The Effect of Investment, Financing, Dividend Decisions, Firm

Growth, and Agency Costs on Firm Value

R. Meutia

1

, Erlina

2

, R. Bukit

2

, and K. A. Fachrudin

2

1

Student of Accounting Doctoral Program Universitas Sumatera Utara

2

Lecturers at Universitas Sumatera Utara

Keywords: Investment Decision, Financing Decision, Dividend Decision, Firm Growth, Agency Costs, Firm Value.

Abstract: The main objective achieved through financial management is to increase the firm value in a sustainable

manner. Several factors that are considered to give effect on the achievement of value including investment

decisions, financing decisions, dividend decisions, firm growth, and agency costs. This study empirically

analyzes the effects of these factors on the firm value. 108 manufacturing companies listing at IDX were

selected purposively as research objects periode 2008-2017. Secondary data in the form of financial

statements were analyzed using multiple regression analysis. The research findings prove that the five

independent factors analyzed have a positive and significant effect on firm value. Furthermore, dividend

decisions are a factor that has the greatest influence on the value compared to other factors. The findings state

that the achievement of higher firm value is relatively more determined by how the management makes

policies related to composition between the portion of profit that is distributed as dividends to shareholders to

the portion of profits reinvested or kept as a reserve in the firm as retained earning.

1 INTRODUCTION

The firm value illustrates the level of public trust in a

company based on its achievements in contributing to

society and other stakeholders (Pandey, 2014:

Syardina et al., 2015). High corporate value also

shows the higher level of prosperity felt by the

company's shareholders, so that achieving high

corporate values is a priority for them.

(Hermunimgsih,2013:Arfan& Rozifar,2013)

This study focuses on manufacturing sector

companies listed in the Indonesia Stock Exchange.

The main phenomenon is because the manufacturing

industry sector is the sector that contributes most to

Indonesia's Gross Domestic Product (GDP)

compared to several other sectors. The phenomenon

related to the large contribution of the manufacturing

sector to national economic growth is also indicated

by the results of the BAPPENAS study, which was

quoted by the April 17, 2018 edition of SindoNews

media that in 2018 Indonesia's economic growth has

the potential to increase by only 5.5% (Endarwati,

2018). Based on the results of the study, as stated by

the Minister of National Development Planning /

Head of the National Development Planning Agency

(BAPPENAS) Bambang Brodjonegoro in Jakarta

dated April 17, 2018, Indonesia's economic growth of

only 5.5% was due to the lack of a breakthrough in

the manufacturing sector the sector has not shown its

role to bring the Indonesian economy even higher

(Endarwati, 2018).

Some of the variables analyzed in this study relate

to investment decisions (investment dicision),

funding decisions (financing decision), dividend

decisions (dividend disicion), company growth (firm

growth) and agency costs (agency cost) as variables

that are considered to affect firm value . Some

theoretical frameworks used in this study include

pecking order theory, which explains that funding is

based on the order of funding preferences that have

the smallest risk, namely retained earnings, debt and

equity issuance (Myers, 1984). This theory also states

that companies tend to be ekternanl financing (Atiyet,

2012). Regarding dividends in Bird in the Hand

Theory, investors want high dividend payments,

because dividends are considered to have more

certain opportunities and smaller risks compared to

those seeking capital gains. Through this thought,

dividend payments are considered to indicate that

management's ability to manage dividend decisions

well can be a positive signal for the high quality of

the company to experience sustainability, as well as

204

Meutia, R., Erlina, ., Bukit, R. and Fachrudin, K.

The Effect of Investment, Financing, Dividend Decisions, Firm Growth, and Agency Costs on Firm Value.

DOI: 10.5220/0009201502040208

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 204-208

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

for investors to reinvest or for the community or other

stakeholders to be willing to invest in in the company

(Bhattacharya, 1979; Black, 1976; Prasentyana,

2014; Connelly et al., 2011; Fenandar & Raharja,

2012). Another theory related to the problem of this

research is agency theory, how individuals or groups

are involved in managing an organization behave in

achieving goals (maximizing values) intersect with

interests that give rise to organizational conflicts

(Abdullah et al., 2012; Bosse & Phillips, 2016).

