Shareholders, Tax Amnesty and Tax Planning for Manufacture

Industry in Indonesia

Muhammad Rifky Santoso, Azhar Maksum, Ramli, Rina Br. Bukit

Economics and Business Faculty, Universitas Sumatera Utara, Jl. Prof. T.M Hanafiah, SH, Kampus USU, Medan,

Indonesia

Keywords: Tax Planning, Shareholders, Tax Amnesty

Abstract: The company minimizes the income tax expenses by applying the tax planning strategy. On the other hand,

the government needs income taxes revenues. Therefore, the government issued a tax amnesty policy so that

income tax revenues increase and taxpayers become more compliant. It is necessary to examine whether the

tax amnesty program can meet the expectations of the government, namely the increase in income tax

revenues and taxpayers being more compliant. By taking a sample of manufacturing companies listed on the

IDX and data from 2014 to 2017, it is known that the tax amnesty program that is in effective in 2016 and

2017 can increase income tax revenue in the tax amnesty year applied but makes the taxpayers more

aggressive in doing tax planning strategy. Compared to domestic institutional shareholders, foreign

shareholders are more aggressive in doing tax planning strategy when tax amnesty is applied. If the

government's goal is only to increase income tax revenues from the rupiah amount, then the tax amnesty can

be used. The negative effect of tax amnesty is that the taxpayers are increasingly aggressive in doing tax

planning.

1 INTRODUCTION

One of a corporate’s objectives is to increase the

shareholders’ wealth. The corporate can increase the

revenues with certain expenditures or decrease

expenditures with certain revenues. One of the

expenditures can be reduced is income tax expenses.

The schema to reduce the income tax expenses is by

using tax planning strategy. One indicator to know a

corporate using tax avoidance strategy is effective tax

rate (ETR). The lower the ETR of a corporate, the

more probable the corporate applied tax planning

strategy.

Management has applied a tax planning strategy

in order to shareholders’ benefits because the strategy

can increase profit after income tax (Wahab &

Holland, 2012) and finally increase the shares’ value.

In other side, tax planning applied by a multinational

company can reduce a government’s revenues and

increase economic efficiency problems (Johansson,

Skeie, Sorbe, & Menon, 2017). In general, tax

planning can harm the state’s revenues and national’s

economy; however, tax planning is beneficial for

shareholders and management.

Board of Directors (BoD) has a power to control

and to operate a corporate after receiving mandate

from the shareholders. BoD has an authority to do or

not to do a tax planning strategy in a corporate.

Meanwhile, the BoD decisions are influenced by the

shareholders. In fact, an individual shareholder can be

a member of the BoD and an institute shareholder can

have a representative in the BoD.

Many papers have examined the relationship

between ownership structure and tax planning. A

company controlled by families who own company

shares is less likely to carry out tax planning

compared to ownership that is not family (Chen,

Chen, Cheng, & Shevlin, 2010). The amount of

ownership is more than the minimum amount to be

able to exercise control will reduce the possibility of

doing tax planning (Gomes, 2000). However, other

studies explain that when the number of ownership is

at a certain minimum, there is no relationship between

ownership and tax planning (Richardson, Wang, &

Zhang, 2016). From previous research, there is a

relationship between ownership structure and tax

planning. Thus the ownership structure becomes a

variable that affects tax planning.

When the government needs more revenues from

taxes, a tax amnesty policy is issued. The application

of tax amnesty in Indonesia has begun on July 1, 2016

until March 31, 2017. The imposition of penalty

162

Santoso, M., Maksum, A., Bukit, R. and Ramli, .

Shareholders, Tax Amnesty and Tax Planning for Manufacture Industry in Indonesia.

DOI: 10.5220/0009200701620169

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 162-169

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

through sanctions on tax amnesty consists of three

stages, each of which is valid for 3 months. The

application of tax amnesty can affect and does not

affect the company's tax planning strategy.

Companies with tax planning aggressively will be

affected by tax amnesty policy. For companies where

the implementation of tax planning is not aggressive,

there is a possibility that tax amnesty does not affect

the tax planning strategy.

