Financial Budgeting, Financial Governance, and Conflict of Interest:

A Critical Challenge to Good Financial Reporting

Idhar Yahya and M. Zainul Bahri Torong

Universitas Sumatera Utara, Medan, Indonesia

Keywords: Finance Report Quality, Budget Planning, Budget Planning, and Conflict of Interest

Abstract: This study aims to analyse the quality of finance report as an act of finance responsibility from North Sumatera

Province to the public, using budget planning, finance administration, and conflict of interest as independent

variables. Data that are being used are premier data. The data are then analysed using warpPLS software, with

106 respondents consisting of the head of working unit, finance and accounting staff, treasurer of expenditure,

and treasurer of income. Data testing is conducted using validity convergent test, average variance extracted,

composite reliability, cronbach’s alpha, and R-Squared test. This study’s result shows that budget planning,

finance administration, and conflict of interest positively and significantly affect finance report quality. It can

be concluded that budget planning and finance administrationare accountability of government finance

management, by keeping interest free of conflict, in order to maintain the objectivity of finance report.

1 INTRODUCTION

Regional government’sfinance report is an integral

part of national finance administration, hence finance

report on government entity must follow the rules of

law and the implementation of government standard

accounting. Finance report is of quality when it gives

information regarding company operation, in

particular cash flow and investor equity (Biddle,

Hilary dan Verdi :2009), whereas (Tang, Chen dan

Zhijun :2008) defines quality finance report as a

report that give the reliable information regarding

performance and finance position. Meanwhile, (Jonas

dan Blanchet:2000) defines that quality finance report

must give information about financial information

completely and transparently, not to mislead or

confuse the user. All these are in line with the rules of

PP No.71/2010; quality finance report becomes very

important when government performance is

evaluated.

Budgeting is imperative in public sector

management, as it is part of government finance

administration, which still receives critic and input,

(Milewska, Jozwik :2014; Usui, Alisyahbana :2003;

Posseth, Nispen:2006; Zarinah, et al: 2016).

Budgeting is the final government struggle for rare

resource, showing the priority of government.

Budgeting is considered as the most important

economic tool of any government (Olurankinse:

2011). Budgeting is paired with finance report to

assess the succeed rate and realisation in one-year

budget. Budgeting is a financial plan about what will

and should be done (Musgrave:1961), while

(Wildavsky:1961) say that budgeting is life source for

government, meaning that budgeting is very

important to conduct public services. Some variants

of budgeting system are developed to meet many

purposes, including finance control, management

planning, fund using priority, and public

accountability. (Schick:1966) stated that basically

budgeting has three function, i.e. planning,

supervising, and managing, yet in early modern

budgeting, the emphasis is on government

supervising. However, this emphasis is reduced is the

next stage of development, as accounting technique,

audit technique, and other technique are found (UU

No.17 tahun 2003).

Increasing demand from society regarding public

service, especially in the early stage of regional

autonomy implementation, with limited income,

force government to improve its effectivity and

efficiency due in many aspects, including public

expenditure. The alternative of for improvement is

better budgeting. Other improvement taken is to

implement performance-based budget, which is

believed to give great benefits for more party

(government, legislative, and society).

Yahya, I. and Bahri Torong, M.

Financial Budgeting, Financial Governance, and Conflict of Interest: A Critical Challenge to Good Financial Reporting.

DOI: 10.5220/0009201702170220

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 217-220

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

217

Belief of good budgeting and conflict of interest

always becomes the bet in preparing the budget,

which effect can be seen clearly in its operation and

in finance report. Finance administration becomes the

main centre in finance accountability, so that finance

report quality can be maintained.

Finance report must be free from all conflict of

interest. Conflict of interest can reduce public belief,

integrity belief, and non-siding with public officials.

(Mafunisa, M J: 2002) Conflict of interest is a

condition where some government officials,who have

authority, act to gain profit for personally or other

people, which can affect neutrality and decision

quality. Conflict of interest will invite problem when

an institute or organisation is involved in a program

implementation or activity; this can ruin motivation

and cause unethical or improper act. (UU No

30/2014). In work place, it can be seen that staff

members with less conflict of interest work better and

more productive than those with more conflict of

interest. However, (Ushie, et al: 2015), stated that

conflict can also bring positive impact, when

proactive conflict management strategy and dialogue

are used to stop bad, low productivity performance.

