Financial Health Assessment Model for

Listed Companies in Indonesia

Khaira Amalia Fachrudin

Faculty of Economic and Business, Universitas Sumatera Utara, Medan, Indonesia

Keywords: Financial Health, Financial Distress, Profitability, Financial Leverage

Abstract: It is important to conduct financial health assessment to measure company’s health so that corrective action

can be taken and it serves as a guide in investment decision. Managers will accordingly be able to detect the

factors that may improve company’s financial health. This study, therefore, aims to produce a financial health

probability assessment model. The population involved companies listed on the Indonesia Stock Exchange.

The target population is all companies experiencing bankruptcy and insolvency in 2018 totalling 23

companies and a total of 23 healthy companies as the comparison. The sample consist of all companies in the

target population. The analysis was conducted using logistic regression. The findings further discovered that

the profitability ratio was potentially likely to improve the financial health of the company, while the financial

leverage ratio was potentially likely to worsen the financial health of the company. The classification accuracy

two years prior to the observation year was 93.5%, and the previous year was 95.7%.

1 INTRODUCTION

The financial health of a company is the ability to

maintain a balance against changing conditions in the

environment and relates to everyone who participates

in business (Csikosova et al., 2019). A financial

health reflects company’s health in financial aspects,

such as health in terms of profitability, financing,

liquidity, asset utilization, and market value.

Financial statements are a prime source of

information about financial health (Ross et al., 2013).

The prediction model of financial distress can also

be adopted to predict company’s financial health

(Arasu et al., 2013 and Sriram, 2008). Its application

has been implemented in research to determine the

soundness of manufacturing companies in Indonesia

using the Altman, Springate, and Zmijewski models

(Sinarti and Sembiring, 2015), research in India used

Altman’s model to measures companies’ financial

health (Kumari, 2013), and research on banking

industry in Bangladesh adopted Altman’s model to

predict financial health (Parvin, 2013). These

models were carried out at different places and times,

thus leaving the possibility that they are not suited to

current condition in Indonesia. Tuckman urged that

financial unhealthy is used to describe companies that

eventually became liquidated (Tuckman and Chang,

1991). In 2018, there were 23 publicly listed

companies in Indonesia receiving special notations on

their ticker shares from the Indonesia Stock Exchange

due to negative business capital or equity, for

example the APEX stock code was miswritten as

APEX.E. The financial distress condition with this

type of insolvency in bankruptcy needs to be minded

as it shows signs of economic failure that potentially

lead to business liquidation (Fachrudin, 2007).

As of now, there has been no financial health

assessment model suited to current conditions in

Indonesia. This research therefore attempted to create

a model that can estimate the probability of

company’s health condition and its level. This model

will largely benefit company’s management,

investors and potential investors, creditors, and

academia.

Theoretical Linkages between Financial Health

and Financial Distress

Business failure causes losses to creditors and

investors who use accounting disclosures to assess

financial health, so financial health assessment can be

done through a financial distress model that also uses

accounting data (Sriram, 2008; Yakymova and Kuz,

2019). Performance measures reflected in the

financial ratios surrogate for important attributes of

Fachrudin, K.

Financial Health Assessment Model for Listed Companies in Indonesia.

DOI: 10.5220/0009200101270132

In Proceedings of the 2nd Economics and Business Inter national Conference (EBIC 2019) - Economics and Business in Industr ial Revolution 4.0, pages 127-132

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

127

the firm's financial conditions such as profitability,

solvency, liquidity, and asset management. Financial

ratios also provided reliable signals of financial health

(Sriram, 2008).

Financial health prediction is one of the most

discussing topics in financial literatures (Javaid and

Javid, 2018). Financial performance is determined by

the financial ratios to be compared between

financially healthy and financially unhealthy

companies to produce prediction models in order to

determine the financial health of a firm (Javaid and

Javid, 2018).