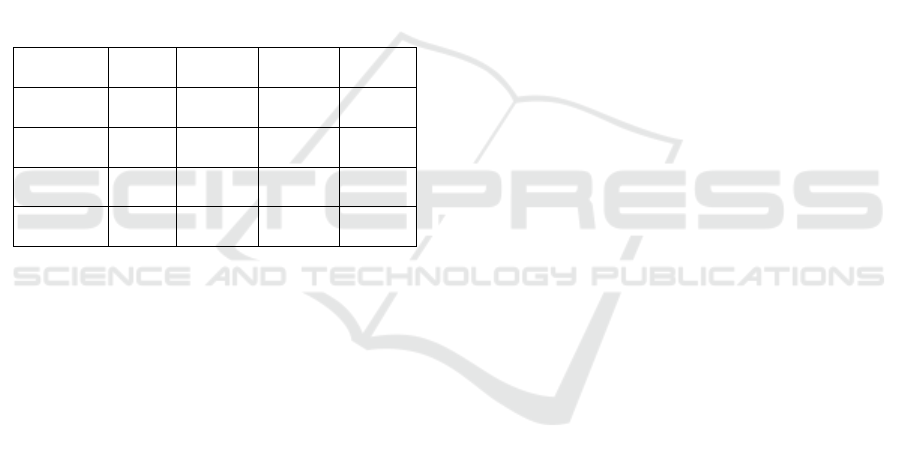

Form data of 137 manufacturing companies listed

on the Indonesia Stock Exchange (IDX), and the

period from 2014 to 2017, it is known that the

tendency of taxpayers to do tax planning after tax

amnesty still exists, as shown in Table 1. It can be

assumed that manufacturing companies listed on the

IDX have carried out aggressive tax planning because

the average of ETR decreases with the existence of

tax amnesty.

Table 1: Effective Tax Rate (ETR) Manufacture Companies

in IDX

2014 2015 2016 2017

M

ean 0.242 0.282 0.096 0.127

M

edian 0.242 0.244 0.249 0.242

M

aximu

m

4.552 5.795 3.924 1.806

M

inimu

m

-1.074 -7.492 -7.677 -10.172

Source: IDX (2018).

Manufacturing companies are more flexible to do

the tax planning strategy because there are no

restrictions in doing business besides the core

business. Some tax planning strategies include

finding businesses and/or tax facilities that have

lower tax rates than the generally applicable income

tax tariff, which is lower than 25%. The

manufacturing industry provides the largest

contribution to Indonesia's gross domestic product

(GDP), which is more than 20% of total GDP. For

2016 and 2017, the percentage of manufacturing

industry GDP to Indonesian GDP was 21.28% and

20.97%, respectively. From this data, this research

use manufacturing industry companies as research

samples.

This paper examines the influence of the

ownership structure on tax planning strategy that is

intervened by the existence of tax amnesty

regulations. The ownership structures in this paper

are domestic institution shareholders and foreign

shareholders. This paper finds that tax amnesty

influences the relation between domestic institution

shareholders and tax planning in different way. Tax

amnesty also influences the relation between foreign

shareholders and tax avoidance in significance.

This article consists of literature study that

explains theory and previous related studies. Method

section explains the type of research and data used.

The results section explains the descriptive statistics

of the data, the relation amongst the independent

variables, and relation between dependent variable

and independent variables. The discussion section

discusses the understanding of the results.

2 LITERATURE STUDY

2.1 Theory

Agency theory arises because of the collaboration

between the two parties resulting in risk sharing due

to different behaviors. The parties are principle and

agent. In the collaboration, there can be a problem

called the agency problem. Agency theory describes

this collaboration as a contract and seeks to divide the

existing problems into two, namely (Eisenhardt,

1989)

1. There is a conflict of interest between the

principle and the agent.

2. Difficult and/or expensive cost for the principle to

ensure that the agent has done his job as it should

be.