Agency costs can be a negative signal for potential

conflicts that occur within the company, where the

greater the value of agency costs can indicate the

greater the likelihood of a conflict between the owner

/ shareholder, management and / or creditors within

the company. . If the potential for conflict within the

company is assessed to be relatively large, it can

disrupt or even threaten the smoothness or continuity

of the company's business activities, so that it can

reduce corporate value in the eyes of investors

(Lachbeb & Slim, 2017; Muntahanah, 2012; Manalu

& Natalia, 2015).

2 PREVIOUS STUDY AND

HYPOTHESES

Some of the results of previous studies found that

investment decisions have a positive and significant

effect on firm value (Gustiandika & Hadiprayitno,

2014; Fernandar & Raharja, 2012; Hasnawati, 2005

and Rizqia et al., 2013). Funding decisions have a

positive and significant effect on firm value

(Hermaningsih, 2011; Gustiandika & Hadiprayitno,

2014; Rizqia et al., 2013 and Dewi et.al., 2014).

Decision on dividends has a positive and significant

effect on firm value (Fernandar & Raharja, 2012;

Rizqia et al., 2013; and Sofyaningsih & Hardiningsih,

2011). The company's growth has a positive and

significant effect on firm value (Syardina et al., 2015;

Dewi et al., 2014; Hermaningsih, 2011 and Paminto

et.al., 2016). Agency costs have a negative and

significant effect on firm value (Fauver & Naranjo,

2010; Layyinaturrobaniyah et al., 2014; Abdullah, et

al., 2012 and Xiao & Zhao, 2014)

Based on the results of previous studies, in this

study it was hypothesized that investment decisions,

funding decisions and dividend decisions and

company growth had a positive and significant effect

on firm value while agency costs were hypothesized

to have a negative and significant effect on firm

value.

3 METODOLOGY

This explanatory research analyzes the influence of

investment decisions, funding decisions, dividend

decisions, and company growth and agency costs that

have an impact on firm value. The object is

manufacturing companies that continue to be listed on

the Indonesia Stock Exchange (IDX) for the period

2008-2017. A total of 108 companies were selected

using a purposive sampling technique (Wilson, 2010;

Sekaran & Bougie, 2016). The basis of selection uses

criteria, namely (a) always listed on the IDX from

2008 to the present, (b) Companies that carry out

relisting during the study period.

Secondary data as the main data of the study were

obtained from the financial statements of each sample

company, using documentation data (Sugiono, 2014;

Sekaran & Bougie, 2016). Secondary data is obtained

from the IDX web, namely www.idx.co.id.

Investment decisions are measured using the

Capital Addition to Asset Book Value Ratio (CAP /

BVA) ratio. The CAP / BVA ratio shows an

additional flow of productive assets and at the same

time shows the potential for growth of the company

(Kallapur & Trombley, 1999). Funding decisions are

proxied using Debt to Equity Ratio (DER), which is a

ratio that shows a balance or comparison of the

proportion of total debt to total equity or own capital

owned or managed by the company (Fachrudin, 2011;

Dewi et al., 2014; Syardiana et al. , 2015). Decisions

Dividends are measured using the Dividend Payout

Ratio (DPR), namely the ratio or ratio between the

value of dividends distributed to shareholders and the

value of net income per share. (Fenandar & Raharja,

2012; Rizqia et al., 2013; Sofyaningsih &

Hardiningsih, 2011). The company's growth in this

study was measured using Growth in Total Assets

which showed the realization of changes in total

assets owned this year compared to the total assets

held in the previous year (Syardiana et al., 2015;

Dewi at al., 2014; Paminto et al., 2016; Safrida,

2008). Agency Costs give rise to expenditures that are

actually not necessary for the owner of the company

or by management, or called free cash flows. Thus,

FCF is considered suitable to be used as a proxy for

agency costs or as a measure of the degree of

manipulation carried out by management (Lachheb &

Slim, 2017). FCF is more cash flow that can be used

to be reinvested or can be distributed as dividends to

shareholders. Apart from being a measure of the

degree of manipulation carried out by management,

FCF also illustrates the growth of corporate cash

creation in the future (Arieska & Gunawan, 2011).

