Social Economic Perception and Status towards the Behavior of

Customers of Islamic Banking Financial Services Users

Doli Muhammad Ja’far Dalimunthe, Yeni Absah, Tetty Yuliaty

Faculty Economics and Business, Universitas Sumatera Utara

Keywords: Socio-Economic Status, Perception, Religious Attitudes, Behavior, Syariah Banks.

Abstract: The rapid development of Islamic banking in Indonesia, still considered relatively low when compared to other

Islamic countries such as Malaysia and Saudi Arabia, with a market share of around 20% and 53% of the total

domestic banking market. This is due to the low interest of the community to become Syariah banking

customers due to the lack of public understanding of Syariah banking.The purpose of this study is to determine

the cause of the lack public interest to transact through Syariah banking by looking at the influence of

perceptions and socio-economic status of behavior, especially Syariah bank customers. Data collected through

interviews and questionnaires. The data analysis technique used is path analysis. The results show that socio-

economic status has a positive and significant effect on religious attitudes and behavior. Perception has a

significant positive effect on religious attitudes but does not have an influence on behavior and religious

attitudes have a significant positive effect on behavior. Status has a significant positive effect on behavior

mediated by religious attitudes. Perception has a significant positive effect on behavior mediated by religious

attitudes.

1 INTRODUCTION

The growth of Islamic banking in June 2018 showed

a positive and intermediation improved with an

increase in assets, funding channeled (PYD), and

third-party funds (DPK) higher than the same period

the previous year. The performance of Islamic banks

in June 2018 generally improved compared to the end

of 2017 indicated by the key financial ratios, baikdari

sisilikuiditas, efficiency, profitability, and capital,

which showed improvement. Sources from the FSA

can be seen the number of CAR of 20.59% and ROA

of 1.69%.

Although the growth of Islamic banking sector

continued to grow during the past few years, the total

market share of Islamic Banks and Islamic Business

Unit reached 5.70% of total banking sector in June

2018. The market share is considered to be relatively

low when compared to other Islamic countries with

the population and economic level are much smaller,

namely Malaysia and Saudi Arabia. Various reasons

can be known as socioeconomic status communities

are low making it difficult to get an understanding,

education especially low incomes so that they do not

feel the need to relate to Islamic banks.

Perception felt important, because perception is a

process when individuals organize and interpret their

sensory impressions in order to give meaning to their

environment. Customer perception is closely related

to their religious attitude that what is done by the

customer is an objective reality that will affect their

behavior to use the services of Islamic banking.

Human behavior is a form of reaction to an object

of one's feelings in this regard Islamic banking.

Attitude is a preparatory act / acts in a certain

direction. In the form of supportive attitude

(favorable) or feelings of support (unfavorable)

which has three components: cognitive, affective and

behavioral. Religious attitude is a state where each

commit oneself on activities always associated with

religion. Thus usually every community that has a

high religious attitudes will tend to apply it. So proper

to if the people of Indonesia, especially in the field

which generally have a high religious attitude will

change his attitude towards Islamic banks in that they

would be interested to become customers of Islamic

banks.

Likewise, customer attitudes towards flowers and

the results are very diverse, so from a variety of these

attitudes give the feel is quite interesting as a picture

of perception, economic and social status of religious

attitudes and behavior of the community in dealing

with Islamic banking. While Islamic banks with

profit-sharing system does not provide certainty as

Ja’far Dalimunthe, D., Absah, Y. and Yuliaty, T.

Social Economic Perception and Status towards the Behavior of Customers of Islamic Banking Financial Services Users.

DOI: 10.5220/0009199901170121

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 117-121

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

117

conventional bank interest income provide revenue

certainty. As a result of socioeconomic status,

perception so that ultimately affect the religious

attitudes and behavior of prospective customers in the

use of financial services in Islamic banking.

Formulation problems of this study are as follows:

1. How to influence customers' perception of

religious attitudes in using financial services of

Islamic banking?

2. How does the influence of Socio-Economic Status

of the Religious Attitude customers in using

financial services of Islamic banking?

3. How will influence customers' perception of

Conduct in using financial services of Islamic

banking?

4. How does the influence of Socio-Economic Status

of the behavior of customers in using financial

services of Islamic banking?

