The Impact of Service Quality to Customer Satisfaction at PT Bank

Sumut Medan

Elisabet Novani Ambarita, A. Rahim Matondang, Amlys Syahputra Silalahi

Faculty of Magister Management, Universitas Sumatera Utara

Keywords: Bank Sumut, Service Quality, Customer Satisfaction.

Abstract: The presence of banking today is very important in supporting various financial activities, especially in the

financial system and payments made by finance. Banking, competition in the banking sector is very tight,

first with a large number of banks which are the main challenges. The customer is the core of business

competition in the service sector. In an effort to create retribution, satisfaction is needed in every service

provided by financial parties. Bank Sumut as the holder of the Regional Bank Champion in North Sumatra

in 2014 always provides the best service and strives to improve service in building satisfaction. This study

suggests to improve the elements of quality service in shaping the Bank Sumut’s customer satisfaction. A

number of 100 regular customers who have experienced 10 years services at Bank Sumut participated in this

study. Data on perceptions of service quality and satisfaction were collected through questionnaire and

interview methods. The influence between variables was evaluated using linear multiple regression. The

results of this study prove the fact of the five elements of service quality, two elements of positive and

significant influence, namely reliability and responsiveness of services. In addition, responsiveness has a

very dominant interest in service quality towards satisfaction. Therefore, in an effort to improve satisfaction

through service improvements, it is very important to provide services that are responsive to challenges and

convenience and provide the best solutions quickly for those customers. Bank Sumut employees must be

able to provide benefits as needed. Inappropriate empathy can actually disrupt customer satisfaction.

1 INTRODUCTION

Banking is an important part of the financial and

economic system that is inseparable from

increasingly competitive business competition. This

condition encourages companies to make various

efforts to continue to exist and survive. Therefore,

the policy in determining a tight competitive strategy

greatly determines the success of the company.

Companies that want to develop and gain

competitive advantage must be able to provide

products in the form of quality goods or services at

low prices, fast delivery, and provide good service to

their customers so that customer satisfaction will be

optimized.

Customer satisfaction is one of the important

elements that greatly determines the success of each

company in facing increasingly competitive

domestic and global competition. Customer

satisfaction is a post-purchase response where

alternatives are chosen at least equal to or exceed the

customer's expectations, while dissatisfaction arises

if the results do not meet customer expectations. In

other words, customer satisfaction is a level of state

of one's feelings which is the result of a comparison

between the performance / product end result in

relation to customer expectations (Kotler, 2011).

Satisfaction can be interpreted as an effort to fulfill

something or make something adequate. Customer

satisfaction is the result of customer assessment of

the quality of products offered by the company.

According to Mowen and Minor (2010) customer

satisfaction is the overall attitude shown by

consumers of goods and services after they obtain

and use them. Customer satisfaction is a level where

the needs, desires, and expectations of customers

will be fulfilled or exceeded through a transaction

that will result in a repeat purchase.

Customers in the banking world are increasingly

selective in choosing banks to deposit their funds in

order to avoid the risk of losing funds due to the

poor performance of a bank. Therefore, customer

satisfaction in the banking world is becoming

increasingly important. Moreover, the banking

Ambarita, E., Matondang, A. and Silalahi, A.

The Impact of Service Quality to Customer Satisfaction at PT Bank Sumut Medan.

DOI: 10.5220/0009201401970203

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 197-203

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

197

business is a service business that is based on the

principle of trust with the mainstay of the quality of

services provided so that the quality of service issues

is a very decisive factor in the success of the

banking business.

PT Bank Sumut, a regional bank with a motto to

always provide the best service continuously strives

to fulfill its promises to its customers by providing

excellent service. The best service image is expected

to be a separate promotion to build a mindset in

encouraging community decisions to be interested in

becoming prospective new customers at PT Bank

Sumut. Providing the best service is a statement of

the corporate culture that has been realized by

implementing applicable service standards

throughout the units of PT Bank Sumut. The aim is

to optimize customer satisfaction at PT Bank Sumut.

