact of disasters through efforts to

preserve the environment as a preventive measure to

minimize disasters.

c) Social or Community

Attention to the community, can be done by

carrying out activities and making policies that can

improve the competence of various fields, such as

scholarships for students around the company, the

establishment of educational and health facilities, and

strengthening the local economy. By carrying out

social responsibility, the company is expected to not

only pursue short-term profits, but also contribute to

improving the welfare and quality of life of the

community and the surrounding environment in the

long run.

Untung (2008) in Mardikanto (2014) argues that

the benefits of CSR for companies are:

1. Maintain and boost reputation in the company's

brand image

2. Get a license to operate socially

3. Reducing the company's business risk

4. Widen access to resources for company

operations

5. Opening broader market opportunities

6. Reducing costs for example related to the

impact of waste development

7. Improve relations with stakeholders

8. Improve relations with regulators

9. Increase employee morale and productivity

10. Opportunities to get awards

2.5.2 Disclosure of Corporate Social

Responsibility (CSR)

According to Ardianto (2011) in Sela (2018),

disclosure of corporate social responsibility or

referred to as corporate social responsibility

disclosure, corporate social reporting, social

accounting, is a way of communicating social

information to stakehoolders. CSR disclosure

standards developed in Indonesia refer to standards

developed by the Global Reporting Initiatives (GRI).

The GRI standard was chosen because it focuses

more on the standard of disclosure of various

economic, social, and environmental performance of

the company with the aim of improving the quality,

rigor, and utilization of sustainability reporting.

Ardianto (2011), Global Reporting Initiatives

(GRI) is an organization-based network that has

spearheaded the development of the world, uses the

most sustainability reporting frameworks and is

committed to continual improvement and application

throughout the world.

The list of social disclosures based on the GRI

standard uses 6 disclosure indicators, namely:

1) Economic Performance Indicators

2) Environmental Performance Indicators

3) Labor Performance Indicators

4) Human Rights Performance Indicators

5) Social Performance Indicators

6) Product Performance Indicator

For this study the indicators used are only three

categories, namely economic, environmental and

social performance indicators. The total performance

indicators used in this study reached 79 indicators,

consisting of 9 economic indicators, 30

environmental indicators, 14 labor indicators, 9

human rights indicators, 8 social indicators, 9 product

indicators.

2.6 Return on Assets

According to Munawir (2007), the probability of a

company shows the ratio between earnings and assets

or capital that produces these profits. In other words

profitability is the ability of a company to generate

profits for a certain period.

Company profitability is one of the bases for

evaluating the condition of a company, for that we

need an analytical tool to be able to assess it. The

analysis tool in question is financial rsio. Profitability

ratios measure management effectiveness based on

the returns obtained from sales and investments

(Sukma and Teguh, 2014).

EBIC 2019 - Economics and Business International Conference 2019

246

A company that has high profitability means

having a large profit. In this study profitability ratios

are interpreted as Return On Assets (ROA) ratios.

ROA illustrates the extent to which the ability of

assets owned by the company can generate profits

(Tandelilin, 2011).

According to Cahyono, et al (2016) ROA

measures the company's ability to generate profits by

using the total assets (wealth) owned by the company

after adjusting for costs to fund these assets. ROA

measures the overall effectiveness in generating

profits through available assets, the power to generate

profits from invested capital. Calculate ROA by using

the net profit after tax formula divided by total assets.

