Determinants of Awareness against Taxpayers Tax Compliance,

Micro, Small and Medium Enterprises in Medan

Herman P.

1

, Hasan Basri Tarmizi

2

, Murni Daulay

2

, and Rahmanta Ginting

2

1

Doctoral Student, Faculty of Economics and Business, Universitas Sumatera Utara

2

Faculty of Economics and Business, Universitas Sumatera Utara, Medan, Indonesia

Keywords: Tax Awareness, Taxpayer Attitudes, Tax Knowledge, Subjective Norms,Tax Amnesty, Tax Compliance

Abstract: This study aims to analyze the effect of taxpayer attitudes, taxpayer knowledge, subjective norms and tax

amnesty on tax awareness of Micro, Small and Medium Enterprises in Medan. Analyzing the effect of

taxpayer attitudes, taxpayer knowledge, subjective norms and tax amnesty on the compliance of taxpayers

for Small and Medium Enterprises in Medan. Analyzing the effect of taxpayer attitudes, taxpayer

knowledge, subjective norms and tax amnesty on tax awareness and tax compliance of Micro, Small and

Medium Enterprises in Medan. The sample in this study were 344 respondents from small and medium

micro enterprises in Medan. Data analysis uses the Structural Equation Modeling (SEM) model. The results

of the study are that There is a significant influence of the Taxpayer's Attitude towards tax awareness of

Micro, Small and Medium Enterprises in Medan. There is no significant influence of Taxpayers' Knowledge

on the tax awareness of Micro, Small and Medium Enterprises in Medan. There is significant effect of Tax

Amnesty on the tax awareness of Micro, Small and Medium Enterprises in Medan. There is no significant

influence of Subjective Norms on the tax awareness of Micro, Small and Medium Enterprises in Medan.

There is no significant influence of Subjective Norms on the tax compliance of Micro, Small and Medium

Enterprises in Medan. There is significant effect of Taxpayers' Knowledge on the tax compliance of Micro,

Small and Medium Enterprises in Medan. There is significant effect of Tax Amnesty on the tax compliance

of Micro, Small and Medium Enterprises in Medan. There is no significant effect of Taxpayer's Attitude on

the tax compliance of Micro, Small and Medium Enterprises in Medan. There is no significant effect of

taxpayer awaraness on the tax compliance of Micro, Small and Medium Enterprises in Medan.

1 INTRODUCTION

Tax compliance issues are a classic problem faced

by almost all countries that implement the tax

system (Amin et al., 2011; Contos et al., 2009;

Sapiei and Ismail, 2014; Supiyandi et al., 2017;

Ikhwan et al., 2018). The main problem of taxation

in Indonesia is still around the level of taxpayer

compliance which is still very low. The level of tax

compliance in Indonesia is still low, with only 30

percent of taxpayers paying taxes. When compared

with the compliance of tax payments in Malaysia

which has 80 percent of registered taxpayers, of

course, Indonesia's tax performance is still far

behind (Sari et al., 2017; Julyan, 2004; McLellan,

1988). Realization of tax revenue in North Sumatra I

Regional Tax Office until mid-June 2011 was

recorded at Rp 4.4 trillion, or around 39% of the

year-round target of Rp 9 trillion. The tax revenue

performance increased by around 9.3% compared to

tax revenue in the same period in 2010 whose value

was recorded at Rp 3.9 trillion. "Gross tax revenue

realization up to June 2011 has reached Rp 4.4

trillion or reached

39% of the target of Rp 9 trillion. The tax

revenue performance increased by around 9.3%

compared to the realization of tax revenue in the

same period in 2010. In the first semester of 2010,

the realization of tax revenue in the Regional Office

of Medan reached Rp 3.9 trillion. The tax revenue of

the North Sumatra I Regional Office in Medan is

still much smaller compared to other regional offices

in Indonesia. The receipt of the North Sumatra

Region I Regional Office in Medan was the 13th

largest compared to other regional offices. In 2008,

6.36 trillion increased to Rp 7.32 trillion and 8.00

trillion in 2010.

112

P., H., Tarmizi, H., Daulay, M. and Ginting, R.

Determinants of Awareness against Taxpayers Tax Compliance, Micro, Small and Medium Enterprises in Medan.