The theory of financial distress is described as a

condition that is influenced by balance sheet

influence and earnings effect. Balance sheet influence

includes liquidity ratios, activity, and financial

leverage. While the earning effect includes

profitability, and retained earnings to working capital

ratio (Nketiah, 2017). The financial ratios used to

predict financial distress will also be used to assess

financial health.

Financial Health Prediction Model

Sriram (2008) created a model for assessing financial

health using fundamental financial variables and

intangible assets with predictive accuracy that was

comparable to prediction rates in the Altman’s model.

Altman (1977) conducted a multiple discriminant

analysis test on manufacturing and retail companies

included in the list of bankruptcy requests (distressed)

and companies that face bankruptcy (non-distressed)

to get a bankruptcy prediction model. The model

obtained is the previous revised model currently

named as Revised Z-Score. The model produced by

Altman was also used to assess financial health

(Sriram, 2008).

The model is :

Z” = 0.717(X

1

) + 0.847(X

2

) + 3.107(X

3

) +

0.420(X

4

) + 0.998(X

5

) (1)

Where :

X

1

= working capital/total assets

X

2

= retained earnings/total assets

X

3

= earnings before interest and taxes/total

assets

X

4

= book value equity/book value of total

liabilities

X

5

= sales/total assets

If the score obtained is <1.23, the company has

the potential to go bankrupt, a score of 1.23 to 2.9 is

classified as a gray area, and a score of> 2.9 is

classified as not having the potential to go bankrupt.

Yakymova (2019) created a model to assess

financial health for municipal companies by

developing a five-factor discriminant model using

data from 50 Ukranian companies during 2014-2017.

The most distinguishing factors between healthy and

unhealthy companies are equity-assets ratio, the

current ratio, and the average accounts receivable

turnover.

The assessment of financial health can also be

carried out using Bonitu B Index (Javaid and Javid,

2018). The formula is as follows:

B = 1.5X

1

+ 0.08X

2

+10X

3

+ 5X

4

+ 0.3X

5

+ 0.1X

6

(2)

Where:

X

1

= cash flow / debts

X

2

= total capital / debts

X

3

= earnings before taxes / total capital

X

4

= earnings before taxes / total revenues

X

5

= stocks price / total assets

X

6

= total revenues /total capital.

If B produces positive value, it means that the

company is positive and healthy, if it generated

negative values, it means that the company has a

negative and unhealthy situation, thus the lower the

value of B, the worse the situation of the company

would be.

Jordan (1998) used the ratio analysis and

identified financial health of water utility. The

function of financial health he made consisted of size

of liquid assets, cash flow, debt, and expenditures

(Jordan, 1998). The variables used in the model

consisted of return on assets, current ratio, debt to

equity ratio, operating ratio, and cash flow coverage.

Other financial distress prediction models used

for finacial health assessment include Springate and

Zmijewski models. Springate uses multiple

discriminant analysis - step wise by using 19 popular

financial ratios to distinguish between healthy and

bankrupt companies (Springate, 1978; Arasu et al.,

2013). The Springate model is as follows:

S-Score = 1.03 X

1

+ 3.07 X

2

+ 0.66 X

3

+ 0.4 X

4

(3)

Where :

X

1

= working capital / total assets

X

2

= earning before interest and taxes (EBIT) /

total assets

X

3

= net income before taxes (EBIT) / current

liabilities

EBIC 2019 - Economics and Business International Conference 2019

128

X

4

= sales / total assets

If the Springate Z-score is smaller than 0.862,

then the company is predicted to go bankrupt,

whereas if the score is greater than 0.862, then the

company is predicted to be healthy (Huo, 2006).

Zmijewski (1984) involved a sample of bankrupt

and non-bankrupt companies listed on the American

and New York Stock Exchange during 1972-1978

under probit analysis. The formula is as follows:

b* = -4.3 – 4.5 X

1

+ 5.7 X

2

– 0.004X

3

(4)

X

1

= net income / total assets

X

2

= total debt / total assets

X

3

= current assets / current liabilities

If b *> 0, then the company is predicted to

potentially experience bankruptcy, whereas if b * <0

then the company is predicted to be free from

bankruptcy.