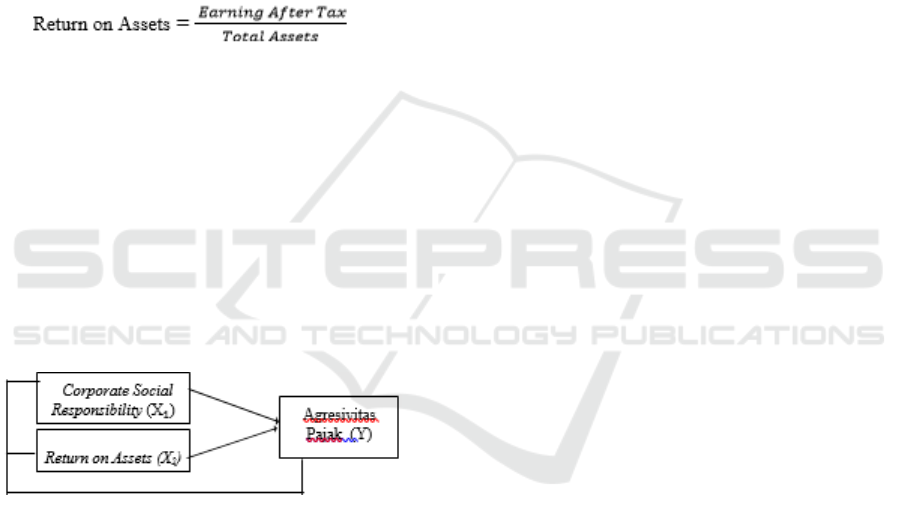

ROA can be calculated by the formula

The higher the value of ROA, the higher the

company's profit so the better the asset management

of a company. The higher the value of ROA, the

greater the profit earned by the company. Agency

theory will spur agents to increase company profits.

When the profits are increased, the amount of income

tax will increase in accordance with the increase in

corporate profits so that the tendency to do tax

avoidance is carried out by the company (Dewinta

and Setiawan, 2016).

2.7 Framework of Thinking

Figure 2.1 Thinking Framework

CSR is how a company pays attention to the

environment, to the impact that will occur due to the

company's operational activities. The company's

performance is said to be good if it is able to obtain

high profits in the current year. High corporate profits

can be obtained by minimizing the burdens that are

owned by the company. one of the expenses held by

the company is the burden of paying taxes. The act of

minimizing the tax burden is often also referred to as

an act of tax aggressiveness. The higher the

company's profit, the higher the company's intention

to carry out tax aggressiveness.

ROA shows the company's ability to generate

profits from assets used by the company in a period.

The income earned by the company tends to be

directly proportional to the tax paid, so the greater the

profits derived by the company, the higher the tax

burden to be borne by the company. Every company

desires to maximize the profits obtained. But the

company is also obliged to pay taxes. When the

profits are increased, the amount of income tax will

increase in accordance with the increase in corporate

profits so that the tendency to make tax

aggressiveness is carried out by the company.

Hypothesis Development

The Influence of Corporate Social Responsibility

Against Tax Aggressiveness

The company is a taxpayer in the form of a permanent

business that has an obligation to pay taxes. As a

taxpayer, companies contribute to national

development. From a community perspective,

companies should pay taxes to the state because the

company has benefited from providing public goods

so that the company can do its business and make a

profit.

In the theory of legitimacy it is stated that the

corporate value system is in line with the value

system of the larger social system in which the

company is a part. This corporate value system is

shown by the company's compliance in paying taxes

and not trying to carry out tax aggressiveness

activities that can be detrimental to many parties.

This is supported by stakeholder theory where the

focus of the company in carrying out its operations

must consider not only the interests of shareholders,

but also must pay attention to the interests of the

community, government, consumers, suppliers,

analysts, and so forth. One way to foster good

relations with stakeholders is with the government to

obey paying taxes. This is because state revenue

through taxes is an instrument used to finance

government spending that is indirectly utilized for the

benefit of the people.

Watson (2011) in Yoehana (2013) states that the

adverse effect of a company because it violates the

social norms of tax aggressive action is the number of

sales that fall because people who know about the

importance of CSR boycott the company's products

and tend to be reluctant to buy products. Lanis and

Richardson (2012) state that companies that carry out

tax aggressiveness actions are considered socially

irresponsible by the public.

The results of research conducted by Lanis and

Richardson (2012) and Ratmono and Sagala (2015)

show that corporate social responsibility has a

negative effect on tax aggressiveness. Companies

The Influence of Corporate Social Responsibility and Return on Assets against Tax Aggressiveness in Mining Companies Listed on the

Indonesia Stock Exchange for the 2014-2017 Period

247

with low levels of CSR disclosure tend to be more

aggressive in making various efforts in order to

minimize the amount of tax that must be paid.

However, it is inversely proportional to the

research conducted by Jessica and Toly (2014) which

shows that there is no significant effect between

corporate social responsibility disclosure on tax

aggressiveness.

Based on the analysis and research findings

above, the research hypothesis is formulated as

follows:

H

1

: Corporate Social Responsibility affects the tax

aggressiveness.

The Effect of Return on Assets on Tax

Aggressiveness.

In Hanafi and Halim (2007) it is stated that ROA takes

into account the company's ability to generate a profit

regardless of the funding used. In other words, ROA

is included in the proxy of profitability. ROA shows

the company's ability to generate profits from assets

used by the company in a period.

The higher the value of ROA, the higher the

company's profit so the better the asset management

of a company. The higher the value of ROA, the

greater the profit earned by the company. Agency

theory will spur agents to increase company profits.