This study aims to determine the effect of

service quality on customer satisfaction at PT. Bank

Sumut Medan Main Branch, by focusing on service

quality in terms of reliability, responsiveness,

assurance, empathy, and tangibility. Customer

satisfaction is believed to be the key to the success

of business development in the banking environment

2 LITERATURE REVIEW

2.1 Customer Satisfaction

Kotler and Keller (2011) states that customer

satisfaction is the level of one's feelings after

comparing performance or the results he receives

compared to his expectations. New customers will

be satisfied if the banking service performance that

they get is the same or more than what they expect

and the feeling of customer disappointment will

arise if the performance obtained is not in

accordance with what is expected.

Customer satisfaction given by the bank will

have a very wide impact on increasing bank profits,

customers will be loyal to the bank, repeat buying

the product and promoting it to other people around

it. In order for us to know that customers are

satisfied or dissatisfied with the bank, it is necessary

to have a measurement tool to determine customer

satisfaction. In determining how much customer

satisfaction with a bank can be done in various

ways. There are 5 dimensions for measuring

customer satisfaction, namely: (1) Buy again; (2)

Saying good things about the company to others and

recommending; (3) Less attention to brands and

advertisement of competing products; (4) Buy other

products from the same company; and (5) Offering

ideas for products or services to companies.

2.2 Service Quality

Service quality as a perception of company

performance (perception of performance based)

experienced by consumers, comes from a

comparison between feelings that should be

expected to be received by consumers from

company services (expectation) with consumer

perceptions about the performance of services

obtained (perception). This means that service

quality is seen as the degree and direction of

differences between consumer perceptions and

expectations (Bauk et al., 2013).

Tjiptono and Chandra (2012) has developed a

service quality measurement tool called

SERVQUAL (Service Quality), this SERVQUAL is

a multi item scale consisting of 22 questions that can

be used to measure customer perceptions of service

quality. Further explained that service quality

includes five dimensions:

a. Tangibles, including physical facilities,

equipment, personnel and means of communication.

This is related to physical facilities, employee

appearance, equipment and technology used in

providing services. Appearance of good employees

will give a sense of respect for the customers being

served while in the equipment and technology used

in providing services will contribute to the speed and

accuracy of services.

b. Reliability, namely the ability to produce

promised service performance accurately and surely.

This means that the service must be on time and in

the same specifications, without errors, whenever

the service is given.

c. Responsiveness, namely the ability of

employees to help customers and provide responsive

services. This is reflected in the speed, accuracy of

services provided to customers, the desire of

employees to help customers and the presence of

employees at rush hour.

d. Assurance, namely ability, politeness, and the

trustworthy nature of the staff, free from danger, risk

and doubt. Regarding the ability of employees to

instill trust in customers, the feeling of security for

customers in conducting transactions, and the

knowledge and manners of employees in providing

services to consumers, knowledge, politeness and

ability of employees will lead to trust and

confidence in the company.

e. Empathy, namely ease of relationship, good

communication, personal attention and

EBIC 2019 - Economics and Business International Conference 2019

198

understanding of customer needs. This is related to

the attention or concern of employees to customers.

Employees care about the problems they face. The

company has objectivity, namely: treating all

customers equally. All customers have the right to

obtain the same ease of service without being based

on whether they have a special relationship with

employees or not

3 RESEARCH FRAMEWORK

This study consists of 5 independent variables

namely X1 (Tangibles), X2 (Reliability), X3

(Responsiveness), X4 (assurance) and X5 (empathy)

and 1 dependent variable Y (customer satisfaction)

so that the research conceptual framework can be

described as follows:

Figure1. Research Framework

4 HYPOTHESIS BUILDING

Anjalika and Priyanath (2018) conducted a study of

the Effect of Service Quality on Banking Consumer

Satisfaction where the results of the study prove that

physical evidence, reliability, responsiveness,

assurance, and empathy have a positive significant

effect on customer satisfaction. Odhiambo (2015)