The value of the company in this study was measured

The Effect of Investment, Financing, Dividend Decisions, Firm Growth, and Agency Costs on Firm Value

205

using the Tobin’s Q ratio, Tobin’s Q ratio is a ratio

that shows companies have investment opportunities

(Skinner, 1993).

Data were analyzed using multiple regression

with the following equations:

Y=b0 + b1CAPBVA + b2DER+ b3DPR +

b4GTA + b5FCF+ e

Where investment decisions are in the form of

CAP / BVA, funding decisions in the form of DER,

dividend decisions in the form of DPR, company

growth in the form of GTA and agency costs in the

form of FCF as well as business value in the form of

Tobin’s Q.

Hypothesis testing is done to determine the

influence of the five variables on the value of the

company. The results obtained are said to be

significant if the value of sig.t or sig F is smaller than

0.05. If the results show a significant effect, it means

that the five variables that are measured have a

significant effect on firm value.

4 RESULTS

Tests related to the influence of investment decisions,

funding decisions, dividend decisions and company

growth as well as agency costs on firm value are

carried out through multiple regeresi using SPSS for

windows version 20. The test results are summarized

in Table 1.

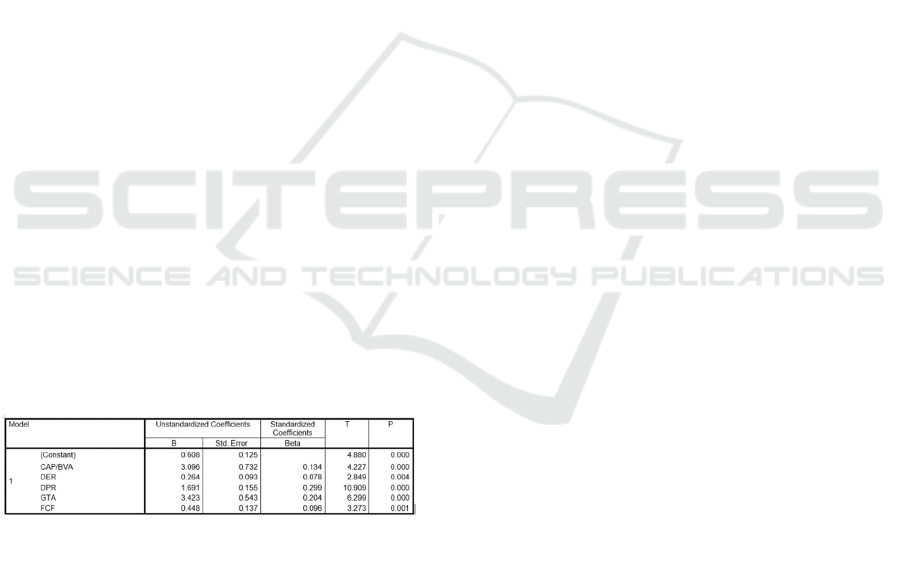

Table 1 Regression Coefficient Test Results Against

Company Values

N

ote: Dependent Variable: Tobin' s Q; R = 0.483; R2 = 0.234;

R2Adj = 0.230.