When the profits are increased, the amount of income

tax will increase in accordance with the increase in

corporate profits so that the tendency to do tax

avoidance is carried out by the company (Dewinta

and Setiawan, 2016).

Based on the analysis and research findings

above, the research hypothesis is formulated as

follows:

H

2

: Return On Assets affect the tax

Aggressiveness.

H

3

: Corporate Social Responsibility, and Return

On Assets jointly affect the Tax

Aggressiveness

3 METHOD

This type of research used in this study is a

quantitative research method.

In this study, the author uses secondary data,

through the financial statements of mining companies

in 2014-2017 obtained from the official website of the

IDX, namely www.idx.co.id and stockok.com. Data

collection techniques in this study were obtained

through documentation studies, by collecting

supporting theory data through journals and

supporting books to be able to describe the problem

under study and collect secondary data.

The sampling technique used in this study is

purposive sampling. The criteria used to determine

the sample are as follows:

1. Mining sector companies listed on the Indonesia

Stock Exchange from 2014-2017

2. The company published an annual report from

2014-2017.

3. Companies that do not experience losses and do not

have a negative value on profit before tax because

it will cause the ETR to be negative.

4. Mining companies that have complete data relating

to the variables needed include Corporate Social

Responsibility, and Return On Assets.

Based on these criteria, 16 companies were

sampled in this study from 42 mining companies

listed on the IDX.

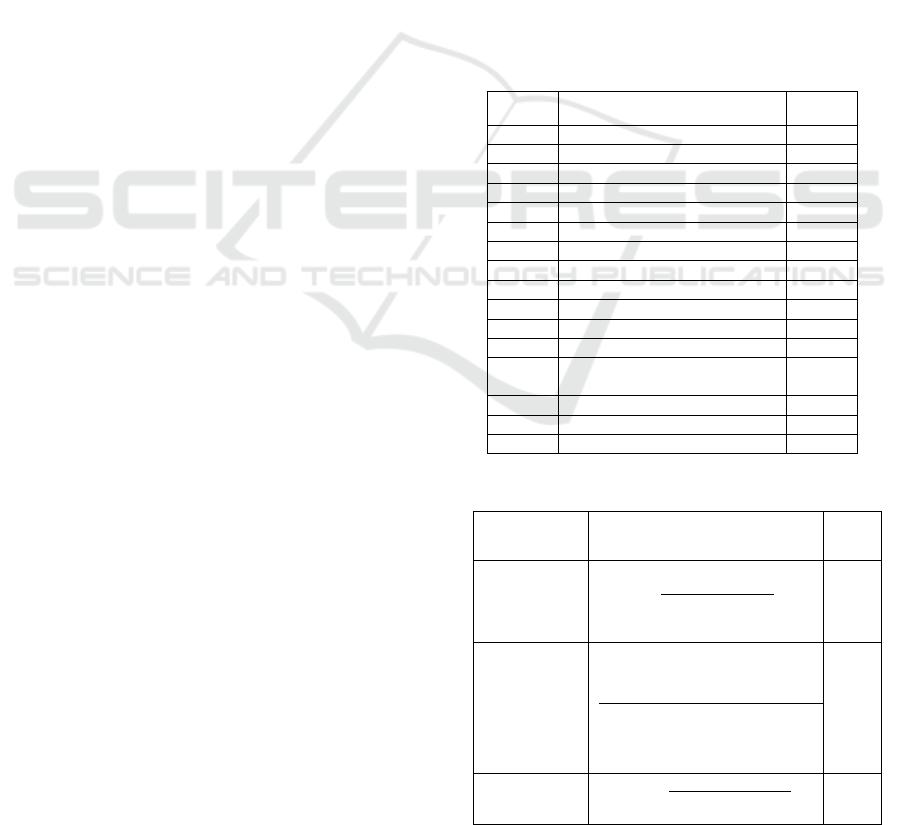

Table 3.1. Sample

Sample Company Name Code

1 Adaro Energy Tbk ADRO

2 Baramulti Suksessarana Tbk BSSR

3 Citatah Tb

k

CTTH

3 Darma Henwa Tbk DEWA

5 Elnusa Tb

k

ELSA

6 Surya Esa Perkasa Tb

k

ESSA

7 Golden Energy Mines Tb

k

GEMS

8 Vale Indonesia Tb

k

INCO

9 Indo Tambangraya Megah Tbk ITMG

10 Resource Alam Indonesia Tb

k

KKGI

11 Samindo Resource Tb

k

MYOH

12 J Resources Asia Pasifik Tb

k

PSAB

13 Tambang Batubara Bukit

Asam (Persero) Tb

k

PTBA

14 Radiant Utama Interinsco Tb

k

RUIS

15 Timah (Persero) Tb

k

TINS

16 Toba Bara Sejahtra Tb

k

TOBA

Table 3.2: Measurement Scale

Types of

Variable/

Variable

Indicator Scale

Dependent

Variable/

Tax

Aggressivenes

(Y)