conducted a research on the Effect of Service

Quality On Customer Satisfaction In Banking

Industry: A Casestudy of Kenya Commercial Bank

(KCB) where the results of the research prove that

physical evidence, reliability, responsiveness,

assurance, and empathy have a positive influence on

satisfaction consumer. Shah et al. (2015) conducted

a study of the Impact of Service Quality on

Customer Satisfaction of Banking Sector

Employees: A Study of Lahore, Punjab where the

results of the study proved that physical evidence,

reliability, responsiveness, assurance, and empathy

had a positive significant effect on customer

satisfaction. Therefore, this study formulates the

following hypothesis:

a. Tangibility has a positive and significant

effect on customer satisfaction at PT Bank

Sumut Medan

b. Reliability has a positive and significant

effect on customer satisfaction at PT Bank

Sumut Medan

c. Responsiveness has a positive and

significant effect on customer satisfaction

at PT Bank Sumut Medan

d. Assurance has a positive and significant

effect on customer satisfaction at PT Bank

Sumut Medan

e. Empathy (empathy) has a positive and

significant effect on customer satisfaction

at PT Bank Sumut Medan

5 RESEARCH METHOD

5.1 Time and Location Research

The research was conducted at PT Bank Sumut

Medan. The time of the study was carried out from

June to July 2018.

5.2 Research Participants

The total population of Bank Sumut Medan

customers at the time of the study period which has

saved more than 10 years as a customer is a total of

1475 Customers. Sampling by Slovin method at

10% error rate is as many as 94 customers. To avoid

data errors, the number of respondents in this study

was 100 customers. Respondents were taken by

random sampling based on available customer data.

The willingness of customers to participate in this

research was requested previously.

5.3 Data Collecting Method

A self-administered questionnaires based on

research framework was employed in this study. The

questionnaires were through validity and reliability

test to ensure our instruments. Instrument validity

measurement we used in this study was using

pearson correlation and reliability measurement was

using Cronbach’s alpha. Our pre-test using 30

sample has proved that the instrument were valid

and reliable.

5.4 Data Processing Method

We employed multiple-linear regression to

determine the cause and effect by determining

The Impact of Service Quality to Customer Satisfaction at PT Bank Sumut Medan

199

customer satisfaction as the dependent variable (Y)

and physical evidence, reliability, responsiveness,

assurance and empathy as independent variables.

The model we used in this study was formulated as

follow:

Y =

o

+

1

X

1

+

2

X

2

+

3

X

3

+

4

X

4

+

5

X

5

+ e

Notes:

Y = Customer Loyalty

0

= Constant Value

1

-

5

= Regression Variable

X1 = Tangibility

X2 = Reliability

X3 = Responsiveness

X4 = Assurance

X5 = Empathy

e = error

6 RESULT

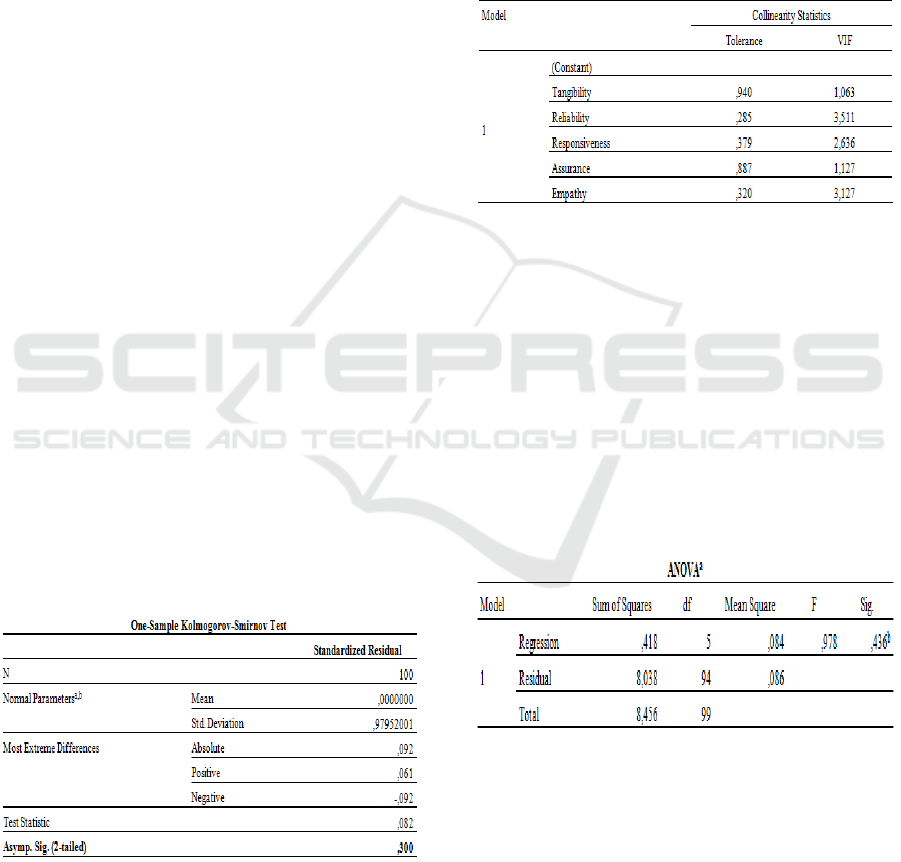

The normality test in this regression model is done

using Kolmogorov-Smirnov statistics according to

the normality test criteria described in the previous

chapter. The results of formal normality testing on

the research model are summarized in Table 1:

Table 1: Kolmogorov-Smirnov Test Regression Model

a. Test distribution is Normal.

Table 1 provides information that the significance

value of normality testing using the Kolmogorv-

Sminrnov test is 0.300. The significance value of the

Kolmogorov-Smirnov test 0.05 indicates that the

distribution of residual research data is normally

distributed. Thus, based on normality testing of data,

the assumption of normality of data has been

fulfilled. The residual data of the model is normally

distributed. This indicates that the regression model

from the results of this study can be generalized well

in the population with residual distribution (error

estimation) that follows the normal distribution.

Table 2: Collinearity Statistics Regression Model

a. Dependent Variable: Customer Satisfaction

Table 2 provide information that there is no

multicollinearity problem between independent

research variables with VIF values <5.0 on each

independent variable. Thus, there is no strong link

between each element of service quality, be it

physical evidence, reliability, responsiveness,

assurance, and empathic attitudes that are able to

bias the regression model in predicting the level of

customer satisfaction of Bank Sumut. Thus, the

research regression model is free from multi-

collinearity problems.

Table 3: Glesjer-Test

a. Dependent Variable: ABS_RES

b. Predictors: (Constant), Empathy, Assurance, Tangibility,

Responsiveness, Reliability

Table 3 provide information which indicates that

there are no heterocedasticity problems with Sig >

0.05. Thus, it can be concluded that the research data

is homocedastic.

The classical assumption of the regression model

has been fulfilled with no obstacles. This indicates

that the prediction model of the regression model

meets the BLUE criteria (best, linear, unbiased

EBIC 2019 - Economics and Business International Conference 2019

200

estimate). The model prediction is close to the actual

state. The regression results from the research model

were evaluated by looking at the magnitude of the

influence of each independent variable on the bound

through the regression coefficient. The regression

coefficient of the research model is summarized in

Table 4.

