Free Cash Flow, Investment, Capital Structure and Firm Value

Rina Br. Bukit

1,*

, Sri Mulyani

1

, Fahmi N. Nasution

1

,

Richard Chinomona

2

1

Department of Accounting, Universitas Sumatera Utara, Jl. Prof. T.M Hanafiah, SH, Kampus USU, Medan, Indonesia

2

Faculty of Commerce, Law and Management, School of Business Sciences, University of the Witwatersrand,

Johannesburg, South Africa

Keywords: Firm Value, Free Cash Flow, Investment Level and Capital Structure

Abstract: Shareholders are very interested in the company's performance and prospects, which are generally referred to

as company value. Information of corporate value declining is not mitigated by companies that have many

stakeholders. Literature shows that the following factors have an impact on company values such as free cash

flow, investment and capital structure. Decreasing the value of the company can endanger all parties including

investors. A supervisory system for company management decisions is needed to reduce losses and adverse

effects of a decrease in company value. However, in-depth research on corporate value models that are

influenced by free cash flow and investment through capital structures is still rarely done. The purpose of the

study was to examine the effect of intervening variable of capital structure in the relationship between free

cash flow and investment with firm value. The research population is non-banking companies listed on the

Indonesia Stock Exchange in 2014-2016. The dependent variable of this study is company value and the

independent variable is free cash flow and investment. Intervening variable is capital structure. Control

variable is company size, audit quality and company growth. The results of multiple regression analysis show

that free cash flow and investment have a positive effect on firm value. The results of this research also show

that free cash flow and investment have a negative effect on capital structure. However, this study did not find

the effect of capital structure on firm value. Hence, capital structure does not play a role as an intervening

variable between free cash flow and investment with firm value.

1 INTRODUCTION

Research on company value is important, which

relates to the level of welfare of shareholders and the

views of corporate stakeholders regarding future

corporate prospects. Companies need to make

effective decisions and take appropriate actions so

that the company continues to survive with high

profits and prosperity (Salvatore, 2005). The ratio of

stock price and book value per share is one illustration

of firm value (Ang, 1997). The firm stock price may

be above or below of its book value which illustrate

the investor's view of the company.

There are several factors affect the value of the

company such as free cash flow, investment and

capital structure. The first factor is free cash flow. The

excess cash can be used for dividend payment or

investment activity. The decision to use this free cash

flow may cause agency conflict (Jensen & Meckling,

1976; Jensen, 1986). Dividend distribution correlates

with the level of welfare of shareholders. But the

value of the company decreases if management uses

free cash flow in investment activities to safeguard its

own personal interests. 0n the other side, profitable

investment activities can improve shareholder

welfare and company value (Perfect, Peterson, &

Peterson, 1995; Richardson, 2005). Thus, effective

use of free cash flow may increase company value

The second factor is investment. The company's

investment activities should have a positive impact on

the value of the company. This investment activity

may bring the higher future cash flow, superior

company competitiveness or new business areas

(Agrawal & Zong, 2006). Therefore, a higher level of

investment may create higher corporate value.

Then, the third factor is capital structure. The

company's capital structure is not only covering

equity value, but also all financial sources including

debt. Debt is one of the financial resources in the

company. Debt is also a tool used by companies to

increase their capital in order to increase profits

(Chowdhury & Chowdhury, 2010). Ogbulu and

Emeni (2012) suggest that long-term debt has more

roles in determining the value of a company than

122

Bukit, R., Mulyani, S., Nasution, F. and Chinomona, R.

Free Cash Flow, Investment, Capital Structure and Firm Value.

DOI: 10.5220/0009200001220126

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 122-126

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

equity, especially in a country with a growing

economy such as Nigeria.

Past study showed that firm size, audit quality and

firm growth influence firm value. This study also tests

firm size, audit quality and firm growth as control

variables. First, company size can be expressed by

total assets or total net sales. Assets are all resources

and assets owned by the company for use in its

operations. The size of the company is considered

able to influence the value of the company. Because

the larger the size or scale of the company, the easier

it will be for the company to obtain funding sources

both internal and external. Firm size is stated to be

positively and significantly related to firm value

(Bukit, Haryanto, & Ginting, 2016).