Predictions of financial distress using predictors

in the form of financial ratios, be it profitability ratio,

capital structure, liquidity, and asset management.

However, Bal (2013) discovered that a good ratio

used to distinguish between failed companies and

successful companies is the ratio of return on assets,

return on capital, and earnings per share, all of these

three ratios are profitability ratios. In the meantime,

Javaid (2018) and Altman et al. (2017) stated that the

financial ratios that have the most impact on

prediction models in identifying the status of failed

and non-failed companies are profitability and

liquidity ratios. The ranking of the popularity of

financial ratios in prediction of financial distress is

dominated by the ratio of net income to total assets,

current assets to current liabilities, total liabilities to

total assets, working capital to total assets, and

earnings prior tointerest and taxes to total assets

(Fachrudin, 2007). For the prediction of financial

distress probability in Indonesia due to the 1997-1998

economic crisis, a significant predictor is the ratio of

net income to total assets and the ratio of total

liabilities to total assets (Fachrudin, 2007).

2 HYPOTHESIS DEVELOPMENT

In 2018, 46 companies with unhealthy financial

condition was found. This preliminary study involved

the variable of financial ratios in the form of net

income to total assets, working capital to total assets,

retained earing to total assets, earning before interest

and taxes to total assets, book value of equity to book

value of total liabilities, sales to total assets, and total

liabilities to total assets (Altman, 1977; Springate,

1978; and Fachrudin, 2007) in order to estimate the

probability of financial health by using logistic

regression in one year and two years prior to the

observation year, that is 2018. Some trials was

conducted by involving all the variables as well as in

stepwise, yet the obtained model was not feasible and

a number of financial ratios were found insignificant.

To this end, this study selected variables of the ratio

of net income to total assets and the ratio of total

liabilities to total assets in order to estimate the

probability of financial health in line with Fachrudin's

research previously conducted in Indonesia

(Fachrudin, 2007).

The hypothesis are :

1. Ratio of net income to total assets has positive

and significant inluences to probability of

financial health

2. Ratio of total liabilities to total assets has positive

and significant inluences to probability of

financial health

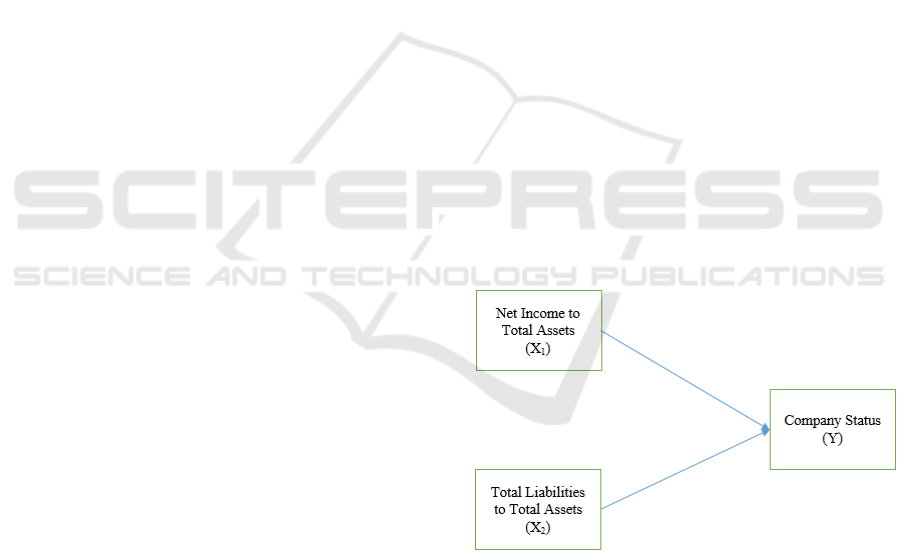

Research Model

This study used profitability ratio and financial

leverage ratio as the variables to estimate the

probability of financial health. The model is as

follows:

Figure 1: Research Model

3 RESEARCH METHODS

3.1 Sample Design

The population in this study involved all 600

companies listed on the Indonesia Stock Exchange.