One of these conflicts of interest is the existence

of the opportunistic management that uses tax

planning as a tool for its interests, which is to increase

the incentives received. Supposedly, the tax planning

can add value to the company and the value exists if

good corporate governance is implemented (Desai &

Dharmapala, 2009). Without good governance, the

tax planning does not produce good results for

shareholders. Therefore, the control of shareholders

can influence the tax planning (Badertscher, Katz, &

Rego, 2013; Gomes, 2000; Khan, Srinivasan, & Tan,

2017) which can affect company value through

transparency (Wang, 2011). The good governance

can reduce the cost of ensuring the agent work

according to the principle expectations.

2.2 Previous Study

Many terms are used by experts to explain the

reduction in income tax, such as tax planning, tax

avoidance, tax sheltering, tax evasion, and tax

aggressive. All actions to reduce income taxes are

called tax planning (Lietz, 2013). Tax planning

includes all actions to reduce taxes, both legal and

illegal, compliant or non-compliant with tax

Shareholders, Tax Amnesty and Tax Planning for Manufacture Industry in Indonesia

163

regulations, and the burden of tax planning can be

related to income taxes or not (Myron S. Scholes,

Wolfson, Erickson, Hanlon, & M, 2016). Tax

planning is designed based on the company's business

strategy with the aim of maximizing returns after

income tax. Tax planning also includes utilizing

facilities provided by the tax authority.

According to agency theory, there are conflicts

between principles (shareholders) and agent

(management). One of these conflicts of interest is the

existence of opportunistic management that uses tax

planning as a tool for its interests, namely increasing

the incentives received. Supposedly, tax planning can

add value to the company and this can happen if the

implementation of good corporate governance (Desai

& Dharmapala, 2009). Without good governance, tax

planning does not provide good results for

shareholders. Therefore, control of shareholders can

influence tax planning (Badertscher et al., 2013;

Gomes, 2000; Khan et al., 2017) which can affect

company value with transparency (Wang, 2011).

With good governance, the cost of ensuring that the

agent has worked according to the principle

expectations can be reduced. Therefore, shareholders

can influence tax planning in the company.

Tax amnesty has applied in Indonesia from July

2016 to March 2017. The tax amnesty gives taxpayers

the opportunity to disclose assets that have not been

reported in annual tax returns by paying a fine. The

nature of the tax amnesty is voluntary. If in the future

the taxpayer is known to have assets that have not

reported during the tax amnesty, the taxpayer will be

subject to more severe sanctions. By participating in

the tax amnesty, the taxpayer debts in the past have

been deleted. The tax amnesty policy is a popular

government policy to increase government revenues

from taxes but it does not increase tax payers’

compliance (Stella, 1991). This revenue increasing is

only from taxpayers who gain benefit from the tax

amnesty (Malik & Schwab, 1991). The

implementation of the tax amnesty can make the

taxpayers not compliant with taxes because there is

hope for the subsequent tax amnesty (Bayer,

Oberhofer, & Winner, 2015).

Many researchers have examined the relations

between ownership structure and tax planning. With

a sample of companies in the USA, companies

controlled by family as owners is less likely to do tax

avoidance compared to ownership that is not family

(Chen et al., 2010). The amount of ownership more

than the minimum amount to be able to control will

reduce the possibility of doing tax avoidance (Gomes,

2000). However, other studies explain that the

relationship between ownership concentration and

tax avoidance is non-linear and inverted U-Shaped.

When ownership concentration is low, the increase in

ownership concentration is positively related to tax

avoidance. Passing the minimum level associated

with effective control, the increase in addition of

ownership concentration negatively associates tax

avoidance (Richardson et al., 2016).

By using a sample of companies in the USA, an

increase in share ownership by institutions in a

company is associated with an increase in tax

avoidance (Khan et al., 2017). With increasing

ownership, the number of shareholder representatives

in the company will increase. Thus the control of

shareholders towards the company is getting bigger to

increase the value of the company by reducing the tax

burden. However, companies that have a greater

concentration of ownership and control, will make

fewer tax deductions than companies with fewer

concentrations of ownership and control (Badertscher

et al., 2013).