Second, audit quality is related to the quality of

company profits. Past study (for example, Alfraih,

2016) supported that the better the quality of external

auditors used by a company, the better the quality of

the value relevance of financial reporting. The

amount of large costs incurred to utilize external

auditor quality is worth the results of the audit

produced. Therefore audit quality is considered

capable of increasing the value of the company.

Third, the company's growth also affects the value

of the company. Companies with high growth rates

are relatively easy to access the capital market. A high

growth company shows its ability to increase the

company value. For example, (Bukit, Haryanto, &

Ginting, 2016) suggest that firms with high growth

rate influence firm value in a positive and significant

way. In this study, company size, audit quality and

company growth are control variables. The purpose

of this research is twofold: First, to tests the effect of

free cash flow, investment and capital structure on

firm value. Second, this study aims to examine the

effect of free cash flow and investment through

capital structure.

2 CONCEPTUAL FRAMEWORK

AND HYPOTHESES

Agency theory explains that the use of excess cash

raises the potential for conflicts of interest where the

excess money is intended for activities that bring their

personal benefits that may be in line or not in line with

the interests of shareholders (Jensen 1986; Jensen &

Meckling 1976; Chung et al. 2005). Previous research

states that companies that have free cash flow tend to

be involved with activities that do not increase the

value of the company; this is predicted in the theory

of free cash flow (Ang et al. 2000; Jensen 1986).

Research needs to be conducted to examine the effect

of free cash flow, investment and capital structure on

firm value. Based on the prior arguments, this study

show that free cash flow and investment affect capital

structure, and subsequently capital structure is also

related to firm value. Therefore, this study argues that

capital structure mediates the relationship between

free cash flow and investment on firm value. The

research framework is shown as follows (see in

Figure 2.1):

Figure 2.1: Firm Value Model

Furthermore, based on the explanation above, this

study develops several hypotheses as follow

H1. Free cash flow, investment and capital

structure are associated with firm value

H2. The effects of free cash flow and investment

on firm value are mediated by capital structure

3 METHOD

3.1 Population and Sample

The population of this study is all non-banking

companies listed on the Indonesia Stock Exchange

during 2014-2016. The selection and collection of

sample data needed in this study was conducted by

purposive sampling. The data analysis method used

in this study is Multiple Regression Analysis with

multiple path analysis.

3.2 Type and Method of Data

Collecting

This study uses secondary data which is collected

from annual reports and published financial reports,

books, and scientific journals related to this research.

Data is obtained from the internet by downloading the

required data by accessing it from the Indonesia Stock

Exchange website (www.idx.com), www.ssrn.com,

www.search.proquest.com, and the website of each

company.

3.3 Variable Definition and

Operationalization

Operational definitions and variable measurements

are shown in Table 4.1 (please see Appendix 1)

Free Cash Flow, Investment, Capital Structure and Firm Value

123

3.4 Method of Data Analysis

Data analysis method is a multiple regression analysis

model. Before data analysis is performed, the

classical assumption test is carried out which includes

normality test, multicollinearity test,

heteroscedasticity test and autocorrelation test. First,

the data normality test is done by probability plot

analysis and the Kolmogorov-Smirnov test. If the

probability is> 0.05 then the data distribution is

normal and if the probability is <0.05 then the data

distribution is not normal. Secondly, a

multicolinearity test is run to examine the correlation

between independent or independent variables that

are expected to not exceed 0.8 (Gujarati, 2003).

Third, heteroscedasticity test aims to test whether in

the regression model there is a variance inequality

from residual observation to another observation. If

the variance from residual one to another observation

remains, then it is called homoscedasticity and if it is

different is called heteroscedasticity. Fourth, the

autocorrelation test aims to test whether in a linear

regression model there is a correlation between

confounding errors in period t with errors in periods

t-1 or earlier.

3.5 Research Model

The first hypothesis will be tested with the regression

equation 1 as follows:

Y= b

0

+ b

1

X

1

+ b

2

X

2

+ b

3

X

3

+ CV +ε

......……… Equation 1

Where:

Y = Firm value

X

1

= Free cash flow

X

2

= Investment

X

3

= Capital structure

X

c1-c3

= Control variables

b

1

– b

3

= beta of each variable

ε = Error Term

The second hypothesis will be tested by the four

steps Baron and Kenny (1986) approach.