The highest value coefficient of 3.423 is the large

influence of Corporate Growth (GTA) on Corporate

Value (Tobin’s Q). Meanwhile, the other four lines

have regression coefficients that are of lower value to

Company Value, namely Investment Decisions (CAP

/ BVA = 3.096), Funding Decisions (DER = 0.264),

Decision on Dividends (DPR = 1.691), and Agency

Costs (FCF = 0.448). All regression coefficients show

significant test results (p <0.05), this means that

investment decisions, funding decisions, dividend

decisions, company growth and agency costs have a

positive and significant effect on firm value which

means that the four hypothetical researches are

accepted. Only the final hypothesis is related to the

agency cost of the hypothesis is not acceptable. It

turns out that agency costs actually have a positive

and significant effect on company value (Lacheb,

Slim 2017; Wardani, siregar 2009) which contradicts

the hypothesis proposed. They found that agency

costs were expenses related to oversight of

manipulative actions that might be carried out by

management in financial management. Thus, the

higher value of agency costs shows the commitment

of the company to minimize the manipulation so that

it is expected to create a conducive atmosphere in

business management and in the future it will be able

to generate greater profits, which means there is a

greater chance of dividend distribution for

shareholders (or, there is an increase in wealth or

wealth from the company's shareholders. Another

argument that the FCF (free cash flow) ratio as a

proxy for Agency Costs illustrates the growth rate of

future cash creation. The increase in FCF value as a

representative of Agency Costs shows the growth

prospects of creation cash that can be achieved by the

company in the future.Thus, if the Agency Costs

increase, it means there is an increase in the

company's cash flow value compared to the previous

period, and this condition shows the greater business

profits that can be get company. If the achievement of

the operating profit increases, it increases the chances

of distributing a larger amount of dividends to the

owner / shareholder of the company. This encourages

the creation of positive market sentiment because the

company concerned has good performance and has

high growth and sustainability potential.

The R

2

(R-Squared) value of 0.234 states that the

contribution of the Investment Decision variables,

Funding Decisions, Dividend Decisions, Company

Growth and Agency Costs contributed 23.4% in

explaining the diversity of Corporate Values. While

the remaining 76.6% states that the diversity of

Corporate Values is influenced by other variables not

included in this research model.

5 SUMMARY

Based on the results of the analysis, it can be

concluded that investment decisions, funding

decisions, dividend decisions, company growth and

agency costs have a positive and significant effect on

the value of IDX manufacturing sector companies.

EBIC 2019 - Economics and Business International Conference 2019

206

This study is considered showing some

weaknesses that require further revision efforts from

the next researchers. The first weakness is that this

study only uses independent variables that are internal

in the company, thus the next researchers can expand

these results by involving external factors that are

thought to influence company values such as

inflation, exchange rates or domestic exchange rates

or interest rates so that a better understanding of the

behavior of company values is obtained. Another

disadvantage is that this study only focuses on

manufacturing companies, the next researcher is

advised to expand the sample to other industry

groups.

REFERENCES

I.M. Pandey, (2014), Financial Management, 10

th

Edition,Vikas Publishing House.

Gita Syardiana, Ahmad Rodoni, Zuwesty Eka Putri, (2015),

Pengaruh Investment Opportunity Set, Struktur Modal,

Pertumbuhan Perusahaan, dan Return On Asset

terhadapNilai Perusahaan,Akuntabilitas.

Sri Hermuningsih, (2013), Profitability, Growth

Opportunity, Capital Structure and the Firm

Value,Bulletin of Monetary, Economics and Banking.

Muhammad Arfan, Heny Rofizar, (2013), Nilai Perusahaan

dalam kaitannyadenganArusKasBebasdanPertumbuhan

Perusahaan (Studipada Perusahaan Manufaktur yang

Terdaftar di Bursa Efek Indonesia),Jurnal

Telaah&RisetAkuntansi.

OktianiEndarwati, (2018), Dorong Pertumbuhan Ekonomi,

RI ButuhTerobosan di Sektor Manufaktur.

www.sindonews.com, edisi 17 April (2018).

IrwanDjaja, (2017), All About Corporate Valuation:

Memetakan, Menciptakan, Mengukur, dan

Merealisasikan Nilai Perusahaan,Elex Media

Komputindo.