The target population is 23 unhealthy companies that

received a special notation on its stock ticker from the

Financial Health Assessment Model for Listed Companies in Indonesia

129

Indonesia Stock Exchange as of December 31, 2018

as they have negative equity. These companies with

negative equity theoretically belong to companies

that experience financial distress with insolvency in

bankruptcy type. They are compared with 23 healthy

companies. Each unhealthy company is compared to

a healthy company that has the highest positive equity

in the same sector and has almost the same total

assets. Saturated sampling was done for 46

companies in the target population.

3.2 Variable

The variables of this study include:

Dependent variabel (covariates) :

X

1

= net income / total assets (NITA)

X

2

= total liabilities / total assets (TLTA)

The dependent variable (Y) is company’s health

status which is a categorical variable. The values are:

1 = The company that has the best level of

financial health

0 = The company that has the worst level of

financial health (experiencing financial

distress - insolvency in bankruptcy type).

3.3 Statistical Analysis

Data analysis was performed by logistic regression

Binary regression model :

y

1

= a + b

1

x

1

+ b

2

x

2

+ μ (5)

Descended into Logistics distribution function :

Pi = 1 / [1+exp (a + b

1

x

1

+ b

2

x

2

)] (6)

Pi = financial health probability whose value is

between 0 and 1

4 RESULTS AND DISCUSSION

4.1 Results

The results of the study are presented in descriptive

statistics and inference statistics in the form of

logistic regression

4.1.1 Descriptive Statistics

Descriptive statistics are presented in Table 1

Table 1. Descriptive Statistics - Mean and Standard

Deviation of the Net Income to Total Assets Ratio and the

Total Liabilities to Total Assets Ratio

4.1.2 Logistic Regression

Logistic regression results are presented in Table 2

Table 2. Logistic Regression Results for Financial Health

Assessment

The value of Hosmer and Lemeshow goodness of

fit shows a significance probability of 0.503 one year

prior to the observation year (2017) and 0.267 in the

previous two years (2016). This value indicates that

these models are feasible for further analysis because

as there is no distinct distinguishment between the

predicted classification and the observed

classification.

Negelkarke R square, respectively, are 0.633 and

0.759, which means that the variability of the

dependent variable can explain the dependent

variable by 63.3% in one year prior to the observation

year and 75.9% in the previous two years. This value

indicates a fit model.

The -2 Log-Likehood indicates a decrease of

34,125 in one year prior to the observation year and

25,001 in the previous two years. These values are

greater than the critical values of chi square table at

alpha 5%, which indicates a better fit model.

The model for two years prior to the observation

year has a significance level of 5%, but for one year

prior this model is not significant at alpha 5% because

the phi value of NITA is 0.060. The statistical results

show that the hypotheses 1 are supported by empirical

data at alpha 5% and hypotheses 2 are not supported

by empirical data at alpha 5%.

N I T AT L T A

2016

Healthy

Companies Mean 0.037 0.371

Stdev 0.145 0.263

Unhealthy

Companies Mean -0.618 3.165

Stdev 2.605 4.051

2017

Healthy

Companies Mean 0.004 0.373

Stdev 0.132 0.203

Unhealthy

Companies Mean -0.227 3.527

Stdev 0.332 5.266

2017

Independent Variable B Exp (B) B Exp (B)