ETR =

ETR = Effective Tax Rate

Ratio

Independent

Variable/

Corporate

Social

Responsibility

(X₁)

P

CSR

=

x 100%

P

CSR=Pen

g

un

g

ka

p

an CSR

Ratio

Return On Assets

(X

2

)

ROA

=

ROA=Return on Assets

Ratio

EBIC 2019 - Economics and Business International Conference 2019

248

The type of data analysis used in this study is

quantitative. And the data analysis method used is

descriptive statistics and multiple regression analysis.

The multiple linear regression equation is as

follows:

Y = a + bX

1

+ bX

2

+ e

Information :

Y = Aggressiveness of company tax is measured

using ETR proxy

a = constant

b = coefficient

X

1

= Corporate Social Responsibility (CSR)

X

2

= Return On Assets

E = Error

Classic Assumption Test

Before the data is analyzed, multiple regression

models must meet the classical assumption

requirements. This classic assumption test is

conducted to find out whether the regression model

really shows a significant and representative

relationship, then the model must meet the classical

regression assumptions. The classic assumption test

conducted is a test of normality, multicollinearity,

autocorrelation, and heterokedastisitas

Determination Test (R²)

This coefficient of determination is used to describe

the ability of the model to explain variations that

occur in the dependent variable (Ghozali: 2013). The

coefficient of determination (R²) is expressed as a

percentage. The value of the correlation coefficient

(R²) ranges from 0 <R² <1. A value close to one

means that the independent variable provides almost

all the information needed to predict the variation of

the independent variable (Ghozali: 2013).

Hypothesis Testing

To test the hypothesis in this study the significance of

the individual parameter test (t test) and the

simultaneous significance test F (F test) were

performed.

4 RESULTS AND DISCUSSION

4.1 Research Result

4.1.1 Descriptive Statistical Analysis

Descriptive statistical test results can be seen in the

following table:

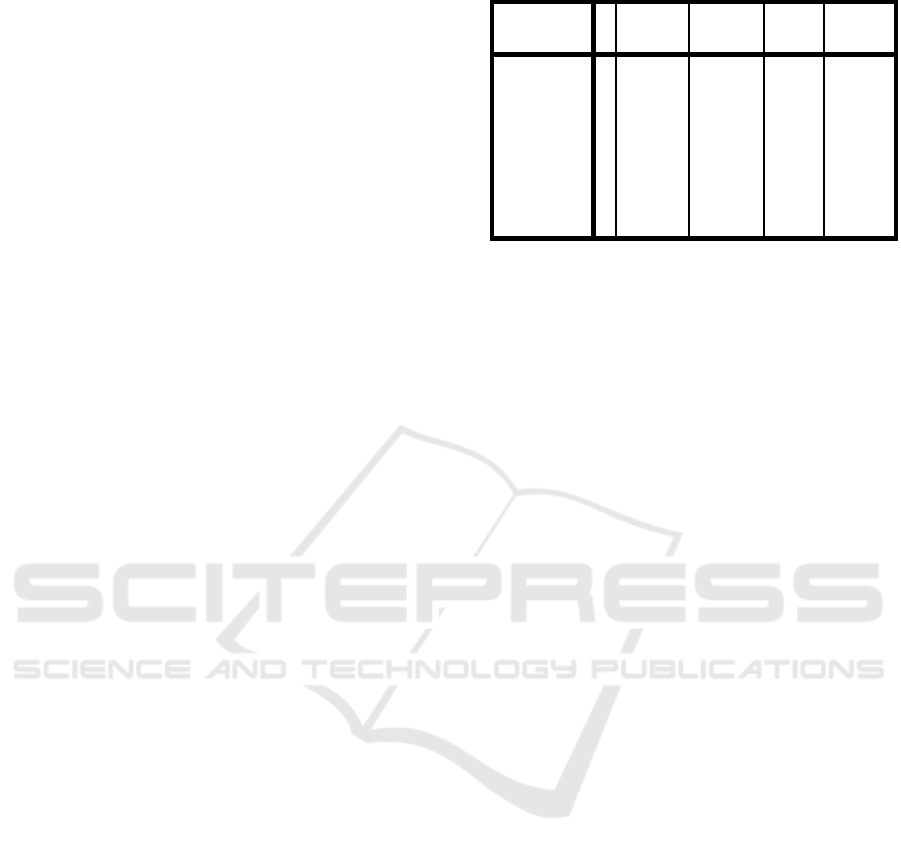

Table 4.1. Descriptive statistical

N

Minimu

m

Maximu

m

Mea

n

Std.

Deviatio

n

CorporateSocia

l

Responsibility

6

4

11,39 62,02 38,1308 14,15197

Return On

Assets

6

4

-,70 29,21 6,3620 5,77839

Effective Tax

Rate

6

4

,01 ,99 ,3691 ,17292

Valid N

(listwise)

6

4

Source, data processed

From the previous descriptive statistical analysis

table can be explained:

1. Variable X

1

, namely corporate social responsibility

with 64 observations, has a minimum value of

11.39, a maximum value of 62.02, a mean value

of 38.1308, with a standard deviation of

14.15197.This shows the average sample

company has a corporate social responsibility of

38.1308 of the total number of corporate social

responsibility owned by the company. The mean

value of corporate social responsibility is greater

than the standard deviation value of 38.1308>

14.15197, indicating that the variable data of

corporate social responsibility has good data

distribution. Because the standard deviation is a

reflection of normal deviations and does not cause

bias.

2. Variable X

2

, namely return on assets with a total of

64 observations, has a minimum value of -0.70, a

maximum value of 29.21, a mean value of 6.3620,

with a standard deviation of 5.77839. This shows

the average the average sample company has a

6.3620 return on assets. The mean value of return

on assets is greater than the standard deviation

value of 6.3620> 5.77839, indicating that the

variable data on return on assets has good data

distribution. Due to the standard deviation is a

reflection of a very high deviation, so that the

spread of data shows normal results and does not

cause bias.

3. Variable Y, namely effective tax rate (ETR) with

64 observations, has a minimum value of 0.01, a

maximum value of 0.99, a mean value of 0.3691,

with a standard deviation of 0.17292. This shows

that the average sample company has an effective

tax rate of 0.3691. The mean value of ETR is

greater than the standard deviation value of

0.3691> 0.17292 indicating that the variable data

of ETR has good data distribution. Due to the

standard deviation is a reflection of a very high

The Influence of Corporate Social Responsibility and Return on Assets against Tax Aggressiveness in Mining Companies Listed on the

Indonesia Stock Exchange for the 2014-2017 Period

249

deviation, so that the spread of data shows normal

results and does not cause bias.

4.1.2 Multiple Linear Regression Analysis

Table 4.2. Regression Analysis

Model Unstandardized

Coefficients

Standardize

d

Coefficients

t Sig.

B Std.

Erro

r

Beta

(

Constant

)

,437 ,156 2,796 ,007

Corporate

Social

R

es

p

onsibilit

y

-,002 ,001 -,294 -

2,359

,022

R

eturn On

A

ssets

-,008 ,002 -,367 -

3,083

,003

Source, data processed

From the results of the multiple linear regression

analysis obtained by the linear regression equation as

follows: Y = 0.437 - 0.002X

1

- 0.008X

2

+ e

From the results of regression testing can be

explained as follows:

1. a constant value of 0.437; shows if the Corporate

social responsibility (X

1

), and Return on assets

(X

2

) value is 0, then the value of ETR (Y) is 0.437.

2. Regression coefficient of the variable Corporate

social responsibility (X

1

) of - 0.002; this means

that if other independent variables have a fixed

value or equal to 0 and Corporate social

responsibility experiences an increase of 1%, then

the value of ETR (Y) will decrease by 0.002.

Negative coefficient means that there is a negative

relationship between Corporate social

responsibility and ETR.

3. The regression coefficient of the variable Return on

assets (X

2

) is - 0.008; meaning that if other

independent variables have a fixed value or equal

to 0 and return on assets has increased 1%, then

the value of ETR (Y) will decrease by 0.008.

Negative coefficient means that there is a negative

relationship between return on assets and ETR

.