5. How do the religious attitude towards behavior of

customers in using financial services of Islamic

banking?

2 METHODOLOGY OF

RESEARCH

The method used is quantitative tool hypothesis

testing is using path analysis. Path analysis (path

analysis) is an extension of the multiple linear

analysis, or the use of regression analysis to estimate

the causal relationships between variables that have

been set previously by the theory (Ghozali, 2013).

The data analysis technique used isBased Component

Structure Equation Model (SEM) with a program

Generalized Structured Component Analysis (Web

GeSCA) version 1.5.

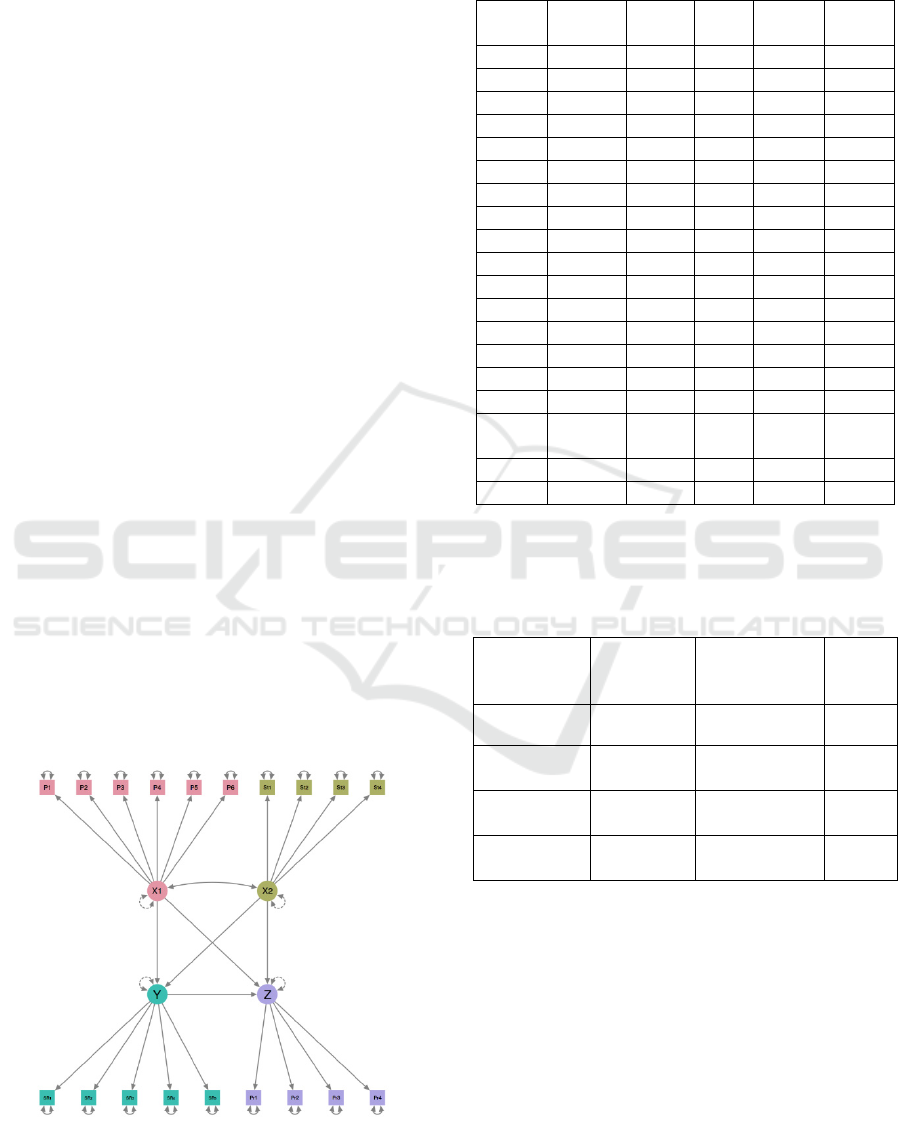

The research model can be seen as follows:

3 RESULT AND DISCUSSION

Here are the results of testing the validity of:

estimate

Std.