DOI: 10.5220/0009199801120116

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 112-116

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Low tax compliance from retail traders while

they dominate the role in the economy. Perpetrators

of retail traders who do not pay taxes, for example,

will sell the same goods at lower prices compared to

other businesses that pay taxes. Business actors who

pay taxes must collect Value Added Tax (VAT)

which will increase the selling price to consumers,

while businesses that do not pay taxes do not do it

for the same item (Nasution et al., 2018; Eddy et al.,

2018; Walsh, 1972) On the other hand, business

actors who pay taxes must set aside the income

earned to pay income tax (PPh) owed, while

businesses that do not pay taxes can enjoy all the

income they earn.

The distortion that occurs between retail traders

who make tax payments with retail traders who do

not pay this tax, in the long run, will reduce the

ability of retailers who make tax payments in

competition in the market. Distortion will also cause

disincentives for tax compliance of retail traders

who make tax payments. To be able to compete in

the market with business people who do not pay

taxes, they will tend to misuse their tax obligations,

for example not collecting VAT or not paying taxes

(Li and Ren, 2010). It is a challenge for tax

administrators to how to make tax-compliant retail

traders tax compliant and obedient retail traders to

remain obedient.

One of the government's efforts to increase tax

revenues is by collecting taxes from Micro, Small

and Medium Enterprises (MSMEs). The reason for

the government to collect taxes from MSMEs is

because they have the potential to increase national

economic growth (Iqbal et al., 2018). SME business

has an essential role in the Indonesian economy. It is

because the SME business is the largest business

unit in the absorption of labor and the formation of

the National GDP (Putra and Hasibuan, 2015;

Merwe et al., 2018; Hasibuan et al., 2016) The

informal sector including SMEs has boosted

Indonesia's economic growth in an improving

direction. However, the contribution of tax revenue

from the informal sector is still below 2 percent. Tax

revenue potential of SMEs in Indonesia is more or

less biased to reach seventy-five trillion Rupiah per

year. According to Bisnis Indonesia Daily states that

SMEs are proven to be resistant to the crisis and able

to survive because they do not have foreign debt,

there is not much debt to banks because they are

considered unbankable, using local input, and

export-oriented. The number of MSMEs in

Indonesia is currently not recorded clearly, so that

the value of SME money tax revenues starting to

take effect as of 1 July 2013 cannot be targeted with

certainty.

If the Taxpayer has a subjective norm that is

following the standard values in the community, the

taxpayer will take action by existing regulations

such as paying taxes and reporting the tax return.

The subjective norms have a significant adverse

effect on the intention of tax non-compliance.

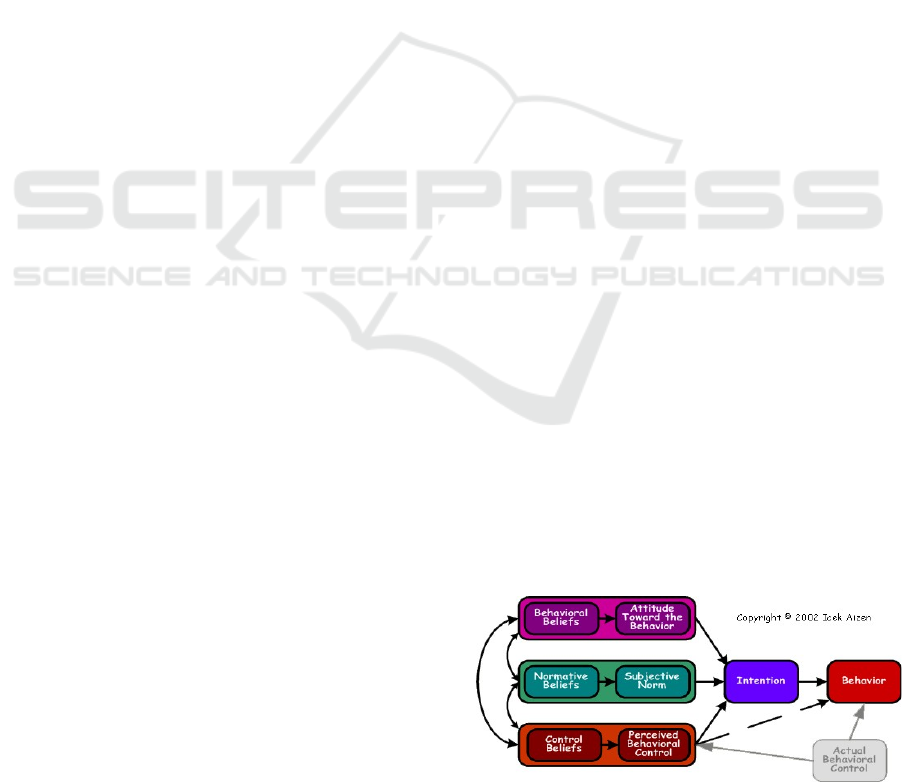

2 THEORETICAL FRAMEWORK

Theory of Planned Behavior explains that the

behavior displayed by individuals arises because of

the intention to behave (Huang et al., 2011;