Constant 2.473 (0.003) 0.084 3.996 (0.002) 0.018

NITA 5.955 (0.041) 385.505 6.993 (0.060) 1089.212

TLTA -2.382 (0.007) 0.092 -5.225(0.002) 0.005

n4646

Hosmer and Lemeshow 0.503 0.267

-2LL 34.125 25.001

Negelkerke R Square 0.633 0.759

Predicted Percentage Correct 95.70% 93.50%

Numbers in brackets indicate significance

2016

EBIC 2019 - Economics and Business International Conference 2019

130

The classification accuracy in one year prior to

the observation year is 95.7% and 93.5% in the

previous two years. Both variables are significant

with the odds ratio shown by the Exp (B) value as

presented in Table 2, describing as follows:

1. One year prior to the observation year, the

increase in net income to total assets ratio would

potentially increase company's financial health by

385.505 times,

2. One year prior to the observation year, the

increase in the ratio of total liabilities to total

assets would potentially reduce company's

financial health by 0.092 times,

3. Two years prior to the observation year, the

increase in the ratio of net income to total assets

would potentially increase company's financial

health by 1089.212 times,

4. Two years prior to the observation year, the

increase in the ratio of total liabilities to total

assets would potentially reduce company's

financial health by 0.005 times.

The models obtained are as follows:

Two years prior

Pi = 1 / [1 + exp (3.966 + 6.993 X

1i

– 5.225 X

2i

)]

(7)

The logistic distribution function can be simplified to:

P

i

= 1 / 1 + 2.718

-(3.996 + 6.993 X1 i – 5.225 X2 i)

(8)

One year prior

Pi = 1 / [1 + exp (2.473 + 5.955 X

1i

– 2.382 X

2i

)]

(9)

The logistic distribution function can be simplified to:

P

i

= 1 / 1 + 2.718

-(2.473 + 5.955 X1 i – 2.382 X2 i)

(10)

P value range between a 0 and 1.

4.2 Discussion

The ratio of financial health prediction reflected by

the balance sheet influence and earnings effect [19]

can be applied to estimate company’s financial

health. The ratios that have a significant effect on this

study are among others the ratio of net income to total

assets and the ratio of total liabilities to total assets.

This finding is in line with previous financial distress

prediction model (Fachrudin, 2007) and previous

financial health assessment model (Csikosova et al.,

2019).

This model did not involve the variable of current

ratio such as Yakymova and Kuz (2019) and Jordan

(1998) models. This is due to the fact that the

preliminary study discovered that this ratio is not

significant since liquidity problem can be handled by

taking debt. Thus, total liabilities serve as an

important predictor.

5 CONCLUSION

Profitability and financial leverage ratios can be used

to estimate the financial health of a company. The

probability value obtained ranged between 0 and 1. A

value of 0 indicates that the condition of the company

is unhealthy. While a value of 1 indicates that the

condition of the company is healthy. The values

indicate the level of company’s health, for example a

value of 0.1 can be categorized as healthy, a value of

0.5 can be categorized as moderate, and a value of 0.9

can be categorized as unhealthy.

6 SUGGESTION

This financial health assessment model can be applied

to companies for assessing their company’s financial

health in the next year or in the next two years.

Company’s managers should make efforts in

increasing company’s profitability by increasing

sales and other sources of income as well as carrying

out activities that might add value to the company so

as expenses can be reduced. A negative net income

will cause negative retained earnings, thus leaving

company's equity negative.

Company managers should be aware of any

increase in liabilities as it can potentially reduce

company’s financial health. Companies have to

consider taking debt, especially debt in foreign

currencies whose value might go up when Indonesian

Rupiah is weakening.

Prospective creditors and potential investors can

use this model to make funding decisions and funds

investment. In so doing, investors who have invested

in company shares can assess the company’s health to

review their investment portfolio.

REFERENCES

Altman, Edward I, Robert G. Haldeman, and P. Narayanan.

(1977). Zeta

TM

Analysis – A New Model to Identify

Bankruptcy Risk Corporations. Journal of Banking and

Finance, 1, 29-54.

Altman, E.I., Iwanicz-Drozdowska, M., Laitinen, E.K. and

Suvas, A. (2017). Financial distress prediction in an

Financial Health Assessment Model for Listed Companies in Indonesia

131

international context: a review and empirical analysis

of Altman’s Z-score model. Journal of International

Financial Management & Accounting, 28(2), 131-171.