Using a sample of companies in Thailand, it is

known that domestic institutional shareholders will

provide effective control of the company compared to

institutional foreign shareholders (Thanatawee,

2014). This monitoring is related to the improvement

of corporate governance that ultimately relates to tax

planning. Foreign shareholders take company

resources that are borne by minority shareholders.

Thus, shareholders have a relationship with tax

planning.

3 METHODS

This study uses a causally comparative method. This

study answers how the relationship between the

dependent variable and the independent variables by

analyzing the effect of independent variables on the

dependent variable. Independent variables are

variable that affects the relationship between

shareholders and tax planning. In this study tax

planning is a dependent variable. The definition of

these research variables is shown in Table 2.

EBIC 2019 - Economics and Business International Conference 2019

164

Table 2: Variable Definitions

Variable Definition

Dependent Variable

Effective Tax

Rate (ETR)

The ratio of the total current income tax expenses to current income before tax according to

accounting (Armstrong, Blouin, & Larcker, 2012; Badertscher et al., 2013; Khan et al., 2017;

Phillips, 2003).

Independent Variables

Shareholders:

1. Institution

(PSInstitusi)

2. Foreign

(PSAsing)

1. The ratio of the domestic institutional shareholders to the number of outstanding shares.

2. The ratio of the foreign shareholders to the number of outstanding shares.

State shareholders, cooperative, union, and foundation established in Indonesia are classified

as domestic institutional shareholders. Some papers use the percentage of institution shareholders

as proxy (Bird & Karolyi, 2017; Wahab & Holland, 2012).

Tax Amnesty

(TA)

It is a dummy variable. The value is =0 if the data used before the tax amnesty applied, and

the value is =1 if the tax amnesty is applied.

Control Variable

LnSize It is a logarithm of the total assets of the company (Taylor & Richardson, 2014).

The population of this study is all manufacturing

companies whose shares are traded on the Indonesia

Stock Exchange (IDX) in 2017. Data collection is

from 2014 to 2017. the samples of this study are:

1. All manufacturing companies whose shares are

traded in 2017 on the IDX,

2. Available financial report data and annual reports,

and

3. Already registered on the IDX before 2017.

There are 126 companies as samples and 504

observations using in this paper. The model in this

paper is as follow:

ETR

i,t

= α

0

+ β

1

TA

it

+ β

2

PSAsing

i,t

+ β

3

PSInstitusi

i,t

+ β

4

(TA

it

* PSAsing

i,t

) + β

5

(TA

it

*

PSInstitusi

i,t

) + β

6

LnSize

it

+ ε

i,t

4 RESULTS

The descriptive variables in this paper are shown

in Table 3.

Table 3. Descriptive Variables

Mean Median Max Min Std.Dev.

ETR 0.198 0.247 5.795 -10.172 0.807

PSInstitusi 0.394 0.419 0.982 0.000 0.316

PSAsing 0.295 0.118 0.998 0.000 0.326

TA*PSInstitusi 0.203 0.000 0.954 0.000 0.306

TA*PSAsing 0.137 0.000 0.998 0.000 0.267

LnSize 14.609 14.425 19.505 11.400 1.548

Table 4. Independent Variables Correlation.

TA PSInstitusi PSAsing

TA*

PSInstitusi

TA*

PSAsing

LNSIZE

TA 1.000

PSInstitusi 0.042 1.000

PSASing -0.067 -0.776 1.000

TA*PSInstitusi 0.666 0.565 -0.441 1.000

TA*PSAsing 0.513 -0.447 0.569 -0.143 1.000

LNSIZE 0.047 -0.040 0.033 -0.001 0.069 1.000

Shareholders, Tax Amnesty and Tax Planning for Manufacture Industry in Indonesia

165

Table 5: The data Processing Results

Independent Variables

Dependent

Variables

ETR

C 0.160350

Prob. (0.0000)

TA 0.015030

Prob. (0.0001)

PSInstitusi 0.050533

Prob. (0.0000)

PSAsing -0.000632

Prob. (0.9491)

TA*PSInstitusi -0.024469

Prob. (0.0004)