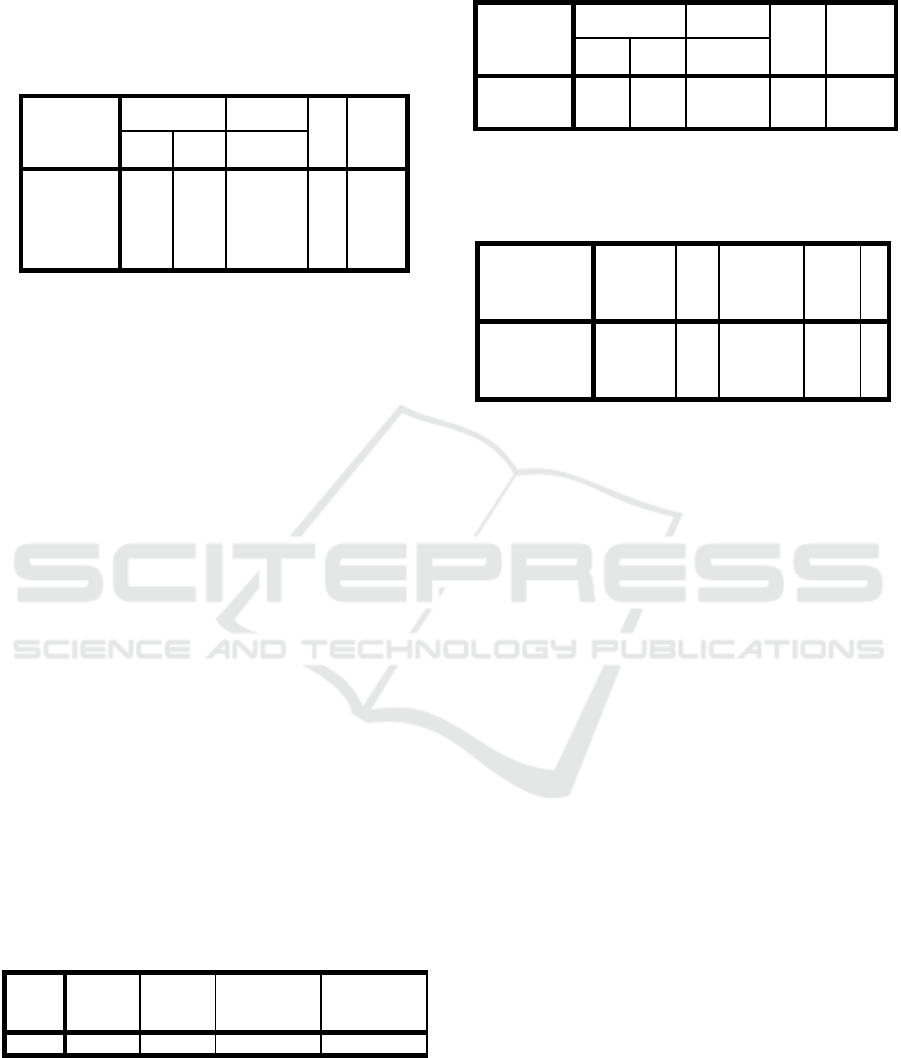

Table 4.3 Determination Coefficient Test

Model Summary

b

Model

R

R

Square

A

djusted R

Square

Std. Error

of the

Estimate

1

,627

a

,393 ,349 ,09476

a. Predictors: (Constant), ROA, CSR

b. Dependent Variable: ETR

Table 4.4. t- Test Result

Coefficients

a

Model Unstandardized

Coefficients

Standardized

Coefficients

T Sig.

B Std.

Erro

r

Beta

(

Constant

)

,437 ,156 2,796 ,007

CSR -,002 ,001 -,294 -2,359 ,022

R

OA -,008 ,002 -,367 -3,083 ,003

a. Dependent Variable: ETR

Table 4.5. F- test Result

ANOVA

a

Model Sum of

Squares

d Mean

Square

F S

Regressi ,320 2 ,080 8,913 ,0

1

Residual ,494

55

,009

Total ,814

59

a. Dependent Variable: ETR

b . Predictors: (Constant), Corporate Social Responsibility,

Return on assets

5 CONCLUSIONS

This study aims to look at the influence of Corporate

Social Responsibility and Return On Assets. From the

results of data analysis, the following conclusions can

be drawn:

1. The results of the study indicate that Corporate

Social Responsibility has a significant effect on

tax aggressiveness, the hypothesis 1 submitted is

accepted. This is evidenced by using the t test

which produces a regression coefficient of -0.002

with a significant level of 0.022.