Based on such problem, the purpose of this study

is to analyse and give empirical evidence regarding

the effect of budget planning, finance administration,

and conflict interest on finance report quality of

regional government.

2 LITERATURE STUDY

National finance system improvement starts from the

implementation of UU No.17/2003, giving the rise to

good governance in managing national finance,

which is professional, open, fair, honest, and

responsible. This rule implementation is expected to

be the powerful law in enforcing the application of

finance management which is clean, dignified, and

free from corruption (Halim: 2012). With this policy,

the quality of regional government’ finance report can

be trusted and believed (PP No.71/2010).

Budget is a finance plan made in a detailed and

systematic way, containing the plan of income and

expenditure in a certain period. Budget is also a

statement regarding performance estimation which

will be achieved in an organisation, measured in

terms of monetary unit. In public organisation, budget

becomes accountability instrument in executing and

conducting a program or an activity funded by public

fund.

Government in completing national finance

management implement budget based performance,

in order to improve transparency and accountability

of public services, as well as effectivity from

implementation of policy and program (Istianah:

2010). The success indication of this budget based

performance is when improvement happens in public

services, social welfare, democracy, fairness,

equality, and good relation between central and

regional government.

System and procedure of administration in

regional treasurer relates to performing tasks and

authority of government treasurer in administration,

and also responsibility of conducting regional

government budget. Administration cannot be

separated from finance report unit. Work unit as

administrativeoperator has an authority to make

connection, resulting in regional income or

expenditure, and also testing and giving the bill to the

user of the budget, meanwhile the operator of

treasurer is given to general regional treasurer. All of

these must be supported by good finance management

(PP No.58 /2005, Permendagri No.13/2006 and

No.59/2007).

Quality finance report must be free from conflict

of interest. Conflict of interest can be defined as

quarrel, dispute, or opposition that happen from a

person or a group of people in daily life (Coser:

1967). Conflict of interest can be a threat to national

government in conducting its function lawfully.

Conflict may be positive and improve performance,

although most are negative in nature and may prove

to be fatal. In short, not all conflict situation is bad

(Omisore and Abiodun: 2014).

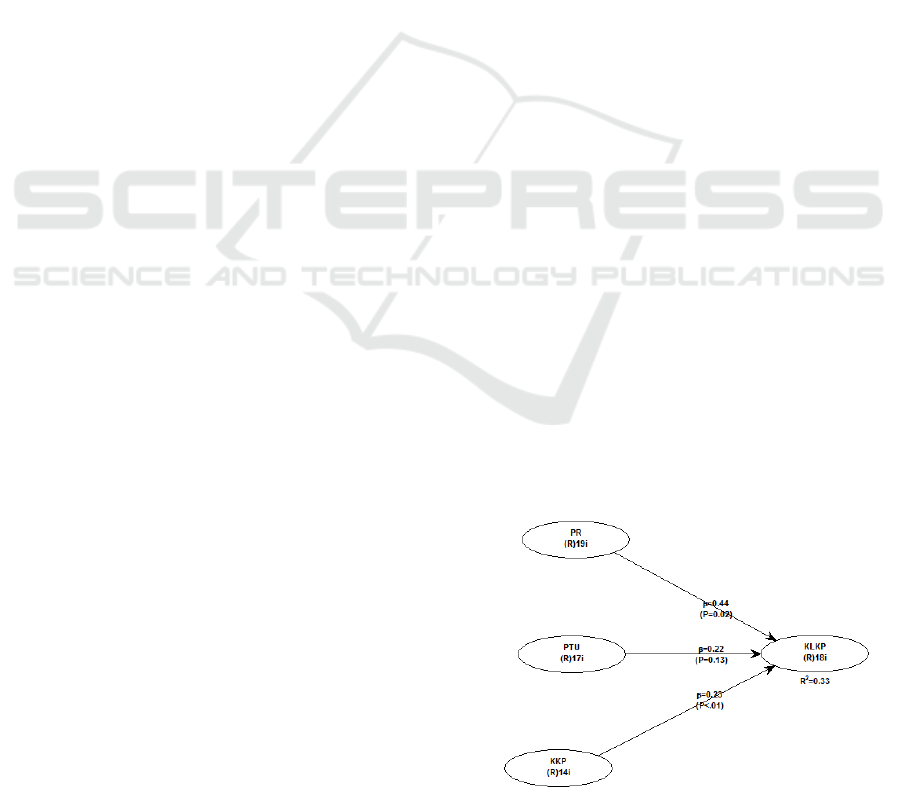

2.1 Conceptual Body and Hypothesis

Based on background and theory study, conceptual

body developed in this study is shown on Figure 1.