Muhammad AzeemQureshi, (2006),System Dynamics

Modelling of Firm Value, Journal of Modelling in

Management.

M. Mougoue, T.K. Mukherjee, (1994), An Investigation Into

Causality Among Firms’ Dividend, Invesment, &

Financing Decision, Journal of Financial Research.

Abdul Halim, (2015), Manajemen Keuangan Bisnis:

Konsepdan Aplikasinya, Edisi Pertama, Mitra Wacana

Media.

Stewart C. Myers, (1984), The Capital Structure Puzzle,The

Journal of Finance.

Ben Amor Atiyet, (2012), The Pecking Order Theory and

the Static Trade Off Theory: Comparison of the

Alternative Explanatory Power in French Firms,

Journal of Business Studies Quarterly.

Sri Dwi Ari Ambarwati, Khoirul Hikmah, (2014),

Hubungan Struktur Kepemilikan, Tingkat Utang,

Dividen, dan Nilai Perusahaan dalam Mengurangi

Konflik Keagenan di Indonesia, Jurnal Keuangan dan

Perbankan.

Linda Purnamasari, Sri Lestari Kurniawati, MellizaSilvi,

(2009), Interdependensi antara Keputusan Investasi,

Keputusan Pendanaan dan Keputusan Dividen, Jurnal

Keuangan dan Perbankan.

Norani Setyo Fitri, (2014), Interdependensi antara

Kebijakan Dividen, Kebijakan Hutang, dan Kebijakan

Investasi padam Saham LQ-45, Artikel Ilmiah, Sekolah

Tinggi Ilmu Ekonomi Perbanas Surabaya.

Yusmar Haritsa, (2013), Interdependensi antara Kebijakan

Dividen, Kebijakan Financial Leverage, dan Kebijakan

Investasi pada Perusahaan Manufaktur di Indonesia,

Artike lIlmiah, Sekolah Tinggi Ilmu Ekonomi Perbanas

Surabaya.

Siwi Puspa Kaweny, (2007), Studi Keterkait anantara

Dividend Payout Ratio, Financial Leverage dan

Investasi dalam PengujianHipotesis Pecking Order

(Studi Kasus: Perusahaan Manufaktur yang Terdaftar

dan Listed di Bursa Efek Jakarta Periode 2004-

2005),Tesis, Program Pasca Sarjana Program Studi

Magister Manajemen Universitas Diponegoro.

A. JatmikoWibowo, F. Indri Erkaningrum, (2002),Studi

Keterkaitan antara Dividend Payout Ratio, Financial

Leverage dan Investasi dalam Pengujian Hipotesis

Pecking Order, Jurnal Ekonomi dan Bisnis Indonesia..

TeguhPrasetyo, (2013), Dividen, Hutang, danKepemilikan

Institusional di Pasar Modal Indonesia:

PengujianTeori Keagenan, Jurnal Dinamika

Manajemen.

Jonathan Wilson, (2010), Essentials of Business Research: A

Guide to Doing Your Research Project

, Sage

Publications, Ltd.

Uma Sekaran, Roger Bougie, (2016), Research Methods for

Business: A Skill Building Approach, 7

th

Edition, John

Wiley & Sons Inc.

Sugiyono, (2014), Metode Penelitian Bisnis, Alfabeta.

Sanjay Kallapur. Mark A. Trombley (1999), The

Assosiation Betwen Investment Opportunity Set

Proxies and Realized Growth, Journal of Business

Finance and Accounting.

Dwita Ayu Rizqia, Siti Aisjah, Sumiati, (2013), Effect of

Managerial Ownership, Financial Leverage,

Profitability, Firm Size, and Investment Opportunity on

Dividend Policy and Firm Value, Research Journal of

Finance and Accounting.

Khaira Amalia Fachrudin, (2011), Analisis Pengaruh

Struktur Modal, Ukuran Perusahaan, dan Agency Cost

Terhadap Kinerja Perusahaan, Jurnal Akuntansi dan

Keuangan.