4 RESULTS

4.1 Descriptive Statistics

Descriptive statistics provide a general description of

the object of research sampled. Explanation of data

through descriptive statistics is expected to provide an

initial description of the problem under study (see

Table 4.1, in Appendix).

4.2 Correlation Coefficient

This study conducted the correlation coefficient test

between independent variables. Table 4.2 (see in

Appendix) shows the highest correlation coefficient

is between the variable of free cash flow and

investment which is -0.164 where the correlation

coefficient number is still below 0.8 (Gujarati, 2003).

Thus it can be concluded that in this research model

there is no problem of multicollinearity.

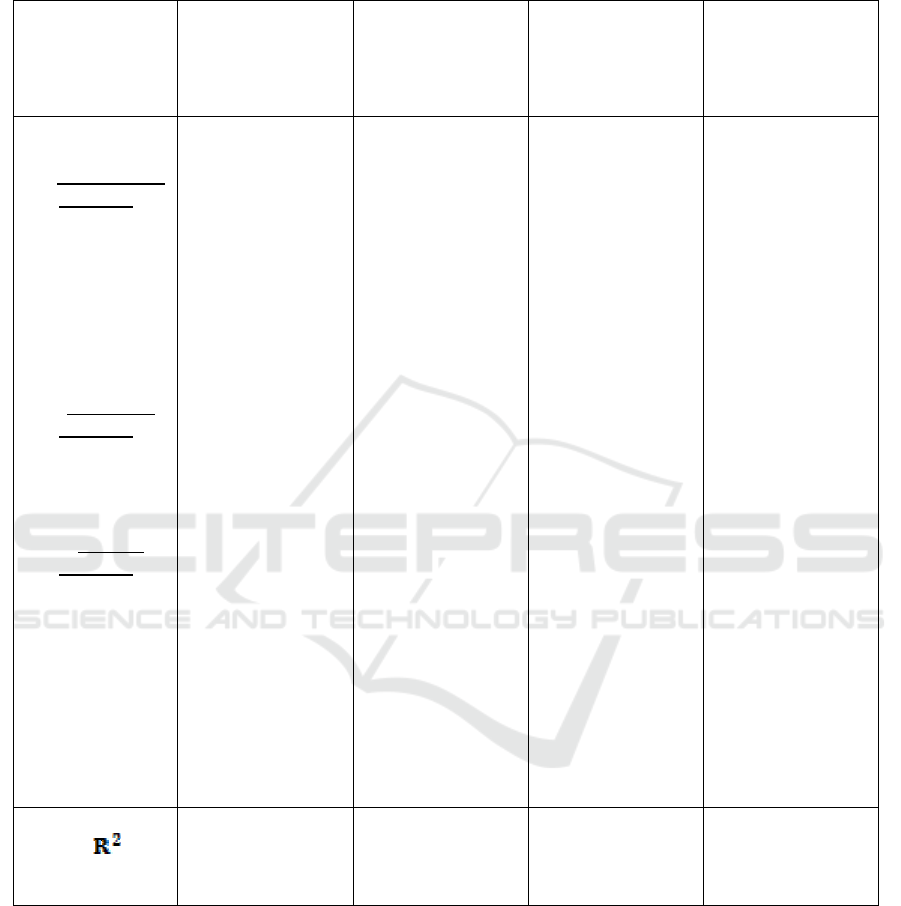

4.3 Research Regression Results

The results of this research also show that free cash

flow and investment have positive effects on firm

value. Hypotheses 1 is supported. This study also

finds that free cash flow and investment have

negative effects on capital structure. This study finds

the positive effect of capital structure on firm value.

However, the coefficients of free cash flow and

investment are still positive and significant in Model

4; it means that capital structure does not play a role

as fully mediating variable between free cash flow

and investment with firm value. (Please see Table 4.3

in the Appendix).

5 CONCLUSION

The results of this research also show that free cash

flow, investment and capital structure have positive

effects on firm value. However, capital structure does

not play a role as an intervening variable between free

cash flow and investment with firm value.

REFERENCES

Alfraih, M. 2016. The role of audit quality in firm valuation.

International Journal of Law and Management Vol.58

No. 5: 575-598.

Agrawal, R. &Zong, S. 2006. The cash flow–investment

relationship: International evidence of limited access to

external finance. Journal of Multinational Financial

Management 6(1): 89-104.