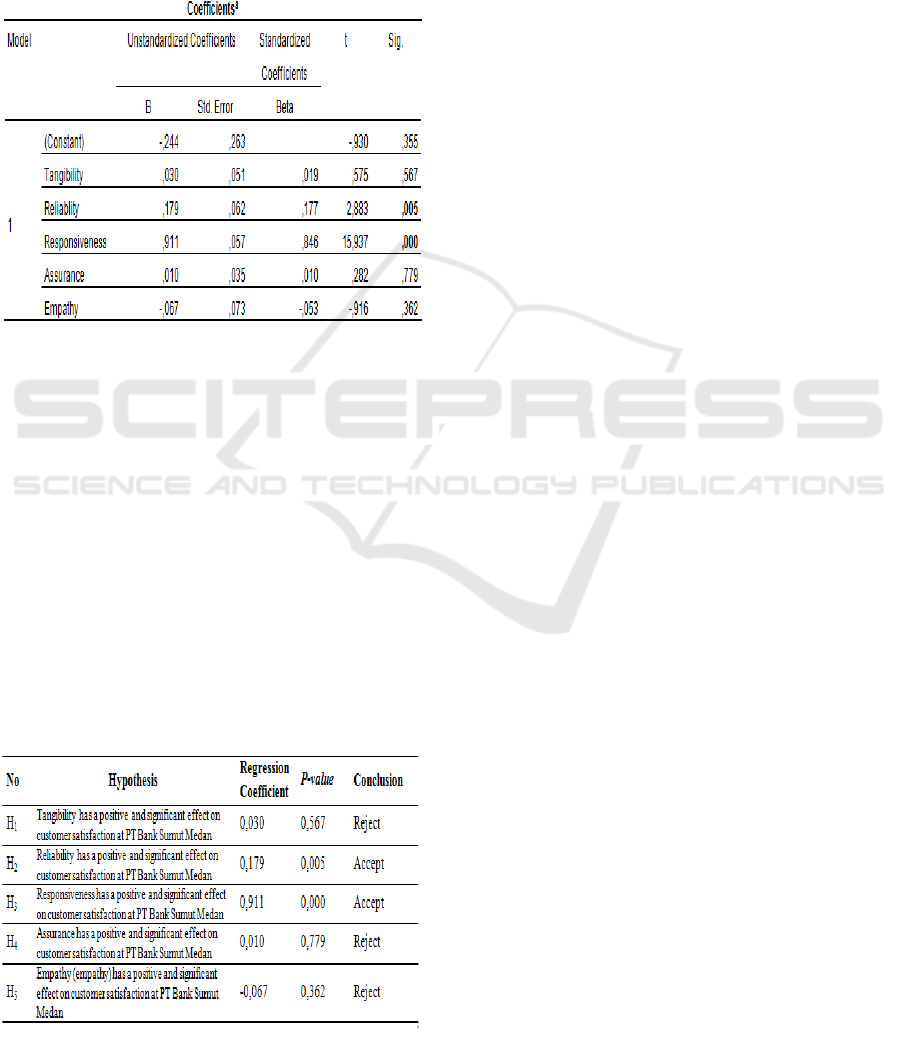

Table 4: Regression Analysis

a. Dependent Variable: Customer Satisfaction

Table 4 summarizes the regression coefficients

for the research model. Based on Table 4, regression

equation models to predict customer satisfaction are

formulated as:

Y=-0,244 + 0,03X

1

+ 0,179X

2

+ 0,911X

3

+ 0,01 X

4

- 0,067 X

5

7 DISCUSSION

The hypothesis in this study will be tested using the

t-test significance test. Hypothesis testing is

summarized in Table 5.

Table 5: Hypothesis Testing

The results of this study are in line with the

theoretical study which states that there is a positive

effect of physical evidence on customer satisfaction.

However, statistically this effect did not prove

significant, unlike the findings of Istiyanto and Tyra

(2011) before. In this study the context that occurs is

banking services where the interaction between

frontliners and customers is a moment of truth from

the provision of services provided. Physical

evidence serves as a supporter in providing good

service, but physical evidence only contributes little

influence in the context of banking services. Today

good physical evidence has been provided by each

of the banking business operators so that the

influence of physical evidence tends to be indifferent

in the minds of customers. Even good physical

evidence will not affect satisfaction if the customer

does not directly feel the benefits.

Research conducted takes the context of service

to Bank Sumut customers. In service to customers, it

is important for banks to build services based on

service accuracy, handling customer complaints, and

service quality. Customers as customers need

accuracy in the services they receive. In the service

encounter that occurs, the customer may have other

complaints about the services provided. Bank

Sumut's ability to resolve these complaints is key in

building service reliability. Besides that, it is also

necessary to pay attention to the quality of services

where services are provided appropriately and

carefully. The suitability of this service will realize

the fulfillment of customer expectations of Bank

Sumut services and deliver customer satisfaction.

Employees who are able to demonstrate their

capacity by carrying out their responsibilities

carefully and instilling a strong sense of belonging

to their customers will make employees satisfied

with the services provided.