Arasu, R., Balaji, C.D., Kumar, S.P., and Thamizhselvi, N.

(2013). Applicability of Fulmer and Springate Models

for Predicting Financial Distress of Firms in the

Finance Sector – An Empirical Analysis. Journal of

Finance and Risk Management, 4(1), 1-9.

Bal, Jay., Yen Cheung, and Hsu-Che Wu. (2013). Entropy

for Business Failure Prediction : An Improved

Prediction Model for the Construction Industry.

Advances in Decision Sciences, 1-14.

Csikosova, Adriana., Janoskova, Maria, and Culkova,

Katarina. (2019). Limitation of Financial Health from

Post-Communist Countries. Journal Risk Financial

Management, 12(15), 1-14

Fachrudin, Khaira Amalia. (2007). Analisis Kesulitan

Keuangan Perusahaan – Studi pada Perusahaan

Manufaktur yang Terdaftar di Bursa Efek Jakarta

Tahun 1995 – 2005. (Unpublish Doctoral Dissertation).

Universitas Brawijaya, Malang, Indonesia.

Javaid, Muhammad Irfan and Javid, Attiya Yasmin.

(2018). Efficacy of Going Concern Prediction Model

for Creditor Oriented Regime via Liquidation - a MDA

Approach. Journal of Applied Accounting Research,

19(4), 552-573.

Jordan, J.L. (1998). Evaluating Water System

Performance and Financing Options. Georgia Water

Series, 3, 1-23.

Huo, Yang Hwae. (2006). Bankruptcy Sitiation Model in

Small Business : the Case of Restaurant Firms.

Hospitality Review, 2(24), 49-58.

Kumari, Nilanjana. (2013). Evaluation of Financial

Health of MMTC of India : A Z Score Model. European

Journal of Accounting and Finance Research, 1(1), 36-

43.

Nketiah, Ebenezer Tuffour. (2017). Analyzing Investment

Decisions Using Altman’s Model to Predict

Organizational Financial Distress. (Doctoral

Dissertation). Capella University, United Sttaes of

Ammerica.

Ross, Stephen A, Westerfield, Randolh W., and Jaffe,

Jeffrey. (2013), Corporate Finance, Tenth edition,

McGraw Hill Irwin.

Sinarti and Sembiring, Tia Maria. (2015). Bankruptcy

Prediction Analysis of Manufacturing Companies

Listed in Indonesia Stock Exchange. International

Journal of Economics and Financial Issues, 5, 354-359

Springate G L. (1978). Predicting the Possibility of Failure

in a Canadian Firms. (Research Project). Simon Fraser

University, Canada.

Sriram, Ram S. (2008). Relevance of Intangible Assets to

Evaluate Financial Health. Journal of Intellectual

Capital, 9(3), 351-366.

Parvin, Afroza., Rahman, Benazir., and Nitu, Alrafa Akter.

(2013). Prediction of Financial Health of Banking

Industry in Bangladesh Using Altman’s Z Score : A

Comparison Between State-Owned Commercial Banks

and Private Commercial Banks. Proceeding of the

International Conference for Bankers and Academics,

335 – 344.

Tuckman, H.P., and Chang, C.F. (1991). A methodology

for measuring the financial vulnerability of charitable

nonprofit organizations. Nonprofit and Voluntary

Sector Quarterly, 20(4), 445-460.

Yakymova, Larysa., and Kuz, Vasyl (2019). The Use of

Discriminant Analysis in the Assessment of Municipal

Company’s Financial Health. Recent Issues in

Economic Development, 12(2), 64 - 78.

Zmijewski, Mark Eugene. (1984). Essay on Corporate

Bankruptcy. (Doctoral Dissertation). University of

New York.

EBIC 2019 - Economics and Business International Conference 2019

132