Ang, J. S., Cole, R. A. & Lin, W. J. 2000.Agency cost and

ownership structure.Journal of Finance 55: 81-106.

Chowdhury, Anup & Chowdhury, Suman Paul. 2010

Impact of capital structure on firm’s value: Evidence

from Bangladesh. Business and Economic Horizons.

Vol.3, Issue 3, pp. 111-122

Jensen, M. &Meckling, W. 1976. Theory of the firm:

Managerial behavior, agency costs, and capital

structure. Journal of Financial Economics3: 305–360.

EBIC 2019 - Economics and Business International Conference 2019

124

Jensen, M.C. 1986. Agency costs of free cash flow,

corporate finance and takeovers. American Economic

Review 76: 323-329.

Ogbulu, Onyemachi Maxwell & Emeni, Francis Kehinde,

2012. Capital Structure and Firm Value: Empirical

Evidence from Nigeria. International Journal of

Business and Social Science. Vol. 3 No. 19

Perfect, S.B., Peterson, D.R. & Peterson, P.P. 1995. Self-

tender offers: The effects of free cash flow, cash flow

signaling, and the measurement of Tobin's q. Journal of

Banking & Finance 19(6): 1005-1023.

Richardson, S. 2005. Over-investment of free cash flow.

Working Paper. University of Pennsylvania.

Rina Bukit, Bode Haryanto, &P Ginting. 2016.

Environmental performance, profitability, asset

utilization, debt monitoring and firm value, IOP

Conference Series: Earth and Environmental Science

Salvatore, Dominick. 2005. Ekonomi Manajerial dalam

Perekonomian Global. 5

th

Ed, Salemba Empat: Jakarta.

APPENDIX

Descriptive Statistics

Table 4.1: Descriptive Statistics

N

Minimu

m

Maximu

m

Mean Std. Deviation

FIRM

_

SZ 382 12,230 33,650 27,460 3,184

AUDIT

_

QLT 382 0,000 1,000 0,393 0,489

GROWTH 377 -58,450 192,250 18,767 39,936

FCF 377 -1,150 0,330 -0,008 0,158

INV 377 -1,000 3,210 0,138 0,525

DER 377 0,030 5,060 0,584 0,625

FIRM

_

VALUE 382 0,080 23,180 1,813 2,927

Valid N

(listwise) 375

Correlation Coefficient

Table 4.2. Correlation Coefficient

FIRM

_

SZ AUDIT

_

QLT GROWTH FCF INV DER FIRM

_

VALUE

FIRM

_

SZ 1

AUDIT

_

QLT 0,061 1

GROWTH 0,090 -0,033 1

FCF -0,013 0,084 0,074 1

INV 0,021 0,035 -0,017 -0,164 1

DER -0,126 -0,102 -0,114 -0,055 -0,157 1

FIRM

_

VALUE 0,150** 0,130* 0,117* 0,092 0,118* 0,050 1

Free Cash Flow, Investment, Capital Structure and Firm Value

125

Regression Results

Table 4.3. Regression Analysis Results

Model 1

DV :

Firm Value

Model 2

DV :

Capital

Structure

Model 3

DV :

Firm Value

Model 4

DV :

Firm Value

Constant

Independent

Variable

Free Cash

Flow

Investment

Mediating

Variable

Capital

Structure

Control

Variable

Firm Size

Audit Quality

Growth

-2,064

(-1,609)

1,847

(1,914) *

0,724

(2,534) **

0,124

(2,649)***

0,669

(2,190) ***

0,008

(2,008) ***

1,262

(4,622) ***

-0,295

(-1,435)

-0,198

(3,256)***

-0,021

(-2,122) **

-0,105

(-1,613)

-0,002

(-2,045)**

-2,587

(-1,953)*

0,446

(1,839)*

0,134

(2,831)***

0,807

(2,630)***

0,009

(2,294)**

-2,798

(-2,134)**

2,018

(2,099)**

0,839

(2,915)***

0,582

(2, 393)**

0,136

(2,913)***

0,730

(2,397)**

0,008

(2,263)**

R

2

Adj

F

Prob F

0,071

0,058

5,636

0,000

0,064

0,051

5,058

0,000

0,058

0,047

5, 663

0,000

0,085

0,070

5,711

0,000

EBIC 2019 - Economics and Business International Conference 2019

126