This research takes the context of banking

services. In banking services, employees must be

able to provide customer needs according to service

and resolve complaints that may occur from

customers. The results of this study confirm the

literature study which states that responsiveness has

a positive and significant effect on customer

satisfaction. The results of this study indicate that

from the aspect of service quality, this

responsiveness variable is a variable that has a

dominant influence. The formation of customer

satisfaction is strongly influenced by the

responsiveness of services provided to customers.

Customers who are given fast service, able to

provide the right solutions to customer needs and

complaints will encourage customer satisfaction.

The Impact of Service Quality to Customer Satisfaction at PT Bank Sumut Medan

201

The faster the customer's expectations of the services

provided are met, the more satisfied the customer is.

This element is the dominant variable in shaping

customer satisfaction. Employees who are able to

respond quickly to customer needs and provide them

in good service will encourage customer satisfaction.

The results of the study confirm that there is only

a small positive effect of the guarantee of Bank

Sumut's services on customer satisfaction. This

influence is not significant in building customer

satisfaction. This is because Bank Sumut itself is an

organization that is trusted by the public and

guaranteed by the state. Standardization of services

makes the products provided can always be

accounted for and provide guarantees to customers.

This encourages the small role of guarantees in

building customer satisfaction. Customers feel

secure about the services provided so that this

guarantee does not have a significant influence in

building customer satisfaction.

The results of this study contrast with theoretical

studies in general. An empathetic attitude will

generally encourage customer satisfaction because

customers feel more valued. In the context of this

study, it was identified that an excessive attitude of

empathy would disturb customers' comfort.

Erroneous identification of needs and character of

customers will have a negative impact on giving

inappropriate empathy. Therefore, in this study it is

recommended to give empathy carefully. Customers

have various characters where each individual is

unique. Thus, giving empathy will not always have a

negative influence, but also does not always provide

positive influence. This condition encourages

insignificant results from this study. In banking

services that have high work intensity, excessive

empathy will make customers feel hampered and

seem less independent. This indicates that empathy

must be applied carefully, especially for customers

of the Bank Sumut Medan.

8 MANAGERIAL IMPLICATION

The results of this study show empirically that there

are positive and significant influences on aspects of

service reliability and responsiveness to the

satisfaction of Sumut Bank customers. This indicates

that efforts to improve service quality in enhancing

customer satisfaction should be focused on

improving service reliability and employee

responsiveness in providing services to these

customers. Every employee must be given

debriefing to be able to accurately service customer

requests and complaints related to his Bank Sumut

products and services. Employees must also be able

to adjust the time of service or improve the queue

system in the event of a long queue. In the case of

difficult work colleagues, it is better for employees

to work together to support optimal services. In

addition, employees must be equipped with the

ability to identify customer problems that appear

confused or have problems in utilizing the Bank

Sumut services. Employees must at least have a

simple record of common problems faced by

customers and solutions that are effective in solving

these problems. This behavior will encourage

responsiveness from employees in providing Bank

Sumut services. Optimal implementation of both

aspects of the quality of this service will be very

important in creating customer satisfaction.

Physical evidence and service guarantees have a

positive but not significant effect on the satisfaction

of Bank Sumut customers. Service quality can be

improved by applying physical evidence and service

guarantees, but has little effect on current customer

satisfaction. The customer's assessment of the

physical evidence of Bank Sumut's services is

perceived to be the lowest is the problem of data

security systems from the Bank Sumut. This

indicates the importance of delivering and proving

the security of Bank Sumut's data system to

customers. The introduction of data security systems

and back-up data from Bank Sumut needs to be

conveyed to the public / customers to improve the

perception of good service from the Bank Sumut. In

addition, customers also consider it important to

provide self-identification or introduce themselves

when providing services to customers. Regarding

service guarantees, Sumut Bank customers perceive

that private documents submitted to Bank Sumut do

not yet fully secure their security. Although on

average (the majority) feel secure, there are still

those who doubt the security. In this case, Bank

Sumut needs to emphasize and account for the

security of the customer's personal documents. In

addition, Bank Sumut needs to improve its services

by providing timely settlement of customer affairs.

For example, the completion of an ATM card has

only been promised to take one month, so when that

time arrives, the new ATM card service must also be

provided. This is one of the keys to improving

customer service quality.