Jafarkarimi et al., 2007; Ritonga et al., 2017)

Whereas three determinants determine the intention

to behave, such as:

1. Behavioral beliefs, individual beliefs about the

results of behavior and evaluation of these results

(beliefs strength and outcome evaluation).

2. Normative beliefs, beliefs about normative

expectations of people others and motivation to

fulfill these expectations (normative beliefs and

motivation to comply).

3. Control beliefs, beliefs about the existence of

things that support or inhibit the behavior that

will be displayed (control beliefs) and

perceptions about how strong things which

support and inhibits the behavior (perceived

power).

Obstacles that may arise when the behavior is

displayed can come from within self or from the

environment. Sequentially, behavioral beliefs

produce attitudes toward positive or negative

behavior; normative beliefs produce perceived social

pressure or subjective norms (subjective norms) and

control beliefs give rise to perceived behavioral

control or perceived behavioral controls.

Figure 1: Theory of Planned Behavior

Determinants of Awareness against Taxpayers Tax Compliance, Micro, Small and Medium Enterprises in Medan

113

3 METHOD

Analyze data using Structural Equation Model with

the formula, Such as :

X1.1 = λ

1

SWP1 + Z

16

X1.2 = λ2 SWP2 + Z

17

X1.3 = λ

3

SWP3 + Z

18

X1.4 = λ

4

SWP4 + Z

19

X2.1 = λ

5

PWP1 + Z

20

X2.2 = λ

6

PWP2 + Z

21

X2.3 = λ

7

PWP3 + Z

22

X3.1 = λ

8

NS1 + Z

8

X3.2 = λ

9

NS2 + Z

7

X3.3 = λ

10

NS3 + Z

6

X3.4 = λ

11

NS4 + Z

5

X4.1 = λ

12

Ta1 + Z

4

X4.2 = λ

13

Ta2 + Z

3

X4.3 = λ

14

Ta3 + Z

2

X4.4 = λ

15

Ta4 + Z

1

Y1.1 = λ

16

KS1 + Z

15

Y1.2 = λ

17

KS2 + Z

14

Y1.3 = λ

18

KS3 + Z

13

Y1.4 = λ

19

KS4 + Z

12

Y2.1 = λ

20

KP1 + Z

11

Y2.2 = λ

21

KP2 + Z

10

Y2.3 = λ

22

KP3 + Z

9

η 1 = γ

23

SWP + γ

24

PWP + γ

25

NS + γ

26

TA + Z

24

η 2

= β

27

KS + γ

23

SWP + γ

24

PWP + γ

25

NS

+ γ

26

TA

+ Z

23

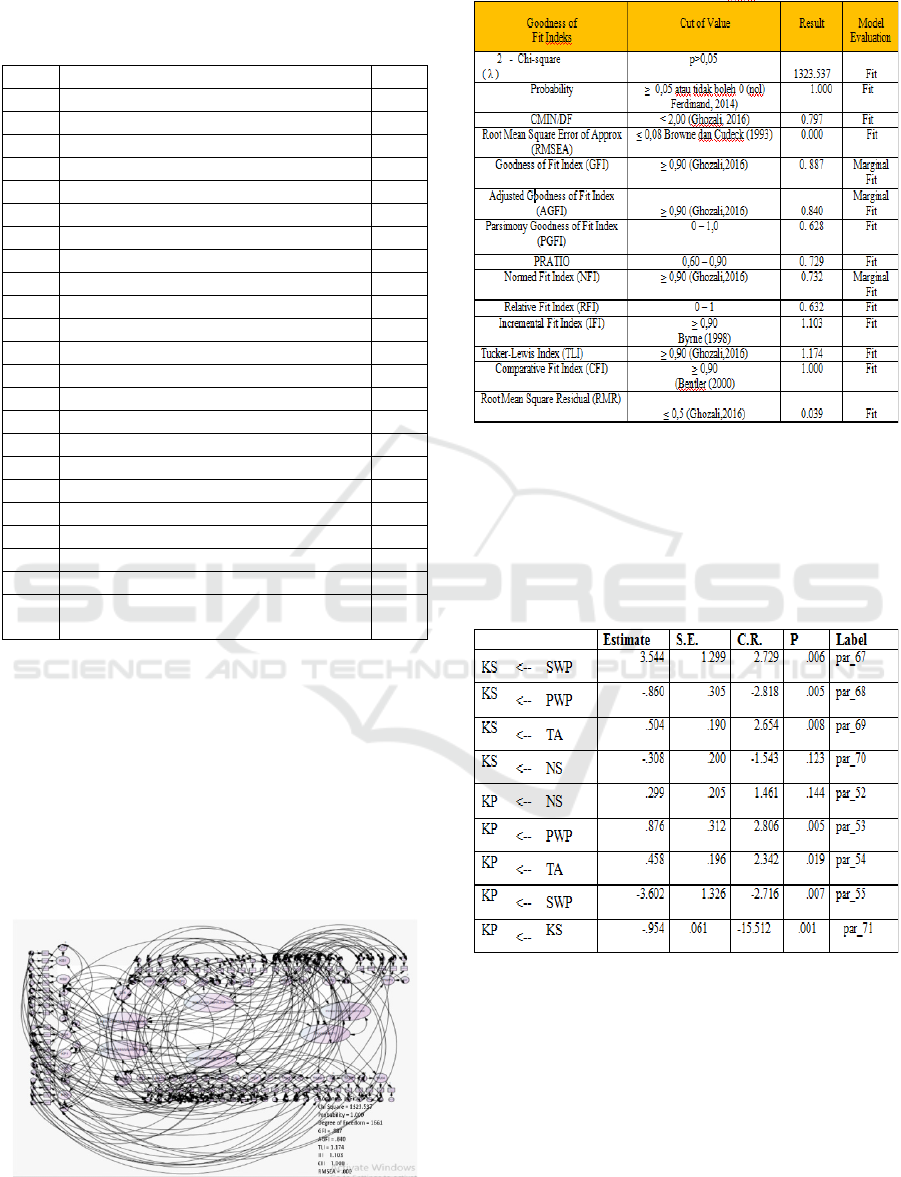

4 RESULT AND DISCUSSION

Based on AMOS output it is known that all

constructing indicators of firs order Taxpayer

attitudes, Taxpayer knowledge, Subjective norms,