TA*PSAsing -0.126650

Prob. (0.0000)

LnSize 0.002218

Prob. (0.2834)

R-squared 0.974389

Adjusted R-squared 0.965370

Prob(F-statistic) 0.000000

Durbin-Watson stat 2.523695

The median of ETR is near to statue tax rate in

Indonesia for the corporate taxpayer, 25%. Std.Dev

of the ETR is 0.81. This fact explains that some

companies have applied tax planning strategy

aggressively. This condition is also supported by the

large range value of the maximum and the minimum

value of ETR. The domestic institution shareholders

(PSInstitusi) have more percentage shares than the

foreign shareholders (PSAsing). This fact is

supported by mean and median of the percentage.

The model in this paper is fixed model because

the number of cross section (N=126) is large, the

number of time (T=4) is small, and the sample is not

random (purposive sampling) (Gujarati, 2003:650-

651). By using big panel data (504 observations), this

paper should pass the correlation and

heteroscedasticity tests. For correlation, this paper

uses the limit 0.8 as a rule of the thumb. If the

correlation is still under 0.8, the correlation is

accepted. The correlation among the independent

variables is shown in Table 4.

The correlation between domestic institution

shareholder (PSInstitusi) and foreign shareholder

(PSAsing) is high (0.776) but it is still under 0.8.

These two independent variables are using the same

base to calculate the ratio, the outstanding shares. For

the heteroscedasticity tests in this fixed model, this

paper is comparing the weighted and unweighted test

in the eviews program. The result of the comparison

is shown in Appendix 1. This comparison argues that

this model has heteroscedasticity and consequently

the model should have treatment to have the best

model. The treatment is done by using the White

cross section standard errors & covariance (no d.f.

correction). The results of the data processing are

shown in Table 5.

5 DISCUSSION

In theory and empirically, tax amnesty is positively

and significantly related to tax planning. Tax amnesty

can increase corporate income tax expenses and

payments of a corporate to be the State’s revenues.

This is evidenced by the increase in state revenues

from taxes in rupiah. So, the government's goal to

increase tax revenues with the tax amnesty policy can

be realized during the enactment of the tax amnesty

policy. This result is in accordance with Stella's

EBIC 2019 - Economics and Business International Conference 2019

166

statement (1991) and the income tax revenues

collected by government as shown in Table 6.

Table 6: Corporate Income Taxes Revenues

Year

Income Tax Revenues

(Rp.Billions)

2012 513.650

2013 538.760

2014 569.867

2015 679.370

2016 855.843

2017 783.970

Tax Amnesty is positively and significantly

related to ETR. Tax amnesty can increase ETR and

reduce tax avoidance. The tax amnesty regulation

requires the taxpayer to declare its assets that have not

been reported so far; consequently the tax burden of

the taxpayer has increased.

Domestic institutional shareholders are positively

and significantly related to ETR. By applying the tax

amnesty policy, the relationship of domestic

institutional shareholders with tax planning

(TA*PSInstitusi) changes, from positive to negative.

Tax amnesty affects this relationship. Tax amnesty

affects domestic institutional shareholders to reduce

the tax burden.

Domestic institutional shareholders affect the

company's tax burden calculated by ETR. In rupiah,

there are additional tax revenues received the State,

but on the corporate side there are actions to reduce

the tax burdens as a percentage of accounting profit.

The relationship of foreign shareholders with

ETR is not significant. By applying the tax amnesty

policy, the relationship of foreign shareholders with

ETR (TA*PSAsing) becomes negative and

significant. It can be concluded that without tax

amnesty policy, the foreign shareholder does not pay

too much attention to ETR. The tax amnesty policy

affects the foreign shareholder to reduce income tax

burdens.

The mean of manufacturing companies’ ETR in

the tax amnesty year is smaller than that of the year

before the tax amnesty applied. This data is shown in

Table 7. These facts are supported by the value of

maximum, minimum, and standard deviation of the

ETR. Thus it is evident that the tax amnesty policy

makes the taxpayers to do more aggressive tax

planning strategy (Bayer et al., 2015).