Putu Yunita Saputri Dewi, Gede Adi Yuniarta, Ananta

Wikrama Tungga Atmadja, (2014),Pengaruh Struktur

Modal, Pertumbuhan Perusahaan dan Profitabilitas

terhadap Nilai Perusahaan pada Perusahaan LQ 45 di

BEI Periode (2008)-(2012),Jurnal Ilmiah Mahasiswa

Akuntansi Undiksha.

Gany Ibrahim Fenandar, Surya Raharja, (2012),Pengaruh

Keputusan Investasi, Keputusan Pendanaan, dan

Kebijakan Dividen terhadap Nilai Perusahaan,

Diponegoro Journal of Accounting.

The Effect of Investment, Financing, Dividend Decisions, Firm Growth, and Agency Costs on Firm Value

207

Sri Sofyaningsih, Pancawati Hardiningsih, (2011),Struktur

Kepemilikan, Kebijakan Dividen, Kebijakan Utang dan

Nilai Perusahaan, Dinamika Keuangandan Perbankan.

Imam Ghozali, (2013), Aplikasi Analisis Multivariate

dengan Progam IBM SPSS 21, Badan Penerbit

Universitas Diponegoro.

Fahmi, I. 2015. Analisis Laporan Keuangan. Bandung:

Alfabeta.

Irawati, S. 2006. Manajemen Keuangan. Bandung: PT.

Pusaka.

Ansori, M. dan Denica, H.N. 2010. Pengaruh Keputusan

Investasi, Keputusan Pendanaan, dan Kebijakan

Dividen terhadap Nilai Perusahaan pada Perusahaan

yang Tergabung dalam Jakarta Islamic Index Studi

pada Bursa Efek Indonesia (BEI). Analisis Manajemen.

4(2): 153-175.

Titman, S., Wei, K.C.J. dan Wei, J. 2004. Capital

Investments and Stock Returns. TheJournal of

Financial and Quantitative Analysis. 39(4): 677-700.

Ratnawati, T. 2007. Pengaruh Langsung dan Tidak Langsung

Faktor Ekstern, Kesempatan Investasi dan Pertumbuhan

Assets terhadap Keputusan Pendanaan Perusahaan yang

Terdaftar pada Bursa Efek Jakarta (Studi pada Industri

Manufaktur Masa Sebelum Krisis dan Saat Krisis).

Jurnal Akuntansi dan Keuangan. 9(2): 65-75.

Brigham, E.F. dan Houston, J.F. 2014.Fundamentals of

Financial Management. Eight Edition. USA: South-

Western College Pub.

Karadeniz, E., Kandir, S.Y., Iskenderoğlu, Ö., dan Onal, Y.B.

2011. Firm Size and Capital Structure Decisions:

Evidence from Turkish Lodging Companies.

International Journal of Economics and Financial Issues.

1(1): 1-11.

Keown, A.J., Scott, D.F. William, M.J. dan Petty, Y.R.

2005.Financial Management.10

th

Edition. New Jersey:

Prentice-Hall Inc.

Paramasivan, C. dan Subramanian, T. 2009. Financial

Management. New Delhi, India: New Age International

(P) Ltd.

Bhattacharya, S. 1979. Imperfect Information, Dividend

Policy, and “The Bird in the Hand” Fallacy.The Bell

Journal of Economics. 10(1): 259-270.

Black, F. 1996. The Dividend Puzzle.The Journal of

Portfolio Management. 2(2): 5-8.

Prasetyanta, A. 2014.Pengaruh Perubahan Dividen terhadap

Profitabilitas Perusahaan pada Masa yang Akan Datang

(Future Profitability).Jurnal Ekonomi dan Bisnis. 17(2):

129-148.

Connelly, B.L., Certo, S.T., Ireland, R.D. dan Reutzel, C.R.

2011. Signaling Theory: A Review and

Assessment.Journal of Management. 37(1): 39-67.

EBIC 2019 - Economics and Business International Conference 2019

208