Error

t-

value

95%

CI_LB

95%

CI_UB

P1 0.5606 0089 6:30 0359 0.6837

P2 0.7482 0059 12.68 0612 0.8192

P3 0.7006 0.0599 11.70 0.5447 0.7934

P4 0.7476 0.0454 16:47 0.6413 0.8167

P5 0645 0.0772 8:35 0.5056 0806

P6 0.6679 0.0585 11:42 0:54 0.7602

st1 0.7655 0.0454 16.86 0672 0842

ST2 0833 0.0257 32.41 0.7766 0.8764

St3 0.8493 0.0184 46.16 0.8171 0.8852

ST4 0.6825 0.0488 13.98 0.5917 0.7771

SR1 0.7447 0.0321 23:20 0675 0.8068

SR2 0.7966 0.0313 25.45 0.7244 0.8488

SR3 0.7612 0.0357 21:32 0.6892 0.8247

SR4 0.8061 0.0401 20:10 0.7174 0.8745

SR5 0.81 0.0318 25.47 0.7326 0.8655

pr1 0.6903 0.0517 13:35 0.5779 0772

comply

pr2

0.7887 0.0372 21:20 0.7172 0.8566

Pr3 0.8189 0.0292 28.04 0.7589 0.8839

pr4 0.7402 0.0549 13:48 0.6085 0825

At a confidence level of 95% or 5% alpha and df 198

then table-t of 1,653. According to the table above, it

can be seen that all the indicators have values –t above

1,653, so it declared invalid. Here are the results of

reliability testing:

variables

Cronbach's

Alpha

Dillon-

Goldstein's

rho

AVE

X2 (Status) 0.7896 0.8647 0.6167

X1

(Perception)

0.7664 0.8375 0.4643

Y (Religious

Attitude)

0843 0.8886 0.6149

Z

(Behavior)

0.7556 0.8458 0.5792

Based on the above table, the variables of

perception, status, religious attitudes, and behaviors

declared reliable by Cronbach's Alpha value and

Dillon-Goldstein's rho greater than 0.6. Although the

value of the variable AVE perception of less than 0.5,

but the indicator status, religious attitudes, and

behaviors value is above 0.5. So that all variables can

be inferred been reliable.