Tax Amnesty, Tax Awareness, and Tax Complience

have a significant loading factor value, where all the

loading factor values exceed 0.4. If all constructing

indicators are significant, then it can be used in

representing data analysis.

Figure 2: Amos Output

Table 1

Goodness of Fit Indeks

Based on the results of the Fit Model

Assessment, it is known that all model analyzes have

good conditions as a SEM model. To see the

relationship between each variable is done by path

analysis (path analysis) of each variable both direct

relationships and indirect relationships.

Table 2: Critical Ratio and P-Value estimation result.

To determine whether a significant influence or

not can be seen from column P which is p- value,

compared with the significance level (alpha = α)

used is usually 0.05. If the p-value is smaller than

0.05 then Ho is rejected. The second way is to look

at the value of C.R (Critical Ratio). If C.R is greater

than 2.0, Ho is rejected. This means that the

influence of independent variables on the dependent

variable shown in the table is significant. An asterisk

(***) at P (Probability Value) indicates a very small

number (less than 0.05).

EBIC 2019 - Economics and Business International Conference 2019

114

Based on table 2 above, it is known:

• There is a significant influence of the

Taxpayer's Attitude towards the tax awareness

of Small and Medium Enterprises in Medan,

where the estimated value is 3.544 with a value

of C.R 2.729 and a probability of 0.006 < 0.05

so that it is known that the Taxpayer's Attitude

significantly affects tax awareness.

• There is no significant effect of Taxpayer

Knowledge on tax awareness of Small and

Medium Enterprises in Medan, where the

estimated value is -0.860 with a C.R. value of -

2.818 and the probability of of 0.005 < 0.05 so

that Taxpayer Knowledge is not known to

effects awarness significantly.

• There is a significant influence of Tax Amnesty

on the awareness of taxpayers of Small and

Medium Enterprises in Medan, where the

estimated value is 2.654 with a C.R value of

2.654 and the probability of 0.008 < 0.05 so that

it is known that tax amnesty significantly

influences the awareness of taxpayers of Small

and Medium Enterprises in Medan.