In empathy in providing Bank Sumut services,

this must be implemented carefully. An empathetic

attitude can be a double-edged sword which can lead

to dissatisfaction or a decrease in customer

satisfaction if it is not implemented carefully. Bank

EBIC 2019 - Economics and Business International Conference 2019

202

Sumut employees must be able to empathize with

customers, but the empathy attitude must be adjusted

before being delivered to the customer. This should

be avoided when the customer feels uncomfortable

with the employee's interference with the personal

problems of the customer. In terms of increasing

employee empathy, employees must be able to

always provide convenience in customer

transactions and provide the best solutions to

customers. However, it also needs to be understood

that employees must not interfere with customer

problems that do not seem to want to be interfered

with by employees.

9 CONCLUSION AND

RECOMMENDATION

Medan Bank Sumut needs to improve the aspects of

responsiveness and reliability of services provided to

customers. Although the current conditions have

been well assessed by customers, this can still be

further improved, especially relating to customer

complaints. Bank Sumut must be able to provide

effective and efficient services, right in meeting

customer requests and complaints, as well as being

able to handle customer queue problems. In addition,

in terms of responsiveness, the Bank Sumut must be

able to respond quickly to every problem and solve

it quickly too.

Empathy to customers must be done carefully.

Empathy must be tailored to the customer who is the

object of service. Every individual is unique which

makes giving empathy and its impact unique. For

this reason, especially in the Bank Sumut Medan this

needs to be carried out carefully. An attitude of

empathy that is not in accordance with the

customer's self can be a double-edged sword, where

empathy is actually valued as something that upsets

the customer or helps the customer depends on the

perception of the customer. Employees must be able

to see the momentum to offer convenience and offer

solutions to customers, especially in transaction

activities.

Physical evidence and guaranteed services need

to be improved but not the top priority in improving

the quality of services to customers. The most

important increase in physical evidence is the

delivery of perceptions of the security of the banking

system and the back-up of data from Bank Sumut to

customers, for example by introducing the system

used to customers. In terms of service guarantees, it

is important to be able to provide service certainty

by fulfilling the service promises of Bank Sumut, for

example the completion of card repairs that are in

accordance with information from the service side.

REFERENCES

Anjalika, W.P.W & Priyanath, H. M. S.. (2018). Effect of

Service Quality on Customer Satisfaction: An

Empirical Study of Customers who have Bank

Accounts in both Public and Private Banks in Sri

Lanka. International Journal of Marketing and

Technology. 8. 11 - 36.

Bauk, I., Kadir, A.R., dan Saleh, A. (2013). Hubungan

Karakteristik Pasien Dengan Kualitas Pelayanan :

Persepsi Pasien Pelayanan Rawat Inap RSUD Majene

Tahun 2013. Jurnal Passcasarjana Universitas

Hasanuddin

Istianto, J. H., & Tyra, M. J. (2011). Analisis pengaruh

kualitas layanan terhadap kepuasan pelanggan rumah

makan Ketty Resto. Jurnal Ekonomi dan Informasi

Akuntansi (JENIUS), 1(3): 275-293

Kotler, P., & Keller, K.L. (2011). Marketing Management,

12th Edition. Indeks, Jakarta

Mowen, J.C., & Minor, M. (2010). Perilaku Konsumen.

Fifth Edition. Edisi Bahasa Indonesia. Terjemahan

oleh Lina Salim. PT Penerbit Erlangga, Jakarta

Odhiambo, M. R. (2015). Effect of service quality on

customer satisfaction in banking industry: A case

study of Kenya Commercial Bank (KCB) (Master’s

dissertation). Nairobi, Kenya.

Shah, F., Khan, K., Imam, A., & Sadiqa, M. (2015).

Impact of Service Quality on Customer Satisfaction of

Banking Sector Employees: A Study of Lahore,

Punjab. Vidyabharati International Interdisciplinary

Research Journal. 4. 54-60.

Tjiptono, F., & Chandra, G. 2012. Service, Quality &

Satisfaction, Third Edition. Penerbit Andi,

Yogyakarta.

The Impact of Service Quality to Customer Satisfaction at PT Bank Sumut Medan

203