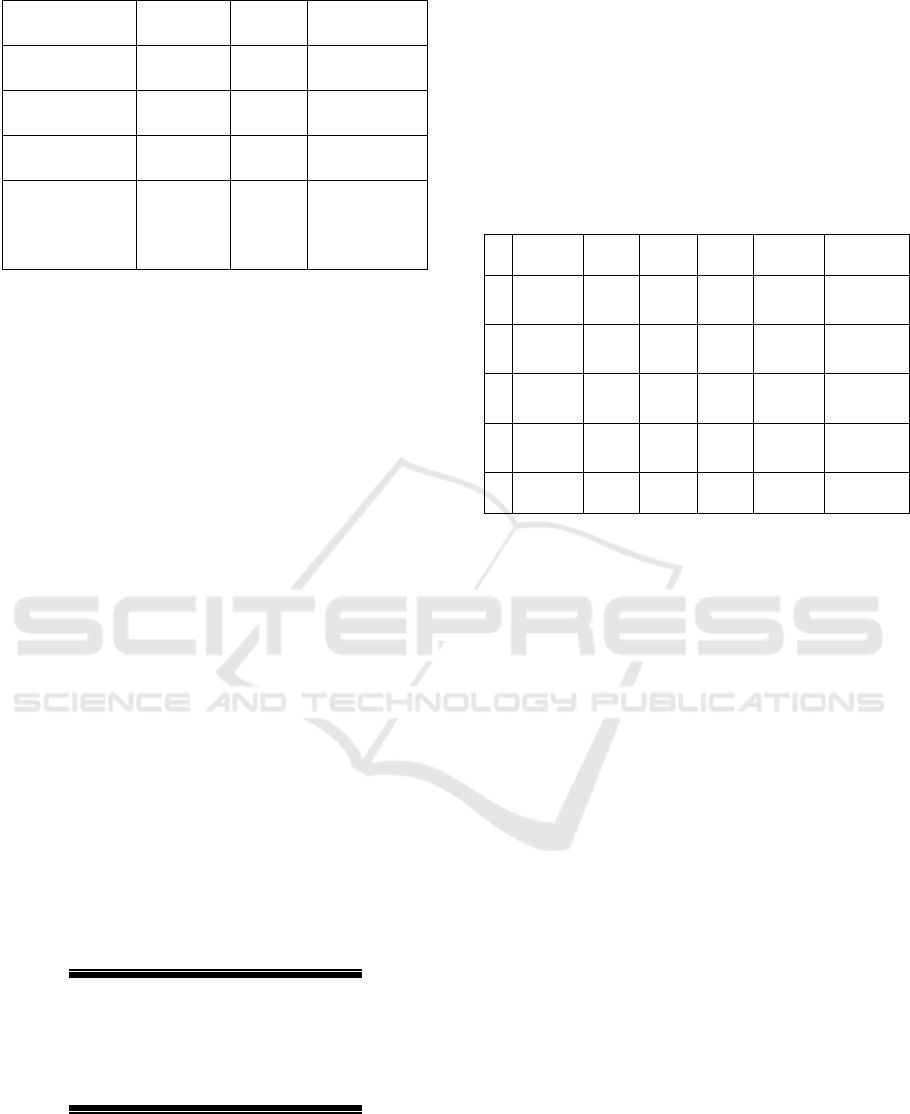

1. Measurement of Fit Testing Model

Testing of this model can be seen in the following

table:

EBIC 2019 - Economics and Business International Conference 2019

118

Measur

e

Std.

Error

Informatio

n

FIT 0.4962

0.020

9

Well

Adjusted FIT

(Afit)

0.4904

0.021

1

Well

GFI 0.9851

0.001

9

Well

Standardize

d Root Mean

Square

(SRMR)

0.1158

0.012

1

Pretty good

Based on the model FIT goodness table, it can be

seen that:

a. FIT shows the total variance of all the variables

described by the model specification. FIT Values

range from 0 to 1. FIT value generated in this study

was 0.4962. That is, the value of the variance of the

data can be explained by the model is equal to

49.62%.

b. AFIT is developed from FIT test values value,

because the value of FIT is strongly influenced by

the complexity of the model. Afit value generated in

this study amounted to 0.4904 or 49.04%, which

means good models to explain the phenomenon

being studied.

c. GFI value is the value Unweight Least Square,

which aims to test whether the resulting model

describes the actual conditions. GFI is a range

of values on a 0 (poor fit) to 1 (good fit). GFI

value generated in this study was 0.9851, this

indicates that the model used in the study is

very appropriate because GFI value close to 1.

d. If SRMR value close to 0 then it indicates the

suitability of the overall model. SRMR value

generated in this study was 0.1158.

2. Analysis of R-Square

Results of analysis of the R-square value can be seen

in the table below:

X1 0

X2 0

Y 0337

Z 0.4316

R-square value on religious attitude variable (Y)

equal to 0.337 so that it can be said that variations in

religious attitudes afford described by state variables

(X1) and perception (X2) is 0.337 or 33.7%. While

the behavioral variables (Z) has the R-square value of

0.4316 so that variations in behavior were able to be

explained by variable status (X1) and perception

(X2), and the religious attitude (Y) equal to 0.4316 or

43.16%. The rest is explained by other variables not

examined or incorporated into the model.

3. Direct Impact Hypothesis Testing

Hypothesis testing direct influence can be seen from

the table below:

estimate

Std.

Error

t-value

95%

CI_LB

95%

CI_UB

Informatio

n

-

X

1

0.3306 0.0868 3,809 0:16 0.4865 Significant

-

X

1

0.2602 0.0826 3:15 0.1211 0.4591 Significant

-

X

2

0.3599 0.0745 4,831 0.2262 0.5007 Significant

-

X2

0.1242 0.0861 1,442

-

0.0554

0.2717

Not

significant

- Y

0.4108 0.0848 4,844 0.1888 0.5576 Significant

Based on the table above, it can be obtained

directly influence the results of hypothesis testing as

follows:

Hypothesis 1, Effect of Status (X1) on Religious

Attitudes (Y)

Status has a significant positive effect on religious

attitudes with coefficient 0.3306 and t-value of 3.809.