• There is no significant effect of Subjective

Norms on tax awareness of Small and Medium

Enterprises in Medan, where the estimated

value is -0.308 with a C.R value of -1.543 and a

probability of 0.123> 0.05 so that subjective

norms are not found to affect tax awareness

significantly.

There is no significant influence of Subjective

Norms on the tax compliance of Small and

Medium Enterprises in Medan, where the

estimated value is 0.299 with a C.R value of

1.461 and a probability of 0.144> 0.05 so that

Subjective Norms are not found significantly

affect taxpayer compliance.

There is a significant influence of Taxpayer

Knowledge on taxpayer compliance of Small

and Medium Enterprises in Medan, where the

estimated value is 0.876 with a C.R value of

2.806 and the probability of 0.005 < 0.05 so that

it is known that Taxpayer Knowledge

significantly affects the compliance of Micro,

Small and Medium Enterprises in Medan.

There is a significant influence of Tax Amnesty

on tax compliance of Small and Medium

Enterprises in Medan, where the estimated

value is 0.458 with a C.R value of -2.342 and a

probability of 0.019 < 0.05 so that tax amnesty

significantly affects the compliance of

Micro,Small and Medium Enterprises in

Medan.

There is no significant influence of Taxpayer's

Attitude on taxpayer compliance of Small and

Medium Enterprises in Medan, where the

estimated value is -3.602 with a C.R value of -

2.716 and the probability of 0.007 < 0.05 so that

Taxpayer's Attitude is not known significantly

influences the compliance of Micro, Small and

Medium Enterprises in Medan.

There is no significant influence of taxpayer

awaraness on taxpayer compliance of Small and

Medium Enterprises in Medan, where the

estimated value is -0.954 with a C.R value of -

15.512 and the probability of 0.001 < 0.05 so

that Taxpayer's Attitude is not known

significantly influences the compliance of

Micro, Small and Medium Enterprises in

Medan.

5 CONCLUSIONS

There is a significant influence of the Taxpayer's

Attitude towards tax awareness of Micro, Small and

Medium Enterprises in Medan. There is no

significant influence of Taxpayers' Knowledge on

the tax awareness of Micro, Small and Medium

Enterprises in Medan. There is significant effect of

Tax Amnesty on the tax awareness of Micro, Small

and Medium Enterprises in Medan. There is no

significant influence of Subjective Norms on the tax

awareness of Micro, Small and Medium Enterprises

in Medan. There is no significant influence of

Subjective Norms on the tax compliance of Micro,

Small and Medium Enterprises in Medan. There is

significant effect of Taxpayers' Knowledge on the

tax compliance of Micro, Small and Medium

Enterprises in Medan. There is significant effect of

Tax Amnesty on the tax compliance of Micro, Small

and Medium Enterprises in Medan. There is no

significant effect of Taxpayer's Attitude on the tax

compliance of Micro, Small and Medium

Enterprises in Medan. There is no significant effect

of taxpayer awaraness on the tax compliance of

Micro, Small and Medium Enterprises in Medan.

ACKNOWLEDGEMENTS

The authors gratefully acknowledge that the present

research is supported by The Ministry of Research

and Technology and Higher Education Republic of

Indonesia of the Year 2019.

REFERENCES

A. Ikhwan, M. Yetri, Y. Syahra, and J. Halim, “A Novelty

of Data Mining for Promoting Education based on FP-

Determinants of Awareness against Taxpayers Tax Compliance, Micro, Small and Medium Enterprises in Medan

115

Growth Algorithm,” Int. J. Civ. Eng. Technol., vol. 9,

no. 7, pp. 1660–1669, 2018.

A. K. Sari, H. Saputra, and A. P. U. Siahaan, “Effect of

Fiscal Independence and Local Revenue Against

Human Development Index,” Int. J. Bus. Manag.

Invent., vol. 6, no. 7, pp. 62–65, 2017.

B. WALSH, “VALUE ADDED TAX,” Ind. Commer.

Train., vol. 4, no. 10, pp. 481–485, Oct. 1972.

D. McLellan, “VALUE ADDED TAX: IMPLICATIONS

OF THE EUROPEAN COURT JUDGMENT FOR

SURVEYORS AND PROPERTY MANAGERS,”

Prop. Manag., vol.6, no. 4, pp. 299–302, Apr. 1988.