2. The results of the study show that return on assets

has a significant effect on tax aggressiveness, then

hypothesis 2 submitted is accepted. This is

evidenced by using the t test which produces a

regression coefficient of -0.008 with a significant

level of 0.003.

3. Corporate Social Responsibility and Return On

Assets simultaneously influence the tax

aggressiveness dependent variable on mining

companies listed on the Indonesia Stock

Exchange in the period 2014-2017, then the

hypothesis 3 submitted is accepted. This is

evidenced from the results of the calculated F

value of 8.913 with a significance value of 0,000.

The resulting significance value is smaller than

0.05.

4. The results of this study indicate that corporate

social responsibility and return on assets are only

EBIC 2019 - Economics and Business International Conference 2019

250

34.9% affecting the tax aggressiveness and the

remaining 65.1% are influenced by other factors.

REFERENCES

Agusti, Yola Wirna. (2014). Pengaruh Profitabilitas,

Leverage, Corporate Governance terhadap Tax

Avoidance. Skripsi. Universitas Negeri Padang.

Ardianto, Elvinaro dan Dindin Machfudz. (2011). Efek

Kedermawanan Pebisnis dan CSR. Jakarta: Elex Media

Komputindo

Ardyansah Danis dan Zulaikha, (2014). Pengaruh Size,

Leverage, Profitability, Capital Intensity Ratio dan

Komisaris Independen terhadap Effective Tax Rate

(ETR). Diponegoro Journal Of Accounting. Volume 3

Nomor 2 Tahun 2014 Halaman (1-9) ISSN: 2337-3806.

Balakrishnan, K., Blouin, J., & Guay, W. (2012). Does Tax

Aggressiveness Reduce Corporate Transparency?.

Social Science Research Network.

Brigham, Eugene F & Houston, Joel F. (2011). Dasar-dasar

Manajemen Keuangan buku 1& 2. (Alih Bahasa : Ali

Akbar Yulianto). Jakarta : Salemba Empat

Cahyono, D. D., Rita, A., & Kharis, R. (2016). Pengaruh

Komite Audit, Kepemilikan Institusional, Dewan

Komisaris, Ukuran Perusahaan (Size), Leverage (DER)

dan Profitabilitas (ROA) terhadap Tindakan

Penghindaran Pajak (Tax Avoidance) pada Perusahaan

Perbankan yang Listing BEI Periode Tahun 2011-2013.

Jurnal Akuntansi. Vol2. No. 2,Maret 2016

Dewinta, Setiawan (2016), Pengaruh Ukuran Perusahaan,

Umur Perusahaan,

Profitabilitas, Leverage, Dan Pertumbuhan

PenjualanTerhadap Tax Avoidance, E-Jurnal

Akuntansi Universitas Udayana

Vol.14.3. Maret 2016, 1584-1613

Dharma, I. M. S dan Ardiana, P. A. (2016). Pengaruh

leverage, intensitas asset tetap, ukuran perusahaan, dan

koneksi politik terhadap tax avoidance. ISSN: 2302-

8556, E-Jurnal Akuntansi Universitas Udayana

Vol.15.1 April (2016): 584-613.

Ghozali, Imam. (2013). Aplikasi Analisis Multivariate

SPSS 23. Semarang: Bp Universitas Diponegoro.

Global Reporting Initiative.(2011).Sustainability Reporting

Guidelines. Boston: GRI

Hadi, Nor. (2011), Corporate Social Responsibility, Graha

Ilmu, Yogyakarta

Hadi, Junilla dan Mangoting,(2014), Pengaruh Struktur

Kepemilikan Dan Karakteristik

Dewan Terhadap Agresivitas Pajak, Tax & Accounting

Review, Vol 4, No 2, 2014

Hanafi M., Muhammad dan Abdul Halim, (2003).

AnalisisLaporan Keuangan. Edisi kesatu,

Cetakan Pertama. Yogyakarta: BPFE

Hidayati, Nurul & Fidiana. (2017). Pengaruh Corporate

Social Responsibility dan Good Corporate Governance

Tergadap Penghindaran Pajak. Jurnal Ilmu dan Riset

Akuntansi. Vol, 5 (No. 3)

Hidayati, A. N. (2013). Pengaruh antara kepemilikan

keluarga dan corporate governance terhadap tindakan

pajak agresif. (Skripsi. Fakultas Ekonomika dan Bisnis

Universitas Diponegoro Semarang).