That is, the higher the socio-economic status, the

attitudes of religious communities is increasing. As

perceived by Purwanto (1990), the tendency to react a

certain way to a stimulus in accordance with the

situation. In this case the person becomes

perangsangnya status to be more religious.

Hypothesis 2 Effect of Status (X1) to Behavior

(Z)

Status has a significant positive effect on the

behavior of the coefficient of 0.2602 and a t-value

of 3.15. This shows that the existing status of a

person it would be easy to act in accordance with

her wishes. As perceived by Prasetijo and Ihalauw

(2005), the behavior is about how the decision-

makers make the decision to buy or transact a

product and taking it where it is supported by its

status.

Hypothesis 3, Influence Perception (X2) on

Religious Attitudes (Y)

Perception has a significant positive effect on

religious attitudes with coefficient 0.3599 and t-

value of 4.831. That is, the greater the public

perception that the religious attitude is increasing. As

perceived by Asshidin (2016) that the attitude of a

person's tendency toward an object or idea and

evaluate the value of a feeling about something.

Social Economic Perception and Status towards the Behavior of Customers of Islamic Banking Financial Services Users

119

Hypothesis 4, Influence Perception (X2) on the

behavior of (Z)

Perception has no influence on the behavior of the

coefficient of 0.1242 and a t-value of 1.442. This

shows that the higher the public perception will not

affect the behavior without the support of their

awareness of the personal and the person concerned.

In accordance with that presented by Kotler and

Armstrong (2008), which encourages a person to

love, toward or away from something is not a

perception but an attitude.

Hypothesis 5, Effect of Religious Attitude (Y)

to Behavior (Z)

Religious attitudes had a significant positive effect

on the behavior of the coefficient of 0.4108 and t-

value is at 4.844. That is, the higher the religious

attitude of society then the behavior is also

increasing. According to the dictionary Chaplin

stated trends are relatively stable and continues to

behave or react in a certain way is the foundation of

attitude,

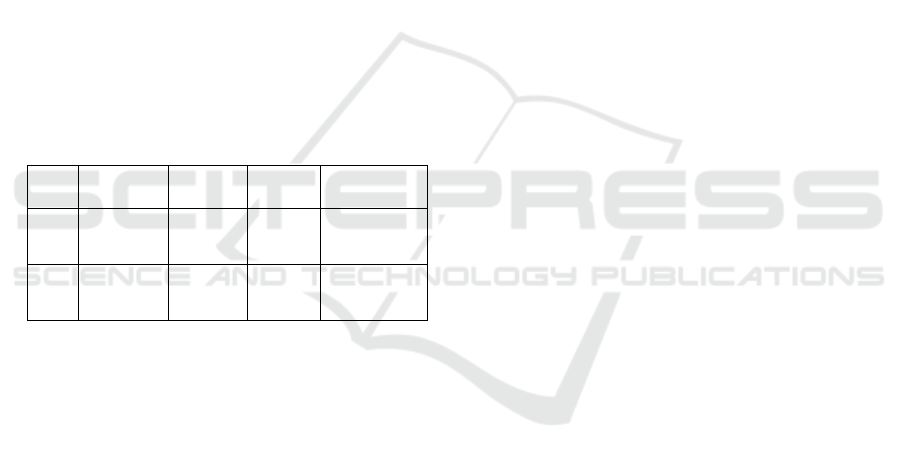

4. Effect Hypothesis Testing Not Live

Hypothesis testing indirect influence can be seen

from the table below:

esti

mate

Std

. Error

t-

value

Inform

ation

Z

~

X1

0.14

78

0.0

436

3:

39

Signific

ant

Z

~

X2

0.13

58

0.0

466

2,

914

Signific

ant

Based on the table above, then the hypothesis test

results can be obtained indirect effect as follows:

Tests of Hypotheses 6, Effect of Status (X1) to

Behavior (Z) mediated by religious attitude (Y)

Test results obtained by the t-value of 2.914, which

means the value is greater than t-table 1.653. It can

be concluded that the status has a significant positive

effect on behavior mediated by religious attitudes.

This indicates that the status based on the religious

attitude will encourage positive behaviors. Due to

the status of a person in the community and religious

attitude will keep him away from bad thoughts and

bad behavior anyway.