E. Huang, N. C. Yeh, and I.-C. Hung, “Using decomposed

theory of Planned Behavior to explain virtual currency

use intention,” in 2011 International Conference on E-

Business and E-Government (ICEE), 2011, pp. 1–4.

G. Contos, A. Eftekharzadeh, J. Guyton, B. Erard, and S.

Stilmar, “Econometric simulation of the income tax

compliance process for small businesses,” in

Proceedings of the 2009 Winter Simulation

Conference (WSC), 2009, pp. 2902–2914.

G. J. Van Der Merwe, L. Van Der Merwe, L. Pretorius,

and J. D. Van Wyk, “Business management models

for high technological small to medium enterprises

(SMEs), incorporating the close relations of

subdivisions within the company, and aspects of

volatile economic climates,” in IEEE International

Engineering Management Conference, vol. 2, pp. 577–

584.

H. A. Hasibuan, R. B. Purba, and A. P. U. Siahaan,

“Productivity Assessment (Performance, Motivation,

and Job Training) using Profile Matching,” Int. J.

Econ. Manag. Stud., vol. 3, no. 6, pp. 73–77, 2016.

H. Jafarkarimi, R. Saadatdoost, A. T. H. Sim, and J. M.

Hee, “Cyberbullying among students: An application

of Theory of Planned Behavior,” in 2017 International

Conference on Research and Innovation in

Information Systems (ICRIIS), 2017, pp. 1–6.

H. M. Ritonga, H. A. Hasibuan, and A. P. U. Siahaan,

“Credit Assessment in Determining The Feasibility of

Debtors Using Profile Matching,” Int. J. Bus. Manag.

Invent., vol. 6, no.1, pp. 73–79, 2017.

I. Ajzen, Constructing a TpB Questionnaire: Conceptual

and Methodological

Considerations. 2002.

L. Julyan, “Value‐added tax on new residential properties:

A comparative study to establish possible alternatives

regarding developers registered for VAT purposes,”

Meditari Account. Res., vol. 12, no. 2, pp. 67–84, Oct.

2004.

Li and Y. Ren, “Government fiscal policy toward SMEs in

China,” in 2010 Second International Conference on

Communication Systems, Networks and Applications,

2010, pp. 158–160.

M. Iqbal, S. H. A. Kazmi, A. Manzoor, A. R. Soomrani, S.

H. Butt, and K. A. Shaikh, “A

study of big data for business growth in SMEs:

Opportunities & challenges,” in

2018International Conference on Computing,

Mathematics and Engineering Technologies

(iCoMET), 2018, pp. 1–7.

M. D. T. P. Nasution, Y. Rossanty, P. B. Sari, and A. P. U.

Siahaan, “Online Shoppers Acceptance: an

Exploratory Study,” Int. J. Civ. Eng. Technol., vol. 9,

no. 6, pp. 793–799,

2018.

M. Gopi and T. Ramayah, “Applicability of theory of

planned behavior in predicting intention to trade

online,” Int. J. Emerg. Mark., vol. 2, no. 4, pp. 348–

360, Oct. 2007.

N. S. Sapiei and K. Ismail, “Components of tax

compliance costs for the Malaysian corporate

taxpayers,” in 2014 International Symposium on

Technology Management and Emerging Technologies,

2014, pp. 438–443.

P. O. H. Putra and Z. A. Hasibuan, “E-business framework

for small and medium enterprises: A critical review,”

in 2015 3rd International Conference on Information

and Communication Technology (ICoICT), 2015, pp.

516–521.

S. M. Amin, R. M. Noor, N. Mastuki, and A. R. Ambali,

“Corporate governance and tax compliance,” in 2011

IEEE Symposium on Business, Engineering and

Industrial Applications (ISBEIA), 2011, pp. 117–122.

Supiyandi, M. I. Perangin-angin, A. H. Lubis, A. Ikhwan,

Mesran, and A. P. U. Siahaan, “Association Rules

Analysis on FP-Growth Method in Predicting Sales,”

Int. J. Recent Trends Eng. Res., vol. 3, no. 10, pp. 58–

65, 2017.

T. Eddy, B. Alamsyah, S. Aryza, and A. P. U. Siahaan,

“An Effect Phenomena Circle

Living Field in Secanggang Langkat,” Int. J. Civ. Eng.

Technol., vol. 9, no. 7, pp. 1575–

1580, 2018.

EBIC 2019 - Economics and Business International Conference 2019

116