Independent variables are budget planning, finance

administration, and conflict of interest, whereas

dependent variables are finance report quality

Figure 1: Theoretical Framework

EBIC 2019 - Economics and Business International Conference 2019

218

Hypothesis from this study is that budget

planning, finance administration, and conflict of

interest affect finance report quality

2.2 Population and Sample

Population from this study is Provincial Government

of North Sumatera. Study procedure is conducted

using survey method and data are obtained from

questionnaire given to respondents. The respondents

are Head of Regional Work Unit, finance/accounting

staff, income treasurer, and expenditure treasurer,

with 106 samples in total.

2.3 Data Analysis Method

For data analysis method, WarpPLS software is used.

PLS (Partial Least Square) is a structural equation

method (SEM), which is variant based, can

simultaneously perform measurement model test and

structural model test.

3 RESULT AND DISCUSSION

3.1 Data Testing

Data testing is done using convergence validity test,

which shows that all variables (outer loading) give

proper value, meaning that all questions on each

indicator are valid (ranging between 0.59 until 0.909).

Other tests performed are Average Variance

Extracted (AVE) test, Composite Reliability (CR)

test, and Cronbach’s Alpha (CA) test; all three tests

show valid value, i.e. higher than the critical number

of 0.5 and 0.7. Finally, R-Squared test is performed

with number of 0.334, meaning that 33.4% of finance

report quality in regional government is explained by

budget planning variables, finance administration,

and conflict of interest, while the remaining 76.6% is

explained by other factors outside of this study.

3.2 Budget Planning Effect on Finance

Report Quality

Based on the result of data analysis, budget planning

positively and significantly affects finance report

quality. This means that good budget planning is the

most important aspect in compiling finance report.

Budgeting aspect is planned by work unit almost a

year prior to its execution, therefore some

miscalculation in budgeting may happen (Abdullah,

2012).

Problem that always arisesis the inability to use

budget properly and fairly due to conflict of interest

or other technical problems that are hard to avoid.

Obeying rules and executing the planned budget

accordingly will greatly affect financial report of

regional government. However, in reality, budget is

often used to achieve a certain purpose, such as

opportunistic behaviourmade by legislative or

executive (Abdullah, Asmara: 2006). Performance-

based budget in regional government has been

implemented since 2002, although in its development

this has not been implemented properly, awareness

for this matter should be improved to cultivate dutiful

character.

3.3 Administration Effect on Finance

Report Quality

Data analysis shows that finance administration

positively and significantly affects finance report

quality. This means that administration’s function is

both for accountability and controlling the execution

of local government budget. Accountability function

means good administration is a requirement for good

finance report quality. Administration’s controlling

function is organised in regional regulation and

legalised by a certain authority. In short, this

adminstation body is important since all organisation

activity are written and compiled (Permendagri

13/2006).

3.4 Conflict of Interest Effect on

Finance Report Quality

Conflict of interest positively and significantly affect

finance report quality. Conflict of interest must be

avoided in all organisations, so that every decision

taken can remain objective. Transparency and

accountability must exist each time finance report is

compiled. In this study, finance report conveyed that

there are still some parts of control division, which

are not working properly, affecting finance report

quality. Control function effectivity is greatly

affected by the organisation structure complexity and

how it is designed. The more complex an

organisation’s structurebecomes, the tighter

supervising and control function needs to be.

Conflict may arise due to differences in

background, culture, and experience from each

member. These differences are sometimes

deliberately made as a strategy for the leader to make

some changes or happen naturally, as stated by

Hocker and Wilmot. Conflict may happen due to

people involved have different purposes or similar

Financial Budgeting, Financial Governance, and Conflict of Interest: A Critical Challenge to Good Financial Reporting

219

purpose but different way of achieving it (Wirawan,

2010: 8).

4 CONCLUSION

a. Budget

Regional government budget is tool of accountability,

management, and regional economy policy as part of

good and clean governance. Government is expected

to improve efficiency in using the budget through

good budget planning, so that society expectation can

be met by conducting some government programs.

Performance-based budget has been implemented,

yet improvement needs to be continued.

b. Administration

The activity of finance administration has the power

to control the budgeting, since there exists authorised

body to supervise as settled in regional regulation.