The tax amnesty policy has more influencing to

the relation between foreign shareholders and tax

planning than that of between domestic institutional

shareholders and tax planning. It is supported by the

coefficient from the data processing results. The

effect of TA*PSInstitutions to ETR is -0.024 and

TA*PSAsing to ETR is -0.127. The foreign

shareholders’ responses are greater than that of the

domestic institution shareholders due to tax amnesty

policy. By applying the tax amnesty policy, the

foreign shareholders are more aggressive in tax

planning strategy than that of domestic institutional

shareholders.

Table 7: ETR Descriptive

Descriptive 2014 2015 2016 2017

Mean 0.257 0.284 0.124 0.125

Median 0.247 0.248 0.248 0.242

Max 2.274 5.795 2.018 1.806

Min -0.513 -7.492 -5.550 -10.172

St.Dev. 0.301 1.014 0.674 1.014

This study does not further examine how the tax

planning strategy with the influence of domestic

institutional and foreign shareholders carried out by

the company when the tax amnesty policy applies.

The results of this regression also find that increasing

the percentage of domestic institutional and foreign

shareholders causes the company carried out the

aggressive tax planning strategy.

Table 5 explains that the adjusted R-squared is

0.965. It can be concluded that the shareholders have

a significant role in doing a tax planning strategy

when the enactment of the tax amnesty policy.

6 CONCLUSION

One way to increase the wealth of a company's

shareholders is to reduce the tax burden and the

burden can be reduced by the tax planning strategy.

On the other hand, the government has an interest in

increasing tax revenues, one of which is tax amnesty

policy. This tax amnesty policy will certainly cause a

reaction from shareholders so that their wealth in the

company does not go down.

The domestic institutional shareholders have a

positive influence on tax planning as measured by

ETR. This means that there is no influence to reduce

the tax burden aggressively. Once tax amnesty is

applied, a reaction arises to reduce the tax burden

aggressively. This could be due to anxiety about the

decline in the value of wealth because they have to

pay greater taxes.

The foreign shareholders do not care about the tax

planning strategy done by the management in the

company. Once there is a tax amnesty policy is

Shareholders, Tax Amnesty and Tax Planning for Manufacture Industry in Indonesia

167

applied, the foreign shareholders will feel disturbed

and influence the corporate tax planning strategy so

that the tax burdens becomes smaller.

The reaction of the foreign shareholders is greater

than that of the domestic institutional shareholders in

carrying out tax planning strategies when the tax

amnesty is implemented. This fact relates to the

ability to monitor a company conducted by the

foreign shareholders is not as good as that carried out

by the domestic institutional shareholders

(Thanatawee, 2014).

REFERENCES

Armstrong, C. S., Blouin, J. L., & Larcker, D. F. (2012).

The incentives for tax planning. Journal of Accounting

and Economics, 53(1–2), 391–411.

https://doi.org/10.1016/j.jacceco.2011.04.001

Badertscher, B. A., Katz, S. P., & Rego, S. O. (2013). The

separation of ownership and control and corporate tax

avoidance. Journal of Accounting and Economics,

56(2–3), 228–250.

https://doi.org/10.1016/j.jacceco.2013.08.005

Bayer, R., Oberhofer, H., & Winner, H. (2015). The

occurrence of tax amnesties : Theory and evidence ☆.

Journal of Public Economics, 125, 70–82.

https://doi.org/10.1016/j.jpubeco.2015.02.006

Bird, A., & Karolyi, S. A. (2017). Governance and Taxes:

Evience from Regression Discontinuity. The

Accounting Review, 92(1), 29–50.

https://doi.org/10.2308/accr-50982

Chen, S., Chen, X., Cheng, Q., & Shevlin, T. (2010). Are

Family Firms more Tax Aggressive than Non- family

Firms? Journal of Financial Economics, 95(1), 41–61.

https://doi.org/10.1016/j.jfineco.2009.02.003

Desai, M. A., & Dharmapala, D. (2009). Corporate Tax

Avoidance And Firm Value. The Review of Economics

and Statistics, 91(3), 537–546.