Jessica, dan Toly, A. A. (2014). Pengaruh Pengungkapan

Corporate Social Responsibility Terhadap Agresivitas

Pajak. Tax & Accounting Review, Vol. 4, No. 1, 2014.

Kurniasih, T., & Sari, M.M.R. (2013). Pengaruh Return On

Assets, Leverage, Corporate Governance, Ukuran

Perusahaan dan Kompensasi Rugi Fiskal pada Tax

Avoidance. Buletin Studi Ekonomi, 1 (18), 58-66.

Lanis, Roman dan Richardson, Grant. (2011). The Effect of

Board of Director CompositiononCorporate Tax

Aggressiveness. J. Account. Public Policy 30, hal 50-

70

Lanis, R dan Richardson, G. (2012). Corporate Social

Responsibility And Tax Aggressiveness: An Empirical

Analysis. J. Account. Policy 31 (2012) 86- 108.

Luayyi, Sri. (2010). Teori Keagenan dan Manajemen Laba

dari Sudut Pandang Etika Manajer. Elmuhasaba. Vol 1,

no 2

Mardikanto Totok (2014). Corporate Social Responsibility

Tanggung Jawab Sosial

Korporasi. Alfabeta Bandung

Munawir. (2007). Analisis Laporan Keuangan. Cetakan

Ke-14. Liberty. Yogyakarta

Noor, Juliansyah. (2012). Metodologi Penelitian, Skripsi,

Thesis, Disertasi dan Karya Ilmiah. Jakarta:

Prenadamedia Group.

Nugraha, N. B. (2015). Pengaruh Corporate Social

Responsibility, Ukuran Perusahaan, Profitabilitas,

Leverage Dan Capital Intensity Terhadap Agresivitas

Pajak. (Skripsi. Fakultas Ekonomika dan Bisnis

Universitas Diponegoro Semarang).

Octaviana, N. E. (2014). Pengaruh Agresivitas Pajak

Terhadap Corporate Social Responsibility : Untuk

Menguji Teori Legitimasi. Semarang : Universitas

Diponegoro.

Sembiring,S.O.(2018). Analisis Pengaruh Corporate Social

Responsibility, Profitabilitas, Dan Ukuran Perusahaan

Terhadap Nilai Perusahaan Pada Perusahaan

Pertambangan Sub Sektor Batu Bara Yang Terdaftar Di

Bursa Efek Indonesia Periode 2013-2016. Skripsi.

Medan: Universitas Methodist Indonesia.

Setianingrum,W.A (2015). Pengaruh Corporate Social

Responsibility Terhadap Nilai Perusahaan Dengan

Profitabilitas Sebagai Variabel Moderasi. Skripsi.

Semarang: Universitas Negeri Semarang.

Suandy, E. (2011). Perencanaan Pajak. Jakarta: Salemba

Empat.

Sugiyono, (2012). Metode Penelitian Pendidikan.

Bandung: Alfabeta

Suharto, Edi. (2010). CSR & Comdev: Investasi Kreatif

Perusahaan di Era Globalisasi. Bandung: Alfabeta

Sukma Mindra, Teguh Erawati,(2014), Pengaruh Earning

Per Share , Ukuran Perusahaan, Profitabilitas, Dan

Leverage Terhadap Nilai Perusahaan , Jurnal Akuntansi

Vol 2 No 2 Desember 2014

Sumarsan, Thomas.(2013). Perpajakan Indonesia. Jakarta:

PT. Indeks

The Influence of Corporate Social Responsibility and Return on Assets against Tax Aggressiveness in Mining Companies Listed on the

Indonesia Stock Exchange for the 2014-2017 Period

251

Suyanto, K.D., & Supramono.( 2012). Likuiditas,

Leverage, Komisaris Independen dan Manajemen Laba

terhadap Agresivitas Pajak Perusahaan. Jurnal

Keuangan dan Perbankan, 2 (16), 167-177.

Tandelilin, Eduardus. (2010).Portofolio Dan Investasi

Teori Dan Aplikasi. Yogjakarta; Kanisius

Yoehana, Maretta. (2013).Analisis Pengaruh Corporate

Social Responsibility terhadap Agresivitas Pajak.”

Diponegoro Journal of Accounting.

UU Perseroan Terbatas No. 40 Tahun 2007 (2007).

Indonesia: www.legalitas.org.

www.idx.co.id

www.sahamok.com

EBIC 2019 - Economics and Business International Conference 2019

252