Administration is often considered as an important

part of comprehensive document or part of legal

proof. Administration must always be conducted

properly because work volume increases each year.

c. Conflict of Interest

Conflict of interest exists when assignments and

responsibilities of an employee have a potential to be

compromised with individual or group interest.

Conflict of interest is real and can be felt (Staff

Guidance note: 2007). There is always a possibility

for conflict of interest to rise or be perceived. Both

possess potential to be problematic, as conflict may

disrupt harmony and balance in organisation.

Objectivity can be affected if conflict arise and

conflict will definitely affect finance report quality.

These problems should be avoided, so that

independency and objectivity can be maintained.

REFERENCES

Abdullah, Syukriy (2012), Perilakopurtunistiklegislatif dan

faktor-faktor yang mempengaruhinya:

buktiempirisdaripenganggaranPemerintah Daerah di

Indonesia, Disertasi, Universitas Gajah

MadaYokyakarta (unpublished)

Abdullah, Syukriy&JhonAndra Asmara (2006),

Perilakuopurtunistiklegislatifdalampenganggarandaera

h, buktiempirisatasaplikasi agency theory di

sektorpublik, SimposiumAkuntansi 9, Padang

Biddle, C, Hilary, G and Verdi,R (2009),‘How does

financial reporting quality relate to investment

efficiency?’, Journal of Accounting and Economics, 48:

112-131

Conflict of interest staff guidance note - Approved by the

Council of Ministers, April 2007 -

https://www.gov.im/media/622901/conflictsofinterestg

uidancenot.pdf/accesJanuari 28,2018

Coser, L.A. (1956). The Functionsof Conflict. New York:

Routledge and Kogan Paul

Isti’anah, 2010. “Penerapan dan

Impelementasianggaranberbasiskinerja”,

jurnalinformasiperpajakan dan keuanganpublik, Vol.5,

No.1, EdisiJanuari

Jonas, G & Blanchet, J 2000, ‘Assessing quality of financial

reporting’, Accounting Horizons, 14(3).

Staff Guidance note:2007 - Chief Secretary’s Office - May

2007

Tang, Q Chen, H & Zhijun, L (2008), ‘Financial reporting

quality and investor protection: a global investigation’,

Working Paper

Milewska,Jozwik:2014;Usui,Alisyahbana:

2003;Posseth,Nispen:2006; Zarinah, et,al:2016;

Kleiman:2001

Milewska, Anna and Małgorzata,Jozwik (2014),

Organization and cganges of local government finance

system in view of implementation of participation

budgeting, ScientiarumPolonorum(ACTA)Oeconomia

13 (4) 2014, 125–134

Musgrave R.A. (1969) Fiscal Systems New Haven: Yale

University Press

Musgrave R.A. (1974) Expenditure Policy for

Development in D.T. Geithman (ed) Fiscal Policy for

Industrialisation and Development in Latin America,

University of Florida Press, Gainville

Mafunisa MJ (2015), Conflict of intersest ethical dilema in

politicand administration. Academic Research

International Vol. 6(2) March 2015

Olurankinse, F, 2010, Inter Local Government Capital

Budget Execution Comparism, American Journal of

Economics and Business Administration3 (3): 506-510,

2011, ISSN 1945-5488, © 2011 Science Publications.

Omisore,Bernard Oladasu and Abiodun,AshimiRashidat

(2014), Organizational conflicts causes,effect and

remendies, International Journal of Academic in

Economics and Management Sciences, Vol.3 No.

Posseth, Johan J.A and Frans.K.M.vanNispen (2006),

Erasmus University- Performance Budgeting in The

Netherlands: From Policy Budget to Accounting for

Policy, A performing Public Sector, Lauven, June, 1-3,

2006.

Usui,Norio and Armida,Alisyahbana (2003), Local

development planning and budgeting in

decentralization Indonesia: update, International

symposium on Indonesia’s decentralization policy,

September 4-5, Jakarta, Indonesia.

Ushie, E. M., Igbaji, P. M., Agba, A.M. Ogaboh (2015),

Conflicts Management in the Administration of Local

Government Councils in Cross River State, Nigeria,

International ISSN: 2223-9944, e ISSN: 2223-9553

www.savap.org.pk 428 www.journals.savap.org.pk

EBIC 2019 - Economics and Business International Conference 2019

220