Eisenhardt, M. K. (1989). Agency Theory : and Assessment

Review. Academy of Management Review, 14(1), 57–

74. Retrieved from http://www.jstor.org/stable/258191

Gomes, A. (2000). Going Public without Governance:

Managerial Reputation Effects; Going Public without

Governance: Managerial Reputation Effects. The

Journal of Finance, LV(2), 615–646.

https://doi.org/10.1111/0022-1082.00221

Gujarati, D. N. (2003). Basic Econometrics (Fourth Edi).

New York: McGraw-HiII/lrwin.

Johansson, Å., Skeie, Ø. B., Sorbe, S., & Menon, C. (2017).

Tax planning by multinational firms: Firm-level

evidence from a cross-country database. OECD

Economics Department Working Papers, (1355),

OECD Publishing, Paris.

https://doi.org/http://dx.doi.org/10.1787/9ea89b4d-en

Khan, M., Srinivasan, S., & Tan, L. (2017). Institutional

Ownership and Corporate Tax Avoidance: New

Evidence. The Accounting Review, 92(2), 101–122.

https://doi.org/10.2308/accr-51529

Lietz, G. (2013). Tax avoidance vs tax aggressiveness: A

unifying conceptual framework. Münster.

Malik, A. S., & Schwab, R. M. (1991). The economics of

tax amnesties. Journal of Public Economics, 46(1991),

29–49.

Myron S. Scholes, Wolfson, M. A., Erickson, M. M.,

Hanlon, M. L., & M, E. L. (2016). Taxes & Business

Strategy (5th Edition). Essex.

Phillips, J. D. (2003). Corporate Tax-Planning

Effectiveness: The Role of Compensation-Based

Incentives. The Accounting Review, 78(3), 847–874.

Retrieved from http://www.jstor.org/stable/3203228 .

Richardson, G., Wang, B., & Zhang, X. (2016). Ownership

structure and corporate tax avoidance: Evidence from

publicly listed private firms in China. Journal of

Contemporary Accounting & Economics, 12(2), 141–

158. https://doi.org/10.1016/j.jcae.2016.06.003

Stella, P. (1991). An economic analysis of tax amnesties.

Journal of Pu, 46, 383–400.

Taylor, G., & Richardson, G. (2014). Incentives for

corporate tax planning and reporting: Empirical

evidence from Australia. Journal of Contemporary

Accounting and Economics, 10(1), 1–15.

https://doi.org/10.1016/j.jcae.2013.11.003

Thanatawee, Y. (2014). Institutional Ownership and Firm

Value in Thailand. Asian Journal of Business and

Accounting, 7(2), 1–22.

https://doi.org/10.2139/ssrn.485922

Wahab, N. S. A., & Holland, K. (2012). Tax planning,

corporate governance and equity value. British

Accounting Review, 44(2), 111–124.

https://doi.org/10.1016/j.bar.2012.03.005

Wang, X. (2011). Tax Avoidance, Corporate Transparency,

and Firm Value. Ssrn. the University of Texas at

Austin. https://doi.org/10.2139/ssrn.1904046

APPENDIX

By using reviews program, the fixed model is tested

by weighted and unweighted for heteroscedasticity.

The result of this test is as follow:

Effective Tax Rate (ETR)

Unweighted Weighted

Significant

Independent

Variables

- TA*PSAsing

R-squared 0.313458 0.974389

Adjusted R-squared 0.071692 0.965370

Prob(F-statistic) 0.031126 0.000000

Durbin-Watson stat 2.669778 2.523695

EBIC 2019 - Economics and Business International Conference 2019

168

There are some different significant between

weighted and unweighted for ETR. The Adjusted R-

squared is 0.071692 for unweighted and 0.965370 for

weighted. It means that the model with ETR as a

dependent variable has heteroscedasticity. It means

that fixed model in this paper has heteroscedasticity

problems

Shareholders, Tax Amnesty and Tax Planning for Manufacture Industry in Indonesia

169