Hypothesis 7, Influence Perception (X2) on the

behavior of (Z) mediated by religious attitude

(Y)

Test results obtained by the t-value of 3.39, which

means the value is greater than t-table 1.653. It can

be concluded that the perception has a significant

positive effect on behavior mediated by religious

attitudes. This shows that the perception which was

followed by a religious attitude will give you the idea

that the behavior captured is a good and right

decision because in accordance with his beliefs.

4 CONCLUSIONS

The results showed that, the Status has a significant

positive effect on religious attitudes. As perceived by

Purwanto (1990), the tendency to react a certain way

to a stimulus in accordance with the situation. In this

case the person becomes perangsangnya status to be

more religious. The higher the person's position in

society, the better the attitude of religious feeling

becomes a role model for people - the people around

him.

Status has a significant positive effect on

behavior. As perceived by Prasetijo and Ihalauw

(2005), the behavior is about how the decision-

makers make the decision to buy or transact a product

and taking it where it is supported by its status.

Perception has a significant positive effect on

religious attitudes. As perceived by Asshidin (2016) that

the attitude of a person's tendency toward an object or

idea and evaluate the value of a feeling about something.

Perception has no influence on behavior In

accordance with that presented by Kotler and Armstrong

(2008), which encourages a person to love, toward or

away from something is not a perception but an attitude.

Religious attitudes had a significant positive effect

on behavior. According to the dictionary Chaplin stated

trends are relatively stable and continues to behave or

react in a certain way is the foundation of attitude,

Status has a significant positive effect on behavior

mediated by religious attitudes. This indicates that the

status based on the religious attitude will encourage

positive behaviors. Due to the status of a person in the

community and religious attitude will keep him away

from bad thoughts and bad behavior anyway.

Perception has a significant positive effect on

behavior mediated by religious attitudes. This shows

that the perception which was followed by a religious

attitude will give you the idea that the behavior captured

is a good and right decision because in accordance with

his beliefs.

REFERENCES

Abdulsyani, (2007). Sociology, schematic, Theory, and

Applied. Jakarta: PT.Bumi. Script.

Asshidin NHN, Abidin Borhan N. and HB. 2016. Consumer

attitude towards international products and uniqueness.

Procedia Journal of Economics and Finance, 35, 632-

638.

EBIC 2019 - Economics and Business International Conference 2019

120

Ary Gina Agustin, ESQ Power Generating Success Secrets:

An Inner Journey Through Ihsan, (Jakarta: ARGA,

2003), Hal.249

Candraditya H. and Idris. 2013. Analysis of Usage of

Electronic Money: A case study on product users Flazz

BCA student at the Faculty of Economics and Business,

University of Diponegoro. Diponegoro Journal of

Management, 2, 1-11.

Ghozali, I. (2013). Applications Multivariate Analysis With

SPSS Program. Semarang: Diponegoro University

Publishers.

Kotler, Philip and Gary Armstrong. 2008. Principles -

Principles of Marketing. Volume 12. Issue 1. Jakarta:

Erlangga.

Kotler, P., & Keller, KL (2012). Marketing Management.

Jakarta: Erland.

M. Ngalim Purwanto, Educational Psychology, (Bandung:

PT. Youth Rosda paper, 1990), p. 141.

Muhammad Alim, Islamic Education, (Bandung: PT Young

Rosdakarya,

Prasetijo, Ristiyanti and John Ihalauw. 2005. Consumer

Behavior. Yogyakarta: Andi.

Schiffman, LG, & Kanuk, LL (2009). Consumer behavior.

Jakarta: PT Gramedia Group Index.

Sitorus, (2000). Acquainted with Sociology. Jakarta: Erland

Sumardi, M. (2004). Poverty and Necessity, Jakarta:

Rajawali Jakarta.

Sumarwan U. 2014. Consumer Behavior: Theory

application in marketing. Bogor: Ghalia Indonesia.

Walgito, Ben. 2003. An Introduction to Social Psychology.

Yogyakarta: Andi Offset.

Social Economic Perception and Status towards the Behavior of Customers of Islamic Banking Financial Services Users

121